Thesis

Since India became an independent nation in 1947, there have been significant changes in how Indians think about investing. Conservative preferences for investing in physical assets, fixed-income instruments, and real estate have given way to bolder investment strategies. That change was supported by the establishment of the first mutual fund Unit Trust of India (UTI) in 1963. Despite occasional crashes in the domestic market, along with the broader international market, the appetite for broader investing strategies in India has increased, bolstered by economic reforms and the inception of the regulatory body Securities and Exchange Board of India (SEBI) in 1992.

From 2012 to 2022, internet penetration in India grew from ~12% to nearly 50%. Some estimates indicate India will have 900 million internet users by 2025. Expanded internet access and increased financial literacy have increased the need to incentivize people to invest in financial instruments like mutual funds and stocks. As a result, India saw an increase in “wealth tech,” a subset of "fintech", focusing on personal finance and wealth management. These startups attempt to differentiate themselves from similar services provided by incumbent banks.

Founded in 2016, Groww is a financial services platform that enables its customers to invest in mutual funds, trade in domestic and US stocks, build systematic investment plans and track their investments more easily. The company aims to “make financial services accessible to every Indian through a multi-product platform”.

Founding Story

Groww was founded in 2016 by four co-workers from Flipkart: Lalit Keshre (CEO), Harsh Jain (COO), Neeraj Singh (CTO), and Ishan Bansal. Motivated by the focus on democratizing investing and making it accessible to the Indian population, the four co-founders left their jobs to build a product, beginning as a mutual fund platform.

Keshre, an Indian Institute of Technology Bombay alumnus, first learned about stocks from one of his friends in college, eventually reading books to learn about investing. He launched his first start-up Eduflix, an ed-tech company in 2011, but this eventually shut down when it wasn’t able to scale fast enough.

While working at Flipkart, Keshre and his other co-founders witnessed how technology and customer-centricity disrupted the ecommerce industry, and realized that a similar user experience was missing from the financial services industry. Only ~20 million Indians held a share in mutual funds from 2016 to 2018, despite 60% of household savings in India being held in financial assets (including mutual funds, insurance, cash, direct equity, etc.). As a result, the founders believed there was an opportunity to make the process of purchasing financial products easier and more transparent.

The founders initially launched an app focused on robo-advising in 2016, which struggled to find product-market fit. Six months later, in May 2017, the company launched Groww as a direct mutual fund distribution platform, offered as a web platform. While initially targeting 100 customers in the product’s first month, the team managed to attract 600 customers. The Groww app was subsequently launched in December 2017 and continued to add other capital market offerings such as stocks, futures & options (F&O), and initial public offerings (IPOs).

Even before the product was officially launched, the founders started creating courses and videos to educate potential users about personal finance and trading. Keshre has said a key defining characteristic of the company has been “customer obsession”. Between 2016 when the company was launched and 2023, Groww grew to over 1K employees.

Product

Groww is a web and app-based investment platform, that allows users to invest in a number of investment products including stocks, mutual funds, futures, options, and intraday trading. As of November 2023, Groww also offers instant loans to eligible customers. In addition to investment and credit services, the company also offers financial education programs in the form of blogs, articles, and videos.

Investment Products

A user can access Groww through the official website or by downloading the app. To start investing, the customer needs to create an account on Groww and verify their Permanent Account Number (PAN), which is issued by the Income Tax Department to Indian taxpayers.

Before creating a dematerialized (demat) account on Groww, customers are asked to select and verify details of their existing bank. Demat accounts are used to track ownership of tradable assets, such as securities transactions in India. Demat accounts with different banks can have different account opening and maintenance charges, but there are no minimum balances or trading requirements once the account is open.

Groww offers demat account opening free of charge, thereby creating an edge over demat accounts offered by traditional brick-and-mortar banks. Customers can then start investing in different investment products through their Groww demat account. Both the website and app provide market updates and technical charts to help make investment decisions.

Stocks: This includes securities listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) including Futures and Options (F&O), Exchange Traded Funds (ETFs), Initial Payment Offerings (IPO), and Sovereign Gold Bonds (SGBs). Groww’s offering also includes stocks available on US markets and in US ETFs.

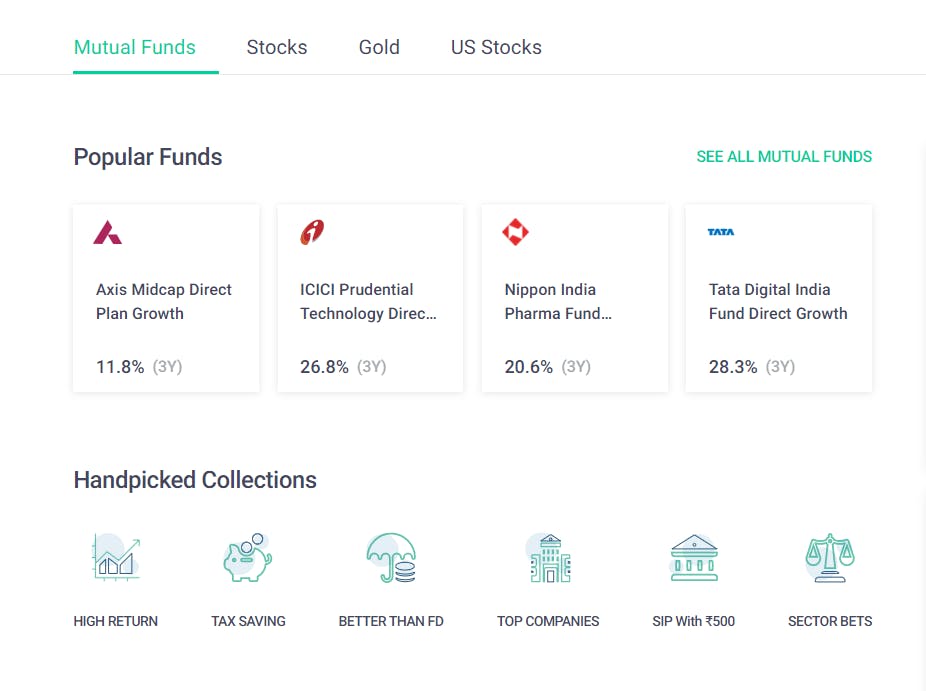

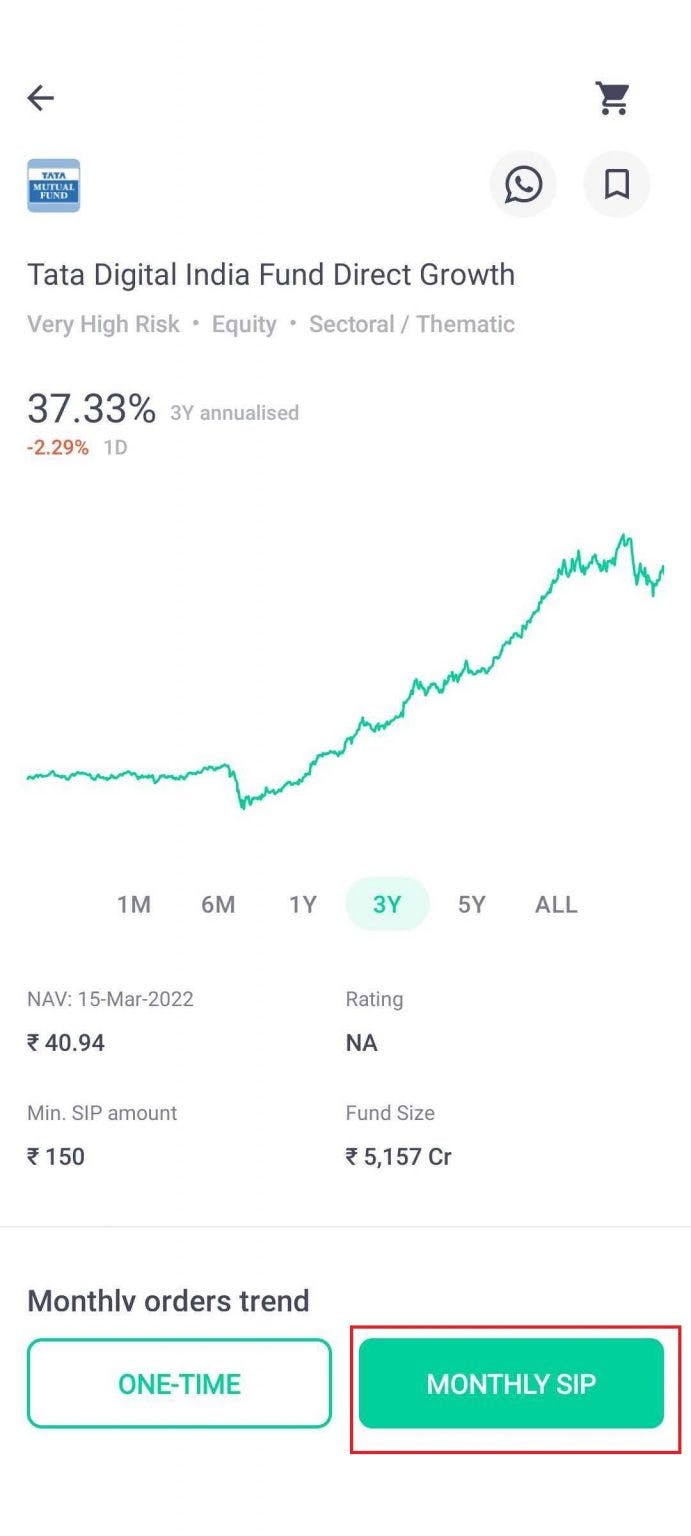

Source: Marketing Mind

Mutual Funds: Groww’s mutual fund offerings can include (1) Direct Fund / Direct Plan, which lets users purchase directly from the mutual fund company, instead of a regular plan which is bought through an advisor or broker, (2) Smart Save, which lets users store idle money, earn higher interest rates compared to a regular savings account, and withdraw quickly, (3) New Fund Offerings, which is a subscription offering for any new fund being launched by an investment company, and (4)Track and Compare, which services that allows comparison of mutual funds along parameters like Net Asset Value (NAV), risk, rating, etc. and tracking returns on current investments.

Source: Groww

Groww Credit

Groww also offers instant loans to select users, with flexible tenures, zero-penalty early closure, and a credit check facility. The eligibility for a pre-approved loan amount is determined based on credit history, current investment amount on Groww, and debt-to-income ratio.

Education

Groww offers financial education resources such as a weekly newsletter Groww Digest, a YouTube channel called Groww Academy, and an annual virtual seminar Groww Thrive, where educators and content creators gather to speak on topics like education, business, and mental health. Geared towards beginner investors, it also has a Personal Finance glossary and various calculators to determine returns on different kinds of investments, payable income tax, brokerage for stock orders, etc.

Market

Customer

Groww’s target customers are millennials who have sufficient savings to invest. The founders mentioned that they “studied how millennials use digital products, from e-commerce to food delivery apps, and used some of those learnings” to design the product experience. According to the company, Groww has over 40 million users, and around 70% are from cities with populations between 20K and 100K.

Market Size

The number of demat accounts in India has grown 2.5x from 2019 to 89.7 million in 2022. With an increase in internet penetration, the digital investment market in India is estimated to grow to $14.3 billion by 2025. By 2030, India will add 140 million middle-income and 21 million high-income households, signaling a huge increase in the number of people with investable income. As of September 2022, there were 7.3K fintech startups in India, which have collectively raised around $30.2 billion. Even though there are 24 Indian fintech companies worth more than $1 billion, India only represents 7% of such companies globally.

Competition

Companies offering online investment brokerage services mostly have similar revenue structures, differentiating on the basis of things like investment products offered, minimum brokerage fees, and equity charges. Competitors for Groww include companies that offer trading facilities, investment platforms, or both.

Zerodha

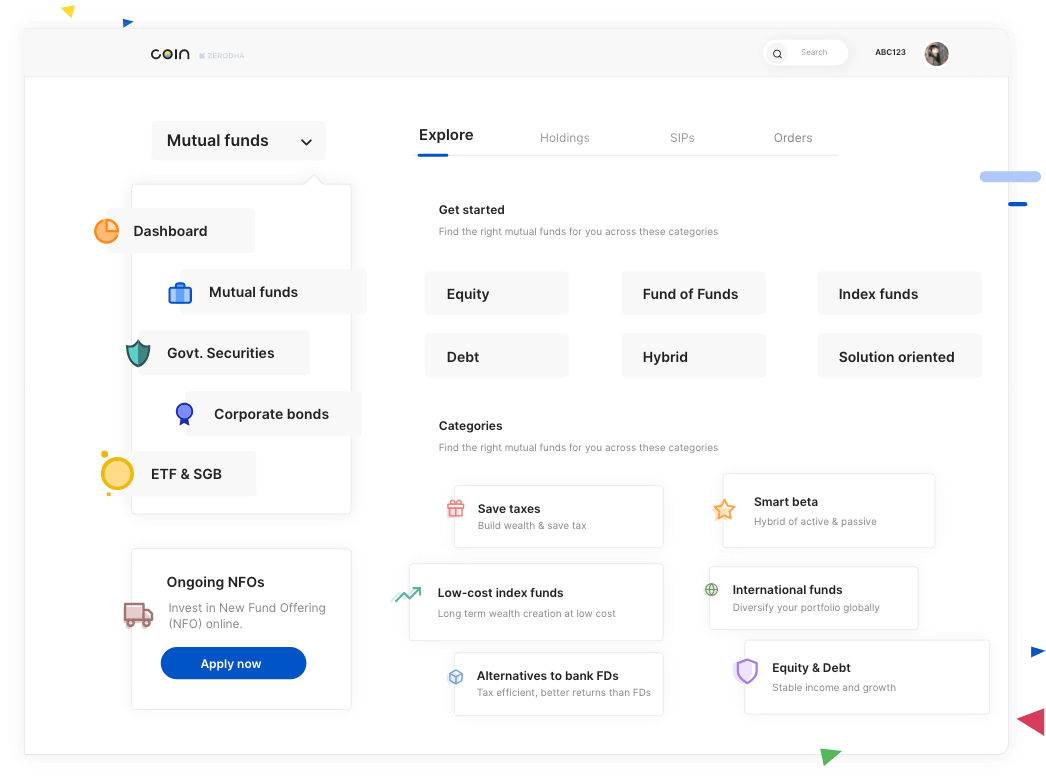

Zerodha is an Indian financial services company started in 2010, with 6 million active investors on its trading platform Kite and mutual fund investing platform Coin. Zerodha is a bootstrapped billion-dollar company that allows customers to trade in products like equity, currency, commodity, IPOs, and mutual funds.

However, it doesn’t facilitate investments in stocks listed on foreign stock exchanges, unlike Groww. It charges a fixed fee for opening a demat account, zero-brokerage mutual fund investment, flat fee on intraday equity and F&O, along with regulatory and statutory charges similar to Groww. Zerodha’s net profit increased by 87% from $135 million (INR 11.2 billion) in its fiscal year (FY) 2021 to $252 million (INR 20.9 billion) in FY 2022, despite a decrease in user acquisition. As of December 2023, the company has over 1K employees.

Source: Zerodha

Zerodha is built on open-source software, allowing it to save on technology costs and partner with companies like Smallcase (a thematic investment platform) and Streak (an algorithm and strategy platform). It also runs a free stock market and financial education program called Varsity. In 2020, the Hurun Global Unicorn List valued Zerodha at $3 billion.

Upstox

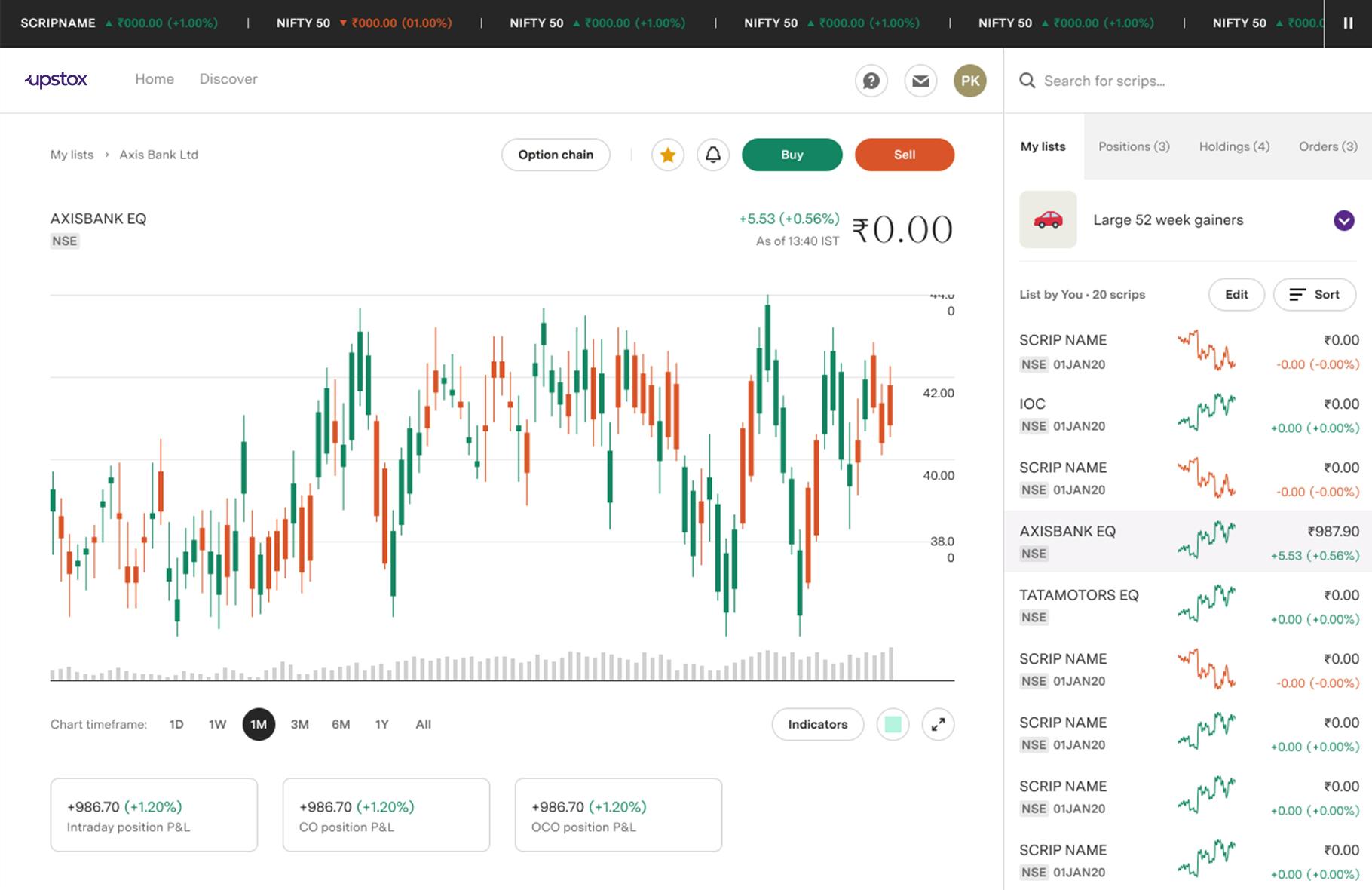

Founded in 2009, Upstox is an investment platform with 4.1 million active investors out of 11 million registered users. Initially named RKSV Securities, it became Upstox in 2016, the same year it raised a $4 million Series A led by Kalaari Capital. In September 2022, the company raised a $108 million Series C at a $3.4 billion valuation led by Tiger Global Management, a firm that has also invested in Groww.

Source: Upstox

Upstox does not charge a fee for creating a demat account, but charges a trading account opening fee, and regulatory fee similar to Groww. It offers investment in a similar set of investment products as its competitors and also provides free educational courses like UpLearn.

In 2021, Upstox became an official partner of the Indian Premier League (IPL), a men’s cricket league in India, as well as the International Cricket Council (ICC), the global governing body of cricket. While Upstox recorded a net loss of $53 million (INR 4.4 billion) in FY22, its operating revenues grew by 44% from $92.1 million (INR 7.6 billion) in FY22.

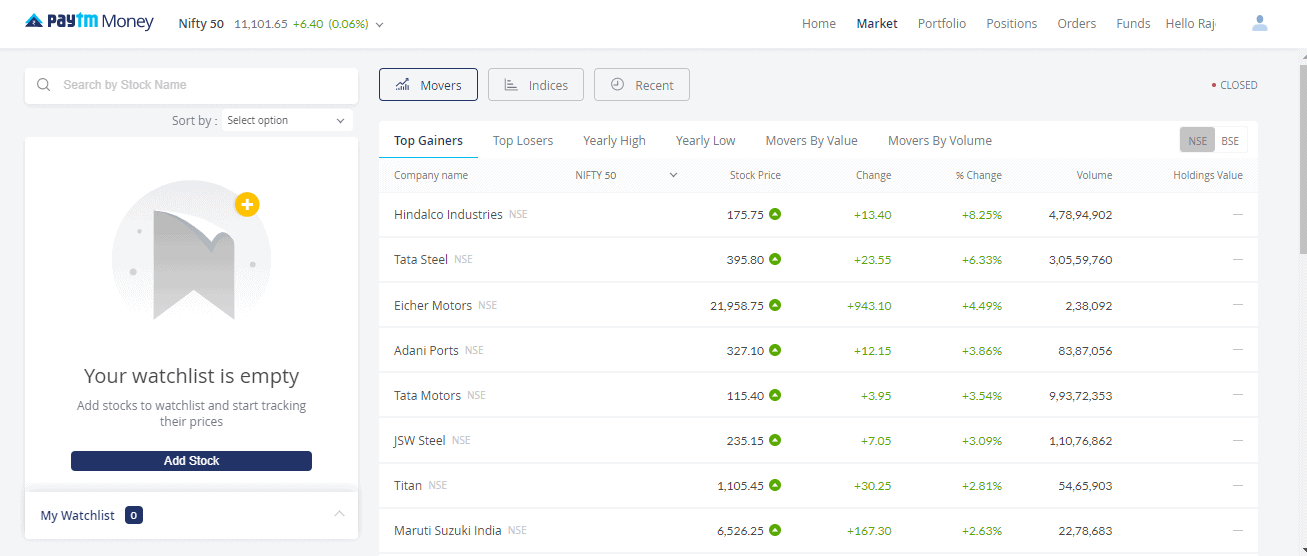

Paytm Money

Paytm Money is an investment platform that also offers advisory services which was founded in 2017. It is the investment and wealth management subsidiary of Paytm, India’s largest payments app. One97 Communications, the parent entity of Paytm, was publicly listed in 2021 and raised $2.5 billion for its IPO. Users can invest in products like direct mutual funds, stocks, IPOs, F&O, and ETFs. It charges an account opening fee, flat fee brokerage, intraday and delivery fee, and regulatory and statutory charges wherever applicable. Investing in mutual funds is free.

In 2023, the company launched a bond investment feature for retail investors, allowing it to invest in government, tax-free, and corporate bonds. Paytm Money had 6.4 million active clients in 2021 and a 59% increase in 2022, with the average new user age at 28. Paytm Money accounted for an INR 107.29 million loss in FY22, even as Paytm itself saw an increase in revenue from the year before.

Paytm's suite of products includes payments, insurance broking, and banking products like savings and current accounts, which gave it a collective active user base of 89 million as of March 2023.

Source: WeInvestSmart

Business Model

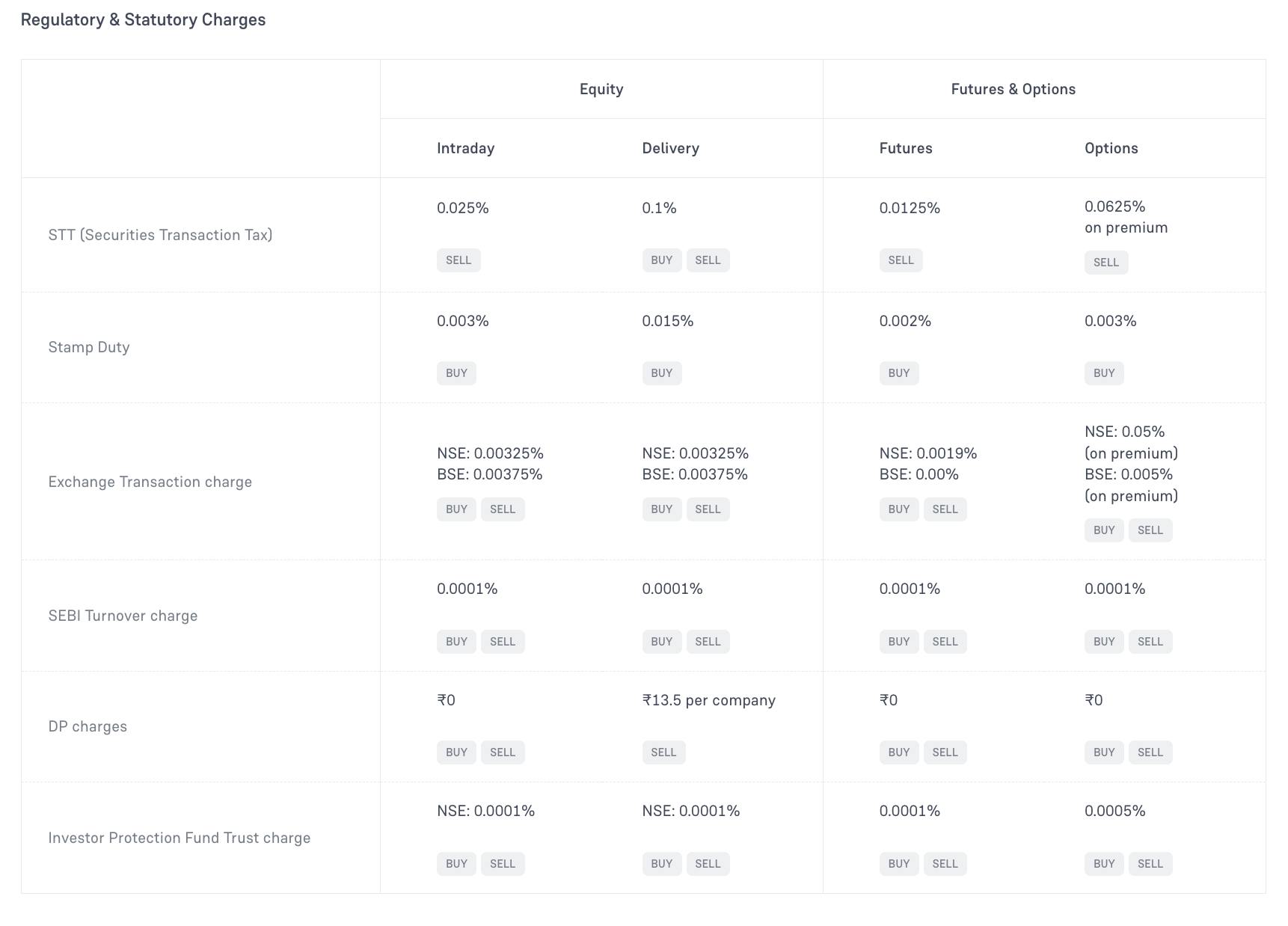

As a zero-commission platform, Groww does not charge a demat account opening fee, maintenance fee, or mutual fund brokerage fee. It does charge flat-fee brokerage on equity and F&O, goods and services tax (GST), etc., and regulatory and statutory charges.

Regulatory and statutory charges include:

Securities Transaction Tax (STT): Direct tax levied on the sale and purchase of securities listed on stock exchanges

Stamp Duty: Charge levied on the contract note, applicable only on buy orders

Exchange Transaction charge: Transaction charges levied by NSE or BSE on both buy and sell orders

Depository Participant (DP) charge: Charges levied on sell orders, not applicable to intraday trading and F&O

Source: Groww

For US Stocks, there are no account opening, maintenance, or brokerage charges. Other charges levied are:

Forex conversion rate: Applicable by the bank

Exchange fee: Charges levied by the exchange the stock is listed on

Groww mainly earns revenue from brokerage and other allied services, and other operating revenue from interest on deposits. Costs for Groww include employee-benefit expenses, followed by advertising and marketing, and technology. Mutual fund offerings serve as a lead generation engine to cross-sell other products and services, like the intraday stock exchange or F&O. In 2020, Keshre mentioned that Groww might explore premium offerings by charging subscription fees and offering advisory services.

Traction

As of December 2023, Groww has over 40 million customers on its platform across 900+ cities in India. It witnessed 200% growth in first-time customers when the pandemic hit during 2020. As of 2021, 60% of users on the platform were from outside the top six cities in India. Groww’s number of active users on the National Stock Exchange increased by 31.5% from 2021 to 5 million in 2022.

Groww’s total revenue increased by 760% year-over-year to around $41 million (INR 3.5 billion) in FY22, resulting in a net profit of $817,700 (INR 68 million), after having reported a profit of $327,080 million (INR 27.2 million) in FY21.

Groww, as a company, consists of a holding entity called Billionbrains Garage Ventures, along with several other subsidiaries. The overall company reported a $28.7 million (INR 2.4 billion) loss for FY22, a 3x spike since FY21. Advertising, promotion, and employee-benefit expenses for the holding company accounted for 73.2% of the total $79.8 million (INR 6.6 billion) expenditure.

In 2022, Groww began offering lending services to select customers, based on their transaction history, partnering with IDFC First Bank. In early 2023, one of Groww’s subsidiaries, NextBillion Technology, completed the acquisition of the mutual fund business of Indiabulls Housing Finance, Indiabulls AMC. This acquisition process, first announced in 2021, will allow Groww to create and manage new investment products. This also puts it ahead of Zerodha, which is awaiting similar regulatory approvals.

Earlier in 2023 Groww also started offering users a payments feature with United Payments Interface (UPI), allowing them to conduct peer-to-peer payments to merchants.

Valuation

In October 2021, Groww announced a $251 million Series E round at a $3 billion valuation, and it has raised a total of $393.3 million in funding as of December 2023. The company’s Series E round was led by ICONIQ and included other investors like Alkeon, Lone Pine Capital, and Steadfast. It also included participation from existing investors Propel Venture Partners, Ribbit Capital, Sequoia Capital India, Tiger Global, and YC Continuity.

Groww’s $3 billion valuation represented a 3x markup since it was last valued at $1 billion in April 2021. The company shared plans at the time to invest new capital in expanding reach to under-penetrated geographies and adding more products and services to the platform. In June 2023, Groww also raised an additional $25 million Series E from Foxhog Ventures at an undisclosed valuation.

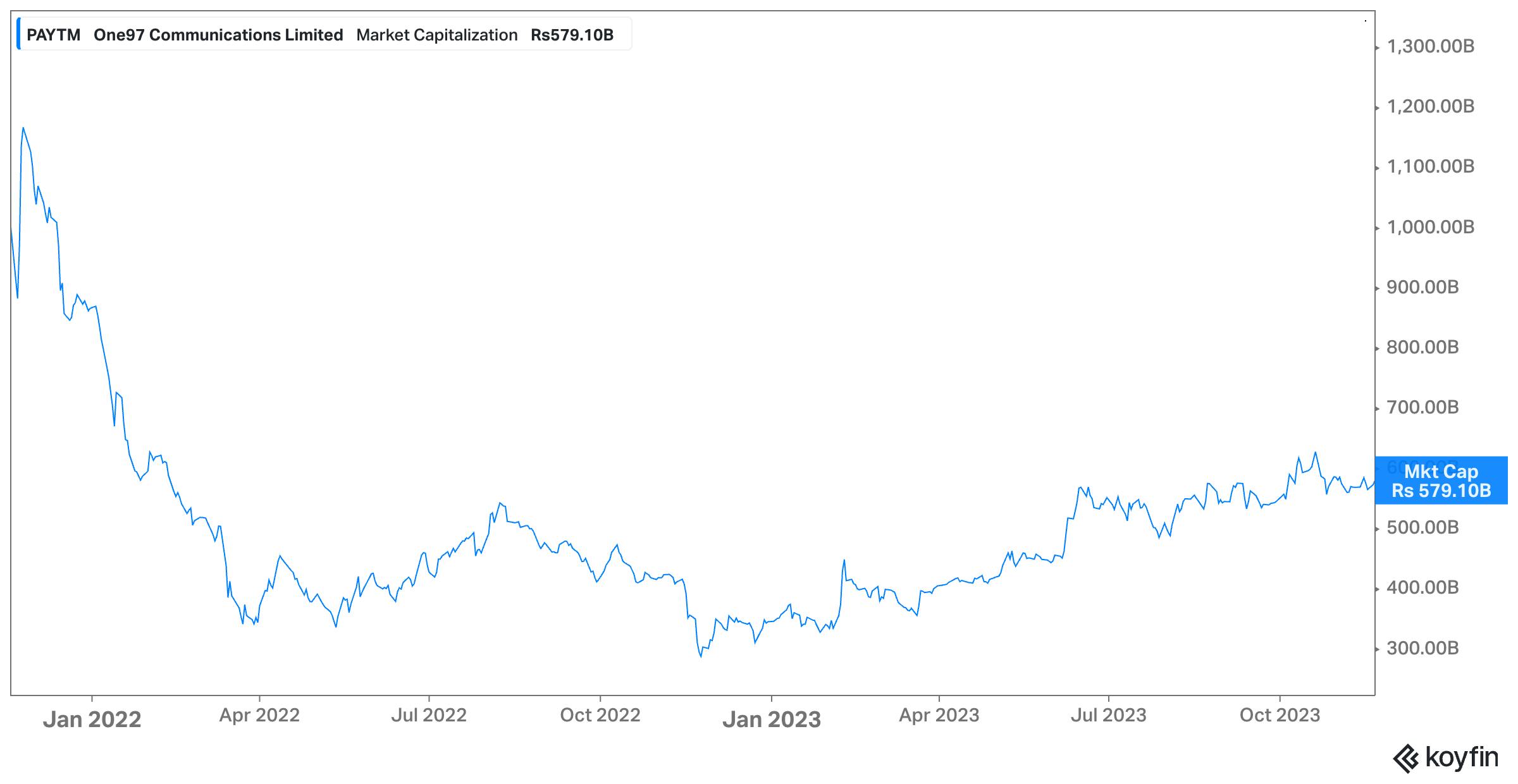

Comparable companies, like Paytm, have seen significant fluctuations in the public markets. After an IPO in November 2021, the company saw an all-time-high valuation of ~$14 billion before dropping to ~$7 billion as of December 2023. That valuation represented a drop from a 31.7x revenue multiple to a 5.6x revenue multiple.

Source: Koyfin

Key Opportunities

Market Expansion

Groww’s vision is defined by the need to “democratize investing in India”, and Keshre’s reference to financial services as a “fundamental need” for people. Given that penetration of the mutual fund industry is low in Indian cities, with a mutual fund AUM-to-GDP ratio of 16% compared to the global average of 74%, there still exists a huge market to be catered to. Most companies in this space are targeting millennials, given that 54% of 16 million new investors in mutual funds between 2019 to 2023 were millennials.

Advertising and marketing accounts for a large chunk of Groww’s costs at 35%. Lowering customer acquisition costs (CAC) and simultaneously increasing accessibility will be a challenge that comes with an upside of tapping into under penetrated market. Even though there is no first-mover advantage in this space, switching costs can contribute to users staying loyal to a platform that solves their needs the best.

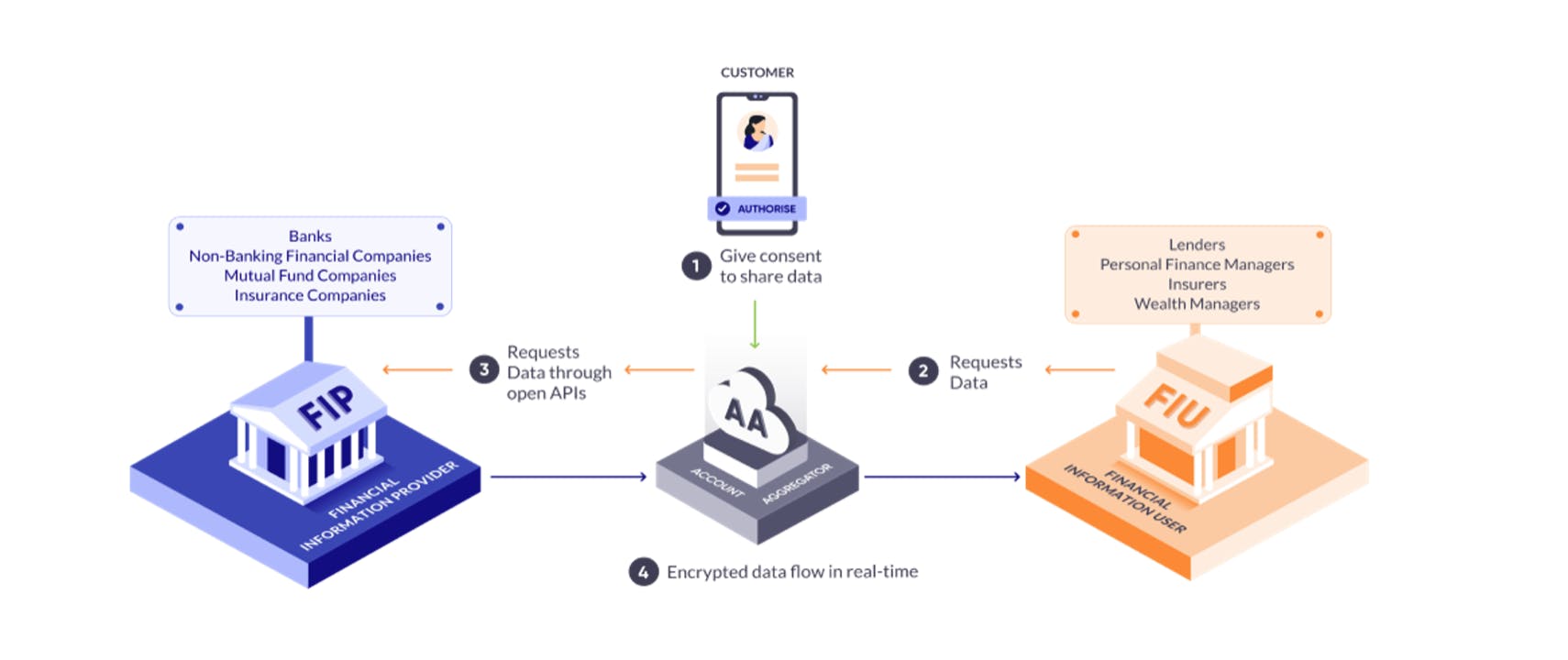

Financial Services Aggregation

The Account Aggregator (AA) network in India will allow users to securely share their financial information between regulated institutions in the AA network. The AA system does not aggregate data on a specific platform, but only manages the consent of the user between Financial Information Providers (FIPs) and Financial Information Users (FIUs), improving ease-of-access and data handling process for the customer.

Source: Sahmati

For example, if a user had investment accounts on Groww and another wealth management app, and both platforms were part of the AA network-regulated institutions, it would be possible for Groww to request access to the user’s data on the other platform and create a combined dashboard. This would allow for easier investment data and strategy tracking for the customer. As the regulation and enforcement of account aggregators increase, it will be beneficial for wealth management and investment apps to be part of the AA network.

Advisory Services

In a survey of over 125 Indian fintech firms and CXOs, 45% of the respondents believed that investment advisory would be the next potential area to be disrupted. The current monetization model has not been able to prove long-term sustainability yet, and offering advisory services can be a way to differentiate from the competition. This will require regulation to step in and standardize licensing procedures for companies that continue to offer advisory and brokerage services.

Key Risks

Competition

The functionality of most investment platforms is fairly similar. As a result, differentiation is typically based on fees for things like account opening, maintenance charges, and minimum brokerage rates. Depending on the layout and number of products provided, the complexity of the layout can change, making some platforms more appealing to beginner investors while advanced investors prefer others. It is also common for most platforms to offer free educational resources through multiple streams like videos, courses, blog posts, newsletters, and articles.

The fact that the top four platforms in this space, Groww, Paytm, Upstox, and Zerodha, are all billion-dollar startups makes it a heavily competitive space. Most platforms are innovating in similar directions and focusing on technology at their center, with Zerodha developing a homegrown order management system and Upstox integrating with UPI 2.0 to easily invest in SIPs. Companies are partnering up with banks to expand their services and offer credit lines to eligible customers, as well as offering peer-to-peer payments as new features.

Monetization

Partnering up with banks to provide lending services is one way to expand the revenue base for companies in this space, which can find it hard to make a profit. In Zerodha’s case, its co-founder Nithin Kamath mentioned that profit was possible for the company because “(our) cost of acquisition is zero. If we had to spend heavily, we wouldn’t be (profitable).”

The market these companies target is not small, but the ability to monetize only through stock brokerage fees is limited because competitors will offer the same service at lower costs. Achieving break-even or profitability in this space can take a few years as the user base grows, and even then it might be necessary to move into lending, advisory, subscription tiers, or other associated services that will allow these companies to become profitable.

Summary

In a short span of time, Groww has managed to occupy a significant market share of millennials who prefer digital investing and has achieved a substantial valuation in the process. It is difficult to differentiate from existing competitors in the space, and a challenge is to become profitable while also reducing CAC. Groww’s strategy to expand into credit lending is one way to offer a larger suite of products to investors, creating a purchase funnel. Groww benefits from having a loyal customer base and significant funding, but it needs to continue to improve unit economics as it pursues becoming well-integrated within the larger fintech space.