Thesis

Global B2B payments exceeded $120 trillion annually as of 2021. Before the COVID-19 pandemic, 33% of B2B payments were made electronically, compared to 70% of B2C payments. After the COVID-19 pandemic, 50% of B2B payments were made electronically as of 2024. While cashless and contactless payments have grown in popularity (60% of all in-person card transactions worldwide were made using contactless payments in 2024) among consumers due to their convenience and simplicity, many businesses still rely on traditional methods like cash, checks, and physical invoices. Paper checks alone accounted for over 50% of B2B payments in 2022, highlighting the sector's slow transition toward digital payment systems.

A 2021 survey found that 65% of businesses spend an average of 14 hours per week on administrative tasks related to collecting payments. In the US, an estimated $3 trillion is tied up in outstanding accounts receivable, with businesses having, on average, 24% of their monthly revenue tied up in accounts receivables, payment terms, or trade credit as of 2024. Inefficient billing and accounts receivables practices contribute to these issues, many of which can be addressed through digitization and automation. Reflecting this shift, 40% of CFOs reported a decrease in check usage in 2022 due to adopting digital accounting systems.

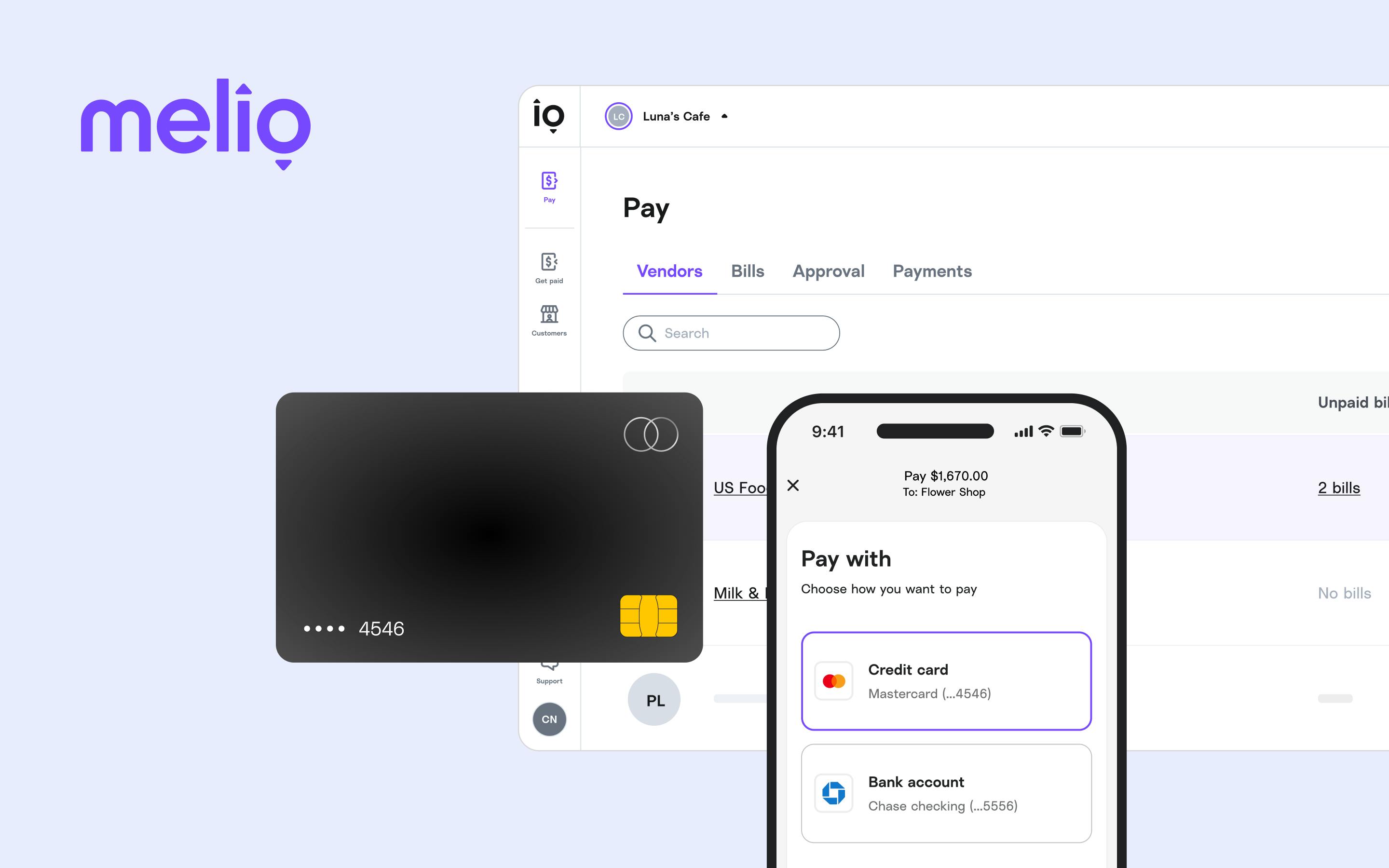

Melio provides businesses with a digital platform to manage B2B payments and accounts receivables. It offers an integrated solution that enables businesses to make and receive payments efficiently to address cash flow needs, reducing late payment fees, and minimizing time spent on administrative tasks. By digitizing payment processes, Melio seeks to help businesses streamline operations, improve financial management, and enhance payment flexibility.

Founding Story

Source: Built In

Melio was founded in 2018 by Matan Bar (CEO), Ilan Atias (CTO), and Ziv Paz (former COO).

In 2009, Bar cofounded The Gifts Project, a social ecommerce platform for Group Gifting that helps online retailers, marketplaces, and gift stores leverage their shoppers’ social buying experience. The Gifts Project was acquired by eBay in 2011 for $20 million, and Bar went on to work for eBay as a head of product in 2011. Then, in 2015, he joined PayPal where he served as director of global peer-to-peer payments.

Bar's experience at PayPal highlighted the stark contrast between the ease of consumer payment systems and the outdated methods SMBs used for B2B transactions. Bar was shocked to see how SMBs in the US utilized applications like Venmo and Square to manage consumer payments while still cutting paper checks for B2B payments. As a result of this experience, Bar conceived the idea to bring the same ease of use to back-office payments that PayPal provides for peer-to-peer payments. He brought together Atias who was working as the VP of R&D at Windward in 2017, and Paz from a private equity fund in Israel, to work on the concept for Melio.

During the early days of Melio, the company onboarded 10 customers and would manage everything for them through WhatsApp. Melio was only doing bookkeeping for their customers at first for four months and managed end-to-end accounting and payables for the 10 small businesses. For example, the customer would send Melio an invoice and Melio would mail paper checks to the customer’s vendors. Through this process and additional scrappy practices, the team continued to iterate the product for its customers.

Paz left the company in 2021 for unknown reasons, after which Tomer Barel joined as COO in March 2022.

Product

Source: Melio

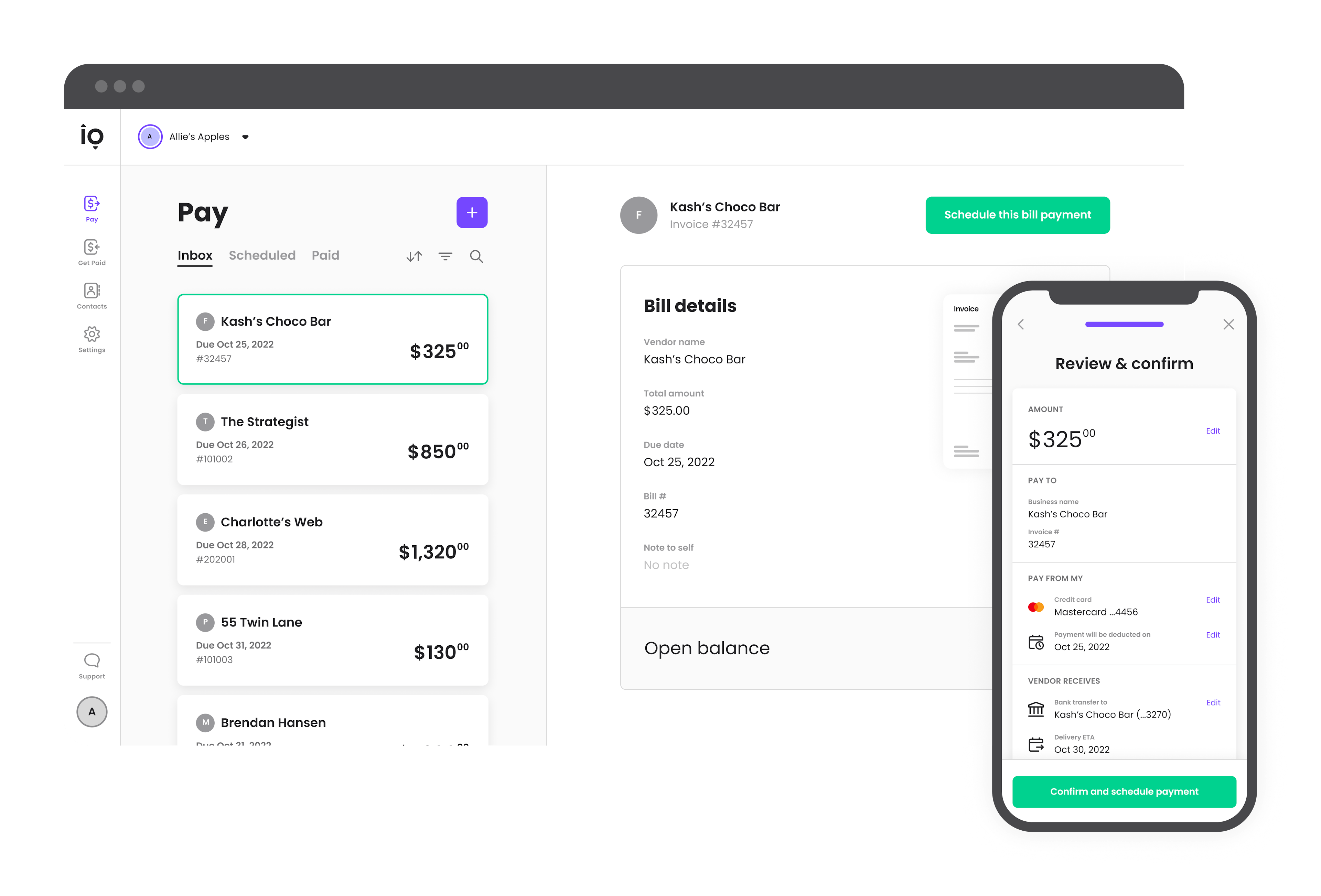

Melio is a payment platform that simplifies bill management for small businesses. It enables users to pay vendors and contractors via ACH bank transfers, checks, or credit cards, even if the recipients do not use Melio. The platform integrates with accounting tools like QuickBooks, supports bill capture, approval workflows, and payment schedules, and provides payment tracking. ACH transfers are free, but fees apply for credit card transactions and certain expedited services.

Accounts Payable

Melio’s Accounts Payable product enables businesses to pay vendors, suppliers, or contractors using their preferred payment method, regardless of how the vendor wants to receive payments. The process is streamlined into three key steps:

Capture: Invoices can be scanned or uploaded digitally, with Melio’s AI-powered tools extracting necessary data to eliminate manual data entry.

Approve: Multi-level approval workflows allow for custom payment terms and ensure efficient payment management, tailored to business needs.

Pay: Payments can be made via ACH for free, credit card for a 2.9% fee, or paper checks for $1.50 each). Options include standard and expedited payments, such as fast checks (within three business days), same-day ACH, or instant transfers for immediate processing, providing businesses with cash flow flexibility.

Melio integrates with accounting software like QuickBooks Online and Xero to enable automatic two-way sync, eliminating the need for dual data entry. This ensures that invoices and customer information are consistently updated across platforms, and payments are auto-reconciled. Users can pay multiple bills at once, split a single bill into multiple payments, or make international payments to 56 countries. Additionally, businesses can pay by credit card, deferring payment for up to 45 days to improve cash flow while earning credit card rewards. Vendors receive payments via check or bank transfer without needing to sign up for Melio.

Accounts Receivable

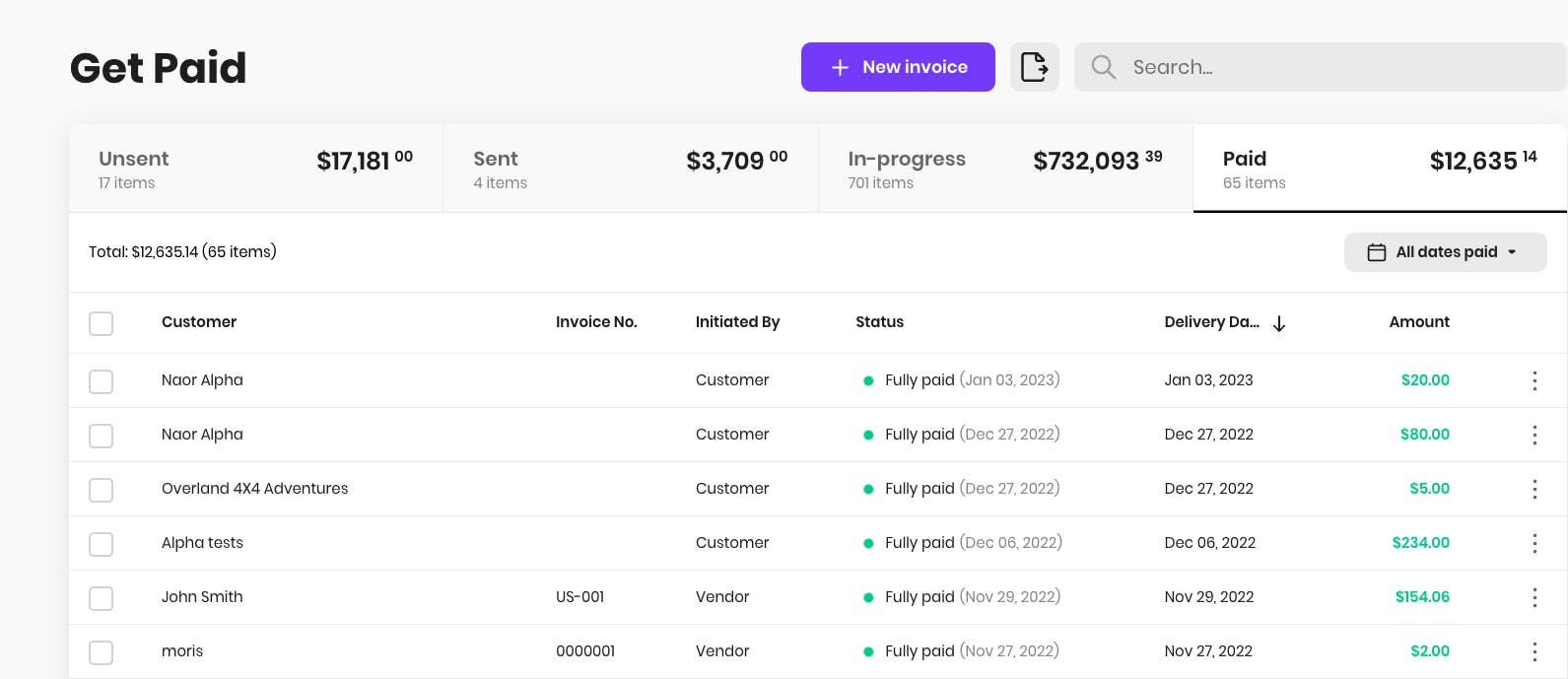

Source: Melio

Melio’s Accounts Receivables product allows businesses to receive payments faster by credit card, ACH, or check. Businesses can send invoices through an email with a built-in payment button. The product streamlines the payment collection process through a three-step workflow:

Select an invoice: Customers can add an invoice or sync with existing back-office bookkeeping software integrations like QuickBooks, Xero, FreshBooks, or Business Central.

Send a request: Invoices are sent with a unique email link with a built-in pay button - business customers can pay immediately.

Get paid: Customers can select their preferred method of payment, to which funds will directly transfer into the requester’s bank account.

Source: Melio

Melio helps businesses streamline the payment process for their customers by providing them with a personalized payment link to pay bills. It will match all incoming payments with invoices so they are automatically reconciled. Businesses can add their branding to payment links, requests, and emails. They can track every payment from request until it's paid and are offered full payment protection from fraud. Open payment requests can be managed from Melio, saving time on administrative work. Melio also allows businesses to decide whether they or their customers will cover credit card fees, adding flexibility to the payment process.

Accountant Dashboard

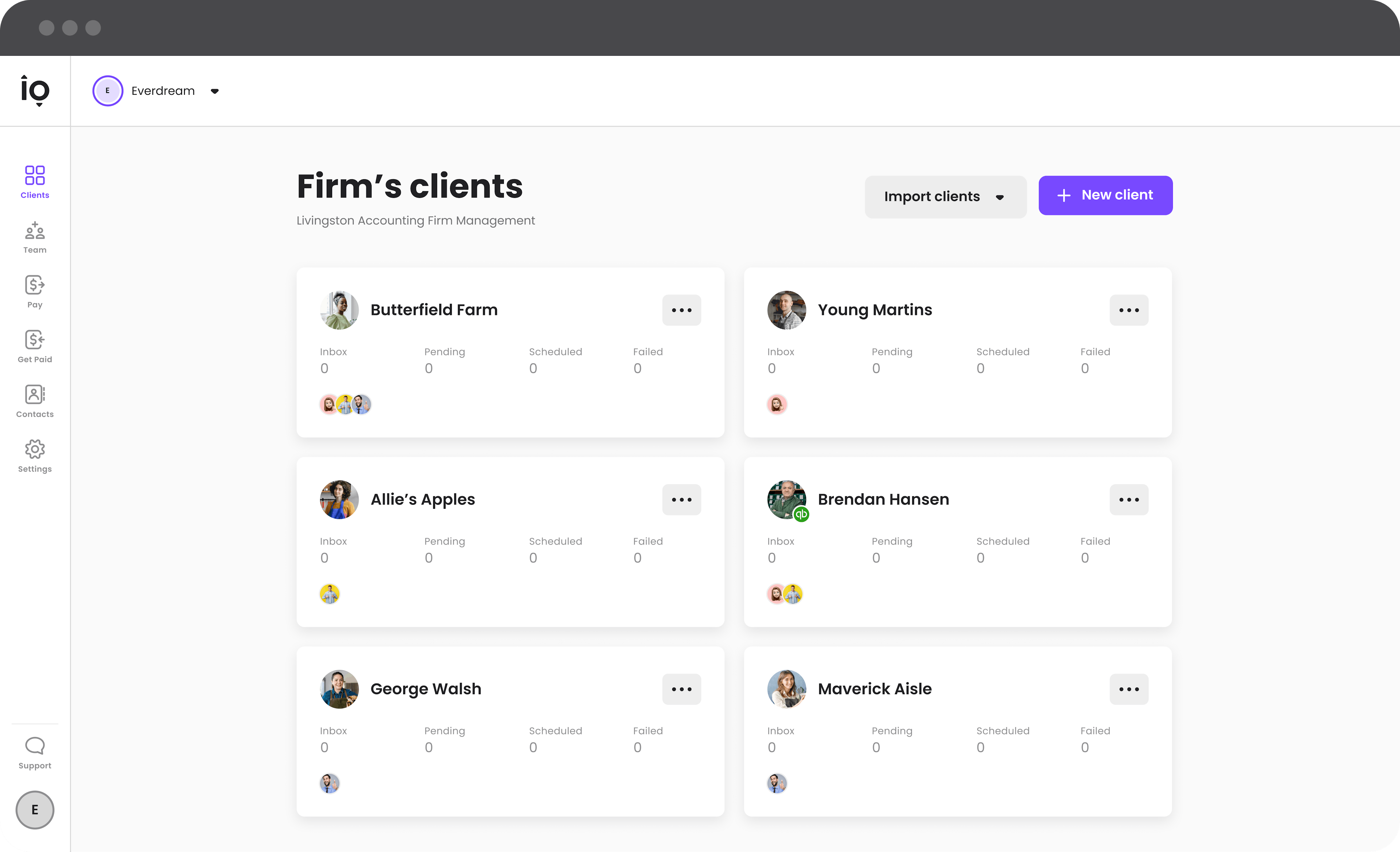

Source: Melio

Melio provides a payment solution specifically designed for accountants managing multiple clients. The platform includes a team management tool that allows accountants to oversee client business payments and set up approval workflows tailored to their needs. Similar to Melio’s general "pay" and "get paid" offerings, this tool is optimized for accountants who require access to multiple businesses simultaneously. By integrating clients’ QuickBooks Online or Xero accounts, Melio eliminates the need for dual data entry, offering an automatic two-way sync for all bills and payments.

Accountants can delegate tasks within their teams by assigning specific client accounts to employees, ensuring efficient workload management and secure data access. Through a centralized dashboard, they can schedule payments on behalf of clients and implement automated approval workflows, assigning levels of responsibility as needed. There are no sign-up fees for accountants, making it a cost-effective solution for professionals managing multiple small businesses.

Get Paid

Melio’s “get paid” offering allows businesses to receive payments by credit card, ACH, or check. Invoices are sent in an email with a built-in pay button.

Melio helps businesses streamline the payment process for their customers by providing them with a personalized payment link to pay the bill and integrating it into back-office bookkeeping software like QuickBooks, Xero, FreshBooks, and Business Central. Melio will match all incoming payments with invoices so they are automatically reconciled. Businesses can add their branding to payment links, requests, and emails. They can also track every payment from request until it's paid and are provided fraud protection.

Secure Payment

Developed in partnership with American Express, users can spin up digital card equivalents with connections to their US corporate or business cards. A 15-digit number is provided that operates as a proxy on top of the actual card information, providing an extra layer of security against websites and merchants. The virtual card is designed specifically for business applications such as travel, software, and electronics expenses. The card is intended to help manage budget limitations and maintain visibility for spending on projects.

Market

Customer

Melio initially focused on serving SMBs in the US, particularly wine shops and hardware stores that lacked tailored financial tools. Unlike larger companies with dedicated finance teams, Melio’s target customers are typically small business owners, as they often manage financial operations directly. The product is designed to address the specific needs of SMBs across various industries, including food and beverage, healthcare, and construction while supporting diverse bill types such as contractor payments and general business expenses. This focus reflects Melio’s strategy to provide a user-friendly, accessible solution for underserved businesses in this segment.

Market Size

The global B2B payments market was valued at $89 trillion as of 2024 and is expected to grow at a 12% CAGR to reach $174 trillion by 2030. Despite advancements in payment technology, traditional methods like checks still account for 50% of all B2B transactions in the US, highlighting an opportunity for digital transformation in this space. The US is home to over 33 million SMBs as of 2023, a key customer segment for Melio. 73% of SMBs reported being willing to pay for a comprehensive, all-in-one payment solution, signaling demand for integrated offerings tailored to their needs as of 2022.

The B2B payments market, encompassing digital payments, accounts payable, and receivables solutions, is evolving, driven by demand for efficiency and cost savings. With traditional payment processes being resource-intensive and error-prone, fintech solutions offer SMBs and enterprises enhanced cash flow management, reduced administrative burdens, and improved financial visibility. Players in the market are innovating to provide tailored solutions to meet the specific needs of SMBs, such as integrating with accounting software and offering flexible payment options. The sector’s growth is further fueled by the rise of ecommerce, which requires faster and more secure cross-border transactions.

Competition

Bill: Bill, founded in 2006, is Melio’s largest direct competitor. It’s a publicly traded company with a market cap of $9.3 billion as of December 2024. Its revenue was ~$1.2 billion from serving over 475K customers in 2024. Like Melio, Bill supports accounts receivables, accounts payables, accounting software integrations, approvals, controls, and mobile apps. Unlike Melio, it offers an all-in-one expense management solution via Divvy, which it bought in 2021. In November 2023, Bill was reported to nearing a $2 billion deal to purchase Melio Payments, but the deal was announced a day later to just be a rumor.

Stripe: Stripe, founded in 2010, is a player in the payments industry with a wide offering of products. Its core business focuses on customer-to-business payments, such as ecommerce. It also has an AR tool called Stripe invoicing. Although Stripe does not directly compete with Melio’s core business, given Stripe's large number of existing customers and brand recognition, it has a large distribution potential. It can expand capabilities and potentially capture more market share as it works with companies such as Slack, Figma, and WHOOP. Stripe has raised $9.4 billion and is valued at $100.1 billion as of December 2024.

Ramp*: Founded in 2019, Ramp is a financial automation platform that has raised $1.8 billion over 10 funding rounds with a valuation of $7.7 billion as of December 2024. It offers card and service controls, accounts payable and vendor management, and real-time savings insights. Ramp is a competitor to Melio as both target the SMB segment with financial tools aimed at streamlining business payments. While Melio focuses on simplifying B2B accounts payable and receivable processes, Ramp offers a broader expense management platform, including corporate cards and bill payment capabilities, positioning itself as an all-in-one financial operations solution for SMBs. Both compete on efficiency and cost-effectiveness in managing business finances.

Tipalti: Tipalti is a payables automation platform founded in 2010. It is more geared towards larger companies with more complex needs, yet still maintains a focus on automated and streamlined AR and AP processes. It offers bank transfers in 196 countries, across 120+ currencies, and 50 payment methods. Tipalti has raised $715 million in funding and was valued at $2.9 billion on secondary trading platforms as of December 2024. Tipalti competes with Melio in the B2B payments space by offering solutions for accounts payable automation. While Melio primarily targets SMBs with simple, user-friendly tools for AP and AR processes, Tipalti focuses more on mid-market to enterprise customers with comprehensive capabilities, including global payments, tax compliance, and payment reconciliation.

Stampli: Stampli, founded in 2015, is similar to Tipalti, with the main difference being not having an invoice or bill generation software product. Compared to Melio, Stampli has a wider product offering and targets larger companies with more complex payment processes. With 70+ pre-built integrations for enterprise resource planning and the introduction of its cognitive AI assistant Billy, Stampli could position itself as a forefront financial automation platform. Stampli has raised a total of $145.7 million as of December 2024.

Business Model

Melio offers three pricing plans designed to cater to the varying needs of businesses as they scale:

Go Plan: This plan is free and is tailored for small businesses just starting with digital payments. It includes basic accounts payable functionality, such as bill payments, invoice management, and the ability to pay via ACH. The Go plan allows businesses to manage payments efficiently but lacks some of the more advanced features that come with higher-tier plans. It is a cost-effective entry point for small businesses that primarily need essential AP functionality.

Core Plan: The Core plan, which costs $21.25 per month as of December 2024, is designed for businesses that need more advanced functionality. It includes all the features of the Go plan, plus added capabilities such as payments via credit cards, the ability to set custom payment terms, and access to additional integrations with popular accounting software. This plan offers more control over payment workflows and is suitable for growing businesses with more complex payment needs.

Boost Plan: The Boost plan, which costs $46.75 per month as of December 2024, is aimed at businesses looking to maximize their AP capabilities. It includes everything from the Core plan, with additional features like priority support, more advanced reporting tools, and faster payments. Boost customers can access premium payment options such as instant payments, and the plan also supports cross-border payments, making it ideal for businesses that operate internationally or need additional flexibility in their payment workflows.

Melio also charges fees for certain payment methods, particularly for faster payment options. These fees are designed to enable the platform to handle high volumes of transactions efficiently, leveraging low customer acquisition and onboarding costs, as well as minimal marginal costs due to its automated software. This allows Melio to offer competitive pricing compared to other payment solutions. When one of its customers sends a payment to a vendor, that vendor does not need to sign up for Melio to receive the payment; however, vendors who do sign up can benefit from faster payment options. Specific fees include $1.50 for mailed checks, a 2.9% fee for card transactions, a 1% fee for instant payments (up to $50), and a flat $20 fee for international payments.

Traction

As of October 2022, Melio was processing $2.5 billion monthly in payment volume. It was on track to reach an annual run rate of $40 billion by the end of 2022. However, in March 2024, Melio laid off 7% of its workforce in its Israel office, due to “organizational changes that include flattening out management layers and internal streamlining processes." This was its second round of layoffs after it let go 10% of its workforce in 2022. The company released a statement in March 2024 that gave the following reasons for the layoffs:

“The rate of growth in the company has caused organizational structural awkwardness in some departments and the creation of inefficient management layers. In the last three years, the Israel office has grown from about 90 employees to over 400, of which the development department alone grew from about 50 employees to about 300.”

Melio is listed under both Forbes’ 2024 FinTech 50 and Cloud 100, and lists trusted partners on its website to be American Express, Intuit Quickbooks, Mastercard, Visa, and Discover. As of November 2024, some unverified estimates place Melio’s revenue around $750 million.

Valuation

As of December 2024, Melio has raised a total of $654 million. It raised a $150 million Series E round in October 2024 at a $2 billion valuation from investors including Accel, Bessemer, Coatue, Frontline Ventures, General Catalyst, Latitude, and Thrive Capital. It raised a $250 million Series D at a $4 billion valuation in September 2021. This indicates a decrease in valuation from $4 billion in 2021 to $2 billion in 2024.

Melio's valuation likely decreased due to a combination of factors including a global economic downturn, reduced funding opportunities in the fintech sector, and challenges in maintaining growth during a post-pandemic market correction. The company has also faced internal restructuring, including layoffs, which signals a shift in priorities and adjustments to align with the tougher economic climate. These factors reflect broader trends in the startup ecosystem, where valuations have been recalibrated as investors become more cautious about high-growth but unprofitable ventures.

Key Opportunities

Partnerships

One significant opportunity for Melio lies in expanding partnerships with established marketplaces and platforms to integrate as their default accounts payable solution. For instance, Melio's integration with Shopify in 2023 and its secure payment feature linked with American Express cards demonstrate its potential to tap into large, engaged user bases effectively. Such partnerships enable Melio to overcome the challenges of reaching the fragmented small business market by leveraging the distribution networks of these platforms, which already consolidate merchants and businesses in one place.

By embedding its solutions within marketplaces, Melio can enhance its visibility and adoption in a scalable, cost-effective manner, positioning itself as a convenient and reliable tool for small businesses. However, maintaining differentiation and negotiating favorable partnership terms will be key to fully capitalizing on this opportunity.

Product Expansion

Another key opportunity for Melio lies in expanding its product offerings to address cross-border payments for small businesses. As global trade continues to grow, many small businesses face challenges in making and receiving international payments efficiently and cost-effectively. While Melio supports international payments to over 50 countries as of December 2024, there is potential to enhance its offerings with features such as real-time exchange rate visibility, multi-currency support, and faster settlement times.

By focusing on this area, Melio could differentiate itself in a competitive B2B payments market and attract small businesses involved in global trade. Given the increasing demand for streamlined cross-border payments, which is expected to grow at a CAGR of 10.8% to reach $124 trillion globally by 2028, expansion in the international payment space could represent an opportunity for Melio.

Key Risks

Crowded Market

Melio faces competition in the B2B payments market, with pressure from both established players and new entrants. Large companies with customer bases and strong brand recognition, such as Bill, pose a particular risk if they expand further into the SMB market, leveraging their existing resources and scale. The attempted acquisition of Melio by Bill in November 2023 for approximately $2 billion highlights the ongoing consolidation efforts within the B2B payments industry, which could intensify competition and limit Melio's market opportunities.

Market Dynamics

Melio faces challenges due to shifting market conditions that have altered investor priorities. Over the last decade, startups were often rewarded for aggressive growth strategies, even at the expense of profitability. However, in 2024, the venture capital environment emphasizes sustainable business models and clear paths to profitability. Venture funding dropped in 2023, falling by 35% compared to 2022, with total investment at its lowest in four years. This contraction has led to corrections in valuations and increased scrutiny of unit economics.

Melio raised capital during a period of record-high valuations, but with changing market dynamics, the company may need to demonstrate strong financial performance and efficient scaling to justify these valuations. This environment also poses risks for securing additional funding or achieving favorable terms in future financing rounds. For example, its Series E round was valued at half the value of its Series D. These pressures are compounded by competition in the B2B payments space, where strategic pivots may be required to align with investor and market expectations.

Summary

Melio is a digital payments platform for small and medium-sized businesses, enabling them to manage accounts payable and receivable with various payment options and integrations like QuickBooks. It simplifies financial workflows, supports cash flow management, and offers features like payment scheduling and international transfers. While providing convenience, Melio competes in a crowded market and faces scaling challenges.

*Contrary is an investor in Ramp through one or more affiliates.