Thesis

The rise of ecommerce has increased consumers' expectations for fast, flexible deliveries. In 2015, almost 60% of consumers were willing to wait up to seven days for a standard delivery. Fast forward to 2023, the average consumer considered a maximum delivery time of 2.2 days the standard. 23% of consumers expected to be offered delivery in less than two hours in 2023, compared to just 4% in 2021. As of February 2023, 32% of consumers would abandon their shopping carts when shipping times were too long.

These changing expectations put pressure on brands — particularly omnichannel retailers — to improve the flexibility and efficiency of their supply chain and distribution operations. One way to achieve such improvement is through supply chain management technology. This can help automate processes, increase productivity, and lower costs. Another way to increase supply chain efficiency is through third-party logistics (3PL) providers. 3PL providers offer comprehensive logistics services including warehousing, transportation, fulfillment, and inventory management. They leverage their expertise and networks to optimize supply chain operations, allowing businesses to focus on their core competencies while ensuring cost-effective and flexible logistics solutions.

Stord is a company that provides a cloud supply chain solution that combines supply chain management technology and “port-to-porch” 3PL logistics. The company offers a network of 3PL facilities throughout the US and transportation services. These logistics capabilities are tied together with Stord’s software offerings including its order management system (OMS) and warehouse management system (WMS).

Founding Story

Stord was founded by Sean Henry (CEO) and Jacob Boudreau (CTO) in 2015.

Henry started working on an idea for a marketplace for flexible storage space following an internship at the Hueco Group in Germany, where he worked on supply chain optimization when he was a freshman at the Georgia Institute of Technology (Georgia Tech). While at Hueco Group, Henry realized there was often a mismatch between warehouse capacity and demand. In an April 2018 interview, Henry stated:

“A lot of [their] locations had hundreds of thousands [of] square feet of empty space that we were trying to figure out how to utilize from overplanning... and a lot of [their] locations were just completely out of space, and we were using third-party warehouses.”

This realization gave him the idea to create an “Airbnb for warehousing”, applying a shared-capacity model to third-party warehouses. The first iteration for Stord was a B2C on-demand temporary storage service. Henry worked on it for “a few months and grew it to a few thousand a month in revenues,” according to a 2018 interview.

Henry met Boudreau during this period through a startup community in Atlanta. Boudreau was 18 at that time, had graduated high school, and was running a web development agency by himself. The pair met for coffee and hit it off immediately. Henry recognized that Boudreau was “great on the technical side, but knew enough about business to be dangerous”; Henry recruited Boudreau to join Stord as cofounder and CTO.

Stord took part in Georgia Tech’s Create-X 2016 Demo Day, as Henry was a student at the university at the time. Chris Klaus, a co-founder of the Create-X program, liked the idea and invested $200K in seed capital. That same year, Stord joined the accelerator program at Dynamo Ventures, which specialized in the supply chain and mobility spaces.

After speaking to mentors and logistics experts while at the program, Henry and Boudreau decided to pivot and focus fully on B2B applications. The pair started building a network of third-party logistics (3PL) providers which could be accessed through their online platform. While at the Dynamo Accelerator, they called over 500 warehouses in a week and visited many to learn about their processes and workflows.

Stord initially struggled with landing customers given the co-founders’ youthful appearance in what Boudreau dubbed a “high-trust industry” Since then, Stord has hired several experienced operators. In November 2019, the company hired Steve Swan as Vice President of Supply Chain. Before joining Stord. Swan had previously been a senior logistics manager at Amazon. As of March 2024, Swan is Stord’s COO.

Product

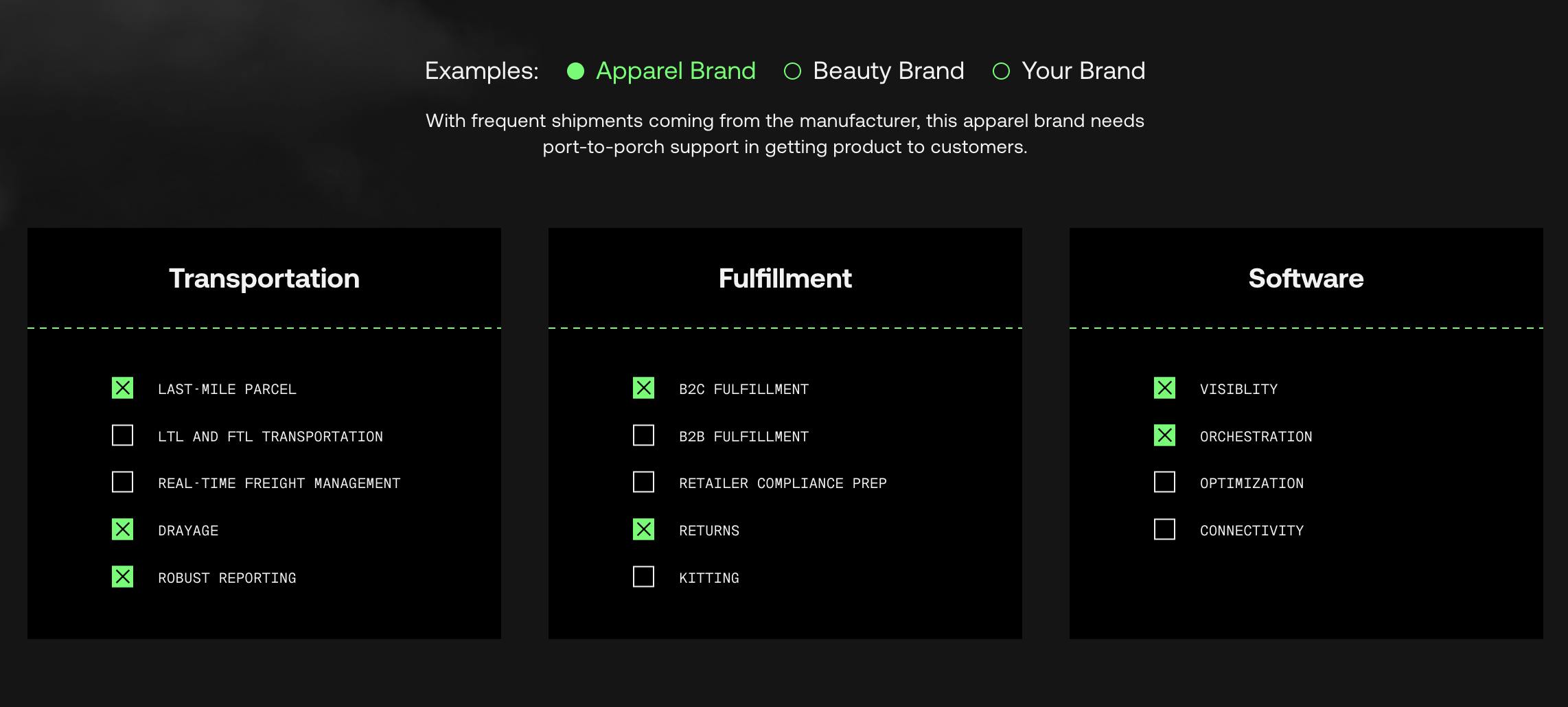

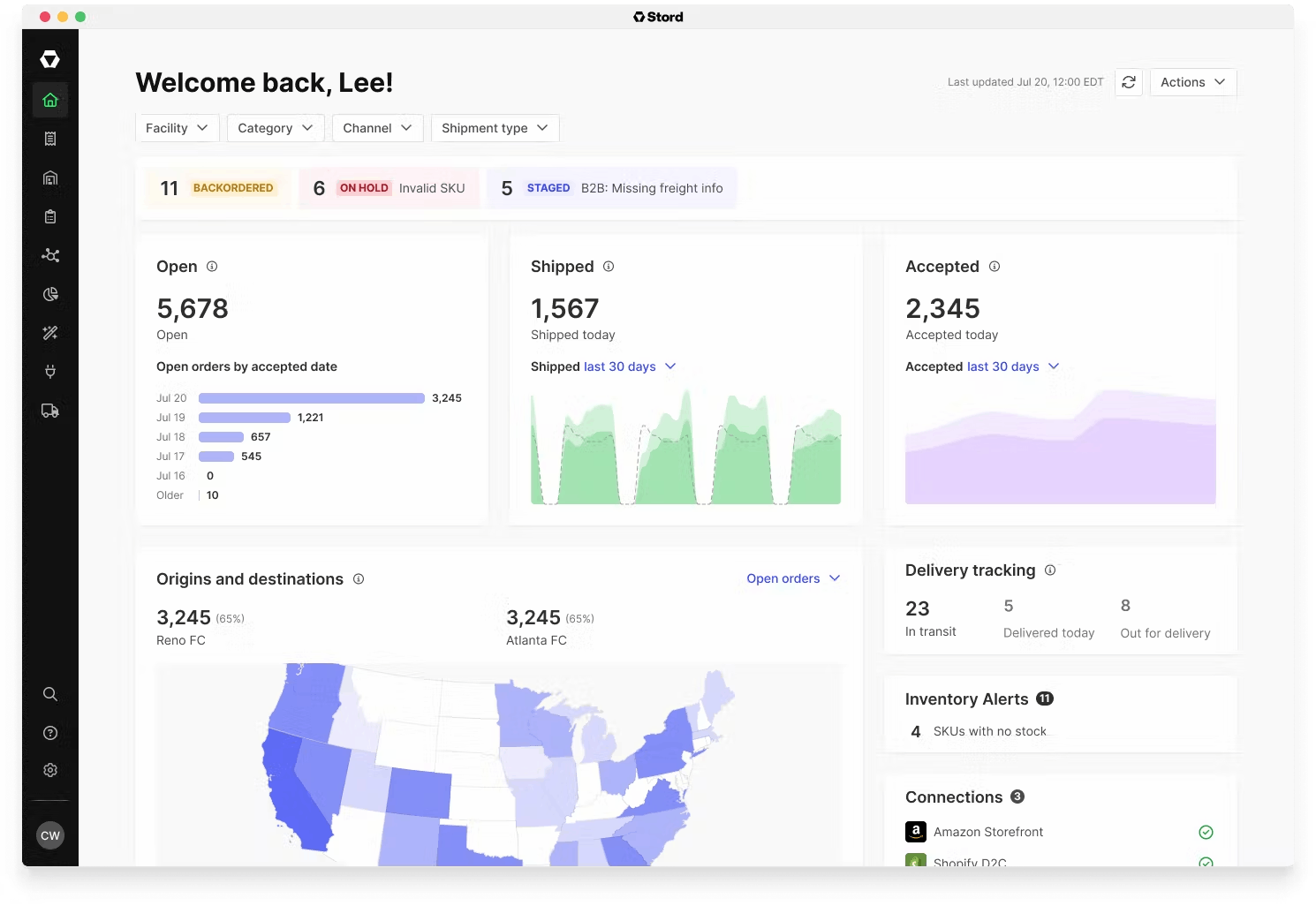

Stord is a cloud-based supply chain solution. Its suite of products connects physical elements of a company’s supply chain with software to increase revenue, reduce costs, and deliver a better customer experience. In a January 2021 interview, CEO Sean Henry described Stord as “the control tower” that allows companies to manage “the entire order-to-ship supply chain cycle.” It consolidates offers across fulfillment and transportation, as well as an order management system (OMS) and a warehouse management system (WMS) into a single platform.

Source: Stord

Fulfillment

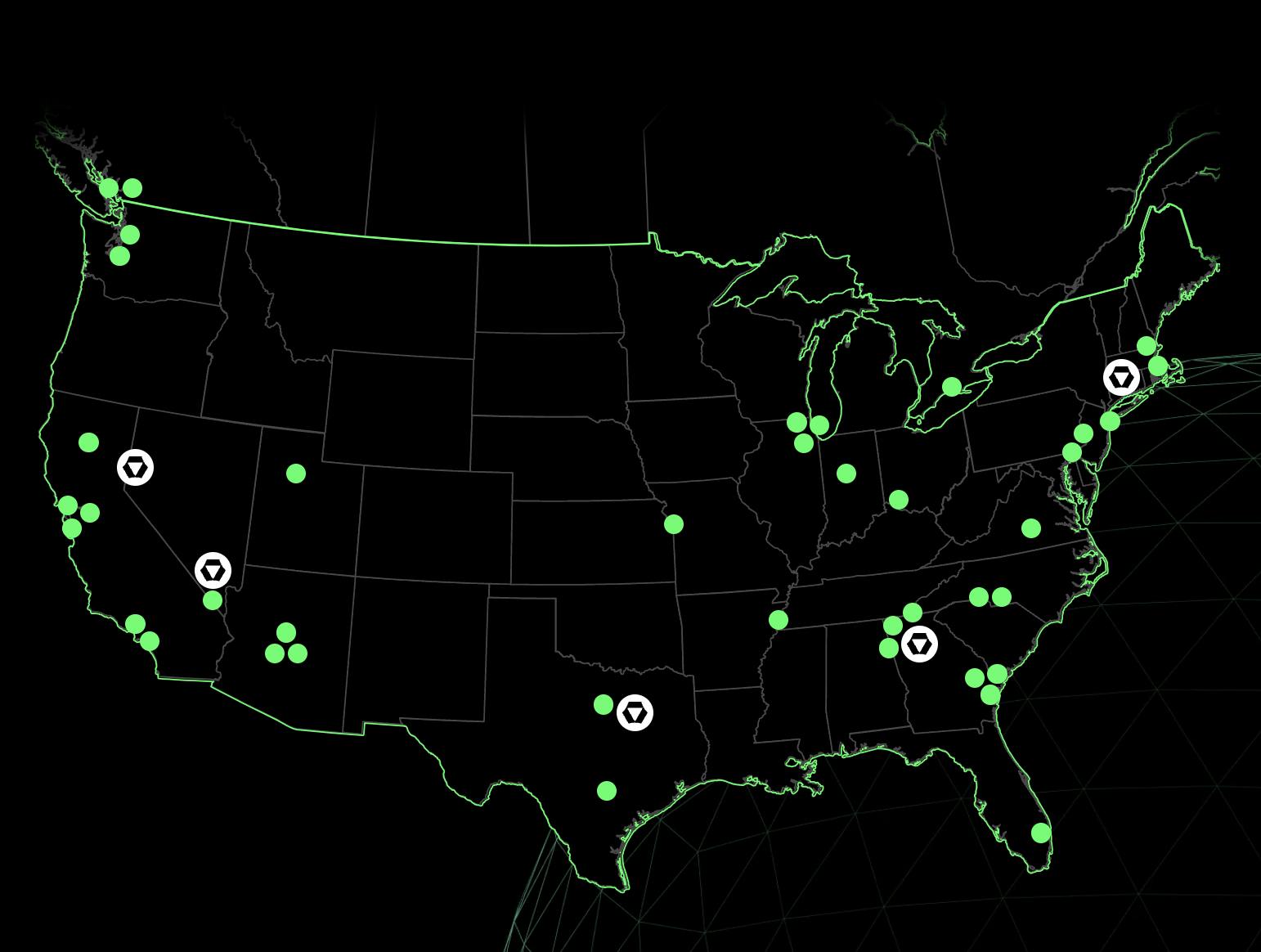

Stord has a network of third-party logistics (3PL) facilities across the US. These facilities are “strategically placed” across five nodes, ensuring 99% coverage in under two days, as well as 99.9% order accuracy as of March 2024. Stord also partners with “highly-vetted, deeply-integrated, and strategically-placed” 3PL facilities to expand its network. As of March 2024, all of Stord’s facilities assumed liability for any damage caused by either the facility itself, or its negligence.

Stord customers leverage these facilities for their logistics and fulfillment needs. In each warehouse, products being moved in and out are scanned, and these movements are recorded in the Stord platform. Customers can use the Stord platform for an up-to-date view of their inventory. The company runs standard cycle counts to ensure the customer’s internal inventory report matches Stord’s. Customers can request a cycle count on-demand at any time through their dedicated Stord Operations Specialist.

Stord’s fulfillment services are tailored to the specific needs of each customer. For example, Stord offers on-demand storage, dedicated or shared facilities, and cold and temperature-controlled storage and fulfillment. Additionally, customers can track inventory across multiple warehouses and 3PLs, control how orders are routed, and track key performance metrics, all through the Stord platform. The company also supports both B2B and B2C fulfillment. It functions like cloud storage, scaling with its customers’ needs through tailored, usage-based pricing.

According to the company, as of March 2024, customers saw an average reduction in transportation costs of 14% and a 38% average reduction in distance traveled. Similarly, customers saw a 32% average increase in ecommerce conversions from two-day shipping as of March 2024.

Source: Stord

Transportation

Stord offers an array of product transportation offerings in what the company dubs “port-to-porch logistics.” Stord, however, is not a freight carrier as of March 2024; instead, it acts as a freight brokerage, connecting its customers with a network of 20K carriers.

As of March 2024, Stord guaranteed 100% coverage for all primary shipments. Stord offers over-the-road tracking, meaning customers can track freight in real-time for full visibility on all shipments, as well as spend visibility to track transportation costs for every shipment at every stage. Additionally, Stord offers AI-powered load matching. Customers can use AI-powered load matching to increase repeat carrier bookings in the Stord network, strengthen carrier-specific experience, and increase efficiency. Stord’s transportation offerings include Full Truck Load (FTL), Less Than Truckload (LTL), Reefer, Drayage, Parcel, and Retail Delivery Consolidation.

FTL shipping uses the entire truck for a single shipment. FTL is advantageous for shipments that need to move quickly to their destination without stops for other cargo, as it goes directly from the pickup to the delivery location. This method is often more cost-effective for large shipments because it maximizes the truck's space and reduces handling risks since the cargo isn't transferred en route.

LTL shipping is used for transporting smaller shipments that do not require the full space of a truck. In this model, cargo from multiple shippers is consolidated into one truck; each shipper pays for their portion of the truck space, based on the size and weight of their shipment. LTL is ideal for businesses with smaller freight needs, offering a more economical option by sharing the transportation costs with other shippers. However, it may involve longer delivery times compared to FTL, as the truck makes multiple stops to pick up and deliver various shipments along the way.

Reefer, short for "refrigerated container" or "refrigerated truck," is a specialized type of freight transportation equipped with cooling and refrigeration systems. Reefers are used to transport perishable goods that require temperature control during transit, such as food products (fruits, vegetables, meat, dairy), flowers, pharmaceuticals, and other temperature-sensitive commodities.

Stord Drayage helps customers transport their containerized products from Atlantic or Pacific ports to their final destination, including the customer’s facilities, Stord warehouses, distribution and fulfillment centers, or 3PL locations. As of March 2024, Stord operated within a network of primary ports in Oakland, Los Angeles/Long Beach, New York/New Jersey, Savannah, and Houston. With Stord Drayage, customers can schedule transportation with ports to ensure specific schedules are met. Stord also offers a flip yard for conducting flip operations, where a shipment has to be unexpectedly moved from one vehicle to another, which can help customers avoid accessorial flip fees. Similarly, Stord offers accessorial cost management to help customers with demurrage, per diem charges, and port detention.

Stord Parcel is a carrier-agnostic last-mile delivery solution that optimizes the delivery process for efficiency and cost-effectiveness. It uses logistics modeling to automatically select the most suitable carrier and service level for each package, considering factors like delivery performance history, distance, and cost. This system allows direct-to-consumer (DTC) and omnichannel brands to access discounted rates from a network of carriers and optimizes the delivery service level based on real-time and historical data, customer expectations, and cost considerations. By evaluating every package's unique requirements and delivery performance, Stord Parcel can often identify opportunities to use a less expensive shipping method without compromising the delivery timeline. According to Stord, brands using Stord Parcel could save up to 15-20% per parcel package as of March 2024.

Source: Stord

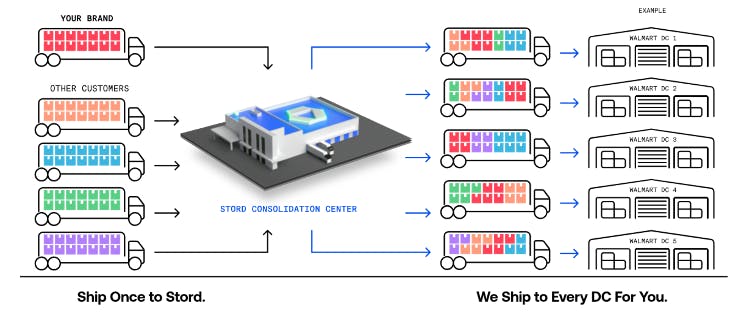

Retail Delivery Consolidation is designed to streamline the process of delivering products to big-box retailers such as Walmart, Target, Costco, and Sam’s Club. It aims to offer cost, speed, and performance benefits by consolidating orders from multiple brands heading to the same retailer location into a single shipment. According to Stord, brands participating in this program can save up to 30% on transportation costs. Additionally, Stord provides expertise to meet the shipping and fulfillment compliance requirements set by large retailers, thus avoiding penalties and chargebacks. As of March 2024, Stord guaranteed stamped signed proofs of delivery within 72 hours, delivery to 100% of Walmart distribution centers every week, and improved supplier scorecards.

Stord One

Stord One is a software suite that interacts with Stord’s physical services as well as customers’ existing systems to manage and optimize their supply chain operation. As of March 2024, Stord One is divided into two main products: Stord One Commerce and Stord One Warehouse

Stord One Commerce is a vendor-and-sales-channel agnostic order management system (OMS). It is designed to streamline and optimize high-volume, omnichannel supply chain operations. This platform is engineered to handle the complexities of managing orders and inventory across multiple facilities and sales channels. Key features of Stord One Commerce include:

Order Routing: Automates the decision-making process for where orders should be fulfilled, based on factors like inventory availability, facility capacity, and shipping costs, to optimize fulfillment efficiency and customer satisfaction.

Multichannel Inventory Management: Allows brands to manage inventory across various sales channels more effectively, avoiding out-of-stock scenarios and operational inefficiencies.

Last-Mile Optimization: Uses last-mile modeling to select the most cost-effective carrier service level for each order. According to the company, as of March 2024, customers could save “up to 12-15% or more” on total parcel spend.

Analytics: Provides brands with a unified view of their operations, offering insights into orders, inventory, and shipments along with comprehensive operational metrics and dashboards.

Source: Stord

By integrating these components, Stord One Commerce connects all elements of a brand's supply chain, from ERPs and online marketplaces to retail partners and warehouse management systems. This not only helps improve operational efficiency but also helps enhance the ability to adapt to changes in demand, supply disruptions, and other external factors.

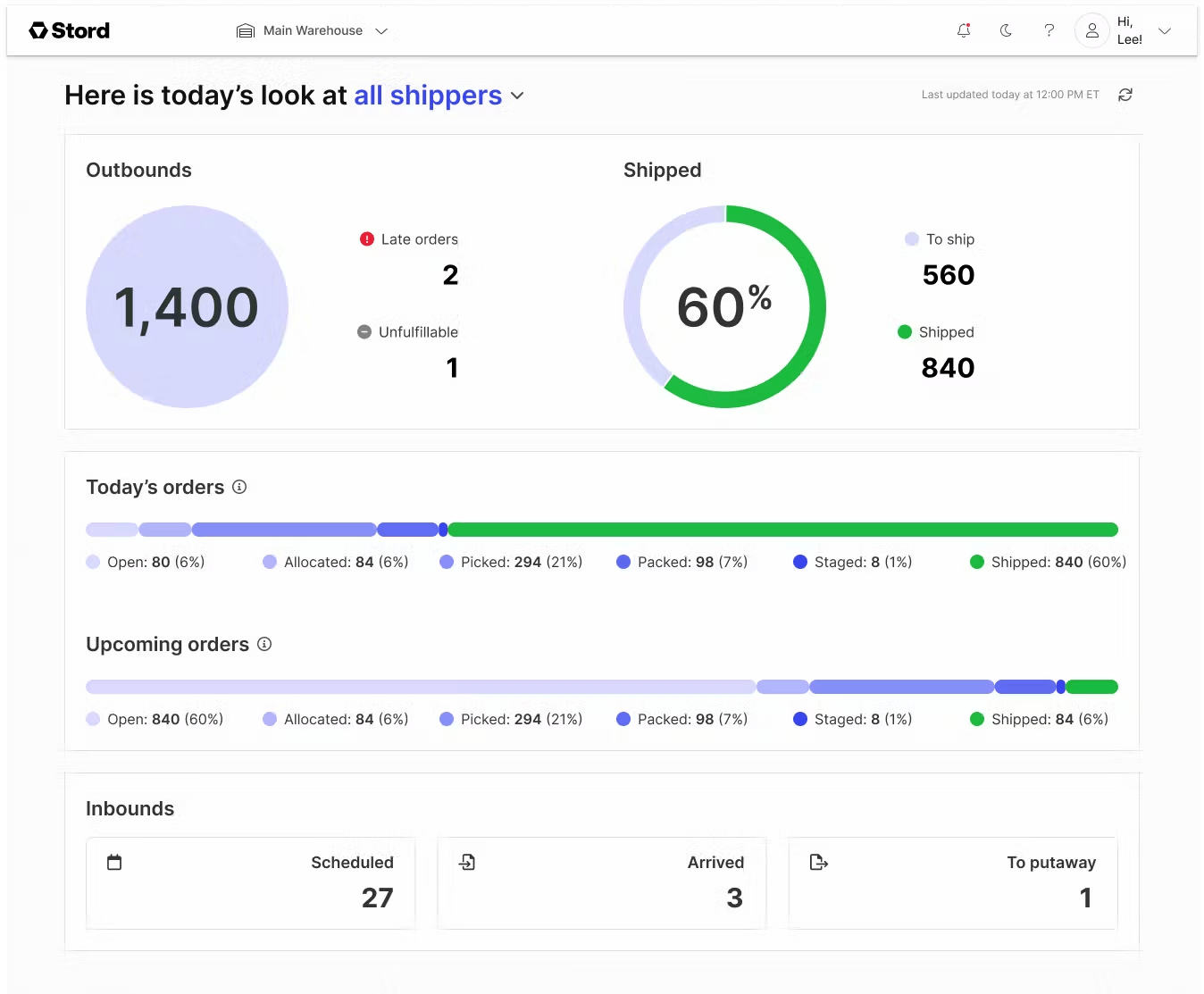

Stord One Warehouse is a cloud-based warehouse management system (WMS). It is designed to optimize warehouse operations and inventory management. It supports high-volume, omnichannel brands by enhancing operational efficiency, accuracy, and customer satisfaction. Stord One Warehouse was purpose-built for Stord’s 3PL partners. According to Stord, as of March 2024, customers using its WMS reported a 3.3x daily order shipped volume increase and a 75% time reduction in pack-out processes. Key Stord One Warehouse features include:

Inbound Order Management: Helps improve receiving process accuracy, reduce inbound errors, and drive better tracking of purchase orders.

Inventory Control: Allows warehouses to perform real-time monitoring and tracking of stock levels with real-time inventory visibility.

3PL Customer Portal & Billing: 3PL partners can access customer order information to improve customer service and provide access to their brand customers to self-service their customer issues. Additionally, 3PL partners can capture billable activity and automatically generate invoices.

Pack Station: Helps accelerate the packing process through simplified workflows for each specific fulfillment channel.

Shipping Optimization: Gain control of all customer orders to seamlessly fulfill orders from multiple sales channels with precise order accuracy

SliPStream Picking: Stord’s “more intelligent” version of wave picking that the company claims “dramatically cuts pick and pack time and boosts workforce productivity.”

Cluster Picking: Allows warehouses to increase labor efficiency by clustering multiple orders into pick clusters. According to the company, as of March 2024, warehouses could increase labor efficiency by 30-40%.

As of March 2024, Stord One Warehouse offered 100+ connections to internal or third-party systems, including ecommerce storefronts, marketplaces, and retail partners as well as financial systems like ERPs. Additionally, customers can integrate other systems and applications via the Stord One API and Stord’s EDI connectivity capabilities.

Source: Stord

For both its OMS and WMS products, Stord offers software implementation. Stord partners with its customers to “scope out a tailored solution that fits perfectly into [their] existing logistics and systems.”

Other Software Products

Consumer Experience: Launched in January 2024, Stord’s Consumer Experience is an extension to the company’s Stord One Commerce OMS. It is “designed to significantly elevate pre-purchase and post-purchase experiences.” It helps ecommerce sites accurately predict delivery dates at checkout, boosting buyer confidence and conversion rates. Post-purchase, it offers a branded tracking portal and customized email updates, which is intended to improve customer satisfaction and reduce service queries.

Inventory Planning: Launched in February 2024, Stord’s Inventory Planning product helps businesses optimize inventory levels. It uses historical and projected sales data, along with marketing insights, to provide SKU-specific demand forecasts. The system automates restocking alerts and suggests reorder points to maintain ideal stock levels, preventing overstock and stockouts. It also advises on the best inventory distribution strategies across complex networks, highlighted through a dashboard that tracks supply gaps, demand changes, aging inventory, and order status.

Market

Customer

Source: Stord

As detailed by a Stord customer in a 2021 interview, the market for supply chain management solutions can be divided into three main customer segments:

Companies that run their own supply chain. These operate their warehouses using their employees. All procurement and distribution are managed in-house.

Companies that own their manufacturing and storage but use third-party logistics (3PL) for distribution. Some large conglomerates, like Nike or P&G, use this model to achieve flexibility in their supply chains.

Startups and smaller retailers that outsource their entire supply chain. These brands don’t often have the resources to run their supply chain or the product volume necessary to ship with a national distribution provider. Consequently, they are faced with a patchwork of regional 3PL providers and overlapping software solutions.

As of March 2024, Stord primarily targeted the third segment. Specifically, the company targeted “DTC and omnichannel brands shipping 1K+ orders per day.” In 2021, 60% of Stord’s customers were ecommerce brands, with the remaining 40% mostly omni-channel retailers, as well as some retail and manufacturing companies. As of February 2024, Stord had “hundreds of DTC and B2B companies” as customers. Notable customers included Athletic Greens, Native, Tula, American Giant, Branded, and Snackpass.

Market Size

Stord’s offerings combine thirty-party logistics (3PL) and supply chain management technology into a single platform. The US freight and fulfillment market was estimated at $1.3 trillion in 2024, expected to reach $1.6 trillion by 2029, and is projected to grow at a CAGR of 4% from 2024 to 2029. The US 3PL market, a subsection of the freight and fulfillment market, was estimated at $238.2 billion in 2024 and was expected to reach $281.2 billion by 2029. The supply chain management technology market was estimated at $28.9 billion in 2022 and was projected to reach $45.2 billion by 2027, growing at a CAGR of 9.4% between 2022-2027.

Stord primarily works with ecommerce brands and omnichannel retailers. Despite a resurgence of in-store shopping following the COVID-19 pandemic, ecommerce continues to grow in the post-pandemic period. Sales grew by 8% year-over-year (YoY) in 2022, reaching $1 trillion and accounting for 14.5% of the total US retail market. In 2023, total ecommerce sales in the US reached $1.1 trillion, accounting for 15.4% of the total US retail market.

Competition

Stord differentiates from its competitors by integrating its physical and digital offerings into one suite. However, within each of the verticals Stord operates, its suite of products has distinct competitive dynamics and primary competitors. Stord also competes with large legacy players such as UPS and FedEx.

Fulfillment Competitors

Shipbob: Shipbob is a fulfillment service that helps ecommerce businesses automate warehousing, manage inventory, and ship orders globally. It was founded in 2014. The company had raised $330.5 million in total funding as of March 2024. It was valued at $1 billion in its June 2021 $200 million Series E funding round. As of March 2024, Shipbob offered its customers access to a network of 50+ fulfillment centers across six countries and was “trusted by thousands of brands” to ship orders to its customers’ shops, including Spikeball, Bloom, 100 Thieves, and Touchland.

Shipmonk: Shipmonk offers order fulfillment services for ecommerce businesses. It was founded in 2014. The company has raised $365 million in total funding as of March 20224, having raised a $65 million growth equity round in January 2021 led by Summit Partners. As of June 2023, Shipmonk had handled over 100 million orders worldwide and operated 18 warehouses offering fulfillment services to its customers. As of March 2024, Shipmonk also offered a “4-in-1” cloud-based software with features including inventory management, order management, shipping management, and warehouse management.

Flexe: Flexe is an omnichannel logistics service with offerings across fulfillment, distribution, same-day delivery, and network capacity. It was founded in 2013. Flexe had raised $263 million in total funding as of March 2024. The company had a valuation of over $1 billion as of its $119 million Series D round in July 2022.

Transportation Competitors

Uber Freight: Uber Freight is the logistics arm of Uber. It was founded in 2017 and, as of March 2024, had $1.1 billion of external funding. As of September 2023, Uber Freight connected over 2 million truck drivers with shipping companies, adding flexible shipping capacity to manage shipping demand during peak season. The company handled over $18 billion worth of freight as of March 2024. While it could work in tandem with Stord, Uber Freight is an alternative to managing shipping through platforms like Stord Transport.

Transfix: Transfix is an AI-driven freight brokerage and logistics partner. It was founded in 2013. Transfix has raised $169 million in total funding across nine rounds as of March 2024. It raised a $40 million Series F in October 2023. Through the Transfix Intelligent Freight Platform, it provides freight brokerage services and logistics software with features including analytics, freight audit & settlement, and live shipment tracking. As of March 2024, Transfix had access to a network of over 425K vetted carrier trucks.

Legacy Competitors

UPS: UPS is an international transportation and logistics company offering a broad range of solutions including the transportation of packages and freight. It was founded in 1907. As of March 2024, UPS was a publicly traded company (NYSE: UPS) with a market capitalization of $131.1 billion. Stord competes directly with UPS’s business logistics offering, which includes ecommerce solutions, warehousing, last-mile delivery, and freight tracking software.

FedEx: FedEx provides customers and businesses worldwide with transportation, ecommerce, and business services. It was founded in 1973. As of March 2024, FedEx was a publicly traded company (NYSE: FDX) with a market capitalization of $62.6 billion. FedEx’s Small Business Center competed directly with Stord through offerings such as FedEx Freight, and the FedEx Ship Manager software, as well as its billing and reporting solutions.

Business Model

As of March 2024, Stord did not have a standard list price for its offerings. Instead, the company tailors its pricing to each customer, stating that “other providers show you a box and tell you to fit your business into that box. Stord looks at your business and builds a box to fit your specific needs.” A former Director of Marketing at Stord explained in a September 2020 interview that the company received a combination of service revenue, software revenue, and commissions.

As described by a Stord customer in April 2021, Stord’s contracts are fully custom deals and sold as a solution to its customer’s needs, noting that its 3PL pricing was generally around market standard. That said, as of March 2024 Stord claimed that it was not “in the game of being the cheapest option out there.”

Traction

In 2020, Stord was moving over $10 billion worth of products through its platform. In March 2021, the company announced it had grown its logistics revenue by 500% and its software revenue by 900% over the previous year. The company also announced in March 2021 that it had grown its overall shipment volume by 150x. In November 2021, Stord CEO Sean Henry projected an average shipping volume increase of 20-35% per customer over the previous year. Henry also stated that Stord “served hundreds of customers” across B2B and B2C at that time. During the 2020-2022 period, Stord grew its revenue by 6.5K%.

In June 2022, however, Stord laid off 59 employees, or about 8% of its workforce. According to two laid-off employees, co-founders Sean Henry and Jacob Boudreau explained this reduction was due to the company having hired too quickly. A company spokesperson said in July 2022 that the layoffs were “part of a routine review” and that Stord had “an extremely strong balance sheet.” As of March 2024, Stord’s website stated that it had been growing 300% year-over-year (YoY). As of Stord’s 2023 keynote, the company’s fulfillment network included over 1K third-party logistics (3PL) partners throughout the US.

Valuation

As of March 2024, Stord had raised a total of $325 million over six rounds of funding from investors including Founder’s Fund, Kleiner Perkins, Susa Ventures, and Bold Capital. In September 2021, Stord raised a $90 million Series D round led by Kleiner Perkins. In May 2022, the company announced it had raised an additional $120 million for its Series D from Franklin Templeton, bringing the total Series D to $210 million raised at a $1.3 billion valuation.

Key Opportunities

Reshoring

US companies have started reshoring their production, driven in part by US-China trade tensions, other geopolitical considerations, and federal policies such as the Inflation Reduction Act and the CHIPS Act. For example, Apple made news in January 2024 when it was revealed that its suppliers had invested over $16 billion in the previous five years to relocate production away from China to other countries, including the US. In a 2023 survey found that 69% of US manufacturers had begun reshoring their supply chains, while 93% of manufacturers were planning to increase the pace of reshoring within their supply chains over the following two years.

This trend opens a strategic window for Stord, as reshoring amplifies the need for robust domestic logistics and supply chain solutions. Companies moving production closer to home require efficient distribution networks for their onshore or nearshore facilities. Stord's capacity to offer bespoke logistics solutions positions it to refine these supply chains effectively. Moreover, the blend of domestic operations with global networks, a byproduct of reshoring, introduces complexities in supply chain management. Here, Stord's "port-to-porch" system stands out as a valuable tool for managing these complex flows.

As such, Stord is well-positioned to support companies in their pivot to domestic production. With businesses seeking to broaden their supplier base and move into new manufacturing geographies within the US and its vicinity, Stord is poised to expand its client roster, thereby enhancing its customer base and revenue prospects.

Data Advantage

According to a former Director of Marketing at Stord in a September 2020 interview, one of the reasons why customers are attracted to the company’s offerings is its wealth of data and capacity to optimize shipping routes and warehouse operations. As explained by Stord CEO Sean Henry during a 2023 keynote, Stord’s “port-to-porch” network was “designed to help omnichannel brands make their supply chain a competitive advantage, tapping into infrastructure at scale, with economies at scale, and shared efficiency.”

The rapid development of AI technology presents an opportunity for Stord to further capitalize on its collected data and offer increasingly better supply chain optimization tools. This could eventually lead Stord beyond supply chain management and closer to supply chain automation, with customers outsourcing their entire supply chain management process. Ultimately, it could make Stord more attractive to larger customers, opening market segments previously dominated by large incumbents like UPS.

Key Risks

Transition to an Asset-Heavy Model

Stord's shift towards becoming a comprehensive fulfillment provider, including operating its warehouses, introduces a set of financial and operational risks by transitioning into a more asset-heavy business model. Increased investments in real estate, equipment, and personnel elevate upfront costs and ongoing expenses.

Furthermore, this strategic pivot could expose Stord to heightened market volatility risks. The logistics and warehousing sector is sensitive to economic cycles and geopolitical tensions; demand for storage and fulfillment services can fluctuate widely based on consumer demand, trade dynamics, and global supply chain disruptions. An asset-heavy strategy locks Stord into certain fixed capacities and locations, which may not always align with rapidly changing market demands or the geographical shifts in supply chain hubs.

This could result in underutilized assets during downturns or capacity constraints during surges, affecting profitability and service levels. Additionally, physical expansion requires Stord to navigate complex operational challenges, including the optimization of warehouse operations, maintenance of facilities, and management of a larger, more diverse workforce. Balancing these operational demands with the need to continue innovating in supply chain technology solutions will be crucial for Stord's success in this expanded role.

Rapid Technological Advancements

Stord's challenge is to lead in adopting and integrating emerging technologies like AI and the Internet of Things (IoT). These technologies could transform logistics operations. AI enables automated decision-making, predictive analytics, route optimization, and IoT improves tracking and inventory management. Successfully leveraging these technologies can improve Stord's services, customer satisfaction, and revenue. However, these technologies require significant investment in R&D and talent acquisition to implement and possibly the formation of strategic partnerships.

Summary

Consumer demand for quicker and more flexible delivery options is growing, pushing brands to enhance their supply chain and distribution operations' flexibility and efficiency. Stord offers a Cloud Supply Chain solution that integrates physical logistics and transportation services with OMS and WMS software. This “port-to-porch” logistics service helps retail and ecommerce companies reduce costs, drive revenue, and deliver better customer experience. Stord stands to benefit from the rising trend of reshoring in US manufacturing and advancements in AI technology, potentially seizing a larger share of the logistics and fulfillment market. However, its shift towards an asset-heavy model and the potential to fall behind in technological innovation compared to its competitors or future entrants to the space pose challenges.