Thesis

The fantasy sports market is large and growing, both in the US and internationally. The last 15 years indicate long-standing secular growth in the mature American fantasy sports market, valued at $8.9 billion in 2021. There were 62.5 million fantasy sports players in the US and Canada as of 2022 — up almost 100% from the 32 million fantasy players in 2010. Fantasy sports also have significant room for international growth in markets like India, where only 20 million people played fantasy sports in 2021 and could reach as high as 150 million by 2024.

Adjacent markets like the sports trading card market are growing too: in the US, it was valued at $4.7 billion in 2019 and is projected to reach $62 billion by 2027.

One of the innovations enabled by Non-Fungible Tokens (NFTs) was the play-to-earn business model, which allows gamers to earn money while playing; a market projected to grow from $780 million in 2021 to $2.8 billion by 2028.

French startup Sorare combines aspects of fantasy sports, trading cards, and a play-to-earn business model; it stands to benefit from the growth of all three. Beginning with international soccer teams across leagues and expanding to include the NBA and MLB, Sorare is a fantasy sports game that lets players buy, sell, and trade NFT player cards that can be played in lineups in fantasy leagues to win rewards.

In January 2023, Sorare announced a four-year licensing partnership with the English Premier League, one of the most popular leagues in the world. With a significant amount of capital from its 2021 Series B raise of $680 million led by Softbank, and partnerships with some of the world’s most-watched sports leagues, it is positioned as a potential category leader in fantasy sports and NFT collectibles.

Founding Story

Paris-based Sorare was founded in 2018 by Nicolas Julia (CEO) and Adrien Montfort (CTO). Julia grew up in southern France before moving to Toulouse to finish his pre-university education and then went to business school in Lyon before moving to Paris at 24. In Paris, he worked as a consultant for a few years, founded an AI incubator, and then joined a startup called Stratumn in 2018, a platform for developing enterprise blockchain applications.

Julia served as VP of Operations at Stratumn when he met Montfort, VP of Engineering. The duo became interested in the potential of NFTs for collectibles, as they had both been passionate sports trading card collectors growing up. They also had a common experience playing in fantasy sports leagues and saw an opportunity to merge their passions into a product using NFTs.

They decided to leave Stratumn in August 2018 and launched their idea for an NFT-based fantasy sports league and trading card marketplace called Sorare.

Product

Sorare is a fantasy sports platform built on NFTs on the Ethereum blockchain that allows players to buy, sell, and collect players for their fantasy teams in the form of sports trading cards. Sorare initially focused on soccer (football for non-American readers) from 2018-2021 and featured 280+ soccer leagues. The company then moved to add the US-based Major League Baseball (MLB) in mid-2022 and the National Basketball Association (NBA) in September 2022.

Source: Sorare

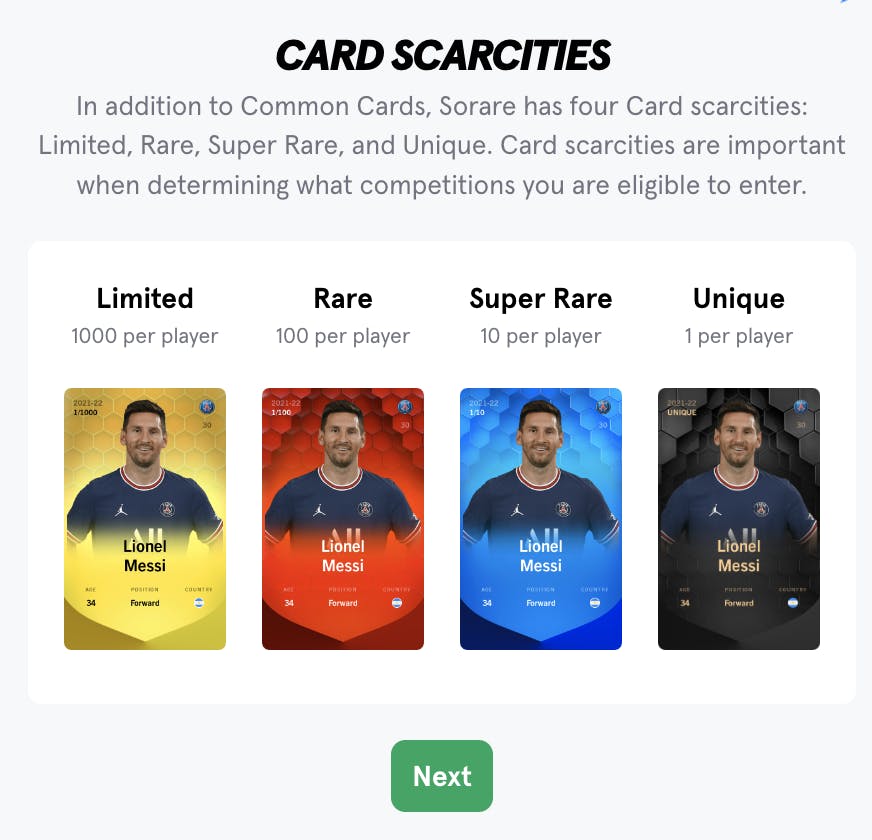

Sorare users (i.e., “managers”) can buy, sell, and trade player cards, enabling them to win prizes that can be exchanged for money on the Sorare marketplace. There are several tiers of cards: Common, Limited, Rare, Super Rare, and Unique. The rarer a card is, the higher the price.

Common cards are the only tier that can’t be bought or sold because they aren’t NFTs; they are only intended to get a user started on the platform. They are ideal for users learning how to use Sorare or playing Sorare for free. For each player card, there are 1K Limited versions (5K Limited cards for the NBA and MLB), 100 Rare versions, 10 Super Rare versions, and 1 Unique card.

Source: Sorare

Sorare abstracts away much of the complexity for the end user. The underlying technology is only used to enforce the scarcity of digital collectibles. Users with no knowledge or interest in crypto are able to participate without the use of wallets, exchanges, or other potential sources of friction for mainstream users who are simply looking to play in a fantasy sports league or collect cards.

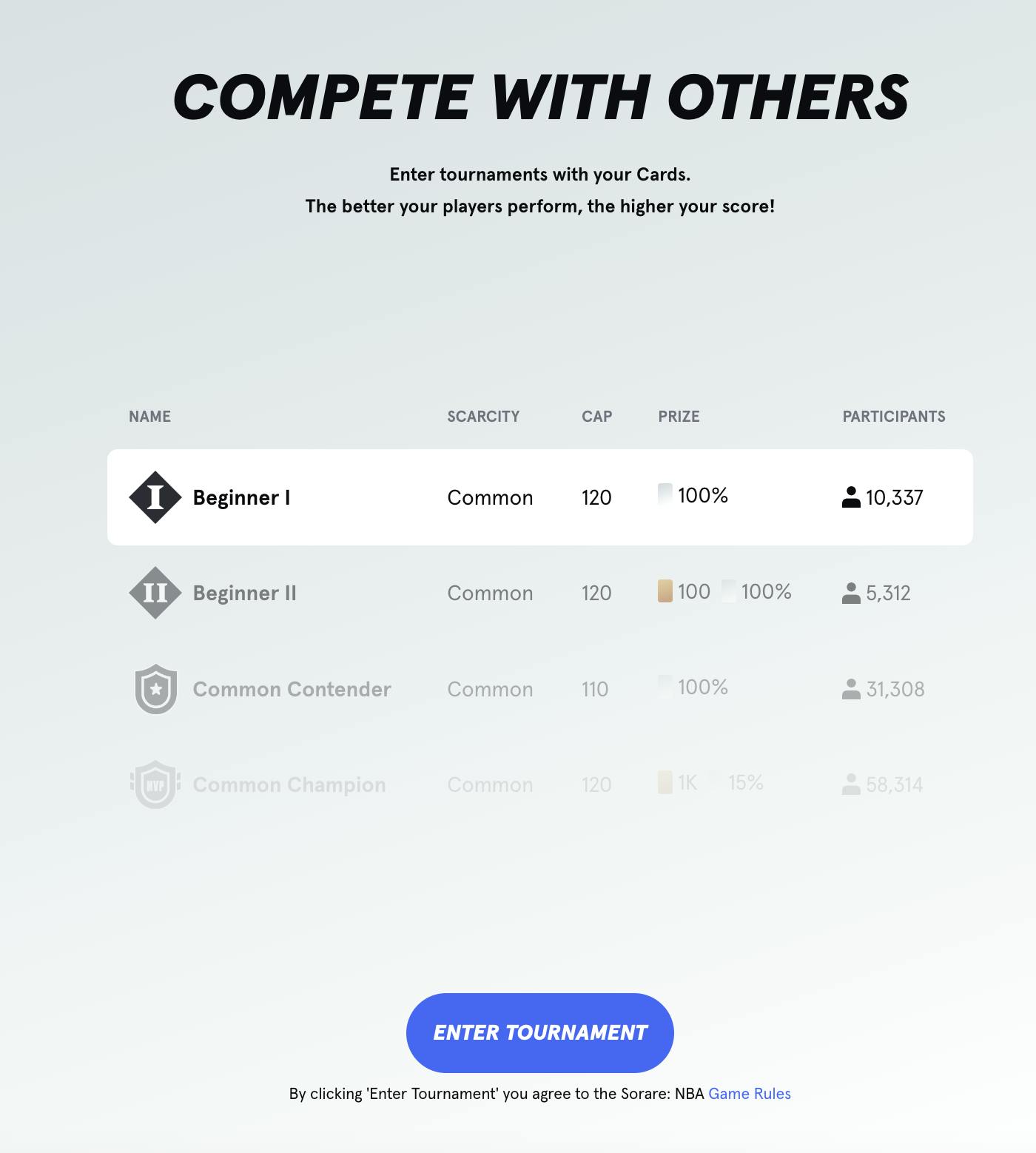

In setting up their team, users pick five players in either soccer or basketball (12 for baseball) and compete with other users based on the real-world performance of their selected players over a given period based on a set of rules. The top 3 performers in a group will receive prizes, including ETH and player cards that can be redeemed for cash or used to improve their team. Others who perform well may also be eligible for lesser prizes.

Source: Sorare

Market

Customer

Sorare’s ideal customers are sports fans, fantasy leagues, and sports card collectors globally. Sorare’s success at rolling out new sports and partnering with new major sports leagues allows it to address one customer segment at a time. Though legacy fantasy sports leagues and analog sports cards already exist, Sorare is one of the few products that combine both value propositions in the same place, with the opportunity for users to monetize their collections via the secondary marketplace it hosts.

Market Size

The fantasy sports market was valued at $18.6 billion in 2019 and is projected to reach $48.6 billion by 2027. Fantasy gaming has roughly doubled in popularity from 32 million players in 2010 to 62.5 million in 2022, with 20% of Americans over 18 reported to participate in fantasy sports. Meanwhile, the sports trading card market in the US was valued at $4.7 billion in 2019 and is projected to reach $62 billion by 2027. Lastly, the play-to-earn gaming market has been projected to grow from $780 million in 2021 to $2.8 billion by 2028.

Competition

Dapper Labs

The closest direct competitor of Sorare is Dapper Labs, the creator of NBA Top Shot, NFL All Day, and UFC Strike. Coatue and a16z-backed Dapper Labs is similar to Sorare because it uses NFTs to highlight athlete performance. However, unlike Sorare, it focuses on NFTs as pure sports collectibles via video highlights of sporting moments. It uses the Flow blockchain for NFTs like NBA Top Shot, whereas Sorare uses NFTs with gaming utility built on ZK rollups on the Ethereum blockchain.

Due to an overlap of target customers, some sports leagues have signed with both competitors, indicating room for their coexistence in the nascent NFT collectible space. LaLiga, the top Spanish soccer league, announced a partnership with Sorare in September 2021 and another with Dapper Labs in the same month. NBA and NBPA see Sorare as an alternative to NBA Top Shot and not as a competitor because of the fantasy game element.

Candy Digital

Candy Digital, backed by Insight Partners and Softbank and has board members such as Fanatics chairman Michael Rubin and Gary Vaynerchuk, is another digital collectibles platform with partnerships like NASCAR, Netflix, American college athletics (called sweet futures), the WWE, and the MLB. However, the decline of the NFT market in 2022 has caused the Fanatics ownership group to divest 60% of their ownership in Candy Digital to Galaxy Digital in a Series A extension round.

Leagues

Existing fantasy leagues like NFL’s Fantasy Football or EPL’s Fantasy Premier League are strong competitors. Sorare has 3 million users as of the end of 2022 compared to the 40 million users who play Fantasy Football or 9 million who play fantasy premier league, which are both free to play.

Business Model

Sorare makes money by issuing new cards on the primary market to its customers. As of November 2021, Sorare was losing money on secondary sales, in part because it was subsidizing gas fees for its users and not taking a cut from the secondary sales. In addition, it likely gives royalties on sales to the sports leagues it partners with in return for the right to use its branding and other licenses.

Traction

Since its public launch in December 2019, Sorare’s paying users have grown from 500 to 55K, with the monthly sales on the primary market increasing from €10K to €17 million. In February 2021, Sorare shared a 70% 3-month retention rate for users who had bought a card. Between January 2021 and September 2021, $150 million worth of cards were traded with 600K registered users and 150K users buying a card or building a team. Sales grew 51x between Q2 2020 and Q2 2021, growing from €40K in revenue in 2020 to €11m in February 2021 alone.

In 2022, Sorare grew its registered user base from 1.2 million to 3 million. The company had 110K users who participated in the paid competition and 35K users who owned 25+ cards. In December 2022, it saw%20across%20180%20countries.) 260K MAU across 180 countries.

Sorare growth can largely be attributed to how quickly they onboarded new partnerships. Throughout 2022 Sorare hit key milestones: Launching its MLB and NBA partnerships, opening a New York office, growing from 20 to 150+ employees, and a partnership with MoonPay to make it easier to on-ramp to ETH from fiat.

Sorare’s main product, Sorare: Football, has now signed more than 300 clubs, including Italy’s Serie A, an elusive English Premier League, and ambassadorships with some of the biggest names in the sport, including Kylian Mbappe, Lionel Messi, and Zinedine Zidane.

Sorare’s two newest sports are baseball and basketball, with Sorare: MLB rolling out mid-season in July 2022 and Sorare: NBA beginning in October 2022. A PGA tour has been announced in partnership with Autograph.

Valuation

In September 2021, Sorare raised a $680 million Series B at a $4.3 billion valuation led by SoftBank’s Vision Fund, with participation from Atomico, Bessemer Ventures, D1 Capital, Eurazeo, IVP, and Liontree. Existing institutional investors from Sorare’s $50M Series A, including Benchmark, Accel, and Headline, followed on in addition to several strategic investors such as Lionel Messi, Gerard Pique, Kylian Mbappe, Antoine Griezmann, Alexis Ohanian, and Gary Vaynerchuk.

Key Opportunities

New Categories of Sports Entertainment

One key opportunity acknowledged by Sorare CEO Nicolas Julia himself is to branch out from fantasy sports gaming to all kinds of sports-based entertainment — as he put it:

“We saw the immense potential that blockchain and NFTs brought to unlock a new way for football clubs, footballers, and their fans to experience a deeper connection with each other. We are thrilled by the success we have seen so far, but this is just the beginning. We believe this is a huge opportunity to create the next sports entertainment giant, bringing Sorare to more football fans and organisations, and to introduce the same proven model to other sports and sports fans worldwide.”

Global Expansion

Each partnership that Sorare signs help contribute to building a global ecosystem for sports. The utility of the collectible NFTs may be used as an entry point for broader fan engagement. Since fanbases are now digitally accessible to other leagues and teams outside their existing countries or locales, Sorare can also provide escalating value and increasing leverage to partner with more and more sports leagues globally as its reach continues to grow.

Key Risks

Barriers to Entry for New Users

Sorare has 3 million users as of the end of 2022, compared to the 40 million users who play Fantasy Football or 9 million who play fantasy Premier League, which are both free to play. Sorare’s scarcity model rewards early adopters or those with the deepest pockets for buying the Rare, Super Rare, or Unique cards. Although Sorare offers free-to-play usage, paying for cards on the primary market is necessary for the full experience. One analysis in October 2021 shows that the top 1% of users have captured 45% of the total value, and the top 20% have 89% of the value. The top 10 most expensive player cards range from €200K to just over €600K, which creates a large barrier to entry for new users to compete and may hamper future growth.

Regulatory Risk

As of January 2023, Sorare isn’t regulated as a gambling product, but that may change. Some have argued that the element of chance with real-world performance rises to the level of gambling. In November 2022, France ruled in Sorare’s favor that it isn’t a gambling product but will require changes to be compliant. As the company expands, it may run into issues in countries like the US.

Summary

Sorare’s mission is to build “the game within the game” for sports leagues worldwide by utilizing blockchain technology to create opportunities for users to engage with their favorite teams while rewarding avid fans with digitally scarce collectibles. The company is well-capitalized and has partnerships with many of the largest leagues and teams across some of the world’s most popular sports. It is well-positioned to grow alongside the broader growth in the fantasy sports market, barring strong regulatory headwinds and a slowdown in the NFT market.