Thesis

In the early 2010s, a chasm emerged between legacy beauty brands like L’Oreal and Estée Lauder and younger generations. These legacy brands were slow to adapt to a shifting culture that increasingly favored brands that built a strong online community over traditional companies that relied heavily on a brick-and-mortar presence. This chasm only widened as more millennials flocked to social media, with the percentage of people between 18-29 years of age who used a social media account increasing from 72% in 2009 to 90% in 2015.

Meanwhile, between Q1 2014 and Q4 2022, ecommerce spending as a percentage of total retail sales more than doubled, increasing from 6.2% to 14.7%. Younger generations have driven an outsized part of this shift to e-commerce: a 2023 study found that 32% of Gen Z shop online daily, up from 25% of millennials who shop online daily. In addition, 80% of millennials do at least some of their shopping online. New and modern direct-to-consumer (DTC) brands heavily invest in their online presence, use social media platforms like Instagram to grow, create narratives around their products, and learn what their audience wants through online interactions and engaged communities. Between October 2021–September 2022, DTC brand sales reached $3.5 billion in the US, up by 7.8% from the previous period. Feminine care DTC brands have seen the most success, capturing a 20.2% category share of total sales.

Glossier is a direct-to-consumer beauty and skincare brand that leverages content and community to power a superior shopping experience. Glossier’s product lines include modern essentials spanning skincare, makeup, body, and fragrance. As one of the early pioneers in the DTC beauty and skincare landscape, Glossier has built an online community of younger female generations with its community-led social media approach and converted them to loyal customers.

Founding Story

Emily Weiss, Glossier’s former CEO and current Executive Chairman as of April 2023, founded the company in 2010. Glossier began as Weiss’s beauty blog “Into The Gloss” (ITG) in 2010, which Weiss created after noticing a disconnect between legacy brands and millennial customers while working as a styling and fashion assistant for Conde Nast and Vogue. Weiss collaborated with well-known beauty companies on advertising and sponsorship campaigns, and she realized many of these companies had difficulty connecting with millennial consumers. As Instagram became increasingly popular, the demand for social media-savvy professionals grew, yet Weiss remembers beauty companies telling her they had no intention of hiring a social media editor.

Weiss claims that one of her main inspirations for starting Glossier was building a makeup and skincare brand whose sweatshirt customers would want to wear, which she observed not to be the case with legacy brands:

"I went through that exercise of looking across 20 or 10 beauty brands, thinking about whether or not I would buy that sweatshirt, wear that sweatshirt… I just kept coming up with the answer ‘no.’"

After Into The Gloss attracted 2-3 million unique monthly site visitors with its millennial-focused beauty content, such as intimate interviews with model Karlie Kloss, Weiss decided it was time to build a makeup brand of her own. In 2014, Weiss raised $10.4 million and officially launched Glossier with 4 products: a moisturizer, a face mist, a skin tint, and a lip balm.

Emily Weiss served as Glossier’s CEO between its inception and May 2022, leading the brand during a successful period of growth. However, Weiss’s ambitions for Glossier to become a social media platform where customers could shop and interact with each other reportedly proved to be controversial and a stumbling block for the brand. In early 2022, Glossier laid off over 80 employees, mostly on its tech team, signaling a departure from its previous plans to become a tech platform. Later, in May 2022, Emily Weiss stepped down as the company’s CEO and handed the reins to former Cole Haan executive and Glossier Chief Commercial Officer Kyle Leahy.

Product

Glossier sells a wide variety of beauty and skincare products that are both healthy for the skin and aim to enhance the wearer’s natural beauty. Its products can be summed up by a slogan Glossier introduced in a 2019 Instagram post: “Skin First. Makeup Second.” This skincare-first mission extends across the brand’s product line.

Skincare

Glossier makes skincare products which include lip balms, serums, moisturizers, and face masks. One of the brand’s most popular skincare products, Futuredew, is an oil serum hybrid meant to give the wearer’s skin a dewy, moisturized look. This line also includes two of the four original products that Glossier started with in 2014: the Priming Moisturizer and the Balm Dotcom Lip Salve. As of April 2023, Glossier sells 17 individual products under its skincare line on its website.

Source: Glossier

Makeup

Glossier produces makeup that aims to be less harsh and more natural than traditional legacy brands. As of April 2023, its makeup line contains 21 individual products, including its bestselling Boy Brow eyebrow pomade, Ultralip lipstick, Cloud Paint blush, and Lash Slick mascara. The makeup segment also includes one of its four original products, the Perfecting Skin Tint foundation, which comes in 12 shades for all skin colors.

Source: Glossier

Body/Fragrance

The brand also sells body and fragrance products, although both are smaller than its skincare and makeup segments in terms of total products As of April 2023, the body segment contains seven individual products, including a body wash, deodorant, and body cream. The fragrance line contains five individual products including perfume and candles, although each product only has one scent: Glossier You.

Source: Glossier

Branding

In addition to its beauty and skincare products, Glossier’s branding helps separate the company from a typical makeup brand. One example of this is Glossier’s “GlossiWear” line. GlossiWear is an apparel line that includes branded beauty bags, water bottles, and sweatshirts. This line fulfills former CEO Emily Weiss’s desire to build a makeup brand whose sweatshirt customers would want to wear.

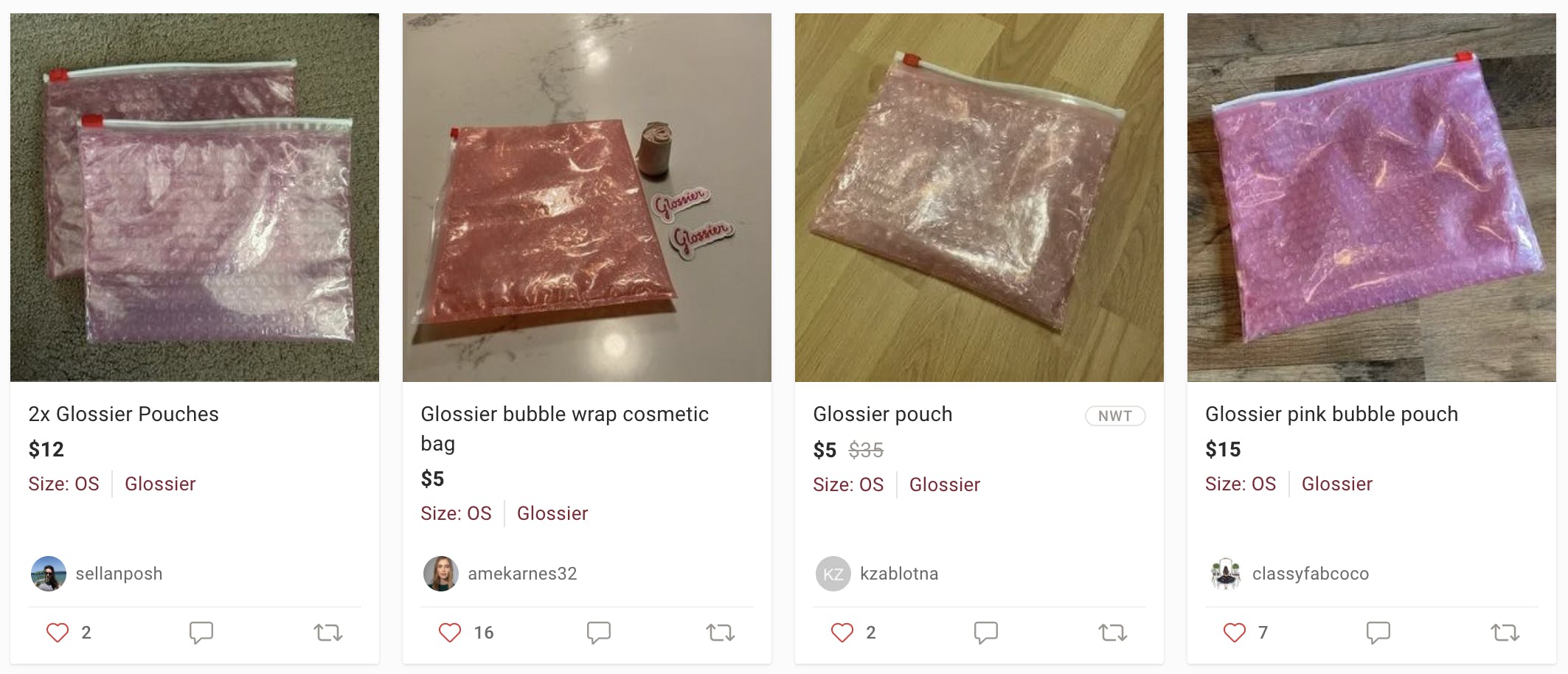

A second example of Glossier’s approach to branding is its minimalist packaging. Customer orders are sent in pink bubble wrap pouches that have become synonymous with the brand, although Glossier gave customers the option to opt out of receiving this packaging due to sustainability concerns in 2019. Many customers reuse these pouches for personal toiletries and other items, and they can be bought separately on secondhand marketplaces like Poshmark. While outside Glossier’s core beauty business, these two examples highlight the strength of the company’s brand among its target audience.

Source: Poshmark

Market

Customer

Glossier’s natural, simple approach to makeup, branding, and online-first community attracts younger generations of women, especially from the millennial and Gen Z generations. When Glossier began producing beauty and skincare products in 2014, younger generations did not have an attachment to legacy brands. They felt there was a disconnect with how these brands were trying to advertise to them.

Since its inception, Glossier’s popularity among younger female generations has remained strong, but the brand is attempting to push past the idea that its products are solely for young women. The company’s founder and former CEO, Emily Weiss, has spoken about her vision to appeal to any generation while also highlighting the importance of its customer community:

“It’s more of a psychographic than a demographic. Whether you’re a 45-year-old lawyer or an 18-year-old customer who saves up for Boy Brow and spends two hours at our New York store making new friends, they have a similar desire to share.”

Market Size

The US direct-to-consumer beauty sales were $6.7 billion in 2021. DTC brands selling feminine care products had captured a 20.2% category share of total sales as of 2023., while pure-play DTC companies increased total sales from $3.3 billion in 2020 to $3.5 billion in 2021.

The global skincare market was valued at $146.7 billion in 2021 and is expected to reach $273.3 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031. The global cosmetics market was valued at $262.2 billion in 2022 and is expected to grow at a CAGR of 4.2% from 2023 to 2030

There are 31.7 million women in the US between the ages of 15 and 30, representing Glossier’s core demographic. A 2019 survey of US women over 18 found that 23% never wear makeup, meaning that 77% of women wear makeup in some capacity. Multiplying the population estimate of women between the ages of 15 and 30 by the percentage of women who wear makeup would indicate that Glossier’s core customer base is 24.4 million women in the US.

Competition

Glossier competes against legacy brands and newer, online-first competitors in the skincare and makeup industries.

Makeup Brands

L’Oreal: L’Oreal is a legacy makeup brand that was founded in 1909 in France. The conglomerate is one of the largest makeup companies in the world, with 36 individual brands under the L’Oreal parent company. L’Oreal achieved €38.3 billion in total 2022 revenue and had a market cap of approximately €230 billion as of April 2023.

Estée Lauder: Founded in 1946, Estée Lauder is a US-based conglomerate of 23 cosmetic brands, including popular names like MAC, The Ordinary, and Bobbi Brown. The company’s total revenue for the 2022 fiscal year was $17.7 billion and its market cap was roughly $86 billion as of April 2023.

Fenty Beauty: Fenty Beauty was founded in 2014 by Rihanna. The brand focuses on providing makeup that can be enjoyed by a wide variety of skin tones and segments its products similar to Glossier. However, Fenty Beauty does not have a skincare-specific line.

Kylie Cosmetics: Founded in 2014 by Kylie Jenner, Kylie Cosmetics produces similar makeup and skincare products to Glossier. In addition, Kylie Cosmetics also produces a line of products for baby care, including shampoo and lotion. Coty, a multinational beauty holding company, acquired a majority stake in Kylie Cosmetics in 2019, valuing the company at $1.2 billion.

Skincare Brands

Drunk Elephant: Drunk Elephant was founded in 2012. It is a skincare brand that emphasizes healthy pH levels for the skin and chooses ingredients specifically based on their biocompatibility. Japan-based Shiseido acquired the company for $845 million in 2019.

Neutrogena: Neutrogena is a legacy skincare brand founded in 1930 and acquired by Johnson & Johnson in 1994. The brand offers similar products to Glossier and other skincare brands, although it has a much wider variety of products within skin care.

Augustinus Bader: Augustinus Bader offers haircare and skincare treatments and products. It was founded in 2018 and grew from $7 million in sales to $70 million in 2020.

Business Model

Glossier products range from costing $10 for a mini face cleanser to $64 for the company’s perfume bottle. Glossier raised prices in June 2022 in response to rising production and shipping costs, with price increases ranging from $1-$4 in the US.

Due to its focus on building a strong online community, Glossier was a pure direct-to-consumer (DTC) company for many years after its inception. Even when the company began to expand to physical retail locations, it opted to open and operate its physical storefronts instead of partnering with a major retailer, with the first physical storefront opening in December 2016. After raising the company’s Series E round in 2021, former CEO and founder Emily Weiss spoke about the company’s online inception and how expanding its retail storefronts was always part of the equation for the brand:

“When Glossier launched as a digitally native beauty company, we were an anomaly in our industry, which has been slow to innovate beyond brick and mortar. Now, nearly seven years into Glossier’s journey, our strategy and the expectations of beauty consumers everywhere are aligned: Beauty discovery increasingly begins online as people look for inspiration from friends and strangers alike, and customers want to move fluidly between immersive and personalized e-commerce and retail experiences. This is the future we’ve always been building for.”

However, despite avoiding big-name retailers since its founding, Glossier’s hesitation to partner with a big brand ended along with the tenure of Emily Weiss as CEO in 2022. When new CEO Kyle Leahy took over in July 2022, she articulated that retail partnerships would be a major part of the company’s business model going forward, which would help bring Glossier to more consumers and grow brand awareness. Glossier debuted in 600 Sephora stores across the US and Canada, which Glossier describes as the company’s “home away from home.”

Traction

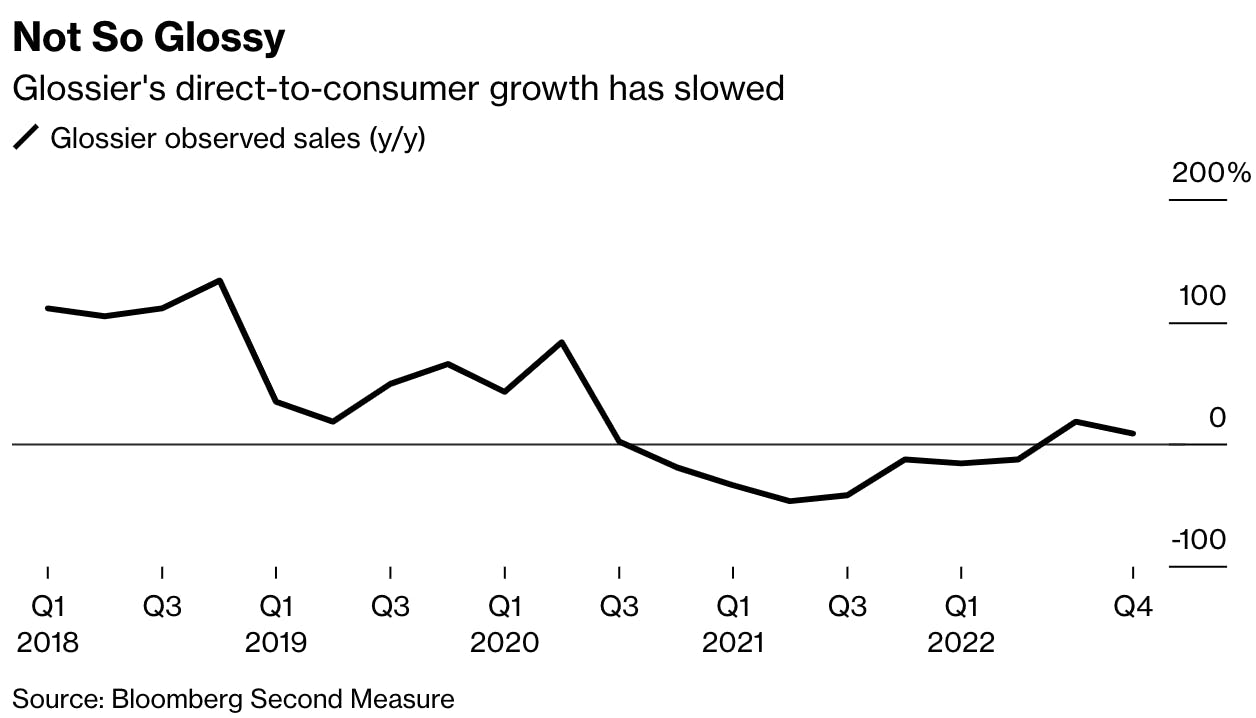

Glossier surpassed $100 million in annual revenue by late 2019. As of July 2022, some estimates pegged its annual revenue figure at $180 million. In March 2023, it was reported that Glossier expects $275 million in 2023 retail sales, although this projection comes on the heels of slowing growth in the company’s DTC channel.

Source: Bloomberg

Glossier now operates 12 permanent locations in several major cities worldwide, including NYC, Los Angeles, Boston, and London. This number increased from two permanent stores in 2020, representing the company’s shift towards retail over the last three years. Glossier products can also be found in 600 Sephora stores across the United States and Canada.

Glossier’s social media accounts are an indication of the brand’s traction and customer awareness, especially among its millennial and Gen Z women demographic. As of April 2023, Glossier has 2.7 million followers on Instagram and 529K followers on TikTok. In 2021, following the company’s Series E funding round, Glossier claimed that two out of every five women ages 18-34 in the US had heard of Glossier and that it had more than 5 million global customers.

Valuation

Glossier raised an $80 million Series E in July 2021 at a valuation of $1.8 billion, bringing the company’s total amount raised to $266.4 million. Lone Pine Capital led the round with participation from several existing investors, including Index Ventures, IVP, Sequoia Capital, Forerunner Ventures, and Thrive Capital. While more recent valuation estimates are not available, some have suggested that Glossier’s failed attempt to become a tech company ballooned the company’s valuation beyond its actual value, as tech companies historically trade for much higher revenue multiples than beauty companies.

Between April 2022 and April 2023, the performance of Glossier’s two major public competitors, L’Oreal and Estée Lauder, did not drastically change. Although the LTM revenue multiple for both companies decreased between August 2022 and October 2022, the metric has improved to reach previous, higher levels in April 2023.

Source: Koyfin

Key Opportunities

Product Expansion

With 50 products, Glossier’s product line pales compared to other brands offering customers a wider variety of beauty products. L’Oreal and Estée Lauder both own several beauty companies with their product lines, effectively dwarfing the size of Glossier. To combat this and grow its existing customer base, the brand announced in March 2023 that it would launch new products every four to six weeks. While it is unclear what these launches will entail, Glossier can expand its product to serve its current customer base or find new customer segments, including men and older generations of women.

Retail Opportunity

Glossier’s February 2023 launch in Sephora marked a distinct break from its previous DTC-only strategy, coming at a time when growth in its DTC business has stalled. While the 600 Sephora stores across the United States and Canada is a start for Glossier, the retail opportunity for the popular brand is greater. For instance, Glossier could partner with other retailers like Ulta, which operated ~1.4K stores across the US as of January 2023 to bring its products to more customers nationwide. Even if Glossier wants to stay exclusive with Sephora, there is room for growth in the more than 2.7K stores globally as of April 2023.

International Expansion

Glossier is positioned to expand into international markets given its strong brand awareness among young female generations. In a March 2023 interview with Bloomberg, CEO Kyle Leahy mentioned that global expansion would be a strategic focus for the brand moving forward. Leahy confirmed this intention to become a global brand in a separate March 2023 interview with Glossy:

“At the highest level, we believe Glossier is a transcendent brand, entering year nine of a 100-year journey. Our mission is to change how the world sees beauty. We view that through the brand that we build, our leadership team, the company culture we build and our impact on the world.”

International expansion signifies an opportunity for Glossier to expand its total market size, although the brand will face challenges in each market it enters, including unique competitive dynamics and different cultural perspectives on beauty.

Key Risks

Workplace Environment Concerns

In 2020, a group of former Glossier employees started a group called “Outta The Gloss” to expose the company’s poor working conditions, especially for “Editors” (Glossier’s term for retail salespeople) and people of marginalized communities. The group claimed that many employees had faced racism and other forms of discrimination from managers and customers, which the brand did not appropriately handle. In the group’s first letter to management from August 2020, the former employees decried the company’s intention to democratize beauty as hypocritical:

“Glossier’s cult status as the millennial pink 1.2 billion-dollar (valuated) beauty brand was largely secured thanks to their vow to “democratize beauty”. We as a collective of former retail employees– aka “editors”– have experienced an ongoing insidious culture of anti-Blackness, transphobia, ableism, and retaliation. We know the proclaimed brand values of inclusivity, accessibility, and equity should apply to us. We ask Glossier’s devoted community: if this democratization is only achieved by perniciously silencing Black and Brown editors and without treating marginalized staff equitably — have they democratized beauty at all, or is it more of the same?”

In response, Glossier apologized for the previous treatment of editors, pledged to improve working conditions, and vowed to introduce better diversity and inclusion requirements for current and potential employees. The company also launched an annual grant program for Black-owned beauty businesses, which is ongoing as of 2023. However, if these measures prove ineffective, the brand might suffer from a tarnished reputation.

Celebrity Competition

Glossier faces stiff competition from several companies across the beauty and skincare landscape, but one specific segment greatly threatens Glossier’s brand strength: celebrity brands. From Rihanna to Kylie Jenner to Selena Gomez and many more, a large and increasing number of celebrities are starting their own skincare and beauty brands, which poses a challenge to Glossier due to the large, cult-like followings of many of these celebrities. Historically, Glossier has shied away from using celebrities to promote its products, instead opting for a more organic, community-centric approach. However, its 2022 collaboration with pop singer Olivia Rodrigo marks a potential turning point in this strategy. Glossier seeks to compete with celebrity brands and maintain its brand image among its core customer demographic.

Alienating Core Customer Base

By attempting to grow beyond its core customer base on multiple axes (product expansion, international expansion, etc.), Glossier risks alienating the core customer base (women ages 15-30) that has propelled the brand to success. Listening to these customers and responding to their desires has become a major factor for the company’s growth since its inception in 2014, which Glossier could lose through its attempts to reach new customer groups.

One previous example of the brand’s growth efforts that backfired is Glossier Play. Glossier Play was launched in 2019 and featured new products meant to appeal to wearers of more traditional, heavy makeup. However, Glossier’s core customer base did not receive the launch well and it failed to gain traction, prompting the brand to shut down the new line a year later. Similarly, if Glossier’s future efforts to grow do not resonate with its strong, core demographic, it will struggle to maintain and gain traction among current and potential consumers effectively.

Summary

Glossier carved out a position in the intensely competitive beauty and skincare markets by meeting its customers online and building a strong core community. The brand’s relentless focus on serving these core customers has allowed it to maintain this position and remain relevant since it released its first four products in 2014. However, with growth in its DTC sales slowing down, questions abound as to whether the brand’s massive bet on retail and plans for further expansion can propel Glossier forward.