Thesis

The US healthcare payment system is confusing, time-consuming, and archaic. With 72% of patients needing clarification on their bills as of 2024, billing workflows are too complex. Not only is there an issue of statement complexity, but patients are flooded with multiple bills. In addition to patient complexity, this contributes to issues for providers as well. In 2024, 75% of providers reported needing more than one statement to collect. Furthermore, it takes 66% of providers over 30 days to collect payment after a patient encounter. The existing payments workflow is dominated by legacy payment methods including checks and money transfers. 71% of providers collected from patients via manual processes as of 2024.

The burden on patients is further increased with rising healthcare costs. The average deductible rose over 53% over the last decade into 2023. In 2024, medical debt was up over 50% over the last five years, causing every two in five patients to skip or delay care. In 2022, out-of-pocket healthcare spending had been rising at ~7% per year which reflects a need for access to financial assistance options including outside funding, self-service tools, and enrolling for Medicaid.

On top of an already outdated and expensive industry, healthcare is seeing further complexity. In 2021, the Centers for Medicare & Medicaid Services (CMS) required hospitals to publish payer-negotiated prices. In 2023, insurers became required to provide cost-sharing information for 500 “shoppable” services, which expanded to all items and services in January 2024. However, this massive amount of information has been largely indecipherable to the average American. In 2024, 69% of bills raised confusion regarding how the cost was determined, and 35% of bills made it hard to decipher who or what the statement was for.

That’s where Cedar comes in. Cedar addresses the patient burden by automating and simplifying billing. The platform also helps patients with medical debt by providing digestible financial assistance options. The company also helps healthcare providers digitize and improve collection time and efficiency by automating the entire patient journey from check-in to billing. Cedar combines data from health systems and insurers to provide patients with a concise and easy-to-understand billing experience. Cedar also uses AI to handle patient support, acting as an intermediary before the patient has to talk to front-desk staff.

Founding Story

Cedar was founded in 2016 by Florian Otto (CEO) and Arel Lidow.

Otto finished his PhD in medicine at the University of Freiburg in 2009 after which he founded ClubeUrbano, a Brazilian deal company that would become Groupon Brazil. He later went on to ZocDoc in 2012 as a VP of Sales overseeing the commercial department. Meanwhile, Lidow studied electrical engineering and finance at Princeton University where he graduated in 2005, after which he went to work at Bridgewater Associates and AppNexus.

Otto came up with the idea for Cedar after his fiancé had a poor billing experience. Following a visit to the ER after fainting, Otto’s finance received a bill a month later which was in a foreign code and unclear on how to pay. Another month later they received another bill that had to be paid via physical mail. To cap it off, a year later they received a call from a debt collector on behalf of a lab company seeking payment for a bill they never received.

Otto would go on to create Cedar to “bring healthcare [into] the 21st century, and put the consumer in the center of everything.” The origin of the Cedar name was simple - it represented healing/calming and was coincidentally a short word for marketing. Having firsthand experienced the difficult financial experiences patients had, Otto’s focus with Cedar was to personalize the patient payment workflow and meet each patient with a unique message and tailored payment plan. Lidow was introduced to Otto by Thrive Capital who led Cedar’s seed round.

Cedar found its first customer by looking for innovative healthcare leaders at a medium-sized scale. Cedar initially avoided juggernauts in the industry who would require a solution capable of handling high-complexity billing with large amounts of policies. The team also sought customers geographically close to allow for high interaction. Cedar eventually found two clients in early 2016 who believed the healthcare billing system was broken and wanted a personalized solution - nine months after finding these first customers, Cedar had built the first version of its product.

Product

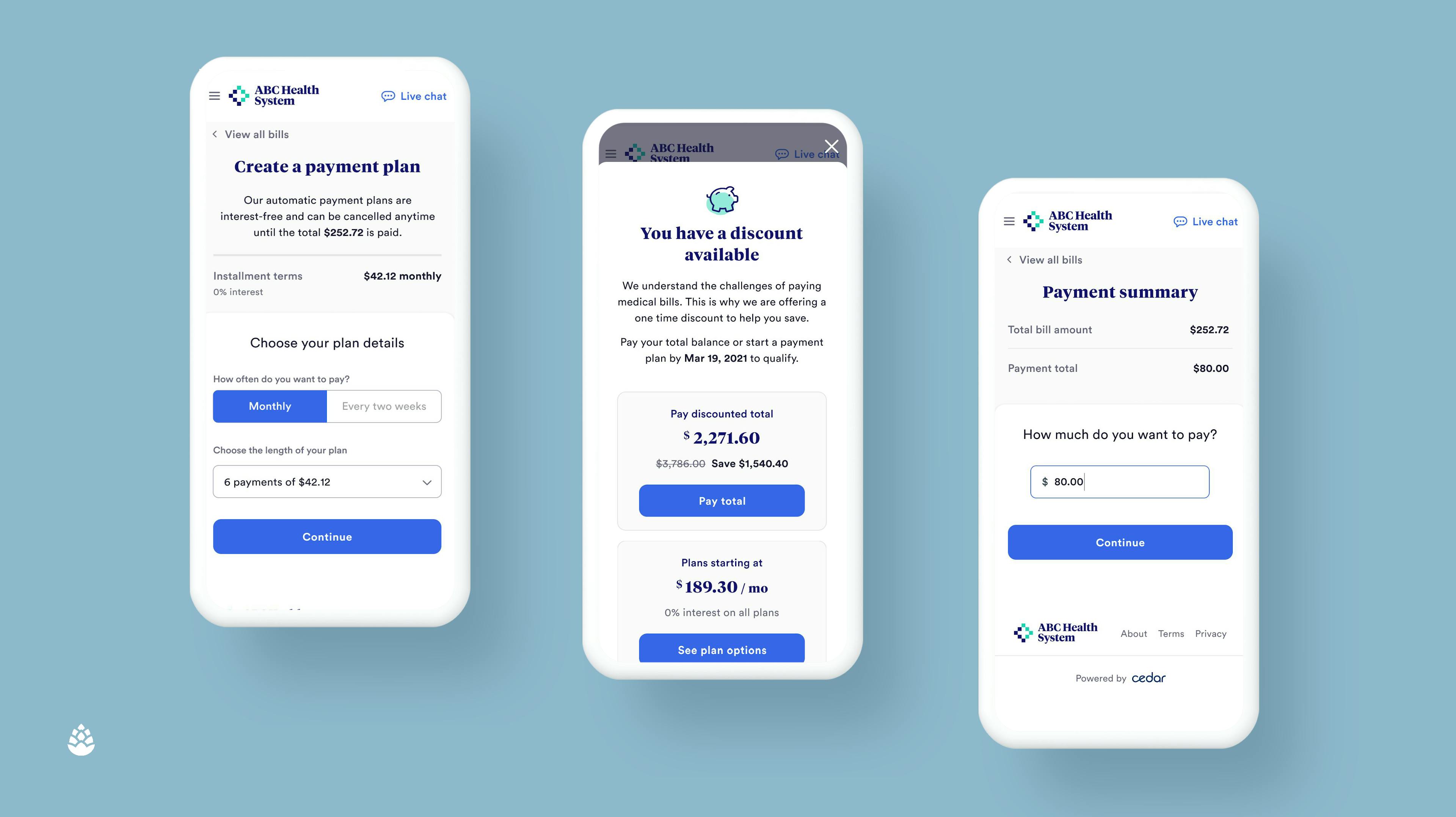

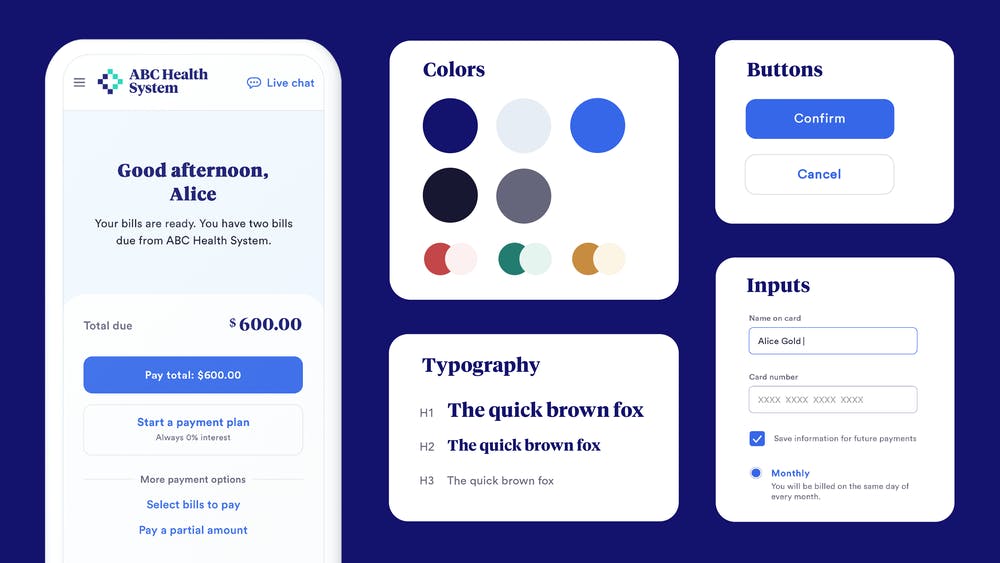

Cedar is an enterprise consumer healthcare platform that manages the end-to-end patient journey. The platform integrates with payers, providers, and HSA/FSA banks to aggregate data. The data is then personalized to drive specific insights for each individual, and from there is used to increase patient engagement and reduce friction. Cedar Suite handles everything from pre-visit intake and cost estimation to post-visit billing and payment.

Cedar Pay

Source: Avia Health

Cedar Pay bridges the gap in payer-provider information by consolidating healthcare bills, Explanation of Benefits (EOBs), deductible status, and HSA/FSA Balances in one place. As soon as a statement is ready, the bill is matched to benefits so that patients can immediately see what they are responsible for.

Further, Cedar Pay can create personalized financial resolution schedules tailored to the individual. Some patients may want to pay instantly, others may need a monthly payment plan, and some may even take a while to check their email, requiring multiple follow-ups. By automating the billing process, front desks no longer waste time on outbound, allowing them to focus on complex patient situations

Cedar Support

Source: Cedar

As of March 2025, Cedar was planning to launch Cedar Support, an AI-powered contact center for healthcare providers. Prior to this broader support product, Cedar offered providers access to Cedar Pre, which handled pre-visit logistics such as sending visit confirmation texts and intake forms that collect demographic, health history, consent, and insurance information. The UI allows patients to interact via a conversational style rather than forms, speeding up intake. This eliminates duplicated requests for information and frees up front desk staff.

Source: Cedar

Alongside logistics, Cedar Pre is responsible for timely notifications to patients for any responsibilities including upcoming visits and payment deadlines. The platform personalizes outbound communication via SMS to reduce no-shows and customer service calls.

Finally, Cedar Pre aggregates data from payers, provider networks, and HSA/FSA banks to provide a cost estimate. This estimate is tailored based on network, service type, customer profile, and more. 32% of consumers want bill estimates before their visit, but 40% say that information is either difficult to find or inaccurate. This lack of early, clear communication of upcoming financial responsibility leads to an increased chance of missed payments. Furthermore, the lack of billing estimation is a major cause of the frustration and stress associated with the billing process.

Cedar Cover

Source: Cedar

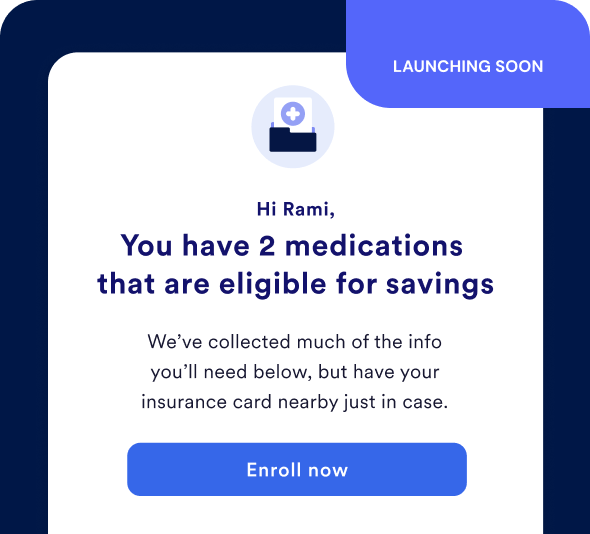

In January 2024, Cedar launched its Affordability Navigator to help connect patients with funding to make healthcare more affordable. As of March 2025, Cedar was planning to launch Cedar Cover, which would provide benefits and financial assistance enrollment. Benefit offerings available include ACA coverage and Medicare Advantage supplemental benefits.

As of November 2023, Cedar announced it was partnering with Advocatia for Medicare enrollment assistance. However, in a March 2025 interview with Contrary Research, Nikita Singareddy, the CEO of Fortuna Health, confirmed that Fortuna was the Medicaid partner for Cedar Cover, assumedly replacing Advocatia.

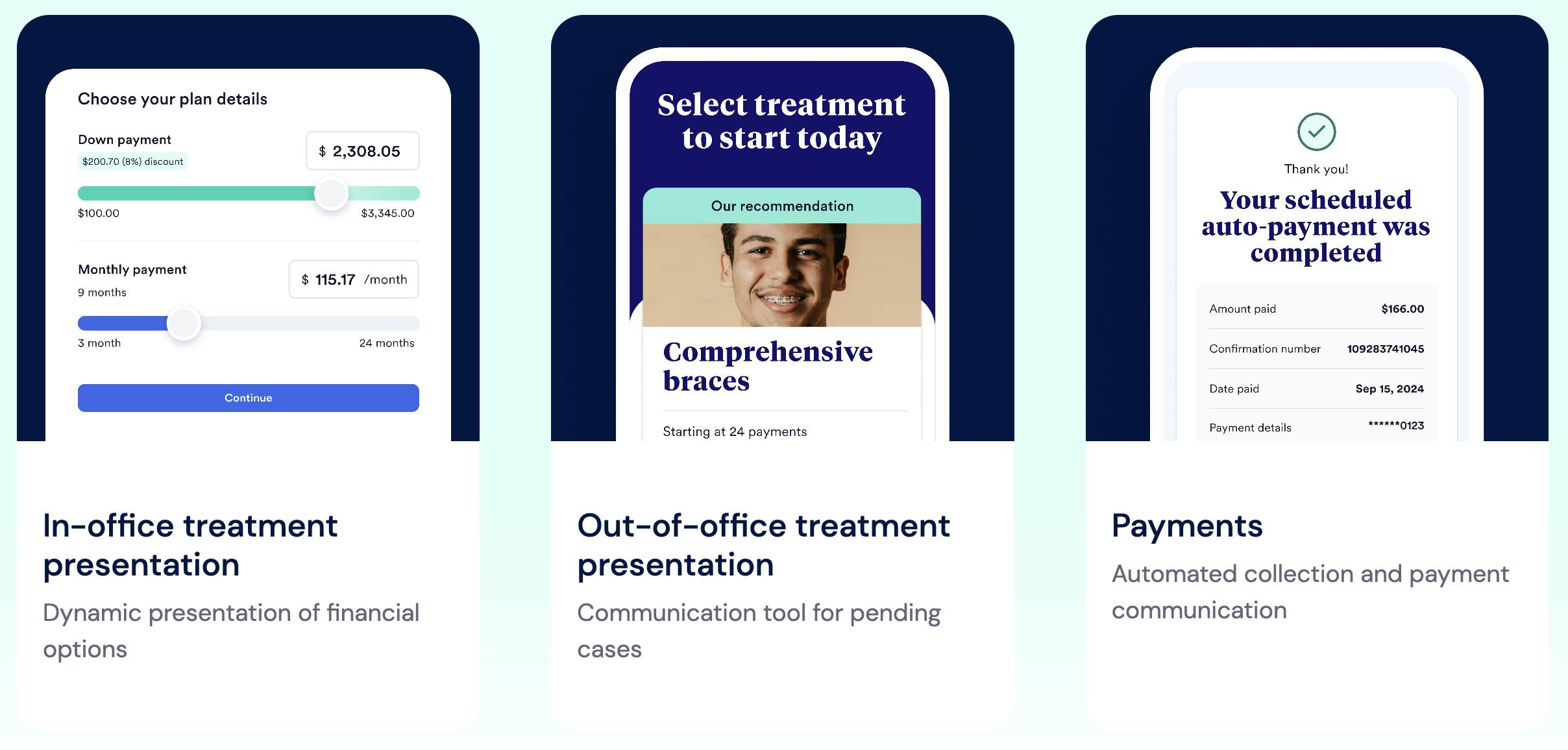

Cedar Orthodontics

Source: Cedar

Cedar announced its expansion into the dental market in April 2024, reportedly partnering with Tend Dental to provide better billing experiences for over 200K Tend members. In December 2024, Cedar launched a purpose-built solution for orthodontic practices. The goal of the dedicated solution is to leverage Cedar’s existing products across patient payments, while also leveraging additional modules across treatment presentations to improve conversions and staff efficiency improvements with prescriptive tools and analytics. In particular, Cedar’s treatment presentations also offer resources around financial conversations that are meant to lead to flexible payment plans, e-signature, and financial policy customization.

Market

Customer

According to one former Cedar executive in August 2022, Cedar’s target customer profile is midsized healthcare systems. One reason for this is that the largest healthcare systems have much higher IT spend and can often afford to build an in-house solution or pay for a fully customized version. Alternatively, smaller systems cannot afford Cedar, per the same source. Cedar serves customers such as Novant Health, Christiana Care, Providence, Allegheny Health Network, Highmark, AnMed, National Physician Group, Talkiatry, and ApolloMD.

Providers who become patients of Cedar typically want a modernized patient touchpoint service. Usually, these customers are dealing with legacy patient collection systems using paper billing and a combination of various point solutions. In addition, these providers typically have limited collection experience, and use Cedar for an immediate increase in collection percentage.

Selling to healthcare providers can be difficult due to their buying tendencies and slow adoption rates. Healthcare is known for long sales cycles. As of July 2024, 30% of B2B sales cycles take between one to three months. Meanwhile, healthcare sales cycles begin at an average of two to three months but can range up to two years depending on the complexity of the product. Furthermore, as of October 2023, providers remained reluctant to switch software providers due to high costs and long transition periods.

Finally, selling into healthcare is difficult due to the nature of reimbursement. Patients rarely pay for the majority of services they receive, with out-of-pocket spending accounting for only 11% of National Health Expenditures in 2022. Instead, the majority of bills are paid through insurance. Medicare, Medicaid, and private health insurance spending represented a combined 69% of NHE in 2023. Insurance reimbursement to providers can take time. Medicare, for example, takes around 29 days to process and pay paper claims per a CMS report in October 2024.

Market Size

Cedar primarily operates in the healthcare revenue cycle management (RCM) market, which was estimated to be $344 billion in 2024, and expected to grow to $657 billion in 2030 at an 11.4% CAGR. In addition, the US Patient Engagement market is estimated to grow from $5.41 billion in 2024 to $17.7 billion in 2030 (21.6% CAGR 2022-2030). Key drivers include the demand for modern solutions, the need for workflow synchronization, billing complexity and its adverse effects on patients, and the expansion of health systems to different care offerings

Looking at customer spending, as mentioned Cedar sells to midsized hospitals. Hospitals with 101-250 beds, considered midsized, spend, on average, $7.9 million in IT operating expenses yearly. Meanwhile, hospitals with 250 beds spend $28.9 million on average. These same large-sized hospitals also had the highest average annual increase in IT expenses since 2017, a rate of about 6%.

Competition

Epic Systems: Founded in 1979, Epic sells an EHR that helps manage the entire patient journey from scheduling an appointment to billing. Additional products they offer include RCM, customer retention tools, and data analytics. Epic generated ~$5 billion in annual revenue in 2024. Epic targets the largest health systems in the country, with over 240 beds. These customers require complex, unique solutions and can afford to pay for these fully customized platforms. A former Cedar executive considers Epic to be Cedar’s biggest competitive threat. Epic is replicating most of what Cedar does in its new product, Cheers, a CRM for healthcare. In addition, Epic’s MyChart centralizes all patient info in one place including medications, test results, upcoming appointments, medical bills, price estimates, and more.

Phreesia: Founded in 2005, Phreesia went public in 2019. As of March 2025, the company had a market cap of $1.7 billion and generated $356 million in revenue in 2024. Phreesia automates tools for patient intake, meaning it competes directly with Cedar, which simplifies registration, scheduling, and insurance verification. The workflow Phreesia offers starts with patient check-in using the company’s mobile app. From there the software handles patient questionnaires that allow patients to submit medical history, demographic, and insurance information. They also offer a dashboard to summarize and manage patient information and send customizable alerts. One way Phreesia differentiates from Cedar is through speciality-specific workflows. The company’s intake process can be customized to cardiology, dermatology, family medicine, and other specialties. Furthermore, in October 2024, Phreesia renewed a contract with the Center for Medicaid Services to keep providing their data analytics tools for the CMS’s alternative payment models.

RevSpring: Founded in 1997, RevSpring is a patient engagement and billing platform focused on managing the patient journey, providing data analytics, and helping tailor payment plans. RevSpring was acquired for $1.3 billion in March 2024 by Frazier Healthcare Partners. Customers of Cedar reported using RevSpring for behavioral health accounts: “We don’t give [Cedar] behavioral health accounts because it is a more sensitive patient population and we don’t give them occupational medicine because it is a different billing model.” RevSpring’s product offering is comprehensive across the patient lifecycle, including patient intake, payment solutions, and data analytics. RevSpring announced in August 2024 a new product, True Up, focused on allowing patients to pay preservice. By combining cost estimation and automatic refund software, RevSpring allows providers to request payments earlier while still giving patients the opportunity. This contrasts with Cedar which offers cost estimation tools but only offers payment collections after services.

InstaMed: InstaMed is another healthcare payment optimization platform and was founded in 2004. In 2019, InstaMed was acquired by JPMorgan Chase for $600 million. The platform centers around combining payers, patients, and providers into one central hub. InstaMed does not deal with pre-visit engagement such as questionnaires and intakes. The platform solely focuses on revenue collection and enables patients to pay their healthcare bills digitally. The platform also uses cloud technology to help transfer data between the three parties.

NextGen: NextGen is an Electronic Health Record system founded in 1974 that was taken private by Thomas Bravo for $1.8 billion in November 2023. NextGen’s software is tailored specifically to ambulatory healthcare providers. NextGen provides a suite of tools beyond the scope of Cedar’s offerings including collections and patient experience tools such as intake and scheduling. However, NextGen’s suite also includes an EHR platform that allows providers to have a database of patient health records, as well as a scribe app that can turn patient-provider conversations into transcripts. NextGen’s product is targeted at small physician groups of under 100 providers.

Business Model

Cedar operates via an enterprise SaaS model selling into health systems, charging a monthly fee based on the number of seats and integrations used by the health system. According to one former Cedar executive, Cedar also offers custom contracts for Cedar Pay in which they charge a fee between 1-4% of all collections.

Traction

As of the end of 2023, Cedar was serving 25 million patients. This was a 14% increase from the 22 million patients they were serving at the end of 2022. As of January 2025, that had grown to 50 million. Notable listed customers include Novant Health, Christiana Care, Providence, Allegheny Health Network, Highmark, AnMed, National Physician Group, Talkiatry, and ApolloMD. One unverified estimate of Cedar’s 2023 revenue was reportedly $102 million.

Valuation

Cedar raised a $200 million Series D led by Tiger Global in March 2021 at a $3.2 billion valuation. Other notable past investors in Cedar include Thrive Capital, Founders Fund, and a16z. In December 2022, Cedar raised a $68 million Series D extension from the Memorial Hermann Foundation. Before their Series D, Cedar raised a $102 million Series C led by Andreessen Horowitz in June 2020 at a $427 million valuation. The deal also included $25 million of venture debt from JP Morgan.

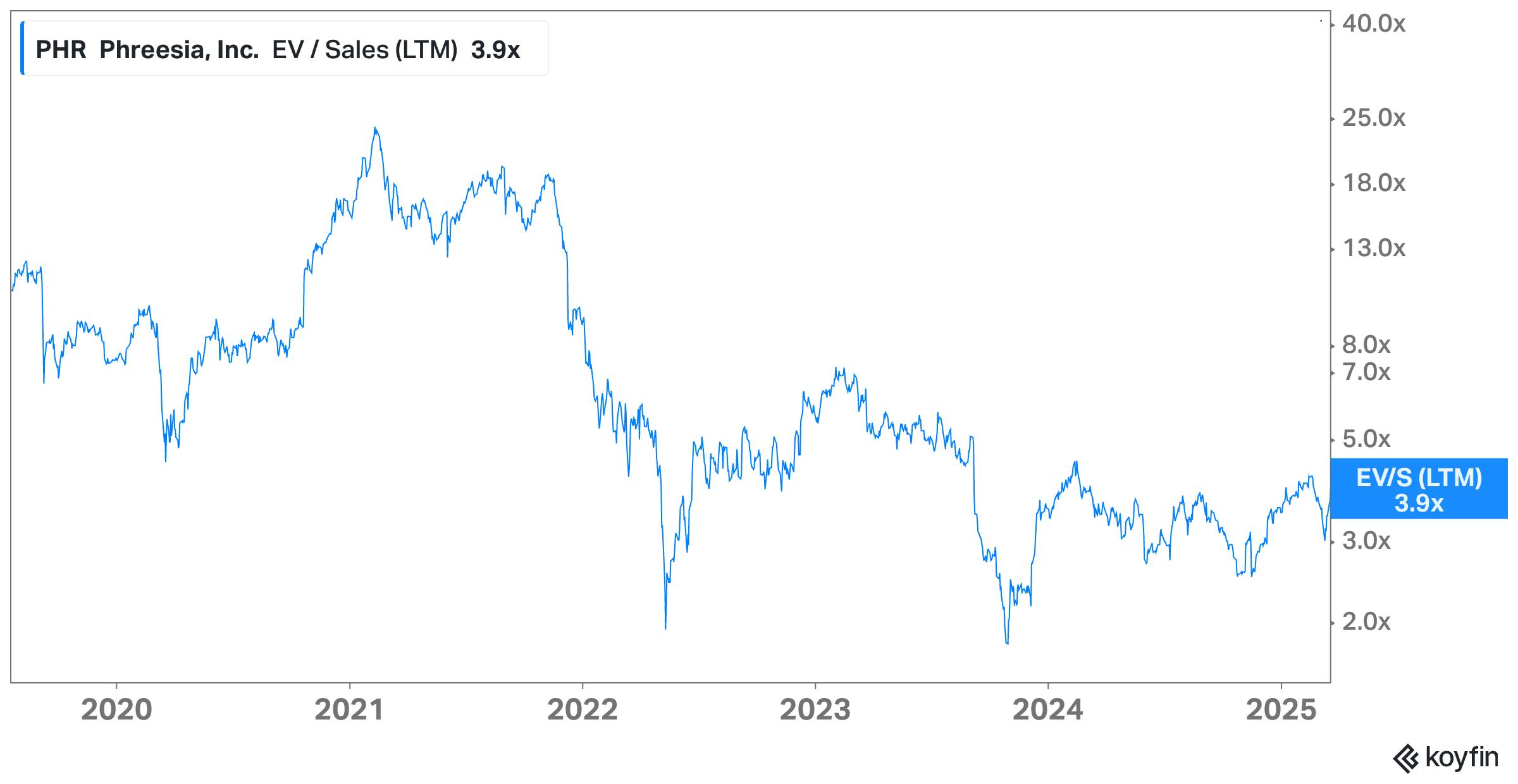

Cedar’s public comparable company, Phreesia, was trading at 3.9x LTM revenue as of March 2025.

Source: Koyfin

Key Opportunities

Vertical-Specific Capability

Until 2024, healthcare providers in niche verticals such as Behavioral and Dental health have avoided one-size-fits-all solutions such as Cedar according to a former customer. These SaaS solutions often fail to capture the intricate billing processes in these verticals. For example, behavioral health billing depends on session length, treatment customization, and service location (telehealth vs in-person).

However, that same source acknowledges, “Cedar knows we want to move [into] them. It’s a matter of them building capability.” As mentioned above, Cedar has shifted in the dental space via its partnership with Tend. They are also shifting into behavioral health, which can be seen via its partnership with Talkiatry, an online psychiatric care platform. There is a clear demand for Cedar to add capacity to serve these new verticals.

Product Expansion

Aside from adding complexity to serve unique verticals, Cedar can also expand its product suite to become more comprehensive across the healthcare workflow. When Cedar was first founded, it was focused solely on providing patients with bills that were easy to understand. Since then, the company has expanded to add patient visit scheduling, customer service, intake, and other features across Cedar Pay, Cedar Support, and Cedar Cover.

For example, Cedar also launched its Affordability Navigator in 2023, which was later expanded into Cedar Cover in partnership with Fortuna Health. As a result, Cedar is positioned to provide patients with financial assistance tools to connect with external funding sources. With 63% of patients unsure about what financial assistance options are available to them, this product is a stress reliever for the billing process.

Key Risks

Competition

Cedar considers one of its more significant competitive threats to come from Epic Systems. Epic controls a large part of the HCIT market and has a chokehold over the largest hospital systems in the country. As Epic did with Cheers, they could potentially replicate Cedar’s other products. Furthermore, because Epic’s main product is EHR software, it can offer Cheers for relatively cheap to prevent systems from switching to Cedar purely on price.

One former Cedar customer stated that they tend to use Cedar for specific functions, rather than utilizing their entire product suite. The health provider wanted to use their in-house call center as they wanted to maintain a sense of community rather than outsource it to Cedar. Furthermore, the provider used Cedar for back-end functions including automated digital bills and payment collection. However, they used Phreesia for their front-end functions including patient intake and insurance verification. That particular customer preferred Phreesia’s focus on just the front-end portion of patient visits to Cedar Pre which they considered not as smooth.

Obsolete Technology

If providers can develop the tools to estimate patient billing responsibility upfront, they will be able to charge patients at the time of service. There will be no need for adjudication tools such as Cedar, and so they will be cut out. As discussed by one former Cedar executive, with accurate price transparency the provider could collect the estimate upfront. Following that, there would be a minimal amount of difference for Cedar to collect after.

For example, Mount Sinai has built its own Online Patient Cost Estimator tool which factors in insurance coverage, the healthcare service, and other factors to give patients a unique cost estimation tool. However, as of now, Mount Sinai uses this just as an estimate and does not charge at the time of service.

There are many trends indicating providers are developing cost estimation tools aside from simply having the ability to collect upfront. The American Health Association believes “Price estimator tools are currently patients’ best and most consumer-friendly source of information.” These tools are easier to decipher than machine-readable files and are an effective way to let patients prepare for potential out-of-pocket costs.

Summary

Cedar is an enterprise platform that automates patient engagement and simplifies billing and collections. The tailwinds supporting the business include the complexity of healthcare bills and the increasing need for financial assistance options. Cedar is focusing on improving the customer experience, which in turn improves payment collection rates and customer retention for health systems.

Going forward, one key question is whether Cedar can create a wedge against the incumbent platforms like Epic Systems. As Cedar expands its product suite across payments, automated support, and benefits enrollment, it exposes Cedar to the broader patient lifecycle. The company’s success going forward will be dependent on its ability to drive adoption across its target customer base for each of its product modules.