Thesis

The workforce has undergone significant evolution in recent decades as it becomes more and more decoupled with geography. In the past, employers would be constrained to only hire people from their local area. However, with developments like the rise of remote work, it is now increasingly possible for businesses to recruit the best people they can find irrespective of location. Remote work presents novel benefits in that employers are able to hire the best talent and workers can earn more without moving to high cost-of-living geographies and or sacrificing time in a long daily commute.

The COVID-19 pandemic accelerated this shift from concentrated to distributed work. However, paying a global workforce is complex and time-consuming. It involves navigating a complex web of regional and national labor and payroll regulations, and the penalty for getting it wrong can be costly. Companies dealing with this currently have suboptimal and expensive options: they can either open a foreign subsidiary, or hire a professional employment organization (a local firm that employs employees for them and charges 15% of payroll). As a result, in 2022, 75% of employers reported difficulty finding the talent they needed, up from 54% in 2019.

Deel is an all-in-one HR platform for global teams. It helps companies simplify the management of an international workforce, from culture and onboarding to payroll and compliance. Deel helps companies hire independent contractors and full-time employees in more than 150 countries based on local laws specific to every country and worker, from contracts and onboarding to holidays, terminations, benefits, and more.

Founding Story

Deel was founded in 2019 by Alex Bouaziz and Shuo Wang, who met while studying at MIT where Bouaziz was studying civil and environmental engineering while Shuo was studying mechanical engineering. Bouaziz was born and raised in France. and Shuo was born and raised in Beijing. Both started their own companies before confounding Deel together. Shuo’s first startup was an air purifier business. Bouaziz cofounded Israel-based Lifeslice, a mobile app to create videos with friends.

Both got to know talented people all over the world through their travel and work and wanted to recruit them remotely for their respective startups. In the process, they realized how complicated and expensive it was to recruit people internationally. This was where the idea for Deel came from; the two co-founders wanted to solve the problem of expensive, inefficient global hiring.

Shortly after its founding, Deel was accepted into Y Combinator in 2019. Its initial product only allowed companies to hire contractors but the team continued to expand Deel’s offering to areas including Employer on Record (EOR), payroll, and HRIS. This product expansion was the result of the growth of Deel’s initial customers, many of whom were themselves YC companies, that grew to have more sophisticated HR needs. By May 2020, as countries were locking down during the COVID-19 pandemic and workers went remote, employers realized they were no longer constrained by physical location in how they hired, and Deel was able to capitalize on the moment, raising $14 million in funding.

Product

Hire Anywhere

Source: Deel

Deel’s Hire Anywhere product streamlines the process of hiring and managing people (contractors and EOR employees) globally and allows businesses to automate onboarding, compliance, invoicing, health benefits, and payments. For EOR employees, Deel has legal entities in 100+ countries and expert visa support to hire employees anywhere on behalf of their customers.

Deel collects all tax and permit documents, generates W9s and 1099s, creates and sends contracts, and maintains an audit trail. The Deel platform also makes it easy to create invoices and make payments globally. It offers one place for all contracts, expenses, and benefits and offers a centralized view of the team. It lets companies pay everyone with one bulk payment and manages tax deductions, pensions, benefits, and government fees. It also simplifies termination by automatically calculating the final payment per the termination date, country labor law, time off used, and more.

Manage Your Team

Source: Deel

In addition to empowering companies to hire globally, Deel has entered a broader segment of the HR market, helping its customers handle domestic payroll and other HR needs. Deel HR enables customers to manage its workforce — from direct employees to international contractors across onboarding, off-boarding, time-offs, workflows, expenses, people directory, org charts, compliance, security, and reporting.

In addition, with Deel Equipment, companies can ship and manage laptops, monitors, and headphones their workforce needs to work from home in a few clicks.

Source: Deel

The Deel platform also allows employers to offer coworking spaces and other perks to employees, as well run background checks on candidates using Deel.

Source: Deel

Deel's platform enables integrations with other platforms such as Intuit Quickbooks, Xero, and NetSuite to help streamline workflows. Integrations allow Deel to automatically sync with accounting software on things like contractor invoices and payment details, allowing users to avoid manual entry, saving time and preventing errors.

Source: Deel

Pay Globally

Deel enables companies to run payroll in 90+ countries with one platform that streamlines international operations and eliminates the ongoing admin of local compliance, taxes, benefits, and more. It unifies contractor payments, employer of record services, and payroll management.

Market

Customer

Deel’s customer profile includes any company that wants to hire and pay workers globally. As of 2023 Deel said it has over 15K customers, including Shopify, Airtable, Dropbox, Intercom, Nike, Subway, Reebok, and Forever21. It works with companies of all sizes across technology, gaming, marketing, logistics, consumer goods, manufacturing, insurance, etc.

Market Size

The global payroll software market revenue is expected to reach $46.6 billion in 2028. The global employer of record market is projected to reach $6.8 billion by 2028, from $4.2B in 2021. As Deel continues to expand its product suite into other HR services, its addressable market is expanding. The global human resource technology market is projected to grow to $39.9 billion by 2029.

Competition

Remote - Remote offers international payroll, benefits, and compliance services for employees and contractors. It was founded in 2017 and raised $496 million in funding. It raised $300 million in its series C round led by SoftBank Vision Fund 2, with previous investors Accel, Sequoia, Index Ventures, Two Sigma Ventures, and General Catalyst participating. It was last valued at over $3 billion. Remote’s customers range from small startups to large enterprises, including GitLab and DoorDash*. Product functionality includes payroll, benefits, taxes, and local compliance for contractors and full-time employees. In its effort to establish global infrastructure, Remote has opted to build out its own entities, which provides its customers with more control compared to an outsourced partnership model that competitors like Papaya use.

Papaya Global - Papaya Global is an HR and payroll platform for global workforce management. It was founded in 2016 and has raised $444 million in funding. It raised $250 million in Series D, led by Insight Partners and joined by Tiger Global, with participation from existing investors Greenoaks Capital, IVP, Scale Venture Partners, and Bessemer Venture Partners. It adopted a different approach than Remote in building its global infrastructure, opting to work with partners instead of establishing its entities. In contrast, Deel has taken a hybrid approach, leveraging partners in certain markets and building out its own entities in others.

Rippling - Rippling is a human resource management company that offers an all-in-one platform to help manage HR and IT operations. It was founded in 2016 and has raised $697 million in funding. It raised $250M in a Series D round co-led by Bedrock and Kleiner Perkins, with participation from existing investors Y Combinator, Sequoia Capital, and more. That round valued the company at $11.25 billion. Rippling has built a platform where employee data is at the center of HR, IT, and Finance products. Rippling Global, Rippling’s global hiring solution, was launched in October 2022 and offers Rippling customers the ability to hire, pay and manage a workforce across the world.

Gusto - Gusto provides payroll, benefits, human resources, and integration services for small- and medium-sized businesses in the United States. It was founded in 2011 and has raised $746 million in funding. It raised $175 million in an extension to its 2021 Series E funding round. It competes with Deel’s recently announced US Payroll offering, an expansion of Deel’s global payroll offering with its first in-house payroll engine, starting in the US.

Before the emergence of new players such as Deel and Remote, companies such as Globalization Partners and Velocity Global were helping companies hire employees globally through an Employer of Record (EOR) model, acting on behalf of clients as the legal employer with all core responsibilities. These traditional EOR companies usually target larger enterprises, offering more opaque pricing models with 15% or more markups on top of employee salaries and other hidden fees such as setup, onboarding, and offboarding costs. As Deel expands into the broader HR market with new products to manage domestic payroll and other HR services, it will compete with public incumbents such as ADP ($93 billion market cap as of February 2023) and Workday ($49 billion market cap as of February 2023).

Business Model

Source: Deel

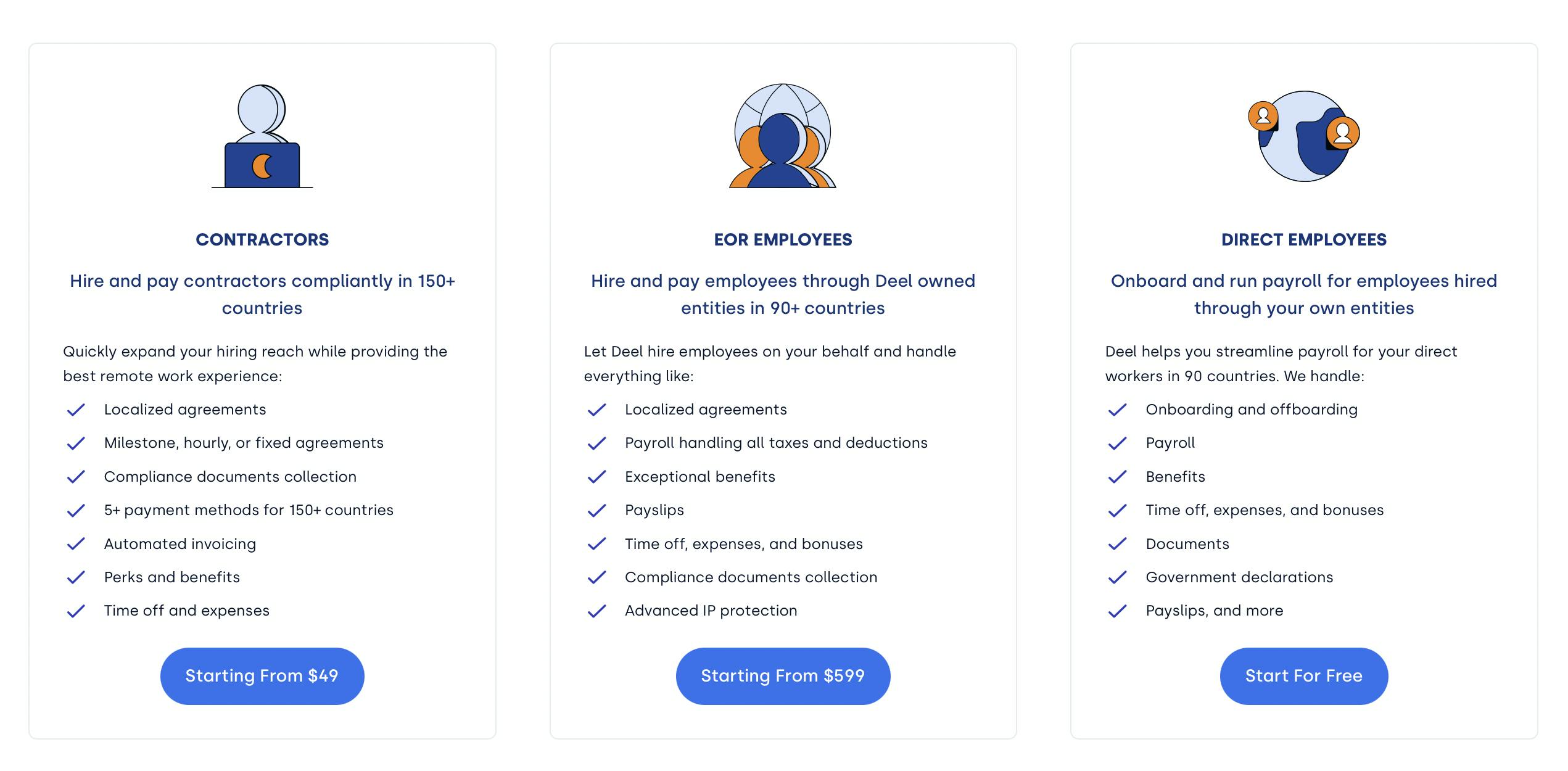

Deel charges its customers directly based on the number of active contracts per month and does not charge contractors or employees. For independent contractors, Deel charges its customers $49 per active contract per month. For full-time employees hired through an EOR model, Deel charges its customers $599 per active contract per month. For direct employees guard through customers’ entities, Deel is free. Deel HR is also free for companies of up to 200 people as of early 2023.

Traction

In 2021, Deel had $4 million in ARR. It saw significant growth in the ensuing two years and hit $295 million in ARR as of January 2023. From April to October 2021, Deel said its global customer base jumped from 1.8K to over 4.5K customers, and in 2023 services over 15K customers including Nike, Subway, Dropbox, Cloudflare, and Shopify. The Deel platform has been used to pay over $5 billion in salaries to hundreds of thousands of workers.

Valuation

Deel raised a $50 million funding round at $12 billion valuation in 2022 after having been valued at $5.5 billion in its $425 million Series D raised in October 2021. New investors in the latest round include Laurene Powell Jobs' Emerson Collective, while existing backers include Andreessen Horowitz, Spark Capital, and Y Combinator.

Previously, in April 2021, the company had raised a $156 million Series C led by the YC Continuity Fund and existing backers Andreessen Horowitz and Spark Capital. Uber CEO Dara Khosrowshahi, Jeffrey Katzenberg, Jeff Wilke, and Anthony Schiller also participated in the round.

At the end of 2022, Deel had reached $295 million in annual recurring revenue (ARR), indicating a ~40X revenue multiple. In comparison, ADP, the leader in the HR software market, was valued at ~$100 billion in December 2022. The company generated ~$16.5 billion in revenue during 2022 while growing revenue at ~10% YoY, representing a ~6.5x revenue multiple. ADP also generated a cash flow of $2.9 billion in 2022.

Deel has been EBITDA positive since September 2022 and has gross margins of 85%, which would put it in the top 15 percent of all public SaaS companies. According to Meritech Capital’s SaaS tracker, only 12 public software companies had LTM gross margins of 85% higher, including Adobe, Atlassian, and Bill.com.

Key Opportunities

Product Expansion

As Deel continues to expand its product suite beyond global payroll and into HR services, it will be tapping into the global human resource technology market, projected to grow to $39.90 billion by 2029. Its payroll-centric SaaS business model enables it to offer a lot of HR tools for free and compete with HR vendors with a bundled offering. As the economic tailwinds force companies to consolidate vendors, Deel is well-positioned to capture HR budgets by solving a wide range of problems for its customers. Deel has made acquisitions to strengthen its product suite, including acquiring Playgroup (payroll and HCM) and Capbase (equip management) in the past 12 months.

Key Risks

Competition

Deel’s global payroll and HR products compete aggressively with lots of players, ranging from specialist vendors to bundled offerings and from startups to public incumbents. Payroll is a sticky offering that companies tend not to switch out of once the entire workforce has been onboarded. That increases the importance of having a predictable and reliable go-to-market motion across market segments.

Summary

Deel unlocked global hiring for the mass market by building a technology platform that married HR tech and fintech, enabling customers to easily hire, manage, and pay contractors and employees worldwide. Deel not only became one of the fastest-growing SaaS companies (reaching $100 million ARR in only 20 months) but also became a highly-valued private HR tech company. As Deel continues to grow, it has begun to expand into the broader HR market with its own HRIS and payroll solution. However, peers such as Rippling have not been idle and have made forays into challenging Deel in the global hiring market. As the HR software market consolidates, the biggest question will be how successfully Deel will be able to win in the other HR segments.

*Contrary is an investor in DoorDash through one or more affiliates.