Thesis

2023 was the hottest year on record “by far" in 174 years of climate record. CO₂ emissions from the energy sector are expected to peak this decade, even as attempts are made to leverage new climate policies and accelerate the pace of clean energy technology deployment. CO₂ emissions from the power sector represent ~44% of global emissions.

The first recorded instance of a renewable power project was a hydroelectric power station built in Northumberland, England in 1878. Fast forward nearly 150 years, renewables are set to provide more than one-third of total electricity generation globally by early 2025, overtaking coal. The share of renewables in electricity generation is forecasted to rise from 30% in 2023 to 37% in 2026. Historically, developers have sourced only 30% of capital for renewable development projects through tax credits, but are seeing a shift within capital markets and renewable energy.

The Inflation Reduction Act (IRA) was signed into law in August 2022 and is predicted to spur $3 trillion of renewable energy development. Less than a year later, on June 14th, 2023 the transferability provision for tax credits was introduced under the IRA and aimed to enhance accessibility of federal tax incentives for clean energy projects while creating a new market overnight.

Crux aims to enable buyers and sellers to exchange tax credits efficiently and transparently in a marketplace that will drive financing for current and future generations of renewable energy and infrastructure projects. It functions as an ecosystem for banks, project developers, and intermediaries to transact on clean energy tax credits by acting as a transaction manager and workflow software for all parties around a deal. Developers are able to submit projects on the platform for buyers to bid on and diligence, thereby simplifying the tax credit sales process and maximizing value for both parties. By bridging the gap in clean project finance, Crux is capitalizing off of two-thirds of the $1.7 trillion earmarked for the IRA during an inflection point between capital markets and renewable energy.

Founding Story

Crux was founded in 2023 by Alfred Johnson (CEO) and Allen Kramer (COO). They previously co-founded Mobilize together in 2017 and sold the company to EveryAction in 2020.

Johnson’s parents met on a campaign trail and he was heavily influenced by politics at an early age. After attending Stanford and pursuing political science, he moved back to Washington D.C. and worked in the U.S. Department of the Treasury. During the Global Financial Crisis (GFC), he worked closely with Lee Sachs, who at the time was counselor to Treasury Secretary Timothy Geithner and head of Obama’s financial crisis response team. This gave Johnson his first introduction to clean energy as he was responsible for assisting with the clean energy incentives that were part of the Recovery Act.

After Johnson’s stint in the public sector, he went back to Stanford to attend business school and shifted to the private markets where he worked at Blackrock in their financial markets advisory group. In 2017, Johnson and Kramer co-founded Mobilize as an event management software for businesses. After selling the company in 2020 to EveryAction, Johnson decided to pivot back into government and worked under Janet Yellen in the Treasury Department as a deputy chief of staff.

After two years at the Treasury, Johnson left and reconnected with Kramer with the objective of starting another company - this time in climate. When Congress passed the Inflation Reduction Act, the pair began thinking of ways to create an efficient market to transact on the billions of dollars of tax credits.

One day while walking his dog, Johnson came across a Volt podcast by David Roberts where Roberts discussed the transferability provision for tax credits in the IRA. This lightbulb moment sparked, and Johnson and Kramer set out to pursue a three-month market study to gauge receptivity from potential customers and investors. The idea was that if the IRA were to be successful and execute on its intent to catalyze the growth of renewable development, there would have to be a market mechanism where financing these projects would be efficient and simple.

The team began raising seed funding for this idea in 2023 before the company had a name. Eventually, they arrived at the name Crux after a series of suggestions. As CEO Alfred Johnson told Contrary Research in an April 2024 interview, the “credit goes to Lowercarbon” for coming up with the final name. Crux raised a subsequent seed extension and began constructing a team with expertise in energy and finance. Robert Parker (Chief Commercial Officer) joined the team along with five additional hires between April and June of 2023.

Product

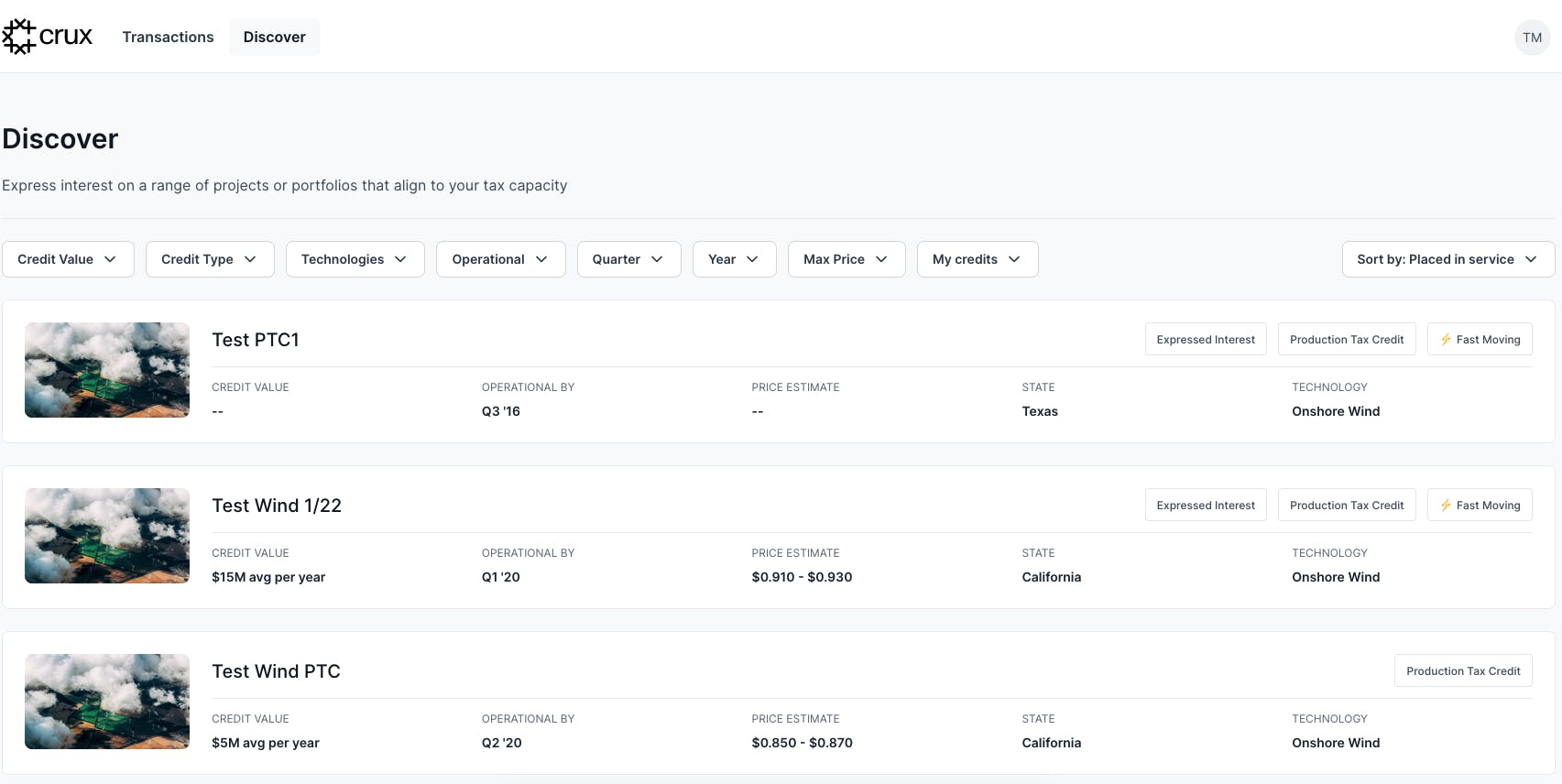

Source: Crux

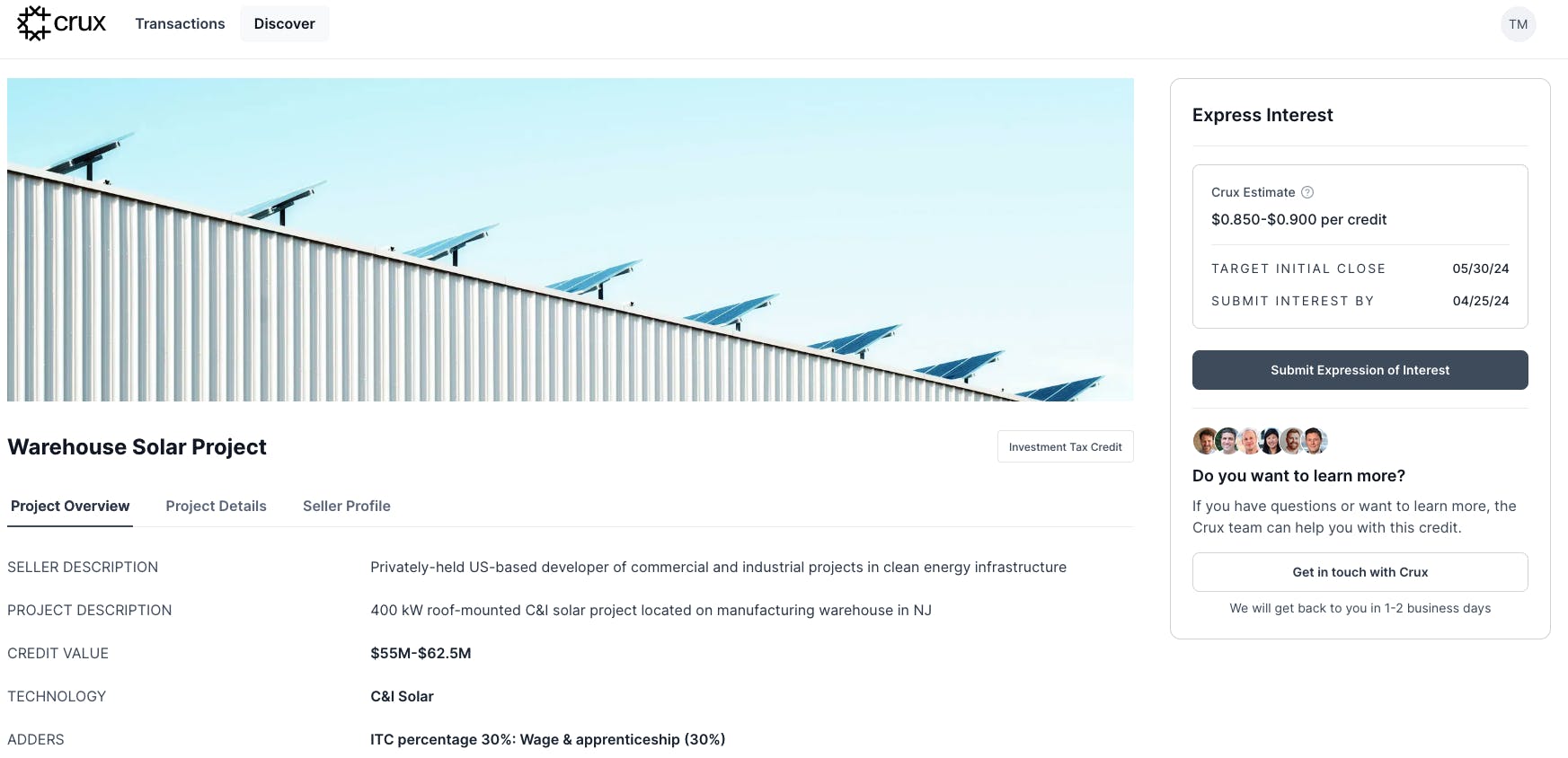

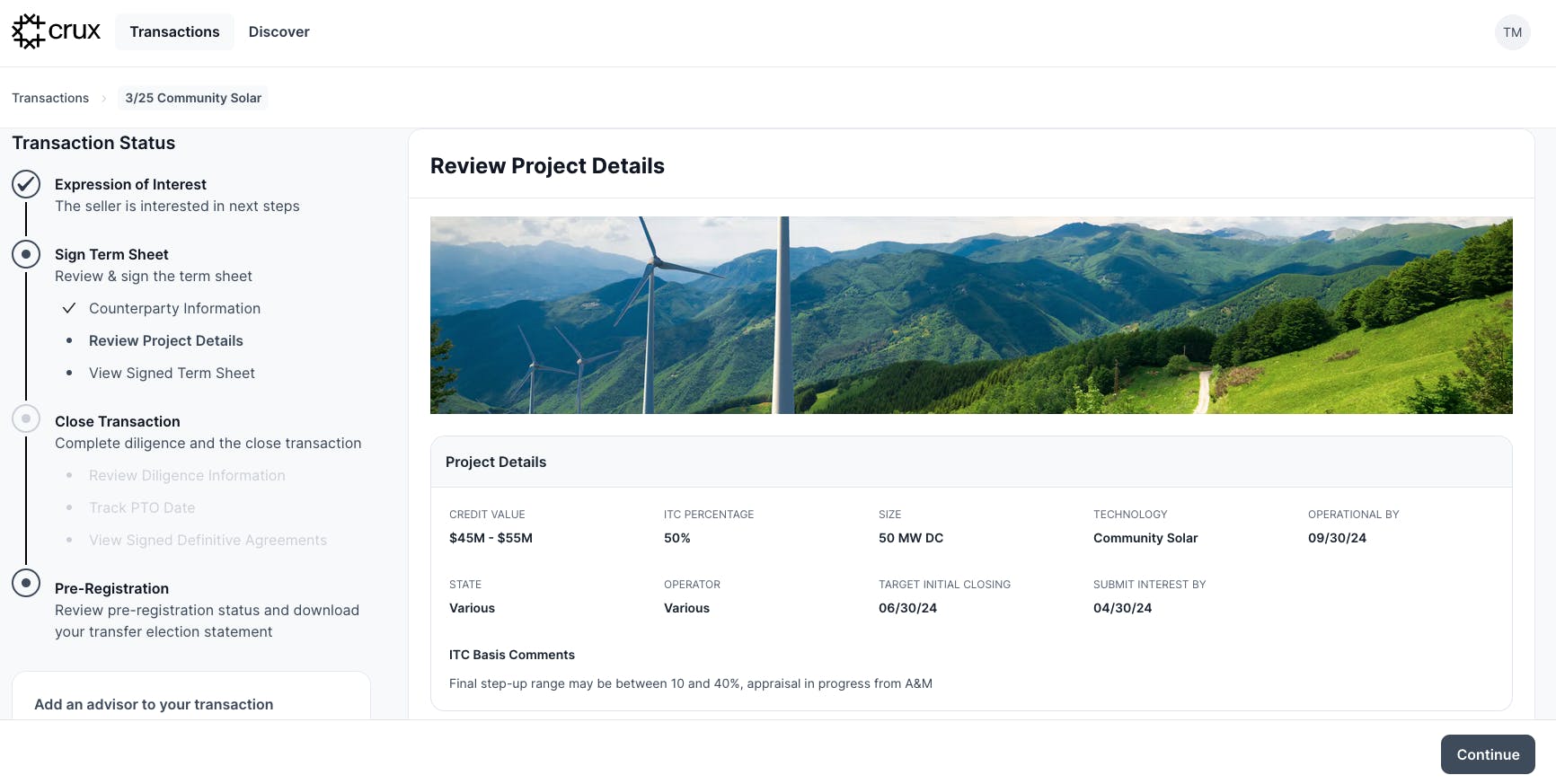

Crux’s core business is providing a marketplace where sellers, buyers, and intermediaries can transact on clean energy tax credits. Users of the platform are directed to a Discover page where they’re able to navigate through projects, list additional projects, and place bids. After parties reach initial commercial alignment, Crux’s software helps facilitate the due diligence process and guide parties through to transaction close.

Transacting

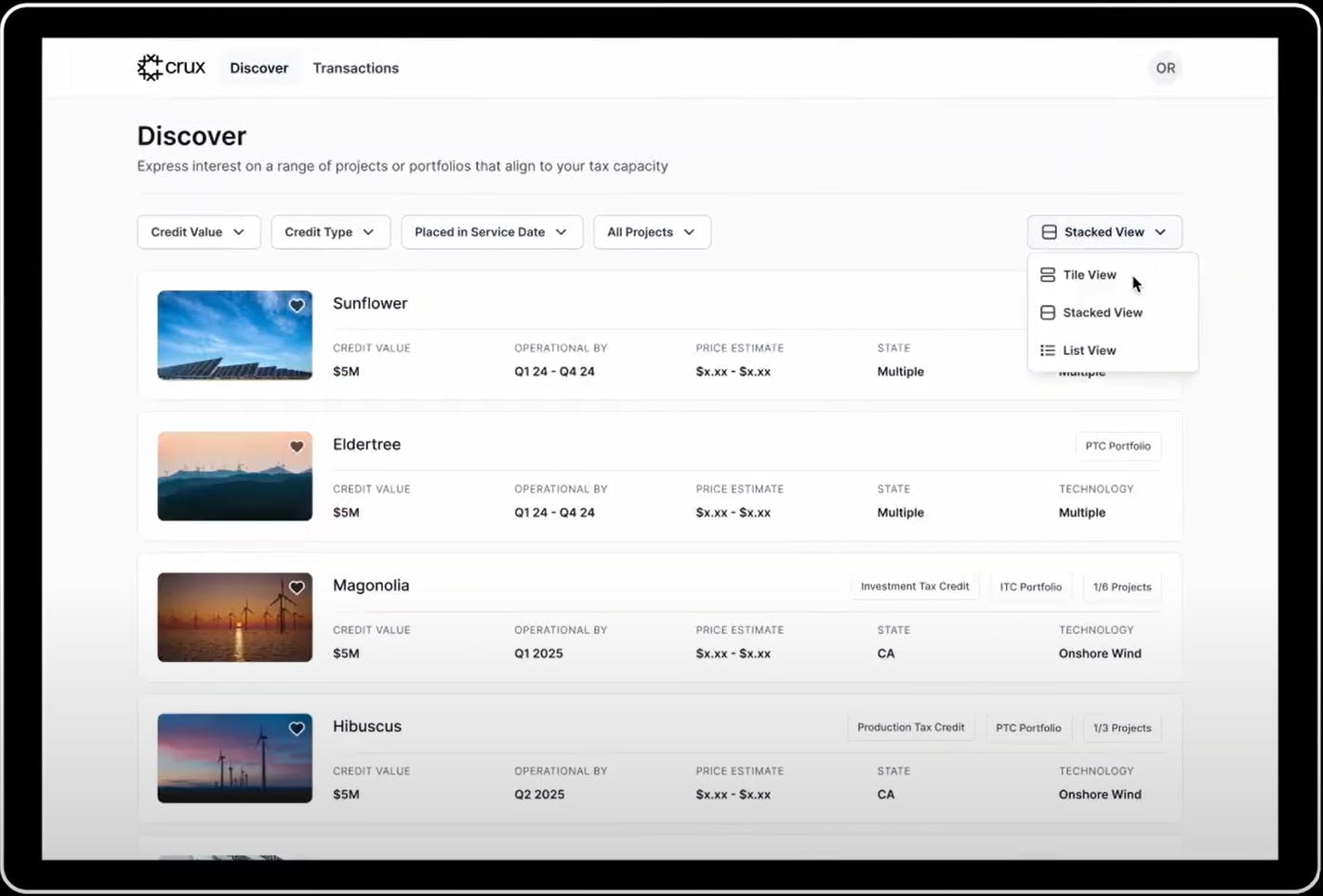

Source: Crux

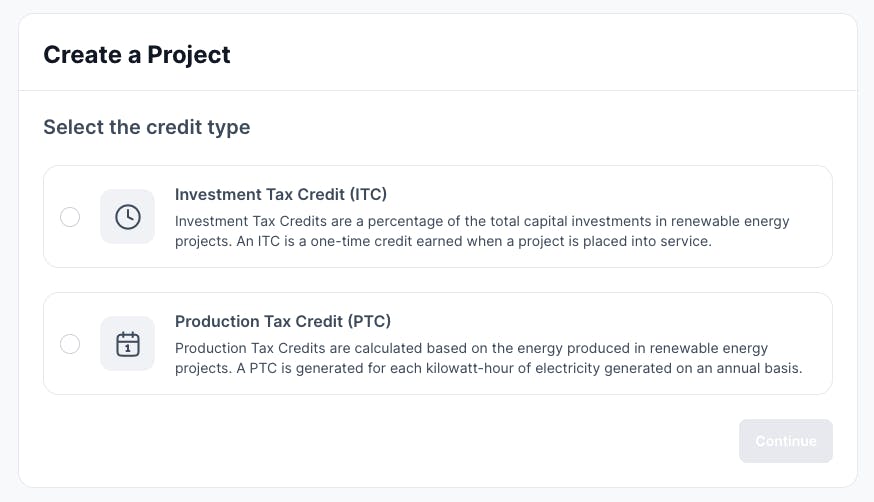

(1) Developers Create & List Projects

Source: Crux

Developers and sellers of tax credits are able to register their projects on the platform by defining a credit type and listing as an individual project or portfolio of projects.

(2) Buyers & Advisors Express Interest

Source: Crux

Sellers are able to counter-bid in-product. If the developer accepts, the parties will exchange confidential information. According to an April 2024 interview with Contrary Research, Crux claimed that “of projects and portfolios on the platform that receive an expression of interest, 40% receive multiple.” Sellers are able to give direct feedback and counter buyers’ proposals on the platform in order to expedite transactions.

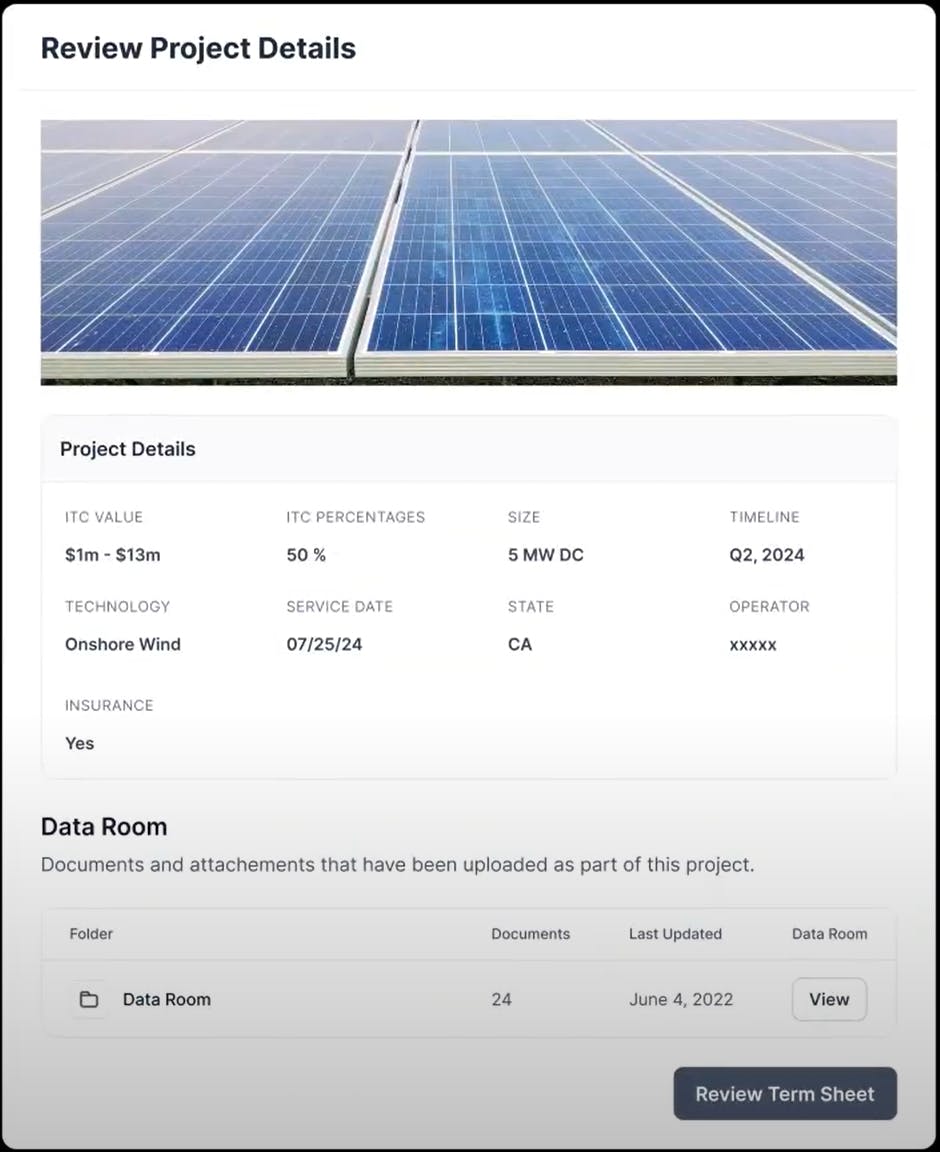

(3) Buyers & Sellers Align on Terms

Source: Crux

Once the term sheet is signed, the buyer has access to the seller’s data room. Both buyers and sellers are able to add advisors to the platform. Intermediaries play a key role in educating buyers and advising on transactions — both of which are necessary to develop a liquid and efficient market. These typically include financial and legal advisors who help facilitate the closing and diligence process of transactions.

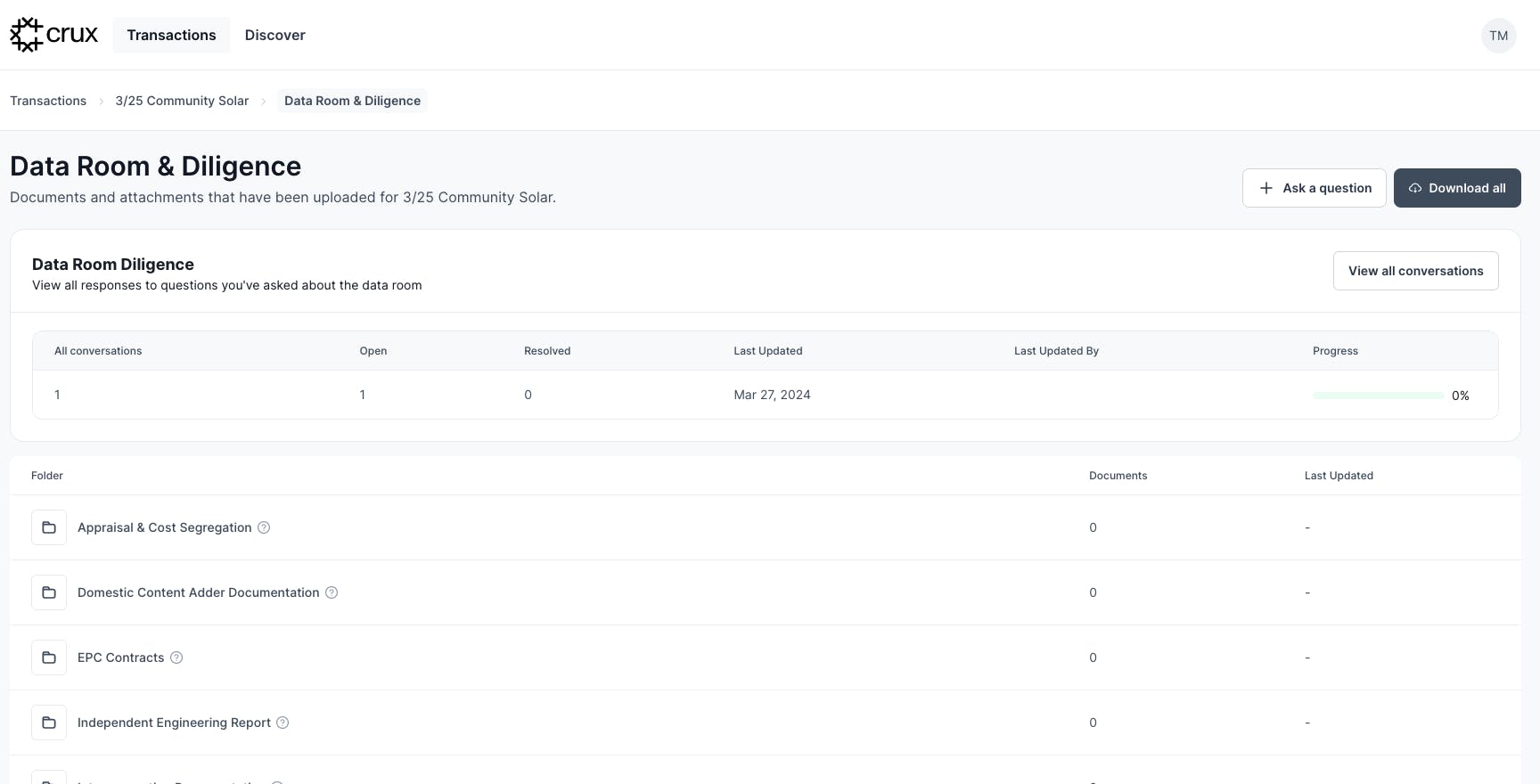

(4) Buyer Due Diligence

Source: Crux

Buyers, intermediaries, and legal advisors are able to ask sellers diligence questions in the data room. This allows for a more efficient exchange of communication for comments, questions, and tracking the diligence process all in one place.

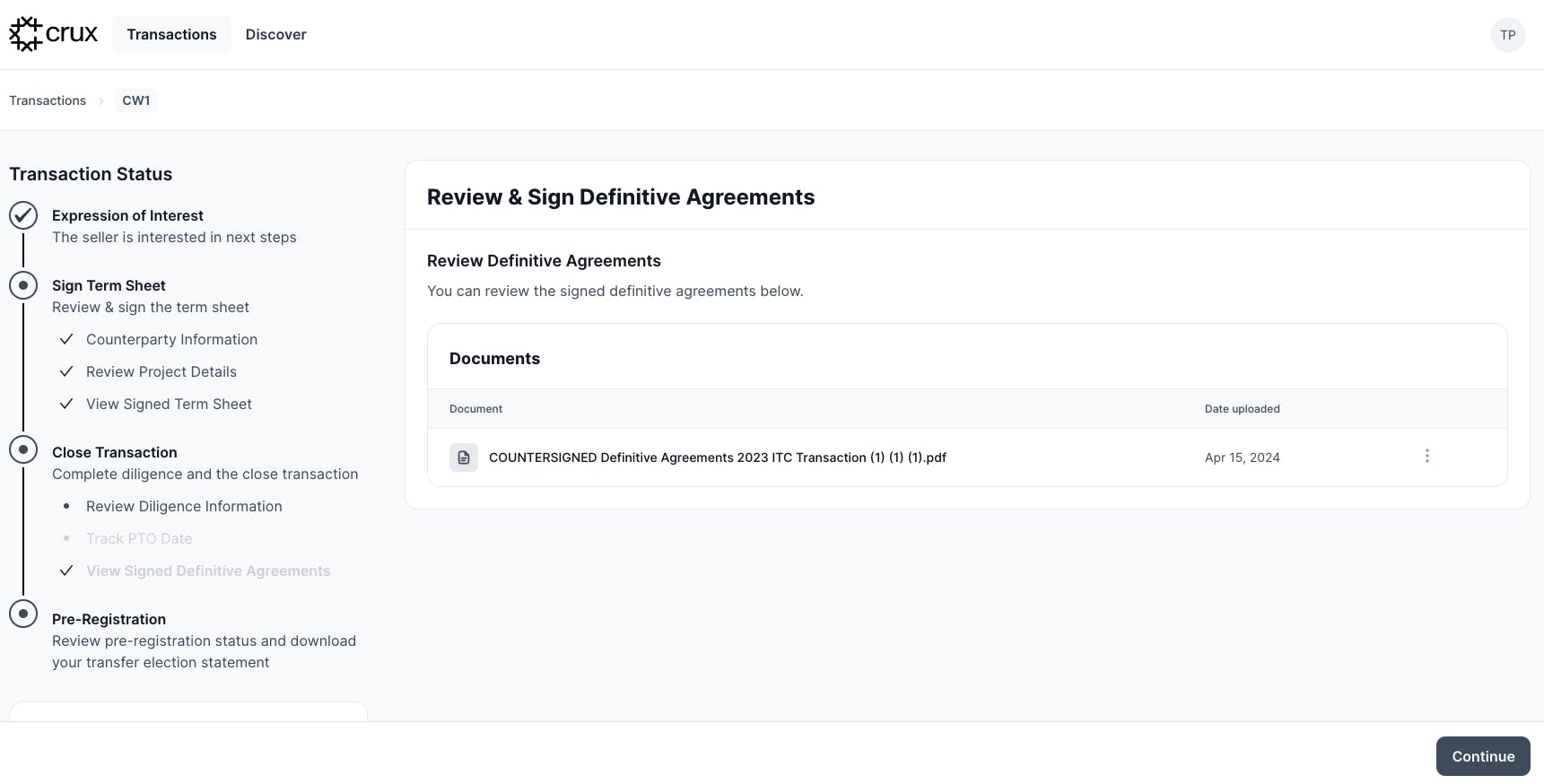

(5) Signing Definitive Documents & Complete Transaction

Source: Crux

Source: Crux

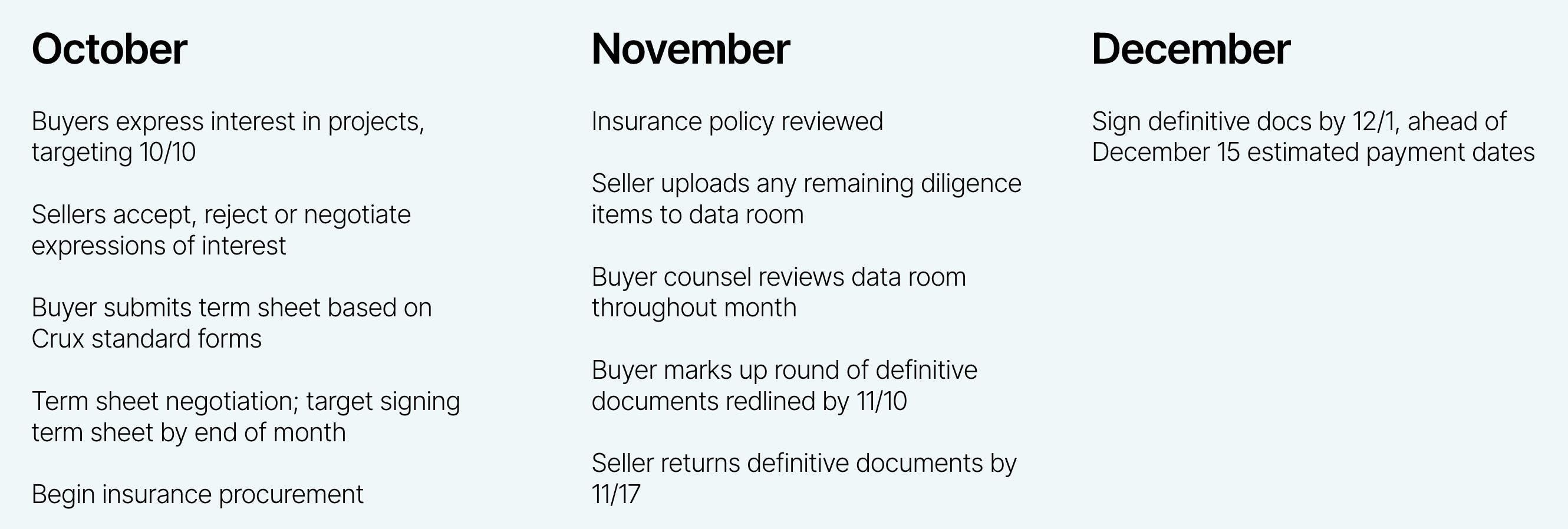

Crux publishes a series of webinars to assist customers with transaction structuring, process, and policy insights. The company also provides a timeline on its website for reference.

Source: Crux

Pricing

Source: Crux

The $10 million credit pricing is averaging at $0.89 per credit while the $100 million credit pricing is at around $0.94 - $0.95 per credit as of March 2024. The price discrepancy is typically indicative of stronger confidence in larger-scale projects being able to execute on development.

Using a simple calculation, if a buyer acquires $10 million in tax credits for $9 million ($0.90 of face value), they achieve an 11% return (($10 million ÷ $9 million) - 1). If the timing of the tax credit transaction coincides with the buyer's tax payment schedule, the internal rate of return (IRR) can significantly exceed the basic return on investment due to the brief holding period.

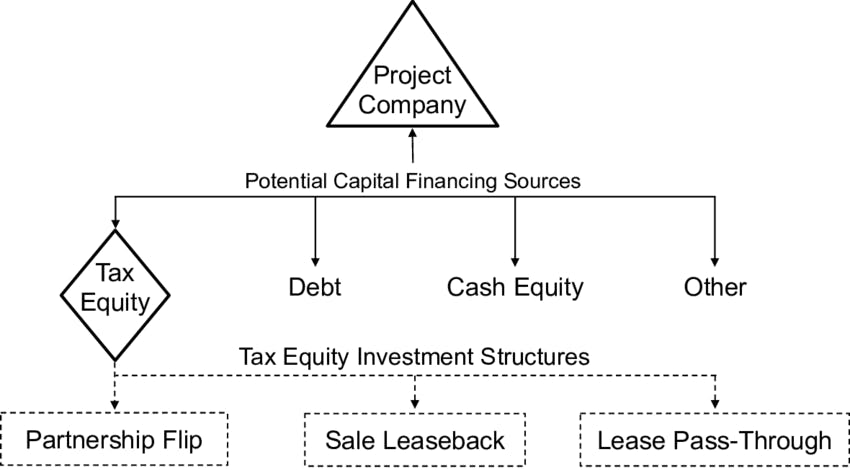

Project Financing

Clean energy projects have three sources of capital to build projects. These include developer equity, debt financing, and tax equity:

Debt Financing: Lenders finance renewable projects based on the project’s risks and future cash flows.

Tax Equity: Third-party investor that provides upfront capital in return for credit on their tax liability and a share of the cash flow generated from the project. Before the IRA, tax credits could not be sold directly so a third party had to enter into an equity partnership with the developer in order to receive tax credits.

Cash Equity: Third-party investors make an equity investment in the project typically comprising the balance of the project’s financing costs not otherwise covered by debt and tax equity.

Tax Equity

Governments use tax credits as incentives that taxpayers can offset against their tax liabilities. Developers lacking sufficient taxable income to utilize these credits fully can partner with tax equity investors, like banks or large corporations, who can claim these credits against their tax liabilities in exchange for upfront capital. This arrangement also allows them to share in the project's cash flow. Historically, due to government regulations ensuring that only at-risk owners benefited from these credits, tax equity's partnership structure was the primary method for developers to monetize their tax credits before the IRA.

Tax Credit

Source: Crux

Many technologies can avail themselves of one of two main types of tax credits that developers consider when financing a project, though some are able to elect between the two. These credits are opt-in so developers must choose which tax mechanism to capitalize off of.

Production Tax Credit (PTC): Tax credits earned by a project/taxpayer based upon a fixed dollar rate per unit of production.

Investment Tax Credit (ITC): Provides upfront tax credit by allowing taxpayers to claim a percentage of the project’s total cost from their tax liability once the project is operational.

Advantages of Transferability

With the introduction of transferability in the IRA, the process of monetizing project tax attributes has become simpler. The issue historically has been that developers don’t earn enough income to fully utilize the tax credit earned by the project.

In a simplified form, CEO Alfred Johnson walks through an example where you earn a $3K voucher from Delta Airlines. If you’re only using up $1K to travel in a given year, Delta won’t pay you the difference so you’ll still have $2K of credit remaining. Relating back to the tax credit, you can utilize the voucher in subsequent years to offset future tax liability but the value of the voucher is unredeemed in the years where you don’t have any income.

Transferability has changed this dynamic because the government has made it legal to sell this tax credit so that a third party with a tax bill can immediately redeem the full value of the tax credit given that they have a large enough tax liability. According to Crux, this has added benefits in the following ways:

Less complex structure & faster execution: Transferable credits have less complex deal structures than tax equity partnerships. Direct transfer takes less time to structure so developers are able to do deals faster. Now third parties no longer have to become co-owners of a development project and bear the risk of an asset’s performance as tax equity investors had to in the past.

Lower execution & diligence cost: Documentation, administrative burdens, and closing are simpler, which means diligence and post-transaction costs are reduced. Since third parties don’t have to form a partnership structure, the diligence is centered around recapture risk rather than the underlying performance risk. In the event that ITC projects are taken out of service or sold during a 5-year recapture period, the tax equity investor must repay a portion of the tax benefits.

Timing: Transferable credits can be sold at any time after a project begins operation, whereas traditional tax equity forces developers to wait until a partnership is structured to put projects into service.

Larger developer & project pool: Developers are able to secure financing for smaller projects and newer technologies. Tax equity projects focused on larger, known developers in the past.

Larger buyer universe: Smaller firms with less taxable income have access to potential tax savings through this market. Before the IRA, only traditional tax equity buyers such as banks had the legal, financial, and structural resources to underwrite projects.

Asset control: Developers won’t have to deal with tax investors becoming co-owners of their projects. This removes uncertainty around the buy-out of tax investors.

Market

Customers

Developers / Sellers: Developers of renewable energy projects (wind, solar, advanced manufacturing, etc.) are eligible for tax equity credits that can offset their tax liability. These developers generally are not cash-generating upon receiving the tax credit and are unable to capitalize off of these tax credits. They typically sell to a counterparty that has a large tax liability and can utilize the tax credit.

Buyers: Banks and insurance companies are traditionally the logical participants in tax equity transactions and more than 80% of the market is comprised of the 10 largest corporate tax investors. In 2020, JP Morgan and Bank of America were responsible for ~50% of tax equity transactions. In an April 2024 interview with Contrary Research, Crux indicated that it’s buyers range in size from Fortune 100 companies to family offices.

Intermediaries: Brokers, syndicators, insurers, and lawyers also act as intermediaries in the market to facilitate tax equity transactions.

Brokers: Connect developers with tax equity investors.

Syndicators: Organize and oversee groups of investors who provide tax equity financing, manage the process, and ensure regulatory compliance.

Insurers: Offer tax insurance to mitigate potential losses.

Lawyers: Structure definitive documents and term sheets around the transaction.

Market Size

The tax credit market is predicted to be more than $80 billion by the end of decade. The market for transferability was over $7 billion in 2023. In 2023, tax equity financing for renewable projects was estimated to be over $20 billion in financing. In 2022, the global power generation market was sized at $1.8 trillion and is expected to double to $3.9 trillion by 2032. Renewables consist of 31% of market share within the power sector with solar power generation predicted to be the highest growth category within the sector.

Competition

Evergrow: Founded in 2021, Evergrow specializes in developing a platform for buying and selling clean energy tax credits. Instead of listing credits on its website, customers interface directly with Evergrow to get an offer for the credit. This platform is designed to simplify financial transactions for project developers by enabling them to sell their tax credits directly to investors, thus facilitating easier access to capital for projects like solar, wind, and carbon capture. The company vets the projects on its website and connects them to family offices, corporations, and other buyers.

Additionally, Evergrow aims to standardize the underwriting process by assisting with long-term offtake contracts (purchase guarantee of carbon credits), which is a major hurdle for banks to pursue a project. Evergrow debuted its first credit transfer on the platform in October 2023. In April 2023, the company secured a second $7 million funding round at an undisclosed valuation led by First Round Capital, XYZ Venture Capital, and Congruent Ventures following a $7 million seed round.

Reunion Infrastructure: Reunion Infrastructure was founded in 2022 and operates as a marketplace for clean energy tax credits, facilitating the buying and selling process between project developers and corporate finance teams. It supports a variety of renewable energy projects such as solar, wind, battery storage, and biogas.

The company offers a platform to monetize tax credits efficiently while providing risk management, insurance, and compliance services. Crux services a similar array of transferable credits. Reunion Infrastructure launched its marketplace in July 2023 and engaged with over 200 clean energy developers representing over $1 billion of tax credits available for transactions. Reunion raised corporate funding in 2023 at an undisclosed valuation led by Segue Sustainable Infrastructure.

Business Model

According to an interview with Contrary Research, Crux stated that it generates revenue by charging success fees for facilitating transactions. This starts with education and onboarding, and discovery and matching between parties on the demand and supply side of its network, through guiding them through diligence, agreements, and transaction closing using the Crux platform and advisor network. Additionally, intermediaries (like tax advisors, brokers, and banks) utilize Crux’s software to manage transactions on behalf of clients within a white-labeled platform.

Traction

As of April 2024, Crux had $8.8 billion of credits available for sale. In Q1 2024, there were $1.5 billion worth of bids submitted on Crux. In an April 2024 interview with Contrary Research, Crux indicated that there were over 100 development partners with transactions across solar, storage, microgrids, and bioenergy in addition to over 20 intermediaries on the platform.

In addition, the company indicated that between 2023 and 2024, 68% of credits over $5 million had received at least one bid, and 39% received more than one. In May 2024, Crux announced a partnership with American Clean Power, giving over 800 member companies access to discounted transaction fees on the platform.

Valuation

In January 2024, Crux raised a $18 million Series A at an undisclosed valuation led by Andreessen Horowitz with existing investor participation by Lowercarbon, Overture, and New System Ventures. This brought its total funding to $27 million. Other key existing investors include Ørsted, LS Power, and Hartree Partners.

Key Opportunities

Exclusive Partnerships

In an April 2024 interview with Contrary Research, CEO Alfred Johnson laid out the potential for exclusivity on the platform:

“Some clients when they list, have seen quite a lot of bidding activity… The clients pulled us to the notion of exclusivity, which we have now increasingly been deploying on the market. In places where we feel confident that the credit will transact, we’re offering a reduction in fees for exclusivity.”

These partnerships provide mutually beneficial outcomes where developers establish trust in Crux’s marketplace and capitalize on a high volume of bids while paying a reduced transaction fee. This advantage can establish Crux as a reliable marketplace and keep a recurring base of development projects on its platform.

Pilot Projects

The introduction of tax credit marketplaces extends to clean energy projects, facilitating transactions that not only help finance first-of-a-kind projects but also support broader sustainability goals. These marketplaces can overcome the initial hurdles of financing innovative projects by providing a transparent, reliable, and scalable platform for buying and selling tax credits. This approach not only speeds up the investment process but also broadens the buyer pool to include those who might not traditionally invest in clean energy or community development projects.

Key Risks

Political Uncertainty

Certain provisions within the IRA could be at risk in the case of a unified political change. The tax credits most at risk for rollback are electric vehicle and emissions-free power plant tax credits. Tax credits have historically had a wide base of support due to the range of bipartisan beneficiaries. There is some sentiment that Republicans will push back on more changes to the IRA as tax credits are popular within red states and industry.

Developer Creditworthiness

The developer is responsible for maintaining and operating the asset throughout the recapture period of the tax credit. In the case of developer insolvency, the tax credit buyer would have to repay a portion of the tax credit purchased. Ensuring a network of reliable developers on the supply side will be crucial to the growth and trust of the market. Tax credit sellers will need to put indemnities and insurance in place to take risks off of buyers and bring comfort around transaction execution.

Regulation

Companies in the industry must be adaptable to an evolving regulatory framework. Regulatory frameworks establish clear rules for conducting transactions, which includes requirements for documentation and disclosure. Platforms such as Crux will have to utilize public policy as a "North Star" to understand potential risks and incentives within the marketplace for all parties. Platforms must continuously update their systems and processes to ensure compliance, thereby avoiding potential fines or legal challenges. This ongoing need to stay current is essential for maintaining market access and competitive edge.

Summary

The IRA has catalyzed a structural shift in how corporations will save on their tax liabilities and reach sustainability goals. Crux intends to be the mechanism for financing a projected $2.9 trillion market by 2032 of renewable energy projects. Infrastructure is at a moment of inflection within renewable energy and the financial markets. As an ecosystem for transferable clean energy credits, Crux wants transactions in renewable markets to become more transparent, efficient, and accessible to developers, buyers, and intermediaries. As the energy transition accelerates, the market will evolve and demonstrate its utility.