Thesis

The COVID-19 pandemic seemed to have had a significant and lasting impact on mental health. A 2022 survey reported that 90% of Americans believed the country was undergoing a mental health crisis, and 47% of parents believed that the pandemic had harmed their children’s mental health. Additionally, a 2023 report on mental health in the US found that 21% of American adults, or roughly 50 million individuals, were experiencing at least one mental illness, with 4.8% of adults experiencing suicide ideation.

Despite high rates of mental illness, mental health care remains inaccessible to millions of Americans. In 2021, about two-thirds of Americans with a diagnosed mental health condition were unable to receive care despite having health insurance. A different survey reported that as of 2023, 55% of US adults with a mental illness were receiving no treatment, with most of these individuals citing cost as the biggest barrier to care.

Of those suffering from mental health challenges, people from lower-income households are more likely to report poorer mental health and therefore are more likely to require mental health care. Cost is not the only barrier to care, as scheduling, stigma, and inability to find a mental health care provider are also cited as significant challenges. Most often, there are not enough mental health professionals to meet demand. A report released in 2023 found that most Americans live in a “mental health professional shortage area” as designated by the US Department of Health & Human Services.

SonderMind aims to address these issues by making mental health care more accessible. SonderMind offers a mental health platform that connects individuals with therapists and psychiatrists who are covered by their insurance. The service simplifies the process of finding and scheduling appointments with therapists who match clients’ specific needs and preferences. It allows mental health practitioners to find patients, gain credentials, and handle insurance billing. SonderMind’s key differentiators in the mental health space are its insurance-covered appointments, in-person appointment options, and specialized care options for veterans.

Founding Story

SonderMind was founded in 2014 by Mark Frank (CEO) and Sean Boyd (former co-CEO). Mental health was a personal matter for Frank, a retired US Army officer who’d not only watched many of his friends battle post-traumatic stress disorder but also struggled to find high-quality mental health care for himself. After graduating from West Point with a B.S. in computer science, Frank served in the US Army for five years, becoming a captain and platoon leader for Operation Iraqi Freedom. After completing his service in 2005, he worked as an associate at CDI Global and as an investment banker at Lehman Brothers and Morgan Stanley.

It was at these institutions that Frank learned about the business side of healthcare, dealing with insurance billing, patient marketing, contracts, and more. Frank left banking to pursue entrepreneurship, specifically in healthcare-related ventures. He founded the radiation therapy center Denver CyberKnife (which later became Next Oncology) in 2009 and SafeImageMD, a SaaS company for sharing medical imaging data, in 2012. He served as a partner of Goldwing Capital, a Denver-based seed investment firm. Frank earned his MBA and Master's of Engineering Management from Northwestern, as well as his M.S. in Computer & Information Sciences from the University of Phoenix.

While Frank brought the patient perspective to SonderMind, his co-founder Boyd brought the practitioner perspective. Boyd began his career as a clinician at Shiloh House, a trauma recovery center in Colorado, in 2004. While working at Shiloh House, he earned his Master's in Counseling from Regis University. Like Frank, Boyd was drawn to leadership — while working on SonderMind, he was named the Executive Director of the Colorado Counseling Association and the Western Region Chair of the American Counseling Association in 2015. While he stepped back from the co-CEO role at SonderMind in 2016, he remains involved in the health startup space. In 2017, he founded Humanly, which provides office space and community space to mental health and wellness professionals.

The seed of SonderMind began when Frank watched his sister, a licensed counselor, struggle with finding patients and insurance issues. As a result, he realized that many of the challenges faced by mental health practitioners were connected to accessibility and affordability issues faced by patients. He knew that the Mental Health Parity and Addiction Equity Act had been passed, which prevented insurance providers from limiting mental health benefits more than physical health benefits.

Frank’s knowledge of the mental health landscape formed his vision for SonderMind. Soon after, Frank met Boyd, who had built not only a successful mental health practice but also a business supporting therapists. By early 2014, the duo officially became partners and formed SonderMind with the goal of making healthcare more accessible to patients and improving the practitioner experience.

Product

SonderMind’s goal is to “democratize behavioral healthcare” by leveraging digital technology. Functionally, SonderMind is both (1) an insurance billing platform that takes the burden of handling insurance payments off of providers, and (2) a matching system that connects patients with in-state therapists and psychiatrists who accept their insurance. SonderMind’s platform can be broken down by its various users: patients, practitioners, and enterprises.

Patients

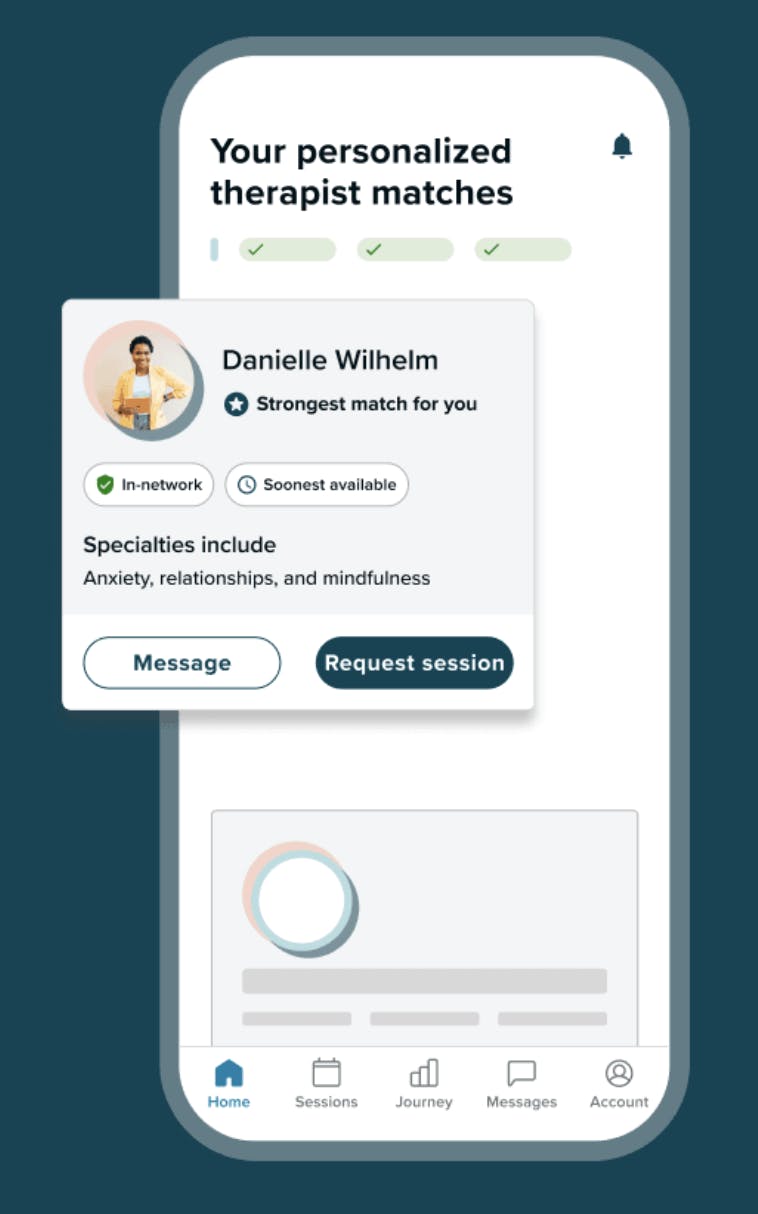

Source: Sondermind

As of July 2024, SonderMind offers its services in 25 US states and Washington D.C. Typically, mental health professionals can only work with patients in their own state, even if they provide virtual sessions. SonderMind’s matching process can be completed via an online questionnaire or phone call, and SonderMind aims to match each patient to a therapist, psychiatrist, or psychiatrist nurse practitioner within 24-48 hours. The matching process considers the patient’s zip code, insurance provider, and personal preferences.

SonderMind supports “most major insurance plans including HSA, FSA, EAP, and Medicare.” Patients whose insurance does not cover therapy can pay out-of-pocket rates, which, as of July 2024, range from $90-$200 for intake sessions and $43-$169 for regular sessions. SonderMind offers appointments seven days a week. It also offers access to mental health professionals who collectively serve all ages. It also offers both virtual and local, in-person options. SonderMind claims that appointments are typically available within seven days and that patients typically see results in fewer than six sessions.

In what may be motivated by CEO Mark Frank’s own experience as a veteran, SonderMind also offers specialized support for veterans. It is a trusted Community Care partner with the Veterans Health Administration, so any veteran with a valid referral from the Department of Veterans Affairs (VA) will have their SonderMind care completely covered by the VA. With SonderMind, most veterans can see a provider within 10 days of their VA referral, and each month, nearly 3K veterans see a SonderMind provider with their VA benefits. SonderMind providers who work with veterans also undergo specialized training with PsychArmor.

Practitioners

For mental healthcare practitioners such as therapists and psychiatrists, Sondermind offers the ability to handle credentialing, billing, and client discovery. It is completely free for practitioners to join SonderMind’s platform, with no ongoing costs.

SonderMind negotiates directly with insurance providers to provide high reimbursement rates for practitioners. Since it has its own billing and customer teams, it also takes care of the claims process and does not require practitioners to wait for reimbursements to be paid. Instead, practitioners are compensated every two weeks for sessions and can also be compensated instantly if they choose to pay a 2% fee.

SonderMind also helps practitioners gain credentials from major insurance providers in their state, enabling them to be accessible to a wider range of patients. Through its full electronic health records (EHR) suite practitioners can schedule patients, send messages to patients, file claims, record clinical assessment results, and conduct telehealth sessions. Practitioners also have the flexibility of conducting in-person or virtual sessions. Additionally, SonderMind offers career support in the form of 1-on-1 onboarding, training, and community events.

Enterprises

SonderMind also offers enterprises the option of providing employees and their dependents mental health care. SonderMind Enterprise Solutions offers insurance-covered therapy or psychiatry sessions, along with digital self-care tools and personalized insights. Many of these features come from SonderMind’s 2022 acquisition of Total Brain, a neuroscience company with a SaaS platform for cognitive screenings, assessments, and biometric tools. By screening employees for mental health conditions and gaining aggregated data on the company’s entire mental health, companies can improve productivity and reduce employee stress levels.

Market

Customer

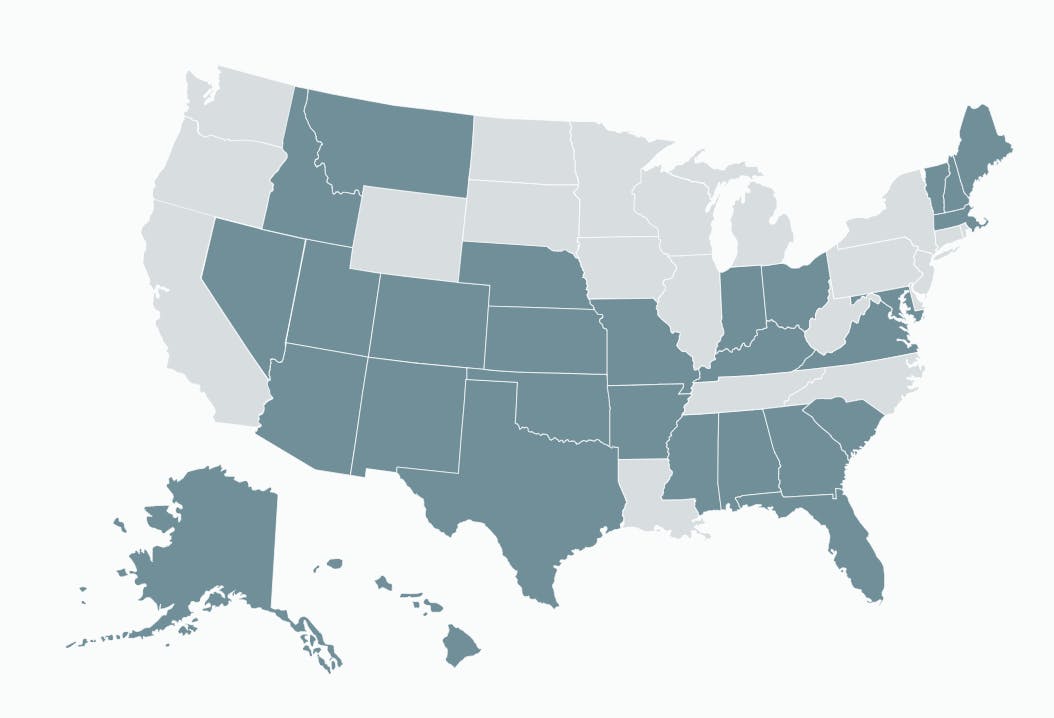

As of July 2024, SonderMind counted over 8K therapy and psychiatric providers as part of its network, up from 1.5K providers in 2021. SonderMind is only available in some US states, limiting its customer reach and market potential. However, the company was also in the process of expanding its coverage from 15 to 25 states.

Source: SonderMind

While SonderMind does not report its exact number of patients, it claims that it has had tens of thousands of patients in its decade-long history and supported over 3 million in-person and virtual therapy and psychiatric sessions. Its coverage includes major insurance providers such as Cigna, Anthem Blue Cross and Blue Shield, United Healthcare, Kaiser Permanente, and Aetna, as well as Medicare Advantage. As of July 2024, enterprise clients of SonderMind include Southern Company, Boeing, IBM, Cerner, and Kaiser Permanente.

Source: SonderMind

Market Size

In 2022, the US virtual mental healthcare market, which encompasses virtual therapy sessions, self-help resources, and data-driven clinical care, was valued at $1.6 billion with a projected CAGR of 10.1% through 2028, when the market is expected to reach a value of $2.9 billion. The projected growth of this market is attributed to the increasing prevalence of mental health conditions during and after the COVID-19 pandemic, along with increasing digitization across healthcare.

The general behavioral health market is even larger. Behavioral health is an industry that includes mental health, substance abuse disorders, and stressors. In 2022, the US behavioral health market was valued at $78 billion and was projected to grow at a 4.7% CAGR to reach $115.2 billion by 2030.

Competition

Talkiatry: Founded in 2020, Talkiatry provides digital mental health services covered by most major insurance plans. Unlike SonderMind, the company only offers psychiatric help, not therapy, and also doesn’t provide local, in-person options for patients. However, Talkiatry has greater geographical availability than SonderMind — as of November 2023, Talkiatry was present in 30 states. In June 2024, that number had grown to 43 states.

In June 2024, Talkiatry raised a Series C round of $130 million led by Andreessen Horowitz which brought its total funding to $245 million. Talkiatry’s annual revenue tripled in 2023, and the company is planning for increased hiring and an eventual initial public offering. As of July 2024, the company has over 300 psychiatrists and supported over 1 million patient visits.

Brightside Health: Brightside is a mental health startup founded in 2017 that offers both digital therapy and psychiatry to patients 13 years and older. Like Talkiatry and SonderMind, Brightside accepts most major insurance providers. What differentiates Brightside from competitors is its geographic reach and focus on patients with preexisting mental health conditions. Brightside is available in all 50 states, but only select states are covered by insurance. Without insurance, plans range from $95-$394/month based on whether the patient chooses psychiatric and/or therapeutic services.

While other companies approach mental health from a well-being or holistic perspective, Brightside primarily markets its services as addressing and supporting a wide range of “conditions,” such as ADHD, anxiety and stress-related disorders, bipolar disorder, insomnia, depression, OCD, and PTSD. Additionally, Brightside advertises that 75% of its patients start with moderate to severe symptoms, and 50% of patients start with suicide ideation. The company’s new Crisis Care plan also provides personalized care plans for those with elevated suicide risk. Brightside has raised a total of $114.4 million in funding as of July 2024.

BetterHelp: Founded in 2013, digital therapy company BetterHelp has amassed over 35K licensed therapists and 4.7 million users as of May 2024, leading the company to claim that it is the world’s largest therapy service. However, BetterHelp does not accept insurance or provide psychiatric services, and its subscription model ranges from $65-$100/week, subscription model. However, as of June 2024, BetterHelp has funded over $65.7 million in financial aid or discounts for certain users.

Part of why BetterHelp doesn’t submit claims to Medicare, Medicaid, or any insurance company is that therapists must work as independent contractors, creating legal complexities, but the company does accept some HSA or FSA cards. Its therapists are reported to have more stringent qualification requirements than SonderMind, including at least three years of experience and 1K hours of experience. BetterHelp was acquired in January 2015 by Teladoc for $3.5 million in cash and $1 million in promissory notes. The company’s estimated fiscal year revenue in 2022 was over $1 billion.

Spring Health: Founded in 2016, startup Spring Health uses machine learning to provide “precision mental healthcare,” or personalized therapy, medication, and wellness services. The company’s ML approach considers several data points for each patient, such as demographic factors, family history, and social health determinants. As of April 2023, Spring Health had a valuation of $2.5 billion and it has raised a total of $366.5 million in funding as of July 2024.

Unlike the aforementioned competitors, Spring Health works directly with employers and organizations to provide treatment plans for employees, claiming that improving employee mental health will reduce absenteeism and boost productivity. This model is similar to SonderMind’s enterprise solutions, just one particular part of SonderMind's business.

Business Model

SonderMind’s business model is common among similar services. Instead of charging patients or practitioners, SonderMind earns commissions through insurance providers. Typically, healthcare practitioners obtain insurance contracts by completing a credentialing application which SonderMind will assist with.

SonderMind negotiates insurance contracts and reimbursement rates on behalf of its practitioners, who effectively work as contractors for SonderMind. For each insurance-covered appointment completed through SonderMind, the company will compensate the practitioner for the appointment, submit a claim to the patient’s insurance company, and receive reimbursement, including a commission, for the appointment.

The company also earns revenue by allowing patients to pay out-of-pocket for appointments. A potential small source of revenue could be fees that SonderMind charges, including no-show and cancellation fees for patients and a 2% instant pay fee for practitioners. It is unclear if there are any significant costs for SonderMind, besides major acquisitions. Its 2022 acquisition of TotalBrain cost $10 million.

Traction

SonderMind experienced traction during the COVID-19 pandemic, with a 400% increase in revenue between its 2020 Series B round and its 2021 Series C round. SonderMind has made several acquisitions, starting with machine learning mental health care company Qntfy in 2021, Total Brain in 2022, and mental health startup Mindstrong in 2023.

Additionally, much of the company’s geographic expansion occurred in summer 2024, as the company unveiled a new expansion plan in June 2024 that increased the total number of covered states from 15 to 25 and also added psychiatric options for states that only provide therapy. Previously, the company had been slow to expand its geographical presence.

In July 2021, when SonderMind was available in 10 states, CEO Mark Frank cited expansion to all 50 states as a major priority, claiming that the company was “ready for extremely rapid scaling into the definitive market leader.” However, prior to June 2024, SonderMind had only added five additional states to its coverage. While it is unclear whether services in new states are available to only individuals paying out of pocket, or if insurance coverage is also supported the much-needed expansion enables millions of Americans to take advantage of SonderMind’s services.

In January 2024, the company laid off 49 employees, or 17% of its total workforce. This followed a separate round of layoffs in December 2022 in which it let go of 50 employees or 15% of its then workforce. The company may also be facing a future legal battle. In February 2024, it was reported that the company had sued its former chief medical officer for taking a similar position with a competitor.

Additionally, the entire digital health space has been struggling to secure funding. In the first three months of 2024, digital health startups received $2.7 billion in funding, the lowest first-quarter funding since 2019, and a decrease from $3.6 billion in the first quarter of 2023.

Valuation

In July 2021, SonderMind raised a $150 million Series C led by Drive Capital and Premji Invest which valued the company at $1.1 billion. As of July 2024, the company had raised a total of $183 million in funding, with other notable investors including General Catalyst who led its $27 million Series B.

Key Opportunities

Focus on AI and Data

SonderMind could leverage the increasing potential of AI by incorporating data science and machine learning into the patient experience. Like Spring Health, SonderMind could require patients to provide more data about themselves in their matching survey and use a more sophisticated machine learning algorithm to not only pair patients with clinicians but also recommend specific types of care.

SonderMind already markets itself as a research-backed company, partnering with the University of Denver in behavioral health research, so it could potentially also venture into AI-related research and analyze how AI can improve patient matching and personalized care.

Additionally, the company could utilize LLMs to improve both the patient and practitioner experience. On the patient side, LLM-powered chatbots could replace traditional hard-coded surveys, making the experience more personalized, human-like, and efficient. As LLMs improve in accuracy, they could potentially conduct assessments and therapy sessions without any human intervention. On the practitioner side, LLMs could help with low-level tasks like summarizing patient worksheets and drafting session notes, as well as more advanced treatment planning.

SonderMind could also build on the work of Mindstrong, which it acquired in 2023, by expanding on Mindstrong’s EHR system that collects data from clinicians and creates learning models from that data. While SonderMind would need to abide by guidelines for handling patient data, the dataset alone could be valuable, as other health-focused startups have profited from aggregating and selling patient data.

Bilingual Support

As of July 2024, SonderMind does not seem to advertise therapy or psychiatry options in languages other than English. However, supporting non-English speakers could be a way for SonderMind to reach a greater range of patients, given its geographical limitations.

2010 census data showed that there were over 60 million Americans who speak a language other than English at home, and many of SonderMind’s covered states, including Texas, New Mexico, Nevada, Florida, and Arizona rank among the most multilingual states in the US. A 2018 survey found that 69.1% of US mental health facilities provide multilingual services, indicating that there could be a demand for mental health support in languages besides English.

SonderMind is also lagging behind competitors that advertise multiple language offerings. BetterHelp offers sessions in 56 languages while Talkiatry allows users to filter psychiatrists with the over 20 languages offered. While SonderMind may offer therapists who do know multiple languages, the English intake surveys and lack of advertisement could discourage non-English patients from choosing them over competitors.

Key Risks

Competitive Landscape

SonderMind is not only competing against other mental health platforms for patients but also practitioners. A crucial component of future success is onboarding a wide network of therapists and psychiatrists, which will help provide patients with a wide range of options.

For instance, in August 2022, BetterHelp reported nearly 350K active users, and as of July 2024, it has over 30K licensed therapists. SonderMind, on the other hand, only has 8K therapists and psychiatrists on its platform and does not seem to report total users or active users. As of July 2024, Brightside is available to insured and out-of-pocket patients in all 50 states, and unlike SonderMind, it accepts not only Medicare but also Medicaid in select states.

While there do not seem to be legal restrictions that prevent practitioners from joining multiple platforms, onboarding, and credentialing with different platforms could take time. Therefore, it is important for SonderMind to both expand and emphasize its key differentiators from competitors as it continues to provide options like in-person visits and both therapy and psychiatry.

AI Risks

Researchers and developers are working on LLM-powered chatbots that mimic therapists and psychiatrists. For instance, one popular chatbot platform, Character.ai, has hosted nearly 500 therapy or psychiatry-related bots as of January 2024.

These bots are typically intended to be inexpensive and available alternatives to human therapy, and the most popular bots have received millions of messages from real users. Investors have also funded startups that produce AI-powered mental health chatbots. While not a full replacement for mental health professionals, chatbots are even beginning to gain legitimacy as potential medical tools — in the UK, mental health assessment chatbot Limbic Access secured a medical device certification and was even used by the NHS to assess patients.

Though the effectiveness of mental health chatbots as therapists or psychiatrists has not yet been proven, these chatbots could be market competitors for traditional mental health providers like SonderMind. If people without insurance coverage are reluctant to pay for human therapy, or want a more flexible, on-demand therapy option, they may turn to free or inexpensive chatbots instead.

Even simpler technologies can help patients bypass third-party services like SonderMind. The main draw of SonderMind for patients is its matching service, but unless the service can incorporate more personalization and benefits, patients can use online directories, such as PsychologyToday, to find therapists and psychiatrists in their area. As these directories improve in their searching capabilities, patients may find it unnecessary to use SonderMind, which does not allow users to browse through potential healthcare practitioners before completing its matching survey.

Summary

Mental health care remains largely inaccessible, especially for low-income individuals, due to cost, scheduling, stigma, and a shortage of professionals. SonderMind aims to address these issues by providing an accessible mental health platform that connects patients with insurance-covered therapists and psychiatrists. Founded in 2014, the company has expanded its network to over 8K providers in 25 states and offers services covered by major insurance companies.

SonderMind has features, such as comprehensive insurance coverage, offerings for both therapy and psychiatry and in-person and virtual options. It could also position itself as a leading mental health service for veterans, with its ability to accept VA referrals and its veteran founder. SonderMind also has the opportunity to expand its coverage to the other half of the US and broaden its use of features, such as AI.