Thesis

People around the world are placing increased focus on their daily health and well-being. In 2021, the global wellness market was valued at $1.5 trillion ($450 billion in the US alone) and was growing 5%-10% annually. In the US, the number of gyms, health, and fitness clubs increased ~29% from 2013 to 2023, with more than one in five Americans attending a health club or studio as of 2021. There also seems to be an increasing number of people participating in athletic competitions at some level. As of early 2023, there are more NCAA student-athletes than ever, and the population of professional athletes is forecast to grow substantially throughout the decade. In the business world, companies are focusing more on employee well-being, health, and sleep with the goal of producing more sustainable and productive workforces.

As consumers increasingly value and seek products and services that address needs across several wellness dimensions, such as mindfulness, fitness, or nutrition, the global wearable fitness tracker market has grown to become valued at $45 billion in 2021. It is projected to reach $192 billion by 2030, riding the rising tide of public health awareness that is driving the broader wellness market along with improvements in wearable technology. Because of these factors, coming off of the COVID-19 pandemic, gadgets that monitor health and wellness are seeing heightened demand.

WHOOP builds a fitness and health wearable product to monitor recovery, sleep, and training, along with a membership for 24/7 coaching to improve health. WHOOP’s performance optimization system tracks recovery, training, and sleeping hours. The company provides athletes, coaches, and trainers with a continuous understanding of strain and recovery to balance training, reduce injuries, and predict performance. The WHOOP strap collects physiological data 24/7 to provide an accurate and granular understanding of the body, and the company’s mission is to offer everyone from data-driven athletes to health-conscious everyday consumers, enterprise-level firms, and healthcare organizations a better way to track physiological activity and optimize daily performance.

Founding Story

WHOOP was founded in 2012 by Will Ahmed (CEO) John Capodilupo (CTO until April 2022) and Aurelian Nicolae (Chief Hardware Engineer). The co-founders met during their undergrad at Harvard.

The idea for WHOOP originated when Ahmed realized how little he knew about optimizing his physiological performance as a student-athlete. Around 2010, Ahmed began reading medical papers on the subject. He observed that proper performance tracking required measuring activities and metrics around recovery including sleep, but that access to comprehensive performance tracking wasn’t widely available. In college, Ahmed also held various internships at a hedge fund, the investment bank Allen & Company, and the private equity firm Lindsay Goldberg, which made him decide not to pursue finance as a career path. Meanwhile, however, he also took a class at MIT where he learned about developing business plans which helped fuel an entrepreneurial mindset.

After graduating in 2012, Ahmed decided to start his own company and began working on WHOOP with Capodilupo, who was then a sophomore studying computer science at Harvard. Around then, Ahmed was also looking for someone to help develop hardware prototypes for WHOOP, and Capodilupo recommended Nicolae, a fellow Harvard grad. The group incubated WHOOP at the Harvard Innovation Lab. In WHOOP’s early days, the team tried to deliver value for professional athletes through WHOOP’s products as early as possible by being among the earliest wearables to include sleep and recovery tracking. The team was able to attract LeBron James and Michael Phelps to be among WHOOP’s first hundred users, which helped buy WHOOP time with investors to develop its consumer business plan.

In 2022, WHOOP hired Jaime Waydo, who previously worked at Waymo and Apple, as CTO; replacing former CTO and co-founder Cadodilupo.

Product

WHOOP 4.0

WHOOP’s primary hardware device is its wearable fitness and body tracker, the WHOOP 4.0, which was released in 2021, six years after the WHOOP 1.0 initial launch in 2015.

The WHOOP 4.0 screenless device is meant to be worn 24/7. As opposed to other wearables with screens and entertainment, navigation, and communication functions, WHOOP is designed to monitor users’ physiological data constantly while not being distracting. All data can be seen via mobile device within the WHOOP app.

Source: WHOOP

Among the WHOOP 4.0’s features are a 33% size reduction from the WHOOP 3.0, 5 LEDs and 4 photodiodes, waterproof on-the-go charging, BLE compatibility, 4-5 day battery life, and waterproofing up to 10 meters. It also tracks biometrics including skin temperature, blood oxygen, and more.

WHOOP App

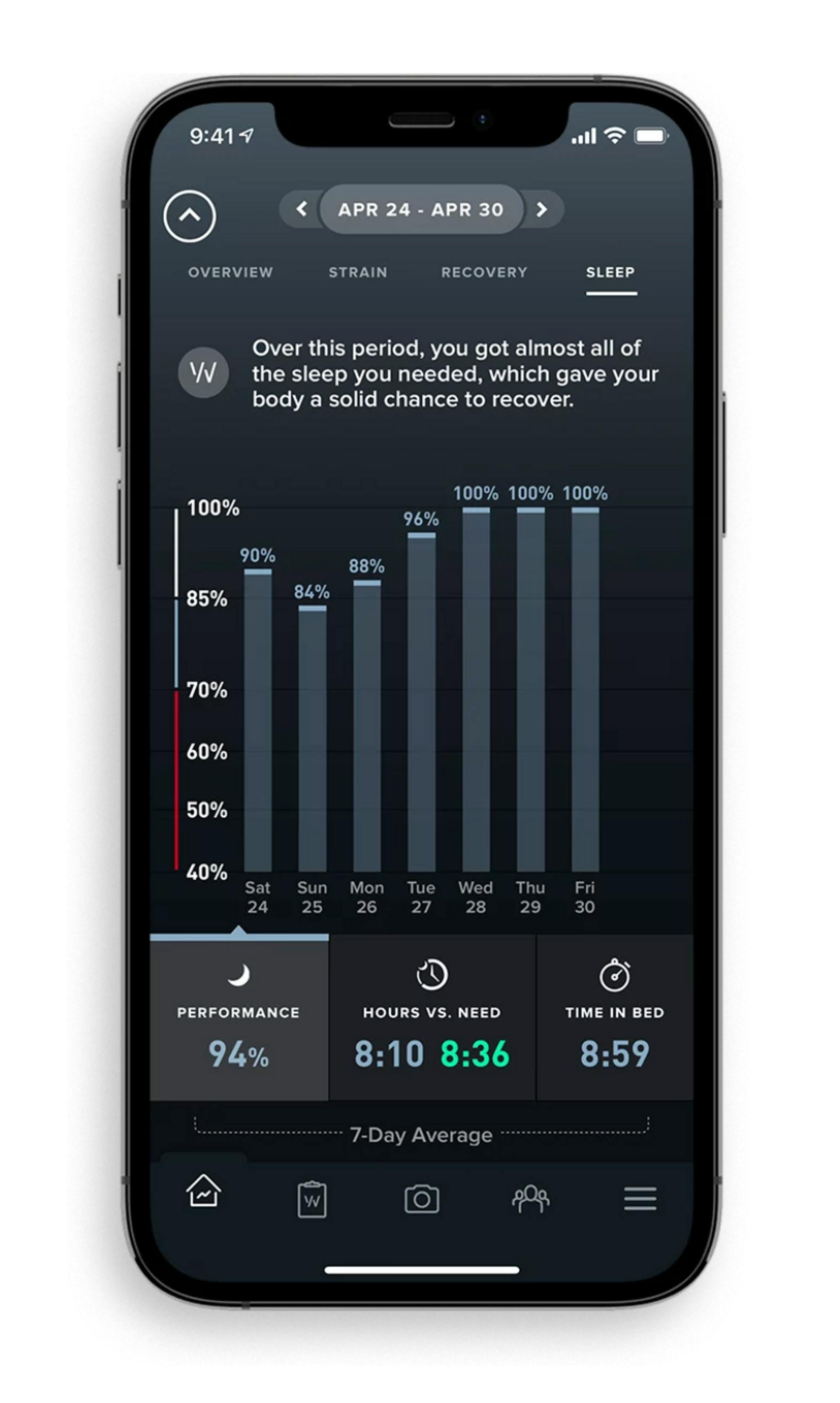

The WHOOP app allows members to access live and historical data and personalized insights. Data from WHOOP devices is primarily collected and analyzed under three categories: Sleep, Recovery, and Strain.

WHOOP Sleep helps users determine their baseline sleep needs and adjusts recommendations based on recent strains, sleep debt, and naps. It also accurately tracks users’ sleep stages, respiratory rate, and sleep efficiency. The WHOOP 4.0 can also vibrate to wake a user at the estimated optimal time.

Source: WHOOP

WHOOP Recovery helps users quantify their daily readiness from 0-100% by measuring biometrics like heart rate variability, resting heart rate, and sleep performance. Green indicates your body is well recovered and ready to perform. Yellow indicates the body is maintaining health, and red indicates the body is working hard to recover.

Source: WHOOP

WHOOP Strain helps users measure their physical and mental stress levels on a scale of 0 to 21, using factors like exercise, work, anxiety, and more. WHOOP also detects activities automatically — from day-to-day errands to sleep to workouts — and offers personalized coaching insights on optimizing strain levels.

Source: WHOOP

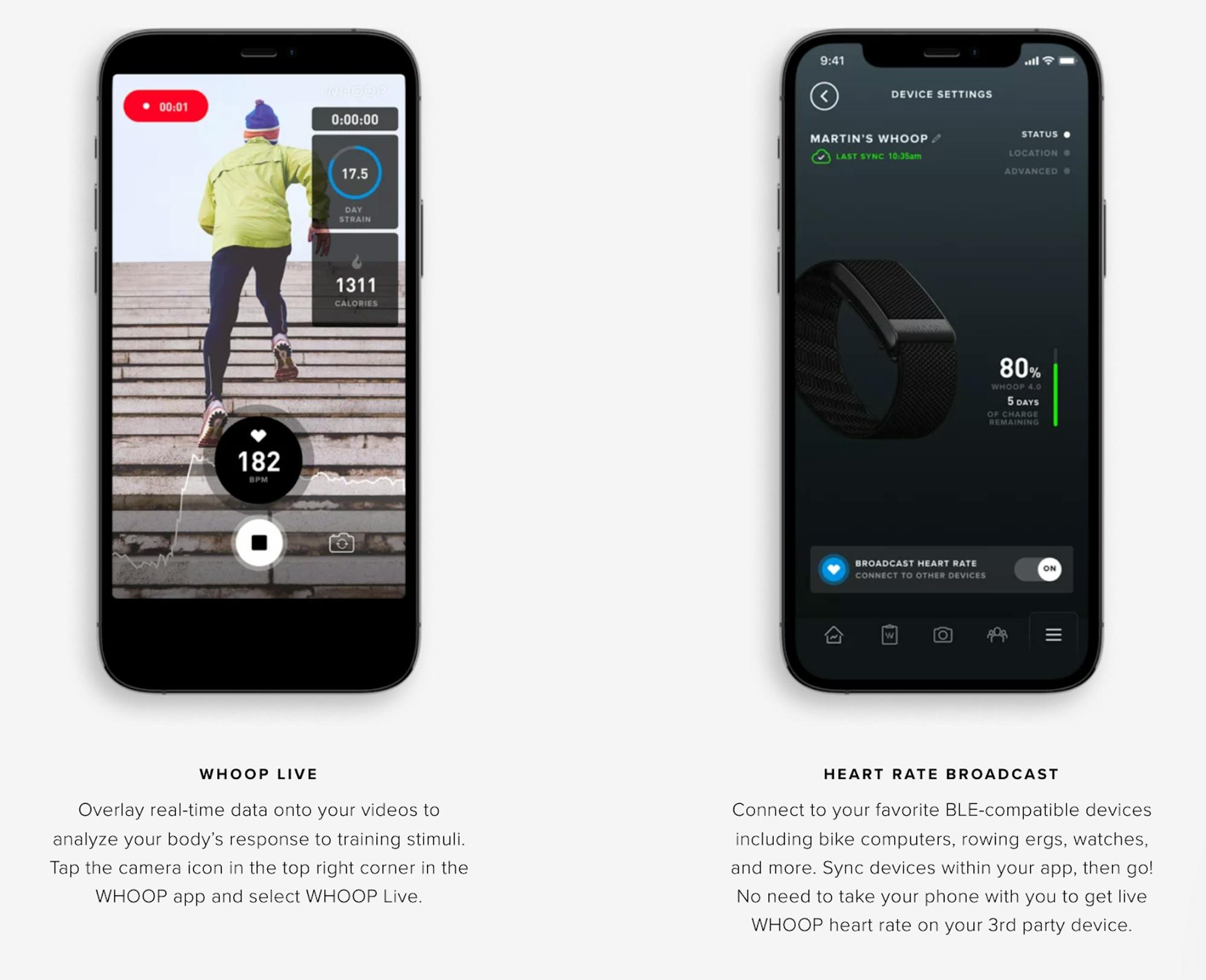

The app’s other features include a journal for logging and tracking behaviors along with community and social functions, access to WHOOP experts, and the ability to overlay real-time recovery, sleep, strain, or heart-rate data onto videos. WHOOP’s Health Monitor offers an overall look at vital signs like heart rate, skin temperature, and blood oxygen. Data can also be exported as a PDF to share with trainers or health professionals.

Source: WHOOP

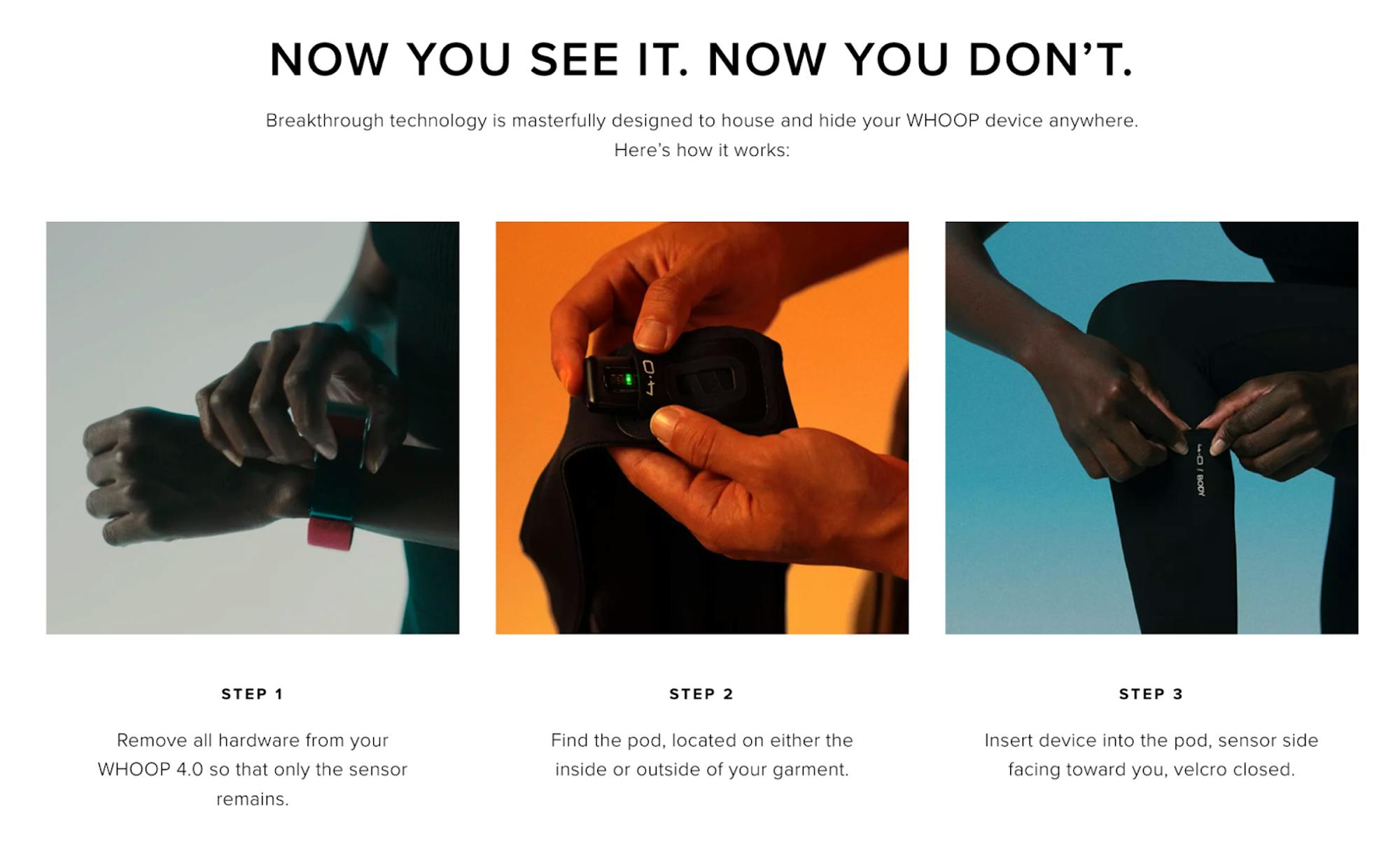

WHOOP Body

WHOOP Body is a line of fitness apparel with WHOOP’s Any-Wear™ technology, meaning it is equipped with small velcro pods that hold the WHOOP 4.0 device so a user can keep using it even off their wrist. The apparel line includes boxers, bralettes, leggings, performance tops, and more.

Source: WHOOP

Market

Customer

WHOOP’s consumer brand primarily targets a class of data-curious athletes. As a product, however, WHOOP CEO Will Ahmed has noted that the company’s devices should appeal to individuals who want or need a high level of insight into their daily physiological activity. “I don't care if you're a 13-year-old girl or an 85-year-old man, if you put on WHOOP it’s going to tell you something valuable about how you can improve your health or improve your performance,” Ahmed has said.

Source: WHOOP

WHOOP also targets enterprise customer segments across athletics, business, government, and defense industries through its WHOOP Unite division. The company markets its enterprise platform to athletics organizations to maximize overall team performance and recovery and to surface insights for the coaching staff. WHOOP says businesses can use its technology to help sleep-deprived teams improve their sleeping performance. It also markets Unite to government and defense organizations to assist with sleep and stress performance.

Source: WHOOP

In February 2022, WHOOP partnered with the United Arab Emirates insurance provider Wellx.ai to help reduce insurance claims and personalize the insurance experience of insurance holders.

Market Size

WHOOP’s total addressable market extends across the global wellness and athletics industries, spanning health-conscious everyday consumers, high-performance and professional athletes, enterprise organizations, and large healthcare providers and systems. In 2021, the global wellness market was estimated to be worth $1.5 trillion, growing 5%-10% annually. In 2022, it pegged the US market at $450 billion, growing at 5%. In the same year, 37% of surveyed consumers were interested in additional products and services in the sleep category.

In 2020, researchers estimated Americans spent $265 billion on physical activity annually, with consumers spending $810 annually per capita in an $828 billion global market. Additionally, in 2021, it was estimated 66.5 million Americans belonged to a health club or studio, and in 2023, there were approximately 115K gyms, health, and fitness clubs in the US, up from 89K in 2013. In the US, professional athletics as a category of employment is expected to grow 36% between 2021 and 2031. Additionally, in 2022, the number of college-level student-athletes surpassed 520K — an NCAA record.

Competition

Oura: Oura sells a smart ring with similar features to the WHOOP 4.0. The company was founded in Oulu, Finland in 2012. It has raised $148.3 million in funding. Similar to WHOOP, the company offers an app and platform that focuses on helping users optimize their Sleep, Readiness, and Activity. Oura says it offers tools for tracking movement, steps, heart rate, recovery, sleep cycles, and blood oxygen levels. The company also offers a premium app subscription for $5.99 per month. Like WHOOP, Oura has an enterprise tier called Oura for Business which lists the US Navy, Brex, the US Army, the UFC, and Nascar on its website. Oura’s brand differs significantly from WHOOP’s Nike-like focus on high-performance athletics.

Levels: Levels sells a continuous glucose monitor and a membership that offers access to the Levels app for insight into how food affects users’ health for optimizing nutrition and activity. The company was founded in 2019 and has raised $57 million in funding. While serving a different purpose than WHOOP, the two companies’ wellness-focused and tech-forward customer bases likely overlap. The Levels product and membership are relatively expensive, costing $199 per year for app access and $199 per month for glucose monitor supplies. To date, Levels has raised $57 million in funding.

Apple: The Apple Watch can be used for fitness and sleep tracking. However, WHOOP CEO Will Ahmed has said he doesn't view Apple as a direct competitor since the WHOOP is not a smartwatch. According to Ahmed, WHOOP devices are designed to be “cool,” “invisible” products you wear solely for high-performance health tracking, so they have no screen. In contrast, the Apple Watch is meant to be a highly interactive device with many other uses and markets to a much large target market than WHOOP’s data-curious, high-performance crowd. Still, there is likely some overlap between Apple Watch and WHOOP customers, especially as Apple further develops its health features.

Fitbit: Fitbit offers wireless, wearable sensors that track a person’s daily activities. It was founded in 2007 and was acquired by Google in 2021 for $2.1 billion. At the time, Fitbit had more than 29 million active users. As of March 2023, the company sells an array of smartwatches and trackers and offers a suite of health, activity, and sleep-tracking tools. Lately, reporting has uncovered some frustrations among Fitbit users. WHOOP CEO Will Ahmed has also said that early in WHOOP’s business, the company had the opposite problem from Fitbit in that WHOOP struggled to sell a high volume of products, but its customers churned at very low levels.

Amazon: Amazon offers a lineup of fitness wearables that includes its Halo Band, which looks nearly identical to the WHOOP 4.0 and, as of March 2023, costs $69.99. The Halo Band measures many health and activity functions across fitness, sleep, BMI, and recovery. Amazon also offers a Halo Membership for $3.99 per month, which gives users access to a suite of health-tracking tools and workout and nutrition content. WHOOP CEO Will Ahmed has described how this move from Amazon reinforced his confidence in WHOOP’s product and defensibility. Ahmed has also tweeted extensively about Amazon’s entrance into the market.

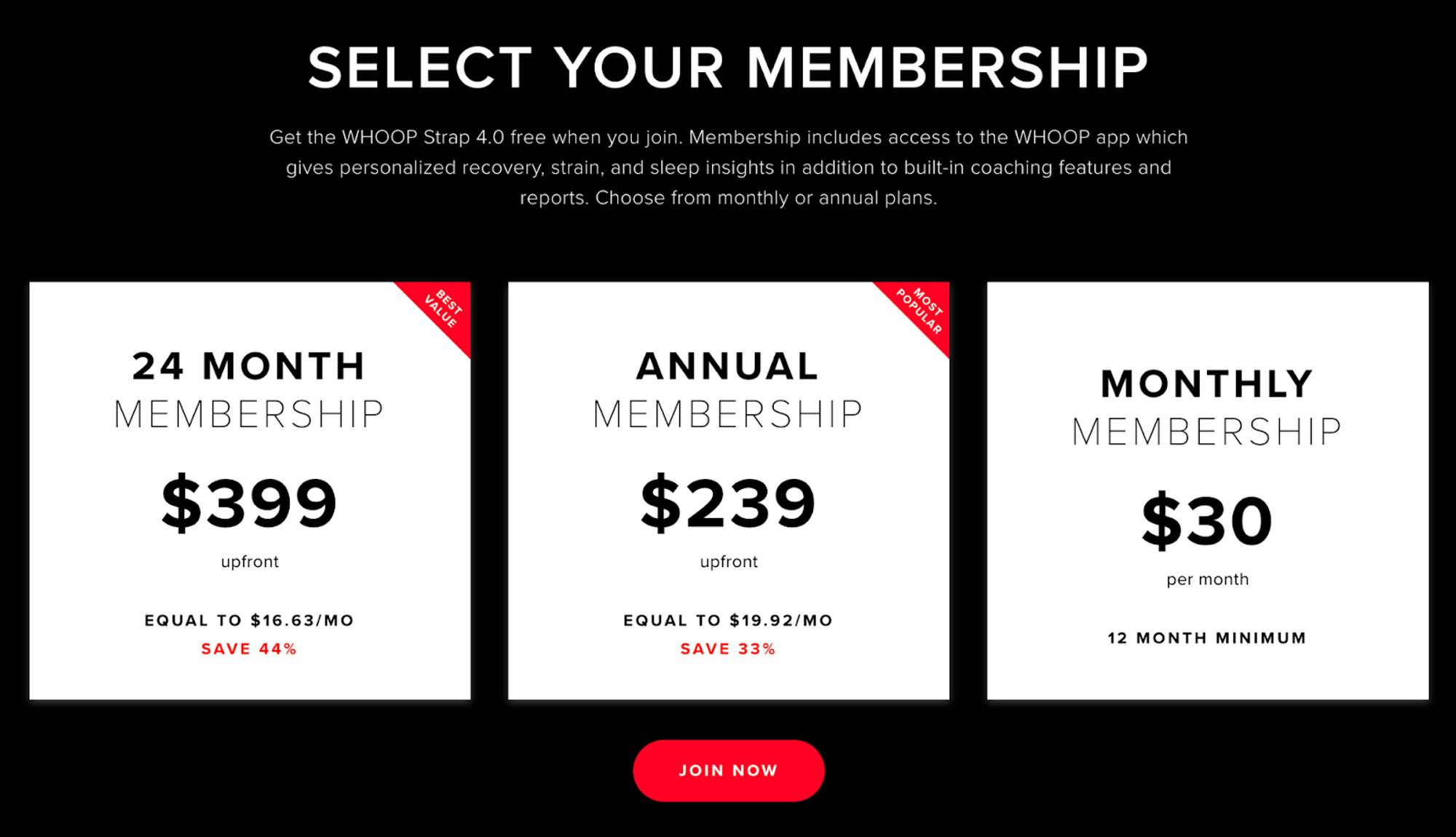

Business Model

WHOOP employs a subscription business model in which customers pay for monthly, annual, or biannual access to the WHOOP platform. The WHOOP band is included in the cost of the membership subscription. WHOOP members can also upgrade their devices for free when new ones are released.

As of March 2023, following recent subscription price cuts, WHOOP’s current subscription pricing is as follows:

Source: WHOOP

Initially, with WHOOP’s commercial launch at the end of 2016, WHOOP devices sold for a $500 one-time fee. At the time, the devices cost $250-$300 to manufacture. As costs decreased with scale, and as the company noticed users churning at low levels over long periods of time, Ahmed realized the value in pivoting to a subscription model. “We’re going to bet on our technology and our product and our analytics and give people the ability to try WHOOP for a dramatically lower price,” CEO Will Ahmed said during a podcast interview. “And if they fall in love with it and we continue to add value to their life, then it’ll be better for both parties in the long run.”

Ahmed has said he looked to Fitbit’s and Peloton’s performance in the private and public markets for inspiration in developing WHOOP’s subscription business model. In particular, he admired the value investors placed on subscription businesses as opposed to hardware that’s purchased once.

In September 2021, WHOOP introduced the WHOOP 4.0 along with a new line of WHOOP Body performance tracking smart apparel that can hold WHOOP devices. The company also sells extra bands, battery packs, sleep masks, and blue light glasses. Also in 2021, WHOOP introduced WHOOP Pro, a $12 per month exclusive membership add-on that offers free shipping on WHOOP Store purchases, 20% discounts on apparel, tri-monthly freebies, early release access, limited edition gear, and a Pro Profile Badge on the WHOOP app.

Source: WHOOP

In June 2022, WHOOP announced its B2B play WHOOP Unite, an enterprise plan for organizations. In a press release announcing the launch, WHOOP said it “works with more than 200 customers in business, healthcare, higher education & athletics, and public service to deliver comprehensive insights and coaching across sleep, stress, and recovery.” WHOOP also said its enterprise headcount was expected to double in 2022. In November 2022, WHOOP announced its entry into brick-and-mortar retail through a deal with Best Buy to sell its products at 200 Best Buy stores in the US and on Best Buy’s website.

Traction

Even early on, WHOOP was able to attract interest from elite athletes. In 2015, when the company announced its $12 million Series B well before public release, WHOOP said its devices were being trialed by Olympians and athletes on teams across all major US professional sports leagues and college conferences. At the time, LeBron James’ trainer Mike Mancias had joined WHOOP as an advisor.

In 2016, WHOOP announced positive results from a performance study involving 230 minor league players from nine Major League Baseball (MLB) organizations. In 2017, the MLB approved the use of WHOOP by players during games. Also that year, WHOOP announced a deal with the National Football League Players Association (NFLPA), making WHOOP the Officially Licensed Recovery Wearable Of The NFLPA. In an announcement, WHOOP said it would allow NFL players to commercialize their health data.

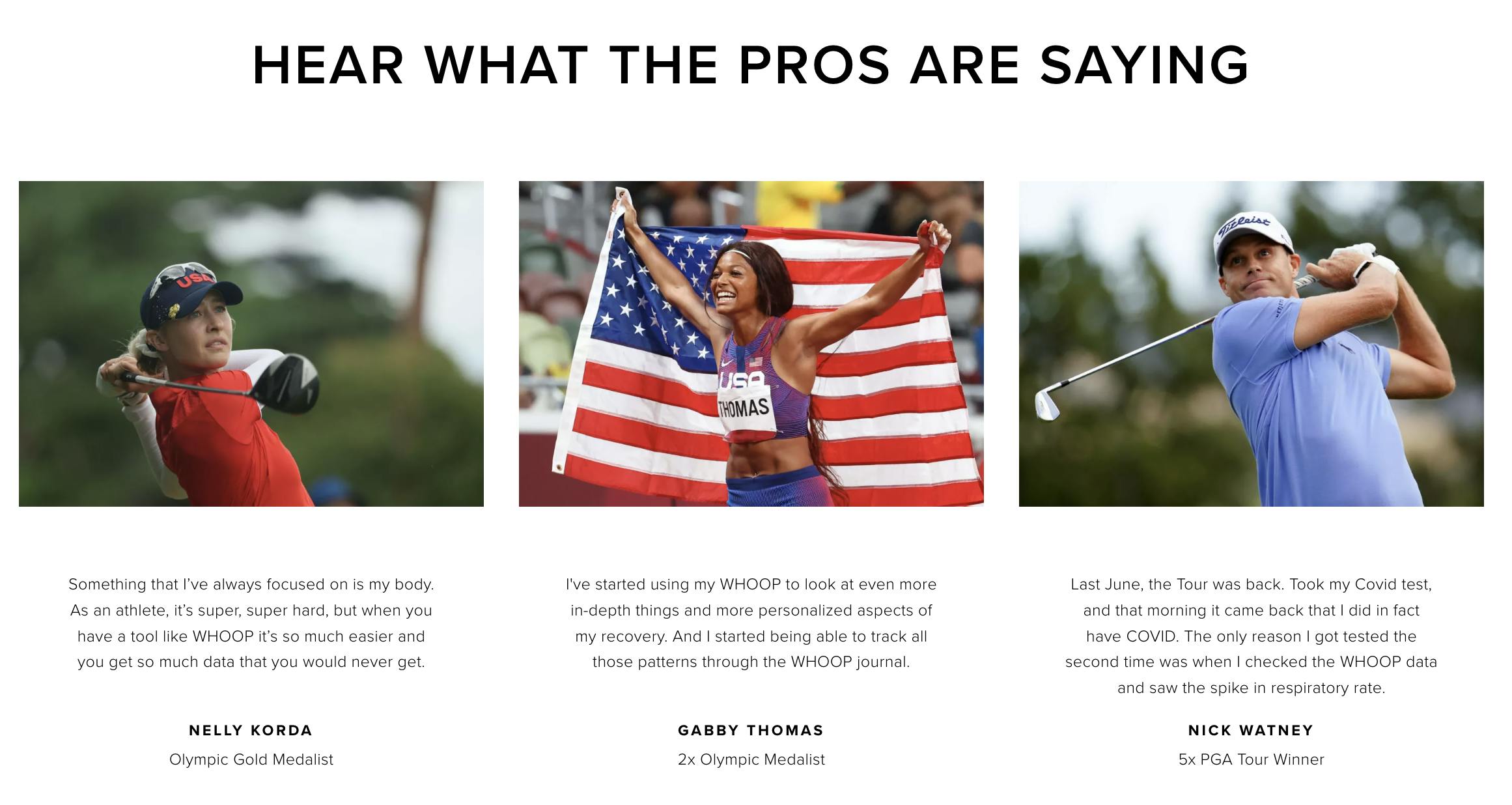

In 2020, a study by the University of Arizona found that WHOOP “offers a highly accurate commercially available wearable for measuring sleep staging.” Also that year, WHOOP collaborated with Cleveland Clinic to conduct a study involving hundreds of COVID-19 cases among WHOOP members and with Abu Dhabi-based G42 Healthcare in a 15K person COVID-19 vaccine trial. In August 2020, WHOOP was named the Official Fitness Wearable of the American WorldTour team EF Pro Cycling. Also, in 2020, CEO Will Ahmed estimated 60% of the PGA TOUR became WHOOP users organically.

That year, golfer Nick Watney’s WHOOP reportedly helped him realize he had COVID, which protected others from getting sick. Soon after, the PGA TOUR procured WHOOP devices for players, caddies, and staff members. In January 2021, the PGA TOUR and WHOOP announced a deal that saw WHOOP become the “Official Fitness Wearable of the PGA TOUR.”

Source: WHOOP

WHOOP was also named the Official Performance Partner of Howard University. In February 2021, WHOOP and the US Army announced a joint study involving 1K paratroopers “to examine the resiliency of soldiers operating in an Arctic environment.” In March 2021, WHOOP and CrossFit signed a multiyear deal that saw WHOOP become the Official Wearable of CrossFit. Later that year, the company acquired Toronto-based sports technology startup PUSH Technology for an undisclosed sum. In November 2021, WHOOP was also named the Official Fitness Wearable of the Women’s Tennis Association.

Source: WHOOP

In 2022, WHOOP formed a Scientific Advisory Council that includes prominent neuroscientist and Stanford professor Dr. Andrew Huberman, among others. The company also entered brick-and-mortar retail through a partnership with Best Buy. In July of 2022, WHOOP conducted a round of layoffs of 15% of its staff. In January 2023, the company conducted an additional layoff impacting 4% of its staff.

Valuation

In August 2021, WHOOP raised a $200 million Series F at a $3.6 billion valuation led by SoftBank Vision Fund 2, with participating investors IVP, Cavu Ventures, Thursday Ventures, GP Bullhound, Accomplice, NextView Ventures, and Animal Capital. Athlete investors in WHOOP include Kevin Durant, Larry Fitzgerald, Patrick Mahomes, Eli Manning, Rory McIlroy, and Justin Thomas. WHOOP has raised a total of $404.8 million in funding.

In 2021, venture-backed companies in the fitness category raised ~$5.9 billion in funding, up from ~$2.4 billion the category raised in 2020. However, funding and valuations in the broader connected fitness category appear to have mellowed. Tonal, for instance, albeit offering a connected home fitness platform as opposed to a wearable device, was reported in February to be raising funding at a $500 million valuation, down from a $1.9 billion valuation in September 2022. Additionally, as of March 2023, Peloton has seen its stock decline approximately 92% from 2020 highs.

Key Opportunities

Enterprise Adoption

In June 2022, WHOOP announced its B2B play WHOOP Unite, an enterprise plan for organizations. In the US, professional athletics as an employment category is expected to grow 36% between 2021 and 2031. Additionally, in 2022, the number of NCAA student-athletes surpassed 520K. The opportunity for WHOOP to partner with athletic organizations and leagues, getting a device in the hands of every competitive athlete in the US, may be large.

From an employee wellness perspective, Fortune 500 companies accounted for approximately 71.8 million employees in 2022. As companies focus on employee well-being as an input of productivity, WHOOP may see more opportunities to serve as an employee benefit. In 2020, WHOOP collaborated with Cleveland Clinic to conduct a study involving hundreds of COVID-19 cases among WHOOP members. In February 2022, WHOOP partnered with the United Arab Emirates insurance provider Wellx.ai to “ reduce insurance claims and hyper-personalize the insurance experience.” Even in the short term, there may be more opportunities for WHOOP to serve medical organizations through studies, patient care, and insurance-provider partnerships.

Brand Strength

Despite the fact that major brands, including Amazon, Apple, and Google, have made forays into the wearable technology space and offer a variety of similar features to WHOOP, WHOOP’s most defensible and advantageous features may be its brand adoption among the athletic elite and product focus — all of which have contributed to what appears to be remarkably low churn among its customers. Doubling down on this source of durable competitive advantage is likely to be a continued source of success for the company.

International Expansion

WHOOP plans to make its app and community accessible to more languages and people. CEO Will Ahmed has recognized international growth as a key next step for the company. In April 2022, the company launched a version of its app in German. WHOOP is positioned to use its WHOOP Live technology to become a central aspect of professional sports broadcasts. The tool, which can relay real-time physiological metrics, has already been used in live broadcasts across golf, racing, and cycling.

Key Risks

Incumbent Distribution

In 2022, Apple’s shipments of Apple Watch were estimated to increase 17% annually and account for about 60% of the global smartwatch market revenue. The company has also reportedly made progress on blood glucose tracking technology that could one day be implemented into the Apple Watch. It may be challenging for WHOOP to keep pace with Apple’s wearable hardware and software developments over time, especially considering Apple’s vast distribution capabilities. While not known well for its wearable health-tracking devices, Amazon has enormous distribution networks, formidable pricing power, and, more recently, vertically-integrated access to healthcare organizations that can be hard for WHOOP to compete with.

Summary

People around the world are placing increased focus on their well-being. On its mission to unlock human performance, WHOOP has raised over $400 million to develop a popular brand and wearable technology platform that can be useful for a variety of use cases, from professional athletes to medical research subjects. WHOOP may be challenged by Apple and Amazon in the long term as the companies further develop wearable healthcare technology and vertically integrate with healthcare organizations. Still, WHOOP has made early strides in forming several strategic partnerships, building a Nike-like technology brand around performance athletics, and developing a product and business model that has proven to be low churn and open multiple avenues for growth.