Thesis

Design thinking and agile development are trends that are redefining the modern customer experience. Nearly 75% of organizations self-report using design thinking. Design thinking is a five-stage process to design better products, services, architecture, and experiences. Participants in a design thinking exercise often require tools like sticky pads, post-it notes, or a project management system with a facilitator guiding them through each step. This process can be done in-person or remotely.

Remote work has continued to gain traction since the COVID-19 pandemic. Due to this, many technology teams rely on digital tools to perform such tasks as design thinking exercises virtually. For example, when COVID-19 lockdowns caused global disruption in 2020, companies like Hopin, Zoom, and Loom in and allowed for business continuity. Hopin took the place of live conferences, while Zoom and Loom took the place of in-person meetings. Initially thought to be temporary, remote work appears to be persisting at an elevated rate post-pandemic, with over 40% of employees in 2023 working either fully remote or hybrid. Further, Americans appear to have embraced the change, with 87% of those offered remote work accepting it in 2022.

Miro is a digital whiteboard and collaboration platform that can be used to enable remote work. For teams looking to brainstorm and collaborate within a distributed or remote team, Miro helps people share a virtual whiteboard space needed to provide clarity and breakthroughs. For its customers during the COVID-19 pandemic and the ensuing shift to remote work, Miro took the place of in-person whiteboard sessions and workshops. Miro's online collaboration tool provides companies with the ability to manage projects, foster idea sharing, and facilitate collaboration within a virtual work environment. As more collaboration, brainstorming, and meetings move online, Miro aims to be the visual collaboration and digital whiteboarding application that enterprises use to get their work done.

Founding Story

Andrey Khusid (CEO) and Oleg Shardin (Board Member & former COO) founded Miro (formerly RealtimeBoard) in 2011. Prior to Miro, Khusid, and Shardin founded an award-winning design agency called Vitamin Group in 2005. Vitamin Group offered clients web, product development, and app design services.

At Vitamin Group, the team encountered an issue; they needed a way to be able to communicate ideas to clients that weren’t in the same room. In an in-person setting, they could share ideas with clients on a whiteboard, so they had the idea to create a digital whiteboard to be able to share ideas remotely.

The first iteration of Khusid and Shardin’s idea was called RealtimeBoard. RealtimeBoard started as a basic whiteboard tool to effectively communicate ideas, both internally and externally with clients. In 2012, Khusid and Shardin left Vitamin Group to focus on building RealtimeBoard full-time. Khusid and Shardin realized that the company had potential beyond a digital whiteboard. Since its founding, RealtimeBoard changed its name to Miro and developed into a major visualization platform to support visual workflows for enterprises of all sizes.

In 2012, Shardin left his role as COO of Miro but remained as a board member. As of September 2023, Khusid remains in his role as CEO. Miro’s other leadership consists of individuals with experience across security, cloud software, and IPO execution. Miro’s senior leadership includes Hollie Castro (Chief People Officer, former CHRO of YETI), Sangeeta Chakraborty (Chief Customer Officer, former VP of Customer Success of Okta), Varun Parmar (COO, former CPO), and Justin Coulombe (CFO, former CFO at SurveyMonkey).

Product

Digital Whiteboarding

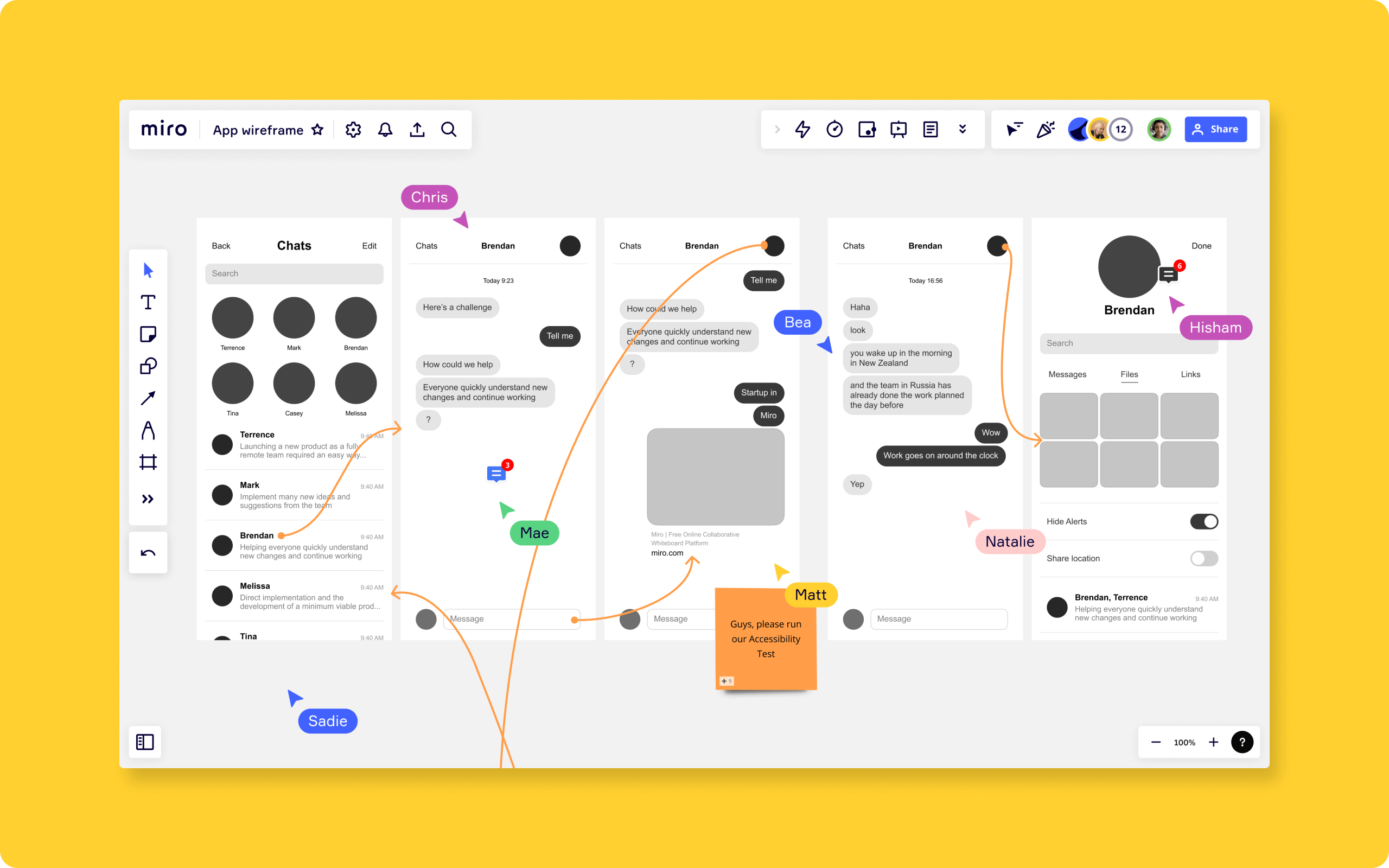

Miro’s core product is built around a visual collaboration and digital whiteboarding application. It allows users to create a board for workshopping, strategy mapping, agile ceremonies, UX research and design, product development, customer discovery, and process visualization. Users can also invite others to collaborate on the same board and join other users' boards.

Miro boards are intended to replace the need for a physical whiteboard where team members meet to brainstorm and strategize. Miro allows users to create post-its, diagrams, and mind maps. The product is relatively simple for users across departments to adopt, which is something customers have noted:

“When the pandemic hit, those of us who thrive on in-person collaboration were worried that our creativity and productivity would suffer. Miro was the perfect tool to help us with collaboration, whiteboarding, and retrospectives while remote.”

In April 2023, Miro updated its Miro boards with additional features such as bulk cropping, bulk resizing, and auto layout.

Source: Miro

Templates

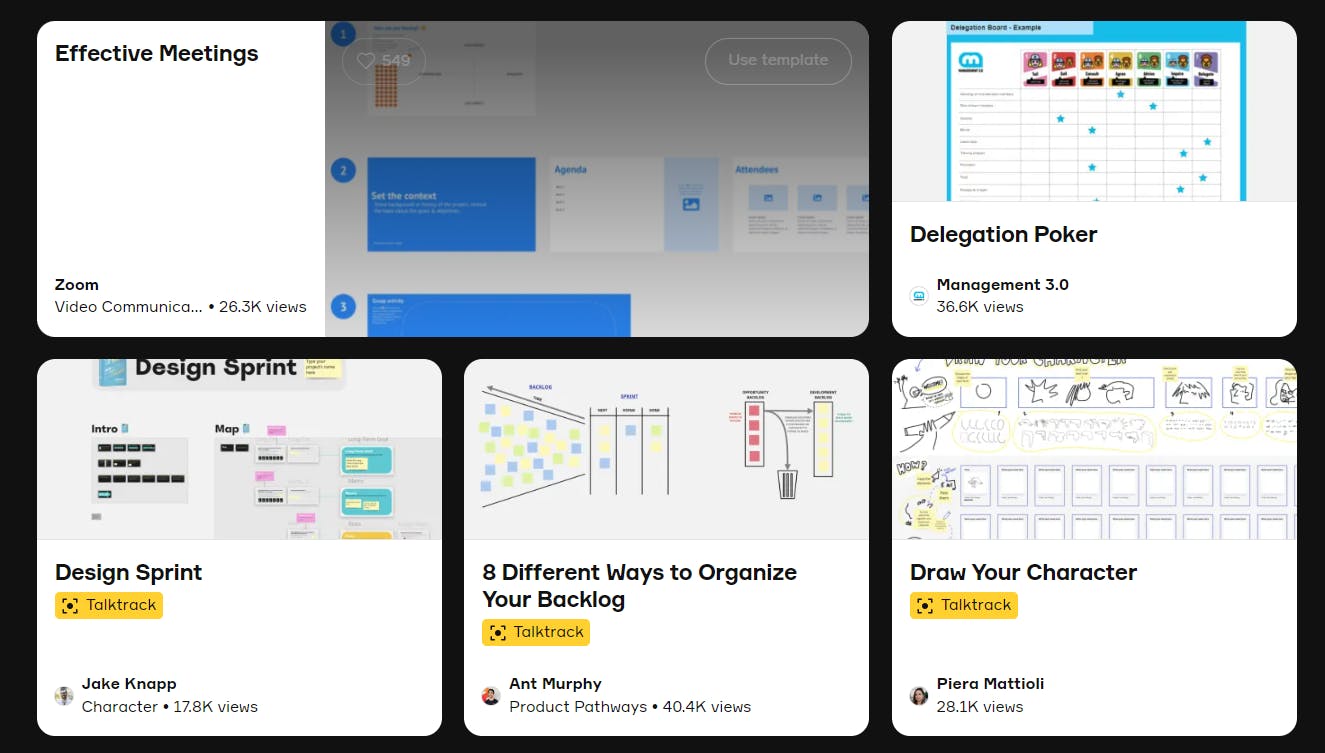

For some, the thought of a blank canvas can be paralyzing. With templates, Miro intends to make it easy for users to find inspiration and get started. Templates are organized by use cases such as “Meetings & Workshops”, “Brainstorming & Ideation”, “Agile Workflows”, “Mapping & Diagramming”, “Research & Design”, “Strategy & Planning”, and “Icebreakers” for team building. While Miro created many of these templates itself, the company has allowed users to build their own. The Miroverse is a community of Miro users who discover, create, and share Miro templates.

Source: Miro

Accessibility

Miro aims to empower teams to communicate and collaborate across formats, tools, channels, and time zones through its developer platform. The platform expands accessibility by allowing developers to build on Miro with any web-based application. Miro is accessible across various platforms such as its web app, mobile (iOS and Android), desktop (Mac and Windows), and interactive displays.

Smart Meetings

Miro’s Smart Meetings offering is a group of tools allowing board owners to host and run meetings and workshops. It enables teams to collaborate while the board owner controls the session. Rather than using a presentation tool like PowerPoint or presenting through screen sharing on a video conferencing app like Zoom, Miro Smart Meetings allows the entire process to happen within Miro. The product was announced in October 2021.

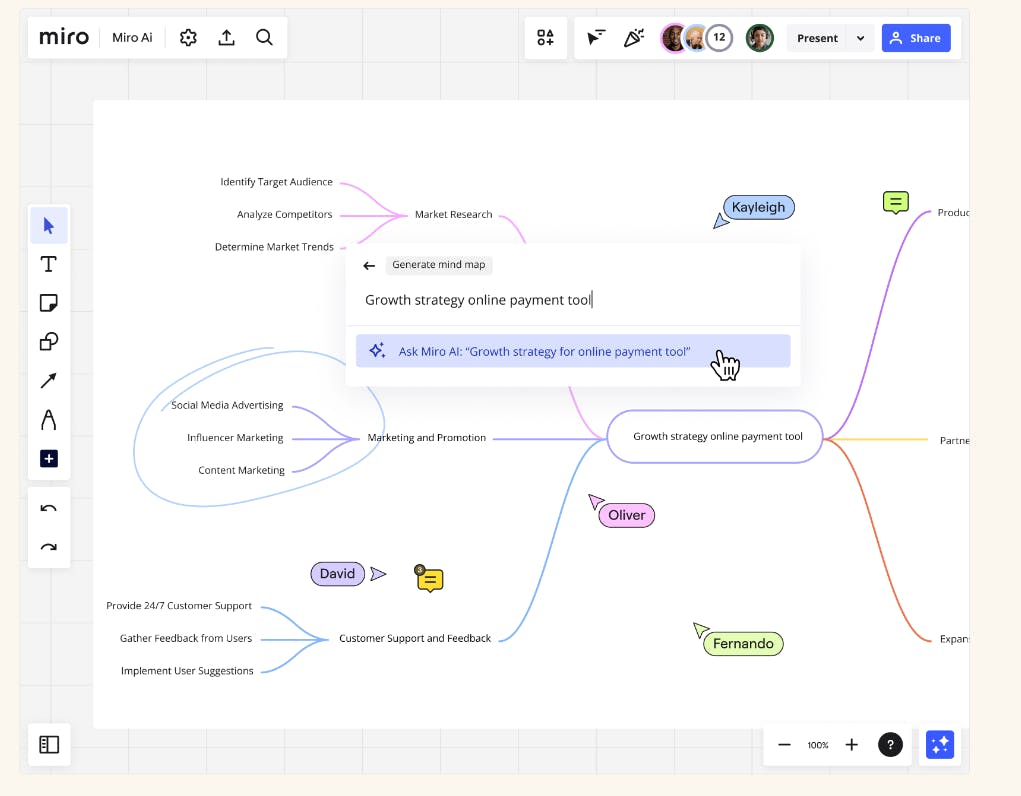

Miro AI

In May 2023, Miro announced a new AI product suite, Miro AI. Miro AI assists users with mind mapping and idea generation. Further, the product can summarize and cluster information to uncover insights from customer research, retrospectives, and workshops. Miro AI can automate product development workflows to transform complex ideas, such as user stories, into structured models.

Source: Miro

Market

Customer

Miro reported having over 60 million users as of September 2023. Further, Miro reported that it served 95% of Fortune 100 companies in 2020. Miro specifically targets enterprise teams including product management, engineering, IT, UX and design, consultant, marketing, and sales teams. Some of Miro’s notable customers include Best Buy, Deloitte, Dell, Shopify, Yamaha, Walt Disney, Ubisoft, CD Projekt Red, PepsiCo, DocuSign, and Macy’s.

Source: Miro

Market Size

The productivity management software was valued at ~$54.8 billion in 2022 and is forecast to grow at a CAGR of 14.0% through 2032 to reach $203.4 billion. In 2022, North America generated the largest share of global revenue at approximately 36% revenue share. The largest growth drivers for productivity management software are increasing adoption in the Asia-Pacific market and advancements in artificial intelligence and predictive analytics.

Design thinking and agile methodologies are project delivery styles that companies use to effectively deliver software or a product. Most of the methodologies require using a tool like Miro. In 2017, 75% of organizations reported engaging in design thinking. In May 2021, at least 71% of US companies used an agile methodology. Despite remote workers decreasing to 59% in 2022 and hybrid or in-person work models increasing in the post-pandemic period relative to the peak of remote work during the COVID-19 pandemic, teams using design thinking and agile methodologies continued to rise, creating an opportunity for Miro to sustain growth.

Competition

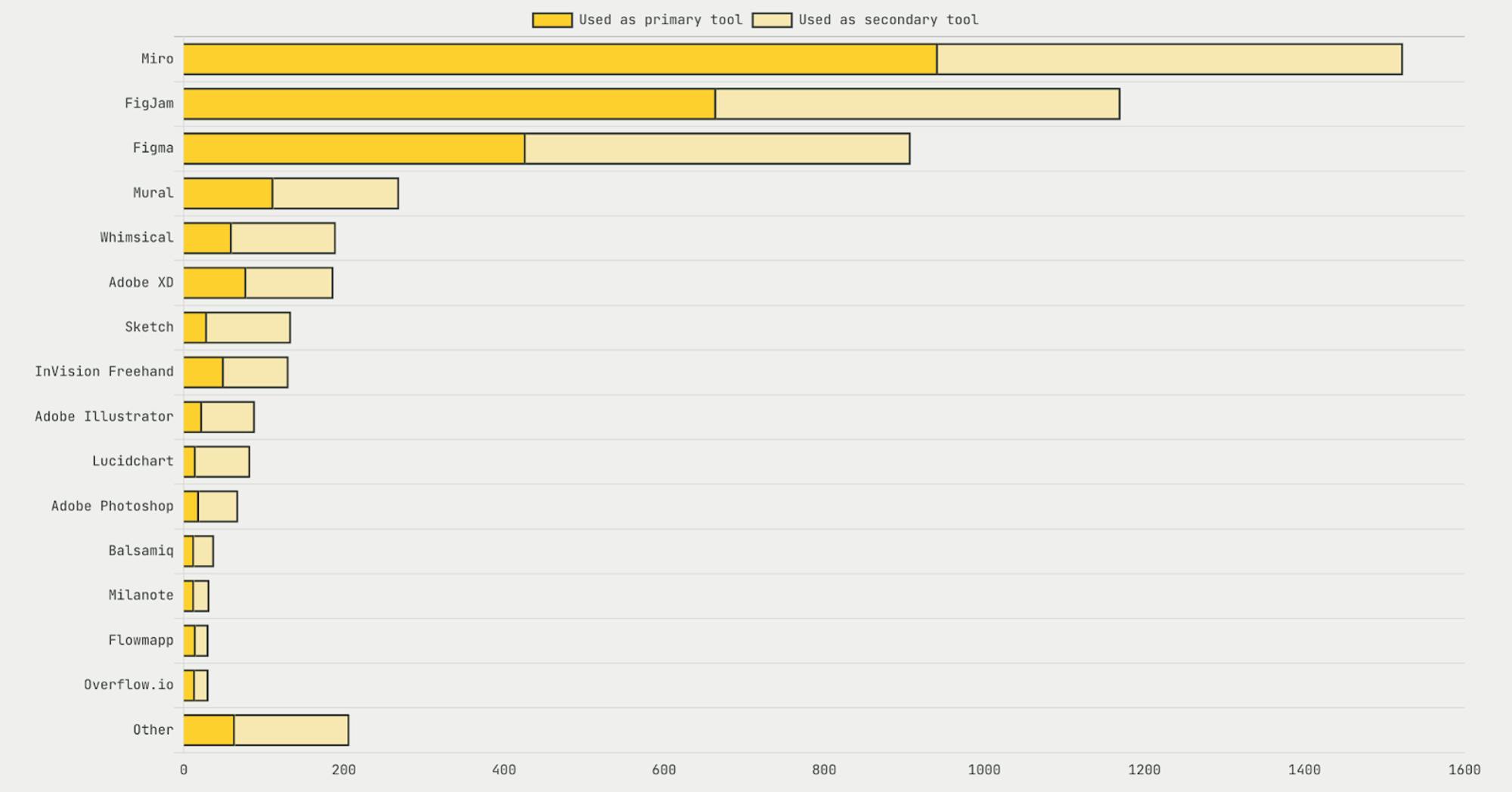

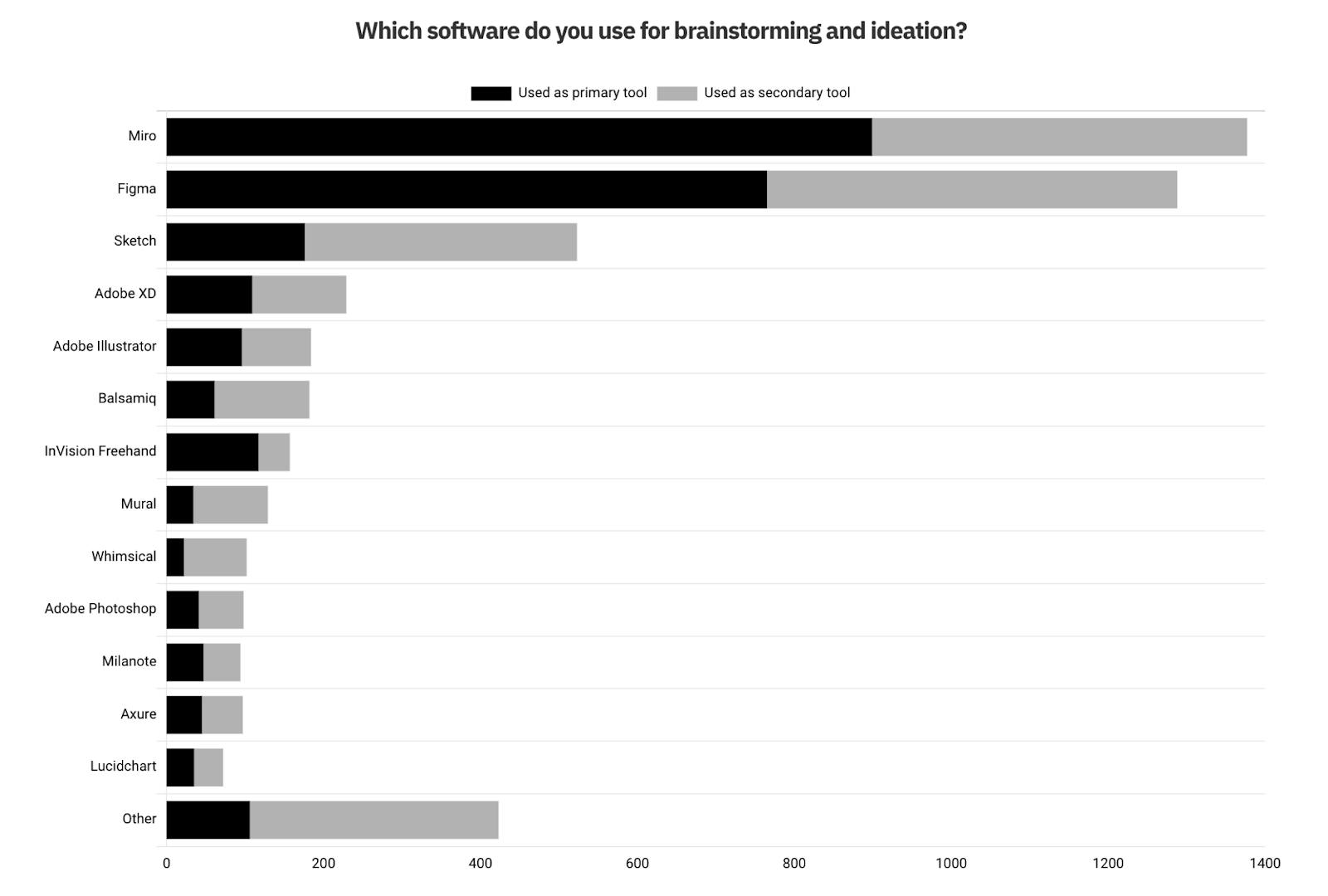

Source: UX Tools, 2021

Figma: FigJam by Figma is a top competitor for Miro, ranking second among designers in terms of preference. FigJam, also an online whiteboard designed for team startups to create, is one core feature of Figma, a collaborative interface design tool. The company was founded in 2012. In September 2022, Adobe announced that it was acquiring Figma for $20 billion. Adobe was aiming to complete the Figma acquisition in 2023. However, in August 2023, the European Union announced that it was launching an antitrust investigation into the acquisition, potentially delaying the deal. Prior to this potential acquisition, Figma had raised approximately $333 million with notable investors including Greylock, Sequoia Capital, and Andreessen Horowitz. The company’s other core product is Figma Design, branded as an all-in-one, collaborative design tool.

Mural: Mural, founded in 2011, is a whiteboarding and collaboration platform designed to “help organizations capture and analyze ideas and create custom workflows to handle project management operations across teams.” As of September 2023, the company has raised approximately $192.3 million from investors including Insight Partners and Gradient Ventures. Mural offers more templates than Miro, but users note that the templates are not as polished on Mural. Further, Miro’s canvas is infinite, whereas Mural’s is large but finite. Users note that Mural is a step ahead of Miro regarding folder organization.

Zoom: Zoom is a video communications platform founded in 2011. The company benefitted from remote work growth during the pandemic, seeing its active meeting participants grow by 29x between 2020 and 2021. In April 2022, Zoom announced Zoom Whiteboards, a collaborative whiteboard product competing against Miro. Further, Miro competes against Zoom with its smart meetings product. While Zoom and Miro have expanded products to compete against each other, Zoom primarily specializes in video conferences while Miro specializes in digital whiteboards. In June 2021, Zoom announced its IPO at a ~$1.8 billion valuation. As of September 2023, Zoom traded at a market cap of approximately $20.8 billion. Prior to the IPO, the company raised $276 million, with notable investors including Sequoia Capital and Qualcomm Ventures.

Canva: Canva is an online design and publishing platform founded in 2012. The company enables users to design customized posters, infographics, and more. Canva allows users to use multiple templates on the same whiteboard, similar to Miro. The company has raised approximately $573 million in total as of September 2022 from funds including Sequoia Capital, Bessemer Venture Partners, General Catalyst, Shasta Ventures, 500 Global, and Founders Fund. While Miro was designed primarily for collaboration and whiteboard tools, Canva was designed primarily as an end-to-end design tool and does not have the same level of collaboration tools.

LucidChart: Founded in 2010, LucidChart has raised $1 million as of September 2023 over one round in July 2011. Three participants were involved including 500 Global, 2M Companies, and K9 Ventures. Like Miro, LucidChart is primarily a collaborative tool for whiteboarding, however, LucidChart is focused on diagramming. Users have expressed that they find LucidChart’s diagramming functionality to have more extensive features than Miro, such as a custom shape library and the ability to link data live, as opposed to Miro. Further, LucidChart claims that Miro only addresses brainstorming capability, whereas it can take an initial idea through execution.

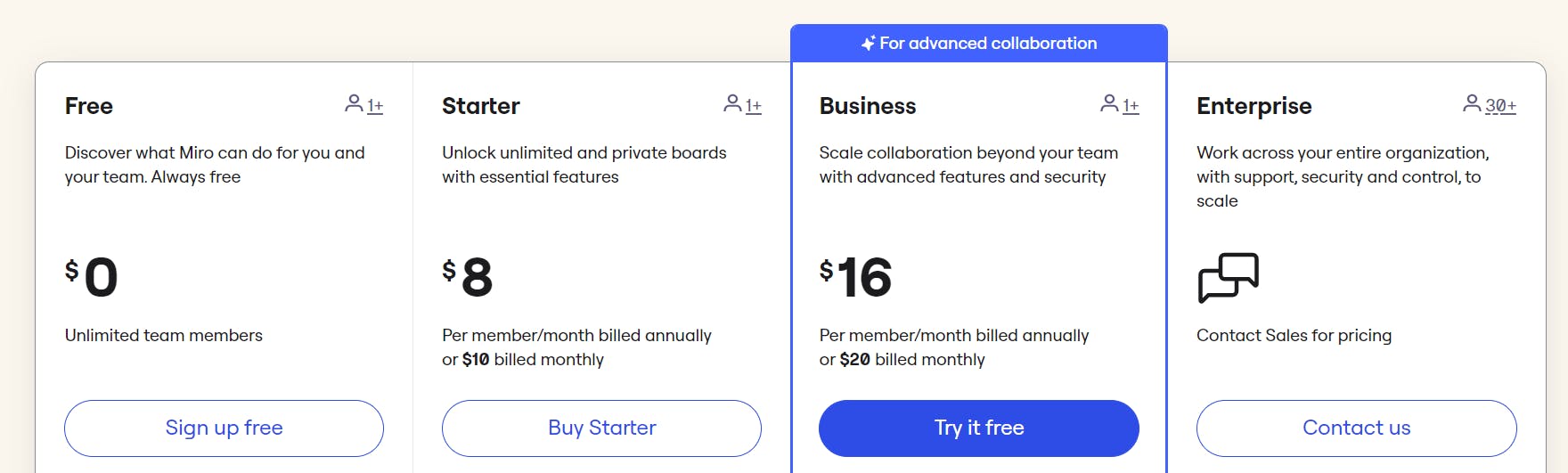

Business Model

Miro operates using a freemium model with subscription tiers for additional features. Miro has four plans: free, starter, business, and enterprise. The free plan limits the number of editable boards each user has to three. The starter plan has unlimited high-resolution boards and is priced at $10 per month or $96 per year. Further, the starter plan has additional features including private mode and unlimited talk tracks. The business plan is $20 per month or $192 per year. It includes all starter plan features along with advanced functionalities of multiple team management and control over which guests have edit access, plus over 2K advanced diagramming shapes.

Miro’s enterprise plan has an undisclosed negotiable price and is designed for teams with over 30 users. The enterprise plan has all of the features included in the business plan, plus additional features including license management and increased customer support. Advanced security features are reserved for business and enterprise customers.

Source: Miro

Traction

As of September 2023, Miro reports having over 60 million users. Further, Miro reported that it served 95% of Fortune 100 companies in 2020. Among the Fortune 100 customer base, Miro reported in 2022 that 20 have contracts of over $1 million ARR. Because Miro is a collaborative tool, it benefitted from the remote-work growth during the pandemic; in 2019, 5% of survey respondents to a design tool survey reported using Miro, and in 2020, that figure grew to 33%.

Source: UX Tools Survey, 2020

In 2021, Miro made over $300 million in annual recurring revenue. Usage increased greatly during the COVID-19 pandemic, resulting in the company reaching 30 million users as of January 2022. As of September 2023, Miro has not disclosed its ARR but has grown to over 60 million users. From 2020 to 2022, the company grew its user base by 500% from 5 million to 30 million users. It also increased the number of paying customers by 550%.

In July 2022, Miro announced its integration with Google Meet, making it accessible to over 3 billion Google Workspace customers and users with Google accounts. This partnership will help Miro and Google Meet compete with Zoom and its online whiteboard tool.

Valuation

Miro raised a $400 million Series C at a $17.5 billion valuation led by ICONIQ Capital in January 2022. The company has raised over $476 million in cumulative funding to date, as of September 2023, from firms including Accel, Atlassian, and Salesforce Ventures. That $17.5 billion valuation from its Series C funding represents a multiple of up to 58x of its 2021 revenue of ~$300 million, although that does not factor in the likely revenue growth it saw by the time of its raise in 2022.

In the public markets, collaboration companies like Zoom, Asana, and Monday.com have seen their revenue multiples collapse from a high of 119x, 89x, and 84x, respectively, to current levels of 3.3x, 5.2x, and 8.5x as of September 2023. Miro’s high valuation could get called into question if the company starts to see similar growth slowdowns that other remote work companies have seen. Miro could potentially be an attractive acquisition target from other large companies with an interest in the design and collaboration market, though the valuation could also be a hindrance here making acquirers less interested in such a high price.

Source: Koyfin

Key Opportunities

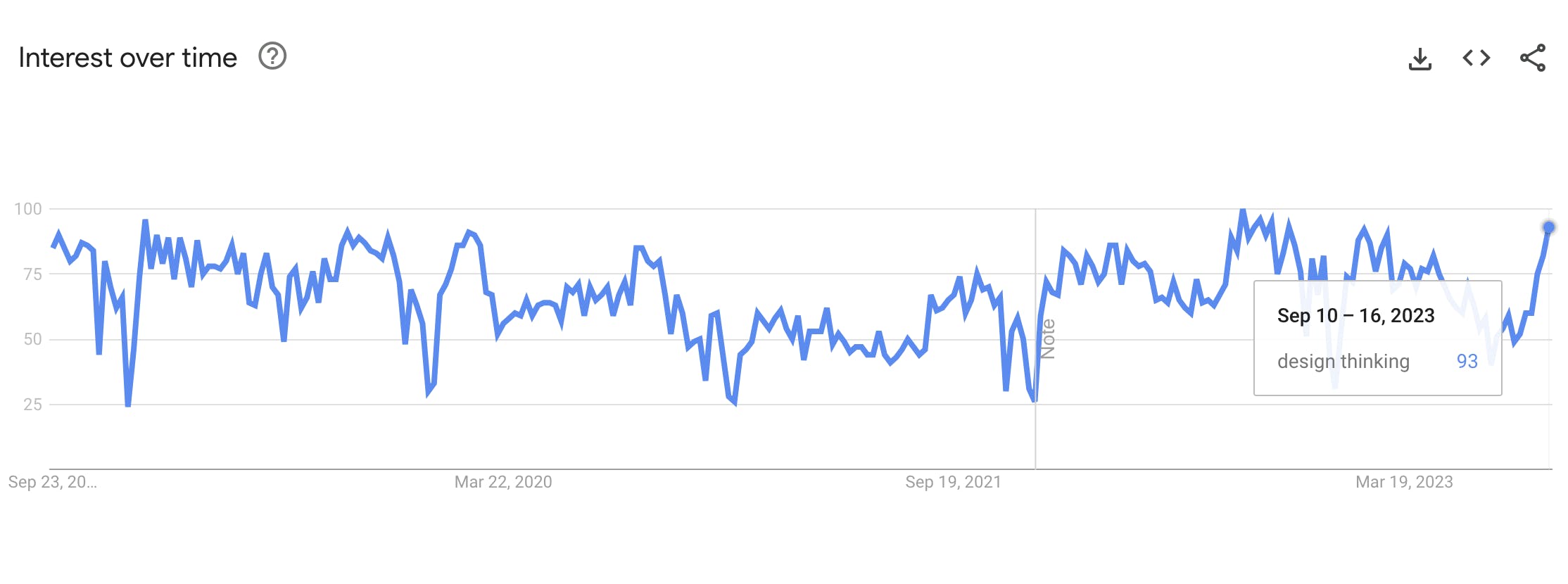

Design Thinking Remains Popular

Over the last decade, design thinking has continued to rise in popularity, particularly within design and innovation-focused organizations. Before COVID-19, sessions were often doncuted in-person and the need continued during the pandemic regardless of the inability of teams to physically come together. That familiarity with easy-to-use digital tools could have staying power, given the longevity of the underlying trends like design thinking and agile development.

Source: Google Trends

Marketplace for Miro Templates

The rise of remote work and teams using design thinking and agile methodologies are key tailwinds for Miro. The company has the opportunity to generate income through premium and user-made templates. There are thousands of templates in the “Mirovers”e. Templates not only provide value to the users by providing a quick way to do work, but it also teaches teams new strategies and processes for tackling their business problems. Miro could build a marketplace to monetize further on these templates to participate in the creator economy, which was valued at $104 billion in June 2022.

Key Risks

Adobe’s Figma Acquisition

In September 2022, Adobe agreed to acquire Figma for $20 billion in cash and stock. If this acquisition goes through pending an investigation by the European Commission, Adobe's approximate 26 million customers in 2023 will have access to Figma's FigJam, representing a significant market share amongst the design community. Miro's partnership with Google could mitigate this risk. Although Adobe was aiming to complete the Figma acquisition in 2023, in August 2023, the European Union announced that it was launching an antitrust investigation into the acquisition, potentially delaying or outright prohibiting the deal.

Return-To-Office Mandates

Miro benefitted from the shift to remote work during the pandemic. Since Miro’s digital whiteboarding and collaboration tools are beneficial for remote workers, Miro could be threatened by return-to-office mandates that companies are enforcing. A survey of 1K companies found that 90% planned to implement return-to-office mandates by the end of 2024, and nearly 30% of those companies stated that they would threaten to fire employees for noncompliance. Miro may have to adjust its strategy to stay relevant in a potential in-person environment.

Summary

Miro's visual collaboration product has gained popularity amongst the design community and has grown significantly during the COVID-19 pandemic. As a result, competitors such as FigJam, Zoom Whiteboards, and Canva Whiteboards have emerged to capture the digital whiteboard market. Now that some workers are returning to the office, Miro continues to serve a hybrid workforce by offering hundreds of product integrations and thousands of templates made by Miro and Miro Experts through the “Miroverse”. To capture more users, and remain relevant in a hybrid work environment, Miro is working on expanding its product offerings to accommodate the pre- and post-meeting experiences.