Thesis

R&D productivity in the pharmaceutical industry remains relatively low, with R&D spending increasing by 44% from 2012 to 2022 but not translating into higher returns due to the lengthy, costly, and complex drug market as of January 2024. Declining productivity is driven by high development costs (comprising 60% to 70% of total costs), lengthy drug development timelines (averaging 12 years), and costly enrollment periods that often take years and represent up to 50% of trial expenses. Additionally, Phase 2 and Phase 3 trials have lengthened, resulting in delays and high failure rates, as up to 80% of clinical trials miss their timelines. This proves the inefficiencies that doctors and researchers face when conducting trials.

COVID-19 accelerated the adoption of decentralized technologies, one of these being decentralized clinical trials (DCTs). A study from 2023 that focused on patients with lower back pain showed that 78% of patients preferred a DCT trial rather than an in-person one. Additionally, 89% of patients who chose the DCT method completed the study, compared to just 60% of patients who chose the traditional method. Additionally, patients who have chronic illnesses prefer telehealth appointments over having to hike to medical centers.

Medable is a SaaS company that provides a global cloud platform with a range of modules designed to support the DCT process and help researchers conduct remote screenings, patient monitoring for trials, give digital consent, provide outcomes assessments, and conduct telemedicine visits. Using its AI-powered platform in electronic clinical outcomes assessment (eCOA) deployments, Medable streamlines and automates manual tasks, provides analytical insights, and speeds up the trial process for a faster time to market. As of October 2024, it has launched in 60 countries, and clinics that are customers have seen 200% faster enrollment and 50% cost reductions.

Founding Story

Medable was founded in 2015 by Michelle Longmire (CEO), Tim Smith (CTO), James Sas (Chief Architect), Fernando Waigandt (Director of Mobile Development), and Perry Robinson (former CCO).

Longmire, a former D1 soccer player with a background in dermatology and genomics, initially researched rare autoimmune diseases. She then shifted her focus to epigenetics, specifically studying identical twins to understand how they had the same genome but what was being expressed was different. This shift emerged from challenges she faced in doing whole genome sequencing on patients and trying to find the underlying cause of a patient’s disease. Her efforts proved ineffective. As a result, Longmire stated in an October 2021 interview:

“We need to get out of the clinic. We need to leverage big data and connectivity to patients to develop a bigger data set that could tell us the stories about people’s daily lives because that’s how much the actual epigenome changes. This is when I thought research and our ability to understand health needs to expand beyond the walls of a clinic. There was something important to be built, and I thought it be better off built as a company instead of a lab setting.”

Longmire began assembling a founding team for the company she wanted to build. In early 2012, Longmire met Sas through a friend in Silicon Valley. A year later, while trying to find engineers, her friend helped her by posting on Twitter (now known as X) that she was looking for an engineer. That tweet ultimately led to Longmire meeting Waigandt, who previously worked as an iOS architect and computer engineer at Globant and Gameloft.

In 2014, Longmire approached Smith, who was a long-time friend and previously worked for Salesforce as a cloud technology specialist, with her idea for Medable. Smith also worked as a web engineer and, before joining Medable, was a CTO at ClosedWon, a Salesforce development company that was acquired by LiquidHub in January 2015.

Together, Longmire, Sas, Waigandt, and Smith began working on an enterprise solution that connected patients with the healthcare clinical trial ecosystem in 2015. The following year, Robinson joined the Medable team as a co-founder and CCO, and in 2021, Pamela Tenaerts, prior executive director of clinical trials at Duke University, joined Medable’s executive board as Chief Scientific Officer.

Product

Medable offers a suite of products designed to support and enhance clinical operations. It also provides a global decentralized trial platform that streamlines design, recruitment, retention, and data quality, replacing siloed tech systems with integrated digital tools, data, and UIs to accelerate trial execution. Medable has also developed an app, that allows patients to join studies, provide consent, and collect data remotely.

Medable’s platform was created to help businesses improve patient access, experience, and outcomes through its products eCOA+, Total Consent, and Studio. Medable also provides solutions in therapeutic areas including oncology and vaccines and serves business types such as mid-to-large pharma, emerging biopharma, and contact research organizations (CROs).

eCOA+

Source: Medable

Medable’s eCOA+ provides digital outcome measures delivered with speed and efficiency to enhance trial findings. Electronic clinical outcome assessment (eCOA+) is part of Medable’s unified data collection platform, which consists of eConsent, telehealth, and sensors along with standardized integrations into existing clinical ecosystems.

Medable claims to have a 50% faster study build time with eCOA+, 400+ pre-built and validated instruments, and 120+ available languages so patients in any geographic location and across diverse therapeutic areas can utilize the service. With a reusable instrument library of 380+ standardized workflows and AI-enabled technology, researchers can capture both objective and subjective participant data to uncover clinically meaningful insights in real time.

Total Consent

Source: Medable

Total Consent is a solution to help inform and consent trial participants that can be done in-clinic or remotely using a computer, phone, or tablet. It has an integrated TeleVisit feature to easily collect compliant signatures and meet patient standards.

Electronic Patient-Reported Outcomes (ePROS) allow sponsors and other stakeholders to track real-time patient data and consent activities within a single dashboard and minimize compliance errors, ensuring inspection-ready audit trials.

Studio

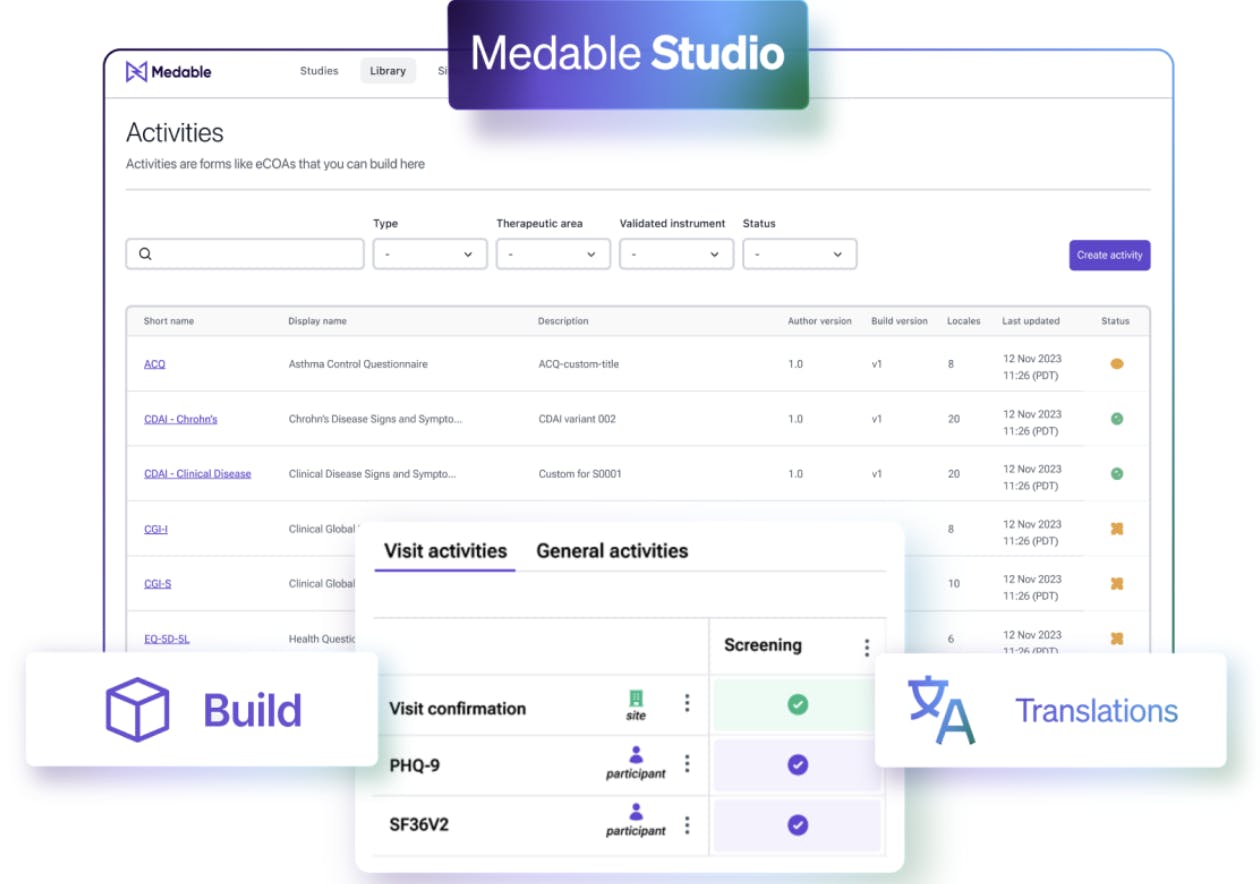

Source: Medable

Medable Studio delivers control over the study creation and launch process, to free users from the roadblocks usually associated with study startup. Medable Studio includes the following offerings:

Visual eCOA Builder: Allows researchers to create assessments, instruments, and diaries with no-code formatting, live preview, and globalization support for translations.

Point-n-Click Schedule of Assessments Builder: Add assessments, instruments, and COAs to a patient schedule and configure standard visits, cycles, and visit types like site, remote, or unscheduled visits.

Translation Workbench: Helps reduce translation bottlenecks and aims to manage all translations seamlessly.

Cross-Study Content Library: Stores assessments, instruments, translations, and locales all in one system for easy reuse from study to study.

Oncology

Medable’s oncology offering simplifies data collection for sites and sponsors while maintaining patient safety and engagement from any location. By enabling those undergoing intensive cancer therapies to participate both remotely from home and on-site, Medable’s oncology offering increases access to trials which can improve retention. Also, the solution’s tokenization feature simplifies data collection post-trial and connects patient trial data to real-world data to capture critical endpoints. Medable’s VP of therapeutic area solutions Musaddiq Khan says “Oncology trials are notoriously complex. Meeting patients where they want while offering real insights to sites and study teams improves the experience for everyone”

Vaccine

Source: Medable

Medable’s pre-built and scalable vaccine offering enables faster trials and aims to achieve better patient experiences with expedited data delivery. The solution offers two options: Core and Flex.

Core: Core allows researchers to deploy a vaccine trial in as little as five weeks, with pre-built tools including eScreening, eConsent, TeleVisit and Scheduling capabilities, eCOA, and customized reporting.

Flex: Medable’s Flex offering is Core with more features. Flex offers a custom set of digital products tailored to the study’s needs and includes sensors and wearables, more complex COAs, advanced system integrations, and access to partner capabilities through Medable’s Partner Network.

Mid to Large Biopharma

Source: Medable

Medable's mid to large biopharma offering helps companies with therapeutic discovery and allows them to maximize ROI. Features like standardized workflows single sign-on and IRT integration provide efficiency and scalability in trials. Medable’s DCT Network enables researchers to leverage a network of partners, data providers, and home health providers.

Emerging Biopharma and CROs

Source: Medable

Medable’s emerging biopharma solution includes eConsent, Televisit, eCOA Oncology library, built-in notifications, tokenization providing life-long follow-up, customer onboarding, and protocol and study design consulting. The solution has been implemented by 45+ emerging biopharma and biotech companies as of November 2024.

Market

Customer

Medable’s customers are typically medium to large-sized businesses operating in healthcare and pharma. Notable customers include CVS Health, Nova Scotia Health Innovation Hub, GlaxoSmithKline (GSK), and Syneos. In 2022, Medable launched its Partner Network to help foster collaboration and accelerate innovation in DCTs by integrating an ecosystem of technology, data, and direct-to-patient partners. Partners include Advanced Clinical, Cognizant, Oracle, and PPD, part of Thermo Fisher Scientific.

In April 2021, Medable partnered with Syneos Health. Syneos is a leading fully integrated biopharmaceutical solutions organization. It implemented Medable’s platform to help increase clinical trial diversity and improve patient access, allowing for a more inclusive patient population.

In September 2022, Medable announced a four-year enterprise contract with GSK to use its DCT platform across GSK’s portfolio. The deal pointed to a growing commitment to hybrid and DCTs, both at GSK and in Big Pharma, evidenced by the 93% increase in DCT starts since 2020.

Another customer, CVS Health, utilizes Medable’s platform to target unmet needs in vulnerable populations. CVS Health’s SVP Tony Clapsis stated:

“Coupling Medable’s software platform and experience with CVS Health’s national reach, analytics, and established clinical trial and care delivery teams and services will further enrich and accelerate our ability to make a difference in the lives of patients and support an improved clinical research process.”

Market Size

The global digital health market was valued at $240.9 billion in 2023 and is expected to reach $1.6 trillion by 2033, representing a CAGR of 21.1% during the forecast period. This market growth can be partially attributed to the DCT model mitigating many of the large-scale challenges that plague traditional clinical trials.

Participant recruitment has become increasingly difficult. The rate of clinical trial participants enrolled per site per month in oncology and non-oncology Phase 3 trials declined by 14% and 54%, respectively, from 2012 to 2014 and 2021 to 2023. With a DCT platform, enrollment becomes convenient and more accessible for patients.

As clinical trials become more complex, the operational burden on trial sites has increased as well. From 2017 to 2020, Phase 2 and Phase 3 trials saw an increase in average endpoints, often requiring specialized equipment or training. While eClinical technologies theoretically streamline processes, most sites must still integrate multiple systems, such as electronic data capture and outcome assessments, before they can begin participant recruitment, adding complexity to trial management.

From a bottom-up perspective, the global DCT market was valued at $8.8 billion in 2021 and is expected to reach $14.2 billion by 2026. The COVID-19 pandemic was a key driver of growth for DCTs. Before the pandemic, about 38% of pharmaceutical and contract research organizations expected virtual trials to be a major part of their portfolio. That figure jumped to 100% by December 2020.

Competition

Viedoc: Viedoc, founded in 2003 by Henrik Blombergsson and Sverre Bengtsson, operates on a similar model to Medable. Viedoc provides digital trial solutions and televisit capabilities and was acquired by Monterro in 2019 at an undisclosed amount. Viedoc’s key differentiation lies in its platform: Viedoc includes some solutions not offered by Medable such as Viedoc PMS, which provides data collection for PMS studies. However, Viedoc is based in Scandinavia with no notable expansion, so it poses little to no threat to Medable’s market.

Florence Healthcare: Founded in 2014 by Andres Garcia, Michael Kassin, and Ryan Jones, Florence Healthcare advances clinical research through data automation, providing remote access for clinical start-ups, data monitoring, and source data review for sponsors. With a valuation of $400 million as of November 2024, it operates on a B2B SaaS model and is enterprise-centric, as patient-centric offerings such as televisit trials are not included in Florence’s platform. Florence Healthcare has raised $116 million in total funding over five rounds including a $27 million Series C-1 led by Insight Partners in June 2022. Florence Healthcare and Medable both offer digital solutions that streamline workflows for DCTs, helping sites manage regulatory documents, coordinate remotely, and improve overall trial efficiency.

Medidata: Founded in 1999, Medidata’s Rave Clinical Trial Management System uses automation to streamline the clinical operations ecosystem and makes the clinical trial process more efficient. The Medidata Platform includes its proprietary Rave EDC, Medidata Detect, and Rave eTMF. However, its emphasis on enterprise has resulted in a lack of patient-centric offerings, unlike Medable. Medidata has raised $20 million in funding over four funding rounds, with its most recent post-IPO equity round in November 2023. French technology company Dassault Systèmes acquired Medidata for $5.8 billion in October 2019.

Science 37: Science 37 was founded in 2014 by Belinda Tan and Noah Craft and serves as a technology-enabled clinical research company with an end-to-end SaaS platform. It has raised a total of $348 million over six founding rounds, with investors Lux Capital and PPD leading seed and post-IPO equity rounds, and was acquired in March 2024 by eMed for $38 million. Science 37 offers solutions like Agile Clinical Trials, a multi-modal DCT offering that supports any study, and Metasite, which recruits and enrolls patients faster. While its offerings are similar to those of Medable, Science 37 lacks a mobile app for participants and does not have a network of partners as extensive as Medable’s Partner Network.

Business Model

Medable operates on a SaaS business model and offers its platform and company-tailored solutions, specifically targeting emerging biopharma, mid to large biopharma, and CROs. Its suite also includes industry-specific solutions for oncology and vaccines. Medable does not openly disclose pricing for any of its products as of November 2024 due to a lack of a one-size-fits-all model. Instead, it provides customized quotes for companies. Companies can also access platform demos of the platform through Medable’s website.

Traction

In February 2022, Medable acquired LEO Innovation Lab’s dermatology-focused platform Omhu A/S, headquartered in Ireland and Switzerland, for an undisclosed amount. Omhu’s product offerings include an app called Imagine that helps patients track their skin conditions over time. Omhu Care, another virtual offering, strives to improve patient access and treatment options for skin conditions, which account for up to 30% of all primary care consultations in Europe.

Christian Sejersen, former Omhu CEO and site lead for Medable Copenhagen said:

“Like Medable, Omhu combines medical and scientific expertise, a thorough understanding of the needs of patients and their doctors, and the research into applying artificial intelligence for the benefits of patients and doctors.”

In 2022, Medable was listed 15th in CNBC’s 50 Disruptors, named to Forbes America’s best startup employers list, and named winner of the Health Entrepreneur Award at the Pharma Awards. Medable experienced 1,453% growth from 2019 to 2022 due to COVID-19’s impact on decentralized health technologies. In a 2022 interview, Longmire stated:

“There was a lot of interest but not a lot of uptake, so when Covid hit, suddenly, the entire medical infrastructure on the research side needed a technology like Medable to be able to execute clinical trials … within a week I was getting calls from all over the world.”

In May 2024, Medable partnered with Masimo, a medical technology provider, to implement wearable devices in clinical research, particularly within lung and breast cancer research. Medable announced it would include Masimo’s MightSat Rx pulse oximeter, a clip-like probe that measures oxygen saturation of the blood, for eight big-pharma-sponsored clinical trials spanning 25 countries and including over 3K patients.

As of October 2024, Medable had deployed its SaaS platform in more than 400 decentralized and hybrid clinical trials throughout 70 countries. Its platform is accessible by over 120 companies and serves more than one million patients and research participants globally, with most being based in the US and Europe. Medable’s Partner Network has also helped Medable sign partnerships with healthcare and biopharma companies. An unverified source estimated Medable’s 2024 revenue to be $73.5 million.

Valuation

In October 2021, Medable raised a $304 million Series D round at a $2.1 billion valuation. The funding round was co-led by new investors Blackstone Growth and TigerGlobal alongside existing investor GSR Ventures. The Series D round marked its fourth raise within 18 months. It has raised a total of about $507 million over nine funding rounds from investors including Streamlined Ventures, Sapphire Ventures, Obvious Ventures, and Launchpad Digital Health.

Key Opportunities

Advancements in AI & Telemedicine

Advancements in healthcare technology drive demand for a more comprehensive and patient-centric platform solution. Medable has the opportunity to address this demand by enhancing its platform to meet enterprise customer and patient needs through advancement in product innovation and user experience. In October 2023, Medable discussed the implementation of AI in their platform, furthering the company’s ability to scale clinical trials and drive increased efficiency across the entirety of a trial. By leveraging AI, Medable aims to streamline trial processes, reduce costs, and accelerate timelines, further solidifying its role in the DCT landscape.

Expanding Global Footprint

Medable can tap into emerging markets where a lack of infrastructure makes traditional clinical trials challenging, such as Africa. As of 2022, Africa hosts a relatively small proportion of global clinical trials, with 861 trials registered as opposed to the Western Pacific which registered 12.3K trials. The genetic diversity and unique disease prevalence across Africa's population could represent a significant but underutilized resource for advancing clinical research.

Initiatives like the Cross Pharma Capacity Development Initiative, led by organizations such as the Science for Africa Foundation, aim to build clinical trial capacity through collaborations with global pharmaceutical companies and stakeholders. This creates a potential opportunity for Medable to leverage its DCT platform to expand research access in Africa, addressing enabling globally relevant data in clinical studies.

Key Risks

Lack of Principle Investigator Oversight

A DCT model often relies on contracting healthcare professionals (HCPs) near patients to perform home health visits, enhancing patient accessibility and trial participation. While this approach promotes patient-centricity, it also increases the complexity of trial oversight. Principal Investigators (PIs) are required to supervise multiple geographically dispersed HCPs, many of whom may not fall under Medable’s direct management. This distributed oversight structure could strain the PI’s ability to ensure adherence to protocols, potentially compromising study integrity and regulatory compliance, which are critical for trial success.

Digital Divide

DCTs are designed to increase access for underrepresented populations, such as rural residents and ethnic minorities, yet barriers remain. Social determinants of health, like socioeconomic status and digital access, can prevent these groups from effectively participating in DCTs. For example, ethnic minorities, older adults, lower-income households, and rural residents are often less likely to have reliable internet or broadband access, which is critical for virtual participation. This "digital divide" threatens a lack of representation for the very populations that DCTs aim to include. Without addressing these access disparities, DCTs could inadvertently reinforce existing health inequities, compromising the generalizability and inclusiveness of trial outcomes.

Summary

The inefficiencies around conducting clinical trials accelerated the adoption of DCTs, prompting organizations to add virtual components to their trial designs. Medable offers a comprehensive DCT platform with AI-driven solutions and a patient-centric mobile app for streamlined trial experiences. As DCTs become more prevalent, leveraging advanced technology and maintaining trial integrity could be crucial for Medable’s success. By incorporating accessible features, Medable has increased engagement among its global user base. However, despite DCT and global digital health tailwinds, Medable’s market position may be challenged by new competitors in an increasingly crowded market.