Thesis

From 2012 to 2021, global assets under management (AUM) grew by 118%, rising from $57.8 trillion to $125.9 trillion. A significant portion of this wealth has been controlled by ultra-high-net-worth (UHNW) individuals, a category defined as those with at least $10 million in net worth. Despite representing only 0.6% of US households, UNHW individuals held 30% of US financial assets in 2022. Between 2010 and 2022, the wealth held by this group more than tripled, contributing to rising demand for more sophisticated wealth management solutions capable of handling complex portfolios.

Prior to this, the 2008 financial crisis exposed limitations in legacy wealth management systems. Before the crisis, fragmented platforms, institution-level data silos, and a lack of visibility into alternative investments limited the ability of advisors to monitor risk and liquidity. When market volatility surged and asset values declined sharply, these structural weaknesses became more visible. The crisis underscored the importance of integrated financial data, transparent reporting, and tools that support real-time oversight of diversified portfolios.

In the years since, the rise of alternative investments has added another layer of complexity to asset management. In 2024, 50% of family office portfolios were expected to have invested in alternative assets, up from 40% in 2022, with allocations to cash and other traditional asset classes declining. These investments, including private equity, real estate, commodities, and farmland, are typically less liquid and involve unstructured, non-standard data formats that create operational challenges for both small teams and large institutions. Managing these investments requires systems that can collect, standardize, and analyze disparate data at scale.

Addepar is a cloud-based investment management platform designed to address these needs. Originally focused on serving wealth managers for UHNW individuals, the company has since expanded to support private banks, asset owners, allocators, and fund managers. Its platform offers tools for data aggregation, portfolio analysis, and reporting, allowing advisors to view entire balance sheets, including alternatives, within a single system. As of September 2025, its clients included prominent companies such as Morgan Stanley, AllianceBernstein, and London & Capital.

Founding Story

Addepar, whose name stems from a Latin phrase that translates to “add a little to a little and you’ll have a great amount”, was founded in 2009 by Joe Lonsdale (Chairman, Former CEO) and Jason Mirra (Former CTO).

After graduating from Stanford with a BS in Computer Science, Lonsdale joined PayPal as an early employee. Following PayPal’s acquisition by eBay in 2002, Lonsdale, like many of his PayPal colleagues, decided to strike out and create his own company. In 2003, following the 9/11 attacks, Lonsdale cofounded Palantir Technologies alongside Peter Thiel. The early aim of Palantir was to gather the country's top technical talent and create a system that could help intelligence services counteract terrorist networks and enhance national security.

In the aftermath of the financial crisis of 2008, Lonsdale saw another opportunity to solve an information asymmetry — this time between wealth managers and existing wealth management software. He aimed to help financial advisors better navigate turbulent market conditions. In 2009, Lonsdale successfully convinced Mirra, who was an intern on Lonsdale's team, to drop out of Carnegie Mellon University and help Lonsdale create Addepar. In 2013, Lonsdale and Mirra convinced Eric Poirier, who had been a Director at Palantir, to leave Palantir and join Addepar as CEO.

In December 2018, Addepar expanded its leadership team with numerous hires in finance, revenue, marketing, and people operations, and appointed Laurence Tosi, former CFO of Airbnb and Blackstone, to its board. Of the executives hired at that time, only Sally Buchanan, VP of People and Operations, remained with the company as of September 2025. As of September 2025, Lonsdale remained Chairman and Advisor, and Poirier continued to serve as CEO.

Meagan Ward joined Addepar in 2019 as Head of Communications, was promoted to VP of Communications in 2021, and became Chief Marketing Officer in 2023. Eric Daniels was appointed Chief Financial Officer in 2022, following prior finance leadership roles at Real Capital Analytics, automotiveMastermind, and NRC. In 2023, John Wiseman became Chief Revenue Officer, bringing experience from CRO roles at FactSet and RCA, and a background in trading technology and go-to-market leadership at Instinet and Bear Stearns.

Product

Addepar offers a suite of products designed to help wealth managers manage their clients’ portfolios. The platform helps wealth managers and investors optimize asset allocation by enabling portfolio transparency with its wealth management platform, including portfolio analytics, report creation, asset trading, and billing automation. Although each of these features is housed within the same software, customers can choose which features they want to pay for.

Navigator

Source: Addepar

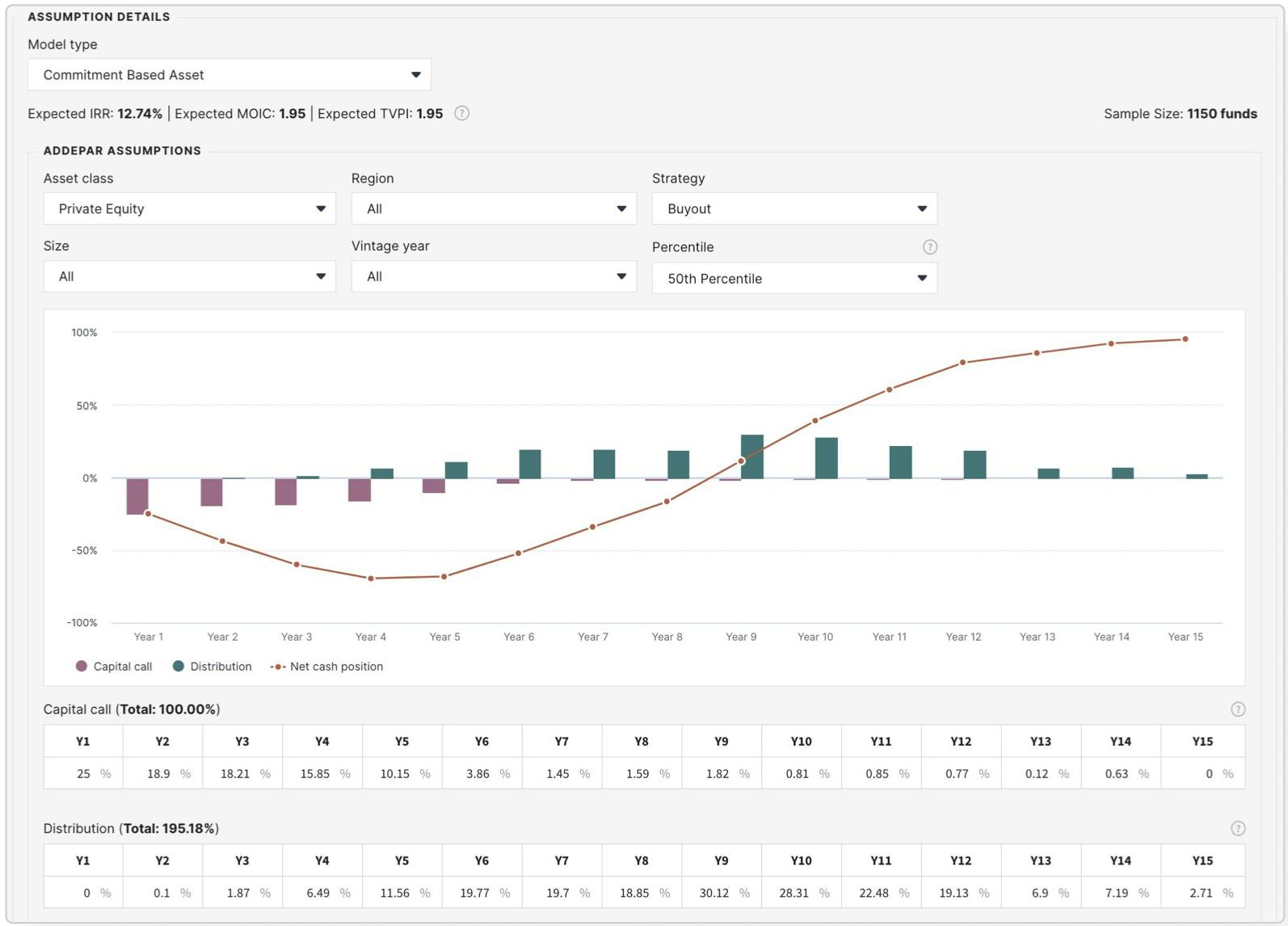

In January 2021, Addepar acquired RCI, a fintech company focused on simulating investment scenarios, and rebranded it as Navigator. Addepar Navigator is a portfolio projection and scenario analysis tool used to model spending, capital commitments, and distributions across an investment cycle. It allows investment professionals to simulate various economic and portfolio-specific scenarios, assess potential liquidity needs, and plan for cash flow timing across different asset classes. In February 2025, Addepar introduced the additions of alternative data management, private fund benchmarking, and cash flow forecasts to its Navigator product.

In February 2025, Addepar introduced an “Alts Data Management” feature that automates the collection and processing of investment documents such as capital account statements and distribution notices. Data is extracted using AI-enabled tools and verified through internal quality checks. The system also supports centralized storage and retrieval of these documents within the platform.

Private fund benchmarks are built from platform data, including performance metrics across approximately 12K funds, 4.4K managers, and 115K LP positions. These benchmarks provide historical performance data, including since-inception and quarterly views, to support comparative analysis and investment planning.

Private fund cash flow forecasts include access to approximately 300 pre-configured assumptions based on over 15K funds and four decades of private equity cash flow data. These assumptions are used to generate forecasts for private fund investments, including private equity, venture capital, and private debt. Users can model new commitments, evaluate capital pacing strategies, and estimate progress toward target allocations.

Trading

Source: Addepar

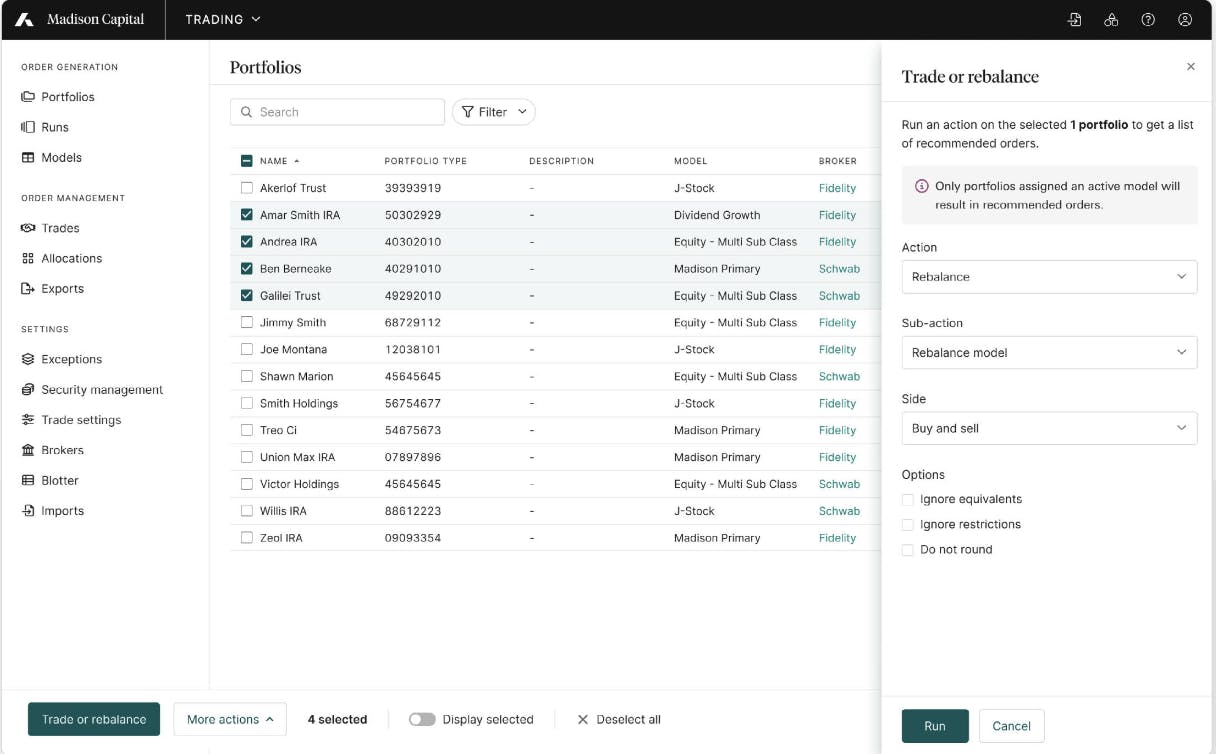

Addepar acquired AdvisorPeak, a Utah-based provider of portfolio management and trading tools, in October 2021. This acquisition enabled Addepar users to natively trade and rebalance investments at scale to align with their clients’ portfolio goals. Although the two companies had previously collaborated, the integration of AdvisorPeak was intended to reduce manual workflows and technological friction. AdvisorPeak was phased out in September 2024 with the launch of Addepar Trading, Addepar’s fully integrated solution.

Addepar Trading is an integrated platform for portfolio trading and rebalancing designed to support advisors and institutions managing both simple and complex investment strategies. It allows users to conduct household-level and bulk account rebalancing, raise or invest cash, and transition portfolios to new models while adhering to client mandates and regulatory requirements.

The platform supports model construction, custom asset allocation, and rebalancing at both the asset class and sub-model level. Users can create security models, apply restriction lists at the security, class, or issuer level, and configure trade settings, including rounding logic, compensation rules, and gain budgets. Cash simulations are also available to help evaluate the impact of adding or removing funds.

Trade execution options include flat-file exports and automated FIX protocol communication, with additional support for post-trade processing via Lightspeed. The system incorporates built-in pre-trade compliance checks and order validation rules, and it supports in-flight adjustments to account for pending transactions and unsettled trades. Advisors can route trades by asset type and manage execution preferences across broker channels.

Addepar Trading integrates with the firm’s Investment Book of Record (IBOR), enabling users to work from a consolidated, near-real-time dataset that includes corporate actions and pending cash items. The platform also provides dashboards, alerts, and entitlements to support monitoring and operational oversight, with access controls configurable by user or role. Built as an API-first solution, Addepar Trading can be integrated with proprietary and third-party systems to fit into broader operational workflows.

Dashboards

Source: Addepar

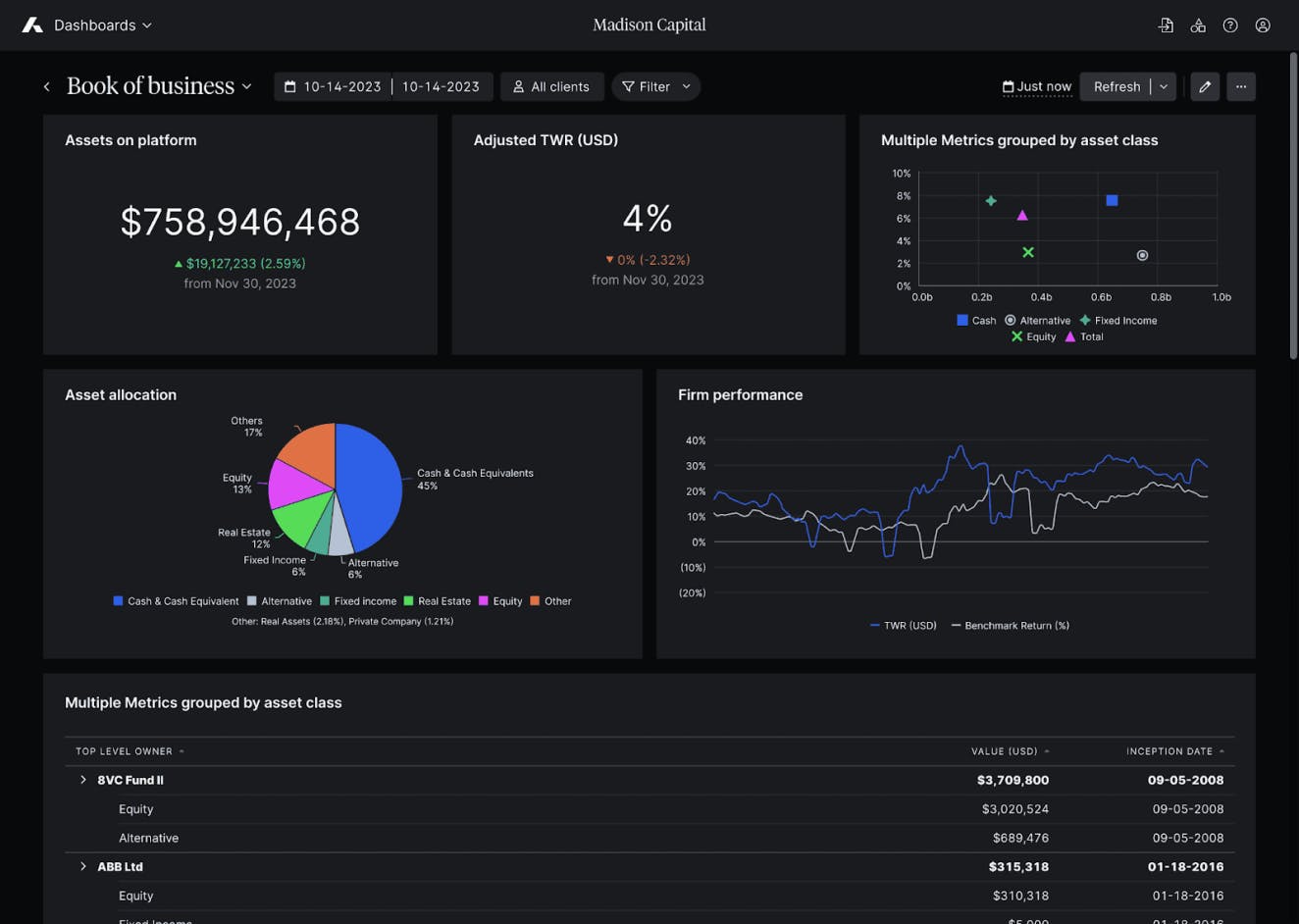

Addepar Dashboards, launched in September 2024, provides users with a configurable interface for viewing portfolio data, operational metrics, and strategy-level information in a single workspace. The product supports customization through drag-and-drop components, resizable widgets, and scheduling options for data refresh. Users can also modify the interface using custom color palettes and toggle between light and dark display modes.

The dashboard interface integrates data from across the Addepar platform, allowing users to consolidate portfolio summaries, workflow notifications, and account-level data in one place. This replaces the need to manually navigate through multiple reports or screens to access the same information. Firms have used dashboards to display daily summaries of portfolio performance and to highlight task-specific alerts, which can help direct advisor attention to higher-priority items.

The tool is designed to support operational visibility while maintaining flexibility for individual users. Dashboards can be tailored by role or workflow, enabling different stakeholders to track the data most relevant to their responsibilities.

Reporting

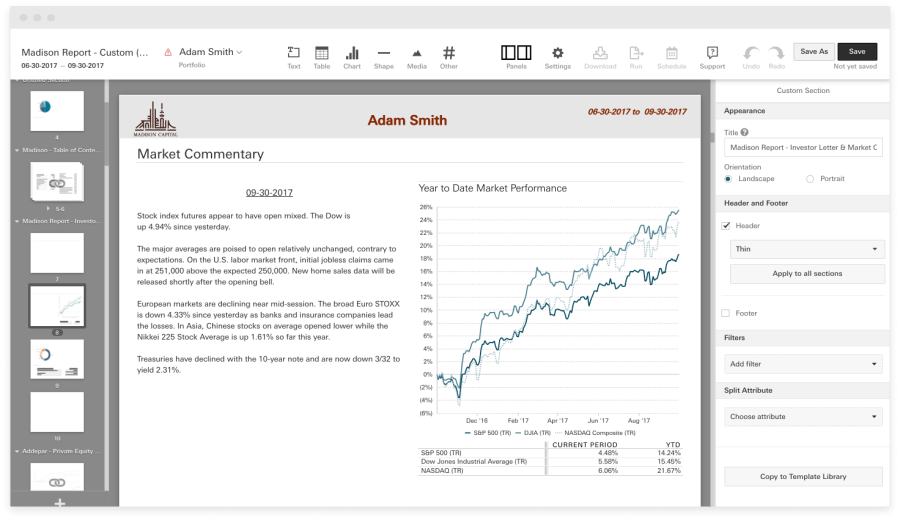

Source: Addepar

Addepar offers a flexible reporting and analytics infrastructure designed to support a wide range of use cases across wealth management. Users can generate customized, client-facing performance reports that consolidate both traditional and alternative asset classes. These reports can be built from standard templates or fully customized layouts, allowing institutions to align output with internal processes, regulatory requirements, or individual client preferences. Use cases include investment policy statements, quarterly performance reviews, and balance sheet reconciliation.

The platform supports reporting at scale, with the ability to apply a single template across up to 50K portfolios as of September 2023. As articulated by a former executive at Addepar, users can “slice it and dice it in a lot of different ways to create different custom analysis”. Reports are configurable using drag-and-drop tools and can incorporate custom attributes to reflect specific investment strategies, roles, or portfolio structures. Analytics tools are also embedded within the reporting suite, enabling users to segment portfolio data, perform investment simulations, and visualize performance over time.

Distribution is handled through Addepar’s integrated Client Portal, enabling secure delivery of branded materials without the need for manual duplication. This functionality helps standardize reporting workflows while supporting complex customization requirements at the institutional level.

Billing

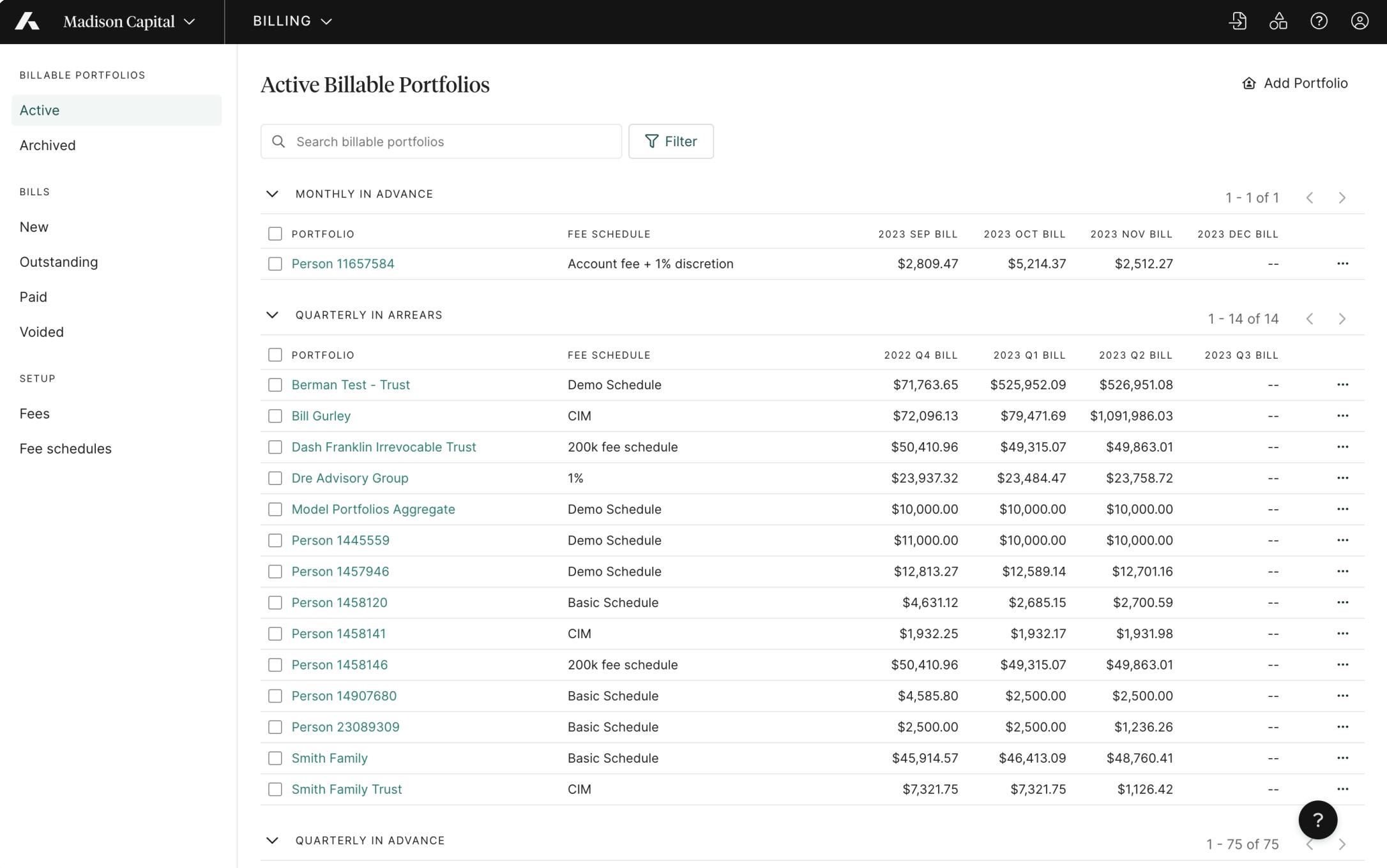

Source: Addepar

Billing clients can be a tedious, manual process for wealth managers. Custom requests from clients, scattered data, and complicated billing systems result in countless wasted hours. Addepar’s billing feature automates much of this work, allowing users to accurately bill their clients for their services by managing fee structures, conducting the actual billing, and reconciling the payments received. Addepar allows users to implement unique billing structures, such as tiered or flat-fee schedules or asset exclusions.

By centralizing billing in one place, Addepar helps create visibility, which could help identify discrepancies. Fee calculations feature capital flow, manual adjustments, and proration to help everyone understand how fees are calculated. With access to past data, users and clients can quickly obtain past invoices, even if the billing structure has changed. Addepar also stations billing functions in a standalone module.

Client Portal

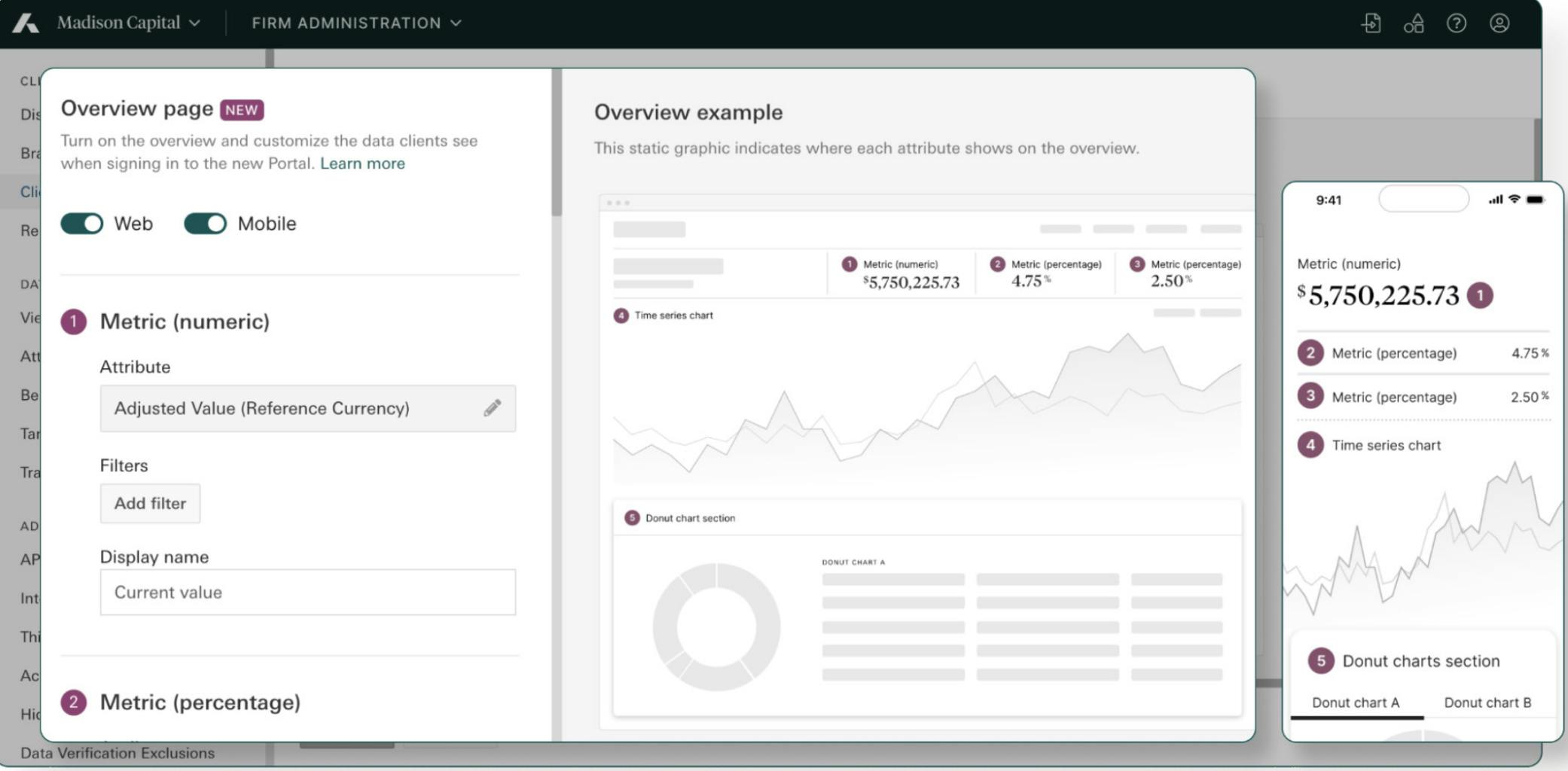

Source: Addepar

Addepar’s client portal was built to help clients securely access their financial information, which is aggregated, analyzed, and presented by their financial advisors using Addepar. Clients can select from multiple portfolios shared by their advisor, view any commissioned reports, and select date ranges to view data for specific periods.

The overview tab provides a high-level summary of portfolio performance, net worth, rate of return, historic performance, and asset allocation. The portfolio tab offers in-depth insights into portfolio performance, allocation, and other relevant details. The files tab allows clients to access, download, filter, and search files shared by their advisor or uploaded by the client. The portal also allows for significant customizability, as clients can request their advisor to customize data display and organization according to their preferences. Data is updated as frequently as provided by custodian banks and broker-dealers.

To ensure data security, Addepar employs industry-standard encryption for data transmission and storage, as well as two-factor authentication. Clients can access the Portal using any web browser, but as of September 2025, they could only use the mobile app on iOS devices.

Integrations

Addepar’s Integration Center allows users to switch between platforms and connect various workflows. In addition to Addepar’s pre-built integrations that require no coding to deploy, Addepar’s API also allows users to build their own integrations with both in-house and third-party systems, ensuring that any legacy systems are not left behind. Example integrations include Wealthbox, eMoney, and Salesforce.

Addison LLM

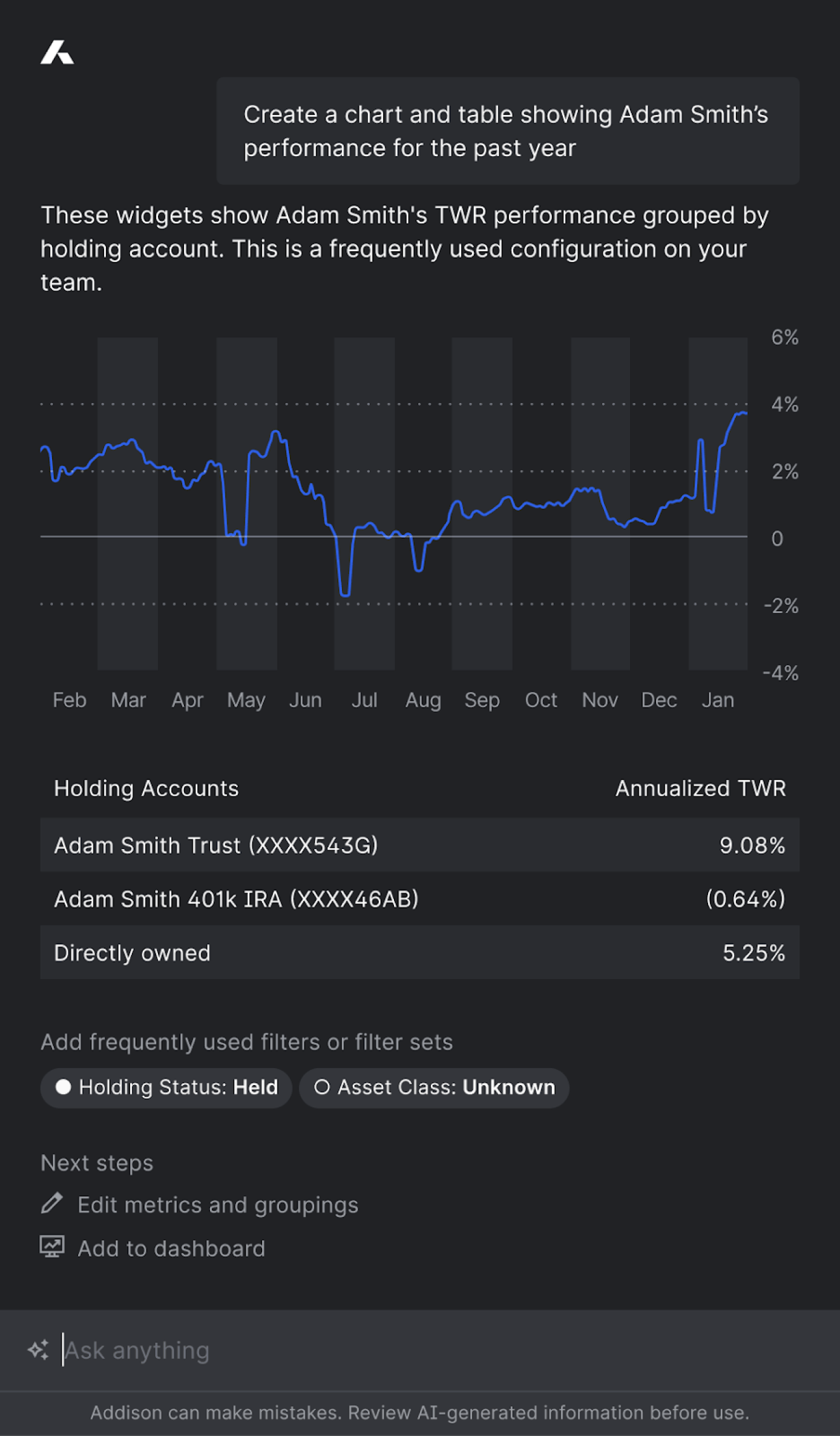

Source: Addepar

In June 2024, Addepar announced it was developing a proprietary large language model (LLM) called Addison, designed specifically for the wealth management domain. Unlike general-purpose LLMs, Addison is a closed system trained on over 15 years of internal data and client service experience.

The model is intended to support highly contextualized use cases within Addepar’s platform and internal operations, with a focus on improving workflow automation, client support, and data interaction through natural language processing. By concentrating on domain-specific tasks, Addepar aims to surpass the relevance and accuracy of general models for its particular use cases. As of September 2025, the Addison LLM product was not yet available to the public.

Market

Customer

Addepar serves wealth managers, family offices, private banks, broker-dealers, and institutions.

Wealth managers use the platform to aggregate client account data across custodians and asset classes, monitor portfolio composition, and generate consolidated reports.

Family offices use Addepar to centralize data across ownership structures and entities, produce multigenerational reports, and manage trading, rebalancing, and billing.

Private banks integrate Addepar with internal systems using its API infrastructure to support data aggregation, workflow automation, and compliance reporting.

In its early years, Addepar targeted the “early adopters in the space”, particularly marketing to RIAs that had the latitude to adopt new technologies. By working with smaller clients first, Addepar was able to incorporate feedback and hone its product. As the technology proved effective and Addepar built out its data analytics capabilities, Addepar began receiving more interest from institutional clients. Since then, Addepar has targeted larger private equity firms, family offices, private banks, and institutions. As of September 2025, Addepar’s client list included Morgan Stanley, CH Investment Partners, Alliance Bernstein, Tiedemann Wealth Management, and Crescent Grove Advisors.

Market Size

The global wealth management software market was valued at $4.9 billion in 2023 and was projected to be worth $12.1 billion by 2030, growing at a CAGR of 13.9%. Growth is expected to be driven by the continued digitization across the economy and a concurrent rise in automation.

In addition, the rising number of high-net-worth and UHNW individuals may drive the growth of the market. Despite comprising only 0.6% of US households, UHNW individuals owned 30% of financial assets in the United States as of 2022. From 2010 to 2022, UHNW individuals more than tripled their wealth, underscoring the need for advanced wealth management software to oversee increasingly complex portfolios.

Competition

Black Diamond: Similar to Addepar, Black Diamond is a cloud-based service that offers robust data aggregation, portfolio management, and reporting features for HNW clients. Originally launched in 2005, Black Diamond was acquired for $73 million in 2011 by Advent Software, where it continued to operate as a distinct business unit. In 2015, SS&C Technologies acquired Advent Software, allowing it to expand its portfolio management and reporting capabilities. As of September 2025, Black Diamond was managing more than $3.6 trillion in assets.

Orion: First launched in 1999, Orion is known for its extensive integration options and a compliance suite that scales regulatory procedures, making it especially beneficial for broker-dealers and advisors managing complex regulatory environments. Similar to Addepar, Orion offers portfolio accounting, native asset trading, and predictive analytics. Orion also has an in-house CRM system, Redtail, which allows advisors to manage client relationships directly within the platform. As of September 2023, Orion managed $3.7 trillion in assets.

Envestnet Tamarac: Founded in 2000, Tamarac was acquired by Envestnet in May 2012. Similar to Addepar, Envestnet Tamarac offers data integration capabilities, custom reporting, billing capabilities, and native trading. Envestnet Tamarac also offers an in-house CRM designed to work with Microsoft Office applications, allowing wealth managers to deliver differentiated client experiences. Envestnet Tamarac also integrates with the entire Envestnet ecosystem, enabling advisors to access a comprehensive suite of tools from a single platform. As of May 2025, Tamarac served over 2.7K RIAs and managed more than $1.9 trillion in assets.

Masttro: Founded in 2010, Masttro provides data aggregation and reporting software for single-family offices, wealth managers, and professional service firms. In March 2023, the company raised $43 million in Series A funding from FTV Capital, and its total funding remained at $43 million as of September 2025. The platform supports aggregation of both liquid and illiquid assets, including private equity, real estate, and personal collections, and offers tools for reporting, data visualization, and document storage.

Masttro served over 10K end clients as of September 2025, with more than five million transactions processed daily through direct custodial feeds. Its platform includes permissioning and data-sharing controls, as well as customizable dashboards and reports. While both platforms support complex asset tracking, Masttro’s focus remains narrower, with a primary emphasis on family office and wealth management use cases.

Addepar’s Differentiation

While there is overlap between Addepar and its competitors, some clients believe that Addepar differentiates itself in its ability to analyze complex ownership structures and alternative investment data. Additionally, some of Addepar’s users have described its competitors as akin to a “coloring book”, offering customization options but requiring users to operate within predefined boundaries. In contrast, these users believe Addepar can be thought of as a "blank piece of paper," providing a higher degree of flexibility and adaptability. As a result, clients who primarily invest in traditional public market assets may not benefit as much from using Addepar.

While some in the wealth management industry perceive Addepar as offering increased flexibility and customizability, others find it more difficult to adopt. Some customers have criticized it for requiring dedicated consultants for implementation, while competitors offer "plug-and-go" systems. Since Addepar is two to three times more expensive than its competitors, as of May 2024, these additional costs have reinforced its reputation as a "premium-priced product."

Despite Addepar’s relatively higher onboarding costs and fees, its ability to handle alternative assets helps provide differentiation for its product. The primary reason for this is that managing alternative assets requires fundamentally different metrics than managing traditional assets, including IRR calculations, multiples, capital calls, and distributions. Incorporating these metrics requires significant backend work and would likely entail growing pains.

For newer competitors who don’t have to significantly modify existing systems, the primary barrier to entry is scale. Addepar has spent over a decade aggregating data feeds and building relationships in the wealth management community, which may provide a data moat and a scale moat that may protect it from competition from new entrants.

Business Model

Although Addepar does not publicly disclose its pricing structure, industry expert interviews have indicated that Addepar can be more than two to three times more expensive than its competitors, a price point management argues is justified by its enhanced functionality. While there may be variation between family offices, RIAs, and institutional banks, clients are typically charged between 1.2 and 1.5 basis points (bps), with each basis point corresponding to 0.01% of assets under management (AUM).

Addepar charges a fixed bps up to a specific asset threshold, transitioning to a tiered pricing model for assets beyond that threshold. For instance, in the hypothetical case of a Registered Investment Advisor (RIA) managing $1.3 billion in assets, under Addepar’s fee structure, the first $1 billion could be charged at 1.2 bps. The subsequent $200 million might be billed at 1.3 bps, and any amount over $1.2 billion, such as the final $100 million, at 1.4 bps.

Addepar also allows clients to “pre-buy” additional capacity at a lower rate. Building on the previous example, the RIA with $1.3 billion in AUM could choose to secure services for up to $1.5 billion at the initial rate of 1.2 bps. However, should their assets exceed $1.5 billion, the fee would revert to its standard rate. Some clients have complained about this arrangement, as it requires them to constantly determine their growth rate to figure out the optimal payment structure.

Traction

Growth

In 2016, Addepar reported 97% year-over-year growth with more than $500 billion in assets on its platform, serving over 200 clients that included wealth managers, family offices, and financial institutions. By December 2018, platform assets had increased to $1.3 trillion, a 30% increase from April 2018.

By April 2021, Addepar supported nearly 600 clients managing over $2.5 trillion in assets, with approximately $15 billion in new assets added to the platform each week. During this period, the company reported adding nearly 150 new client firms. As of July 2021, about 10% of Addepar’s clients and revenue were from outside the United States, with clients located in over 25 countries.

Between December 2022 and December 2023, assets on the platform increased from $4 trillion to over $5 trillion. By December 2023, Addepar reported serving more than 1K client firms and processing 7 million custody accounts daily across more than 40 countries. Over the same timeframe, the company’s headcount grew by more than 200 employees, reaching over 850. Although Addepar does not disclose revenue or profit figures, sources close to the company reported in May 2024 that Addepar scaled ARR by more than 10x in recent years.

By September 2024, Addepar reported $6 trillion in platform assets managed by over 1K client firms in 45 countries. In February 2025, assets on the platform rose to $7 trillion, with more than 1.2K client firms, 40% of which involved alternative investments. As of May 2025, the company reported adding over $25 billion in new assets weekly and operating in more than 50 countries.

Product Expansion

In January 2021, Addepar acquired Real Capital Innovations (RCI) to enhance its ability to model and analyze complex portfolios, particularly those involving illiquid assets and multi-entity ownership structures. This addition enabled forward-looking investment simulations using customizable capital market assumptions.

In October 2021, Addepar acquired AdvisorPeak to integrate rebalancing, trading, and order management capabilities directly into its platform. The acquisition aimed to improve advisor workflows by supporting dynamic asset allocation and trade execution aligned with client portfolio objectives.

In September 2024, Addepar launched two internally developed products: Addepar Trading, a native trading and rebalancing solution built on insights from AdvisorPeak, and Dashboards, a customizable interface for viewing portfolio data and operational metrics.

In February 2025, Addepar expanded Navigator with the addition of ”Alts Data Management”, which automates the collection, extraction, and verification of private fund data. At the same time, the company introduced private fund benchmarks, based on anonymized platform data from over 12K funds, and added cash flow forecasting features to Navigator using historical capital call and distribution patterns across private equity, venture capital, and private debt.

In May 2025, Addepar acquired Arcus, an AI workflow automation startup, to support further integration of AI and machine learning into its platform. The acquisition focused on enhancing data processing capabilities, including anomaly detection, reconciliation, and predictive analytics.

Notable Partnerships

In January 2022, RBC Wealth Management signed a firmwide agreement to offer Addepar’s platform to over 2.1K financial advisors, including those within its clearing division. As of January 2022, this was Addepar’s largest enterprise deployment and expanded its reach within the North American advisor market. Later that year, in October 2022, HSBC US Private Banking selected Addepar as its consolidated performance reporting platform to support its $65 billion client base. In November 2022, UBS partnered with Addepar and Mirador to provide ultra-high-net-worth clients with a comprehensive, real-time view of their portfolios, including both liquid and illiquid assets.

In 2023, Addepar expanded its presence in the UK wealth market. In January of that year, multi-family office Artorius adopted Addepar for data aggregation and performance reporting for its multi-family office businesses in the UK. In September, London & Capital also partnered with Addepar to integrate the platform into its global reporting infrastructure.

In May 2024, US-based Corient Private Wealth selected Addepar as its central platform for client portfolio data and reporting. By September 2024, Addepar had formed an exclusive agreement with Itaú Private to deliver reporting and data aggregation tools to clients in Brazil. That same month, Ultra Financial Partners, a US RIA, adopted the platform to improve visibility into client portfolios with both traditional and alternative assets. In June 2025, HSBC extended its partnership with Addepar to its UK Private Banking division, following its earlier US rollout.

Valuation

In May 2025, Addepar raised $230 million in a Series G funding round co-led by Vitruvian Partners and WestCap, bringing the company’s post-money valuation to about $3.3 billion. The company stated that proceeds from the round would support global expansion and product innovation and provide liquidity to employees and early shareholders.

This followed a $166.3 million Series F round in June 2021, which valued the company at $2.2 billion and was led by D1 Capital Partners. As of September 2025, Addepar had raised a total of $761.4 million across eight funding rounds, with participation from investors including Vitruvian Partners, 8VC, Valor Equity Partners, and WestCap.

Key Opportunities

Geographic Expansions

Addepar has an opportunity to continue expanding internationally by addressing region-specific requirements in markets such as the EU, the Middle East, and Asia-Pacific. These regions represent a growing share of global wealth. As of July 2024, the Asia-Pacific region experienced the fastest increase in wealth since 2008, nearly 177%.

To serve these markets, Addepar can build on its trading and data capabilities by incorporating localized tax logic, regulatory reporting, and currency management features, including real-time FX conversion and hedging. High concentrations of family offices in Asia and the Middle East present a potential client base that may benefit from culturally specific features, such as Shariah-compliant investment filters, multilingual reporting, and mobile-first portfolio summaries. Offering support for data localization, flexible entity structuring, and inflation-adjusted analytics would further align Addepar’s product with international compliance standards and user expectations.

Investment in Community and Thought Leadership

Addepar is actively deepening its competitive moat by expanding beyond portfolio management software into a broader ecosystem of value-added services tailored to wealth managers. The company has introduced in-house investment research to support data-driven decision-making and distinguish itself as a strategic partner rather than a pure software vendor. Additionally, Addepar is cultivating a high-engagement client community through exclusive events, including an annual summit for Registered Investment Advisors (RIAs) and Multi-Family Offices (MFOs), as well as in-person learning and networking forums. These initiatives may foster client stickiness, enable peer-to-peer collaboration among Single Family Offices (SFOs) and MFOs, and cement Addepar’s role not just as a tool, but also as a thought partner.

Increased AI Utilization

Addepar is expanding its use of artificial intelligence across several core functions, aligning with a broader industry trend toward verticalized AI in financial services. The company plans to launch an internal AI assistant, Addison, aimed at improving platform usability through natural language interaction and real-time access to portfolio data. Developing in-house models may allow Addepar to reduce dependence on external providers and better tailor functionality to investment management workflows.

As of March 2025, Addepar’s applications of AI were focused on automating operational tasks and improving data processing. The launch of Addepar Alts Data Management introduced AI-enabled tools to standardize and analyze complex alternative asset data. Addepar’s integration with Databricks supports this work, offering access to AI infrastructure while maintaining internal control over data governance and security.

In May 2025, Addepar acquired Arcus, a startup focused on AI-driven workflow automation. The acquisition was intended to support intelligent data management, anomaly detection, predictive insights, and reconciliation processes across the platform. These initiatives suggest a long-term effort to embed AI at the infrastructure level, with the goal of reducing manual effort and increasing the accuracy and responsiveness of core workflows.

Regulatory Compliance Tools

Addepar could enhance its value proposition by developing a regulatory compliance service tailored to the financial industry. By leveraging its existing data aggregation and analysis capabilities, Addepar could offer a Compliance as a Service (CaaS) platform, ensuring that its clients not only remain compliant with complex regulations but also manage to do so with enhanced efficiency and reduced operational costs. Additional use cases could include real-time monitoring of transactions for regulatory breaches, automated reporting systems that compile and submit required documents to regulatory bodies, and risk assessment tools that evaluate compliance risks associated with different investment strategies.

Increased Investment in Alternative Assets

The continued growth of alternative investments presents an ongoing opportunity for Addepar to expand its support for clients managing complex portfolios. As of 2024, approximately half of family office portfolios were expected to invest in alternatives, up from 40% in 2022, while allocations to other asset classes, such as cash, have declined. Alternatives, including private equity, venture capital, real estate, commodities, and farmland, have typically been held by institutional and high-net-worth investors due to their complexity, high minimums, and limited liquidity. These assets often involve unstructured data, inconsistent reporting formats, and higher operational costs, creating challenges for firms with limited staff or fragmented systems.

Addepar’s Alts Data Management product addresses these issues by centralizing alternative investment data and standardizing it for analysis and reporting. As allocations to alternatives increase, demand for tools that can streamline data processing and improve visibility across portfolios is likely to grow.

Key Risks

Downmarket Growth

Given that there are only so many large-cap RIAs, family offices, and wealth managers, Addepar may need to eventually expand the type of customers it serves. However, some signs point to potential difficulty in downmarket growth. Because smaller-cap RIAs and family offices have less exposure to alternative assets, they may be more comfortable using Addepar’s competitors, who are less expensive and easier to onboard.

Moreover, despite positioning itself as a software company, the wealth management software industry is heavily dependent on manual processes to handle data reconciliation, which could pose a challenge for Addepar in scaling operations.

Lack of an In-House CRM System

While Addepar continues to be a strong player in the wealth management software industry, companies like InvestCloud have gained market share due to their focus on design and customer interaction tools. Addepar has moved to close this gap by improving integration across existing tools, introducing more end-to-end solutions, and developing client-facing tools.

Despite these improvements, Addepar’s lack of an in-house CRM system may give potential customers pause. Although Addepar integrates with third-party CRMs like Wealthbox, relying on third-party CRM solutions can introduce complexities when updates or changes are made to either platform. Using third-party integrations can also increase data security risks and limit control over the user experience. Potential and existing clients may perceive the lack of an in-house CRM as a drawback, particularly since competitors such as Orion and Envestnet Tamarac possess one.

Complex Pricing Structure

Addepar’s pricing system has been criticized for being overly complex and increasingly expensive, particularly for firms that are rapidly scaling their AUM. Some users have expressed frustration over a pricing model in which fees increase with AUM but do not decrease proportionally when AUM drops. Furthermore, the complexity of Addepar’s software often requires users to hire external consultants to help manage the platform, serving as an indirect cost to using Addepar. Some clients have said that despite the complexity and the price, they continue to use Addepar due to its unique features and the high switching costs associated with migrating years’ worth of data. However, if a competitor were to emerge with a similar service at a lower price point or with better customer support, potential and existing clients may feel compelled to switch.

Summary

Addepar is an investment management platform serving wealth managers, family offices, private banks, and institutions who are seeking data aggregation, analysis, visualization, reporting, and trading tools. It enables a unified and detailed view of client portfolios, empowering financial advisors and investors to manage and customize investment strategies. Though Addepar is more expensive than competitors, it offers tools to analyze and manage alternative assets, provides extensive customer support, and is investing in AI and automation to simplify customer workflows. Addepar’s core opportunities lie in international expansion, continuing to build its community and thought leadership, and investments in AI. To continue expanding, Addepar may consider expanding its product scope and simplifying its pricing structure.