Thesis

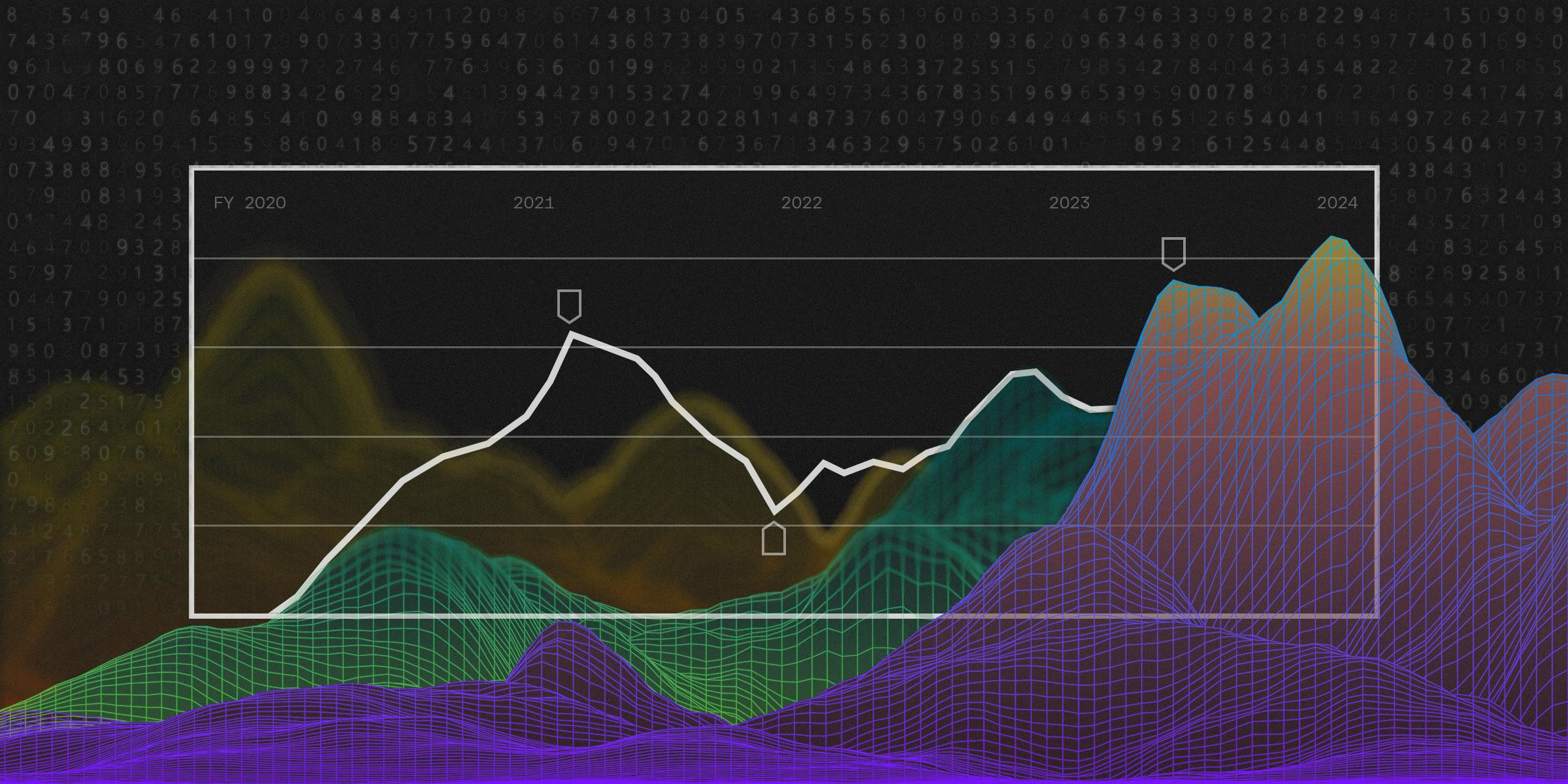

Worldwide software spend is expected to reach over $900 billion in 2023. High-growth businesses used over 150+ SaaS tools as of 2023, spending almost 1K hours buying and managing them. One survey in February 2023 found that the average global end-user spending on SaaS products from 2021-2022 grew by 33%, driven in part by the shift to remote work.

Despite the costs associated with SaaS usage, companies often leave money on the table because they are not effectively renegotiating contracts or monitoring cost savings. This leads them to lack visibility into pricing, resulting in an opportunity for better spend management. The average company overpays on software by 30% because of these challenges and it is estimated that inefficiencies in software buying will lead to more than $200 billion and 3.9 billion working hours wasted in 2023.

Tropic initially started as procurement-as-a-service solution, but in the past year, it expanded into a broader suite of tools to streamline spend management. Tropic's platform is intended to help businesses to take control of their procurement processes, achieve cost savings, and enhance operational efficiency. In a macroeconomic environment where controlling costs have become increasingly important, Tropic seeks to be a unified spend management platform that companies can rely on to manage their software spend.

Founding Story

Tropic was founded in 2019 by David Campbell (CEO) and Justin Etikin (COO). Campbell grew up on a ranch in the Mojave Desert, and had developed an entrepreneurial side from a young age. He went on to study English Literature at Berkeley, and spent a year and a half after college completely cut off from the outside world in an attempt to write the “next great American novel.” Campbell moved up north and lived in a cabin in the woods with no phone or internet for a year and a half. He told Contrary Research:

“I always thought that I would do something creative. In a roundabout way, what I found is that entrepreneurship is kind of the most creative pursuit that you can undertake. Because company building is much more multi-faceted, much more involved and has lots more room for creative output then, say writing a book or putting out an album.”

As Campbell told Contrary Research, the idea for Tropic stemmed from his personal experiences. He served as the Vice President of Strategic Accounts at Wunderkind (formerly BounceX) where he scaled revenue from $100K to roughly $100 million. In the course of this, Campbell observed that the company frequently sold to procurement teams that were lacking the ability to execute transactions. At Wunderkind, he also realized how big of an issue the lack transparency in software pricing was. As he told Contrary Research:

“I remember when we were selling to Nike and I had my first experience with the absurdity of software pricing… We were selling a $100K contract to Nike and the CRO told me, ‘Why don’t you make it $1 million and see if they sign?’ Lo and behold, they did, and so we 10x’ed the contract value with no change in the underlying value of the platform.”

In his next role at Microsoft’s Financial Services group, Campbell also noticed that unmanaged contract spend could lead to layoffs as companies struggled to cover the cost of the contracts that they had been locked into. Between working at Wunderkind and Microsoft, Campbell had also seen that both startups and enterprises alike struggled to buy software. As he told Contrary Research:

“At this point in my career, I had seen how startups buy software — which is poorly… then I had seen how mid-markets bought and managed software — which is poorly — and now I got exposure to the biggest companies on Earth, and AIG was paying Microsoft $100 million a year and coming up on renewal. They often had no idea what they had bought from Microsoft.”

Drawing on these insights, Campbell founded Tropic with Etkin, who previously worked with Campbell at Wunderkind as the VP of Operations. While there, Etkin had to build a procurement solution in-house for Campbell’s sales team, because there was no suitable solution on the market to buy. Together, they built a procurement and vendor negotiation platform that became Tropic. As of August 2023, Tropic manages billions of dollars for hundreds of companies.

Product

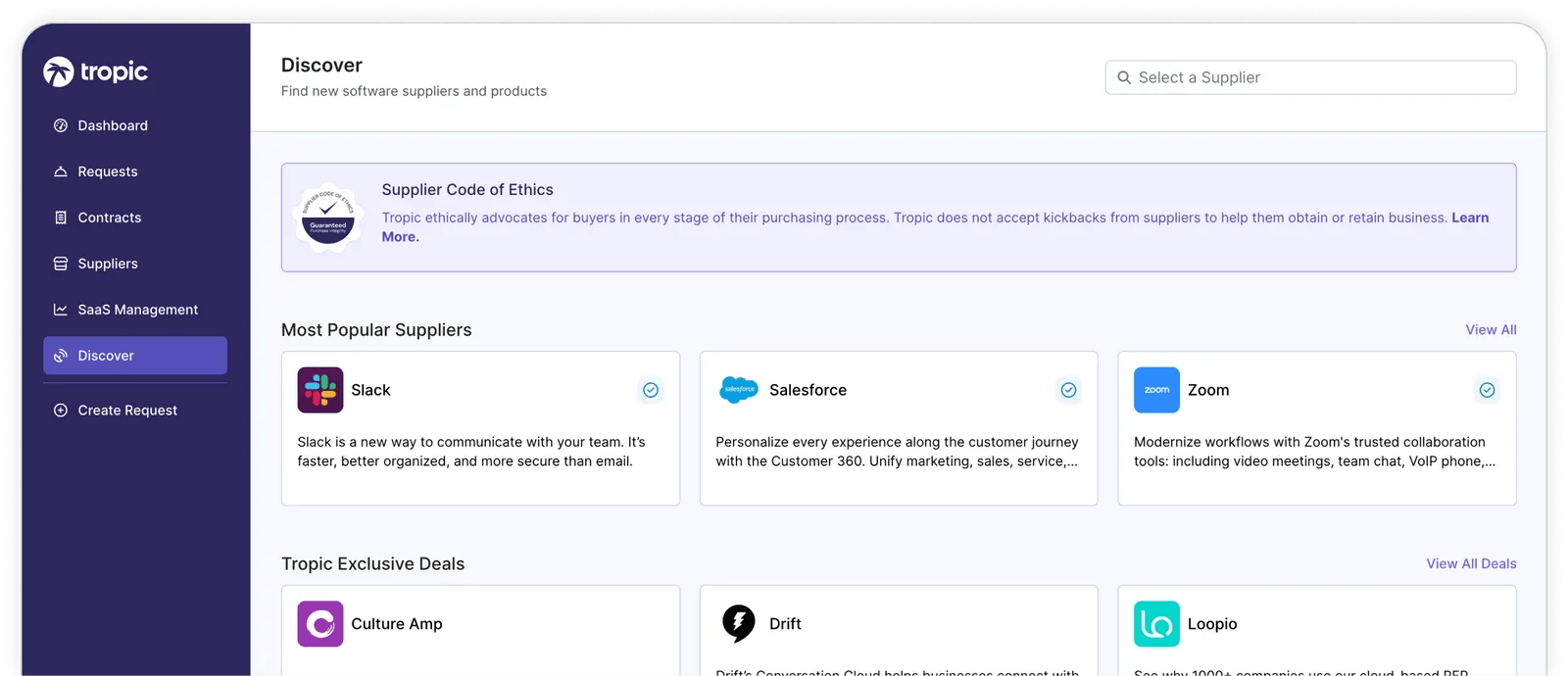

Discover

Tropic’s “Discover” offerings are focused on providing transparency and intelligence in the procurement process so that buyers can get the best prices and streamline requirement gathering. There are three main products in this category:

Sourcing Intelligence: Tropic allows buyers to discover accurate pricing estimates by providing pricing benchmarks on thousands of sellers. Tropic’s Discover is “the largest unbiased database of SaaS suppliers,” powered by its proprietary Supplier Graph. The Supplier Graph pulls in contract, usage, utilization, and transactional data from across Tropic’s network—tens of thousands of supplier contracts totalling billions in managed spend. Customers can enrich their own data set with Supplier Graph data to uncover better purchasing decisions.

Source: Tropic

Pre-Negotiated Deals: Tropic offers pre-negotiated deals to buyers. Tropic emphasizes that it does not accept kickbacks from sellers, which means that it is able to pass 100% of referral commissions back to the buyer in the form of pre-negotiated discounts.

Intelligent Intake: Tropic provides a streamlined intake form that guides employees through purchase requests, capturing important details upfront to get through standard compliance and budget requirements. Once a purchase request is submitted via Tropic, it gets routed to the right person at the right time, looping in managers, finance, IT, legal, and other stakeholders wherever needed.

Approve

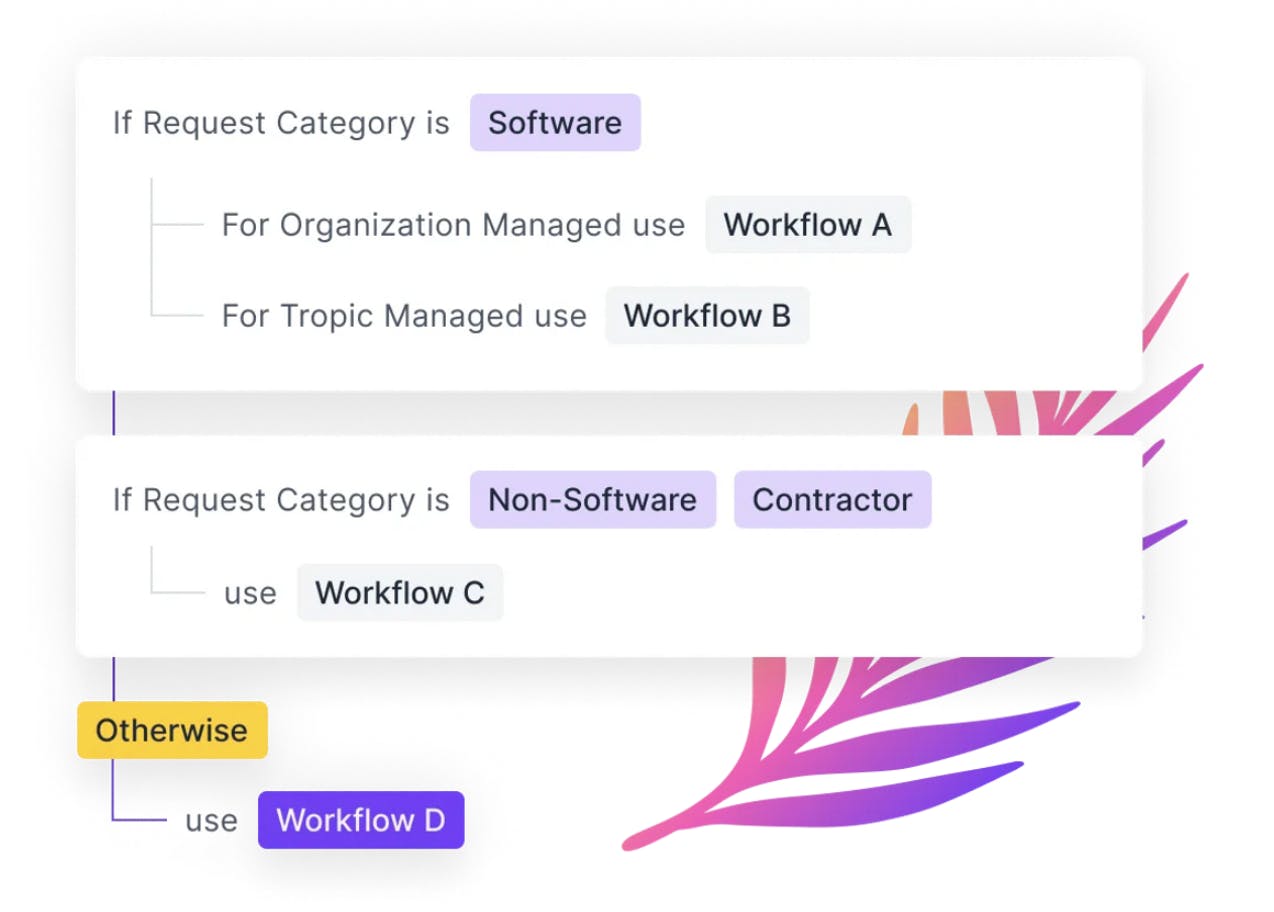

Tropic’s “Approve” offerings seek to make it easy to approve new software spend, streamlining approval processes and ensuring compliance.

Workflows: Tropic’s rules-based workflow logic routes requests to the right person at the right time. Purchases can be funneled through a centralized approval process that ensures finance, IT, and legal compliance. Complex purchasing logic can be configured for different workflows which can be used for different types of purchases.

Source: Tropic

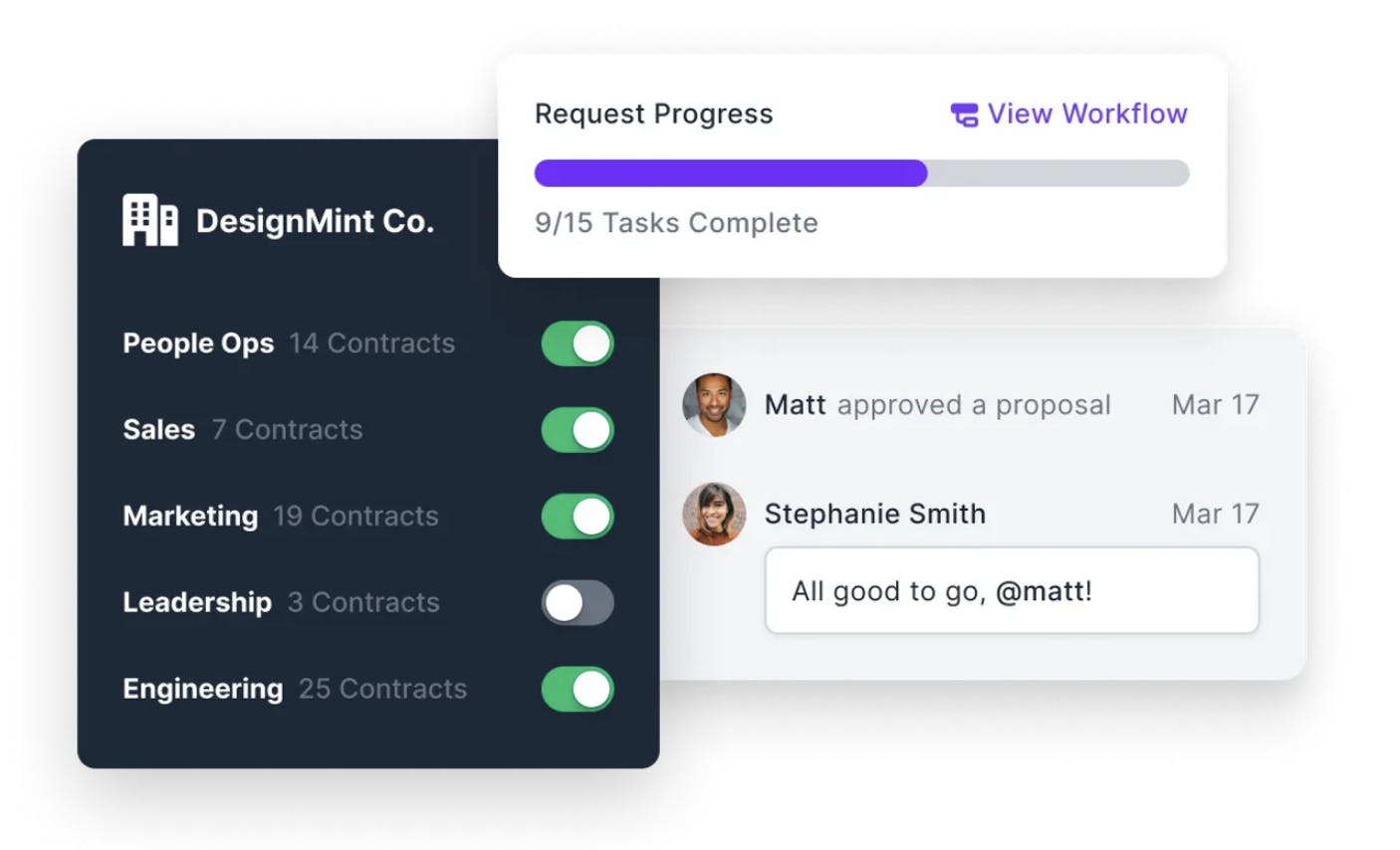

Collaboration: Tropic removes administrative burdens by giving team members access to a portal where they can kick off requests, collaborate on assigned tasks, and view the status of requests.

Source: Tropic

Financial Controls: Tropic allows for buyers to build financial policies into every purchase. Intelligent workflows can be built to automatically collect required documents, select approved payment methods, and generate purchase orders automatically once a request passes he proper approvals.

Supplier Onboarding: Tropic allows buyers to centralize and streamline details around new suppliers, including questionnaires, documents, and bank information. The Supplier Portal keeps suppliers aligned and informed throughout the process, giving them a place to respond to requests and upload documents. This product improves as Tropic onboards more and more suppliers, because if Tropic has already seen a supplier, then it allows buyers to instantly access all of their compliance attestations and supporting documents.

Source: Tropic

Manage

Tropic’s “Manage” offerings seek to make it easy to manage all supplier relationships and all contract details. There are four main products in this category:

Supplier Management: Tropic provides a central source of truth where a business can track supplier, log contract details, manage relationships, track usage and utilization for SaaS tools, and monitor dollars spent. A unified platform means users can access documents in seconds, and prepare an audit in minutes. It also provides a renewal calendar that sends reminders so that buyers do not miss renewals.

Accounting Automation: Tropic’s automation tracks every transaction, generates reports, catches errors, and boosts efficiency. Tropic provides an always up-to-date record of actual costs through accounting and ERP integrations, allowing for the reconciliation of all transactions with every supplier and contract.

SaaS Management: Buyers can connect their SaaS applications to Tropic to monitor usage trends, allowing for the rightsizing of contracts when necessary. It allows buyers to easily see what software is or isn’t being used, and to what extent.

Forecasting & Budgeting: Tropic allows teams to track every contract and transaction against budgets. Contract, actual, and budgeted spend can all be compared in real-time.

Save

Tropic’s “Save” offerings seek to allow business to optimize their software spend and save money.

Spend Optimization: The spend optimization feature allows businesses to identify savings opportunities and take action in seconds. This can help companies rightsize agreements, eliminate shadow IT, minimize overlap, and negotiate with better leverage.

Expert Advisory: Tropic offers expert pricing negotiation services. Tropic’s in-house experts can negotiate on a buyer’s behalf, handling all communications and attempting to maximize savings outcomes.

Additional Features

Additionally, Tropic integrates with many Communication, ERP, Accounting, HRIS, and other software. This enables workflow improvements and increased data visibility. Overall, Tropic’s product strategy has focused on expanding from procurement-as-a-service into a broader suite of software, data, and service packages. Many of the features above, notably automated intake forms, dynamic approval workflows, supplier onboarding, spend detection, and more, seek to create “a unified spend management platform that brings many point solutions under one roof to help CFOs consolidate their stack.”

Market

Customer

Tropic’s customers include companies like Notion, Intercom, Zapier, Plaid, and Ironclad. Any company that buys software is a potential customer of Tropic’s, though larger companies with higher software spend likely have more of a need for Tropic’s solutions.

Source: Tropic

Tropic has noted that the average company has more than 100+ software contracts, and enterprise organizations can have over 500. It claims that the average company overpays by 30% for software due to a lack of transparency and too much complexity in managing the agreements internally. Such companies often have to go through complex buying processes that involve multiple systems and internal teams.

The key stakeholders and users of Tropic within companies include Finance, Procurement, IT, and Security teams. Tropic views Finance and IT/Security teams as the “gatekeepers” for most procurement processes. Tropic primarily sells to the mid-market today. As Campbell told Contrary Research:

“There's a lot of meat on the bones in the mid-market. I feel like there’s pressure for founders to move upmarket quickly because you need to increase the size of your contracts. But we're signing pretty big contracts already. We can sign a $200K contract with a 500 person company. And I think that most companies can't do that. Other SaaS point solutions would sign a $30K or $50K contract to that same customer. The breadth of our product and our ability to demonstrate the cost takeout that you can realize from signing us enable us to sign pretty big contracts this mid-market segment.”

However, Campbell does has ambitions to move upmarket in the near-term and is focused on building the product intentionally before scaling up. He tells Contrary Research:

“We do plan to go upmarket in fairly short order. In the mid-market, we can really be a procure-to-pay platform that a 500 person company needs. It doesn't want to buy a clunky dinosaur. In fact, to be procure-to-pay platform for a 200K person company, I think we would have to compromise on features or functionality because we are so opinionated on software as a category. If we sell to a huge supply chain company with lots of physical products, where software is number five on the list, the value of that opinionated nature falls apart.”

Market Size

The global market for spend management was valued at $16 billion in 2021 and is expected to grow 10% YoY over the next decade, and Tropic does emphasize that it can handle both SaaS and non-SaaS spend, unlike some of its competitors.

At its most broad, however, Tropic’s addressable market could be understood as any company that buys software. Worldwide software spend is expected to reach over $900 billion in 2023, up 11.8% from $807 billion in 2022. One 2019 study found that the average enterprise organization uses 175+ applications, and companies can spend almost 1K hours buying and managing them.

Competition

Tropic’s competition lies mainly in two segments: 1) Tropic’s beachhead segment of procurement-as-a-service, and 2) Tropic’s targeted expansion segment of becoming a full spend management platform.

Procurement-as-a-Service

Ramp: Ramp is a finance automation platform that helps businesses spend less time and money. Founded in 2019, it has raised $1.4 billion in total. Ramp raised $550 million in debt financing and $200 million in equity at a $8.1 billion valuation in March 2022. Ramp promises “guaranteed savings on SaaS with Ramp’s expert negotiators.” While Tropic advertises 4x ROI on its procurement services as of August 2023, Ramp advertises 3x ROI.

Vendr: Vendr is a SaaS buying and management platform. Founded in 2019, it has raised a total of $156 million. Most recently, in June 2022, it raised a $150 million Series B led by Craft Ventures and SoftBank Vision Fund 2. Tropic notes a few areas of differentiation with Vendr, stating that Tropic is more unbiased since it does not take commission fees from suppliers (while Vendr does), and that Tropic offers a full procurement service, while Vendr only offers a negotiation service.

Sastrify: Sastrify is a Germany-based Series B startup focused on SaaS buying. Founded in 2020, it has raised a total of $55 million. In May 2023, it raised a $32 million Series B led by Endeit Capital. As of 2023, Sastrify has a dominant position in Europe, growing more than 400% from 2022 to 2023 in the region, and it claims that its platform is more automated and affordable than its U.S. counterparts. However, Sastrify only offers procurement. Customers will still need to look for other SaaS management platforms for support. It is also scaling a global team that will focus more on the United States.

Spendflo: Spendflo is a SaaS buying and optimization platform. Founded in 2021, it has raised a total of $15 million. In April 2023, it raised an $11 million Series A led by Prosus Ventures and Accel. In its Series A, Spendflo noted that it was growing faster than Tropic, with 30% monthly growth as of 2023, although this was likely against a lower base than Tropic.

Spend Management

Ramp: Ramp also competes on the spend management axis, in addition to the procurement-as-a-service axis. Ramp offers a vendor management solution that “automatically tracks transactions for every business you pay, so you can quickly analyze your spend and discover insights.”

Rippling: Rippling offers an all-in-one platform to help manage HR and IT operations. Founded in 2016, it has raised a total of $1.2 billion. It raised a $500 million Series E at a $11.3 billion valuation in March 2023. Rippling has built out spend management features including bill pay. Rippling’s offering is tightly integrated with its corporate card, HR, and expense management solutions, allowing for a very centralized platform that connects spend management with the source of truth for employee data, which is something that standalone spend systems like Tropic may not be able to do natively.

Vendr: Vendr also competes in spend management, and like Tropic, it is seeking to expand from its procurement-as-a-service wedge into a fully-fledged spend management platform. Tropic notes that an area of differentiation here is that while Vendr mainly only deals with SaaS spend, Tropic also offers procurement and spend management services for non-SaaS spend as well.

Zylo: Founded in 2016, Zylo has raised $72 million. It raised a $5 million Series C extension from MassMutual Ventures. Zylo enables companies to organize, optimize, and orchestrate SaaS. It also offers SaaS negotiation professional services. Zylo specifically serves the IT, procurement, software asset manager, and CIO departments that may want to outsource the negotiation aspect of SaaS management. Zylo is a more mature product with marquee customers like Salesforce and GitHub. However, Zylo’s negotiation offering was only released in 2021, leaving it with less data and traction than Tropic.

Productiv: Productiv helps CIOs unlock business value by understanding application engagement. Founded in 2018, Productive has raised a total of $73 million. In March 2021, the company raised a $45 million Series C led by IVP. Productiv’s spend management and procurement solutions are smaller pieces of the business, but its competitive moat lies in the strength of its benchmarking data. Productiv has a larger book of enterprise customers, including Meta and Dropbox, who have more robust procurement organizations and data points. As such, some customers have pointed out that Productiv is able to deliver stronger insights and recommendations than other vendors.

Business Model

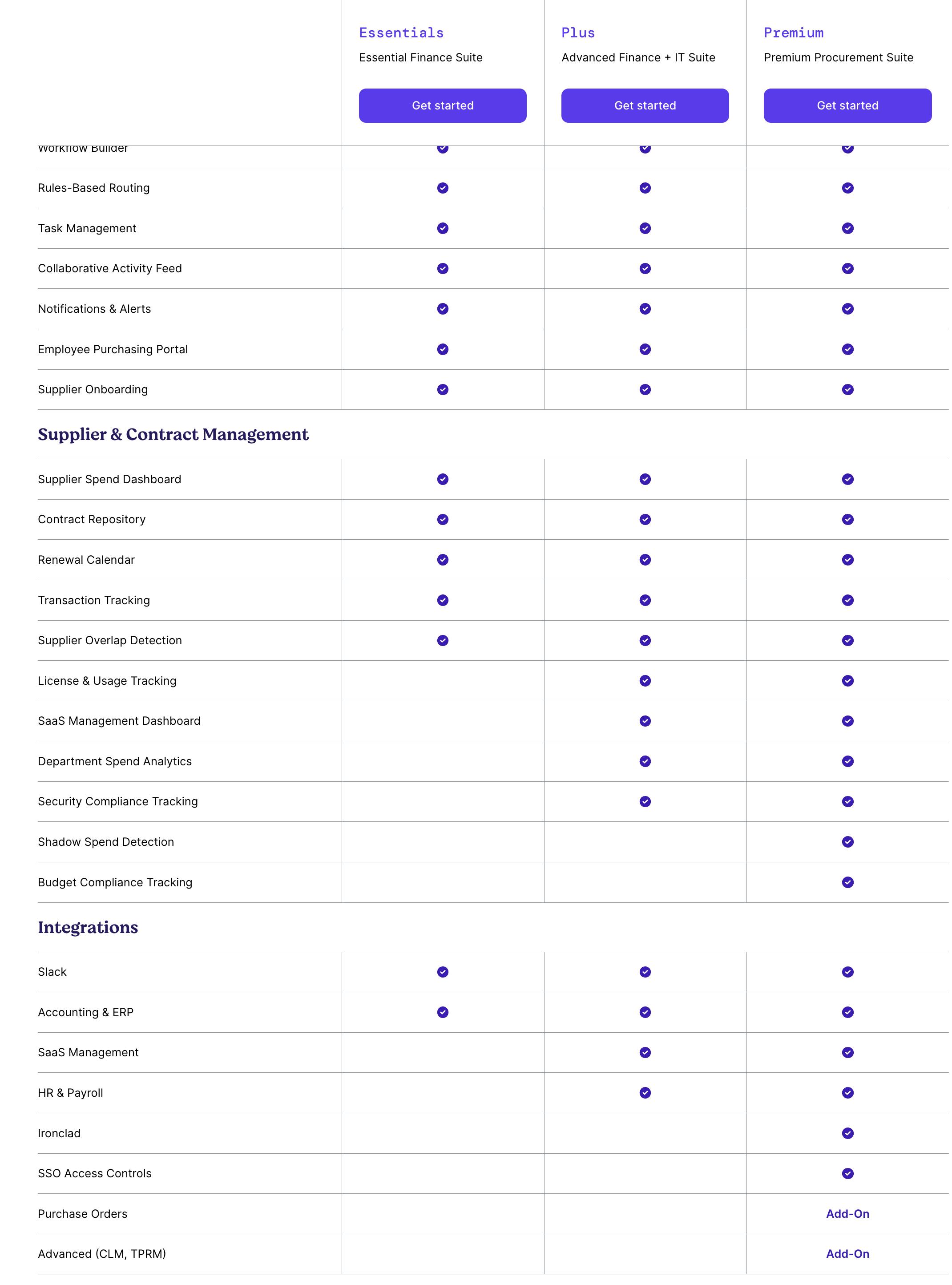

Tropic has three pricing plans: Essentials, Plus, and Premium. All three plans include all sourcing intelligence and request/approval management features, but the more expensive plans have more features around supplier and contract management, as well as in integrations.

Source: Tropic

Traction

Tropic has reported that in the months between its Series A in August 2021 and Series B in February 2022, Tropic had doubled its revenue, headcount, and customer count. Tropic also noted that at the time of the Series B, it had “well over 100 customers and near 100% customer retention.” Additionally, in August 2021, as part of its Series A press release, Tropic shared that it had crossed $250 million in managed spend and had added over 60 customers between August 2020 and August 2021.

Valuation

In February 2022, Tropic announced a $40 million Series B led by Insight Partners. This round was raised a few months after its $25 million Series A in August 2021. The Series B round brought Tropic’s total funding to $67 million. Other investors in Tropic include Founder Collective and Canaan Partners, as well as prominent angels such as Plaid co-founder William Hockey and Flatiron Health co-founders Nat Turner and Zach Weinberg. Tropic did not share its revenue for its Series B, but for comparison, Vendr, a close competitor, noted that it had raised a $150 million Series B at 83x revenue multiple just a few months after Tropic’s Series B.

Key Opportunities

Procurement as a Wedge into Spend Management

Tropic can leverage its procurement product as a wedge to expand into broader spend management. With a product strategy centered on expanding beyond procurement-as-a-service, Tropic aims to offer a comprehensive suite of software, data, and service packages that drive cost reduction and bottom-line growth throughout the procurement process. In an interview with Contrary Research in May 2023, Campbell noted that the initial procurement product was always meant to be more of a “hook” that would enable Tropic to collect a critical mass of data that could then be monetized.

The inclusion of features like automated intake forms, dynamic approval workflows, supplier onboarding, and spend detection can create a unified spend management platform. By consolidating various point solutions under one roof, Tropic can position itself as a partner for CFOs seeking to streamline their software stack, providing an opportunity to expand their market presence and unlock new revenue streams in the broader spend management realm.

Increased Focus on Spend Optimization

An important opportunity for Tropic lies in the increased focus on spend optimization in times of economic uncertainty or downturns, when organizations become more diligent in managing their expenses and seeking cost-saving measures. For instance, Campbell stated that:

"Private and public markets demand efficiency and discipline… Savings has replaced sales as the CFO’s top priority. In board meetings, bottom-line efficiency now beats top-line growth.”

A heightened focus on spend management due to macroeconomic conditions creates a favorable environment for Tropic's software solutions, which empower businesses to streamline procurement processes, consolidate suppliers, and gain visibility into their spend. By offering comprehensive tools for spend optimization, Tropic can help organizations navigate economic challenges, achieve significant cost savings, and enhance operational efficiency. Capitalizing on this opportunity can enable Tropic to establish itself as a trusted partner in driving financial resilience and success for businesses in a rapidly changing economic landscape.

Cloud Cost Optimization & Marketplace

Beyond subscription software spend, Tropic can expand into adjacent categories such as cloud cost intelligence. Platforms like CloudZero and CloudHealth are even more granular than Blissfully or Zylo, diving deeper into compute levels (e.g. EC2 on AWS) and computing spend. Tropic can further deepen its value proposition and expand use cases by expanding into this category through acquisition or in-house development. This move would be in line with their current direction of expansion — building savings for another suite of software instead of moving up the procurement workflow chain.

Key Risks

Graduation Risk

Graduation risk could have an impact on Tropic’s net revenue retention. As customers optimize their procurement processes, consolidate suppliers, and negotiate better contracts, the potential for additional savings diminishes over time, since the low-hanging fruit can be quickly captured. This decline in savings could lead to a decrease in net revenue retention for Tropic as customers may decide that they have already reigned in their software spend and figured out pricing visibility and procurement processes after using Tropic for a few months or years.

To mitigate this risk, Tropic must continuously innovate and offer advanced features and functionalities that provide ongoing value and justify the cost for its customers. Building strong relationships, providing exceptional customer support, and continually demonstrating the return on investment can help Tropic retain customers and mitigate the potential impacts of graduation risk on their net revenue retention.

Competition from Existing Players and New Entrants

Tropic faces a significant risk due to intense competition from both existing players and new entrants in the spend management and procurement software market. Moreover, well-capitalized new entrants are entering the market. In 2021, Ramp acquired Buyer, a negotiation-as-a-service company, and now offers procurement as part of its core spend management offering. The combination is powerful, as Ramp already has a full purview of its customers’ spend data and does not require additional onboarding like Tropic. Rippling and Brex have expanded similarly into this space. Other fintech platforms like Mercury, Rho, Airbase, and Divvy also have opportunities to build fast follows. More competition gives software buyers optionality but weakens third-party negotiators’ value propositions as the service becomes commoditized.

Vendors Transitioning to Transparent Pricing

Tropic benefits from the lack of transparent pricing in the software industry. However, there are also organizations known for transparent pricing, such as Atlassian, regardless of the customer’s size. To speed up negotiations and customer onboarding, suppliers could do two things: make pricing transparent, and simplify the sales process. This not only makes it easier for customers to navigate the purchasing process but also reduces reliance on procurement teams. This is already the case for many small organizations (e.g. self-serve).

Summary

Tropic offers a set of tools designed to streamline and optimize the entire procurement and management lifecycle, spanning negotiation, procurement, accounting, and spend optimization. In a macroeconomic landscape where controlling costs is of high importance, Tropic aims to position itself as a unified spend management platform that companies can depend on to effectively manage their software expenditures. It must fend off competitors in a crowded space, and prove that it can expand beyond just procurement to become a true platform for CFOs and IT/Security teams.