Thesis

In 2018, about 182 million people in the U.S. owned at least one credit card. Despite this, not all businesses and vendors accept all or any of the major credit cards, since credit card merchant fees can range from 2.87% to 4.35% which can make them unaffordable for some businesses and transaction types. For consumers, this leads to unnecessary hassle; for small businesses who can’t afford merchant fees, it can limit the potential customer base.

Plastiq is an intermediary payments platform that transforms a credit card payment into an invoice payment so that people can use credit cards anywhere, anytime. More specifically, Plastiq charges a flat 2.85% fee before the transaction for the customer to convert a credit card payment to an ACH, check, or wire transaction. Plastiq allows customers to use any card in places where they normally wouldn’t be accepted, while still retaining access to the convenience, rewards, and cash flow offered by their existing credit card.

Founding Story

Plastiq founder Eliot Buchanan was an undergraduate student at Harvard University when his father tried to pay part of Buchanan’s tuition with a credit card. It wouldn’t work since many institutions such as universities only accept payment via banks (i.e. invoices) because large transactions and big ticket purchases make credit card fees prohibitively expensive. This gave Buchanan the idea for Plastiq:

"I thought, why is this the case—is it just me that wanted to do this? Credit cards have been around 60 years, around 10% of the world's GDP runs through them. It's a pretty successful instrument, and yet I can't pay for something as important and simple as my tuition."

After Buchanan realized this, he was determined that he “had to find a way to solve it”. He set out to start a company to do just that. He kept a spreadsheet of interesting people he needed to meet to fill the gaps in his skillset in college, and recruited fellow student Daniel Choi to co-found the company with him after graduating

They launched the company in 2012, living together in the same apartment for nearly six years as they built the company. Since Plastiq was based in Boston, it was difficult for the company to secure its first round of funding; the earliest investor was Ryan Moore of Accomplice, an early-stage Boston-based fund. However, the Plastiq founders eventually decided to move to the Bay Area for better access to funding and talent.

Product

Plastiq utilizes an embedded finance model to create an all-in-one bill-pay solution that offers access to working capital through short-term financing. The technology allows people or businesses to pay a vendor’s bill using the credit card of their choice while making sure the vendor is paid via wire transfer/ACH.

Plastiq Pay

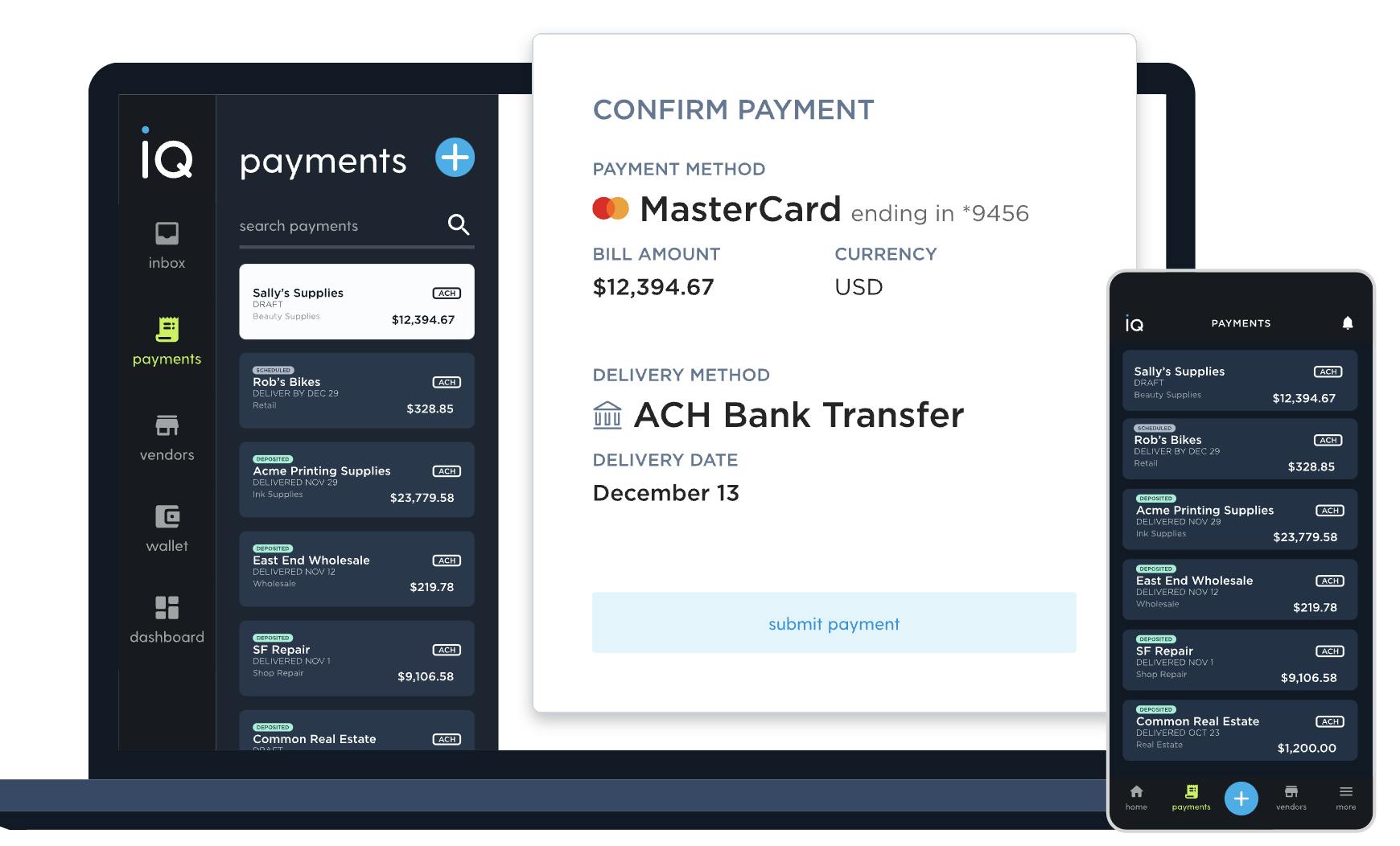

Source: Plastiq

Plastiq Pay lets customers pay for products or services with their credit cards, even when cards are not accepted. Plastiq Pay charges a 2.85% fee up front in order to convert a credit card payment to check/ACH/wire so that businesses/individuals could pay vendors from 45+ countries. Plastiq Pay optimizes cash flow by allowing businesses and individuals to pay products or services without needing the cash on hand. In addition, instead of having to manage multiple accounts, they simply pay Plastiq, which makes the original payment on their behalf.

Plastiq Accept

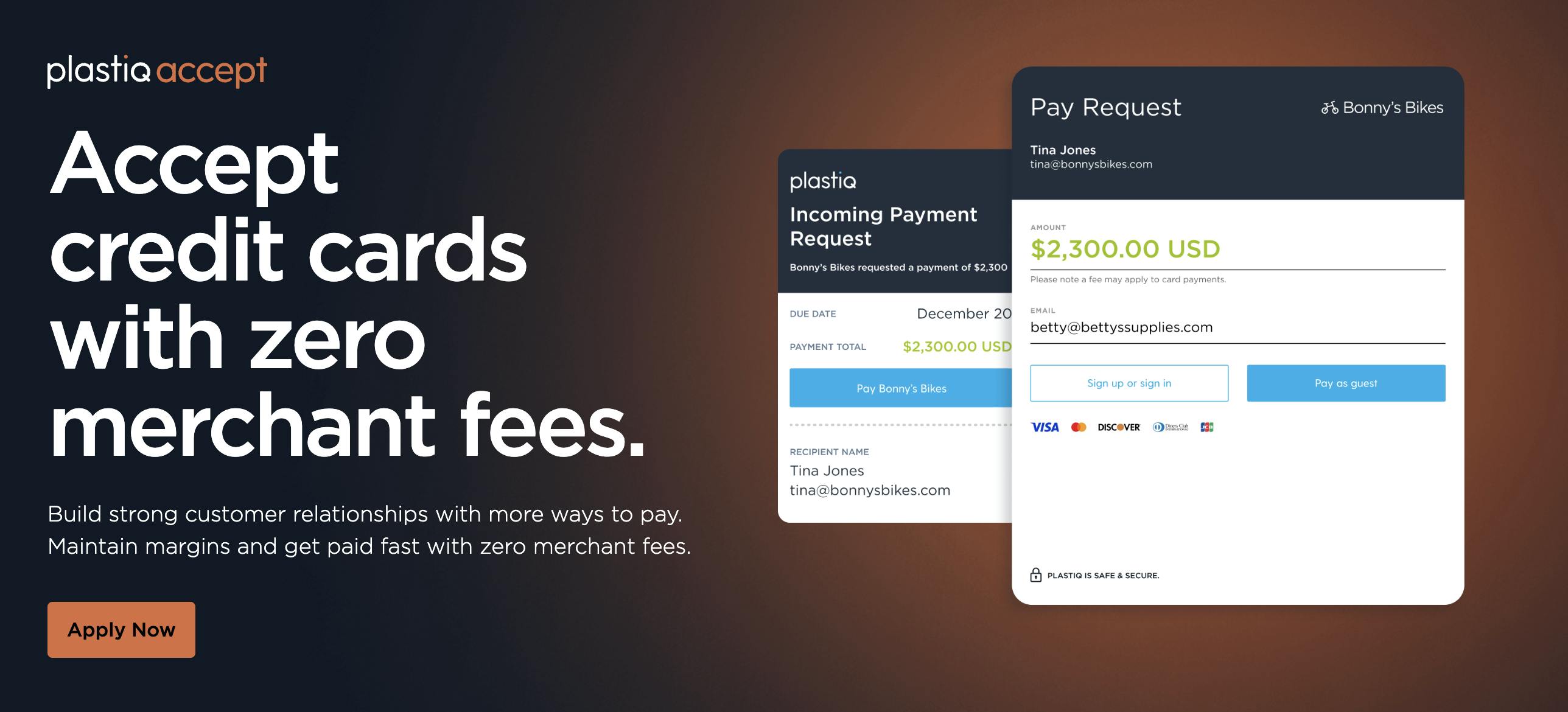

Source: Plastiq

Plastiq Accept allows businesses to get paid via credit cards and avoid merchant fees by providing a branded landing page and a link that they can use to receive payments. No integration or fee is required. Functions offered by Plastiq Accept include customized payment links, payment requests, QR codes, and check-out SDKs.

Plastiq Connect

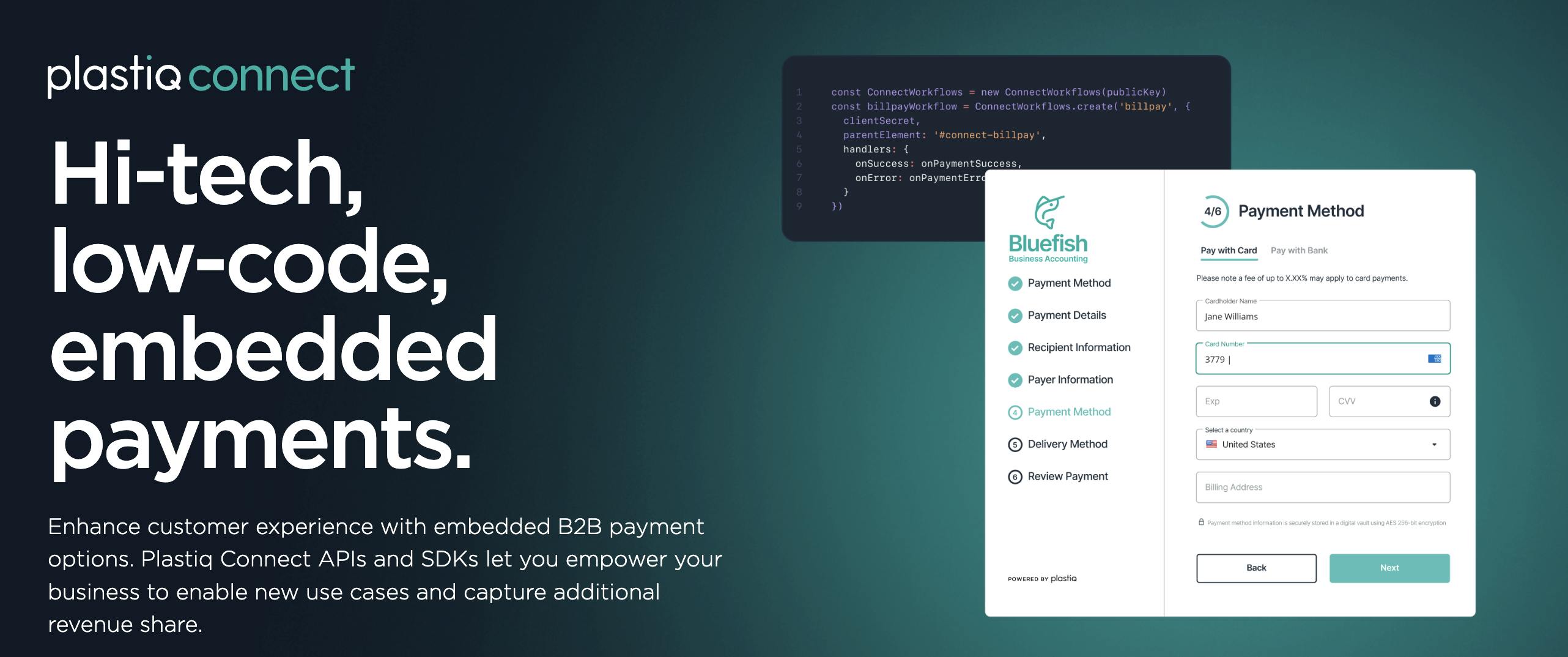

Source: Plastiq

Market

Customer

Plastiq targets two types of clients.

First, from an accounts receivable perspective, Plastiq benefits businesses that are high growth or very profitable, but have high up-front costs and don’t get paid right away. These businesses are looking to reinvest their money but may not have the necessary cash for it. Plastiq allows them to pay their vendors upfront using credit and scale more quickly.

Second, from an accounts payable perspective, Plastiq benefits businesses that have a hard time getting paid, and are spending too much time and effort chasing invoices. By organizing everything into one place and having a centralized hub for invoices, the businesses will understand who they need to talk to.

Market Size

The global B2B payments market was valued by Mastercard at $125 trillion, with 98% of payments flowing through ACH, check, and cash and only 2% on credit cards, implying significant room for growth if credit card transactions grows to encapsulate a larger share of B2B payments over time.

Competition

Between 2016 and early 2021, among fintech verticals, capital markets received the most venture funding at ~$8 billion, with payments receiving the next most funding at ~$6 billion. As a payments company, Plastiq has a number of different competitors.

B2B Fintech Startups

Melio is a direct competitor to Plastiq with similar products. Both companies offer payment tools for small businesses through payable and receivable dashboards, allowing them to pay with credit cards. In July 2022, Melio entered into a partnership with Capital One. One advantage of Melio over Plastiq is that it doesn’t have monthly subscription fees.

Other startups with similar products include Fidelity Payment Services and WePay. In addition, more niche payment companies like RadPad andPlacePay specialize in rent payment with 2.99% rates.

Established Fintech Companies

One example of this is Square, which is popular among small businesses as well. Square offers product features including inventory management and all-in-one reporting. With a similar business model to Plastiq, it would be easy for Square to expand upon its preexisting payment process functionalities.

Business Model

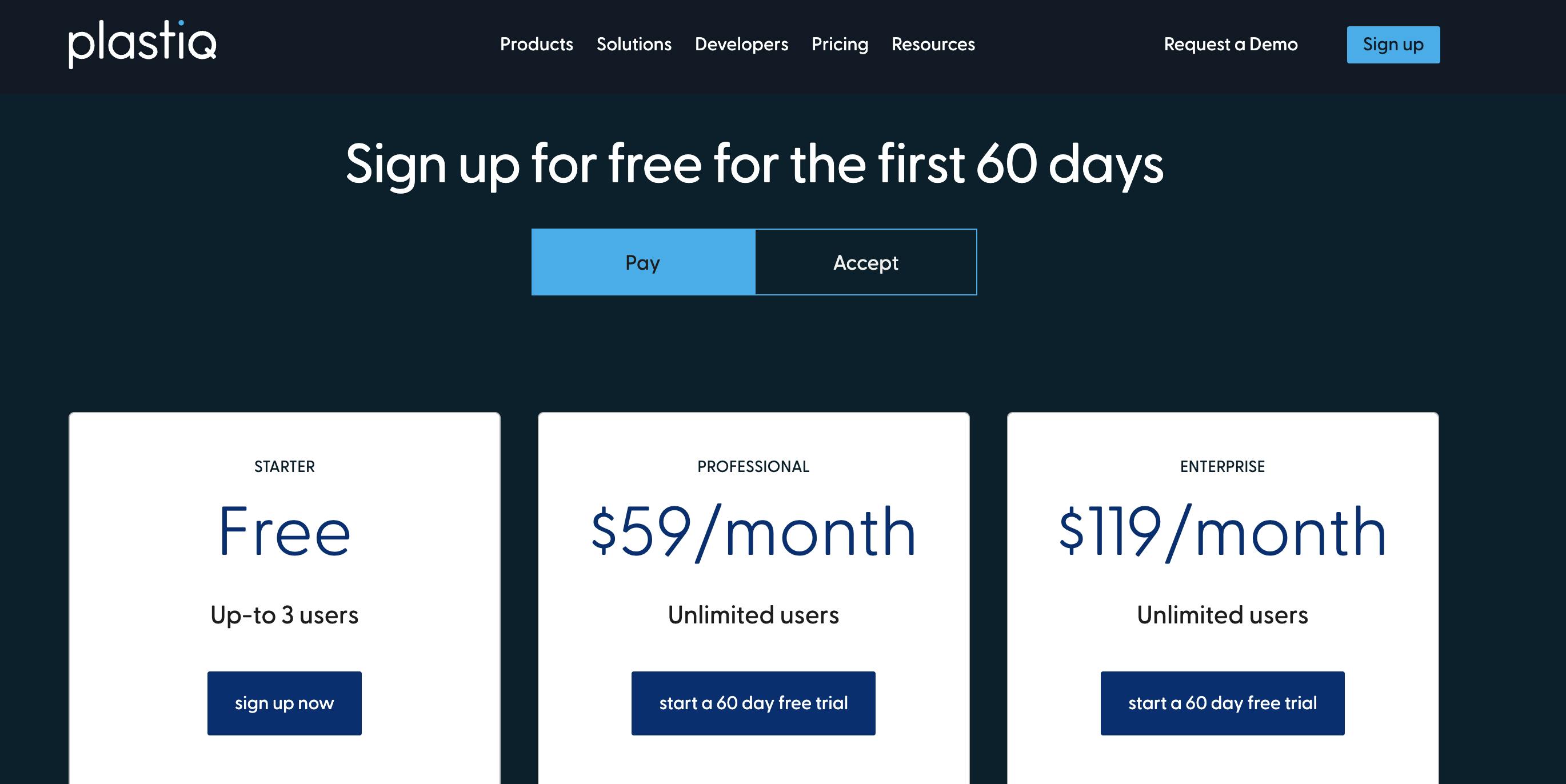

Source: Plastiq

Plastiq operates on a SaaS model, currently offering 3 plans for both Plastiq Pay and Plastiq Accept:

A free plan for up to 3 users with basic functionalities

A professional plan for $59/month, allowing unlimited users with features such as payment workflow, Quickbook online sync, and invoice data capture

An enterprise plan for $119/month with premium features such as Account Management Support, and Oracle Integration

Plastiq also charges a 2.85% fee per card transaction and $5 / $39 (domestic / international) for wire transfers.

Traction

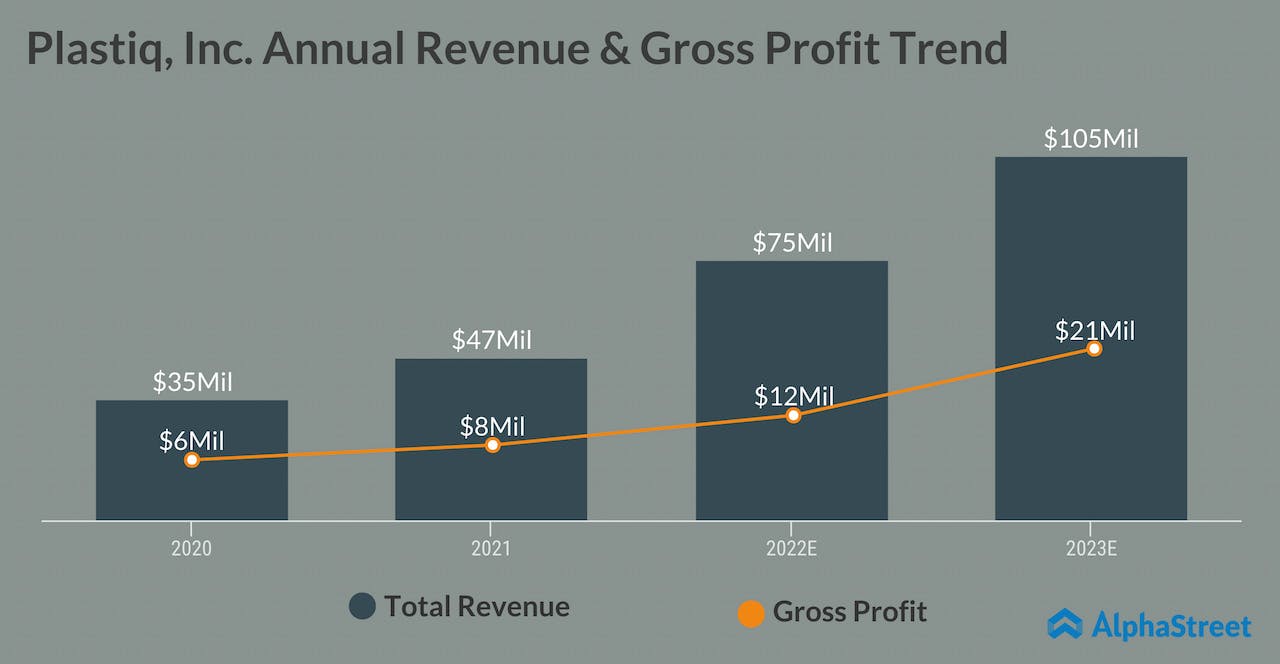

Source: AlphaStreet

Plastiq’s total revenue and gross profit have both increased from $35 million ARR and $6 million profit in 2020 to $75 million ARR and $12 million in profit as of 2022. In August 2022 there were 195K payers using Plastiq, and more than 200K suppliers across 50 countries and more than 20 currencies, with card volume growth of more than 66% year over year. Plastiq has also partnered with business credit cards like Ramp and Brex to offer customers expanded credit lines.

Valuation

Plastiq has raised a total of $141.8 million in funding over 10 rounds. Their latest funding was a SPAC merger with Colonnade Acquisition Corp. announced in August 2022 which valued the company at $480 million and raised $320 million in capital.

Key Opportunities

Collaboration with Other Payment Applications

One area of opportunity for Plastiq is partnering with other payment applications. This is a strategy that Plastiq has already begun to pursue. In December 2021, Plastiq entered into a partnership with PayGround, a patient payment app that allows payment to any medical provider, in order to allow patients to create their PayGround Digital Wallet and pay their medical bills through their preferred payment method; either credit card, HSA, FSA, or even linking their bank account all from within the PayGround app.

Integration with Established Fintech Companies

Plastiq is currently established within the small business payment sector. Not only is it accepted by most major credit cards such as Visa, Mastercard, and American Express, but it even has its own page on Visa's small business hub. Moving forward, integrations with established fintech players could attract more clients for Plastiq and make it more mainstream.

Key Risks

Policy Changes Within Banks

In April 2022, Chase announced an expanded definition of “cash-like transactions” which for Chase credit card holders refers to purchases that trigger the penalties of taking a cash advance. Penalties include expensive fees and interest while also disqualifying the purchase from earning rewards, such as cash back, points, or miles. In this announcement, a Chase spokesperson mentioned that popular payment platforms such as PayPal, Apple Pay, and Plastiq “could be treated” as cash advances, although Plastiq says it automatically declines transactions if the issuer treats them as a cash advance. This reveals a potential risk for Plastiq—relying too much on third party institutions like Chase that might change policies on a whim and suddenly cut off Plastiq’s ability to do business.

Potential SPAC Risks

Plastiq announced in August 2022 that it will be going public by merging with Colonnade SPAC in a $480 million deal. SPACs became a popular method of going public in 2020, but going public via SPAC comes with a few risks compared to the traditional IPO. First, a SPAC management team could have misaligned goals compared to the company itself such as target markets and operating metrics. Second, since Plastiq will not need to disclose as much financial information, building investor trust can be more difficult.

Summary

Plastiq gives customers the ability to pay by credit, even when credit is not accepted by the vendor. The product also allows vendors to accept credit without incurring merchant fees. As only a small minority of big-ticket purchases and B2B transactions take place with credit, there is significant opportunity to expand, and partnerships with other adjacent companies such as payment applications or business credit cards that put Plastiq in a strategic position within its category at it prepares to go public via SPAC.