Thesis

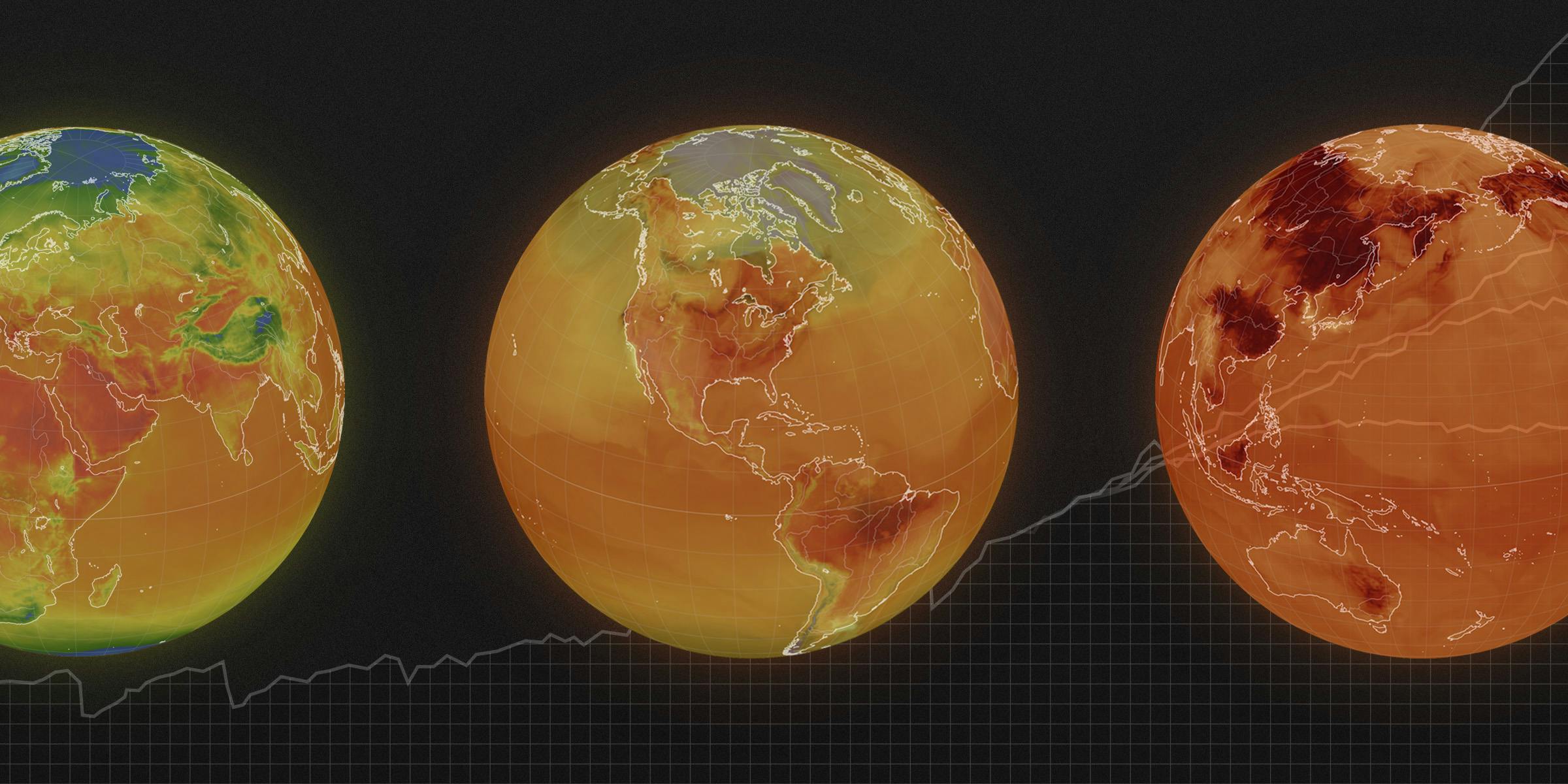

From 2022 to 2023, the number of companies across the globe that reported their carbon emissions and risks increased by 24% — a figure representing over 23K companies and including around 8K companies disclosing emissions for the first time. In particular, Scope 1 and Scope 2 emissions, which are direct and indirect emissions respectively, are increasingly becoming required disclosures. Historically, these types of disclosures have been voluntary, but they are starting to become mandatory. This trend is set to accelerate with regulations like the SEC’s landmark ruling in early 2024, which mandated Scope 1 and 2 emissions disclosures, and the EU’s mandate requiring all large enterprises conducting business in the EU to report emissions.

The increasingly stringent regulatory landscape surrounding climate disclosures is driving heightened demand for carbon accounting services that address the complex and time-consuming process of measuring emissions across a company’s operations. As of March 2024, only 45% of US-based companies disclose their Scope 1 and 2 emissions, a figure that is poised to rise significantly to ensure compliance with new legislation. Meanwhile, VC funding has aligned with this trend, with a record $17.7 billion invested in the carbon and emissions tech sector in 2023.

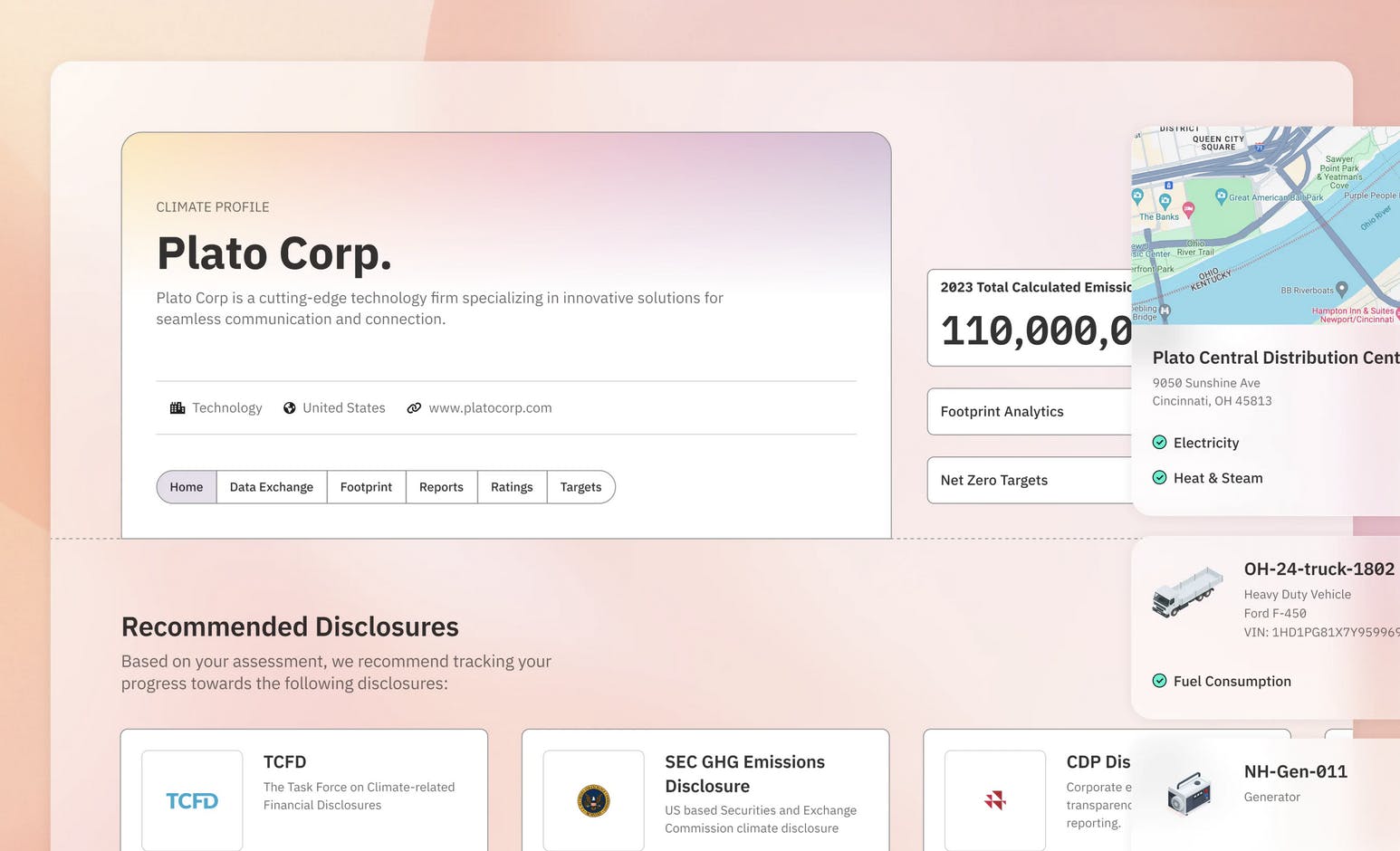

Persefoni is an AI-powered carbon accounting SaaS platform that helps companies and investors measure and disclose their carbon emissions, thereby responding to these increasing stakeholder and regulatory pressures. Persefoni aims to position itself as a carbon-focused Enterprise Resource Planning (ERP) platform, akin to Oracle, by integrating and managing all relevant data sources required for real-time, auditable emissions measurement. The platform ensures compliance with disclosure standards used by asset managers and investors to track their portfolios' carbon footprints.

Founding Story

Source: Persefoni

Persefoni is an Arizona-based startup co-founded by Kentaro Kawamori, Jason Offerman, and Kim Stroh in 2020. The founding team met at Chesapeake Energy, an oil and gas production company. Kawamori was the Chief Digital Officer (CDO), Offerman was the Director of Technology Platforms, and Stroh was a Data Science and Advanced Analytics manager.

Kawamori’s passion for environmental stewardship was largely shaped by his sustainability-oriented upbringing in Germany. After brief technical roles at companies like Accenture and Insight, he sought to understand the growing global emissions problem straight from the source. In 2018, Kawamori set out to do that by joining Chesapeake Energy.

As CDO at Chesapeake, Kawamori was tasked with streamlining emissions reporting for investors and clients like Blackrock and Fidelity. Faced with the challenging job of bridging data gaps to accurately calculate emissions for climate disclosures, Kawamori was inspired to create a solution. Speaking with CEOs of public companies further solidified his interest in addressing these recurring pain points within the Climate Management and Accounting Platform (CMAP) space.

Kawamori approached two colleagues, whose combined experiences helped hone the idea and bring it to fruition. Offerman, who was working under Kawamori at the time, had decades of experience in building ERPs. Stroh was also immediately on board with the idea to found a SaaS startup aimed at providing business value alongside environmental impact. Regarding the mission of the company, Kawamori shared:

“Ultimately, Persefoni wants to make measuring and tracking every organization’s carbon footprint as ubiquitous as managing their financial performance.”

The original founding team continues to lead the company, with Kawamori as CEO, Offerman as COO, and Stroh as CDO.

Product

Persefoni's platform is a CMAP designed to automate the complex process of calculating company carbon footprints, with the Persefoni AI tool embedded as a foundation. The product offers a transparent and integrated solution for tracking and analyzing carbon emissions with both free and paid products. Persefoni is a plug-and-play software that can be implemented quickly and bypasses the status quo of hiring specialist consultant firms to calculate a footprint, which can be quite expensive, often costing an average of ~$500K.

Data Aggregation for Calculating Emissions

Source: Persefoni

Data aggregation is a crucial pain point for companies because many don’t know what data sources are worth gathering. Even if they do know, sometimes data is not available. Even if a company is capable of gathering its own critical information, its logistics vendors may not be, which creates a blind spot for the company. Persefoni fills the information gap by identifying critical data to gather and filling in any data gaps with industry averages. For instance, Persefoni can use industry averages for logistics companies if a vendor does not use physical sensors to create accurate estimates.

Persefoni’s software helps companies manage and report three types of emissions:

Scope 1: Direct greenhouse gas emissions from sources that are owned or controlled by the company, such as emissions from company facilities

Scope 2: Indirect emissions from the consumption of electricity, steam, heat, or cooling

Scope 3: Perhaps the most challenging to track and measure, these are indirect emissions from the company’s operations, such as those from suppliers, and product use

Several carbon reporting frameworks exist to help facilitate common standards between companies. Persefoni’s software complies with Greenhouse Gas Protocol accounting (GHG) as well as Partnership for Carbon Accounting Financials (PCAF) standards.

Most sustainability reporting frameworks, the common ones being TCFD, SASB, and GRI, rely on the GHG as a standard methodology for carbon accounting. The corporation methodology covers topics such as what greenhouse gases need to be measured or what percentage of joint ventures should account for in a company’s footprint. Over 90% of Fortune 500 companies use a version of the GHG Protocol for their reporting.

However, GHG gives limited guidance for Scope 3 emissions required by asset managers to calculate disclosures for companies they own or finance. PCAF is a methodology developed in Europe and supported by over 250 financial institutions, such as Bank of America, Citi, and Deutsche Bank. The methodology accounts for “financed emissions” of companies to which banks and asset managers have given capital. PCAF uses information like car mortgages and project financing to estimate how much a bank or investor is enabling emissions. Persefoni also adheres to PCAF and fills in information gaps by using industry averages for Scope 3 emissions.

Persefoni introduced the second iteration of its product, Persefoni CMAP 2.0, in October 2022, which enables customers to request emissions data from suppliers through the platform, resulting in a more comprehensive understanding of an organization's carbon footprint.

Reporting, Insights, & Learning

Source: Persefoni

Persefoni provides reporting tools that generate detailed carbon footprint reports and interactive dashboards like the Persefoni Footprint Ledger. These tools help companies visualize their carbon data by scope, track progress against reduction targets, and communicate their carbon strategy to stakeholders and regulators.

Going a step further to ensure customers have confidence in their emissions disclosures and can stay current on global standards, Persefoni offers products such as its Climate Policy Library, which is a data room of worldwide carbon accounting laws. Customers can also request and receive expert advice on how to stay compliant with the SEC and California Climate Disclosure Rules. For further education, they may even take courses like Persefoni’s SEC Executive Primer featuring modules and culminating in a certification for a deeper understanding of these regulations.

Customized Decarbonization Strategies

Source: Persefoni

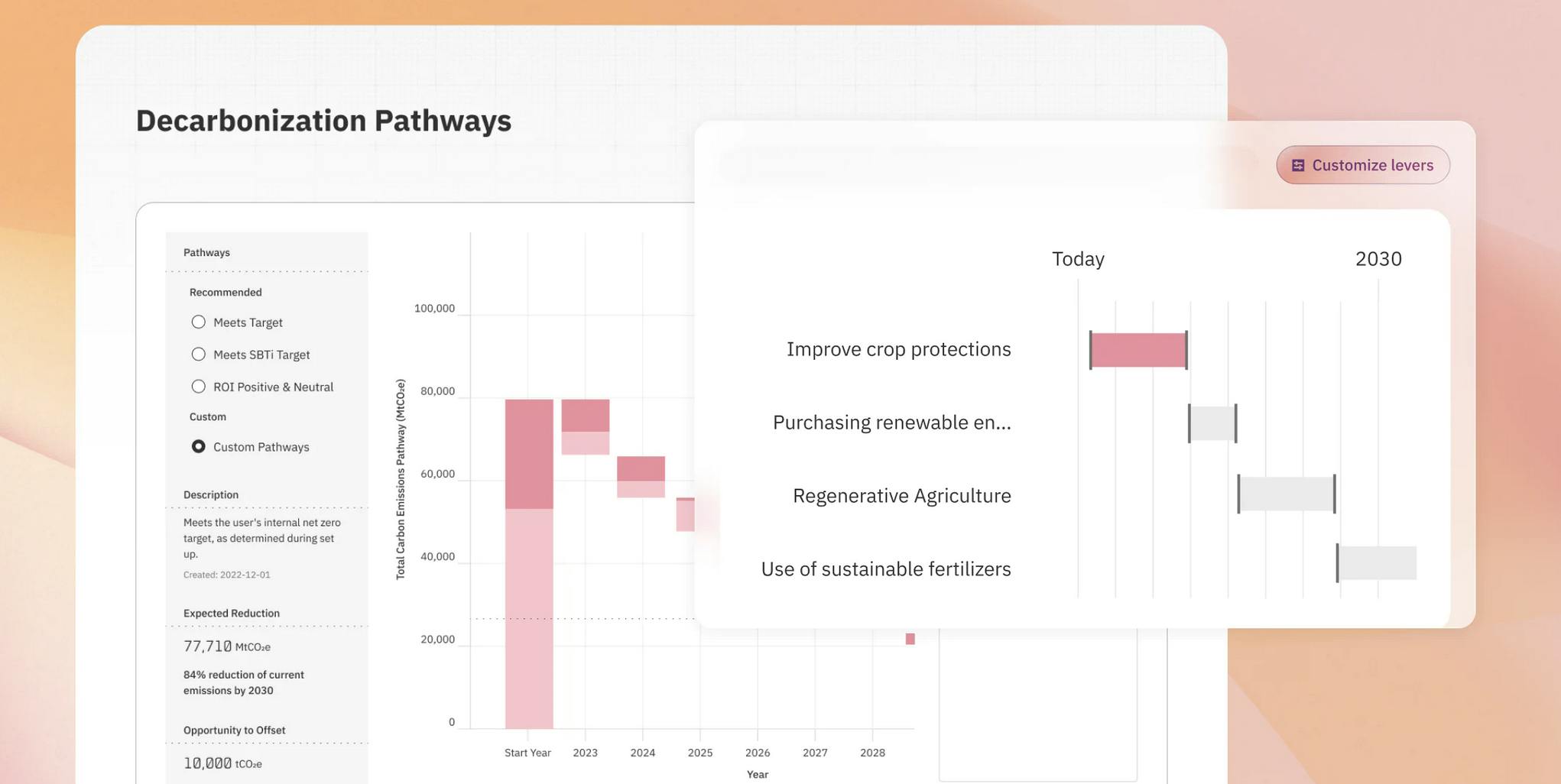

Persefoni’s Net-Zero Navigator helps clients generate industry-specific decarbonization scenarios, goals, and recommendations based on existing emissions data. It features a progress tracker based on objective metrics as well as other reduction targets.

While some carbon accounting platforms have expanded into implementing their suggested strategies, such as offering carbon offsets, in December 2021 Kawamori stated that Persefoni had little interest in moving into the market for carbon offsets because it creates mixed incentives. Instead, the company partners with Patch*, a carbon offsets marketplace, so customers can easily port their emission footprint data to match it with offset purchases.

Market

Customer

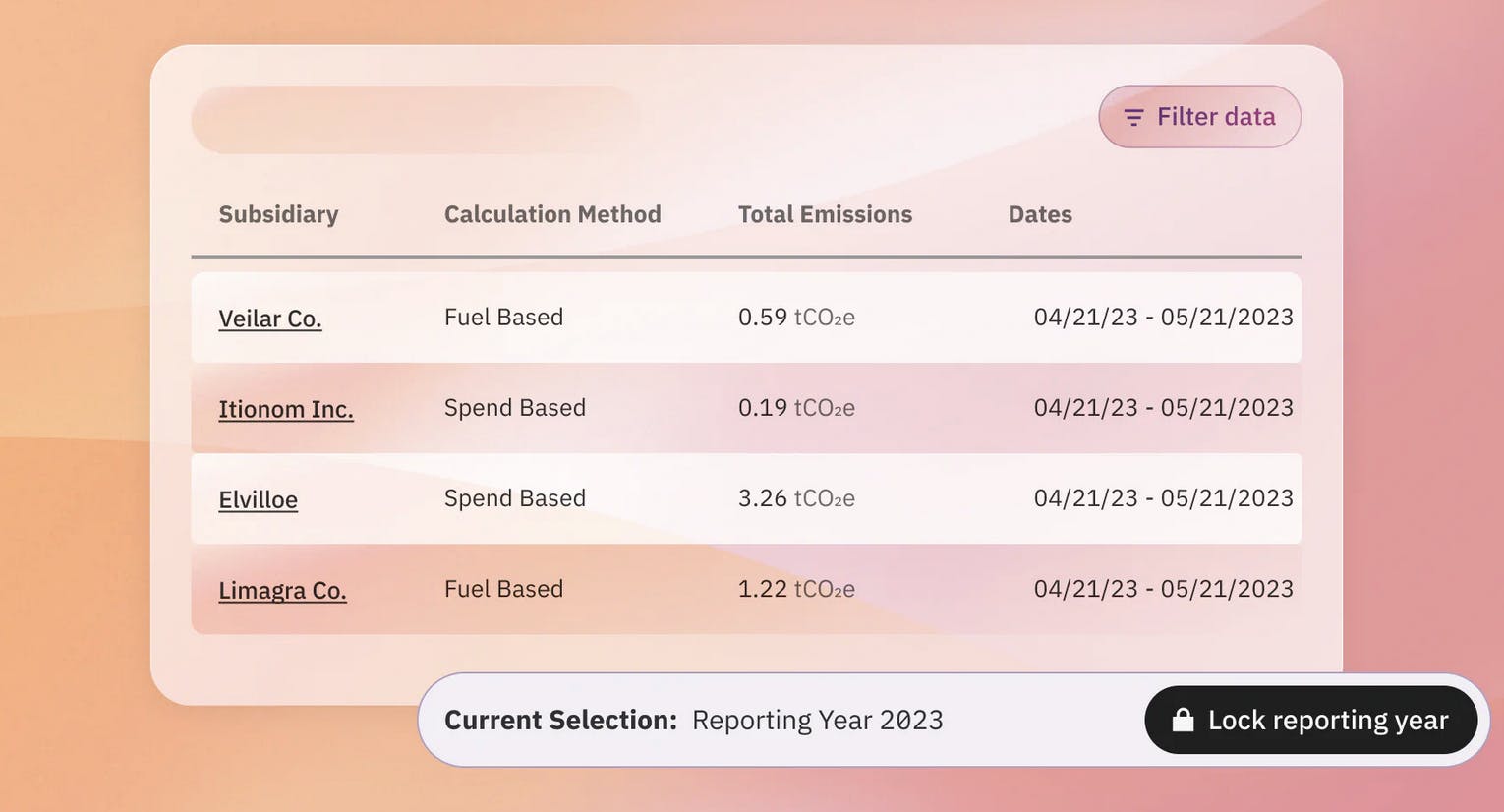

Source: Persefoni

Persefoni’s customers span across categories such as private equity, industrial conglomerates, genetic testing, and sports teams. Some of Persefoni’s customers include four of the top 10 largest PE firms and four of the top 25 banks. Persefoni’s platform has also been used to power sustainability reports from organizations like Bain Capital, Apollo, and L Catterton.

Typically, Persefoni’s target customers include (1) financial institutions, and (2) corporations. Both groups face increasing stakeholder and regulatory pressure to disclose their environmental impact, driving the market growth for carbon accounting services.

Market Size

In 2023, the Climate Disclosure Project (CDP), a non-profit offering a global repository of institutional disclosures, reported a 24% increase in companies voluntarily disclosing their carbon footprint compared to 2022. Furthermore, as of March 2024, 79% of surveyed institutional investors held that climate risk disclosures were equally as important if not more important relative to financial risk disclosures. Despite investing in ESG reporting resources and structures, companies continue to grapple with challenges. Over half identify data quality as their primary issue with ESG data, while 88% rank it among their top three challenges.

Global regulatory pressure for carbon disclosures is also intensifying, which paves the way for Persefoni’s products to further permeate the market and support a growing need. Besides the SEC’s new ESG rules for disclosures in the US and the EU’s Corporate Sustainability Reporting Directive (CSRD), countries around the world, like Canada and Japan, have proposed climate and ESG policies. These global efforts highlight a collective move towards standardized, transparent climate risk reporting, driven by regulatory bodies and financial stakeholders demanding greater accountability and action on climate change. Raising companies’ compliance requirements through carbon disclosure regulations will ensure carbon accounting software is a must-have.

In 2023, the global carbon accounting software market was valued at $15.3 billion. It is projected to grow to $18.5 billion in 2024 and reach $100.8 billion by 2032. According to Deloitte, 74% of public companies plan to invest in tools and technology for ESG reporting throughout mid-2025.

Competition

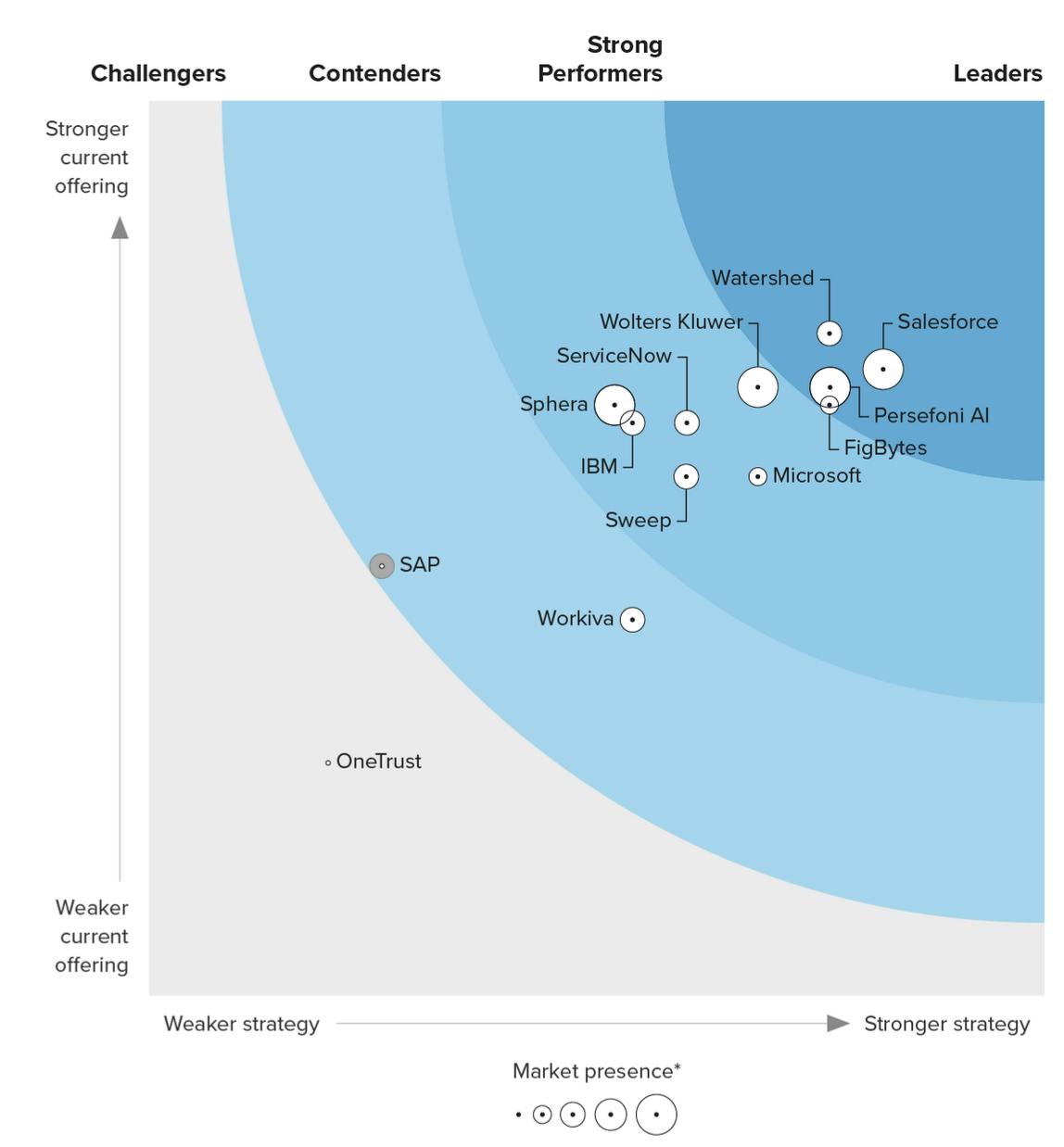

Source: Forrester

Emerging Platforms

Watershed: Founded in 2019, Watershed is a software carbon accounting company competing with Persefoni for corporate accounts. Watershed offers consulting and support to identify Scope 3 supply chain and logistic metrics unique to a company, creating company-specific calculations for carbon accounting. As of Q2 2024, Persefoni appears to be better suited to support regulatory disclosure compliance. At the same time, Watershed is better for companies seeking to reduce their footprint or become net-zero.

FigBytes: Founded in 2014, FigBytes is a sustainability platform that is focused on enabling customers to automate and manage ESG programs and carbon accounting. The company was acquired by Advanced Manufacturing Control Systems (AMCS) in November 2023. FigBytes’ product is built on Microsoft Azure and offers a broad suite of modules, from supplier engagement portals and reporting dashboards.

OneTrust: Founded in 2016, OneTrust, is primarily a data governance platform. In Q1 2022, Forrester provided an overview of the sustainability management software market. In that report, it listed OneTrust as having a stronger current offering than Persefoni and only a slightly weaker strategy. OneTrust touted its “ESG solution” as enabling “organizations with environmental, social, and governance technology built into the OneTrust platform. However, by Q2 2024, Forrester had downgraded OneTrust to having both the weakest current offering and weakest strategy in the broader market. In addition, as of September 2024, on OneTrust’s product page didn’t list any ESG or sustainability products.

Enterprise Competitors

Salesforce: While Salesforce is primarily known as a CRM platform, the company serves the broader sustainability market through its Net Zero Cloud (NZC) product. Salesforce’s NZC delivers features like a net-zero marketplace and double materiality assessments, emphasizing seamless implementation and user-friendly dashboards. It integrates data efficiently and offers robust support for ESG monitoring and compliance. NZC's strengths include automated process tracking, intuitive workflows, and AI-enhanced reporting with its Einstein AI, targeting the effort primarily at existing Salesforce customers and those seeking comprehensive ESG capabilities.

Wolters Kluwer: Originally founded in 1863, Wolters Kluwer has become a broad platform of regulatory software products across health, tax/accounting, ESG, finance, and more. In 2016, the company acquired Enablon, a software platform for environmental, health, and safety (EHS), sustainability, and operational risk management. Rather than focusing specifically on carbon accounting, Enablon addresses a number of use cases in risk management across health, sustainability, and operations. Enablon also has an extensive partnership ecosystem including vendors such as “Makersite for product lifecycle analysis and Enhesa for self-assessments against standards like GRI, CDP, and the Sustainability Accounting Standards Board (SASB).”

Microsoft: In June 2022, Microsoft launched its Cloud for Sustainability product. The goal of the product was to “unify data intelligence, build more enduring IT infrastructures, reduce the environmental impact of operations, and create more sustainable value chains.” In addition, Microsoft’s sustainability cloud includes a broad partnership network with vendors such as ABB, Bentley Systems, Honeywell, Accenture, PwC, and many others. The product is capable of addressing “broader sustainability metrics, monitoring water, waste, social, governance, and biodiversity.” In February 2024, Microsoft announced “new data solutions and generative AI advancements” in its Cloud for Sustainability product.

IBM: IBM plays in the broader sustainability market through its Envizi ESG Suite. Since its acquisition by IBM in 2022, Envizi has enhanced its sustainability monitoring capabilities and integrates with IBM products for comprehensive asset, cloud, and facilities management. Envizi focuses on Scope 3 emissions tracking for industries with complex supply chains. The platform also focuses on environmental risk assessments and sustainability KPI optimization. However, it falls short in double materiality assessments and has a less extensive partner ecosystem compared to competitors.

Differentiation

While Persefoni had previously differentiated itself through PCAF-enabled services for asset managers, in September 2023, PCAF announced a partner program, and listed Watershed as its “first accredited provider.” Persefoni claims to have a competitive edge with its specialized carbon accounting datasets. These datasets reportedly go beyond the typical internal data used by companies like IBM and Salesforce. For instance, understanding Scope 3 emissions requires industry-specific secondary data, which Persefoni has gathered extensively. This reportedly helps give Persefoni an advantage in providing accurate and comprehensive carbon accounting services.

Business Model

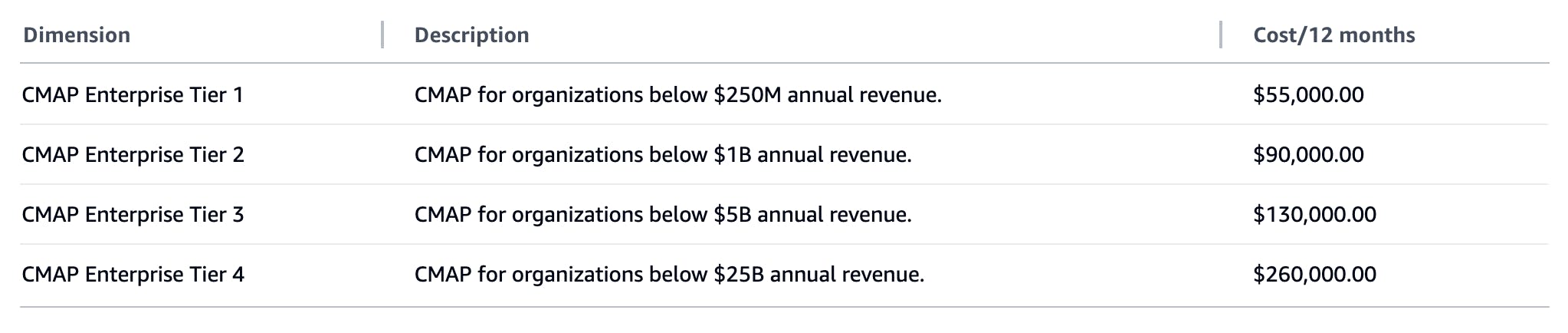

Persefoni is a SaaS business with one-year to multi-year contracts. Pricing for Persefoni’s services depends on customers’ annual revenue, with costs increasing incrementally with organization size. For organizations with annual revenues under $250 million, a 12-month contract costs approximately $55K, while a 36-month contract is priced at $165K. On the higher end, organizations with annual revenues up to $25 billion pay $260K, or $780K for a 36-month contract.

Persefoni’s “Advanced” version adds features like customization and a designated Climate Solutions Expert, as well as allowing for unlimited users. Persefoni does also offer a freemium version, dubbed “Pro”, which measures most Scope 1, 2, and 3 emissions and helps create basic analyses and summary reports required for disclosures.

The company’s sales model also relies heavily on partnerships — for example, Persefoni partners with Patch*, a carbon offsets marketplace that provides an API service for Persefoni customers to match their footprint data with offset purchases.

Traction

According to reports published in March 2023, Persefoni computed over 8.6 gigatons of CO2 emissions for its clients since its founding three years prior. Additionally, Persefoni rapidly delivered on its vision to offer proprietary AI technology for its clients — a goal also achieved in 2023 with the launch of PersefoniGPT. Some unverified estimates of Persefoni’s revenue indicate the company had over $30 million in 2023. Persefoni ended 2021 with under 90 employees and has since grown to over 300 personnel as of 2024.

Valuation

In August 2023, Persefoni raised a $50 million Series C-1 led by TPG Rise at a $300 million valuation. Persefoni’s other notable investors include Clearvision Ventures, ENEOS Innovation Partners, NGP Energy Capital, Bain & Co., Alumni Ventures, and Rice Investment Group, which is a former employer for Kawamori and Offerman, and the leader of Persefoni’s seed round. For comparison, one Persefoni competitor, Watershed, raised a $100 million Series C in February 2024, valuing it at $1.8 billion.

Key Opportunities

PCAF Adoption

Persefoni has made a bet on the continued adoption of the PCAF standard. In 2021, the European Banking Authority, SEC, and the International Sustainability Standards Board all referenced PCAF. The Task Force on Climate-Related Financial Disclosures (TCFD) also adopted PCAF for financed emissions. TCFD is a GHG Protocol standard supported by 1.7K governments and organizations. The US, UK, and Canada are driving further PCAF adoption. They are looking to adopt TCFD as the GHG protocol standard for carbon disclosures. If TCFD/PCAF standards become mandatory, Persefoni’s value proposition will continue to increase.

As of July 2024, PCAF has grown to more than 500 signatories, representing a diverse set of financial institution types and geographies. These institutions represent over $87 trillion in assets. Less than half of these massive companies have actually disclosed their emissions, though a majority have committed to doing so.

That adoption creates an opportunity for Persefoni to assist in the disclosures process. Persefoni has been an official partner of PCAF since October 2023, which is likely to be advantageous as governments continue to adopt PCAF standards. Global entities like TCFD already officially recommend PCAF for measuring and disclosing emissions, and similarly, the SEC recommends PCAF as one of three international reporting standards.

Partnerships

Since it was founded, Persefoni has built a number of partnerships to support the company’s product capabilities and distribution. In July 2022, the company partnered with The Carnrite Group, a management consultancy serving energy, industrial, and private equity firms. The goal of the partnership was to expand the accessibility of Persefoni’s platform by combining it with the sustainability advisory practice and carbon data collection of firms like The Carnrite Group. Persefoni can continue to partner with organizations to accelerate its mission of “crafting unparalleled carbon and climate solutions,” according to Kawamori.

In July 2024, Persefoni established a partnership with First Street, a company specializing in climate risk data and analytics. First Street provides detailed, location-based information about physical risks associated with climate change, such as extreme weather events and rising sea levels. Persefoni partnered with First Street to integrate advanced physical risk management capabilities into its platform. This new offering, expected to be available for purchase by the end of 2024, provides location-based climate risk data, enhancing enterprise climate reporting and compliance. The product aims to streamline reporting for standards like the SEC and CSRD, improving accuracy and saving time.

Developing future partnerships will continue to increase capabilities and adoption of Persefoni’s products, and also improve data quality and availability by embedding sources from partners. Through partnerships, Persefoni can accelerate its growth, expand its product suite, and solidify its position as a CMAP leader.

Key Risks

Recession

Macroeconomic threats often deter policymakers from enforcing stricter carbon disclosure standards. In particular, recessions and energy geopolitics disincentivize politicians from prioritizing environmental regulations over economic stability. During periods of economic downturn, US consumers tend to shift their focus away from buying sustainable products or prioritizing overall environmental agendas, instead choosing to focus on broader economic concerns. Although interest in funding sustainability companies is more widespread compared to the CleanTech movement of the mid-2000s, global governments may still be hesitant to implement rigorous carbon accounting measures that propel these businesses forward — a reluctance that stems from the potential economic trade-offs and political risks associated with stringent environmental policies.

Politicization of Carbon Standards

While governments worldwide are increasingly focusing on climate-related regulations, these policies are subject to change based on the prevailing political climate. The EU is pushing forward with the CSRD and the US is seeing new climate-related disclosure rules codified by the SEC, but these regulatory landscapes can be highly volatile. Political shifts, policy polarization, and transitions of power can lead to either stricter regulations or rollbacks, creating a challenging environment for companies like Persefoni trying to maintain compliance. Additionally, policy uncertainty can increase the cost of capital for low-carbon initiatives, making companies less willing and able to invest in the green transition — a potential issue for Persefoni’s customer base.

Summary

Persefoni’s carbon accounting software helps to automate the process of tracking and disclosing carbon emissions. As more companies focus on providing transparency around emissions, and more regulatory bodies start to push for mandatory disclosure rather than voluntary practices, the need for these types of solutions is becoming increasingly important.

As Persefoni seeks to take advantage of some of these regulatory and market awareness tailwinds, the company will also face stiff competition from emerging players, like Watershed, as well as larger incumbent platforms, like Salesforce and Microsoft. Persefoni’s success going forward will depend, at least in part, on its ability to continue to see adoption among large corporations and financial institutions, and the establishment of key partnerships for distribution and awareness.

*Contrary is an investor in Patch through one or more affiliates.