Thesis

The EPA has shown that companies across industries have high greenhouse gas emissions that may be leading to global climate change. Companies and cities accounting for more than 25% of global CO2 emissions and over 50% of the world's GDP have pledged to achieve carbon neutrality by 2050. With increasing interest in curbing emissions, more investors are funding businesses in this space.

Annually, 15% of emissions are a result of deforestation. $80 billion was invested in carbon market initiatives in 2019, and less than 2% went to reforestation. Forests play a critical role in the fight against climate change because of their ability to draw down atmospheric carbon. Halting deforestation and promoting forest restoration could contribute to over one-third of all climate change mitigation needed by 2030. However, measuring forest carbon capture is underdeveloped because of a lack of reliable data. This lack of transparency makes it difficult to see whether the many forest conservation projects underway today are having a meaningful impact on emissions.

To address this and modernize the forest carbon market, Pachama has developed a carbon credits marketplace and monitoring software to verify projects' impact. It uses satellite imagery, LiDAR imaging, and remote sensing to measure the carbon stored in forests over time and detects changes to the forest including events like illegal logging. The company shares insights from this monitoring with both carbon offsetters and project developers. Pachama believes that the best way to reduce emissions is by protecting and restoring forests through the sale of carbon credits to businesses and consumers. Its goal is to restore 100 million hectares of forest by 2030.

Founding Story

Source: Biz Journals

Pachama was cofounded by Diego Saez Gil and Tomas Aftalion in 2018. Diego Saez Gil was born in Argentina. After graduating from University, he moved to Spain to work. Eager to help young travelers trying to save money while exploring Europe, in 2011, Diego founded WeHostels, a mobile travel booking app acquired by StudentUniverse in 2013.

A couple of years later, Diego decided to launch another travel-based startup called Bluesmart, which was focused on luggage. Accepted into the 2015 Y Combinator batch, Bluesmart was one of the first smart luggage systems, but the company quickly shut down after all US airlines banned luggage with batteries due to risks of fires. Assets were liquidated to TravelPro in 2018, and Diego was back on the hunt for his next big idea. His longtime interest in South America’s wilderness was rekindled on a visit to the Amazon, where he witnessed the alarming scale of deforestation. Over the summer of 2020, Diego’s house was burnt down in a California forest fire, amplifying his desire to work in a related space.

Pachama co-founder Tomas Aftalion, an alum of Carnegie Mellon University, worked as a machine learning engineer at fintech startups like Branch International and MoneyLion until he got together with Saez Gil to co-found Pachama. They set out to create a way for businesses and people to stop deforestation.

After going through Y Combinator in 2019, Pachama raised a $4.1 million seed round led by Ryan Graves of Saltwater Capital (co-founder of Uber) and Chris Sacca of Lowercase Capital. At the time of its seed round, Pachama had 23 forest projects across Brazil, Peru, and coastal areas of the United States. Using satellite imagery and machine learning algorithms, Diego and Tomas were confident they could create a trustworthy platform that provided donors with evidence that their funds were making a tangible difference in the world.

Product

Carbon Offset Marketplace

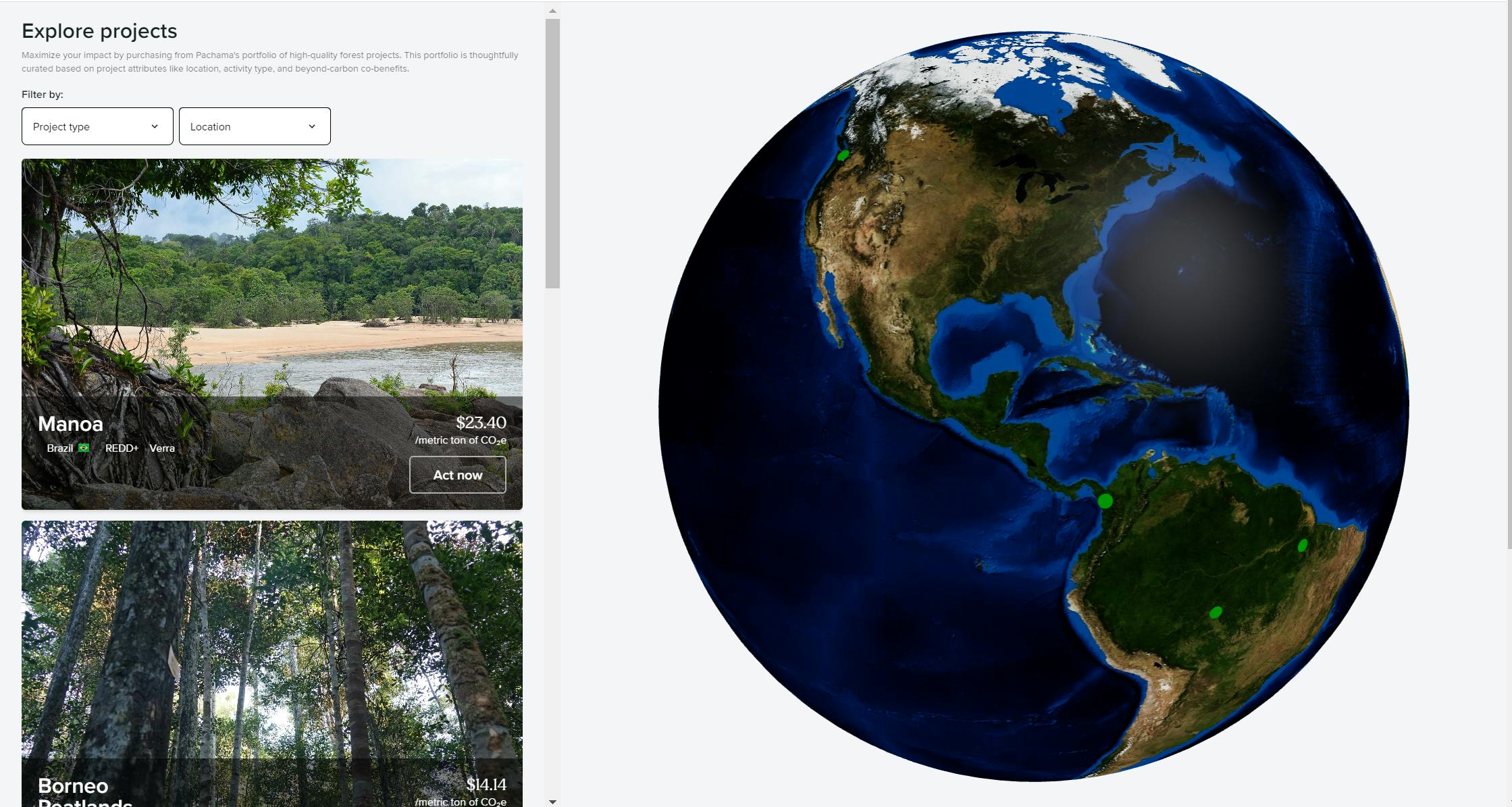

Source: Pachama

Individuals and organizations can buy carbon offsets from the vetted list of projects on the Pachama Marketplace. The projects are curated based on project attributes like location, activity type, and beyond-carbon co-benefits. Buyers can view and audit purchase history, download carbon credit certificates, manage roles and access, and track the status of open orders. They can also share automatically-generated impact pages to inspire others.

Panchama remotely verifies projects and ensures they follow international standards for carbon credits. It also checks projects to ensure they are protecting real carbon in old-growth trees or growing new ones. It trains machine learning models using satellite imagery, a network of field plots, LiDAR imaging, and other remote sensing data to identify key forest characteristics used to estimate carbon.

Pachama’s marketplace also establishes baselines, a measurement of what would have happened in the area if a carbon project had not started. Using factors such as distance to roads, topography, forest structure, and more, Pachama can determine the incremental amount of GHG emissions removed. It is also developing a forest monitoring system to detect carbon project changes over time and share updates with offsetters and project developers.

API

Pachama is building an API so other companies can easily integrate their marketplace into their product or service. It enables companies to offer their customers and partners vetted carbon credits from forest projects verified by Pachama’s remote sensing and machine learning technology.

With the API, developers will be able to sort, analyze and select forest carbon projects based on attributes including location, biomass, and community involvement. They will also be able access the history of purchases through Pachama's API, including information about the number of credits retired over time.

Market

Customer

Pachama is a two-sided marketplace serving two groups of customers: projects and buyers.

Whether a project partner is starting a new project, in the process of verification, or looking to sell existing carbon credits, Pachama connects them to carbon credit buyers through the marketplace. The projects could be across categories like forest conservation, management, reforestation, and afforestation.

The carbon credit buyers can be corporations or individuals. Pachama works with enterprises like Salesforce, Shopify, Flexport, and Workday.

Market Size

Since 2015, when the Paris Agreement was signed, capital allocations to carbon markets have consistently increased 50% year over year. As of the end of 2022, the carbon footprint management software market is valued at $9.1 billion.

The carbon accounting software market share is expected to increase by $9.6 billion from 2021 to 2026. Meanwhile, the global carbon offsets market could be worth $200 billion by 2050. The demand for carbon credits could increase by a factor of 15 or more by 2030 and up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030.

Competition

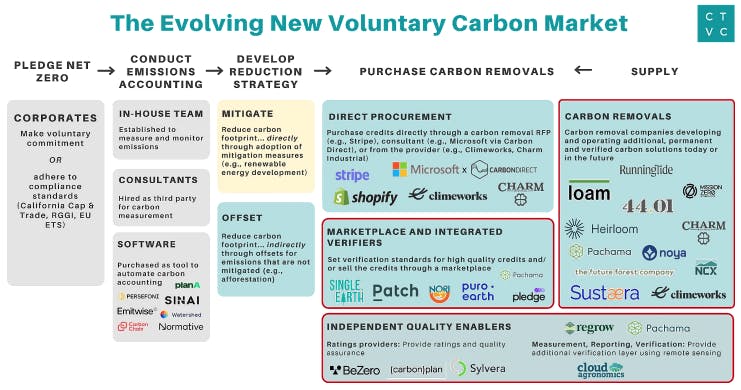

Source: CTVC

Patch* - Patch is a digital marketplace and set of APIs that helps businesses find and purchase carbon offsets to reach their net zero goals. Patch's marketplace includes a variety of carbon offset projects such as reforestation, seaweed protection, and landfill gas capture. In addition, Patch's APIs allow companies to include carbon offset options in their checkout process, enabling customers to offset the emissions from the products they purchase. It was founded in 2020 and has raised $81 million in funding.

Cloverly - Cloverly builds the carbon credit infrastructure for businesses, consumers, and organizations to make direct contributions to carbon removal powered by the Cloverly API. It was founded in 2018 and has raised $2 million in funding.

NCX- NCX enables corporations to support landowners and their forests through its forest carbon marketplace. It was founded in 2010 and has raised $78 million in funding.

Climate Trade - Climate Trade is another marketplace allowing companies and individuals to take action against climate change by purchasing carbon, plastic, and biodiversity offsets directly from project developers. With the ClimateTrade API, companies can integrate these offsetting functionalities into their platform. It was founded in 2016.

In addition to carbon offset marketplaces, companies such as Watershed and Pledge also offer end-to-end solutions for tracking and reducing carbon emissions. These companies provide services for carbon accounting, reduction, and offsets. In-house teams and consultants have relationships with offset projects and can often bypass marketplaces. If a company invests millions into carbon projects annually, it will likely avoid a middleman like a marketplace taking a cut of the donation for themselves. Companies such as CarbonCheckout and EcoCart offer carbon offset options directly to consumers at checkout.

Business Model

Source: Pachama

Upon purchase of a carbon offset project, 80% of the transaction goes to the project. Pachama takes a 20% fee to verify and monitor the project, run the platform, and provide customer support. The prices in the marketplace range anywhere from between $5 to $40 per metric ton, depending on location and the type of project. In addition, the cost of Pachama’s portfolio is constant, no matter what project a buyer purchases.

Pachama users. Source: Pachama

During Pachama’s first year, it was able to secure a partnership with Mercado Libre, South America’s largest ecommerce company, to manage its $8 million offset project. As of November 2021, Pachama had verified and onboarded 30 projects on 3 continents, including projects in Louisiana and Brazil. As of May 2022, Pachama was providing nature-based offset projects to 800 customers with names including Shopify, Salesforce, Flexport, Workday, SoftBank, Vouri, Athletic Greens, Microsoft, Airbnb, and Netflix. The company said it had worked with 46 project developers in 14 countries and reviewed more than 150 forest projects globally.

Valuation

In May 2022, Pachama announced it had raised $55 million in a Series B funding led by Future Positive with the participation of Saltwater Capital, Serena Williams, and Social Capital. Business Insider claims Pachama was worth ~$355 million as of August 2022. For comparison, in Februrary 2022 Watershed raised $70 million in Series B at a $1 billion valuation.

Key Opportunities

Product Expansion

The ocean absorbs about 31% of the carbon dioxide released into the atmosphere. Blue carbon is the term that refers to carbon captured by the world’s oceans and coastal ecosystems. It fits directly in line with Pachama’s mission to decarbonize the world while promoting biodiversity. Blue carbon projects like restoring kelp and mangrove gardens and protecting and rehabilitating coral reefs will sequester massive amounts of carbon while providing food and shelter for sea animals.

Geographical Expansion

The majority of Pachama projects are in the US and South America, with a couple in Indonesia. Continents like Africa and Asia have tons of land that could be restored, growing the number of projects offered and increasing reach to companies and possible customers in the Eastern Hemisphere.

Government regulation

As sustainability becomes a top priority for governments worldwide, there is a growing trend toward transparency in reporting carbon emissions. A key example is the European Union's Corporate Sustainability Reporting Directive, which mandates medium and large companies to report on their carbon emissions, impacting 50K European businesses and foreign firms with European branches. Similar measures are being considered in the United States, and other countries are expected to follow. This move towards accountability is likely to drive businesses to seek the assistance of companies like Pachama to achieve net-zero emissions through carbon credits.

Key Risks

Skepticism of Carbon Offsets

In order for the carbon offset industry to achieve long-term success, the credibility and transparency of carbon offset projects are critical. Some companies, such as United Airlines, have publicly denounced carbon offsets and instead have committed to decarbonizing their operations before investing in offsets. Bloomberg reports that "study after study has indicated that most offsets available on the market don't reliably reduce emissions," which can damage the reputation of the projects genuinely making a positive impact.

High Commissions

Individuals and corporations may invest their capital elsewhere if its 20% fee is more expensive than similar services. They may prefer direct procurement, which includes no middleman and negates the need for a marketplace.

Ineffectiveness

Trees are more economically valuable once they are cut down for timber or to make room for agriculture. Forest conservation projects heighten the costs of this.

When one section of trees is protected through offsets, it may lead people to simply cut down a different area of trees. Tim Searchinger of Princeton University claims that when there is demand for a product (i.e., meat) and deforesting a patch of land to cultivate that meat becomes necessary, the price paid to a landowner will inevitably trump offsets elsewhere.

Pachama uses baselines to prove that additionality (i.e. that carbon captured that would not have otherwise been captured were it not for an offset project) is occurring. However, the effectiveness of these baselines is still being investigated. If Pachama can prove additionality, it is a strong signal for success.

Summary

Pachama believes that nature-based carbon removal projects are the most effective way to rebalance the atmosphere and rehabilitate biodiversity. Co-founder and CEO Diego Saez Gil claims that 1 billion hectares on the planet are available for reforestation with the potential to plant 1 trillion trees and sequester 200 gigatons of GHGs. That is enough gasses sequestered to remove two-thirds of the emissions since the industrial revolution. To fill this space, the total number of projects must increase from 500 to tens of thousands, creating ample opportunity for growth.

The main questions determining Pachama’s future success revolve around government regulations on company emissions, whether companies and individuals choose to work with marketplaces, and Pachama’s ability to convince customers that nature-based projects are superior. With competing marketplaces reaching similar milestones, Pachama is in a foot race to lead the market before carbon credits truly boom at the turn of the decade.

*Contrary is an investor in Patch through one or more affiliates.