Thesis

Each quarter, public companies face scrutiny from investors and analysts over the state of their earnings reports. If a company misses its consensus estimates for quarterly earnings, its stock will likely be met with a flurry of selling activity, causing the share price to plummet. In response to these pressures, companies tend to focus more on the following quarter’s report instead of their long-term strategic ambitions to satiate the demands of short-term investors.

This phenomenon, referred to as short-termism in public markets, was corroborated in a 2005 study of 400 CFOs of large public US companies. Almost 80% of interviewees said they would forfeit long-term economic value to meet quarterly growth targets. A separate study found that short-termism was negatively correlated with a company’s return on R&D investments. One McKinsey study comparing companies with different time horizons discovered that average revenue and earnings growth were 47% and 36% higher respectively for companies focused on the long term between 2001 and 2014.

CEOs and investors are keenly aware of this issue. Laurence Fink, CEO of the asset management firm BlackRock, outlined the dangers of short-termism in his 2015 letter to CEOs in which he discussed how short-term thinking negatively affected shareholders and reduced crucial long-term innovation. The founder and former CEO of American food-chain Panera Bread, Ron Shaich, talked about the negative impacts of short-termism and how it increased over his tenure as CEO when the company went private in 2018:

“When I started 25 years ago, I will tell you that a third of our investors were looking at this for a year longer. Today, I will tell you two-thirds of our investors are thinking literally quarter to quarter.”

Long-Term Stock Exchange (LTSE) is a new SEC-registered national securities exchange intended for companies and investors in every industry who share a long-term vision. By de-emphasizing the short-term focus of quarterly reports and requiring companies to describe how they will meet their long-term goals, LTSE wants to capitalize on the growing awareness of short-termism and its adverse effects while helping companies broaden their strategic time horizons. It wants to enable companies to adopt a set of governing practices that prioritize a broader group of stakeholders, long-term decision-making, and aligned executive and board compensation with long-term performance. While investors can sell their shares anytime, they can also disclose their intentions to be long-term shareholders. LTSE believes this dynamic will create a stronger relationship between companies and their investors.

Founding Story

LTSE was founded in 2016 by Eric Ries, who previously founded several startups, including the fashion discovery platform IMVU where he served as CTO. In the past he has advised startups, venture capital firms, and large companies, including GE, with whom he partnered to create the FastWorks program geared towards shortening product development cycles. Ries has also served as an entrepreneur-in-residence at Harvard Business School, IDEO, and Pivotal.

Ries initially came up with the idea for a long-term stock exchange five years prior to the company’s founding in his New York Times bestselling book The Lean Startup. In the book, which discusses how companies can launch new products more efficiently, Ries briefly mentioned the idea of a long-term stock exchange that would incentivize long-term investment in capital markets and create positive social externalities due to an increased emphasis on corporate innovation.

Despite his belief in the idea, Ries did not initially think he would be the one to start the long-term stock exchange. However, after it became clear that no one else was going to pursue the idea, Ries began creating the exchange by incorporating LTSE Services in 2012 and launching the company’s first product, an equity management platform for private companies called LTSE Equity, in 2015. After announcing the launch of the Long-Term Start Exchange in 2016, it took him three years to gain SEC approval, and trading did not start until September 2020. One year later, the company listed its first two companies, Asana and Twilio, in August 2021.

Along the way, LTSE was able to attract several high-profile executives from a wide range of industries, including banking, tech, and governmental agencies. This list includes the company’s new CEO Maliz Beams, who had formerly served as CEO of Voya Financial. According to the company’s website, Ries has transitioned into an Executive Chair/Chairman of the Board role with LTSE.

Product

New Listings

Companies can get listed on the Long-Term Stock Exchange when they go public or as a dual listing after listing on the Nasdaq or NYSE. Listing on LTSE allows companies to raise new capital and helps them position themselves as innovative companies focused on long-term value creation.

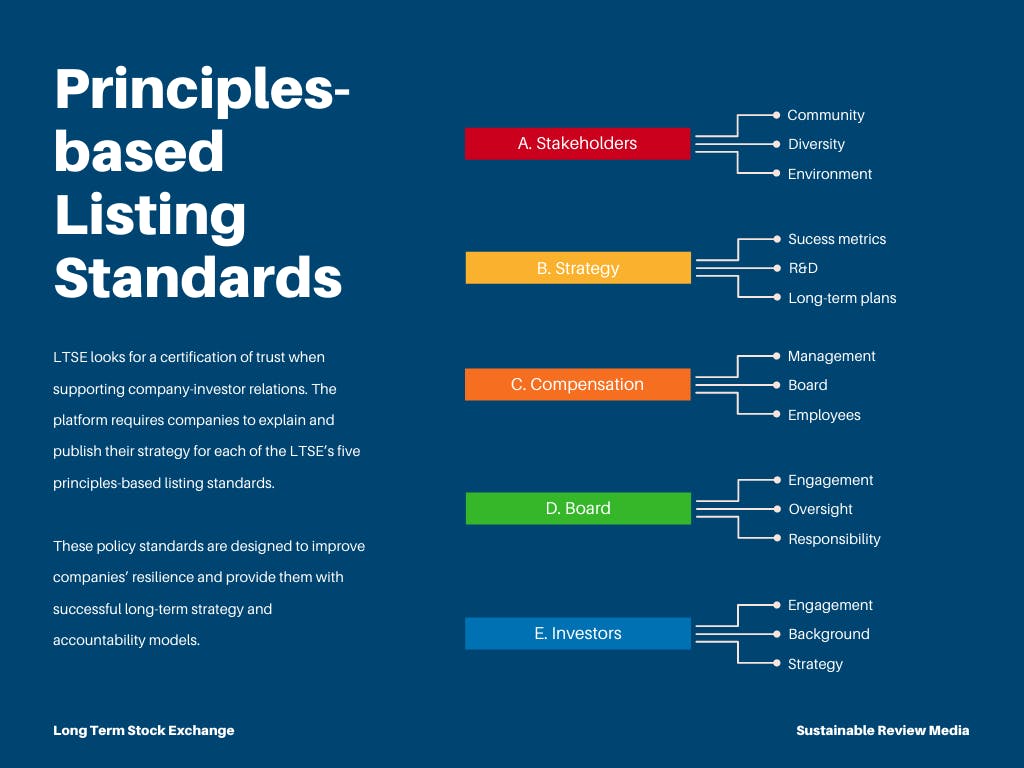

When a company decides to list on LTSE, it must outline how it will meet five key principles revolving around maintaining a long-term strategic focus, including tying executive/board compensation to long-term performance and engaging a wide array of long-term stakeholders. These principles are designed to hold companies listed on the exchange accountable for their short-term actions and reflect a company’s commitment to a higher standard of long-term thinking. LTSE requires companies that list with it to publish and maintain long-term policies.

Source: Sustainable Review

Trading

LTSE works with broker-dealers to facilitate trading on existing stocks. Unlike other exchanges, LTSE offers a Very Simple Market (VSM) that has four differentiating factors: 1) zero transaction fees, 2) no undisplayed orders, 3) every participant has access to the same public market data feeds, and 4) only simple order types. LTSE’s focus on price and order transparency aims for “dark pools” that give certain market participants preferential treatment above other investors and do not benefit from short-term volatility.

LTSE Equity

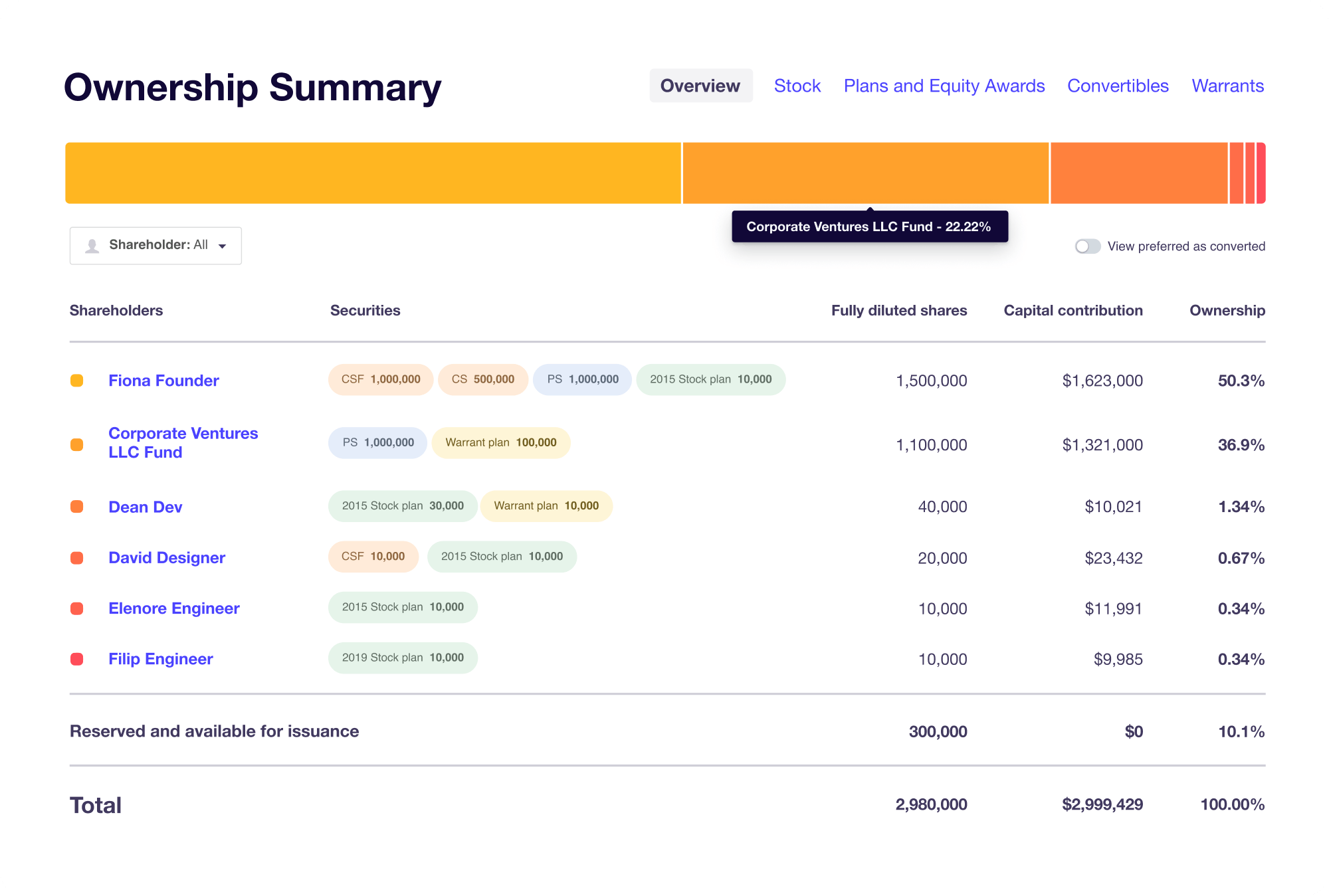

Source: LTSE

LTSE Equity is an equity management platform for startups of all sizes. It helps private companies manage their cap tables, issue stock options, perform 409A valuations, meet compliance requirements, and create models for future financing and exit scenarios. It is the single source of truth for a company’s employees, lawyers, and investors, with access control, data privacy, and collaboration features.

Market

Customer

LTSE’s ideal customers are private companies preparing to go public and public companies with a particular focus on long-term innovation rather than quarterly results. While these types of companies could come from any industry, Eric Ries has observed that many of the exchange’s listings come from the tech sector — two out of the three listings to date on the exchange come from the tech industry. Well known tech companies that have been listed on the LTSE include Asana, ThreadUp, and Twilio.

Market Size

Since LTSE supports initial public and dual listings, the market for LTSE’s listing services includes both public and private companies. The number of public companies listed in the United States was 4K in 2020, having decreased from 5.5K in 2000. Despite this decrease in public companies, the total market cap of public US equities increased during the same period and reached $51 trillion in October 2022.

Between 2013 and 2022, the average number of IPOs per year in the Americas was 373, while annual deal proceeds were $107.8 billion. Over this period, both figures peaked in 2021, with 1,124 deals raising $350 billion, including IPOs from notable tech companies like Coinbase, GitLab, and Roblox.

Secondary transactions for venture-backed companies grew steadily between 2010 ($25 billion) and 2021 ($105 billion) and are expected to reach $130 billion by 2030. This secondary trading volume does not accurately reflect the value of all venture-backed companies but does provide a partial estimate of the value of private company shares that are transacting in a given year.

Competition

Legacy Players

New York Stock Exchange (NYSE): The NYSE was founded in 1792 and remains the world's largest and oldest stock exchange. Roughly three-quarters of the S&P 500 and more than 80% of the Fortune 100 are listed on this exchange. 19 of the 20 largest U.S. IPOs of all time are listed on the NYSE. The NYSE is owned by Intercontinental Exchange, an American holding company it also lists. The NYSE uses an auction market. This means there is no middleman.

Nasdaq: Nasdaq was the world's first electronically traded stock exchange, established in 1971. It is the world’s second-largest stock exchange. Although the exchange is officially based in New York, there is no physical trading floor. All trades are handled electronically with what is simply called an Electronic Communication Network (ECN). The NASDAQ uses a dealer's market. This means that buyers and sellers are not buying directly from one another but rather through an intermediary. It is more inclined toward the technology, health care, and consumer services sector. Some large companies listed on the Nasdaq include Microsoft, Google, Facebook, Amazon, Tesla, and Apple. The Nasdaq Composite Index is heavily weighted toward the technology sector and has become a staple of financial market reports.

Chicago Board Options Exchange (CBOE): CBOE is the largest options exchange in the US and was founded in 1973. It offers trading across multiple asset classes and geographies, including options, futures, US and European equities, exchange-traded products (ETPs), global foreign exchange (FX), and multi-asset volatility products.

New Entrants

The Members Exchange (MEMX): MEMX was launched in September 2020 and was founded by a group of banks, financial services firms, market makers, and retail broker-dealers. It is backed by Goldman Sachs, BlackRock, Morgan Stanley, Fidelity, Citadel, and Virtu Financial. With an aggressive approach to pricing, MEMX has gained more than 4% market share, surpassing the volume of some exchanges run by Intercontinental Exchange Inc's New York Stock Exchange, Nasdaq Inc, and Cboe Global Markets. MEMX offers favorable pricing for brokers, which results in a small loss for the exchange on each trade.

IEX: IEX started as an Alternative Trading System in 2013, and the story behind this founding was chronicled in Michael Lewis’s 2014 book, Flash Boys: A Wall Street Revolt. IEX Exchange is a national securities exchange in September 2016 for facilitating the trading of U.S. equities.

Miax Pearl Equities: Miax was founded in 2012 as an options exchange. It expanded to equities in 2020. The exchange raised $22 million from market makers, including Citadel Securities and UBS, in prepaid blocks of fees that will convert to equity. The three options exchanges run by Miax account for about 15% of the US options market.

Despite the entry of new offerings in the stock exchange space, new entrants have only managed to capture roughly 7% of the daily trading volume in the US equities market as of February 2023. Three legacy exchanges combined represent more than half of the US market. In addition, LTSE is the only new exchange approved for new listings, and it does not appear that any other new exchanges are going after this market segment.

Business Model

Exchanges make money through listing fees, trading fees, and selling trading data to traders, firms, and news outlets.

LTSE’s business model is unique for two reasons. First, LTSE does not sell proprietary trading data to investors to ensure all investors have access to the same data. Second, LTSE does not charge transactional trading fees on each trade like most other exchanges, instead opting for a $10,000 annual membership fee.

LTSE relies heavily on revenue from new listings. The exchange’s initial listing fee for companies is between $150K and $500K depending on the company’s market capitalization. LTSE also charges an annual listing fee of between $90K and $300K in 2023, and this will increase to between $150K and $500K in 2024.

LTSE also earns revenue from its equity management platform, LTSE Equity, which is a SaaS product with tiered pricing:

Free: Only for companies with up to 10 shareholders and less than $1 million raised.

Fundamentals: $60/month to $250/month, depending on the number of shareholders.

Boost: $330/month to $550/month, depending on the company’s stage.

LTSE’s pricing for listing fees is not too different from the Nasdaq and NYSE. Recently, the Nasdaq and NYSE changed their initial listing fee structures to include a one-time fee of $270K (plus a $25K application fee) and $295K, respectively. However, these two exchanges have lower minimum annual listing fees compared to LTSE, with the NYSE minimum annual fee being $80K and the Nasdaq minimum reaching as low as $50K.

Traction

LTSE began trading in September 2020. As of February 2023, LTSE made up less than 0.01% of the daily trading volume on the US Equities Market.

Over the first three years since LTSE formally launched, three companies have been listed on the exchange. Asana is a collaboration software company that went public in 2020 on the NYSE and dual-listed on LTSE in August 2021. As of February 2023, Asana is still listed on LTSE, although the stock plummeted in 2022 in the face of rising interest rates. Twilio, a customer engagement software company went public in 2016 on the NYSE before dual listing in 2021 on LTSE. However, Twilio voluntarily delisted from the exchange in December 2022, citing its commitment to improving operating profitability and cutting unjustified costs. ThredUp is an online clothing resale platform that went public in 2021 on the Nasdaq and dual-listed on LTSE in late 2022.

LTSE Equity has 36K startup customers, including ClearCo, Outschool, and DrChrono, as of February 2023. The company also possesses official partnerships with accelerators and banks, including YCombinator, TechStars, SVB, and First Republic.

Valuation

LTSE raised $100 million at an undisclosed valuation in June 2022 from James Walton, a member of the Walton family that founded Walmart and now owns half of all Walmart shares. This latest funding round raises LTSE’s total funding amount to $169.4 million. In 2019, the company had previously raised $50 million in Series B funding led by Founders Fund, with new investors joining existing ones like Andreessen Horowitz, Obvious Ventures, and Initialized Capital in 2019. Although the company’s valuation has never been publicly disclosed, it was estimated to be between $400 million to $600 million in June 2022.

Key Opportunities

Private Companies Waiting To Go Public

The median time to IPO for companies lengthened from 8 years in the 1980s to 11 years from 2001 to 2022. This trend is pronounced in venture-backed tech companies, as the median time to IPO increased from 6.5 years in 1980 to 15 years in 2022.

Possible reasons for this trend vary, including access to higher amounts of capital in private markets, not wanting to submit to the intense regulatory scrutiny of being a public company, and the desire to focus on long-term initiatives instead of quarterly earnings reports. This last reason is well-documented among both tech CEOs and investors. In a 2018 letter to the SEC, notable LTSE backer Marc Andreessen also cited these pressures as “one of the most damaging” factors in a company’s decision to delay its public launch.

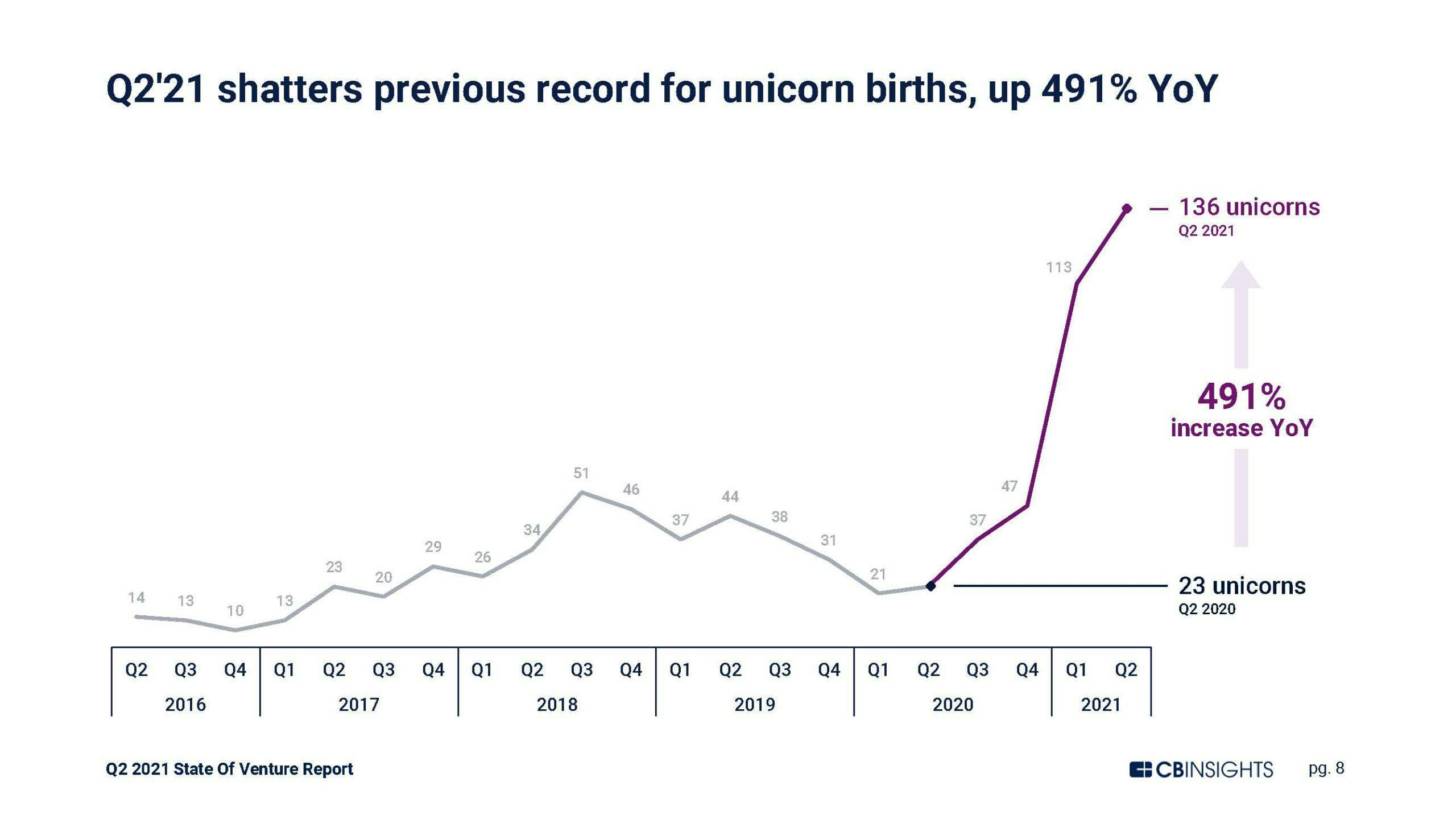

Due to these trends, the number of unicorns - private companies valued at over $1 billion - dramatically increased between 2016 and 2021, with the total number of unicorns reaching over 1.2K companies as of February 2023. This list includes several noteworthy tech companies, including Stripe, Canva, Databricks, and Epic Games. This presents an opportunity for LTSE as the exchange that targets long-term-focused companies with a particular emphasis on the tech sector.

Source: CB Insights

The Rise of ESG

In 2022, a Mckinsey study found that more than 90% of S&P 500 companies publish ESG reports, up from 85% in 2017. In addition, the same study found that 70% of Russell 1000 companies publish ESG reports. On the investment side, global inflows into sustainability-focused funds rose from $5 billion in 2018 to almost $70 billion in 2021. Total ESG-related assets under management (AUM) are projected to reach $33.9 trillion by 2026.

With its focus on ESG causes, LTSE has the opportunity to benefit from the increasing awareness of how companies interact with the environment, society, and other stakeholders, given that many ESG initiatives have a long time horizon. As an increasing number of companies seek to improve their ESG impact, LTSE could emerge as a perfect mechanism for companies to signal their commitment to these issues.

Key Risks

Skepticism of the Underlying Premise

Many argue that the short-term pressures on companies are not inherently negative and serve a purpose in the corporate world. Hedge funds and activist investors are the most outspoken proponents of this argument that the quarterly earnings cycle ensures that management is not slacking and is truly focused on growth. There’s growing evidence against the argument that quarterly focus on earnings is hurting innovation. The total R&D spending increased steadily between 2000 and 2019, and businesses spent more than $500 billion on R&D in 2020 alone. Research from the Fed also shows little evidence to prove that increased share buybacks, which are lauded as an example of short-term corporate thinking, cause lower corporate investment.

This skepticism prompts questions as to whether LTSE is even necessary. Jesse Fried, a Harvard law professor with expertise in corporate governance, believes the exchange will become a marketing tactic for Silicon Valley CEOs and investors instead of an exchange promoting long-term innovation. If these critics are right, companies will have difficulty justifying the additional costs for listing on an exchange that doesn’t serve their long-term vision, especially during intense cost-cutting from companies.

IPO Market Freeze

The US IPO market experienced a severe downturn in 2022, with total deal volume decreasing 78% from 2021. Tech companies received the brunt of this harsh IPO environment. For example, zero tech companies raised over $1 billion in a 2022 IPO after 15 companies achieved this in 2021. There is uncertainty that the IPO market will rebound in 2023 due to recessionary fears and interest rate hikes from central banks. If this trend of a weak IPO market continues, LTSE’s listings-centric business model could be at serious risk.

Summary

Market participants have debated the impacts of short-termism for decades, with proponents arguing that it keeps CEOs in check and focused on growth, while opponents believe it stifles vital long-term corporate innovation. Despite the debate, innovation for exchanges, especially for new company listings, is few and far between. LTSE has the opportunity to change this by providing a new exchange for companies dedicated to long-term innovation.

Despite the exchange’s grand intentions, only three companies have been listed on LTSE during the first three years of trading, and only two remain listed. Regardless of what investors and supporters believe, the key question stands as to whether LTSE offers a valuable enough solution for companies to justify costly dual listings, especially during bleak business environments.