Thesis

Labor markets across advanced economies are facing structural challenges. Many industries are experiencing persistent shortages of workers willing to perform physically demanding, repetitive, or low-prestige jobs. For example, the US manufacturing sector is projected to face a deficit of 3.8 million workers through 2034. Repetitive, physically demanding tasks, stagnant wages, and low job prestige have made these roles increasingly unattractive, especially to younger generations who prioritize flexibility, purpose, and autonomy.

In parallel, global aging trends are driving increased demand for home care services, further exacerbating labor scarcity. Globally, over 700 million adults aged 65 and older require some form of assistance, a figure that is expected to rise as populations continue to age. In the US alone, the over-65 demographic is projected to grow to 82 million (47% increase) by 2050. This age group’s share of the total population is also anticipated to rise from 17% to 23% by 2050.

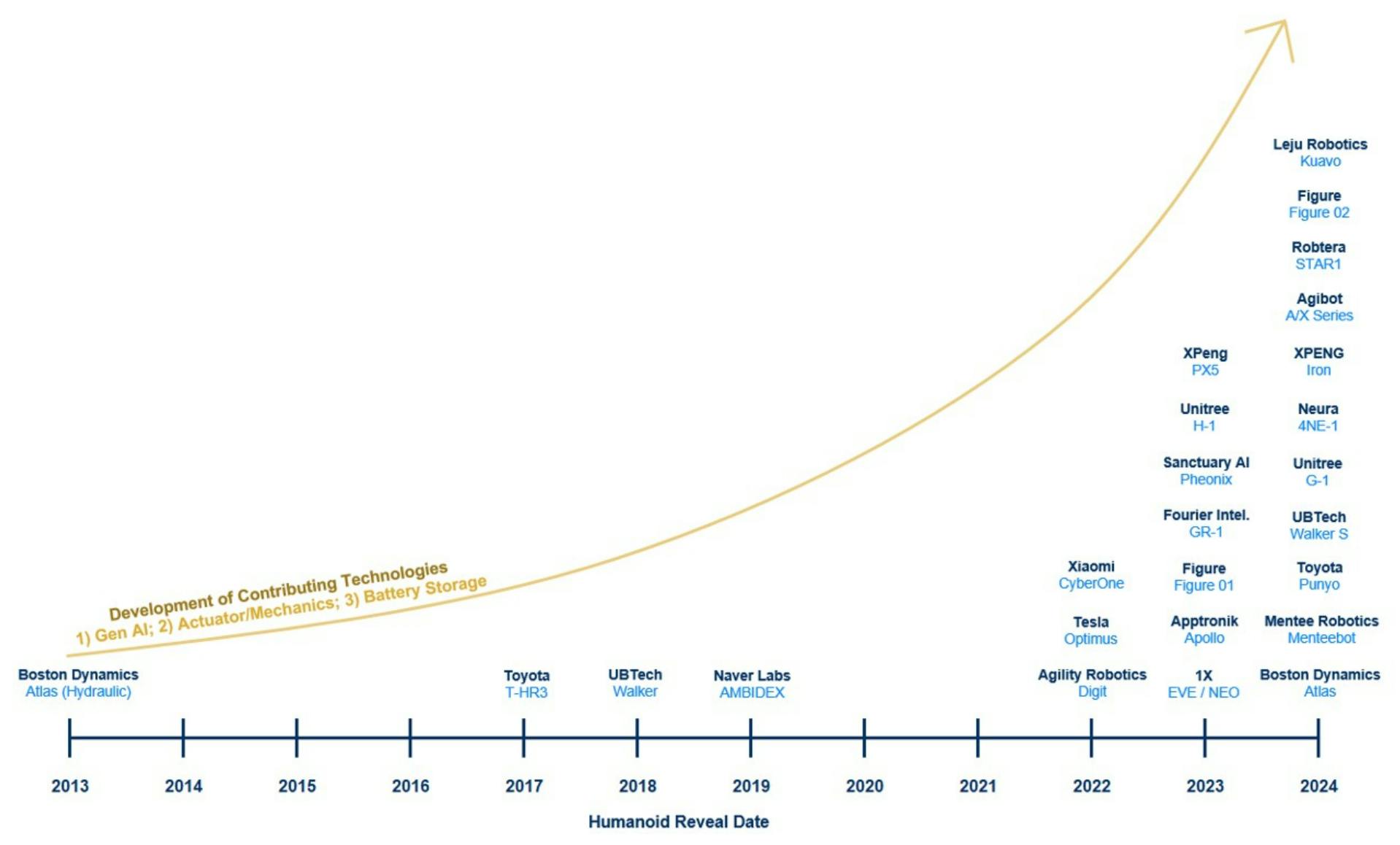

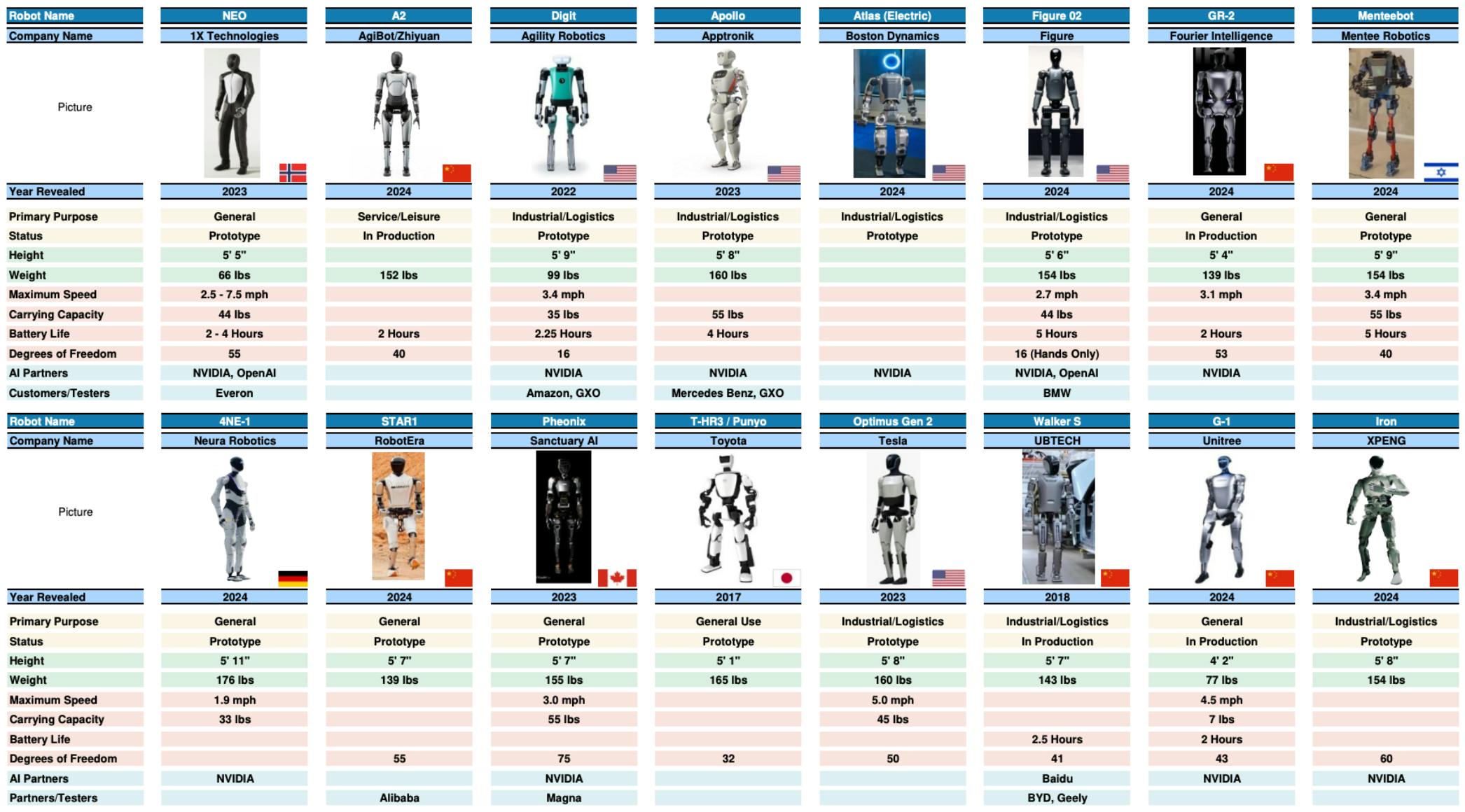

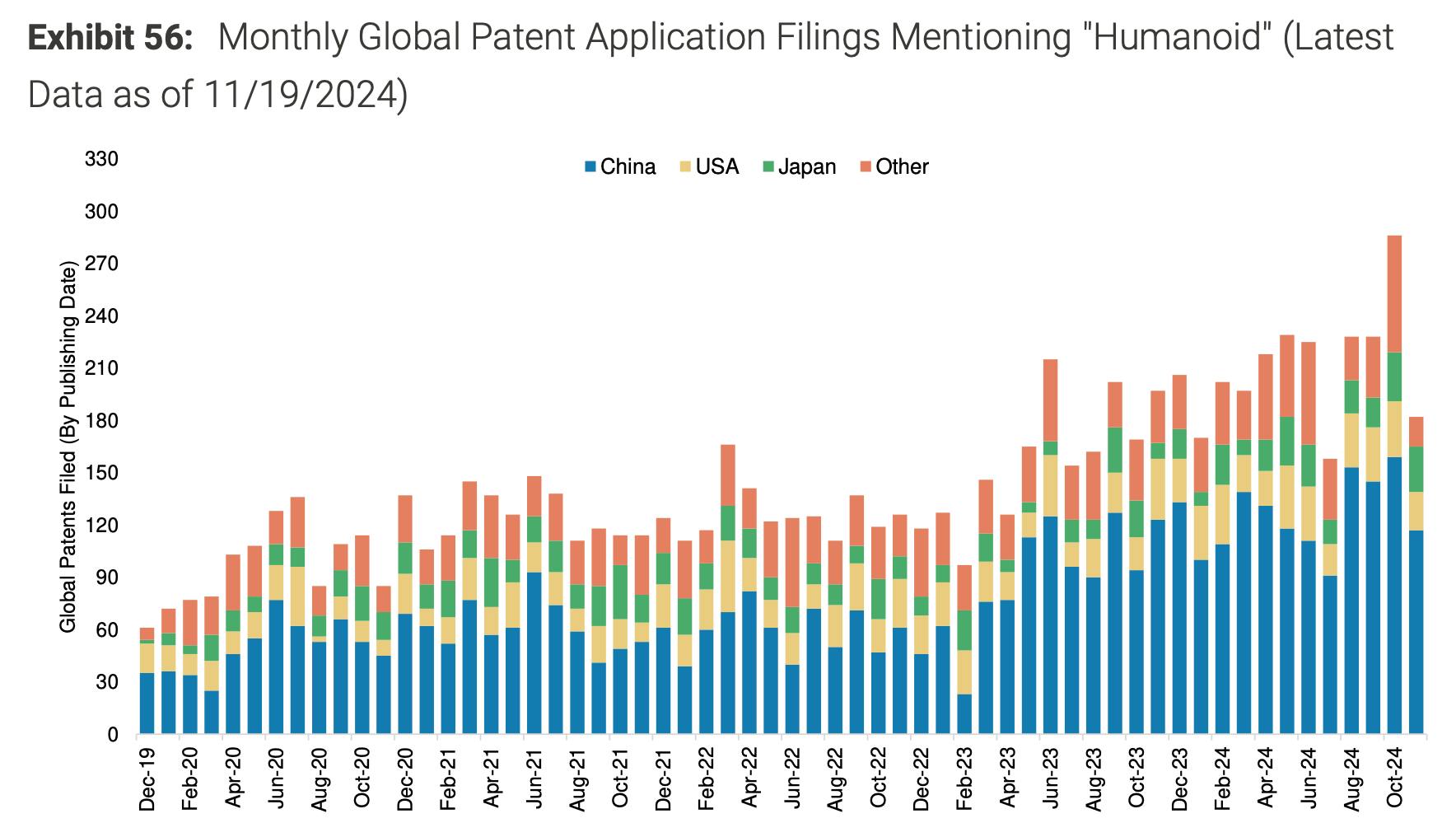

The 2020s brought advances in AI, robotics hardware, and energy systems, accelerating progress toward machines capable of performing a broad range of physical tasks. One such machine is the humanoid robot, designed to replicate key aspects of human form and function, typically including bipedal locomotion, articulated arms and hands, and the ability to operate in environments built for humans. Momentum in the field is accelerating, with monthly global patent filings mentioning “humanoid” have more than quadrupled from 2019 to 2024. By 2025, dozens of startups and established companies from all around the world have previewed their humanoid prototypes to the public, most of which were purpose-built for industrial deployments.

Source: Morgan Stanley

In April 2025, one humanoid went onstage for a TED talk, delivering the following message:

“As a species, humans have mastered energy to the level where it is, for all practical purposes, completely abundant. 200 years ago, no one could have imagined a world where energy was so accessible that most people would take it for granted. If you had asked the smartest person on Earth whether we could one day summon light with the flip of a switch, they would have said it was impossible. Even if the brightest minds worked on it together for an eternity. But today, it's just that easy. Energy is everywhere. All around us, all of the time. Now what if I told you that the same is about to happen with labor? We are standing at the gates of a future where the work needed to build the products we use, the services we rely on and even the chores in our homes will be as effortlessly accessible as energy is today, enabling you to explore new frontiers and focus on what makes you truly human.”

However, realizing this vision will require more than sophisticated hardware. Achieving general-purpose humanoid utility requires moving beyond the narrow environments of today’s industrial deployments. Developing true embodied intelligence means exposing robots to the diversity, unpredictability, and complexity of real-world settings, particularly the home. Just as internet-scale diversity was key to the emergence of large language models, household environments offer the richest training ground for physical reasoning and adaptability.

The humanoid featured in the April 2025 TED Talk was Neo, developed by 1X Technologies. Unlike many competitors focused on industrial settings, 1X is pursuing a consumer-first strategy, with the belief that homes offer the best environment for training general-purpose embodied AI. By deploying Neo into real-world domestic spaces, the company aims to build a data flywheel that will enable its robots to learn continuously from unstructured, dynamic interactions.

Founding Story

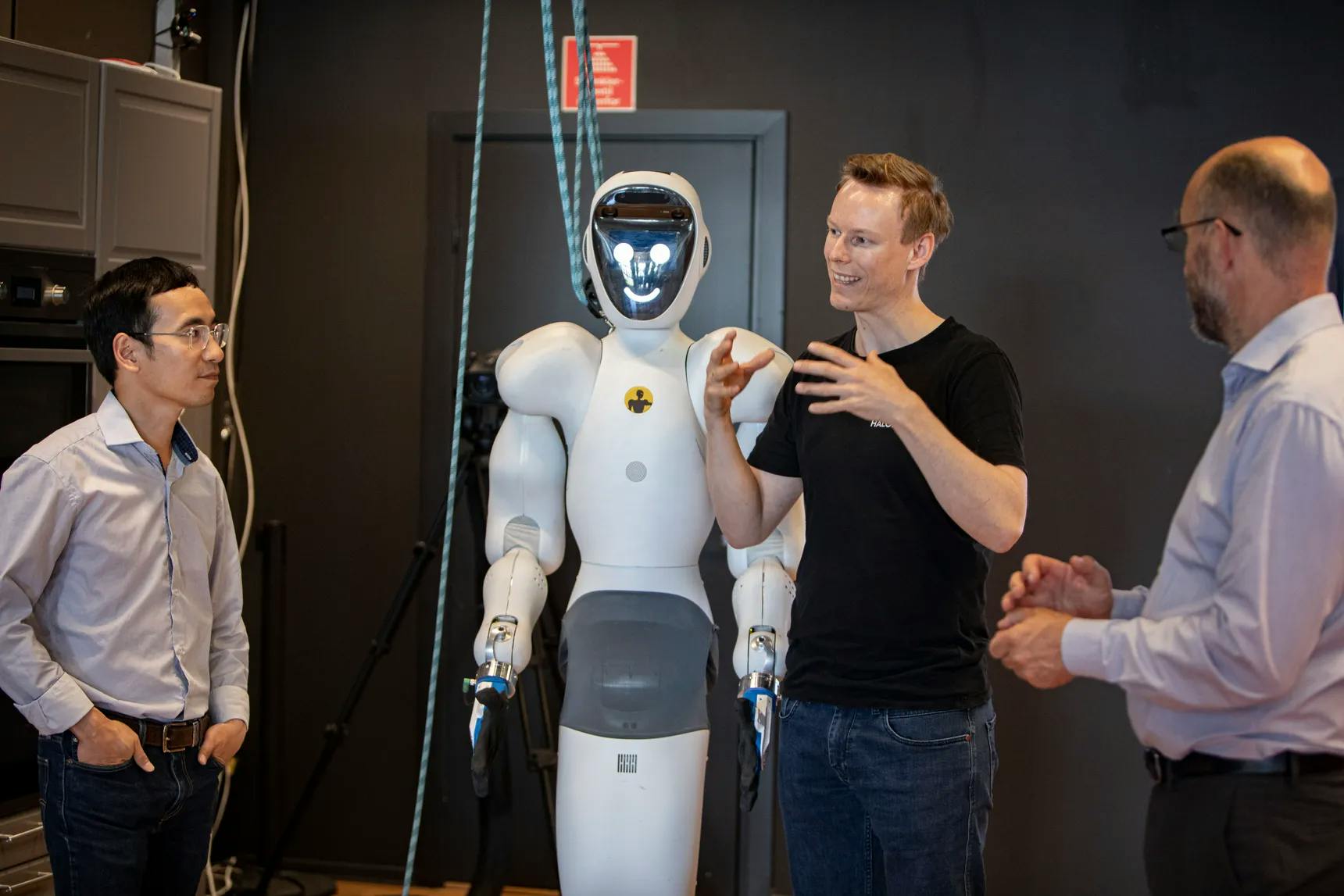

1X (formerly Halodi Robotics) was founded in May 2014 by Bernt Børnich (CEO), Phuong Nguyen (former CTO), Jørgen Sundell (Machinist) and Pål Løken (Board Member) in Moss, Norway.

In his childhood, Børnich learned to program on the Intel i486 computer and was an active video game modifier. By the time he was 11, he decided he wanted to make humanoid robots, and has pursued the robotics field ever since. After graduating from Oslo University with a bachelor’s degree in Robotics and Nano-electronics, Børnich worked as an engineer at Data Respons, an embedded systems developer for the industrial sector.

Nguyen attained a Ph.D. in Robotics at the University of Ulsan, moved to Norway for his Postdoc in March 2011, and worked in the intensive care unit at the Oslo University Hospital. Sometime in 2014, Børnich, Nguyen and Sundell were approached by Løken, who wanted to invest into a robotics company, and hence, Halodi Robotics was founded.

In its first few years, Halodi focused on developing core hardware innovations, including proprietary motors and drive systems that would enable safe interaction with the physical world. The team rejected the conventional approach of using high-ratio harmonic gears, which introduced friction, reflected inertia, and limited controllability. Instead, they built Revo1, a cable-driven differential transmission paired with low-friction motors.

Source: Robohub

In July 2017, Halodi publicly previewed its first prototype, Eve, demonstrating basic tasks such as sorting products in a warehouse and performing simple kitchen operations. In January 2019, Eve was shown autonomously navigating a warehouse on two wheels and sorting packages.

By 2021, Halodi had expanded its operations beyond Norway, opening offices in Montreal, Canada and Oakland, California. The company had accumulated $3 million worth of orders in its pipeline, with early traction coming from the security industry. It exhibited at major security expos such as ISC West and GSX Atlanta. In April 2021, ADT Security Services, the largest provider of electronic surveillance and alarm systems in the US, invested in Halodi.

In March 2022, Halodi signed an agreement to deliver 140 Eve robots to ADT. According to the company, the third version of Eve cost approximately 1 million Norwegian kroner ($100K) to produce, with ADT leasing each unit for about 500K kroner per year, representing a contract value of roughly 70 million kroner annually. Other paid pilots included Italian packaging firm Altopack, Norwegian retail technology supplier Strongpoint, Sunnaas Hospital in Norway, and Belgian elderly care organization I-Mens.

Source: Digi.No

A key inflection point came in 2022, when Halodi began merging its humanoid hardware with modern AI approaches, hiring former Google Brain researcher Eric Jang and integrating NVIDIA Jetson AGX Xavier into its robots. The company also joined NVIDIA’s Inception program for robotics startups. In February 2023, Phuong Nguyen left the company and founded Physical Robotics in August of the same year.

In March 2023, Halodi rebranded as 1X Technologies and closed a $23.5 million Series A round led by the OpenAI Startup Fund. Alongside this transition, the company shifted its focus from commercial pilots to its long-term ambition of delivering humanoid robots for everyday consumer use in the home.

Product

1X is building a vertically integrated platform for general-purpose humanoid robots. The company’s product architecture combines three core pillars: (1) robotic hardware designed to operate in unstructured environments; (2) an embodied AI stack trained on physical interaction data; and (3) an in-house manufacturing capability. Together, these elements support 1X’s ambition to bring humanoid robots into the home, where the system can perform a wide range of physical tasks, generate novel training data, and ultimately advance toward human-level dexterity and autonomy.

Humanoids

From the company’s inception through 2023, 1X focused its development efforts on Eve, a wheeled humanoid designed to validate core hardware and AI approaches. The company then shifted to Neo, its first full bipedal humanoid. As of June 2025, 1X has unveiled two iterations of Neo – Beta and Gamma.

Eve

Source: Robots Guide

Eve was designed as a lightweight humanoid robot capable of safely operating in structured environments. The platform features 25 degrees of freedom, including dexterous arms, legs, and a two wheel base for mobility. Eve uses 1X’s proprietary Revo1 motor with tendon-driven joints to enable motion. The robot is equipped with high-resolution panoramic cameras for perception, runs a hybrid control stack (Intel i7 for real-time control, Nvidia Xavier for AI inference), and operates autonomously for up to four hours on a single battery charge. Eve can navigate indoor environments, manipulate doors, and perform basic logistics tasks.

Development of Eve began with the company’s founding in 2014, with the first prototype publicly demonstrated in July 2017 performing simple warehouse and kitchen tasks. In 2019, 1X released a new version of Eve capable of autonomous navigation and package handling in warehouse settings. The robot was trained through imitation learning, using video and tele-operated demonstrations to build a base model that could be adjusted for specific industrial environments. Eve’s architecture allowed operators to control the robot remotely while the system learned and generalized its capabilities over time.

As of June 2025, Eve remains in active commercial deployment and is marketed by 1X as an industrial robot. It is used primarily in logistics and security applications, with deployments across various customers. The platform has served as a proving ground for 1X’s embodied AI models and hardware innovations. While the company’s R&D efforts have since shifted to the Neo platform for consumer and broader general-purpose use cases, Eve continues to operate in industrial settings and provides an ongoing source of operational data for the company’s foundation models.

Neo

Source: 1X

Neo is 1X’s second-generation humanoid robot, built for safe and scalable operation in human environments. Weighing just 66 pounds, Neo can lift up to 150 pounds, thanks to a tendon-driven actuation system that delivers human-like strength. The robot is soft and has no pinch points, making it suitable for direct interaction with people. Neo is designed to handle a range of tasks in the home, such as physical chores, basic manipulation, social interaction, while operating fully autonomously.

Neo builds on nearly a decade of research and development on the Eve platform, with lessons learned in hardware design, embodied AI, and manufacturing. In August 2024, 1X unveiled Neo Beta, its version of Neo designed to prove core capabilities, including safe locomotion, manipulation, and safe performance in home environments. Beta units were deployed internally and with early test users.

In February 2025, the company introduced Neo Gamma, a refinement of Beta that incorporates feedback from the first wave of deployments. Gamma improves manufacturability and reliability, bringing Neo closer to full consumer readiness. While Beta served as an engineering validation platform, Gamma is intended as the first version that can be produced and deployed at scale.

As of September 2024, 1X was producing large batches of Neo Gamma at its factory in Norway. The manufacturing process for Neo has been made more efficient than for Eve, enabling the company to pursue an ambitious production roadmap for thousands of units in 2025, tens of thousands in 2026, hundreds of thousands in 2027, and millions in 2028. 1X maintains a public waitlist for consumers interested in participating in the Neo program, with the goal of learning from real-world usage to further refine the platform.

AI

At the core of 1X’s product architecture is a proprietary AI stack, trained on real-world data collected from its humanoid robots operating in homes and offices. This allows the company’s AI to generalize to new environments and tasks, continuously improving through experience. The stack is built around two key components – a World Model that serves as a learned simulator for predicting future states, and Redwood AI, a vision-language model that controls Neo robots in real time.

World Model

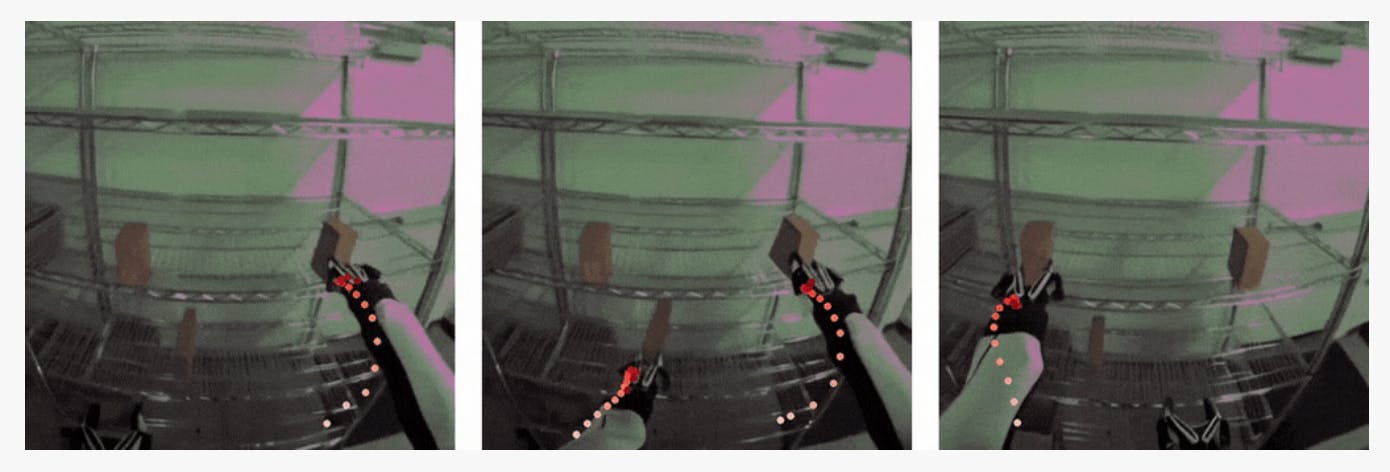

Source: 1X

1X’s World Model is a machine learning simulator that predicts how the physical world reacts in response to a robot’s actions. It is trained on thousands of hours of video and action data collected from Eve performing manipulation tasks in homes and offices. This approach allows 1X to simulate interactions across different environments without relying on traditional physics-based simulation tools.

According to 1X, conventional simulators often struggle to model deformable objects, complex household environments, and multi-contact interactions. In contrast, the World Model is trained directly on real sensor data, enabling it to predict body dynamics, object deformations such as folding laundry, articulated objects such as doors and drawers, and interactions under partial observability. The model is also action-controllable, meaning it can generate different predicted futures based on varying robot actions, all from the same starting observation.

1X uses the World Model as a tool for performance evaluation and as a foundation for building scaling laws in robotics. This enables the team to test and refine robot policies across millions of simulated scenarios and to systematically measure improvements as data, compute, and model size increase. While the current version of the World Model has known limitations, such as occasional object coherence errors and imperfect physical realism, it plays a critical role in 1X’s efforts to develop embodied intelligence that can safely and reliably operate in the real world.

Redwood AI

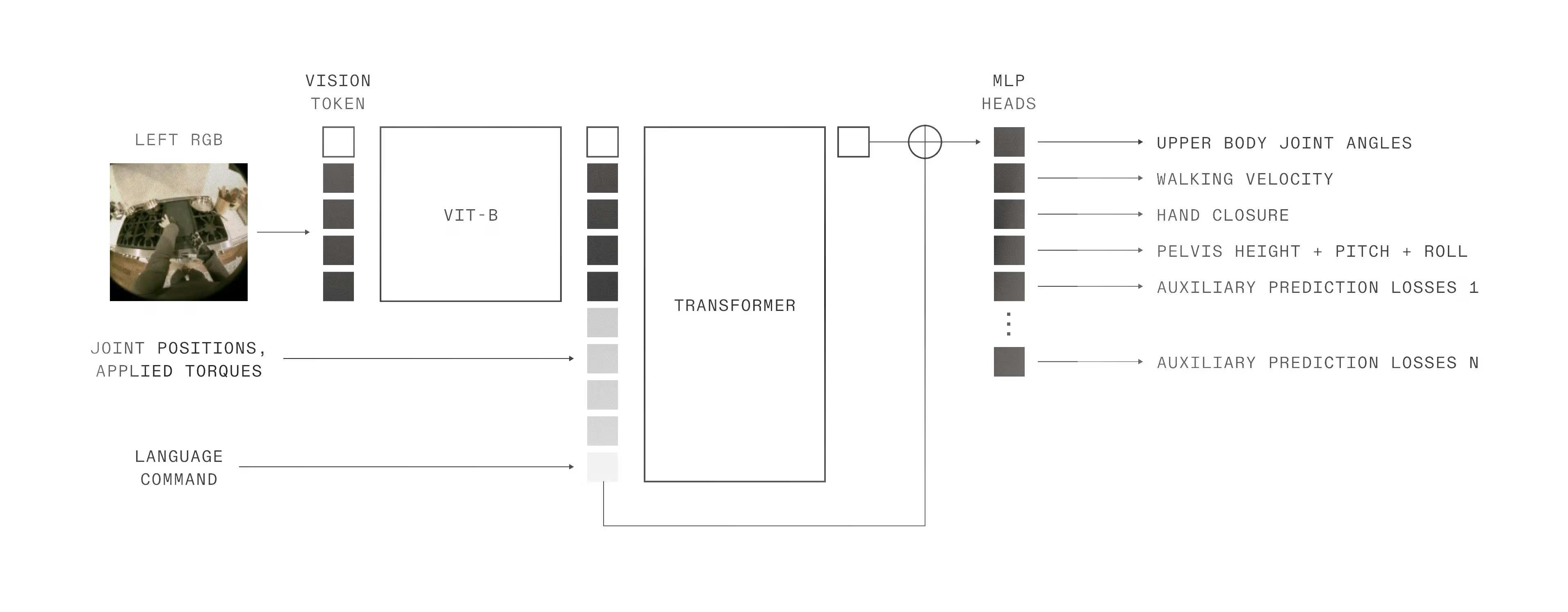

Source: 1X

Redwood AI is 1X’s core model for controlling Neo robots and was revealed in June 2025. It is a vision-language transformer designed to support Neo’s end-to-end manipulation tasks in human environments. Redwood enables Neo to retrieve objects, open doors, navigate through homes, and interact with the world in a safe and generalizable way. The model is trained on a large dataset collected from both Eve and Neo platforms, and has 160 million parameters.

Redwood’s architecture integrates language goals, vision inputs, and other data to produce physical actions. The model jointly controls locomotion and manipulation, allowing Neo to coordinate its arms, legs, and torso during complex tasks. This enables behaviors such as leaning into heavy doors, bracing against walls, and repositioning the entire body to optimize for manipulation. Redwood is also trained to perform mobile manipulation, allowing Neo to plan navigation and object interactions together rather than as separate behaviors.

The model runs fully onboard Neo’s embedded GPU, which enables offline operation in environments with poor connectivity. Redwood is trained to learn from both successful and failed demonstrations, improving robustness and generalization to new scenarios. Additional cognitive prediction targets, such as estimating the location of hands and objects in image space, further enhance its ability to generalize to unseen environments. Voice control is supported through an offboard language model, which parses user commands and provides structured inputs to Redwood.

Manufacturing Facility

Source: 1X

1X operates its own manufacturing facility in Moss, Norway, co-located with its campus and engineering team. This proximity enables rapid feedback between hardware engineering, manufacturing, and assembly, allowing the company to iterate quickly on both product design and production processes. The facility is responsible for actuator manufacturing, robot assembly, and final testing of both Eve and Neo platforms.

The manufacturing team spans a range of disciplines, including mechanical design, process engineering, automation, quality assurance, and supply chain management. This structure supports the company’s goal of scaling Neo production while maintaining high safety and quality standards. The facility employs quality control practices adapted from the automotive industry, such as Design Failure Mode and Effects Analysis (DFMEA), to proactively identify and mitigate risks during assembly.

The company views its in-house manufacturing capability as a competitive advantage, maintaining tight control over product quality and iteration speed. This approach is central to 1X’s plan to scale Neo production from thousands of units in 2025 to millions of units by the end of the decade. As CEO Bernt Børnich put it:

"At 1X, we prioritize scalable, cost-efficient manufacturing by integrating engineering expertise and rigorous quality control. Our approach leverages advanced technologies and carefully selected materials to enhance production efficiency. Committed to scalability, we ensure every process is optimized for cost-effectiveness and growth."

In July 2025, 1X announced it would consolidate its Moss, Norway and Sunnyvale teams into new headquarters in Palo Alto, California, aiming to accelerate product development.

Market

Customer

1X initially focused on industrial customers as a way to validate its hardware and embodied AI systems in controlled environments. Over time, the company has shifted its core focus to the consumer market, reflecting CEO Bernt Børnich’s belief that true general-purpose intelligence will require deploying robots in homes. Consumer environments are far more unstructured and dynamic than industrial settings, providing the diversity of experiences needed for robots to learn.

The Eve platform was piloted across logistics, healthcare, warehousing and security use cases, where it performed mobile manipulation tasks such as package handling and facility patrol. Key customers included ADT Security Services, which signed a 140-unit agreement in 2022, as well as Altopack, Strongpoint, Sunnaas Hospital, and I-Mens. As of June 2025, Eve remains in production and is marketed as an industrial robot.

With Neo, 1X is targeting the consumer market, positioning the robot as a general-purpose household assistant. The company estimates that Neo could save users an average of 2.3 hours per day on household chores such as cleaning, tidying, and object retrieval. 1X also envisions a strong community-driven product improvement loop, where early adopters will help teach robots new tasks and personalize their behavior.

Market Size

The AI hardware market is predicted to reach $128.7 billion by 2033, growing at a CAGR of 23.9% from 2024 to 2033. 1X operates within the humanoid robotics segment, which Goldman Sachs expects to reach $38 billion by 2035. Between 2024 and 2035, robot shipments could increase fourfold to 1.4 million units, driven by a significant 40% reduction in material costs, leading to a faster path to profitability.

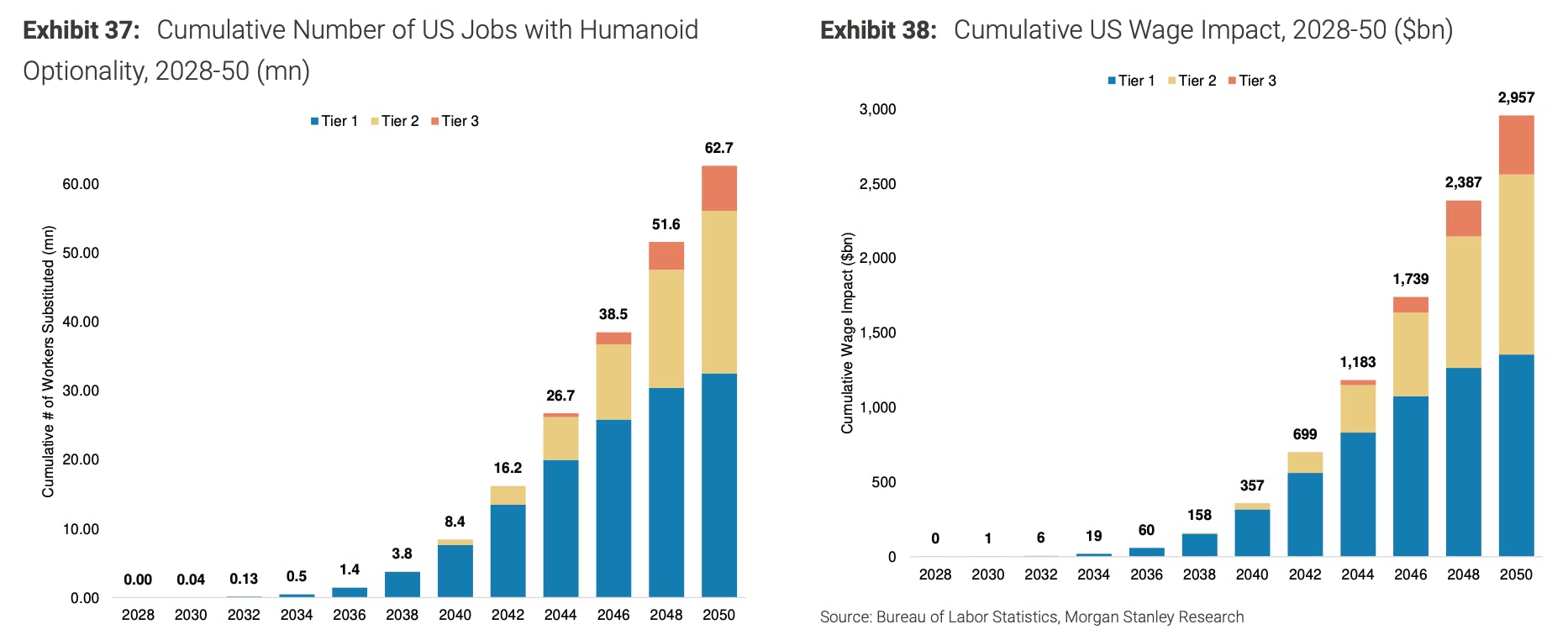

Source: Morgan Stanley

In another estimate, Morgan Stanley provided a longer-term view of the category’s potential, predicting that the US market alone could reach a cumulative installed base of 8 million humanoid robots by 2040 and 63 million by 2050. This would correspond to an annual market generating roughly $240 billion in revenue by 2040 and $1 trillion by 2050. Their analysis suggests that approximately 75% of occupations and 40% of US employees could be supported by humanoid automation, implying an addressable US market of around $3 trillion in labor value. Globally, the potential opportunity is expected to be several times larger.

Competition

1X faces competition from numerous humanoid robot startups and established companies, both domestically and globally.

Source: Morgan Stanley

Startups

Figure: Founded in 2022, Figure is a robotics company developing humanoid robots that combine AI with human-like form and functionality. Its latest model, Figure 02, is designed to perform a wide range of tasks across commercial applications in industries like manufacturing, logistics, and warehousing. The company raised a $1 billion Series C in September 2025 from notable investors like NVIDIA, Salesforce, Intel, Qualcomm, and Brookfield. As of September 2025, Figure AI has raised a total of $1.9 billion.

While both 1X and Figure AI are targeting the general-purpose humanoid market, Figure has decided to focus on commercial deployment before the consumer market. In February 2024, Figure signed a commercial agreement with BMW to deploy humanoid robots at BMW’s manufacturing facility in Spartanburg, South Carolina. In April 2025, Bloomberg reported that Figure was in talks with UPS to deploy its humanoids into UPS’ logistics network.

In June 2025, Figure faced scrutiny around the secrecy of its partnership with BMW. The company was also criticized for releasing heavily edited videos of its robots performing fine motor tasks, without yet conducting a live public demonstration. CEO Brett Adcock has defended this approach, emphasizing a focus on rapid engineering progress over event marketing, and stated that Figure aims to manufacture and deploy approximately 100K humanoid units over the next four years.

Agility Robotics: Founded in 2015 and based in Pittsburgh, Pennsylvania, Agility Robotics is developing humanoid robots to address labor shortages in the distribution, retail, manufacturing, and logistics industries. Originally a spin-off from Oregon State University, the company created Cassie, a bipedal robot lacking a torso and perception systems. Cassie set the Guinness world record for the fastest 100-meter run by a bipedal robot in December 2022. Agility’s flagship humanoid robot, Digit, features a unique “backward” leg design that enhances maneuverability in factory and manufacturing settings.

Digit is sold alongside Agility Arc, a cloud automation platform that monitors fleets of Digit robots and integrates with existing client workflows, as well as Arc Accessories, a suite of charging docks, work cells, and control pendants. In October 2023, Agility signed a collaboration agreement with Amazon to test Digit in Amazon warehouses. In June 2024, Agility signed a multi-year RaaS to begin deploying Digit in GXO’s logistics operations in what Agility claims is the robotic industry’s first commercial deployment of humanoid robots. While both Agility and Figure are focused on humanoid robots for automation and labor replacement, Agility Robotics is more specialized in industrial settings like warehouses and logistics, whereas Figure AI has a broader vision of developing general-purpose humanoid robots for both commercial and household applications. As of September 2025, Agility Robotics had raised a total of $178 million at a valuation of $550 million, with key investors including the Amazon Industrial Innovation Fund, Sony Innovation Fund, Playground Global, and DARPA.

Apptronik: Founded in 2016 and based in Austin, Texas, Apptronik is developing general-purpose humanoid robots. Apptronik was originally funded by NASA to develop space-intended humanoid robots, Valkyrie 1 and Valkyrie 2. Over time, this work transformed into Apollo, Apptronik’s most recent model. Apollo is built modularly and can be mounted on any base platform (stationary or mobile). It intends to operate in the warehouse and manufacturing industries before aiming to extend into consumer household markets, similar to Figure’s model. Apptronik signed a collaboration agreement with car manufacturer Mercedes-Benz in March 2024 to test Apollo at its manufacturing facilities and a partnership agreement with Google DeepMind in December 2024 to bring AI capabilities to Apollo. Apptronik bootstrapped until its Seed round and has raised a total of $431 million at an undisclosed valuation. Key investors include Capital Factory, Perot Jain, WorldQuant Ventures, NASA, NSF, and the US DoD.

Incumbents

Tesla: Founded in 2003 and based in Austin, Texas, Tesla is a vertically integrated electric vehicle manufacturer and autonomous software developer. Under founder Elon Musk’s direction, the company began developing Optimus, a general-purpose humanoid robot. The robot was revealed at Tesla’s AI Day in August 2021, and prototypes were displayed at Tesla’s second AI Day in September 2022. The latest robot iteration, Optimus Generation 2, was unveiled in December 2023. In May 2024, Tesla showed Optimus performing tasks in a Tesla electric vehicle manufacturing plant. Musk claims that Optimus will be controlled by the same AI system Tesla is developing for the advanced driver-assistance system used in its cars. In June 2024, Musk projected Optimus to enter limited production in 2025, where the company will have over 1K Optimus robots working at Tesla.

Musk further projects Optimus to begin sales in 2026 and predicts that Optimus could potentially bring Tesla’s market cap to $25 trillion. In March 2025, Musk estimated that Tesla would manufacture around 5K robots before the end of the year, targeting a price tag below $20K.

Boston Dynamics: Founded in 1992 and based in Boston, Massachusetts, Boston Dynamics is a robotics company developing both highly mobile, practical humanoid and non-humanoid robots in the manufacturing, construction, energy, defense, education, and logistics industries. Boston Dynamics’ humanoid robot products include the Atlas line. The first version of Atlas was produced under the direction of DARPA and constructed by Boston Dynamics.

The most recent version of Atlas was unveiled in April 2024 and is designed to improve human capabilities and is intended to address labor shortages in 3D industries. Boston Dynamics signed a collaboration agreement with car manufacturer and investor Hyundai in April 2024 to test Atlas at manufacturing facilities. Boston Dynamics was originally spun out of MIT and CMU and operated independently until it was acquired by Google in 2013. The company was thereafter acquired by SoftBank in 2017, and Hyundai acquired a controlling stake in the company from SoftBank for $880 million in 2020.

Ubtech: Founded in 2012 and based in Shenzhen, China, Ubtech Robotics is a robotics company developing both humanoid and non-humanoid robots in the commercial and healthcare industries. Ubtech’s humanoid line includes the Walker S, Walker X, Walker, and Panda Robot. The Walker S is Ubtech’s latest humanoid robot, with integrated VLMs, 3D semantic navigation, integrated LLM reasoning, and object detection to manipulation capabilities.

Ubtech is using Walker S for manufacturing use cases and plans to eventually use the robot model for consumer household use cases, which is Figure’s goal as well. Ubtech signed a collaboration agreement with car manufacturer Dongfeng Liuzhou Motor in June 2024 to test Walker S at manufacturing facilities. Ubtech‘s IPO raised $130 million in December 2023, and the company's market cap was $60 billion as of September 2025. Ubtech was formerly backed by key investors Tencent, ICBC, CITIC Securities, Minsheng Bank, and Jinyuang Group.

Business Model

The key driver of adoption for humanoid robots is cost-performance parity with human labor. Customers ultimately care less about how a robot works than about whether it delivers the desired outcome at an acceptable cost. If the robot’s lifetime cost exceeds that of human labor, especially if quality is lower, it will struggle to justify adoption. As humanoid hardware scales and component costs decline, 1X and other players aim to drive robots across this economic threshold.

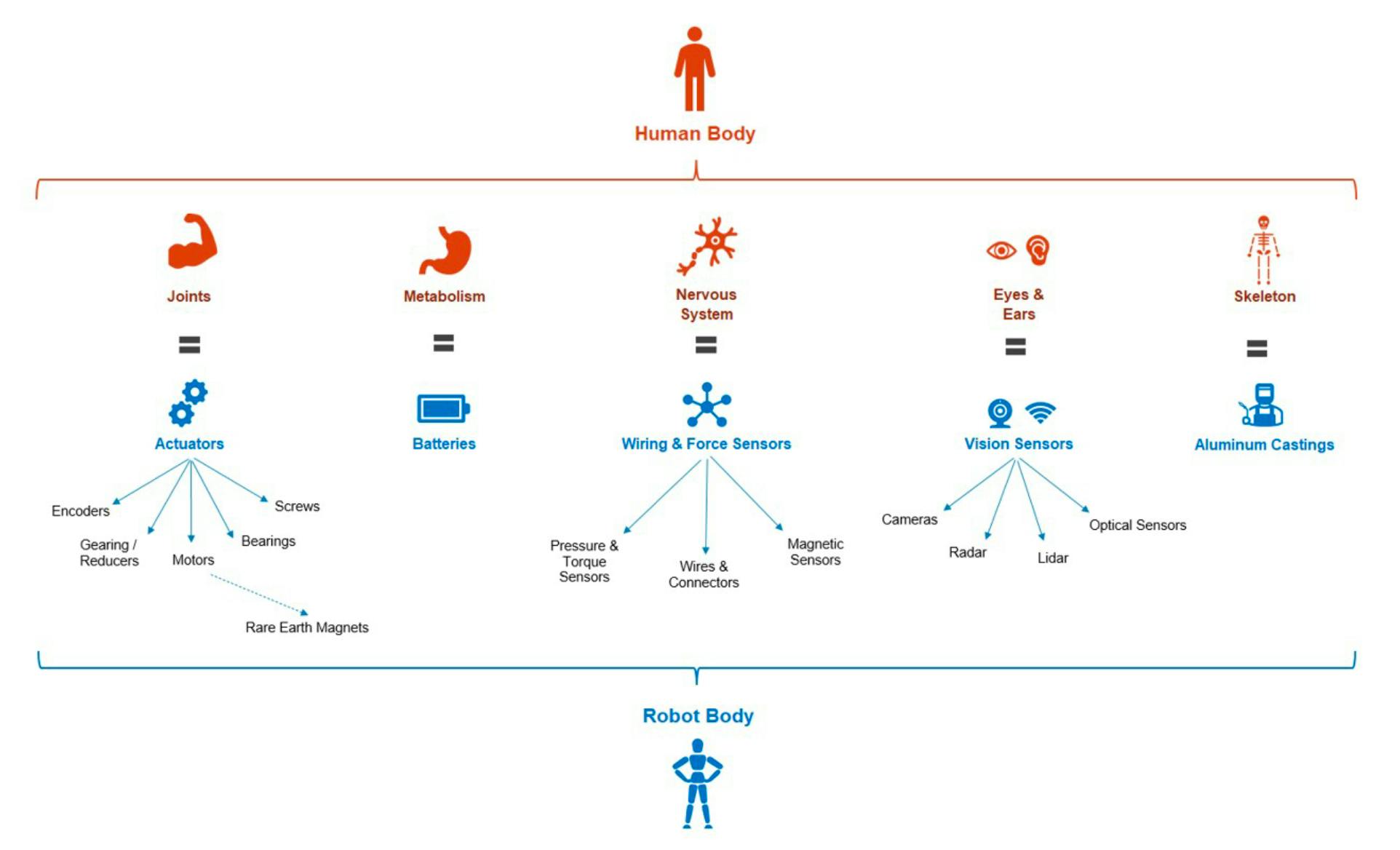

At the core, humanoid robots are designed to mimic the human body in functionality and capability. Actuators serve as joints, batteries act as metabolism, wiring and force sensors function as the nervous system, vision sensors provide the eyes and ears, and aluminum castings form the skeletal structure. The goal is to replicate the versatility and dexterity of human labor in a form factor that can operate in existing environments designed for people.

Source: Morgan Stanley

In the near term, 1X generates revenue through humanoid sales and robot-as-a-service (RaaS) contracts with industrial customers, primarily through the Eve platform. Industrial clients such as ADT Security Services lease Eve units for applications in security, logistics, and healthcare. For example, in 2022 the company reported producing its third-generation Eve at a cost of just under 1 million Norwegian kroner ($100K) per unit, leased to ADT at approximately half a million kroner per year.

With the launch of Neo, 1X is shifting toward a consumer-first model. The company maintains a public waitlist and has begun piloting Neo with early home users. CEO Bernt Børnich sees consumer homes as the ideal environment to train embodied AI models, with each deployed Neo contributing valuable data to improve system performance. In August 2024, Børnich estimated that Neo’s manufacturing cost is roughly comparable to that of a mid-range autonomous car.

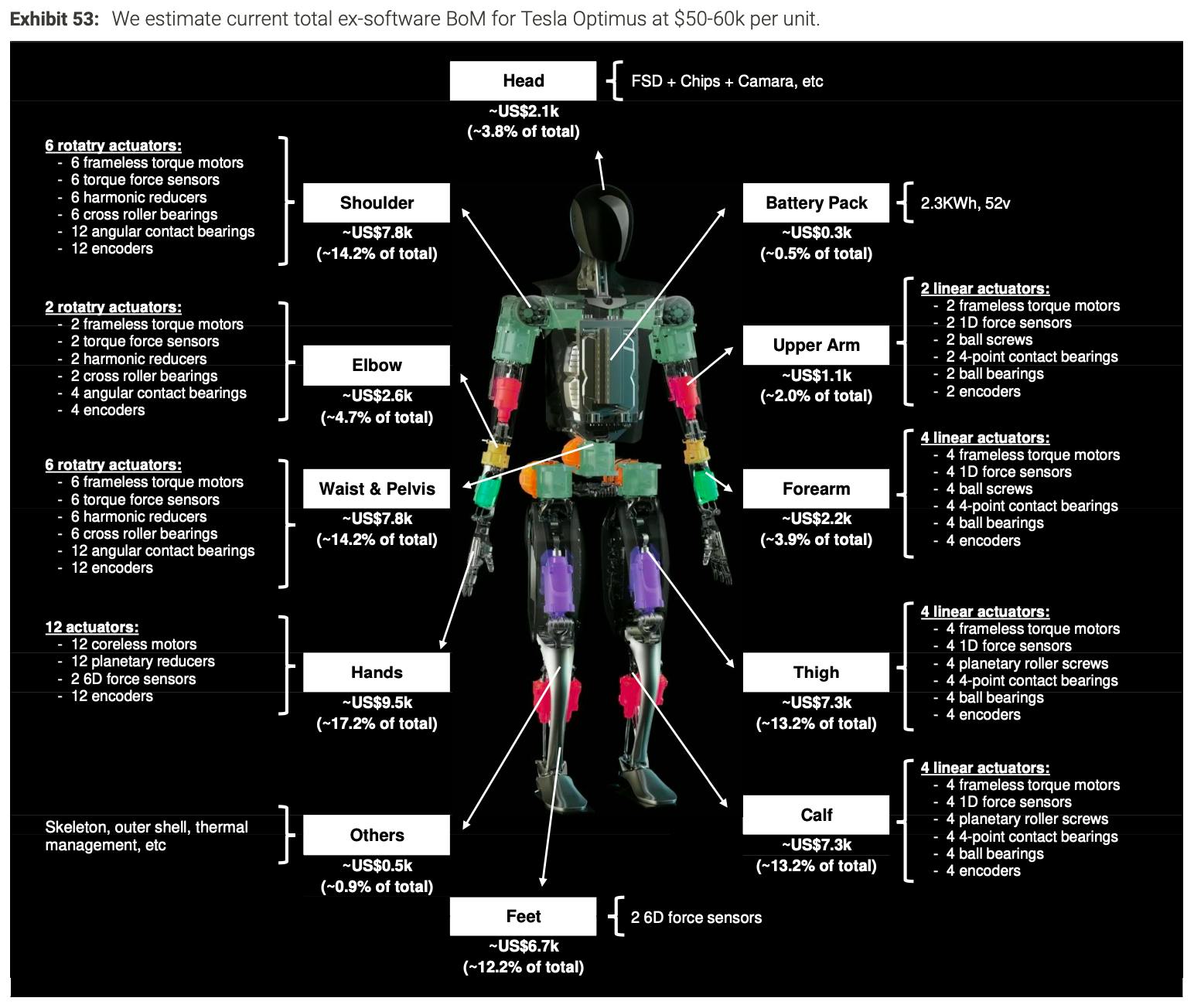

Cost competitiveness will be critical to scaling humanoid adoption. According to Morgan Stanley, current humanoid bill-of-materials (BOM) costs range from $10K to $300K, depending on configuration and application. Tesla’s Optimus Gen2 BOM is estimated at $50K to $60K per unit, with a target of $20K at scale. Levers for cost reduction include scaled manufacturing, accelerated AI-driven R&D cycles, and sourcing cost-effective components, particularly from Asia.

Source: Morgan Stanley

1X’s vertically integrated model is designed to capture similar efficiencies. The company manufactures its own actuators and core components and operates a dedicated assembly facility in Norway. Its production roadmap targets thousands of Neo units in 2025, tens of thousands in 2026, hundreds of thousands in 2027, and millions by 2028, with the goal of driving down unit costs and enabling broader consumer adoption.

1X’s long-term business model may mirror Tesla’s approach, in combining one-time hardware sales with recurring software revenue, while continuously reducing costs through vertical integration and scale. This structure positions the company to compete effectively as the humanoid market matures and performance thresholds improve.

Traction

As of September 2025, 1X has not publicly disclosed full-year revenue figures. However, the company’s commercial agreement with ADT Security Services has served as an important source of industrial revenue. In 2022, the Eve platform generated approximately 70 million Norwegian kroner (~$7 million) through robot leasing agreements with ADT.

In July 2024, the company appointed Jorge Milburn as VP of Sales, who previously led Tesla’s global growth team, playing an important role in building Tesla’s global Supercharger network and launching the Model 3 in Europe. The company also hired ex-BMW lead designer Per Selvaag as VP of Design. In parallel, Dar Sleeper, a former Tesla product manager involved in the Cybertruck launch, joined as VP of Growth to help build the 1X brand and drive customer demand. These additions complement earlier key technical hires, including former Google Brain research scientist Eric Jang, who joined the company in April 2022.

In August 2025, 1X announced Vikram Kothari as its new VP of Operations. Kothari previously led supply chain organizations at SpaceX for Dragon, Starship, Raptor, and Launch Avionics, following nearly a decade at Microsoft managing hardware supply chain. His experience scaling complex, high-performance operations is expected to support 1X’s efforts to industrialize humanoid production and prepare for broader commercial deployment.

1X has also made efforts to raise public awareness and showcase its humanoid capabilities. In November 2024, Neo Beta appeared on celebrity chef Nick DiGiovanni’s popular YouTube channel, where it assisted in cooking a full steak dinner. As of September 2025, the video has surpassed 40 million views. While the demonstration was conducted via teleoperation, it highlighted Neo’s mechanical dexterity and ability to navigate complex domestic tasks. The company views such demonstrations as a foundation for building toward fully autonomous capabilities.

In January 2025, 1X acquired Kind Humanoid, a Palo Alto-based robotics startup. Kind had previously attracted attention for enlisting renowned designer Yves Béhar to help develop its first commercial robot. The acquisition brought Kind’s design talent into the 1X team, together with founder and ex-Google robotics researcher Christoph Kohstall.

Source: 1X

In NVIDIA’s March 2025 GTC keynote, CEO Jensen Huang demonstrated Neo Gamma autonomously performing domestic tidying tasks using a post-trained policy built on NVIDIA’s GR00T N1 model. According to 1X CEO Bernt Børnich, integrating GR00T N1 has accelerated Neo’s learning and reasoning capabilities, complementing 1X’s proprietary models.

Valuation

In January 2024, 1X raised a $100 million Series B round led by EQT Ventures, at an undisclosed valuation. The round brought the company’s total funding amount to $136 million. Prior to this, 1X raised a $23.5 million Series A at a $210 million post-money valuation led by OpenAI, with participation from Tiger Global and a group of Norwegian investors.

Key Opportunities

First-Mover Advantage

While most humanoid robotics companies are initially targeting industrial and logistics settings, 1X is taking a different approach by prioritizing home use cases. The company views consumer deployment as both a large commercial opportunity and a strategically differentiated path to market. Industrial-first players face more direct competition and slower iteration cycles, as warehouses and factories offer relatively controlled environments with well-defined tasks. In contrast, homes present a vast market and a more challenging environment where embodied intelligence will need to generalize across countless novel situations.

Founder and CEO Bernt Børnich has clearly articulated this strategy: “The home and consumer has to happen first before we go into all of these other markets”. By focusing on consumer deployment, 1X aims to establish leadership in both market adoption and embodied AI performance, giving it a potential first-mover advantage that could be difficult for later entrants to match.

Data Flywheel

Deploying robots in homes also enables 1X to build a powerful data flywheel that can drive compounding improvements in its AI models. Each home robot operates in an unstructured, constantly changing environment, generating continuous embodied experience across locomotion, manipulation, object interaction, and social context. This data provides the raw material needed to improve both low-level control and high-level reasoning. Embodied learning offers unique advantages that traditional large language models cannot replicate. Whereas LLMs are trained on static internet text, 1X’s AI models learn directly from physical outcomes in the real world. Each success or failure becomes new training signal for future behavior. Over time, as more Neo units are deployed, this growing corpus of embodied experience could give 1X a sustainable competitive advantage in building general-purpose robotic intelligence.

Key Risks

Production Complexity

The company’s vertically integrated approach, with in-house manufacturing and robot assembly, is an advantage for cost control and product iteration. However, it also introduces significant execution risk and capital intensity as the company ramps up. Børnich has openly acknowledged this challenge: “Something kind of magical happens when you go from tens of thousands to hundreds of thousands of units… Many companies fail there”. Successfully navigating this scaling transition will require operational discipline across engineering, manufacturing, and supply chain.

On the AI side, significant technical hurdles remain. World modeling and spatial reasoning are still imperfect, and 1X’s own leadership has been candid about current limitations. “All our current AIs completely fail at most reasoning tasks”, Børnich noted in June 2025. While the company has made visible progress through its work with Redwood AI and world models, embodied intelligence remains an unsolved challenge. Managing consumer expectations will be critical as Neo enters homes.

Cost Curve

Consumer willingness to pay for humanoid robots remains largely unproven, and achieving sustainable unit economics is one of the most significant hurdles facing 1X and the broader category. While the company has stated that Neo’s manufacturing cost is comparable to a mid-range autonomous car, total system costs may keep prices above mass-market affordability for some time. This limits the near-term addressable market to early adopters and premium segments.

Intense Competition

Tesla, Figure, and other well-capitalized players are pursuing aggressive development timelines and unit cost targets. Tesla in particular is leveraging its automotive scale advantages and vertically integrated supply chain to pursue a bill-of-materials (BOM) cost target of approximately $20K per unit. This could allow Tesla to undercut competitors on price once Optimus reaches mass production.

At the same time, global innovation in humanoids is intensifying. Monthly global patent filings mentioning “humanoid” have more than quadrupled since 2019, with a steep rise in 2023-2024. The majority of recent activity is concentrated in China, which is emerging as a leading hub for humanoid component manufacturing and system integration. This trend highlights growing international competition, particularly from Chinese players who may bring lower-cost hardware to market quickly.

Source: Morgan Stanley

For 1X, competing against well-funded US firms and Chinese manufacturers will require sustained execution across both AI and hardware. The company’s differentiated focus on consumer use cases and embodied AI could provide defensible advantages, but the race to scalable humanoid deployment is likely to intensify significantly over the next several years.

Safety and Consumer Acceptance

Bringing humanoid robots into homes introduces a new set of challenges around safety, privacy, and consumer perception. Unlike industrial deployments, where robots operate in controlled environments, consumer robots must coexist with people, pets, and children in unstructured settings. Any high-profile technical failure, safety incident, or PR misstep could materially slow market adoption and damage consumer trust.

Safety is a fundamental requirement for 1X’s strategy. The company has invested in designing Neo to be passively safe, using lightweight, gearless actuators and soft exterior materials. Despite these efforts, achieving robust safety across a wide range of unpredictable household scenarios remains an open challenge. In parallel, 1X and other humanoid players must navigate evolving consumer expectations around privacy and trust. Robots operating in the home will need to demonstrate not only physical safety, but also responsible handling of audio, visual, and contextual data.

Summary

1X is building a vertically integrated platform for humanoid robotics, combining proprietary hardware, embodied AI, and in-house manufacturing. While many competitors are focused on industrial deployments, 1X is prioritizing home environments, which it views as the best setting to train general-purpose embodied intelligence. The company has made significant progress with its Neo platform, is scaling manufacturing, and has started initial consumer deployments. Key challenges ahead include scaling production from thousands to millions of units, improving AI reasoning and reliability, achieving sustainable unit economics, and navigating safety and consumer trust. If the strategy succeeds, 1X could build a strong position in the emerging market for consumer humanoids.