Thesis

Almost every technology company is a complex web of equity ownership from the founders to the investors to the employees. Managing that process is a combination of strike prices and share counts recorded on a company’s capitalization table, or cap table for short. The status quo for managing a company’s cap table is an expensive lawyer and a complicated spreadsheet getting sent back and forth, updated any time a company’s ownership dynamics changed. Unfortunately, every time issues arise in that process it can cost over $20K in legal fees to fix.

Beyond managing cap tables, the process of facilitating an organization’s equity has a number of other variables such as employee compensation, 409A valuations for tax purposes, financial reporting and QSBS tax exemptions. In 2024, there were 4.6K funding rounds, with each financing requiring 2-5 lawyers involved. Not to mention the hundreds of in-house counsel lawyers helping to manage a company’s equity.

Carta was built as a platform to manage a company’s cap table and has expanded to address the broader suite of needs in managing an organization’s financial and operational complexity. The company has accumulated an extensive network of venture-backed startups and venture investors. As of February 2023, 95% of startups choose Carta as their cap table management software.

Founding Story

Henry Ward (CEO) and Manu Kumar founded Carta in 2012 starting with equity management for private companies.

Before becoming an entrepreneur, Ward worked on software for fixed-income traders. In 2011, he started a company called Secondsight to bring algorithmic fixed-income trading to retail investors. During his failed attempt to raise a seed round for Secondsight, Ward met investor Kumar, who later suggested Ward start a company to help manage stock certificates.

Several months later, in July 2012, Ward and Kumar co-founded eShares. As the company moved beyond digital stock certificates to 409A valuations and compliance, eShares rebranded to Carta in November 2017. The word “carta” means a charter, or a formal document for incorporation. A comprehensive word for the variety of products that Carta offers its customers.

Product

Equity Management

Cap Table Management

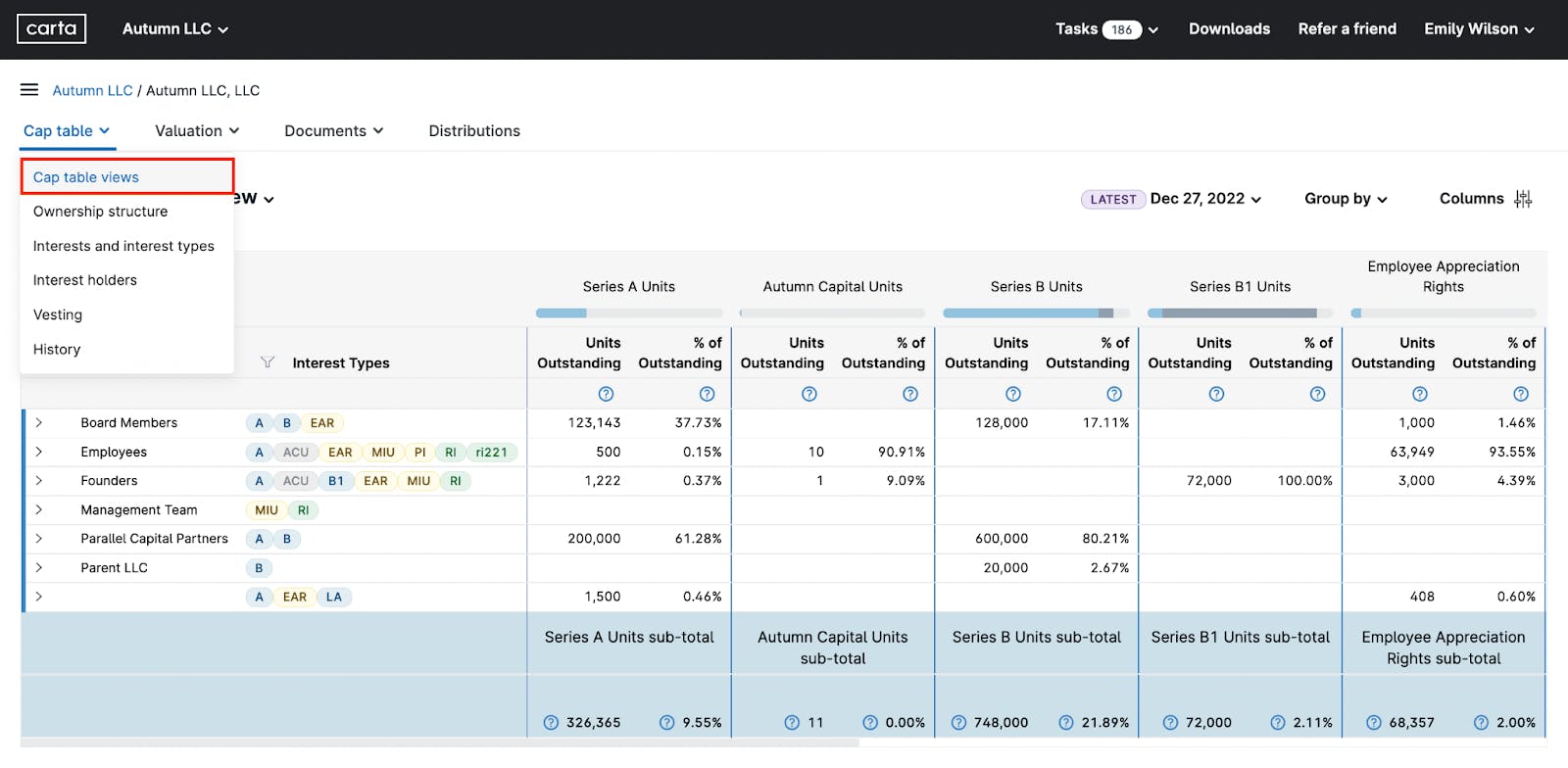

Source: Carta

Carta provides equity management for private companies, including cloud-based cap table management software. A cap table tracks a company’s equity owners and requires updating when trading or issuing securities, like in a funding round. The company offers a solution for tracking company ownership, issuing shares, and managing security holders. The platform eliminates the need for spreadsheets, providing a centralized and secure system for all equity-related activities. Companies can issue shares directly to stakeholders and process stock transfers electronically.

Cap Table Management also facilitates the creation and management of employee equity plans with electronic exercising capabilities. To support compliance efforts, Carta’s Cap Table Management platform generates audit-ready reports for GAAP and IFRS standards, assists with Rule 701 management, and produces necessary tax forms such as 83(b) and Form 3921. The platform includes integrated stakeholder communications, HRIS and payroll system integrations, and secure money movement via ACH and wire transfers as an SEC transfer agent. Carta's acquisition of Capdesk, a London-based equity management platform, in September 2022 further expanded its capabilities and geographic reach, particularly in Europe. This move strengthened Carta's position in offering equity management solutions to startups globally. At the time of acquisition, Capdesk boasted £90 billion of assets and over 3.5K companies on its platform.

Equity Advisory

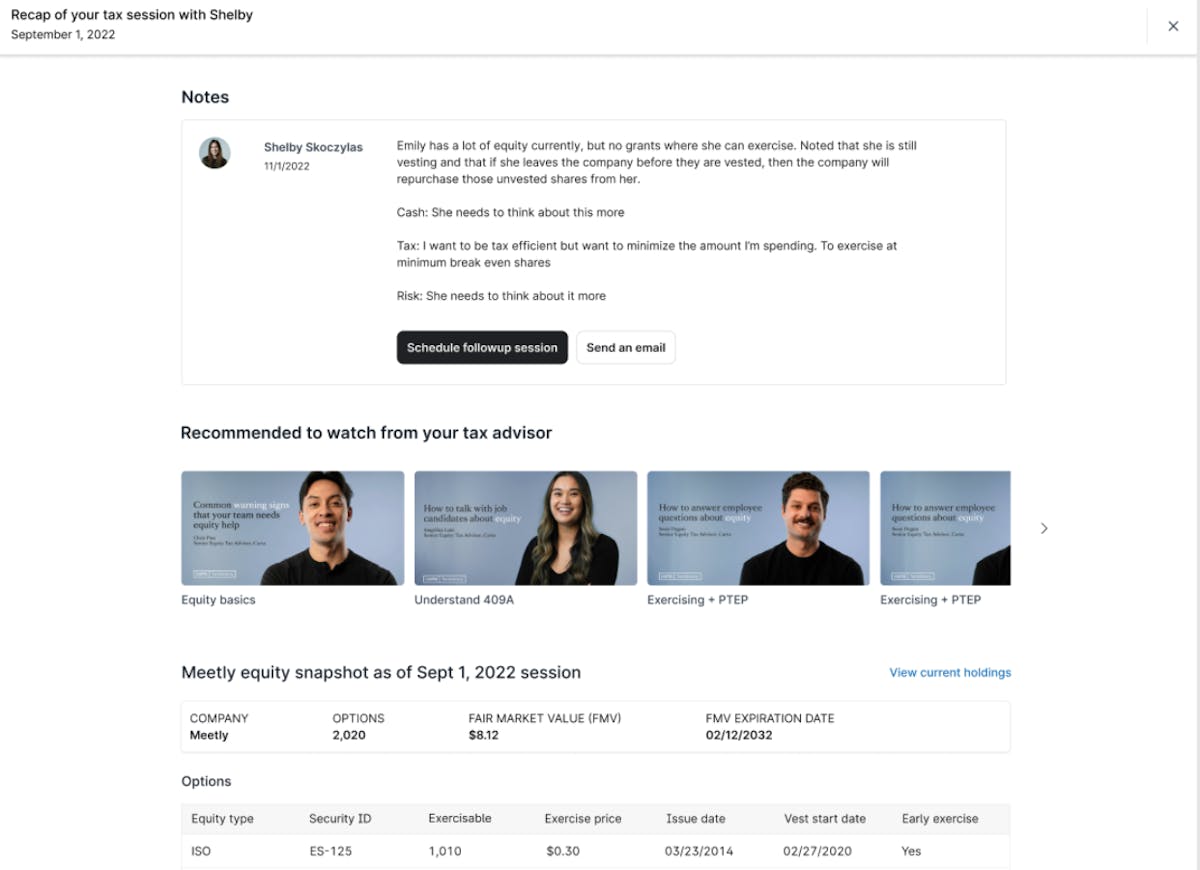

Source: Carta

In April 2021, Carta announced its acquisition of YearEnd, a company offering tax advice to startup employees. Carta later rebranded YearEnd as Equity Advisory. Carta’s Equity Advisory helps stock-compensated employees understand their equity and manage it with an awareness of tax implications. The core product provides unlimited one-on-one equity education sessions with experienced equity tax advisors, allowing employees to review all their equity grants and understand the costs associated with exercising options. This personalized approach ensures that each employee receives tailored guidance on their specific equity situation.

The service goes beyond basic education by offering tax strategies, providing insights on the implications of exercising or selling equity, and highlighting potential tax breaks and credits. Employees gain year-round access to on-demand educational content covering topics such as equity awards, vesting, and valuations. Equity Advisory is directly integrated with the company's cap table, ensuring that all information provided is accurate and up-to-date. Additionally, Carta offers an integration with Slack, enabling easy session booking and notifications.

QSBS Attestation

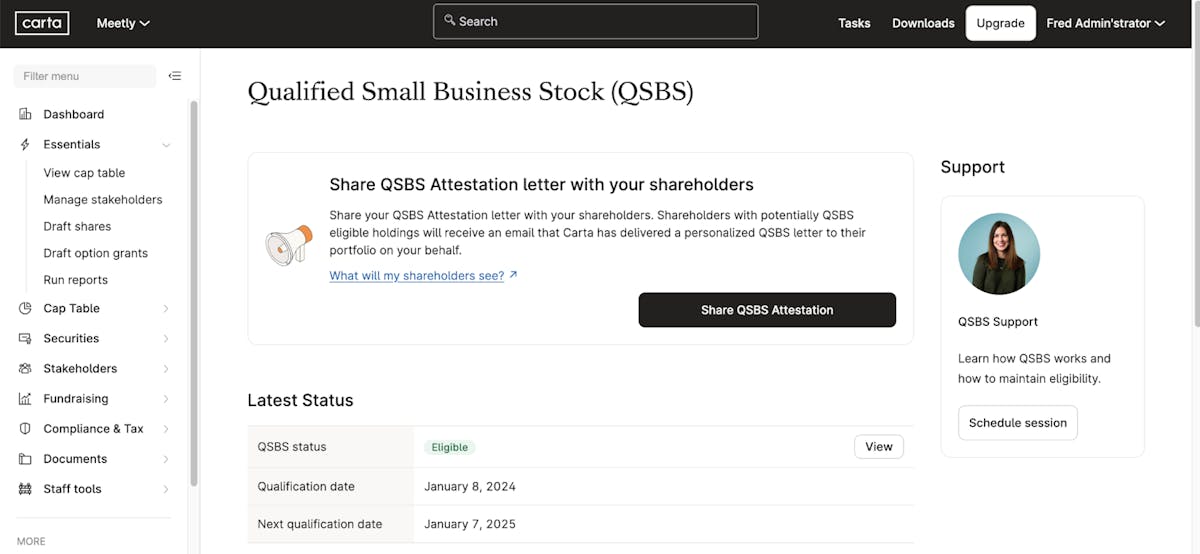

Source: Carta

Carta's QSBS Attestation product aids the complex process of managing Qualified Small Business Stock (QSBS) tax exemptions. This solution enables companies to establish eligibility dates and qualify securities while providing a centralized dashboard for efficient tracking and administration. The product offers in-product tagging of eligible securities and automatic notifications to shareholders regarding QSBS-verified or eligible shares. Carta's QSBS Attestation ensures continual guidance on maintaining QSBS eligibility and performing automatic checks with each 409A valuation. Focused on facilitating smooth tax filing, the product generates necessary QSBS documentation within 10 business days, simplifying compliance and maximizing tax benefits for eligible shareholders.

Total Compensation

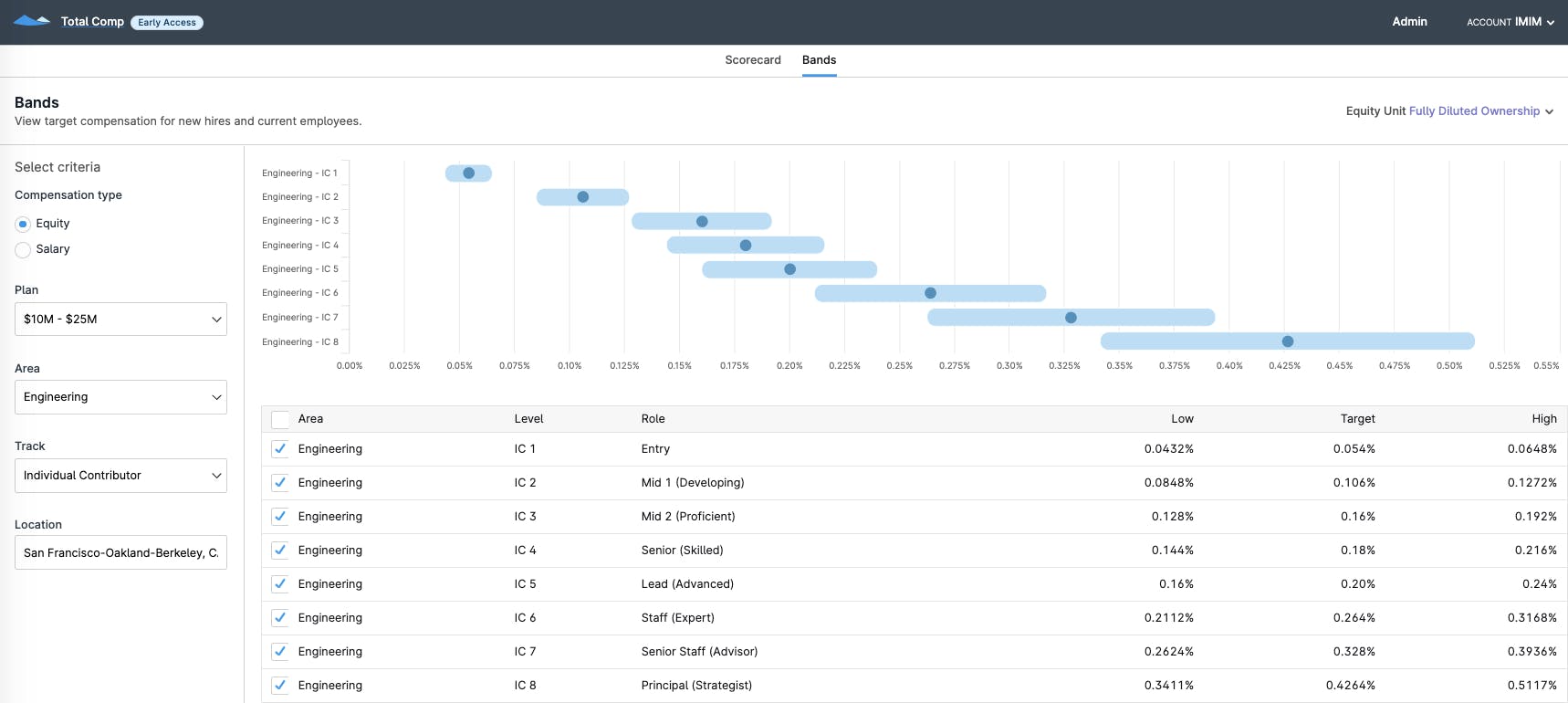

Source: Carta

Carta's Total Compensation, launched in April 2021, is a solution designed to help companies create and manage competitive compensation strategies tailored for the startup ecosystem. Leveraging what Carta claims to be "the largest set of private company equity and salary data," the product offers insights across various roles, levels, and regions, updated quarterly to ensure the most current market information. At its core, Total Compensation enables companies to benchmark their compensation packages against industry standards, develop and iterate on compensation plans, and address pay inequities. The product's equity planning tool helps determine appropriate equity grants and forecast related expenses, integrating with existing cap table data to prevent over-allocation. For post-fundraising scenarios, Total Compensation includes burn rate management functionality. For efficient HR processes, it offers integration with human resources information systems (HRIS). By enabling data-driven compensation decisions and clear communication, Total Compensation aims to help companies attract and retain talent without overspending.

409A Valuations

Annual 409A valuations are a critical requirement for most tech companies, especially those with over 10 employees and more than $5 million in fundraising. These valuations determine the common share value on a company's cap table, enabling tax-compliant option grants for employees. Carta aids this process by providing comprehensive 409A valuation services for compliance with regulations. Carta's 409A Valuations product manages the expensing of stock-based compensation in accordance with Accounting Standards Codification (ASC) 718. It also simplifies the preparation of Form 3921 when employees exercise incentive stock options (ISOs). To maintain audit readiness, Carta offers 409A audit support and account audit reports. Additionally, Carta identifies disqualifying dispositions. Disqualifying dispositions are ISO sales that occur less than two years since the grant or less than one year since exercise.

Liquidity

Liquidity is Carta’s secondary market for private companies. Carta’s SEC-registered agent said the platform serves “company-led secondary offerings, such as tender offers.” The platform is designed to streamline the process of running tender offers for companies. The integrated system leverages cap table data to facilitate efficient launch, transaction, and settlement of tender offers, minimizing delays and errors. Companies gain access to tools for customizing deal parameters and seller models, allowing for strategic planning and optimization of tender offer structures. Liquidity provides end-to-end control over the tender offer process, from setting terms and selecting buyers to approving orders. It incorporates a user-friendly workflow management system that guides eligible sellers through offer review, document signing, and proceeds estimation through their personal Carta accounts.

Upon deal closure, Carta's Liquidity solution simplifies the final steps with one-click functionality for reviewing deal summaries, distributing proceeds, and updating cap tables. This allows companies to achieve liquidity without an IPO, potentially delaying or foregoing one altogether. With Liquidity, companies can run tender offers, with cap tables automatically updated to reflect each transaction. Carta’s Liquidity product provide more flexibility than tender offers. They resemble a stock exchange with additional rules. Companies can control which entities transact and how much they transact. Buyers and sellers can access the same information as they would with a public company, although the information is secure and requires permission to access. Throughout the process, companies benefit from dedicated team support, offering insights on deal structuring, industry best practices, and current market trends.

In February 2021, Carta launched CartaX as a marketplace platform to connect buyers and sellers of private market stock. Transactions could leverage Carta’s Liquidity product for the transaction, but Carta was acting as a market maker in facilitating the transactions. By June 2023, Carta had facilitated ~$10 billion in liquidity transactions across ~270 transactions. Then, in January 2024, Linear CEO Karri Saarinen published a LinkedIn post indicating that CartaX had used private cap table data to identify Linear investors who had never been disclosed and then contacted them in order to purchase shares. As a result, Henry Ward announced Carta’s plans to exit the secondaries business:

“Because we have the data, if we are trading secondaries, people will always worry that we are using the data, even if we are not. So we have decided to prioritize trust, and exit the secondary trading business.”

Fund Management

Carta introduced its Fund Management module to better serve its network of investors. Carta's Fund Management solution offers a comprehensive suite of tools for venture capital and private equity firms. Besides their software products, Carta also offers 1-on-1 consulting to help with fund strategy.

Carta has built a network of VCs using their platform for portfolio management as well. VCs then ask startups to use it for their cap table management, offering investors the benefit of viewing their entire portfolio in one place. Meanwhile, portfolio companies benefit from discounted rates for cap table management. Investors with more portfolio companies using Carta’s to simplify operational complexity are 21x more likely to also use their funds’ administration. After capturing mindshare, Carta expanded its product suite into functionality around compensation management and private market equity, before moving away from the latter.

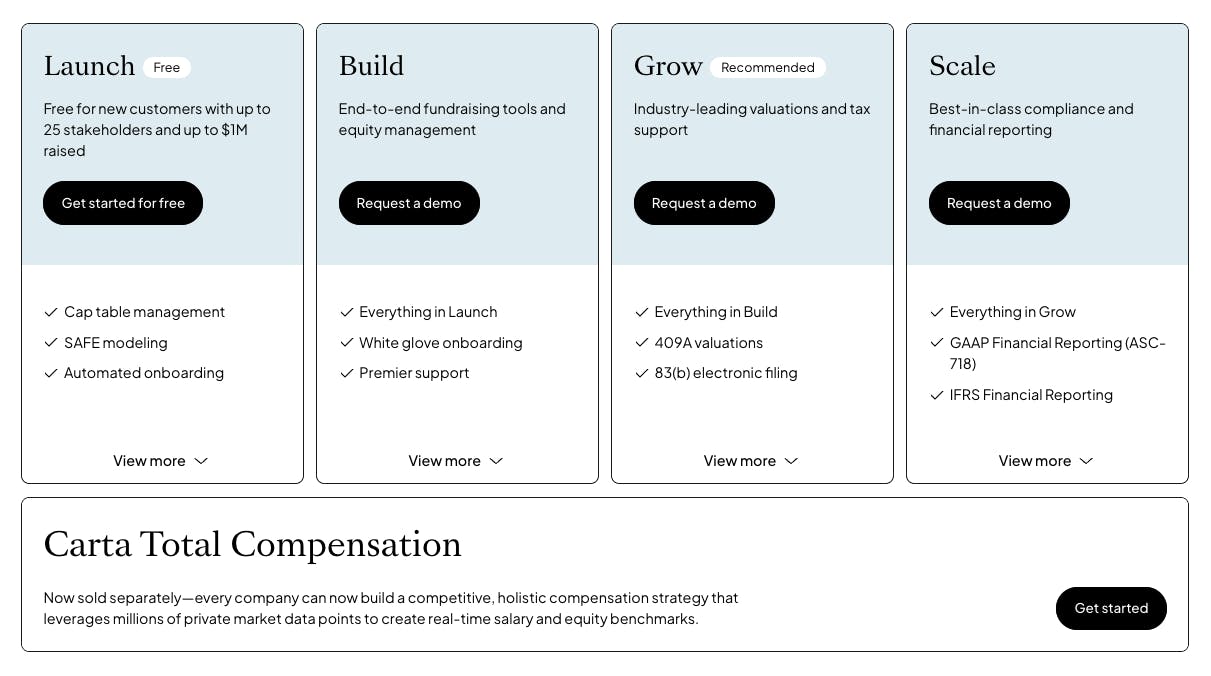

Fund Admin Portal

Source: Carta

The Fund Admin Portal is a platform for fund management and administration. It provides real-time access to fund performance metrics, including IRR, TVPI, DPI, and RVPI, allowing investors to evaluate their investments. The portal's scenario modeling tool enables analysis of various fundraising and exit options, helping users understand potential impacts on existing shareholders. Users can initiate capital calls, distributions, and investments directly through the platform, enhancing operational efficiency. Communication features include secure messaging with fund administrators, investor updates, and board management tools. For due diligence, the Fund Admin Portal offers virtual data rooms with integrated document tracking and access control. The platform's API allows integration with other reporting software, consolidating transaction and holdings data for comprehensive LP reporting. By bridging the gap between cap table providers and fund administrators, the Fund Admin Portal offers a single solution for fund management, investor relations, and performance analysis.

Fund Formations

Investors can form and launch funds with Carta's Fund Formations service. This service guides investors from thesis to capital call in as little as six weeks, offering a step-by-step process to set up legal entities, plan capital calls, and develop robust financial models. Fund Formations provides support from formation specialists, and a closing experience for sharing documents and conducting KYC checks. The service caters to both emerging managers and seasoned investors, supporting them from formation to administration across all their funds. In June 2022, Carta announced its acquisition of Vauban, a platform for investors to launch and manage their funds and raise and deploy capital. Based in the United Kingdom, Vauban focused on European ventures. The acquisition adds to Carta’s offerings for investors and provides Carta with a foundation for international growth. Over half of US-based special purpose vehicles and funds have a non-US-based LP, demonstrating the global nature of venture capital.

ASC 820 Valuations

ASC 820 Valuations provides accurate, audit-ready fair value measurements for investment portfolios. Developed with Big 4 firms, this service employs software and specialists to determine appropriate methodologies, collect data from portfolio companies, and complete comprehensive valuations. Funds can receive ASC 820 valuations required every financial reporting period. The process ensures compliance with accounting standards and delivers unbiased assessments critical for each financial reporting period, giving fund managers confidence in their investment valuations. Limited partners (LPs) are able to sign documents and view fund finances.

Fund Tax

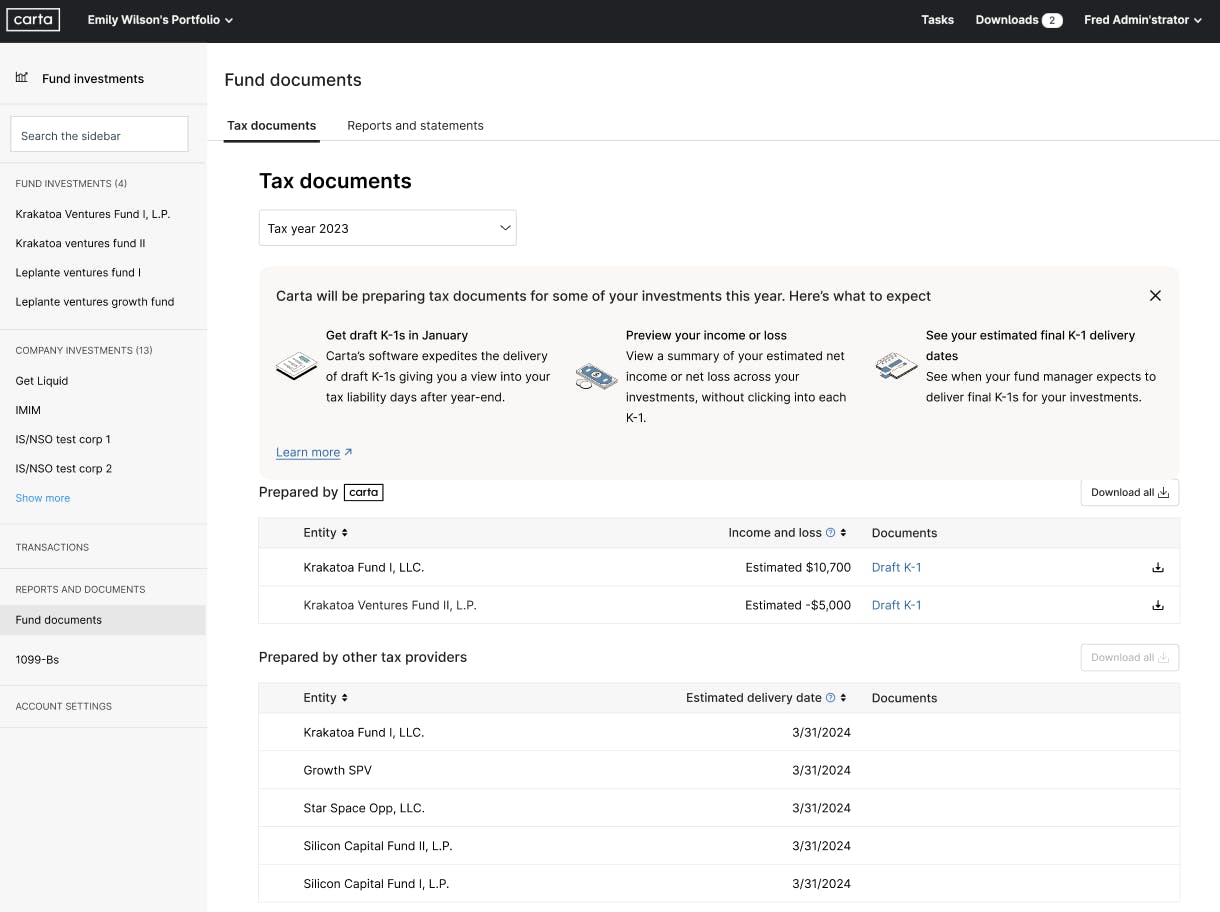

Source: Carta

Carta offers Fund Tax as an integrated tax preparation and filing service for funds. This is an add-on to Carta's Fund Admin Portal. It centralizes accounting and tax management, providing visibility into tax return progress through a dashboard. Supported by industry experts, Fund Tax ensures accurate preparation of Form 1065s, K-1s, and state tax documents. The service includes one-on-one consultations with tax professionals and can accommodate funds with international components through an additional package. By streamlining the tax process, Fund Tax aims to simplify tax management for fund managers, offering efficiency and transparency throughout the tax preparation cycle.

SPV Management

Carta's SPV product offers a solution for creating and managing special purpose vehicles. The platform supports both syndicate and institutional SPVs, with options for Delaware LLC or LP structures in the US, offshore, and international jurisdictions. It handles formation filings, legal documentation, and banking setup while facilitating investor compliance checks and capital calls. SVP features customizable reporting periods, side letters, and carry structures. This allows investors to focus on deal-making while Carta manages the administrative complexities of SPV operations.

Capital Call Line of Credit

Carta's Capital Call Line of Credit provides venture capital and private equity firms with flexible, on-demand financing outside regular call schedules. This product offers transparent terms, fixed pricing, and an efficient application process, enabling firms to quickly access capital for time-sensitive deals or unexpected expenses. Through a single login, fund managers can easily request advances, manage paybacks, and view loan information. Carta has partnered with Coastal Community Bank and Customers Bank to offer these loans, featuring a straightforward fee structure that remains consistent regardless of drawdown frequency. Capital Call Line of Credit allows firms to seize investment opportunities without burdening their LPs, all through Carta's Fund Admin Portal.

Market

Customer

Carta’s ideal customers are startups and venture funds. Early-stage startups become paid customers as they grow and raise more capital. Investors participating in rounds with startups using Carta get the benefit of easy visibility into their portfolio’s cap tables through a centralized dashboard. As startups become familiar with Carta they’re more likely to use Carta for other needs, like liquidity and compensation management, in the future. Notable Carta customers include Calendly, Base10, Valor Ventures, Relativity, Flexport, and Greycroft.

Market Size

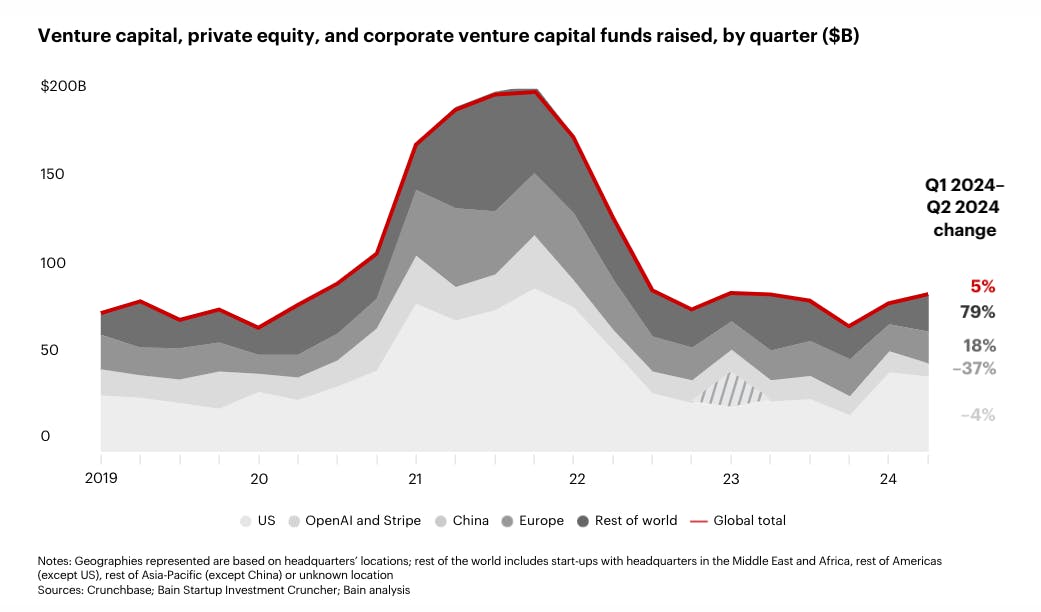

Source: Bain & Company

Carta focuses primarily on VC firms and VC-backed businesses. The global venture capital market grew 11x between 2006 and 2021 and is projected to grow at a CAGR of 20.1% from 2022 to 2027. Growth in the VC market provides a larger base of potential Carta customers.

In Q2 2024, global venture funding grew 5% quarter over quarter, with 4.5K deals equating to $94 billion in capital funding to startups. In 2023, equity management software was a $654.6 million market that’s projected to grow at a 13.5% CAGR reaching $2.9 billion by 2036. This growth is driven by the demand to go paperless and eliminate manual processes through more automation.

Competition

Carta has historically dominated cap table management with a 95% market share as of Q1 2021. The company’s customers are 47% middle market and 47% small business. While there is meaningful friction for customers to switch away from Carta’s products, there are always opportunities. For example, Carta’s negative press around CartaX created some hesitation around how much customers could trust Carta in managing their data. In addition, specialized solutions in some of Carta’s product categories may win over customers who are more focused on a best-in-class solution as opposed to an all-in-one.

Equity Management

Pulley: Founded in 2019, Pulley is a cap table and equity management platform that offers a solution for startups and growing companies, with a particular focus on early-stage businesses. The company's product suite includes cap table management, 409A valuations, equity issuance, fundraising tools, and compliance support. As of January 2025, Pulley had secured $50.2 million in funding across three rounds, with notable investors including Founders Fund, Stripe, Elad Gil, and Y Combinator. As of October 2022, Pulley was valued at $250 million.

Distinguishing itself from competitors like Carta, Pulley emphasizes faster onboarding and valuation processes, claiming same-day onboarding and 409A valuations in less than five days, with an average onboarding time of 7-10 days compared to Carta's up to 90 days. This efficiency may provide an advantage in customer acquisition, particularly among its core user base, as 86% of Pulley's customers are small businesses. The platform is designed to support companies from incorporation through growth stages, offering a more customizable solution that can scale with the business. Pulley also supports token cap tables, an essential feature for web3 startups. In 2023, Pulley gained market share and increased attention from concerns with Carta’s workplace environment.

Pave*: Pave stands as Carta's primary competitor in the compensation management market for tech startups, offering a comparable product suite. Founded in 2019, the company was valued at $1.6 billion as of June 2022 after raising $163 million in total over four funding rounds. Pave has raised money from notable investors like a16z, Contrary, Index Ventures, Bessemer Venture Partners, and Y Combinator. The company's offering is structured into three main components: Market Data, Compensation Workflows, and Communication. Pave provides free access to its Market Data module when companies connect their HRIS and cap table data. In a strategic move to enhance its data resources, Pave acquired Option Impact in July 2022, along with the Venture Capital Executive Compensation Survey (VCECS). This acquisition improved Pave's Market Data, allowing customers to access both Option Impact and VCECS data alongside Pave's proprietary dataset.

Pave's Communication product, similar to Carta's Total Rewards Statement, enables employees to visualize their total compensation package. Compensation Workflows offers subscribers tools to develop compensation strategies and gain deeper insights into employee data, facilitating the addressing of pay inequities and targeted compensation for high performers. As of January 2025, Pave reported a customer base of over 8.5K private and public companies, claiming to be the largest compensation provider for private companies globally. This extensive customer network contributes to Pave's growing dataset, potentially challenging Carta's ability to maintain a competitive edge in product offerings. However, Carta maintains an advantage through its established relationships with startups for cap table management, which inherently provides access to employee equity data.

Global Shares: Global Shares was founded in 2005 and acquired by J.P. Morgan in 2022 for €665 million. The company is a provider of equity compensation management services and software for companies worldwide. Now part of JPMorgan Workplace Solutions, Global Shares offers a platform for equity compensation administration and reporting. Its solution provides technology for employees to access their equity holdings, financial education, and insights, while offering full-service administration and seamless integration with HRIS and tax systems. Global Shares differentiates itself from competitors like Carta by providing a more integrated approach with dedicated support teams and a focus on connecting various financial systems. The company has a strong presence in Europe, particularly due to its Irish roots, and has been aggressively targeting the early-stage market. J.P. Morgan's acquisition of Global Shares, along with other purchases like Aumni, appears to be part of a broader strategy to capture valuable company data for potential future IPO opportunities and investment banking services.

Fund Management

Standish Management: Founded in 2007, Standish is a specialized fund administration services provider catering to managers and general partners of various private equity funds. The company markets itself to various private funds, including real estate, buyout, and VC funds. Standish Management provides fund administration solutions, including accounting, reporting, and technology services, designed to help clients scale their operations efficiently while allowing them to focus on their core investment activities. With a portfolio of over 4K administered entities, Standish Management has established a presence in the fund administration space. While both Standish Management and Carta offer specialized services for fund administration and equity management, Standish Management's focus appears to be broader, encompassing a wide range of fund administration services and customized technology solutions for various types of private funds.

Aduro Advisors: Founded in 2012, Aduro Advisors is a specialized fund administrator catering primarily to VC and PE funds. The company offers a suite of services for fund operations, accounting, and investor reporting. At the core of Aduro's offering is FundPanel.io, the company’s proprietary software platform designed for fund operations, investor relations, and portfolio monitoring functions. This platform provides clients with real-time access to critical fund information and institutional-grade reporting capabilities. While Aduro Advisors shares some similarities with Carta in terms of offering solutions for managing equity and fund administration, Aduro's focus is more narrowly tailored to fund administration services, particularly for venture capital firms. This specialization allows Aduro to offer a more targeted approach to fund operations and accounting compared to Carta's broader equity management services.

AngelList: AngelList was founded in 2021 and they have raised a total of $170.2 million in funding over eight rounds as of January 2025 from investors like Tiger Global Management, Max Levchin, Google Ventures, a16z, Kleiner Perkins, and 500 Global. As of March 2022, the company was valued at $4 billion. AngelList provides a similar hub for venture investors. AngelList offers a wider scope of products. Like Carta, it provides equity management and fund administration but doesn’t provide compensation management software. However, the company does offer banking services, such as deposit accounts, debit cards, and free wire transfers, to startups and transparently provides pricing on its website.

Business Model

Source: Carta

Carta attempted to sell a subscription, but startups viewed the price as too high. Ward adapted by restructuring the pricing to a $20 fee per stock certificate. The traditional stock certificate issuing process could require paralegals and cost over $100, so the new pricing model is more closely aligned with Carta’s value proposition. Carta later returned to a subscription model. A fee-per-stock certificate model concentrates revenue around funding events and disincentivizes companies from adding many small shareholders. A subscription model, in contrast, provides revenue regardless of funding events and does not discourage companies from adding many small shareholders.

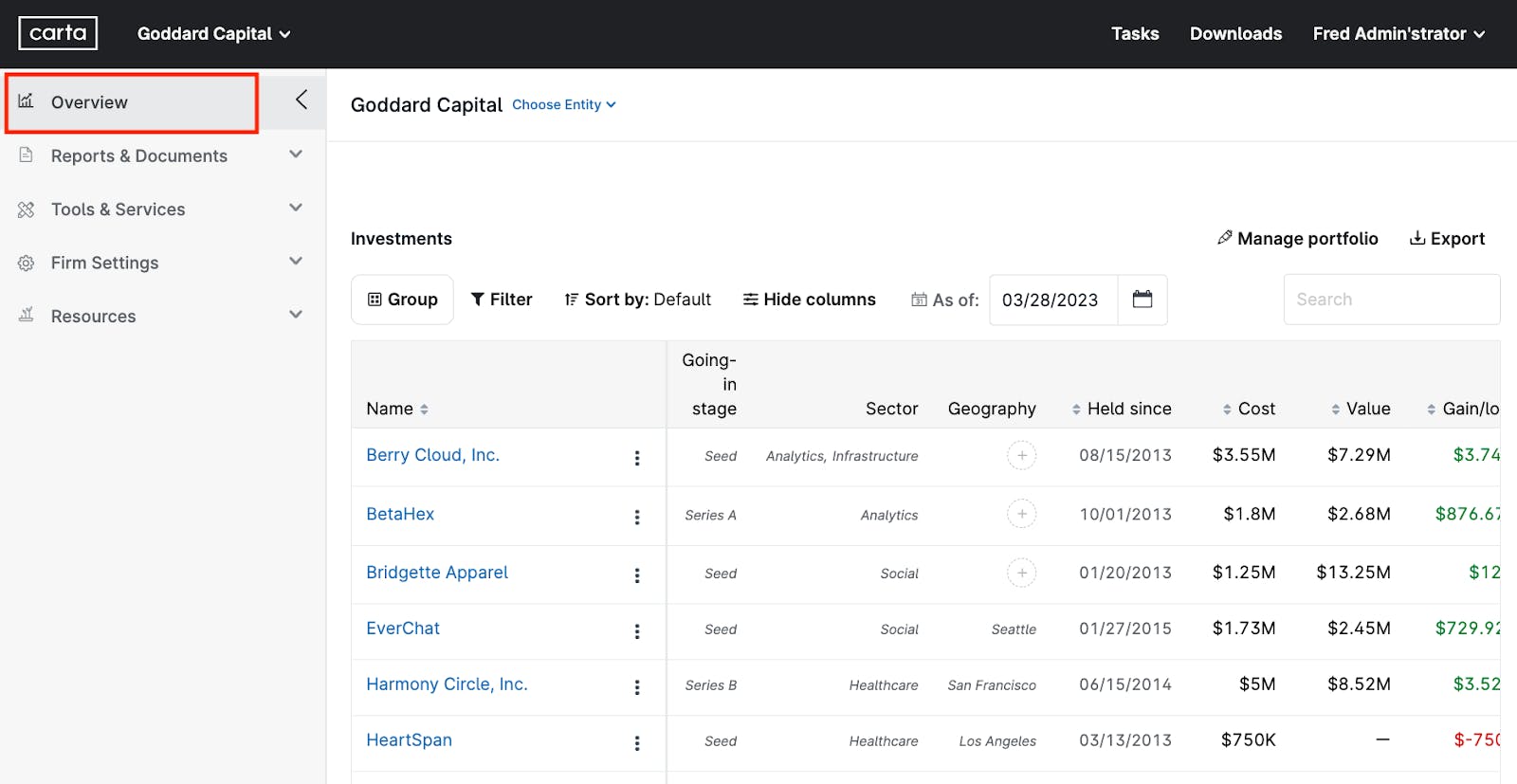

Carta offers four tiers of plans for private company equity management: Launch, Build, Grow, and Scale. The free tier, “Launch,” provides cap table management for smaller, newer startups. Each upgraded tier unlocks additional features, such as 409A valuations, exit modeling, and expense reporting. Customers can separately add liquidity programs, complex 409As, and advanced modeling to their plans. The website does not provide pricing, and customers must contact the sales team to explore the paid tiers. Karri Saarinen, CEO of Linear, has raised $52 million in funding and reported paying Carta $10K annually for cap table management.

Pave, Carta’s Total Compensation’s main competitor, offers benchmarking for free in exchange for company data. Carta may not need to request data for benchmarking, considering it already manages companies’ cap tables containing employee equity grant information. Pave offers its other products as annual subscriptions. Carta may replicate the yearly subscription model for all of Carta’s Total Compensation product, including benchmarking.

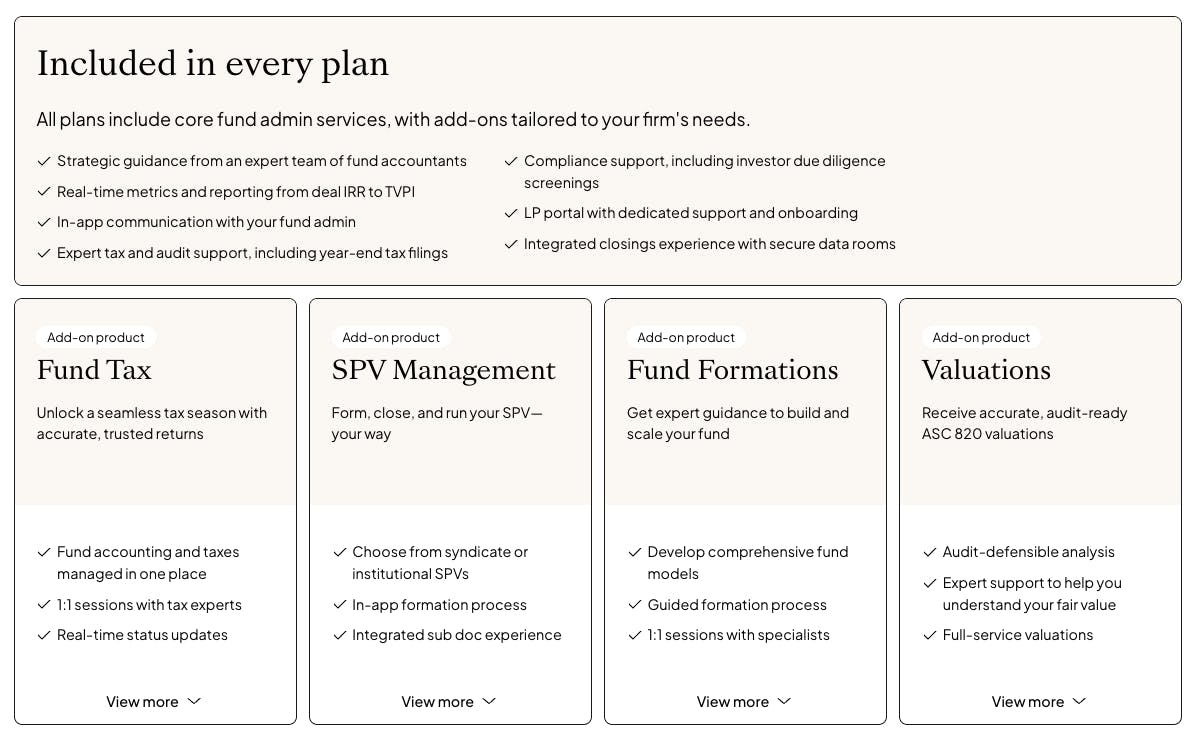

Source: Carta

Carta’s investor services product offers a single plan for fund administration. The plan provides basic tracking of portfolio company ownership. Investors can add on fund accounting and taxes, SVP formation, fund formation, and ASC 820 valuations in addition to the paid subscription. Like their equity management product, Carta does not list pricing for their investor services products and requires potential customers to contact their sales team.

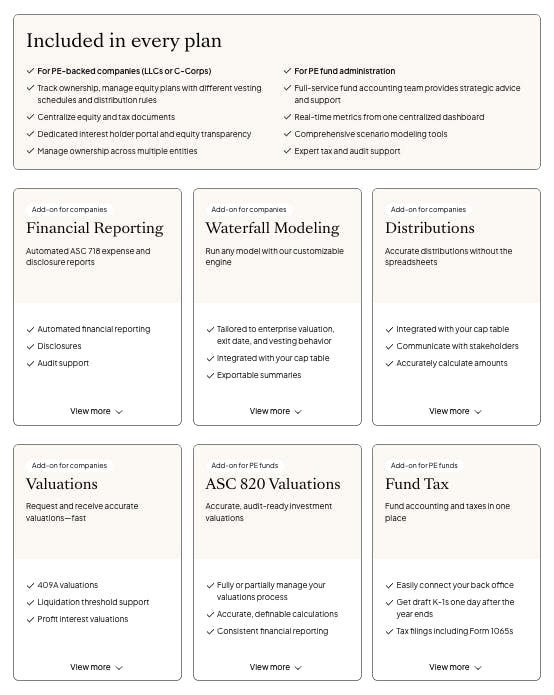

Source: Carta

Carta offers its Fund Management product to private equity funds as well. With a similar plan for VC investors, Carta’s PE product has one basic plan with add ons for reporting, modeling, distribution, valuations, and taxes. Investors, both VC and PE, using Carta’s Capital Call Line of Credit are charged $2K per $1 million borrowed, and a one-time $3K closing fee for use.

Traction

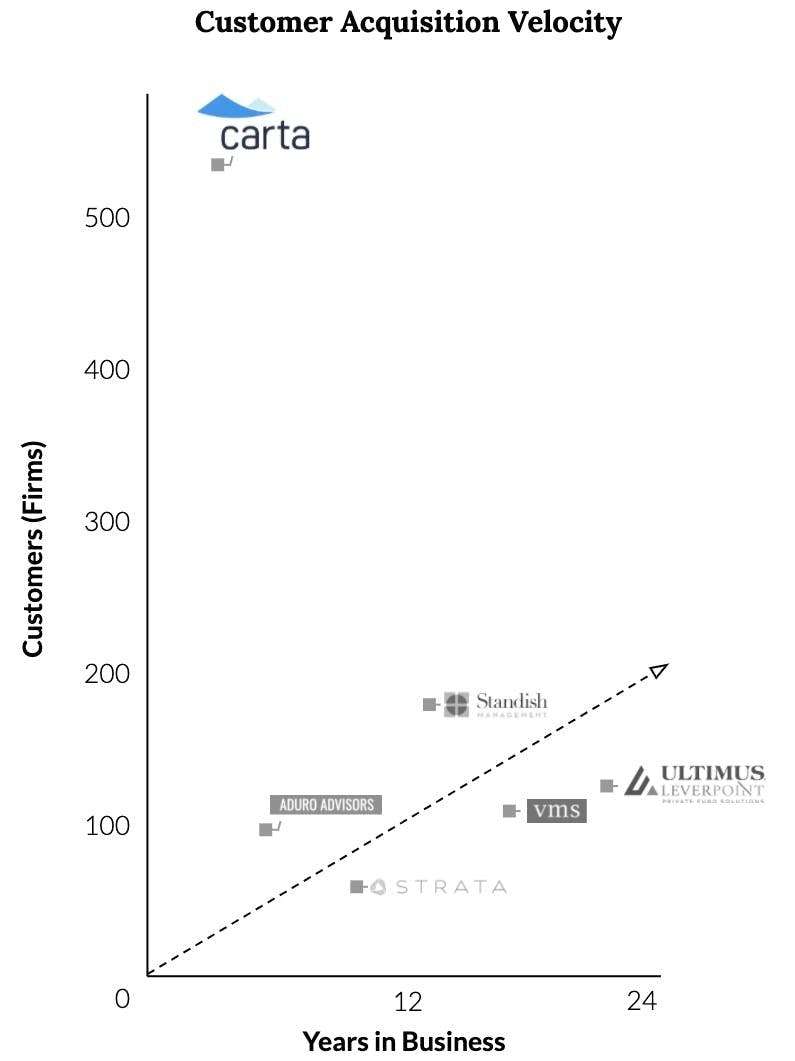

Source: Tribe Capital

As of 2024, Carta administers nearly $150 billion in assets across 8K funds and SPVs. Carta reported $370 million in ARR at the beginning of 2024, a 37% increase from 2022, with its cap table business generating the bulk at $250 million. The company's equity management business has grown from 15K to over 33K companies between 2020 and 2023. Despite facing challenges in its liquidity programs, with a 30% decrease in participating companies and 58% decline in transacted dollars from 2021 to 2022. In August 2024, Public then acquired the brokerage accounts of Carta’s Liquidity business. Carta is investing in its core services, particularly in fund administration, which has become one of the fastest-growing in the industry despite being unprofitable.

Valuation

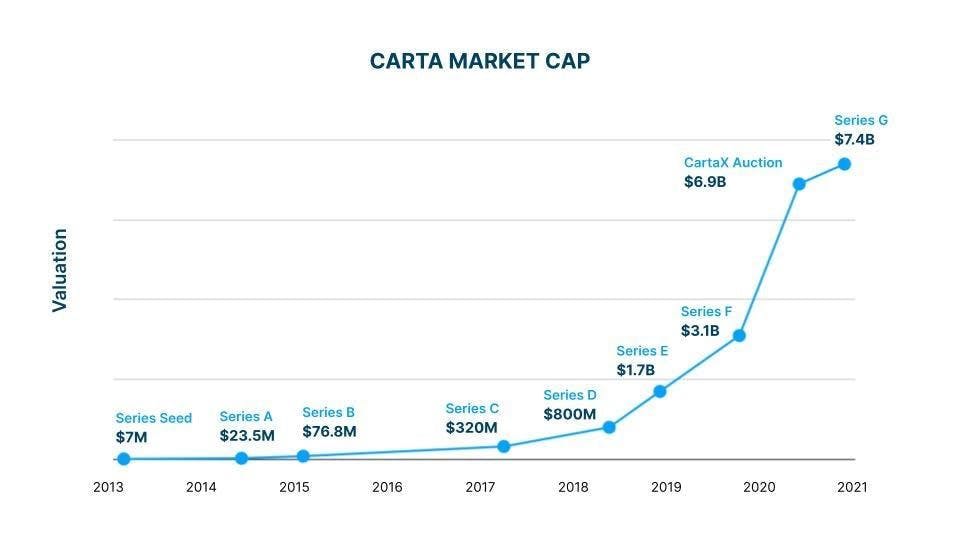

Source: Henry Ward

In February 2021, the company held an auction on Carta Liquidity to arrive at a market-determined pre-money valuation of $6.9 billion, a 46x recurring revenue multiple. In August 2021, Carta then leveraged that valuation to raise a $500 million Series G round led by Silver Lake which valued the company at $7.4 billion. Roughly 15 months after the $500 million raise, Ward said that Carta was worth $8.5 billion following another secondary sale. However, as of January 2025, Carta's valuation on secondary markets had decreased to $3.5 billion. This represents a 53% decrease from its Series G valuation, bringing its implied revenue multiple down to approximately 9.5x based on reported annual revenue for 2023.

In response to a slow private market funding environment and fears of a recession, Carta laid off 10% of its staff, estimated to be around 200 employees, in January 2023. Carta CEO Henry Ward noted the impacts of the slowdown on the company in an email to employees at the time of the layoffs: “If our customers suffer, so do we. And right now the entire tech and venture ecosystem is suffering.”

Key Opportunities

Network of Startups & Investors

Carta intentionally pursued extensive market penetration for venture-backed companies and their investors. The strategy is producing network effects leading to better customer acquisition and retention.

As early as 2016, some investors required their potential portfolio companies to use Carta for their cap tables. As of April 2023, Carta offered a VC partner program offering discounts to portfolio companies to use Carta. Investors with more portfolio companies on Carta are 21x more likely to pay for Carta’s fund administration product. The investors have instant visibility into the cap tables of all their portfolio companies.

The growing Carta network nudges future investors and startups to choose Carta and existing ones to remain with Carta, creating a long-term competitive moat. With the extensive and growing network, other products like Carta Total Compensation could help Carta further monetize their customer base.

Banking Partnerships

The SVB collapse has created new opportunities for bank partnerships in the tech and startup sectors. This shift allows companies, like Carta, to form partnerships leveraging traditional banks' resources, compliance frameworks, and customer trust while offering a complementing solution. For Carta, strategic alliances with banks could provide rapid customer base expansion, enhanced product offerings, reduced acquisition costs, and a competitive advantage in the equity management market. By bridging traditional banking and software, Carta could capture market share in the evolving equity management landscape.

Key Risks

Private Companies Going Public

After failing to catch on, Carta began shutting down its offering for public companies by reaching out directly to its public customers in early 2023. Without this offering, private companies will have to migrate off of the Carta platform at the time of their IPO, meaning that Carta will not be able to retain the most successful private customers on its platform. Carta’s offering for public companies had problems and lagged behind multiple competitors, including Computershare and Morgan Stanley, which have product offerings that better cater to companies making this transition. Therefore, while a risk for Carta going forward, the immediate impact of this decision will likely not be large, as these issues prevented its public market offering from becoming an important part of Carta’s core business.

Distraction From Core Products

Carta provides a more extensive range of products than its competitors. For instance, Shareworks does not offer compensation management software, and Pulley does not provide fund administration. Pave focuses only on compensation benchmarking. Ward acknowledged Carta’s weaker execution on new product lines, in 2024 he said:

“Some of my other ideas have worked — like captables, 409As, fund administration, private equity. But ALL of my ideas around liquidity — auctions, investor matching, secondary trading, open tender offers, have not worked. I might not be the entrepreneur that can solve this problem.”

Competitors’ narrower focus may produce higher quality products, pulling customers away from Carta. Despite its dominance in the equity management market, Carta has only the seventeeth highest satisfaction score on G2 as of January 2025. If competitors offer better products, unsatisfied Carta customers may leave. New startups may look at reviews like those on G2 and choose one of the top options. Yin Wu, the founder of Pulley, said in October 2020 that investors wanted a better cap table product, suggesting investors found Carta unsatisfactory for their needs.

Lack of Token Support

Web3 startups sometimes raise funds and track ownership with cryptocurrencies instead of traditional equity. Cryptocurrencies can allow for voting rights, staking, and lending. They also provide liquidity through centralized and decentralized cryptocurrency exchanges without the need for a stock exchange. Carta competitors like Pulley support both token cap tables and traditional cap tables. Other competitors like LiquiFi focus only on cryptocurrency cap tables. Ethereum, the blockchain with the second highest market cap, experienced over 440 initial coin offerings (ICOs), raising over $10 billion in the first half of 2018. As of August 2022, Carta does not support cryptocurrency cap tables.

Workplace Environment Concerns

An August 2020 article published in the New York Times detailed complaints by over a dozen current and former Carta employees about the company. The employees, many of whom were women, said they were disparaged and excluded from meetings and then blamed for those problems. When they raised concerns about the mistreatment, their professional careers suffered, including pay cuts and firings.

Multiple employees have filed lawsuits against Carta. For example, Emily Kramer, Carta’s former Vice President of Marketing, sued the company in July 2020. She claims Carta paid her less than her male colleagues in the lawsuit. She also claims the CEO and co-founder, Henry Ward, used vulgar language towards her, an incident resulting in her exit from the company. Carta denied Kramer’s claims. The lawsuit was settled unconditionally in February 2023, although it is unclear whether monetary reparations were included as part of the settlement.

In October 2022, former Carta CTO Jerry Talton wrote a letter to the company’s board accusing CEO Henry Ward of various misdeeds, including dismissing reports of abusive behavior at the company and firing women for discriminatory reasons. Following his letter, Carta placed Talton on administrative leave before firing him in December 2022 and then levying a lawsuit against him a week later for alleged wrongdoings of his own. The company hired a third-party law firm to investigate Ward after Talton’s letter, but has not commented on the outcome of the investigation and as of January 2025, the legal battles between Talton and Carta continue.

The allegations against Carta and its CEO Henry Ward may continue to cause legal issues, hiring difficulties, and negative press. The company’s leadership has seen a high level of churn through all this. Carta’s COO, Tom Keiser, left the company in July 2024 after being with Carta for only 11 months.

Trust & Data Usage Concerns

Carta faced a significant credibility crisis in January 2024 when a prominent startup customer accused the company of misusing confidential information. This incident raised alarm among Carta's other customers and led to threats from founders to move their business elsewhere. The situation highlighted the delicate balance Carta must maintain between leveraging its vast data resources and maintaining customer trust.

In response to the backlash, Ward announced the company's decision to exit the secondary trading business, acknowledging that even the perception of data misuse could erode trust. This move, while potentially addressing immediate concerns, may impact Carta's growth strategy and valuation. As Cloudflare's CEO Matthew Prince had speculated, Carta's high valuation was predicated on building "the world's biggest secondary market" using customer data.

The incident underscores the broader challenges Carta faces in defining its product and ensuring data security. As a platform holding sensitive information for numerous startups, any suspicion of improper data use could lead to a mass exodus of customers, severely impacting Carta's business model and market position.

Summary

Carta's platform manages financial and operational complexity for startups and investors, with a focus on equity and fund management. The company has built a network of venture-backed startups and investors, capturing 95% of the cap table management market at one point. Carta has expanded its product suite to include liquidity solutions and compensation management tools. While the company has seen significant growth and raised capital at high valuations, it faces challenges including workplace environment concerns, trust issues related to data usage, and competition from focused competitors in specific product areas. Carta's future success hinges on leveraging its network effects, navigating potential banking partnerships, and addressing core product execution while maintaining customer trust.

*Contrary is an investor in Pave through one or more affiliates.