Thesis

US credit card transaction volume in 2022 was $3.1 trillion. Transaction volumes without credit cards are significantly larger. 2022 was the 10th consecutive year in which the value of Automated Clearing House (ACH) payments increased by at least $1 trillion. ACH is a network that electronically moves money between bank accounts across the United States. In 2022, the ACH network processed 30 billion payments, totaling $76.7 trillion. Wire transfers are another common payment method. ACH and wire transfers work similarly but with different timelines and rules. ACH payments pass through the Automated Clearing House and can take several business days. Wire transfers are direct and immediate transfers between two financial institutions that move over a network called Fedwire. There were more than 14 million wire transfers in February 2023.

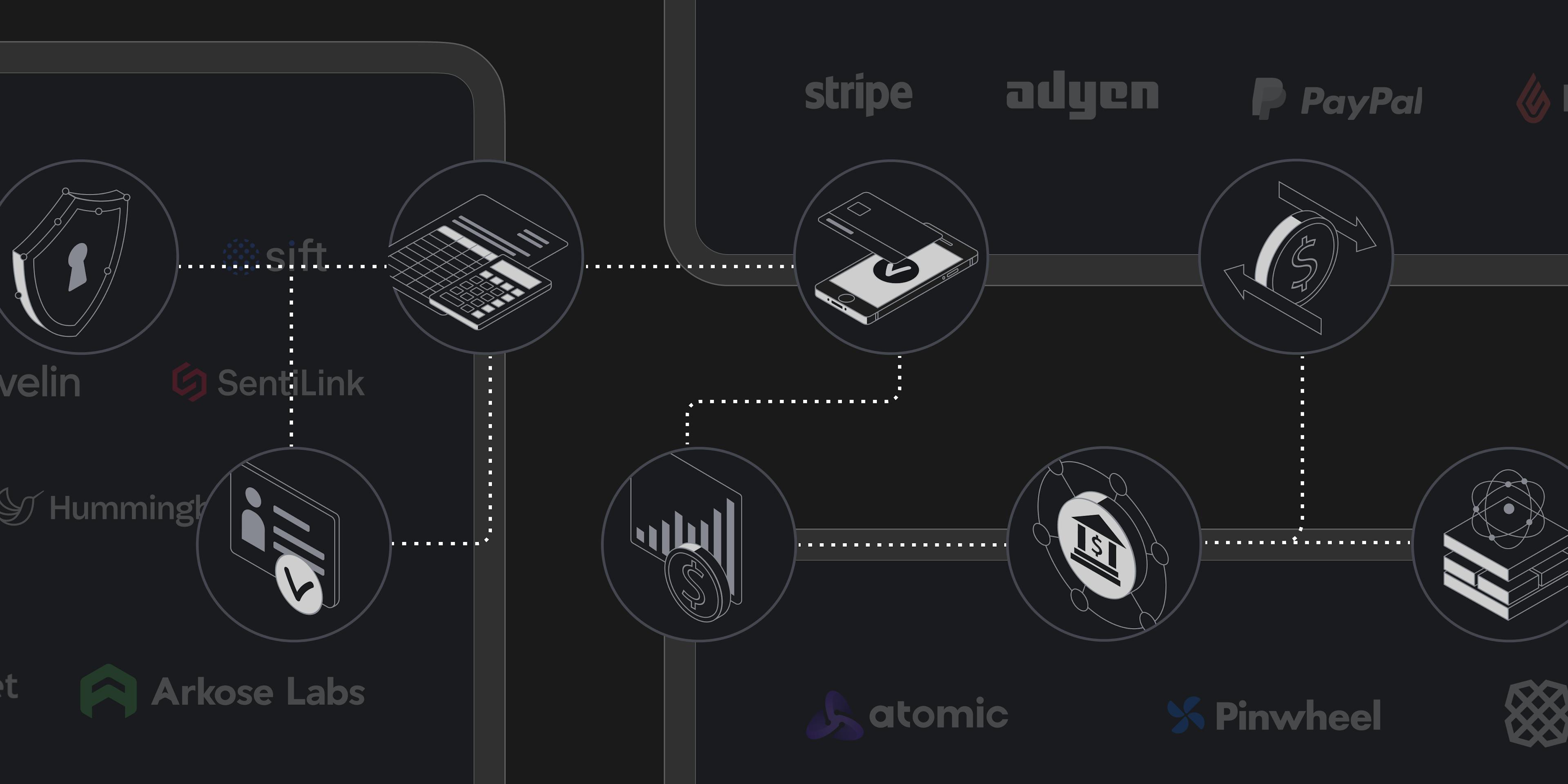

Despite the high volume of transactions, moving money between banks is time-consuming and cumbersome, and many payments between companies take several days to clear. Companies have to manually handle payment operations around transactions not involving credit cards or develop their integrations separately for each bank and every payment rail they work with. Finance and accounting teams initiate, approve, reconcile, and report the daily ACH, wire, and check payments. A 2023 survey found more than 1 in 3 executives described manual reconciliation as the most frequent headache in B2B, while 88% feel their company faces problems with payment operations due to high transaction failures, a low accurate reconciliation rate, and data quality errors. Most banks do not have modern, easy-to-use software or APIs for businesses to integrate payment rails such as ACH and wires.

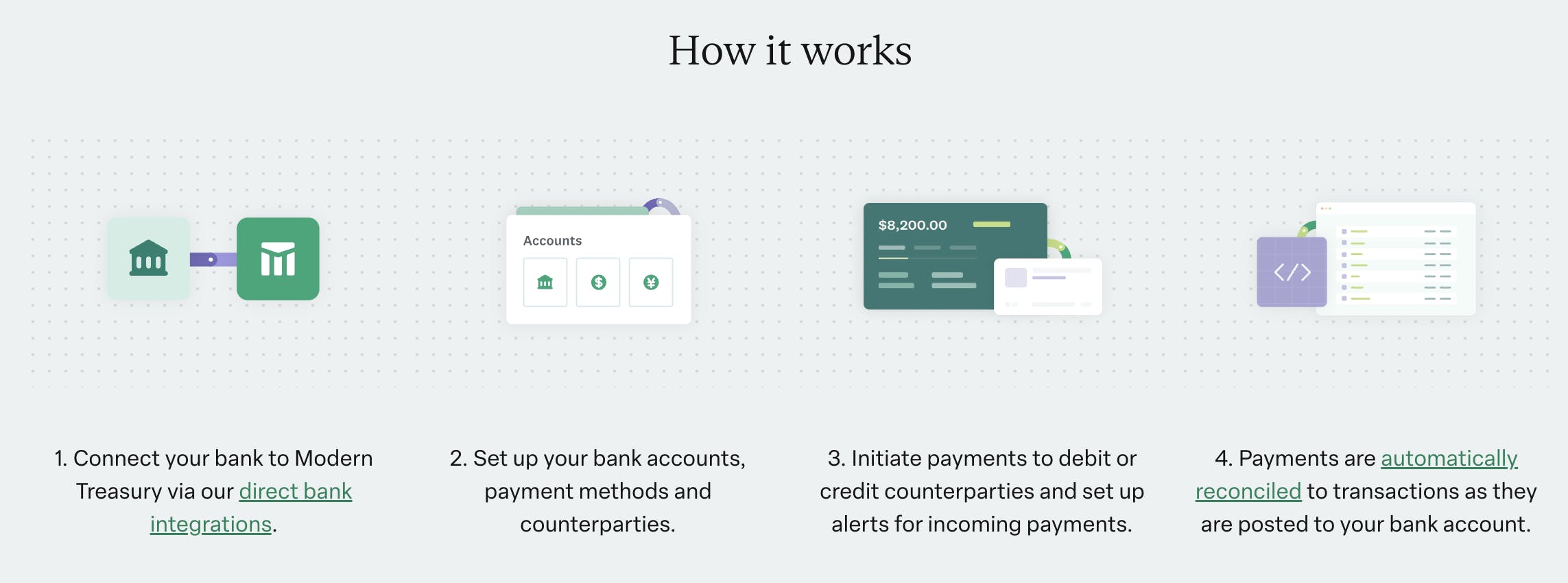

Modern Treasury provides payment operations software for companies, allowing them to move and track money easily by automating the cycle of money movement from payment initiation through to approvals and reconciliation. Its API enables companies to connect to banks and send and automatically reconcile wires, ACH, and real-time payments; it also facilitates continuous accounting instead of letting the transactions pile up until they are cleared at the end of the month.

Founding Story

Source: Forbes

Modern Treasury was founded in 2018 by Dimitri Dadiomov (CEO), Matt Marcus (CPO), and Sam Aarons (CTO). They met at the mortgage marketplace company LendingHome (now Kiavi). They were tasked with building a retail investment platform that would enable high-net-worth individuals to deposit money onto LendingHome’s platform and receive interest income from mortgage loans.

In three years, the trio was able to scale the product from 0 to selling over $300 million worth of mortgages. For the platform to power those transactions, the team had to become comfortable with payment rails such as ACH and wires, often facilitating tens of thousands of payments each month on those rails. The sheer volume of transactions led the team to try and automate the payments process, as it then required a human to log into the bank, enter an account number and routing number, and hit send.

But when the team contacted its bank in search of an automated solution they learned it didn’t have a solution either. Instead, they would have to build out their own integrations with the bank for each transaction method. While the team did so successfully, they faced more challenges ahead — particularly in reconciling the vast volume of payments it was now powering. The accounting team would print out bank statements, come down to the floor that Dadiomov and Aarons were on, and manually go through items to ask what the transactions were for and figure out the correct General Ledger code and accounting category to tag the transaction in.

After this experience, the team reached out to their connections at other companies to understand how they addressed the challenge and were surprised by their findings. Companies usually hired a dedicated team to run the process, which could still take upwards of 20 days to close a month’s transactions. This was when they realized there was a potential to build a product that helped companies automate their payments, perform reconciliation, and manage accounts. Armed with this knowledge, they participated in the YC summer 2018 batch.

Product

According to an interview with Modern Treasury conducted by Contrary Research in May 2023, Modern Treasury's forthcoming product changes as of 2023:

A payments platform that provides companies with an integrated payments experience including control and visibility across banks with a single dashboard and API.

A ledger database that allows companies to log and track transactions from multiple systems within a single source of truth.

Additional features of the Modern Treasury product include: reconciliation, virtual accounts, compliance, and pre-built UIs.

Payments

Modern Treasury’s Payments product allows customers to integrate with banks on Modern Treasury’s network using one API. Instead of building their integrations with different banks and for different payment methods, customers can send and receive payments programmatically over ACH, wires, and RTP using Modern Treasury’s API.

Modern Treasury automatically monitors and visualizes ongoing and completed transactions, including relevant context and cash flow. As it initiates each payment, it stores the context of each transaction and simplifies the reconciliation process for its customers

The platform also features built-in controls on its payments product to ensure the right users at the company have access to specific financial information and payment initiation functionality.

Source: Modern Treasury

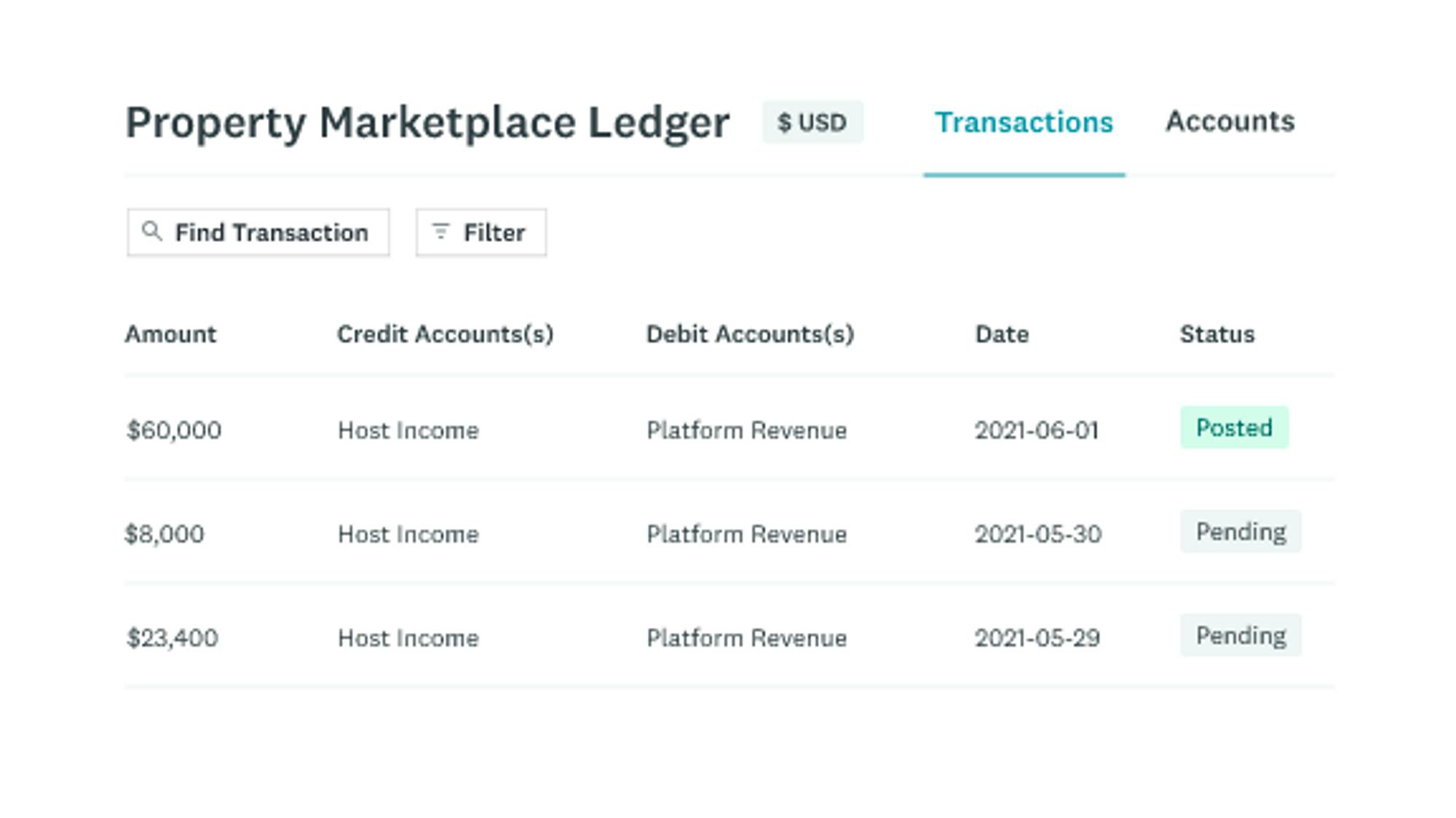

Ledgers

Ledgers is a fully managed database for recording user balances and transactions. It includes built-in data entry and handling safeguards, such as double-entry bookkeeping, immutability, and audit trail. It supports custom currencies and account categories. It supports various use cases like holding user balances, building lending or investing products, and having a central source of truth for card issuing programs.

Source: Modern Treasury

Features

Additional features of Modern Treasury's product offerings include reconciliation, virtual accounts, compliance, and pre-built UIs.

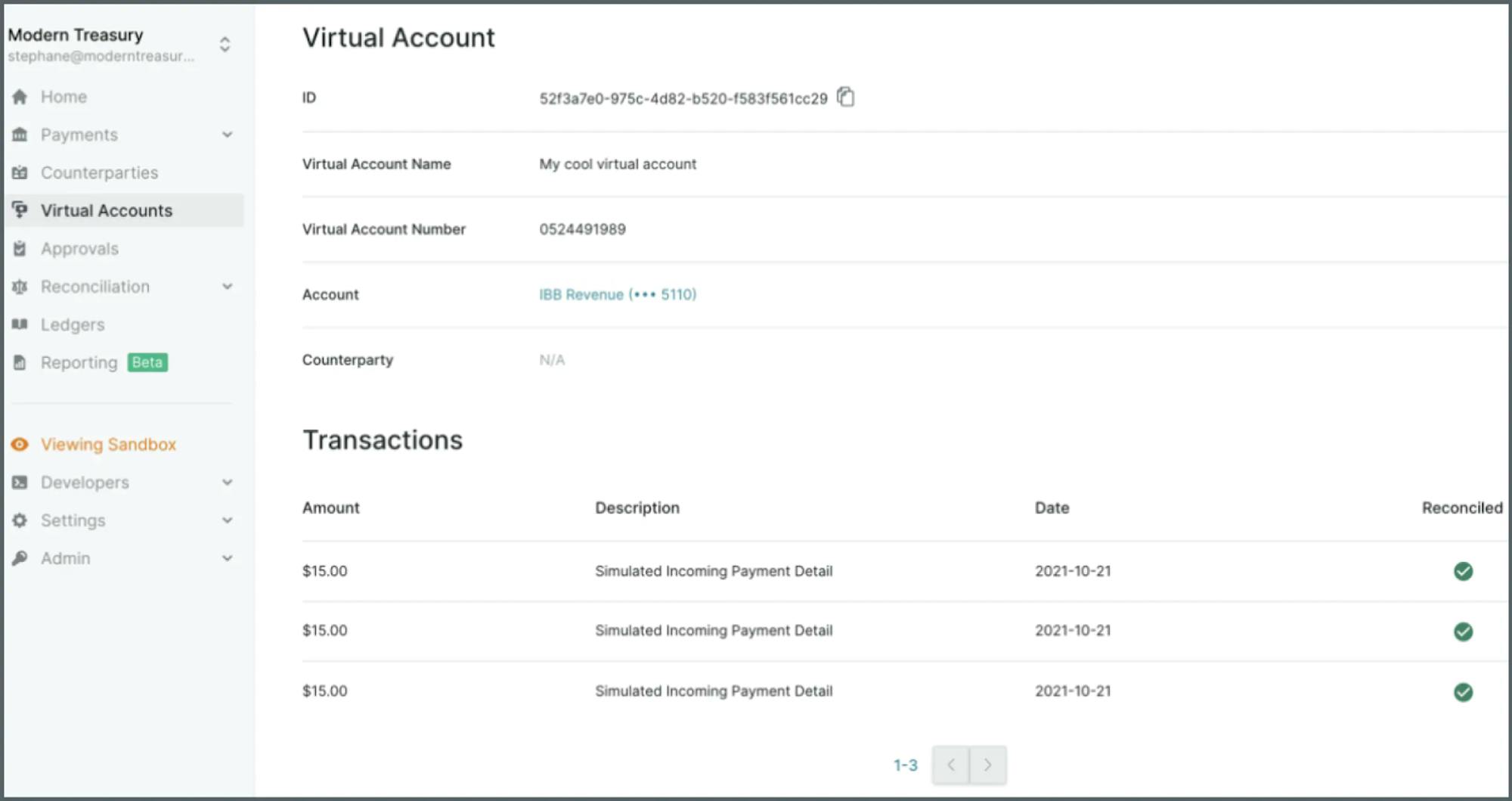

Virtual Accounts

Virtual accounts are temporary accounts — which do not hold a balance — that can be used to transact on behalf of a real account.

Modern Treasury allows companies to programmatically generate virtual accounts and assign them to users, invoices, or other entities. Using virtual accounts, companies can gain visibility and streamline the reconciliation of payments. Each transaction features an Incoming Payment Detail object that provides necessary data for accurate reconciliation, including a transaction code and a virtual account number. Customers can route payments into virtual accounts via ACH, wire, and RTP through a single integration.

Source: Modern Treasury

Compliance

Modern Treasury has built Anti-Money Laundering (AML) compliance and fraud prevention into payment workflows to help businesses unify those functions with their payment operations.

Compliance also helps to speed up bank onboarding. With its Know Your Customer (KYC), Know Your Business (KYB), and transaction monitoring features, businesses can operationalize Bank Secrecy Act (BSA) / AML policy and ensure that they are compliant with regulatory requirements. This helps minimize the risk of fraud and ensures that businesses meet their regulatory obligations.

Market

Customer

Modern Treasury serves any company needing modern APIs to manage how they move money and run payment operations. The company has seen adoption across marketplaces (ClassPass, Outdoorsy), healthcare (Sana), fintech (Revolut, Pipe, Navan), and real estate (Side, Haus).

Marketplaces need to move money between buyers and sellers and track user balances. Financial services need payment operations infrastructure to power seamless payment experiences for users. Healthcare companies have fund flows requiring custom payment approval rules and segregation of funds between different bank accounts. As of March 2022, Modern Treasury had 100 customers.

Market Size

Modern Treasury is building payments infrastructure to power over 1 quadrillion (or 1000 trillion) bank transfers yearly. In 2022, the ACH network processed 30 billion payments at a total of $76.7 trillion. ~67% of total ACH payments were attributed to B2B payments in 2020. Furthermore, over 200 million wire transfers took place in 2021.

Competition

Dwolla: Founded in 2008, Dwolla is a white-label service that offers APIs to power transactions through payment networks, including ACH, wires, and real-time payments. Dwolla started with services focused on its local market Iowa before making a strategic shift in 2016, becoming a fintech company and selling its payment software directly to businesses, offering consumer bank transfers as a payment option. Dwolla has raised $72.4 million in funding. In 2019, Dwolla processed $11 billion in gross payment volume and $20 billion in 2020. As of July 2021, its platform had 3 million end users, with 500 customers using its services.

Astra: Astra offers a platform that allows developers to add faster settlement and financial automation to their existing products. Astra was founded in 2016 and has raised $14.9 million in funding. According to a finance executive at a fintech unicorn, one area where Astra stands out is indemnification, especially regarding ACH transactions. Astra focuses on offering ACH pushes instead of pulls and only facilitates transactions up to the amount customers have on their balances. Like Modern Treasury, it facilitates ledger automation, ACH transfers, and peer-to-peer transfers.

Moov: Founded in 2017, Moov provides open-source financial services building blocks. The company makes sending, receiving, and storing money modular and composable. It has taken a developer-first approach in building primitives in modern Go libraries and wrapped in REST—including ACH, wires, RTP, and a ledger for stored balance. Moov has raised $77.5 million in funding. Unlike Modern Treasury, which supports ACH and wires, Moov supports cards and ACH rails.

Sila: Sila, founded in 2018, offers payment APIs and digital wallets. The company was founded by the cofounder of neobank Simple, which sold to BBVA in 2017. It has raised $20.7 million in funding. Like Modern Treasury, its API enables customers to initiate ACH payments and offers virtual accounts. Sila partnered with Sequoir, a blockchain trading and custody infrastructure provider, to create custom blockchain solutions for businesses, including the Sequoir API that enables Bitcoin, Ethereum, and other digital asset execution, settlement, and custody to be embedded in products.

Business Model

The company's revenue model combines a subscription-based software-as-a-service (SaaS) and a usage-based model. Modern Treasury's pricing is not disclosed publicly. The company told Contrary Research that "our business model is one where we charge upfront based on functionalities and products our customers use".

Traction

As of March 2023, Modern Treasury’s customers reconcile over $5 billion per month, up 75% from $2.8 billion in March 2022. In May 2023, Modern Treasury stated in an interview with Contrary Research that it no longer publicly discloses reconciliation. In March 2022, Modern Treasury had 100 customers, including Revolut, Gusto, BlockFi, and Navan. Modern Treasury has expanded integrations by supporting payment processors like Stripe. It has a network of over 20 bank partners.

Modern Treasury underwent a round of layoffs in December 2022. Unverified sources suggest the layoffs impacted around 20% of the company’s workforce.

Valuation

Modern Treasury has raised $183 million from investors, including Benchmark, Altimeter Capital, and Salesforce Ventures. It announced a $135 million Series C that valued the company at $2 billion in March 2022.

Key Opportunities

Expanding into Further Payment Operations

Modern Treasury can become the one-stop shop for payments — akin to a Salesforce for payment operations — by partnering with additional banks, expanding into new countries, broadening its product offerings, and developing additional third-party integrations. By expanding its capabilities Modern Treasury could attract more customers of varying size and sophistication.

Adoption of Real-time Payments

Despite being the world’s largest economy, the US ranks only ninth in real-time payment volume, with $1.8 trillion in transactions in 2022. One growth opportunity is the increased adoption of real-time payments in the US. Real-time payments are instant payment methods that operate 24/7, including RTP (a payment network used to send money between banks in the US), Signet, and FedNow, which is the Federal Reserve’s payment rail that will launch in July 2023.

Receiving payments 24/7, 365 days a year would constitute a significant shift in what American consumers are used to. Wider adoption may help real-time payment methods absorb cases from other payment methods like checks, cards, and ACH, especially for use cases that are less cost sensitive.

As an example, the launch of FedNow could spell the end of paper checks, which are still the standard for payroll and government disbursements. With its existing bank integrations for real-time payments, Modern Treasury allows companies to send payments programmatically through these rails.

Key Risks

Fragmentation

Like Plaid and Zapier, Modern Treasury’s core barrier to entry against new entrants is the volume and breadth of its integrations, including the number of banks, accounting software, and payment methods. That creates a competitive vulnerability to players who can move faster in creating those integrations. And it also makes geographical expansion much harder.

Bundling

Modern Treasury’s growth could be threatened by the entry of large payments incumbents into payment operations tools. These companies could feasibly bundle these tools into their existing payment flows, creating a bundled solution which Modern Treasury may find difficult to match with its own offering.

Summary

Modern Treasury offers a payment operations platform that helps companies power the end-to-end process of payments, from initiation and monitoring to reconciliation. Companies can easily tap into the global banking system through Modern Treasury's APIs and use payment methods such as ACH and wires to power transactions. Modern Treasury provides companies with automatic monitoring of transactions, helping them make sense of the transactions by retaining the required context. In doing so, it positions itself to become the system of record for money.