Thesis

Greenhouse gases (GHGs) are being released into the atmosphere at increasing rates, leading to global temperature increases. In 2015, a group of nations that were collectively responsible for 76% of global GHG emissions met in Paris and agreed to dramatically reduce emissions through mandatory reporting, carbon taxes, and more. What would come to be known as the Paris Agreement is a global call to prevent temperatures from rising 2 degrees Celsius (°C) above pre-industrial revolution levels. Because of this pact, many consumers, businesses, and nations began making strides in the following decade to reach net zero emissions.

Annually, the world emits around 50 billion tons of GHGs every year, mostly comprised of carbon dioxide (CO₂), methane, and nitrous oxide. Energy production is by far the largest contributor to the problem, generating nearly three-quarters of the emissions. While renewable energy is seeing quick growth, fossil fuels (oil, coal, and gas) still produce 80% of the planet’s energy. To have any chance of meeting the goals laid out in the Paris Agreement, carbon capture will have to be a meaningful part of the global response to climate change.

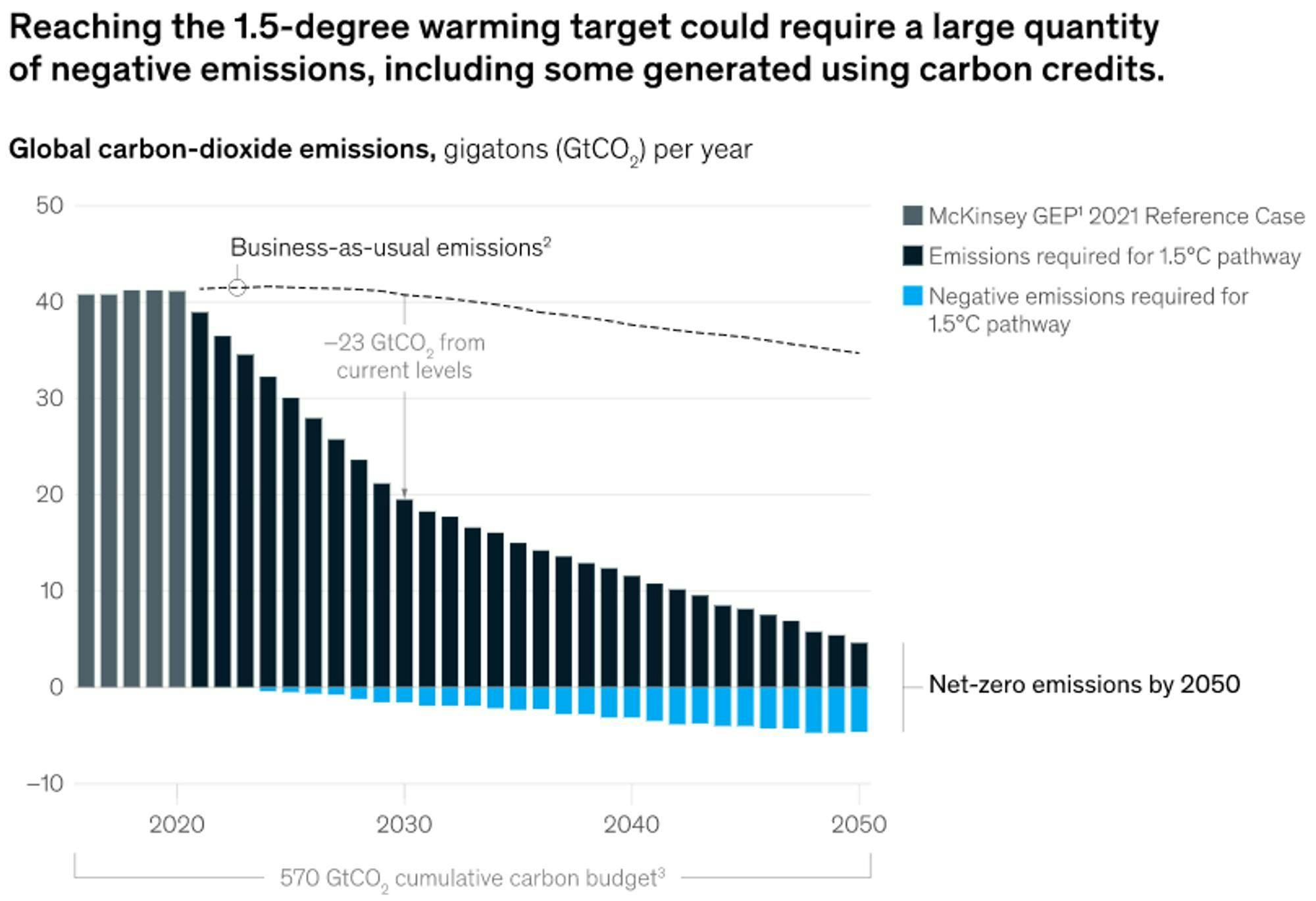

The International Panel on Climate Change (IPCC) has called for six gigatons (Gt) of carbon removal every year by 2050 to prevent temperatures from breaching the more conservative level of 1.5 °C increased since pre-Industrial Revolution levels. By the same year, the Energy Transitions Commission estimates that 70-220 Gt of carbon must be removed to achieve the same goal. While lowering emissions is important, the IPCC and others have stated that lowering or even ceasing all emissions will no longer be enough. To remove enough GHGs to meet the PICC’s goals, carbon dioxide removal (CDR) investments must grow from $10 billion per year to $200 billion annually by 2030.

Charm Industrial captures CO₂ for carbon offsets by converting biomass into carbon-rich bio-oil and injecting it into retired gas and oil wells for long-term carbon storage. The company uses leftover organic materials from harvesting corn, rice, almonds, and more in addition to timber slash and uses fast pyrolysis to instantly heat the material and produce oil and nutrient-dense ash for fertilizer. While some CDR methods use large fans or other high-tech approaches, Charm Industrial just uses simple photosynthesis to remove GHGs.

Charm Industrial believes its solution is superior to other CDR processes because all offsets are 100% additional, meaning that the GHG reduction being claimed wouldn’t have occurred without the purchase of an offset. It also claims that it removes CO₂ from the atmosphere permanently, “out of reach of wildfires, soil erosion and land use change”. In addition to long-term storage, Charm Industrial is also using its bio-oil to clean the production of steel. Its mission is to return Earth’s atmospheric CO₂ concentration to 280 parts per million (ppm); as of June 2024, CO₂ concentration in the atmosphere was 426.9 ppm.

Founding Story

Peter Reinhardt (CEO), Shaun Meehan (former Chief Scientist), Kevin Meissner (former CTO), and Kelly Hering (another former CTO) founded Charm Industrial in San Francisco in 2018. Reinhardt grew up in Washington where he studied physics before pursuing a bachelor’s degree in aerospace engineering from MIT. While there, he started two companies. The first was Iomy Labs, a company based on the provisional patent for “A System for Harvesting Hydrogen Gas from Ambient Water Vapor”. Next, he founded Segment, a customer data platform, which caused him to drop out of MIT. After nearly 10 years, the company reached several hundred million in revenue and was acquired by Twilio for $3.2 billion.

In 2015, while still at Segment, Reinhardt began looking for ways to offset the company’s emissions. He started off by buying offsets that were supposed to be protecting rainforests in the Amazon and in Indonesia, but when he looked into how the money was being spent he became skeptical that it was being used effectively to permanently sequester carbon emissions — both the details of the process, as well as the permanence of the impact of methods such as replanting or protecting forest to sequester carbon, gave him reasons to doubt.

As a result, around 2018, Reinhard began talking with his friends about how it might be possible to permanently sequester carbon dioxide. The founding team’s first plan was gasifying biomass to produce syngas for industrial processes, and then char to be returned to the field. However, shipping biomass to central gasification plants was extremely expensive.

in 2020, Meehan had the idea of using small, modular pyrolyzers in the field to produce a liquid bio-oil instead of syngas while still producing char to be taken back to the field, significantly reducing transportation costs. However, the process would still require significant costs to make work for industrial processes. Instead, Meehan realized they could take the produced bio-oil and inject it underground. This was much cheaper because the pyrolyzers were small enough to fit into the back of a semi-trailer and thus would not require a central plant. After just 10 months, the first injection into a well was completed. The high heat char farm completed 5K tons of carbon removal injections throughout 2021 and is working to increase this number.

The company has seen notable churn in its leadership, with most of the founding team outside of Reinhardt, who remains as CEO, having left the company. Meissner, who had formerly been CTO, left the company in January 2020, while Hering and Meehan both stepped down in February 2023.

Product

The product Charm Industrial sells to the market is carbon offsets, priced at $600 per ton of carbon removed as of June 2024. These offsets are created by reducing organic material into bio-oil and then injecting it deep underground. When compared to crude oil, bio-oil contains much more water and is thus less energy-dense, unable to sustain a flame, and more acidic. Because it is not energy-dense, it isn’t useful for powering vehicles or industrial processes, but works well for carbon offsets due to the high amounts of carbon it contains.

Bio-Oil Production

To create bio-oil, Charm Industrial takes leftover corn stover, rice straw, almond shells, and other harvesting byproducts from farmers. Additionally, the company purchases timber slash, the organic material left after forest fires and logging operations. In fact, the company is often paid to take forestry residue, as there is a significant glut from wildfire prevention work.

In regard to farm residue, some critics claim that Charm Industrial will do more harm than good by removing nutrient-dense materials from farmers’ fields, but the company disagrees. While farmers must keep some level of leftover crops to re-fertilize their fields, it is estimated that of the 400 million tones of corn stover generated annually in US fields, only half is needed to sustain soil health. In addition, because of the char production and application in Charm Industrial's process, the majority of nutrients are returned to the soil, and can actually reduce soil carbon.

Source: MIT Technology Review

Using a pyrolyzer, the dry materials are converted into a viscous bio-oil. The process heats the materials to 500 °C in a matter of seconds, producing bio-oil (50%), ash or bio char (30%) used as a soil additive, and CO₂ (20%). CEO Peter Reinhardt describes rapid pyrolysis similar to a hot pan:

“Imagine flicking water on a pan and it goes pffsst and kind of vaporizes into steam. We are basically doing that with cellulose”

Source: Charm Industrial

To reduce potential emissions due to long distance shipping of “fluffy” high-volume materials, the pyrolyzers have been designed to operate close to, or even on, farm fields where the biowaste is produced. In terms of efficiency, fast pyrolysis, transportation, and injection do create their own emissions. Every ton of biomass Charm Industrial takes contains about 1.7 tons of CO₂. After the process is complete, about 0.9 tons of carbon are successfully sequestered.

While the process is not perfect, and the team believes they can substantially improve upon this with time and scale, no carbon would have been sequestered if the materials was left to burn or rot. If burned on farms, the materials are immediately converted to CO₂, if left to rot then they are converted within two to three years.

Source: MIT Technology Review

Bio-Oil Sequestration

The US has millions of abandoned oil and gas wells where large amounts of fossil fuels were once stored for hundreds of millions of years. Charm Industrial returns a more carbon-dense oil to these wells. Experiments replicating the environment of deep wells have shown that the bio-oil hardens within 48 hours of injection, preventing sinkholes and increased seismic activities caused by abandoned oil wells. Charm Industrial claims that the CO₂it sequesters is locked away for 1 million years.

Iron Making Made From Bio-Oil

As CEO Peter Reinhardt told Contrary Research, modern ironmaking occurs in blast furnaces or direct reduction furnaces. These processes convert iron ore (rust) mined out of the ground into de novo iron (called pig iron, sponge iron, or hot briquetted iron). Then, that de novo iron is combined with scrap (recycled steel and iron) in the steelmaking process, which is when the iron is alloyed with carbon, chromium, nickel, etc., and formed geometrically. This can be done via an electric arc furnace or a basic oxygen furnace. While steel is the most recycled material in the world as of 2024 (40% of all steel that's produced is created through recycling and steel can theoretically be recycled forever once produced), the steel industry will be unlikely to ever get to 100% recycled scrap in steelmaking due to continuous growth in demand, as well as copper impurities that must be blended down with de novo iron.

The majority of emissions in the overall steel industry come from the ironmaking process rather than steelmaking. So while electric arc furnaces can leverage renewable energy to reduce emissions, blast furnaces use an inefficient and carbon-intensive coal process. In order to limit emissions, these facilities can be converted to direct reduced iron (DRI) plants that use natural gas, producing fewer emissions. To eliminate the majority of emissions from DRI facilities, bio-oil can be used to produce syngas, the primary ingredient used in DRI plants, through steam reformation.

While the CO₂ from this process is not stored underground, the use of bio-oil to create steel prevents the need to mine for additional fossil fuels, avoiding 1.5 tons of carbon dioxide equivalents (CO₂e) per ton of steel. If industrial plants place a filter on their flue stack to capture released carbon, an additional 1.2 tons of CO₂e can be removed per ton of steel.

In an August 2023 interview with Contrary Research, Charm Industrial CEO Peter Reinhardt explained the way the company thinks about the demand premiums that exist across both markets they serve, both voluntary and regulatory carbon removal offsets, as well as iron production:

“Bio-oil can either be injected underground as carbon removal, or we can use it in iron making as a replacement for coal and natural gas. The way I think about these two markets is premiums market sequencing. The capital costs are high, and you come down a cost curve, so you need to start in small premium markets, and then work your way into large commodity markets. Think about the Roadster, the Model S, and the Model 3. In this market, voluntary carbon removal markets are the highest premium, regulatory carbon removal markets are the next highest premium at a larger scale, and then the lowest premium is in iron making, but [it has] vast scale.”

Market

Customer

Charm Industrial’s process involves three key stakeholders: (1) farmers who sell their biowaste materials, (2) oil wells who sell rights to re-inject oil, and (3) companies or organizations wishing to buy carbon offsets. Purchasing biowaste and access to oil wells for re-injection are technically costs for Charm Industrial, although for forestry residue the company is often paid to take those materials. The primary customers for the output of Charm Industrial’s process are the companies looking to buy carbon credits.

Companies like Microsoft have pledged to reach net zero emissions or become carbon negative in the 2020s. Doing so may be a response to customer demands, an effort to attract new employee pools, a preparatory action for future government regulation and incentives, or just part of the company’s mission. In 2020, Microsoft announced a $1 billion climate innovation fund which allows its VC arm to focus on allocating capital to climate companies. Other companies may choose to simply offset emissions instead of making investments.

As of June 2024, Charm Industrial’s notable customers include Microsoft, Alphabet, Meta, Shopify, Microsoft, Stripe, McKinsey, Zendesk, JPMorgan Chase, Figma, Canva, Boom Supersonic, and more. Additionally, carbon offset vendors such as Patch, Commons, and Klimate host Charm Industrial offsets on their platforms. Finally, companies like Stripe, Shopify, Square, and Sourceful allow their customers to incorporate offsets into shipments and transactions through partnerships with Charm Industrial.

Source: Charm Industrial

Market Size

The market for software to manage carbon offsets was valued at $9.1 billion in 2022. Meanwhile, market demand for voluntary carbon offsets was estimated to be ~$2 billion in 2021, and could grow to as much as $40 billion by 2030. Since the signing of the Paris Agreement in 2015, capital allocations to carbon offsets have increased by 50% annually. However, carbon offset market is still in the early days, and uncertainty around future legislation makes it difficult to predict how the market will operate in the future. Some estimates indicate the market could reach as much as $200 billion by 2050 as nations and corporations alike attempt to meet their climate goals.

Charm Industrial operates both in the carbon offset market as well as the carbon removal market, which is valued much lower than the broader offset market because not many carbon removal technologies have yet reached commercial scale. In 2021, the market for carbon removal was valued at $418 million. This grew to $532.1 million in 2022, and could reach as much as $2.1 billion by 2032, representing a 14.8% projected CAGR. Carbon removal technologies include biochar, direct air capture (DAC), enhanced carbon mineralization, and ocean alkalization.

Reduction of GHG emissions is a top priority for any climate-conscious organization since carbon removal is unlikely to keep up with current levels of output. In accordance with estimates of six Gt of CO₂ needing to be removed from the atmosphere annually by 2050, emissions must also fall to 6 Gt from the 50 Gt released annually today. The question remains what percentage of funding will come from mandatory versus voluntary offsets.

Source: McKinsey

Competition

According to Katie Holligan, Head of Operations at Charm Industrial, the company’s offsets are unique because they are a form of permanent CO₂ removal which is completely additional. This means the carbon removal would not have happened without the purchase of the offset. Nature-based offsets, mostly focused on forest conservation and reforestation, are notoriously controversial in terms of additionality and are not permanent since the trees and plant life will eventually die or burn. Lastly, Charm Industrial does not need to perfect new technology like DAC to remove carbon because it is just leveraging photosynthesis. While all forms of carbon removal are important, Charm Industrial believes its offerings are superior.

Anyone selling a carbon offset is effectively a competitor to Charm Industrial. Most buyers will search through a list of vendors before deciding which offsets to purchase, basing their decision on price, features, and regulatory incentives. Competitors in the permanent carbon capture market can be placed in a number of buckets given the wide variety of approaches available. Bio-oil sequestration would typically fall under Biomass Carbon Removal and Storage (BiCRS), which is a subset of Carbon Dioxide Removal (CDR).

Charm Industrial's primary competitors in permanent CDR will be companies doing one of three other major methods: (1) Direct Air Capture (DAC), (2) Enhanced Rock Weathering (ERW or EW), and (3) Ocean Alkalinity Enhancement (OAE).

Direct Air Capture (DAC)

Occidental Petroleum: Occidental Petroleum was founded in 1920, and is publicly traded with a market cap of $56 billion as of June 2024. Since 2019, Occidental had been working with Carbon Engineering on DAC. Carbon Engineering's approach was unique because, rather than attempting to capture emissions at the point of creation, like a factory flue, the carbon was removed directly from the atmosphere for permanent underground storage underground, or for clean fuel production production used in transportation. In August 2023, Occidental announced it was acquiring Carbon Engineering for $1.1 billion.

Climeworks: Climeworks, founded in 2009, is a Switzerland-based company that has raised CHF 733.6 million (approximately $816.1 million) as of June 2024. Its process uses a wall of industrial fans equipped with filters to identify and capture CO₂ molecules. Once the filter is full, the fan unit is enclosed and heated, releasing the CO₂ for permanent storage underground, or even commercial use cases such as carbonation for soda. To store the CO₂, Climeworks has partnered with CarbFix.

Climeworks has signed large deals with Microsoft, JPMorgan Chase, and others. As of May 2022, DAC facilities coming online were set to remove 1 million tons of carbon annually, much more than Charm Industrial is capable of capturing as of 2024. Its pricing of $300-800 per ton is in the same range as Charm Industrial.

Heirloom: While many carbon capture efforts are man-made, there are some naturally occurring methods of carbon capture. As Heirloom's Head of Marketing explains,

"Limestone is made up of calcium oxide (CaO) and CO₂. When CO₂ is removed from the limestone, the calcium oxide wants to return to its natural limestone state and is ‘thirsty’ for CO₂, acting like a sponge by pulling CO₂ from the atmosphere. Heirloom’s technology accelerates this natural property of limestone, reducing the time it takes to absorb CO₂ from years to just three days."

Heirloom, founded in 2020, has received $54.3 million in funding from investors like Bill Gates and Elon Musk as of June 2024.

Enhanced Rock Weathering (ERW)

UNDO: Started in 2022, UNDO leverages a naturally occurring process called rock weathering. In nature, when carbon dioxide mixes with rainwater the process forms carbonic acid. When that carbon-infused rainwater falls to the ground it changes to carbonate form and can be stored in the rocks it hits. UNDO accelerates the process by crushing basalt rock and spreading it across farmland in the UK, Australia and Canada. This increases the amount of carbon that is captured from rainfall. UNDO is part of the carbon removal portfolios of companies like Microsoft and Stripe.

Eion: Started in 2020, Eion crushes and transports olivine, the most common mineral in Earth's upper mantle, to farmers. Because the mineral is more efficiently spread to capture rainfall, 40%-70% of the CO₂ that would be captured can be captured in 6-9 months. In addition, Eion uses a process called "soil fingerprinting" to measure the efficiency of its process.

Ocean Alkalinity Enhancement (OAE)

Ebb Carbon: Started in 2021, Ebb Carbon's process works with a number of facilities that process seawater, such as aquaculture farms, and desalination plants, in order to intercept salt water before it returns to the ocean. Ebb applies low-carbon electricity to this saltwater to "separate it into acidic and alkaline solutions." Ebb then monitors the alkaline solutions and returns it to the sea when its reached normal Ph levels, which lowers the acidity of the sea. Over time, this “alkaline solution reacts with dissolved CO2 in seawater to create bicarbonate (HCO3)”, which can be a form of stable carbon storage that can last for 10K+ years according to the company. Ebb Carbon has raised $23 million in funding as of June 2024.

Planetary: Started in 2019, Planetary uses a process of returning alkaline solutions to the ocean in order to remove acidity and capture carbon. It does this by identifying waste minerals around the world, and then processing the materials through an electrolyzer that can separate the water and salt to produce a pure alkaline hydroxide. That hydroxide is then transported to ocean outfalls and reintroduced to the ocean.

Carbon Capture, Utilization, & Storage

Another approach, Carbon Capture, Utilization & Storage (CCUS), includes companies attempting flue stack CO₂ capture, rather than atmospheric removal.

CarbonCure: Since its founding in Canada in 2007, CarbonCure’s technology has drawn significant attention. The company uses CO₂ captured from stationary point source emitters such as natural gas plants and then injects the CO₂ into concrete during mixing where it is stored forever, even if the building is later destroyed. The carbon-injected concrete is actually stronger than traditional concrete, removing regulatory barriers and allowing companies to use less cement in their mixtures.

As of June 2024, the company has raised a total of $92.4 million in funding, including an $80 million funding round led by Blue Earth Capital in July 2023 at an undisclosed valuation. The company had sold 750 of its mineralization systems to 30 countries as of June 2023, resulting in 28 million cubic meters of concrete. CarbonCure offsets are also sold on the Patch platform.

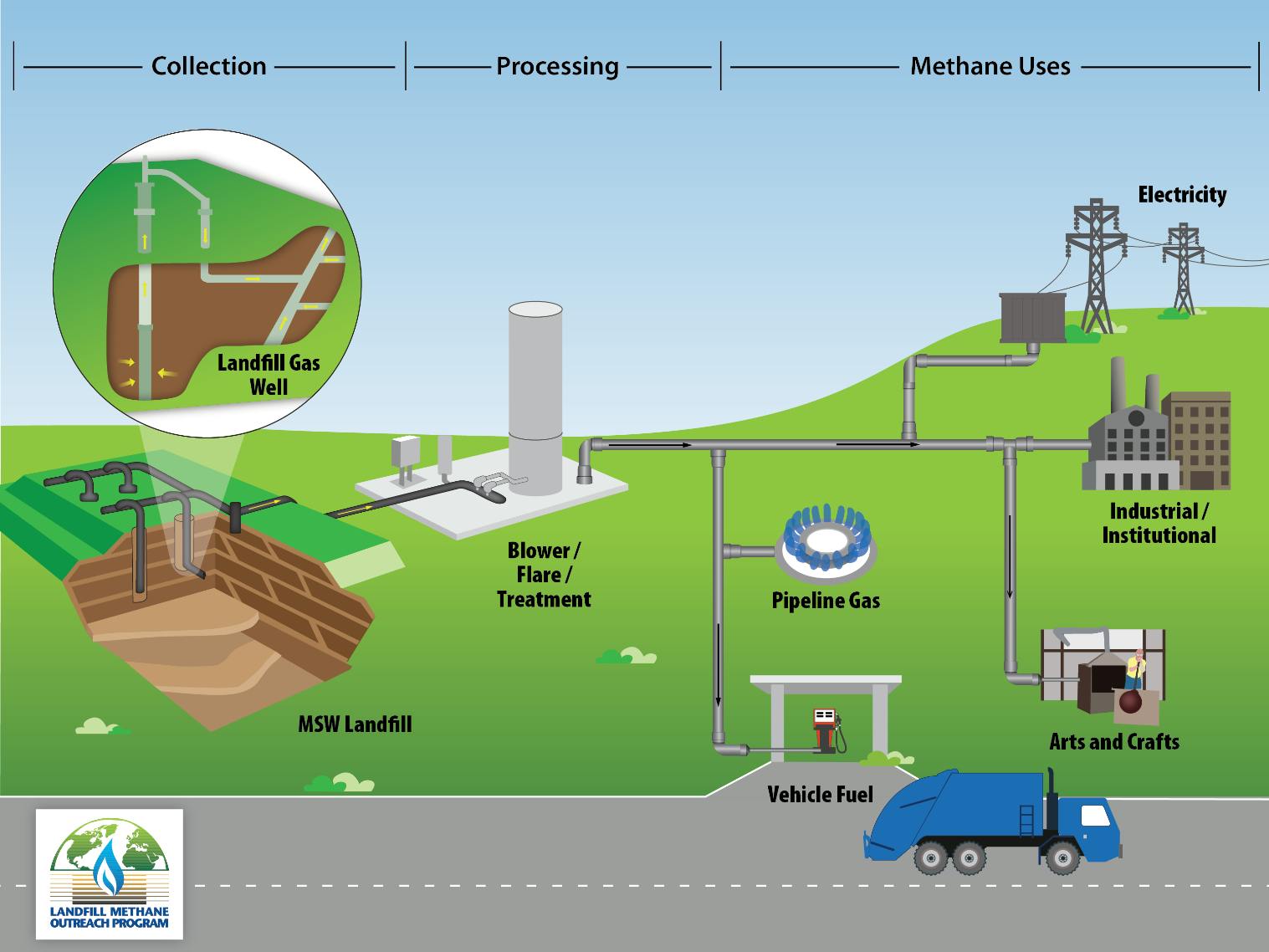

Landfill Gas Capture: While there does not appear to be a single company leading the charge in selling carbon credits to buyers focused on landfill gas, there are many individual projects doing so. Garbage in landfills produces methane, a gas that is 28-34x more potent than CO₂, which can be used to generate electricity and fuel stoves, or it can simply be flared off, converting it into less harmful emissions like CO₂. If it becomes economical for landfills to permanently reduce emissions by converting them into electricity, there is obviously no shortage of trash in the distant future to be used.

Source: EPA

CarbFix: Located in Iceland, where Climeworks’s first large-scale plant was constructed, CarbFix is one of the leaders in underground mineralization. CO₂ from Climeworks fans or fossil fuel burning production sites is dissolved in water and then injected deep underground, filling cavities that will turn into stone after a few years of naturally occurring reactions. Carbfix has also made partnerships with companies like Removr to inject hundreds of thousands of metric tons of CO₂ underground. The company was founded in 2006 and has raised a total of $117 million in funding as of June 2024.

Business Model

After buying agricultural waste from farmers, Charm Industrial funds its operations by selling carbon credits to companies and consumers, both through its website and third-party vendors. As of May 2023, Charm Industrial charges on average $600 per ton of CO₂ removed, but website visitors have the ability to change the monthly payment amount from as low as $25 for consumers and $100 for companies to as high as $5K for consumers and $20K for companies. Additionally, enterprise pricing is available for organizations with a larger budget. Companies and consumers may make the decision to purchase credits from a third-party vendor such as Patch if they wish to create a diverse portfolio of offsets on a single platform.

While prices for Charm Industrial’s credits are still relatively expensive, the company hopes to reduce them from $600 to only $100 by 2040. This is only achievable once sales scale higher than current R&D expenses and the current systems become more efficient. In an interview with Contrary Research in August 2023, Reinhardt described how the cost structure for Charm Industrial could change over time:

“The long-term cost curve is getting down to the $50-100 price range. It's hard to estimate the time axis because it depends on how fast you scale up. Wrights Law — the more you manufacture something, the cheaper it gets — that applies to plant scaling. If you make a plant 10x the size, it can get 40% cheaper. At some point, the [capital expenditures for us] become cheap enough that biomass becomes the dominant cost. So we flip from biomass getting delivered to picking up the biomass on the field and converting it on field. 90% of the cost of biomass is the transportation.”

Traction

To improve upon its technology, Charm Industrial spent 2021 and 2022 running a closed pilot program. From January to June of 2023, the company increased carbon removal delivery per week by 5x and brought two additional pyrolyzers online in the month of May. The company seems to be cautious about taking on additional customers as it has stated that it is still pushing to increase capacity to meet the demand of current customers. At the same time, engineers are working to eradicate issues such as corn kernels jamming pyrolyzers, premature solidification of bio-oil, and more.

In May 2023, Charm Industrial announced a deal with Frontier, an advance market commitment (AMC) that bought $53 million in offtake agreements with Charm Industrial to remove 112K tons of CO₂ between 2024 and 2030. Frontier is a coalition to accelerate carbon removal technologies funded by companies like Stripe, Alphabet, Shopify, Meta, McKinsey, Autodesk, H&M Group, JP Morgan Chase, and Workday. Though the Frontier AMC has pledged $1 billion in funds to CDR technology, this partnership is by far its largest to date, having only spent $5.6 million on other investments. An important clause of the deal notes that the price per ton will decrease 37% by 2030 though Frontier hopes that number will be closer to 75% if key government incentives take shape.

In 2021, Charm Industrial began a partnership with Klimate.co, a platform for carbon removal strategies. It expanded this partnership in 2024 so that Charm Industrial could leverage Klimate.co’s customers to “help facilitate the upcoming delivery of nearly 1900 tons of permanent carbon dioxide removal”. According to Charm Industrial’s ledger, the company had removed a total of 7.2K tonnes of carbon dioxide from the atmosphere.

Valuation

Charm Industrial raised a $100 million Series B in June 2023 with the intention of doubling down on R&D and building a fleet of pyrolyzers to be deployed in Colorado and the broader US corn belt. The round took place at an undisclosed valuation, and it was led by General Catalyst. Other investors in Charm Industrial include Lowercarbon Capital, Thrive Capital, Kinnevik, and Elad Gil. While Charm Industrial does appear to have raised a seed round in January 2019 shortly after the company was founded and a subsequent round in January 2021, no details were disclosed for either round; as a result, the company’s total known funding is $100 million.

Key Opportunities

Pyrolyzer Fleet

As mentioned previously, Reinhardt’s goal is to create a fleet of pyrolyzers that can be stationed at farms around the US to reduce transport costs:

“Continued acceleration requires ramping up our operations in Colorado and the broader corn belt, and expanding our lone pyrolyzer into a continent-wide fleet of tens of thousands of pyrolyzers. The future of carbon removal will be a massive investment in the heartland of America. Each Charm pyrolyzer will produce bio-oil for sequestration and improve the soil with biochar. By 2050, we need roughly 10 billion tons per year of carbon removal, which will require 70% year over year growth for the next 27 years (twice as fast as software).”

Decreasing the cost of transportation would dramatically decrease the price of offsets, making them much more competitive with nature-based credits and other offerings. Doing so requires the company to make small, easily managed systems that require low levels of on-site training to avoid degradation of quality control with scale.

Changes in US Policy

Katie Holligan of Charm Industrial mentioned that the company is pushing for policy change that allows incentives for a broader group of CDR technology solutions. As of May 2023, the CDR policy only covered sequestration of gaseous CO₂, not liquid bio-oil, so tax incentives do not benefit the company.

Section 45Q of the US IRS code provides tax credits for all kinds of carbon removal. As of 2022, $85 per ton of CO₂ removed will be issued as a tax credit to qualifying companies. This number increases to $130 for direct air capture companies. Charm Industrial could be a meaningful contributor in creating favorable terms for bio-oil companies as well.

In an August 2023 interview with Contrary Research, Charm Industrial CEO Peter Reinhardt, described the status quo for policy in carbon removal, and how things are starting to evolve:

“Direct air capture (DAC) has been the presumed way that we’ll do carbon removal in the policy world for the last 10 years, so it’s been baked into [most regulations and tax incentives.] But there are currently zero operating direct air capture sequestration facilities in North America. About 80% of all permanent carbon removal deliveries has been delivered by Charm. So more subsidies keep piling up for DAC. But our first executive hire was our Head of Policy, and things are changing. The Department of Energy announced recently that $35 million of funding would go towards carbon removal, and specifically included all types of carbon capture.”

Increased Integration of Technology

Charm Industrial also has ideas for how farmers can harvest their crops while creating bio-oil at the same time. The company's R&D team is experimenting with modular equipment that can be attached to various harvesting vehicles that would pick up biowaste and complete pyrolysis on the go. Once again, such technology would decrease the cost of transporting voluminous dead crops and allow Charm Industrial to offer competitive pricing to its customers.

Key Risks

Availability and Price of Feedstock

Selling crops to be made into bio-oil is not the only option for farmers and loggers looking to convert their plant residue into income. Some farmers sell their leftover crops to companies that reduce them into large amounts of biochar, like the ash produced by Charm Industrial, which they use on their own fields and sell to other farmers. Biochar is both a permanent form of carbon storage and also returns nutrients to the soil for future plant growth. Additionally, the biowaste may be converted into ethanol, a fuel additive found in 98% of US-sold gasoline. While this is not a form of carbon sequestration, it does reduce the amount of gasoline pumped from the ground and overall air pollution.

Overall, sellers have options and Charm Industrial will have to provide competitive offerings to continue to source enough feedstock. Writers from MIT have noted that sourcing may become difficult with scale, but Reinhardt believes this problem is too far into the future to care about now:

“I would say this is a theoretical concern we encounter in academic circles, but in practice is very far from reality. Maybe at a really massive scale there starts to be some questions about how we are going to compete for biomass. Right now, we have biomass coming out of our ears.”

Lack of Trust in Carbon Offsets

While Charm Industrial’s carbon offsets seem to be of higher quality than most on the market, the general sentiment of carbon credits can still affect the company’s long-term success. Demand for carbon offsets may quickly outpace supply which would lead to buyers spending less time verifying the quality of purchases and sellers offering anything they can. Additional pressures from tax incentives and consumer expectations have already led to varying levels of fraud and deceit.

Companies like Disney, Shell, Gucci, and others have been accused of purchasing “phantom credits” that made no real contributions to carbon reduction. Admittedly, it is difficult to calculate the exact amount of carbon sequestered by various projects, but in some cases, the offsets appear to be fictitious. United Airlines publicly denounced the entire market for carbon credits stating that companies need to focus much more are reducing their emissions before they start buying offsets. One article stated that “study after study has indicated that most offsets available on the market don't reliably reduce emissions," making it difficult for high-quality projects to seem to gain trust.

One solution Charm Industrial and others can pursue is increased regulation of project verification, complicating the process for unworthy projects and thus improving the reputation of the industry. If carbon credits continue to show low levels of reliability, companies and governments may search for alternative solutions.

Safety & Availability of Injection Wells

While the company claims that because the bio-oil hardens, it will be a stable solution, time will tell. Old wells and caverns have been used for decades to store wastewater and other toxic liquids with varying degrees of success. Scientists and federal regulators admitted in 2012 that of the 150K deep industrial fluid waste wells in use, they were unsure of the amount of leakage taking place. Leakage has led to problems in the past such as waste contaminant bubbling up to a Los Angeles dog park in 2010 and sewage finding its way into South Florida aquifers in the 1990s.

Saeed Salehi, a professor of petroleum and geological engineering at the University of Oklahoma, stated that because bio-oil has a different chemical composition than the petroleum and natural gas that is currently stored in salt caverns, it will take years of oversight to determine the effectiveness. Reinhardt has been clear that the company is strictly following federal regulations and that safety is their top priority. If leakage or other issues arise due to bio-oil-filled wells, it would force Charm Industrial to pay large sums of environmental damage fees, not to mention a complete rethinking of its business model.

In addition to safety, the availability of permits for adequate injection wells is limited. Charm Industrial is one of the first companies to look for bio-oil injection, so there is a limited number of wells that can handle the supply of bio-oil the company would look to inject. In an interview with Contrary Research, Reinhardt explained this limitation as follows:

“A more real concern is injection well permitting. Nobody knows how to permit this thing; there’s no permit for bio-oil sequestration because we’re one of the first to come along and do this. Class 6 wells for injecting CO₂ first became a well class in 2008, but there was enough legal stuff around it that nobody wanted to touch it until 2012. And its 2023, and there are only three permitted wells for Class 6.”

Summary

Charm Industrial is a carbon sequestration company converting agricultural waste into carbon-dense bio-oil to be permanently sequestered underground or used as a fuel source for steel production. By focusing on permanent, entirely additional carbon offsets, the company positions itself well to avoid the common criticism plaguing the carbon credits market. As government regulation increases and more companies begin depending on carbon credits for tax incentives and fee avoidance, Charm Industrial and other CDR companies could play a large role in increasing the lagging supply of credits.