Thesis

In the first eight months of 2023, the United States experienced 23 weather and climate disasters exceeding a billion dollars in damage, the highest number in recorded history. In an effort to reduce their carbon footprint, consumers are beginning to shift to renewable sources of energy. Renewable energy generated about 20% of total US energy output in 2021 and projections show significant share growth from solar and wind power. However, 80% of US energy still comes from nonrenewable sources. Despite the growing adoption of renewable energy, the carbon footprint of the United States continues to grow due to the increasing demand for energy, with 2022 reaching an all-time high in energy-related CO2 emissions.

Until recently, public utilities did not have incentives to embrace green technology. As a result, the decision to transition to renewable energy sources such as solar panels has largely rested in the hands of the consumers. Despite almost half of Americans expressing interest in solar panels, only 6% have them. Two-thirds of Americans live in a situation unfavorable to cost-effective solar power generation. Further, installing rooftop solar panels can cost up to $20K, pricing out many consumers.

Arcadia, a community solar and energy management software solution provider, intends to address these issues. Arcadia began as a community solar platform, partnering with renewable energy suppliers and bringing incentives to consumers to switch without the high upfront costs. The company’s goal was to make the switch to renewable energy more convenient for consumers. In November 2021, Arcadia expanded and began offering an energy management software platform, Arc, for third-party utility providers and businesses. Amid the growing number of policy changes at the federal level such as the Inflation Reduction Act (IRA), Arcadia could be positioned to grow alongside the renewable energy industry as a whole.

Founding Story

Kiran Bhatraju (CEO), Ryan Nesbitt (President), and Kate Henningsen (COO) co-founded Arcadia in 2014. After graduating from the University of Pennsylvania, Bhatraju began working on Capitol Hill in 2009. In this position, he learned about the complexities of energy in the United States, a market that is fragmented across all 50 states Further, he observed that, at a high level, solar and wind energy were beginning to reduce costs and carbon emissions. However, since each state had a unique energy distribution method, the federal government was not making any significant regulatory changes to bring about a green energy future. This ultimately led to Bhatraju’s initial idea for Arcadia: he wanted to create a software platform to make clean energy decisions more convenient.

However, prior to founding Arcadia, Bhatraju first founded a company called American Efficient in 2010. American Efficient aimed to capitalize on the tailwinds of sustainability, energy source diversification, and utility unbundling, leading utilities to change business practices. The company sells energy management software to utilities. Bhatraju believed that utilities had little incentive to invest in consumer-friendly operations and would not be leading the effort for renewable energy grid integrations.

After four years at American Efficient, Bhatraju left to start Arcadia. Instead of targeting utilities to make clean energy decisions as he did at American Efficient, Bhatraju decided to leave the decision to the consumer. Arcadia’s goal was to make it easy for the average person to access green energy, saving them money and helping the environment. Bhatraju noted:

“It just felt like giving users a way to connect to clean energy was going to be a more effective use of my time [than working in Washington]. ... Starting a company felt like a way that I could drive change and make a difference faster.”

As a result, Bhatraju teamed up with Ryan Nesbitt, a former consultant at Bain & Co., to found Arcadia in 2014.

Arcadia’s third co-founder, Kate Henningsen, joined in 2015. Henningsen had four years of corporate litigation experience prior to joining. After having her first child, Henningsen became increasingly passionate about the clean energy transition movement, wanting to create a better future for her children. Further, she was interested in joining a startup in a highly regulated industry suited to her legal background, such as energy.

Henningsen spent her time reaching out to healthcare and energy startups, explaining how she believed a lawyer could advance the companies. Among these startups was Arcadia, and Bhatraju responded and asked for more information. Henningsen wrote Bhatraju a memo describing the strategic legal issues that she saw in Arcadia and how she thought she could contribute. She officially joined the team as Arcadia’s third co-founder and COO.

Co-founder Ryan Nesbitt left Arcadia in 2018 to focus on web3 and impact investing. As of September 2023, Bhatraju and Henningsen remain in their respective roles as CEO and COO. In total, Arcadia has approximately 620 employees as of September 2023. Patrick McCamley, a Partner at Skyline Partners International, joined the team as the CCO in 2020 and later replaced Nesbitt as President in 2022. John Rucker, the former CFO at Slice, joined Arcadia in 2021 as CFO.

Product

Community Solar

Source: Arcadia

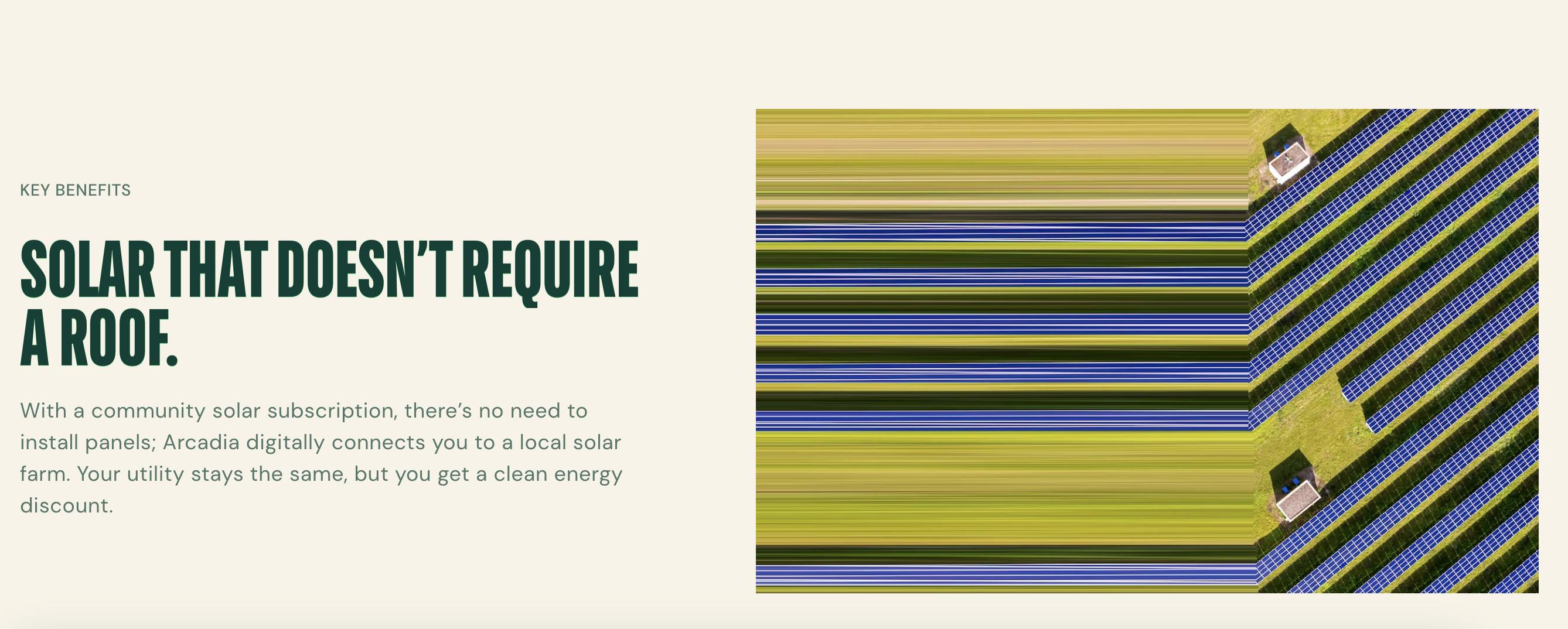

Arcadia’s first product was a platform for consumers to buy renewable energy with a focus on community solar. Since 2016, community solar has been helping consumers nationally get renewable energy by sidestepping access challenges. 50% of people do not live in a region conducive to solar or a building allowing rooftop solar. Additionally, building solar on a home has high upfront costs with limited economies of scale. Community solar sidesteps access issues by being a scaled solar project built in a favorable location.

In addition to selling energy to the grid, the community solar project sells “Renewable Energy Certificates” (REC) to consumers and businesses so they can claim ownership of the solar energy production. Even if REC owners are far away and don’t physically use renewable energy on their actual grid, they can still “own” solar production to drive solar development in the nation. In many states, REC users get a government-subsidized credit on their energy bill. The aim is to make community solar energy “usage” cheaper than the status quo and spur additional community solar investment.

Arcadia facilitates transactions between all stakeholders. Consumers sign up with Arcadia and pay their utility bills on the Arcadia platform. On the back end, Arcadia buys wholesale RECs from solar developers, tracks the consumers’ energy usage, and pays the utility company. The utility company in turn provides the physical electricity to the consumer. By tracking the consumer energy usage, Arcadia knows when to retire the REC when usage is matched and applies earned credits. Depending on the utility’s original pricing, state regulations, and renewable energy tariffs, Arcadia can reduce energy bills by 5-10% while giving consumers the benefit of promoting solar energy production. Solar developers on the platform benefit from focusing on their core operations while offloading customer acquisition, UI/UX, energy usage verification, and payments to Arcadia.

Arc Platform

Arcadia launched a B2B platform in October 2021 called “Arc.” The key feature of Arc is its Plaid-like utility integration allowing businesses to access consumer utility data in a reliable and clean format regardless of the utility. The data is critical for any company looking to manage energy with services such as finding the optimal time to charge an electric vehicle or helping consumers figure out how to reduce their energy bills.

Arc has several use cases across industries. As of September 2023, Arc is intended for solar and storage, EV charging, energy management, carbon management, and property management. Arc intends to help companies in these industries fight climate change by providing access to energy data and APIs. The product is composed of five sub-products: Plug, Switch, Bundle, Signal, and Spark.

Plug: Plug enables businesses to access global energy data from thousands of providers in over 50 countries. Users can access electricity usage in 15, 30, or 60-minute intervals. Further, Plug aims to reduce errors in collecting and standardizing electricity data so businesses can make better-informed decisions.

Source: Arcadia

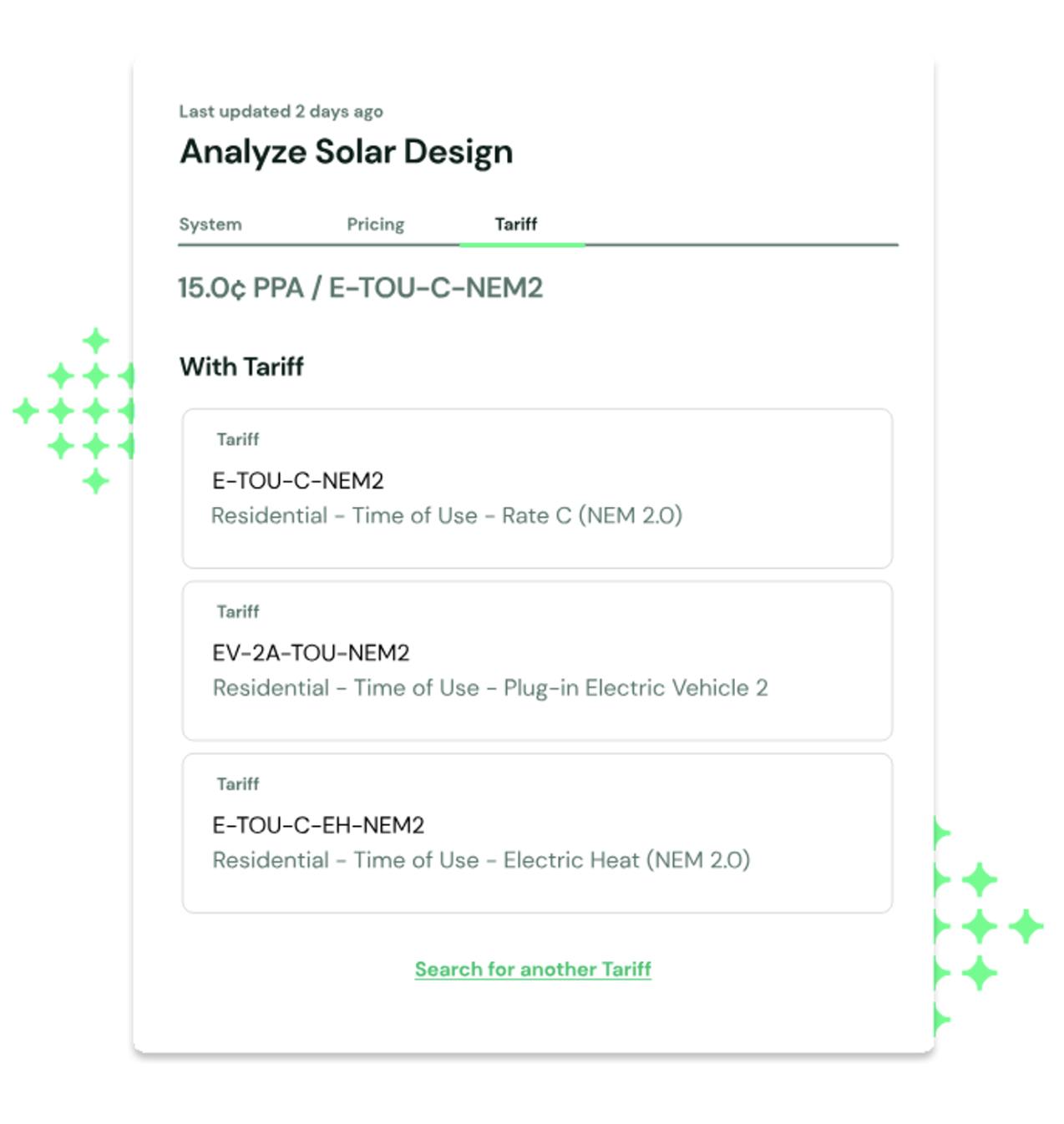

Switch: Switch provides users with energy cost simulations and calculations for solar and storage proposals. It aims to produce an accurate prediction of electricity costs so businesses can make better-informed decisions. The product is powered by a tariff engine to make site-specific predictions. Further, Arcadia claims that the product can drive sales by enabling instant access to quote-sharing and accelerated proposal delivery. Regarding Switch, Arcadia notes that:

“The National Renewable Energy Laboratory (NREL) independently reviewed Switch’s forecasting capabilities and confirmed 99.5% accuracy — so your calculations represent real forecasts and savings.”

Source: Arcadia

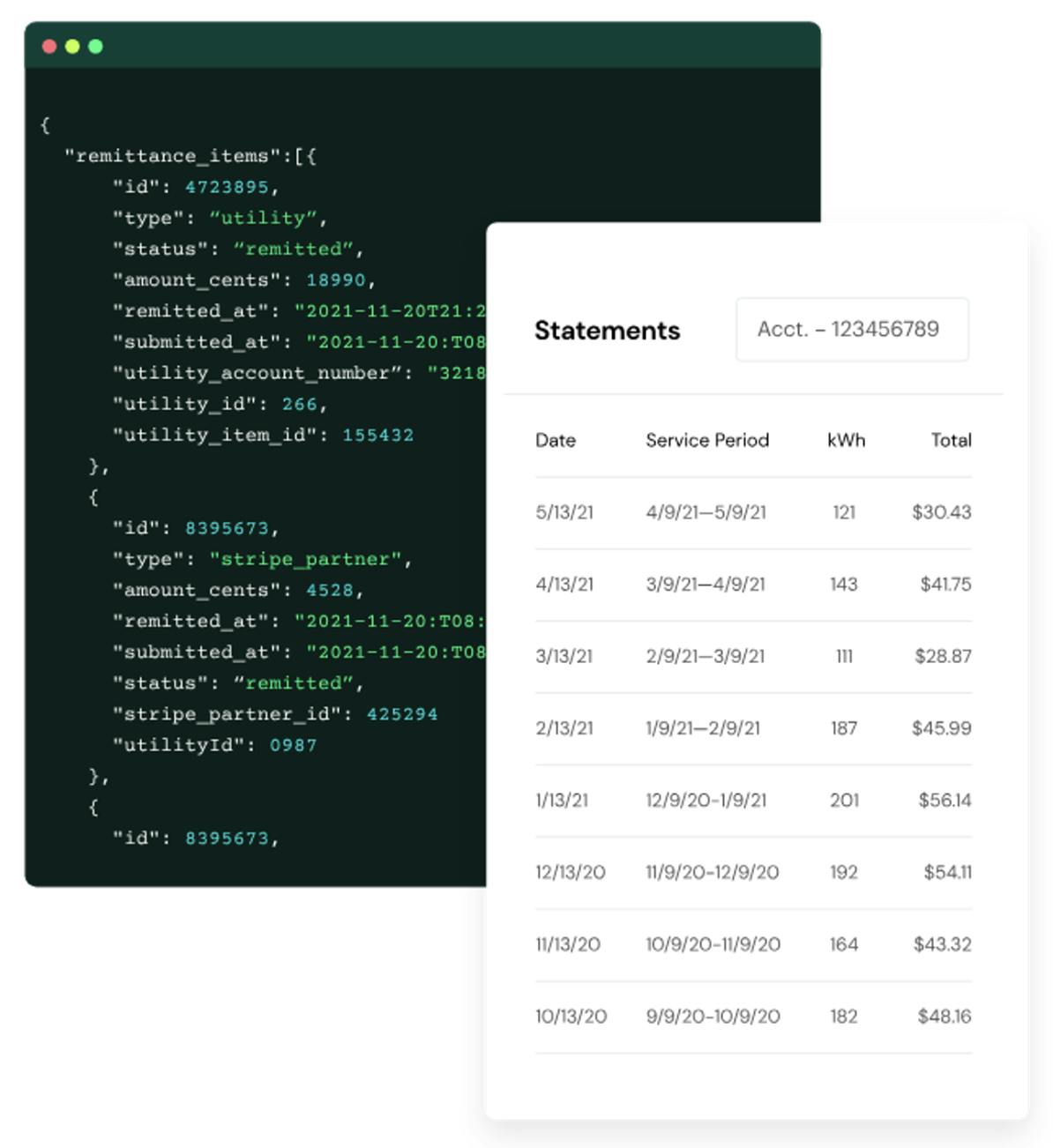

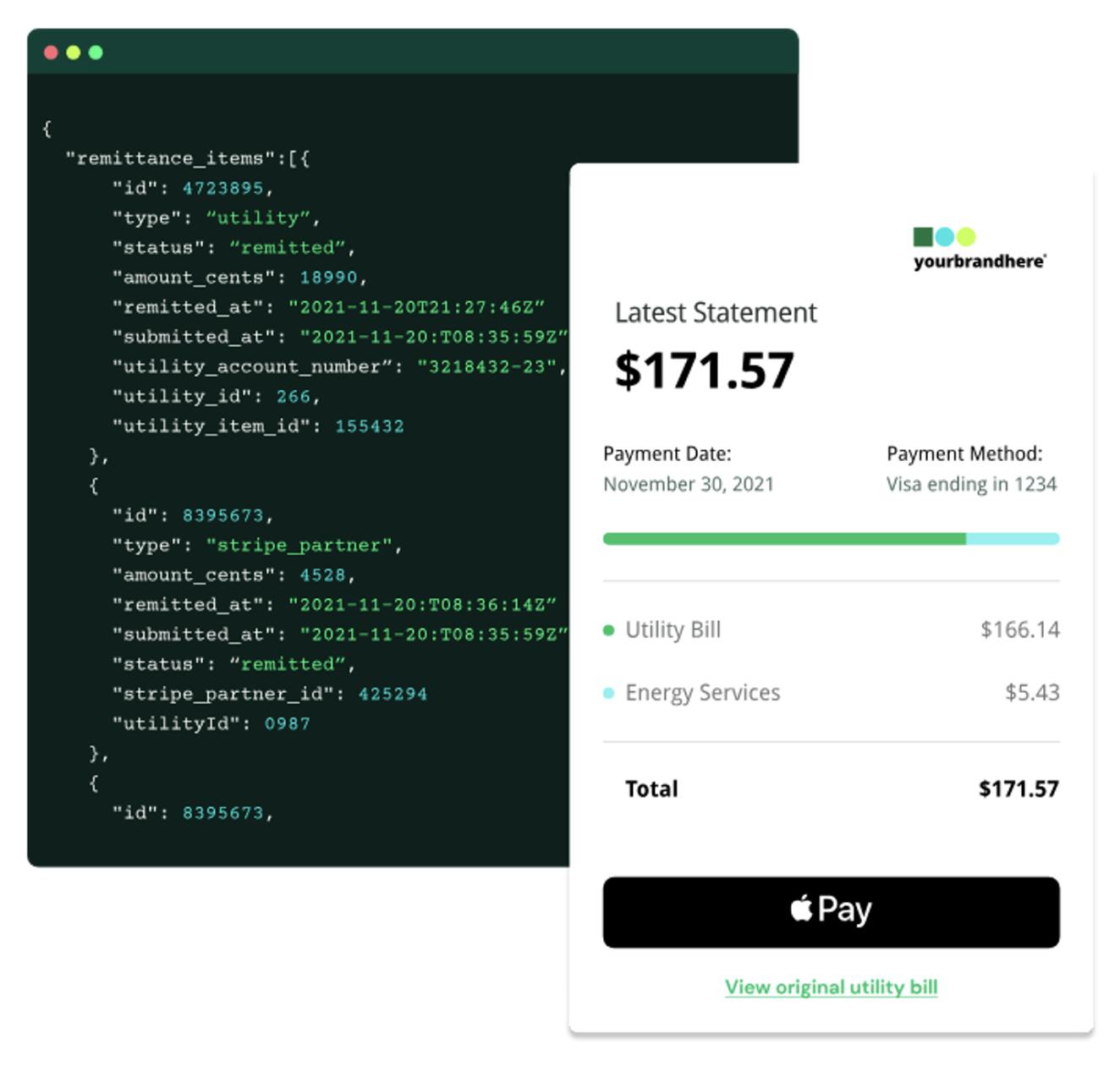

Bundle: Bundle enables customers to streamline the energy billing workflows. Energy providers can build comprehensive, simplified, and transparent statements to send to customers. Further, bills can be customized and branded. Consumers can enroll in auto payments and Arcadia will process the payments through Arc Bundle. Bundle can also automatically calculate, split, remit, and scale end-user payments.

Source: Arcadia

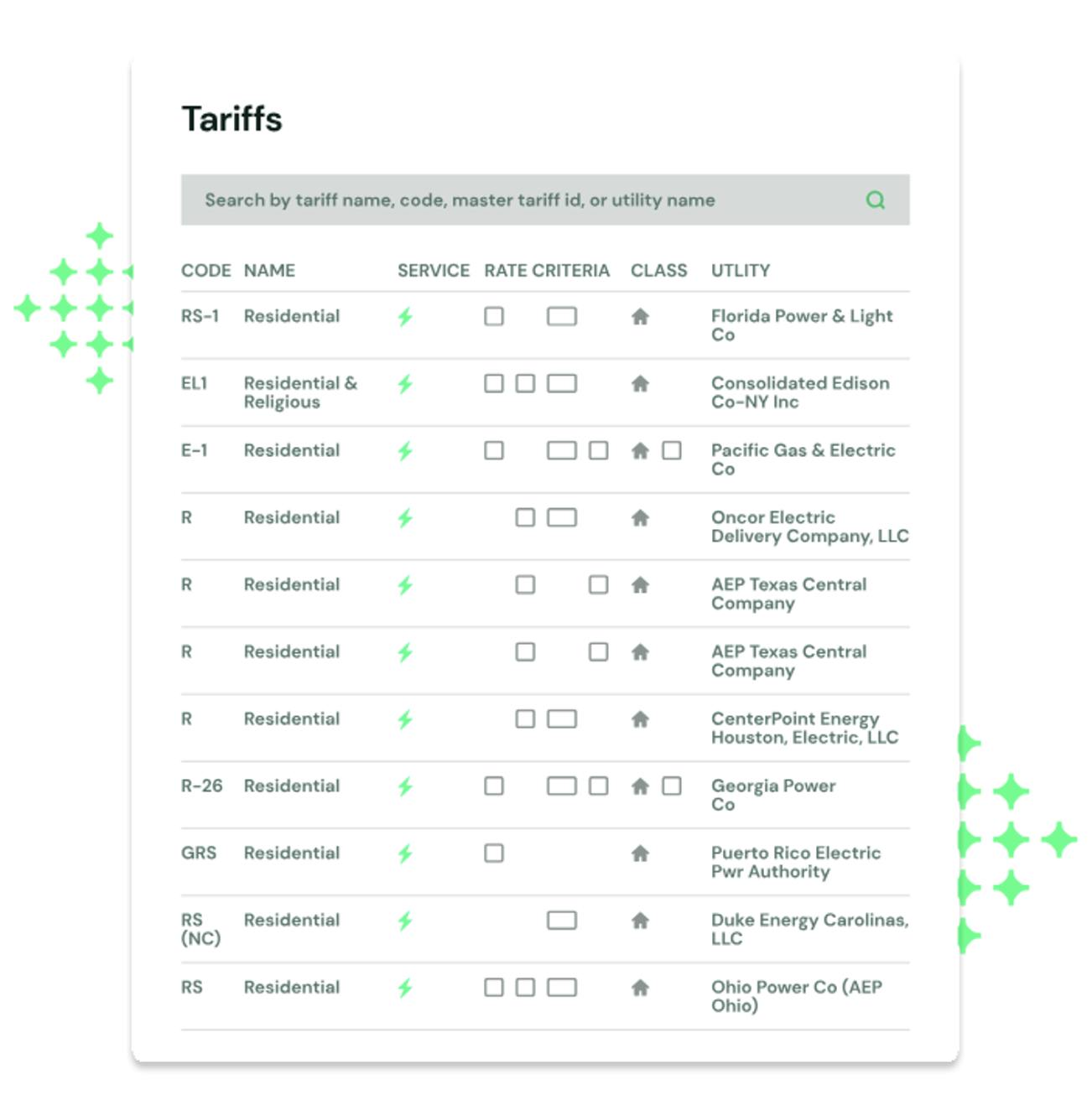

Signal: Signal enables customers to build energy cost-benefit analyses, derived data sets, and bill audit models. Signal provides tariff data and calculations in a single interface. The product captures tariff structure and combines that with usage data to enable accurate calculations across multiple geographic regions and utilities.

Source: Arcadia

Spark: Spark provides advanced analytics for energy usage and savings. Spark offers features like energy usage analytics, smart scheduling recommendations, and automated optimizations for EVs and smart devices. Unlike other products, Spark is a more advanced analytical product, offering more analytical analysis across more devices. Further, Spark’s recommendations can ensure that consumers are on the best tariffs possible.

Source: Arcadia

Market

Customer

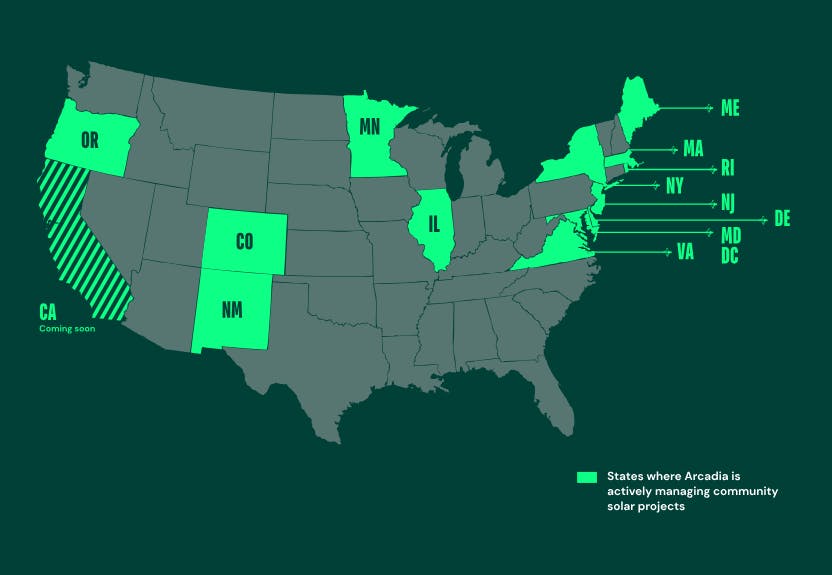

Arcadia’s Community Solar platform targets consumers, businesses, and developers. Homeowners, renters, and businesses can sign up to switch their current electricity provider to Arcadia. Developers partner with Arcadia to manage community solar projects. Developers that Arcadia has existing partnerships with include AES, Aspen Power Partners, and Cypress Creek Renewables. As of September 2023, Arcadia manages community solar projects in the following states: ME, MA, RI, NY, NJ, DE, MD, VA, IL, MN CO, NM, OR, and the District of Columbia. California is soon to follow.

Source: Arcadia

The Arc platform is a B2B software solution for a variety of businesses, primarily targeting alternative energy providers. Specifically, Arc targets solar and storage, carbon management, energy management, electric vehicle, and property management businesses. Notable customers of Arc include Ford, Palmetto, Aurora, and Stem.

Source: Arcadia

Market Size

Community solar is a nascent but swiftly expanding market. On the supply side, community solar grew from 100 MW capacity in 2015 to 3.2K by the end of 2020, representing enough energy to power 600K households. In 2021, the US government aspired to grow that capacity by 8x to power 5 million homes by 2025.

The global solar power market size was valued at $234.8 billion in 2022 and is projected to grow at a CAGR of 6.9% to $373.8 billion by 2029. In particular, community solar is expected to grow significantly due to demand for solar energy from consumers and program design innovation.

Arcadia’s Arc product plays in a unique market that is not encompassed in a known market report. An adjacent market is the utility energy and analytics market. The utility and energy analytics market was valued at $2.2 billion in 2021 and is expected to grow at a CAGR of 14.7% to $9.8 billion by 2032. In addition, Arc is adjacent to the solar software market, valued at $189.6 million in 2021 and expected to grow at a CAGR of 6.3% to $273.8 million by 2027.

Competition

Community Solar Competitors

Nexamp: Nexamp, named the number one community solar company by Solar Power World magazine, is a Boston-based community solar provider founded in 2007. Nexamp offers community solar services to homeowners and renters. Like Arcadia, Nexamp partners with developers to produce the energy. Nexamp reports that on average, subscribers save an annual average of $275 on energy spending. Since its founding, Nexamp has raised a total of $1.2 billion in disclosed capital. Most recently, Nexamp secured $400 million in debt and equity financing to develop up to 250 MW of solar and storage projects in June 2023. Nexamp did not disclose its valuation in this funding round.

CleanChoice Energy: CleanChoice Energy is a Washington DC-based clean energy supplier founded in 2011. Like Arcadia, CleanChoice Energy offers community solar to homeowners and renters. In 2021, the company surpassed 200K clean energy customers and managed 50 solar community farms. Since its founding, CleanChoice Energy has raised an $11 million Series A in 2014 and undisclosed debt financing in 2021. The company has not disclosed its valuation.

Neighborhood Sun: Neighborhood Sun is a Silver Spring-based community solar provider founded in 2016. The company claims that, since launch, it has collectively saved consumers over $2 million on electricity bills. Neighborhood Sun’s goal is to bring access to clean energy to consumers who may not be able to afford to install renewable sources otherwise. In April 2022, the company launched a community investment campaign on WeFunder. As of September 2023, Neighborhood Sun has raised a total of $5.5 million and has an approximate $27.5 million valuation.

Arc Software Competitors

NextEra Energy Resources: NextEra Energy Resources is a Juno Beach-based leading clean energy provider founded in 2000. The company offers several energy products, including grid-scale renewables, onsite solar, energy storage, RECs, and more. Like Arcadia, NextEra Energy Resources offers community solar. Further, the company offers an energy management software solution called NextEra 360. Like Arc, NextEra360 captures data utilizing integrations and APIs. In June 2014, NextEra Energy Resources announced its IPO. In September 2023, the company was trading at a market cap of around $134 billion.

UtilityAPI: UtilityAPI is an Oakland-based software provider founded in 2014. Like Arc, UtilityAPI offers software solutions to facilitate the clean energy transition. UtilityAPI targets businesses seeking to transition to clean energy with data integrations and APIs, and targets utility providers with vision and engagement products. Since its founding, the company has raised $11.7 million of disclosed capital. In May 2022, UtilityAPI raised a $10 million Series A led by Aligned Climate Capital. The company’s valuation was not disclosed.

Business Model

Community Solar: Arcadia charges a $5/month fee for its community solar offering. The energy bills are paid through Arcadia’s interface, but outside of the $5 fee to consumers, the bill payment is remitted to the energy provider. In comparison to the $20K average cost of installing solar panels on a residential roof, Arcadia positions community solar as a cheaper alternative to accessing clean energy. Arcadia also monetizes by charging the energy providers when it connects consumers to clean energy, but Arcadia does not publicly disclose this fee.

Arc: As of September 2023, Arcadia does not publicly disclose its pricing structure for Arc. Arc is a SaaS platform so it likely has a monthly or annual license fee based on some combination of usage and the number of active users.

Traction

Community Solar: As of September 2023, Arcadia’s Community Solar offering had 1.6+ GW under management and over $500 million in total utility billing transactions processed. In June 2023, Arcadia acquired Oregon Shines for an undisclosed amount. This acquisition made Arcadia the largest community solar subscription provider in the state of Oregon. As of September 2023, Arcadia self-reports as the leading community solar provider. Further, over 50 leading asset owners and their investors utilize the community solar platform.

Arc: As of September 2023, over 350 companies used the Arc platform. Arcadia’s Arc customers range from Fortune 500 corporations to renewable energy companies. Notable customers include Ford, Oracle, and Aurora Solar.

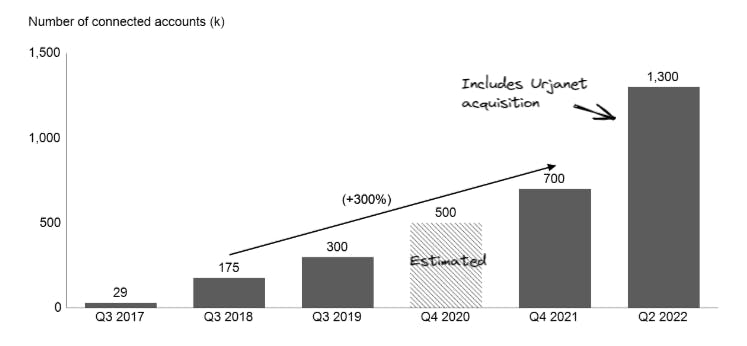

By 2021, Arcadia had 700K utility connections through the platform across all 50 states utilizing 700 MW of solar projects and wind projects. Arcadia amassed data and methods of integrating with the 125 utilities accounting for 80% of US consumer utility accounts. In late 2021, Arcadia gave third parties access to consumer utility data and integration APIs. In 2021, the company acquired Urjanet, a leading global utility data aggregator. This acquisition made data and integrations for 9.5K global utilities available to Arcadia. In total, Arcadia and Urjanet have connected over 1.3 million accounts, representing approximately $20 billion in yearly utility bills in May 2022.

Source: Contrary Research

Valuation

Arcadia has raised a total of $495.5 million in disclosed funding. Most recently, Arcadia raised $125 million in venture funding led by Magnetar Capital in December 2022. Past investors included JP Morgan Asset Management, Tiger Global Management, and G2 Venture Partners, among 35 total investors. Arcadia’s valuation was not disclosed in its December 2022 funding round. Prior to that, in May 2022, Arcadia raised a $200 million Series E led by JP Morgan Asset Management. The company’s valuation was also not disclosed at that time.

As of September 2023, Arcadia has made five acquisitions since 2021. In March 2021, the company acquired Real Simple Energy for an undisclosed amount. In April 2021, Arcadia acquired Nanogrid for an undisclosed amount to break into the EV space. In November 2021, it acquired iSolar for an undisclosed amount to broaden its community solar assets and subscriptions. In March 2022, Arcadia acquired Urjanet for an undisclosed amount to expand its Arc product. In June 2023, it acquired Oregon Shines for an undisclosed amount to expand its community solar offering and subscriptions.

Key Opportunities

Inflation Reduction Act

In August 2022, the US government passed the Inflation Reduction Act. The new law is intended to benefit clean energy industries, especially solar. Through 2032, the IRA is projected to lead to 48% more solar deployment than would be projected in a no-IRA scenario. By 2033, it is projected to quadruple the total solar capacity from 2022, reaching 669 GW of capacity. In total, the IRA is projected to lead to $565 billion in new investment over 10 years starting in 2022, or $144 billion more than expected in a no-IRA scenario. Growth in the clean energy industry is likely to benefit Arcadia. As more solar power facilities are built, Arcadia will have more partnership opportunities for its community solar offering and more potential customer opportunities for its Arc product.

Grid Modernization and Product Expansion

Investors and consumers are changing their purchasing habits. For example, electric vehicles are projected to grow from 2.5% to 32% of car sales from 2020 to 2030. As a result of greater EV penetration, more companies like Weavegrid could grow to help consumers reduce electricity costs by managing charging choices.

Changing public sentiment and regulatory efforts could encourage growth in clean energy industries that Arcadia could capitalize on. Arcadia is already expanding to offer more products adjacent to electric vehicle manufacturers and charging companies, such as its acquisition of Nanogrid. As clean energy and adjacent industries mature, Arcadia could continue to find other pockets in the market to expand into new customer bases and grow existing customer bases.

Utility Disintermediation

As of June 2023, a growing number of consumers are demanding a switch to third-party energy suppliers. For example, in Connecticut, at the end of 2021, 10% of Eversource customers were with third-party suppliers, and by the end of Q1 2022, that number had grown to 19%. Arcadia’s utility platform benefits from a growing number of third-party energy providers. The disintermediation of utility providers and the shift to third-party providers present more customer opportunities for Arc.

Key Risks

Faltering Government Incentives

The industries that Arcadia serves are nascent and reliant on governmental and regulatory support. By extension, Arcadia’s products rely on the same support. The regulatory tailwinds for solar and community solar were favorable in 2023 as the US solar market reached new records. Legislators look to continue supporting solar development and addressing climate change. Further, the Inflation Reduction Act was written to likely be irreversible, meaning in the short term, clean energy policy should be favorable.

Despite the current favorable policy, the growth of solar and clean energy industries is susceptible to decline in less favorable environments. In 2022, the solar market growth slowed despite favorable legislation. Legislative uncertainty, tariff policy, supply chain issues, and rising prices led to delayed and canceled projects.

The IRA alone will not solve all of the solar market’s issues. Despite the $370 billion in US incentives, the industry still faces supply issues, trade tensions, and delays in connecting to power grids. Further, future policy may be needed to continue solar market growth, and it is uncertain if future administrations would be willing to support the industry.

Limited Decarbonization Regulation

Government regulation enforcing decarbonization could generate demand for Arcadia’s services. In June 2022, the US Supreme Court limited the federal power to enforce decarbonization policies. Historically, the federal government has been limited in its efforts to shift to clean energy. While the limited government intervention in decarbonization represents a risk to Arcadia, new developments could create an opportunity for Arcadia. In September 2023, the Biden Administration announced new efforts to reduce greenhouse gas emissions and combat the climate crisis. This could signal an enduring shift in decarbonization policy.

Summary

Arcadia is a community solar and energy management software provider that was founded in 2014. Arcadia could be positioned to capitalize on the growing renewable energy industries such as solar, wind, EV, and carbon management. Arcadia intends to encourage consumers to shift to renewable sources of energy by offering convenient, cost-incentive benefits with no upfront costs. Arcadia’s Arc platform is intended to provide businesses and third-party renewable energy providers with integrations, APIs, and access to data to optimize energy management. Newer federal policies such as the Inflation Reduction Act and further September 2023 proposals could drive renewable industry growth that Arcadia could be positioned to capitalize on.