Thesis

The United States’ 2021 Federal Sustainability Plan calls for almost every industry to reach "net zero" emissions by ~2030. Globally, over 70 countries, representing 76% of the world's emissions, have committed to reaching net zero carbon emissions through methods such as carbon taxes and mandatory reporting.

The UN defines net zero emissions as cutting greenhouse gas emissions as close to zero as possible, with any remaining emissions reabsorbed by the atmosphere, oceans, and forests. When a company claims to have reached net zero emissions, it’s claiming to have removed as much carbon from the environment through carbon offsets as it has produced (net zero emissions does not mean a company does not produce any carbon). In fact, one in five of the world's 2,000 largest companies have announced commitments to reach net zero emissions. These initiatives are driven by government requirements for public reporting of emissions and consumers making purchasing decisions based on a brand's sustainability.

This is where Patch comes in. Patch is a digital marketplace and set of APIs that helps businesses find and purchase carbon offsets to reach their net zero goals. Patch's marketplace includes a variety of carbon offset projects such as reforestation, seaweed protection, and landfill gas capture. In addition, Patch's APIs allow companies to include carbon offset options in their checkout process, enabling customers to offset the emissions from the products they purchase.

Founding Story

Patch co-founders Aaron Grunfeld and Brennan Spellacy met while working at Sonder, where they launched multiple teams together including the supply chain team. Finding that they were successful working on 0 to 1 projects, they decided to try and replicate their success outside of Sonder. Brennan has been interested in climate change and the environment since he was young, and even pursued a formal education in chemical engineering at McGill University in order to have a career in the field. He later worked as a software engineer. When Aaron and Brennan decided to start a company together, Brennan wanted to combine his passion for software and climate change, leading to the creation of Patch.

When considering what to build, Aaron and Brennan saw two main paths in sustainability: (1) preventing more carbon generation (e.g. EVs, solar power) or (2) removing carbon already in the environment (e.g. carbon sequestering). They evaluated these options and concluded that the first was already advancing rapidly, but the second had not yet taken off. Carbon marketplaces already existed, but they were not yet digitized or productized, leading to poor liquidity, poor supply and price transparency, and high commission structures. This made the market inaccessible and without a clear winner. Aaron and Brennan saw similarities to the short-term housing market before Airbnb, and believed they could solve the problem by creating a B2B marketplace.

To get started, they implemented an API distribution technique. The goal for many carbon removal companies and projects is to remove 10-20 gigatons (10-20 trillion kilograms) of carbon per year for the next 20-30 years, but global capabilities are currently at about 1/100th of that capacity. This could be achieved through a few large investments, or billions of smaller transactions, which Aaron and Brennan believe is more likely. To facilitate such a high volume of transactions, they believe automation is necessary, allowing for climate action to be incorporated into everyday flows.

Product

Patch is a technology company that has developed an API allowing any business and their customers to mitigate their negative climate impact. The company's product consists of two primary components: a marketplace, and an API.

Patch’s Marketplace

Source: Patch

Patch’s marketplace is focused on aggregating climate projects with high potential and easy accessibility. These projects include financing for geothermal, solar, wind, and hydrogen energy projects, as well as supporting regenerative agriculture and carbon sequestration through direct air capture. Customers can choose one or multiple options they believe are worthwhile.

Many companies do not have available resources to build internal sustainability teams that can locate projects, evaluate their claims, and set up financing, recurring investments, and reports to share internally. Patch takes on these responsibilities, allowing customers to select projects from a pre-validated list and receive reports to ensure their money is being used effectively.

Patch’s API

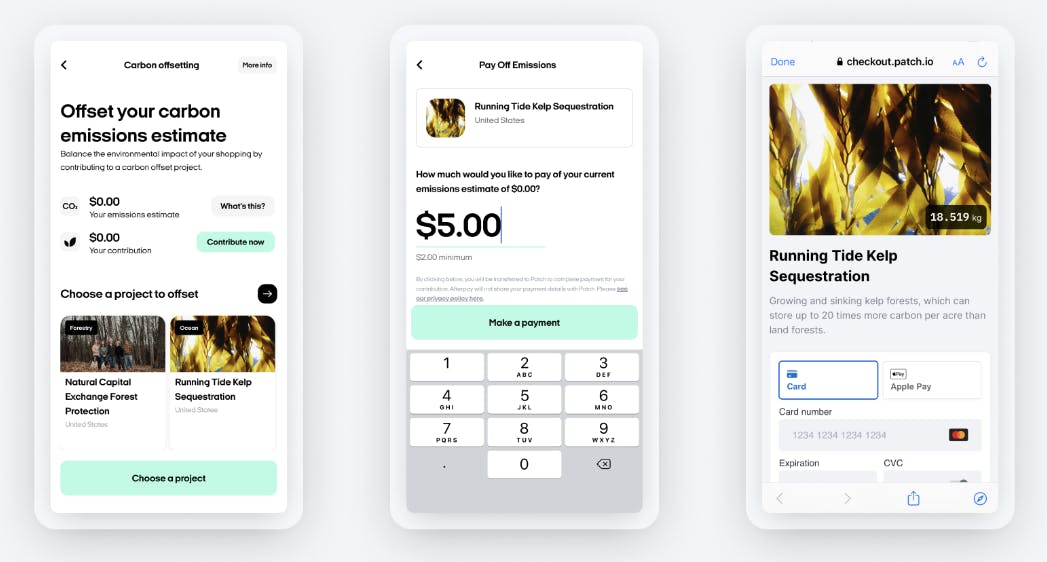

Source: Patch

Some competitors in the carbon credit space only allow businesses to invest across projects. Patch, by contrast, created its API to help businesses involve its customers in the carbon offset market as well. With Patch’s API, any business with an online presence can include options for its customers to make a donation, offset its purchases, and more. This is an important capability because consumers are demanding it. The 2021 Global Sustainability Study revealed that 60% of global consumers now place sustainability as a major criteria when making purchases. Over the previous five years prior to 2021, 85% of people claimed that they have actually shifted their purchases towards more sustainable products, so it is in the best interest of companies to make the change in the interest of customer retention.

Patch's partners use the company's technology in various ways. For example, some companies in the cryptocurrency space use Patch to create carbon neutral blockchain transactions, while others in the shipping and travel industry allow customers to offset emissions from vehicles. Afterpay, which allows customers to purchase products and pay for them in installments, works with Patch to provide a carbon emissions dashboard for each customer within the Afterpay Shopping App. Customers can view their carbon footprint and purchase verified offsets from Patch at a low cost, while also earning loyalty points.

Market

Customer

Patch offers a platform designed to be industry agnostic, so any business can benefit from its services. Co-founder Brennan Spellacy said that “typically we partner with technology or tech-enabled companies who want to offer some sort of climate positive or carbon neutral service or experience.”

Most companies that decide to work with Patch, or invest in any form of sustainability, are doing so for one of the following reasons:

It aligns with their internal values: Many companies such as Microsoft and Salesforce speak about sustainability and protecting the planet in their company values.

Positive marketing and branding: Whether you believe action should be taken or not, sustainable marketing boosts customer trust and loyalty.

Their investors are mandating climate action: Individual investors, as well as institutions, are asking companies they have invested in to decarbonize operations. BlackRock, the world’s largest asset manager, uses their commitment to sustainability and letters to clients and companies to push for change across their extensive portfolio.

Their customers are demanding it: Many consumers are starting to investigate brands they love. Today, 34% of the global population says they would pay more for sustainable produces or services, at an average premium of 25% for a sustainable alternative.

One major complication with incumbent carbon marketplaces is that there are minimum investments required to start a carbon portfolio. Many projects that do not have an online presence (i.e. a way for you to donate through their website) and require partnerships and a large sum of money to get started. Because Patch has extensive reach through its business partners, customers can pay to sequester as little as one gram of carbon on their transactions, or as much as they would like.

A second blocker these customers currently face is high activation energy required to start reducing carbon emissions at your company. Most organization need to start a new team, hire new employees, find consultants, conduct B2B procurement for carbon projects (negotiating, due diligence, legal reviews, etc.), which ends of taking significant time and money. With Patch and other B2B carbon marketplaces, you can get started immediately.

Market Size

The carbon footprint management market is estimated to be worth $9.1 billion as of the end of 2022, with North America being the largest shareholder followed by Europe, the Asia-Pacific region, and others. The market is projected to grow to $12.2 billion by 2025 and $16.9 billion by 2031. This growth is dependent on government legislation, consumer demand for sustainable products and practices, and investor pressure. Because of this, some believe the carbon removal tech industry will grow more than 4x faster during the same time period, possibly reaching $30 billion.

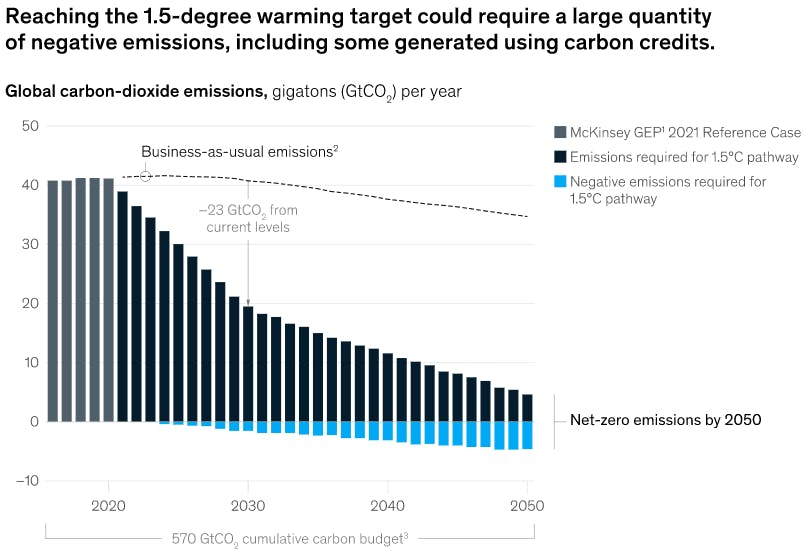

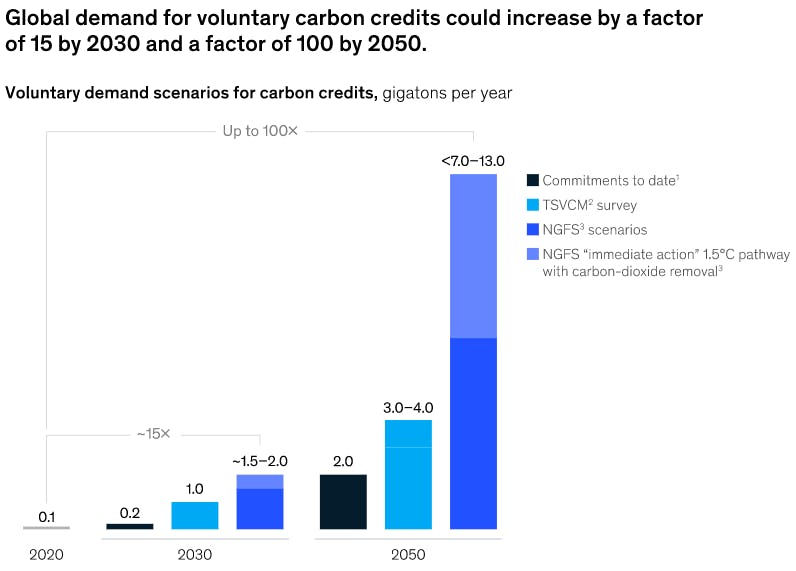

In the carbon offset market where Patch operates, McKinsey has done research on projected demand for carbon offsets through 2050, the final year of the Paris Agreement. McKinsey estimates demand for carbon credits is expected to increase 15-fold to a $50 billion market by 2030, and 100-fold by 2050.

Source: McKinsey

To achieve net-zero emissions, the area below zero (representing negative emissions) must be equal to the area above it. This would effectively cancel out any carbon emissions through carbon sequestration. While it is currently not possible for businesses to operate in a completely carbon neutral manner (releasing no carbon), negative emissions are a necessary component. As businesses work to reduce their carbon emissions, and as new technologies such as hydrogen fusion and solid state and hydrogen batteries become available, demand for offsets is likely to increase due to increased regulation.

Source: McKinsey

According to projections, demand for carbon offsets could reach 7 to 13 gigatons by 2050. However, it may be difficult to secure sufficient funding for these capital-intensive projects. Patch believes a marketplace will be necessary for carbon offset projects to reach full scalability. However, it is possible that demand for offsets could become so high that these projects will have the ability to choose their clients without the need for a marketplace.

Competition

Patch does not offer a full suite of products to cover every step of the carbon reduction process. As a result, customers will need to use multiple solutions to track and achieve their carbon goals. While other companies, like Persefoni or Watershed provide carbon accounting software, Patch is specifically focused on providing access to carbon offsets.

Carbon Credit Marketplaces

In terms of direct competitors, Patch is not the only B2B carbon offset marketplace; competitors include Cloverly, Climate Trade, and others. Patch's API is a unique offering, but other companies are also finding ways to offer carbon offset options directly to consumers at checkout, such as CarbonCheckout and EcoCart.

End-to-end Carbon Emission Tracking & Reduction Solutions

In addition to carbon offset marketplaces, there are also companies offering end-to-end solutions for tracking and reducing carbon emissions such as Watershed and Pledge. These companies provide services for carbon accounting, reduction, and offsets. Patch does not offer a comprehensive solution for companies seeking an all-in-one solution, though it does offer various solutions for calculating your current carbon footprint and tracking progress.

It's worth noting that different industries have widely varying carbon footprints, and companies like CarbonCloud have specialized in calculating the climate impact of specific supply chains, such as those in the food industry.

Business Model

Both Patch’s marketplace and its API for offsetting carbon emissions generate revenue through a percentage of purchase model. The marketplace is often utilized by companies seeking to offset carbon emissions resulting from their internal operations, such as office energy usage, business travel, and other emissions from cloud computing. This revenue is not recurring and depends on the specific carbon offset goals of the company in question. The API allows customers to offset carbon emissions throughout the product delivery process, including use of delivery trucks and warehouses. As long as sales volume remains steady or increases for a particular company, the API generates predictable and recurring revenue.

Traction

Patch has not made its revenue figures public, but its client list includes well-known brands such as Plaid, Bain & Company, AfterPay, and Farfetch. Patch's current employees, numbering around 80, have experience at companies such as Stripe, Plaid, and Shopify, demonstrating a strong affinity for the company's integration technology, not just their mission. The team has grown threefold since March 2022, and around 80% of current open positions are in sales or related fields, indicating confidence in product market fit.

Valuation

In September 2022, Patch successfully raised a $55 million Series B round led by Energize Ventures, bringing total funding to $80 million since its founding in January 2020. The company’s total funding is ~$80 million from firms like Coatue, Andreessen Horowitz, and Contrary. While it is challenging to accurately assess the valuation of decarbonization firms like Patch due to the limited number of publicly-traded companies in the space, it is worth noting that Watershed raised $70 million at a valuation of $1 billion just six months prior to Patch's Series B.

Key Opportunities

Vertical integration to increase product suite

As previously mentioned, many competitors are not only building a marketplace, but also helping businesses track and reduce their carbon emissions. Patch has stated that their current plan is to focus on being the best marketplace and avoid distractions by not offering additional products. However, it remains to be seen if companies that offer a wider range of services will gain an advantage.

Plenty of consumers are also interested in offsetting their daily activities through recurring donations. Providing a B2C portal for people to set up payments to projects it feels are making a difference could be an alternative to developing entirely new products for their existing customers.

Educate customers on how to market sustainability

In order for Patch to be successful, it is important for their customers to effectively market the sustainability of their products to consumers. Consumers often base their purchasing decisions on sustainability, so the better Patch's customers can promote the integration of Patch offsets, the more sales they will generate.

Legislation & regulatory tailwinds

There is increasing legislative and regulatory support for transparency in sustainability efforts. For example, the European Union's Corporate Sustainability Reporting Directive requires medium and large businesses to report on their carbon emissions, which will impact 50K European businesses as well as foreign companies with European branches. The United States is also considering similar measures, and other countries are following suit. As a result, businesses may turn to Patch and other companies for assistance in achieving net zero emissions through carbon credits.

Key Risks

Customers Searching for Lower Fees

As companies increasingly look to make ESG investments, they are often faced with the dilemma of having to pay high fees to middlemen to access the convenience they offer. Patch, a marketplace for carbon offset projects, is no exception. However, if its revenue model proves to be more costly than that of its competitors, businesses may opt to take their investments elsewhere.

Another risk facing Patch is the possibility that businesses will bypass marketplaces altogether and choose to work directly with carbon offset projects. For example, Microsoft recently signed a 10-year contract with Climeworks to remove 10K tons of CO2 as an offset for the tech giant.

Mixed Reputation of Carbon Credits

One major issue is carbon credits have a reputation for being ineffective. Carbon offset projects are often approved by just one registry, which may have little oversight. In addition, some projects that receive substantial funding or tax breaks are not always legitimate. For example, a study in India found that 52% of carbon offset projects would likely have been implemented even without funding from carbon offsets. There are also instances of companies purchasing land in Africa to plant trees, leading to the eviction of 22K local community members. Companies like Sylvera have emerged to create a better quality rating framework around carbon offsets.

Moreover, quality of projects is extremely volatile. Even various environmentalists and activists argue allowing companies to offset their emissions rather than reducing them outright will actually encourage more emissions. As more companies are required to offset their emissions, the price of carbon credits could increase significantly, diminishing the impact of investment. Addressing climate change requires both carbon reduction and removal, but carbon offsets only incentivize removal.

The credibility and transparency of carbon offset projects is crucial for the industry to thrive long term. Some companies, like United Airlines, have even gone as far as publicly denouncing carbon offsets and instead committing to decarbonizing their operations to the best of their abilities. However, as Bloomberg reports, "study after study has indicated that most offsets available on the market don't reliably reduce emissions," which can damage the reputation of those projects genuinely making a positive impact.

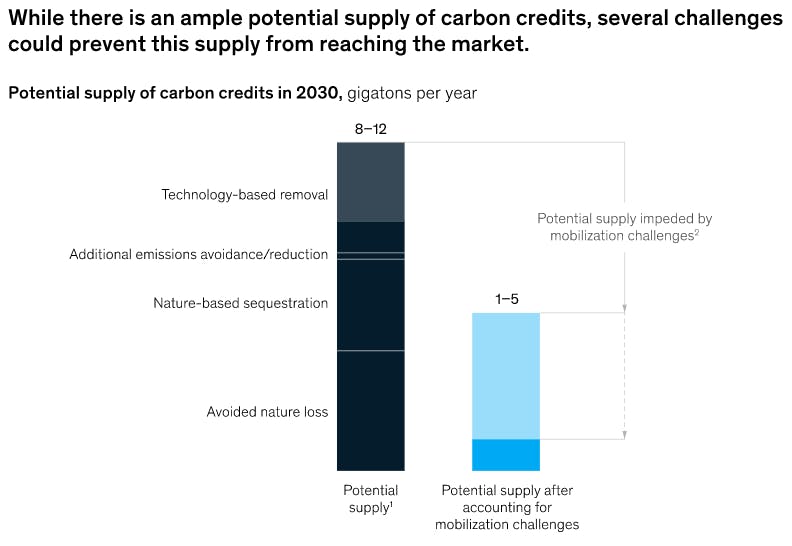

Supply Issues in a Fragmented Market

The carbon offset market is also highly fragmented, with projects ranging from large, venture-funded companies to small landowners. This can make it challenging for companies like Patch to find and onboard credible carbon offset projects to their platform. As the demand for carbon offsets grows, it may become increasingly difficult to aggregate enough supply to meet customer needs. If Patch cannot meet public demand, companies may look to sign contracts with projects or find another way to purchase offsets.

Source: McKinsey

Assuming demand for carbon credits passes 10 gigatons of carbon per year by 2050, supply could be below 5 gigatons. Various obstacles to rapid supply generation include: the rate and complexity of scaling efforts, geographic concentration of carbon offsetting opportunities, difficulty attracting funding, and more. Such challenges are not unconquerable, but they require proactive efforts. If carbon offsets are to be a large portion of carbon footprint destruction before 2050, these problems should be tackled today.

Summary

Tackling climate change is a growing priority for companies. Patch believes carbon offsets are an essential tool in addressing climate change and the best way to boost their adoption is by creating an easy channel for businesses looking to do their part to find verified projects that will help the planet and boost their brand. Patch’s success will largely depend on its ability to source enough high quality carbon removal projects for its customers, legislation for governments around the world, and general demand for carbon offsets by companies and consumers.

Patch’s strategy of placing climate action directly in the hands of consumers through platforms of established companies has shown early success, but the future is still unpredictable. As the market for sustainability tools grows quickly, it looks to establish itself as the top marketplace for carbon offsets.

Disclosure: Patch is a portfolio company of Contrary