Thesis

Software companies are generating more product data than ever, creating an analytics complexity crisis that is costing organizations substantial time and resources. As product development cycles accelerate and companies launch products across web, mobile, API, and embedded platform channels, the number of user touchpoints has exploded.

The average B2B SaaS company used approximately 106 different software tools as of 2025, with product teams often juggling multiple overlapping analytics solutions just to understand basic user behavior. This tool sprawl creates data silos where user actions across different platforms can't be connected, integration nightmares that consume engineering resources, and slower product development cycles. The financial impact is significant: 80% of data scientists' time is spent on preparing and managing data for analysis, while data preparation and migration alone can consume 25-30% of analytics budgets. Small and mid-sized businesses invest anywhere from $10K to $100K annually for data analytics, representing 2-6% of their total budget.

This data complexity is driving demand for analytics solutions from the ground up, fueled by the rapid adoption of product-led growth strategies. 60% of SaaS companies identify as product-led as of 2024, up from just 35% in 2021. Companies that once relied on sales-driven growth now need granular insights into user behavior to optimize conversion funnels, reduce churn, and drive expansion revenue. Product-led companies are demonstrating the value of this approach, achieving 50% year-over-year growth compared to 21% for traditional SaaS companies. This shift coincides with developers gaining increasing influence over technology purchasing decisions. This bottom-up adoption pattern, combined with the competitive pressure to be data-driven, is creating sustained demand for analytics platforms that can keep pace with modern development workflows.

PostHog consolidates product analytics, session replay, feature flags, A/B testing, and other capabilities into a single platform designed specifically for this technical audience. While competitors chase no-code solutions for business users, PostHog deliberately builds for engineers with SQL access, extensive APIs, and the ability to self-host the entire platform, directly addressing the data complexity and integration costs that plague modern software teams. By combining an all-in-one platform with developer-centric design and open-source transparency, PostHog is positioned to become the default analytics infrastructure for the next generation of product-led companies.

Founding Story

PostHog was founded in 2020 by James Hawkins (CEO) and Tim Glaser (CTO). The pair first met while working at Arachnys, a London-based regulatory technology startup.

Hawkins brought an unusual background to the founding team. He spent his early years as a competitive cyclist, competing internationally while teaching himself web development on the side to fund his athletic pursuits. After transitioning away from cycling, he worked his way up at Arachnys from individual contributor to VP of Sales over four years, gaining deep insight into how technical and business teams collaborate around data.

Glaser's path was more traditionally technical. He started coding at 11, was getting paid for his code by 13, and had his first formal employment at 16. After moving to London, he also joined Arachnys, where he wore multiple hats as a product manager, software engineer, and eventually R&D lead. His experience building data infrastructure at Arachnys directly informed PostHog's technical architecture.

Before PostHog, the founders explored a different startup idea focused on helping engineers manage technical debt. As they detail in their blog post, this initial venture taught them valuable lessons about product-market fit but ultimately didn't gain traction. The experience of building products blind, without clear visibility into user behavior, planted the seeds for what would become PostHog.

Product

Core Product

Source: PostHog

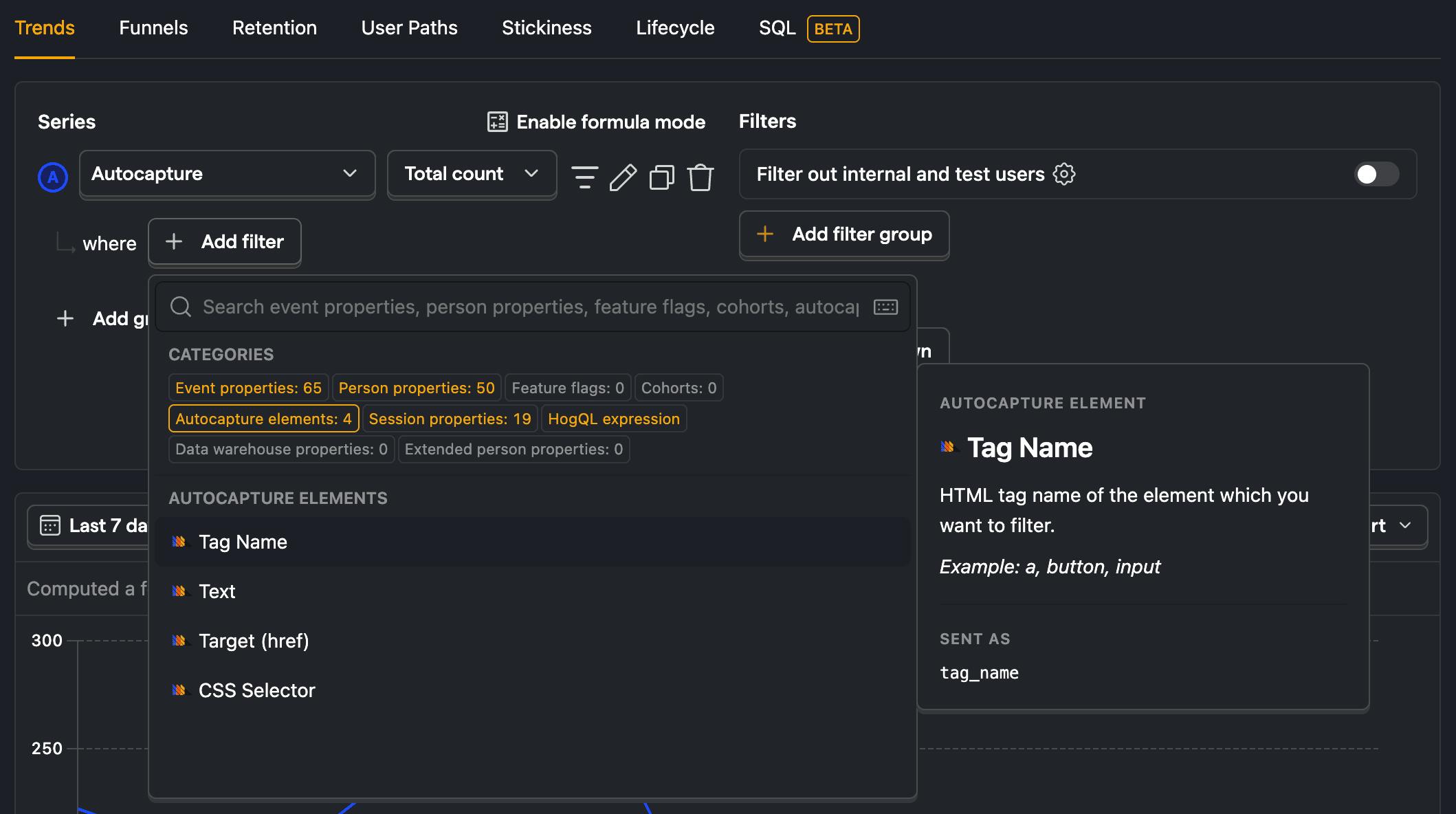

PostHog's core offering is a comprehensive product analytics platform designed specifically for developers and product teams. Unlike traditional analytics tools that require extensive manual instrumentation, like Mixpanel or GA4 event tags, PostHog's autocapture technology automatically tracks every user interaction, including clicks, page views, and form submissions, without requiring code written to track each event.

The platform's foundation rests on Product OS, which provides a unified data layer connecting all PostHog features. Built on ClickHouse, an open-source columnar database optimized for real-time analytics, PostHog can process billions of events while maintaining sub-second query performance. This architecture enables teams to ask complex questions about user behavior without the typical constraints of traditional analytics platforms.

Platform Overview

Source: PostHog

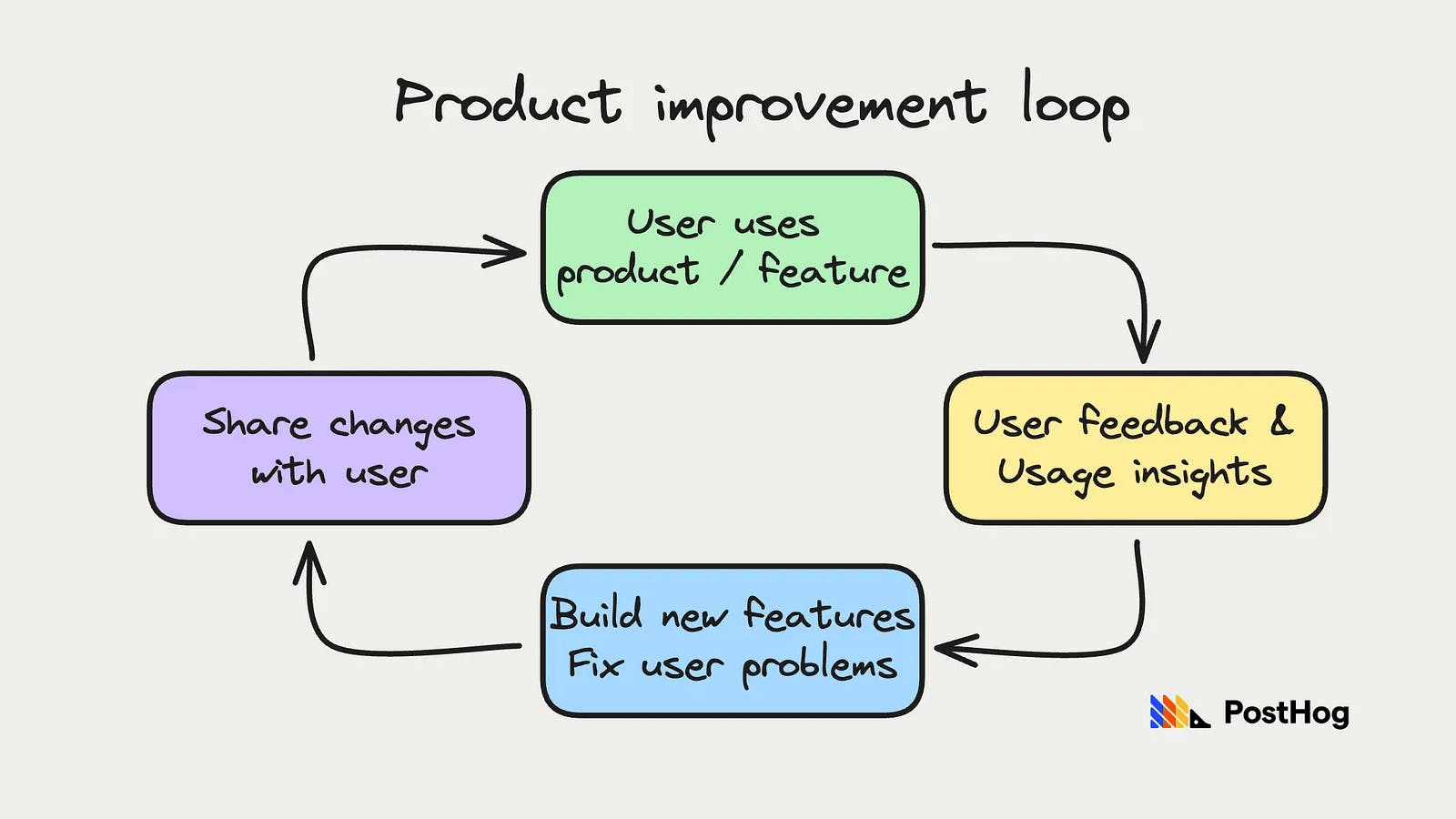

PostHog's platform philosophy centers on eliminating tool fragmentation. As their documentation states, "Product OS ties all user and product data together across all PostHog products, enabling teams to focus on product improvement rather than data engineering."

The platform provides several key capabilities:

Autocapture & SDKs: PostHog's JavaScript library automatically captures frontend events, eliminating the need to manually instrument every user interaction. SDKs are available for all major development platforms including JavaScript, Python, Ruby, iOS, Android, React Native, and Flutter. The posthog-js library alone has over 1.3 million weekly downloads on npm (as of September 2025).

HogQL: PostHog created HogQL, its own flavor of SQL that provides direct database access. Users can write complex queries, create custom reports, and build sophisticated analyses without leaving the platform. HogQL supports advanced operations like JSON manipulation, array processing, and window functions.

Session Analytics: Every event is automatically tagged with a session ID, connecting related user actions within activity windows by default. This enables cohort analysis, user journey mapping, and seamless connection to session replays for qualitative insights.

Collaboration Features: Notebooks allow teams to combine queries, visualizations, and commentary in shared documents. Real-time collaboration features let multiple team members explore data together, bridging the gap between technical and non-technical users.

Product Portfolio

PostHog offers nine interconnected products within its platform:

Product Analytics: The flagship product provides event-based analytics with trends, funnels, retention analysis, and path analysis. The platform's autocapture means teams get comprehensive data from day one. During Y Combinator’s Startup School rollout, PostHog captured ~30 % more events than Google Analytics because GA’s third‑party script was blocked for a significant subset of users.

Web Analytics: A privacy-friendly alternative to Google Analytics that requires no cookie banners. It provides standard web metrics, page views, unique visitors, and bounce rates, while respecting user privacy and GDPR requirements.

Session Replay: Teams can watch actual user sessions to understand behavior and debug issues. Each replay includes the full DOM, console logs, network activity, and performance metrics, synchronized with analytics events for comprehensive debugging.

Feature Flags: Deploy features safely with granular rollout controls. PostHog's feature flags support percentage rollouts, user targeting, and multivariate flags for complex feature configurations. The flags integrate directly with analytics, enabling automatic impact measurement.

Experiments: Run A/B tests with built-in statistical significance calculations. The platform handles sample size calculations, monitors for statistical significance, and automatically tracks the impact on key metrics.

Surveys: Collect qualitative feedback through in-product surveys. Supports NPS, CSAT, multiple choice, and open-text questions, with targeting based on user properties or behavior.

Error Tracking: Monitor application errors with automatic grouping and alerting. The system captures stack traces, user context, and session replays of errors for faster debugging.

Data Pipelines (CDP): As of September 2025, data pipelines connect PostHog to 60+ destinations, including data warehouses, CRMs, and marketing tools. The CDP functionality enables both data import and export.

Data Warehouse: Import data from external sources like Stripe, HubSpot, or custom databases. Users can join this external data with PostHog events for comprehensive analysis using SQL.

Market

Customer

PostHog explicitly builds for the “highest-performing product teams building the most-loved products at high-growth startups”. The company's ideal customers are full-stack product developers who care deeply about user experience and have decision-making authority over their tools.

The primary ideal customer profile consists of B2B SaaS companies that maintain engineering-led cultures and have leadership teams that value data transparency and prefer tools they can understand and extend. Secondary targets include early-stage startups, particularly those in accelerators like Y Combinator, which may grow into primary customers.

Notable customers demonstrate this focus. Y Combinator uses PostHog across multiple products, including Startup School and Co-Founder Matching. As Cat Li, Product and Engineering Lead at YC, explains: "PostHog became the obvious choice because it didn't have issues with adblockers or third-party cookies dropping 30% of user data like other platforms." The platform helped YC increase engagement by 40% through systematic experimentation.

PostHog has also achieved significant penetration in the startup ecosystem. 54% of Y Combinator's Winter 2023 batch adopted PostHog, making it one of the top three most-used products among YC companies.

Other customers like Hasura and Phantom highlight PostHog's appeal to technical teams. These companies chose PostHog specifically because it provided SQL access to raw data, enabling custom analyses impossible with traditional analytics tools.

Market Size

The market for product analytics and developer tools represents a growing opportunity. The global product analytics market was valued at $10.5 billion in 2024 and was projected to reach $42.7 billion by 2034, representing a 15.1% CAGR.

PostHog competes directly in this market with established players like Amplitude, Mixpanel, and Adobe Analytics. Adjacent to this, the broader software development tools market adds another $6.6 billion as of 2024 and was projected to reach $22.6 billion by 2033. The largest related market, application development software, totaled $257.9 billion in 2024 and was projected to grow at a 22.8% CAGR between 2024 and 2030, indicating the massive shift toward software-driven business models that drive demand for analytics tools.

Several key trends are accelerating these markets’ growth. As of April 2025, organizations use an average of 106 SaaS tools, creating integration complexity that motivates consolidation efforts. Gartner predicts 70% of organizations will consolidate their analytics tools by 2025, creating an opportunity for unified platforms. Meanwhile, the global developer population has expanded to 28.7 million as of 2024, and as developers gain more influence over tool selection within their organizations, developer-focused platforms like PostHog benefit proportionately. Additionally, privacy regulations, including GDPR and CCPA, drive increasing demand for first-party analytics solutions, where PostHog's self-hosting option and privacy-first design directly address these compliance requirements.

Competition

Competitive Landscape

The product analytics market has evolved from monolithic enterprise solutions to a diverse ecosystem of specialized tools. Pure-play analytics vendors like Amplitude and Mixpanel face pressure to expand beyond core analytics. Multi-product platforms like Pendo struggle to achieve depth in any single area. Meanwhile, enterprises cobble together point solutions; using Mixpanel for analytics, FullStory for session replay, LaunchDarkly for feature flags, and Hotjar for user feedback. Rather than excelling in one area, PostHog provides serviceable functionality across multiple products, betting that integration value exceeds the importance of feature depth for most teams.

Competitors

Amplitude: Founded in 2012, Amplitude trades at a $1.5 billion market cap with trailing twelve-month revenue of $307 million as of September 2025.

Amplitude pioneered behavioral analytics for product teams, introducing concepts like user journeys and predictive analytics. The platform excels at complex analyses and serves enterprise customers like Microsoft and Shopify. However, Amplitude lacks session replay capabilities and charges per monthly tracked user, making it expensive for consumer applications. PostHog differentiates through bundled functionality and usage-based pricing that scales more favorably.

Mixpanel: Founded in 2009, Mixpanel has raised $277 million, including a $200 million Series C in November 2021, led by Bain Capital at a $1.1 billion valuation. Despite being an early pioneer in product analytics, Mixpanel has struggled with execution, deprecating features like A/B testing to focus solely on analytics.

Mixpanel remains popular among marketing teams for its intuitive interface and powerful segmentation. However, the platform requires extensive manual event tracking, lacks autocapture, and provides limited free usage. PostHog reports being the "fastest-growing Mixpanel alternative with deployment increasing +327% year-over-year while Mixpanel decreased -17%."

Pendo: Founded in 2012, Pendo has raised $479.8 million from investors including Thoma Bravo and Silver Lake, reaching a $2.6 billion valuation in its November 2021 Series F round. Pendo positions itself as a "product experience platform," combining analytics with in-app guides and user feedback tools.

Pendo excels at product adoption and user onboarding, making it popular among customer success teams. The platform's strength in in-app messaging complements basic analytics capabilities. However, Pendo lacks depth in pure analytics and A/B testing compared to PostHog, and its enterprise focus results in long sales cycles and high prices.

FullStory: Founded in 2012, FullStory has raised $197.2 million, including a $103 million Series D in August 2021 led by Permira at a $1.8 billion valuation. The company specializes in "digital experience intelligence," essentially session replay with basic analytics.

FullStory provides exceptional session replay capabilities with features like frustration detection and error clicking. The platform serves over 3.1K customers, including Peloton and JetBlue. However, users report that "FullStory lacks strong data analysis capability and requires researchers to export to other tools for in-depth qualitative analysis." PostHog provides comparable replay functionality alongside comprehensive analytics.

Hotjar: Founded in 2014 and bootstrapped to $27 million in revenue, Hotjar was acquired by Contentsquare in July 2021. The company provides websites with heatmaps, basic session recording, and feedback tools.

Hotjar democratized user research by making heatmaps accessible to small businesses. However, the tool focuses exclusively on websites, lacks product analytics, and provides limited technical capabilities. PostHog encompasses Hotjar's functionality while adding developer-focused features and mobile support.

Business Model

PostHog operates on a usage-based SaaS model that charges customers separately for each product based on usage. This granular pricing structure ensures customers only pay for what they use, which reduces churn from underutilized features and particularly benefits startups that can use PostHog free until they achieve meaningful scale. PostHog offers three deployment options:

PostHog Cloud provides a free tier supporting 1 million events, 5K session recordings, and 1 million feature flag requests monthly. Beyond these thresholds, PostHog charges $0.0000500 per event for analytics, $0.005 per session recording, $0.0001 per feature flag request, and $0.20 per survey response, with costs decreasing at higher volumes. Experiments are included with feature flags at no additional cost.

Self-Hosted deployments use the open-source version of PostHog under its MIT license. While free, self-hosted deployments are limited to a couple-hundred-thousand events per month due to infrastructure complexity at scale.

Enterprise plans add advanced features like SSO, role-based access control, and dedicated support, with custom contracts for large organizations.

PostHog's growth strategy centers on a developer-centric, product-led approach that rejects traditional outbound sales. The company focuses on content marketing to developers through its engineering blog, which covers deep infrastructure topics that attract its ideal customer profile. PostHog’s open-source distribution model has generated 29K GitHub stars as of September 2025, with contributors often becoming internal champions who drive adoption within their organizations. PostHog practices radical transparency by making its entire handbook, compensation bands, strategy documents, and even failed experiments publicly available, which reduces vendor-lock anxiety among developers. Rather than employing SDRs or requiring demos, the company maintains a self-serve funnel with a small sales-assist team to keep customer acquisition costs low.

The company's technical infrastructure, built on ClickHouse, provides significant cost advantages. ClickHouse offers 10-100x compression ratios that lower storage costs per event, enable sub-second columnar queries that eliminate the need for costly pre-aggregation tiers, and scale infrastructure spending logarithmically, allowing PostHog to reduce per-event pricing as volume grows.

PostHog benefits from multiple network effects that compound growth. Their integration with Y Combinator exposes PostHog to new startups, while product-led expansion drives customers to add additional products after initially adopting analytics. The open-source community contributes to faster roadmap development through pull requests, which drives broader adoption. These combined effects have yielded exceptional efficiency metrics, including a 5-day customer acquisition cost payback period and sustained 15.7% month-over-month growth for 12 consecutive months as of October 2024.

Traction

PostHog reached $9.5 million ARR in 2024, representing 138% year-over-year growth. As of September 2025, the median customer increases spend by 3x within 18 months. This growth comes almost entirely through product-led acquisition. As of September 2025, PostHog has been installed by over 108K companies, with adoption accelerating among developer-focused companies. Notable customers actively using PostHog include Airbus, Hasura, and Phantom.

PostHog runs lean for its scale, with 101-250 employees as of September 2025. The company is generating between $40K and $95K in ARR per employee at a $9.5 million ARR as of 2024.

Valuation

PostHog completed a $70 million Series D in June 2024, led by Stripe, valuing the company at $920 million and bringing total funding to $107.2 million. Notable investors include Y Combinator, GV (Google Ventures), Lux Capital, and strategic investor Stripe. The Stripe partnership provides both capital and potential distribution through Stripe's extensive developer ecosystem.

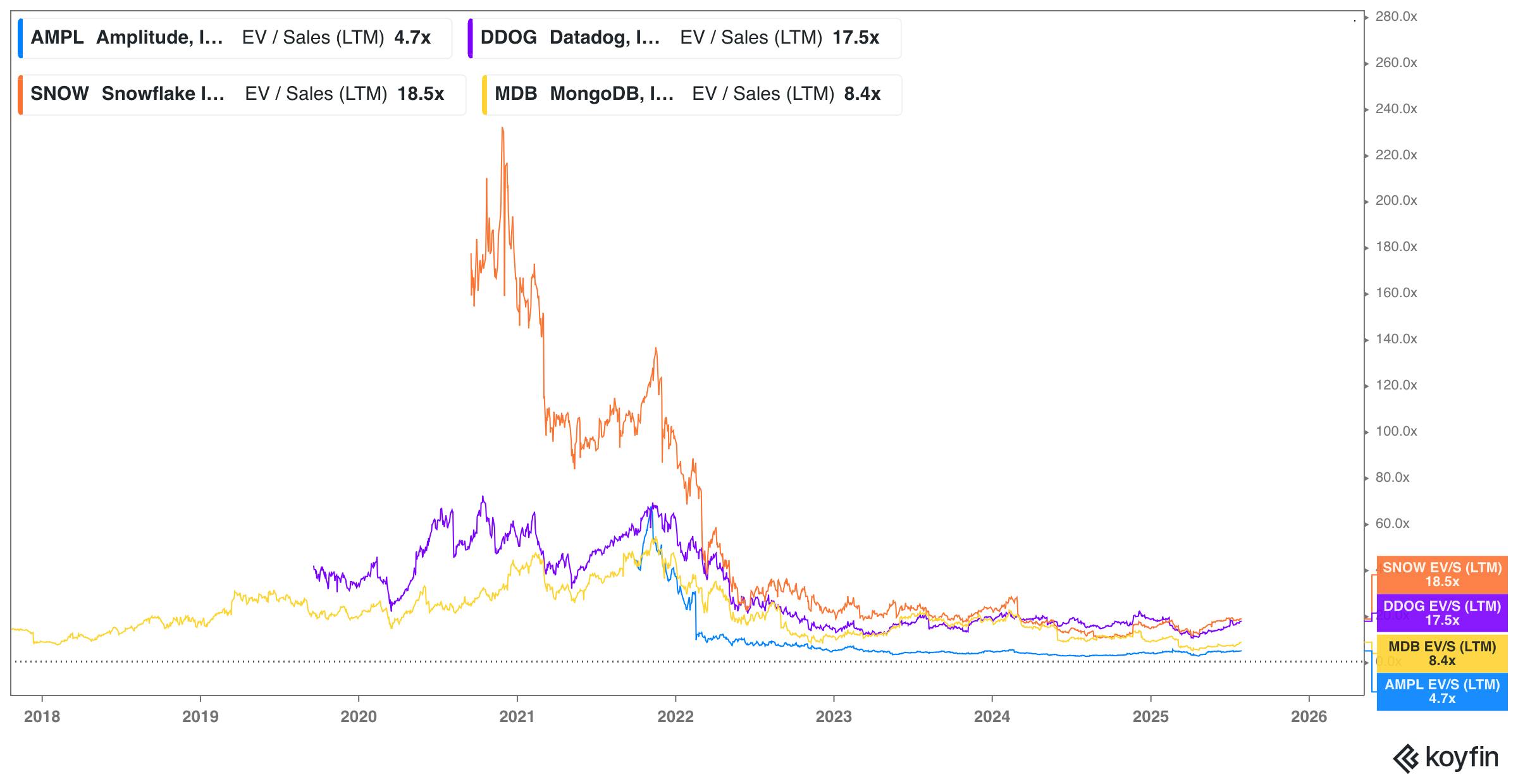

Public analytics and developer tools companies have experienced significant multiple compression since the peak seen in 2021. As of September 2025, companies like Amplitude and Datadog trade at 5-15x revenue multiples, down from highs of 25-40x during the software boom. At PostHog's $920 million valuation and $9.5 million ARR, the company trades at approximately 97x revenue. While this represents a significant premium to public comps, it reflects PostHog's 138% growth rate and the market's continued appetite for developer-focused platforms, and prices in expectations for sustained rapid expansion.

Source: Koyfin

Key Opportunities

Platform Consolidation Wave

A wave of consolidation targeting SaaS companies is expected in 2025 as the pace of adoption of AI puts pressure on cloud-based business models. This trend is being accelerated by subscription fatigue showing up in buying behavior: net‑new SaaS purchases took 17% longer in Q1 2024 (avg. 41 days), and portfolios are shrinking.

As of April 2025, organizations use an average of 106 SaaS tools, creating integration complexity and data silos that drive consolidation efforts. Gartner predicts that by 2025, 70% of organizations will be compelled to shift their focus from big data to small and wide data to leverage available data more effectively, highlighting the need for unified platforms that can handle diverse data sources. Meanwhile, some low-code no-code (LCNC) platforms offer a powerful remedy to SaaS sprawl by consolidating multiple tools and simplifying workflows, demonstrating clear market demand for integrated solutions.

The observability and analytics space specifically is seeing rapid consolidation, with major acquisitions including Datadog's acquisition of AI-powered data observability startup Metaplane, Cisco's $28 billion acquisition of Splunk, and WSO2's acquisition of API analytics startup Moesif.

Unlike competitors that are acquiring companies to build comprehensive platforms, PostHog ships an integrated suite. The company's ability to replace multiple disparate tools (analytics, session replay, feature flags, A/B testing, surveys) with a single platform directly addresses the enterprise demand for vendor consolidation and reduced complexity. This architectural advantage becomes increasingly valuable as organizations require more granular control over their telemetry data, from collecting, processing, and routing to storage and archival, capabilities that PostHog provides natively rather than through expensive acquisitions.

AI Integration and LLM Observability

The artificial intelligence market presents a massive expansion opportunity for PostHog. The global Artificial Intelligence Software market reached $17 billion in 2024 and was projected to reach $80.6 billion in 2031, with a CAGR of 29.64%.

By 2026, more than 80% of companies are expected to have deployed AI-enabled apps in their IT environments, up from just 5% in 2023. This rapid adoption is creating critical gaps in observability infrastructure. As Datadog VP Michael Whetten stated,

"Observability is no longer just for developers and IT teams; it's now an essential part of data teams' day-to-day responsibilities as they manage increasingly complex and business-critical workflows. This complexity will become even more pronounced as more businesses deploy AI applications."

The market for data observability tools was worth $2.1 billion in 2023 and is expected to grow at a 12.2% compound annual growth rate between 2024 and 2030. The acquisition frenzy validates this opportunity: Coralogix acquired AI observability platform Aporia, Datadog acquired Metaplane for AI-powered data observability, and multiple other consolidations are targeting AI monitoring capabilities.

PostHog's early launch of Max AI positions them ahead of competitors in this transition. Unlike competitors building AI observability through expensive acquisitions, PostHog is integrating these capabilities natively. As companies scale AI applications, they need unified tools that can track token usage, latency, costs, and model performance alongside traditional product analytics.

Developer-First Market Expansion

The developer tools market is growing as developers gain increasing influence over technology decisions within organizations. There are estimated to be over 47 million developers globally as of May 2025, representing a rapidly expanding addressable market for PostHog's developer-centric approach. The broader software development tools market is projected to reach $22.6 billion by 2033, growing from $6.6 billion in 2024.

This developer empowerment trend is creating structural advantages for tools like PostHog. The observability market has grown from $61 billion in 2019 to $105 billion in 2023, with much of this growth driven by the shift toward developer-friendly, self-service tools. There was over $10 billion in aggregate ARR across both public and private pure-play observability vendors as of February 2024, highlighting a thriving market for next-generation startups to capture.

Traditional enterprise sales patterns are being disrupted by bottom-up adoption, where individual developers and teams drive tool selection. ChatGPT has claimed the #1 spot in the shadow IT chart, demonstrating how developers increasingly adopt tools independently before formal procurement processes. This trend particularly benefits developer-focused platforms that can be adopted without lengthy sales cycles or executive approval. PostHog's success with Y Combinator companies demonstrates this market opportunity in action. As these companies scale and developers move to larger organizations, they often champion the tools they know and trust, creating a powerful viral distribution mechanism.

Regulatory-Driven Privacy Market

Global privacy regulations are creating a structural shift toward first-party analytics solutions with architecture like PostHog's. The implementation of GDPR, CCPA, and emerging privacy laws worldwide is driving enterprises to seek alternatives to traditional third-party analytics platforms that may pose compliance risks. The global data privacy software market was valued at $13.9 billion in 2023 and was expected to grow at a CAGR of 25.4% through 2030 in 2023, driven primarily by regulatory compliance requirements.

European companies, in particular, are actively seeking GDPR-compliant analytics solutions that keep data within their own infrastructure. As of November 2024, 90% of organizations are predicted to adopt a hybrid cloud approach by 2027, using a mix of on-site servers and cloud technology, creating demand for analytics solutions that can operate across both environments.

PostHog's self-hosting option and privacy-first design directly address these regulatory requirements. Unlike traditional SaaS analytics providers that process data in third-party infrastructure, PostHog allows enterprises to maintain complete control over their analytics data. The company's open-source foundation provides additional transparency advantages, as enterprises can audit the code and ensure compliance with their specific regulatory requirements.

This regulatory pressure creates a competitive moat for PostHog, particularly in regulated industries like healthcare, finance, and government. The company's MIT-licensed version enables organizations to deploy analytics infrastructure within their own environments while maintaining full data sovereignty, a capability that becomes increasingly valuable as privacy regulations continue to tighten globally.

Key Risks

Platform Complexity and Developer Alienation

PostHog faces a critical risk in feature bloat that alienates its core technical audience. Customer feedback reveals growing concerns about platform complexity, with one user specifically stating, "Too bloated. I just want to see which UTM campaigns my visitors come from and build some simple funnels" in a product review. This feedback reflects a broader industry problem where feature bloat, also known as feature creep or feature fatigue, occurs when products have too many features and functionalities, ultimately detracting from the product's original purpose.

The risk is compounded by research showing that feature bloat can lead to customer churn, overly complex products, and unforeseen technical debt. For developer tools specifically, complexity is particularly dangerous because technical users value simplicity and efficiency above feature count.

PostHog's expansion into multiple product areas (analytics, session replay, feature flags, A/B testing, surveys, AI) creates mounting pressure to add features across all verticals. Each new capability requires a share of finite UI space, documentation, and user attention.

Open Source Scalability Constraints

PostHog's open-source foundation creates significant scalability constraints that could limit enterprise adoption. The company's own July 2025 documentation acknowledged that its MIT-licensed single-box Docker install is "unlikely to handle more than a couple-hundred-thousand events per month". This limitation forces growing companies into complex infrastructure decisions at relatively low usage volumes.

Teams exceeding these thresholds face two options: provision a multi-node ClickHouse cluster or migrate to PostHog Cloud. The first option requires significant technical expertise, as ClickHouse scaling involves complex manual processes that can severely impact query performance during data rebalancing. Organizations report that "ClickHouse doesn't automatically rebalance data in the cluster when we add new shards" and that the available rebalancing utilities have "limitations in terms of performance and usability".

The support implications compound this technical challenge. PostHog's open-source tier is community-supported, and the company warns that it offers no SLAs or guaranteed support. For enterprises requiring uptime guarantees, this creates a forced migration to paid tiers precisely when technical complexity peaks. Even ClickHouse Cloud, the commercial version of PostHog's underlying database, has scaling limitations: services can scale horizontally to a maximum of 20 replicas, and single replica services cannot be scaled for all tiers.

This creates a challenging dynamic where PostHog's most cost-sensitive users (those using open source) hit scaling walls just as its technical complexity increases. Organizations at this inflection point may opt for commercial alternatives with clearer enterprise support solutions rather than navigate complex self-hosting challenges.

Competition from Well-Funded Incumbents

PostHog faces formidable competition from incumbents with significantly superior capital resources and established enterprise relationships. The competitive landscape includes Pendo, Amplitude, Mixpanel, and FullStory. These competitors maintain multiples more capital than PostHog's $107.2 million total funding, providing substantial advantages in product development, sales, and market expansion.

These competitors are increasingly converging toward PostHog's all-in-one positioning. Amplitude has significantly expanded beyond core analytics, now offering Amplitude Experiment for A/B testing, feature flags, audiences for segmentation, and Customer Data Platform capabilities. The company has also added session replay capabilities and is positioning itself as "the all-in-one platform that gives you Analytics, user guides, Session Replay, Experimentation, and CDP", directly competing with PostHog's integrated approach.

Similarly, Mixpanel has expanded beyond its analytics roots, adding session replay functionality and new Marketing Analytics features designed as a comprehensive toolkit. Both competitors are leveraging their superior capital positions to build comprehensive platforms through R&D and acquisitions, potentially eroding PostHog's differentiation as the integrated alternative.

Regulatory Compliance Scaling Challenges

Processing billions of user events creates substantial privacy and compliance risks that scale disproportionately with PostHog's growth. The company must navigate an increasingly complex regulatory landscape, including GDPR, CCPA, HIPAA, and emerging privacy laws, while maintaining product development velocity. PostHog's team has directly acknowledged this challenge, stating, "SOC2 compliance was a big challenge for us with such a small team. There were only 30 team members at PostHog at that point".

As PostHog expands internationally and serves larger enterprises, it must simultaneously comply with multiple regulatory frameworks across different jurisdictions. Each new regulation requires legal review, technical implementation, process documentation, and ongoing monitoring - resources that divert attention from core product development.

The challenge is compounded by PostHog's data processing model. Unlike pure SaaS analytics tools that process data in standardized ways, PostHog's self-hosting options and flexible deployment models create complex compliance scenarios. Organizations in regulated industries like healthcare and finance require detailed auditing capabilities, data residency controls, and breach notification procedures that must be supported across multiple deployment configurations.

Additionally, emerging AI regulations add another layer of complexity. As PostHog integrates AI capabilities like Max AI, it must navigate evolving regulations around AI transparency, bias prevention, and algorithmic accountability. AI-focused compliance frameworks will become standard requirements rather than optional features.

The resource implications are significant: compliance teams, legal counsel, security audits, and certification processes all require substantial investment. For a company of PostHog's size competing against well-funded incumbents, these regulatory burdens could constrain growth capital and limit international expansion opportunities.

Summary

PostHog represents a contrarian bet in the product analytics market: that developers, not business users, should drive tool selection. By building an all-in-one platform with radical transparency and open-source roots, PostHog has captured the imagination of technical teams worldwide.

The company's metrics validate this approach. Growing from zero to $9.5 million ARR in four years, achieving 138% year-over-year growth, and capturing 54% of Y Combinator's latest batch demonstrates clear product-market fit. The recent $70 million Series D led by Stripe provides capital and strategic value to accelerate expansion.

PostHog's success hinges on a fundamental belief: that the future of business software will be chosen by developers, not executives. If it is right, PostHog could become the default analytics infrastructure for the next generation of technology companies. If it is wrong, they risk becoming another overcomplicated platform in an already crowded market.

PostHog must balance growth with focus, expansion with simplicity, and community with commercialization. Its ability to navigate these tensions while maintaining the trust of developers will determine whether PostHog becomes the defining analytics platform of the developer era or merely another well-funded also-ran.