Thesis

In the US, retail shopping is increasingly moving online. US ecommerce sales reached $1 trillion in 2022 for the first time. As demand for online goods rises, more businesses are emerging to supply that demand. There were more people starting businesses on a monthly basis in 2023 than ever before — of the more than 1 million Shopify merchants, most are first-time entrepreneurs, which implies that the rise of ecommerce has increasingly democratized entrepreneurship.

For ecommerce merchants in the US, one in four leverages Shopify to power their store. Many of these ecommerce entrepreneurs are capital constrained, meaning they’re incapable of growing their businesses substantially. When the average business sees its ability to grow organically start to drop, the company will often look to be acquired by a private equity firm, or another type of investor, with more specialized expertise to help them grow. But acquisition options have been limited because private equity firms didn’t typically buy ecommerce-focused businesses.

Marketplaces for buying and selling online businesses have been around since at least 2009, with companies like Flippa. In 2018, companies like Thrasio emerged as ecommerce rollup vehicles, also known as aggregators, with the intention to buy, roll up, and operate independent ecommerce businesses using shared infrastructure. During COVID, the percentage of retail sales occurring online jumped from ~10% in 2019 to nearly 16% in 2020. In 2021, aggregators raised over $9 billion in new funding, demonstrating that there was a large appetite for more exit options amongst the independent ecommerce business community.

OpenStore provides liquidity for ecommerce merchants. By automating the pricing process, OpenStore gives business owners an offer within one day and closes within the week, providing founders access to a payout. Whether through their acquisition process with instant liquidity or the newest service OpenStore Drive, they aspire to take over Shopify stores managing everything from marketing and advertising to customer service and inventory, allowing ecommerce merchants to move on to whatever comes next.

Founding Story

Keith Rabois (CEO) launched OpenStore in March 2021, three months after he was approached by his friend and fellow investor Jack Abraham. The company was backed by their respective venture firms, Founders Fund, and Atomic. Rabois recruited the remaining founding team, Michael Rubenstein (former president), Matt Lanter (head of product), and Jeremy Wood to join him to co-found the company in Miami. Prior to founding OpenStore, Rubenstein founded and served as general manager of DoubleClick Ad Exchange, a business unit inside Google. Meanwhile, Lanter had been an engineering manager at Opendoor and chief of staff at Founders Fund. Wood had previously been an engineer at Google.

The idea for OpenStore came from a conversation Abraham had with a direct-to-consumer brand entrepreneur who was looking to sell his business and was not finding enough options to do so. After this conversation, Abraham realized that the small businesses on Shopify, which had been growing rapidly in number, were facing important limitations. These included sub-optimal access to capital, increasing customer acquisition costs, lack of access to cutting-edge technology, and high operating costs in areas like shipping. He believed that the key to solving these challenges for small ecommerce businesses was giving them access to scale.

Rabois, meanwhile, had experience at companies like PayPal, Square, and Yelp which gave him experience in customer acquisition of the long-tail of merchants. His experience at OpenDoor, which provided liquidity to homeowners looking to quickly sell their homes, was also relevant in helping him gain the necessary experience to found OpenStore. With OpenStore, Rabois saw the opportunity to recreate the experience of spontaneous shopping discovery online. Rabois believes OpenStore is not in the business of utilitarian search, but rather of discovery. When consumers don’t know what they want but are in the mood to shop, OpenStore wants to be their online destination. Rabois outlined OpenStore’s goal as follows:

“Acquire more and more brands successfully, faster, absorb them perfectly, run them flawlessly, then stitch them all together so that from a consumer perspective we have effectively a decentralized department store. People discover goods at scale that they didn't know they needed ”

Product

OpenStore Offer

Source: Forbes

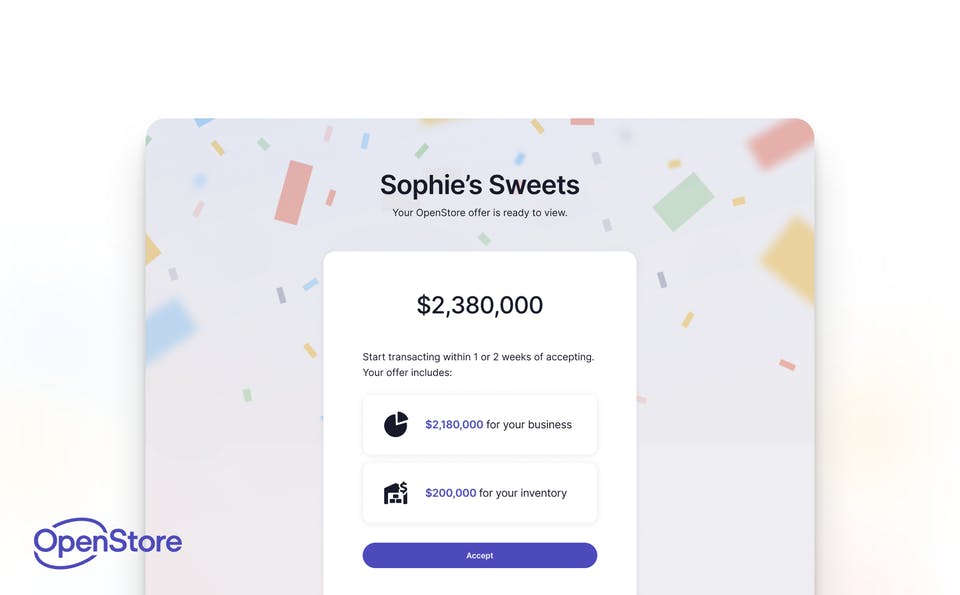

OpenStore’s acquisition offer to ecommerce businesses derives a valuation from combining the value of the operating business and on-hand inventory. Unlike with a simple revenue or cash flow multiple valuation formula, OpenStore’s proprietary engine incorporates metrics such as customer acquisition growth, average order value, and customer repeat rate pulled from the information merchants provide.

The acquisition process begins by linking a Shopify store that is being submitted for sale, adding financials, and connecting any existing ad accounts. To qualify for an OpenStore offer, a store must meet the following criteria:

6+ months of operations

$500K+ in net sales

Profitable in the next 12 months

70% of sales on Shopify

Majority of customers and sales are in the U.S.

Product category isnʼt restricted on Facebook

From initial pricing to diligence, transition, and passive income, the process takes 5 days with a 24-hour pricing evaluation and a 2-week diligence period. If the store owner accepts the cash offer, the team undergoes a diligence process that typically takes under two weeks to confirm the store is acquisition-ready. This diligence process involves a mix of people asking questions and an assessment of technology. OpenStore’s goal is a one-day close, with 1-5% of this done by humans and 95% automated.

After a store owner accepts an offer from OpenStore, OpenStore pays them 80% of the offer amount up front. The remaining 20% is distributed after a few months of transition once the transition period is over.

OpenStore Drive

Source: OpenStore

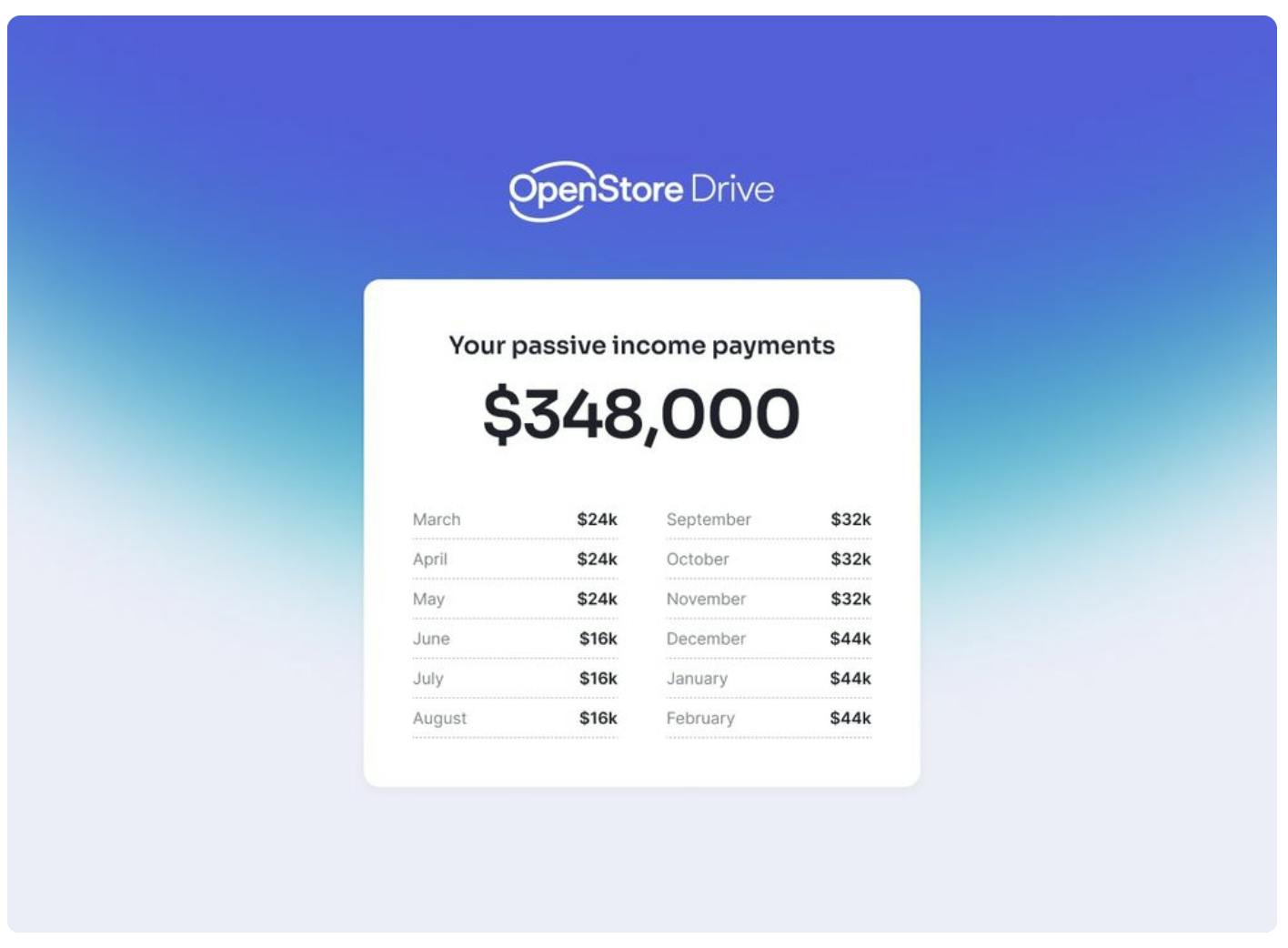

For entrepreneurs not ready to step away fully from operating their store, but who are still looking for liquidity, OpenStore Drive allows founders to take a break from managing their store and receive passive income while maintaining ownership.

OpenStore Drive offers entrepreneurs the chance to leverage OpenStore’s scale, operating platform, and experience and let OpenStore take over store management for one year. As with OpenStore’s liquidity offer, to use OpenStore Drive entrepreneurs connect their Shopify and advertising accounts to receive a customized proposal for the fixed, monthly, and passive income payments based on a forecast of the store's profit. If accepted, the entrepreneur will transition within 45 days and receive quarterly check-ins on the store's performance. After one year, they can decide whether to sell the store or resume operations.

OpenStore launched this more flexible option in response to customer feedback many entrepreneurs weren’t fully ready to part ways with their stores but wanted to take a less active role in them. OpenStore charges a 10% management fee to manage the store. If the store exceeds the expected revenue that was projected in the proposal process, OpenStore keeps the excess, creating an incentive for OpenStore to build the business as large as it can.

OpenStore Shop

Source: OpenStore

By either acquiring fully (OpenStore Offer) or managing in part (OpenStore Drive), OpenStore has exposure to 40+ ecommerce brands. OpenStore Shop is the online storefront where OpenStore can show its aggregated product offerings. On a platform like Amazon, 60% of the products sold come from third-party sellers, and that extends across 30K+ brands. OpenStore’s thesis in offering an aggregated view of brands that they own and/or operate is to ensure a lower volume, but higher quality, in terms of customer selection. In February 2023, the company described its ultimate vision of a higher-quality buyer experience this way:

“OpenStore’s horizontal orientation and aggregation of stellar Shopify stores with the best SKUs will ultimately result in — from the consumer’s perspective — a decentralized department store. People can discover goods at scale, including products they didn’t even know they needed, unlike the model of utilitarian search and immediate payoff.”

Market

Customer

The ideal brand for OpenStore to work with is a merchant doing $500K to $10 million in gross merchandise volume a year, with the majority of sales taking place on Shopify. OpenStore also targets customers in the U.S. with at least 6 months of operating history. While OpenStore serves a horizontally broad market and makes no distinction by category, as of February 2023 ~40% of its acquired brands were apparel. One exception OpenStore does make is to exclude products restricted by the commerce policies on Facebook. This would include typically restricted items like alcohol, tobacco products, and guns. OpenStore targets long-tail merchants (i.e. stores that sell low volumes of hard-to-find items to many customers instead of large volumes of a reduced number of popular items). Instagram is the most popular source of customer acquisition for OpenStore brands; in Q3 2022, 70% of the store’s revenue was driven by engagement from Instagram.

Market Size

OpenStore operates brand websites and targets the direct-to-consumer space and works with merchants doing at least $500K in annual sales. As of December 2022, there were over 2 million brands on Shopify. The majority of Shopify stores make less than $1 million in revenue. As of June 2021, 42,566 websites had over $100K in sales, and 707 stores made over $1 million. The direct-to-consumer ecommerce sales accelerated through the COVID-19 pandemic, growing 33.8% year over year to $102 billion in sales during that period.

Competition

Shopify: Shopify itself previously offered an Exchange marketplace that included anything from new stores to fully operational businesses, with sales prices ranging from $50 to $1 million. As of November 2022, Shopify decommissioned its marketplace and recommended merchants use other marketplaces to sell their commerce brands.

Thrasio: Thrasio is an indirect competitor to OpenStore, given it is the largest acquirer of Amazon third-party private-label businesses, and doesn’t typically target Shopify brands. The company was founded in 2018. In October 2021, it closed a Series D of over $1 billion in funding led by Silver Lake and Advent International which valued the company at between $5-10 billion. As of October 2021, Thrasio said that it had a rate of buying 1.5 businesses per week and had 200 brands in its portfolio. However, by May 2022, Thrasio announced a layoff of up to 20% of its workforce and announced that it would be replacing its CEO.

Pattern Brands: Pattern Brands is a company that acquires, operates, and grows Shopify home goods brands on a single platform, and was founded in 2019. Pattern Brands raised a $25 million Series B in July 2022 on top of $60 million in acquisition capital brought in the year prior. The team previously founded Gin Lane, a brand agency that built dozens of direct-to-consumer brands like Harrys. Its portfolio consists of six businesses.

Win Brands: Win Brands also acquires and scales direct-to-consumer brands. It was founded in 2017 and has raised $90 million in funding. It has a portfolio of lifestyle and wellness brands.

Cap Hill Brands: Cap Hill Brands is a consumer products company that invests in and operates DTC brands. It was founded in 2020, has acquired 35 brands, and wants to enable each brand with centralized operations, technology infrastructure, and management. It has raised $250 million in funding.

Business Model

While OpenStore is not buying brands for synergies across categories, it absorbs and integrates shops into its operations functions. It benefits from economies of scale toward the back end of the OpenStore supply chain, receiving better rates with higher total shipping volumes. Over time, OpenStore wants to house distribution centers closer for faster delivery. As for new product development, OpenStore intends to create its own brands and only aspires to be at the forefront of creating new products if it is informed by the data.

OpenStore takes a 10% management fee on its Drive offering. If a store meets its qualification criteria, the owner receives a Drive proposal within 1 day of requesting it. OpenStore Drive proposals outline 12 fixed monthly passive income payments (net of a 10% payout management fee) that the owner will receive over the course of a year.

As of September 2022, OpenStore had no sales team for its store acquisition and relied on organic acquisition. Acquisition costs ranged between the low hundreds of thousands of dollars to a few million dollars.

Traction

In September 2022, it was reported that over the preceding 18 months, OpenStore acquired dozens of businesses representing tens of millions in revenue. As of late 2021, OpenStore has acquired over 40 stores across different categories. OpenStore remains horizontally broad, with about 40% selling apparel. As of March 2023, it was the world's largest owner and operator of Shopify Stores.

OpenStore closed on its first brand, FarmFoods, in September 2021. By March 2022 OpenStore had built an operations team with 103 employees with 46 engineers.

OpenStore has now successfully purchased 40+ brands. The 33 brands on the OpenStore Shop site are distributed across Men’s, Women’s, Kid’s, and Home categories representing a little over 1.1 million Instagram followers, averaging ~33K a brand.

Valuation

OpenStore has raised a total of $155 million in funding from investors including Atomic, Founders Fund, Lux Capital, General Catalyst, and Khosla Ventures. In September 2022, OpenStore raised a $32 million Series B round led by Lux Capital which valued the company at $970 million.

Key Opportunities

Pricing Engine Data Flywheel

OpenStore evaluates the fair market price of the business it evaluates for Offers and one-year projections of the expected business performance for Drive. The business's success is predicated on its pricing engine's accuracy. The pricing engine may improve over time as it makes more offers, buys, and runs more businesses, which may in turn yield more data points as it attracts more customers.

Rise of Social Commerce

Social media has become an integral part of most consumers’ shopping experience. One estimate indicates that 71% of shoppers are likely to make a purchasing decision based on their social media experience. Given 70% of OpenStore’s revenue was driven by engagement on Instagram, it’s clear that the company is already tapping into the social nature of commerce. When consumers feel connected to a brand, they’re 57% more likely to increase their purchases from that brand. If OpenStore is able to effectively offer up brands to consumers that they wouldn’t have otherwise found, the company can tap into the social aspects of brand discovery.

Vertical Integration

Currently, one of the value propositions of working with OpenStore is the reduced rates on shipping. OpenStore is able to aggregate the demand for shipping across its brands, which can be more affordable than an individual brand making a small number of shipments. Other ecommerce providers, like Amazon and Shopify, have aggregated their own fulfillment internally and offered it as a service to third-party businesses. As OpenStore’s volumes grow, it could bring its own fulfillment in-house to reduce the cost of shipping.

Key Risks

Supply Chain Exposure

For ecommerce companies like OpenStore, it is difficult to manage the volatility of supply chains. Marketing, materials, distribution, and labor have become more expensive since 2021. Thrasio, the Amazon aggregator and a competitor of OpenStore, had gone through layoffs and leadership changes in 2022 partially as a result of the inherent business model complexities that require significant capital and exposure to macroeconomic environments

Maintaining Customer Expectations

Ecommerce customers have come to expect free shipping, frictionless checkout, personalization, omnichannel customer experience, immersive user experience, customer reviews, and in many cases, brands aligned with their values. From 2013 to 2019, the average cost to acquire a customer increased by ~70%. The influx of D2C brands has created a dynamic where it is 5-25x more expensive to acquire a new customer than it is to retain an existing customer. As OpenStore continues to acquire brands, it may face the brunt of these deteriorating economics.

Competitive Platforms

There are 9.5 million e-commerce sites available in the US, offering consumers a wide range of options. There is growing competition for distribution across social platforms amongst ecommerce and DTC brands with accelerated adoption of social buyer growth across platforms like TikTok. This is especially relevant given that OpenStore relies on Instagram to drive a majority of sales for its brands, and the rise of other social platforms could create barriers to acquiring new customers. In addition, OpenStore’s focus on Shopify is not unique, and other companies have seen the advantage that Shopify offers sellers as a platform. OpenStore is likely to increasingly see competition both on its main source of distribution (Instagram) and hosting (Shopify.) The heavy competition and rapidly changing nature of shopping online creates challenges for brands seeking an audience.

Summary

OpenStore aims to provide liquidity to ecommerce merchants. To address the rapid growth of Shopify entrepreneurs who had limited avenues for capital for their businesses, OpenStore seeks to provide a hassle-free acquisition process. In its first years of operation, the OpenStore team has acquired 40+ brands, has raised over $150 million in funding, and has achieved a valuation close to $1 billion. If it is successful, its goal of building a decentralized department store could offer OpenStore a strong position in the growing ecommerce market in the U.S. However, it faces significant risks to its business including a competitive, dynamic market with high operational demands and high capital intensity. Other businesses in the space have struggled as a result.