Thesis

For decades, reaching orbit and beyond was exclusively the domain of national space agencies like NASA, ESA, and Roscosmos, which had massive budgets and political mandates. By the 2020s, private companies will be launching satellites, landing on the Moon, and planning Mars missions. This commercialization is creating new economic opportunities beyond Earth's atmosphere.

The global space launch market is projected to grow from $14.2 billion in 2022 to $31.9 billion by 2029, at a CAGR of 12.3%. Small satellites weighing below 500 kgs are being deployed rapidly, with over 2.3K SmallSats launched in 2023 alone and projections of over 14K to be deployed by 2033. Meanwhile, the lunar economy is emerging as the next frontier, with NASA's $2.6 billion Commercial Lunar Payload Services (CLPS) program funding private lunar missions. This growth is driven by falling launch costs, miniaturization of satellite technology, and increasing demand for space-based services across telecommunications, Earth observation, and scientific research.

As the industry matures, a visible gap has emerged in the market for medium-sized payloads between 500-2000kg that lack cost-effective launch options, forcing customers to either downsize their missions or pay for partially empty larger rockets. This challenge is compounded by the Moon's lack of built-up infrastructure, with minimal commercial capabilities for reliable lunar surface operations, especially during the challenging lunar night when extreme cold (-292°F/-180°C) and the absence of sunlight for approximately fourteen Earth days severely limit operations. Most lunar landers and rovers are designed only for short-term daytime missions, significantly constraining commercial and research potential. This is further complicated by the complexity of space operations integration, where customers must coordinate between multiple vendors for launch, in-space transportation, and lunar services, resulting in increased costs and mission risks.

In March 2025, Firefly Aerospace became the first commercial company to successfully land on the Moon, marking a historical moment in the commercialization of lunar exploration. Firefly Aerospace has evolved from a rocket manufacturer to an end-to-end space transportation provider, offering integrated launch, lunar, and on-orbit services from Earth to cislunar space and beyond. The company's Alpha rocket is designed to lift 1,030kg (2,270 lb) to low Earth orbit and 630 kg (1,390 lb) to Sun-synchronous orbit (SSO) at $15 million per launch, filling the medium-lift market gap, while its Blue Ghost lunar lander can deliver up to 240kg to the lunar surface with the unique capability to operate through the harsh lunar night. By vertically integrating its component manufacturing in-house and providing complete mission solutions from Earth to the Moon, Firefly Aerospace eliminates the integration complexity that has traditionally forced customers to coordinate between multiple vendors. This approach reduces costs and mission risks while positioning the company to capture significant value in the rapidly expanding space transportation ecosystem.

Founding Story

Firefly Aerospace was founded in March 2014 by Thomas Markusic (Chief Technical Advisor), Eric Salwan (Director of Commercial Business Development), Michael A. Blum, P.J. King, and Max Polyakov (Board Member). The company was initially established as Firefly Space Systems, with the vision of providing affordable and reliable access to space for small payloads.

Markusic earned a PhD in Mechanical and Aerospace Engineering from Princeton University in 2002. Before founding Firefly Aerospace, he served as Vice President of Propulsion at Virgin Galactic and held key roles at SpaceX as Director of the Texas Test Site, Blue Origin as a Senior Systems Engineer, and NASA as a Propulsion Research Scientist. His background as a propulsion and systems engineer provided the technical foundation for Firefly Aerospace’s launch vehicle development.

Salwan worked as a Systems Analyst for over two decades before co-founding Firefly Aerospace. Blum had launched multiple ventures across Germany, North America, and Asia after earning his bachelor's degree in Economics and International Studies from Yale University in 1998. Before Firefly Aerospace, he served as Director and CEO of XCOR Aerospace, another private spaceflight company.

King received a Master's degree from Cranfield University and doctoral studies at Stanford University, which he left to pursue entrepreneurship in the 1990s. Before Firefly Aerospace, King had established ventures in energy and cryptocurrency. Polyakov's background includes a focus on space technologies, machine learning, and enterprise software. He holds a Ph.D. in International Economics and started a venture fund called Noosphere Ventures, an international asset management firm dedicated to the development of space technology.

The company began with self-funding from its founders and a small group of entrepreneurs. By November 2014, Firefly Aerospace had grown to 43 employees and moved its headquarters from Hawthorne, California, to Cedar Park, Texas, where Firefly Aerospace purchased 215 acres of land for engine testing and manufacturing facilities. The company quickly developed its first rocket design, the Firefly Alpha, and performed its first hot-fire engine test in September 2015.

In the same year as its founding, Firefly Space Systems was sued by Virgin Galactic, alleging that Firefly Space Systems’ then CEO, Tom Markusic, a former Virgin Galactic employee, misappropriated trade secrets and confidential information to start Firefly Space Systems. This lawsuit led to a complete staff furlough by the end of 2016, followed by bankruptcy and liquidation.

The company's assets were subsequently acquired by Polyakov's Noosphere Ventures in March 2017, which restructured and relaunched the company as Firefly Aerospace. Polyakov invested over $200 million of his funds into Firefly Aerospace over the next four years, enabling the company to develop its technology and grow its team. In 2021, the US Committee on Foreign Investment (CFIUS) required Polyakov to sell his stake in Firefly Aerospace for national security reasons and suspicions of his being a Russian spy. He reluctantly sold his shares in May 2021, just as tensions between Russia and Ukraine escalated. In May 2024, the US government lifted all restrictions previously placed on Polyakov and his companies, allowing him to potentially reinvest in Firefly Aerospace, though as of June 2025 he had not yet returned to the company.

Since its restructuring, Firefly Aerospace has made several notable executive appointments. In August 2024, Jason Kim was appointed as Chief Executive Officer, effective October 2024. Kim brings more than two decades of experience in the aerospace and defense sectors, including his time at the US Air Force, Northrop Grumman, and Raytheon, and previously served as CEO of Millennium Space Systems.

Firefly Aerospace has attracted talent from several different aerospace companies such as SpaceX, Boeing, and Lockheed Martin, over the years. Firefly Aerospace’s CTO as of June 2025, Shea Ferring, has over three decades of experience designing, building, and testing spacecraft. Ferring has worked on more than 60 space missions and vehicles, including Mars Exploration Rovers and Falcon 9. As of June 2025, Firefly Aerospace employed more than 700 people and was continuing to expand its leadership team with industry veterans to support its growing launch, lunar, and on-orbit programs.

Product

Firefly Aerospace offers an integrated suite of space transportation solutions spanning from Earth Launch to lunar surface operations. The company has developed a broad ecosystem that enables end-to-end space missions through three core product lines: launch, lunar, and orbit.

Launch

As of June 2025, Firefly Aerospace planned to scale two launch vehicles: (1) Alpha Launch Vehicle (ALV) and (2) Medium Launch Vehicle (MLV).

Alpha Launch Vehicle

Alpha is Firefly Aerospace's small-to-medium lift launch vehicle designed to deliver payloads to low Earth orbit (LEO) in support of commercial, civil, and national security missions.

Alpha can smoothly deploy 1,030 kg to LEO (300 km) and 630 kg to sun-synchronous orbit (500 km). The rocket is 29.5 meters in length with a 2.2-meter diameter fairing. Its propulsion system consists of four Reaver engines in the first stage and one Lightning engine in the second stage, both using LOX / RP-1 propellants.

Alpha fills a critical market gap between small payload launchers (<500 kg) and heavy-lift providers (>8,000 kg), offering dedicated launches and rideshare missions with competitive pricing. The vehicle has demonstrated "on-demand launch" capabilities, with proven ability to encapsulate, mate, and launch payloads with just 24-hour notice.

Source: Firefly Aerospace

Eclipse: Medium Launch Vehicle

As of June 2025, the Medium Launch Vehicle was being developed to address larger payload requirements and is scheduled for first flight by 2026. In May 2025, it was revealed that Firefly Aerospace had named its advanced MLV “Eclipse.”

Eclipse will be able to deploy 16,300 kg to LEO (300 km), 3,200 kg to the geostationary transfer orbit (GTO), and 2,300 kg to trans-lunar injection (TLI). The rocket is planned to be 59 meters in length with a 5.4-meter diameter fairing. The first stage of the propulsion system will be powered by seven Miranda engines producing 7,161 kN of vacuum thrust; the second stage powered by one Vira engine delivering 890 kN of vacuum thrust.

Source: Firefly Aerospace

Eclipse features a high-strength, lightweight carbon composite airframe and tanks to reduce vehicle mass and lift heavier payloads at a lower cost. Manufacturing and testing are co-located at Firefly Aerospace's Texas Rocket Ranch to accelerate vehicle production, and the vehicle offers a customizable 5-meter class fairing to support various mission types.

Lunar

Blue Ghost Lunar Lander

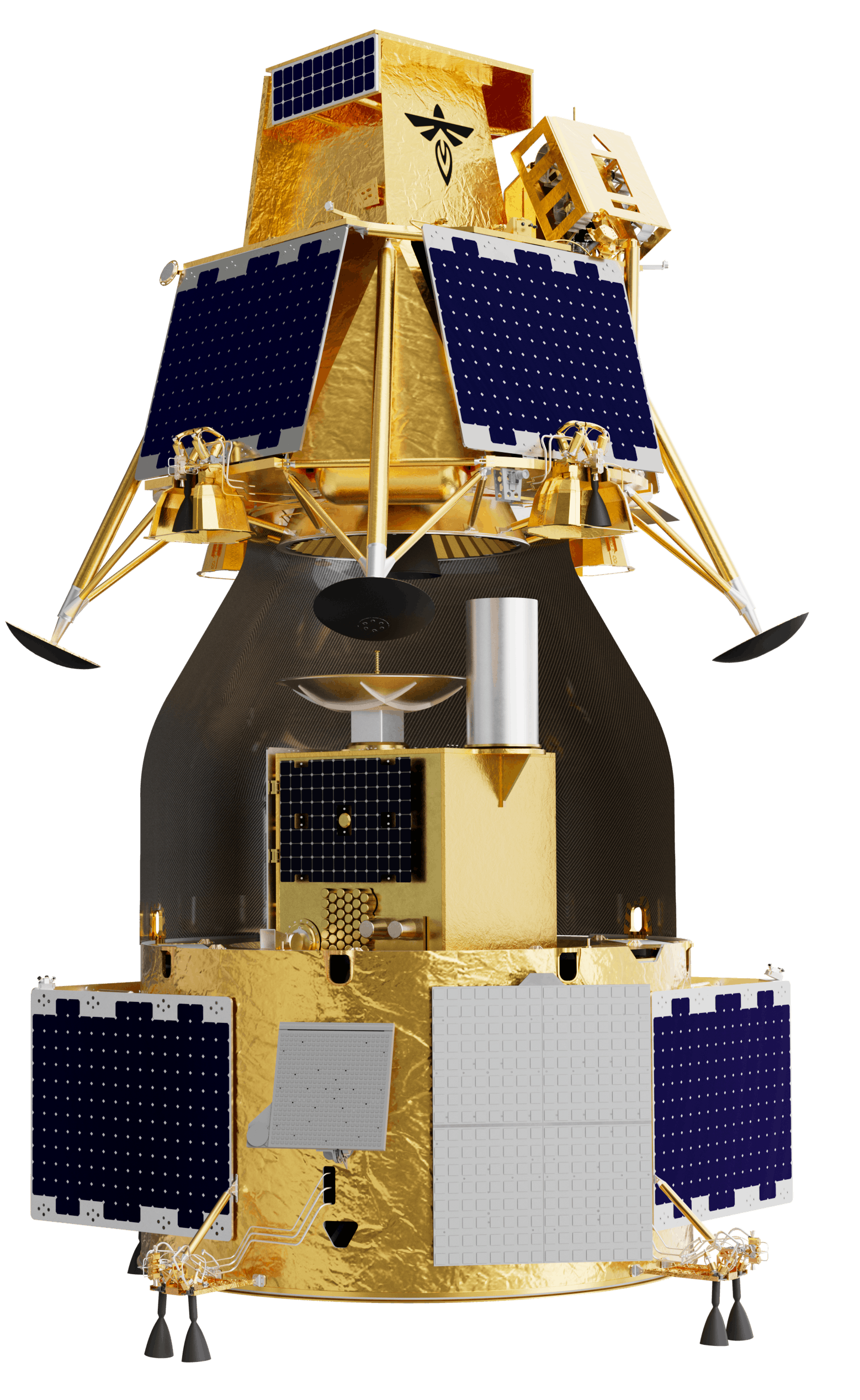

Named after the bioluminescent Phausis reticulata firefly species, Blue Ghost is Firefly Aerospace’s lunar lander designed to deliver payloads to the lunar surface.

Blue Ghost is designed to deliver payloads to the lunar surface with a payload capacity up to 240 kg to the lunar surface and up to 2,700 kg to lunar orbit (in coordination with Elytra transfer vehicle). It provides over 400W of power available for payload operations, with solar panels that can be mounted on the sides or deployed above the top deck. The lander is specifically designed to last through the lunar nights. It has a box-shaped framework with four landing legs and two decks for mounting equipment. Communication capabilities include 6 Mbps downlink average (10 Mbps peak) and 0.2 kbps uplink average (2 kbps peak).

Blue Ghost made history in March 2025 when it became the first commercial lunar lander to successfully touch down on the Moon, delivering 10 NASA payloads to Mare Crisium. The lander provides data, power, and thermal resources for payload operations throughout transit to the Moon, in lunar orbit, and on the lunar surface.

The lander provides data, power, and thermal resources for payload operations throughout transit to the Moon, in lunar orbit, and on the lunar surface. Firefly Aerospace's Cedar Park facility serves as the company's mission operations center and the location of payload integration, with a 50K-square-foot spacecraft facility that includes two mission control centers and an ISO-8 cleanroom to accommodate multiple landers.

Source: Firefly Aerospace

Orbit

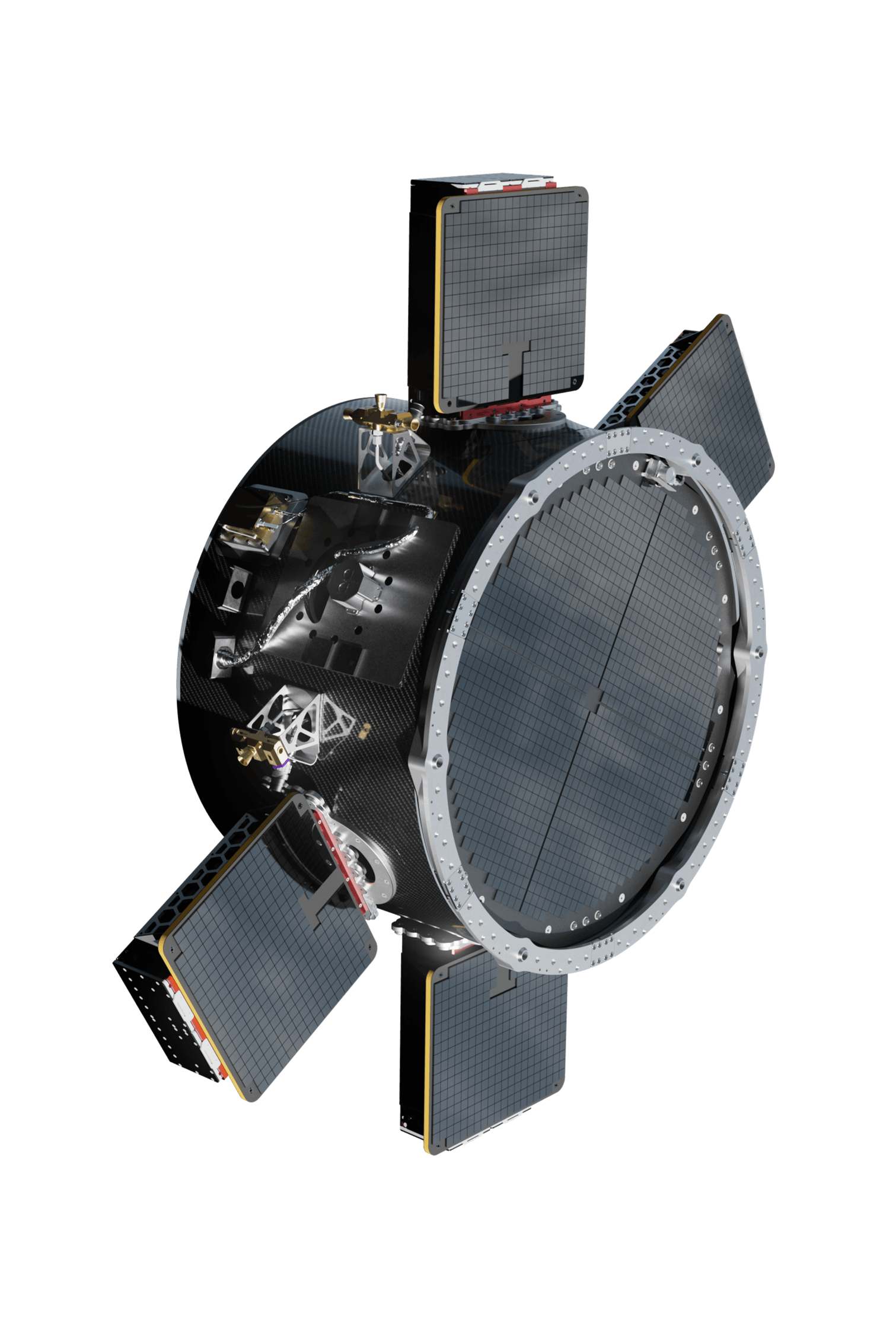

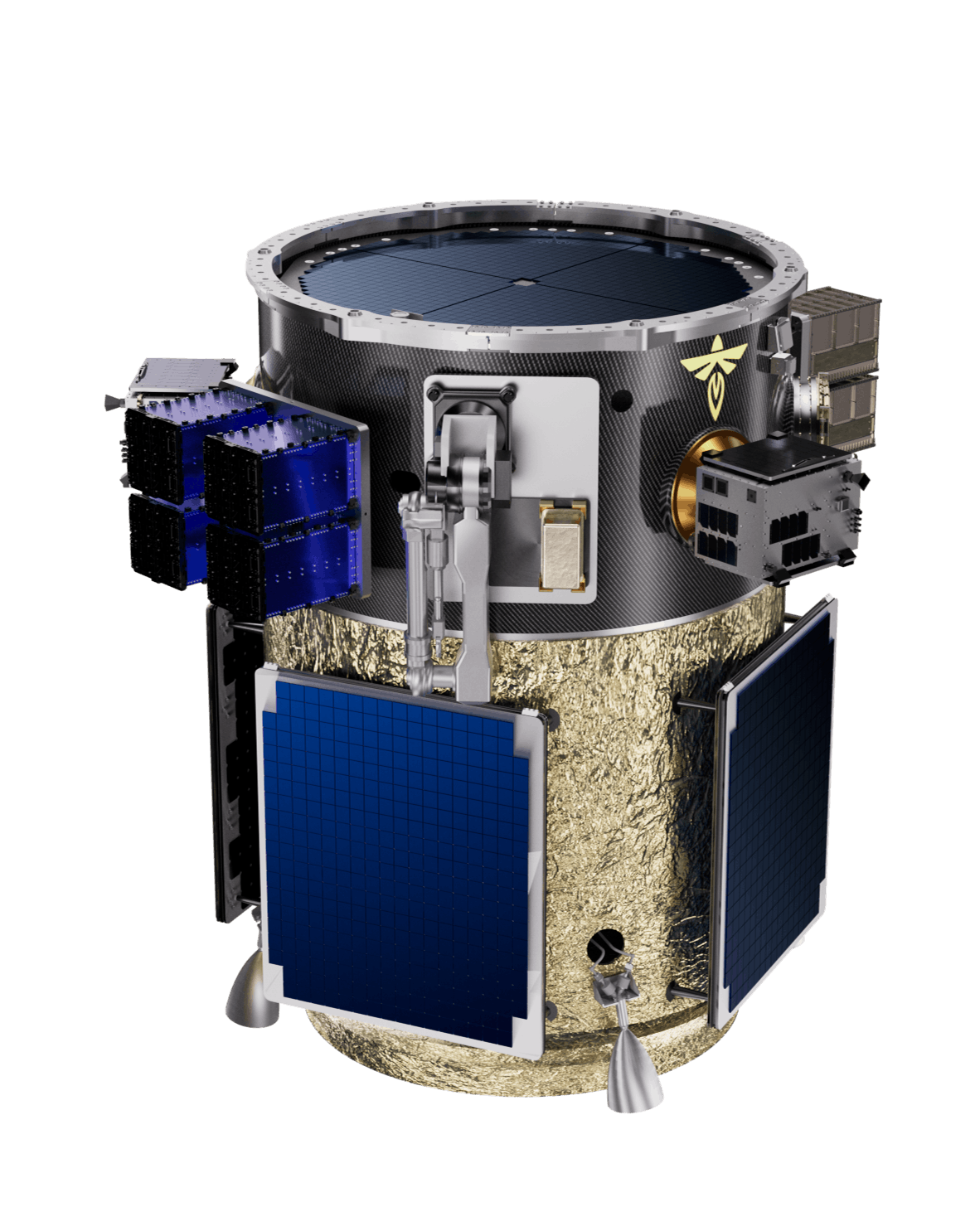

Elytra Space Utility Vehicle (SUV) is Firefly Aerospace's orbital vehicle platform that comes in three variants—Elytra Dawn, Elytra Dusk, and Elytra Dark—designed to provide on-orbit solutions across low Earth orbit, cislunar space, and beyond.

Elytra Dawn

Designed to support responsive hosting, ridesharing, and delivery missions in LEO. It can be rapidly deployed on Alpha for urgent mission needs and offers multiple on-demand deployment opportunities for rideshare customers.

Source: Firefly Aerospace

Elytra Dusk

Supports larger, more advanced missions from LEO to geosynchronous orbit (GEO) with enhanced maneuverability, power, and autonomy. Dusk also provides responsive on-orbit tasking, including relocation, space domain awareness, and de-orbiting services.

Source: Firefly Aerospace

Elytra Dark

Designed as persistent orbital infrastructure supporting missions from LEO to lunar orbit and beyond. Multiple vehicles can be coordinated for advanced space domain awareness and on-orbit servicing. It’s designed to be rugged to support interplanetary transfers and deployments across extreme environments.

Source: Firefly Aerospace

Elytra also serves as an edge computing platform in space, equipped to support hosted software applications with real-time data processing in orbit. This helps overcome bandwidth challenges by processing data onboard rather than downlinking massive volumes to Earth. It hosts applications like Klepsydra's AI navigation system, processing sensor data onboard for real-time attitude determination, guidance, navigation, and control.

Multiple satellites can be deployed in unique orbital planes from a single launch of Elytra, such as placing three 17 kg CubeSats, or small Rubik’s Cube-sized satellites, in sun-synchronous orbits separated by approximately 60 degrees. Elytra can also transfer payloads from initial deployment orbits to higher altitudes, extending the reach of Alpha's launch capabilities.

The maiden flight of Elytra was originally scheduled for 2024 aboard Firefly Aerospace’s Alpha rocket, though as of June 2025, it was expected sometime in 2025. Each Elytra variant is equipped with flight-proven hardware used on the Alpha launcher and qualified systems common to Firefly Aerospace's Blue Ghost lunar lander, such as carbon composite structures, avionics, and propulsion systems.

Firefly Aerospace allows customers to work with a single provider for launch to operations, a capability emerging in new space companies. The company provides more affordable options for payloads that would otherwise need to downsize or pay for partially empty larger rockets, and is vertically integrating everything with its Automated Fiber Placement (AFP), making carbon composite structures in-house.

Blue Ghost has notably secured multiple NASA Commercial Lunar Payload Services contracts, with three missions planned for 2025, 2026, and 2028. Alpha successfully launched the Victus Nox mission for the Space Force, demonstrating responsive launch capabilities by deploying a defense payload with just a 24-hour notice.

Market

Customer

Firefly Aerospace serves several distinct customer segments in the space transportation ecosystem. The company's primary customers include government agencies, with NASA being a cornerstone client through the Commercial Lunar Payload Services (CLPS) program. This partnership has yielded multiple contracts worth $228 million for lunar deliveries between 2025-2028, including a significant $179 million contract for a 2028 mission to the Gruithuisen Domes. The Department of Defense is another key government customer, particularly valuing Firefly Aerospace's responsive launch capabilities demonstrated through missions like Victus Nox.

Beyond government agencies, Firefly Aerospace targets commercial satellite operators deploying small to medium-sized payloads (500 kg- 2000 kg) that require dedicated launch services. These customers often face a market gap where their payloads are too large for small launchers but don't justify the expense of larger rockets. For example, Spire Global signed a Launch Services Agreement for multiple Alpha missions to deploy its Lemur spacecraft constellation. Firefly Aerospace also serves other space companies needing orbital transfer and deployment services, particularly after acquiring Spaceflight Inc. in 2023.

Firefly Aerospace’s customer base is moderately diversified but still concentrated primarily among government contracts, which provide stable revenue but can involve complex procurement processes and lengthy sales cycles. The company's commercial customer segment is growing as the small satellite market expands, potentially offering more diversified revenue streams. The National Oceanic and Atmospheric Administration (NOAA) has also emerged as a customer, with Firefly Aerospace securing a contract to launch the QuickSounder satellite for environmental monitoring.

Market Size

The space transportation market where Firefly Aerospace operates encompasses several interconnected segments with substantial growth trajectories. The global space launch market is projected to grow from $14.2 billion in 2022 to $32 billion by 2029, at a CAGR of 12.25%. Firefly Aerospace's Alpha rocket targets the small-to-medium lift segment of this market.

A significant portion of this growth comes from the small satellite sector. The small satellite (below 500 kgs) market is growing rapidly, with over 2,304 SmallSats launched in 2023 alone and projections of over 14K to be deployed by 2033. This proliferation of small satellites creates consistent demand for launch services, with Firefly Aerospace positioned to capture value in the medium-lift segment that bridges the gap between small payload launchers (under 500 kg) and heavy-lift providers (over 8,000 kg).

The lunar payload delivery market represents another growth vector, with NASA's Commercial Lunar Payload Services (CLPS) program alone valued at $2.6 billion. Firefly Aerospace has already secured a meaningful number of contracts in this category. As commercial lunar activities accelerate beyond government missions, this segment presents additional growth opportunities.

Satellite deployment, hosting, servicing, and other on-orbit services are growing rapidly as more satellites require in-space transportation and maintenance after reaching initial orbit.

Defense and national security applications are now focusing on increasing responsive capabilities for national security missions, with the Department of Defense allocating $27.6 billion for space programs in 2023. Commercial investment in space companies reached $12.4 billion in 2022. There’s clearly a sizable capital influx supporting the development of the lunar economy as commercial lunar activities accelerate.

Competition

Competitive Landscape

The space launch market features a mix of established aerospace giants and newer entrants focused on different payload segments. SpaceX currently dominates the US launch market, accounting for 87% of the country's orbital launches in 2024. However, the medium-lift launch segment where Firefly Aerospace operates is becoming increasingly competitive as more companies recognize the market opportunity for satellites in the 500 kg to 2000 kg range.

Firefly Aerospace differentiates itself through its integrated space transportation ecosystem spanning from Earth to the lunar surface. While competitors like SpaceX and Blue Origin pursue broader ambitions across multiple market segments, Firefly Aerospace has carved out a specialized position by focusing on medium-lift launch capabilities and lunar services. The company's competitive advantages include its vertical integration with many of its components built in-house, reducing supply chain vulnerabilities.

American Competitors

SpaceX: SpaceX, founded in 2002 by Elon Musk, is the dominant player in the launch service market, offering the Falcon 9 and Falcon Heavy rockets for orbital launches and developing the Starship system for lunar and Mars missions. The company raised $750 million in January 2023 at a $137 billion valuation, with Andreessen Horowitz leading the round. SpaceX has raised over $9.8 billion in total funding from investors, including Founders Fund, Sequoia Capital, and Google. While SpaceX's Falcon 9 can accommodate medium-sized payloads through rideshare missions, its primary focus is on larger payloads, leaving an opportunity for Firefly Aerospace to serve dedicated medium-lift customers who need specific orbital parameters that rideshare missions can't provide.

Blue Origin: Blue Origin, founded in 2000 by Jeff Bezos, develops reusable rockets for both suborbital and orbital missions, with a focus on space tourism and heavy-lift capabilities. The company is privately funded primarily by Bezos, who has invested billions into the company. Unlike Firefly Aerospace, Blue Origin has not yet demonstrated lunar landing capabilities for commercial missions, though it is developing the Blue Moon lander for NASA's Artemis program.

Rocket Lab: Rocket Lab, founded in 2006 by Peter Beck, provides small satellite launch services through its Electron rocket and is developing the medium-lift Neutron rocket. The company went public via SPAC in August 2021 and, as of June 2025, has a market cap of $12.4 billion. Before going public, Rocket Lab raised $288 million in venture funding from investors including Khosla Ventures, Bessemer Venture Partners, and Data Collective. Unlike Firefly Aerospace, Rocket Lab's current Electron vehicle focuses on smaller payloads (up to 300 kg), leaving a gap in the medium-lift market that Firefly Aerospace's Alpha rocket (1,000 kg capacity) addresses. Rocket Lab's upcoming Neutron rocket will compete more directly with Firefly Aerospace's Alpha when it launches.

ABL Space Systems: ABL Space Systems, founded in 2017, develops small-to-medium launch vehicles for satellite deployment. The company raised $200 million in a Series B round in October 2021 at a $2.4 billion valuation, led by T. Rowe Price. ABL has raised approximately $420 million in total funding from investors including Venrock, New Science Ventures, and Lockheed Martin Ventures. As of January 2024, the company was seeking to raise $100 million in new funding and had already closed over $40 million. ABL's RS1 rocket is designed to carry up to 1,350 kg to LEO, making it a direct competitor to Firefly Aerospace's Alpha rocket in the medium-lift segment. However, ABL lacks Firefly Aerospace's integrated lunar capabilities and has experienced delays in its launch program.

Intuitive Machines: Intuitive Machines, founded in 2013, is a Texas-based lunar services company that has secured multiple NASA Commercial Lunar Payload Services (CLPS) contracts. The company went public via SPAC in February 2023 and, as of June 2025, had a market cap of $1.3 billion. Intuitive Machines successfully delivered six NASA payloads to Malapert A in the lunar South Pole region in early 2024, but ended prematurely after the lander landed in a crater and tipped over, preventing it from generating enough power. The company was reportedly planning a second mission (IM-2) scheduled to land at Mons Mouton near the lunar South Pole in March 2027. Intuitive Machines recently secured its fourth NASA CLPS contract worth $116.9 million to deliver six payloads to the lunar South Pole in 2027. While both Firefly Aerospace and Intuitive Machines offer lunar landing services, Intuitive Machines lacks Firefly Aerospace's integrated launch capabilities, instead relying on launch providers like SpaceX.

International Competitors

Orbex Space: UK-based Orbex Space, founded in 2015, is developing the Prime launch vehicle for small satellite deployment to polar and sun-synchronous orbits. The company raised $24 million in Series C funding in December 2022, led by the Scottish National Investment Bank. Orbex has raised approximately $163 million in total funding from investors including BGF, Heartcore Capital, and the UK Space Agency. Orbex's Prime rocket targets payloads up to 180 kg, positioning it as a competitor in the smaller end of Firefly Aerospace's addressable market. Unlike Firefly, Orbex focuses exclusively on small payloads and does not offer lunar landing capabilities.

ispace: ispace is a Japanese company that develops lunar landers and rovers for commercial lunar exploration. Founded in 2010, the company launched its SMBC x HAKUTO-R Venture Moon lander alongside Firefly's Blue Ghost in January 2025 aboard a SpaceX Falcon 9 rocket. ispace raised $46 million in a Series C funding round in August 2021, led by Incubate Fund. The company has raised approximately $195.5 million in total funding from investors, including the Development Bank of Japan, Suzuki Motor, and Japan Airlines. ispace's previous landing attempt in April 2023 ended in a crash, but its current mission aimed to land on the Moon in June 2025. Unlike Firefly, which focuses on both launch services and lunar delivery, ispace specializes exclusively in lunar transportation and exploration services.

Business Model

Firefly Aerospace generates revenue through multiple streams related to its space transportation ecosystem. The company’s primary revenue source is providing launch services for small to medium-sized payloads (up to 1,000 kg) to low Earth orbit using its Alpha rocket. Firefly charges approximately $15 million per launch, offering a cost-effective solution for customers in the 500-2000 kg payload range.

Beyond launch services, Firefly sells customized spacecraft, including its Blue Ghost lunar lander, to government agencies and commercial customers. Firefly also offers on-orbit services through its Elytra line of orbital vehicles, including satellite deployment, hosting, and servicing missions. Additionally, Firefly secures contracts with agencies like NASA, including a $93.3 million award for lunar payload delivery in 2023.

Firefly's business model is asset-heavy, requiring significant upfront investment in research, development, and manufacturing facilities. Major costs include research and development expenses for launch vehicles, spacecraft, and propulsion systems; manufacturing and operational costs, including materials and production of carbon composite structures; salaries for a skilled workforce of engineers and technicians; and infrastructure costs for launch facilities, manufacturing plants, and clean rooms.

The company has expanded its manufacturing capabilities significantly, growing its "rocket ranch" facility from 90K square feet to 200K square feet using its Series C funding. This vertical integration approach, with many components built in-house, aims to reduce supply chain vulnerabilities and control quality

Traction

In March 2025, Firefly became the first commercial company to successfully land on the Moon with its Blue Ghost lunar lander, delivering 10 NASA payloads to Mare Crisium. The mission operated for more than 14 days on the lunar surface and continued five hours into the lunar night, with the final data received on March 16, 2025. This achievement marked the longest commercial operation on the Moon to date, with Blue Ghost transmitting 119 GB of data to Earth, including 51 GB of science and technology data.

Firefly secured a multi-launch agreement with L3Harris for up to 20 Alpha launches between 2027-2031, including two to four missions per year, depending on customer needs, in addition to three previously contracted launches for 2026. The company signed a contract with Lockheed Martin for 15 committed launches through 2029.

In particular, the company has worked to demonstrate capability in regards to responsive launch services. In September 2023, Firefly was selected by the US Space Force for the Victus Nox mission, demonstrating rapid launch capabilities by launching just 27 hours after receiving the go-ahead. This led Firefly to earn a second contracted "rapid response" mission with the US Space Force scheduled for 2025.

In June 2023, Firefly acquired Spaceflight Inc. to strengthen its on-orbit solutions, adding flight-proven orbital vehicles and extensive mission management expertise that has supported the deployment of more than 460 payloads.

Valuation

Firefly Aerospace closed an oversubscribed $175 million Series D funding round in November 2024 at a valuation exceeding $2 billion. This round reportedly moved from term sheet to close in just two months and was led by RPM Ventures and additional new investors such as GiantLeap Capital and Human Element.

Firefly Aerospace has raised a total of $746.6 million across multiple funding rounds since its founding in 2014. Previous rounds include:

$300 million Series C (November 2023) led by AE Industrial Partners and Mitsui & Co.

$75 million Series B (March 2022) led by AE Industrial Partners

$75 million Series A (May 2021) led by DADA Holdings

$100 million Secondary Market round (May 2021) also led by DADA Holdings.

The capital from the Series D round was planned to be allocated to expand market reach with Firefly's Elytra spacecraft, as well as a transition to full-rate production of the Alpha launch vehicle, and an acceleration of hardware qualification for new vehicles in development, including the Medium Launch Vehicle being co-developed with Northrop Grumman.

Firefly's $2 billion valuation positions it competitively within the space launch market, though still significantly below industry leader SpaceX, which has reached valuations exceeding $100 billion. For context, Firefly's closest public competitor, Rocket Lab, has a market capitalization of $12.4 billion as of June 2025.

Key Opportunities

Commercial Lunar Services

With NASA's ongoing Commercial Lunar Payload Services (CLPS) program valued at $2.6 billion, Firefly has a significant opportunity to secure additional contracts and expand its lunar operations. The program's goal is to "enable rapid, frequent, and affordable access to the lunar surface" through commercial providers, with NASA planning a cadence of two CLPS deliveries per year. The company's Blue Ghost lunar lander, capable of delivering up to 240 kg to the lunar surface and operating through lunar day and night, gives Firefly a competitive edge in this growing market. As lunar exploration and potential resource utilization gain traction, Firefly could leverage its technology to capture a larger share of government and commercial lunar missions.

Small Satellite Launch Market Growth

The small satellite (below 500 kgs) market is growing rapidly, with over 2,304 SmallSats launched in 2023 alone and projections of over 14K to be deployed by 2033. This growth is driven by increasing demand for Earth observation, communication constellations, and advancements in remote sensing technologies. Firefly's Alpha rocket, designed to deliver payloads up to 1,030 kg to low Earth orbit, is well-positioned to serve an expanding domain.

Firefly plans to conduct five Alpha launches in 2025 from Vandenberg Space Force Base, with further expansion to new launch sites in Virginia and Sweden targeted for 2026. This global launch capability will help Firefly avoid the “traffic jam" at major US launch facilities that Adam Oakes, Firefly Vice President of Launch Vehicles, identified as a significant challenge in the industry. The company's first Alpha launch from Wallops Island, Virginia, is expected in the first quarter of 2026, with the inaugural launch from Esrange Space Centre in Sweden targeted for late 2026 or early 2027. This expansion will enable Firefly to maintain flexibility, avoid costly delays, and better serve the growing demand for dedicated small satellite launches.

Reusable Launch Technology

Firefly is actively developing reusable rocket technology for its Eclipse MLV, which aims to reduce launch costs by up to 50%. Eclipse, which is being co-developed with Northrop Grumman, will feature a recoverable booster designed to return to its Virginia launch site for future use. As Bill Weber, Firefly Aerospace’s CEO, has explained:

“Northrop and Firefly have a similar perspective and that is, for that class of rocket, reusability is a requirement for a bunch of reasons. Economically, it becomes an advantage because we don't have to go build additional floor space... Similarly, the pricing structure for customers starts to get super competitive, which we absolutely love, and we’ll be right in the middle of.”

The company is implementing a "return to launch site propulsive landing" approach for booster recovery, similar to SpaceX's Falcon 9 strategy. Engineers are enhancing the Miranda engines that will power the Eclipses to perform multiple burns during flights, ensuring they can endure the demands of propulsive landings and atmospheric reentry. These engines have been designed with capabilities such as deep throttling to aid the reusability approach.

Key Risks

Launch Challenges

Firefly Aerospace has experienced several launch failures and anomalies that highlight the technological risks inherent in their business. Their first Alpha rocket launch in September 2021 ended in catastrophic failure when the vehicle exploded approximately 2.5 minutes into flight after experiencing an anomaly during first-stage ascent. Investigation revealed that one of the four Reaver engines shut down about 15 seconds into the flight due to an electrical issue, causing the rocket to lose control as it reached supersonic speed. In December 2023, the company’s fourth Alpha launch failed to achieve the target orbit due to a software issue in the Guidance, Navigation, and Control (GNC) system that prevented proper commands from being sent to the Reaction Control System thrusters. Despite the progress, Firefly still faces multiple challenges in achieving consistent launch reliability. Each failure not only results in mission loss but also potentially damages customer confidence and delays future launches while investigations are conducted.

Competitive Pressure

Firefly operates in an increasingly competitive market dominated by well-established players with significantly greater resources in terms of technology and capital. The company faces competition from industry giants like SpaceX, Blue Origin, Rocket Lab, and Northrop Grumman. SpaceX, in particular, has a first-mover advantage in the industry with reusable rocket technology and economies of scale that allow for competitive pricing. SpaceX’s Falcon 9 can deploy over 17.5 tons of payload to LEO for less than $4K.

Engineering Challenges

The engine design that Firefly Aerospace has created uses a tap-off cycle that takes gas directly from the combustion chamber to drive the turbopump, which simplifies the system but introduces other complications. One significant issue is the risk of combustion instability, which can lead to uneven performance. Also, when using RP-1 fuel in a fuel-rich mixture, soot can accumulate on the turbine wheel over time, potentially degrading engine performance during flight by reducing the size of orifices in the turbopump and impacting thrust. The engine is also "bootstrapped," meaning it needs some combustion in the main chamber to start the turbine, and this startup sequence is particularly sensitive. While Firefly claims to have developed proprietary technologies to address these issues, they represent ongoing engineering challenges that could affect mission success if not properly managed.

Geopolitical & Regulatory Risks

Firefly has faced geopolitical and regulatory challenges that could resurface in the future. In late 2021, the US Committee on Foreign Investment (CFIUS) required Ukrainian investor Maxim Polyakov to sell his nearly 50% stake in Firefly for national security reasons, despite his objections. This forced ownership change demonstrates the regulatory scrutiny that space companies with international connections face. Noosphere Venture Partners, Polyakov's investment firm, noted that the divestiture request came amid rising tensions between Ukraine and Russia. Additionally, Firefly previously had an R&D center in Ukraine that was impacted by the Russian invasion, with their Dnipro factory being bombed and many Ukrainian engineers either joining the military or fleeing the country. Geopolitical tensions can directly impact progress in the category by increasing regulatory hurdles that could disrupt continuity or force unwanted changes.

Summary

Firefly Aerospace operates in the rapidly growing space transportation market, focusing on small-to-medium lift launch services, lunar landers, and orbital vehicles. The company has achieved several notable milestones, including becoming the first commercial company to successfully land on the Moon in March 2025 and securing multiple NASA CLPS contracts worth $228 million. Firefly's Alpha rocket fills a critical market gap for payloads between 500 kg and 2000 kg, while its Blue Ghost lunar lander is designed to support lunar night operations.

Firefly has raised $746.6 million to date, including a $175 million Series D in November 2024, valuing the company at over $2 billion. The funding will support expansion of its Elytra spacecraft program, transition to full-rate production of the Alpha rocket, and development of its Medium Launch Vehicle in collaboration with Northrop Grumman. The company faces competition from established players like SpaceX and Rocket Lab, as well as emerging lunar-focused companies like Intuitive Machines and ispace.

Key questions remain about Firefly's ability to achieve consistent launch reliability after several failures, its path to profitability in a capital-intensive industry, and how effectively it can scale operations to meet contracted launch demands. The company's next Alpha launch is scheduled for 2025 on a mission for Lockheed Martin, while its Medium Launch Vehicle remains on track for a 2026 debut.