Thesis

Operations software serves as a key part of any organization, from scaling startups that need to quickly arm their teams to manage customer accounts to large enterprises that need to visualize and track user signups. This type of software is distinct from customer-facing software, like a retail website; instead, operations software is typically custom software built to streamline and codify a team's business processes. As of 2020, nearly half of all software fits this description. However, 60% of developers don’t believe their organizations invest adequate resourcing in this, despite 80% that believe in the criticality of such tooling.

Building custom software from scratch traditionally requires dedicated (and expensive) engineering resources and weeks of iteration and eventual deployment. Deprioritizing operational software entirely can result in error-prone processes built on top of spreadsheets. Buying off-the-shelf software typically lacks the customization necessary for evolving needs. Despite the challenges, operational software is a critical mainstay for growth. Over $4.5 trillion is spent on IT expenses yearly, with over 40% of engineering time at larger companies spent on internal tooling. Teams require software that is flexible enough to meet the unique requirements of their business, without the tedious overhead of building and deploying a custom application.

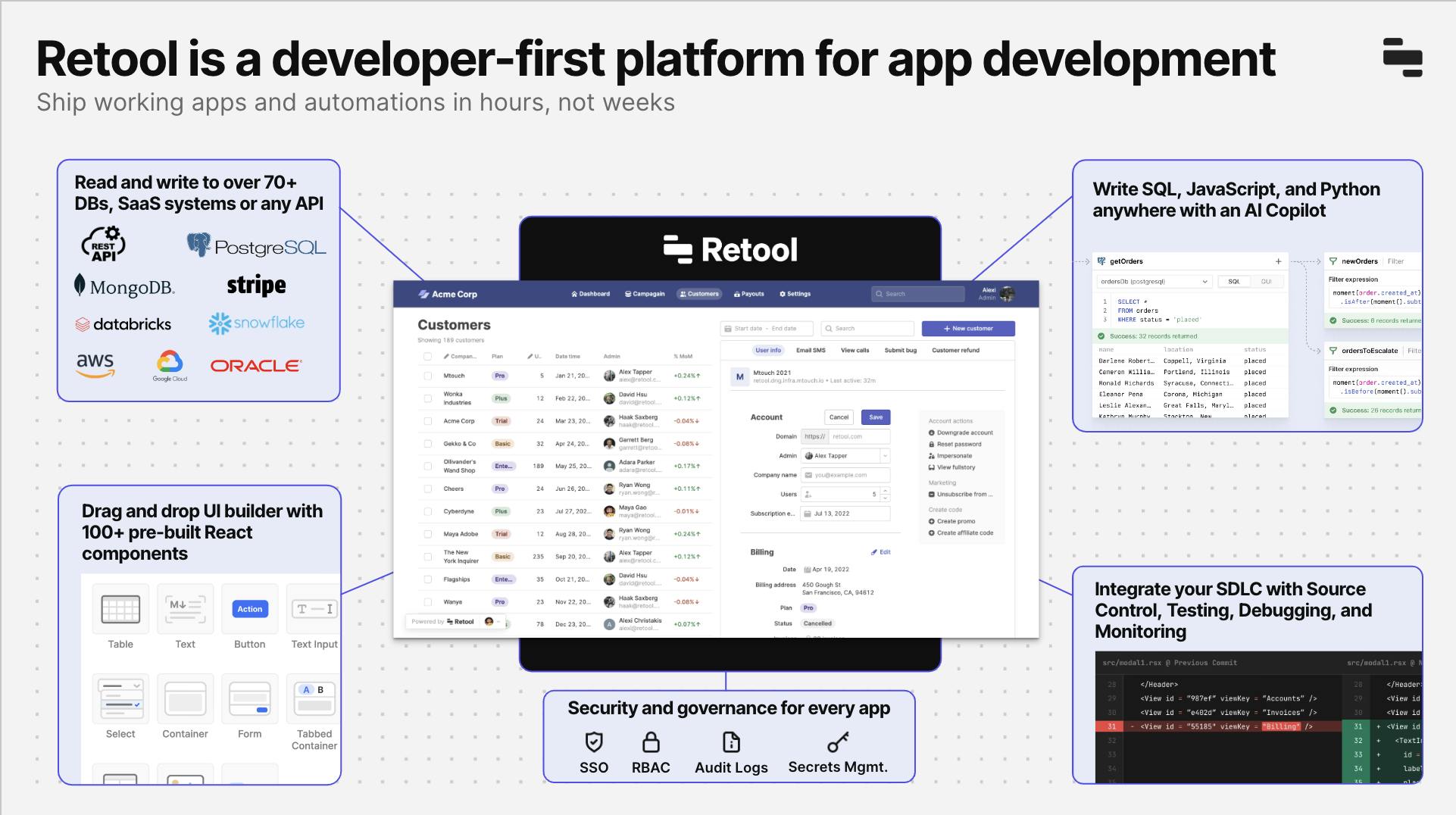

Retool is a developer tool built to streamline operations via a low-code development platform. It abstracts away the foundational, yet tedious work of building applications, including hundreds of out-of-the-box components to spin up a web app, a series of complementary backend and external facing products, and a suite of enterprise features (like granular access controls, custom SSO, and audit logging). Retool provides a development environment to quickly build full-stack applications, allowing engineers to focus on shipping against their customer-facing roadmap, rather than prioritizing, haggling with, and iterating on operational tooling.

Founding Story

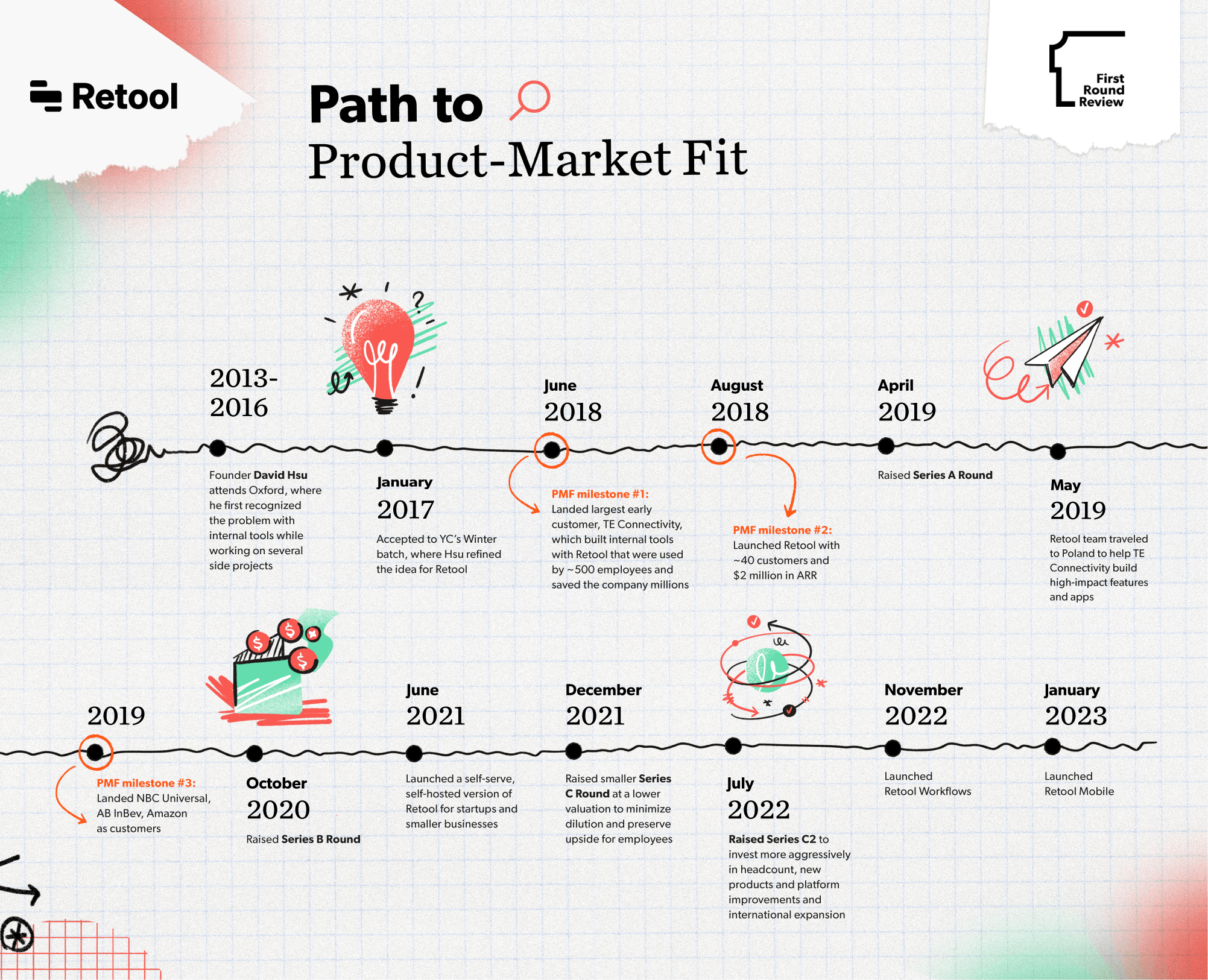

Retool was founded in June 2017 by CEO David Hsu. A few months earlier, Hsu had been building a UK-based Venmo competitor called Cashew. They’d found strong product market fit among the Oxford campus (David’s alma mater), with over 20% week-on-week growth. The company entered the Y-Combinator 2017 batch on the back of this growth. However, Hsu was experiencing early warning signs of the unit economic troubles that other peer-to-peer payment solutions had faced, with Cashew burning around $1K a day, and generating a net loss on each new payment processed.

As its runway waned, Hsu and his team recognized the gravity of the situation and started to rethink the business model or pivot entirely. As they thought through new opportunities, they realized the power of many internal systems and tools they’d already built to power Cashew, like KYC dashboards and fraud alerting. Having built all these tools from scratch, Hsu posited: “What if we took the code that we already had from Cashew and repurposed it? What if we gave it to other developers so they didn’t have to build the same internal systems from scratch?”

Having noticed that most tools were comprised of similar components (tables, buttons, lists, filters), he realized an opportunity to abstract away some of the common aspects of applications like front-end components, data connectors, and permissions, allowing developers to focus on the bespoke business logic to power their tools. The team demo’ed the product at YC’s demo day, having already procured a $1.5 million enterprise pilot and clearer product-market fit.

Source: First Round Capital

Product

Retool consists of multiple product lines, all aimed at easing the developer experience in building custom application tooling. At its core, “Retool removes the tedious parts of development like wrestling with UI libraries, stitching together data sources, and configuring access controls. In turn, engineering teams can ship internal tools 10X faster and focus more time building the core product.”

Source: Super Monitoring

Since launching as an internal tool builder in 2017, Retool has since expanded into a full-stack solution, including a backend workflow builder, native mobile product, and external facing Retool portal. The product is built off heuristics of accessibility and flexibility, allowing developers to iterate quickly off foundational blocks and modules, while also extending functionality via custom code.

Source: Retool

Web Application

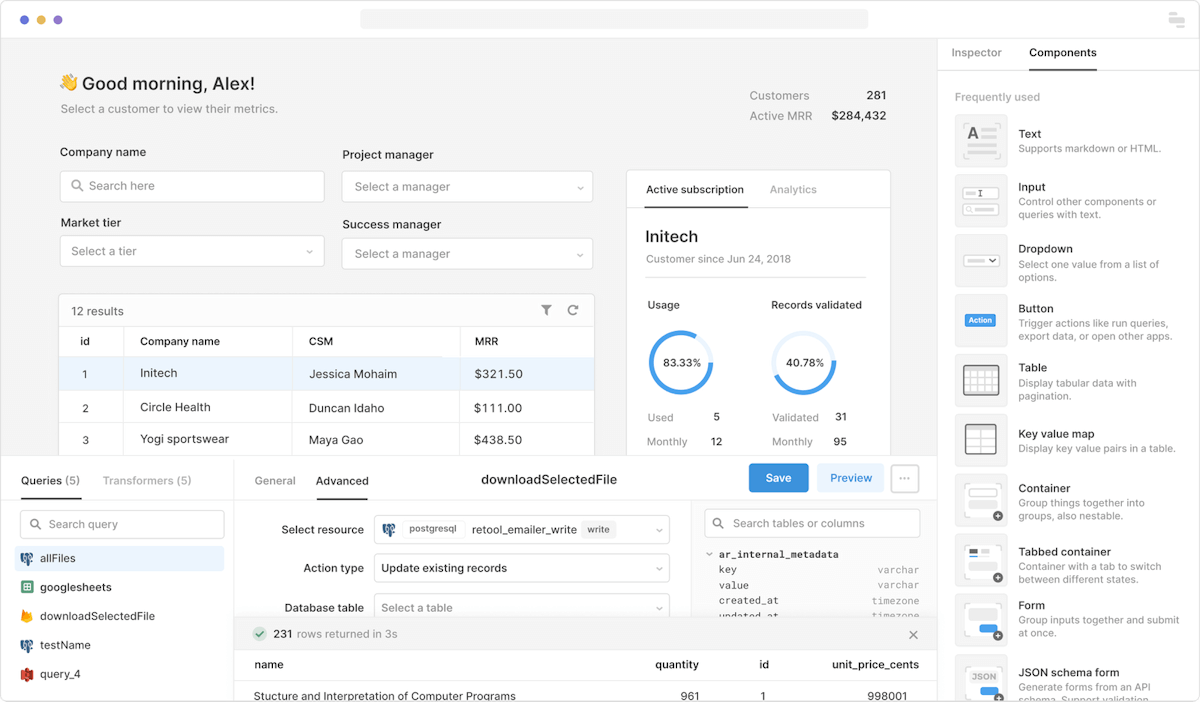

Integrated Development Environment (IDE): Retool is a developer-first product, meaning it’s invested heavily into the developer experience. In 2023, it relaunched its core developer environment, indexing on learnability and flexibility. The interface is comprised of the following areas:

Canvas: Arrange components to build your app's interface

Navbar: Configure, preview, share, and manage your app

Left Panel: Explore components, queries, transformers, and constants

Right Panel: Create and edit components

Status Bar: Select the app environment, releases, runtime, and debug apps

The IDE provides several features to aid the developer, including a component tree to visualize the hierarchical breakdown of applications, code search to quickly search through code and components, a state tab to find the current state of app properties and debug tools to diagnose and debug applications.

Components: Components act as the building blocks for building web applications in Retool. Building UI elements from scratch is a tedious task, so Retool provides over 100 of them out of the box (with room for customization). Each component exposes properties and events developers can access and interact with via code.

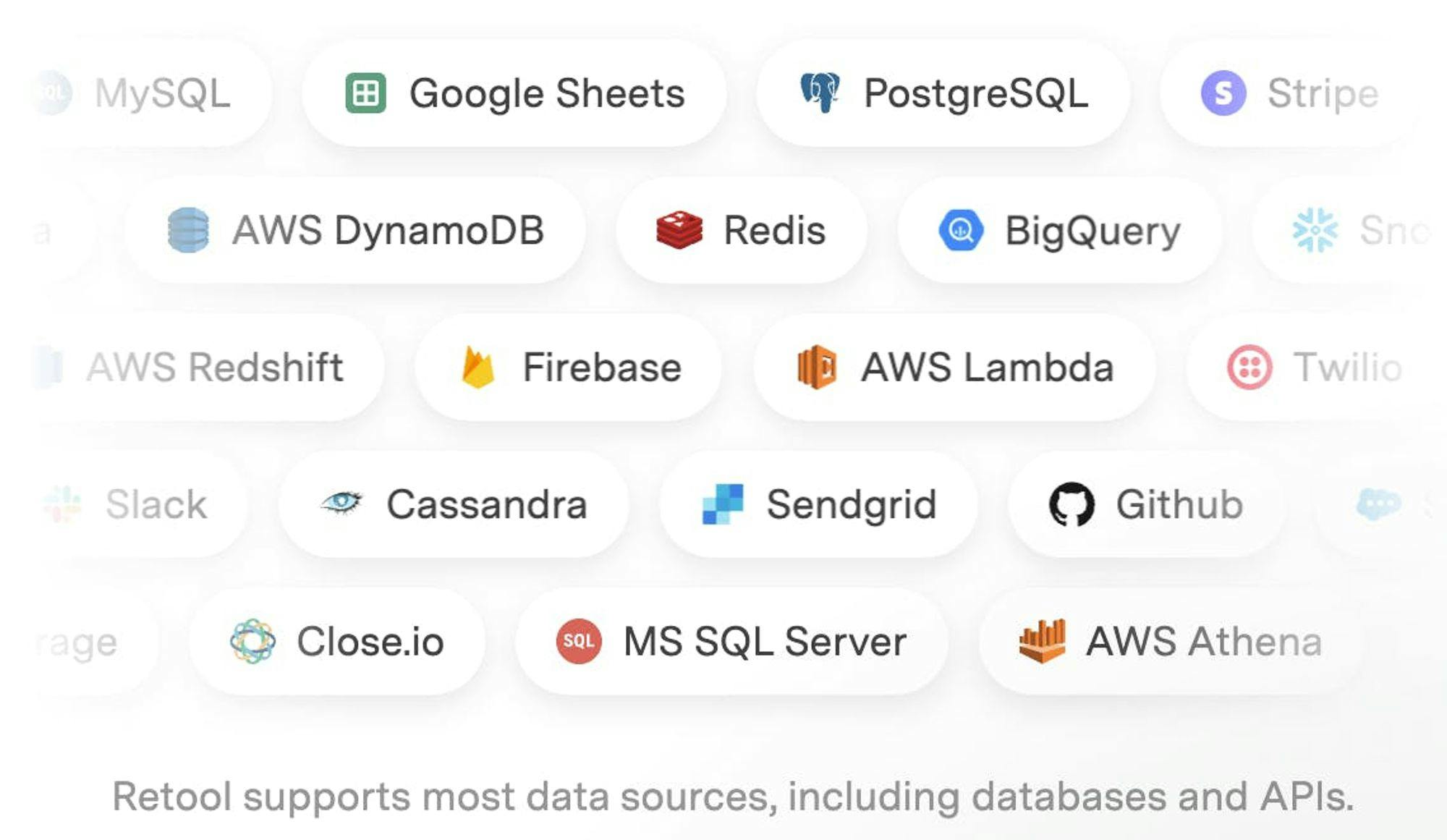

Resources: Resources represent the data sources that users may connect their Retool instances to. Resources are decoupled from and configured separately from individual applications, allowing for flexibility in permissioning and usage. Retool supports a wide range of built-in integrations and allows for connections to any REST, GraphQL, or SOAP API. Each resource has its own configuration options including authentication credentials, database connection settings, and API settings.

Source: Retool

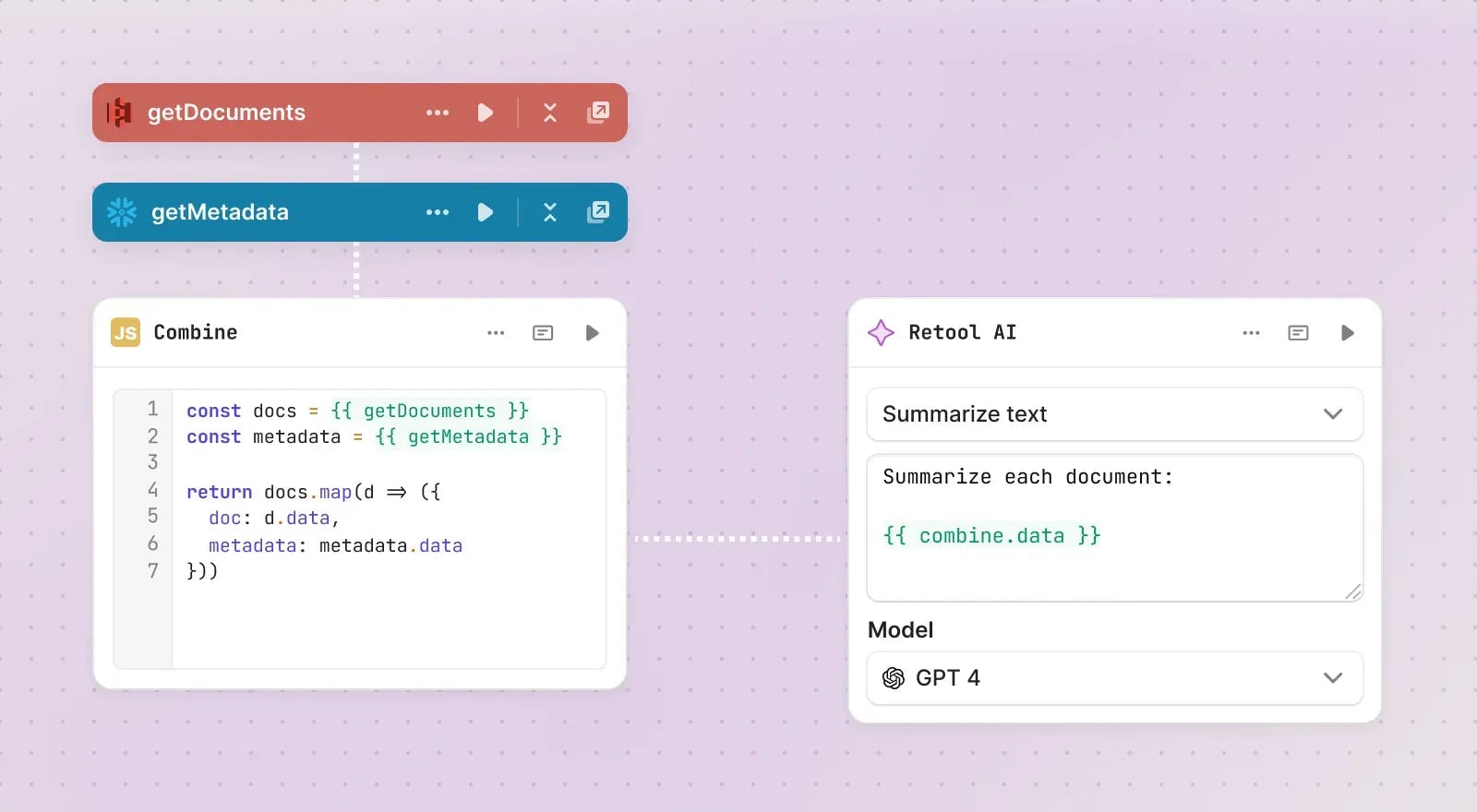

Workflows

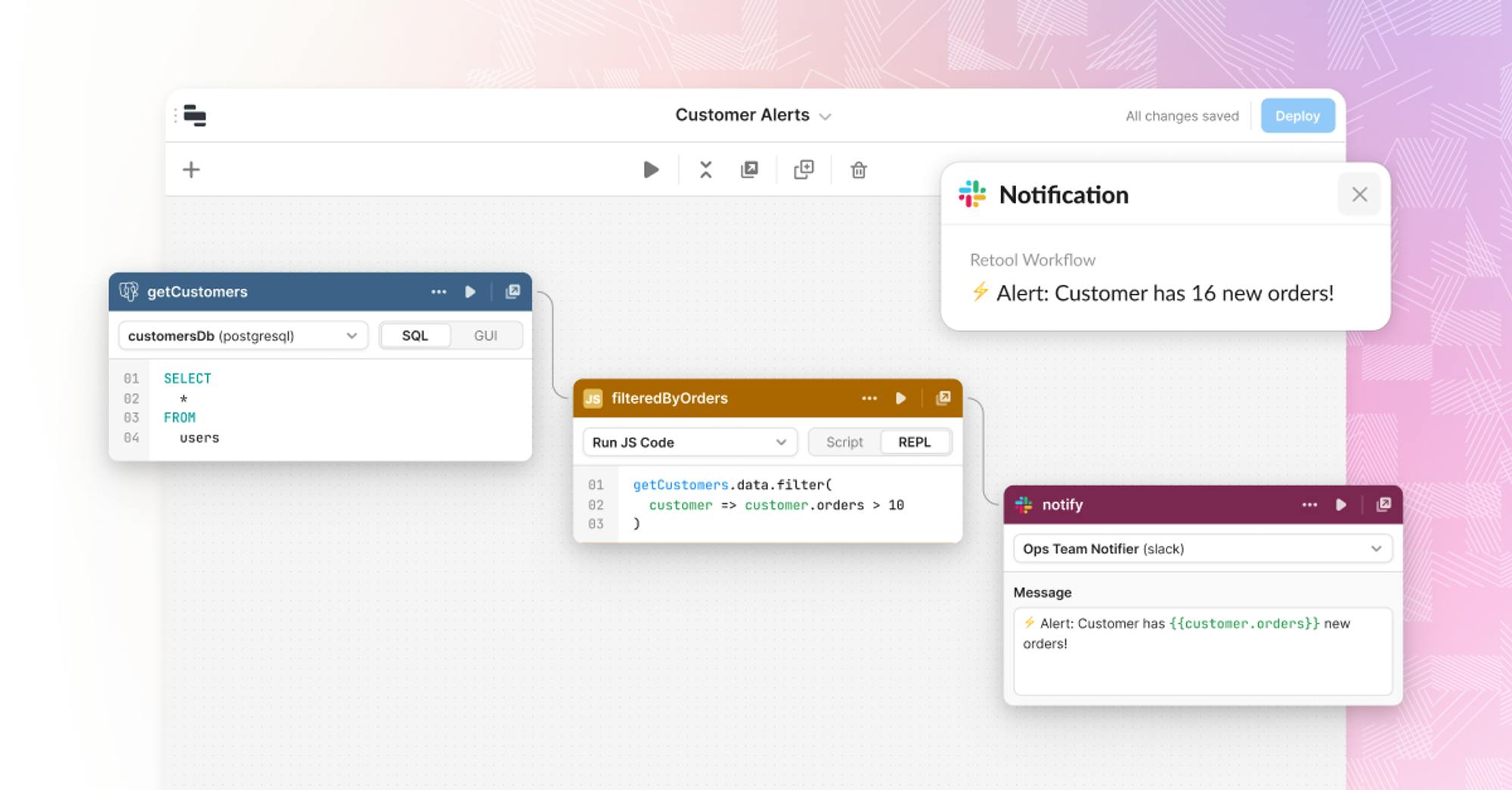

Retool Workflows is the visual backend for building cron jobs, custom alerts, and ETL tasks. Similar to web applications, workflows are built off the concept of blocks, which can be stitched together as a series of steps to perform business actions. The workflows can read and write from the existing resources provisioned, allowing for in-line Javascript and Python development. Workflows extend the functionality of Retool, allowing for asynchronous jobs that can be scheduled and invoked via a webhook.

Source: Retool

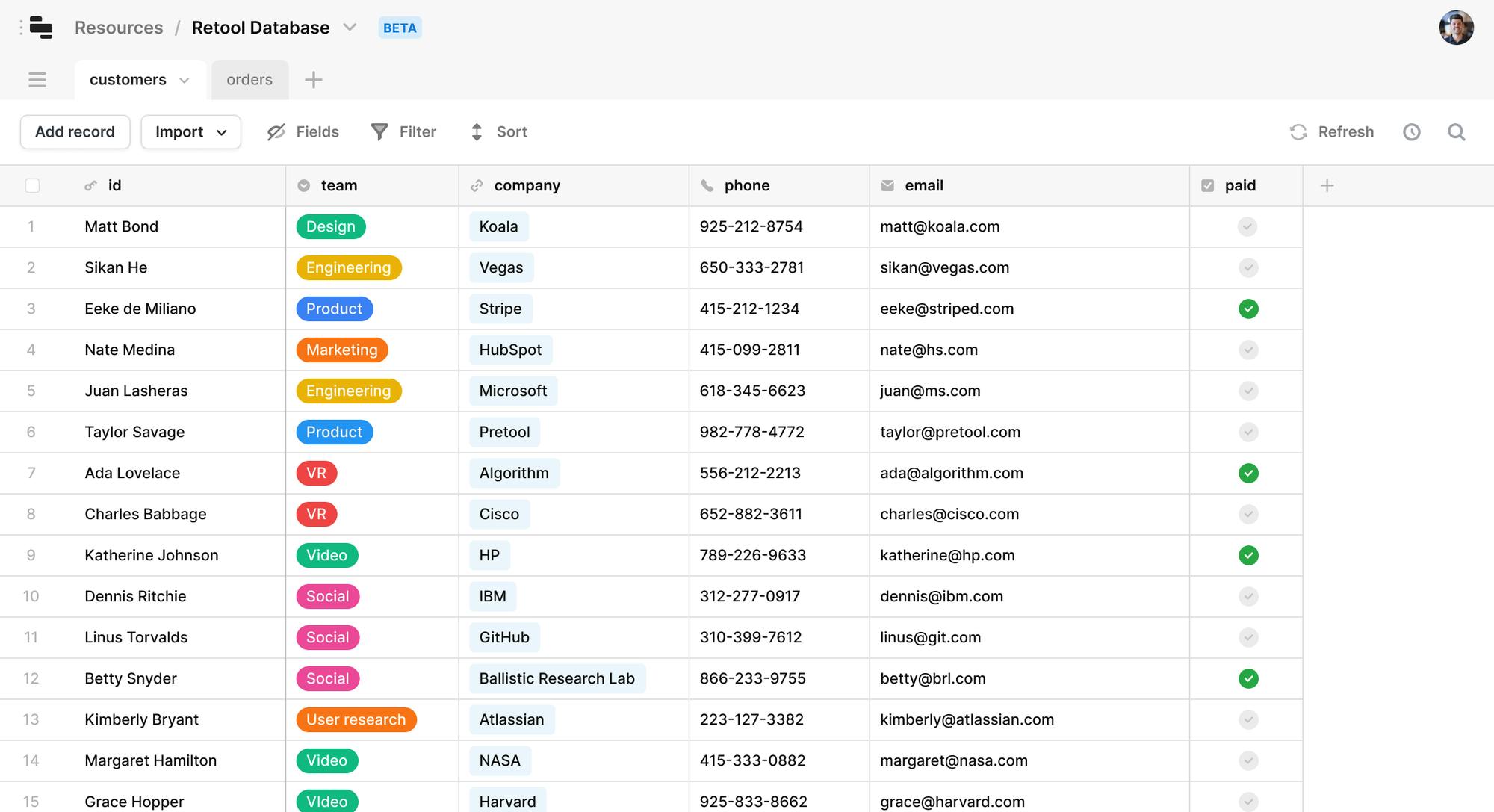

Retool Database

Retool Database is a Retool-managed and hosted Postgres Database. Rather than haggling with scripting and queries to provision tables, edit schemas, and version changes, Retool built an interface to interact with the underlying database directly, allowing for the speed of a spreadsheet and the power of Postgres

Source: Retool

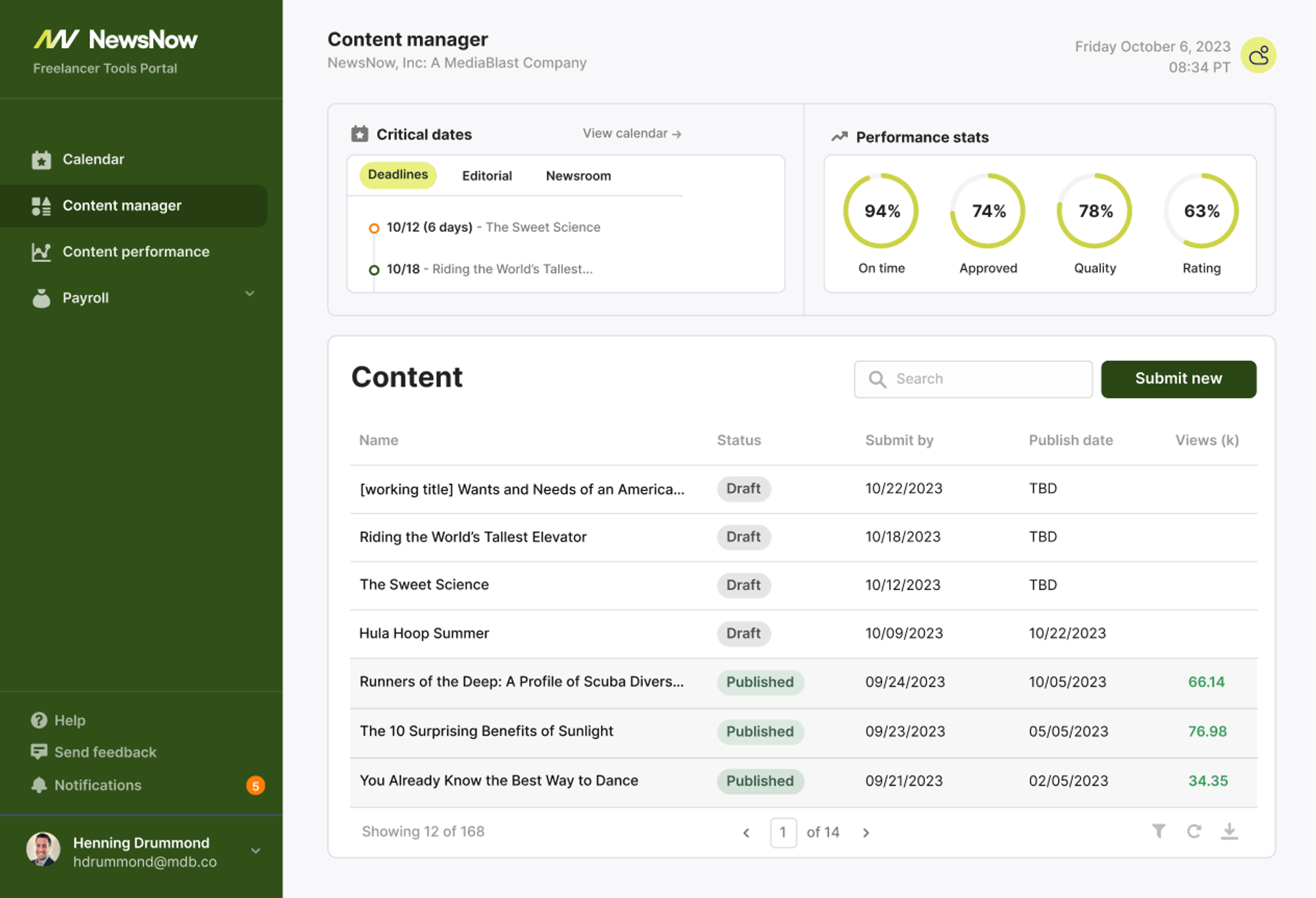

Portals

Retool Portals was built to expose Retool applications to external audiences, including customers and partners. The portal provides the same flexibility as the core web application builder, including granular permissions and flexible configuration, yet extends it through a fully white-labeled experience.

Source: Retool

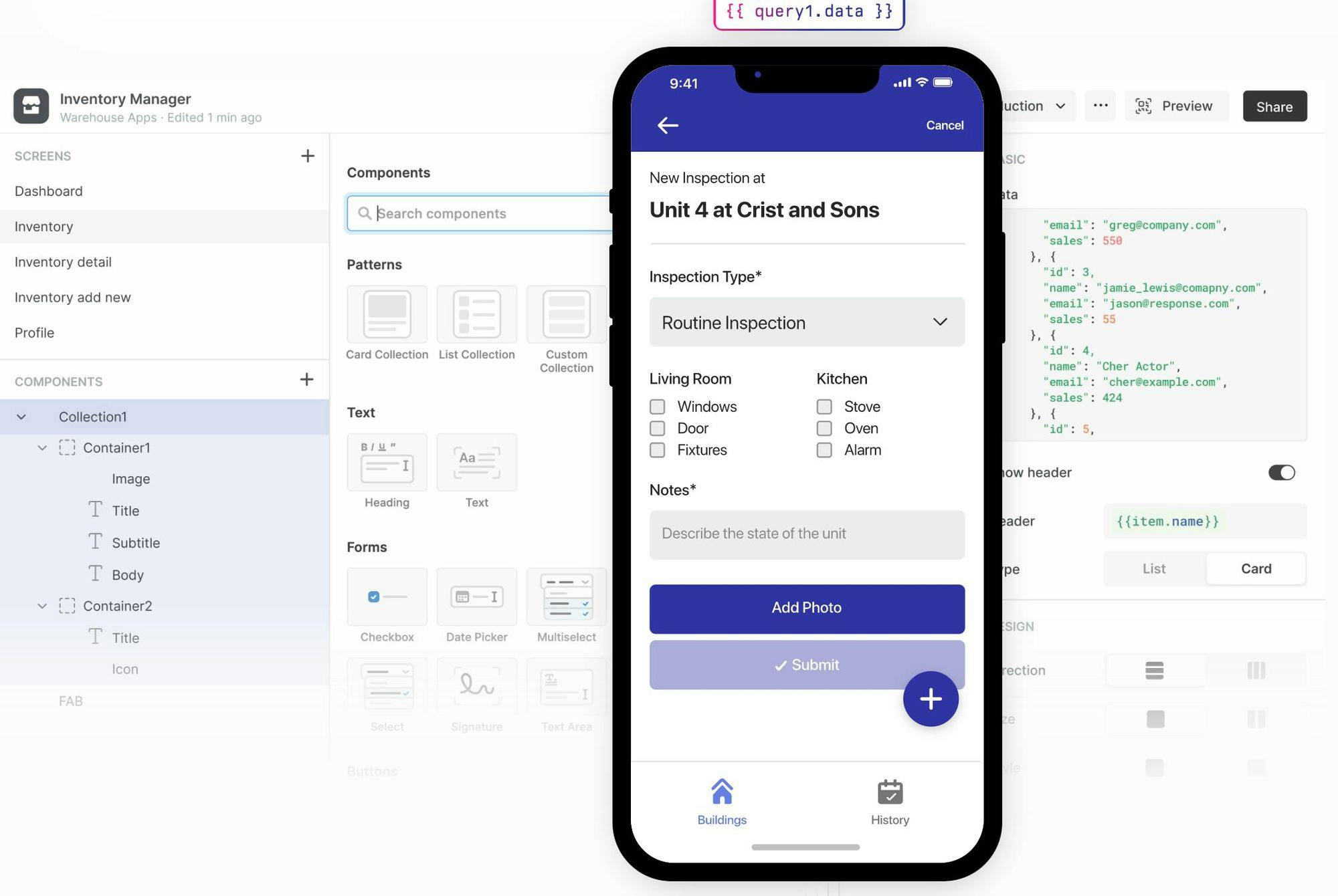

Mobile

Source: Retool

Retool Mobile simplifies the building of iOS and Android apps. Because many customers are often reliant on large field workforces for operations, Mobile was introduced as a product to quickly spin up and deploy native iOS and Android applications. Mobile offers out-of-the-box components including a barcode scanner, NFC reader, geolocation tracker, and more, allowing for flexible mobile app creation and iteration.

Retool AI

Source: Retool

As a low-code software builder, Retool is well-positioned to take advantage of AI's promise, both for creating AI applications and augmenting building capacity with AI. Retool AI is a suite of tools for building AI-powered tools for the organization, including quick actions leveraging AI, storage of text via vector stores, and native connections to LLM models.

Additional Functionality

Templates: Retool has hundreds of ready-made templates for common use cases. These include templates for a custom CRM, a Stripe Refund Tool, an AI-powered changelog, a Slack Notifier, and more.

Custom Deployment: Based on the company's security measures, Retool offers a self-serve cloud and on-premise deployment option. The on-premise option allows companies to host Retool behind their VPNs and within their VPCs and allows customers to scale infrastructure and services.

Enterprise Functionality: Operational tooling aims to be reliable, maintainable, and secure, though often is deprioritized as teams shift and priorities change. As software engineering has grown, tools and tactics have emerged to achieve such goals, such as code review, testing RBAC, audit logging, infrastructure as code, and more. Retool provides several features with a focus on enterprise readiness to make the platform enterprise-ready, including Custom SSO, Role-based access control, Environments and Spaces, Audit logs and Usage Analytics, and multiple hosting options.

Market

Customer

Source: Retool

Retool has customers across several industries and verticals, from single-person startups to Fortune 500 companies. In addition to a core customer base in tech, Retool has also expanded into industries like fitness, manufacturing, and financial services. As Eric Vishria, a partner at Benchmark, claims:

“Virtually every company runs a software service… Disney used to make content, now it also has to run Disney+. Banks used to store money, now they compete on their apps. Every one of these cloud services has an unmanaged mountain of scripts, cron jobs, SQL statements and internal dashboards that keep it running.”

All companies require operations software to grow their business, yet often lack the resourcing and time to build such solutions from scratch. Retool is focused on increasing the efficiency of developers in attempting to scale quickly.

One example of a Retool customer is Doordash*. Doordash had to build internal dashboards and workflows to operate its delivery network, coordinating between customers, delivery people, and merchants. One example where the internal tool pain was particularly felt was the Dasher rewards program, which required a team to manually fill out a spreadsheet and send it over to the engineering team, who would then run weekly scripts with that data. This manual process led to many errors that led to a suboptimal Dasher experience. With Retool, Doordash was able to reduce the build time for each internal tool from 1-2 months to 30-60 minutes. Doordash now has 40+ internal tools built on top of Retool.

Market Size

The market for internal tools was projected to reach $250 billion in 2022 and continues to grow year over year. With more than half of all applications and over 40% of engineering time spent on internal tools, Retool addresses very tangible needs in the developer tools space. In 2023, over 85% of developers felt their organization spent more time on internal tools than the year, though a growing proportion using something other than custom, home-grown apps.

Competition

The most direct competitor to Retool’s offering is custom software. Albeit tedious, home-grown tooling provides complete control over and application and data layer. In particular, for companies that deal with sensitive data or are seeking to build something mission-critical that they don’t want to be dependent on a third-party tool, it may make more sense to build in-house. Other competitors to the core Retool platform generally reside as emerging low/no-code startups. These include:

Airtable: Airtable is a collaborative database centered around a spreadsheet. It raised a $735 million Series F at an $11 billion valuation in December 2021. It is a lighter solution than Retool, as it's more spreadsheet-based, whereas Retool can be used to build complex UIs. Hsu compares the two in a Hacker News post here. In January 2024, Airtable announced the acquisition of Airplane*, an internal tool builder similar to Retool.

Zapier: Zapier is a no-code workflow builder that reached a $5 billion valuation and over $140 million in ARR as of March 2021, despite only having raised a total of $1.2 million in total funding from its October 2012 seed round. It stitches together workflows across 5K+ apps to automate internal processes. With the launch of Retool Workflows, these companies may increasingly compete.

Superblocks: Superblocks is focused as an internal tool builder. Superblocks raised a $37 million Series A in August 2022. In that funding announcement, Superblocks reported that it had hundreds of customers and claims to allow for much greater customization and integrations.

Appsmith: Appsmith was founded in 2019 and has raised over $50 million from investors like Accel, Canaan Ventures, and Insight Partners. The company is open-source, has over 25K stars on Github, and offers 45+ ready-made widgets that can be drag-and-dropped into their app builder. Over 10K teams use Appsmith, including IBM, Adobe, and AWS.

Google AppSheet: Google AppSheet is a platform that allows users to create mobile and web applications without the need for extensive programming knowledge. It's a no-code development platform, which means that users can design and deploy apps using a visual interface, often by simply manipulating spreadsheet data. It integrates with various Google services and other data sources like Google Sheets, Excel, and SQL databases. It’s estimated that 500+ companies use AppSheet.

While the Retool product lines work in one platform, individual products and features do have competitors of their own. Retool Mobile provides similar mobile app building to companies like Glide, Retool Database shares similar functionality to Airtable, and Retool Charts competes against existing analytics providers like Tableau. Retool’s integration resources are comparable to products like Workato, Tray, and Parabola.

Business Model

Source: Retool

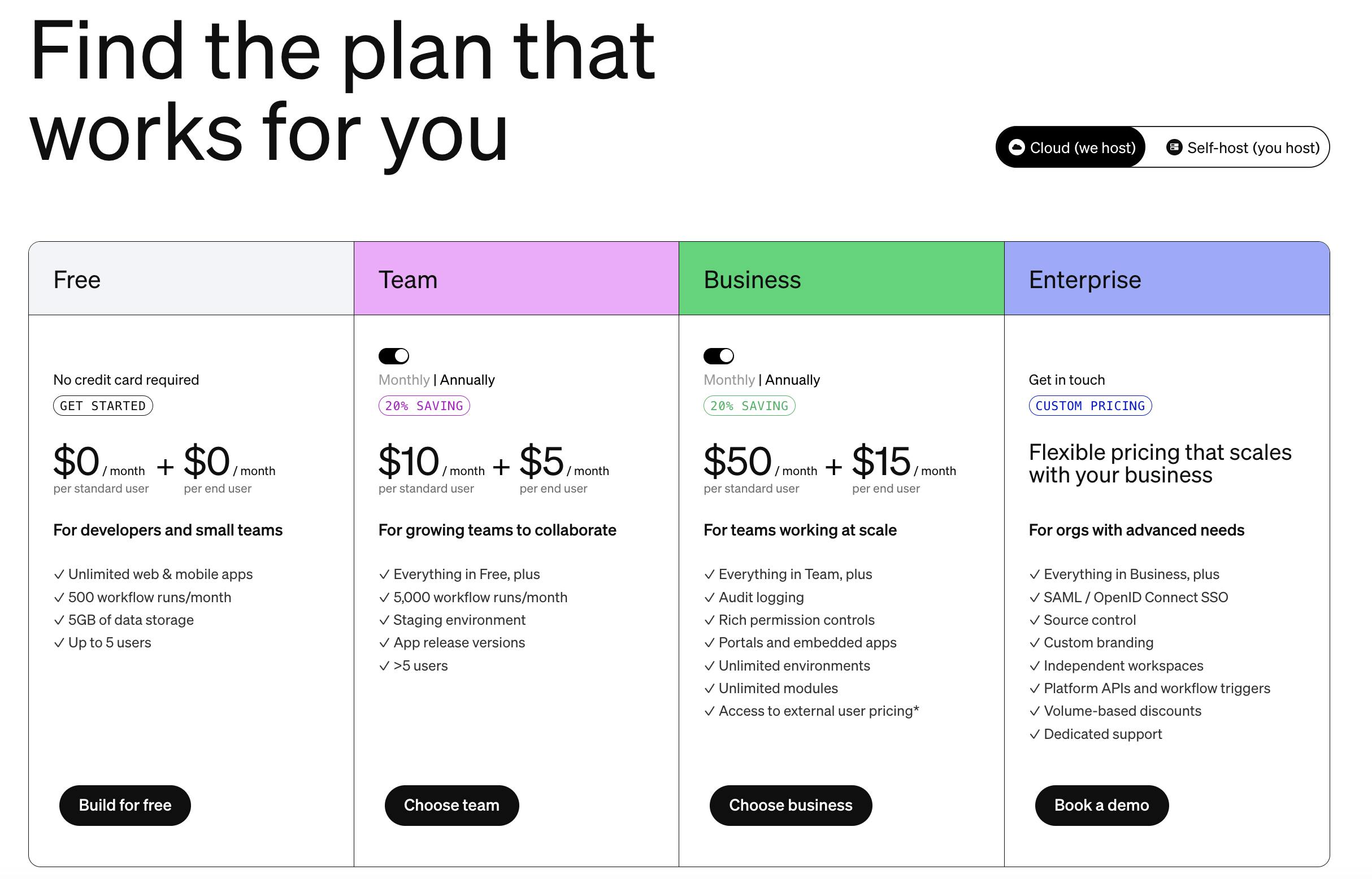

Retool offers a tiered, per-seat software subscription pricing model. In 2023, it rolled out an updated pricing model to distinguish between end users (consumers) and standard users (builders). The move was meant to democratize the ability to build and share applications at scale. Retool offers $25K in free Retool startup credits through the Retool for Startups program. This allows for quick capture of high-potential, fast-growing startups early and helps to grow alongside them.

Though Retool started primarily with a product-led motion targeting the self-serve segment of the market, Retool has invested heavily in a more enterprise go-to-market motion. It has grown its sales team from ~6 employees in 2020 to ~75 as of April 2024. As the company has progressed towards a more traditional enterprise go-to-market strategy, it has introduced custom pricing and additional features for enterprise customers.

Traction

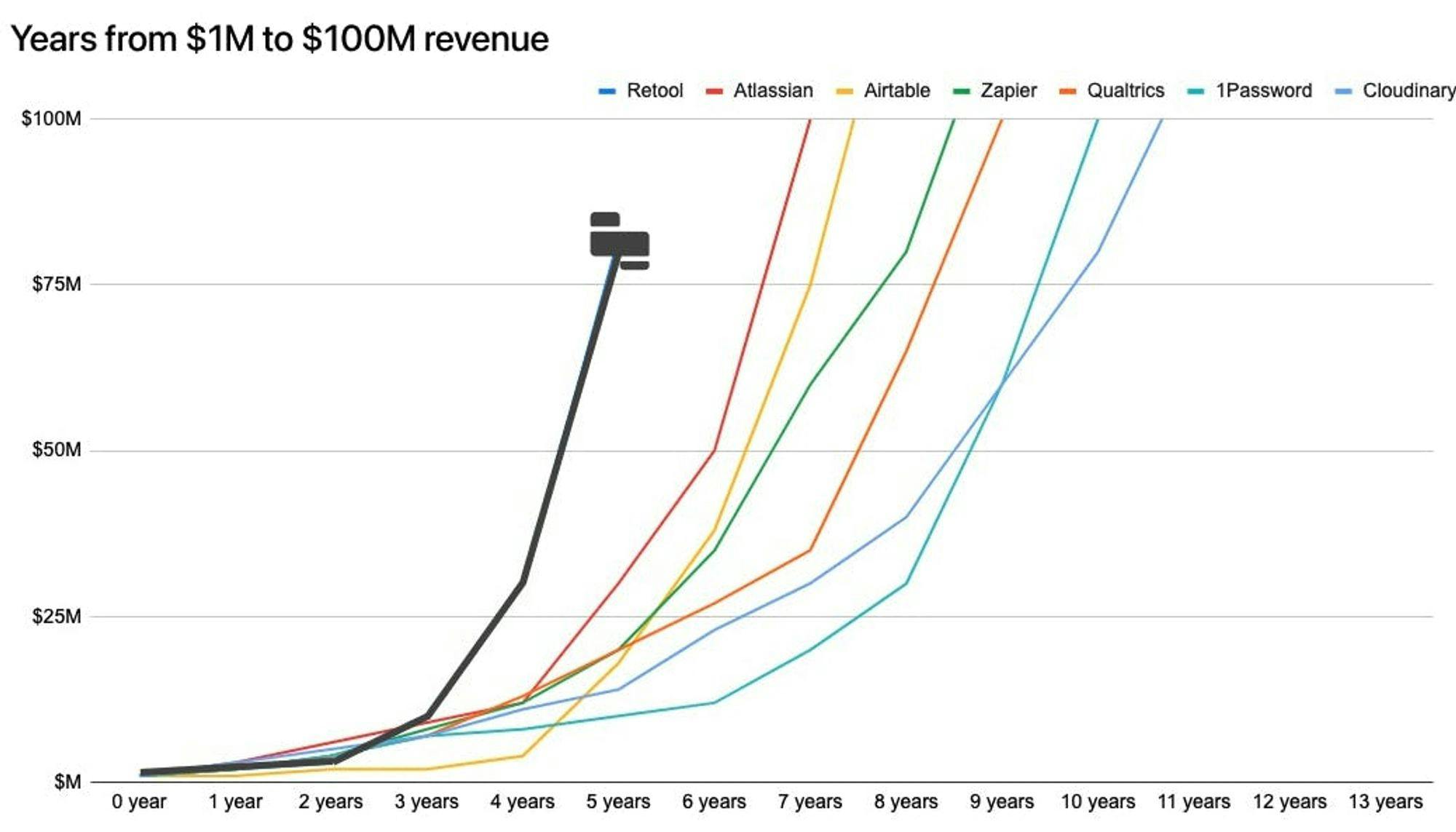

Retool's July 2022 Series C2 funding announcement reported that “it has seen more than 500K apps built on its platform with billions of queries pointing to strong usage of that software.” The company has grown from ~$10 million in ARR in 2020 to ~$80 million in ARR in 2022. Notable customers include Amazon, Mercedes-Benz, Doordash*, the NFL, NBC, Rakuten, Brex, Lyft, Plaid, Coinbase, Ramp*, and more.

Retool has scaled its revenue rapidly, crossing the $75 million ARR threshold within five years of founding according to an unverified third-party source. Retool reported in December 2021 that it was cash flow positive. It strived for efficient growth from the beginning having had several million dollars in revenue when the team was just four people.

Source: Sacra

Valuation

In July 2022, Retool announced that it had raised a $45 million Series C2 at a $3.2 billion valuation with participation from Sequoia, Stripe co-founders John and Patrick Collison, GitHub’s former CEO Nat Friedman, and Elad Gil.

Keeping the valuation and dilution low was an intentional decision. Hsu has managed fundraising with the philosophy that “a lower valuation and lower dilution is substantially better for employees.” Retool expects that it will reach ~6% dilution by the time it reaches a $5 billion valuation, which as Forbes writer Alex Konrad pointed out:

“compares favorably to cloud data company Snowflake, which gave up 60% of its equity in dilution by the time it reached a $3.6 billion valuation; API company Twilio, which was diluted 37% at IPO and work messenger Slack, which was diluted 36%.”

Retool’s Series C was smaller than Series B in terms of funds raised. Hsu only allowed existing backers of Retool to participate in its Series C.

Key Opportunities

New Functionalities

As of April 2024, Retool supports SQL and Javascript as languages used to build internal apps. It does not yet support some popular languages often used to perform internal tasks. Its built-in UI components cover many use cases but are less suited for custom UI work, such as animations or special popups. Building out these use cases and supporting a wider array of popular languages are clear areas of opportunity for the company.

In addition, Retool has continued to build out functionality emphasizing platform stability, including releasing a new runtime to improve app speed and a clearer change log for documenting application updates. Continued investment in developer trust will result in lower churn and, likely, increased adoption of tools within companies.

External Applications

Retool is slowly moving towards enabling the building of external tools as the next natural step. Retool Mobile advertises that will be possible to extend “the power of Retool everywhere you need it: in the field, at the warehouse, or on-site with your customers.” If Retool can successfully address external tools, it could become a staple in all app development. This is much easier said than done, as external apps can be much more complex than internal tools due to unpredictable usage, much larger user bases, and higher variance between external apps; but if the company can pull it off, it will expand Retool’s addressable market significantly.

Partnerships & Services

Retool is an application development platform, meaning it still does require developer expertise to build well-architected, utility applications. One estimate indicated that by 2025, nearly one-third of global sales will come from partnerships — cross-industry players working together to create solutions. For Retool to meaningfully scale its operations, the company will need trusted partners to help co-sell the product, as well as to train and build Retool applications for newer customers. Retool has begun building out this effort by introducing a partners page and Professional Services team but will require proper execution.

Key Risks

Developments in AI

Recent AI technologies have reduced the barrier to entry and the cost of building applications. For instance, ChatGPT has enabled non-technical professionals to build applications, and tools like Github Copilot have made developers more productive and efficient. While custom development will require developer resources, there could be a future where the marginal value of a tool like Retool diminishes. Retool must stay up to speed with AI developments and incorporate that speed into their core product.

Competition

As Retool continues to expand its product surface area, it also expands its competitive landscape. The ability to sell an all-in-one product vs. a best-in-class offering will require Retool to compete on multiple fronts simultaneously, from no-code app builders to integrations and databases.

Graduation Risk

Retool is often used to spin up MVPs for key internal tools. As companies grow and their internal processes mature, there is a risk that they will likely seek to build a more robust, permanent solution for their internal tools, improving upon the MVPs they have built on Retool. Customers could decide to build tools in-house for cost and quality management.

Summary

Retool is creating an easier way to build internal tools. Internal tooling continues to represent trillions of dollars of spend and millions of developer hours every year. Retool has built a product suite that attempts to make building these tools easier — a drag-and-drop interface for building custom tools, pre-built templates, an API for integration with other systems, and more. Retool has achieved strong traction and growth. The developer market is dynamic and moves rapidly, meaning the solution to a developer’s needs today may be obsolete in the next week. As a Result, while Retool has established itself in the market, the company will have to continue to confront a changing landscape, both from existing competition and AI innovation, while avoiding graduation risk for many of its customers.

*Contrary is an investor in Doordash, Ramp, and Airplane through one or more affiliates.