Thesis

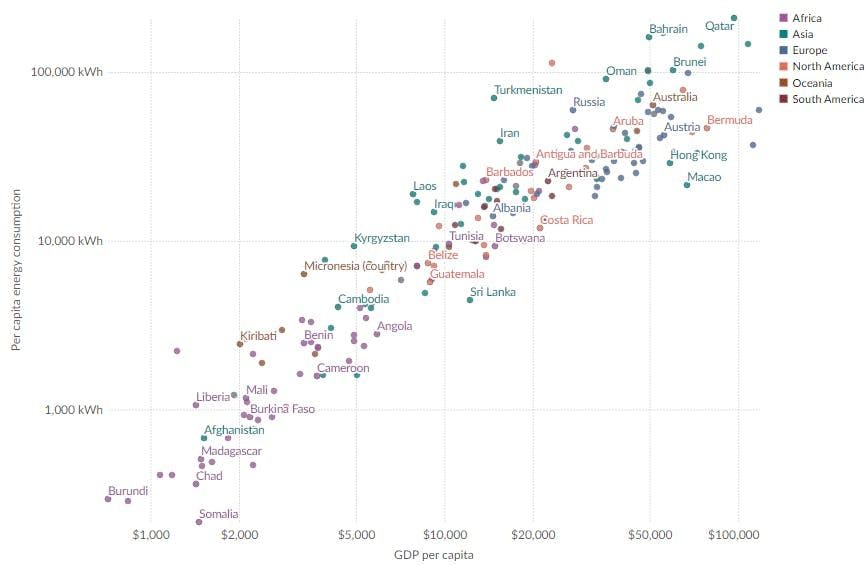

Throughout history, the abundance of energy has been correlated with human prosperity. Societies that have harnessed new and plentiful energy sources, whether through agriculture, industrialization, or modern electricity generation, have experienced significant advancements in technology, economic growth, and quality of life. Access to reliable energy is crucial for economic development and improved living standards.

Source: Our World in Data

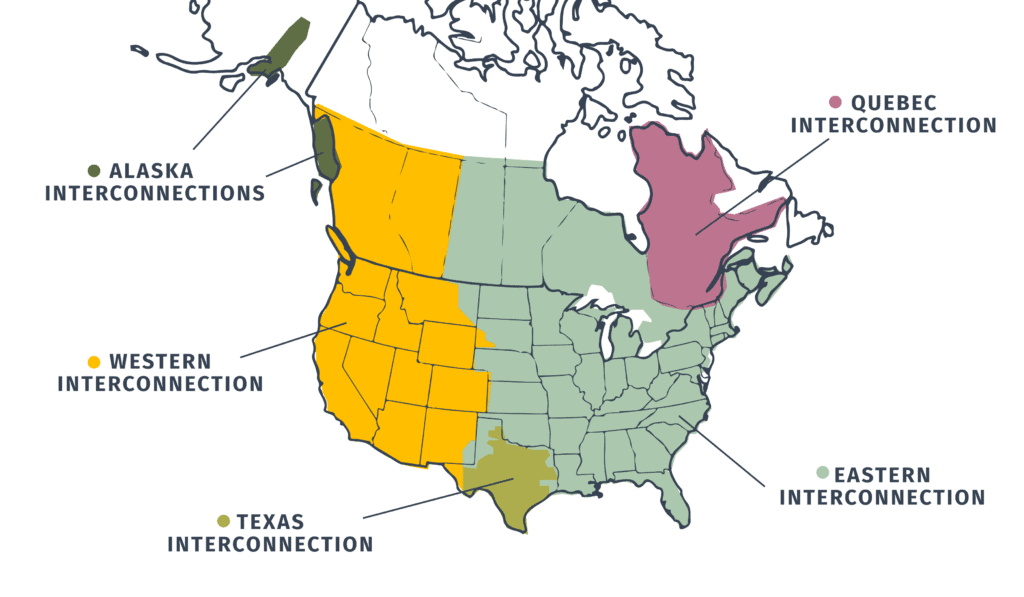

Reliably distributing energy to consumers across the country requires a vast infrastructure of transmission lines. The electrical grid is the largest and most complex machine in the world, connecting over 12.5K power plants in the US alone, with more than 160K miles of high-voltage power lines and millions more miles of low-voltage distribution lines.

The first grid in the United States dates back to 1882 when Pearl Street Station, the first commercial power plant, began generating electricity. In modern times, there are four grid interconnections in the United States: Western, Eastern, Texas, and Alaska. The Texas grid is effectively an island, and the grid is separated due to political reasons.

Source: SimpleThread

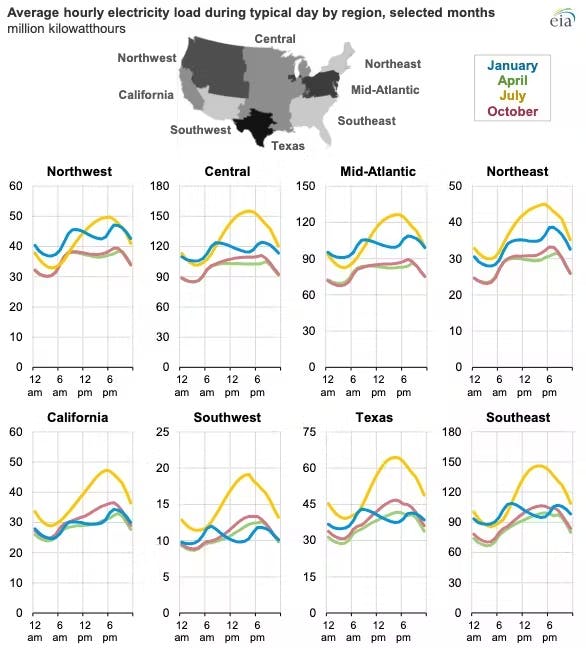

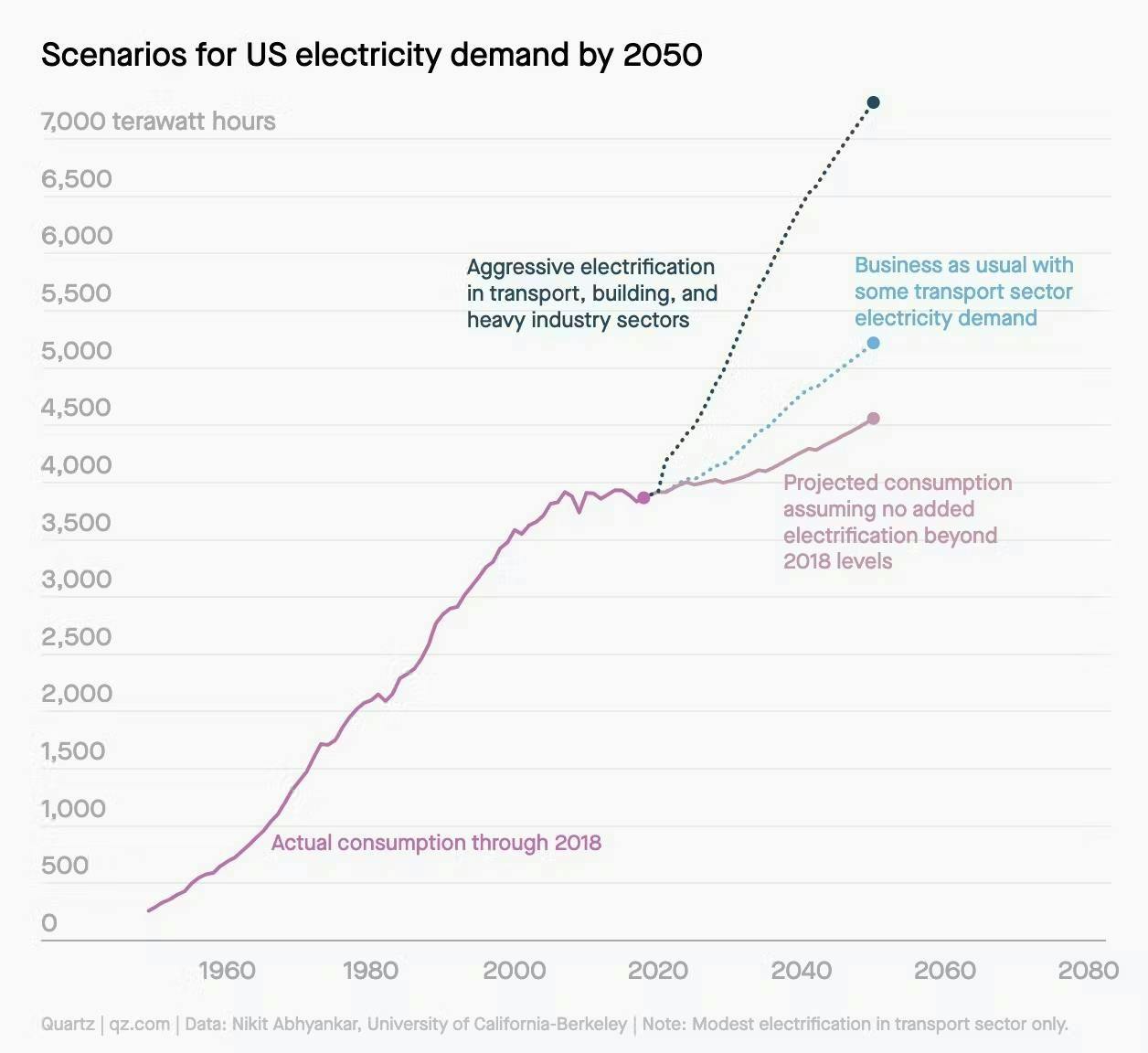

The US is rapidly electrifying its economy, making average electricity consumption significantly higher and less predictable. Projections indicate that rapid electrification could increase total electricity demand by as much as 35% by 2050. Increased use of EVs and heat pumps, in particular, could double a household's electricity consumption, as EV batteries alone store the equivalent of two to three times the average daily household power use. Global spending on electrification technologies and other clean infrastructure upgrades is on track to reach $3.3 trillion in 2025. Many states, like California, are mandating all vehicles sold after 2035 to be electric, heightening the urgency to ensure that the electric grid can keep up with future demand.

Source: Quartz

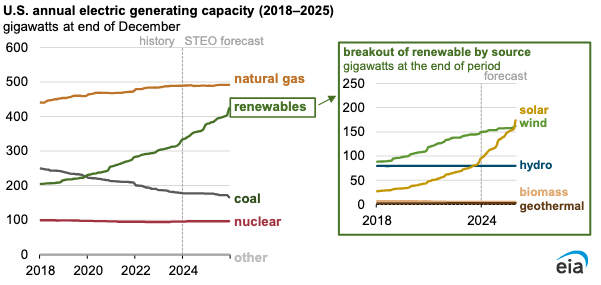

Most of that new demand will be met by renewable energy sources. Solar energy, in particular, has become the “cheapest source of electricity in history”; in 2022, the world surpassed one terawatt in total solar installations. In some states like Texas, renewables generated about 30% of all power in 2024. The queue for proposed new power projects is also dominated by solar and wind nationwide. Renewable energy sources, however, are intermittent. Compared to traditional electricity sources like coal and gas, wind and solar power depend on the weather, making electricity generation unpredictable. As renewables’ share of production capacity increases, energy supply will become more volatile with excess energy during the day and shortages at night.

Source: eia

However, the electric grid is not prepared for this increased power demand and an increasingly volatile supply of energy. The grid has been built to balance a stable supply of electricity to meet a predictable demand. Moreover, the distribution infrastructure is aging quickly, as 40% of the grid infrastructure was built before the 1970s.

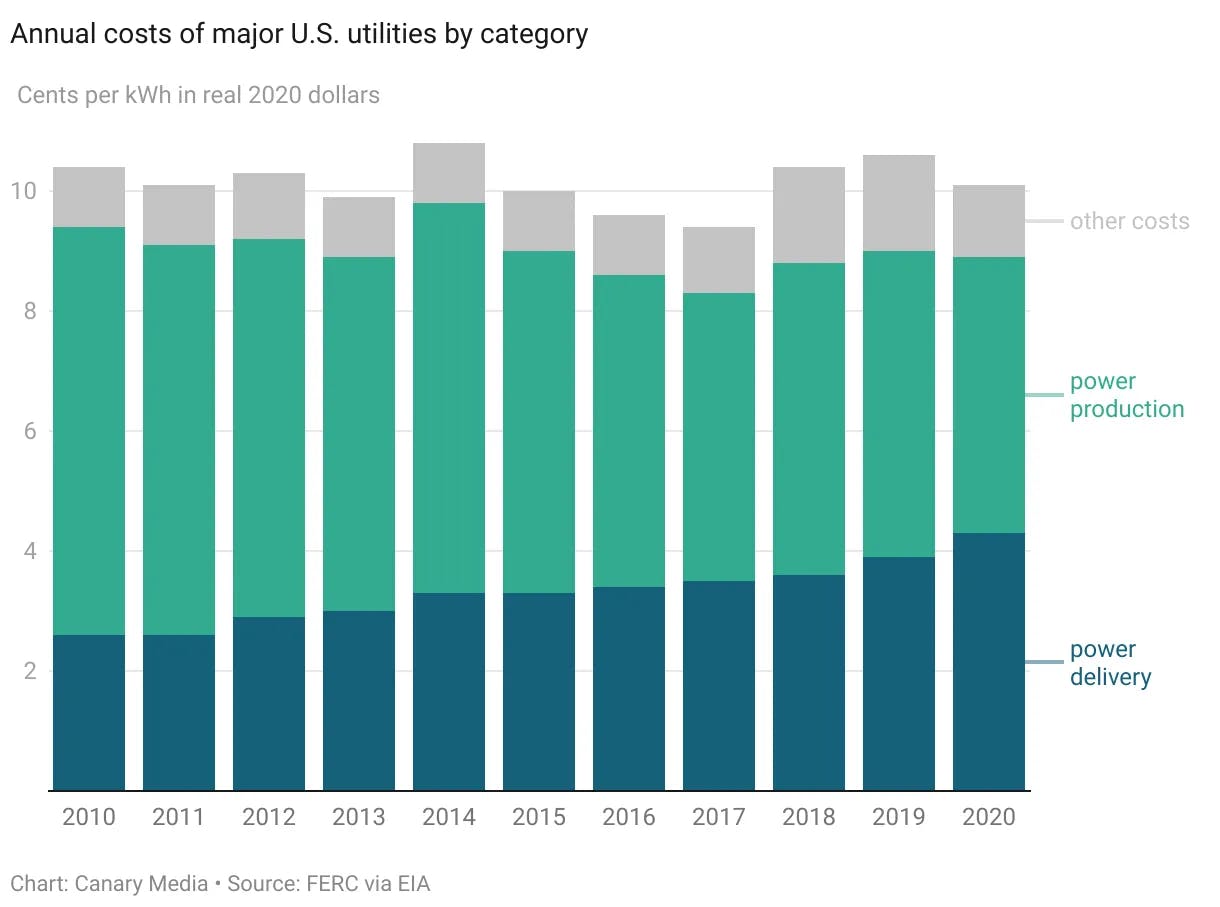

Despite cheaper generation costs from renewables and natural gas, customers are suffering higher prices as costs for delivering electricity increase. As electricity demand grows, these delivery costs rise because transmission lines must be built to handle peak loads, which are costly to construct and maintain. Meanwhile, the average length of electricity outage per customer increased from about 210 minutes in 2013 to over 335.5 minutes per year in 2022.

Source: FERC via EIA

The Texas power grid faces acute distribution challenges due to its heavy reliance on renewables, which makes energy supply more variable. After a historic winter storm in 2021, more than 4.5 million homes, approximately a quarter of all residences, were without power for several days. Texas utility operators allowed the price of electricity to go up to $9 per kilowatt-hour, resulting in electricity bills of thousands of dollars for many residents. This extreme incident highlights how the combination of grid stress, variable supply, and rising costs affects electricity delivery.

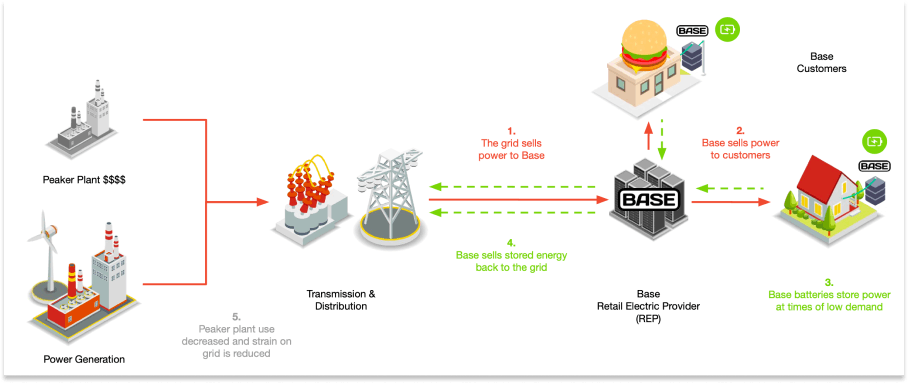

Base Power*, also known as Base, aims to relieve pressure on the grid by building a distributed battery portfolio. It uses a Retail Electric Provider (REP) model to distribute batteries to homeowners throughout Texas. Placing batteries next to homes solves both the supply volatility and demand volatility problems of the grid by allowing homes to store energy when demand and prices are low, and discharge when demand and prices are high, reducing stress on the transmission lines.

Base aims to become the “modern power company of the electric era” by offering its customers a reliable and affordable home energy service powered by a network of batteries. Base provides its customers with a home battery, monthly energy service, and installation. Base’s strategy is to start on the demand side, addressing grid bottlenecks, and eventually vertically integrate into energy. With enough customers and batteries, Base can optimize energy production, storage, and distribution, cutting out middlemen and lowering energy prices.

Founding Story

Source: Fort Worth Inc

Base was founded in 2023 by Zach Dell (CEO) and Justin Lopas (COO).

Dell, raised by an entrepreneur, was motivated early on to solve difficult problems through building companies. During college, he explored ways to expand access to affordable, reliable power, including a project in India converting human waste into biogas. His interest in energy deepened, and Dell became fascinated by batteries when he interned at Blackstone prior to his senior year of college in 2019. While there, he evaluated a lithium mine purchase and realized that battery storage was a large source of growth, and the US had underdeveloped infrastructure. After Blackstone, Dell joined Thrive Capital, where he attended as many meetings with battery companies as possible to better understand the space.

Lopas had a background in mechanical engineering and manufacturing. He graduated from the University of Michigan with a degree in mechanical engineering and began his career at SpaceX as a manufacturing engineer, later leading manufacturing engineering on Falcon Thrust Structures. At SpaceX, Lopas became one of the first four people building the Starbase in Texas and worked on Starhopper, the first prototype of the Starship program. In 2020, he joined Anduril* as Head of Manufacturing, leading a team of 150 people responsible for manufacturing engineering, operations, and supply chain.

Dell and Lopas met in late 2022, when Dell visited Anduril’s Costa Mesa factory as part of Thrive’s investment in Anduril. Lopas, then Head of Manufacturing at Anduril, gave him a tour of the facility. Dell and Lopas immediately got along and found a mutual interest in building something in the energy space.

The two identified the electric grid as the primary bottleneck to energy abundance, with batteries as the key to overcoming its constraints. They spent the next six months discussing interesting companies working in hardware and energy, pitching each other startup ideas. Those conversations led them to decide to start a company together.

Over the following months, they discussed a number of ideas and strategies for improving the grid. Their initial idea in February 2023 was an electrification platform for the built environment, starting with premium residential customers and eventually moving into high-volume home builders and commercial projects.

By April 2023, they refined their concept to a vertically integrated approach to create a modern electric utility. They decided they would focus on designing and selling battery packs optimized for residential homes, allowing consumers to generate, store, and sell energy. Between the two of them, they covered finance and manufacturing expertise, but they realized the company would also need to excel at distributed software systems, supply chain, and operations.

For that reason, they recruited Jared Greene as their Head of Software, who joined the company as part of the founding team in August 2023 to lead software and engineering. Greene previously worked at SpaceX, where he led engineering on the Starlink team. He saw a parallel between his work on Starlink and Base’s novel deployment strategy.

Product

Residential Battery Storage

The electricity market rests on three pillars: generation, transmission, and consumption. All three must work together for the grid to work effectively. However, the growing supply of intermittent renewable energy is making it difficult for grid operators to balance the supply and demand of electricity. Electricity transmission moves power at the speed of light, requiring that electricity generated must match electricity demand at all times to "balance the grid."

Since the grid lacks significant storage, it requires power generation to match consumption exactly. Historically, this was solved by using a combination of different electricity sources. Baseload power plants ran consistently to meet steady demand, while more expensive peaker plants were dispatched during higher demand periods. While natural gas plants were flexible and could be turned on and off easily, making them ideal for meeting fluctuating daily demand, renewables produced energy intermittently.

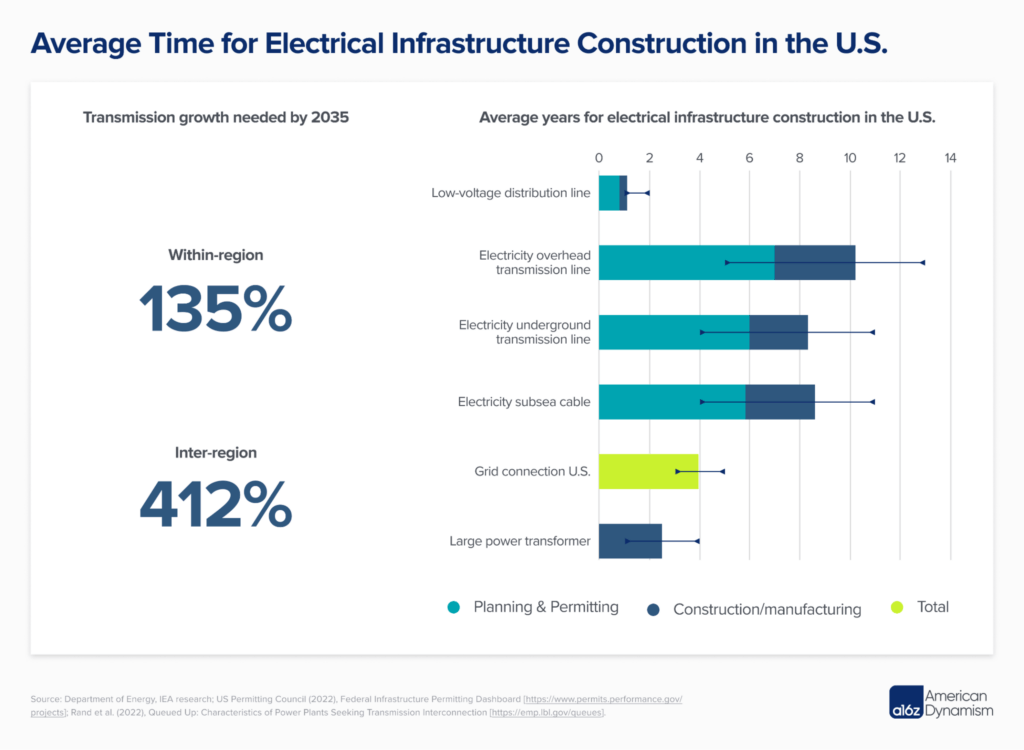

That formula is no longer sustainable as the economy continues to electrify. Instead of predictable supply meeting predictable demand, the grid now faces volatile supply meeting volatile and growing demand. Adding more transmission capacity is one solution, but modernizing or expanding the grid infrastructure is becoming harder, slower, and more expensive due to regulatory hurdles and project complexities. For example, building new high-voltage transmission lines is costly, estimated at $20-30 billion annually. The average overhead transmission line takes more than a decade to build, with seven years spent in planning and permitting alone.

Source: a16z

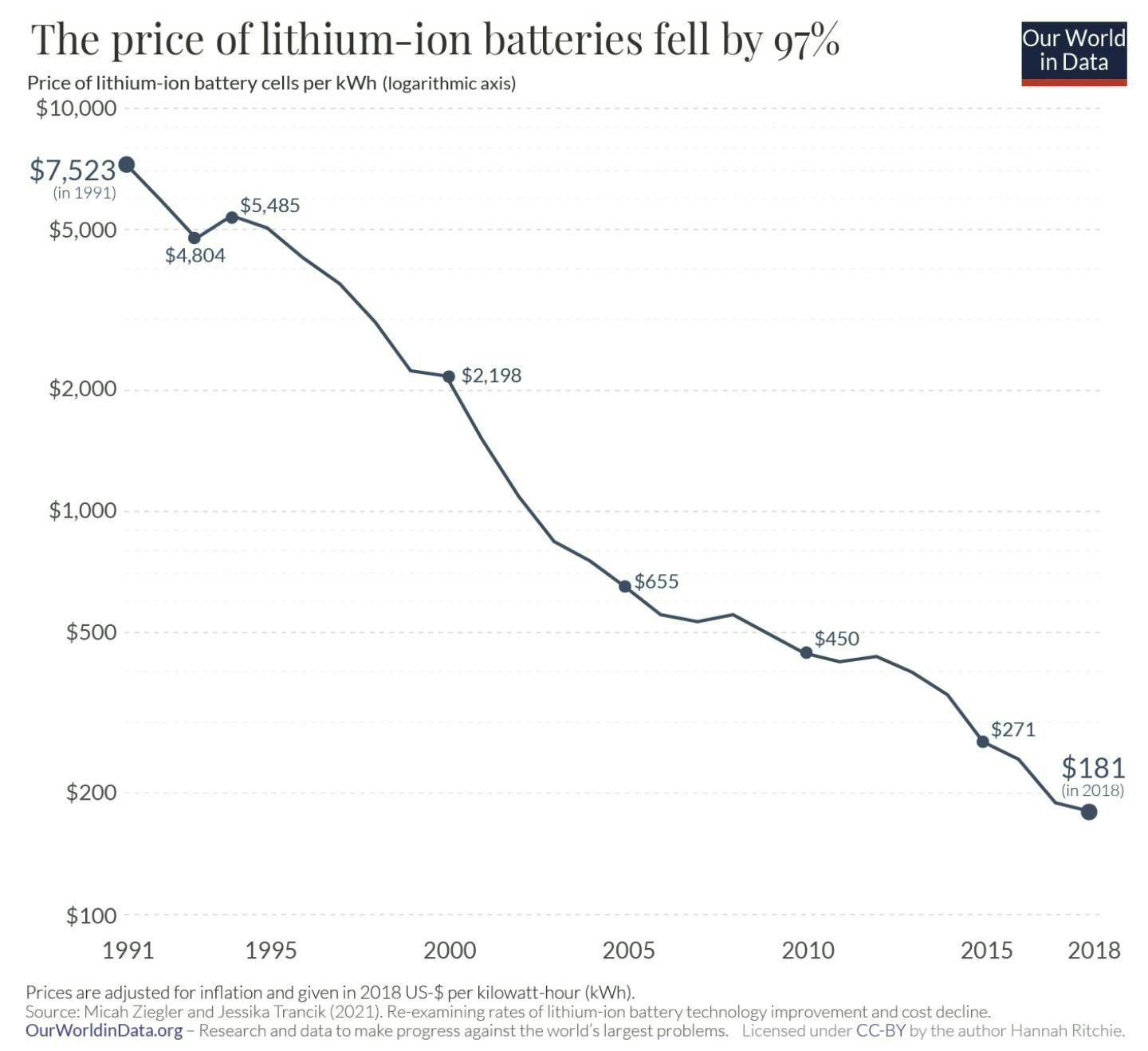

Adding storage capacity to the grid is another solution that can relieve pressure on the grid. Batteries, in particular, are getting cheaper, which is making them a more efficient solution than adding new transmission capacity. As described by Casey Handmer:

"Batteries and transmission are in direct competition. Both enable electricity arbitrage—the profitable repricing of a resource by matching different levels of supply and demand. Transmission moves power through space (technically null space, at the speed of light) and batteries move power through time."

Batteries are complementary to renewables, smoothing out demand and supply instability caused by variable energy sources like wind and solar, as well as enhancing the usability of stable energy sources like nuclear power by making them more dispatchable.

Load factor is the ratio of average power demand to peak power demand over a given period; a low load factor indicates wasted resources. For example, Texas's grid is sized for 85 GW but is running at a load of ~60-70 GW as of October 2025, resulting in a load factor of 70%.

Batteries can help maximize and stabilize load factor by charging when demand is low (thereby increasing trough demand) and discharging when demand is high (lowering peak demand), optimizing the use of existing infrastructure. As battery costs fall and challenges for adding transmission rise, batteries become more competitive for longer distances.

Source: Our World in Data

Installed battery capacity tripled from 5 GW to 15 GW between 2021 to 2023 and is expected to reach 40 GW by the end of 2025. A grid with storage reduces the need for generation overbuild, achieving high reliability with less infrastructure. Adding 12 hours of storage to the US grid could cost $500 billion and pay for itself quickly, compared to $7 trillion for transmission upgrades.

But battery deployment is still not progressing as quickly as it could because of interconnection queues. Most of the battery storage capacity in the US is concentrated in centralized grid-scale battery farms. This is due to cost, as batteries are expensive for individual customers. It costs approximately $15K for a unit that pays itself back in 12 years, even after the 30% IRA tax credit. Because of that, battery capacity is less valuable in individual homes, as customers cannot arbitrage price volatility as effectively as professional battery farm operators.

However, placing batteries in large storage farms next to electricity generation only helps in solving the supply volatility problem by storing excess energy generated during peak production times, for example, when it’s windy or sunny and peak power is not needed. The power must still be transmitted between the generation facility and the consumers to support the maximum load during high-demand periods. It does not help to smooth out the ”duck curve" caused by volatile electricity demand.

Large-scale grid battery deployments also face interconnection queues, on average waiting 4.8 years to connect to the grid. The only solution is deploying batteries on a smaller scale close to consumption centers, where they can be easily connected to existing grid connections.

Residential batteries, by contrast, sit directly at the point of consumption and solve both the supply volatility and demand volatility problems. It allows homes to store when demand (and prices) are low and discharge when demand is high. From the grid's perspective, homes with batteries draw only ~25% of their peak load, reducing stress on transmission lines. Making the deployment of batteries financially viable in consumption centers would be the most effective solution to ‘balance the grid’, both on the supply and demand side.

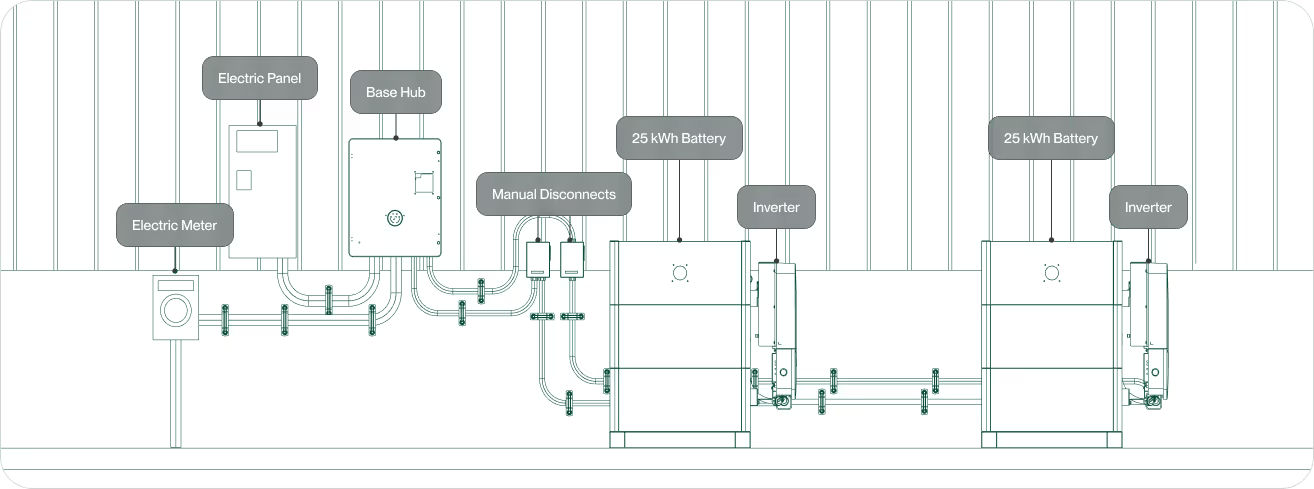

Base Battery

Base’s core product is a battery for residential energy storage. As of October 2025, the company has three batteries available for purchase: Wall Mounted (total energy of 20 kWh), Single Ground Mounted (25 kWh), and Double Ground Mounted (50 kWh). These batteries are also referred to as Gen 1, Gen 2, and Gen 3 models, respectively. Each battery has an 11.4-kW inverter. The batteries are designed to last 15 years with Base handling maintenance.

Because Base's batteries are larger than those of competitors, it can act as the single source of power for the home, eliminating the need for a separate critical loads panel required by systems like the Tesla Powerwall. The batteries are installed next to the electricity meter and serve as the home’s interface with the grid, providing real-time data on customers’ load and optimizing overall energy use.

Source: Base Power

Base’s battery is designed to maximize a home's standard 240-volt, 200-amp electrical capacity, providing whole-home backup in the event of a power outage. On average, Base's backup battery system has enough capacity to power the customers’ homes for around one day, or two days with the Gen 3 model. With average outages lasting 15 to 45 minutes, Base has found that the batteries protect its customers from 97% of outages.

Base began by assembling its own battery pack in stackable modules to simplify installation. With its Gen 1 model in 2024, Base purchased off-the-shelf battery packs and integrated its own compute modules, allowing the company to gather data on the batteries’ operation. In late 2024, Base launched its Gen 2 model, where it designed the system in partnership with manufacturers. Its Gen 3 launch in 2025 steps further into vertical integration, with Base aiming to control more of the system stack.

Source: Base Power

As of May 2024, Base was not planning to produce battery cells, believing that cells would become commoditized and that cell chemistry is complex. Instead, the company believes that focusing on pack assembly will allow it to take advantage of new cell types as better battery chemistries emerge. As of October 2025, it uses lithium iron phosphate (LFP) cells, which are more environmentally friendly and abundant compared to nickel-manganese-cobalt (NMC) cells used in EVs. Looking ahead, Base plans for a Texas-based factory to produce its vertically integrated battery systems. Its hardware is UL certified, and installations are performed by licensed professionals to ensure safety and reliability.

Installation

Base manages battery installations itself through a process it calls the “Deployment Factory”. It views installation as tightly coupled with pack assembly. The custom battery packs Base is developing are designed for easy installation, requiring no special equipment or connectors. Base claims that installation times are also decreased by 50-75% by providing a large battery that can power the entire home, eliminating the need to install a critical loads panel.

Source: Fort Worth Report

The company believes that in the long term, as the batteries themselves become commoditized and cheaper, the real bottleneck and cost driver will shift to the costs of installation.

Retail Electricity Provider

In addition to installing residential batteries, Base also becomes its customers’ retail electricity provider. It helps customers reduce electricity loads by charging batteries during times of low demand and discharging batteries during peak times. Base is building sensors and software to aggregate demand signals from its network of connected Base batteries, enabling intelligent charge and discharge of electricity based on real-time data. As Base puts it: “Your home or office should run on 4 am power, not 6 pm power.” Customers benefit from automatic backup, transparent billing, and real-time monitoring via a web app.

Source: Base Power

Generator Recharge Port

In Fall 2025, Base launched the Generator Recharge Port, which allows Base batteries to connect directly to a backup generator during a grid outage. The port contributes a steady 3kW to power the home, adding another layer of resilience during extended blackouts. This add-on will cost an additional $1K for customers.

Base Power ultimately aims to develop a decentralized battery network that serves as a virtual power plant, enabling revenue generation through power arbitrage. A fleet of software-controlled energy storage systems will give Base an edge in power trading. Base's system can access sub-second data, whereas other market participants receive data on a five-minute delay. With a large enough fleet, Base envisions backward integrating into power generation to build a fully integrated utility, controlling the entire supply chain of electricity.

Customer

Base targets homeowners as a Retail Electric Provider (REP), purchasing electricity from wholesale providers and reselling it to consumers. It launched in Texas due to the state’s frequent outages and volatile power prices driven by renewable generation. The Electric Reliability Council of Texas (ERCOT) is the Texas grid operator and manages a market that is roughly 80% competitive and 20% regulated. Base operates in the deregulated part of Texas, where power generators, grid operators, and REPs are separate. As of October 2025, Texans can choose from over 140 REPs.

Between 2000 and 2023, Texas experienced 210 weather-related outages, which is the highest of any US state. This is driven by extreme weather, aging infrastructure, and the high penetration of renewable sources in the energy mix of more than 40%. ERCOT is also particularly vulnerable to external shocks, which can disrupt electricity supply and cause extreme price spikes.

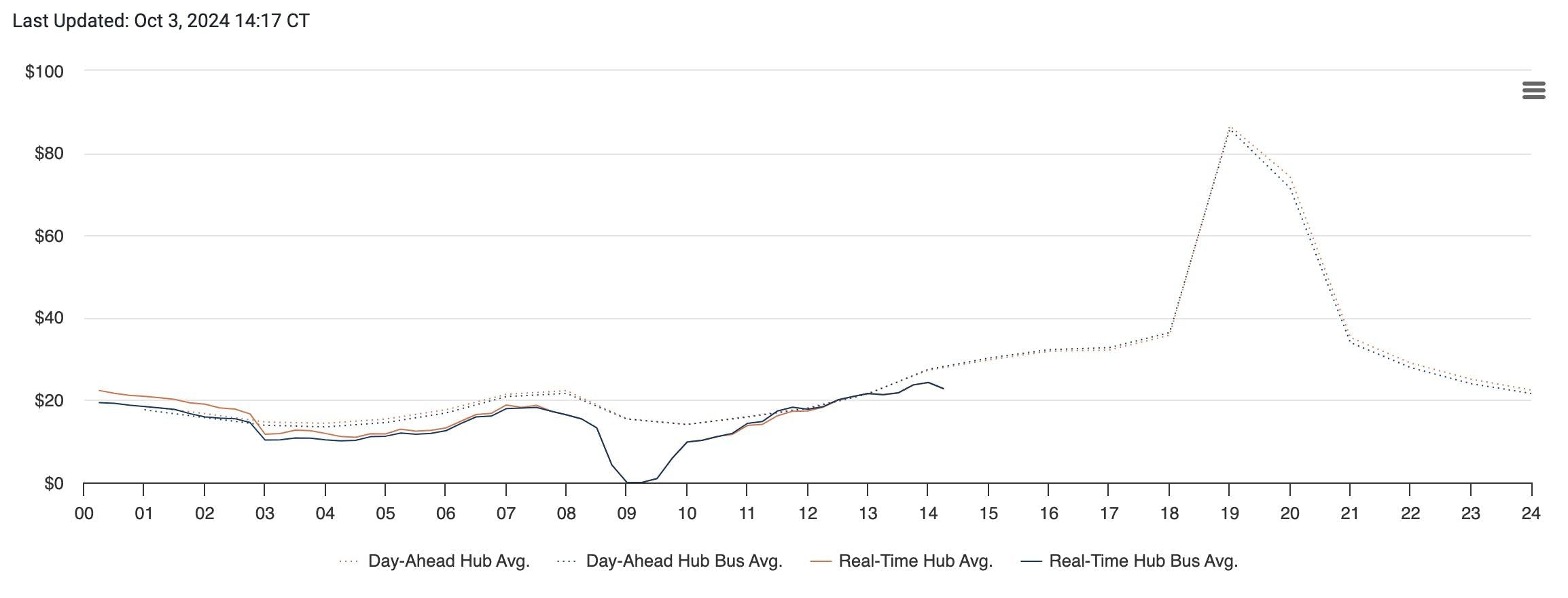

Source: ERCOT

Base offers its customers savings on their monthly electric bills and protection from grid outages for a fraction of the cost of a generator or alternative battery. The Base battery acts as a fail-safe during periods of severe weather and high demand, protecting customers from 97% of outages, according to Base.

According to the company, Base also offers customers lower average electricity prices. The home battery charges during periods of low demand and discharges during peak load. In Texas, electricity prices change dynamically every 15 minutes. The changes in power during a single day can be more than 10-fold, so taking advantage of the price volatility can lead to significant savings for customers.

In addition to retail customers, Base is planning to provide grid operators with ancillary services like frequency regulation and demand response, once its battery portfolio reaches sufficient scale.

Market Size

Single-family homes represent about 20% of US power demand. As of July 2024, the total monthly sales of electricity in the US were at $54 billion, with $27.5 billion being residential sales. In 2022, the average annual amount of electricity sold to (purchased by) a US residential electric utility customer was an average of 865 kWh per month.

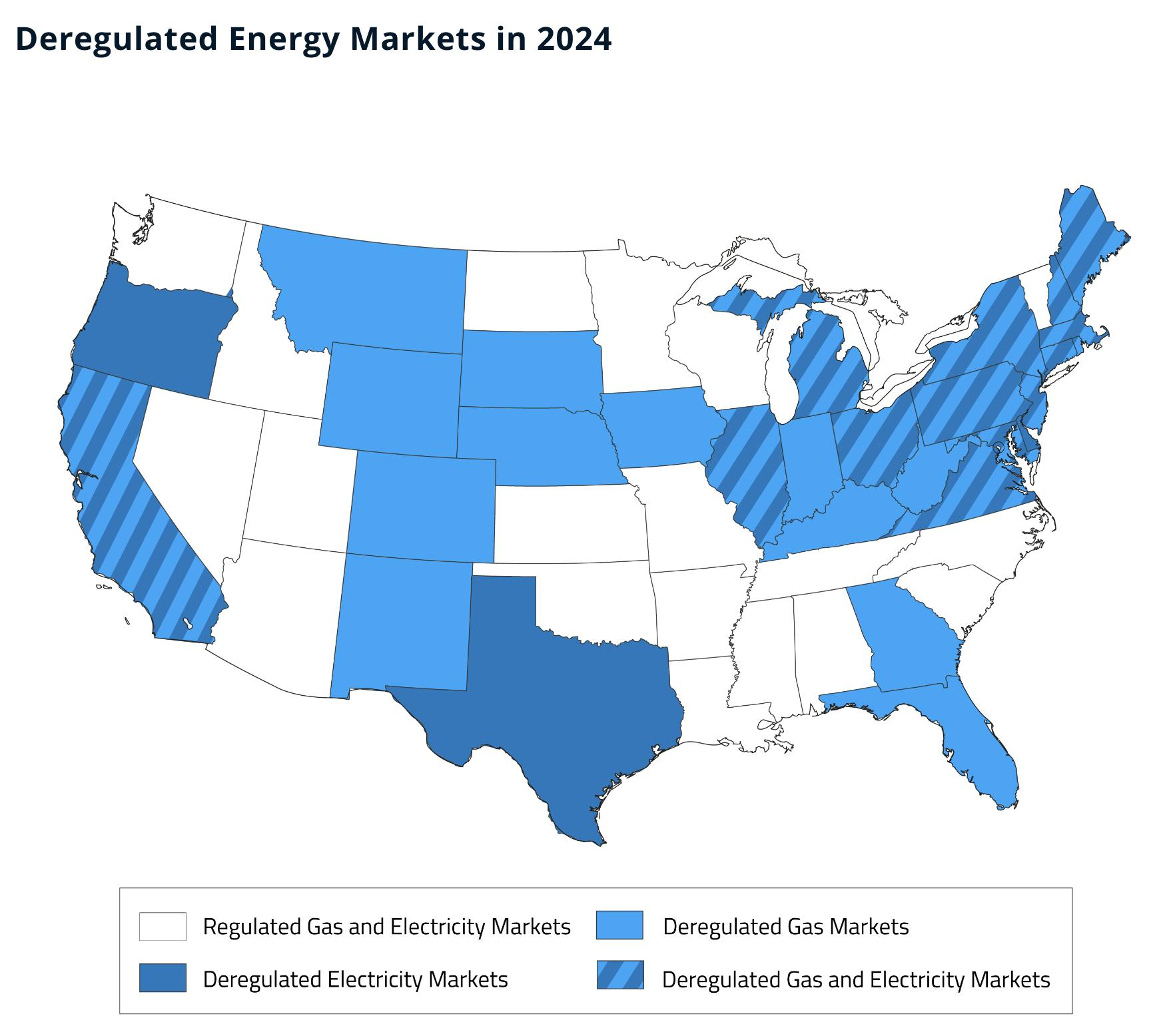

Base aims to establish itself in Texas and expand to other deregulated markets to address the growing instability that will come with the growth of renewables and electrification. In 2022, the total retail sales of electricity in Texas were 475 million MWh. With an average price of $0.1 per kWh, that would present Base a total TAM of $47.5 billion per year just in Texas.

Source: Electric Choice

In an interview with Contrary Research, Base Power’s founders said about the map above that it does not capture the full nuance of the situation. Although the map shows Michigan as deregulated, it practically isn't; there are no retail providers as the state restricts providers to a cap of 10% of the customer base. Similarly, California is only deregulated for commercial customers.

Outside of Texas, other at least partially deregulated markets where Base could operate as a REP include California, Connecticut, Washington DC, Delaware, Illinois, Massachusetts, Maryland, Maine, Michigan, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, and Virginia. These states accounted for over 129 million out of the 394 million kWh of yearly US retail electricity sales as of July 2024. In addition, electricity consumption in the US is expected to grow by 15% to 90% by 2050, depending on the expansion of electric vehicle use.

Competition

Residential Battery Storage

The residential battery storage market has seen increasing interest due to the growing adoption of renewable energy and the need for reliable backup solutions in homes. While many residential batteries are designed to be paired with rooftop solar systems, they also provide backup power during outages and help customers manage energy costs, particularly during peak electricity pricing periods. However, the high cost of these systems and the long payback period for consumers create an obstacle to wider adoption.

Tesla Powerwall: Tesla introduced the Powerwall in 2015 to accelerate the transition to sustainable energy. The Tesla Powerwall 3 was launched in early 2024 and is a compact home battery that stores energy generated from solar panels or directly from the grid, providing backup power during power outages and helping consumers avoid peak electricity rates. Each unit has a usable capacity of about 13.5-15 kWh, meaning most homes require two or three units to meet their storage needs. This capacity is smaller than all the batteries Base offers.

Tesla has built its energy business around high-margin hardware sales, leveraging its brand to position itself as a premium option in the residential battery market. Unlike some competitors that focus on modularity, Tesla's strategy is centered on bundling Powerwall units with its solar energy products. The Powerwall also integrates with Tesla's broader ecosystem, offering seamless energy management through Tesla's software platform.

However, despite its brand recognition and functionality, Tesla Powerwall faces challenges. It comes with high upfront costs of about $1K per kWh, or $15K total before tax credits. While Tesla has a wide market reach, its primary focus on high-end customers may limit broader adoption among cost-conscious buyers. In comparison to competitors, the Powerwall’s capacity per unit is lower, often requiring customers to purchase multiple units to meet their energy needs.

Sonnen EcoLinx: Founded in Germany in 2010, Sonnen is a residential battery storage provider. Its home battery, the sonnenCore+, has a capacity of 10 kWh or 20 kWh and is designed for backup power, load management, and optimized energy use. The sonnenCore+ is stackable up to three units for a max of 60 kWh. What sets Sonnen apart from its competitors is its focus on integrating battery storage with home automation platforms and its virtual power plant (VPP) technology, which enables homes to operate independently from the grid and participate in energy trading.

Sonnen’s strategy differs from that of Tesla and other competitors in that it focuses on both individual home energy management and broader energy system integration. Through its VPP technology, Sonnen connects multiple homes with their batteries, allowing them to function as a distributed energy resource. This feature could be attractive to customers who are interested in energy independence and maximizing the value of their home battery systems.

Sonnen has also built its business around high-end customers, similar to Tesla, but its offering of smart home integration and Virtual Power Plant (VPP) services differentiates it in the market. However, the 10kWh capacity of the sonnenCore+ and its advanced features are pricier than Base, with an estimated total cost of $11.5K, which could be a barrier for some consumers. Sonnen had raised a total of $169.2 million in funding as of October 2025, including a $71 million round of funding, which included a partnership with Shell in 2018.

Enphase IQ Battery: Enphase Energy, founded in 2006, is a public company that is known for producing solar inverters. It has expanded into the residential battery market with its IQ Battery product. Unlike Tesla and Sonnen, Enphase’s battery system is highly modular, with each unit providing 10kWh of storage. This modular approach allows customers to scale their energy storage based on their individual needs.

The IQ Battery is designed primarily for homes with rooftop solar installations, and its system is compatible with both indoor and outdoor settings. One of Enphase's key advantages is its software platform, which allows homeowners to manage and monitor their energy usage in real time through an app. The battery system is also designed to operate in and withstand extreme temperatures. The batteries are certified for both indoor and outdoor installation, with operations between -15°C and 60°C, and start at around $2K in price.

Enphase’s strategy differs from competitors by focusing on a lower-cost, modular approach that appeals to a broader market of consumers. The IQ Battery’s lower capacity per unit may not meet the needs of larger homes or those requiring significant backup power, but its flexibility, scalability, and affordability may make it more broadly appealing.

Retail Electricity Providers

In the retail electricity market, providers offer various options to consumers, primarily focusing on payment flexibility, fixed and variable rate plans, and renewable energy products. Traditional REPs, such as TXU Energy and Reliant, dominate this space, but new entrants like Base are differentiating themselves by offering energy solutions that integrate battery storage and software-driven energy management.

TXU Energy: TXU Energy, founded in 1882, is one of the largest retail electricity providers in Texas, and offers a wide variety of energy plans, including fixed-rate, variable-rate, and renewable energy options. TXU offers tiered pricing structures and incentives such as free electricity during certain hours of the day. While TXU does offer solar energy options, it does not provide solutions that enable consumers to store energy or manage power during outages.

Reliant Energy: Reliant Energy, founded in 2000, is another major retail electricity provider in Texas. It is a subsidiary of NRG Energy and offers a range of fixed and variable-rate plans, as well as renewable energy options. Reliant offers renewable energy plans targeted towards environmentally conscious consumers. However, it does not offer battery storage as part of its service. While it provides renewable energy options and some smart home integrations, its approach is primarily geared toward offering competitive electricity rates rather than empowering consumers with energy storage or backup power during outages.

Backup Alternatives

Generac: Founded in 1959, Generac operates in the backup energy market. Generac's primary offering includes traditional backup generators that run on gasoline, natural gas, or propane, providing reliable battery backup power during outages. These generators provide a solution for homes in regions prone to frequent power outages, especially in areas with extreme weather conditions.

Generac has ventured into the battery storage space with its PWRcell 2 product, aiming to compete with companies like Tesla in the home energy management market. The PWRcell 2 battery can be paired with rooftop solar systems or used as standalone backup power, offering battery modules of 3 kWh that can be stacked to 36 kWh. A PWRcell 2 battery system costs $14K-$25K. By integrating both generators and battery storage options, Generac appeals to a wide range of consumers who prioritize either long-term sustainability or immediate backup power reliability.

Business Model

Base Power's business model involves installing a network of batteries to capitalize on fluctuations in energy prices while offering consumers lower fixed monthly utility bills.

REP

Base purchases electricity from power generators and sells it to customers at a fixed monthly rate as a retail electricity provider. The company offers contracts with yearly billing, with pricing reviewed year-on-year based on usage data from the Base battery.

In addition to energy services, Base provides its customers with a battery pack. Base owns the batteries, charging customers $695 upfront for installation and a monthly fee of $19. Previously, Base charged $4K upfront for installation, but after changing this pricing in February 2025, Base found a 30% MoM increase in signed customers between February and March 2025.

For Base, the full process of installing a battery for a new customer costs around $10K. Base also receives a tax credit from IRA for up to 30%, or $3K, of the project cost. As of July 2025, it will take around four years to pay back the cost of its Gen 1 battery, and three years with Gen 2.

Power Trading

The REP model allows the power company to distribute many batteries across the grid and pay back the cost of the battery installation. Base’s core revenue stream, however, involves using its battery portfolio to trade energy and provide ancillary services to the grid. By trading on the battery storage capacity, Base is able to capitalize on price arbitrage and profit by charging the batteries at times of low demand and discharging at times of peak load. Base aims to purchase electricity in stable day-ahead markets and then profit by selling it in volatile real-time markets. As of July 2025, Base estimates that a battery in ERCOT will average $40/kWh over the next decade. For instance, a 30 kWh battery (Gen 2) will generate $1.2K revenue a year in power trading.

Source: Not Boring

Traction

Base first began installing batteries in 2024 and saw increasing traction over the course of 2025. By August 2025, Base had installed over 1.5K home batteries, totaling approximately 30 MWh, and plans to expand that to 250 MWh by the end of 2025. As of July 2025, Base had almost 50K customers, who save 10-20% a month on electricity.

Similar to its strategy in 2024, Base is focused on deploying as many batteries as possible in 2025. In June 2024, Base was installing about one battery pack a day. This number had scaled to nine batteries a day in October 2024 and 20 batteries a day in July 2025. Base stated that it will install 50 batteries a day over the course of the next few months, as of July 2025. Base’s revenue scaled, growing from $500K in May 2025 to $700K in June 2025. The company projects $12 million in revenue for 2025 and anticipates reaching $70 million by the end of 2026.

In August 2025, the company launched in the Dallas-Fort Worth area, expanding from areas like Austin, Houston, and San Antonio. According to the company, Base has backed up its customers in every outage since then and saved customers tens of thousands of dollars on their energy bills.

Base has also formed strategic partnerships with homebuilders and utilities to expand its reach. In December 2024, Base partnered with Lennar, a leading construction company in the US, to provide homeowners with complimentary backup batteries and the option to enroll in Base’s monthly electricity service, giving Base direct access to new homes and potential customers. Through this partnership, Base had deployed over 200 home batteries as of April 2025.

In March 2025, the company announced a partnership with Bandera Electric Cooperative to support its member battery program and gain access to existing homes through the utility. Additionally, Base’s partnership with the GVEC in June 2025 extended its work with Lennar, deploying battery systems operated directly by the utility using Base’s software. Base is also looking to partner with some regulated utilities in Texas to give them the opportunity to lower their costs with batteries.

Base is investing in both manufacturing capacity and geographic expansion to scale its operations. The company plans to develop its own battery factory in Texas, and as of April 2025, it was searching for a site in the Austin area.

Valuation

In October 2025, Base announced a $1 billion Series C led by Addition with participation from new and existing investors, including Andreessen Horowitz, Lightspeed Venture Partners, Thrive Capital, and Contrary.

In April 2025, Base raised $200 million in Series B funding, bringing its total funding to $275 million and valuation to $841 million. Its Series B was co-led by Addition, Andreessen Horowitz, Lightspeed Venture Partners, and Valor Equity Partners with participation from existing investors Thrive Capital, Terrain, and others. Its board includes Valor Equity Partners Founder Antonio Gracias, who has served on the boards of Tesla and SpaceX, and Addition Founder Lee Fixel.

Key Opportunities

New Market Expansion

Following its successful launch in Austin, Base has expanded its services to the Dallas-Fort Worth area. The company plans to operate as a REP across Texas and other partially deregulated states, including California, Connecticut, Massachusetts, New York, and more. Additionally, Base plans to expand to regulated markets in Texas by partnering with some regulated utilities. In August 2025, Dell posted on LinkedIn announcing that Base is expanding out of Texas, and is looking to hire a “New Geographies” role to lead new market launches.

To support this expansion, Base plans to develop its own battery factory in Texas, and as of April 2025, was searching for a site in the Austin area. This would enable greater control over supply chains and implement full vertical integration, which is its goal.

Commercial Opportunities

Base Power is positioned to capitalize on the growing demand for energy resilience among commercial property owners. With increased emphasis on uninterrupted power supply, especially in sectors where even brief outages can lead to significant operational losses, large-scale battery storage installations are becoming an attractive solution. Commercial properties, from manufacturing facilities to data centers, require backup power systems that can offer both reliability and scalability.

Base Power’s expertise in residential storage installations provides a strong foundation for expansion into commercial settings, where larger battery systems can be installed to prioritize outage protection. The ability to integrate energy storage solutions that not only provide backup power but also allow companies to capitalize on demand response programs makes this an area of immense growth. Additionally, the integration of battery storage with new construction projects can reduce installation complexity and costs, making this a strategic focus for Base as it continues to build relationships with developers.

Government Subsidies

A significant opportunity for Base Power lies in the increasing public sector support and financing for energy storage solutions. As of October 2025, the Inflation Reduction Act (IRA) offered transferable tax credits that incentivize stand-alone battery deployment, making battery storage a more financially attractive option for both developers and end-users. The One Big Beautiful Bill Act (OBBBA), passed in July 2025, is expected to continue these incentives through 2033.

There are tax credit marketplaces such as Crux that assist with connecting buyers trying to lower their tax bill and renewable project developers. This, combined with a steady decline in battery costs, presents Base with an opportunity to scale aggressively.

Partnerships

Base has already successfully partnered with utilities and homebuilders, such as Lennar, Bendera Electric Cooperative, and GVEC. These partnerships were critical for Base’s expansion. For instance, through the partnership with Lennar, Base deployed over 200 home batteries as of April 2025.

Another significant opportunity for Base lies in regulated markets where partnerships with utilities can enable the deployment of battery storage for grid support. Utilities face increasing pressure to manage peak demand and improve grid stability, and battery storage has emerged as a key tool for load balancing. Base can partner with utilities to deploy battery systems that support the grid during high-demand periods, offering services like peak shaving and load shifting.

Moreover, in regulated environments where utilities often have to manage renewable energy integration, Base Power’s battery storage systems can store excess generation from solar or wind, smoothing out fluctuations and providing grid services like frequency regulation. With recent policy tailwinds, such as the IRA and OBBBA’s incentives for battery storage, utilities are incentivized to incorporate these systems, providing a critical entry point for Base to expand its footprint through utility partnerships.

Permitting Reform

Permitting remains a significant hurdle for energy storage installations, with processes varying widely across municipalities. In some municipalities, permitting for battery storage can take as little as two days, while in others it may drag on for several weeks. Streamlining and standardizing these processes through policy reform represents an essential opportunity for Base Power.

Advocating for and participating in the creation of local and state-level policies that simplify permitting could drastically reduce the installation timeline and associated costs. As more regions look to accelerate renewable energy deployment, there is a clear need for permitting reforms that allow for quicker installations without compromising safety or regulatory standards. By positioning itself as an advocate for such reforms, Base Power can help drive policy changes that benefit both the industry and consumers, while also positioning itself as a leader in navigating and shaping the regulatory landscape around energy storage installations.

Key Risks

Utility Companies & Regulatory Barriers

Base’s model, which relies on distributed energy resources (DERs) such as residential battery storage, faces significant challenges from traditional utility companies and evolving regulatory frameworks. Utility companies often have vested interests in maintaining centralized power generation models and may resist the widespread adoption of distributed energy solutions. As Base states, “If Base doesn’t work outside of deregulated markets, if it can’t break into utilities, it becomes a less good business. The size of the prize is smaller, and it’s more competitive.”

Additionally, regulatory changes could slow the deployment of DERs, as policies can be complex and vary across jurisdictions. Despite these challenges, Base Power's decentralized approach provides consumers with greater energy independence, and regulatory hurdles, though impactful, are likely surmountable as the energy market continues to evolve toward cleaner, more flexible solutions.

Grid Infrastructure Limitations & Upgrade Costs

The US’ electrical grid infrastructure poses a significant challenge to the widespread adoption of battery storage. It is not fully designed to handle large-scale battery operations, which require upgrades, such as enhancing neighborhood transformers at a cost of approximately $2K each. These infrastructure investments could slow down deployment in the short term. Additionally, human factors, such as regulatory hurdles and resistance from utility companies, complicate grid upgrades. However, as demand for distributed energy resources grows, these upgrades become increasingly necessary and achievable, particularly with ongoing technological advancements and neighborhood-level adoption strategies.

Vertical Integration Challenges

One potential risk for Base is the challenge of successfully executing vertical integration. While the company has successfully integrated across battery generations, its plan to launch a factory will demand major investment in talent, manufacturing, and regulatory compliance. If vertical integration efforts fall short, the company’s growth can slow, and speed is crucial for Base’s success.

Summary

The grid is becoming increasingly overloaded by aging infrastructure, a volatile energy supply, and rising demand. The growing electricity demand, fueled by the electrification of various sectors, places immense pressure on the grid, a system already stressed by aging infrastructure and increased renewable energy integration. Battery storage offers a transformative solution by addressing both supply and demand volatility. Base Power installs home batteries, allowing customers to store energy during low-demand periods and use it during peak times. This mitigates high energy costs and protects customers from power outages while easing pressure on the grid. Starting in Texas, Base Power plans to expand its model to other deregulated markets, aiming to eventually become an integrated utility. By creating a network of distributed battery storage, Base Power is not only offering households energy reliability but also a chance to play a pivotal role in modernizing the grid and ensuring the future of energy abundance.

* Contrary is an investor in Base Power and Anduril through one or more affiliates.