Thesis

US healthcare spending in 2021 totaled $4.3 trillion, equal to roughly $12.9K per person. Healthcare costs have risen significantly as a proportion of GDP over the last 60 years, from 5% to 18% — among the world’s highest. The need to achieve better results is more pressing than ever, and people are becoming more aware of the difference between purchasing goods and services versus accessing healthcare.

Convenient care, encompassing urgent care and retail clinics, has quickly grown in popularity due to its cost and time-saving benefits. Urgent care centers are ideal for non-emergency medical needs such as colds, sprains, ear infections, and rashes for which a primary care doctor cannot be seen immediately. Such care allows patients to be seen within 24 hours at a fraction of the cost of an emergency room visit and saw an increase in demand during the COVID-19 pandemic. As of January 2023, the number of urgent care centers nationwide was increasing annually at a rapid rate of 7% per year.

Another parallel trend is the rise of virtual medical appointments. In 2022, 74% of patients opted to schedule appointments via phone, while 36% preferred online scheduling through their provider or health plan. In consumers ages 25 to 34, this number increases to 45%. ~85% of 2.2K physicians surveyed in 2020 reported that they used telehealth to treat their patients. From 2019 to 2020, there was a significant increase in the adoption of telehealth services by clinicians, with usage rates climbing from 18% to 48% in the US during the COVID-19 pandemic. 62% of consumers stated they would choose virtual care instead of in-person care for health and wellness advisories in 2020.

Solv is a digital platform allowing patients to book same-day doctors’ in-person and virtual appointments for urgent care visits. The company integrates video visit capabilities, secure messaging, and patient management tools for healthcare providers to ensure quality healthcare and help grow their practices.

Founding Story

Solv was founded in 2016 by Heather Fernandez (CEO) and Daniele Farnedi (CTO). Before founding Solv, all three founders worked at Trulia, a real estate marketplace. At Trulia, Fernandez was the SVP & GM of Business Services, and Farnedi was the CTO.

After Trulia was acquired by Zillow in 2015, the cofounders decided to take on problems in healthcare after discovering their shared passion for healthcare and exploring various ideas over the course of a year. As a mother of three kids, Fernandez had experienced challenges as a firsthand healthcare consumer. They decided they wanted to provide an accessible solution to the problems consumers often face in the US healthcare industry. The founding of Solv was driven by two major problems in particular: difficulty in accessing high-quality doctors, and lack of transparency in appointment pricing.

Looking back at her experience at Trulia in helping consumers create better real estate decisions, Fernandez reflected that similar technology could be applied to improve healthcare decisions and the healthcare consumer experience. As she said in 2018:

“The technology advancements that have changed all parts of lives can and should enable consumers to live well, stay healthy, and get access to the healthcare that they deserve for themselves and their family.”

Product

In-Person Care

Solv’s in-person care is a service that focuses on connecting users with third-party healthcare options in their local area based on geographical proximity and treatment needs. The platform allows users to search for and schedule last minute, in-person medical appointments with providers and book ahead for up to 24 hours in advance. Treatments can also be further tailored according to whether the patient is a child or adult.

Source: Solv

In the “What?” data entry field, users can manually enter symptoms, desired services, or preferred healthcare providers or choose from a predefined list of generalized options such as “Flu shot” or “Ear ache.” Additionally, an “Urgent Care” option is also available. In the “Where?” section, users select their preferred location to access the in-person service, while the “When?” section provides a timeframe that is divided into five time periods: ASAP, evening of the current day, morning of the next day, afternoon of the next day, and evening of the next day. In the “Who?” section, users choose if they want child-friendly healthcare providers.

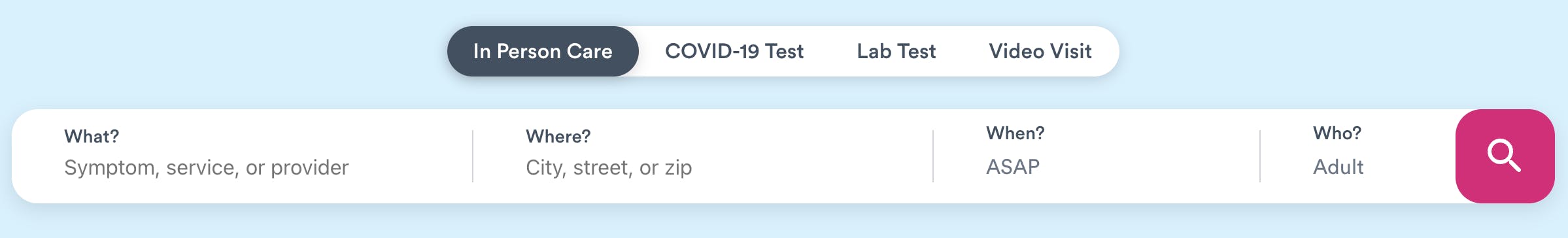

Source: Solv

Upon clicking the search icon, users are presented with a list of third-party healthcare provider options, with the top-ranked “Best Match” provider prominently featured. Each provider’s profile includes location, distance, rating (based on a five-star scale and number of ratings), and distinguishing characteristics like “short wait time” and “sparkling clean.” Available appointment slots are listed at the bottom of each profile. Users can refine their search by applying filters for accepted insurance plans and preferred provider ratings. Users click on the desired time slot with the associated provider to select one.

Source: Solv

Lab Tests

Lab testing options include, but are not limited to, COVID tests, rapid COVID tests, STD testing, TB tests, allergy tests, pregnancy tests, comprehensive metabolic panels, HIV tests, A1C tests, and thyroid tests. Users can also manually enter the service, lab, or test type they seek.

Solv lists its website's most popular tests under “browse services”. This directs users to provider listings using the user’s current location rather than having to input the qualitative manual data typically required within the lab test option. In addition, Solv allows users to schedule in-person tests such as COVID-19 through third-party providers.

Source: Solv

Video Visits

To find online appointment options on Solv, users provide their precise geographic location and specify the desired timeframe for their treatment in the “Location” and “When?” sections. Subsequently, the algorithm generates a comprehensive data list showcasing all virtual telemedicine providers that match the criteria. Available options include urgent care clinics, family practices, and virtual clinics.

Source: Solv

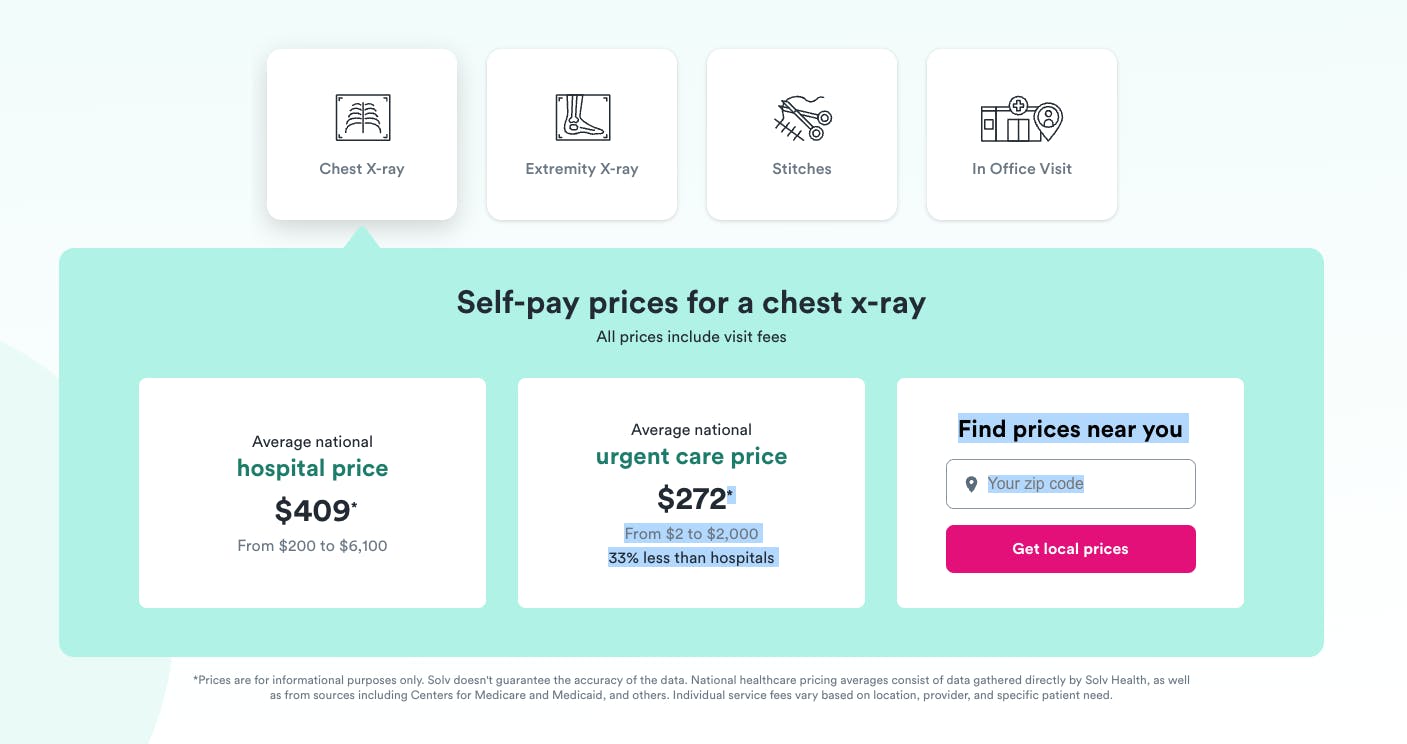

Solv ClearPrice

Solv ClearPrice is a transparent pricing feature. ClearPrice provides users with upfront and transparent cost information for healthcare services, ranging from X-ray consultations to prices for stitches. Users can compare the prices of healthcare procedures before booking an appointment. This helps consumers make informed decisions about their options and understand the financial implications of each procedure, such as hidden costs.

Source: Solv ClearPrice

Solv Triage

Solv Triage offers online symptom checking and triage services. Users input their symptoms and receive personalized recommendations on the next steps, such as scheduling an appointment or seeking immediate medical attention. This is done in the form of a short quiz.

Source: Solv Triage

Solv for Providers

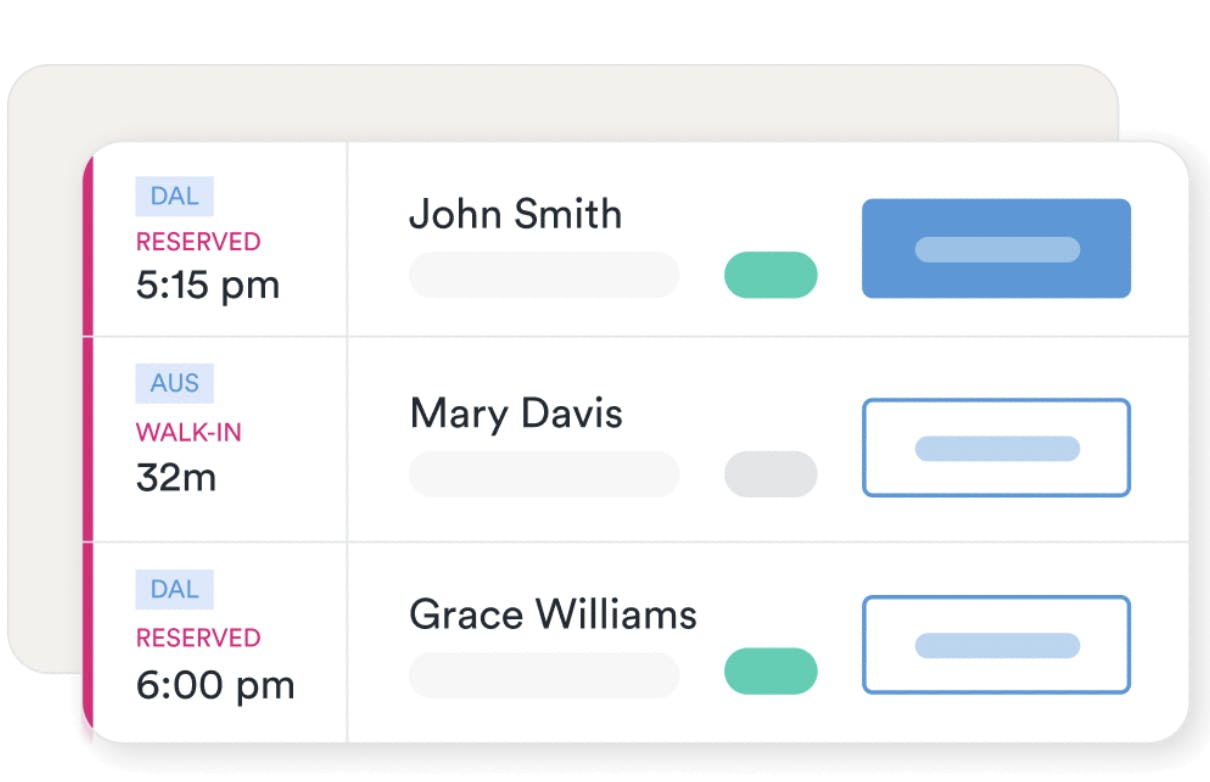

Solv for Providers integrates Solv’s platform with existing CRMs used by healthcare providers. Solv’s tools include streamlining patient and workflow management with appointment scheduling tools, digital check-in capabilities, and patient communication tools. This includes features like SmartQueue, aimed at optimizing walk-ins and book-ahead patients, and Solv Pay, where providers can send HIPAA-compliant documents and SMS messaging for unpaid invoices to patients. Providers can improve their website experience with branded online booking, digital registration, text messaging, and payments. They can discover bottlenecks in their front desk workflow.

Source: SmartQueue

Market

Customer

Solv serves patients looking for same and next-day healthcare appointments and urgent care providers looking to serve patients.

Fernandez has said that the company’s central objective was to decrease the friction between healthcare providers and individuals seeking medical services. Audience demographics in the app and website usage reflect a 54% female to 45% male distribution, with the largest segment of users by age being 23% of users between the ages of 25 to 34, showing that young users are a large part of Solv’s user base.

On the healthcare provider front, Solv has established partnerships with urgent care centers, primary care clinics, and individual specialty practices. One notable customer of Solv is Walgreens, which operates urgent care centers and medical clinics across the US. Consumers can use the Solv platform to book flu shots, COVID-19 tests, and other lab tests at their nearest Walgreens location.

Market Size

Urgent care is rapidly growing due to convenience, lack of primary care, high ER costs, and increased health system and private-equity investment. There were 11.2K active urgent care centers in the US as of January 2023 and that number is increasing annually at a rate of 7%. Urgent care centers are ideal for non-emergency medical needs such as colds, sprains, ear infections, and rashes for which a primary care doctor cannot be seen immediately. The urgent care market is projected to reach $48 billion in revenue in 2023, a 21% increase from 2019. 80% of the US population is within a 10-minute drive of an urgent care location. Health insurers and hospitals are becoming more focused on keeping patients out of the emergency room.

The global telehealth market, meanwhile, was valued at $83.5 billion in 2022, projected to grow at 24% from 2023 to 2030. The US telehealth market accounts for half of the global market as of December 2022, estimated to be valued at $41.7 billion. By end-user segmentation, healthcare providers accounted for 57%. Multiplying this percentage by the US telehealth market, Solv’s total addressable market for its telehealth service offering will be $23.8 billion.

The US healthcare information technology market size was valued at $96 billion in 2020 with a 13.4% CAGR growth rate from 2021 to 2030. This would estimate the market to reach a value of $344 billion by 2030. In 2022, global healthcare providers comprised a 69.9% revenue share of the end-user segment. The North American region accounted for 44.9%. Solv’s platform targets health providers, 44.9% of 69.9% multiplied by $96 billion would translate to a total addressable market of approximately $30 billion for the in-person care segment.

Competition

Zocdoc: ZocDoc provides an extensive directory of providers across many specialties with an on-the-spot appointment booking capability. Zocdoc benefits providers by providing them access to millions of patients and streamlining their appointment workflows. Zocdoc provides providers with scheduling and patient flow tools to connect with patients. In 2022, the company said it enabled booking in-person or virtual care across over 200 specialties and over 12K insurance plans. It has integrations with 150 electronic health record systems (EHRs) and works with over 60 health systems. Unlike ZocDoc, Solv focuses only on urgent care, while ZocDoc offers a wider range of appointment booking from primary care to specialists like dermatologists.

Nexhealth: Nexhealth is a real-time patient booking platform. It was founded in 2017 and has raised $177 million in total funding. It integrates with practice management and electronic health record systems. It includes HIPAA-compliant online forms, two-way messaging, booking, payments, and appointment reminders. It reached a valuation north of $1 billion in 2022 and managed the health records of over 68 million patients.

Teladoc: Teladoc is a publicly-traded virtual care provider, changing healthcare delivery's access, cost, and quality dynamics. Teladoc acquired Livongo, a health tech company focused on chronic conditions, for $18.5 billion in 2020. Like Teladoc, Solv offers virtual appointments.

PlushCare: PlushCare connects doctors and patients for on-demand care. It was founded in 2015 and raised $31 million in funding. Health benefits platform Accolade acquired PlushCare for $450 million in 2021. Unlike Solv, it did not just focus on urgent care and same or next-day appointments.

Amino: Amino is a digital health company founded in 2013. The company’s platform offers users guidance in finding medical help for personalized needs and matching individuals with in-network facilities. Like Solv, Amino’s search engine generates a list of healthcare recommendations for its users. While its founding roots were in providing a direct-to-consumer product, Amino Health has evolved to deliver its offerings in a B2B2C model, unlike Solv. The company has raised $125 million in total funding.

Business Model

For consumers, Solv is free to use. Solv’s website and mobile app match consumers with healthcare providers based on their healthcare needs. This ranges from booking same-day appointments for everyday health needs to locating the nearest urgent care clinic. Consumers also have the option to treat their needs using the Solv Video Telemed setting through the app, allowing for remote consultations.

Solv generates revenue from selling software to healthcare providers on its platform. It does not disclose its pricing, but providers can apply to request a quote on the provider-facing Solv Health website. Solv works with different types of providers, such as healthcare systems, urgent care clinics, and primary care physicians. Solv’s software integrates into the provider’s existing EHR systems. Integrations supporting Solv’s platform include healthcare software like DrChrono, Athenahealth, Allscripts, and Epic. The platform features encompass online bookings, SMS communications, video telemedicine, and digitization of paperwork.

Traction

The number of urgent care visits managed through Solv tripled from 2018 to 2019 — from 2.7 million to 8 million. In October 2022, Solv launched Solv Connect, a nationwide direct booking marketplace with 6 million monthly users as of October 2022. As of February 2023, over 51 million health appointments have been booked through Solv. Solv Connect is integrated with most major EHRs, including Allscripts, Cerner, Epic, and Athena Health, as of September 2021.

Valuation

Solv raised a $45 million Series C at an undisclosed valuation in May 2022 led by Acrew Capital and Corner Ventures, with participation from Benchmark and Greylock, who were investors in previous rounds. The round also had participation from actress Kerry Washington and the founders of Cityblock, Stitchfix, and PagerDuty. The Series C brought Solv’s total funding to $95.1 million. Investors from previous years include Light Street Capital, Multicare Health System, Rethink Impact, and notable individuals like Ayori Selassie.

A comparable public company to Solv is Teladoc Health, which has seen revenue multiple drop from ~13x in June 2021 to 1.7x in June 2023. 2021 and 2023 revenue estimates for Solv were unavailable as of June 2023.

Source: Koyfin

Key Opportunities

Growing Telemedicine Adoption

The growth rate in the telehealth market is attributed to consumer demand for increased accessibility through telehealth services. People seek the treatment of mild conditions in the comfortable setting of their own home, a trend accelerated by the high emphasis on social distancing during the COVID-19 pandemic. This has increased the demand for technology-driven platforms to deliver quality healthcare and reduce cost concerns. By providing and expanding, telehealth options, Solv can continue catering to the growing demand for virtual consultations.

Working with Primary Care Providers

Solv can explore partnerships or integrations with primary care providers to offer a more comprehensive healthcare booking platform. By connecting patients with urgent care and primary care services, Solv can provide a seamless continuum of care and enhance the patient experience.

Data Analytics

Solv can leverage the data it gathers from patient interactions and appointments to generate insights for healthcare providers. Solv can help urgent care centers optimize operations and efficiency by analyzing trends, patient flow, and resource utilization.

Key Risks

Regulatory Environment

The current regulatory environment requires healthcare IT companies to adhere to certain compliance and regulations, such as the Health Insurance Portability and Accountability Act (HIPAA). The use of sensitive patient data creates concerns regarding how healthcare companies can retain and utilize patient data for operational improvements. It also presents data privacy concerns for healthcare providers, who must retain and uphold patient confidentiality to industry standards. These concerns and the need to adhere to federal, state, and local regulators can impact Solv’s business model by causing increased costs and risks.

Data Breach Controversy

In March 2023, Solv made headlines with a data breach in its partnership with UC San Diego Health, where 54K customers were impacted. UCSD said in its announcement that:

"UC San Diego Health is notifying patients that our technology vendor, Solv Health, used analytics tools without our authorization on the scheduling websites for our Urgent Care and Express Care clinics. The analytics tools they used on the scheduling websites captured and transmitted information to their third-party service providers."

This breach, and others like it in the future should they occur, could harm Solv’s reputation and prevent growth in its usage among US healthcare providers, who tend to be risk averse when it comes to data management and patient confidentiality.

Summary

Solv is a healthcare startup aiming to address the growing consumer demand for accessible and convenient healthcare services. The founders recognized the need for accessibility to high-quality doctors and transparency in appointment pricing, leading to the development of the Solv app for consumers and creating a consumer-centric platform for all healthcare providers.

With the growing healthcare industry witnessing a shift in consumer behavior towards virtual consultations and solutions, Solv has capitalized on this trend by providing a seamless experience and platform to both the supply and demand sides through telehealth offerings and in-person consultations. The mobile application and website allow users to find and book appointments for tailored health needs, choose a preference for in-person or virtual visits and schedule lab tests with local providers. The consumer platform also features symptom-based search, appointment scheduling, transparent pricing information, and online symptom checking. Solv has gained visibility among healthcare providers through established strategic partnerships with industry leaders like Walgreens and MultiCare Health System.