Thesis

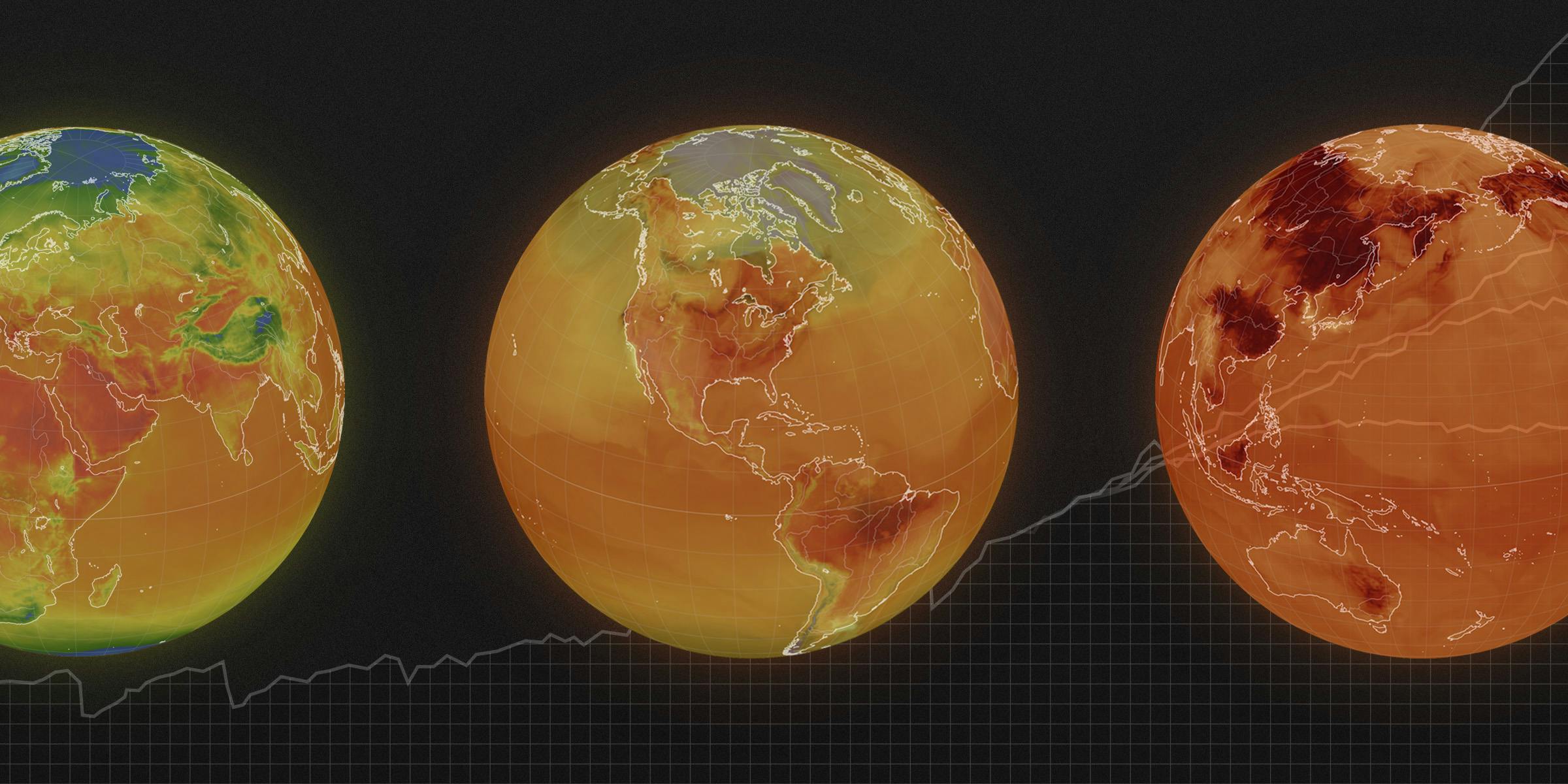

Starting in 2022, macroeconomic conditions began forcing some corporations to tighten their budgets. However, governments like the US and EU have been in talks to implement mandatory corporate emission reporting. In January 2023 the EU created mandatory ESG reporting rules, which mandate European and non-European companies operating in Europe to file annual sustainability reports.

Corporations may have no choice but to measure and report their carbon emissions. Even before accounting for future mandatory carbon accounting, the voluntary carbon offset market is set to grow over 25% annually from 2022 to 2028. Over one-third of the world’s largest 2K companies had published net zero carbon targets as of June 2022. Companies are shifting to net zero carbon goals due to consumers’ focus on sustainability.

Watershed is a software platform aiming to help companies decarbonize their operations. The company provides both a carbon accounting platform for customers to accurately measure and track their carbon footprint and a carbon offset marketplace. Watershed’s marketplace helps corporations find and buy carbon offsets that meet their corporate goals. By purchasing carbon offsets through Watershed, corporations can meet their net-zero commitments. For example, corporations can fund projects to help reforest the Amazon and get carbon credits in return.

Vetting carbon offsets and educating customers are key pain points addressed by Watershed. By providing a full suite of services Watershed’s vision is to become the one-stop shop for corporate sustainability teams. Watershed’s suite of services includes measuring, reducing, and reporting carbon emissions.

Founding Story

Watershed was founded in 2019. Watershed’s founders, Taylor Francis, Avi Itskovich, and Christian Anderson, developed a passion for fighting climate change starting at a young age. Taylor, for example, watched Al Gore’s An Inconvenient Truth in middle school. The documentary inspired a passion leading him to join Al Gore’s Climate Reality program. While participating in the program at the age of 18, Taylor traveled to speak about climate change.

The three founders of Watershed began working together at Stripe. Stripe is a financial technology company with a reputation for being active in the climate space starting in 2017 when the company set the goal to become carbon neutral. During his time at Stripe, Watershed's co-founder Christian Anderson helped launch Stripe Climate. Stripe Climate serves as a vehicle to receive corporate donations to fund carbon removal projects. Nan Ransohoff, Stripe’s Head of Climate, founded Frontier, an advanced market commitment of $925 million from companies like Stripe, Alphabet, and Shopify, to fund permanent carbon removal between 2022-2030, the most significant commitment of its kind.

In an overview of Watershed’s founding story, Mario Gabriele described Anderson’s involvement in Stripe’s climate efforts this way:

“In 2019, Anderson was given a chance to further the company’s climate commitment, outlining the new approach in an August blog post, ‘Decrement carbon.’ In it, Anderson stated Stripe’s promise to pay for the direct removal and long-term sequestration of carbon dioxide “at any available price.” Stripe didn’t just want to be carbon neutral; it wanted to be net-negative. To meet that goal, the company committed to spending twice as much on sequestration as offsets, with a minimum of $1 million per year. In the words of one former Department of Energy official, it was a 'breathtaking and audacious' initiative.”

Product

Measure

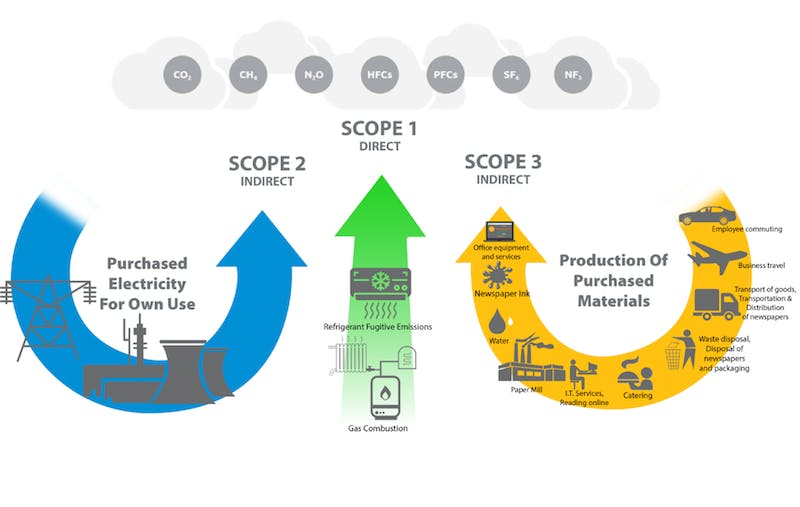

Measuring emissions for any company can be a resource-intensive process that can require hours of analyzing operations. To better understand different types of emissions, the Greenhouse Gas Protocol outlined three scopes of emissions, Scope 1, Scope 2, and Scope 3. Each scope consists of different types of emissions:

Scope 1: Direct emissions from owned assets (e.g. facilities, equipment, or vehicles)

Scope 2: Indirect emissions (purchased electricity, heating, or cooling)

Scope 3: All other indirect emissions, typically from a 3rd party (transportation, distribution, waste, energy, fuel, travel)

Source: Compare Your Footprint

Measuring direct emissions involves significant data collection from expense reports, APIs, and manual reports. Meanwhile, measuring upstream and downstream emissions requires deep collaboration with external stakeholders. Because of the complexity of measuring emissions, companies will often use industry averages to estimate their likely emissions. However, using industry averages creates a lot of room for error, with some error rates as high as 40%. Companies tend to even omit Scope 3 in their emissions-reduction goals, despite it containing 88% of a company’s emissions on average, because of the complexity of estimating.

In April 2023, Watershed announced the acquisition of VitalMetrics, the creator of the Comprehensive Environmental Data Archive (CEDA). CEDA, as a data asset, is possibly the most exhaustive database of emissions coverage globally. The company claims to cover 95% of global emission types. Having access to this data enables Watershed’s customers to more confidently estimate their own emissions.

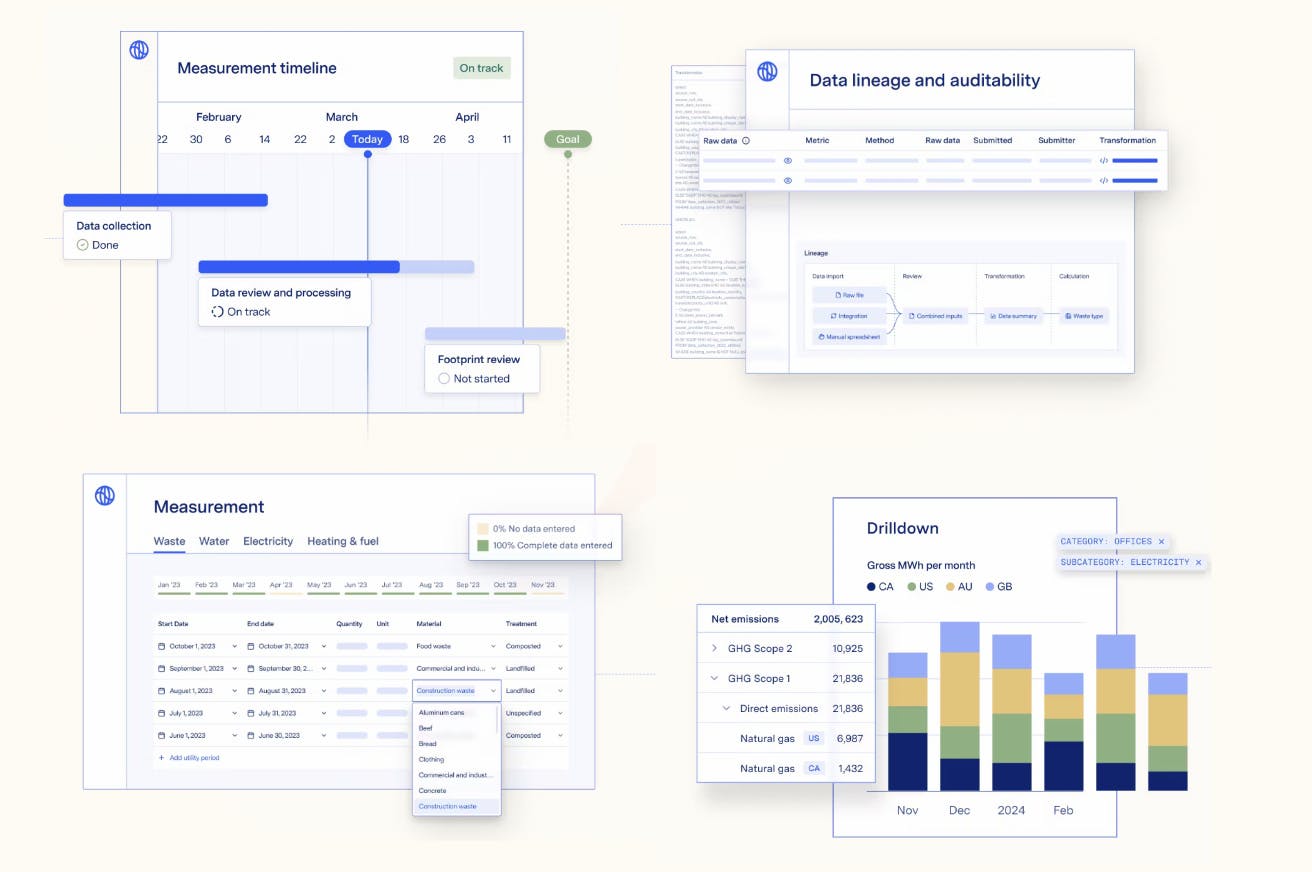

Watershed claims to streamline emission measurement using customer data to estimate a company’s Scope 1, 2, and 3 emissions. For example, Watershed will use an Excel spreadsheet or a purchase order PDF to estimate emissions. Watershed also works with a company’s suppliers to accurately assess a company’s Scope 3 emissions. In November 2022, Watershed announced a supply-chain emissions tracking module to better address Scope 3 emissions with a “combination of public and private data from suppliers to estimate the emissions footprint of the larger supply chain.”

One example of a Watershed carbon measurement customer is Sweetgreen. Watershed can work with the farmers supplying Sweetgreen's ingredients to assess emissions. This leads to more accurate carbon footprint assessments compared to relying on industry averages. If Sweetgreen chooses to source from a farm with greener practices, it would reduce its Scope 3 footprint. Without supplier-specific carbon footprints, Sweetgreen would have relied on industry averages, providing little incentive to switch to a greener supplier.

Source: Watershed

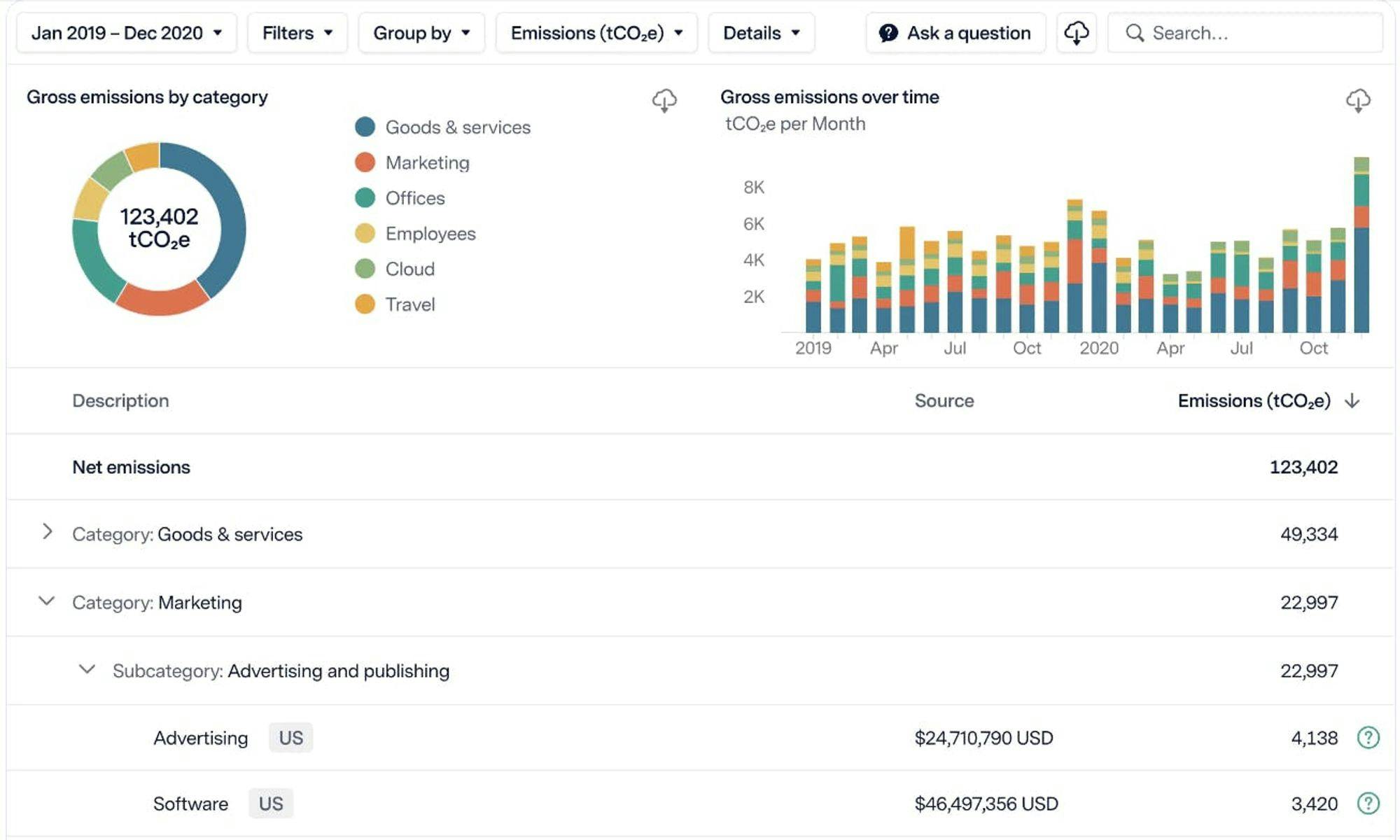

A dated view of Watershed’s product that is no longer on its website shows an expense item-level drilldown to illustrate the exact emissions coming from particular expense areas (e.g. advertising, software, etc.).

Source: Watershed

One expert indicated that the process of collecting data for emissions can consist of gathering “20 CSVs from 20 different departments.” In January 2022, one customer of Watershed indicated that the company didn’t offer an API to ingest data, making it unclear how manual the process is for data ingestion and measurement.

Report

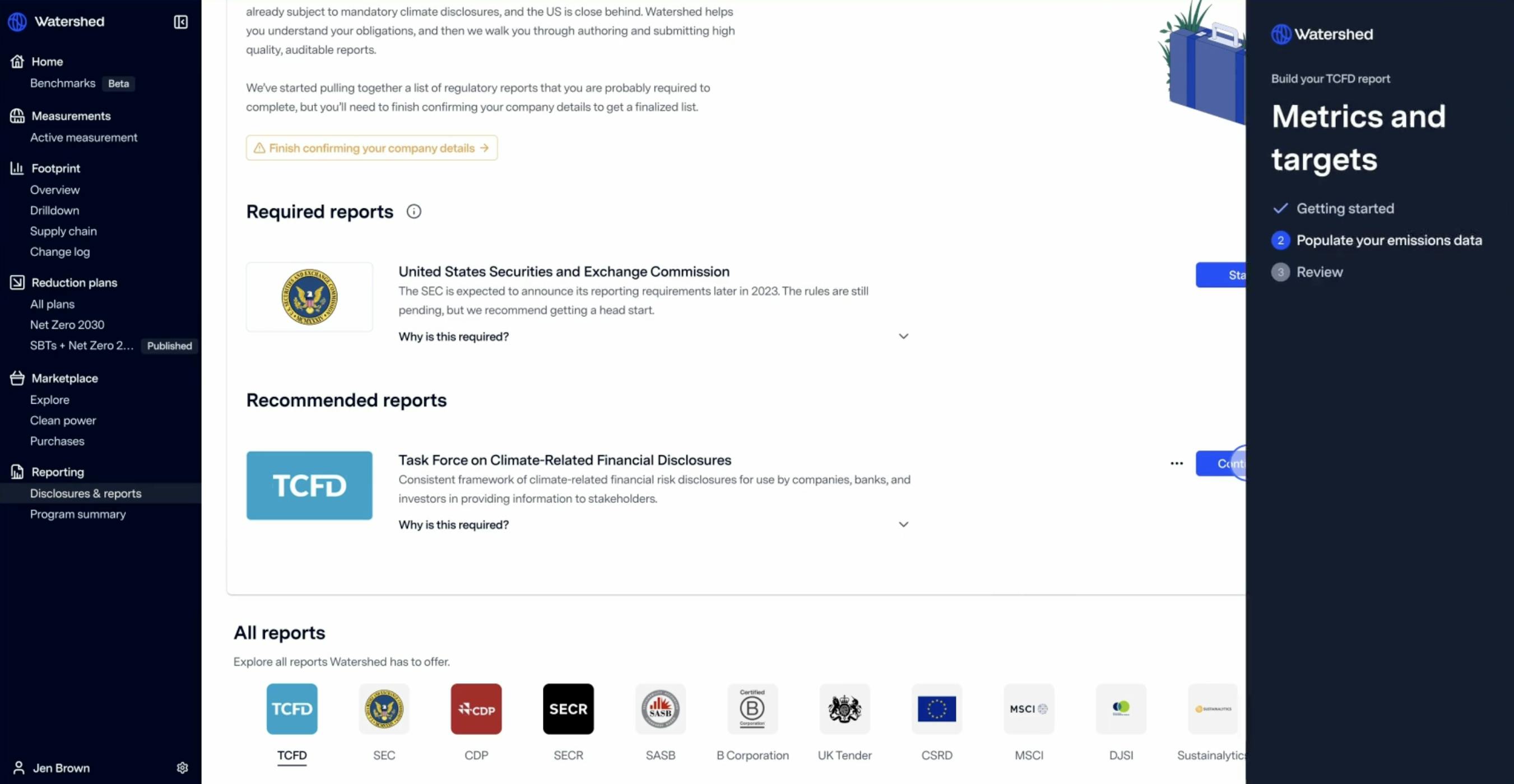

Source: Watershed

The need for carbon measurement and accounting can be driven by both voluntary and mandatory markets. As of November 2023, the majority of carbon markets are still voluntary. However, the growth of regulations will increasingly require companies to measure and manage their emissions. However, governments like the US and EU are in talks to implement mandatory corporate emission reporting. In July 2023, the EU implemented new mandatory ESG reporting laws.

In order to comply with these types of regulations, or to satisfy shareholders in voluntary carbon markets, companies must create reports and communicate their efforts. With so many standards for reporting on greenhouse gas emissions (TCFD, CDP, SASB, to name a few), drafting reports consistent with each standard can be an arduous process for a company looking to report how it is taking climate action. Watershed’s software helps automate report generation to comply with reporting standards.

The first step is to identify relevant disclosure requirements. Addressing those disclosures can often include the creation of dozens of different reports. As a result, Watershed’s product both flags relevant disclosures, and then helps customers build these reports using existing data in the Watershed platform.

Act: Reductions & Progress Tracking

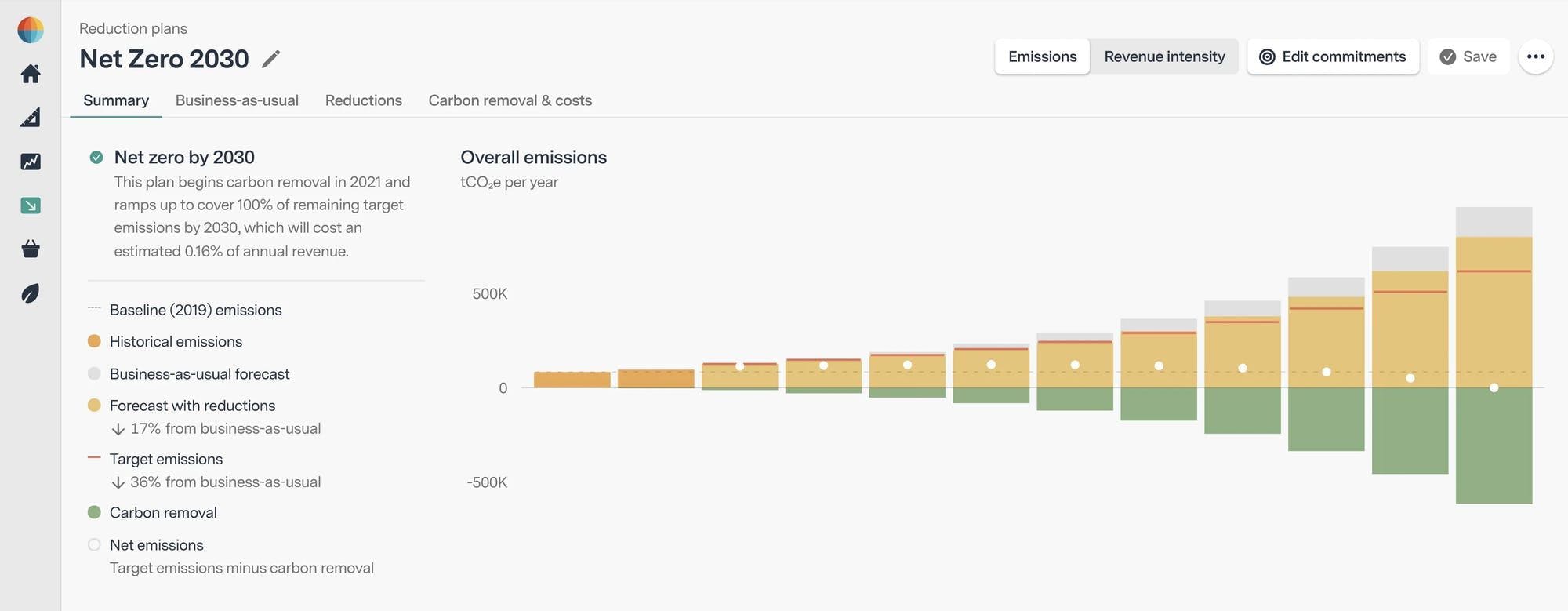

Source: Watershed

Most companies are not measuring and reporting their emissions in order to simply maintain the status quo. Instead, companies are using emission measurement as the first step towards reducing emissions. Typically, a consulting firm would help a company identify the most effective strategies to reduce their particular type of emissions. Watershed, on the other hand, provides an interactive dashboard for sustainability teams to identify high ROI emissions reduction activities. The dashboard also models emissions scenarios using different assumptions.

Carbon Offset Marketplace

Source: Watershed

As much as companies can measure and attempt to reduce their emissions, there are often a subset of emissions that can’t be reduced. Instead, these companies can purchase carbon offsets commensurate with their unavoidable emissions, allowing the company to achieve net zero emissions.

Carbon offsets are created by firms who either avoid emissions (e.g. using renewable energy vs. fossil fuel-based energy) or projects that offset negative carbon activities (preventing deforestation) or remove carbon from the atmosphere and store it somewhere (e.g. naturally through planting trees or using advanced technology to remove CO2 and store it underground).

While Watershed has had a carbon offset marketplace for several years, in September 2023 the company announced an expanded ecosystem of partners and advisors focused on enabling high-quality offsets. This ecosystem can educate its customers on selecting a portfolio of offsets based on type (e.g. nature-based offsets like tree-planting vs. Direct Air Capture (DAC) projects), quality (based on the permanence of the carbon removal, or how verifiable the reduction is), or other important factors.

While the market for carbon offsets is expected to grow from $2 billion in 2020 to around $250 billion by 2050, there is still a meaningful amount of skepticism in terms of carbon offsets quality, including reports from The Guardian, Bloomberg, and Vox.

Market

Customer

Large companies like Microsoft and Ford making commitments to reach ambitious goals of net zero emissions create a big driver for carbon accounting and offsets. The internal buyer of emissions measuring and reporting services can change depending on the company, but will often be driven by a corporate social responsibility team, or a compliance team. 90% of Fortune 500 companies publish some kind of ESG reporting, and increasingly companies are deploying budgets for solutions to help them.

Market Size

As companies grow in size and complexity, it becomes increasingly difficult to measure a carbon footprint. As a result, most companies looking to purchase carbon accounting solutions likely have 250+ employees. In the US alone, there are 164K+ companies with over 250 employees. As a result, assuming an annual contract value of $50K-$100K, that represents a market opportunity of between $8.2 billion and $16.4 billion for Watershed to address.

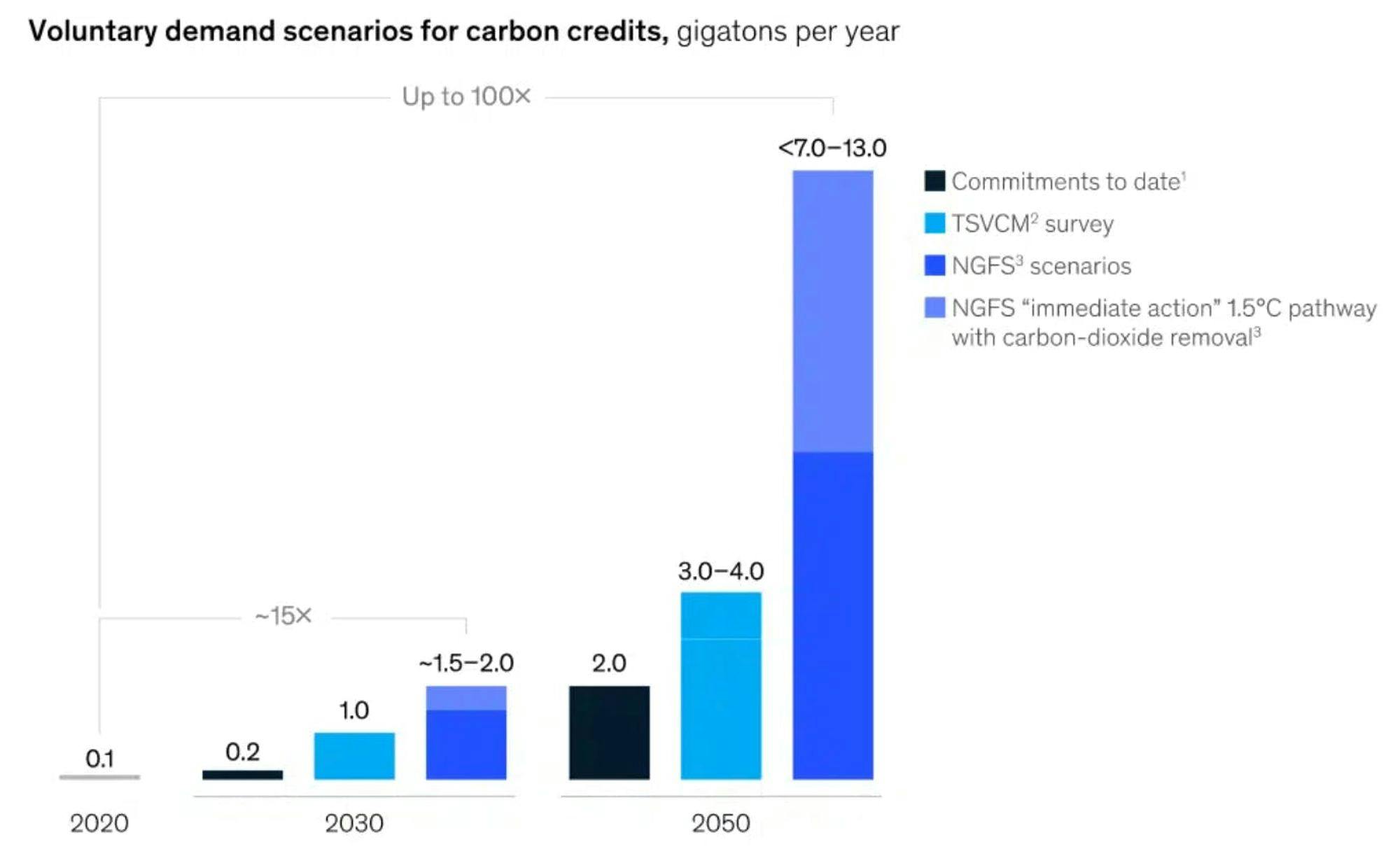

Third-party estimates of the size of the carbon accounting market at $12.7 billion in 2022, and expected to grow to $64 billion by 2030. For carbon offsets, while the market was estimated at $2 billion in 2022, the volume of carbon offsets issued dropped by 21% in the face of macroeconomic uncertainty. Going forward, the demand for voluntary carbon offsets is expected to grow by 100x from 2020 to 2050 as more companies look to limit their carbon footprint and achieve net zero goals.

Source: McKinsey

There are expected regulatory changes from the SEC that would require climate disclosures from corporations. Many of Watershed’s customers use Watershed to help report annual progress on climate goals (e.g., DoorDash’s* ESG report) in order to generate positive PR. If climate reporting becomes mandatory, Watershed’s market size will increase dramatically as corporations scramble to become compliant.

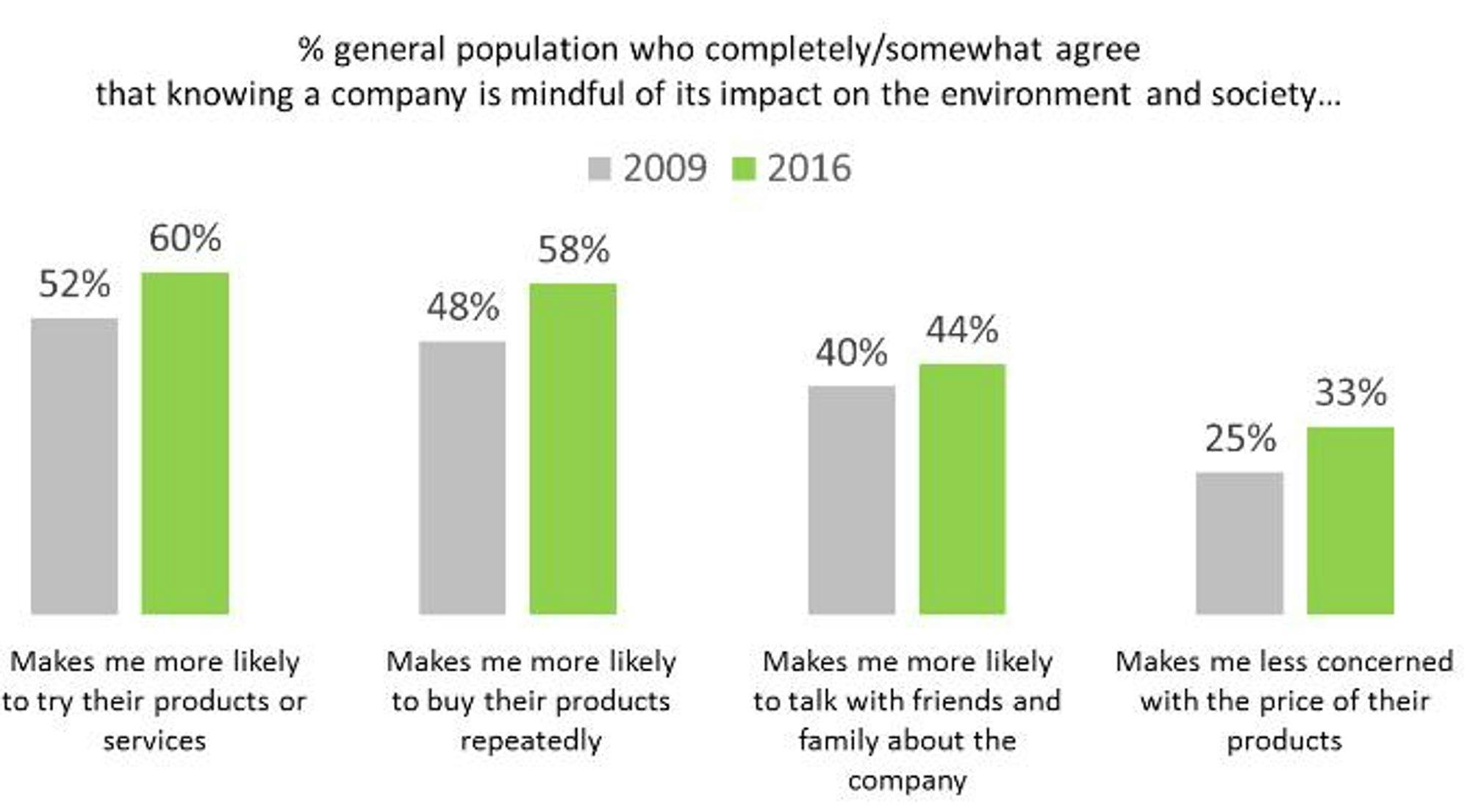

Consumers are also starting to care more about the environment. Studies estimate that 85% of consumers are shifting to more eco-conscious buying habits. As consumers continue choosing “green” products, brands can set themselves apart by adopting more sustainable practices. They can start measuring and reducing their carbon footprints — exactly what Watershed is built to do.

Competition

Source: Contrary Research

Watershed’s primary function is as a carbon accounting platform, competing with products like Persefoni and Sinai. One key difference between Watershed, Persefoni, and Sinai is in their customer bases. Persefoni seems to tailor its product for asset managers, while Sinai focuses on resource-intensive industries like transportation, mining, and construction. Watershed focuses primarily on customers in tech and direct-to-consumer (DTC) businesses. In theory, the carbon footprint of tech and DTC businesses is straightforward, given their relatively simple value chains.

In addition to other carbon accounting startups, Watershed also competes with other carbon offset marketplaces like Patch*, and enterprise solutions from incumbents like Microsoft and Salesforce.

Carbon Accounting

Persefoni: Founded in 2020, Persefoni is a carbon accounting platform built to automate manual calculations of company carbon footprints. Persefoni enables customers to more effectively aggregate their various datasets to calculate their carbon footprint, display carbon sources, and generate reports. The company has raised a total of $164 million in funding, and claims to have customers including four of the top 10 largest PE firms and four of the top 20 banks.

SINAI Technologies: Founded in 2017, SINAI is a carbon accounting platform focused on helping customers measure and reduce carbon emissions using guidelines around science-based targets. The company has customers such as BMO, Siemens Energy, and Penn Engineering. Since its founding, SINAI has raised a total of $36 million in funding from firms like Energize Capital and Obvious Ventures.

CarbonChain: Founded in 2019, CarbonChain is a carbon accounting platform specifically targeted at manufacturers, commodity traders, and their banks. Companies tied to physical supply chains have a more complex emissions footprint, and can also access unique sustainable financing if they can demonstrate emissions measurement and reduction. Customers include Lloyd’s, Concord, and Gunvor.

Sweep: Founded in 2020, Sweep is a carbon accounting platform built with international reporting standards in mind for both companies and financing partners. The company is based in Paris, with customers like Balderton and Ubisoft, and has raised $100 million in funding from firms like Coatue.

Carbon Offset Marketplaces

Patch*: Founded in 2020, Patch is a digital marketplace and set of APIs that helps businesses find and purchase carbon offsets to reach their net zero goals. Patch's marketplace includes a variety of carbon offset projects such as reforestation, seaweed protection, and landfill gas capture. In addition, Patch's APIs allow companies to include carbon offset options in their checkout process, enabling customers to offset the emissions from the products they purchase. The company claims to have 200+ customers including Autodesk, Visa, Deloitte, Persefoni, and IDEO. As of September 2022, Patch has raised $82 million in total funding.

Pachama: Founded in 2018, Pachama is a carbon credits marketplace and monitoring software to verify projects' impact. It uses satellite imagery, LiDAR imaging, and remote sensing to measure the carbon stored in forests over time and detect changes to the forest including events like illegal logging. The company shares insights from this monitoring with both carbon offsetters and project developers. Pachama works with enterprises like Shopify, Salesforce, Flexport, and Workday, and as of May 2022 the company had raised $79 million in total funding.

Sylvera: Founded in 2020, Sylvera is a data-driven ratings agency that evaluates the quality of different carbon offset projects. Sylvera is more of an adjacent player to Watershed, rather than a direct competitor. Potentially, Watershed could use Sylvera to quantify the quality of offsets available on its platform. Sylvera works with customers like Chevron, Mitsubishi, Salesforce, and Shell, and as of July 2023, the company had raised $95 million in total funding.

Enterprise Offerings

Microsoft: In October 2021, Microsoft announced the launch of Microsoft Cloud for Sustainability. The product points to similar goals of helping customers record, report, and reduce their carbon emissions. Some customers of Microsoft’s solution include Grupo Bimbo, Ingredion, and FLSmidth. Historically, Microsoft has been a large buyer of carbon offsets, with purchases in 2022 estimated at 1.5 million metric tons.

Salesforce: Another large buyer of carbon offsets has been Salesforce since 2017. In September 2022, Salesforce announced the launch of its own carbon credit marketplace, initially launching with 90 projects. Offset projects extend across categories like forestry, land use, and renewable energy, and can be bundled into collections of offsets.

IBM: In January 2022, IBM acquired Envisi, a platform to automate the collection and consolidation of more than 500 data types and supports major sustainability reporting frameworks. IBM Envisi’s product has modules across scopes 1, 2, and 3, as well as ratings, reporting, and decarbonization efforts. Envisi’s customers are primarily in Australia, with names like Melbourne Water and Growthpoint.

Business Model

While Watershed’s pricing model is not public, it seemingly charges an annual subscription for the product. Companies like Persefoni and Salesforce reportedly charge between $48K and $260K.

Some verticals can be significantly more complex for Watershed to serve than others. For example, an automotive customer’s emissions profile vastly differs from a SaaS company. Watershed would need to train its emissions models from scratch for its early automotive customers. As a result, Watershed’s revenue model is likely more scalable within a vertical and not as scalable across verticals. Each new vertical requires R&D and potentially a different go-to-market strategy.

Traction

Source: Watershed

While it is unclear exactly how many customers Watershed has, notable companies working with Watershed include Airbnb, Spotify, Stripe, Warby Parker, and Pinterest. While Watershed’s revenue is not public, its logo list as of November 2023 contains 48 unique logos. Some unverified sources have indicated Watershed’s customer count could be ~250.

Some unverified sources have indicated Watershed's revenue could be ~$25 million, which could indicate an average contract value (ACV) of ~$100K depending on the actual total count of Watershed’s customers.

Valuation

In February 2022, Watershed announced a $70 million Series B at a $1 billion valuation from previous investors Kleiner Perkins and Sequoia. In June 2022, Watershed announced a $55 million extension of the prior Series B. Later, in June 2023 Watershed announced an expansion of its partnership with Lowercarbon Capital and shared that the firm had previously invested in the company’s Series B, seemingly indicating the Series B extension.

Both Watershed’s initial Series B and the company’s prior Series A in February 2021 were led by John Doerr of Kleiner Perkins and Michael Mortiz of Sequoia. The last time these two investors co-led an investment was their 1999 investment in an early round for Google. Other investors include former Vice President Al Gore, and Steve Jobs’s widow, Laurene Powell Jobs.

While the company’s rise has been significant, reaching a $1 billion valuation in ~2.5 years after founding; faster than companies like Stripe, Uber, and SpaceX, understanding the long-term value of the company is more difficult, as carbon accounting platforms are still relatively nascent and there are few comparable companies to understand how Watershed would be valued in the future.

You could potentially compare Watershed to ERP platforms like Oracle or SAP, or vertically-focused ERPs, like Veeva or Toast. If Watershed is successful the company would be considered a core system of record for managing carbon accounting. These types of ERPs can trade anywhere from 2-11x LTM revenue.

Source: Koyfin

Key Opportunities

Increasing Demand for Eco-Friendly Products

A large part of the rise in carbon accounting startups like Watershed is due to the growing number of net zero commitments. Over a fifth of the world’s largest 2K companies are publicizing net-zero targets. Growing consumer interest in products and services sold by impact-oriented companies is driving the rise in net zero commitments. Watershed is set to benefit from the consequences of consumer trends driving more companies to make net zero commitments.

Source: New Hope

Regulatory Tailwinds

Regulatory tailwinds could accelerate the need for companies like Watershed. Climate disclosures could become mandatory in the near term. In Europe, the EU now requires companies to submit climate-related disclosures starting in the 2023 fiscal year, while the SEC in the US proposed similar rules to standardize climate disclosures in March 2022. In the UK, since 2022 companies also have to make climate-related disclosures.

As of mid-2023, there were talks of other climate-related political tailwinds, like carbon taxes at the state level in the US or carbon emissions tariffs on imports into the EU. Any such legislation would accelerate the use of software platforms like Watershed to measure and report emissions.

Data Intelligence

In order to be accurate and effective, Watershed will need to be able to ingest a large amount of data from its customers. Over time, that data would enable Watershed to differentiate itself using data intelligence. For example, if Watershed were to work with dozens more companies like Sweetgreen, it would build a robust inventory of data on the food value chain, differentiating itself in its ability to serve customers in the food space. As a result, it could acquire customers in the food space more efficiently, accelerating a growth flywheel in the vertical and deepening its moat.

Key Risks

Saturating Initial Target Market

The majority of Watershed’s customers are technology companies. That sector concentration could be a risk as penetration increases, and Watershed is forced to expand into new verticals. Watershed might have to spend significant R&D and business development resources to serve new verticals. Growing to serve new verticals opens up Watershed to more competition that may prove challenging to overcome. Watershed might find it challenging to enter new verticals, especially in complex and manufacturing-heavy value chains, like automotive.

For example, automotive companies like Ford might want to see evidence of Watershed’s software streamlining the measuring and reporting process. To measure and report emissions using software, Watershed would need data on the automotive supply chain’s emissions, but it cannot gather relevant intelligence without an automotive customer.

The challenge of entering new verticals is evident in their software-heavy logo list. As a result, industries like automotive could continue to rely on standard consulting firms or go to a Watershed competitor like Sinai with more manufacturing experience.

Economic Slowdown Affecting Customers

Without emissions measurement and reporting regulations, companies’ net zero commitments are voluntary. In a recessionary environment, corporations may tighten their budgets. They might spend less on voluntary initiatives to conserve cash for necessary expenses, like payroll. Layoffs at some of Watershed’s customers, like Allbirds, Klarna, Stripe, and Warby Parker, indicate the company could see logo churn or declining net revenue retention as its customers prepare for an economic downturn.

Product Differentiation

With notable competitors like Persefoni and Sinai, Watershed could struggle with product differentiation. As of November 2023, it seems competitors differentiate themselves by their go-to-market approaches and customer bases, but it may not be a long-term differentiator. Watershed does seem to be building a portfolio of tools, starting with its carbon offset marketplace. Still, Persefoni follows the same strategy by launching its carbon offset offering in partnership with Patch*, a carbon offset API startup.

Summary

Watershed’s platform represents the necessary aspects for any climate program: the ability to measure, reduce, and offset any carbon emissions. While the market for climate solutions continues to grow to meet demand, there are obstacles to the growth. The fluctuating legislation, particularly in the US, can impact how much of this market is voluntary vs. mandatory. There are also a number of competitors tackling different verticals with specialized climate programs. Watershed’s opportunity is to continue to expand its coverage of different verticals and increase its platform capabilities across the climate market.

*Contrary is an investor in DoorDash through one or more affiliates.