Thesis

Venture capital is a large and growing industry. $694 billion was invested across global venture deals in 2021, and approximately $1.4 trillion was deployed in total between 2021 and 2023. That capital represents a lot of companies: for context, there were 54K venture-backed startups operating in the US alone at the end of 2023. But despite the size of the venture industry, cap table management in venture remains a clunky process. In an ideal world, founders would be able to reach agreements with investors, sign their term sheets, and then get back to building their companies. But that is, for many startups, wishful thinking, and signing a term sheet is just the first of many steps in managing a cap table.

Cap table management is complicated. If poorly executed it can prove expensive, considering that legal fees for reconciling conflicting versions of a company's cap table can exceed $20K. This complication stems from the moving parts inherent to venture funding, such as vesting schedules for different employees, changing share counts and liquidation preferences across multiple funding rounds, and secondary transactions. And yet, some of the world’s largest venture-backed private companies still have their lawyers issue paper securities and model their cap tables in Excel.

In 2019, Pulley was founded to address this problem. Pulley is an equity management solution that serves more than 5K companies as of October 2024, offering a comprehensive suite of products that includes fundraising modeling, 409As and compliance, and equity issuance. Pulley’s cap table management solution provides founders with a comprehensive view of their companies’ current equity structure, accounting for external investors and complex employee vesting schedules, and its scenario modeling tools allow founders to project potential cap table scenarios stemming from future fundraising rounds. Pulley has also expedited the employee onboarding process, providing detailed employee offer letters with integrated option grants, eliminating the need for third-party e-signature tools like DocuSign.

Founding Story

Pulley was founded in 2019 by Yin Wu (CEO) and Mark Erdmann (co-founder).

Prior to Pulley, Wu had founded three other startups, and her interest in technology dates back to her high school years in Louisville, Kentucky, when she started coding to help with science fair projects. After being named a finalist in the Intel Science Talent search, Wu headed to Stanford for college, where she served as a co-president of the Business Association of Stanford Entrepreneurs during her senior year.

While leading this group at Stanford, Wu helped organize YCombinator’s (YC) “Startup School,” developing relationships with the startup accelerator’s cofounders, Jessica Livingston and Paul Graham. One semester before graduating, she dropped out of Stanford after her first startup, AdRaid, a company that developed technology that made it easier for creators to superimpose ads in videos, was accepted into YC’s 2011 batch. Although AdRaid was a success within YC, raising $1 million one week after demo day, the company struggled to gain traction with advertisers and content creators, and Wu shut it down within a year.

In 2013, Wu launched her second startup, Prim. This was a same-day laundry delivery service, like DoorDash for laundry. However, Prim was eventually shut down in January 2014, and some of its technology was sold to a small private equity firm, because, according to Wu, “the market for upper-class people in the Bay Area willing to overpay for laundry rather than doing it themselves wound up being too small, and competition from mom-and-pop laundromats was too fierce.”

Between 2014 and 2015, Wu pivoted to her third startup, Echo, a customizable smart lock screen for Android users that functioned as a priority inbox for notifications. Echo was Wu’s biggest pre-Pulley success, garnering more than five million downloads. In September 2015, she sold the business to Microsoft for an undisclosed sum, where it now exists as Microsoft Launcher.

Post-acquisition, Wu spent two years at Microsoft. During that time, she reconnected with Erdmann, a CBRE software engineer who had worked at machine learning company CrowdFlower while Wu interned there in 2010, and the two decided to work together on a new project.

After a failed attempt to build a blockchain project for decentralized information during the 2018-2019 crypto bear market, they founded Pulley in 2019. With Pulley, Wu wanted to serve a customer base that she understood better than anyone: founders, saying:

“At the end of the day, it always comes back to who do you want to help? Who do you want to spend all of your time with, because there's no guarantee of success for any startup that you work on. You get energy from people that you're helping and working with, and that makes a pretty good day, and for me, it came back to founders.”

Source: Pulley

Product

Pulley offers seven core services: cap table management, fundraising modeling, 409A valuations, SAFEs, employee experience, communications hub, and liquidity.

Cap Table Management

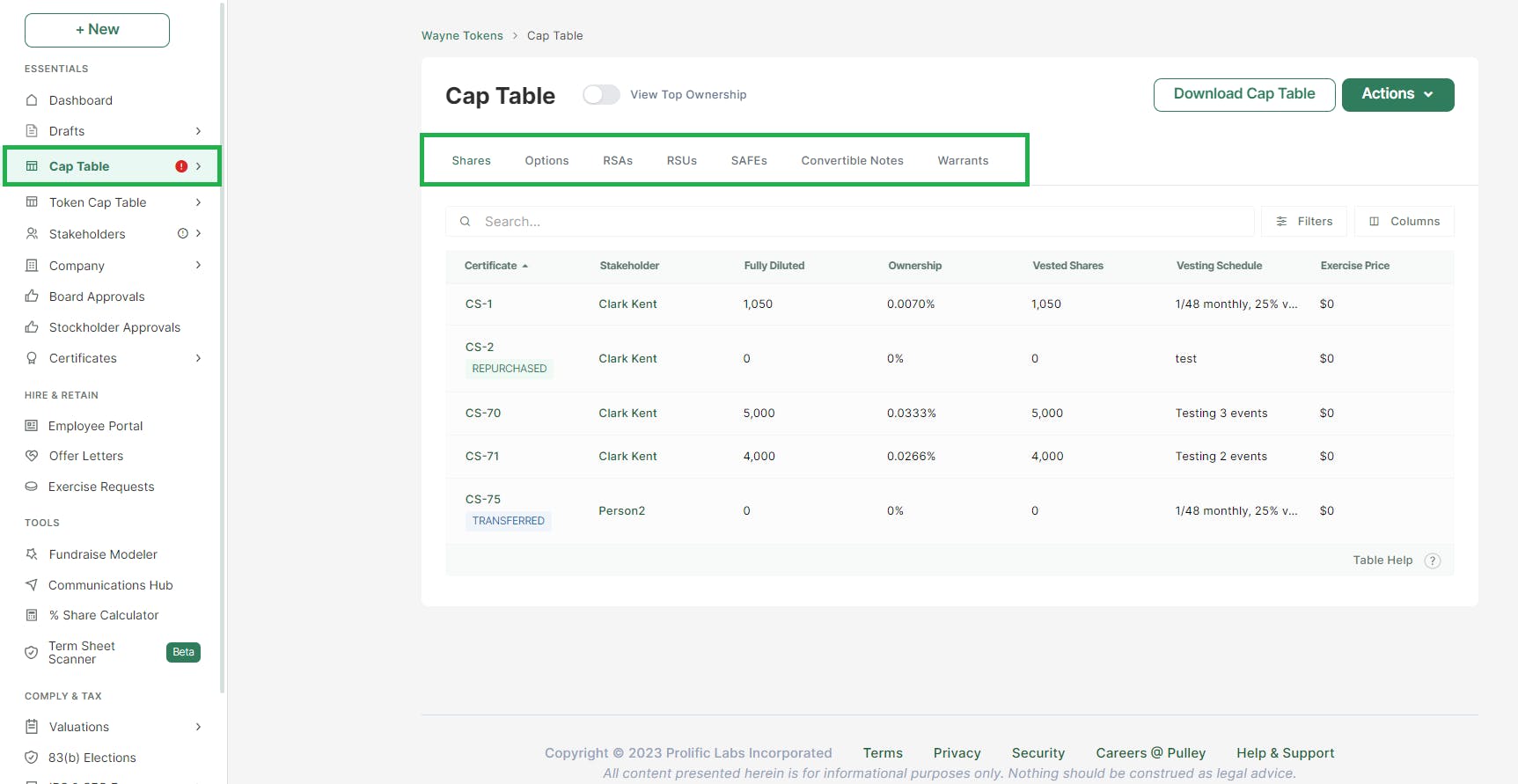

Pulley’s cap table management solution integrates existing securities and issues new securities, and legal documentation for new securities issuances can be completed on-platform. Once all securities have been accounted for, Pulley’s cap table dashboard provides a full breakdown of a customer’s equity structure.

Users can then open the cap table for review and filter by security type, such as shares, options, or convertible notes. Customers can also exercise and cancel options, reprice option grants, and reclassify shares from the cap table dashboard.

Source: Pulley

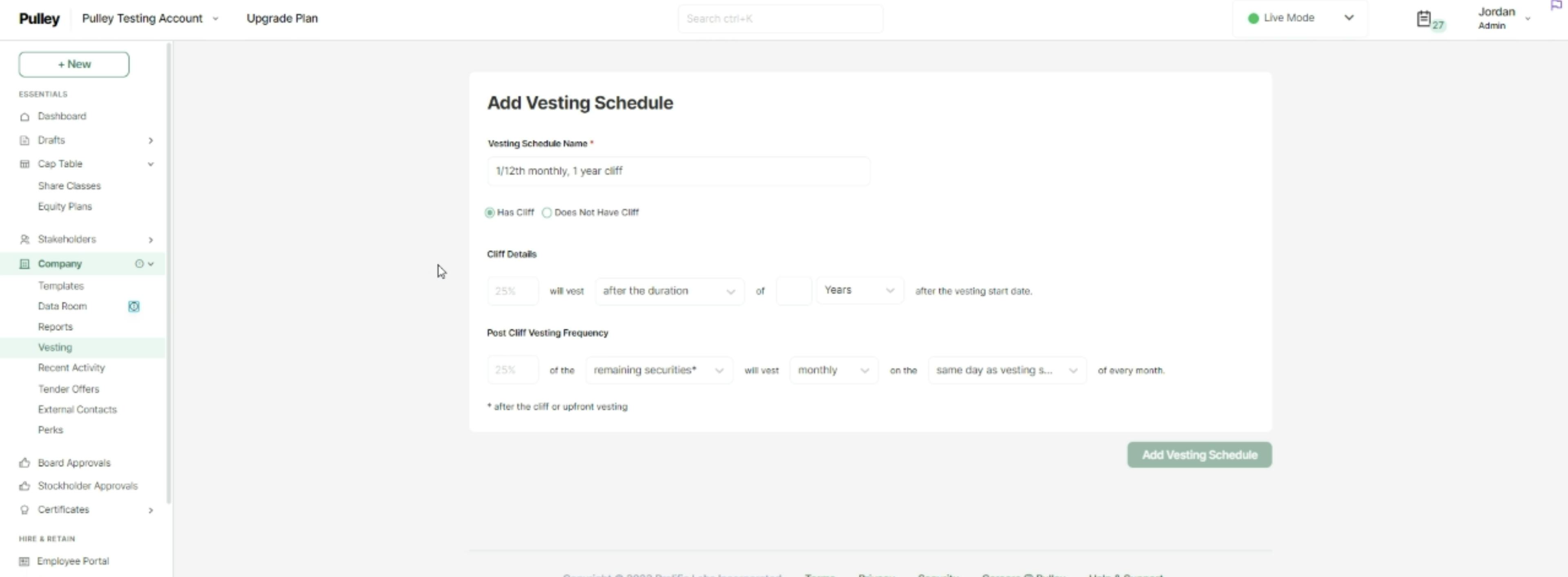

Pulley also offers customers custom vesting schedules for issued securities. Under the vesting tab on the cap table dashboard, users can add new vesting schedules, customize whether the schedules will have a vesting cliff, and set the frequency of vesting after the cliff period. Users can also create milestone vesting events, in which shares are granted upon to completion of company-specific goals.

Source: Pulley

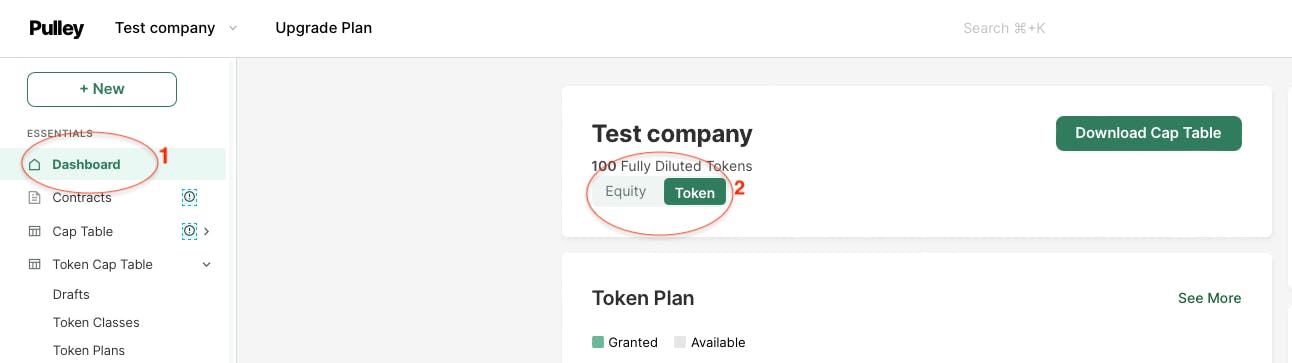

Pulley supports cryptocurrency tokens as well as traditional equity. Users can record and distribute ERC-20 tokens and ETH tokens on the platform, while Polygon and Solana are recording only. If a user has a token cap table already set up, a toggle between breakdowns for Equity or Tokens will be shown.

Source: Pulley

Pulley’s cap table management platform also offers the following tools:

Data Rooms: Pulley provides an on-platform data room that serves as a repository for all documents associated with a company’s cap table.

Sandbox: Pulley offers a sandbox test environment that replicates the current live cap table, allowing users to test and simulate possible equity transactions.

Shares Calculator: While standard equity compensation practices involve granting equity based on the percentage of fully diluted shares, percentages cannot be included in offer letters because the total number of shares at a company changes over time. To address this, Pulley provides a % Shares Calculator to simplify converting between percentages and the number of shares.

83(b) Elections: Pulley can generate pre-filled 83(b)s for stakeholders to sign, which can then be mailed to the IRS.

Stock Certificates: Companies can design and manage physical stock certificates within Pulley.

Fundraising Modeling

Spreadsheets used for modeling fundraises can be error prone, as they risk failing to account for variables like pro-ratas and option pool increases. Pulley’s fundraising modeler is synced to its cap table dashboard, and it supports discounts, pro-ratas, SAFEs, option pool refreshes, and more, allowing users to model complex fundraising scenarios with ease, and these models can then be exported and distributed to company executives and legal teams as needed.

Pully also provides detailed pro-formas for future funding rounds, so companies can see how employee and investor equity stakes will be impacted going forward, and it supports distribution waterfalls for private equity customers as well. As of October 2024, a few drawbacks of Pulley’s modeler are that it does not support simulating multiple fundraising rounds, isolating and analyzing investors' positions post-fundraising, or managing multiple active equity plans, and it does not account for phantom shares, double-trigger acceleration of options or RSUs, repurchase of RSAs, management carve-outs, participating preferred shares, or currency conversions for non-US currencies.

409A Valuations

For privately held companies, the only way to grant options on a tax-free basis is through a 409A valuation. Pulley offers customers an audit-ready 409A valuation in just a few business days, ensuring that they remain compliant with IRS rules.

SAFEs

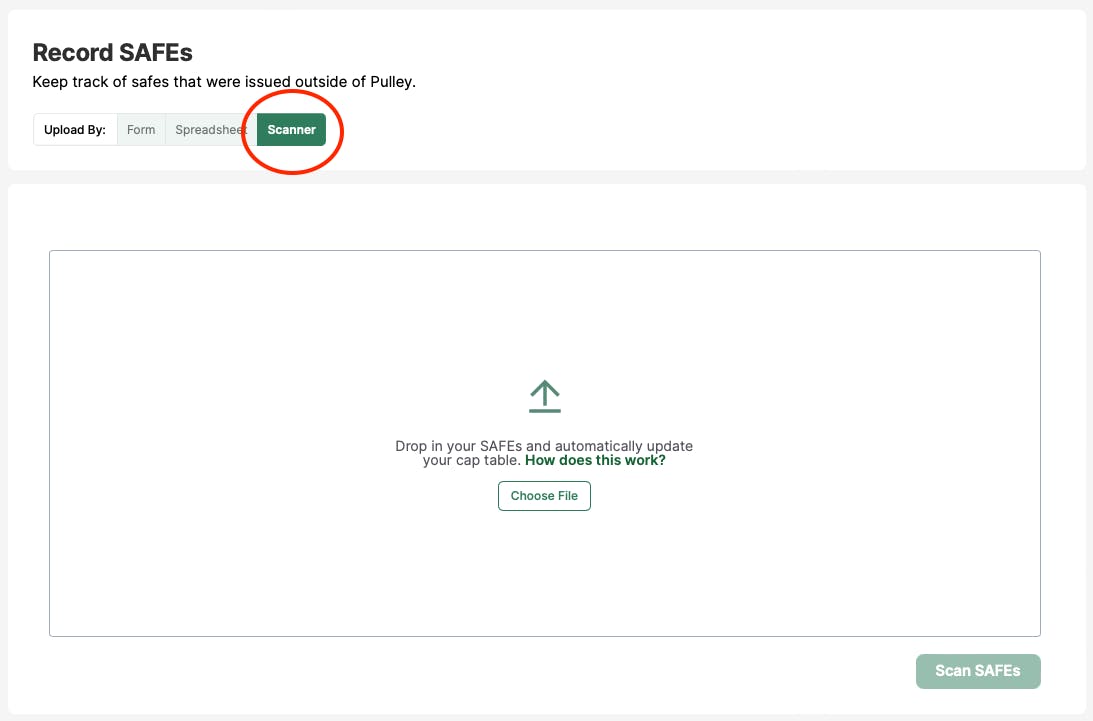

SAFEs, or Simple Agreements for Future Equity, are a form of non-debt, convertible financing that was created by Y Combinator in 2013 as a simplified way to invest in early-stage, pre-revenue startups, and Pulley allows customers to upload their SAFEs on-platform as well.

Source: Pulley

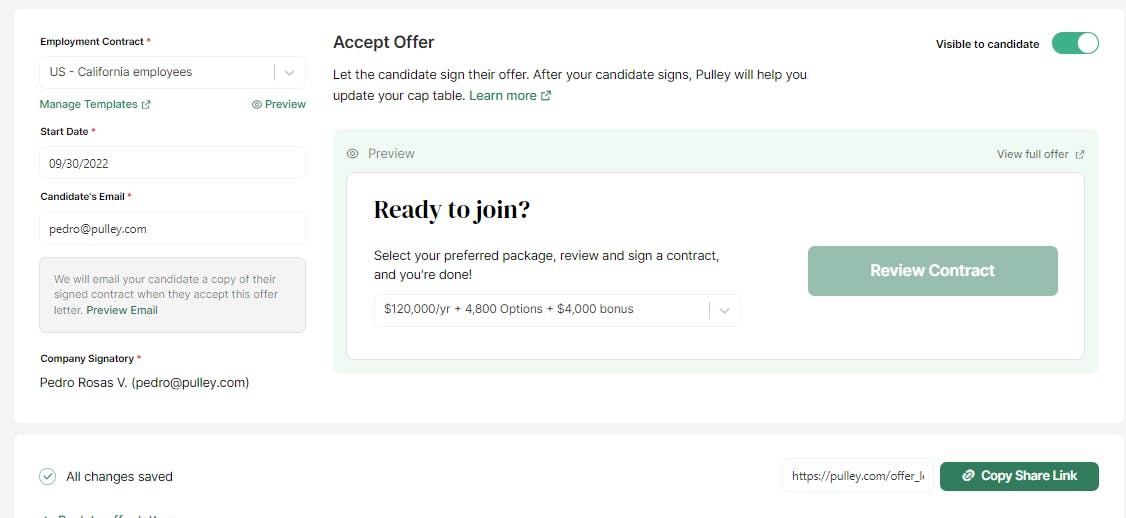

Employee Experience

Pulley streamlines the hiring process by combining employees’ option grants with their offer letters, and these grants flow through to the company’s cap table in real time. Pulley's offer letters also clearly outline what an employee’s equity will be worth under different growth scenarios, ensuring that employees have a clear understanding of their equity compensation. Employers can also present multiple compensation packages with varying equity and salary offers, allowing employees to choose their preferred packages.

Source: Pulley

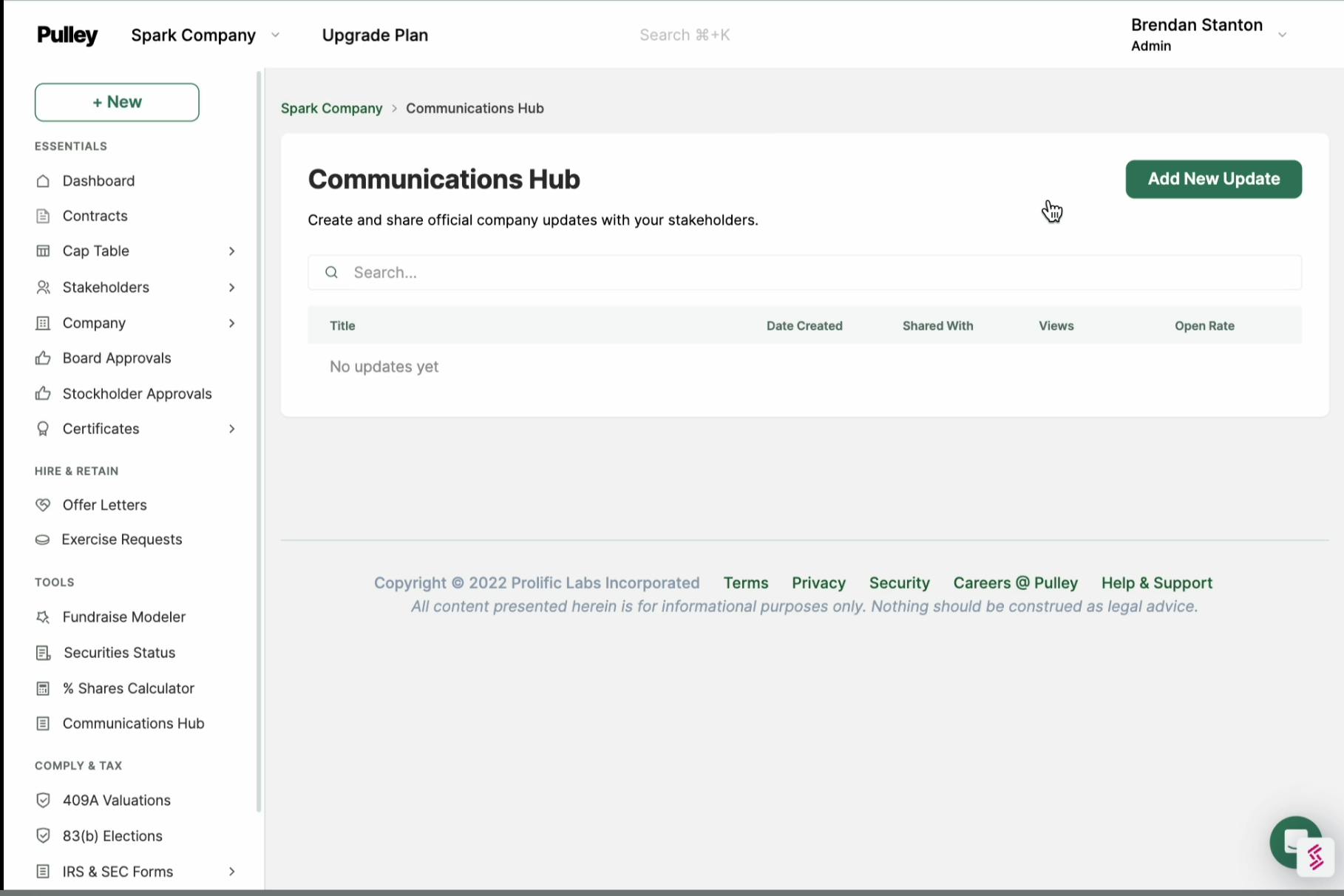

Communications Hub

Pulley also enables its customers to generate specific stakeholder updates for investors, employees, and advisors in its Communications Hub.

Source: Pulley

Liquidity Programs

Pulley has partnered with Nasdaq Private Market to help customers create company-controlled secondary liquidity programs that give them more flexibility in employee compensation and allow investors to invest for the first time, increase their holdings, or exit their positions if they are no longer aligned with the company’s trajectory.

Market

Customer

Startups

Pulley serves startups, cryptocurrency projects, LLCs, law firms, and private equity firms, but its primary customer group is startups, and its core product offering (cap table management, fundraising modeling, 409A valuations, and SAFEs) streamlines equity management for startup founders. Pulley works with startups of all sizes. As of February 2024, Pulley worked with 70% of recent YCombinator graduates, a cohort that is primarily pre-revenue, and the company offers specialized pricing packages for companies with more than 40 stakeholders.

Investing Groups

Pulley also offers portfolio tracking, distribution waterfalls, employee portfolios, and broad-based ownership programs for private equity firms. While these solutions are useful for true late-stage private equity firms, they are especially valuable for early-stage venture funds, and startup accelerators YCombinator and Techstars are both Pulley customers.

Market Size

The global equity management software market was worth $518 million in 2022, and that figure is expected to grow at a CAGR of 14.3% through 2032 to reach $1.9 billion. Tise growth is being fueled by the increasing adoption of equity-based compensation schemes and annual venture capital investments exceeding hundreds of billions of dollars per year across different startups.

The global portfolio management software market, which includes equity management solutions for venture and private equity funds, is even larger, valued at $3.2 billion in 2022, and it’s projected to grow at a 14.2% CAGR through 2032 to reach $11.8 billion.

Competition

Carta: Carta is one of the largest equity management platforms providing cap table solutions, serving 40K companies that represent 2.4 million equity holders as of October 2024. Founded in 2012, the company reached $370 million ARR in January 2024, with cap table solutions and fund administration representing $250 million and $100 million in revenue, respectively. In August 2021, Carta raised a $500 million Series G at a $7.4 billion post-money valuation, and the company’s total funding through October 2024 is $1.2 billion across 13 rounds. However, Carta’s valuation has since sharply declined, with the company working on a secondary sale that would value it at $2 billion in June 2024.

Carta’s valuation decline has coincided with multiple PR crises over the last year as well. In October 2023, The San Francisco Standard published a story on two lawsuits from former female employees, one alleging sexual harassment and one alleging she was fired for requesting remote work accommodations for chronic migraines.

Three months later, in January 2024, Carta suffered a major credibility hit after Karri Saarinen, the CEO of Linear, tweeted a screenshot of an email showing that Carta was reaching out to a Linear angel investor to see if they wanted to sell their shares on Carta’s secondary marketplace, as part of Carta’s push to build a “private stock market for companies.” Saarinen later noted that at least three of his angel investors received the same email, and another angel investor said one of his portfolio companies had the same complaint. On January 8, 2024, three days after Saarinen’s tweet, Carta’s CEO Henry Ward announced that the company would discontinue its secondary trading business.

Shareworks: Morgan Stanley’s Shareworks is an equity management platform designed to help companies manage their cap tables and employee stock plans. Shareworks was founded in 1999 and acquired by Morgan Stanley in 2020 for $1.1 billion. Unlike Carta, which has a large startup customer overlap with Pulley, Shareworks’ product suite is catered to larger, global companies, as it offers tools for global due diligence and supports multiple currencies and languages.

AngelList: AngelList is a multifaceted platform that serves fund managers, individual investors, and startups. Founded in 2010, AngelList had more than $124 billion in assets on the platform in October 2024, representing over 85K investors, 23K funds and syndicates, and 12K active startups. In March 2022, the company raised a $100 million Series B at a $4 billion valuation, and it has raised a total of $170.2 million through 8 funding rounds. While AngelList does offer cap table management, its core products are its fund management solutions.

Astrella by EQ: Astrella was developed by AST Private Solutions in 2019 and it provides equity management services, including cap table management and equity compensation plans, to private companies across the globe. Unlike Pulley, which is concentrated on U.S.-based startups, Astrella has a global presence, with sales offices in Dublin and Tel Aviv.

Capbase by Deel: Capbase, which is a product of Deel, is a platform that helps startup founders more quickly launch and scale their companies. Founded in 2018, Capbase had raised a total of $6 million in venture funding before it was acquired by Deel for an undisclosed sum in January 2023. While Capbase does offer cap table management, its focus is helping founders incorporate and start their businesses. Capbase’s solutions include three-day incorporation, board of advisors construction, and hiring and onboarding assistance.

Business Model

Source: Pulley

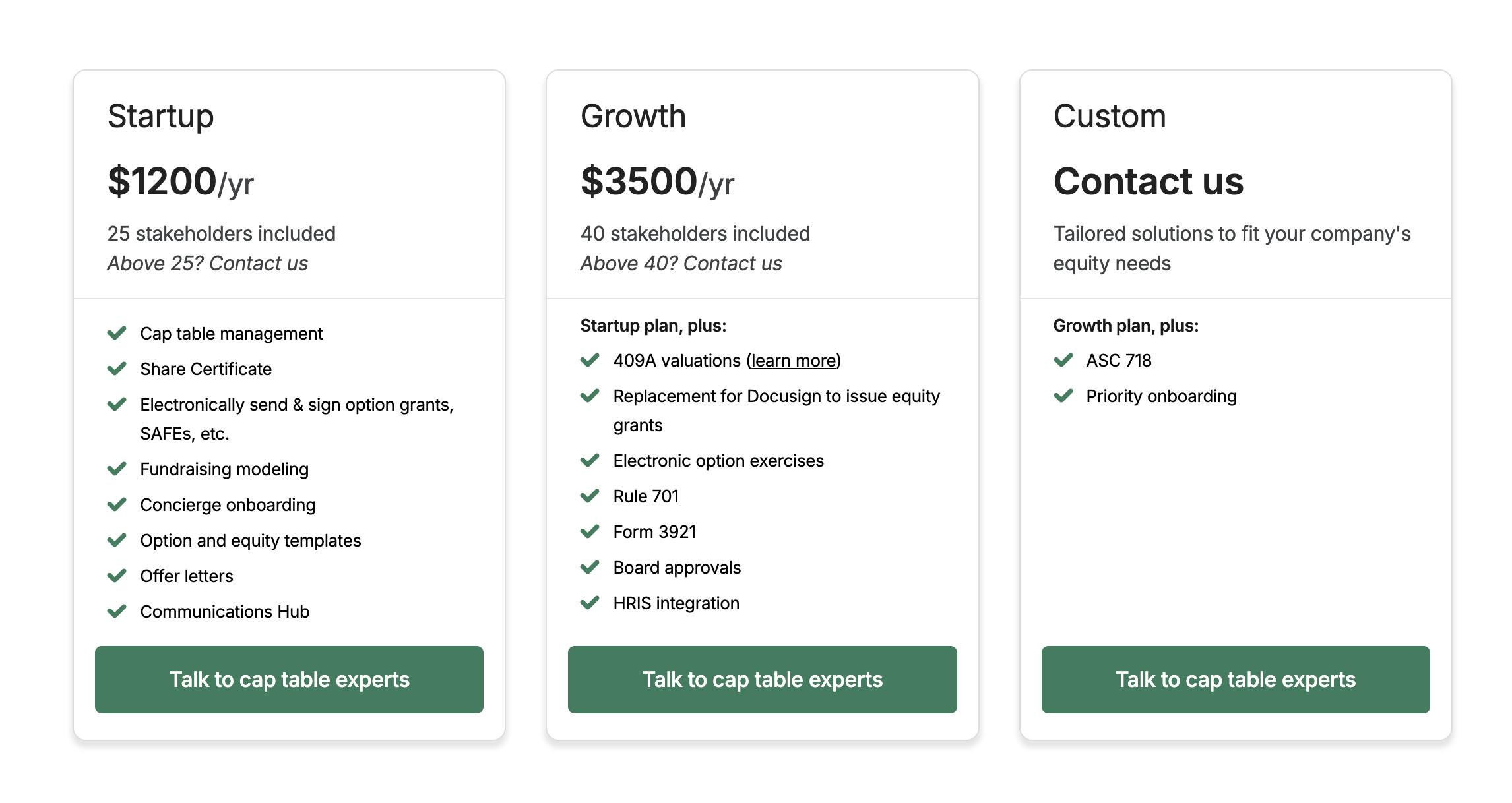

Pulley offers a straightforward, three-tier subscription model, and its prices are based on the size of the customer.

Startup ($1.2K/year): Pulley’s Startup plan is for smaller companies with up to 25 stakeholders. Pulley’s cheapest tier, the Startup plan offers cap table management, share certificate generation, electronic sending and signing of option grants and SAFEs, fundraising modeling, concierge onboarding, option and equity templates, offer letters, and a communications hub.

Growth ($3.5K/year): The Growth plan, which is available to customers with up to 40 stakeholders, includes all features of the Startup plan, as well as 409A valuations, a replacement for DocuSign to issue equity grants, electronic option exercises, Rule 701, Form 3921, board approvals, and HRIS integrations with companies like Gusto and Bamboo.

Custom: The Custom plan offers tailored solutions to fit a company's specific equity needs. This includes all features from Growth, as well as ASC 718 compliance and priority onboarding.

In January and May 2024, Pulley also offered to discount the cost of Pulley by the remaining balance on companies’ existing cap table contracts for those who wanted to switch platforms.

Traction

As of October 2024, Pulley has more than 5K customers, and as of February 2024, the company expected to triple its revenue from 2023, bringing in “tens of millions of dollars in 2024.” One tailwind that has benefited Pulley was widespread customer dissatisfaction with one of its competitors, Carta, in January 2024.

In January, Karri Saarinen, the CEO of Linear, expressed his distrust of Carta after he found out the company was doing cold outreach to Linear angel investors to see if they wanted to sell their shares on Carta’s secondary marketplace without Linear’s consent. Further down his thread, Saarinen noted that at least three of his angel investors received the same email, and another angel investor said one of his portfolio companies had the same complaint.

On January 8, 2024, three days after Saarinen’s tweet, Carta discontinued its secondaries marketplace in an attempt to restore trust, but many of its customers decided to move on. Wu promised that those who switched over to Pulley by the end of January would be given discounted fees to cover the cost of existing cap table contracts, leading to a surge in interest for Pulley, with demo requests increasing eightfold compared to the month prior. By February, Pulley had added approximately 400 new customers, bringing the customer base to 4.6K, up from 2.2K at the beginning of 2023. Forbes noticed Pulley’s momentum, and the media company included the cap table management provider in its Forbes Fintech 50 list in 2024.

Pulley has also maintained strong ties with its startup accelerator, YCombinator, and as of February 2024, more than 70% of recent YCombinator graduates are Pulley customers.

Valuation

In July 2022, Pulley raised a $40 million Series B led by Founders Fund, with participation from existing investors such as Stripe and Elad Gil, at a $250 million valuation. This followed the company’s $10 million Series A in October 2020, which was led by Stripe and included Caffeinated Capital, General Catalyst, 8VC, and many angel investors, as well as Pulley’s $125K seed round led by YC in March 2020.

Key Opportunities

International Expansion

As emerging capital markets, such as Asia, continue to mature, there will be a growing need for equity management software internationally. Pulley, which supports local currencies and regulations in 80 countries as of October 2024, has the opportunity to build a foundation abroad. While venture funding in Asia has declined significantly from its 2021 peak, investors still deployed $18.1 billion in the region in Q4 2023, which represented 24% of total global venture dollars.

Expanded Incubator Partnerships

One of Pulley’s biggest advantages is its high adoption rate among YCombinator graduates, where it held a 70% market share as of February 2024. Company tech stacks are sticky, and Pulley has proven that onboarding early-stage startups as they graduate from their respective accelerators is an excellent customer acquisition strategy. Pulley has the opportunity to replicate its success with YCombinator companies by building relationships with other incubators, such as TechStars and AngelPad.

Carta’s Damaged Reputation

While Carta is still much larger than Pulley, the company’s credibility with both its customers and the general public has suffered as a result of its recent lawsuits and secondary trading PR debacle, opening the door for a competitor to take some of those customers. Pulley has already directly benefited from Carta’s missteps, gaining about 400 new customers in February 2024, and the company could continue to build on that momentum going forward.

Key Risks

Competitive Landscape

Competition is fierce in the equity management space, as there are a finite number of startups in need of cap table management in any given year. Despite its recent issues, Carta still controls a much larger market share than Pulley, with eight times as many customers (40K vs. 5K), and Carta’s free cap table solution for early-stage companies is more affordable than Pulley’s lowest cost solution of $1.2K per year. While Pulley does service LLCs, private equity funds, and law firms, its primary customer segment is still startup founders, and despite Carta’s secondary sales-related PR mishap, the latter is still a much larger competitor.

Volatile Customer Base

Venture capital might be a large asset class, but startups are small companies with high failure rates, and that combination makes for a tough customer base. While all SaaS companies have to manage churn, Pulley also has to account for a volatile startup life cycle that will cause it to lose customers over time as startups fail. It’s crucial for Pulley to acquire new customers quickly to compensate for declining revenues due to customers shutting down.

Additionally, because startups tend to be small, the revenue potential of most of Pulley’s customers is limited. While big tech companies like Microsoft and Google could afford to spend millions of dollars on SaaS and fintech solutions, 25-person startups can’t, so Pulley has to grow and maintain a large customer base to meaningfully increase its revenue.

Summary

After founding three other companies, Yin Wu partnered with Mark Erdmann to launch Pulley in 2019. Pulley has since become a leading equity management platform that serves over 5K companies, and it is on pace to make “tens of millions of dollars” in 2024.

Pulley has a startup-focused product suite that provides cap table management, 409A valuations, fundraising modeling, and SAFEs, and unlike some of its competitors, electronic signatures can be completed on platform, with no need for third-party tools like DocuSign.

While Pulley has benefited from strategic missteps from one of its largest competitors, Carta, it is still fighting an uphill battle to continue growing its market share in a fierce environment full of competition. While international markets provide a long-term expansion opportunity, Pulley will need to both take market share from Carta and defend itself against other competitors to maintain its growth trajectory.