Thesis

The U.S. cannabis market was valued at $13.2 billion in 2022. By 2030, it is projected to be a $100 billion industry in the US. The broadening legalization of cannabis and rising acceptance of its use for medical purposes are driving the market's growth. In 2019, 38.4 million US adults consumed cannabis at least once annually from a legal or illicit source. 36% of cannabis consumers report using cannabis daily, and 59% use cannabis at least once a week.

More and more Americans are supporting marijuana legalization — the number reached a record high in 2022, with 88% of US adults saying that marijuana should be legal for either medical or recreational use. As of January 2023, 21 states (and Washington D.C.) have legalized cannabis for recreational use, while 37 have legalized it for medical use. As the cannabis industry has grown, so has the need for modern, high-quality infrastructure to power cannabis businesses. The major credit card networks can't accept cannabis-related transactions until sales are legalized at the federal level. As a result, for consumers, purchasing cannabis still comes with friction and obstacles. Meanwhile, owners of cannabis businesses face unique challenges specific to the cannabis industry that compound the other challenges that come with running any small business.

Dutchie is a technology platform powering cannabis commerce, streamlining dispensary operations, and providing safe and easy access for consumers. For cannabis businesses, it is a one-stop shop, providing a point of sale, payments, insurance, and more. Dutchie wants to help them start, operate, and grow. It also helps consumers discover and shop from local recreational and medicinal dispensaries.

Founding Story

Dutchie was founded in 2017 by two brothers, Ross Lipson (formerly CEO) and Zach Lipson (chief product officer). Prior to founding Dutchie, Ross founded Grub Canada, an online food ordering company in Canada that was launched in 2008. Grub Canada scaled quickly and was sold to Just Eat in 2012 for $30 million. Through these experiences, Ross said that he learned “how to bring tech into a retail environment and create value for the entire chain from consumer to the business.” In 2013, Ross co-founded RepPro, a web-based software that allows financial advisors and their staff to store client information and fill out financial applications. It was acquired in 2017.

October 1, 2015, was the day that recreational cannabis was legalized in Bend, Oregon. Ross was living in Oregon at the time and found himself waiting in a long line to buy weed. That’s when he came up with the idea of enabling online ordering for cannabis. By July 2017, he had launched Dutchie with his brother Zach to help dispensaries put their menus online so customers could easily place orders for pickup.

Dutchie started off as an online ordering service for cannabis, which billed itself as a tool for dispensaries to reach more consumers. Dutchie’s first customer was the same dispensary Ross had been standing in line for when he had the eureka moment to start Dutchie. Within months, 50 other dispensaries in Oregon had signed up with Dutchie.

In November 2022, Dutchie’s board ousted co-founders Ross and Zach Lipson and replaced Ross with Tim Barash as CEO (Barash previously served as Dutchie’s executive chairman). As of February 2023, there is an ongoing lawsuit filed by Ross Lipson against Tim Barash and four board members. The court case alleges that the defendants staged a hostile takeover.

Product

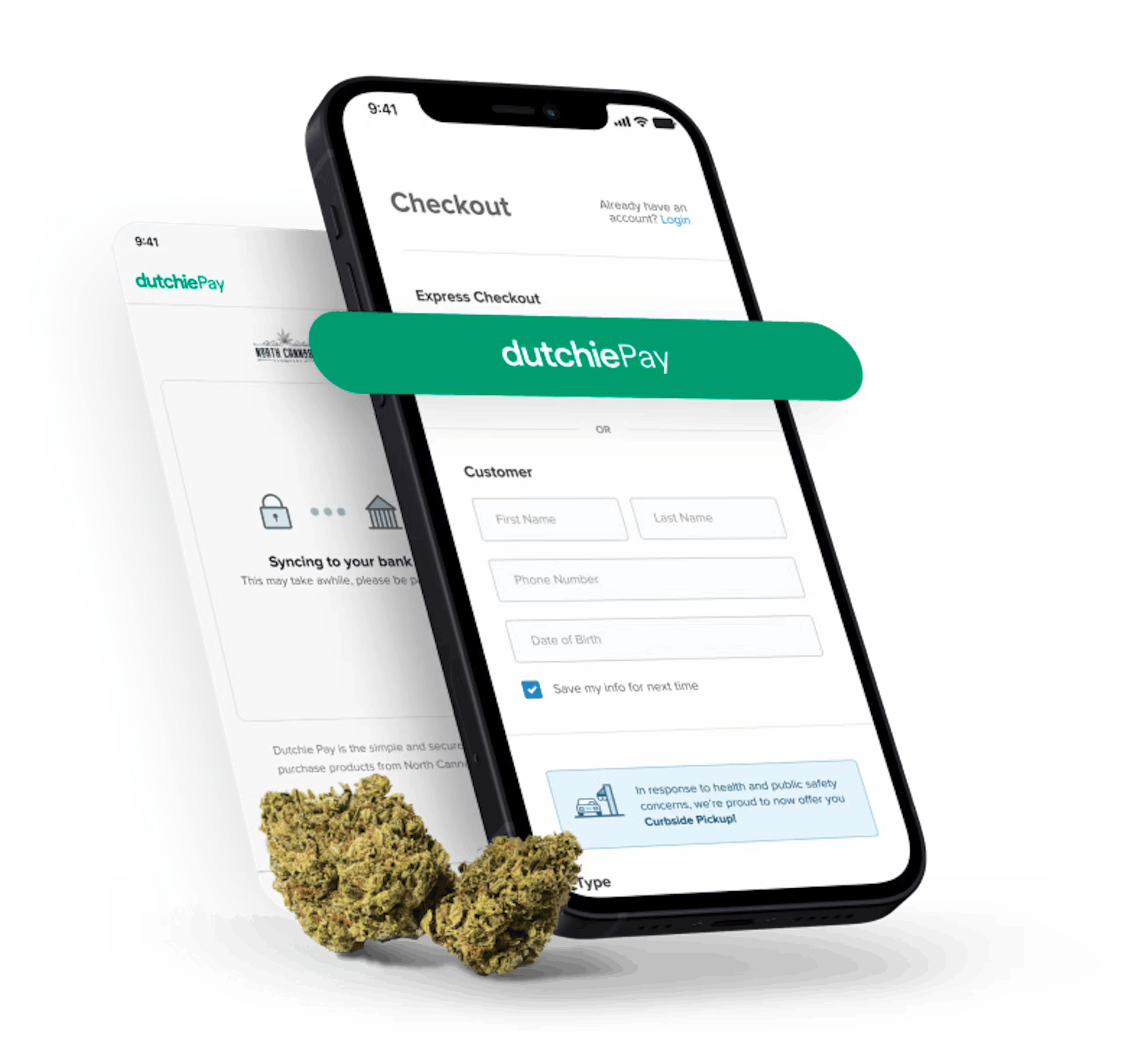

Payments

Cannabis is a highly-regulated industry, which is still overcoming lingering stigma. Many traditional payment processors do not support transactions involving cannabis. As a result, 90% of all dispensary transactions are handled in cash, with other options being ACH transfers or dubious cashless ATM transactions. This creates inefficiencies in operations, tax remittance, and safety risks.

A few striking anecdotes about the downsides of cash payments for cannabis include dispensary owners getting kidnapped or robbed at gunpoint, having to invest in armored cars, and walking around with $300K in a backpack to go pay taxes. As the company observed in a press release:

“Providing modern payment solutions is one of the biggest barriers remaining to normalizing the cannabis shopping experience and is essential for the industry to better compete with the illicit market and provide local and state governments with even more critical new tax revenues.”

As a solution to this, Dutchie offers Dutchie Pay, a one-click payment option for cannabis online and for delivery via an ACH bank transfer. Dutchie also allows dispensaries to offer a compliant, secure, and cash-free payment option with its in-store PIN debit solution. Dispensaries who used Dutchie Pay have reported benefits including:

30% increase in average order value

32% decrease in abandoned cart rates

15% reduction in cash management costs

More repeat purchases — 82% of consumers made a second purchase after signing up for Dutchie Pay

Dutchie’s payment solution integrates with its point of sale (POS) and ecommerce products.

Source: Dutchie

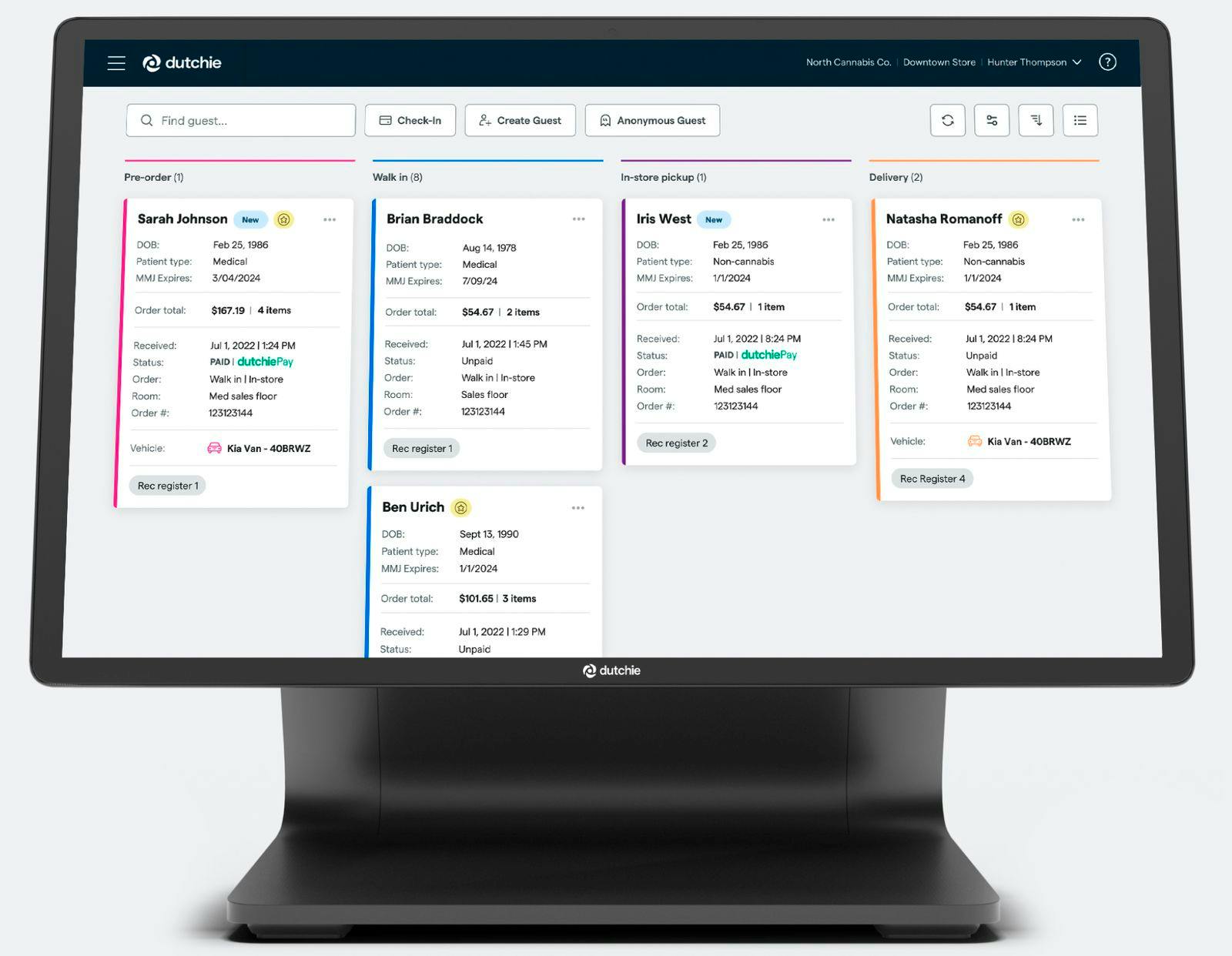

Dutchie Point of Sale

Dutchie offers a POS solution that serves both front-end and back-end needs. On the front end, Dutchie POS allows for the consolidation of all orders (online, in-person, delivery) into one centralized source of truth and creates a streamlined checkout solution for customers. On the back end, the POS provides actionable reporting and insights for business owners (e.g. most popular products, business hours, average order value, and more), product tracking, and the ability to customize internal tooling for back-of-house workflows.

The Dutchie POS system is tailored to the particular needs of the cannabis industry. It has automated compliance that adjusts to the specific requirements of different states’ laws and allows for the acceptance of cannabis-friendly payment methods. The POS system also allows dispensary owners to maintain accurate inventory.

Source: Dutchie

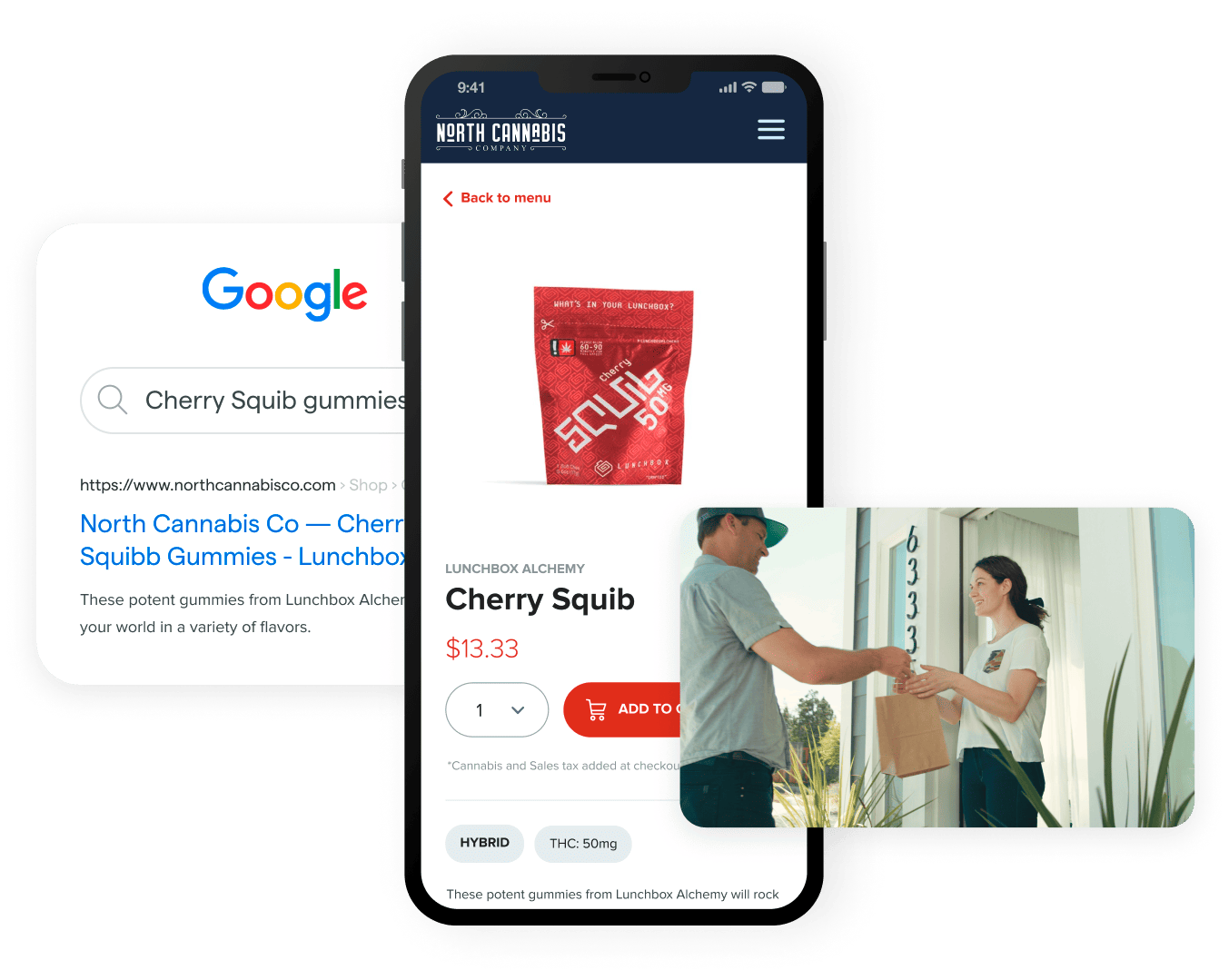

Dutchie Ecommerce

Dutchie Ecommerce is a solution that allows dispensary owners to grow their customer base and increase sales. Dutchie enables dispensaries to create online storefronts with an embedded menu that takes one line of code to implement and subdomain menus that can offer SEO benefits. It allows dispensaries to bring much of what they need to sell cannabis online in an SEO-friendly site, including order management, embedded menus, and discount offerings.

Source: Dutchie

Dutchie Insurance

As of 2020, only six insurance carriers offered plans for cannabis insurance. This meant that getting insurance as a dispensary could be difficult and costly. Dutchie launched Dutchie Insurance as a response to fragmented insurance providers unfamiliar with the intricacies of the cannabis industry. Dutchie has tailored its insurance coverage to the needs of cannabis operations and offers customers the ability to insure the entire supply chain from cultivation to retail. Dutchie Insurance also has trained insurance agents on staff to help customers with this product offering.

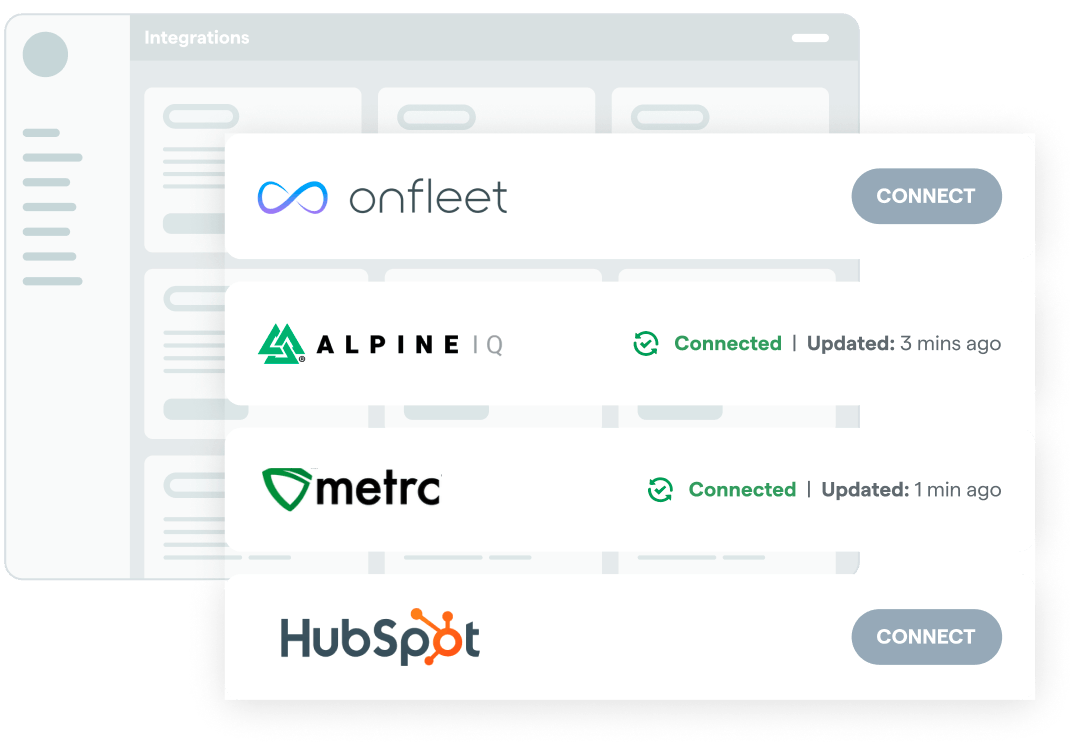

Integrations

Since businesses often use a variety of technology solutions to manage their operations, it can be inconvenient for business owners if those different technology solutions don’t work well with each other. Dutchie has integrated with over 60 technology partners to make its product more convenient to use for small businesses. Using these integrations, dispensaries are able to slot Dutchie into their existing operational workflows. Dutchie also integrates with other cannabis technology providers and standard business tools across accounting, analytics, ERPs, and more, such as Hubspot, Google Analytics, and SAP.

Source: Dutchie

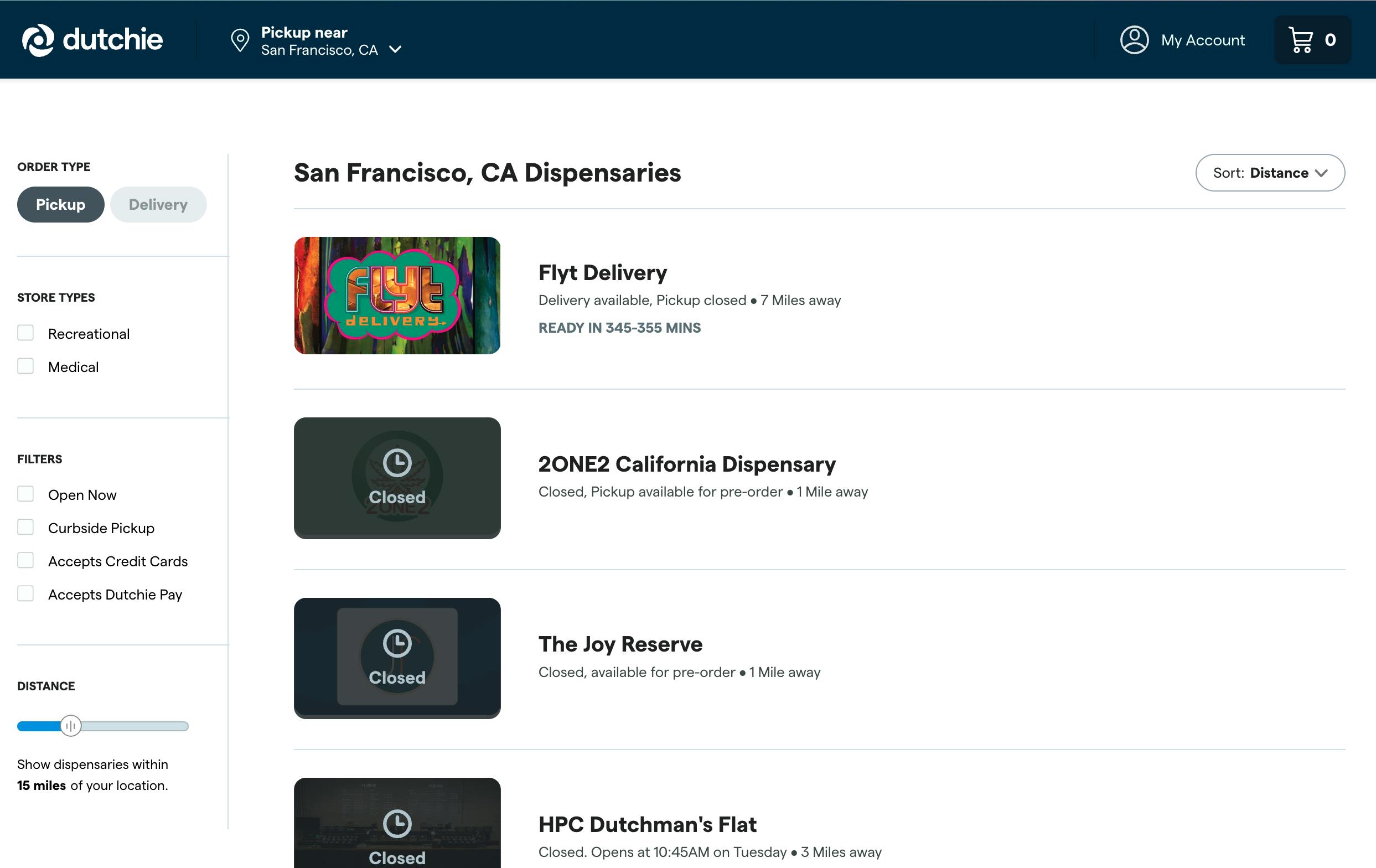

Consumer Ordering

Dutchie allows consumers to discover dispensaries and order cannabis products directly on its website. On the Dutchie website, consumers can find dispensaries, filter their searches, and order cannabis products for pickup or delivery. Dutchie Pay lets consumers connect their bank accounts and make payments.

Source: Dutchie

Market

Customer

Dutchie's primary customers are cannabis retailers. As of August 2021, there were ~8.6K state-issued cannabis retail licenses in the US. These merchants have unique compliance, software, payments, and safety needs. Many dispensaries see going digital as a way to bolster sales and growth. Dutchie offers an all-in-one solution to streamline digitization for these businesses that addresses the unique challenges dispensaries face. Dutchie also serves consumers directly with its consumer ordering feature.

Market Size

Source: Flowhub

The total cannabis market size depends on federal and state regulations. In the US, cannabis can only be sold where it is legal by state law. Thus, the cannabis market size can grow or shrink depending on regulatory developments. In the US, public opinion overwhelmingly favors cannabis legalization, with 88% of Americans in favor. While cannabis is still illegal federally, 37 states have legalized cannabis for either recreational or medical use as of February 2023.

Another key factor in determining the market size is the public sentiment around cannabis. In the US, public sentiment has grown much more accepting of marijuana use. This is evidenced by the percentage of Americans who have tried cannabis at least once, which grew from 40% to 52% in the period from 2015 to 2022. Growth in cannabis usage is especially strong in younger populations, who see it as a potentially healthier alternative to alcohol.

Competition

Given that the market is relatively new, having emerged suddenly because of major regulatory changes in the US in 2012, there are many companies vying to establish a position in the quickly evolving cannabis market. There were 205 funding rounds for cannabis companies in 2021, with each round being, on average, $20 million in size. Among these, direct competitors to Dutchie that provide dispensary software and POS solutions include the following:

Jane Technologies: Founded in 2015, Jane Technologies allows dispensaries to take their cannabis offerings online easily. In August 2021, it announced a $100 million Series C led by Honor Ventures, bringing its total funding amount to $127 million. In 2019, Jane saw $100 million in transactional volume, with 1 million people on the platform, and worked with 1K dispensaries. Compared to Jane Technologies, Dutchie is a more expansive end-to-end solution.

BLAZE: Founded in 2016, BLAZE is a POS and ERP system for cannabis businesses. In May 2021, it raised an $8 million Series A, bringing its total funding amount to $9.5 million. The company has 1.4K+ users across the US and Canada, and has a particularly strong presence in California.

Cova: Founded in 2016, Cova has built POS and retail management solutions for cannabis retailers. In December 2021, it was acquired by Waitr for an undisclosed amount. Cova primarily operates in Canada and offers alternative financial solutions such as crypto and branded gift cards. In May 2020, Cova announced a partnership with Dutchie “to offer online ordering to cannabis customers for in-store pickup or delivery.”

Weedmaps: Founded in 2008, Weedmaps is a marketplace for cannabis customers. In June 2021, Weedmaps went public via a merger with Silver Spike Acquisition Corp, a special purpose acquisition company (SPAC). Weedmaps reported $193 million in revenue for FY2021 with 96% gross margins. While Dutchie serves as more of a back office, ecommerce, and POS solution, Weedmaps is primarily focused on serving consumers directly as a marketplace.

Business Model

Dutchie charges a monthly subscription fee for its software, which ranges from $500 to $1K, per month, per dispensary.

Traction

Dutchie has over 6K dispensary partners. In its October 2021 Series D announcement, Dutchie reported that it had seen 100% year-over-year growth of dispensaries that were customers. The COVID-19 pandemic was a large tailwind for Dutchie. In the early days of the pandemic after the initial US lockdowns in March 2020, Dutchie saw its business surge 700% overnight, since lockdowns made the use of an e-commerce platform essential for all dispensaries. Dutchie has also been active on the acquisitions front, acquiring two leading cannabis point-of-sale and enterprise resource planning solutions, LeafLogix and Greenbits, in 2021. In June 2022, Dutchie laid off 8% of its 700-person workforce.

Valuation

In October 2021, Dutchie announced that it had raised a $350 million Series D at a ~$3.8 billion valuation led by D1 Capital Partners with participation from Tiger Global, Dragoneer, DFJ Growth, Thrive Capital, Gron Ventures, and Snoop Dogg’s Casa Verde Capital. In total, the company has raised $603 million.

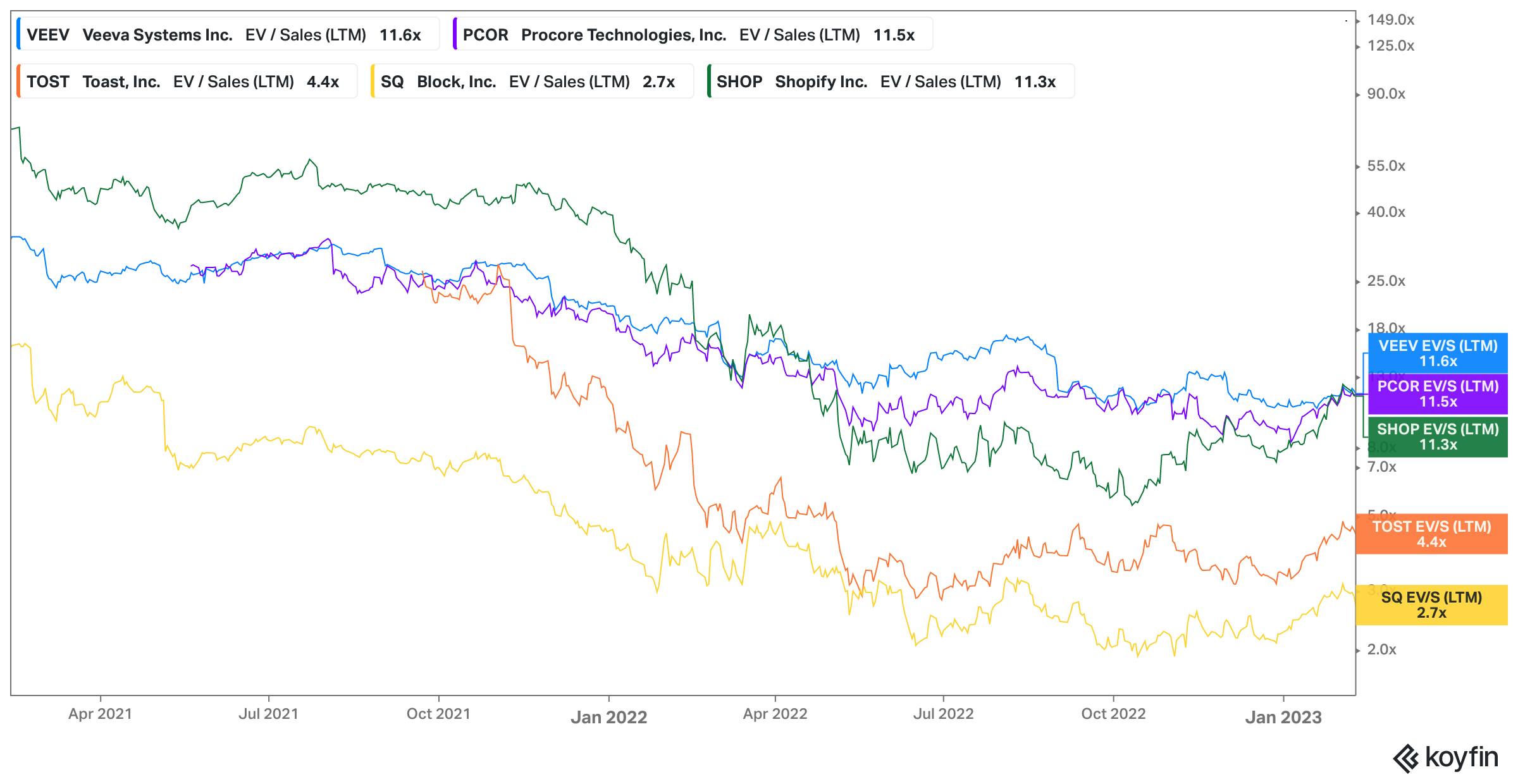

Source: Koyfin

In April 2022, it was reported that some existing Dutchie investors had explored selling their shares at a $1.7 billion implied valuation, less than half the ~$3.8 billion valuation it had achieved in October 2021. Some investors were reportedly offering to sell their shares at valuations under $1 billion.

Key Opportunities

Legalization

Given the large and growing public support for marijuana legalization in the US, Dutchie’s TAM could benefit from more regulatory tailwinds. With a strong market position as a leading player, if marijuana is legalized in more states or federally, Dutchie is well-positioned to capture share in those new markets if and when they materialize.

Platform Expansion

Dutchie’s strategy is similar to other vertical software companies: it worked to establish a strong position in its category by becoming the system of record for all transactions and customer interactions. Once it established that position, it began to layer on more products to cover more pain points and expand its offering. This approach enables Dutchie to upsell its existing user base to drive up key metrics like average revenue per user, net revenue retention, and customer lifetime value. Dutchie can continue to launch new products to enhance the core vertical software platform and bolster its economics.

Extending Through the Value Chain

Dutchie has an opportunity to extend further in the value chain and touch players like growers and cannabis wholesalers that serve the retailer directly. Dutchie could build a two-sided B2B marketplace connecting wholesalers and retailers to enable those parties to transact with each other in a more streamlined fashion and enable dispensaries to experiment with new cannabis products to grow their businesses. In this way, Dutchie could provide more value to the dispensaries it serves, bringing it closer to its goal of being a one-stop shop for all cannabis business needs, while monetizing transactions on a B2B marketplace.

Key Risks

Regulatory Risk

The rate at which cannabis legalization has occurred in the US could potentially slow as marijuana reform faces a "more challenging environment” with a shifting political situation at the state and federal level in the US. This could slow the growth of the cannabis market overall.

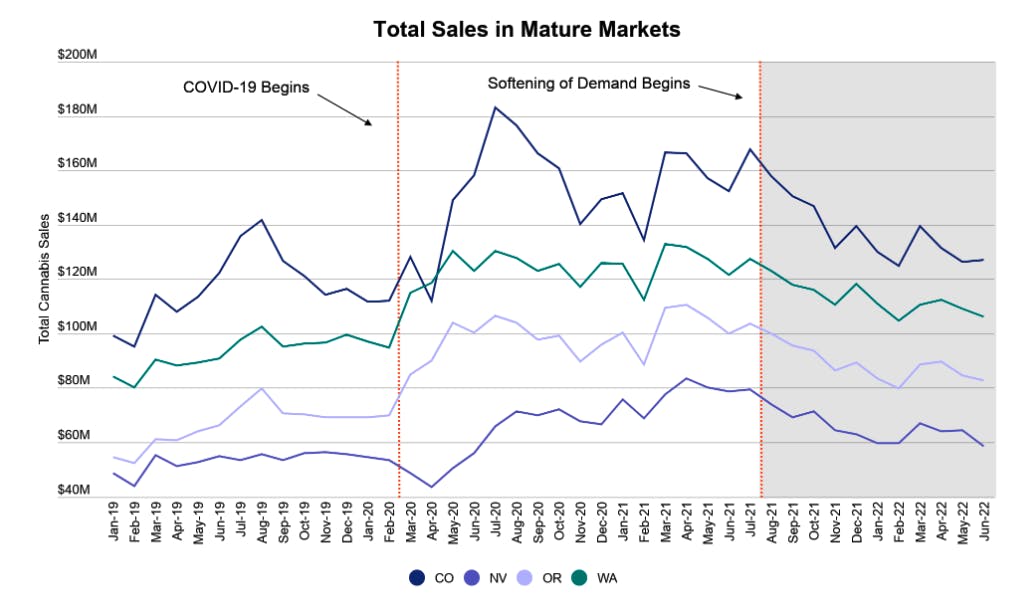

Market Size

The rapid growth that the cannabis industry saw through the COVID-19 pandemic has slowed in the post-pandemic period. Additionally, there are signs that consumers’ willingness to pay for cannabis has decreased, with 39% of participants in a survey reporting that they had purchased less expensive cannabis in 2022 than in 2021. A more challenging macroeconomic environment may also decrease spend on discretionary goods like cannabis.

Growing into its Valuation

Despite raising over $600 million in capital, Dutchie still hasn’t achieved positive cash flow. As public markets prioritize profitability over growth, Dutchie’s equity value seems to have dropped, as evidenced by the reports of Dutchie's equity sale attempts at reduced prices. Additionally, the cannabis industry as a whole is experiencing depressed valuations. Cannabis ETF MSOS, for example, was down almost 70% from 2021 to June 2022. Meanwhile, large US cannabis companies like Curaleaf, Green Thumb Industries, and Trulieve saw a 60% drop in stock price over the same period. With the company reportedly burning $20 million every month, it remains to be seen whether Dutchie can eventually become profitable, especially as a tougher macroeconomic environment could make additional rounds of funding difficult.

Internal Turmoil

There has been internal turmoil at Dutchie involving layoffs and the ousting of the founders, which has resulted in an ongoing lawsuit. These events may damage morale internally and could put Dutchie’s ability to execute its strategic priorities in jeopardy.

Summary

The legalization of recreational marijuana use in the United States and Canada has created a new, lucrative market that could be worth $100 billion by 2030. As new cannabis retailers come to the fore and seek better ways to grow and operate their businesses, Dutchie has built a solution to help dispensaries achieve those goals. Dutchie is building the “all-in-one technology platform powering the cannabis industry,” with point of sale, ecommerice, payments, and insurance solutions specially tailored for the needs of cannabis businesses. Though it has a plethora of opportunities by its positioning as the leading software for the cannabis vertical, it must contend with potential regulatory hurdles and demonstrate a path to profitability.