Thesis

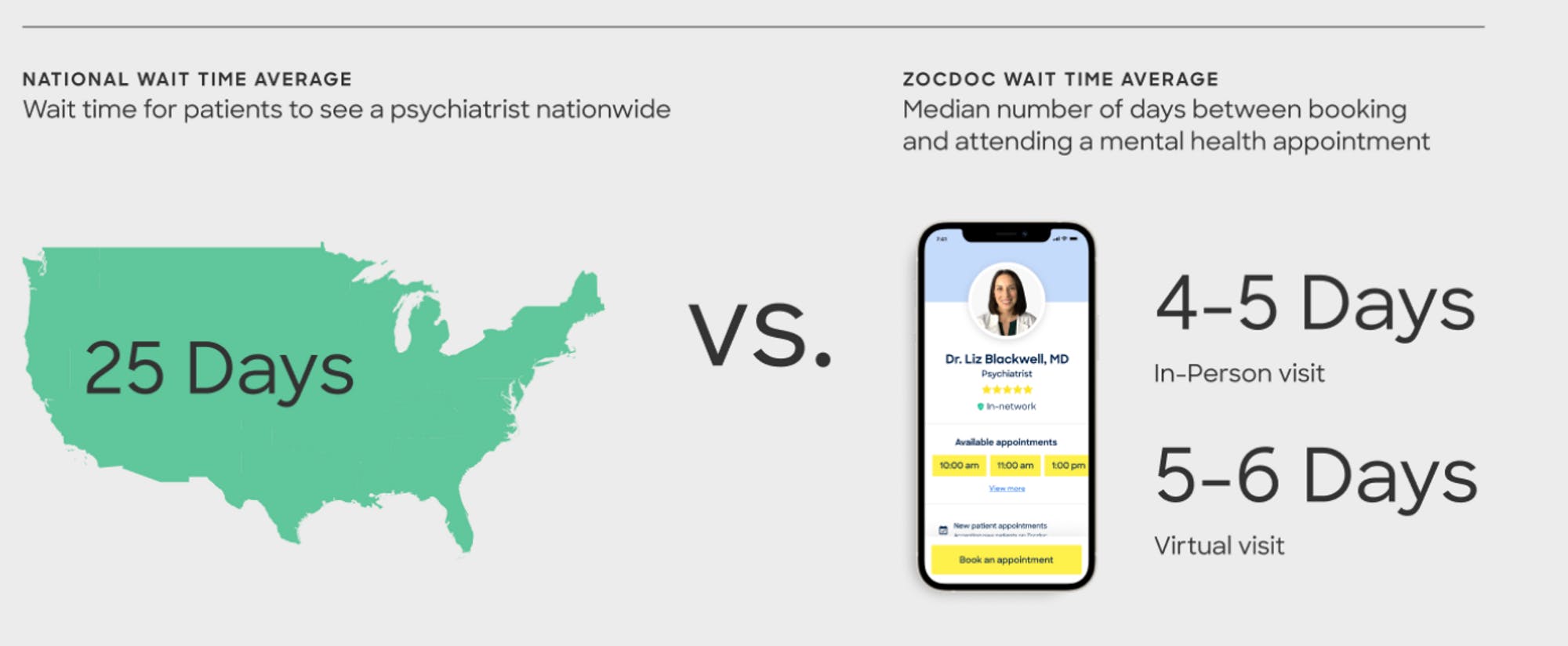

As of 2019, more than 50% of doctor visits in the US were to primary care physicians. However, getting an appointment to see a doctor is as challenging as ever. In 2022, the average patient appointment wait time is up 8% since 2017 and 24% since 2004. It also took around 26 days for a new patient to get an appointment with a provider in 2022. Too few primary care physicians are attempting to care for a growing, aging population requiring more attentive care. The US is expected to face a shortage of between 21K-55K primary care physicians by 2033.

Skipping regular preventive care because patients can’t get timely appointments could lead to additional problems, while improving access to care in significant ways could dramatically reduce the $320 billion in healthcare costs attributed to health inequities. In addition, lack of accessibility can be frustrating for consumers since patients are no longer satisfied paying for care that doesn’t offer the same self-service and convenience as airlines, restaurants, and ride-share offer.

Zocdoc allows patients to find nearby healthcare providers who accept their insurance and book appointments instantly online. It aims to improve access to care by aggregating millions of in-person and virtual appointments across a nationwide provider network of over 200 specialties and over 12K insurance plans. With Zocdoc, patients can see doctors’ open appointment times and book them online, make informed choices with verified reviews, and stay on top of check-ups with reminders. Zocdoc makes doctors discoverable to patients, reduces the number of no-shows, and fills in last-minute openings in doctors’ calendars caused by cancellations and shifting schedules.

Founding Story

Zocdoc was founded in 2007 by Oliver Kharraz, Cyrus Massoumi (who served as the first CEO), and Nick Ganju. Karraz is a physician who comes from a 300-year family tradition of doctors. He built and sold his first internet company in 1994 during his medical training in Germany. Kharraz, a neurologist turned healthcare IT consultant, and Moussomi met while working at Mckinsey and spent time in leadership positions at software companies. Prior to Zocdoc, Ganju also worked in technology, serving in CTO roles (cfX, eBoodle, Mixonic), and lived in Silicon Valley.

Massoumi recounts a painful flight to New York City in 2007 as inspiration to start Zocdoc. He happened to rupture his eardrum on the flight and attempted to track down a physician in the city in relatively short order. After struggling to find an appointment at any local doctor’s office, Massoumi decided to move forward with Zocdoc. Zocdoc’s launch was announced shortly after at the TechCrunch40 conference (now called TechCrunch Disrupt) in 2007, with the goal to make patients aware of open appointments for local doctors in real-time, anytime, and book those times 24/7 and even minutes before the appointment.

The initial launch focused on physicians in New York. Massoumi went door to door to persuade doctors to take a chance. PowerPoint in hand, his goal was to get physicians to list their unfilled appointment times on the website. The service expanded rapidly across additional cities and medical specialties, supported by a $3 million seed investment from Khosla Ventures in 2008.

Product

Patients

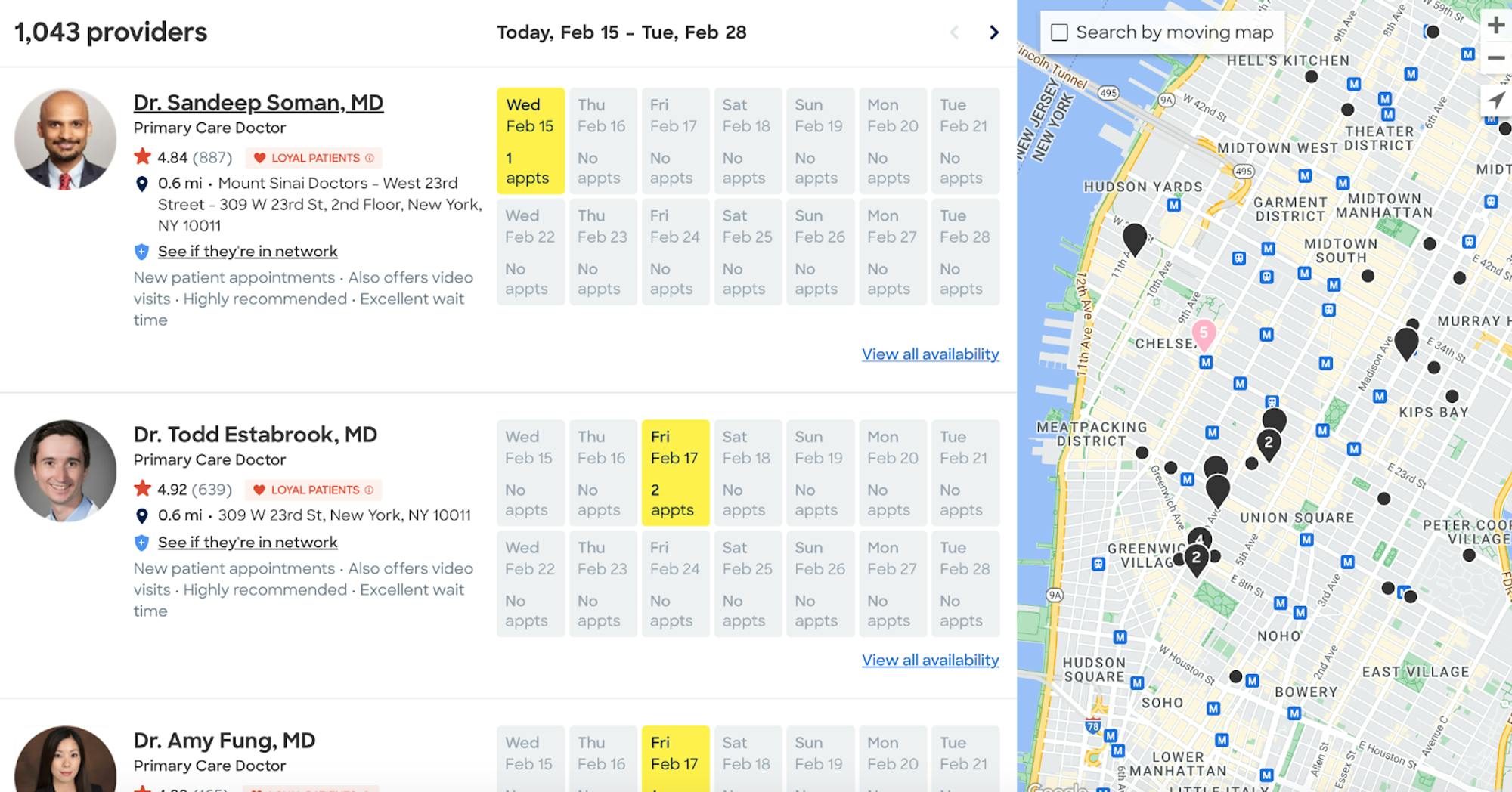

Source: Zocdoc

Patients can explore Zocdoc’s searchable provider directory in two primary ways:

Specialty: Patients can search for the specific provider specialty of interest with an additional browse tool for some of the most commonly sought provider types like primary care physicians, pediatricians, urgent care providers, OBGYNs, psychiatrists, psychologists, therapists/counselors, ophthalmologists, optometrists, orthopedic surgeons podiatrists, chiropractors, and dentists.

Procedure/Problem: Patients can search for a procedure/problem with an additional browse tool for some of the most commonly sought procedures like ADD, annual physical, IUD insertion, marriage counseling, OBGYN emergency, LGBT care, cortisone shots, dental emergency, Nexplanon removal, ENT emergency visit, couples therapy, prenatal care, pre-surgical clearance, pain medication prescription, gastroenterology emergency, or hair loss.

Patients can apply filters like location, insurance coverage, and wait time to narrow their search. Each physician shows appointment availability. Reviews help patients in making sure it is the right fit. Based on historical data, it also shows an estimated in-office wait time.

Zocdoc began implementing an insurance verification tool that leverages AI as early as 2017. In 2020, during the COVID-19 pandemic, Zocdoc announced video visit appointments. In 2021, it rolled out a vaccine scheduler system that became widely used in certain metros.

Doctors

Zocdoc helps healthcare providers reach millions of patients searching for care online and showcase their practice through reviews, photos, and awards. Providers automatically receive bookings in their calendars or scheduling software and can send automated requests for intake forms, insurance cards, and IDs. Patients can choose from a list of in-network providers who have availability for an in-person or telehealth appointment. When patients book an available time, providers get notified after a booking.

Zocdoc For Developers

Zocdoc’s API expanded its capabilities beyond the Marketplace, positioning Zocdoc as the infrastructure for digitizing the nation’s patient flow. Developers can build on top of Zocdoc’s technology to build new services. The first use case, Care Navigation, was about making provider-to-provider referrals in the United States more efficient and trackable. Care Navigation will enable care coordinators to view providers’ real-time appointment availability, regardless of their specialty, insurance plan, or EHR, and digitally book appointments on behalf of patients.

Market

Customer

Zocdoc benefits patients by providing an extensive and easily accessible directory of providers across many specialties with an on-the-spot appointment booking capability. Zocdoc benefits providers by providing them access to millions of patients and streamlining their appointment workflows. Zocdoc benefits larger practices and health systems by providing scheduling and patient flow tools to more seamlessly connect with their patients.

Market Size

The medical scheduler market, a subset of healthcare administration and healthcare assistants, is estimated at $11.7 billion. The global telemedicine market is expected to reach $155 billion by 2027.

Competition

As digital health becomes an increasingly powerful force in the healthcare landscape, there has been an explosion of platforms and tools allowing easier access to care.

Nexhealth - Nexhealth is a real-time patient booking platform. It was founded in 2017 and has raised $177 million in funding. It integrates with practice management and electronic health record (EHR) systems. It includes HIPAA-compliant online forms, two-way messaging, online booking, online payments, telehealth, appointment reminders, and other features. It reached a valuation north of $1 billion in 2022 and managed the health records of over 68 million patients.

Teladoc - Teladoc is a publicly-traded provider of virtual care, changing the access, cost, and quality dynamics of healthcare delivery. Teladoc acquired Livongo, a health tech company focused on chronic conditions, for $18.5 billion in 2020.

Patientpop - Patientpop is a provider practice management and marketing solution that helps providers attract patients, manage their reputation and grow their business. It offers online scheduling tools, although the marketing approach attracts patients rather than a public-facing directory. It was founded in 2014 and has raised $125 million in funding. It merged with Kareo in 2021, rebranded as Tebra, and has access to more than 100K providers with more than 85 million patients.

PlushCare - PlushCare is a digital healthcare company that connects doctors and patients for on-demand services. It was founded in 2015 and raised $31 million in funding. Health benefits platform Accolade acquired PlushCare for $450 million in 2021.

Healthgrades and Vitals are provider search directories that focus on allowing patients to learn more about providers as part of their search/selection process. However, these platforms do not focus on providing appointment-booking tools.

Other competitors focus on a specific specialty or demographics. Ro is a digital health company focused on erectile dysfunction, hair loss, skincare, and fertility. Opencare and Localmed are early-stage dental appointment-booking platforms. Zocdoc also has considerable competition in international markets. In some instances, platforms have gained popularity in a single country, such as Accurx in the UK and Doctolib (which raised €150M in 2019) in France.

Business Model

Zocdoc’s initial business model allowed providers to pay an annual subscription fee of $3K so the provider could be included in the Zocdoc directory. This fee was maintained regardless of the number of patients that came through the system. Zocdoc began making changes to its business model because the flat fee was seen as a constraint on the company’s growth. It adopted a fee-per-patient booking in 2019. Booking appointments with Zocdoc is free for patients.

Traction

Source: Zocdoc

In 2022, the company said it makes finding and booking in-person or virtual care easy across over 200 specialties and over 12k insurance plans. It has calendar integrations with 150 EHRs and works with more than 60 leading health systems. It services millions of in-person medical appointments and nearly one million video visits.

Zococ became EBITDA profitable in September 2019 and had its first EBITDA profitable quarter in Q4 2019. It grew revenue by 36% year-over-year in the first two months of 2020.

Valuation

Zocdoc has raised just over $375 million as of February 2023. It announced $150 million in growth financing from Francisco Partners in 2021. It was valued at $1.8 billion at the time of a raise in 2015 and previously valued at $700 million in 2011.

Key Opportunities

The Insured Population

As the number of insured individuals in the US continues to increase, estimated now to be more than 300 million individuals, Zocdoc will continue to have an opportunity to serve patients seeking appointments. Zocdoc is well-positioned for newly insured patient capture as an existing market leader.

Telehealth

While Zocdoc provided telehealth services prior to COVID, the pandemic highlighted the company’s ability to service the high demand for telehealth. Even with a post-pandemic demand slump, Zocdoc could be positioned to capture the virtual care market.

Interoperability Leadership

As digital health expands, there are more opportunities to make processes in the health journey more efficient. This requires wrangling with a growing diversity of tools, often nested within one another, and placing them intelligently into existing technology stacks and among users where they will have the greatest impact. Zocdoc’s integration with the Epic App, the vaccine scheduler, and its recent API launch are examples of leadership position in interoperability.

Key Risks

Competition

A growing number of appointment-booking solutions are going after several verticals of healthcare. Zocdoc has to keep up the product momentum to fight off competition from horizontal players and vertical upstarts across regions.

Growth Potential

Zocdoc’s future growth potential may be a victim of its prior success, given the high level of adoption of Zocdoc across metros in the United States. This may mean that further US expansion has some inherent constraints.

Summary

Consumer-facing tools providing more efficient access to healthcare providers and appointments are increasingly in demand. Zocdoc has executed its original inspiration on making it easier to search for a doctor. The company has grown quickly from its beginnings as a post-dotcom website to an expansive and interoperable marketplace. The company is well-positioned to maintain market leadership in appointment booking but will need to continue innovating to realize growth.