Thesis

Over 5.3 billion people worldwide were using the internet as of April 2024. Celebrities such as athletes, musicians, and actors have taken advantage of this fact to amass large online audiences. As of April 2024, for example, the ten most followed Instagram accounts were owned by either athletes or entertainers such as Lionel Messi, Ariana Grande, Beyonce, and Dwayne “The Rock” Johnson.

Non-fungible tokens (NFTs) are a means for brands and creators to reward fans and customers for being active and loyal supporters. NFTs contain unique characteristics that give celebrities the ability to incrementally monetize their global fan bases. NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. The ownership and transferability of NFTs are managed and verified through smart contracts. This means that NFTs allow for authenticated ownership and asset scarcity that cannot be manipulated. Smart contracts can self-execute, essentially enforcing the contract’s terms without the need for an intermediary. Additionally, smart contracts are software-defined, so NFT creators can pre-program the smart contracts to generate royalties even after a primary sale. This allows the creator to benefit after each incremental sale of the NFT, even if it occurs on a secondary market.

Autograph is a platform that brings together “icons” (i. e. celebrities) in sports, entertainment, and culture to create NFT-based digital collections and NFT-enabled experiences for their fans. Autograph takes advantage of NFTs’ “token-gated” structure to allow holders of NFTs, such as Tom Brady 2022 Season Tickets, to participate in invite-only events and receive custom goods. The company’s stated mission is “to empower the world to build and own the future of fandom.” As of April 2024, notable Autograph partners included co-founder Tom Brady, Simone Biles, Tiger Woods, Derek Jeter, Wayne Gretzky, Tony Hawk, Naomi Osaka, Usain Bolt, and The Weeknd.

Founding Story

Autograph was founded by Dillon Rosenblatt (CEO), Josh Payne (Senior Advisor), Richard Rosenblatt (Co-Chairman of the Board), and Tom Brady (Co-Chairman of the Board) in 2021. After attending the Iovine and Young Academy at the University of Southern California (USC), Dillon Rosenblatt started working on building a crypto hedge fund. This gave him early exposure to NFTs and led him to develop the concept of Autograph. In an April 2021 interview, he described the intent to “bring the most amazing people we can together and become the official partner to the world’s biggest talent.” He then pitched the idea to his father Richard Rosenblatt and family friend Tom Brady, both of whom became co-founders of the new venture.

Tom Brady is a retired American football quarterback regarded as one of the greatest players in NFL history and known for winning seven Super Bowl titles during his career. Richard Rosenblatt is an entrepreneur who has built, operated, and sold several Internet media companies, including Demand Media Inc. (“Demand Media”), iCrossing, Inc., Intermix Media, Inc. (“Intermix”), Myspace LLC, and iMall. He co-founded Whip Media Group (“Whip Media”) in 2014 and as of April 2024 served as its Chairman and CEO. As of April 2024, he also served as special advisor to the board of directors of DraftKings, which likely contributed to the exclusive agreement between Autograph and DraftKings.

Through Richard Rosenblatt and Tom Brady’s connections, Autograph assembled a notable board of advisors, including Tiger Woods, Derek Jeter, and Wayne Gretzky. As of April 2024, Autograph’s board of directors also included Apple SVP Eddy Cue and Abel Makkonen Tesfaye (aka The Weeknd), along with notable crypto experts such as Arianna Simpson (General Partner at a16z), Ilya Fushman (Partner at Kleiner Perkins), Chris Dixon (General Partner at a16z), Dick Costolo (01A partner), and Velvet Sea Ventures' partner Michael Lazerow.

Product

Autograph’s NFTs provide access to exclusive collections from popular names in sports, music, and entertainment, whom the company dubs “icons.” These icons are directly involved in the development of their NFTs and the experiences and content tied to them. Initially, Autograph’s NFTs were sold exclusively on the DraftKings Marketplace, a digital collectibles ecosystem that offers curated NFT drops and supports secondary-market transactions. As of April 2024, however, Autograph’s NFTs had also been distributed through other marketplaces such as OpenSea. As of April 2024, Autograph NFTs were minted on the Polygon blockchain, an Ethereum-compatible layer 2 solution, and the Ethereum blockchain.

Preseason Access Collection

Autograph’s first NFTs dropped in October 2021 and consisted of physical and digital collectibles of the company’s celebrity founding partners, including Tom Brady, Wayne Gretzky, and Simon Biles. The company dubbed this the Preseason Access Collection.

These NFTs gave holders VIP access to the celebrity’s first limited edition drop and allowed them to gain access to Autograph’s private discord community. The collection contains tiers for rarity and accessibility, dubbed Carbon, Platinum, Emerald, Sapphire and Ruby.

For the “Signed” version of these NFTs, the Autograph team sent iPads loaded with an app to corresponding celebrities, who then used the Apple pencil to scribble their signature on each NFT. This was a time-consuming task for the icons, sometimes taking them hours, to make the NFT feel personalized. As a result, there are fewer editions, and the signature makes these NFTs more expensive.

Source: Autograph

Mystery Containers

A mystery container is an Autograph NFT that can be “opened” to reveal one of a set of predefined collectibles tied to an icon. Each of these collectibles was part of a larger collection. For example, when a collector bought the Tiger Woods Mystery Container, the revealed collection would be one of twenty-five potential collectibles within the Tiger Woods Iconic Fist Pumps Collection.

The number of unique editions per container varied by icon. The Tiger Woods Mystery Container had 16K editions, for example, while the Naomi Osaka Mystery Container had 11K editions. These containers also come at different drop price points depending on the icon, ranging from $30 per container for Simone Biles to $80 per container for Tiger Woods.

Source: Autograph

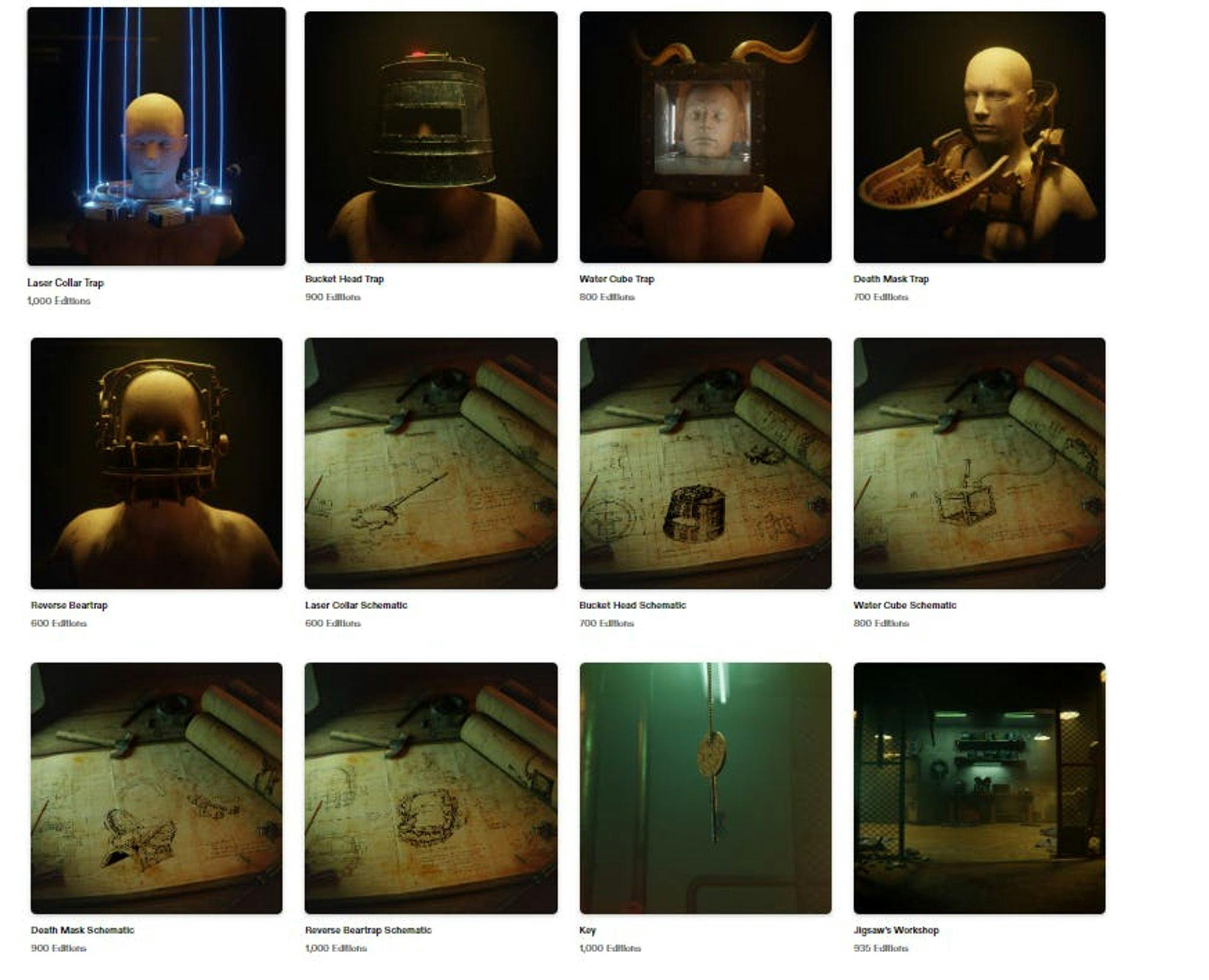

Saw Chapter 1 Collection

In October 2019, Autograph, Lionsgate, and Twisted Pictures partnered to release exclusive digital collectibles from Saw, a horror film franchise that has earned more than $1 billion at the box office. Autograph named this the Saw Chapter 1 Collection.

This collection, dropped on October 28th, 2021, includes five Traps, five Schematics (each corresponding to a trap), one Key, and one Jigsaw Workshop, each with up to 1K editions. Users may complete a “Set” by acquiring (1) one trap, (2) the corresponding schematic (for example, the Reverse Beartrap corresponds to the Reverse Beartrap Schematic), and (3) a unique key that will correspond to all traps and schematics. The Key would also unlock privileges in connection with future Saw or Lionsgate drops or experiences.

Source: Autograph

This collection is part of a broader partnership between Lionsgate and Autograph. As of October 2021, the company had plans to collaborate on NFTs for franchises such as John Wick, The Hunger Games, The Twilight Saga, Mad Men, and Dirty Dancing. However, these collaborations had not taken place as of April 2024.

Signature Experiences

Autograph Signature Experiences is a product line offered by Autograph and launched in August 2022 aimed at further engaging fans with icons. By owning the limited-edition NFT crafted specifically for the chosen icon or brand, participants gained entry to a portal featuring token-gated access to merchandise and experiences across both the digital and physical realms.

The first example of this product line was the Tom Brady 2022 Season Ticket NFT within “The Huddle” Collection, which launched in September 2022. The Huddle served as an interactive portal, allowing fans to participate in an exclusive collaboration with the quarterback, attend invite-only IRL events, and receive custom goods — both digital and physical — crafted specifically for this community.

Members gain access to The Huddle by owning a Season Ticket NFT — a dynamic NFT that allows holders to participate throughout Tom Brady’s 2022-2023 season. The Huddle introduces offerings enabled by its token-gated structure, such as digital events, in-person gatherings, and custom merchandise. For example, these were some of the events from November 2022:

Source: Autograph

Other Collections

As of April 2024, Autograph had dropped 16 NFT collections in total. For example, Autograph created ESPN’s first set of NFTs. These commemorated Man in the Arena: Tom Brady, a ten-part series from ESPN+. There were seven different NFTs throughout two drops. For the utility of the Tom Brady Golden Ticket, purchasers received credit toward travel and hotel arrangements in Tampa, FL to meet Tom Brady after a session of the 2022 Tampa Bay Training Camp, a signed Tom Brady Football, and an ESPN+ Subscription for one month.

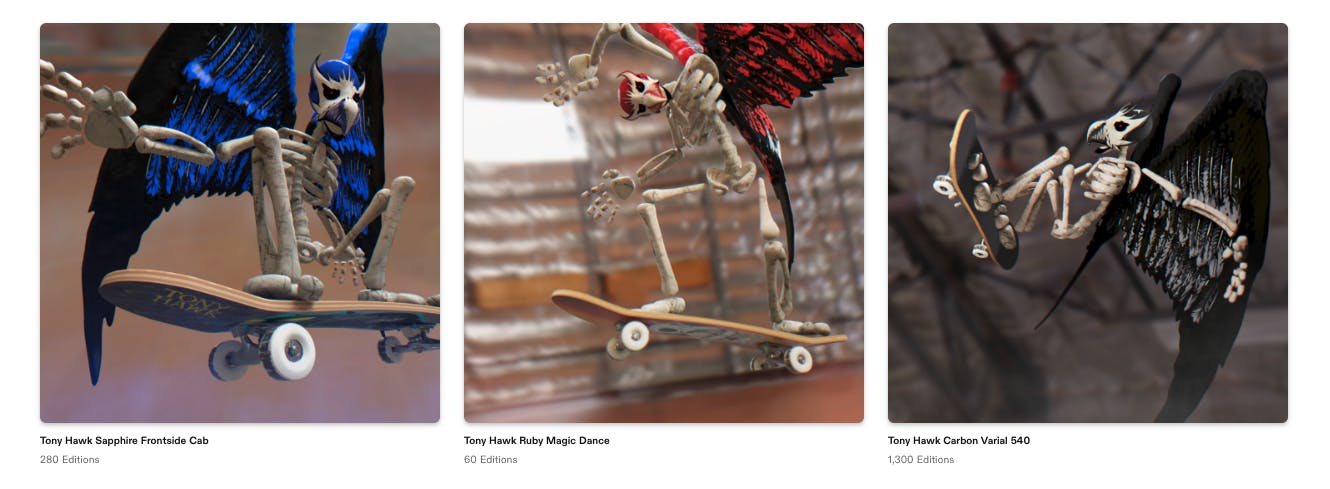

Another notable example was the Tony Hawk Last Trick Skateboard Collection. This collection was launched in December 2021 to commemorate Hawk’s retirement of five of his “most memorable tricks, with each trick memorialized in the form of limited-edition NFTs that will live on forever.” Each NFT was a 3D scanned digital replica of the exact board Tony Hawk used to complete the trick, and the primary buyer of the NFT received the physical version of the skateboard via mail. Both the physical skateboards and their digital replicas were signed by Tony Hawk.

Source: Autograph

As of April 2024, other collections included the Tiger Woods Iconic Fist Pumps Collection, the Usain Bolt: Tracks & Records Collection, the El Rey: The Rafael Nadal Collection, and the 2022 Indianapolis 500 Collection.

Market

Customer

As described by CEO Dillon Rosenblatt in a July 2022 interview, Autograph’s typical customer is a sports collector who already understands the value of physical collectibles. In this interview, Rosenblatt described Autograph’s main audience as “broader sports fans, but to get a bit more specific, these digital communities that build around the icons.”

In line with this idea of targeting “broader sports fans”, Autograph decided to set its prices significantly lower compared to other NFT services. For example, Autograph sold 5K Tom Brady Carbon Premier NFTs at $12 each. In an April 2022 interview, Rosenblatt stated “We could have charged much, much more, but the point was to create an accessible experience [and] to get this in a ton of people’s hands.”

Market Size

Autograph operates at the intersection of NFTs and collectibles (mainly sports collectibles). The NFTs market was estimated to reach $2.4 billion in value by the end of 2024. This figure, however, follows the 2021-2022 NFT boom-bust cycle. In November 2021, the market value for all NFTs was estimated at $3 trillion but had fallen to $1 trillion in June 2022. In 2023, NFT sales reached $17.6 billion, similar to sales recorded in 2021.

The collectibles market as a whole, which includes sports memorabilia, toys, art, and NFTs among other items was estimated at $462 billion in 2023. Within this, the sports collectibles market specifically was estimated at $26.1 billion in 2021 and was expected to grow to $227.2 billion by 2032. This includes sports memorabilia, NFT sports collectibles, and sports trading cards.

A December 2021 report estimated that 4 to 5 million sports fans had purchased an NFT sports collectible in 2022, predicting that NFTs for sports media would generate more than $2 billion in transactions that year, double 2021’s figure. According to an August 2023 survey, around 40% of Gen Z and millennial sports fans are “at least somewhat familiar with the use of NFTs and fan tokens in sports.” However, only 5% of sports fans surveyed stated that they had purchased or received a sports or athlete-related NFT or received a team fan token in the previous year.

Competition

Autograph faces competition from three types of companies: (1) Legacy players like Sotheby’s and Medium Rare; (2) NFT-Native companies like Dapper Labs and Candy Digital; and (3) NFT sports games companies like Sorare.

Legacy players

Sotheby’s: Founded in 1744, Sotheby’s is an art, antiques, collectibles, and luxury items auctioneer. As of April 2024, it had 80 offices and an annual worldwide sales turnover of over $7 billion. Through multiple sale formats, Sotheby’s provides sellers the ability to sell through auctions, buy-now, generative drops, and sales of editions. Sotheby's offers a curated array of NFTs including Digital Art, Luxury, Collectibles, Sports, and Pop Culture. For example, in March 2022 English soccer team Liverpool partnered with Sotheby’s to launch its first NFT collection. The collection was called “LFC Heroes Club”, and contained illustrations of over 24 Liverpool stars.

Source: OpenSea

Medium Rare: Medium Rare partners with athletes, celebrities, and brands to build media & entertainment properties. It was founded in 2018. The company initially was in the business of staging live events such as the Carnage Festival. However, due to the COVID-19 pandemic, it was forced to pivot and open new revenue streams. One of these was to partner with celebrities and sports teams to release NFTs. For example, in 2021 Medium Rare partnered with American Football player Rob “Gronk” Gronkowski to issue NFTs celebrating his four Super Bowl championships. The Gronkowski NFTs cost $28K to produce and generated $2.1 million in revenue. The company also partnered with the Golden State Warriors in April 2021 to launch the Golden State Warriors Legacy NFT Collection, selling over $2 million with an average price of $6.1K per NFT

NFT Native Companies

Dapper Labs: Dapper Labs creates consumer-focused blockchain products. The company was founded in 2018. It is known for products such as NBA Top Shot, NFL All Day, UFC Strike, LaLiga Golazos, and CryptoKitties. Dapper Labs had raised $612.5 million across seven funding rounds as of April 2024 and was valued at $7.6 billion as of its $250 million Series D funding round in September 2021. As of April 2024, Top Shot — Dapper Labs’ most successful product — had around 1.6 million users and around $1.2 billion in total sales across 30 million marketplace transactions.

Candy: Candy is an NFT company that allows users to buy and trade licensed NFTs from specific brands such as DC and the Major League Baseball (MLB) league. It was founded in 2021. The company had raised $138.4 million across three rounds as of April 2024 and was valued at $1.5 billion as of its $100 million Series A round in October 2021. In August 2021, Candy signed an exclusive deal to license NFT-backed digital MLB cards. As of April 2024, the company produces NFT assets for ten brands, including Netflix, WWE, Getty Images, and the Sex Pistols.

NFT Sports Games

Sorare: Sorare is a fantasy sports platform built on NFTs that allows players to buy, sell, and collect players for their fantasy teams in the form of sports trading cards. The objective of the Sorare game is to collect the highest-performing player cards for the lowest possible value. Sorare initially started with soccer, partnering with 180 organizations including Real Madrid, Liverpool, and Juventus. As of April 2024, Sorare also supported NBA and MLB fantasy cards. The company had raised $739.2 million across four funding rounds as of April 2024. It was valued at $4.3 billion as of its $680 million Series B round in September 2021.

Business Model

Autograph partners with artists, athletes, and entertainment companies, and onboards them into its platform to create a suite of NFT offerings and products, which it then sells to end consumers. Autograph generates revenue in two ways. First, Autograph sells NFTs in a “drop” format, meaning that the NFT is released at a moment in time in a primary sale. For example, the Tom Brady Mystery Container sold 16.6K NFTs for $80 each, a total of $1.3 million in revenue. The second way that Autograph generates revenue is through royalties on secondary market transactions, as evidenced by the company’s terms of service, which as of April 2024 stated:

“[Autograph] may impose a fee on any secondary sales of such Company NFT after its initial purchase, regardless of whether such secondary sale occurs on the NFT Platform or on some other platform, and such fee will be deducted from the proceeds from selling the Company NFT.”

Traction

According to a company spokesperson, Autograph had sold over 100K NFTs as of November 2021. Its inaugural Tom Brady Preseason Access Collection — released on August 2021 — had drop queues 3x larger than the available supply and sold out instantly. Autograph’s Preseason Access Collections for Wayne Gretzky, Tony Hawk, Derek Jeter, Naomi Osaka, and Simone Biles all sold out within minutes after their release in October 2021. An analysis of the company’s website reveals the majority of its drops sold out in their primary sale.

As of April 2024, Autograph had released a total of 16 drops; however, the company had not released any new drops at this point since the Forest Hills Stadium 2022 Collection in July 2022. Autograph’s revenue reportedly “sank” in 2022 due to the wider downturn in the NFT market. In December 2022, the company reportedly laid off “a handful” of employees. In May 2023, Autograph laid off over 50 employees, close to 33% of its workforce.

Valuation

As of April 2024, Autograph had raised $205 million in total funding over three funding rounds from investors including a16z, Kleiner Perkins, 01 Advisors, and Velvet Sea Ventures. In July 2021, the company raised a $35 million Series A funding round at a pre-money valuation of $700 million. In January 2022, Autograph announced a $170 million Series B funding round at an undisclosed valuation.

While as of April 2024 Autograph had not publicly updated its valuation since its Series B funding round, other NFT platforms have seen their valuations cut down significantly. For example, in April 2023 Tiger Global disclosed its equity position in OpenSea had dropped from $126.8 million to $30.2 million, a 76% drawdown. This cut OpenSea’s valuation down from $13.3 billion in 2022 to $3 billion. In November 2023 Coatue, another OpenSea investor, marked down the value of its share in the company by 90%.

Key Opportunities

Bringing on New Partners

As of April 2024, Autograph counted celebrities such as Tom Brady, Simone Biles, Tiger Woods, Derek Jeter, Wayne Gretzky, Tony Hawk, Naomi Osaka, Usain Bolt, and The Weeknd as its partners. Autograph can leverage the high-profile nature of its partners to further selectively onboard new partners with large followings. Additionally, Autograph has the opportunity to expand beyond focusing largely on athletes — which was the case as of April 2024 — into other areas such as actors, musicians, or artists of other kinds, as well as entertainment brands. The company has already proved its ability to do this, with drops for musicians like The Weeknd and studios like Lionsgate.

Expansion with Current Partners

As of April 2024, Autograph had not dropped NFTs from its partners since its Forest Hills Stadium 2022 Collection in July 2022. There is room for the company to launch more NFTs with its partners. One way to do this while potentially bypassing the NFT market turmoil which resulted in Autograph laying off over 50 employees in May 2023 would be to further focus on utilizing NFTs’ “token-gated” structure to offer more intimate experiences between NFT holders and celebrities. This would tie Autograph’s NFTs’ value to a tangible experience, instead of risking depending on speculators. The Tom Brady 2022 Season Ticket NFT was a good example of bringing this idea to life.

Key Risks

Macroeconomic Cycles

Cryptocurrency markets go through boom-and-bust cycles. Macroeconomic turmoil in 2022-2023 impacted general interest in buying NFTs, resulting in a 63% drop in sales YoY during that period. When Bitcoin and Ethereum prices dropped by ~70% from 2022 to 2023, NFTs lost significant value. Beyond the inherent value of each NFT offering such as access to a community or intimate experiences with a celebrity, NFTs are speculative assets. The success of Autograph’s offerings depends in part on speculators buying one of the company’s NFTs in the hope that it will be worth more in the future. During periods of market volatility, speculative assets, which have uncertain future value, can be impacted significantly.

Controversy and Reputational Risk

Autograph was co-founded by Tom Brady. The company leveraged Brady’s celebrity to build its initial projects and attract its roster of celebrity partners. Celebrities, however, are exposed to reputational risks and controversy. Brady himself, for example, was caught up on the 2022 collapse of FTX, for which he served as an “ambassador”. Furthermore, former FTX CEO Sam Bankman-Fried had been appointed part of the Autograph Board of Directors in October 2021.

In December 2022, lawyers filed a class action lawsuit against Bankman-Fried and several celebrities involved with the company, including Brady and Naomi Osaka, another Autograph partner. Bankman-Fried was sentenced to 25 years in prison in March 2024. Such controversies can diminish trust and interest in both the NFT market as a whole and Autograph specifically, challenging the company’s growth.

Summary

NFTs give celebrities the ability to monetize their large and growing global fanbases through collectibles and immersive experiences. A December 2021 report estimated that 4- 5 million sports fans had purchased an NFT sports collectible in 2022. Though cryptocurrencies and NFTs have faced significant headwinds in the past few years, the desire for sports memorabilia and fandom persists. Autograph can capture further share in this market with its partnerships with top athletes, entertainers, and brands. Autograph needs to expand its suite of product offerings to further engage fans from the collectibles market and enable direct interactions between celebrities and fans through the “token-gated” structure of NFTs. The company also needs to avoid further controversy and reputational risk, which challenge its growth.