Thesis

In 2021, the global wellness market was valued at $1.5 trillion ($450 billion in the US alone) and was growing 5-10% annually. Society has seen a rising trend of consumers taking control of their daily health, with over 50% of US consumers reporting wellness as a top priority in their daily lives. From tracking daily physical activity to monitoring sleep quality and heart rate, individuals are turning to technology to gain insights and make data-driven lifestyle choices. The trend has also spread to the corporate world, where respondents in a 2023 survey of health insurance brokers indicated that 64% of enterprise clients plan more investment in employee wellness programs. With the global health and wellness market projected to reach $12.9 trillion by 2031, there is an increasing demand for products and services that help individuals monitor their health and make informed decisions based on the data they collect.

Despite technological advancements, unique challenges still exist in wearable health trackers. Users demand functional, aesthetically pleasing, and easy-to-use devices. Additionally, consumers want their wearables to provide personalized, actionable insights into their health and wellness — not just raw data. Novel use cases for health trackers have also emerged over time. During the pandemic, for example, over 10% of US smartwatch owners used them to detect COVID-19 symptoms. To address these consumer needs, wearables evolve to seamlessly integrate into users’ lives, providing valuable insights without hindering daily activities.

Oura is a health technology company that designs and makes wellness wearable rings that track and improve sleep and performance. Its core product is a wearable in a ring-shaped form that monitors multiple physiological parameters, including sleep stages, heart rate, and physical activity. Along with its companion app, the Oura Ring provides customers with insights intended to help improve their health and well-being.

Founding Story

Oura was founded in 2013 in Finland by Petteri Lahtela (ex-CEO), Kari Kivelä, and Markku Koskela. Lahtela had spent 14 years in the mobile and telecom sectors primarily focusing on product development. He decided he needed a deeper purpose, and turned his attention to human health and performance. In 2004, he joined a company developing IT systems for chronic disease management and prevention. This experience gave him an understanding of how the human body responds to changes in lifestyle and gave him the idea of developing a product that would give users that feedback more immediately. Koskela, the company’s founding R&D manager, spent over a decade at a hyperspectral imaging solutions company in product and technical roles

Kivelä, with over a decade of software development experience at Nokia, was investigating the intersection of technology and fitness. He envisioned developing a wellness device that was both functional and aesthetically appealing. Joining forces with Hannu Kinnunen, a former employee at Polar, a company specializing in heart rate and activity monitoring, the trio co-founded Oura.

Source: Kickstarter

The cofounders faced several challenges in the company’s early stages. Funding was difficult to secure, and years of research and development went into designing a device that was technologically superior while also comfortable enough for 24/7 use. The unique ring form factor added another layer of complexity.

In 2015, the first Oura Ring was launched after 3 years of development, surpassing its Kickstarter targets for fundraising. That same year, Oura's rings were delivered to customers, including Harpreet Singh Rai, a portfolio manager at a hedge fund. In September 2017, Rai invested in the business, joined its board of directors, and became President. He moved from New York to San Francisco and was appointed CEO in 2018. That year, Oura released the second version of its product.

Product

Oura’s product offering centers around its wearable, the Oura Ring, and a suite of applications that help both consumer and enterprise users access and understand their data and health insights.

Oura Ring

The Oura Ring is a compact wearable device that tracks users’ health and wellness metrics. The Oura Ring, which is built from titanium and is water-resistant, includes a variety of sensors to collect health data and claims a battery life of up to 7 days. Its form factor, intended for 24/7 wear, has won several design awards, including the 2018 Red Dot Award for product design.

Data captured by the Oura Ring includes body temperature, heart rate variability (HRV), resting heart rate, respiratory rate, sleep stages (including timing, duration, and quality), and daily physical activities. Additionally, it collects data about the wearer's behavior, such as total daily steps and an estimate of calorie burn.

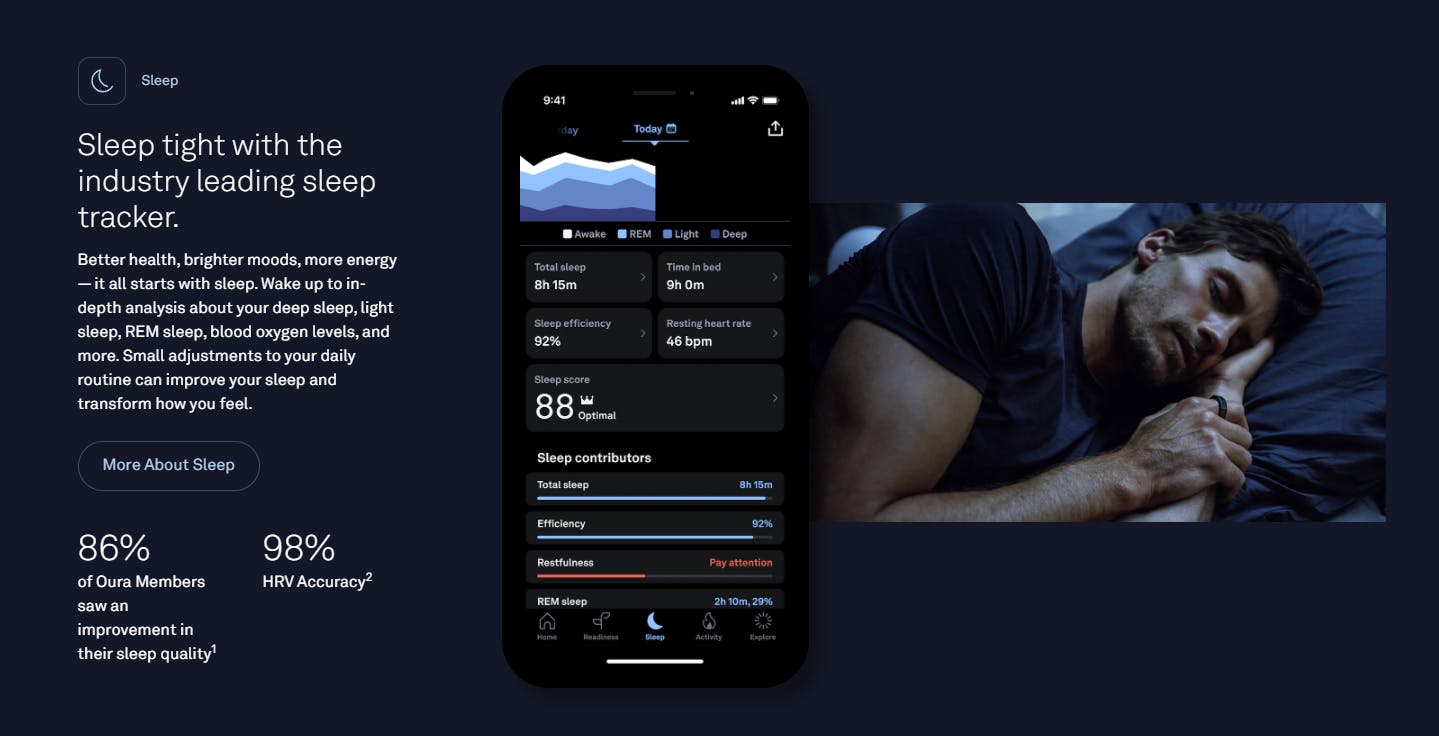

Source: Oura

In 2021, the company announced the third generation of the Oura Ring, which introduced 24/7 heart rate monitoring, blood oxygen monitoring, and period prediction.

Oura App

The accompanying Oura App is designed to compile and present the data gathered by the Oura Ring. The app translates the raw data into legible sleep, readiness, and activity insights. The primary functions of the Oura app are divided into:

Sleep Score: This is Oura Ring’s original use case. The Sleep Score (0-100) informs users of how well they slept at night and guides them on ways to improve their sleep quality.

Activity Score: The Oura Ring tracks over 30 physical activities, providing information like calories burned and heart rate. The Activity Score (0-100) informs users of how physically active they have been throughout the day and provides recommendations on increasing their score.

Readiness Score: By evaluating a user’s overnight heart rate, body temperature, prior physical activity, and sleep, the Oura Ring provides a Readiness Score (0-100) that acts as an evaluation of a user’s overall wellness. Users with low readiness scores are prompted with recommendations that Oura believes will improve their overall health and wellness.

Source: Oura

Oura Membership, an optional subscription, unlocks features like personalized health insights, blood oxygen level monitoring, and period prediction. While the wearable is still functional without the subscription, with the app providing the essential Sleep, Activity, and Readiness Scores, more detailed health information and insights are not included.

Oura Cloud

Also referred to as Oura on the Web, Oura Cloud is a platform for users to view and analyze their health data on a broader timescale. With exportable data and graphs, users can spot trends or anomalies over weeks, months, or years. Users can view their Readiness, Sleep, and Activity data from the Dashboard.

Source: Oura

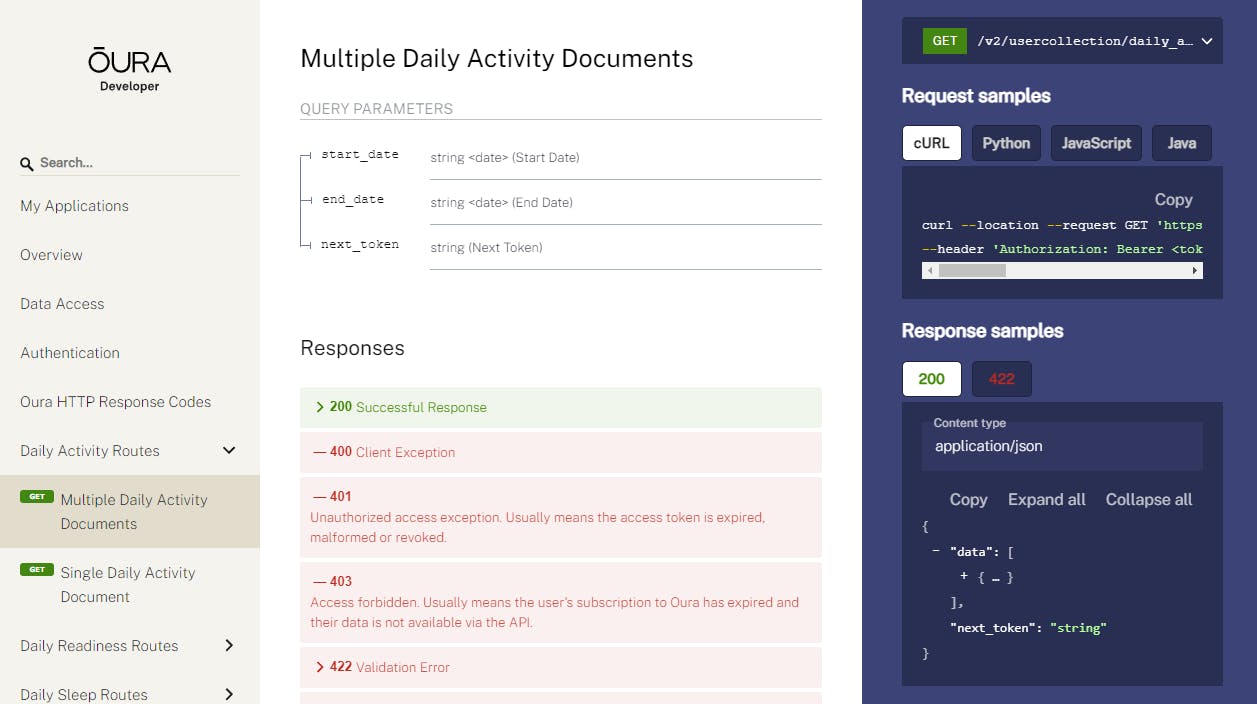

Oura API

The Oura API allows developers to access and integrate user health data from the Oura platform into third-party applications and services. Third-party applications and services can access raw sensor data and processed metrics through the API, such as sleep score, activity, and readiness metrics. The API enables broader utilization and analysis of wellness data collected by the Oura Ring with wellness devices or platforms in the market.

Source: Oura

Oura for Business

Oura for Business is an enterprise solution which enables companies to identify and share daily health insights and trends to their employees and teams. Using both the Oura Ring and software platforms, it also provides group-level insights that help connect individual health and wellness outcomes with business impacts, addressing issues like burnout, fatigue, performance optimization, and illness detection.

Market

Customer

Oura’s initial customer base comprised highly health-conscious individuals and biohackers attracted to the concept of quantifying and tracking their own wellness, sleep, and recovery data. As health and preventative care continue to become a higher priority for many consumers, Oura has found a broader customer base of individuals looking to monitor their health outcomes. The wearable has also found traction in professional sports, with Oura establishing partnerships with the NBA and WNBA to place its rings on athletes to help track health, wellness, and performance.

Oura has expanded into the corporate wellness landscape through its Oura for Business arm. Many companies are now prioritizing employee health benefits. Capitalizing on this trend, Oura targets enterprises that seek to provide data-driven wellness benefits to their employees. From individual health enthusiasts to professional athletes and forward-thinking corporate wellness programs, Oura’s customers believe in data-driven approaches to personal wellness.

Market Size

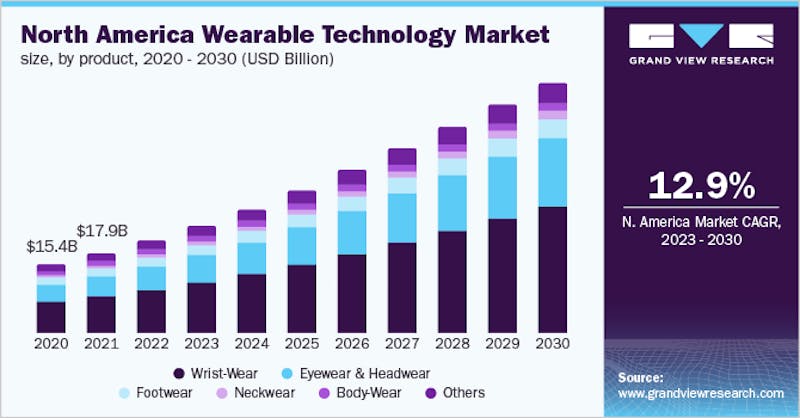

The global wearable fitness technology market, within which Oura operates, was valued at $61.3 billion in 2022 and is expected to reach $186.1 billion by 2026, representing a CAGR of 14.6% for the period. Key drivers for growth include increased consumer health consciousness, an emphasis on fitness and wellness monitoring, and technological advancements in wearable technology. Oura’s specific market is also bolstered by increasing awareness and wider mainstream adoption of apps an devices intended for tracking sleep.

Source: Grand View Research

Corporate wellness is an emerging segment for Oura, with the global corporate wellness market size valued at $53 billion in 2022, with an expected CAGR of 4.4% to reach $74.9 billion by 2030. Amid public conversation around burnout and quiet quitting, companies are looking for wellness solutions to increase employee satisfaction and well-being, making corporate wellness a potential avenue of growth for Oura.

Competition

Whoop: Founded in 2012, Whoop is a fitness technology company known for the Whoop Band, a subscription-based, wearable fitness tracker. The Whoop Band measures heart rate variability, sleep patterns, and exercise recovery. Its unique selling point is the integration of personalized coaching insights, making it a competitor to the Oura Ring, which offers similar insights with its Activity and Readiness Scores. Unlike Oura, which charges a high upfront price for its wearable and an optional monthly subscription, Whoop offers its wearable for free and derives revenue from a mandatory subscription. To date, Whoop has raised $404.8 million with notable investors including Softbank, IVP, the NFL Players Association, and Jack Dorsey.

Xiaomi: A leading consumer electronics company known for its affordable smartphones in international markets, Xiaomi entered the fitness wearable market in 2014 with the Mi Band. Famous for its affordable, feature-packed devices, Xiaomi reported selling over 120 million Mi Bands in 2021. Generally priced below $60 in the US market, the Mi Band series has received strongly positive reviews over its seven hardware iterations, with reviewers praising its functionality and feature set at its price point. Consumers, especially those new to wearables, might opt for more affordable Xiaomi offerings when compared to the $300 price tag of the Oura Ring. Xiaomi went public on the Hong Kong Stock Exchange in July 2018 and has a market cap of $34 billion as of June 2023.

Garmin: Founded in 1989, Garmin is a multinational technology company best known for its GPS product offerings in the outdoor, automotive, and fitness markets. Garmin released one of the first wearables in 2001, the Forerunner 201, a GPS-equipped running watch. An idea ahead of its time, wearables at Garmin came back into focus in 2013 after significant technological advancements, the release of the smartphone, and a new company CEO. Today, Garmin offers an extensive catalog of dozens of wearables with premium offerings like the Vivoactive receiving high praise for their fitness tracking features. Garmin’s many wearable products, especially those focused on specific niches like golfing, diving, and hiking, could appeal to customers looking for a more focused wearable with dedicated functionalities rather than a more generalized wearable like the Oura Ring.

Fitbit: Fitbit was founded in 2007 with the brand quickly becoming synonymous with wearable health and fitness technology. Capturing 41% of the worldwide wearables market in 2014, the year before its IPO, Fitbit reported selling 3.9 million devices in Q1 2015. While Fitbit faced intense competition in the years following its IPO, its acquisition in 2021 by Google provided it with a distribution channel from one of the world’s most recognized brands, native integration with the Google Fit platform, and hundreds of billions of dollars in free cash flow. With nearly a dozen smartwatch and fitness tracker product offerings today, Fitbit’s device integrations with Google Fit provide users comprehensive health insights and social features, making it a notable competitor for Oura.

Apple: With its launch of the Apple Watch in 2015, Apple has held its dominant position in the smartwatch market, with a 30% global market share in 2022. The Apple Watch’s advanced health monitoring features — including ECG, fall detection, and blood oxygen tracking — in conjunction with its seamless integration with the broader Apple ecosystem positions it as a significant competitor to the Oura Ring. In June 2020, watchOS 7 saw Apple add native sleep tracking to Apple Watches, directly competing with the Oura Ring’s core functionality. Despite its relatively recent entry into the wearables market and rapid consumer adoption of the Apple Watch, Apple’s strong retail store presence, along with its overwhelming success in the consumer electronics ecosystem, make it one of the most significant competitors for Oura.

Business Model

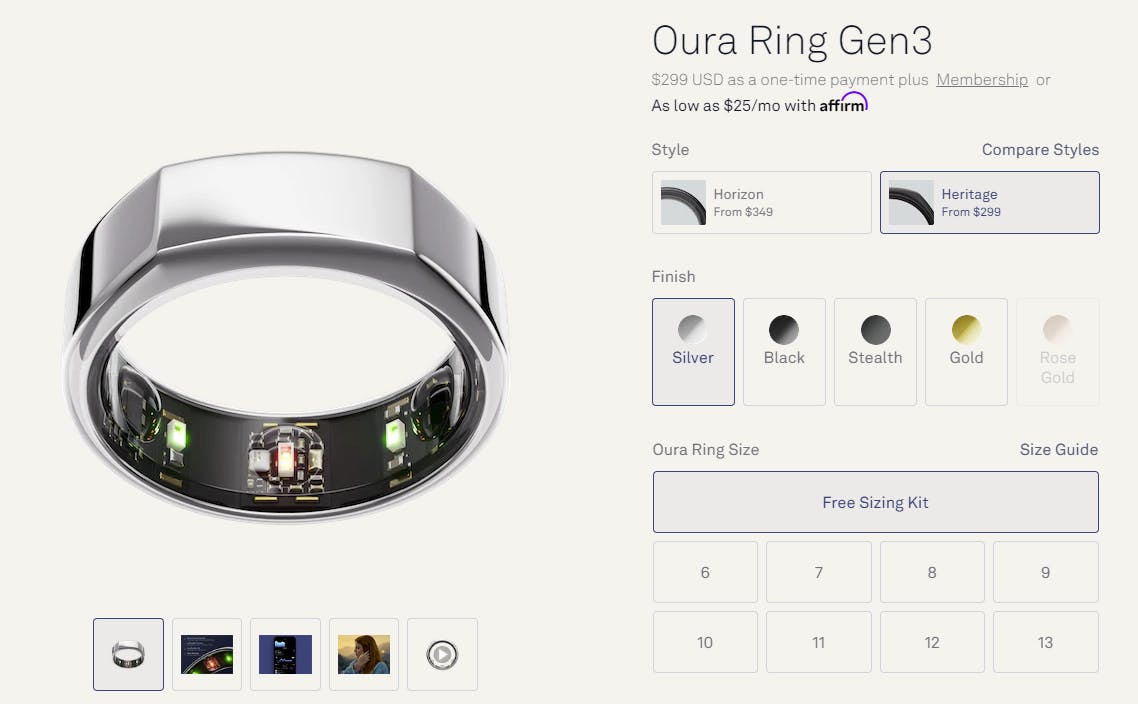

Oura operates a dual revenue B2C model, combining a one-time product purchase with an optional monthly subscription service. Its primary revenue stream, realized at the time of purchase, comes from selling the Oura Ring. Customers have the following options:

Heritage ($299): Oura’s 3rd Generation smart ring was released in October 2021.

Horizon ($349): Oura’s redesigned 3rd Generation smart ring was released in October 2022.

The primary difference between the two models is design, with the newer Horizon model featuring a more rounded form without a flattened section like the Heritage.

For both Heritage and Horizon models, customers can select premium Stealth, Gold, or Rose Gold finishes, which increase the base price of the ring by up to $200.

Source: Oura

Though it has some nascent distribution partnerships, including selling the Oura Ring at Best Buy and in some Therabody and Gucci stories, the majority of Oura Rings are sold directly to customers via the company’s own website.

Oura Membership is an optional monthly subscription priced at $5.99/month ($6.99/month for international customers). Oura Membership grants users additional health-related features and provides Oura with an additional recurring revenue stream. Oura’s subscription is a relatively recent income stream, having been introduced in October 2021 alongside the third-generation Oura Ring.

Following pushback from the Oura community and existing customers who spoke out against the company introducing a subscription model, Oura grandfathered existing customers by offering them a free lifetime offer to Oura Membership. In addition to selling to individual customers, Oura operates a B2B model by partnering with organizations to provide Oura Rings in bulk for employees and partners. This offering, named Oura for Business, has helped Oura secure partnerships with enterprise customers like NASCAR and the WNBA.

Traction

Oura did not experience substantial initial success after launching on Kickstarter in 2015. Although the ring received generally positive reviews, its high price point, singular focus on sleep tracking, and unwieldy form factor kept it a relatively niche product. The company sold only 150K rings prior to 2020. The COVID-19 pandemic that year, along with the social, cultural and technological trends that arrived with it, significantly accelerated Oura’s growth.

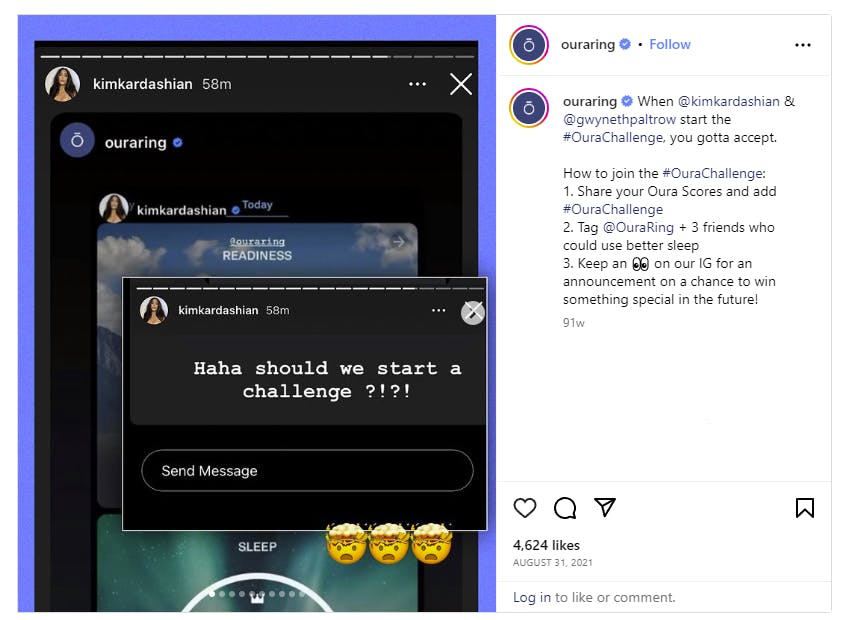

Source: Instagram

As the pandemic spread, health institutes and researchers across America quickly began studies around the detection, prevention, and treatment of COVID-19. The potential for wearable devices to help provide early warning detection of COVID-19 was of particular interest to some institutions. The UCSF Osher Center for Integrative Health and the WVU Rockefeller Neuroscience Institute, among others, launched studies partnered with Oura. In particular, WVU announced the ability to predict COVID-19-related symptoms using Oura Rings. Organizations like the NBA and Las Vegas Casinos, which sought to keep their business activities running in a safe manner, responded positively to this early research, ordering thousands of Oura Rings for their employees. Amid this surge of interest, Oura raised a Series B in 2020.

Source: Gucci

This marked an inflection point for Oura breaking into the mainstream consciousness. Oura reported selling 500,000 rings in 2021 and hit the 1 million milestone the year after. The company forged new partnerships with high-profile organizations like Real Madrid, Red Bull, and UFC, while celebrities including Prince Harry, Kim Kardashian, and Jack Dorsey have been seen wearing Oura Rings. In 2022, the company announced a limited edition $950 Gucci x Oura Ring collaboration, which would be sold in Gucci retail locations. In April 2023, Oura announced a partnership with Best Buy for distribution in 850+ retail stores across the US.

Valuation

In May 2021, Oura announced $100 million in a Series C funding round led by The Chernin Group and Elysian Park Ventures (the investment arm of the Los Angeles Dodgers Ownership Group). The company later raised a venture round for an undisclosed amount in April 2022 that valued the company at $2.5 billion. Key investors in Oura include Forerunner Ventures, Block, and Alumni Ventures. To date, Oura has raised $148 million in funding.

Oura announced selling 1 million smart rings in March 2022, up from its reported 500,000 units sold in May 2021. Assuming Oura sold approximately 500,000 smart rings from 2021 to 2022 to reach the reported 1 million mark and each smart ring was priced at the company’s standard $299 price point, Oura’s yearly revenue is estimated at $150 million. The company’s most recent $2.5 billion valuation assumes a 16x to 17x revenue multiple. This estimation is speculative as specific revenue data from Oura is not publicly available and does not account for any revenue generated by Oura’s subscription offering.

Key Opportunities

Mental Health Expansion

Expanding into mental health care represents a significant opportunity for Oura to broaden its user base and deepen its impact on personal wellness. Numerous scientific studies suggest a strong correlation between mental health and sleep quality, which is Oura’s core competency. Oura’s existing suite of biometric data collection, already adept at tracking sleep quality and daily activity, can be further harnessed to monitor indicators linked to mental health. By tracking anomalies and patterns in heart rate variability, sleep disruptions, or activity levels, the Oura app could alert users to potential signs of stress, anxiety, or depressive episodes. Oura could leverage this information to partner with mental health apps or services, providing seamless data sharing for therapy or mental wellness coaching. This strategic move creates an additional value proposition for current users and opens a new potential market among those seeking comprehensive mental health management tools. The mental health market was valued at $383 billion in 2020 and is estimated to reach $537 billion by 2030.

Further Partnerships

While Oura has made inroads in partnering with fitness and wellness brands, there are significant opportunities for Oura to partner with health coaching services and medical practitioners. Partnering with more brands and organizations could improve Oura’s brand recognition and distribution. In contrast to competitors, Oura lacks a network of physical stores or a highly visible global brand that would help with distribution. Forging partnerships with fitness, wellness, and health organizations could enhance Oura’s ability to distribute its products to potential customers, driving customer acquisition and bolstering its position in the wearables market.

Personalized Services

Oura could leverage rich biometric data from users, including sleep cycles, body temperature, heart rate, and activity levels, to offer personalized wellness services within the Oura app. Personalized wellness recommendations, such as sleep, diet, and exercise, are predicted to increase in importance to consumers. Oura’s wellness recommendations could include deals and offers from organizations or services Oura has already partnered with — like offering discounted Equinox memberships, as an example. Adding personalized services to Oura could differentiate the company in the competitive wellness tech market and introduce an additional revenue stream.

Key Risks

Limited Product Offering

Oura’s business model revolves around a single product: the Oura Ring. Despite the product’s success, the reliance on a single product line exposes the company to risks, particularly if market preferences shift or competing products outperform it. Established consumer tech giants, including Apple and Fitbit, can offer a diversified range of wellness products, reducing their vulnerability to product-specific market changes. These firms can also leverage synergies between their product lines to enhance overall product appeal, an opportunity unavailable to Oura. While technology in the wearables space continues to advance, a ring-based form factor still has significant limitations in features and capabilities. With wearables increasingly feature-rich, consumer expectations for such devices have expanded beyond health and sleep tracking. Contactless payments, which may present a challenge in a ring-based form factor, is one feature research studies expect to grow in popularity in the wearable space. If Oura Ring’s sales decline or plateau, the lack of alternate revenue streams could hamper the company’s sustainability. Diversification could be crucial for Oura's longevity in this intensely competitive and rapidly evolving market.

Limited Distribution

Oura’s limited distribution network poses a significant risk to its business model. The company mostly sells its Oura Ring directly to consumers through its online store, limiting its exposure to potential customers. In contrast, established competitors like Fitbit and Apple have their products available in popular retail outlets and ecommerce platforms like Amazon and Walmart, providing wider market visibility. Oura’s dependence on a direct-to-consumer model can also limit its ability to scale quickly if demand surges, a lesson many other brands have learned through experience. A lack of a diversified distribution strategy can restrict its growth potential, particularly in markets where ecommerce penetration is relatively low. Even post-COVID, ecommerce accounts for only 20.4% of global retail sales. Expanding distribution through partnerships with brick-and-mortar chains and third-party retailers could help mitigate this risk but entail additional costs and complexities. Oura’s partnership with Best Buy, announced in April 2023, indicates it is making an effort to expand distribution outside of its own channels.

High Price Point

Oura’s high price point risks the company’s continued growth and success. The Oura Ring, with a floor price of $299, can be contrasted with many comparable fitness trackers and smartwatches on the market:

The Oura Ring’s high cost could be a barrier for potential customers, particularly those new to wearable technology and hesitant to make such a substantial investment. Competitors offering products with similar or more extensive features at a lower or comparable cost could make it challenging for Oura to convince a broad customer base that the Oura Ring’s features and form factor justify the premium price, especially when the products are compared head-to-head. If Oura cannot demonstrate significant value compared with cheaper or more feature-rich alternatives, it may struggle to grow its market share and achieve long-term profitability. This risk is exacerbated by economic downturns, during which consumers tend to reduce discretionary spending and gravitate towards lower-cost options.

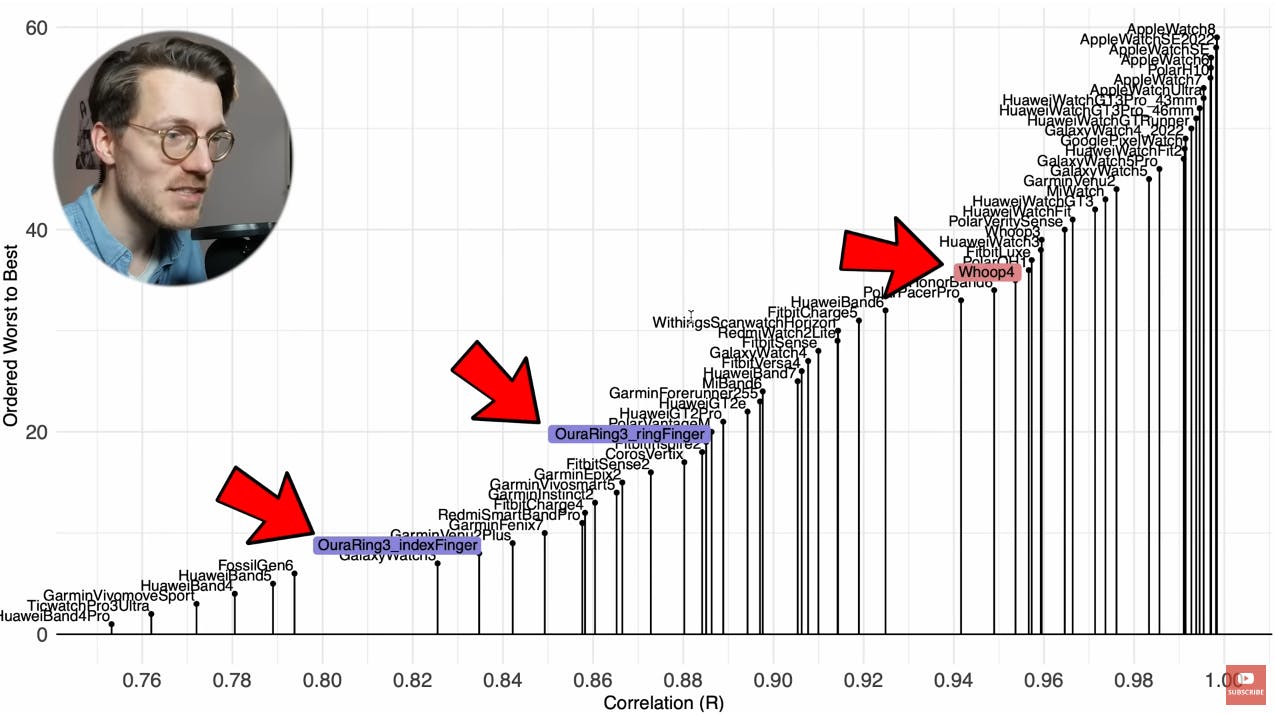

Data and Measurement Accuracy

The value proposition of the Oura Ring to customers is contingent on the accuracy of data, measurements, and insights provided by the wearable sensors and Oura’s algorithms. Users rely on the device for precise data about their sleep patterns, activity levels, and health metrics. However, sensor inaccuracies or inconsistent measurements can compromise the Oura Ring’s data's validity. These inaccuracies jeopardize customer trust and undermine Oura’s competitive edge in a crowded wellness wearable market.

Source: YouTube

Reviews by high-profile organizations like the New York Times, sleep bloggers, and independent research studies report inconsistent activity and sleep-tracking results with the Oura Ring. Given the increasing scrutiny and competition in the wellness tech industry, maintaining the accuracy and reliability of data measurements remains a significant risk to Oura’s business model.

Summary

Oura operates in the growing digital health and wellness sector, focusing on sleep tracking and personalized health insights through its wearable ring device. Capitalizing on an increasing consumer trend towards the quantification of health, Oura has managed to carve out a distinct niche with an emphasis on sleep quality. Its unique form factor and extensive metrics have gained significant consumer traction and celebrity endorsements. Yet, its challenge lies in maintaining the Oura Ring’s relevance and differentiation as the wearable tech market gets increasingly crowded, with big players like Apple and Fitbit continuously expanding their health-tracking capabilities and folding them into more developed software ecosystems. Additionally, transitioning towards a recurring revenue model through its subscription service will test the company’s adaptability. As Oura advances its tech, solidifies its subscription offerings, and nurtures its B2B partnerships, its ability to balance user acquisition, retention, and revenue diversification will determine its success in this competitive space.