Thesis

Globally, commerce is continuing to move online. 81% of customers began their shopping journey online as of 2022, and businesses are seeking to innovate and capitalize on changing customer preferences. One innovation driven by these changing customer preferences is embedded finance, which integrates financial services into non-financial business infrastructure. Embedded finance tools can allow non-financial businesses to drive business growth, improve customer satisfaction, and increase profitability. For example, ecommerce companies often embed buy now, pay later (BNPL) services into their platforms to improve purchasing accessibility. In the US, embedded financial services accounted for $2.6 trillion, or 5%, of total US financial transactions in 2021. Moreover, banks are increasingly receptive to the fintech movement, with the share of US-based institutions viewing partnerships with fintechs as at least somewhat important rising to 89% in 2021, up from just 49% in 2019.

Despite this momentum, the underlying payments infrastructure has long remained a walled garden, particularly in the B2B world. While large enterprises can easily access a suite of tailored financial products through incumbent banks, SMBs, which represent 57% of B2B card volume, struggle to access these products. These SMBs face manual reconciliations, limited liquidity, and slow, overly complex payments. As a result, 89% of SMBs are reconsidering their relationship with their legacy providers, creating a significant opportunity for fintech platforms to capitalize on financial products. Infrastructure pioneers like Stripe and Block (formerly Square) made significant headway, but none of the underlying technology changed considerably, and new, unique use cases remained costly and cumbersome.

Moov, a payments infrastructure platform for financial and non-financial software platforms, is attempting to fill this gap. Moov describes itself as an “open source community committed to delivering high-quality, industry-standard financial service protocols for any business looking to receive, send, or store money.” For over a decade, fintech has revolved around new UIs and a rebundling of similar financial products, Moov aimed to rebuild the underlying infrastructure and back-end technology. The company has become an issuer processor, acquirer processor, and program manager, disintermediating middleware and legacy systems. Moov began with ACH disbursement but has evolved to offer a full suite of embedded financial tools to clients, including payment acceptance, card issuing, and money storage solutions. Its approach also allows clients and their bank partners to serve demographics and use cases otherwise neglected by traditional financial services.

Founding Story

Moov Financial was founded in 2018 by Wade Arnold (CEO) and Bob Smith (President). Arnold began his career as a programmer working in a variety of engineering and software development roles. In 2008, he launched his first venture, Banno, a white-label engagement platform for banks and credit unions. Upon Banno’s acquisition by Jack Henry in 2014, Arnold joined the latter as a Managing Director for a brief stint before spending two years at BillGO, a bill payments platform, in various senior roles. Arnold has said that it “was those experiences at Banno and BillGO that ultimately led to Moov”.

Moov President Bob Smith, meanwhile, had extensive experience in financial services, albeit from a less technical background. He worked for several years in commercial lending and investing, then joined Arnold at Banno as the Founding Chairman in 2008. A decade later, he teamed up with Arnold again to start Moov, setting out to “change the future of payments.” While Smith co-founded Moov and maintains an active role, Moov initially began as Arnold’s personal project. Frustrated with the cost and complexity of existing payments infrastructure, Arnold began building a “protocol to API” for ACH in 2017, eventually releasing the first commercially available open-source ACH library in January 2018. Arnold has said that:

“I was inspired to build Moov because, through three different startup companies inside of the financial service space, we spent a lot of time dealing with legacy infrastructure rather than building the product that we wanted to take to market. And so, rather than building another abstraction, I decided to take on the job of building straight to the payment that works.”

Later, Moov opened a public Slack group that helped kickstart a broader open-source community of payments and fintech developers. On the back of this growing momentum, Moov closed a $5.5 million seed round in August 2020, led by Bain Capital Ventures.

Product

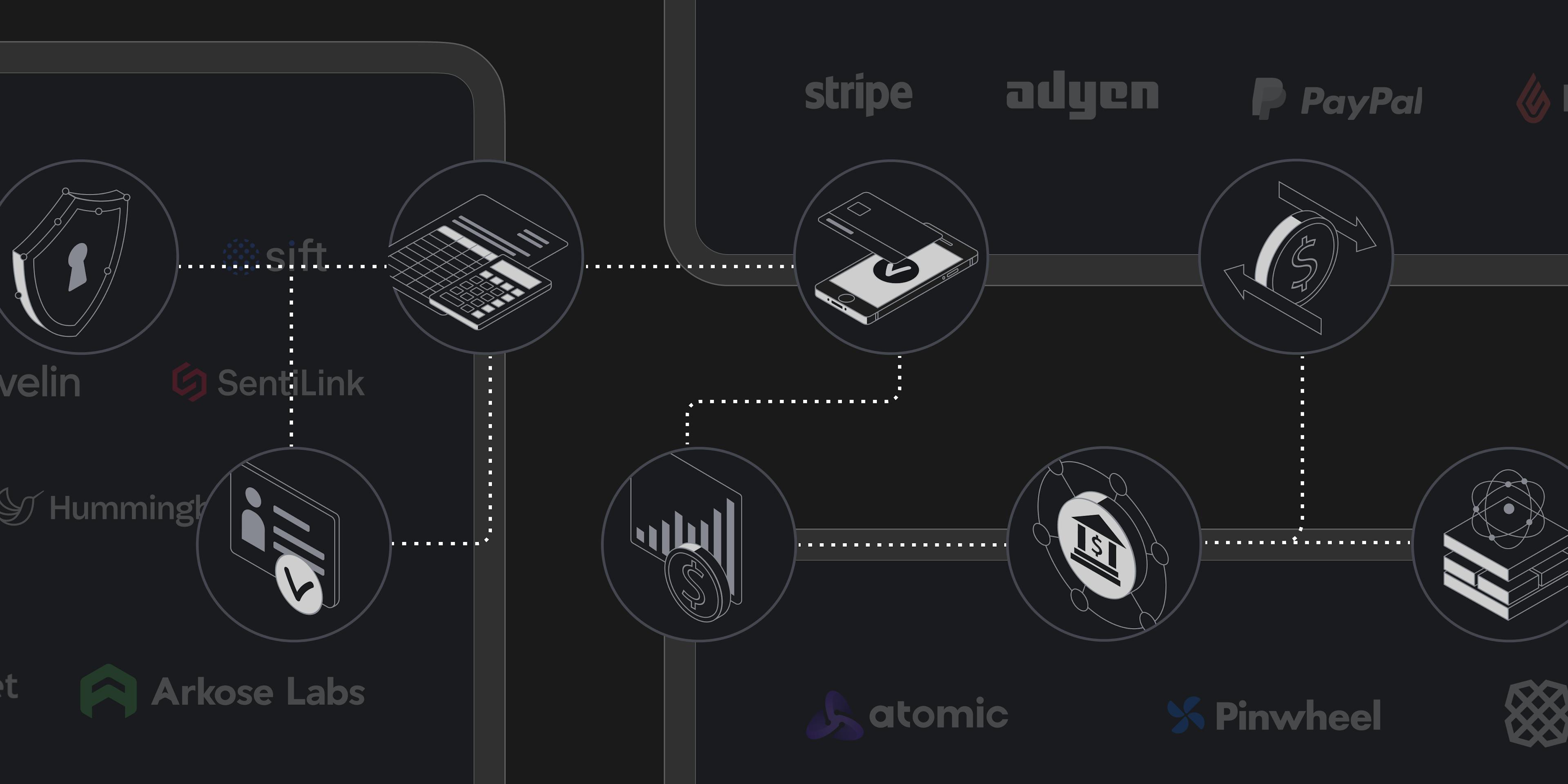

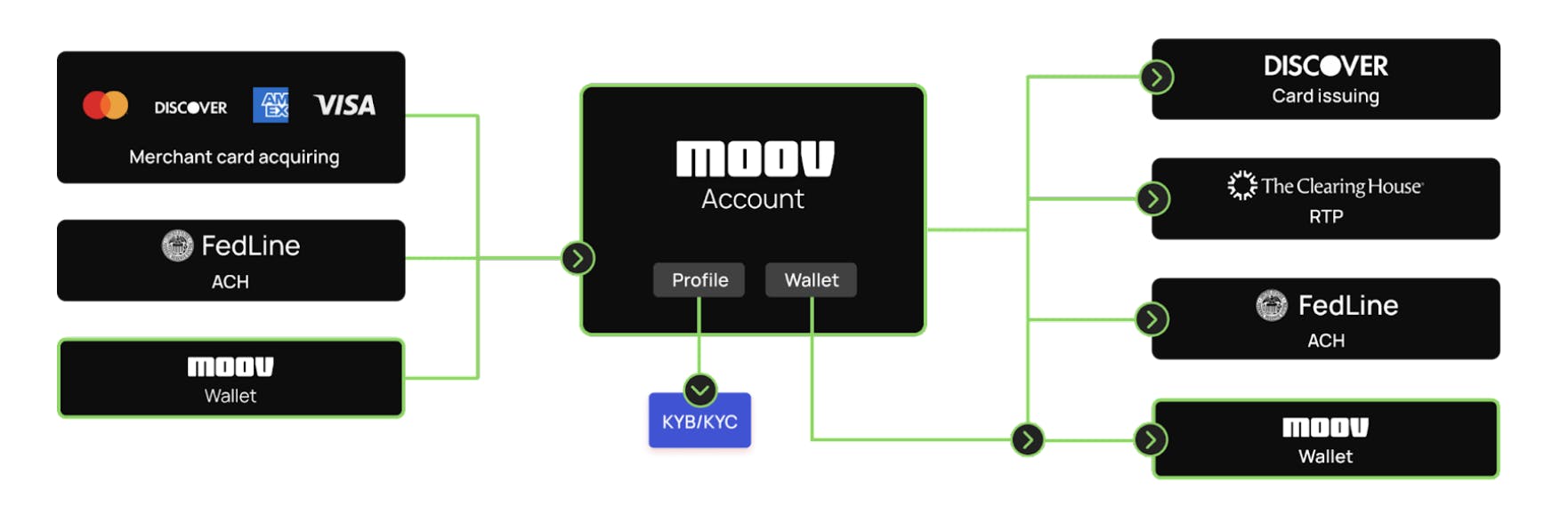

Born out of an open-source community, Moov provides embedded fintech solutions that allow businesses to accept and store funds, remit payments, and issue cards. Specifically, Moov’s clients can enable their customers to accept payments, issue cards, and conduct ACH transfers. The platform is modular and bank-agnostic and integrates directly with card and payment rails.

The design of the platform is intended to enable a variety of use cases across payments and banking. It is also designed to create more efficient, flexible experiences for clients and their end users. Moov also handles user onboarding, licensing, program management, and risk/compliance, with the goal of abstracting away much of the complexity around launching and scaling a financial offering. CEO Wade Arnold describes Moov as offering a “payments toolset that other companies can tap into without having to learn all of the stuff.”

Source: Moov

ACH Transfers

Moov’s ACH transfer product is the foundation of the platform. The product allows clients to originate ACH debits and credits with full compliance and transparency, enabling payouts, account-to-account transfers, and other complex and multi-party use cases. Clients can reach nearly any US bank account and use all settlement windows offered by the Federal Reserve, all with full visibility and control over the payment flow.

All standard ACH debits are processed same-day, when available. In the background, Moov handles fund returns and other exceptions. The company provides live updates and webhooks to notify clients of the status of ACH transfers. Further, Moov handles client onboarding, account linking, and verification. The company’s ACH transfer product is compliant with Nacha standards.

Card Acceptance

Launched in July 2022, Moov’s card acceptance solution allows clients to accept card payments online with all major card networks. Moov is a registered payment facilitator, removing many of the intermediaries in the card acceptance process and streamlining merchant onboarding, verification, and account creation. As a registered payment facilitator, Moov is certified to help sub-merchants accept payments. For example, a software company using Moov could enable its customers to accept payments.

Moov enables clients to manage customer card information, accept card-not-present payments, manage refunds, voids, and disputes, and enable customers to pay with various payment methods including Apple Pay. Further, Moov handles all security, compliance, and risk. Overall, clients can accept card payments online with full visibility and control and little friction or middleware in between.

Card Issuing

Moov’s card issuing solution is, as of August 2023, in closed beta. This product enables clients to issue cards for their clients. Moov provides the sponsor bank, provides program management, and connects clients to the card network. This solution allows clients to instantly provision virtual cards for expense management, employee benefits, and other payouts and on-demand use cases. Further, it is intended to help Moov minimize fraud by allowing clients to set authorization controls to limit where and when cards can be used. Used in tandem with Moov Wallets and other platform features, the solution enables clients to collect added interchange revenue and better engage and retain customers.

Moov Wallets

Moov Wallets offer a secure and convenient way to store funds on the platform. With the wallet, clients can accumulate collected payments, make instant wallet-to-wallet transfers, pre-fund for faster payouts, and cash out to external accounts anytime. Underpinned by Moov’s ledgering and reporting infrastructure, the product expands the efficiency and flexibility of Moov’s payment functionality. Clients can create transfer groups to associate multiple transfers together and send them sequentially. Additionally, in combination with Moov card issuing, users can attach virtual cards to Moov Wallets where customer spend controls can be implemented.

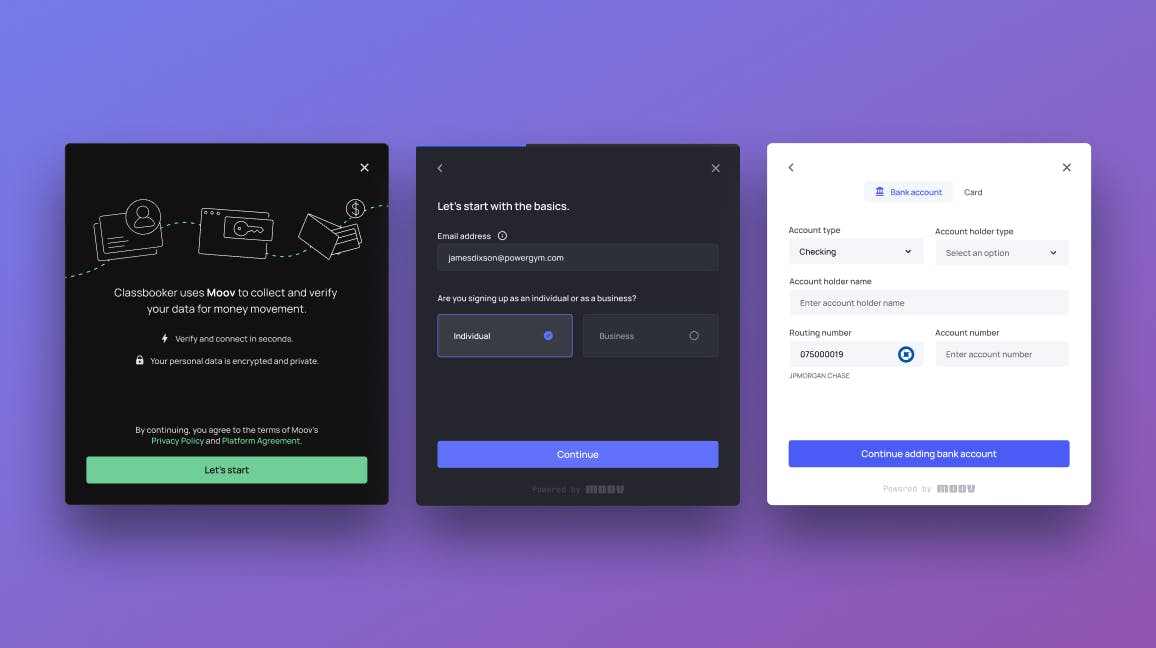

Moov Drops

Deployed across the company’s product suite, Moov Drops are prebuilt UI components that help builders save time on development and design. Builders can embed these modular building blocks directly into their product, creating interchangeable experiences around functions including onboarding, linking cards, and adding bank accounts. Error handling, auto-fill, and other innovative features are built in, and each component comes with customizable themes and colors.

Source: Moov

Market

Customer

Moov provides embedded fintech products for marketplaces, software companies, and other financial and non-financial brands that are creating “modern commerce experiences.” According to CEO Wade Arnold, Moov’s “go-to-market is software companies that don't know anything about payments and want to embed payments inside of their platform.”

Moov serves US-based customers as of September 2023, and it is unknown if the company plans to expand internationally. These customers are typically larger companies that serve small businesses, such as fitness marketplaces that connect gyms and fitness instructors or a “yoga studio as a service” platform. GoodChange, a fundraising platform for advocacy groups, and TapWater, an embedded lending startup, are two of Moov’s publicly listed customers. Moov has not disclosed how many customers utilize the platform.

Market Size

While Moov operates across a number of segments within financial services, it sits broadly within embedded finance, a category encompassing any platform that merges software and financial services and provides value-added financial products within software and services. In 2022, the global market for embedded finance was valued at $66.8 billion, projected to grow at a 25.4% CAGR to reach $622.9 billion by 2032. As a provider of embedded payment and card-issuing products, Moov is positioned to take advantage of the market growth. The key driver for this growth is attributed to changing consumer preferences.

B2B payments remain at the core of Moov’s offering. Financial services embedded into ecommerce and software platforms accounted for $2.6 trillion in 2021, representing nearly 5% of total US financial transactions. By 2026, this figure is estimated to exceed $7 trillion. Likewise, the B2B embedded payments market in the US was approximately $700 billion in 2021 and is expected to nearly quadruple to $2.6 trillion in transaction value by 2026. This growth is expected to increase embedded payment revenue proportionally, from $1.9 billion in 2021 to $6.7 billion in 2026.

Competition

Stripe: Stripe, a fintech market leader, is a developer-oriented payments company that helps businesses of all sizes accept card payments. While Stripe’s core product revolves around online payment acceptance and multi-party payment solutions, it also provides checkout, fraud prevention, lending, card issuing, and other financial tools. The company began in the SMB segment but has since moved upmarket, inking deals with Amazon, Shopify, Ford, and other enterprises. While it has long delayed its IPO, Stripe raised $6.5 billion dollars at a $50 billion valuation in March 2023. This $50 billion valuation was significantly reduced from Stripe’s prior public valuation of $95 billion. In total, Stripe has raised approximately $8.7 billion since founding in 2010.

Finix: Finix is a payment facilitator primarily serving online marketplaces and SaaS platforms. Like Moov, Finix offers embedded payment solutions, ACH payment processing, and payment acceptance. The company’s customers include club management software ClubEssential and powersports dealer management software Revvable. In August 2022, Finix announced $30 million in funding from investors including the General Partnership, Franklin Templeton, and American Express Ventures. In total, the company has raised $133 million since launching in 2015.

Payrix: Payrix, founded in 2015, is a payment facilitator specializing in embedded payments primarily for vertical SaaS companies. Payrix has two tiers of embedded payment solutions: Payrix Pro and Payrix Premium. Both products enable SaaS companies to enable customers to process payments, but Payrix Premium offers higher payment revenue in exchange for the SaaS company assuming a higher degree of control over the payment stack and full risk liability. In October 2020, the company announced that its total funding exceeded $50 million, led by Blue Star Innovation Partners and Providence Strategic Growth.

Unit: Unit is a banking-as-a-service platform that helps clients embed financial products into their platforms. Like Moov, Unit provides embedded card issuing, payments, and accounts, but also includes embedded lending. In addition, the company provides deposit accounts, debit and charge cards, and ACH and wire payments, among other features, enabling an array of use cases across consumer, freelance, and business banking. Unit partners with member FDIC sponsor banks on the backend, and its customer base includes AngelList, Cleo, and Benepass. In May 2022, Unit announced that it had raised $100 million in funding at a $1.2 billion valuation led by Insight Partners. Since its founding in 2019, the company has raised nearly $170 million in total funding. Unit is continuing to add new features including same-day ACH and white-label UIs.

Bond: Bond is an embedded card issuing solution founded in 2019. Unlike Moov, Bond’s two primary card-issuing products are categorized by business and consumer. The company’s business charge card enables clients to issue cards to its business clients to earn interchange revenue, understand customer transaction data, and grow customer loyalty. Bond’s consumer-secured credit card enables clients to issue a credit-building card to customers and includes an FDIC-insured deposit account. For both products, Bond owns compliance workflows. In June 2023, FIS acquired Bond for an undisclosed amount to expand its fintech portfolio. Prior to the acquisition, Bond raised a $32 million Series A in July 2020, led by Coatue. In total, the company raised approximately $42 million prior to the acquisition.

Business Model

Moov does not explicitly disclose its revenue or pricing model, but CEO Wade Arnold has indicated in the past that the company charges a “platform fee that gives you X number of users that have KYC (know your customer) KYB (know your business) and X number of transactions on top of that.” As Moov explains on its website, it gives customers pricing with the “flexibility to grow.”

Finix, a payment facilitator competing against Moov, has three pricing plans for embedded payments. Finix’s flat rate, ideal for small businesses, charges 2.75% + $0.30 per transaction for Visa, Mastercard, and Discover and 3% + $0.30 for American Express. The dynamic pricing plan, ideal for merchant businesses, SaaS platforms, and marketplaces charges 0.3% + $0.30 + interchange + dues and assessment per transaction. Finix’s custom pricing plan, ideal for mid-to-large-sized companies, is negotiable. Moov likely has a comparable pricing model for embedded payments to Finix.

Traction

Moov hasn’t reported any significant metrics, but it has continued to hire aggressively in the face of industry headwinds. In the wake of Moov’s Series B in January 2023, CEO Wade Arnold reflected on the company’s positioning within the broader economic environment, remarking that “it’s exciting to be a company with cash to hire and take advantage of the layoffs that are happening”. Its fully-remote team now spans 25 states and three countries. As of August 2023, Moov had 135 employees, representing a 55% year-on-year growth. The company has not disclosed how many customers utilize the platform.

Moov has won the Visa Everywhere Initiative, grew its meetup of fintech developers into a flagship industry event, and amassed a web of direct integrations with the Clearing House, the Fed, and all of the major card networks, becoming the first merchant acquirer in more than a decade.

Valuation

While Moov has not publicly disclosed its valuation, it has raised more than $77 million in financing since its inception in 2018. Most recently, the company announced a $45 million Series B in January 2023 led by Commerce Ventures. Andreessen Horowitz, Bain Capital Ventures, Visa, and Sorenson Ventures participated in the round. In December 2020, Moov announced a $27 million Series A led by Angela Strange, Peter Levine, Seema Amble, and Andreessen Horowitz. Moov’s Series A was only three months after announcing its $5.5 million seed round led by Bain Capital Ventures.

Key Opportunities

New Value-Added Services

Moov’s near-term roadmap is heavily focused on expanding its payment functionality. However, Moov could expand its offerings to include other financial products including lending and insurance. By expanding into new financial verticals, Moov can become a one-stop shop for its customers, deepening engagement, improving efficiency, and increasing its bottom line. In 2021, the market for embedded lending was $4.7 billion and is forecasted to grow at a CAGR of 19.4% to $32.5 billion in 2032. Likewise, embedded insurance is projected to see exponential growth in the next decade.

Expanded Partnerships

While Moov has already established partnerships with notable companies including Plaid and Pathward, expanding its network of strategic and infrastructure partners would deepen the company’s value proposition and widen its footprint in the ecosystem. Continuing to add bank partners on the platform improves redundancy and efficiency, and a more robust referral partner program can be a critical sales engine.

For example, Moov’s partnership with Plaid allows its clients to link financial accounts utilizing Plaid’s platform. As a result, account holders do not have to wait to complete micro-deposit verification processes and can instead link financial accounts instantly through Plaid. Future partnerships could strengthen Moov’s overall ecosystem, delivering a higher-quality end product to users.

Key Risks

Competition

CEO Wade Arnold has argued that Moov has “no direct competitors.” However, the banking and payments infrastructure space is filled with an array of startups and legacy players. Banks continue to move down-market, and disruptive infrastructure platforms like Stripe have significant market traction. As Bain’s Embedded Finance Report explains, “the supply of new enablers [like Moov] could far outstrip demand”, compressing margins and forcing a race to the bottom.

Perhaps more critically, consolidation and vertical integration continue to pick up pace across fintech, and growing closed-loop networks like Square and Venmo have the potential to displace Moov. Further, Moov faces competition from other embedded fintech providers at similar venture stages, including Finix, Payrix, and Unit.

Regulatory Uncertainty

With Blue Ridge Bank, Cross River, and other financial institutions facing regulatory pressure, regulators are increasing the scrutiny of fintech companies and their banking partners. The FDIC, OCC, and CFPB are increasingly stepping in to protect consumers and businesses, creating significant uncertainty around onboarding, transaction monitoring, and other compliance and risk functions.

Moov sits in a precarious position between end users and its partner banks. In recent guidance, US regulators have noted that they are keeping a close eye on the relationships between banks and fintech companies. KPMG issued a note to clients, stating: “Expect continued supervisory intensity, particularly to large organizations, ‘new or novel structures and features’ such as fintech ‘partnerships’, and services for ‘critical activities’.” Due to Moov’s business model relying on partnerships with banks, the company is particularly susceptible to changing regulation.

Fraud

Most US companies expect increased fraudulent activity in 2023 and beyond, in part driven by the growing adoption of ACH, instant payments, and digital payment methods. Between 2021 and 2022, the number of attempted fraud transactions rose by a significant 92%. Block was scrutinized for alleged “rampant” fraud occurring on its platform. Further, the average fintech company loses $51 million annually to fraud, totaling $20 billion in 2022. Moov is susceptible to several forms of fraud, including social engineering, presentation attacks, synthetic identity fraud, account takeover, and ACH fraud. As Moov expands into new and more innovative use cases and technologies, it’s imperative that the company implements robust fraud prevention tools.

Summary

Moov is an open-source fintech platform that aims to solve payment needs for marketplaces, software companies, and other businesses. It is a certified payment facilitator offering embedded financial services products to its customers. The company’s product suite spans rails like ACH and RTP, virtual accounts, and card issuing and acquiring, leveraging direct connections to the major payment rails to unlock a full ecosystem of financial products. With the scope and sophistication of the payments ecosystem in the US only expanding, Moov and its entrenched community of developers aim to help usher payments and banking into a new era.