Thesis

According to the CDC, more than one third of American adults don’t get enough sleep on a regular basis. Further, between 50 million and 70 million Americans suffer from sleep disorders in 2022. Problems with sleep are only getting worse, with 88% of Americans in 2019 having said that they lose sleep due to binge-watching TV shows or other streaming entertainment before bed.

Though technology is in part driving the problem, it is increasingly being used as a solution. 37% of Americans utilized sleep trackers according to one 2022 survey, with respondents spending an average of $147 on sleep tracking devices and an additional $40 on sleep apps. The number of sleep tech users and their lifetime value is only increasing, with the $15 billion sleep tech device market in 2022 expected to grow to as much as $95 billion by 2032, driven by growing adoption.

Eight Sleep is a sleep technology company whose stated mission is to fuel human potential through optimal sleep. The company’s products include a bio-tracking mattress cover that uses thermoregulation to improve users’ sleep quality by up to 32%, according to the company. Eight Sleep was named in Fast Company’s “Most Innovative Companies of 2018” and was recognized twice in TIME’s Best Inventions of the Year.

Founding Story

Eight Sleep was founded in 2014 by Matteo Franceschetti (CEO), Massimo Bassi (CTO), and Alexandra Zatarain (VP of Brand & Marketing). CEO Matteo Franceschetti was an athlete when he was in his teenage years, playing sports such as tennis, skiing, and motorsports. He began his career as a lawyer at two large UK law firms. However, he knew that he always wanted to be an entrepreneur. After his early work as a lawyer, he co-founded his first company, Global Investment, in 2008. The company developed solar plants across Europe and was acquired in 2011. Francheschetti came up with the idea of Eight Sleep when he realized that although he spent a third of his life sleeping, there had been no recent innovation to better sleep with mattresses.

After its initial launch, Eight Sleep raised $100K and sold more than 8K units of its first product in pre-orders through a crowdfunding campaign on IndieGoGo in 2015. The founders were rejected twice for Y Combinator before applying one final time. For their in-person interview, they built a bedroom in the office, showed the Y Combinator team their mattress, and were accepted into the summer 2015 cohort.

Franceschetti has since mentioned that board members have played a key role in the company’s growth and development. For example, Founders Fund investor Keith Rabois reportedly provided the business with important advice on improving its unit economics. Antonio Gracias, from Valor Equity Partners, has provided the brand with advice on company building, drawing from his experience as the first investor in Tesla and SpaceX. The company also put together a Scientific Advisory Board (SAB), which it announced in August 2019, to collaborate on the intersection of product development and the advancement of science.

Product

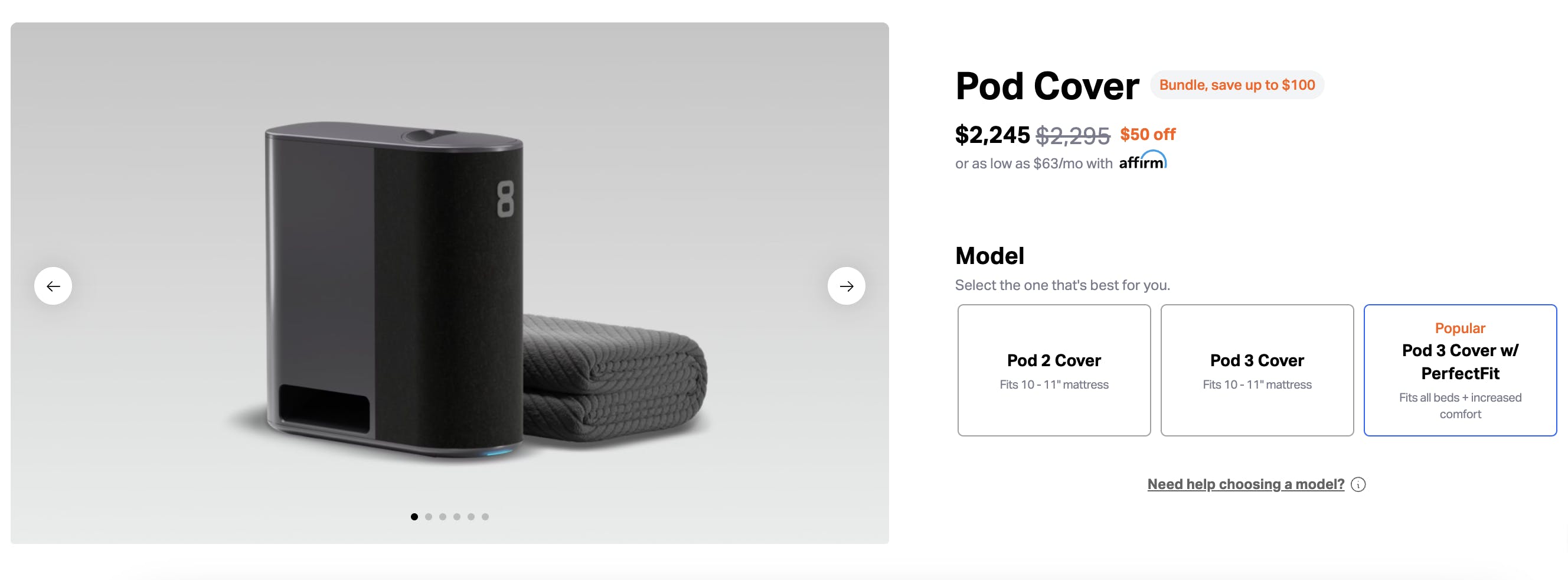

Eight Sleep sells two main products: the Pod Cover and an accompanying mattress, both of which are controlled using the Eight Sleep app.

Pod Cover & Mattress

Eight Sleep’s Pod Cover is designed to fit on customers’ existing mattresses, similar to a mattress cover. The company sells a “PerfectFit” cover that fits all mattresses, but a customer can opt to get one that fits 10”-11” mattresses for $100 cheaper.

The Pod 3 Mattress is Eight Sleep’s premium mattress, designed with medium firmness, pressure relief layers, and a “MaxChill” layer. The Pod Cover comes with a 30-night trial, while the mattress comes with a 100-night trial. The Pod 3, which launched in July 2022, is the latest generation of products from the company as of October 2023. It features product improvements such as doubling the number of sensors compared to the prior generation.

Source: Eight Sleep

Excluding promotions, the Pod 3 with a queen-size Eight Sleep mattress costs ~$3.3K as of October 2023, and the Pod 3 cover alone costs ~$2K.

Core Features

There are a few defining features that come with the Pod 3 generation of products, including Temperature Autopilot and the GentleRise vibration alarm.

Temperature Autopilot

The Pod 3 technology automatically sets the mattress to a predefined temperature so that users can get into bed and fall asleep faster. This product feature is called Temperature Autopilot, a proprietary algorithm that changes the temperature of the mattress based on user biometrics. The mattress temperature can range from 55° F to 110°F.

The Pod is also able to split the mattress temperature into dual temperature zones if two people are sleeping on the same mattress. This is a common pain point in relationships, as 54% of people get into arguments over the temperature in their living space.

The concepts of thermoregulation and thermoneutrality are the underlying reasons why this technology has the potential to improve sleep quality. Thermoregulation is when the body maintains temperature independent of external temperature. It is a survival mechanism in order to preserve homeostasis. Thermoneutrality is when the body doesn’t have to work to regulate temperature.

Sweating and shivering are both common thermoregulation methods. Getting ready for bed is also a thermoregulatory activity, as the body starts to cool down before sleep, but environmental heat can disturb this process. That means it’s important to get the external temperature to an ideal state in order to maximize sleep quality. During the course of sleep, body temperature increases when one moves from non-rapid eye movement (NREM) to rapid eye movement (REM) sleep. During REM sleep, the body stops thermoregulation, increasing the need for adjusting to the right external temperature.

Eight Sleep’s Temperature Autopilot feature is designed to optimize thermoregulation for sleep. As the night progresses, Temperature Autopilot will adjust the temperature of the Pod to help the user transition from one sleep cycle to the next. Temperature Autopilot has the potential to become more accurate over time with more data points, taking into consideration factors such as historical sleep patterns, prior temperature preferences, external weather, room temperature, and user feedback.

GentleRise Vibration Alarm

Another feature of Eight Sleep products is the ability to wake up users through a chest-level vibration and gradual change in temperature, reducing the need for a loud alarm. The alarm can be set and managed in the Eight Sleep app and can be coordinated with temperature variations so that users can wake up warmer than they sleep.

The Eight Sleep App

Source: Eightsleep

In addition to its physical products, Eight Sleep also has an app. Through sensors on the Pod product line, Eight Sleep tracks biometrics and relays them to the Eight Sleep app. The Pod can track heart rate, HRV, respiratory rate, time slept, sleep stages, and disturbances without the use of a wearable — all of which data is displayed on the app on a dashboard. Users can get notified if there are any abnormal biometrics.

Source: Connect the Watts

The app also comes with digital coaching, providing insights so that users can get better sleep, and a library of meditation videos and sleep sounds from experts. Recently, the company announced integrations with wearables apps such as Peloton, Apple Health, Oura, and Garmin to get better insights from the increase in types of data available.

Eight Sleep Value Proposition

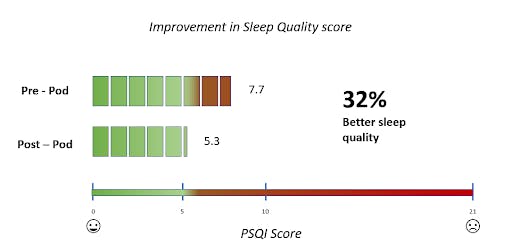

Eight Sleep’s products’ value proposition is to improve sleep quality, and it has conducted studies to demonstrate its products’ ability to do just that. In one study the company conducted, 50 participants were asked to fill out a Pittsburgh Sleep Quality Index (PSQI) questionnaire before and after sleeping on the pod. The PSQI determines sleep quality on a scale from 0 to 21. Scores below 5 indicate “good sleep quality” while scores above 5 indicate “poor sleep quality”.

Source: Eight Sleep

After a month, users in this study reported 32% better sleep quality scores on average than prior to using Eight Sleep. Those scores consist of 34% higher daytime energy scores, 23% fewer sleep interruptions, and 44% faster sleep onset. In addition:

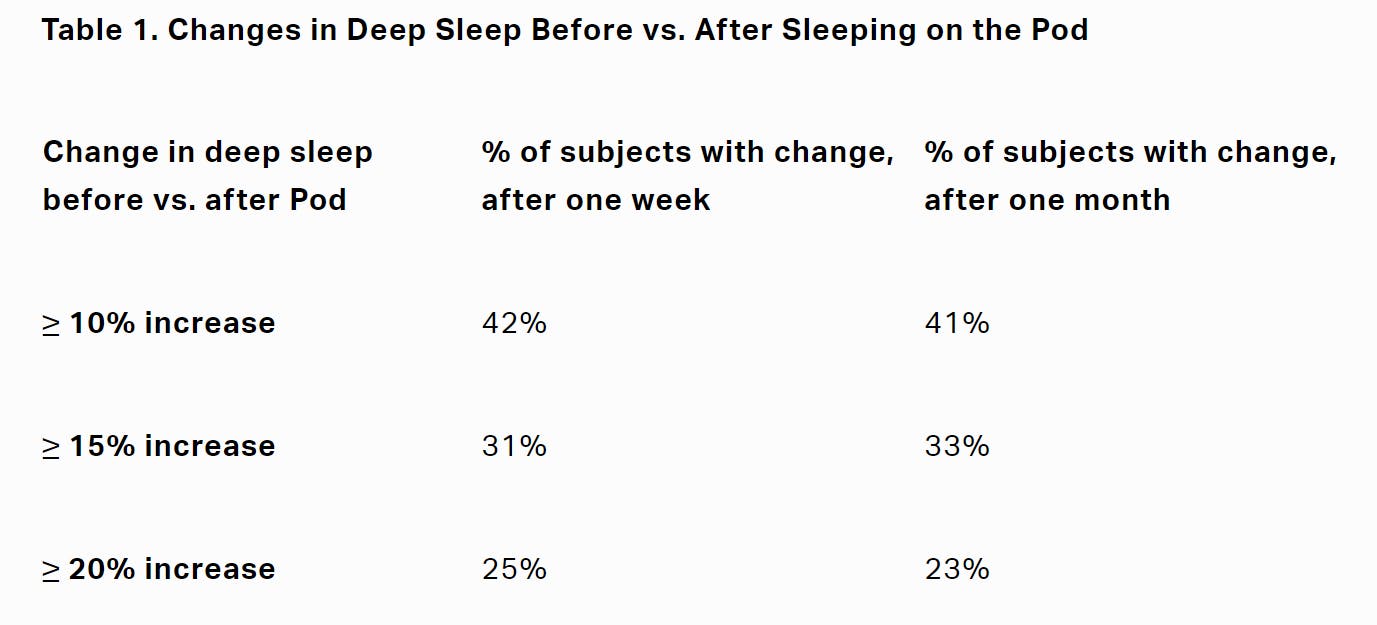

Furthermore, in a separate study, Eight Sleep found that subjects experienced a 10% or greater increase in deep sleep after one week of sleeping on the pod.

Source: Eight Sleep

Market

Customer

The target customer for Eight Sleep is the health-conscious consumer. These are consumers with a high level of awareness of nutrition, fitness, stress, and optimizing their health environment, and who prioritize spending on these areas. Health-conscious consumers are an increasingly large population — the percentage of Americans who qualify as health-conscious consumers has doubled in the five years preceding 2023.

Millennials seem to be the generation most responsible for driving the health-conscious trend. Within the broader population of health-conscious consumers, consumers that specifically utilize bio-tracking wearables and sleep-tracking devices are also growing in number. Wearable device users in the United States grew from 25 million in 2014 to an estimated 67 million in 2022.

Market Size

There are a couple of different markets to be analyzed in understanding the addressable market for Eight Sleep.

First, the sleep technology device market size was $15 billion in April 2023; it was projected to grow to $67 billion by 2030, representing an 18% CAGR. Growth in this market is being driven by the adoption of products such as smart watches and bands wearables, and non-wearables such as sleep monitors and beds. Wearable devices represent 76% of the product share of the market size. North America currently commands 42% of the market share across geographies.

The second way to analyze Eight Sleep’s addressable market is by reference to the premium mattress market since Eight Sleep straddles the line between a premium mattress product and a tech-enabled sleep-regulating product. The premium mattress market size was $7 billion in 2021 and is projected to grow at a 6% CAGR until 2027.

Competition

There are a few types of competitors to Eight Sleep across the industries it straddles:

Legacy mattress manufacturers (Tempur-Sealy, Serta-Simmons)

Direct competitors in mattress technology (Sleepme, Sleep Number)

Legacy Mattress Manufacturers

Legacy mattress manufacturers such as Sealy, Tempur Sealy, and Serta Simmons are relevant competitors since Eight Sleep sells a mattress at a similar price point. While these manufacturers do not have a thermoregulation-driven product like Eight Sleep, the company will still have to convince consumers to pick its mattress over alternatives.

The legacy mattress market is fragmented, with no overwhelmingly dominant player. Because mattresses are fairly commoditized, players must compete mostly on brand differentiation, typically via advertising. Eight Sleep has the potential to differentiate within the market because of its product edge.

Tempur Sealy: Sealy is a long-established brand in the mattress industry, founded by Daniel Haynes in 1881 in Sealy, Texas. The company primarily manufactures and sells mattresses, and it has operated as a subsidiary of Tempur Sealy International since 2012. Sealy was acquired by Kohlberg Kravis Roberts for $1.5 billion in 2004, before being purchased by Tempur-Pedic for about $229 million in 2012. Over the years, Sealy has expanded its product range to include three main brands: Sealy Posturepedic, Stearns & Foster, and Bassett. This diversification in product offering is a notable contrast to Eight Sleep's specialized focus on sleep fitness and smart mattresses.

Meanwhile, Tempur represents the other half of the subsidiary. Founded in 1992, Tempur-Pedic is a pillow and mattress manufacturer, specializing in viscoelastic foam, otherwise known as memory foam. The company was initially based on NASA's research to develop a material that would cushion aircraft seats. Tempur-Pedic was bought out by TA Associates for $350 million in 2002, and later, the company merged with Sealy in 2012, a transaction that was valued at $228 million. In contrast to Eight Sleep's technology-driven approach to sleep improvement, Tempur-Pedic's origins and unique selling point are grounded in the use of a particular material memory foam for comfort and support.

Serta Simmons: Founded in 1870, Simmons is one of the oldest bedding companies in the United States and is a subsidiary of Serta. Both Simmons and Serta filed for Chapter 11 bankruptcy on January 23, 2023. Serta Simmons offers various bedding products ranging from $400 - $10K across both Serta and Simmons sites. Serta Simmons is currently privately held and doesn’t disclose any funding information, but reports in 2018 speculated that it had $3 billion in revenue, when it merged with Tuft & Needle. Similar to Tempur Sealy, Serta Simmons is a legacy company with hundreds of products to choose from. While the company may be familiar to users, Eightsleep’s unique sleep-fitness advertising makes it stand out.

Direct Competitors

Sleepme: Sleepme is a sleep technology company that is the parent company of ChilliSleep. The company was founded in 2016 in North Carolina. Sleepme has raised a total of just $1 million from debt financing as of October 2023. The company sells the Dock Pro Sleep System, which, similar to Eight Sleep’s suite of products, comes with a Dock Control unit that controls the temperature, a Chilipad Pro Mattress cooling pad that goes on a mattress, and the Sleepme app. This app lets users automate temperature adjustments, control the Dock Pro, and set a warming alarm. The Dock Pro Sleep System price ranges in price from $1.1K to $2.1K, depending on size and whether the customer is buying one system or two, which is needed for partner sleeping. Additionally, Sleepme has a feature called “Hiber-AI” which changes the bed temperature based on real-time data from the sleep tracker.

Sleep Number: Founded in 1987, Sleep Number sells tech-enabled mattresses. Sleep Number is a public company and has a market cap of $358 million as of October 2023. Sleep Number’s “Climate360 Smart Bed” can adjust the temperature of each side of the bed based off a partner's preference to optimize sleep. It can also adjust a user's preference of firmness, comfort, and support on each side. It comes equipped with “Partner Snore” technology which raises one partner's head if they begin snoring. Through the SleepIQ app, users can get insights on biometrics and how long and how well they slept. The price of the mattress ranges from $10K - $13.5K depending on size, placing it on the higher-end of mattresses, even when compared to Eightsleep’s premium pricing.

Adjacent Competitors

Wearable companies like WHOOP and Oura don’t sell the same hardware as Eight Sleep, but they do provide similar value propositions via biomarker tracking, health insights, and coaching experiences related to sleep quality.

WHOOP: Founded in 2012, WHOOP offers a wearable wristband with detailed health analytics. The company last raised a $200 million Series F led by SoftBank, amounting to a total of $404.8 million as of October 2023. WHOOP's $200 million Series F in August 2021 priced the company at a $3.6 billion valuation. WHOOP overlaps most with Eight Sleep through its “WHOOP Sleep” feature, which monitors sleep performance (tracking sleep stages, disturbances, and biometrics) and coaches users on how much sleep is needed. Users are asked to track specific habits throughout the day, allowing them to A/B test their behaviors. A monthly membership costs $30/month.

Oura: Founded in 2013 and based in Finland, Oura is another popular wearable company. The company’s most recent round of funding, in April 2022, valued it at ~2.6 billion and brought its total funding to $148.3 million. The company has sold one million units of its product, a smart ring called the Oura Ring. The ring form makes it more portable and versatile in some respects, but potentially less detailed in its sleep tracking in comparison to a full-body mattress. Oura’s sleep insights platform includes an Oura Sleep Score, biometrics data, blood oxygen sensing, and sleep coaching.

Business Model

Eight Sleep’s business model combines hardware sales with a subscription layer, similar to Apple, Tesla, and Peloton. The Pod 3 Cover product ranges in price from around $2K - $2.4K depending on size. With the mattress included, the cost ranges between $3.3K and $4.3K depending on size and add-ons, with a lower price for the previous generation (Pod 2).

Additionally, the company sells a $15 ”Pro” monthly subscription which includes access to Temperature Autopilot, Sleep Content Library, and Digital Coaching, and a “Plus” subscription for $24/month with an extended warranty. It also sells accessories including comforters, pillows, and sheets.

Source: Eight Sleep

Traction

Eight Sleep has not disclosed user growth or revenue numbers. However, CEO Matteo Franceschetti has said that there are “several thousand” Eight Sleep users. During the time of its Series C raise in August 2021, the company was expecting to triple revenue in 2021 compared to 2020. If it sold 10K Pods at an average price point of $2.5K, that would bring hardware revenue to $25 million and subscription ARR to $1.8 million assuming that all product purchases also subscribe to the Eight Sleep app (10K users x $15/month x 12 months).

Beyond revenue and users, the company has also gained traction with athletes, with about 100 star athletes currently using the pod. As of November 2022, Eight Sleep has 71.4K followers on Instagram, and its top YouTube video received 4.4 million views. The company had 118 employees as of October 2023. On the negative side, in July 2023 reports emerged that some Eight Sleep users were experiencing leaks.

Valuation

Eight Sleep raised an $86 million Series C in August 2021 at a valuation of close to $500 million. Since there are no publicly available revenue numbers from Eight Sleep it’s difficult to understand its valuation relative to its revenue.

As a proxy, Apple, Tesla, Peloton, Sleep Number Corp, and Sony are comparable consumer technology companies that are publicly traded and sell hardware. The chart below demonstrates that valuations have come down for those companies since the time of Eight Sleep’s August 2021 raise, indicating that the current valuation of the company is likely lower than it was at the time of its Series C.

Source: Koyfin

Key Opportunities

Enterprise Partnerships

Low-quality sleep doesn’t just affect employees, it affects employers too. Low-quality sleep decreases workplace productivity, which can cost employers $1.9K per employee annually. Additionally, bad sleep is linked to $3.4 - $5.2K in additional healthcare costs per person.

Given these costs, Eight Sleep can partner with corporations to provide discounted access to its products by promoting the benefits to both companies and their employees if employees get better sleep. If corporations are willing to share the cost with employees, the lower price point could increase user adoption, allowing Eight Sleep to scale faster and more efficiently via large employer contracts. Peloton, for example, has a corporate wellness program and has onboarded customers like Accenture Interactive, Nasdaq, Samsung, Sky, and SAP.

Delivering Viable “Sleep Compression”

One of CEO Matteo Franceschetti’s main goals is to compress the amount of sleep users need from the typical eight hours to only six hours by accelerating the transition between each cycle of sleep. If Eight Sleep is able to do this while maintaining sleep quality, that would massively increase the value proposition of the pod. People could be awake for 13% more of their lives without sacrificing sleep quality.

Emphasize Preventative Health

Proactive biometric screenings can potentially detect early signs of illness such as diabetes and high blood pressure. There is an opportunity for Eight Sleep to focus not just on improving the quality of sleep, but also implementing preventative health insights based on its biometric data to help users prevent chronic disease.

Product & Market Expansion

Eight Sleep has plans to expand beyond the US to Europe and the UK. The sleep market is a global opportunity and Eight Sleep can grow its user base by focusing on more geographies. In November 2021, it expanded to Belgium, France, Germany, Italy, Netherlands, and Spain, and it can continue to expand to other markets globally. Additionally, the company is planning to develop solutions outside of thermoregulation that focus on the other pain points that contribute to sleep quality such as noise and light.

Key Risks

High Price Point

How many people are willing to pay on average $2.5K for a tech-forward mattress or mattress cover? Crossing the gap from early adopters to mass adoption may be difficult, since the Pod 3 is quite expensive. If most people view improving sleep quality as a want instead of a need, they might struggle to justify the cost of an Eight Sleep versus alternatives like turning the AC down, getting better blinds, wearing noise-cancellation ear plugs, etc. Eight Sleep has to find a way around this, perhaps by furthering education to potential consumers on the importance of sleep and the specific value provided by dynamic thermoregulation that only Eight Sleep can deliver.

Competition With Wearables

Eight Sleep and wearables provide different technologies with different use cases but clash in the sense that both provide biometrics data, insights, and coaching through a monthly subscription. Consumers will likely not want to pay for two different subscriptions that provide a similar dataset. It’s possible that consumers would choose to only pay for the wearable subscription since that includes 24/7 biometrics and not just sleep. Eight Sleep, however, does provide something unique with Temperature Autopilot in that consumers would lose all the machine learning benefits that come from the Pod if they chose to not pay for the subscription.

New Entrants & Defensibility

With the large potential market opportunity, and small current user base of Eight Sleep, there is still plenty of time for new entrants to come in and launch a competing product that overtakes Eight Sleep’s market share. Multiple big tech companies such as Apple, Alphabet, Samsung, and Huawei are already competing in the adjacent wearables space. Other companies that launch a smart mattress might be able to compete with Eight Sleep by offering some or many of the same benefits at a potentially lower price point. A crowded smart mattress market could cause Eight Sleep to lose pricing power, and thus decrease long-term margins and revenue growth.

Summary

The market size for sleep technology as a whole is large, but there are many players either directly or indirectly competing for this space. Sleep quality is increasingly seen as important because of its demonstrable effects on health and productivity. As public awareness of this grows, consumers are increasingly willing to spend to improve their sleep. Meanwhile, technological advancements have made it possible to track and improve on sleep quality in new ways. Eight Sleep, with its Pod 3 generation of products, is focusing on capturing this opportunity with the increasingly health-conscious modern consumer.