Thesis

Personal and professional expectations of software are evolving. The consumerization of the enterprise means that users have high standards for software, wanting enterprise tools to be as easy to use as consumer tools. B2B tools of the past were often slow, clunky, and required tedious instruction manuals and extra support. In 2023, people expect great UX from their workplace software in a world where the best user experiences are free.

Workplace software is continuously being re-invented. Communication, collaboration, and creation tools must combine consumer-level aesthetics and ease of use. Enterprise software development remains a challenge, despite the advancements in consumer software over the last decade. Many modern tools and best practices from the consumer products world have yet to be applied to the enterprise software market. To stand apart, enterprise software products must deliver a great product journey - from onboarding to adoption, retention, and growth. Companies need modern product analytics tools to gain insights into B2B users' needs and optimize the product experience. The global product analytics market is projected to grow from $5.9 billion in 2021 to $16.7 billion in 2028.

Pendo is a comprehensive product experience platform that allows companies to combine software usage analytics with in-app guidance and user feedback, enabling teams to deliver better product experiences to their customers. It allows companies to analyze where customers find the most value in their products, prioritize roadmaps, collect feedback, and onboard users.

Founding Story

Pendo was founded by Todd Olson (CEO), Eric Boduch (ex-GM Adopt), Rahul Jain (VP of Corp Dev), and Erik Troan (CTO) in 2013.

Boduch was previously the CEO of Smash Technologies, a mobile platform that allowed companies and advertisers to capitalize on a user’s interest and extend that interest into a transactional experience. Jain had spent 3 years in venture capital before working as a product lead in the Emerging Technologies Group at Cisco Systems. Torn was the first engineer at Red Hat and had built and led engineering teams through the IPO. Boduch parted ways with Pendo in 2022 to launch a venture studio.

At 14, Olson began programming and landed a job at MBNA Bank in Delaware, where he built software and managed databases. By graduation from Carnegie Mellon, he had created a data integration product and co-founded Cerebellum, for which he had secured seed capital. Cerebellum raised $17 million but eventually ran out of funding and shut down. Olson then became VP of Product at TogetherSoft and started another startup, 6th Sense Software, which he sold to Rally Software. After leading Product development at Rally, he teamed up with his co-founders to start his third startup, Pendo, taken from the Latin word for "value" (literally meaning "I pay out").

Product

Pendo was originally founded with a focus on offering product managers more effective tools for making decisions that drive product success. However, the product has expanded to address use cases across UI/UX, sales, customer success, and marketing teams in addition to product or engineering teams. Pendo splits its product suite into two different categories: Pendo Engage, which targets customers, and Pendo Adopt, which is for a web-based portfolio of employee-facing applications.

Source: Pendo

Analytics

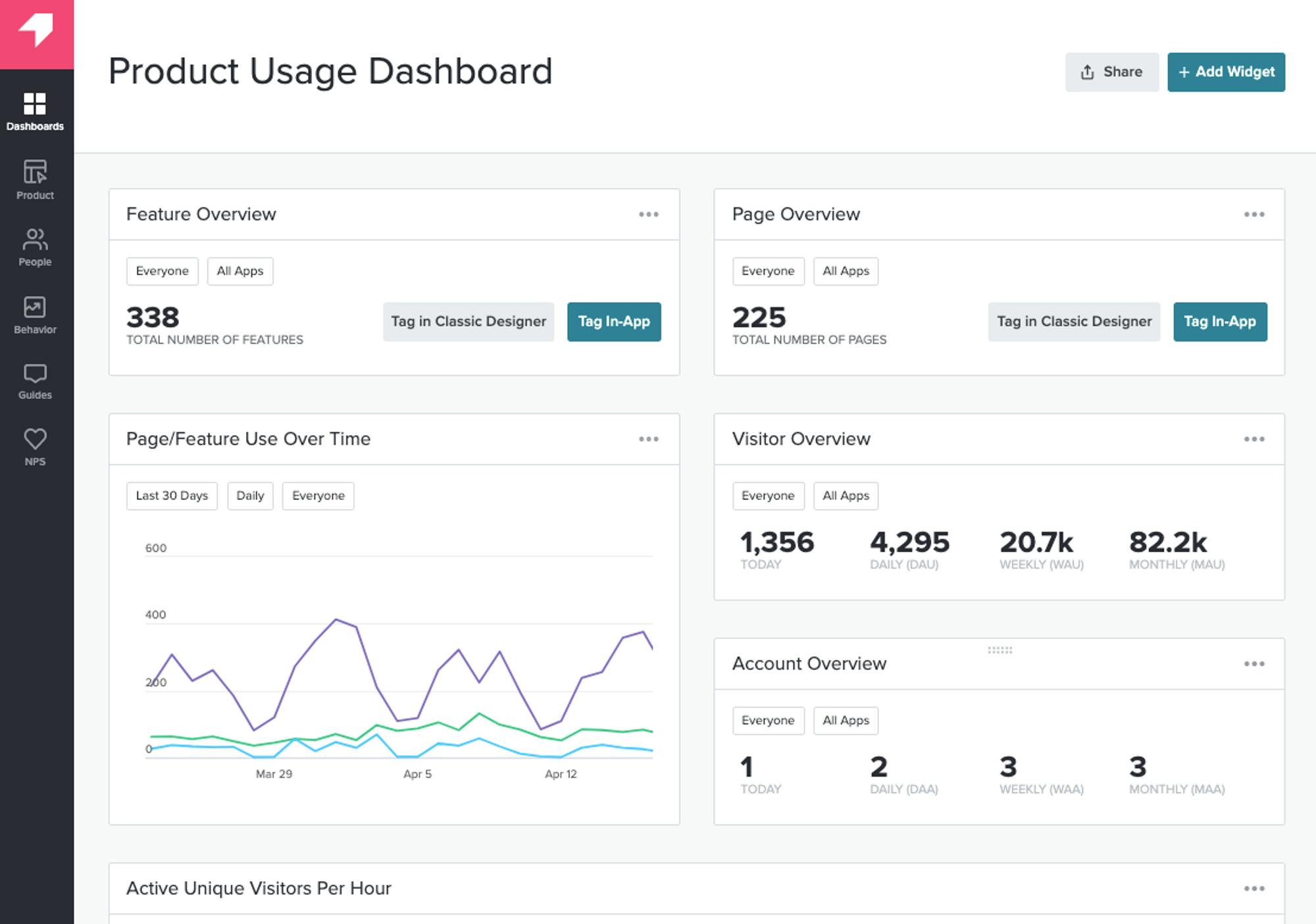

Pendo Engage’s analytics allows customers to understand the user journey and evaluate product usage by tracking feature adoption data and uncovering key trends. Customers can see which features are being used, where users get stuck in their workflow, and can pull insights from third-party integrations. Customers need to install a snippet of code, a short JavaScript function that retrieves and loads the Pendo agent code to get started. Pendo Analytics helps customers analyze how often first-time users return to particular features and offers a Product Engagement Score, a single quantitative metric that measures overall product engagement by combining existing adoption, stickiness, and growth metrics.

Source: Pendo

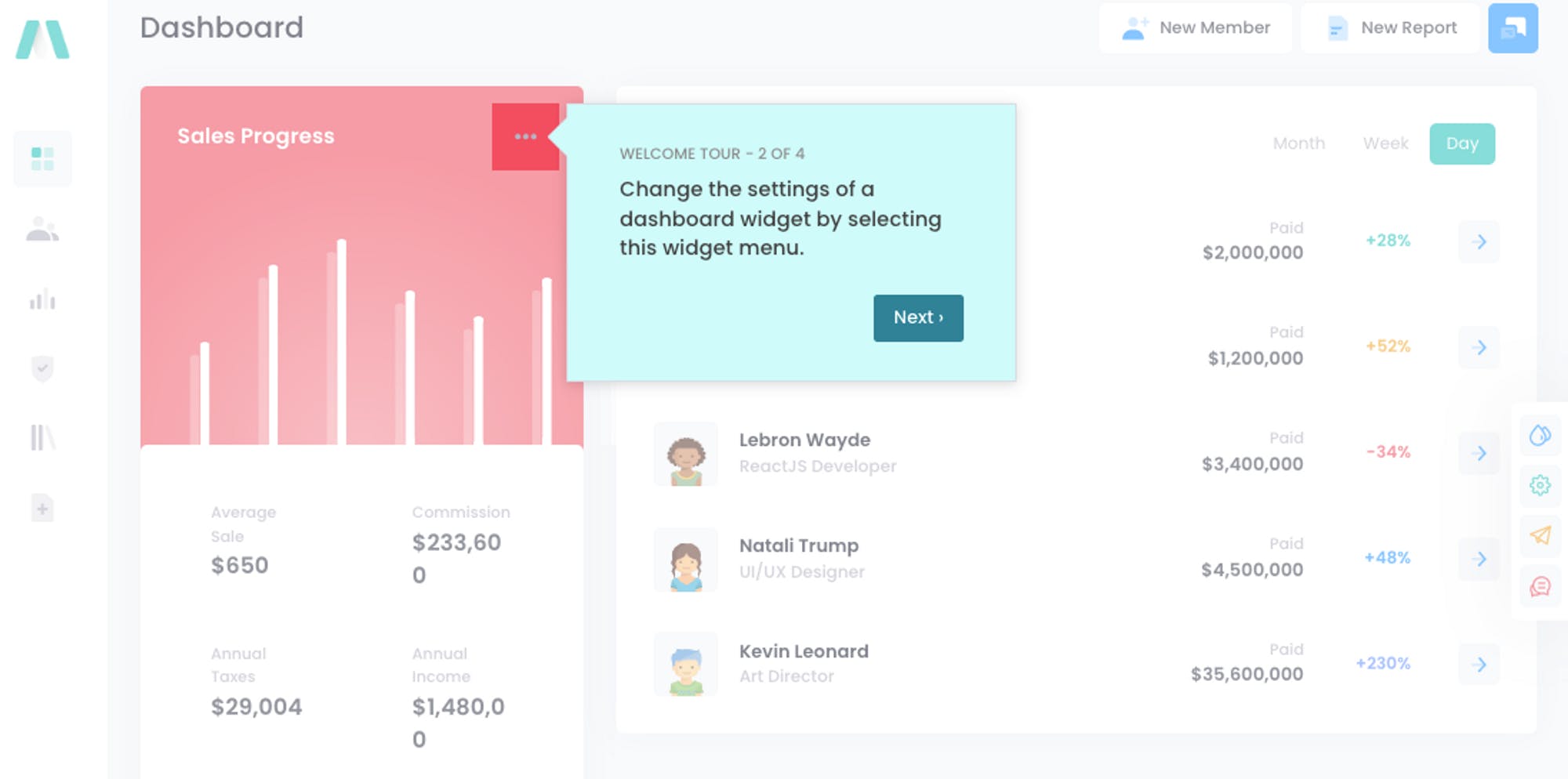

In-App Guides

Customers can personalize in-app communication to improve the product experience and adoption. In-app communication are intended to increase software adoption, especially by guiding users to new features. These guides can be deployed without any added engineering effort. Guides can target specific segments of users at any specific time contextually, rolled across multiple web or mobile apps, and designed with a simple visualizer.

In-app guides can also help employees with contextual guidance across apps. It can serve as a self-service resource so employees can know what to do without seeking help from others. The data and results from in-app guides can be measured and leveraged to determine how effectively employees can build skills and use a particular system.

Source: Pendo

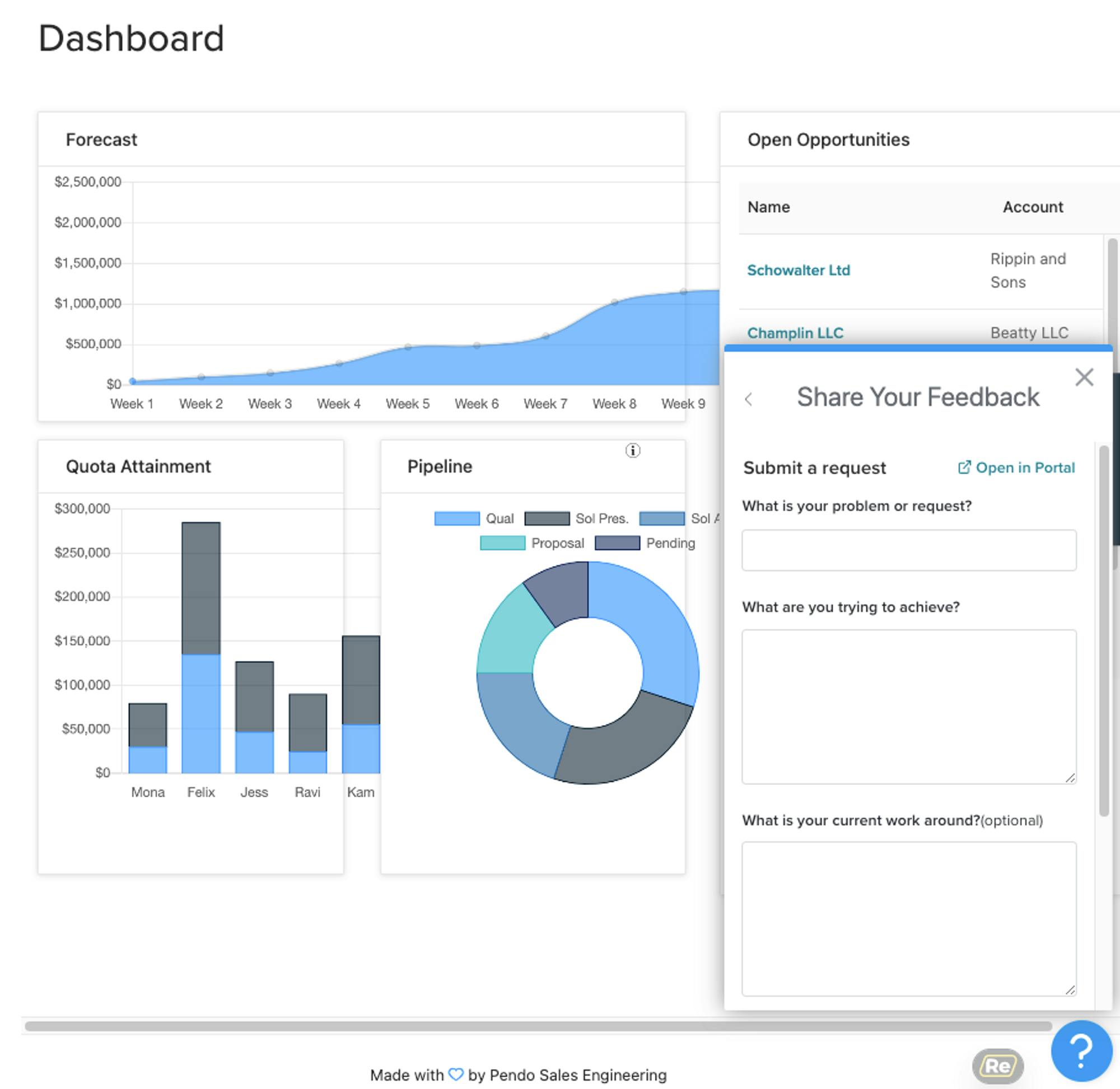

Feedback

This Pendo feature allows companies to request feedback at scale. Feedback can be collected and analyzed based on segment, spending, and tags. Users can be automatically updated as requests are reviewed by the appropriate product teams. Integrating Jira, Salesforce, or other third party tools can create more comprehensive feedback stacks. Pendo Feedback can be external-facing to users, or business teams can use it to submit requests on behalf of users. This integrates Analytics and In-App Guides, so all three products can work together.

Source: Pendo

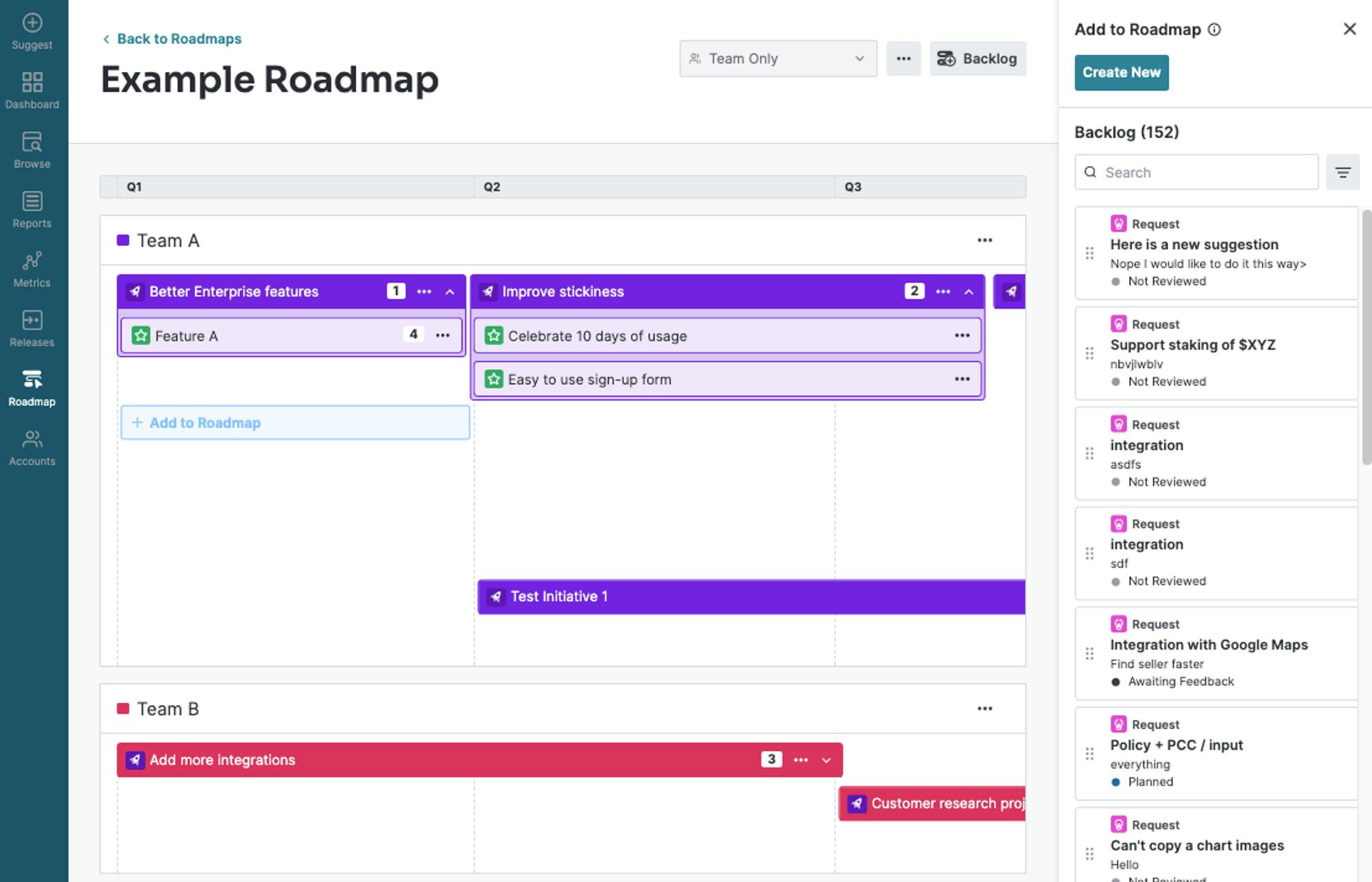

Roadmaps

This feature allows companies to communicate priorities, align stakeholders, and bring Pendo-collected data into their product roadmaps. Every feature and initiative on the roadmap can be validated and visualized in terms of impact with the analytics collected through Pendo. When initiatives and features are created, they can be linked to specific user feedback requests, total votes, and dollar values.

Source: Pendo

Mobile

Pendo supports a code-less solution for various mobile frameworks and provides mobile-specific insights, such as app version and operating system, to provide actionable data on improving apps. In-app guides and communication can be deployed without needing to release a new app version or any engineering effort. Customers can evaluate product usage to determine the most used features.

SaaS Portfolio Insights

This offering ensures customers have the right tech stack for their team while encouraging app or service adoption and driving ROI. Customers can analyze their entire software portfolio to determine whether tools are or aren’t being used, and license utilization can be reviewed to identify underused areas or opportunities to consolidate. These analytics can spot usage trends, and customers can track specific usage goals.

Integrations

Pendo supports integrations with dozens of apps and services, such as Salesforce, Zapier, Jira, Snowflake, Figma, Tableau, and many more.

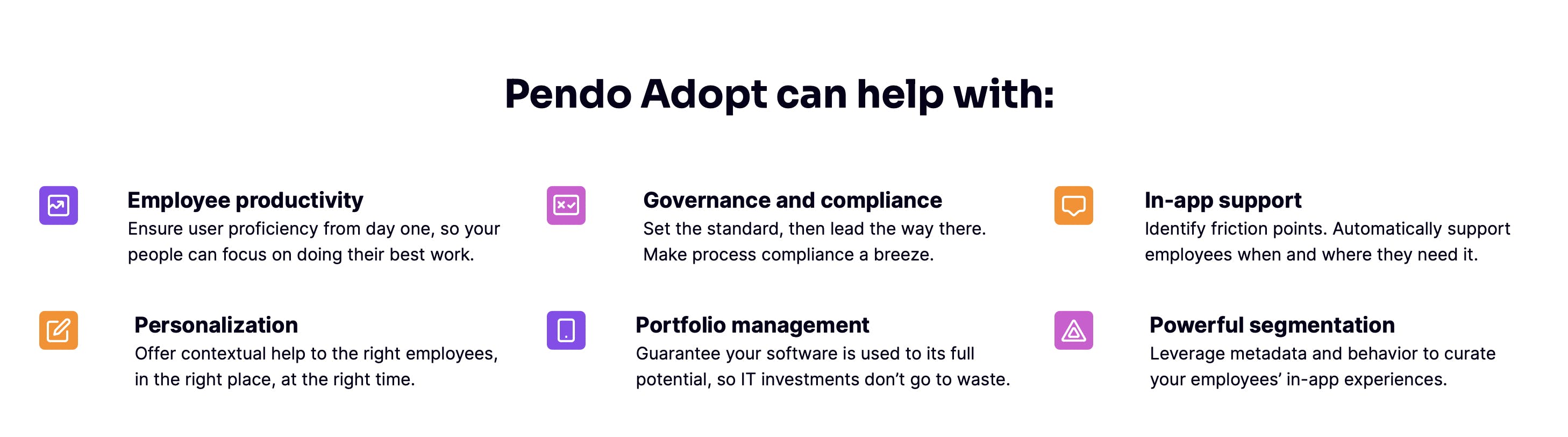

Pendo Adopt

Pendo Adopt helps companies better understand how employees are using workplace software and take action to increase employee productivity. It was launched in February 2022.

Source: Pendo

Additional Services

Pendo also offers other services to support customer teams in driving product adoption, such as a Pendo Essentials Training Certification, technical online or premium support, and a team of engagement managers, solutions engineers, and technical onboarding specialists.

Market

Customer

Pendo's ideal customer profile includes companies that build and sell software products or digital experiences. Pendo's platform is designed to help companies with product-led growth strategies. It is used across various use cases, including user onboarding, in-app support, product planning, and revenue growth. It is used by companies like Morgan Stanley, Okta, Cisco, Global Payments, Invision, and Marketo.

Market Size

The global product analytics market is projected to grow from $5.9 billion in 2021 to $16.7 billion in 2028. The product analytics market growth parallels the growth in the digital product space, as they both feed directly into the success of the other — it has been stated that product analytics is the number one measurement of digital success. The pandemic has contributed heavily to the growth of SaaS businesses. Any opportunity to make data-driven decisions to stand apart is a driving force contributing to the growth of the product analytics market.

Competition

Mixpanel: Founded in 2009, Mixpanel is a product analytics company. Mixpanel also supports features like user analytics, dashboards, user tracking, and user segmentation while having a flatter learning curve. However, Mixpanel is missing a number of features that Pendo offers, such as interactive walkthroughs, tooltips, onboarding checklists, announcement modals, NPS surveys, in-product feedback surveys, and in-app resource centers. Mixpanel’s main focus is data analytics for products, but it misses out on the additional features Pendo offers for additional user interaction and insights, especially predictive analytics. Since Mixpanel has a lower price point, less capability, and more ease of use, it’s best for companies in the early stages of growth. It has raised $277 million in funding.

Amplitude: Founded in 2012, Amplitude is a product intelligence platform that provides digital product tools that help teams run and grow their businesses. It went public in 2021. Amplitude, like Pendo, also allows teams to track user journeys and explore various report types, all while intelligently analyzing behaviors. Amplitude tracks across mobile, desktop, and web and has more support for mobile, which is helpful for companies with a heavier mobile focus. Amplitude does offer marketing analytics, which Pendo does not. Pendo differentiates from its closest competitor, Amplitude, by supporting qualitative data collection, sentiment analysis, automatic data collection, and more robust guide formats.

Google Analytics: Google Analytics is a web analytics service offered by Google that tracks and reports website traffic, currently as an offering inside the Google Marketing Platform. Pendo focuses more on feature and customer usage and metrics, whereas Google Analytics focuses on website traffic and user acquisition. Google Analytics is designed around analyzing public-facing marketing and transactional websites, while Pendo combines behavioral analytics with user feedback and personalized in-app messaging to analyze user behavior. As a result, both solutions often coexist in a single business. However, Google Analytics 4 includes predictive insights with AI learning, which Pendo is not currently offering.

Heap: Founded in 2013, Heap provides automated data aggregation that lets users gather real-time information on every action that users take, enabling the automatic collection of a large amount of valuable information without having to set this up manually. Pendo also offers a data auto-capture feature but does not have the same depth of insights into the data or support for A/B testing. However, Heap’s data analytics is harder to use than other tools because the insights are not always user-friendly or easy to parse, take up quite a bit of storage, and have fewer integrations. Heap may be better for experienced teams looking to pull reports from large amounts of data. It has raised $218 million in funding.

Userpilot: Founded in 2018, Userpilot is a product analysis system focusing on user experience and onboarding optimization. It offers growth insights, product analytics, and in-product experiences for onboarding, feature adoption, and retention. Userpilot also supports feedback surveys and in-app messaging. However, while this messaging system is similar to Pendo’s, Userpilot falls short on analytics tools. It has raised $6 million in funding.

Pendo’s core competition is within its primary product analytics suite. However, by expanding into more broadly understanding a company’s internal SaaS usage, this also expands Pendo’s competitive landscape to include companies like Vendr, and Zylo.

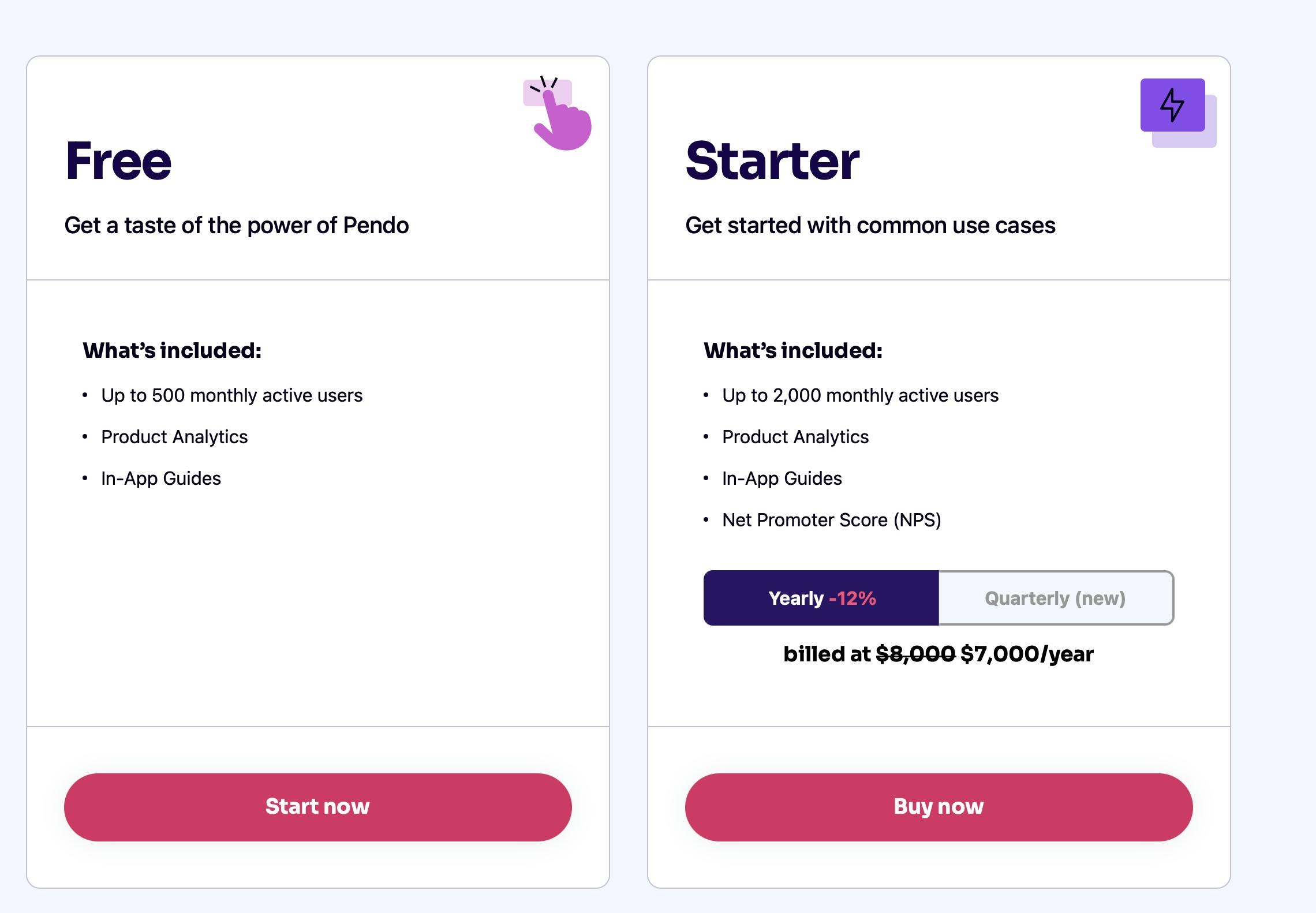

Business Model

Pendo operates on a freemium model, and pricing varies between its Pendo Engage and Pendo Adopt offerings. The Pendo Engage Free plan includes product analytics and in-app guides for up to 500 monthly users. The Pendo Engage Starter plan includes product analytics, in-app guides, and net promoter score support for up to 2K monthly users, billed at $7K annually.

Source: Pendo

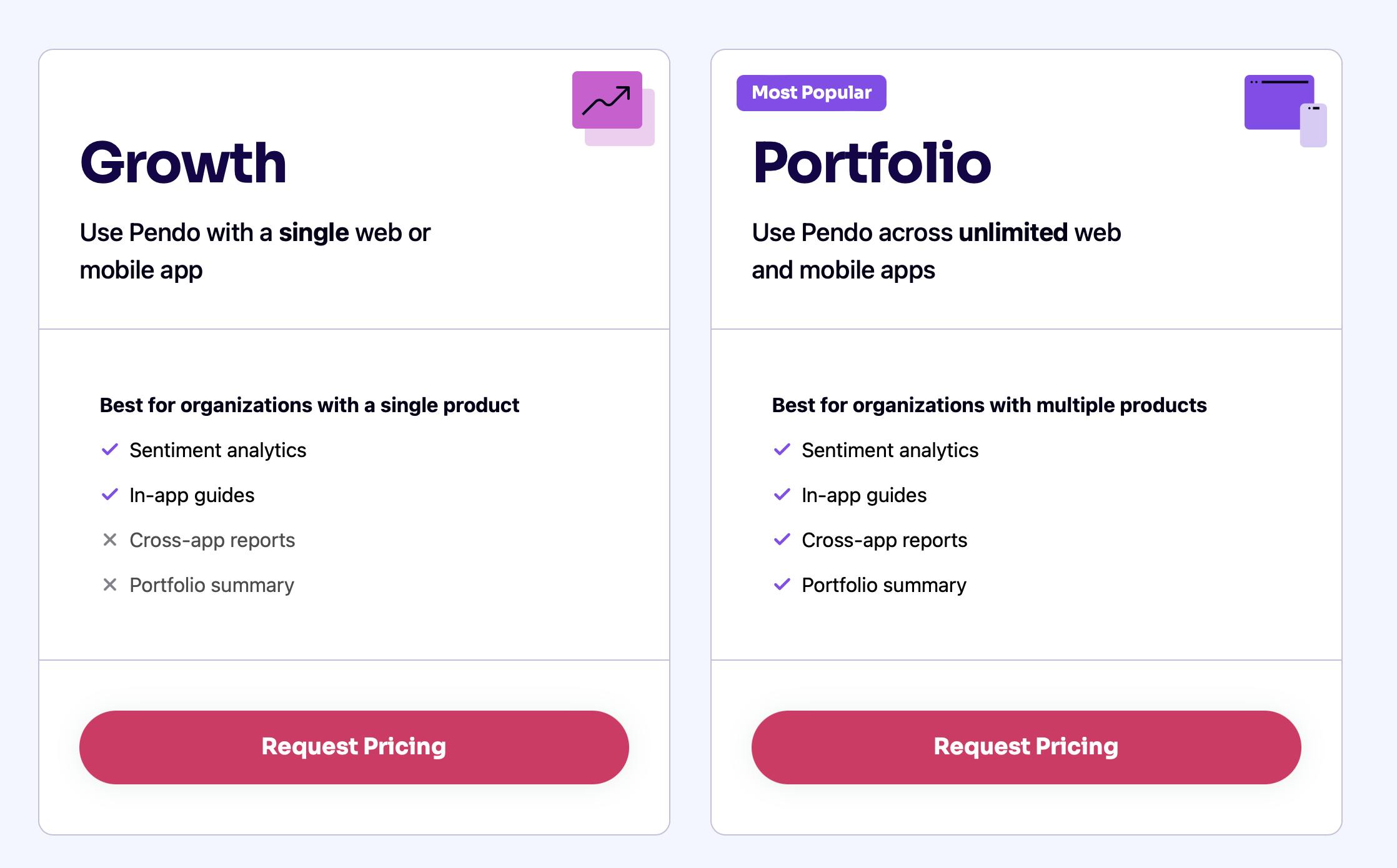

The next two pricing plans are focused on companies that want to scale. Pricing for these two plans is available by request.

Source: Pendo

The Pendo Adopt product suite has pricing available by request but includes digital adoption solutions to drive adoption across software that customers’ employees rely on within their business.

Traction

In July 2021, Pendo announced that it had surpassed $100 million ARR, and as of April 2022 the company was seeing ARR growth of 60% year-over-year. In 2022, Pendo experienced 40% growth in customers that paid over $100K annually, doubled its number of contracts valued at $1 million or more, added 500 new customers — 17 of which were Fortune 500 companies, and boosted its Pendo Free subscribers by 118%.

More than 8.7K companies use Pendo to improve software experiences for 700 million people monthly. Pendo opened a new EMEA headquarters in London and expanded its Asia-Pacific presence to Australia and New Zealand in 2022. Over 1K product leaders attended Pendo's 6th annual Pendomonium event in Raleigh in 2022.

Valuation

Pendo announced a $150 million Series F round led by B Capital in 2021, bringing its valuation to $2.6 billion, and nearly doubling since the company’s $100 million Series E round in 2019 at a valuation of $1 billion. Pendo’s Series F was raised at the same time the company announced it was at ~$100 million ARR, meaning the valuation represents a 26x ARR multiple.

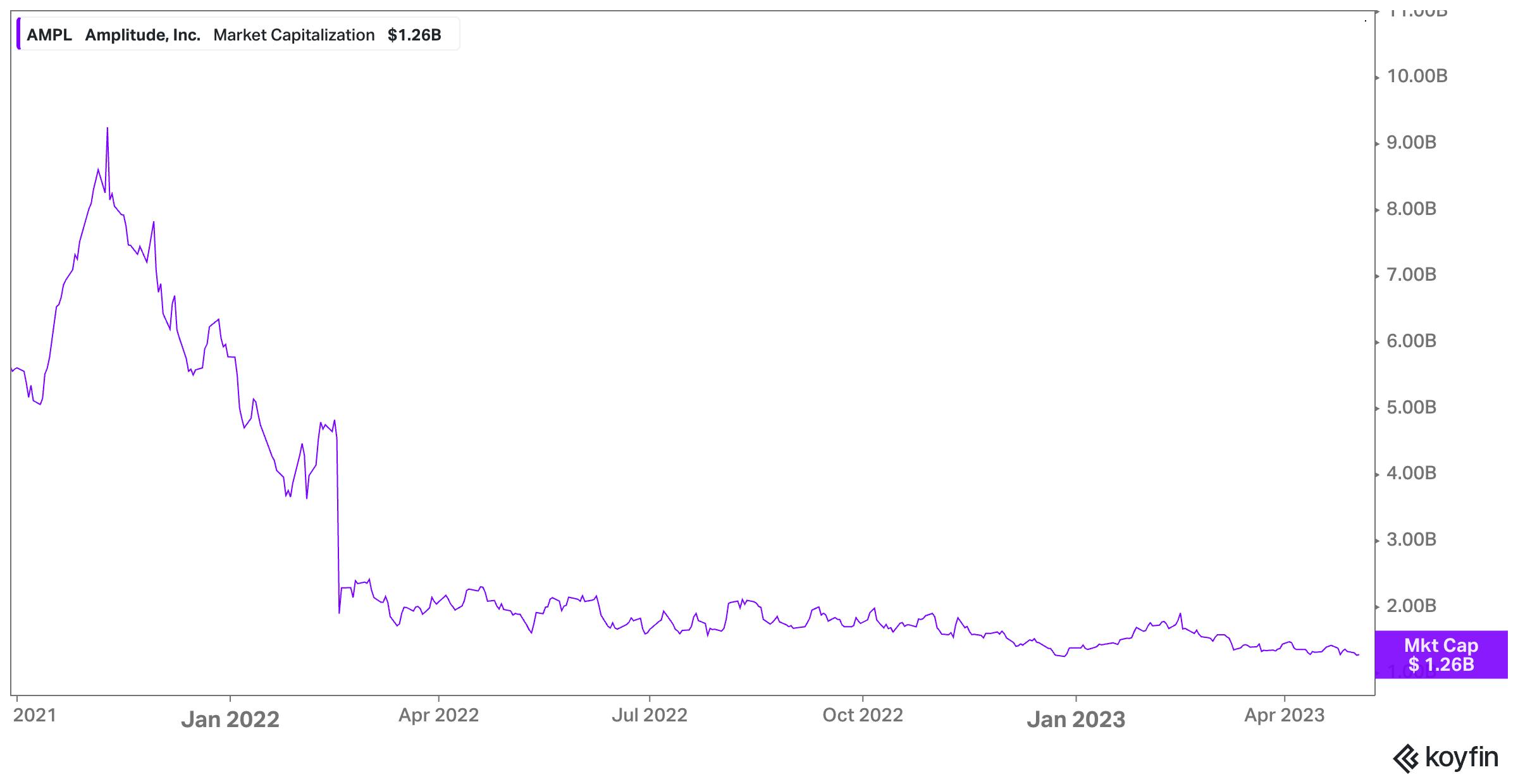

Pendo’s closest competitor, Amplitude, went public in 2021 at a market cap of $5 billion. After peaking in November 2021 at $9.2 billion, as of May 2023 Amplitude’s market cap was $1.3 billion. Prior to IPO, Amplitude raised a Series F at a $4 billion valuation. At a $1.3 billion market cap, that represents a 4.1x LTM revenue multiple.

Source: Koyfin

Key Opportunities

Community

Pendo has invested heavily in the idea of a product community, which sets it apart from other competitors. In February 2022, the company acquired Mind the Product, a community of product managers and an organization that focuses on bringing product people together. Mind the Product has the largest Slack community of product managers. This mimics similar acquisitions of software companies ingesting communities, such as Stripe acquiring Indie Hackers or Zapier acquiring Makerpad. Through this acquisition, Pendo has created a channel to reach product teams across industries, allowing them to market to a niche group of people while differentiating themselves from other product-focused companies. Other investments in the concept of the community include Pendomonium conferences, which each attract hundreds to thousands of product leaders, and Pendo’s Product Certification courses, which also attracts thousands of product people.

Pendo Adopt

Pendo Adopt, launched in 2022, is a new suite of offerings that helps companies better understand how employees are using workplace software and take actions to increase employee productivity. It presents an opportunity to upsell its customers as the company enters a new market. By 2025, 70% of organizations are expected to adopt digital solutions throughout their technology stack to improve their application user experiences. Moreover, 89% of IT and business leaders report increasing the adoption of employee-facing software is a priority.

Predictive Analytics

Pendo currently does not market itself as having a robust predictive analytics offering. Google Analytics supports predictive metrics and automatically enriches data through machine learning to predict users' future behavior. By enhancing its analytical capability to support predictive metrics, Pendo could further differentiate itself and enhance its current product.

Key Risks

Competition

One risk that Pendo faces is a lack of customer loyalty due to competitive over-saturation. Currently, competitors offer smaller product suites with deeper functionality, but if they were to ramp up to support additional features with the same level of depth, Pendo might lack enough differentiation in the market. Additionally, Pendo’s cost depends on its customers’ numbers of users and features, which means that cost increases with scaling. If customers decide that Pendo’s all-in-one pricing model does not work well for their business, they may downgrade to a service that offers the specific features they need for a lower cost.

Summary

Product intelligence, analytics, and feedback play incredibly important roles in user experience, which determine the success of many software products today, especially in an oversaturated market where marginal differences could lead to an inability to compete. Pendo offers a low-code, one-stop shop for customers looking to access a robust suite of solutions, ranging from product insights on behavioral data to feedback collection directly from users. It has expanded and differentiated its product suite with employee analytics and in-app guidance features while providing deeper functionality in various product intelligence areas. Pendo has complemented its existing product offering with a strong presence in the general product community, which gives them a foot in the door when taking up market share. Pendo must continue to match the competition's capabilities to hold onto its current position.