Thesis

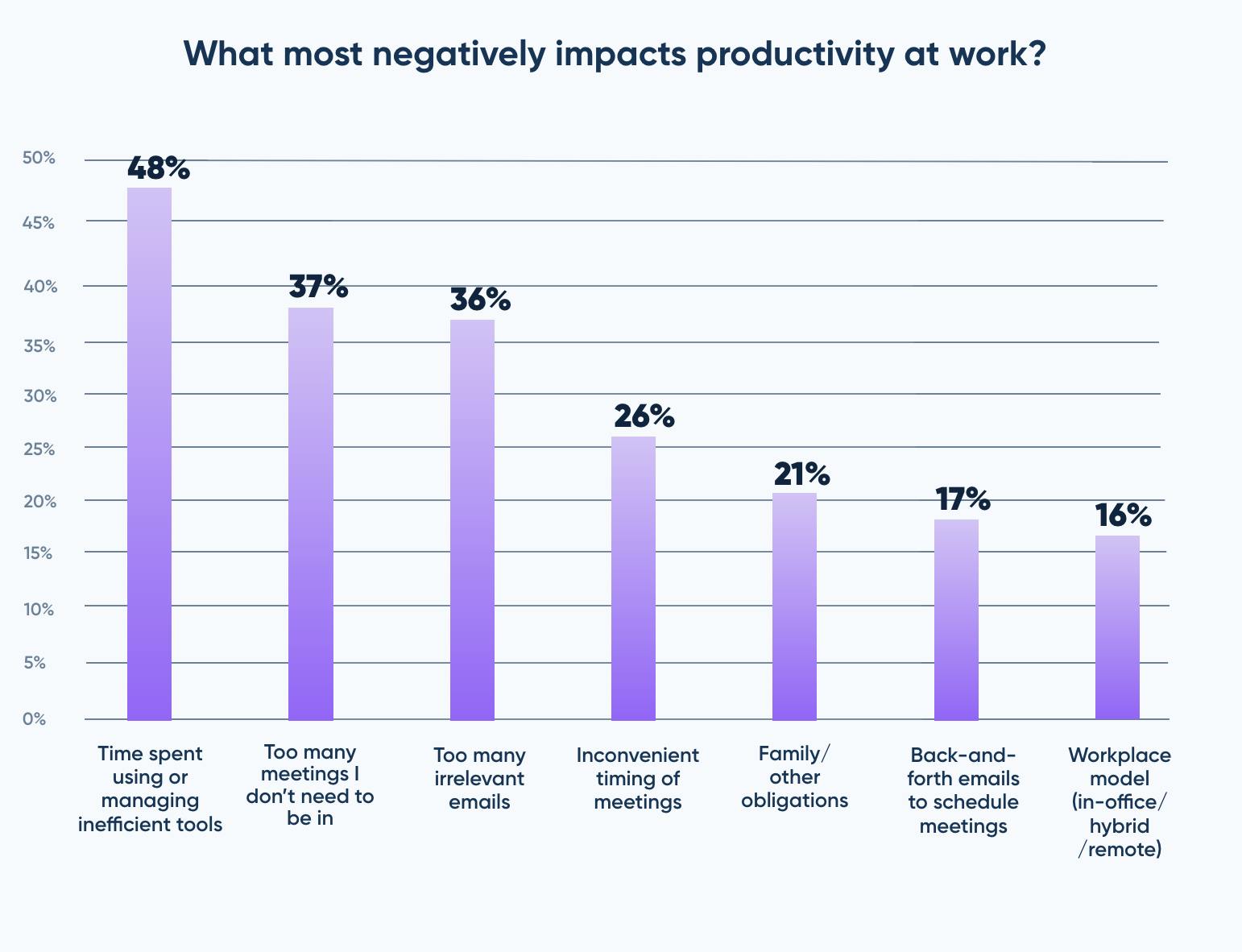

Since the early to mid-2010s, cloud-based productivity tools have helped workers streamline manual tasks like data entry or document processing. Demand for such tools stems from ongoing productivity challenges for knowledge workers: 46% of workers struggled to complete their jobs within a 40-hour workweek in 2022. The shift towards automation allows employees to redirect their attention towards higher-value tasks. For instance, 50% of director-level employees found their calendars difficult to manage and “[spent] an outrageous amount of time” rearranging meetings or scheduling external appointments in 2022. Excessive emails, scheduling challenges, and poorly timed meetings reduce workplace productivity.

As of 2023, 40% of workers spent up to 30 minutes per week scheduling meetings, and each meeting was delayed, on average, by almost 11 minutes due to attendees not being synced on meeting details. Research from Microsoft in 2023 stated that people felt like they had two jobs: the job they were hired to do and another job of “communicating, coordinating, and collaborating” on emails and meetings, leaving people feeling “quite overwhelmed.” As a result, 76% of employees were willing to pay out of pocket for productivity tools to free up time for their job responsibilities.

Calendly is a cloud-based platform that automates the process of scheduling meetings by allowing users to share their availability through a customized link. Instead of back-and-forth communication to find a suitable time, invitees can select from available time slots that automatically sync with the user's calendar, integrating with tools like Google Calendar, Microsoft Outlook, and Salesforce. Designed for entire organizations, Calendly helps teams like sales, recruiting, and customer success departments by routing meetings to the right people, coordinating across time zones, and providing automated reminders. By June 2024, Calendly was used by 86% of Fortune 500 companies. Calendly’s mission is to "create a world where people actually love meetings."

Founding Story

Calendly was founded in 2013 by Tope Awotona (CEO).

Awotona was born in Nigeria and graduated from high school at the age of 15. Following graduation, he moved to Atlanta and enrolled at the University of Georgia to study computer science. His father, who “had a great job at a major corporation in Nigeria but decided to [start] his own business”, inspired Awotona’s entrepreneurial drive.

During his freshman year of college, Tope Awotona worked at CVS, where he noticed how his manager would spend one hour counting and recording the money in the cash register every night. This inspired his first business idea: a machine that could handle cash transactions and eliminate the need for manual registers. At 17 years old, he filed a provisional patent and pitched the idea to NCR, but couldn’t pursue it further because he wasn’t old enough to fly up to their headquarters.

By sophomore year, he felt disconnected from his computer science peers and uninspired by coding, Awotona took a summer job selling alarm systems door-to-door. He discovered a passion for sales and persuasion, prompting him to switch his major to management information systems to balance both technical and business skills. After college, Awotona honed his sales experience at a travel agency and then IBM, but found the path to becoming an account executive too long. He left IBM for an account executive role at Perceptive Software, an experience he credits as instrumental to the success of Calendly:

"It opened my eyes that people who start great companies are very human and very ordinary in most ways. What is extraordinary about them is they take action. They see something and they grab it rather than wait for someone else to come fix it. And then of course, there is a lot of uncertainty along the way and they learn fast and they adjust and they just figure it out. That was an aha moment for me. That was the first time where I was like, you know what, entrepreneurship is attainable for me. These people are smart and I think I’m just as smart as they are and I can do it as well."

After his time at Perceptive, Awotona moved to Vertafone where he “[worked] with [the] legal [team] to get contracts amended” and “got very comfortable negotiating very complicated agreements.” He also learned about accounting and revenue recognition, allowing him to develop a more holistic understanding of other business operations outside of sales.

During his tenure at Vertafone, he also began experimenting with a side hustle business. He launched ProjectorSpot.com, an online platform for selling projectors, and later YardSteals, which sold home and garden equipment. He eventually shut the businesses down because he didn’t realize that they “required a lot more work than anticipated.”

After these initial entrepreneurial attempts and his time at Vertafore, Awotona joined EMC as a sales representative where he encountered a challenge: scheduling meetings with people. After trying 10 different scheduling apps and finding them unsatisfactory, he noticed a gap in the market. The existing apps at the time had paying customers, but they complained about the apps’ limitations. Seeing this as an opportunity, Awotona decided to fully commit to solving the problem. He liquidated his 401K, withdrew $200K from his personal savings, and took out a loan to fund his vision of creating a simple, intuitive scheduling tool. He built it specifically for salespeople and customer success people, and was “letting everyone use it for free.”

Though Awotona had a somewhat technical background through his education in MIS, he was eager to find a technical cofounder. He partnered with a Ruby development shop called Railsware, based in Kyiv, Ukraine. Awotona liked Railsware in particular because the team there was excited about his idea.

Calendly's first customer was BrightBites, a client of Railsware who needed scheduling software to sell educational tools to teachers. Those teachers also started using it themselves for parent-teacher conferences, driving the product’s early adoption. Awotona continued letting customers use the product for free until July 2014, a few months after Calendly raised its $550K seed round in April 2014.

The company has made several key executive hires in the early 2020s. Jessica Gilmartin (Chief Marketing & Revenue Officer), who previously worked as Head of Product for Google and Asana, joined Calendly in January 2023. John McCauley (CFO) was hired in June 2022 and previously served as CFO at Seismic. Stephen Hsu (Chief Product Officer), a former Salesforce executive, was added in May 2023. Jigar Desai (CTO) was hired in December 2023 and was a former executive at Meta and PayPal.

Product

Calendly is a scheduling automation platform designed to simplify the process of booking meetings for departments of businesses including sales, marketing, recruiting, customer success, revenue operations, and information technology. It eliminates the need for back-and-forth emails by allowing users to set their availability preferences and share a link, which others can use to schedule a time that works for both parties.

Source: Calendly

Calendly serves a range of industries including technology, financial services, professional services, and education, and is intended to help users streamline workflows, improve productivity, and reduce scheduling conflicts.

Scheduling Automation

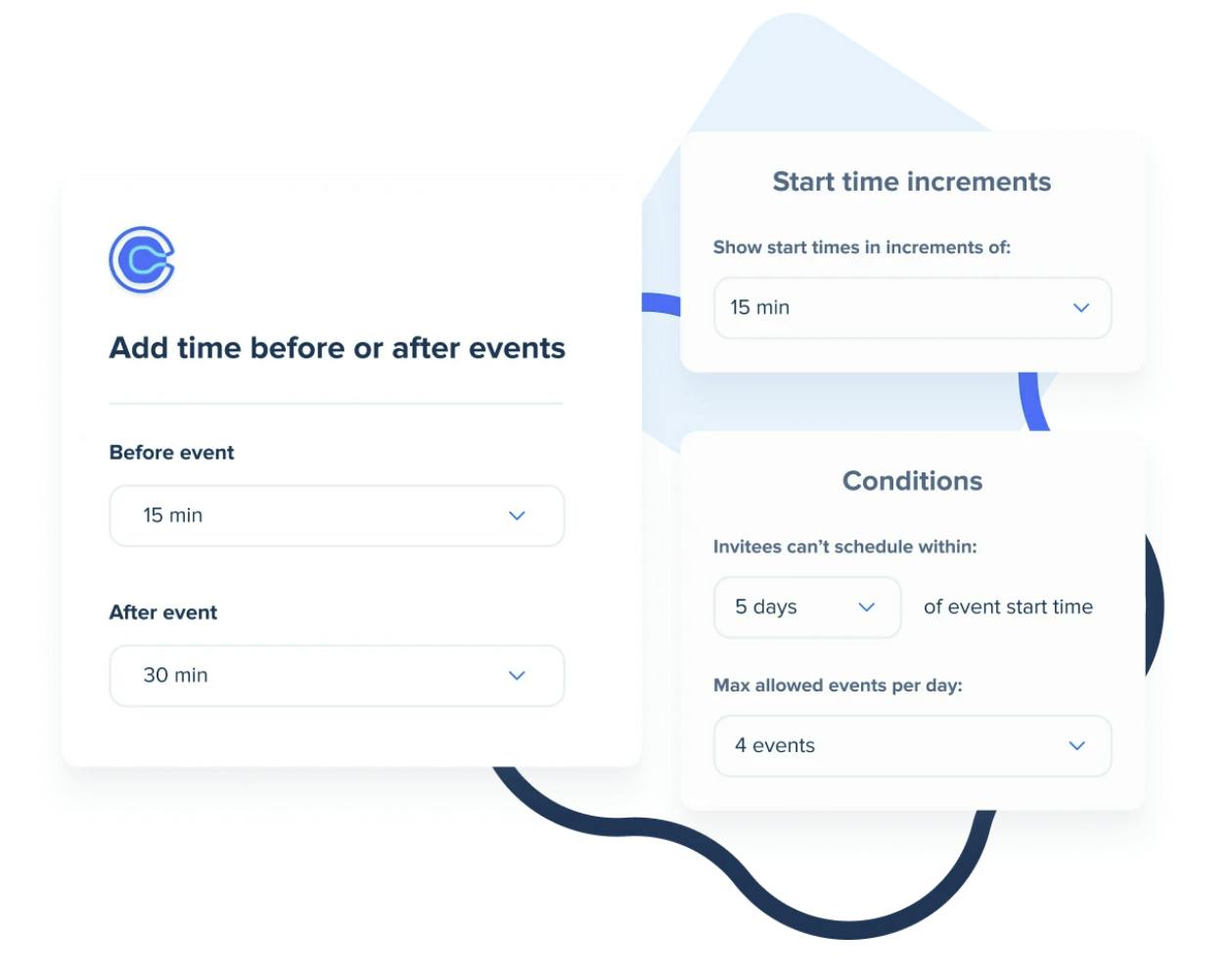

Calendly’s core feature is real-time scheduling, where users share their availability via a link or an embedded option on a webpage or email. To avoid last-minute meetings, users can set conditions such as how far in advance invites can be scheduled, the maximum number of events per day, and buffer times between meetings. Hosts display their available times, and invitees select a suitable slot to book directly on the host's calendar. Calendly detects time zones automatically.

Source: Calendly

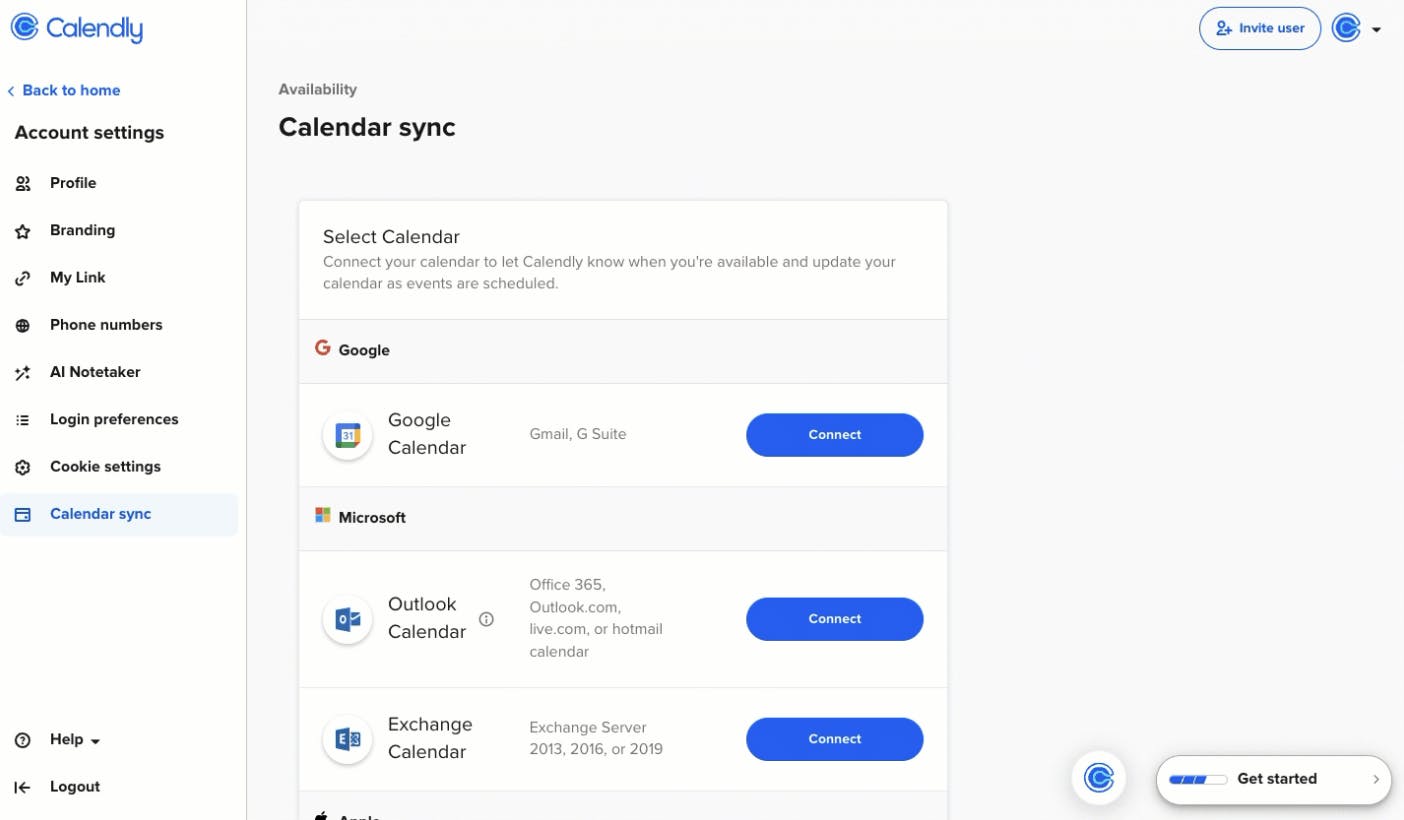

Calendly integrates with Google and Microsoft calendars, ensuring that meetings are not scheduled during times when users have other events. The syncing helps keep schedules up to date.

Source: Calendly

Users can choose their meeting format, whether in person or virtual. Calendly integrates with platforms like Zoom, Microsoft Teams, WebEx, and Google Meet, automatically generating a meeting link when the event is scheduled.

Team Scheduling

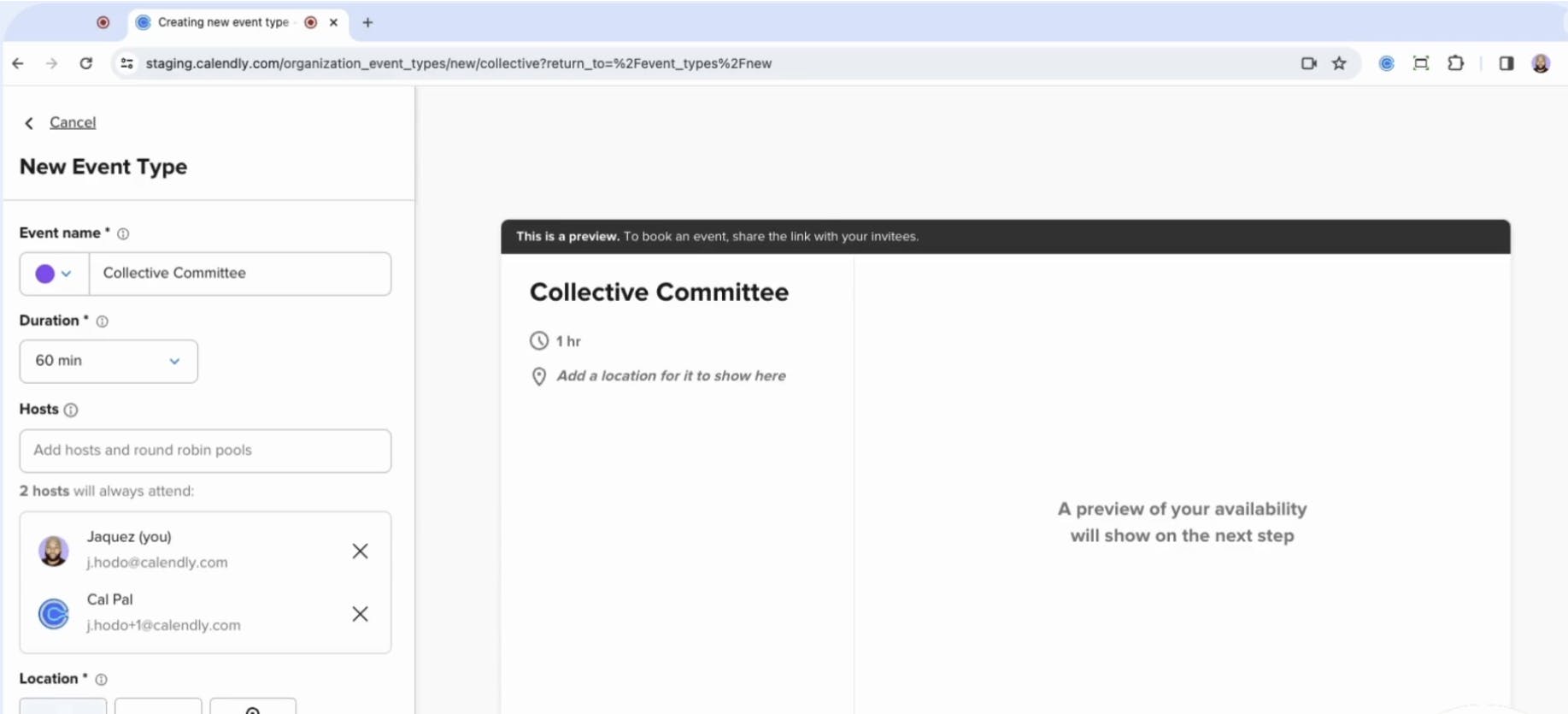

Calendly supports scheduling both group meetings and round robin events. For group meetings, it displays the time slots when all selected hosts are available simultaneously, ensuring convenient scheduling for invitees.

Source: Calendly

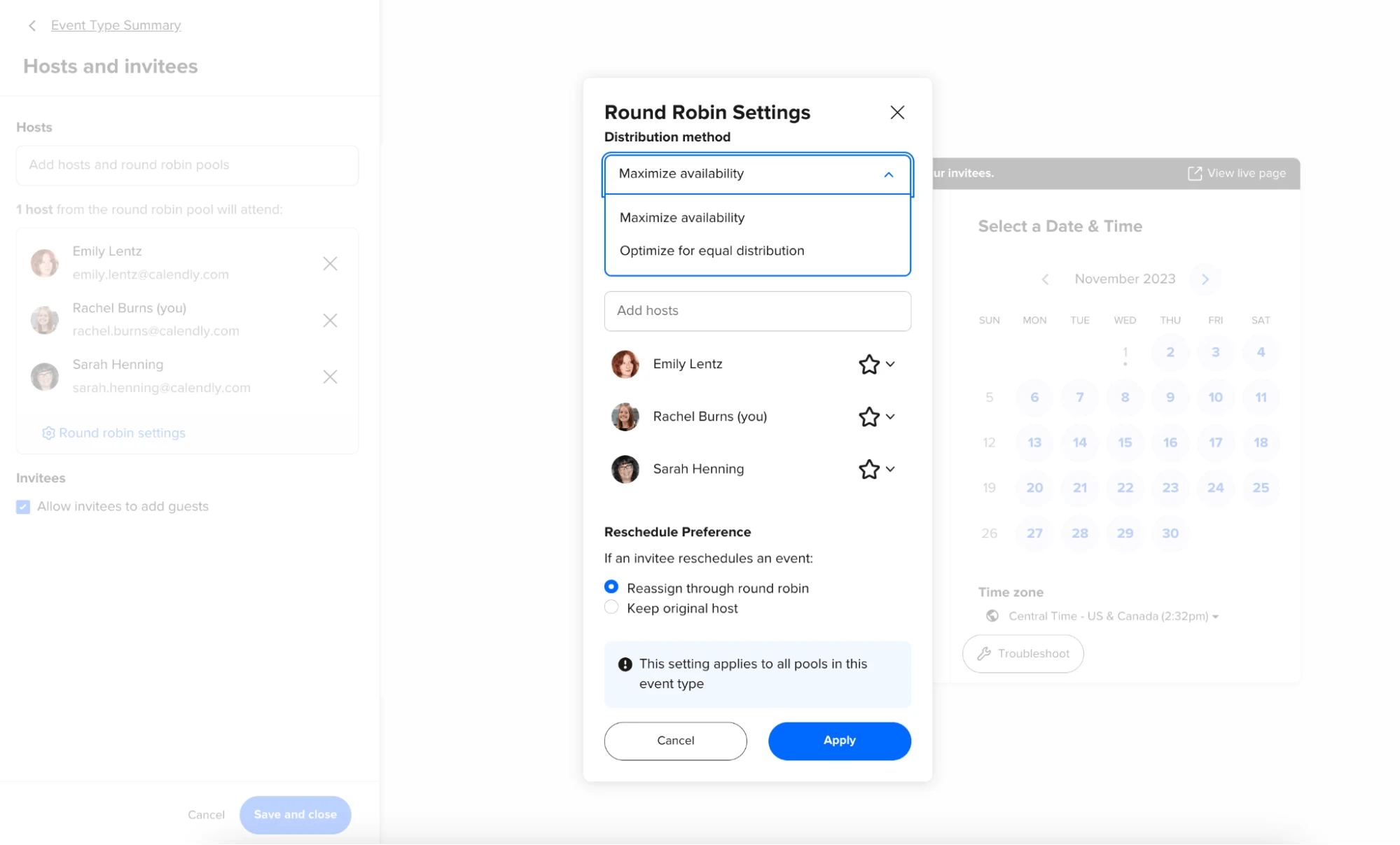

For round robin scheduling, Calendly distributes meetings among team members based on availability. It can automatically assign invitees to meet individually with hosts, either randomly or according to a preset order. This ensures a more balanced meeting load across the team. Moreover, Calendly offers flexibility in meeting locations, whether in person or through teleconferencing. Its integration with video conferencing platforms allows users to select their preferred tool, even if participants use different software. This means that regardless of whether someone prefers Zoom, Microsoft Teams, or another solution, Calendly can accommodate their choice.

Source: Calendly

Automated Workflows

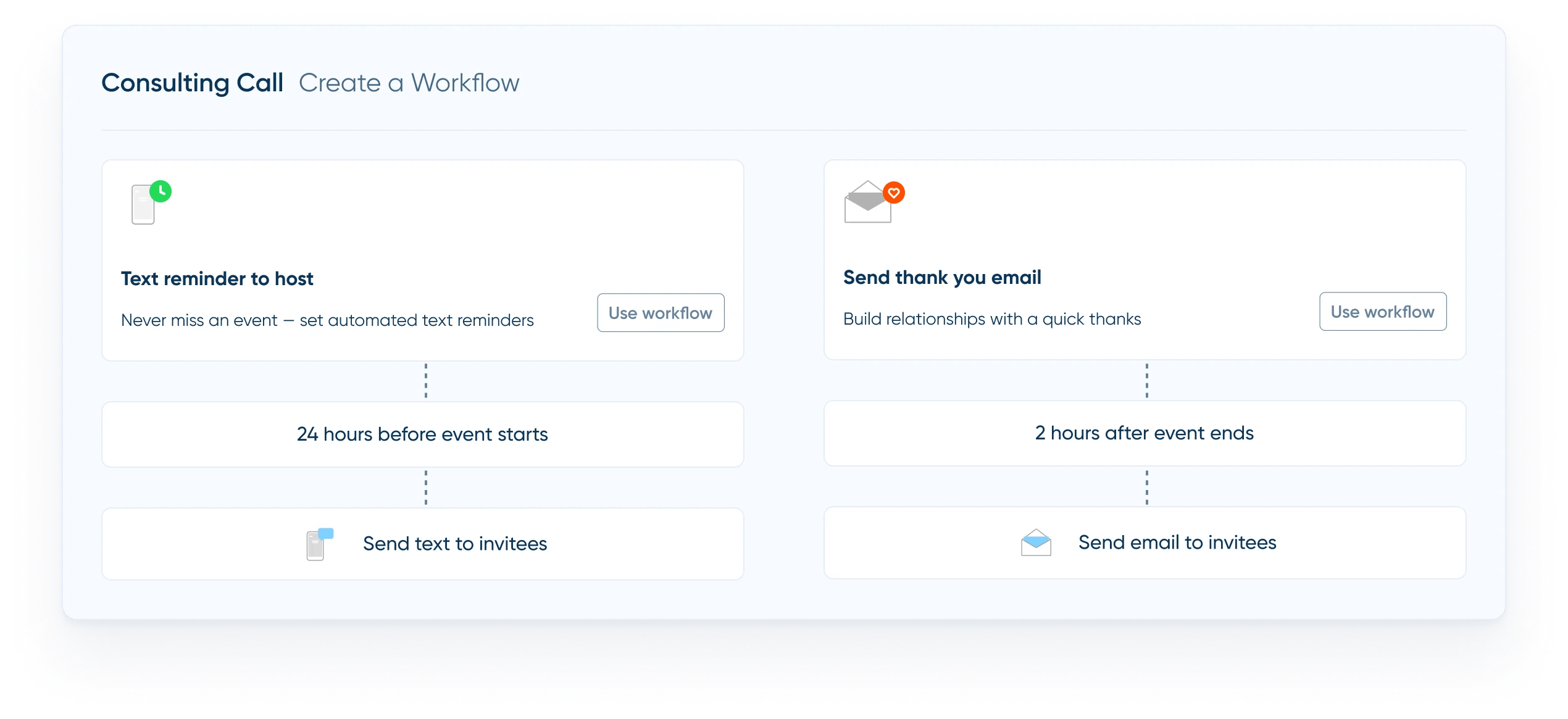

Calendly automates both reminders and follow-ups for scheduled meetings, helping to reduce no-shows and save time on post-meeting communication. This feature allows for routine communications before and after every meeting.

Source: Calendly

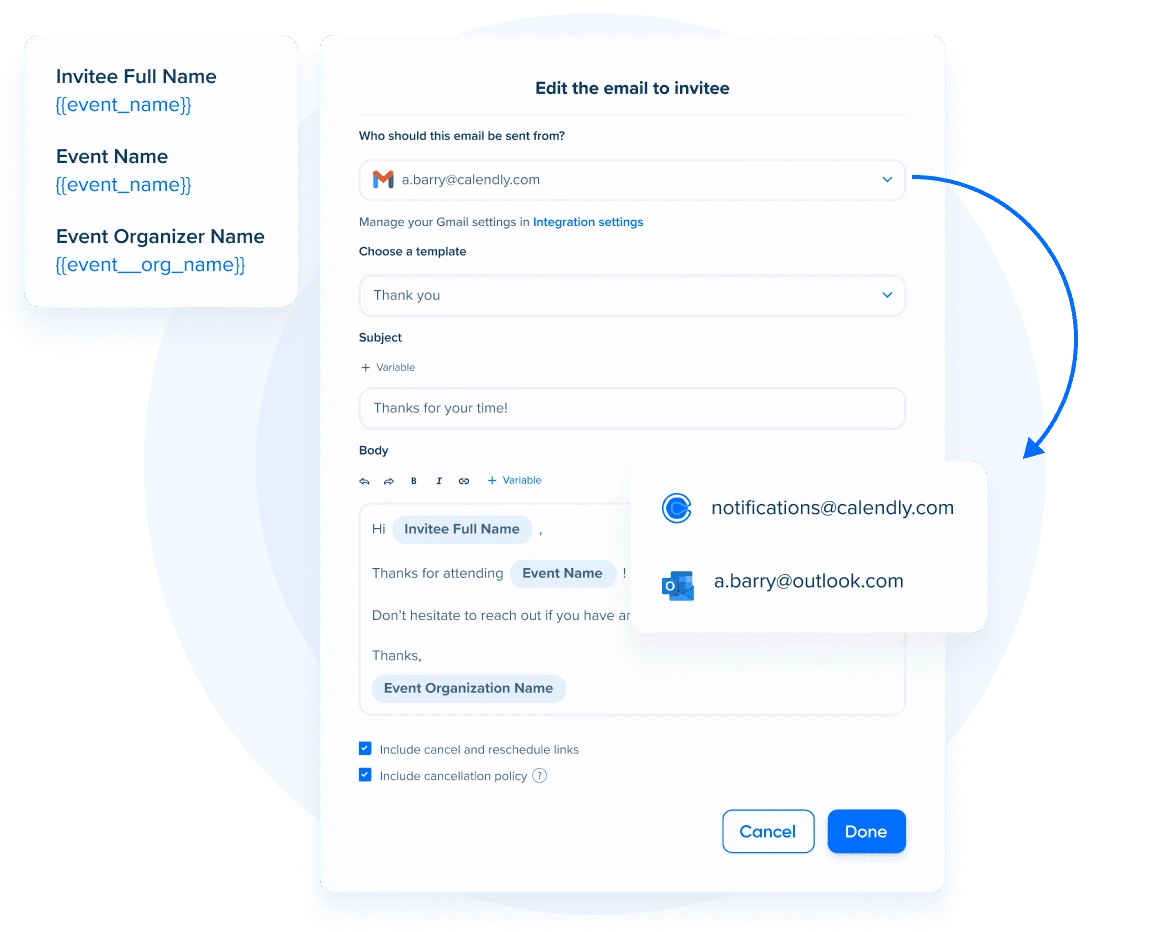

Users can create message templates that include customizable fields, allowing reminders and follow-ups to be sent automatically with personalized details. This streamlines communication without the need for manual input, ensuring participants stay informed throughout the scheduling process.

Source: Calendly

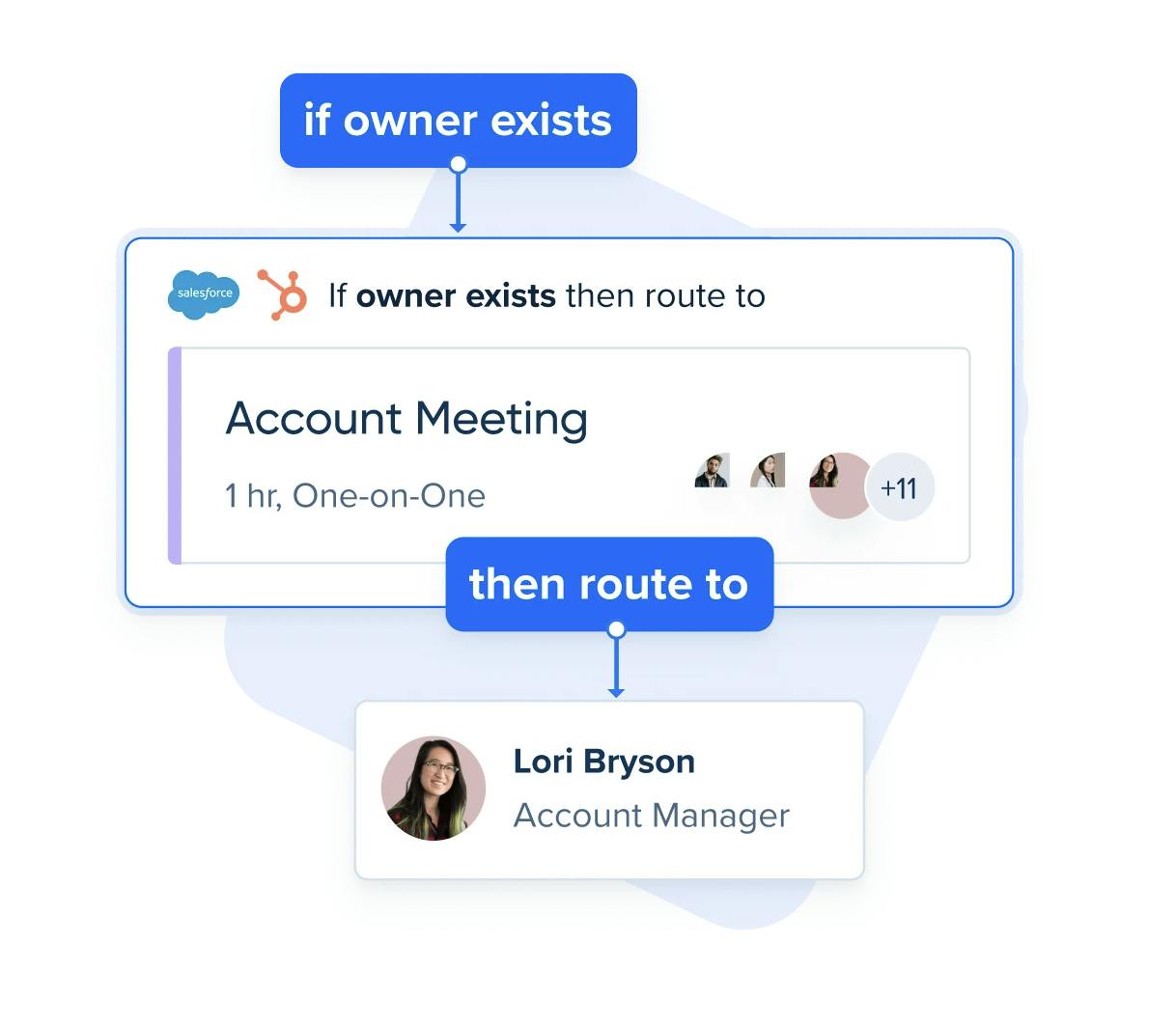

Meeting Routing

Calendly can screen invitees by asking them custom questions and based on their responses, automatically route them to the appropriate host or team member. This helps ensure that the right person is handling each meeting.

Source: Calendly

Calendly’s routing form can be embedded on any website or shared via a link to streamline lead assignment or meeting scheduling. It also integrates with CRM platforms like HubSpot, Marketo, and Salesforce, enabling businesses to automatically route sales leads to the correct team member or owner. This helps ensure that potential customers or clients are connected with the appropriate representative.

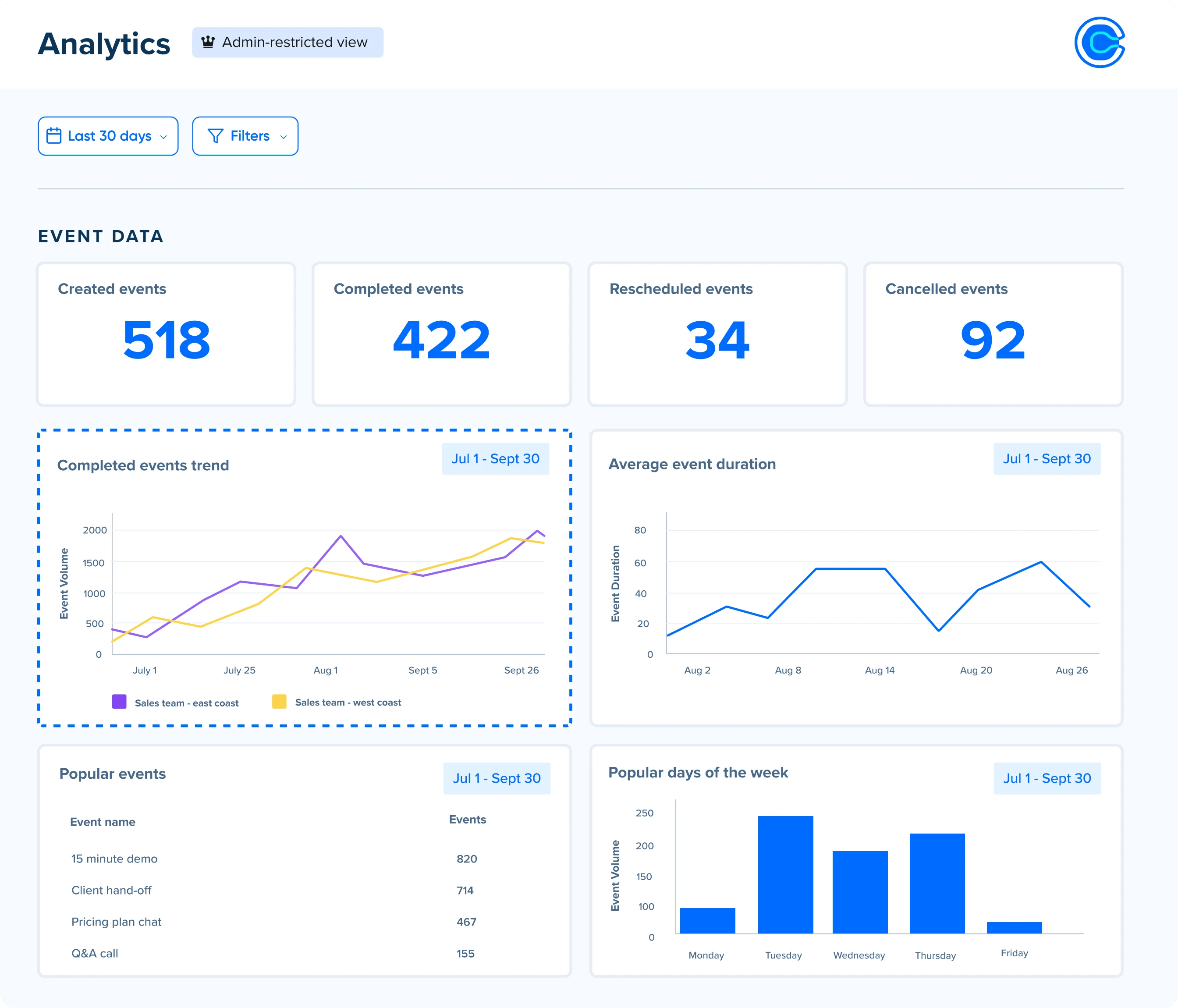

Analytics

Calendly features a customizable dashboard that tracks meeting trends, allowing users to filter data by specific groups and event types. This helps teams identify their most productive times for meetings by analyzing when they schedule the most. Additionally, the dashboard highlights the users who book the highest number of meetings, which can be particularly useful for sales teams. It also reveals the most popular meeting types, providing insights that can enhance marketing strategies.

Source: Calendly

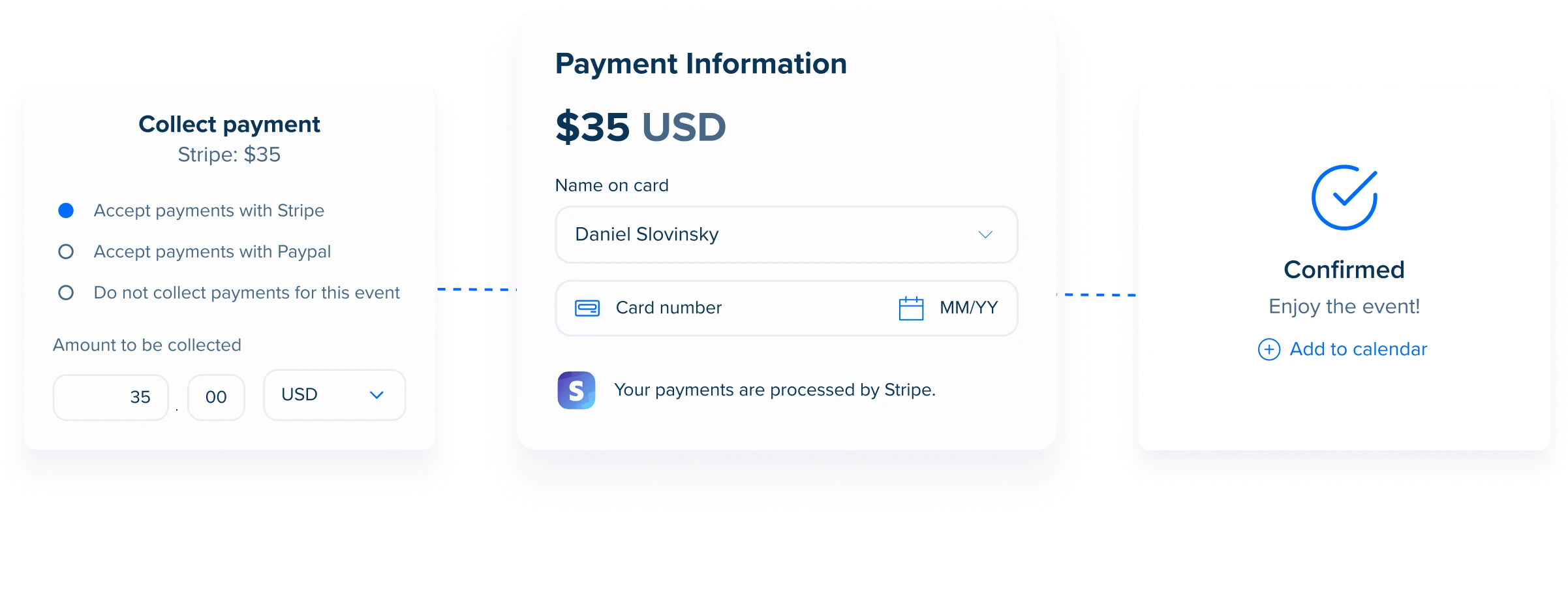

Payments

Calendly allows users to collect payments when a meeting is scheduled. Transactions can be processed through platforms such as Stripe, PayPal, or Stax. This payment requirement also reduces the likelihood of no-shows, as invitees have a financial stake in attending. After a meeting is scheduled, receipts are automatically generated, and users can issue refunds directly through the platform.

Source: Calendly

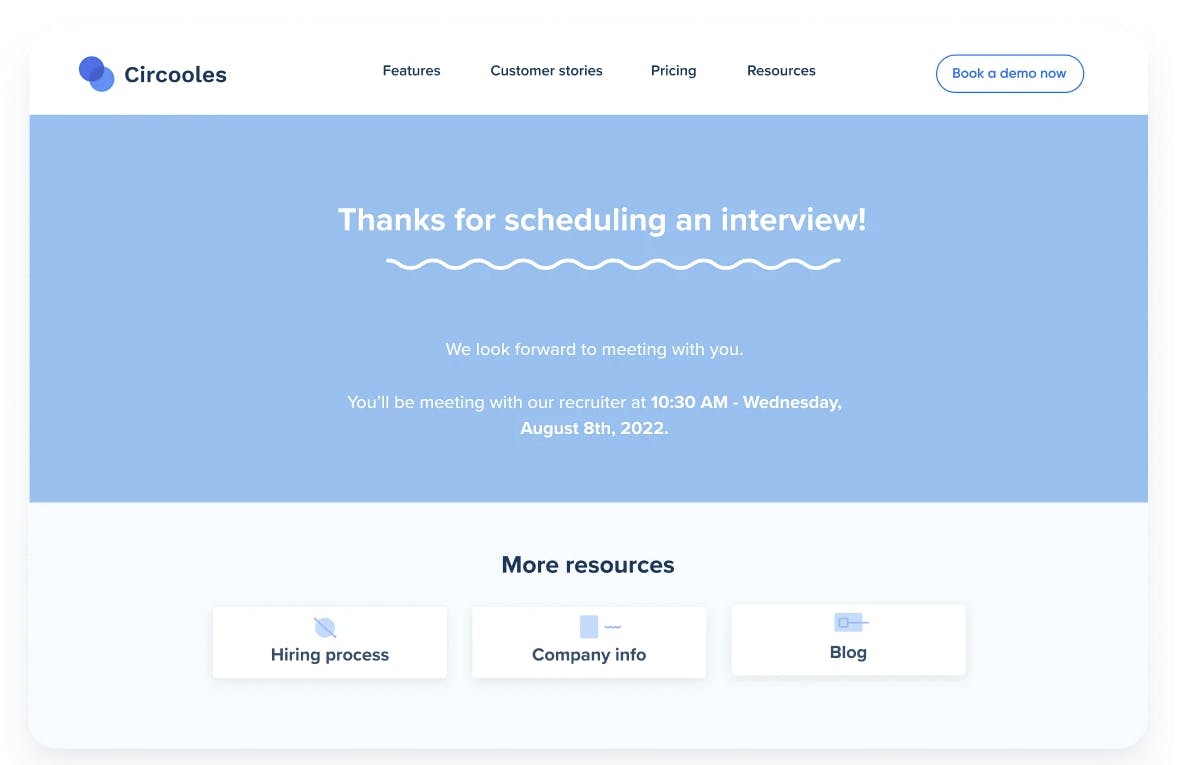

Applicant Tracking Software Integration

For recruiters, Calendly automatically syncs candidate records with Applicant Tracking Systems (ATS) like Greenhouse, JazzHR, Zoho Recruit, and Lever, minimizing the need for manual data entry. The platform helps recruiting teams automate round-robin calls and find availability for group meetings. After a meeting is booked, recruiters can create a custom confirmation page to provide applicants with additional information about the process or redirect them to any relevant webpage.

Source: Calendly

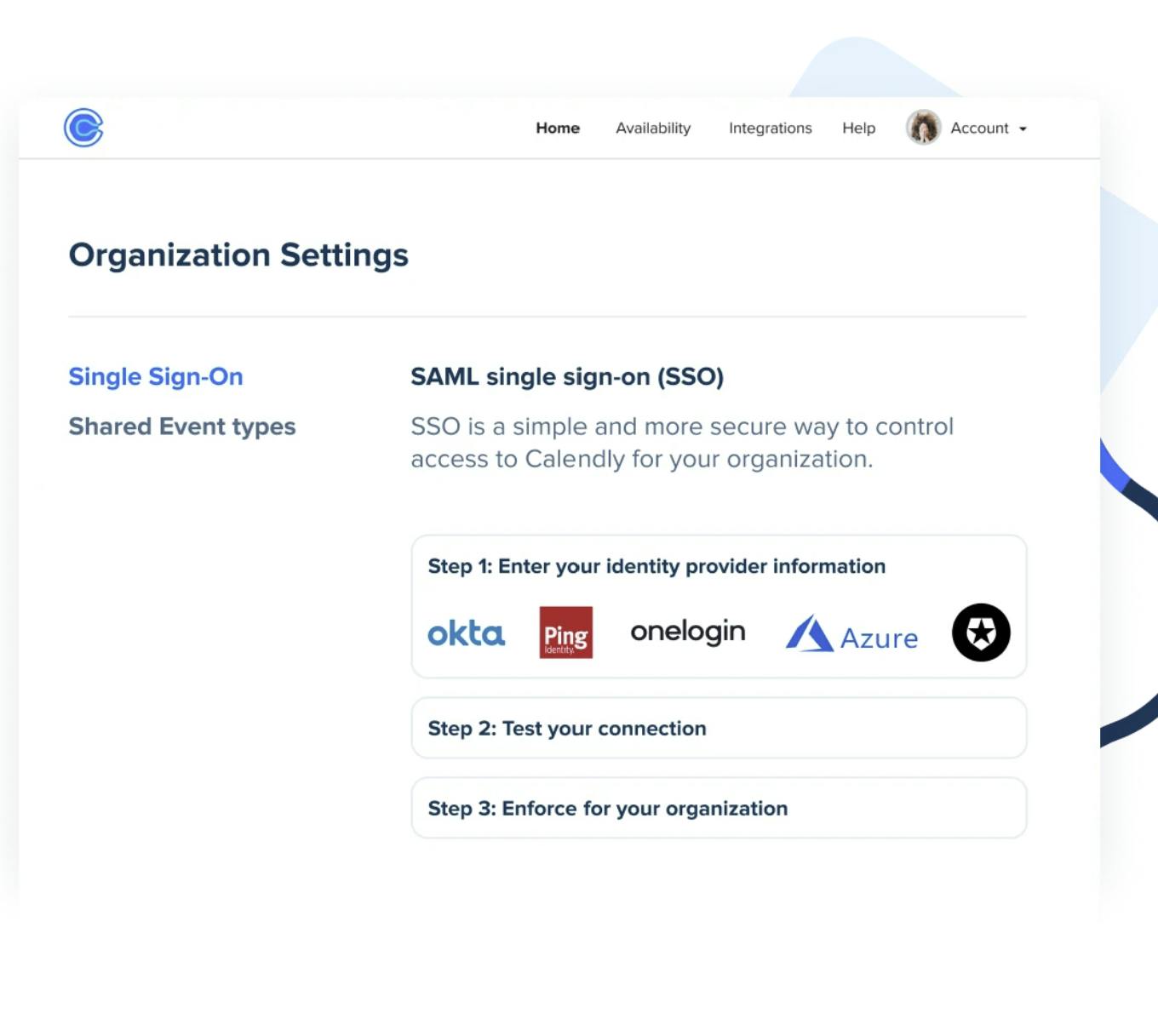

Enterprise Security

Calendly's security features make it suitable for enterprise use, including certifications such as SOC 2, GDPR, and FINRA. These certifications ensure compliance with data governance standards across various industries and regions, providing organizations with confidence in the platform's ability to protect sensitive information.

Source: Calendly

Calendly also offers Security Assertion Markup Language (SAML) single sign-on (SSO) for user authentication, along with a System for Cross-domain Identity Management (SCIM) for user provisioning. These features enhance security by ensuring that enterprise user accounts are protected.

Source: Calendly

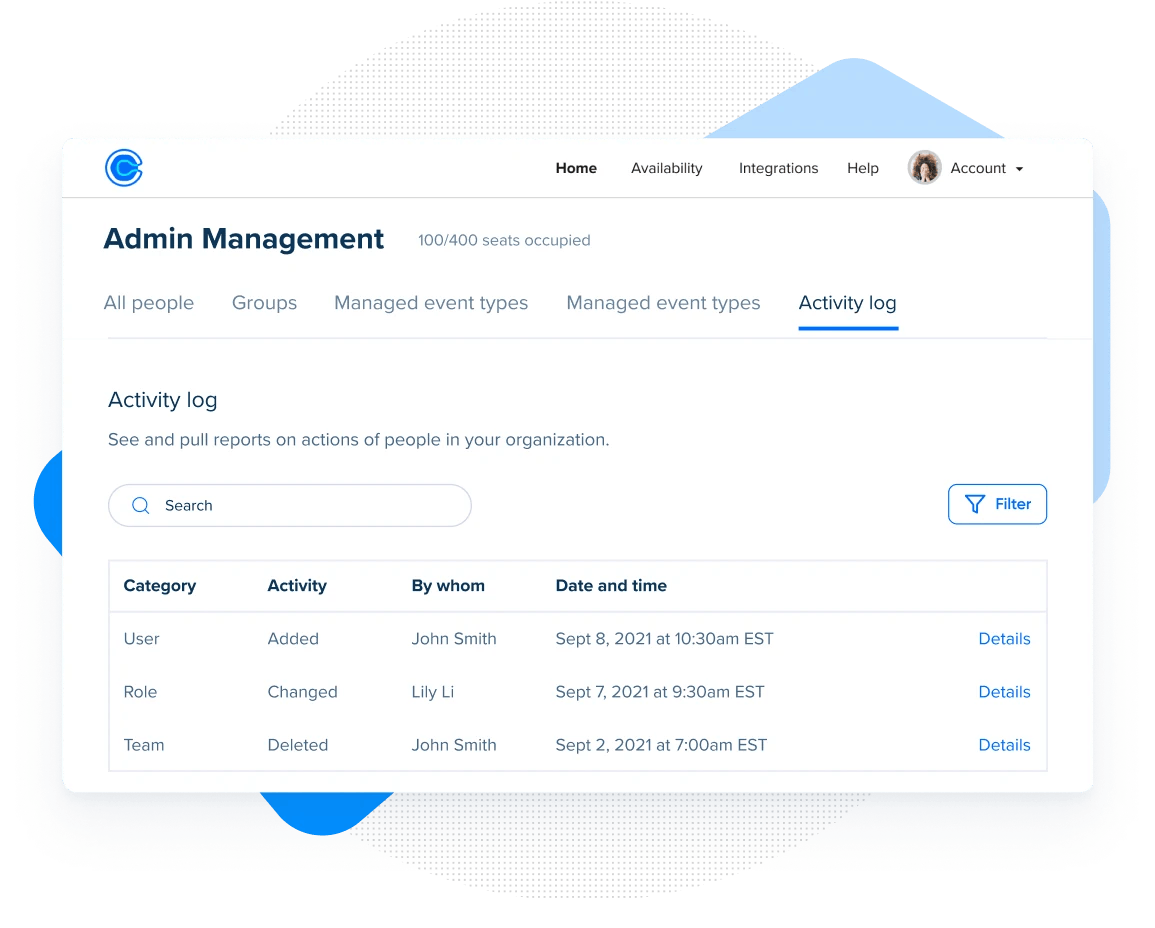

Calendly also features an administration dashboard that allows organizations to manage users. Administrators can organize team members into groups and standardize meeting types and automated reminders across the entire team. This centralized control helps streamline scheduling processes and helps with consistency in meeting management.

Source: Calendly

Market

Customer

As of October 2024, Calendly serves the technology, financial services, professional services, and education industries. Within these industries, it serves business units including:

Sales: Sales teams utilize Calendly to enhance responsiveness to customer inquiries, integrating with CRM systems to ensure accurate meeting documentation.

Marketing: Marketing teams primarily use Calendly for scheduling meetings with agencies, partners, and vendors.

Customer Success: Customer success teams rely on Calendly for customer experience by allowing clients to schedule meetings directly through the company website or support chat. Research indicates that slow response times can lead to a 15% increase in customer churn.

Recruiting: Recruiters use Calendly to streamline the interview process. According to the company, using Calendly increased the number of initial screening calls by 100% in 2024.

Market Size

The global calendar app market was valued at $5.7 billion in 2023 and is projected to reach $16.4 billion by 2030, growing at a CAGR of 10.4%. More specifically, Calendly operates in the appointment scheduling software market, globally valued at $406.9 million in 2023 and projected to reach $1.6 billion to grow at a CAGR of 16.1% until 2032. North America held the largest market of appointment scheduling software, with a market size of $139.5 million in 2023.

In 2021, Calendly itself estimated that the global addressable market for scheduling was $20 billion, which was far greater than third-party estimates of the same market would indicate. The company did not elaborate on how they arrived at this estimate.

Competition

Scheduling Software

Doodle: Doodle is an online calendar tool created for time management and coordinating meetings. It was founded in 2007 and was acquired by Tamedia in 2014. While initially developed with the intention to meet with people in college without continuous back-and-forth emails, Doodle eventually pivoted to serving enterprises. Although Doodle offers similar core scheduling features as Calendly, it differs in group scheduling. Calendly allows for the ability to schedule round-robin meetings and utilizes a poll to schedule group meetings. Furthermore, Doodle lacks the integrations that sales and recruiting teams have with Calendly.

Acuity Scheduling: Acuity Scheduling is an online appointment scheduling software for businesses. It was acquired by Squarespace in 2019. Acuity focuses on selling to businesses in the service industry like stylists or life coaches. However, it differs from Calendly’s enterprise features because it doesn’t offer security and administrative management.

YouCanBookMe: Founded in 2008, YouCanBookMe is an online tool for scheduling meetings and appointments, popular among universities and education businesses. For small-to-medium businesses, YouCanBookMe is a cheaper option compared to Calendly as it gives businesses access to its tools starting at $10 per month, while Calendly doesn’t unlock all its features until a user pays $16 per month. YouCanBookMe raised $150K collectively through two rounds of debt financing in 2011 and 2014.

Chili Piper: Chili Piper is a meeting and scheduling booking software primarily designed for revenue teams to optimize the conversion of inbound leads into sales. Founded in 2016, it raised over $54 million in funding from investors like Tiger Global Management and G Squared. While Chili Piper offers features that overlap with Calendly, such as meeting routing, it has half the amount of Calendly’s available CRM integrations and a limited variety of tools. It positions itself as a cost-effective alternative, with team plans starting at $15 per user per month compared to Calendly’s $20. Additionally, since Chili Piper offers flexible pricing, it allows enterprises to pay extra for advanced features or opt out of them to reduce costs.

Coconut Software: Founded in 2007, Coconut Software is an enterprise appointment scheduling software that is used by banks and credit unions like RBC. In 2021, it raised $35.8 million in funding from investors like Klass Capital and Information Venture Partners. Calendly also has clients within the financial services industry, but Coconut strictly focuses on one vertical.

Functional Platforms

Hubspot: Founded in 2006, Hubspot is a public company with a $27 billion market cap as of October 2024. It offers an online meeting scheduling tool. The meeting scheduler can be integrated into CRM software like Calendly, but Calendly is more customizable with variables like calendar invitations and email reminders.

Salesforce: Founded in 1999, Salesforce has a market cap of $272 billion as of October 2024. It was the first cloud-based CRM solution. Salesforce launched a scheduling service in 2019. The difference between Calendly and Salesforce’s services is that Salesforce requires users to be paying members of the entire Salesforce platform. In addition, it requires APIs to connect with calendars other than Salesforce’s native calendar. Overall, Salesforce scheduling can only be utilized if a company is an existing user. The scheduling aspect is an add-on feature.

Zoom: Founded in 2011, Zoom pivoted from being a video conferencing tool for small businesses and individuals to offering a suite of enterprise-grade solutions, including integrations with major business tools, advanced security features, and products like Zoom Phone and Zoom Rooms. As of October 2024, it had a market cap of $21 billion. It launched Zoom Scheduler in March 2023 to compete with scheduling platforms. A drawback is that users can’t use other videoconferencing software besides Zoom through its scheduler. As of November 2023, it also doesn’t offer any integrations with other apps while Calendly integrates with more than 100 apps.

Enterprise Platforms

Microsoft: Founded in 1975 and worth over $3 trillion as of October 2024, Microsoft offers meeting scheduling through Microsoft Booking, which integrates with Microsoft 365 and Teams. It only works with Microsoft calendars, while Calendly can integrate with both Google and Microsoft calendar applications.

Google: Founded in 1998 and worth $2 trillion as of October 2024, Google offers scheduling as a feature through Google Calendar. An area where Calendly is more versatile than Google Calendar’s appointment scheduler is with meeting customization and notifications. However, Google Calendar allows unlimited synchs with other calendars, even with a free Gmail account. As of July 2024, Google Calendar had 500 million users.

Business Model

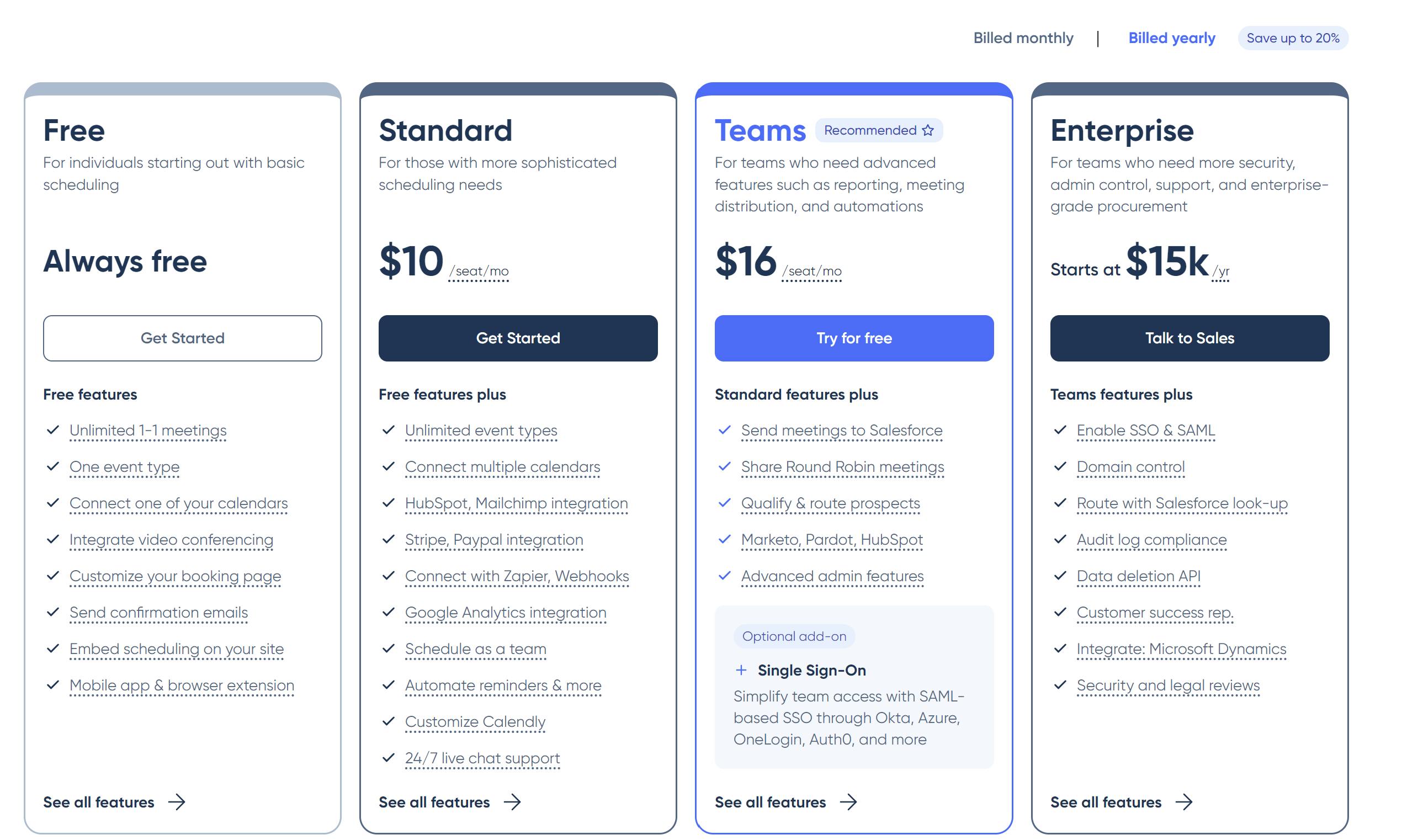

Calendly’s pricing model has four tiers as of October 2024:

Free: The free tier is designed for individual users, offering features like unlimited 1-1 meetings or connecting one calendar from Google Calendar or Microsoft Outlook to Calendly.

Teams: Teams can be purchased for $16 per month per person, and offers additional features like CRM integrations, sharing round-robin meetings, or accessing routing forms.

Enterprise: For the enterprise level, pricing differs based on the company, but starts at a minimum of $15K. It features security and legal reviews, domain control, and a customer service representative from Calendly.

Source: Calendly

Calendly’s business model revolves around product-led growth (PLG) strategy, where user acquisition is driven by the product itself. When users share their scheduling links with others to coordinate meetings, they expose potential users to the platform’s features. If the recipient finds value in the experience, they are likely to create their own account, initiating a cycle of organic growth. This strategy leverages user-driven exposure to expand Calendly’s user base without relying heavily on marketing.

Source: Sacra

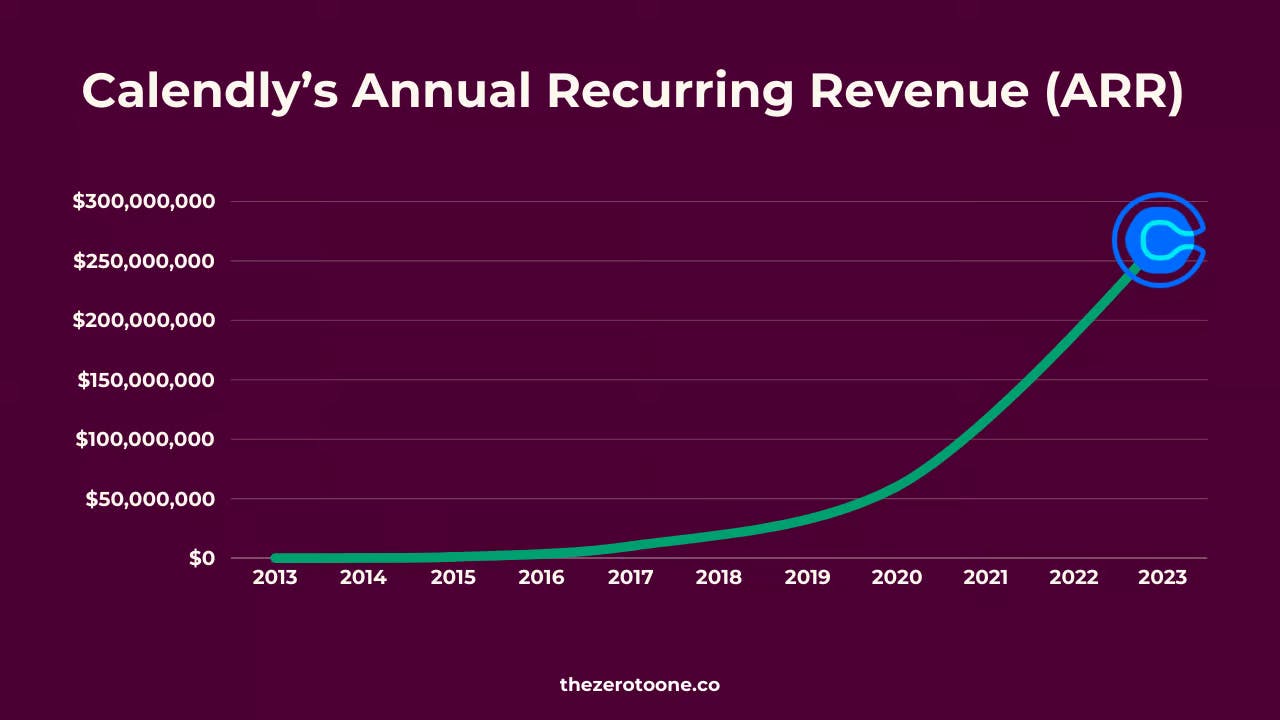

Traction

As of November 2023, Calendly had over 20 million users and served 100K companies. It became profitable in 2015, achieving $1 million in revenue, and by the end of 2023, it reached $276.1 million, more than doubling its revenue from $100 million in 2021. In September 2023, Calendly reported 61% year-over-year growth in its enterprise segment, with 86% of Fortune 500 companies utilizing its services. Additionally, in June 2023, the number of customers spending over $50K on Calendly grew by 400% year over year.

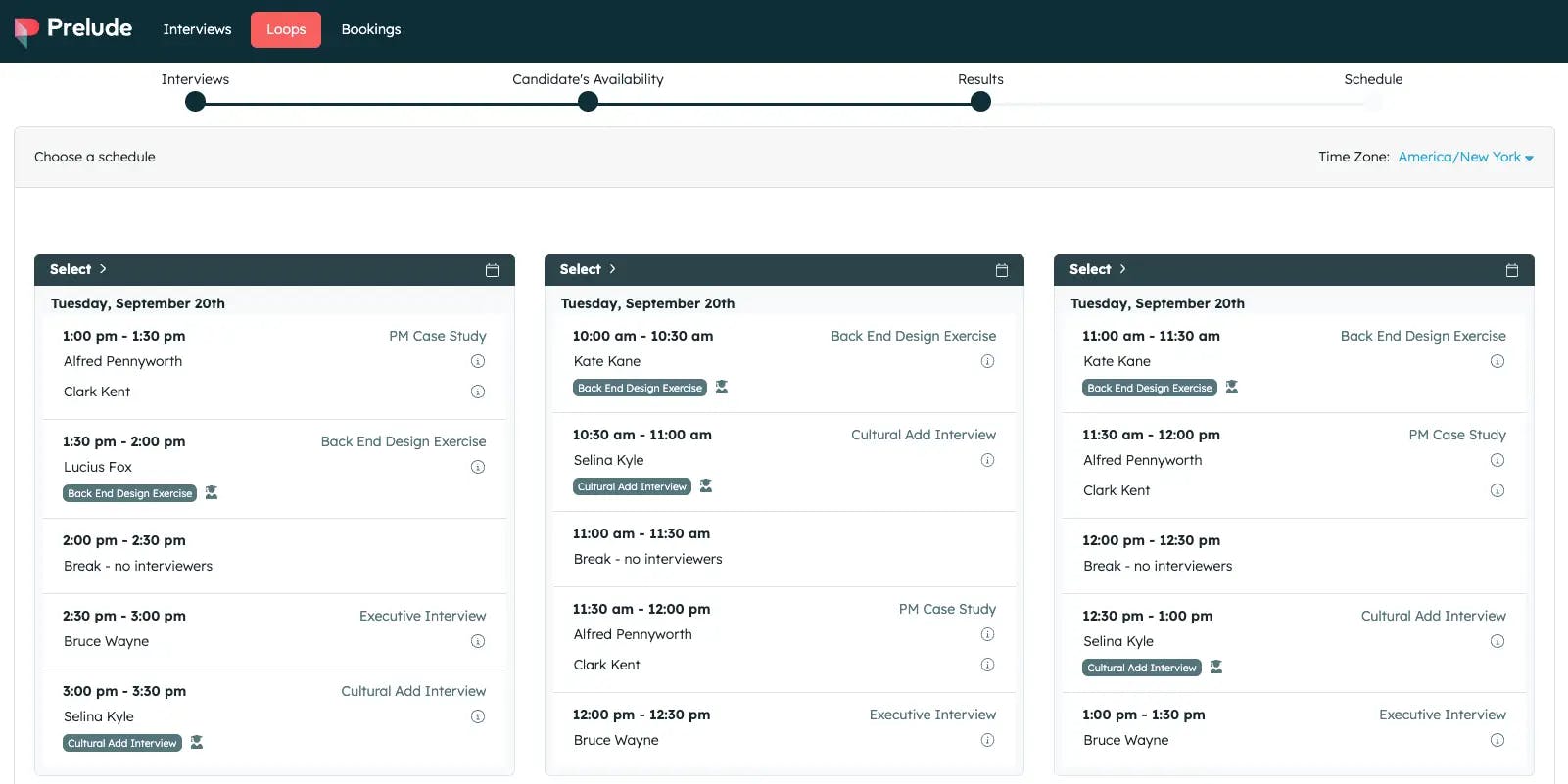

In 2022, Calendly expanded its capabilities through acquisitions, first acquiring Prelude, a company specializing in automating scheduling for recruitment, and then Hugo (formerly MeetingNotes), an enterprise solution that allows employees to collaboratively manage notes, tasks, and meetings in one place.

Source: The Zero To One

Valuation

Calendly raised a $350 million Series B round at a valuation of $3 billion from OpenView Venture Partners and ICONIQ Capital in January 2021 which brought the company's total funding to $350.6 million. Prior to its Series B, the only other round of funding Calendy raised was a $550K seed round from Atlanta Ventures in April 2014.

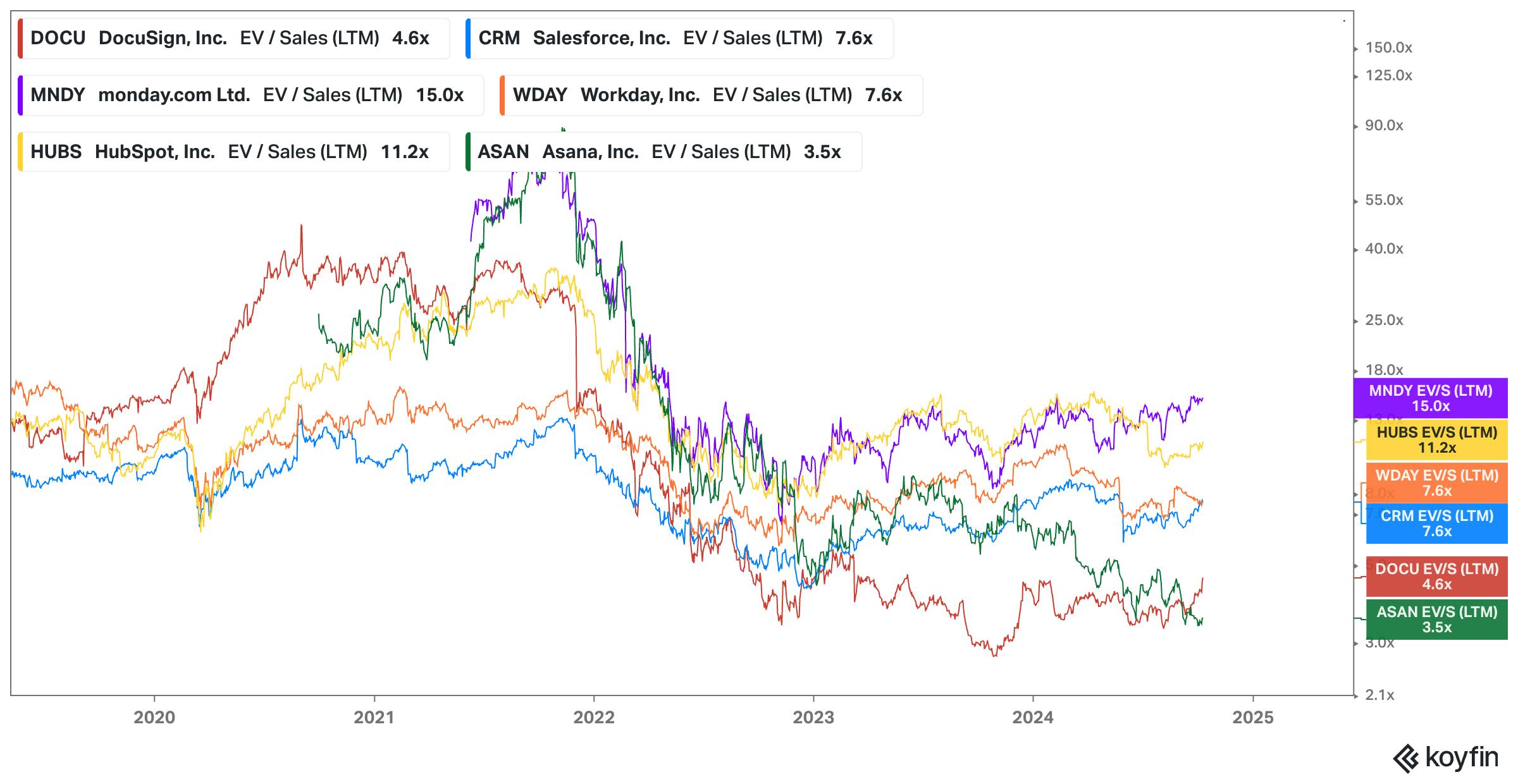

In 2020, Calendly generated $70 million in revenue, resulting in a ~42.9x revenue multiple. As an enterprise software tool with a seat-based pricing model, it can be compared to companies like Workday, HubSpot, Salesforce, Monday.com, Asana, and DocuSign. These companies, as of October 2024, had revenue multiples which ranged from 3.5x to 15x. This suggests that Calendly’s investors were potentially willing to pay a premium for each dollar in sales due to its placing outside of the range of the comps’ multiples when the last round was raised in 2021.

Source: Koyfin

Key Opportunities

Corporate Development

Calendly's acquisition of Prelude in 2022 helped position itself to streamline interview processes, from initial screenings to final rounds. For instance, Samsara saved 600 hours annually by using Prelude's software, which integrates with ATS to manage the interview lifecycle in 2022. The long-term objective is to incorporate Prelude's capabilities into Calendly's platform, allowing it to emerge as a leader in recruiting automation. This integration opens up opportunities for Calendly to market Prelude’s solutions to its existing customer base while also reaching out to Prelude's clients, which include companies like Cloudflare, Samsara, and Duolingo.

Moreover, Calendly can adopt a similar M&A strategy to delve deeper into other verticals. It can expand its workflows surrounding its core scheduling functionality, further embedding its software into its customers' productivity ecosystems. Calendly has the potential to develop tools, not only for scheduling calls with prospective clients, but also for actively managing sales pipelines, onboarding new users, and facilitating calls. This initiative could enable Calendly to extend its reach into areas traditionally served by companies like HubSpot and Drift, enhancing its offerings in sales, customer success, marketing, and recruiting through more vertical-specific features and third-party integrations.

Source: Calendly

Enterprise Customer Growth

In May 2024, Awotona set a goal for Calendly to reach $1 billion in annual revenue. To support this, it secured licenses to operate in specific industries. For example, Calendly adheres to FINRA guidelines and holds ISO/IEC 27001 and SOC 2 certifications to serve clients in financial services as of October 2024.

Historically, Calendly leveraged bottom-up, word-of-mouth self-service growth, which worked for smaller companies. However, acquiring and retaining large enterprise customers with 1K+ employees will likely necessitate a robust sales, marketing, and account management strategy. Enhanced enterprise penetration not only improves customer retention but could also increase average revenue per user through more lucrative contracts. Additionally, there is potential to boost revenue from existing clients by expanding sales to other departments and teams within an organization.

Key Risks

Platform Transition

Calendly grew due to its simplicity and ability to eliminate back-and-forth emails for scheduling meetings. However, many enterprise software providers have integrated similar scheduling features into their platforms. Companies like Microsoft, Google, Zoom, Salesforce, and HubSpot offer their own meeting schedulers, making it more cost-effective for enterprise users to pay for an add-on to an existing subscription rather than adopt a new service like Calendly.

In response, Calendly aims to position itself as a platform rather than a replicable feature. Since 2021, the company expanded itself vertically by developing features tailored for sales and recruiting and building APIs to integrate with other platforms, thereby serving as a central hub for meeting management. However, as the original value proposition of offering simple and intuitive scheduling software becomes less distinctive, Calendly's transition into the enterprise software space and its goal of becoming a platform could prove to be a more challenging undertaking.

Crowded Market

As of May 2024, Calendly faces competitive pressures from companies that are more specialized than Calendly in their respective markets. For instance, Coconut Software focuses solely on the financial industry and is utilized by banks like RBC, while YouCanBookMe caters to the education industry, with universities as clients. A former executive from Coconut stated that the platform was adopted by banks and credit unions in the US. Competing against niche players poses challenges for Calendly because they likely have a deeper understanding of their customer base and can customize their software to better meet their needs. As Calendly targets multiple industries, there is a risk of overextending its resources, which could hinder its ability to address customer requirements as it continues to grow.

Summary

Calendly is a cloud-based scheduling automation platform that offers a user-friendly interface, enhancing productivity for its users. The company broadened its offerings with complementary features that improve the overall meeting lifecycle. Its growth and profitability led to a valuation of $3 billion in 2021. Looking ahead, Calendly has opportunities for further expansion by acquiring more enterprise customers. However, it faces significant competition from larger enterprises that can integrate similar features into their platforms, as well as niche competitors that cater to targeted user needs. To remain competitive, Calendly may have to innovate and position itself as a comprehensive platform rather than a replicable feature.