Thesis

The wealth management industry is undergoing a structural shift driven by intensifying fee pressures, evolving client expectations, and the rise of digital platforms. The market is projected to grow to $83 trillion in assets under management by 2027, fueled by expanded access to investment advice and the robust growth of the American economy. Clients now demand more tailored solutions and real-time decision-making, pushing firms to integrate technology with human expertise to deliver highly customized investment experiences. This transformation marks the transition to Wealth 3.0, where personalized portfolios of individual stocks replace the mutual funds of Wealth 1.0 and the ETFs of Wealth 2.0.

Simultaneously, the rise of enterprise RIAs, which have consolidated over $2 trillion in assets as of December 2024 with expectations to reach $10 trillion in the next decade, has reshaped the independent advisory landscape. As aging advisors sell their practices, these enterprise RIAs, fueled by private equity, are consolidating firms to drive efficiency and profitability, but face the difficult challenge of doing so without sacrificing the personalization that clients demand.

Vise* operates within this evolving market by providing financial advisors with an AI-powered platform that automates portfolio creation, management, and client communication. Unlike traditional investment vehicles such as ETFs, which offer broad market exposure through predefined products, Vise enables advisors to customize portfolios based on individual client preferences, risk tolerance, and tax considerations. By leveraging AI, Vise allows advisors to scale their business and deepen client relationships while delivering personalized portfolios at scale.

Founding Story

Vise was founded in 2016 by Samir Vasavada and Runik Mehrotra, who first met at a summer camp at Northwestern University, living across the hall from each other. The two initially started small, building apps for local businesses such as car washes and gas stations. Mehrotra’s interest in mathematical research led them to explore AI’s potential in automating software development, culminating in their first startup at just 13 years old. Recognizing inefficiencies in the wealth management industry, Vasavada and Mehrotra identified a gap in technology solutions tailored for independent financial advisors. This insight led them to consult for major financial institutions, including UBS, BCG, MassMutual, and Deutsche Bank, where they gained firsthand knowledge of how AI could transform investment decision-making. A conversation with JPMorgan Chase CEO Jamie Dimon reinforced their belief in a shifting advisory landscape, as more financial advisors left large firms to operate independently.

Vise was built with the vision of enabling financial advisors to scale their practices exponentially through AI-driven portfolio management. To navigate the complexities of the wealth management industry, the founders assembled a team of experienced leaders and advisors, including Larry Raffone, former CEO of Edelman Financial Engines; Chip Roame, founder of Tiburon Strategic Advisors and former chairman of Envestnet; Andrew Waisburd, PhD, former Head of Invesco’s Global Indexing business; Travis Fairchild, CFA, former partner and portfolio manager at O’Shaughnessy Asset Management (OSAM); Ross Znavor, former Head of Commercialization for Aladdin Wealth Tech at BlackRock; and Kamal Jafarnia, JD, co-founder and former General Counsel for Opto Investments.

Product

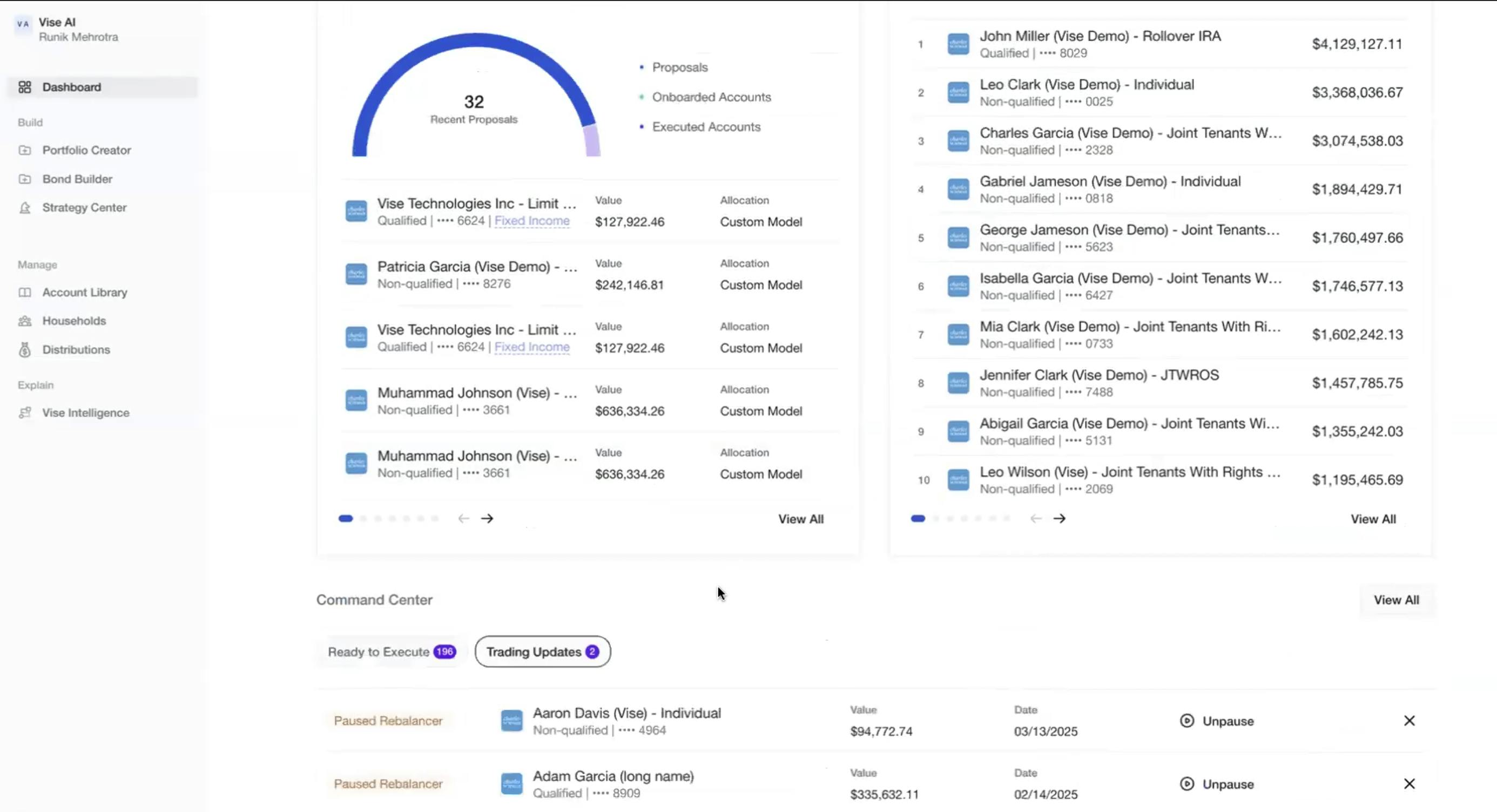

Source: Vise

In a June 2025 interview with Contrary Research, Mehrotra explained how Vise’s product is built around three core functions: Build, Manage, and Explain—each focused on enabling financial advisors to deliver deeply customized portfolios at scale, which is the thesis of the business, according to Mehrotra.

Build refers to Vise’s portfolio construction capabilities, enabling advisors to create customized portfolios tailored to each client’s goals, needs, and preferences. Vise allows advisors to build portfolios around locked positions, cash allocation targets, do not buy restrictions, country/sector/industry exposures, individual tax budgets and more. Advisors have access to a broad set of strategies within the Vise platform and can also add their own strategies based on their investment methodology.

Client portfolios can be constructed using a diverse set of sub-asset classes including proprietary equity factor strategies, options overlays, long/short equity, ETF strategies, individual fixed income and alternative investments, all in one account. Traditionally, many of these strategies have only been available for affluent clients. Vise aims to democratize these investment offerings providing access to any financial advisor and investor at scale

Manage encompasses the technological infrastructure that automates the ongoing management of client portfolios. This includes security selection, trading & rebalancing, tax efficient transitions, and model management all handled at scale for thousands of managed accounts. Advisors can monitor performance, initiate changes at the strategy level, and have those updates automatically cascade across all associated client portfolios, making portfolio administration more efficient and scalable.

Explain is the client-facing component of the platform, designed to help advisors clearly communicate the rationale behind portfolio decisions. While this area is evolving, it reflects Vise’s broader vision of combining robust asset management capabilities with modern, advisor-centric software to enhance transparency and trust in client relationships.

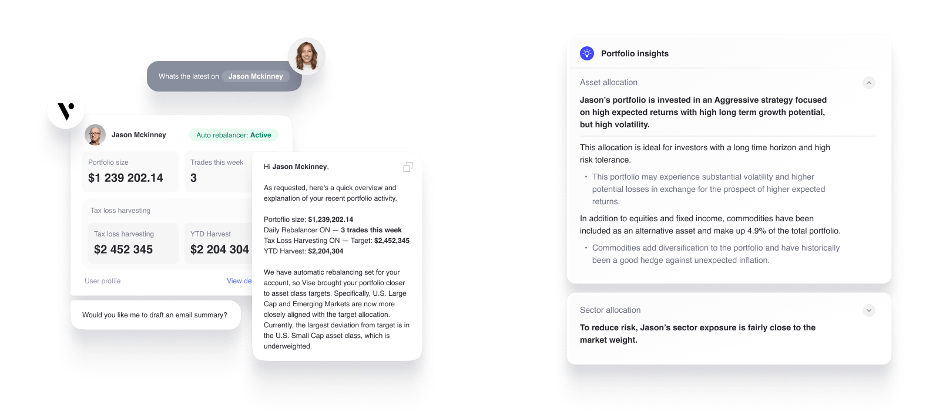

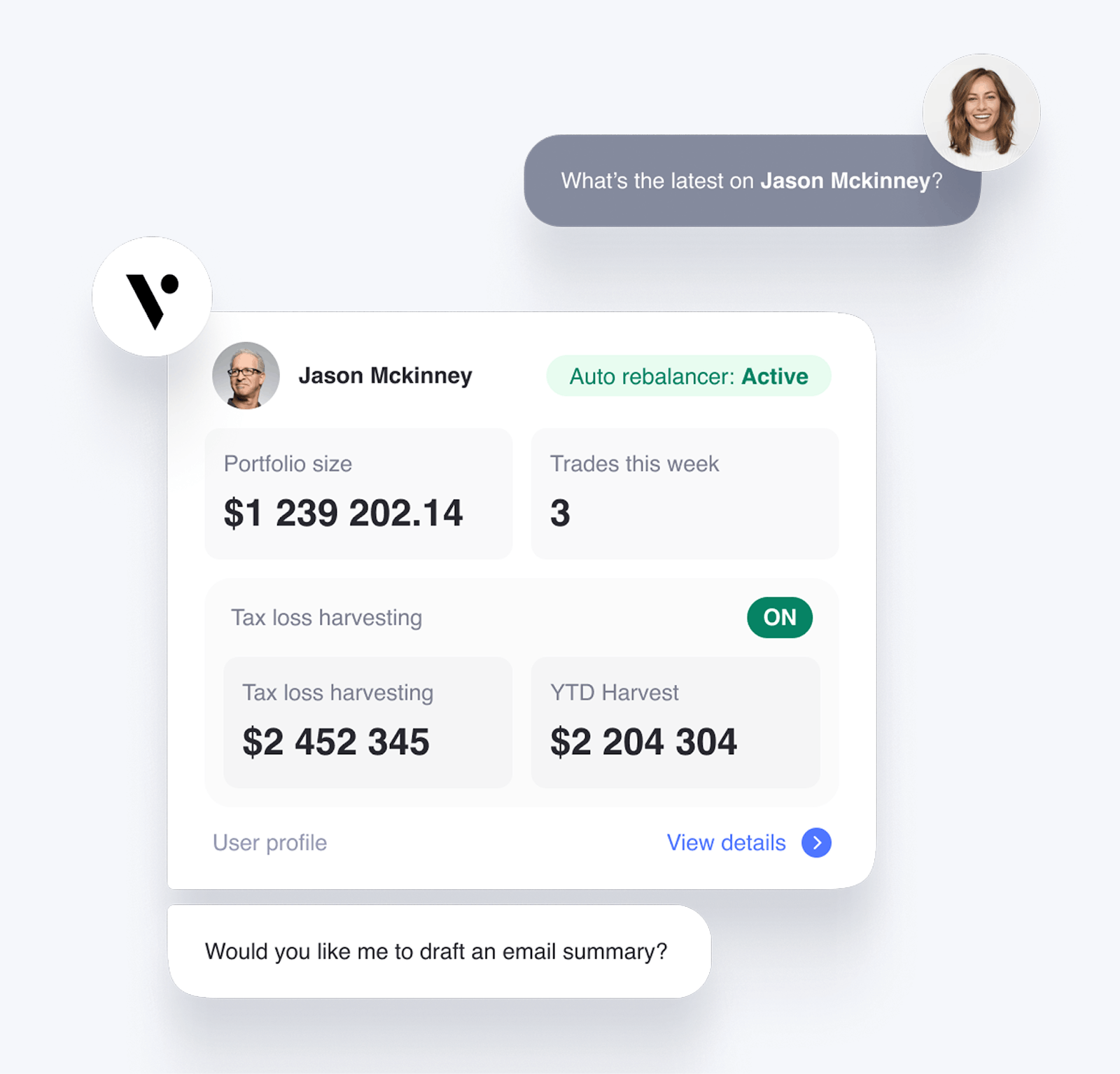

Explain leverages thousands of client data points to deliver performance insights, simplify complex trading decisions into more clear narratives, and create personalized reports that show how a Vise-managed portfolio can benefit each investor by leveraging AI. Vise Intelligence is the company’s proprietary AI engine built on large language models (LLMs). It transforms data into actionable insights, and streamlines day-to-day workflows. The goal of the product is to give advisors more time to focus on serving clients and growing their business.

Portfolio Creator

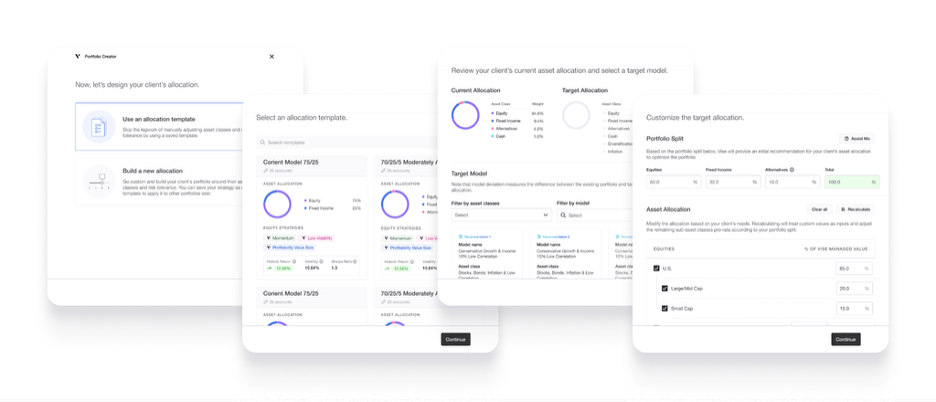

Source: Vise

Vise’s portfolio creation process is designed to give financial advisors a high level of control, flexibility, and automation when constructing customized portfolios for their clients. The experience is centered around the Portfolio Creator, a construction workflow that enables advisors to build an end-to-end personalized portfolio for a client.

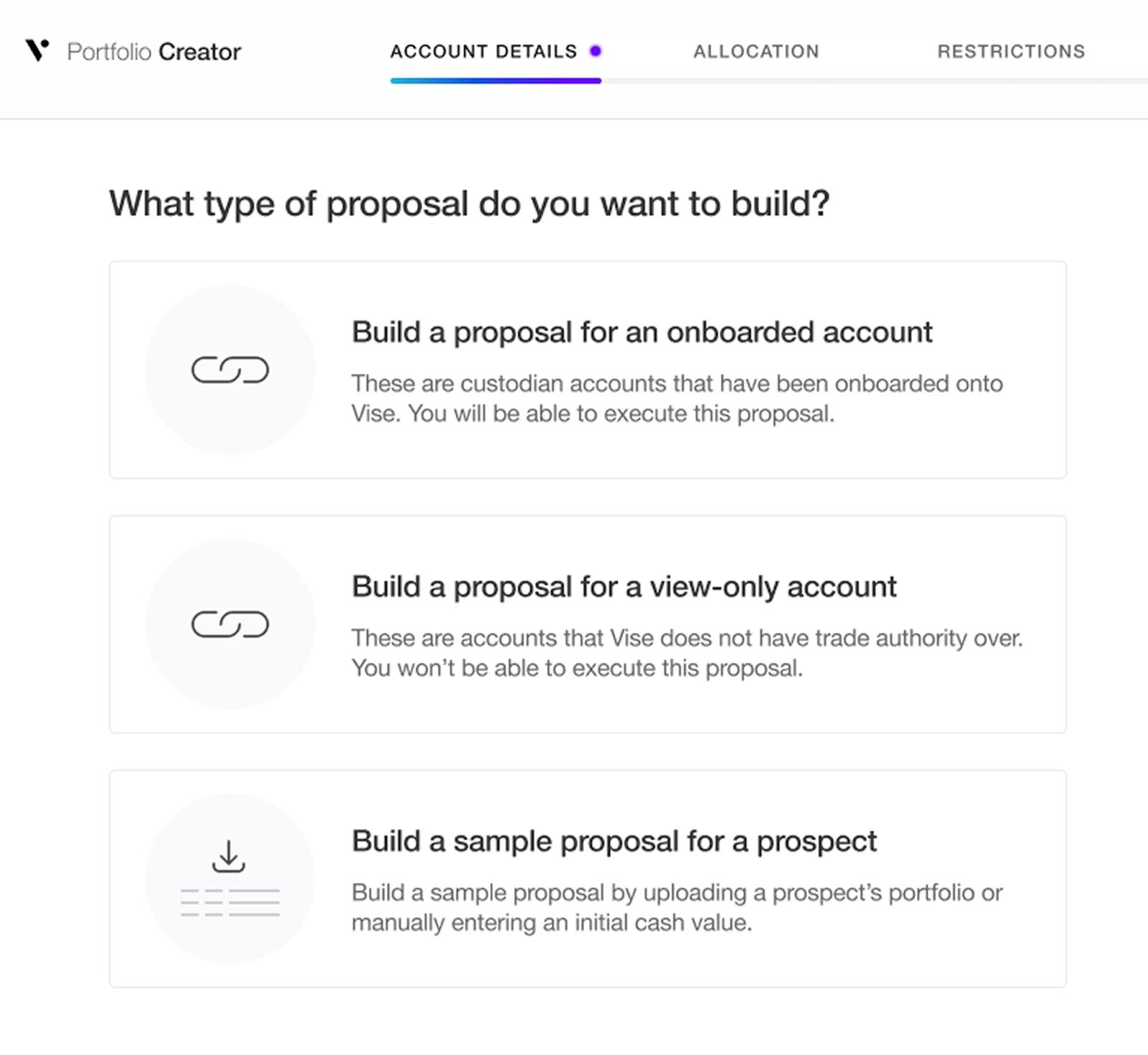

Source: Vise

Advisors can onboard both existing and prospective client accounts directly into Vise via integrations with major custodians such as Schwab, Fidelity, Raymond James, Pershing, and Interactive Brokers. If custodian access is unavailable, Vise can also ingest data from third-party platforms like Orion, upload position CSV and excel files, or parse holdings directly from PDF statements using generative AI models. This allows advisors to easily reconstruct portfolios from disparate or legacy systems. This allows advisors to ingest client data from 3rd party and legacy systems optimizing time to portfolio construction and proposal generation.

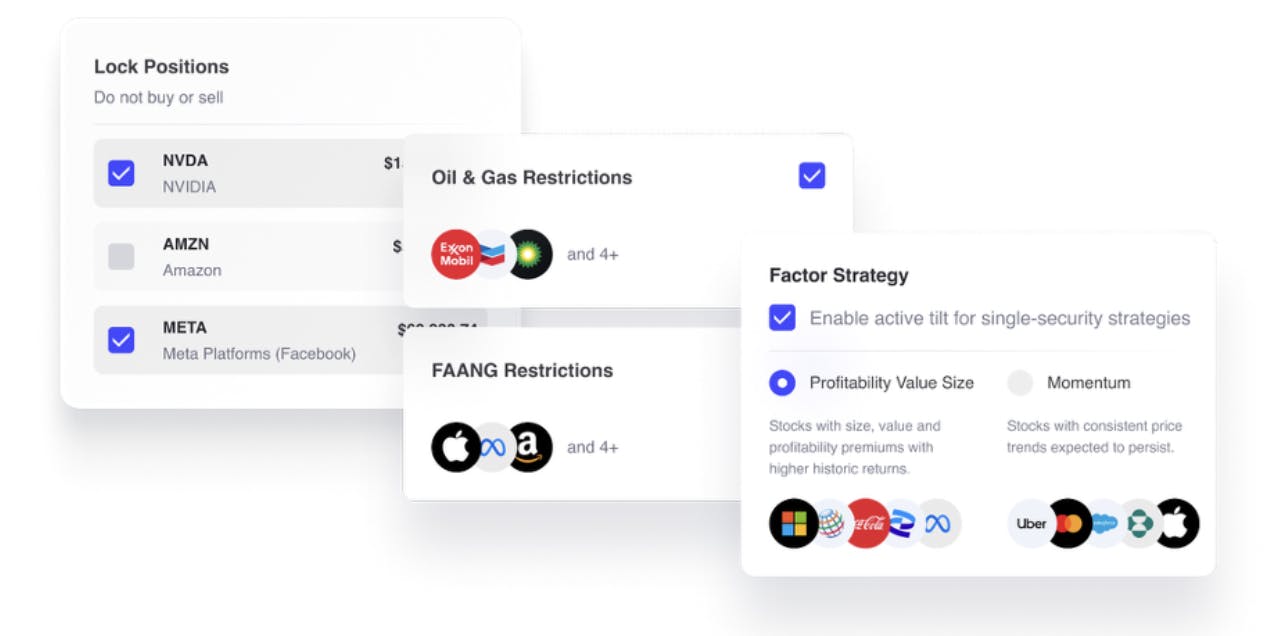

Once a portfolio is ingested, Vise analyzes the existing positions and enables advisors to set constraints—such as locking positions (e.g., Microsoft, Meta, etc.) at a client’s request. Advisors can set key parameters such as cash allocations, and sweep excess cash into money market funds if desired, and begin building a target portfolio.

The platform supports both client home office models as well as the ability to create custom models. Advisors can build target portfolios with all major asset classes, from equities, to fixed income, and alternatives, and select the type of strategy for each class, including ETF’s, direct indexing, and structured products, such as options overlay and long/short strategies. Advisors can further tailor portfolios using factor strategies, such as quality, value, and momentum, including Vise’s proprietary “blended multi-factor strategies."

Vise also allows for granular customization, including exclusion of specific companies, sectors (e.g., oil or fracking), countries (e.g., Russia or China), or value-based categories (e.g., environmental, military) to deliver personalized portfolios in line with investors’ beliefs as well as enabling advisors to make active bets in segments where they have high conviction.

Overweights and underweights can be applied at the sector and country level—for example, overweighting semiconductors or China by a specific percentage. The platform adjusts the remainder of the portfolio accordingly to maintain overall balance.

Source: Vise

One of Vise’s core differentiators is tax transition analysis. Rather than liquidating entire portfolios into cash and reinvesting in a model, Vise enables advisors to transition portfolios tax-efficiently while staying within client-defined tax budgets. The platform runs multi-period scenario analyses to evaluate the impact of different tax budgets on cost, turnover, and performance, helping advisors optimize tax efficiency.

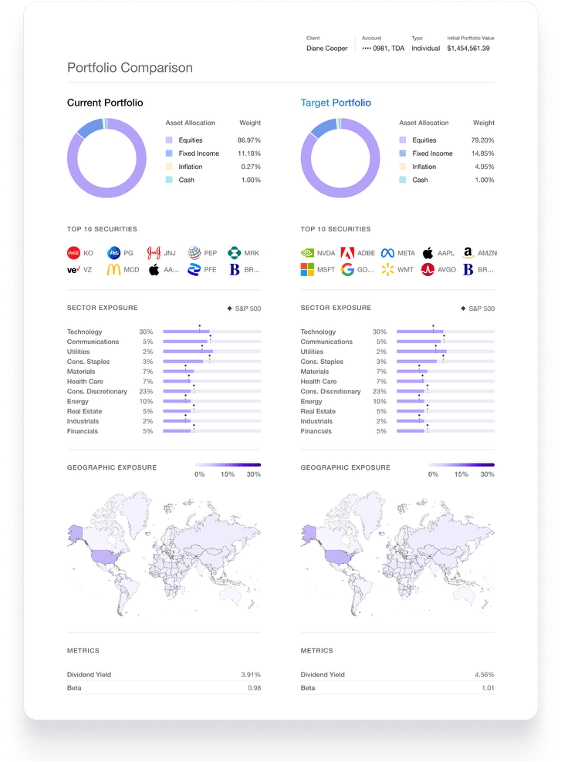

After incorporating all constraints, strategies, and preferences, Vise generates a fully customized portfolio tailored to the client’s current holdings, tax budget constraints, and investment preferences. The platform then produces a detailed Portfolio X-Ray (end-client transition report) that compares the existing portfolio with the proposed one, showing allocations, exposures, top holdings, sector breakdowns, tax savings, and transition turnover. This side-by-side comparison helps advisors present compelling proposals to prospects and clients.

Source: Vise

Portfolio Management

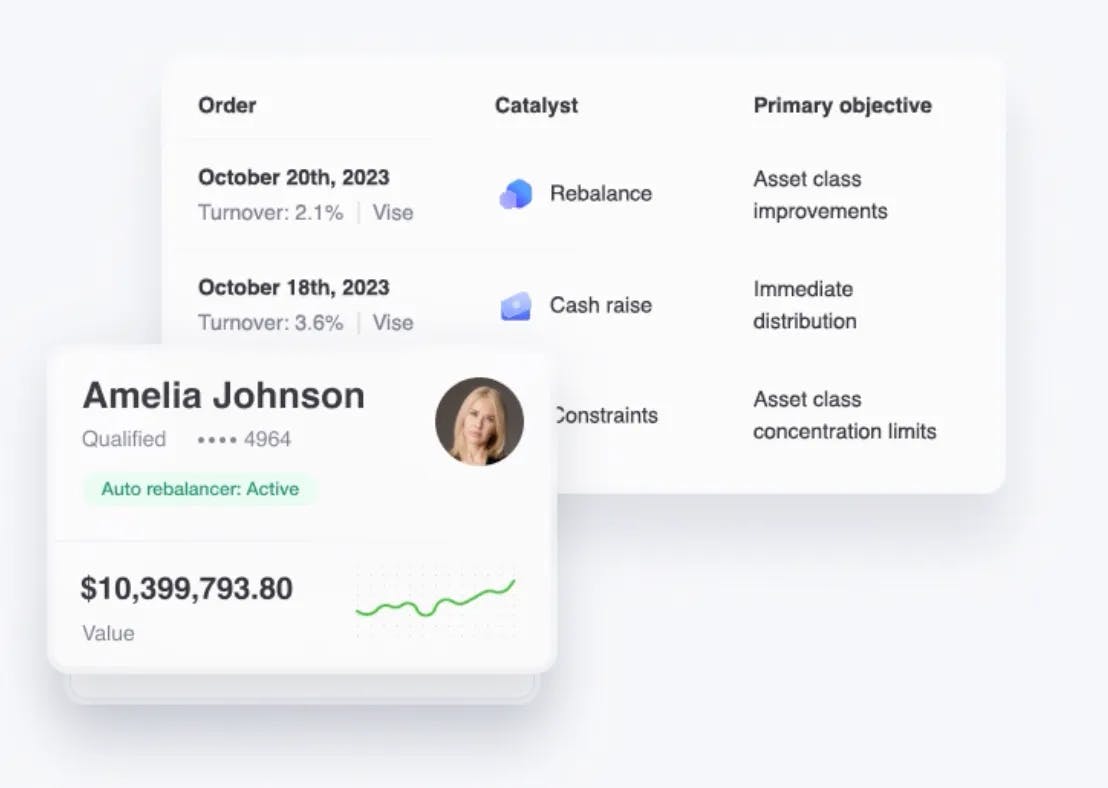

Vise automates key portfolio management functions, enabling advisors to oversee and monitor client accounts at scale. The platform facilitates portfolio strategy updates, automated rebalancing, and daily tax-loss harvesting, reducing the manual workload for advisors. Vise continuously monitors market shifts and identifies rebalancing opportunities to maintain asset allocation targets and client objectives, ensuring portfolios remain aligned with long-term strategies.

Source: Vise

Portfolio Explanation

To strengthen advisor-client relationships, Vise provides AI-powered tools that translate complex investment data into clear, client-ready insights. The X-Ray Transition tool compares a prospective client’s existing portfolio against a Vise managed account including details surrounding projected outcomes and potential. Trade Rationale, on the other hand, explains the catalyst behind every trading decision.

Source: Vise

Vise Intelligence

Source: Vise

Vise leverages AI to continuously optimize investment strategies, factoring in a broad range of data points, including risk tolerance, time horizon, and asset preferences across global equities, fixed income, real estate, and commodities. The platform’s “always on” strategy ensures that portfolios are constantly monitored and adjusted in response to market conditions, providing a dynamic investment approach that reduces the need for manual intervention.

At the core of Vise’s technology is its portfolio construction engine. This engine not only designs initial portfolios but also continuously manages them through automated rebalancing and trade execution, directly routing orders to custodians. Functionally, this back-end engine acts as an AI-powered asset manager, with the front-end interface serving as the advisor’s means of interacting with it.

The intelligence behind this engine is rooted in advanced statistical models rather than traditional generative AI. Vise has developed its own in-house nonlinear portfolio optimizer, designed for multi-period optimization, which considers both current and future investment horizons. In a June 2025 interview with Contrary Research, Mehrotra explained the company’s strategy employs two features that make this optimizer particularly differentiated: deep customization and speed & efficiency:

“Vise should be your all-in-one portfolio management tool that helps you be your core portfolio management stack - that helps you build, manage, and explain deeply customized portfolios in a way that's meaningful.”

Because Vise fully owns its optimization infrastructure, it can offer a high degree of configurability. Unlike legacy direct indexing platforms that rely on commercial optimizers like MSCI’s Barra, Vise can rapidly build new "dials" and strategy parameters, giving advisors greater flexibility to tailor portfolios around client needs. Traditional optimizers often use branch-and-bound algorithms, which can take an indefinite amount of time to compute. Vise instead applies a method involving a convex envelope, enabling its optimizer to run in under a second. This allows the system to handle large volumes of accounts and re-optimize portfolios frequently, resulting in more responsive and scalable portfolio management.

On the advisor-facing side, Vise integrates generative AI models to augment client engagement. These tools generate clear explanations and talking points about portfolio decisions, asset allocations, and market movements—helping advisors articulate insights, answer client questions, and strengthen trust. The AI generates breakdowns of portfolio changes and performance drivers in an accessible format, designed to help advisors deepen relationships and win new business.

Market

Customer

Vise targets RIAs and enterprise RIAs, positioning its platform as a tool to enhance advisor capabilities rather than replace them with automated robo-advisors. The ideal customer profile consists of wealth managers who are growing meaningfully both inorganically and organically. Vise appeals to financial advisors who view technology as an enhancement to their advisory services, allowing them to focus on client engagement while automating technical portfolio management tasks. The platform’s ability to integrate seamlessly into existing advisory workflows makes it particularly attractive to RIAs and enterprise RIAs seeking operational efficiency at scale.

The firm’s product strategy aligns with two ongoing industry shifts. First is the breakaway advisor trend: as technology makes it easier to launch independent practices, many advisors are leaving wirehouses, or full-service broker-dealers, like Merrill Lynch, Morgan Stanley, in search of more autonomy. These newly independent RIAs often seek infrastructure like Vise to build, manage, and explain highly customized portfolios. Second is the acceleration of RIA roll-ups: larger firms, often backed by private equity, are acquiring smaller RIAs to form scaled national platforms. Over $1 trillion in assets have already been rolled up, with projections suggesting this will reach $4.5 trillion in the next decade — representing over 3% of all U.S. wealth.

The status quo in portfolio management has traditionally relied on manual, time-intensive processes, limiting advisors’ ability to scale their businesses efficiently. Previous technology solutions, including Web 2.0-era robo-advisors, attempted to disintermediate human advisors rather than empower them. Advisors today spend significant time manually organizing data, rebalancing portfolios, and preparing reports for client meetings. Existing solutions often lack AI-driven automation and real-time insights, forcing advisors to balance relationship management with time-consuming technical tasks.

NewEdge Wealth (part of NewEdge Capital Group, which manages over $55 billion in assets) leverages Vise to customize asset class exposure, automate rebalancing, and optimize tax strategies at scale. Vise also provides client-specific insights and reporting to enhance NewEdge’s investment communication. Manhattan West (an LA-based firm with over $1 billion in assets) initially partnered with Vise, left, and later returned after the platform’s enhancements in tax transition, tax-loss harvesting, and personalized tax management. These improvements align with Manhattan West’s focus on tailored solutions for high-net-worth clients.

Market Size

Vise operates within the wealth management technology sector, specifically targeting RIAs and enterprise RIAs with AI-powered portfolio management solutions. The company competes in the B2B fintech space, within the "advisor tech" or "wealthtech" subcategory, which serves financial advisors rather than direct-to-consumer robo-advisory platforms. Vise’s solutions address multiple components of wealth management, including investment management platforms, portfolio construction tools, client communication systems, and AI-powered financial advisory technology.

The global wealth management industry is projected to reach $83 trillion in AUM by 2027, with the market expected to grow by $460.1 billion from 2025 to 2029. In the US alone, there are approximately 15.5K RIAs as of 2023, representing Vise’s core potential user base. Additionally, the number of asset management clients has been expanding, with 4.4% year-over-year growth, reaching 56.7 million clients, while overall client numbers increased by 3.5% in 2024.

Industry dynamics are also driving demand for technology-enabled solutions. The retirement of baby boomer financial advisors is creating succession challenges, with 37% of advisors expected to retire in the next decade, prompting firms to seek scalable, AI-driven tools that improve efficiency and continuity. At the same time, high-net-worth investors in the US are increasingly open to changing wealth management providers, with 46% planning to switch or add new relationships within 12-24 months. Among this group, two-thirds want greater personalization in financial planning and investment strategy, a trend that aligns with Vise’s AI-driven approach to portfolio customization.

AI adoption in wealth management is accelerating, with 45% of asset and wealth management firms in a 2024 survey by PwC expecting AI to create new revenue streams, and 43% believing it will enhance the client experience and speed up time to market.

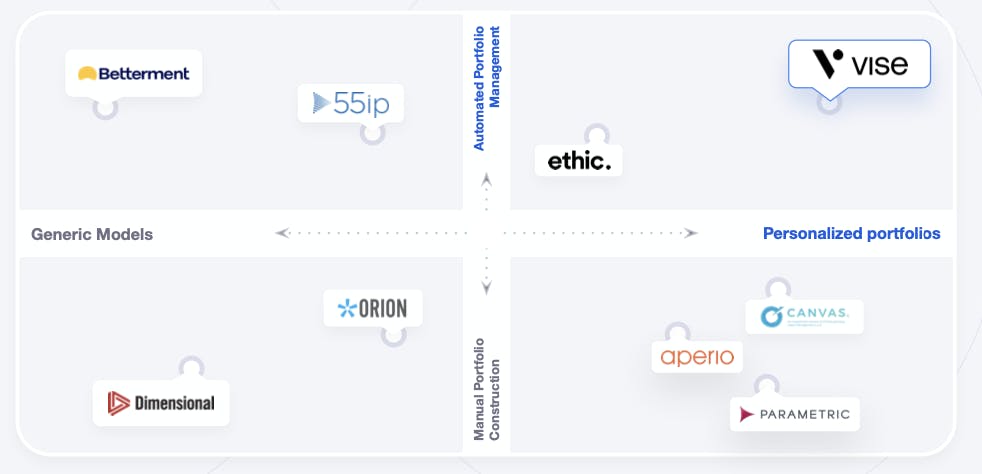

Competition

Competitive Landscape

The wealth management technology sector is dominated by large incumbents such as Envestnet, Morningstar, and Charles Schwab, which provide broad platforms serving thousands of advisory firms. These traditional players offer portfolio management, analytics, and advisory tools but have been slower to adopt AI-driven, personalized portfolio construction—a gap that emerging startups like Vise are working to take advantage of. Most of an advisor’s time is spent on non-revenue generating activities with 25% of time spent on portfolio management, translating into over $1 million of annual costs.

The AI-powered wealth management technology market remains nascent. Incumbents have primarily opted to acquire AI capabilities rather than develop them in-house, as seen in JPMorgan’s acquisition of OpenInvest and Vanguard’s acquisition of Just Invest. Meanwhile, competition among advisor-focused fintech companies is evolving, with some startups focusing on simpler automation (Pebble), niche investment strategies (OpenInvest), or broader practice management solutions (Fundment).

Vise’s potential competitive moats stem from data network effects, where increased advisor usage enhances AI-driven portfolio intelligence, and switching costs, as once an advisor integrates Vise into their workflow, moving to another platform becomes more difficult. In an June 2025 interview with Contrary Research, Mehrotra explained how the advisor should always be front and center when cultivating client relationships and in return, Vise does all the behind-the-scene planning:

“Vise is everything in the background. It does the planning and the planning integrates with the investment management. It generates the portfolios, trading, and the reports for the RIAs. We want to predict the outcome that's most useful for the advisor, and then show them the information that's most interesting.”

Source: Vise

Legacy Incumbents

Vanguard: Vanguard provides brokerage services, mutual funds, ETFs, and wealth management solutions, emphasizing low-cost investing. Through Vanguard Institutional, it offers advisors digital tools for portfolio construction, investment management, and client servicing. Vanguard's digital advisor service, Vanguard Digital Advisor, provides automated portfolio management for retail clients. It also operates Vanguard Personal Advisor Services, combining human and digital advisory capabilities. These offerings position Vanguard competitively against both traditional incumbents and newer wealthtech providers. While best known for low-cost index funds, Vanguard also has a growing robo-advisory presence and digital tools for advisors (via Vanguard Institutional).

Envestnet: Envestnet is a provider of integrated portfolio, practice management, and reporting solutions for financial advisors and institutions. Its platform supports investment selection, model portfolio management, financial planning, and data aggregation, serving over 100K advisors and managing trillions in assets. In November 2024, Bain Capital acquired a majority stake in Envestnet, signaling a renewed focus on scaling its wealthtech capabilities and accelerating innovation. Envestnet’s open-architecture ecosystem and deep integrations with asset managers, custodians, and fintechs position it as a key incumbent in the advisor tech space and a broad competitor to platforms like Vise.

Morningstar: Morningstar is a global financial services firm best known for its investment research, data, and ratings on mutual funds, ETFs, and other investment products. Its Direct Advisory Suite platform provides financial advisors with portfolio analytics, planning tools, and investment recommendations. Morningstar also offers direct indexing, ESG data, and model portfolios, expanding its presence in portfolio construction and advisor enablement. While traditionally known for research and data, Morningstar’s growing suite of advisor tools and digital investment products increasingly positions it as a competitor in the wealthtech landscape.

Addepar: Addepar is a financial technology company founded in 2009 by Joe Lonsdale and Jason Mirra. It offers a cloud-based platform designed for professional wealth, investment, and asset management firms. The platform specializes in data aggregation, analytics, and portfolio reporting, providing investment professionals with real-time insights into complex portfolios. As of 2024, Addepar's platform manages over $7 trillion in assets across more than 45 markets worldwide. The company has expanded its offerings to include tools for portfolio trading and rebalancing, scenario modeling and forecasting, and streamlined billing. Addepar's open platform integrates with over 100 software, data, and service partners, delivering comprehensive solutions for a diverse range of clients, including family offices, independent advisors, private banks, and broker-dealers.

Parametric: Parametric, a subsidiary of Morgan Stanley Investment Management, is a provider of custom direct indexing, tax-managed equity, and rules-based investment strategies. It offers portfolio solutions to high-net-worth individuals, institutions, and advisors, with a particular emphasis on tax optimization and customization. Parametric is an active player in the direct indexing space, managing over $560 billion in assets as of June 2025. While not a full-stack advisor platform, its tax-aware portfolio management tools and custom SMA capabilities make it a frequent integration partner for advisors building highly personalized investment solutions.

Canvas: Canvas is a customizable investment platform launched by O’Shaughnessy Asset Management (OSAM) in 2019 and later acquired by Franklin Templeton in 2021. Canvas enables advisors to build and manage custom portfolios using factor investing, ESG filters, and tax-aware direct indexing through a drag-and-drop interface. Advisors can personalize portfolios by adjusting exposures, integrating client preferences, and automating tax-loss harvesting. Canvas emphasizes flexibility, control, and transparency in portfolio design, aiming to reduce advisor reliance on third-party model portfolios.

Robo-Advisors

While Vise is not directly competing with robo-advisors, these companies represent alternatives to traditional wealth managers. As a result, the more these companies are able to attract customers, the more it limits Vise’s ability to serve those clients through advisors. In addition, some robo-advisors, like Betterment, have evolved their offerings to address financial advisors as well as consumers directly.

Betterment: Founded in 2008, Betterment was one of the first direct-to-consumer robo-advisors before expanding into B2B wealth management solutions with Betterment for Advisors. With $435 million in total funding as of June 2025, Betterment has meaningful market penetration but follows a different go-to-market strategy—starting as a consumer-facing product before expanding to offer advisor tech, whereas Vise was built specifically for financial advisors from inception. Betterment’s acquisition of Makara in 2022 signaled its move into crypto asset management, an area where Vise hasn’t historically focused as of June 2025.

Wealthfront: Wealthfront is a robo-advisor offering automated investment management, financial planning, and cash accounts through a mobile platform. It manages over $80 billion in assets and provides services like tax-loss harvesting, automatic rebalancing, and high-yield FDIC-insured cash accounts. In 2024, it launched automated bond ladders for US Treasuries. Wealthfront charges a 0.25% advisory fee with a $500 minimum investment. A planned $1.4 billion acquisition by UBS in 2022 was called off, though UBS later invested via a convertible note.

Startups

Ethic: Ethic, founded in 2016, is a data-driven technology platform that enables advisors, family offices, and institutions to build customized, sustainable portfolios. The platform uses investment consulting technology to construct passive portfolios optimized to minimize tracking errors relative to market benchmarks, while aligning with clients’ sustainability values. By combining ESG insights with index-based investing, Ethic offers a differentiated approach to personalized, values-driven portfolio construction—positioning it as a competitor to Vise in the space of tailored, automated investment solutions. As of June 2025, Ethic had raised $162.8 million in total funding, including a Series D funding round of $64 million in April 2025.

55ip: 55ip, founded in 2015, is a financial technology platform that enables advisors to implement tax-efficient investment strategies through intelligent automation with a total funding of $10 million as of June 2025. Its core offering, ActiveTax Technology, facilitates tax-smart portfolio transitions, ongoing tax management, and optimized withdrawals. By integrating model-based analytics, proposal generation, and automated trading, 55ip enhances advisor efficiency and improves client outcomes. Positioned as a competitor to Vise, 55ip focuses specifically on tax optimization within model portfolios, with a focus on the tax-aware portfolio automation space.

Pebble: Pebble, founded in 2021, offers automated portfolio management and client engagement tools for financial advisors, and has $5 million in total funding as of June 2025. While both companies target financial advisors, Pebble provides a templated approach to portfolio construction, whereas Vise differentiates itself through customizable, AI-driven solutions.

OpenInvest: OpenInvest, founded in 2015, developed an ESG-focused portfolio customization platform before being acquired by JPMorgan Chase in 2021. Before the acquisition, the company raised a $10.5 million Series B in April 2020 with QED Investors leading their Series B, resulting in total funding pre-acquisition of $24.3 million. Like Vise, OpenInvest emphasized personalized portfolio construction, but its focus was limited to ESG investing, whereas Vise offers broader AI-powered investment intelligence. OpenInvest’s product is now integrated into JPMorgan.

Business Model

Vise generates revenue primarily through asset-based fees charged on the investment strategies it delivers via its platform. The company partners with a range of financial advisors, from small independent advisors to large enterprise RIA firms, including those introduced through strategic relationships with wealth management firms.

The core of Vise’s monetization is a fee on assets under management (AUM), which typically averages between 25 to 30 basis points. However, the actual fee varies depending on the investment strategy employed. For example, direct indexing—a widely used strategy among smaller advisors—commands around 20 basis points, while more sophisticated strategies such as active management, options overlays, and long/short equity can carry higher fees, ranging from 75 basis points up to 1%. These premium strategies are more commonly adopted by large advisors managing more complex client portfolios and are particularly valuable due to features like tax-loss harvesting across both long and short positions.

In some cases, particularly with large enterprise clients, Vise also charges a software licensing fee. However, this fee is typically waived for smaller advisors, who instead access the platform for free and pay solely for the investment strategies they utilize. This integrated software-plus-strategy approach serves a dual purpose: it allows Vise to distribute its own investment strategies directly within advisor workflows, and it creates an incentive for wealth management partners as it drives adoption of their strategies over those of competing asset managers.

Traction

Vise has gained traction among both RIAs and enterprise RIAs seeking to automate portfolio management and enhance operational efficiency. While the company has not publicly disclosed revenue or user growth figures, it has announced partnerships with several firms in the wealth management industry.

In October 2024, Vise announced a partnership with NewEdge Wealth, part of NewEdge Capital Group, which manages over $55 billion in assets. According to a press release, NewEdge is using Vise to support portfolio customization, automate rebalancing, and optimize tax strategies.

Manhattan West, a Los Angeles-based RIA with over $1 billion in assets, initially adopted Vise, later paused its use, and subsequently re-engaged with the platform after updates to its tax management features. In explaining the firm’s return, Vise’s co-founder Samir Vasavada cited enhancements in tax-loss harvesting and personalization as key factors in the firm’s renewed adoption.

Vise’s product is positioned to serve trends in the advisory industry, including the emergence of breakaway advisors launching independent practices and the consolidation of RIAs through roll-up strategies backed by private equity. These trends may influence demand for technology platforms that support scalable and personalized investment management.

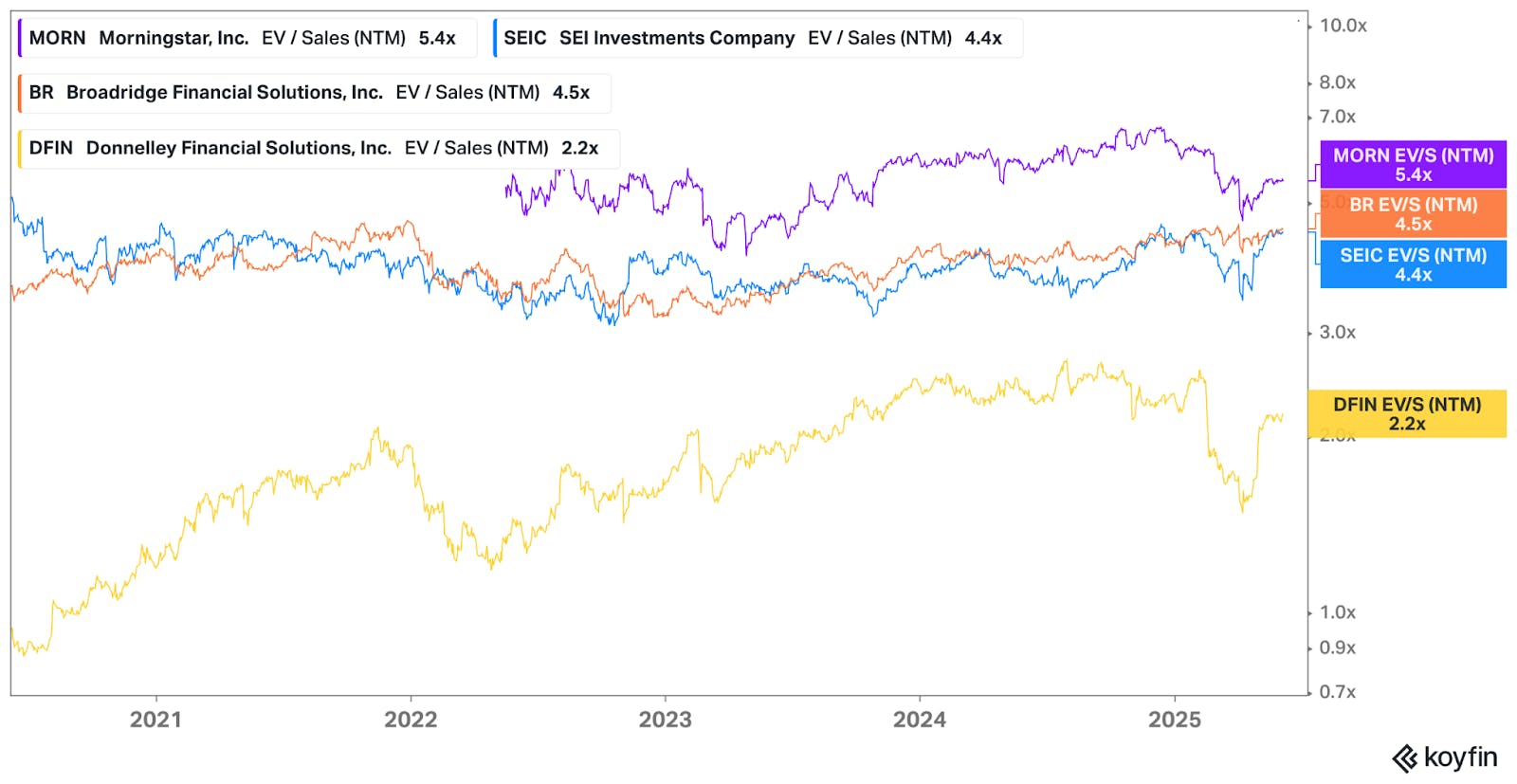

Valuation

In May 2021, Vise raised a Series C led by Ribbit Capital for $65 million at a $1.05 billion valuation. As of June 2025, the company has raised more than $125 million in venture capital funding from investors including Ribbit Capital, Sequoia Capital, Founders Fund, Contrary, Bling Capital, Bond, and Allen & Company.

There are a variety of comparable businesses in the broader wealth advisory space, from public companies like Morningstar and Charles Schwab, with market caps of $13.1 billion and $159.1 billion respectively as of June 2025, to private equity owned businesses, like Envestnet, which was acquired by Bain Capital for $4.5 billion in November 2024. As of June 2025, comparable businesses were trading at a range from 2.2-5.4x revenue depending on variables like scale, consistency, and tech-enabled growth. The higher the growth, the higher the multiple a particular company can command.

Source: Koyfin

Key Opportunities

RIA Consolidation & Inorganic Growth

The wealth management industry is experiencing rapid consolidation on the RIA side, driven by an aging advisor population and significant private equity investment. As more advisors retire or seek succession solutions, enterprise RIAs are aggressively acquiring smaller firms and rolling them into centralized, scalable operating models. These consolidated platforms are under pressure to achieve operational efficiency and margin expansion, often by standardizing investment processes across hundreds of client relationships.

However, standardization creates risk. Post-acquisition, many advisors struggle to maintain the level of portfolio personalization their clients have come to expect, especially when transitioning to a centralized investment model. This tension between scalability and customization presents a unique opportunity for Vise.

Vise is built to help enterprise RIAs preserve the advisor-client relationship while driving platform-wide efficiency. By automating personalized portfolio construction at scale with built-in tax management, compliance alignment, and customization levers Vise allows consolidators to streamline operations without sacrificing personalization. As M&A activity accelerates, platforms that can bridge the gap between individual advisor autonomy and centralized control will become indispensable.

Market Consolidation

Market consolidation in the wealth-tech and advisory platform space could directly benefit Vise by reducing competitive fragmentation, allowing the company to capture greater wallet share among RIAs. The advisor technology market is crowded with specialized tools competing on various niche services, such as tax-loss harvesting, portfolio rebalancing, and ESG investing. Consolidation—whether through strategic acquisitions or competitors exiting the market—would streamline advisors’ technology stacks, positioning integrated platforms like Vise to become the default option for advisors seeking comprehensive, end-to-end solutions. Additionally, consolidation typically improves unit economics by increasing scale and reducing customer acquisition costs, enabling Vise to achieve profitability more quickly and sustainably.

As the wealth management industry consolidates, it is more likely to rapidly move away from manual portfolio construction toward software-driven, scalable solutions. As advisory firms prioritize scale, operational efficiency, and personalization, platforms like Vise that offer integrated, advisor-focused investment management software become increasingly valuable. The shift from in-house portfolio management to outsourced, tech-enabled investment solutions is already underway, and Vise is built specifically for that transition.

Accelerated Outsourcing

Wealth managers are facing increasing pressure from both regulators and cost-conscious clients to deliver more value at lower fees. This dynamic is pushing advisors to outsource non-core functions like investment management while maintaining personalization. The SEC’s ongoing focus on Reg BI, fiduciary standards, and enhanced disclosure requirements around conflicts of interest makes automated, rules-based portfolio management more appealing and defensible from a compliance perspective.

Platforms like Vise enable advisors to delegate investment decisions to a third party while maintaining transparency and customization. This trend has already driven a broader movement toward model portfolios and TAMPs (Turnkey Asset Management Platforms). Vise takes this a step further by offering hyper-personalized portfolio automation with integrated compliance features, making it a natural evolution of the TAMP model.

Generational Wealth Transfer

Over the next two decades, an estimated $68 trillion in assets will shift from Baby Boomers to younger generations, notably Millennials and Gen Z, who exhibit markedly different expectations and behaviors regarding financial management and advice. Unlike their parents, these younger investors prioritize digital-first experiences, transparent fee structures, and personalized services that align with their values, such as ESG investing and socially responsible strategies. As this demographic shift accelerates, traditional advisory platforms built for older generations face growing pressure to modernize or risk losing market share.

For Vise, this generational transfer presents a significant opportunity to attract a wave of new, digitally native advisors—and their clients—who demand tech-forward solutions and deeply personalized investment portfolios. By aligning closely with the expectations and preferences of the next generation of investors, Vise can differentiate itself from legacy platforms that lack the agility or innovation needed to effectively serve this market.

Specifically, Vise could enhance its value proposition by deepening capabilities in areas important to younger investors, such as impact investing, financial wellness education, and intuitive digital interfaces. Embracing these trends proactively would position Vise as a strategic beneficiary of the ongoing wealth transfer, allowing it to capture a greater portion of the massive influx of assets changing hands.

Key Risks

Lack of Data

A critical risk to scaling the platform's intelligence and delivering personalized, automated financial planning lies in the inconsistent availability and completeness of client data. While the vision relies on sophisticated AI models making meaningful inferences about clients’ financial goals, risk tolerances, and broader personal context, the reality is that much of this foundational data is currently missing or only partially captured. Without a comprehensive dataset—including detailed financial plans, stated goals, and nuanced risk preferences—the models cannot generate accurate or actionable insights at scale.

Although the quality of AI inference models is improving rapidly, their effectiveness is still fundamentally constrained by the quality and granularity of the input data. As a result, the platform remains limited in its ability to automate personalized planning and advice to the quality of data available. As long as a robust client data foundation is established—and ingestion processes are standardized across the client base—there is more limited execution risk that the full potential of the technology to be realized.

Competitive Pressure

The RIA technology ecosystem is crowded with well-funded incumbents and emerging players. Larger platforms like Orion, Envestnet, Morningstar, and even Schwab and Fidelity offer overlapping solutions—often with deeper integrations, broader feature sets, and longer track records. Many of these competitors have strong distribution through custodial relationships or advisor networks. Vise’s ability to scale may be constrained if advisors opt for bundled solutions from established vendors or if similar AI-based offerings are launched by larger players with more resources and brand trust.

Moreover, the wealth-tech industry has seen substantial venture capital inflow, fueling new entrants who can aggressively pursue RIAs through competitive pricing, tailored services, or niche specialization (e.g., direct indexing, ESG, or tax-focused strategies). As the space becomes increasingly crowded, customer acquisition costs rise, and maintaining distinct competitive advantages becomes more challenging for Vise, potentially limiting growth and profitability.

Adoption Friction

While the RIA market is growing, converting advisors to new platforms remains a slow and high-friction process. Advisors are notoriously loyal to existing tech stacks due to workflow disruption, client transition risk, and compliance concerns. Even with compelling technology, Vise must overcome skepticism—especially as a relatively young platform. In 2023, only about 2.3% of advisors expected to switch portfolio management systems within the next 12 months, despite some platforms receiving average satisfaction scores of just 6 or 7 out of 10. Without a strong pipeline of onboarding, education, and success stories, Vise may struggle to achieve meaningful adoption at scale.

Summary

The wealth management industry has increasingly standardized investment portfolios through centralized model frameworks, enabling firms to scale operations and reduce advisor-level variance. However, this standardization has led to portfolios that many advisors and clients perceive as overly generic, limiting personalization and differentiation.

Vise positions itself as an all-in-one platform that enables RIAs and enterprise RIAs to deliver more customized investment portfolios at scale. The company’s technology automates the creation, implementation, and management of customized model portfolios, including portfolio construction, tax optimization, and tax-loss harvesting. A core element of Vise’s offering is enabling transitions from legacy products (e.g., mutual funds, ETFs) into more personalized portfolios in a tax-efficient manner.

*Contrary is an investor in Vise through one or more affiliates.