Thesis

Sustained economic growth and digital advancement following the 2007-2009 financial crisis have led to a surge in retail trading and the broader democratization of capital markets. As of February 2023, retail traders contributed roughly 23% of total stock trading volumes, a notable increase from 15% in 2022. As the number of retail investors has grown, the variety of what holds financial value has also expanded. Digital assets, sports memorabilia, and even sneakers became tradeable assets that hold value.

Increased accessibility to markets has been made possible by financial product innovation and the growth of online trading platforms like Robinhood, TD Ameritrade, and Public which have contributed to collectively lowering the cost and friction of investing by offering commission-free trading, fractional shares, and no minimum deposits required.

One of the markets that has gained traction in this environment has been prediction markets. Prediction markets allow participants to trade contracts representing the likelihood of future events, leveraging collective intelligence to generate forecasts. These markets operate on the principle of supply and demand, with prices reflecting the consensus on event probabilities.

Kalshi is a prediction market that allows users to trade directly on the outcomes of specified events. In 2020, the Commodity Futures Trading Commission (CFTC) approved Kalshi as an authorized Designated Contract Market (DCM), making it "the first regulated exchange where [users] can buy and sell contracts on the outcome of events", known as event contracts. Events that can be traded on include climate events such as the highest temperature in Chicago on a given day, financial events like the yearly range of the S&P, or cultural events like which film will win the Oscars. Kalshi’s mission is to “give Americans a tool to take control of economic risks that affect their everyday lives”.

Founding Story

Kalshi was founded in 2018 by Tarek Mansour (CEO) and Luana Lopes Lara (COO). Lara and Mansour met while undergrads at MIT. Both were international students and had similar interests in the history of the financial markets. After being in many of the same classes, co-authoring papers, doing projects, and even interning at the same company together, Mansour and Lara found that despite their many similarities they also worked together in a complementary way.

Mansour completed his BSc in Electrical Engineering, Computer Science, and Mathematics in 2018. While at MIT, he gained early experience within financial markets and with building products through internships at companies like Goldman Sachs, Palantir, Five Rings Capital, and Citadel. Throughout these experiences, he held various roles ranging from financial analyst to software engineer. After working full-time as a quantitative trader, he left after five months to co-founded Kalshi.

During Lara’s time at MIT, she studied Computer Science with a minor in Mathematics, and later completed her Master's of Engineering in the Computational Cognitive Science Laboratory. Lara's background also includes internships as a software engineer at Bridgewater Associates and as a Quantitative Trader at both Five Rings Capital and Citadel Securities.

Early on in their work experience, both were uniquely exposed to event-based trading and the problem of not having to do so indirectly. Mansour observed it while at Goldman Sachs, where he was structuring products for institutions who wanted to hedge themselves against Brexit. Lara realized the same concept while at Bridgewater and Citadel, where thesis-driven investments were based almost entirely on predictions

The core issue, experienced by institutions and individuals alike, was that there were too many outside factors that affect stock prices, futures, etc. when taking a position on a particular event. Structuring these positions to benefit indirectly from a specific outcome while also hedging outside risk involved a great deal of complexity. Mansour and Lara set out to simplify this all to allow investors to directly trade on specific events.

Unlike most startups that can ship products, test with users, and iterate accordingly, the majority of the early days of Kalshi were spent dealing with regulation. After securing a spot in the 2019 Y Combinator winter batch, the first three years of the company’s life were spent attempting to convince regulators to approve of their startup idea. The team had to build the exchange itself, a broker, and a surveillance system that complied with all regulations and that would be able to handle millions of traders, all before having a live product or a single real user.

Product

Marketplace

Kalshi’s exchange enables investors to bet on the outcome of events via an event contract marketplace. These contracts span a variety of categories including climate, entertainment, culture, public health, and more.

Each event contract is structured as binary questions about a future event without the need for a proxy. Investors can buy "Yes" or "No" positions depending on whether or not they think an event will occur. Prices of these contracts vary, based on the real-time, market-determined likelihoods of an outcome. As Kalshi describes it:

“Trade event contracts for the outcome you think is most likely. Contract prices reflect the view of traders as to the chances of the event happening. Each contract is worth $1 if you're right.”

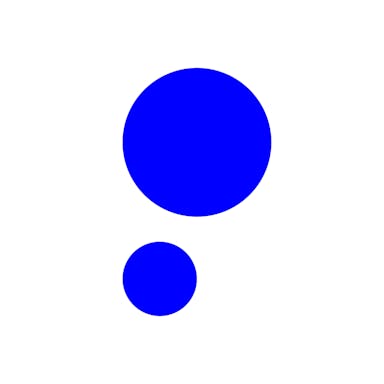

Each contract has a different risk-reward ratio with implied probabilities reflected by the price of the contract.

Source: Kalshi

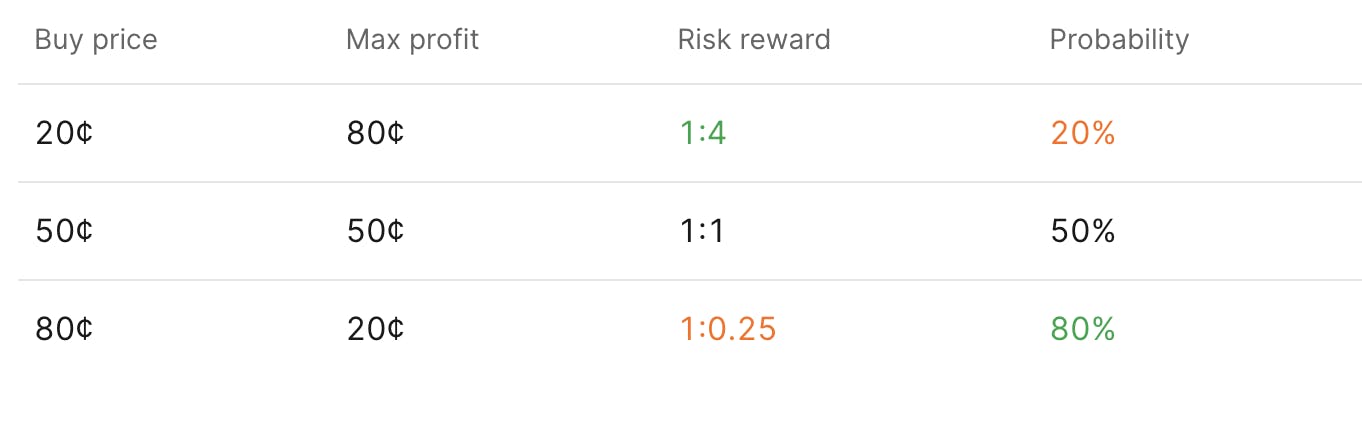

Kalshi allows traders to browse trades directly on the marketplace, through a search function supported by categorized filters. For example, here are some event trades that were listed on the marketplace in December 2023:

Source: Kalshi

Kalshi offered 149 events that it was possible to trade on as of December 2023. Event categories included economics, financials, politics, climate, culture, science, health, world, and transportation.

Contracts

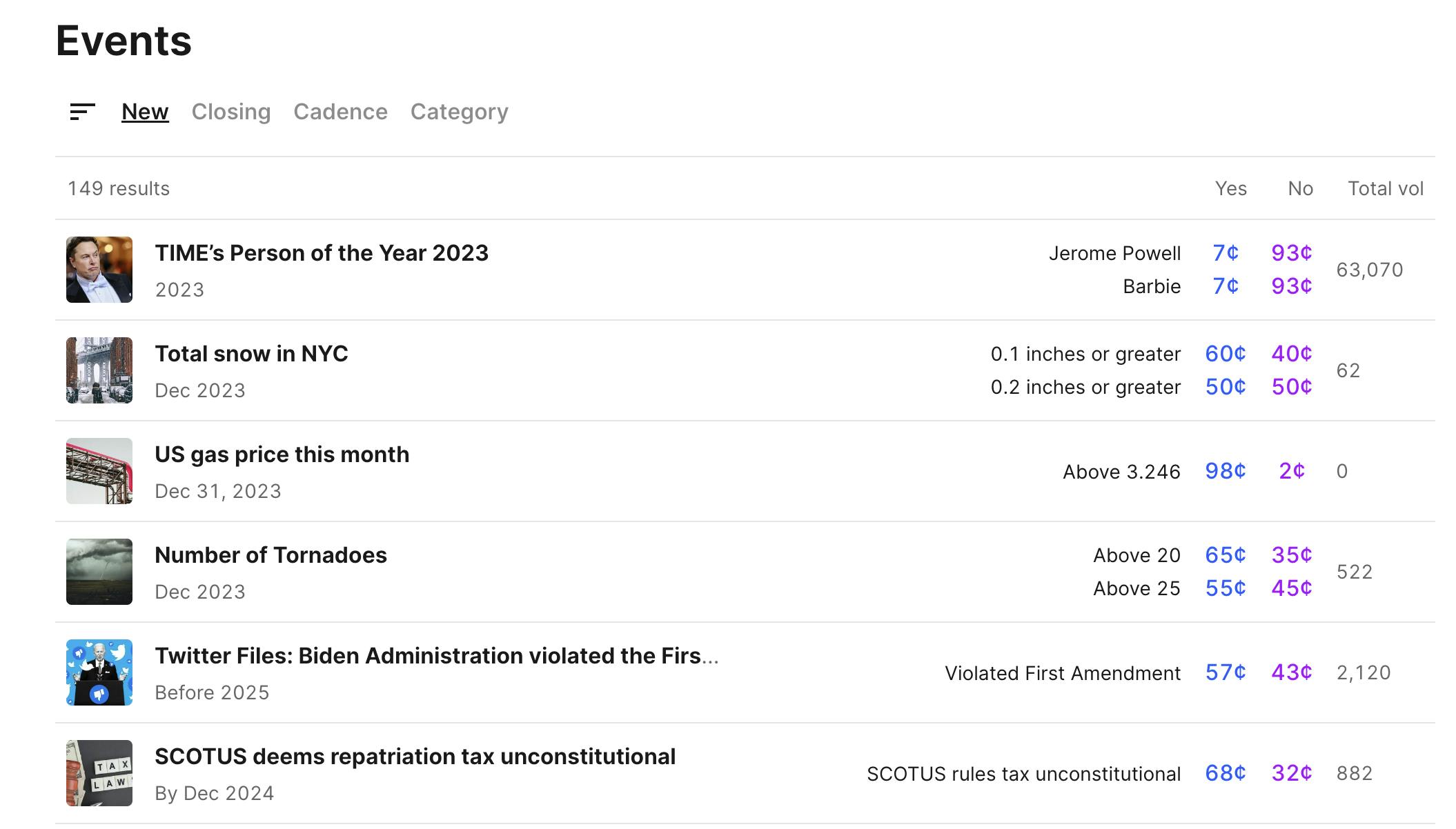

Once a contract is found, it is up to the trader to first read the rules of the contract. These rules outline everything from the expiration date, the scope of the contract, the payout criteria, any contingencies, and more. For example, here are the rules specified for an event contract on the release date of an upcoming video game (GTA 6).

Source: Kalshi

If the trader agrees to the rules and decides to take the bet, they then need to choose the position (”Yes” or “No”), the quantity of the order, and if using a limit contract instead of quick, the price they are willing to pay.

Among the types of event contracts that Kalshi offers are zero-days-to-expiration (0DTE) contracts. 0DTE are derivatives (options, futures, or swaps) that reach their expiration on the day they are traded. Examples of this include Kalshi’s Nasdaq and S&P Daily Close Contracts, where the outcome is decided at the close of a given day. A distinct advantage of Kalshi’s Nasdaq and S&P Daily Close contracts is the ability to trade over the weekend for Monday’s closing price.

Order Types:

Kalshi offers two different order options to facilitate trading as of December 2023.

Quick Orders are instant buy orders where traders can immediately purchase a specific number of contracts at the best available prices. A trader specifies the quantity and direction (Yes or No) that they want, and Kalshi gets those contracts as cheaply as possible at the moment the order is placed.

Limit Orders are for traders who have a specific price in mind and want to buy contracts at that price or a better one. With limit orders, traders can set the desired price and the number of contracts they wish to purchase. The order will only be executed when the market reaches or surpasses the specified price.

API

Source: Kalshi

Kalshi’s API gives traders access to public information on the exchange and enables them to create automated trading based on that information. This includes market data, as well as a trader’s portfolio, orders, and trades. Using the API, traders can get access to historical data to set backtests and live market data for prices and trade executions.

Risk Management

Kalshi is federally regulated by the CFTC as a Designated Contract Market (DCM). It uses a regulated clearinghouse, LedgerX LLC, that provides clearing services for the company — holding member funds and clearing trades. This is intended to reduce counterparty risk. Trades are also required by Kalshi to be fully cash-collateralized to reduce risk to the ecosystem as a whole. In addition, customer funds are put in segregated, dedicated accounts to further reduce risk.

Market

Customer

According to a March 2022 interview with Kalshi’s co-founders, Kalshi’s main users are “advanced retail investors, like options traders” who are looking for direct exposure to events they want to trade on. The company states that “the majority of participants on Kalshi today are retail traders, as opposed to institutional traders.”

Because Kalshi is regulated, according to Mansour, it has been able to attract more sophisticated institutional capital from market makers, brokers, and others over time, especially compared to unregulated alternatives which are not as appealing to such customers.

Overall, Kalshi categorizes its users into three main buckets:

Directional Traders: These are either individual traders or institutions who are looking to trade based on their convictions using event contracts on a regulated exchange.

Hedgers: Another primary use of Kalshi is reducing financial risk via hedging. Event contracts can be thought of as insurance against a range of events that might adversely affect a person or institution’s portfolio — examples of threats that Kalshi says users can hedge against include natural disasters or regulatory risks.

Market Makers: Market makers play an important role in providing liquidity in financial markets. On Kalshi, individuals and small institutions act as market makers, allowing for easy entry and exit for traders.

Kalshi also has a trading arm, Kalshi Trading, which participates in trading on the exchange and which the company says is a separate entity from Kalshi Exchange. The company asserts that the trading arm has “strict informational barriers” to prevent it from unfair access to non-public information.

Market Size

As a whole, the global securities brokerage and stock exchange services market includes revenue earned from transaction fees collected by brokers and exchanges that sell securities. As a whole, this market is estimated to have grown from $1.7 trillion in 2022 to $1.8 trillion in 2023 at a compound annual growth rate (CAGR) of 8.7%. The percentage of total trading volume coming from retail investors was 23% as of February 2023.

While the prediction market size is difficult to evaluate since Kalshi is the only regulated exchange at the moment, the market size of brokerages as a whole is relevant since some types of security trading are indirect ways to bet on events, which Kalshi makes it possible to directly trade on. That said, the sports betting industry may be a helpful proxy to estimate the prediction market’s eventual size if regulation trends in its favor over time. It was valued at $81.7 billion in 2022 and is expected to reach $231.2 billion by 2032, representing a CAGR of 11.1%.

Competition

CME: CME was founded in 1898 and went public in 2002, with a market cap of $78.6 billion as of December 2023. In 2022, CME Group launched an event-based marketplace that provides traders with access to over 11 of the most traded futures markets. The major difference between Kalshi and CME is that CME lists event contracts with partner brokerages. Interactive Brokers, Tradovate, Edge Clear, Blue Line Futures, Optimus Futures, Ironbeam, and Ninja Trader all offer event-based contracts through CME. Kalshi offers direct-access trading and lists all of its event contracts on the Kalshi exchange. In addition, CME is focused exclusively on commodities, currency, and indexes, while Kalshi offers a wider array of tradable markets including politics, culture, and climate.

PredictIt: PredictIt is a New Zealand-based online prediction market that offers exchanges on political and financial events. It acts as an online marketplace for investors looking to buy and sell shares in an expected outcome. PredictIt was founded in 1996 and raised $1 million in funding in 1999, but didn’t launch online to the public until November 2014. Unlike Kalshi, which took a regulatory-first approach, Predictit has dealt with regulatory issues throughout its period of operation, and its legal issues have not yet been resolved and constitute a significant threat to the platform.

Polymarket: Polymarket is a cryptocurrency-based prediction market founded in 2020. It raised a $4 million seed round led by Polychain Capital in 2020, with participation from other notable investors including Naval Ravikant and Balaji Srinivasan. Polymarket operates globally but is not operational in the US as of December 2023 — for users in the US, it is view-only trading is restricted. Additionally, trades on Polymarket place with cryptocurrencies as the medium of exchange, so users must deposit crypto funds as opposed to fiat currencies. In 2022 Polymarket settled a $1.4 million suit with the CFTC for offering noncompliant event contracts.

Augur: Augur was founded in 2014 and is a global, no-limit betting platform built on the Ethereum blockchain. Augur has raised $5.3 million in total funding, with $5.2 million of this coming from an ICO in 2015. Unlike Kalshi, Augur is a decentralized, peer-to-peer protocol for prediction markets based on the blockchain. Augur operates globally on the Ethereum blockchain. Additionally, it supports sports betting, a market not supported by Kalshi as of 2023.

Business Model

Kalshi operates under a binary options marketplace model, offering event contracts structured around yes-or-no questions about future events. Unlike traditional futures, the prices of these contracts do not represent the expected value of an underlying asset. Instead, the resolution of the event itself constitutes the "underlying" value of each contract in the market.

The platform generates revenue through trading fees. Kalshi charges a variable transaction fee for each trade, based on the expected earnings for the contract. This expected earnings calculation considers the maximum potential earnings from the contract multiplied by the implied probability of achieving those earnings. Kalshi says that its fee formula is as follows:

“fees= round up (0.07 x C x P x (1-P))… P = the price of a contract in dollars (50 cents is 0.5)… C = the number of contracts being traded … round up = rounds to the next cent.”

Its full fee schedule can be viewed here, with general trading fees described by the formula above. Kalshi’s average trading fee sits at around 0.8%. To enhance accessibility to two of its most popular markets, Kalshi adjusted its fee structure for the S&P and Nasdaq markets in September 2022, halving the pricing.

This business model allows Kalshi to cater to retail traders and differentiate itself from traditional bookmakers, as it does not have a stake in the outcome of events, and solely relies on transaction fees for its revenue generation. Other than a $2 fee any time a user makes a withdrawal from Kalshi to their linked bank account, Kalshi does not charge any settlement, wire, membership, or ACH fees. Additionally, Kalshi doesn’t allow margin or leverage trading, so the most users can lose on a trade is the total cost of purchased contracts, up to $25K.

Traction

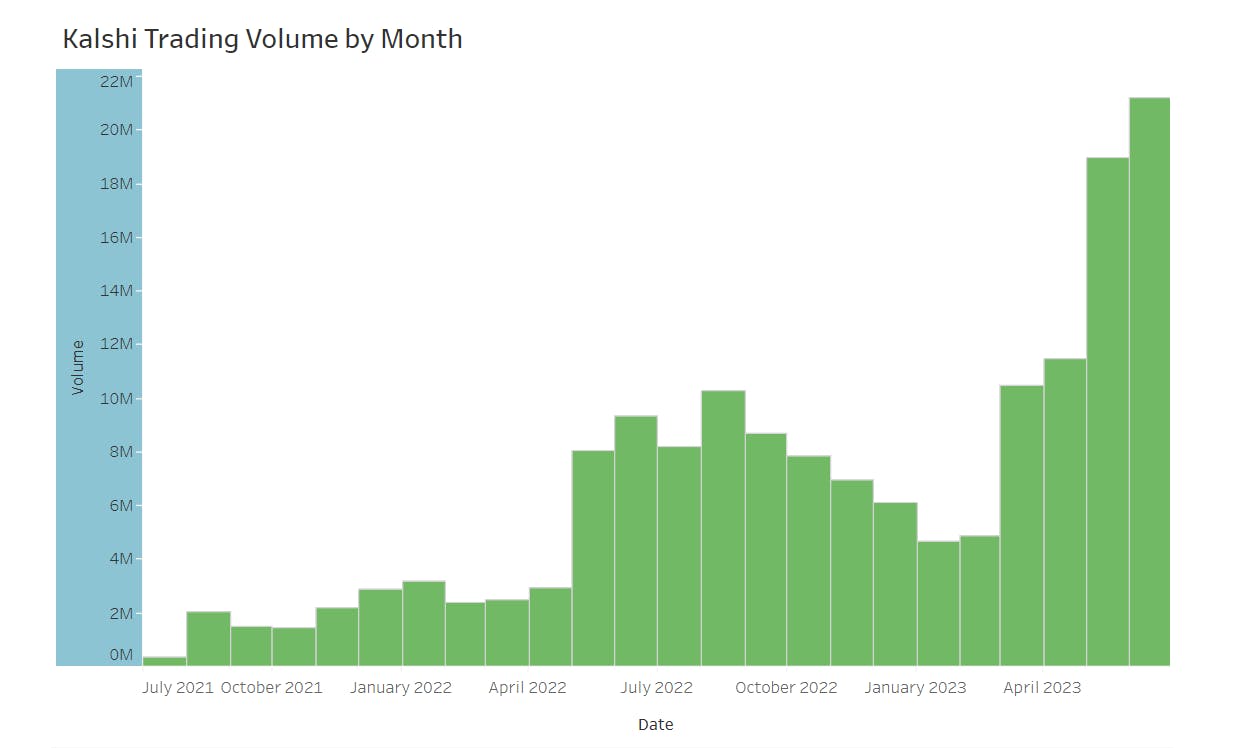

As of December 2023, Kalshi supported 300+ regulated markets, had greater than 120 million contracts traded, and had 4 million in open interest, i.e. the number of options or futures contracts held by traders in active positions. According to Bloomberg, Kalshi was doing about $10 million a month in trading volume as of April 2023 and had doubled that to reach about $20 million by June 2023, up from $347.8K in July 2021.

Source: Mickbrainsfield.com

Valuation

Kalshi has raised a total of $38.7 million in funding as of December 2023, with its latest round having been a $2.5 million Series A-II from Soma Capital in January of 2022. This round was an extension of its $30 million Series A led by Sequoia in February 2021, at which time Kalshi was valued at $120 million. Other investors in the round included Charles Schwab, chairman of Charles Schwab Corporation, Henry Kravis, co-chairman & co-CEO of KKR, SV Angel and previous investors including Neo and YC Continuity.

Key Opportunities

Expanding Market for Information

Markets for information and events, which allow investors to hedge or directly bet on events where they would have previously been only able to place indirect bets in traditional securities markets, are growing. The sports betting market, which is expected to reach $231.2 billion by 2023, is rapidly growing at an 11.1% CAGR and is one particular type of event-based market; it is reasonable to assume that if regulation allows for the continued growth of event contract markets, it will see similar growth in size.

Expansion from Retail Traders to Professional Investors

Kalshi has capped trades at $25K for retail users. In June 2023, Kalshi announced that it was planning to expand its retail investor base to attract more professional traders. To do so, it is planning to expand the cap on trades to as much as $250K. This could help continue to diversify Kalshi’s user base and attract greater institutional interest, which could accelerate growth in trading volumes and therefore revenue.

Key Risks

Gambling vs. Investing

The short-term win/lose nature of event contracts can be misused as a substitute for gambling if proper research isn’t done on them. The expansion of market types to include culture, entertainment, and politics on the platform could create a risk of attracting a majority of novice investors who resemble users of sports betting platforms, as opposed to the advanced retail investors that Kalshi targets. This association may make it difficult to attract professional traders as the company expands further, and could create harm to Kalshi’s reputation.

Regulatory Risk

Kalshi is the first event contract exchange to be regulated as a designated contract market by the CTFC, and the only one to have received US regulatory approval as of December 2023. However, in September 2023 the CFTC issued an order prohibiting “certain Congressional Control Contracts” on Kalshi because they were deemed unlawful and “contrary to the public interest.” The contracts responsible for this appear to have been related to the upcoming 2024 elections and in November 2023 Kalshi sued the CFTC, saying that the organization had exceeded its mandate.

Ethical Concerns

During the missing Titanic submarine crisis in June 2023, Polymarket, a crypto-based futures trading platform, received more than $2.3 million worth of bets on whether the submarine would be found. Although this particular bet occurred on a competing platform to Kalshi, the public backlash was significant, and future events could create reputational damage for prediction markets as a whole. To avoid this Kalshi specifically does not support wartime, assassination, or violent events. However, it does have active contracts related to natural disasters, diseases, etc, which puts it at risk of receiving similar public backlash.

Kalshi Trading

Given the monumental collapse of FTX due to its trading firm Alameda Research which was owned by the same person, the risk of an exchange with a related trading organization, such as Kalshi Exchange and Kalshi Trading, is more salient than ever. Although the company states that Kalshi Trading is a separate entity from Kalshi Exchange with completely separate operations, any conflicts of interest could pose both financial and legal risks for the company down the line.

Summary

Prediction markets that allow participants to trade contracts based on the outcome of various events are still in their early days. Kalshi as a platform has differentiated itself with its achievement of regulatory approval and its ability to offer a wide range of event outcomes, including those related to finance, politics, and pop culture. Utilizing a unique pricing mechanism that enables binary outcome trading, Kalshi aims to enhance market accessibility and accuracy, providing a platform for participants to express and monetize their insights while generating valuable predictive data. Looking forward, Kalshi has a sizeable opportunity to further expand its customer base to institutions and become the NYSE for event trading, should the market continue to grow and regulatory relationships be maintained.