Thesis

Lower launch costs have crowded low Earth orbit with small satellites as of August 2025. In 2024, almost 2.8K small satellites reached space, representing 97% of spacecraft launched that year. While private companies are increasingly involved with these low-earth orbit launches, governments are the primary facilitators of missions that extend further from Earth; NASA has budgeted $2.6 billion from 2025–2028 for commercial deliveries to the Moon. Getting to orbit is now routine for private space companies, but moving around once you are there is not.

Most space payloads still face long, expensive transfers to high-energy orbits. Electric propulsion can take four to nine months to reach geosynchronous equatorial orbit (GEO), tying up capital and delaying service. Those months of idle time confer deferred revenue, additional exposure to the radiation belts, and more operational risk during the riskiest phase of a satellite’s life. By contrast, a chemical tug like Impulse’s Helios can complete the same trip in under a day, dramatically shortening time-to-orbit. Faster chemical transfer directly improves a mission’s economics, lowers radiation damage, and enables responsive deployments that electric propulsion cannot match.

Impulse Space intends to meet those demands with a green-propellant platform. The company has built novel thrusters for precision maneuvers, a high-energy stage designed to push multi-ton satellites from low Earth orbit (LEO) to GEO in under a day, and a lander engine designed for the first commercial Mars attempt. All of the company’s hardware uses the same nitrous‑oxide–ethane or methane‑oxygen propellants, common avionics, and 3‑D‑printed plumbing, allowing test data, manufacturing tools, and future certification files to support the entire fleet.

As constellations crowd low orbit, advantages may accrue to logistics providers that can move payloads from launch separation to their final orbit quickly, cleanly, and at predictable cost, an increasingly important consideration as the space economy grows. Analysts expect the space economy to grow from $630 billion in 2023 to $1.8 trillion by 2035. By unifying maneuvering thrusters, transfer stages, and lander engines around one propellant family and one design language, Impulse Space aims to become the express freight network that links low-cost launch to the growing space economy.

Founding Story

Impulse Space was founded in September 2021 by Tom Mueller (Chief Executive Officer). A propulsion pioneer in the space industry, Mueller launched the company in Redondo Beach after retiring from SpaceX in November 2020, where he spent nearly two decades working on the Falcon and Dragon propulsion programs.

Mueller’s career in aerospace began in St. Maries, Idaho, and advanced through fifteen years at TRW Inc., where he led the development of LOX/RP‑1 engines. In 2002, he became employee No. 1 at SpaceX and went on to design the Merlin, Draco, and SuperDraco engines, eventually serving as CTO of Propulsion. After a brief retirement, he returned to the field to focus on building orbital-transfer vehicles and custom thrusters. His interest in propulsion stretches back to childhood science-fair experiments, for which he welded a water-injected oxy-acetylene rocket engine, a project that first brought him to California and convinced him he would return to build spacecraft.

By early 2022, Mueller had recruited a leadership team with deep aerospace experience. Barry Matsumori (Chief Operating Officer), who had previously led sales at SpaceX and Virgin Orbit and served as CEO of BridgeComm, joined in March 2022. Kevin Miller (VP of Propulsion) worked for 14 years on the Merlin and Raptor engines at SpaceX and now leads the development of Impulse’s Saiph and Deneb thrusters. Drew Damon (VP of Spacecraft Programs), after thirteen years at SpaceX in test and propulsion, oversees vehicles like Mira and Helios. Together, Mueller and his team aim to sell orbital logistics as an essential infrastructure layer.

Product

The journey from low Earth orbit (LEO) to geostationary orbit (GEO) is a critical step in the installation of modern space infrastructure. While LEO offers proximity and ease of access, satellites in this band orbit every 90 minutes, requiring large constellations to maintain continuous coverage across the globe. GEO, on the other hand, sits 35.8K kilometers above the equator, where satellites orbit at the same rate as Earth’s rotation. This synchronicity keeps a GEO spacecraft fixed in the sky, making it ideal for telecommunications, weather forecasting, and continental‑scale broadcasting. A ground antenna can stay pointed at a single point in the sky, simplifying operations and enabling persistent high‑throughput links for underserved regions. GEO satellites function as “towers in the sky,” providing vital support beyond the reach of terrestrial infrastructure.

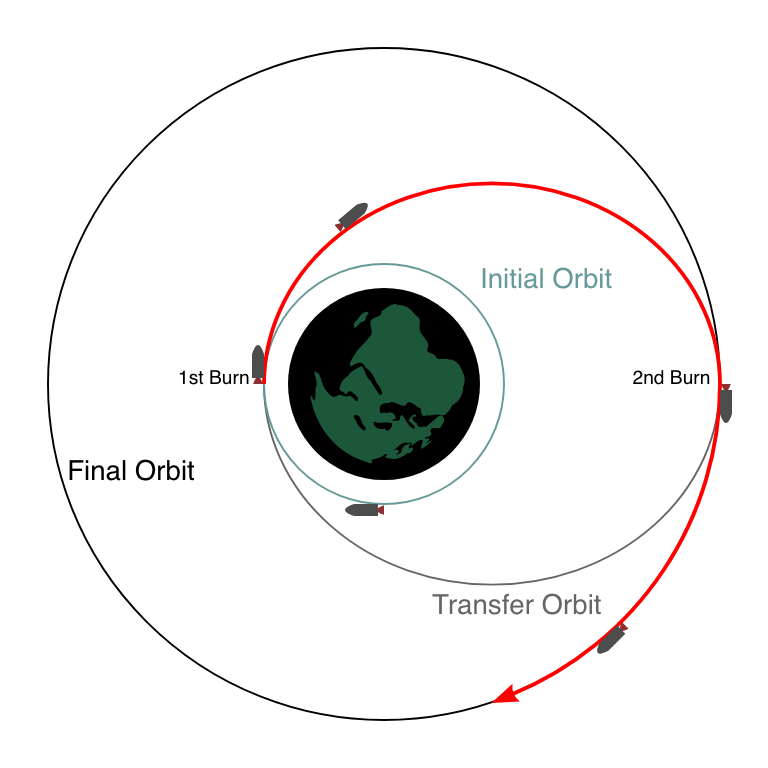

But getting to GEO is not easy. While rockets routinely drop off payloads in LEO, reaching GEO, or performing a “transfer” between orbits requires far more energy. A simple transfer example, the Hohmann transfer, involves coasting through a long elliptical orbit with precision engine firing at both ends.

Source: Orbital Mechanics

Most modern forms of transfer are more complex and aim to cut down on time relative to simpler orbits. Traditional chemical systems do the job quickly but at a high cost. Electric propulsion, now widely used, can cut mass but takes 4–9 months to spiral outward, while other transfer methods can take even longer, idling valuable capital and exposing spacecraft to radiation belts. Operators have historically relied on either heavy‑lift rockets capable of putting payloads directly into GEO or onboard motors, but both options impose trade‑offs against cost, complexity, or delay.

Impulse Space aims to offer a solution where companies do not have to pick between the three and can get fast, flexible, last‑mile delivery.

Proprietary Engines

At its core, a rocket engine works by pushing mass in one direction so the vehicle moves in the opposite direction. Propellants are pushed into a chamber, ignited, and expelled out of a nozzle at extremely high speed. The faster and more efficiently an engine can burn and push that gas, the more thrust it generates. Higher pressures inside the engine can increase the exit velocity of the gases, which is why pump‑fed engines can be so powerful.

Impulse’s engine innovation underpins its product strategy. Impulse has built three distinct chemical thrusters tailored to different mission classes.

Saiph

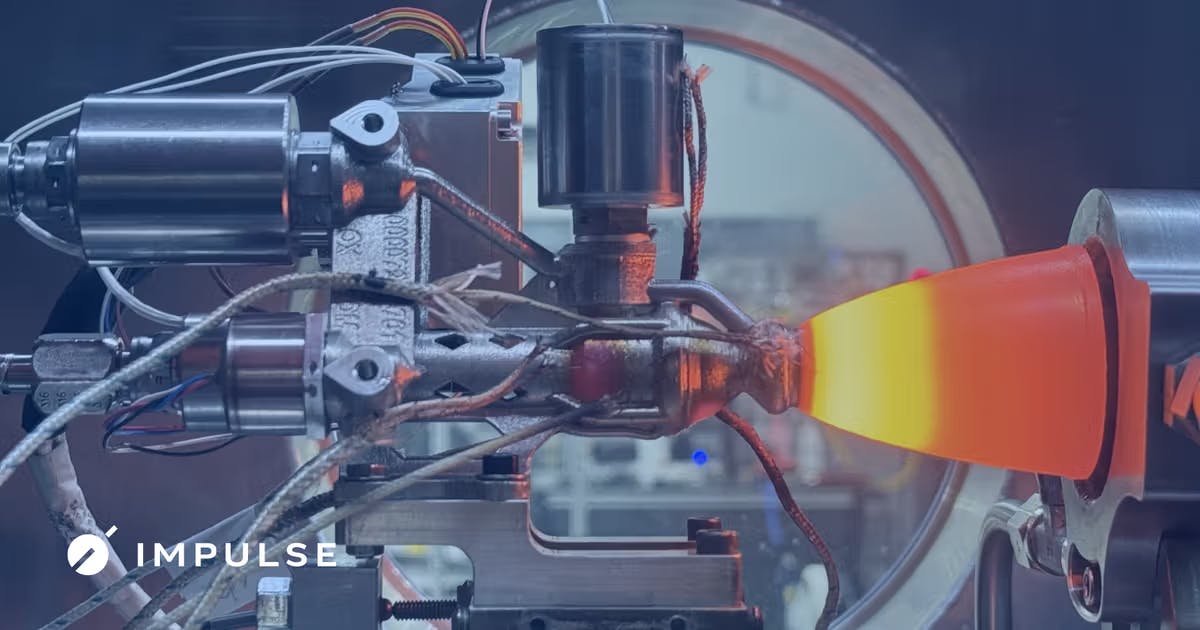

The Saiph engine is the company’s flagship thruster for small-to-medium satellite transfer. It burns a green bipropellant blend of nitrous oxide and ethane that can be stored as room-temperature liquids. This avoids the toxicity of legacy propellants like hydrazine and eliminates the need for complex cryogenic infrastructure.

What distinguishes Saiph from other engines is its self‑pressurizing design: it uses its own heated propellant vapors to drive the combustion chamber, doing away with bulky helium tanks. Each Saiph engine produces 26 newtons of thrust and is engineered for longevity: tested for over 50K hot starts (going from on to off), it is built to survive years of repeated ignition without degradation. That makes it suited for orbital‑transfer vehicles like Mira that require many small engine burns over time. Impulse’s qualification campaign proved its ability to sustain 65K seconds of total firing time, including continuous twelve‑minute burns.

Source: Impulse Space

Deneb

Deneb powers the heavy‑lift end of Impulse’s fleet as a 67 kilonewton staged‑combustion engine built around liquid oxygen and liquid methane, the same methalox pairing flown on SpaceX’s Raptor.

Instead of Saiph’s self‑pressurizing tanks, Deneb feeds its chamber with high‑speed turbopumps, letting the engine reach chamber pressures and thrust levels far beyond what pressure‑fed hardware can sustain. That turbomachinery, combined with an oxygen‑rich cycle, delivers hotter, cleaner burns that squeeze maximum impulse from every kilogram of propellant. In simple terms, using turbopumps is like forcing more fuel and oxygen into the engine, which makes the “explosion” inside much stronger and more efficient, the same way a turbocharger boosts a car engine’s power.

The engine is the core component of Helios, Impulse’s high‑energy kick stage. Because Deneb is cryogenic, its tanks need active cooling, adding complexity; yet that same cooling capacity opens the door to cislunar and interplanetary routes. Impulse is already marketing the engine for deep‑space prototypes under the Space Development Agency (SDA) HALO program.

Source: Impulse Space via X

Rigel

Finally, Rigel is Impulse’s lander‑class engine, built specifically for the company’s commercial Mars lander campaign with Relativity Space. Like Saiph, it burns nitrous oxide and ethane so that the same ground hardware can service both gentle maneuvering and high‑throttle descent. Rigel produces 800 newtons of thrust, which is enough for propulsive landing yet still compatible with a simple pressure‑fed system. The engine’s entire fluid path is printed as a single lattice‑type structure with no external tubing, trimming mass, or failure points for the punishing vibrations of entry, descent, and landing. Still in qualification, Rigel anchors what Impulse and Relativity bill as the first commercial Mars landing attempt, targeting the 2026 window.

Source: X, @Impulse Space

Product Suite

These engines serve as the foundation for Impulse's two orbital transfer vehicles, Mira and Helios, as well as its operational services, LEO Express and GEO Rideshare. These vehicles and services fall into the class of orbital transfer vehicles (OTVs), sometimes called “space tugs.”

In simple terms, OTVs act like space taxis or tugboats. Rockets drop satellites off in a shared parking%20is%20computed.) orbit after launch, but that orbit is rarely the satellite’s final destination. OTVs are then used to carry these payloads to their target orbit. They use propulsion systems to provide what’s known as last‑mile delivery. They dock with or release payloads from their deployment platforms and perform a series of energy releases, or burns, to move them to precise, higher‑energy orbits such as GEO. This approach saves customers from building propulsion hardware into every satellite and can shorten the time to begin operations from months to days.

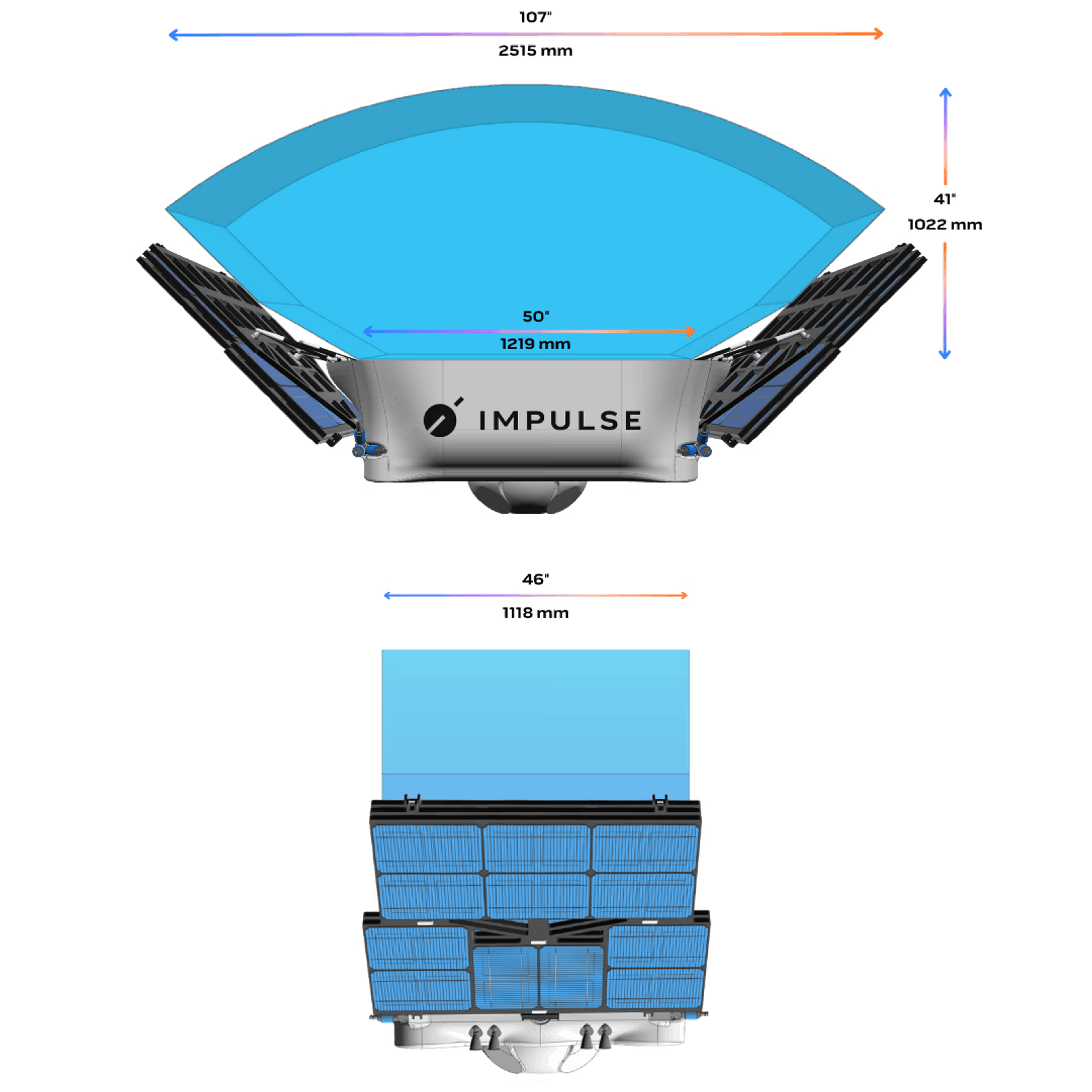

Mira

Mira, the company’s flagship operational tug, is optimized for payloads up to 300 kg. It launched its first mission in 2023 and sold out every port on its first three ride-share flights. Mira is powered by eight Saiph thrusters, giving it exceptional maneuverability and endurance. On early flights, Mira successfully deployed a customer satellite, executed multiple orbital burns within a single orbit, and demonstrated autonomous collision avoidance. Mira accomplished this on a spacecraft small enough to fit inside the ride-share bay of a SpaceX Falcon 9. What sets Mira apart from other OTVs is speed: it can transfer a micro-satellite from LEO drop‑off orbit to GEO in under ten days, a timeline that slashes the radiation dose and commercial downtime compared to electric tugs, which can take up to 270 days.

Source: Impulse Space

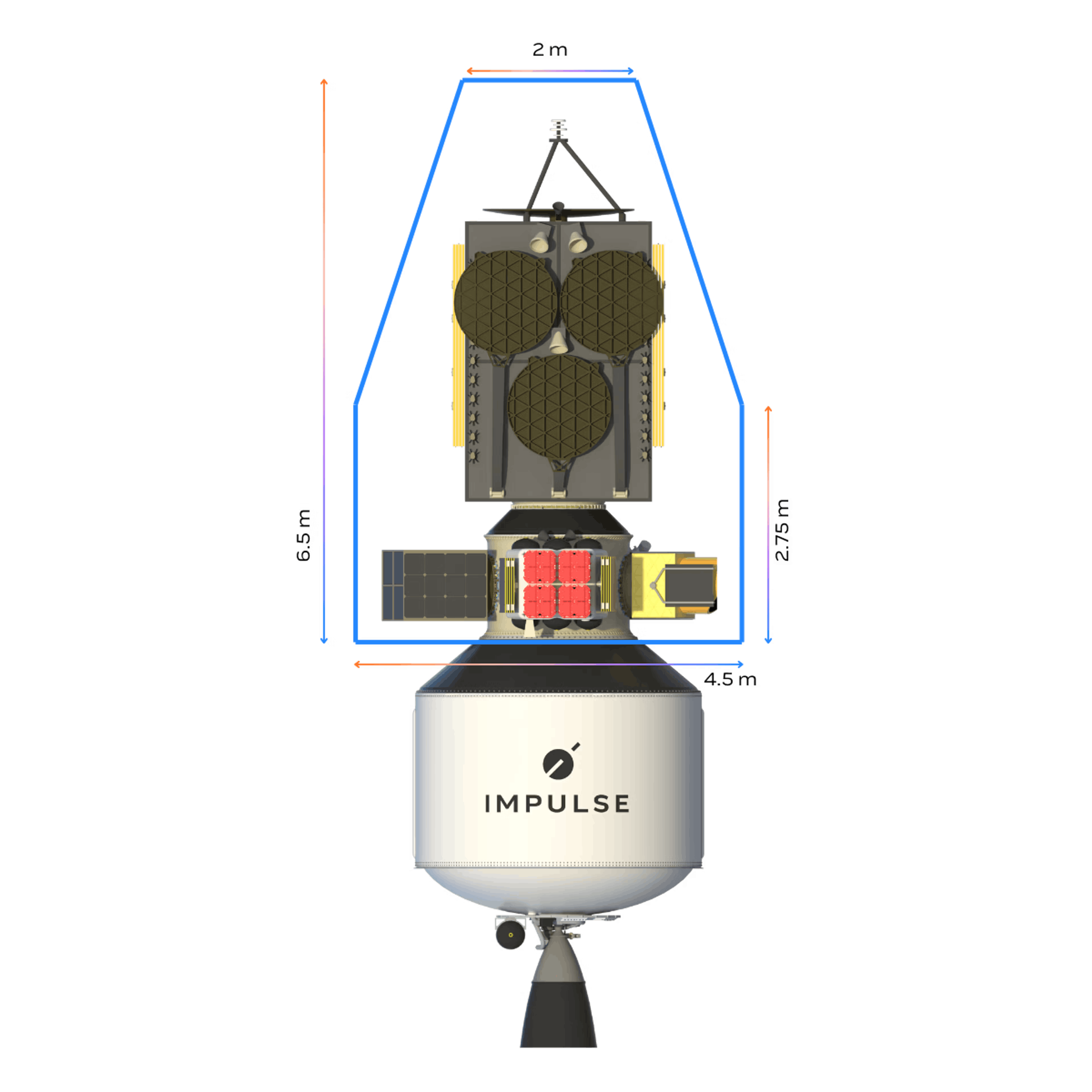

Helios

Helios, still in development, is built for the high-weight end of the payload spectrum. It’s powered by the Deneb engine and designed to carry a four‑ton‑class payload from LEO to GEO within eight hours. In combination with medium and heavy‑lift launch vehicles, Helios is also advertised to move five-plus tons from LEO to GEO in less than a day. That value proposition convinced satellite operator SES to sign a multi‑launch agreement starting in 2027, making Impulse the first independent tug provider on a Tier‑1 commercial manifest.

Source: Impulse Space

GEO Rideshare

The third offering, GEO Rideshare, packages these capabilities for smaller customers. Instead of chartering a full Mira or Helios vehicle, a company can buy a single deployment slot on a shared transfer flight. This lowers the cost barrier for startups, universities, and new space firms while still offering the same rapid orbit‑raising benefits. GEO Rideshare supports Impulse’s architecture as a space logistics layer where overnight shipping becomes possible in space.

Together, these products allow Impulse Space to offer a logistics stack that solves a core problem of the space economy: getting where you need to be, quickly and reliably, without burning your mass budget. The modularity of their engines, the design maturity of Mira, and the scalability of Helios have helped Impulse sign contracts totaling over $200 million in deal value as of August 2025.

Market

Customer

Impulse Space’s ideal buyers are organizations that only unlock revenue or mission value once a payload is settled in its operational orbit, and for whom existing transfer options waste either time or money. Operators note that during the period while a satellite is being brought to orbit, the satellite is not earning.

The first group of potential customers is commercial operators of large, geostationary communications satellites. As of August 2025, this group pays for dedicated heavy‑lift launches that can send directly to GEO, or spend four months to nine months spiraling on electric propulsion to get to their target location. A chemical transfer stage that compresses the trip to days lets those companies begin broadcasting or data‑relay service far sooner.

A second group of customers includes broadband constellations and Earth‑observation networks planning frequent refresh cycles. These organizations often ride-share dozens of satellites on a rocket to a single low orbit and then disperse across multiple orbital planes; OTVs can perform targeted deployments into custom orbits instead of waiting months to drift.

National security space agencies represent the third major potential customer base. These groups are shifting toward tactically responsive architectures that demonstrate launch‑to‑operations timelines on the order of hours to days: for example, the Victus Nox mission launched 27 hours after receiving orders. Many such procurements are structured as firm fixed‑price contracts.

Finally, a growing class of space‑station and on‑orbit‑servicing prime contractors prefers to buy off‑the‑shelf propulsion rather than designing it in‑house: for example, Vast selecting Impulse to provide the Haven‑1 station propulsion system, announced Jun 15, 2023. This creates an engine‑sales revenue stream and embeds Impulse hardware within emerging infrastructure. These users are technically sophisticated and already negotiate fixed‑price launch services, so the purchase decision becomes a direct trade‑off between the cost of lost service time and the price of a tug.

This customer base is broad and internationally distributed. Impulse works with commercial telecom fleets, Earth‑observation startups, defense ministries, civil‑science agencies, and habitat builders (for example, SES, Anduril, Vast). This distribution mitigates concentration risk and reduces dependence on any single vertical or region.

Market Size

Orbital logistics sits at the intersection of launch, satellite manufacturing, and on‑orbit servicing. Orbital logistics describes the incremental spending required to move payloads between orbits after the launch vehicle has completed its job. The broader space economy was valued at $630 billion in 2023 and is projected to reach $1.8 trillion by 2035. Within that expanding environment, orbital transfer vehicles (OTVs) occupy a narrow but fast-growing niche: providing last‑mile transport from rideshare drop‑off points to precise operational orbits.

OTV services are a small market as of August 2025, but are scaling rapidly as ride-share launches proliferate. These services accounted for about $1.5 billion in 2024 and are forecast to reach $5.2 billion by 2033. Some alternative methodologies place the 2030 figure closer to $5.6 billion, depending on how classes of vehicles and mission types are included.

When the lens expands to the broader space logistics category, which includes OTVs plus on‑orbit refueling, servicing, and in some cases, assembly, the market becomes significantly larger. Forecasts predict growth from $4.0 billion in 2030 to $19.8 billion by 2040, a compound annual growth rate of 17.3%. An even wider definition that folds in in‑space manufacturing anticipates $16.5 billion in 2030, growing to $38.6 billion by 2035, reflecting the convergence of transportation, servicing, and production capabilities into an integrated ecosystem.

Propulsion hardware sales represent another swath of the market. Operators of large platforms routinely purchase maneuvering thrusters and propulsion modules, and government mobility awards add incremental, milestone-based spending. Recent examples include a $375 million power‑and‑propulsion contract for NASA’s Gateway station, a $112 million lunar delivery task order, and a $34.5 million responsive space mobility contract awarded in 2025. These awards layer on top of a broader $73 billion global defense space budget as of 2024.

Putting these figures together, a realistic near‑term market for OTVs alone is expected to reach $4–6 billion by 2030. The broader space‑logistics market, including propulsion packages and responsive contracts, points to low‑ to mid‑teens of billions by the early 2030s, with long‑term potential to exceed $19 billion by 2040 as demand for fast, flexible, and reusable in-space transport accelerates.

Competition

Competitive Landscape

Over the past five years, in‑space logistics has evolved from proof‑of‑concept experiments to a real commercial service category. This shift was cemented when Mission Extension Vehicles from Northrop Grumman successfully connected, or docked, with Intelsat satellites in 2020 and 2021, extending satellite lifespans without requiring new launches.

At the same time, venture‑backed players began demonstrating operational cadence. As of August 2025, D‑Orbit has completed over a dozen missions with its chemically propelled ION Satellite Carrier, deploying more than 180 payloads since 2020. Exotrail followed suit with its all‑electric SpaceVan, completing its first successful delivery mission in late 2023. Together, these companies proved that orbital transfer vehicles (OTVs) are no longer theoretical.

Still, the market remains fragmented. Integrated players like Rocket Lab bundle launch and in‑space mobility through their Photon kick stage, which notably delivered NASA’s CAPSTONE mission to lunar orbit in 2022. Firefly Aerospace deepened its stake in the mobility market by acquiring Spaceflight Inc. and its Sherpa line of OTVs, combining launch and transfer services under one roof.

Meanwhile, a wave of focused startups is carving out niches: Momentus uses water‑based plasma propulsion on its Vigoride platform; Atomos Space launched dual test vehicles that performed autonomous docking and refueling in 2023; and Australia’s Space Machines Company has debuted the hybrid‑propulsion Optimus Viper for tactical delivery missions. Funding levels range widely, and no player has yet achieved market dominance. In order to understand where Impulse Space has a competitive advantage, a deeper dive is needed.

Competitors

Established Providers

Northrop Grumman: Northrop Grumman (founded 1994) is a major aerospace & defense contractor with a market cap of around $84.2 billion as of August 2025. Through its SpaceLogistics subsidiary, Northrop offers in‑space servicing vehicles like the Mission Extension Vehicle (MEV) that dock with and extend the life of aging satellites. MEV‑1 (Feb 2020) and MEV‑2 (Apr 2021) successfully attached to Intelsat GEO satellites, effectively acting as jet packs. MEV uses Hall‑effect electric propulsion with xenon (see also a technical overview of MEV’s xenon Hall strings). Northrop is now developing the Mission Robotic Vehicle (MRV) to install small Mission Extension Pods on multiple satellites for life extension. Northrop is an incumbent focusing on large GEO satellites and efficient electric propulsion, whereas Impulse targets agile orbital transfer for smaller payloads using high‑thrust engines.

Rocket Lab USA: Founded in 2006, Rocket Lab is a publicly traded launch and space‑systems company with a market cap of $23 billion as of August 2025. Rocket Lab’s Electron rocket and Photon orbital stage offer bundled launch‑and‑tug services. Photon delivered NASA’s CAPSTONE to a lunar transfer in 2022 via a series of on‑orbit burns using its HyperCurie bipropellant, pump‑fed engine. The company has achieved dozens of successful missions launched. Photon is an integrated space tug using storable chemical propulsion similar to Impulse’s approach, but Rocket Lab also controls its own launch vehicles and has a track record of deep‑space missions.

Firefly Aerospace: Firefly Aerospace (originally founded in 2014 as Firefly Space Systems and reorganized as Firefly Aerospace in 2017) is a private launch‑vehicle and spacecraft developer that, in 2023, acquired Spaceflight Inc. to expand into orbital‑transfer services. Firefly builds the Alpha rocket and Blue Ghost lunar lander, and now offers last‑mile delivery via Sherpa OTVs inherited from Spaceflight. The Sherpa family includes variants with chemical propulsion (Sherpa‑LTC) and electric propulsion (Sherpa‑LTE), which have deployed customer satellites from SpaceX rideshare missions. Firefly has raised $796.6 million as of August 2025. It raised a $175 million Series D in November 2024 at a $2 billion valuation and positions itself as an end‑to‑end provider for launch and transport by leveraging flight‑proven Sherpa vehicles. This integrated model offers a competitive alternative to Impulse’s standalone chemical tugs, especially for customers seeking a one‑stop launch‑and‑delivery solution.

In Space Transport Startups

D‑Orbit: Founded in 2011, D‑Orbit is an Italian space logistics company and among the first NewSpace firms in this sector. D‑Orbit operates the ION Satellite Carrier tug, which uses a proprietary chemical module for rapid transfers. It now claims the deepest flight record in this niche, with 17 missions and 180+ payloads delivered since 2020 on Falcon 9 and Vega launches. D‑Orbit offers both last‑mile deployment and hosted‑payload services. The company has raised $201.2 million as of August 2024. Its Series C closed in 2024 at €150 million ($166 million) at an undisclosed valuation, led by Marubeni with investors including Seraphim Space, CDP Venture, and the European Investment Bank. D‑Orbit competes directly on chemical‑propulsion transfer for smallsats and retains a lead in operational heritage (15+ ION vehicles) and a broad customer base as of August 2025.

Momentus Inc.: Founded in 2017, Momentus Inc. is a US space‑mobility company developing Vigoride transfer vehicles propelled by a water‑plasma microwave electro‑thermal system (MET). Momentus flight demos included a mid‑2022 attempt with power and communications problems and a 2023 mission deploying payloads. Momentus targets efficient, low‑thrust electric transfers, in contrast to Impulse’s high‑thrust chemical approach. Momentus raised $25.5 million through 2019 and then went public via SPAC in 2021, netting $247 million in cash proceeds at an undisclosed revised enterprise value, speculated to fall between $700 million and $1.2 billion. The company has faced regulatory actions tied to national‑security concerns and licensing disclosures (SEC order, licensing decisions). By August 2025, its market cap was under $10 million.

Exotrail: Founded in 2017, Exotrail is a French space‑mobility company offering Hall‑effect electric propulsion and the SpaceVan OTV, plus mission‑design software and cloud operations. Exotrail has raised €70 million to date, including a $58 million Series B in February 2023 led by Bpifrance, Eurazeo, and CELAD at an undisclosed valuation. The first SpaceVan demo flew in late 2023, with a customer cubesat delivered after three months of orbit‑raising. Exotrail later announced a multi‑launch agreement with MaiaSpace for SpaceVan missions starting in 2027. SpaceVan’s all‑electric strategy prioritizes propellant efficiency over speed, contrasting with Impulse’s faster chemical maneuvers.

Atomos Space: Founded in 2018, Atomos Space is a Colorado‑based US startup that developed reusable orbital‑transfer vehicles designed to rendezvous and dock with client satellites. Atomos’s approach was to station its “space‑tug” vehicles in orbit and use high‑efficiency electric propulsion to adjust orbits as needed. In a 2024 demonstration mission, two Atomos spacecraft successfully executed autonomous rendezvous, docking, and in‑space refueling with one another. The company raised $31.5 million in a mix of venture funding and government contracts, including a $16.2 million Series A round closed in late 2022, co‑led by Cantos Ventures and Yamauchi No. 10 Family Office. In April 2025, Atomos was acquired by Katalyst Space Technologies, which stated it would integrate Atomos’s reusable OTV platform and team into its own operations. Atomos’s model emphasized on‑orbit reusability and electric propulsion over chemical systems. The design focus was on repeatedly moving between payloads over time instead of one‑time rapid transfer. This makes its approach slower but more serviceable compared to Impulse’s fast, high‑thrust chemical transfers.

Space Machines Company (SMC): Founded in 2019, SMC is an Australian startup developing orbital‑transfer vehicles called “Optimus.” It reached a milestone in March 2024 by launching its first Optimus‑1 on SpaceX’s Transporter‑10 rideshare. Optimus is intended to deploy satellites into target orbits and, over time, perform limited orbital servicing. Australia’s space agency describes Optimus as a servicing platform designed for in‑orbit support. SMC also secured an A$8.5 million Australian Space Agency grant in 2024 for Mission MAITRI, a collaborative Australia‑India project. The Optimus‑1 propulsion system used a bi‑propellant engine from Valiant Space, while future versions are expected to incorporate hybrid propulsion (chemical combined with electric). As of August 2025, SMC operates as a small, regionally focused company but has demonstrated early technical capability through Optimus‑1.

The key technical differentiator between Impulse and these competitors is propulsion choice and the mission timelines enabled by that choice. Electric tugs such as Atomos’s vehicles or Exotrail’s SpaceVan provide high fuel efficiency but require months to complete orbit‑raising. Chemical tugs, like those from Impulse or Space Machines Company, prioritize speed, enabling satellite operators and defense customers to begin service much faster.

At the same time, the competitive landscape is evolving. Firefly Aerospace has expanded into mobility by acquiring Spaceflight Inc. and its Sherpa OTV line. Reusable architectures demonstrated by Atomos through on‑orbit docking and refueling show how services could evolve. Meanwhile, propulsion systems themselves are becoming a component market: for example, Vast has contracted Impulse to supply propulsion for its Haven‑1 space station. The company that can scale speed, reliability, and hardware deployment will define the standard.

Business Model

Impulse collects revenue through three levers. First are fixed-price fees for its in-space transport stages: adding a Helios tug to a Falcon 9 rideshare costs around $20 million, while smaller payloads simply pay SpaceX’s published $6.5 k per kg base rate plus a modest surcharge, keeping sub-100 kg missions under roughly $1 million. Second, the company sells its own chemical-propulsion hardware: bipropellant Saiph thrusters and associated tanks. These are sold as packages that satellite and station integrators routinely budget for as part of their programs. Third, milestone-based US government contracts such as the $60 million STRATFI award inject cash into prime contractors that underwrite R&D while validating new capabilities for later commercial rollout.

Most costs exist in engineering headcount and capital equipment inside the company’s vertically integrated 60K-square-foot Redondo Beach factory with flight test stands. Day-to-day mission costs, which include ride-share slots, insurance, methane-oxygen propellant, and post-flight refurbishment, are being passed straight through to customers. Once a tug’s build cost has been spread over several flights, the only fresh spending per mission is operational labor and fuel. Staged government payments provide predictable cash injections that lessen the need for additional venture capital or debt.

Traction

Impulse Space has more than thirty commercial, civil-space, and defense contracts as of August 2025. Altogether, these deals are estimated to be valued at around $200 million.

Every port on the company’s first three “LEO Express” missions was fully subscribed as of August 2025. The inaugural flight on SpaceX’s Transporter-9 in November 2023 and the follow-ups aboard Transporter-12 in January 2025 and the planned flight for later 2025 all appear as “sold out” on the Mira manifest. These flights provide capabilities beyond ordinary satellite deployments: mission updates from LEO Express-1 and LEO Express-2 show Mira raising its own orbit twice in a single lap around Earth and steering itself to avoid debris, meaning the tug can reposition satellites quickly and safely.

Source: Impulse Space

The same speed advantage persuaded global operator SES to sign a multi-launch agreement with Impulse in May 2025 for the methane-fueled Helios stage. Traditional satellites crawl from low-Earth orbit up to geostationary orbit on low-thrust electric engines, but Helios can tow them the full 22k miles in a single day. This speed can save operators months of lost revenue. SES became the first “Tier-1” fleet owner to buy tug services from an independent startup, which has been considered a “turning point for orbital logistics.”

The US Space Force is betting on the same hardware for national-security missions. Via a US Space Force contract worth $34.5 million, Impulse will create a combined Mira and Helios stack that can sprint to any point above Earth and reposition government sensors within hours of being called up. In addition, NASA placed Impulse on its VADR roster, a standing contract that lets agency scientists book launches without a new bidding process each time. Also, a Defense Innovation Unit-funded demo will see Mira carry an Orbit Fab propellant shuttle to geostationary orbit for on-orbit refueling next year in the quest for “gas stations” in space.

Defense prime contractor Anduril Industries also chose Mira as the chassis for AI-driven surveillance craft, integrating autonomous navigation and electronic-warfare payloads to create agile “space drones” that can watch, jam, or relay data. For Anduril, partnering with Impulse removes the cost and complexity of building an entire spacecraft bus from scratch.

Impulse is also turning its in-house engines into a product line. Commercial station builder Vast bought eight Saiph thrusters for the Haven-1 module launching in 2025. Selling propulsion hardware diversifies revenue and shows that customers trust Impulse components even when they are embedded in someone else’s vehicle.

Deep-space ambitions are another vertical that Impulse continues to attack. The purely commercial Mars lander mission announced with Relativity Space in 2022 is now slated for 2026. In that partnership, Impulse supplies the cruise stage, entry capsule, and Rigel-powered lander. In return, Relativity’s reusable Terran R provides lift. If successful, this partnership would mark the first privately financed landing on another planet.

Valuation

As of August 2025, Impulse Space has raised $300 million since 2021. The company raised $300 million Series C led by Linse Capital in June 2025 at an implied valuation of $1.8 billion. The company initially raised a seed round of $20 million led by Founders Fund in 2022, then added a Lux Capital $10 million note in June 2022. A $45 million Series A led by RTX Ventures in July 2023 a $150 million Series B in October 2024 led again by Founders Fund were the most recent funding rounds as of August 2025.

Public-market peers show how investors price space infrastructure today. Small-launch specialist Rocket Lab carried a $22.2 billion market cap as of August 2025, against a trailing-twelve-month revenue of $466 million, which is a price-to-sales multiple above fifty. At the other extreme, orbital-transfer rival Momentus was worth just $8.9 million in 2024 while generating about $1.9 million in sales, a multiple just under five. Impulse’s private $1.8 billion valuation lands between a high-growth company priced like Rocket Lab and a distressed peer priced like Momentus. Impulse commands a premium because it already has paying customers and its high-thrust tug has flown, while simultaneously avoiding valuations reserved for firms with hundreds of millions in revenue today.

Key Opportunities

Regulatory Shift Away from Toxic Propellants

Historically, hydrazine has been the go‑to propellant for in‑space propulsion, but it's highly toxic and difficult to handle. Regulatory bodies are pushing for safer alternatives. Two examples include the European Union’s REACH directive and NASA’s own safety roadmap, which are accelerating the phase‑out of hydrazine. Impulse’s propulsion systems use nitrous oxide and ethane, a combination that qualifies as a green propellant while still outperforming many legacy solutions. Nitrous‑based engines offer 25% more delta‑v per kilogram than hydrazine monopropellants, meaning Impulse meets safety alignments and provides a more efficient solution with its green propellant.

Cheap Heavy‑Lift Rockets Create Precision‑Delivery Gaps

The economics of space launch are being rewritten. SpaceX’s Starship targets a marginal launch cost under $5 million to place 150 metric tons in low‑Earth orbit, or $30 per kilogram. Other launch providers are also advancing: Blue Origin’s New Glenn will carry 45 tons with reusability in mind, and ESA’s Ariane 6 will carry 15 tons for about €100 million, which is roughly $1,000 per kg to orbit. But these vehicles typically leave payloads in parking orbits, which creates a “last‑mile delivery” problem getting satellites from LEO to their final destinations. That’s where Impulse can fill a gap in logistics: its high‑thrust, chemical orbital transfer vehicles can complete delivery in hours, compared to the weeks or months required by electric tugs. As launch costs fall, demand will rise for precise orbital mobility, exactly what Impulse provides.

Propulsion‑as‑a‑Service Flywheel

Beyond its own tugs, Impulse is monetizing its engines directly. It is supplying Saiph thrusters to Vast’s Haven‑1 space station (announced June 2023), giving it early traction in the component market. This could lead to a flywheel: the more third parties adopt Impulse’s thrusters, the larger the installed base, which boosts reliability data, spreads recurring service revenue, and builds trust in its in‑house vehicles. Long term, Impulse could also become a propulsion vendor across low‑cost, distributed space systems, much like how avionics providers sell into both military and civilian aircraft platforms.

Defense Spending Shift to Responsive Space Mobility

As defense strategy adapts to space‑based threats, demand is growing for vehicles that can reposition satellites or deploy new assets on short notice. The US Space Force has already made two major bets on Impulse Space: a $34.5 million tactically responsive mission contract (October 2024) and a $60 million STRATFI prototype to develop on‑demand maneuver capabilities (August 2024). These programs reflect Tactically Response Space (TacRS) priorities demonstrated on missions like Victus Nox, where a satellite was launched and activated within 27 hours of notice. Such contracts signal a growing opportunity for rapid orbital mobility providers as allied nations look to replicate the Space Force’s model.

Key Risks

Launch‑Provider Concentration

Impulse’s entire near‑term manifest flies on SpaceX’s Falcon 9 rideshare program. The company itself confirms three bookings for 2026 in a press release about securing Falcon 9 missions. If even one booster overhaul or pricing revision forces SpaceX to reshuffle its rideshare calendar, Impulse has no alternate rocket lined up, so revenue inflows would pause. Shifting a tug or kick stage to alternative launchers such as New Glenn or Ariane 6 is not a plug‑and‑play exercise; new payload adapters must be qualified, software revalidated, and insurance repriced, so any Falcon stand‑down that lasts a quarter or more could starve the company of both cash and customer confidence.

Heavy‑Lift Direct‑Insertion Threat

Elon Musk has said that Starship could push launch costs to roughly ten dollars per kilogram, and flight‑test milestones such as the October 2024 booster catch demonstrate rapid progress toward full reusability and single‑shot cislunar trajectories. If operators can buy a near‑direct ride to geosynchronous orbit or the Moon for under $70 million, the value proposition for paying a separate orbital‑transfer‑vehicle premium shrinks dramatically. In that scenario, Impulse would be selling a two‑step trip when competitors can offer one, leaving only niche missions such as cluster deployments, delayed phasing, or inclination changes as defensible turf.

Cryogenic‑Propellant Operational Risk

The Helios kick stage runs on liquid oxygen and methane, a combination that boils away rapidly unless actively refrigerated. Company founder Tom Mueller highlighted this as the principal engineering hurdle when unveiling Helios. NASA’s long‑duration storage studies show that even with advanced cryocoolers, tanks in low‑Earth orbit can lose up to 60 percent of propellant within months without perfect insulation and fluid management. If Impulse cannot demonstrate reliably serviced zero‑boil‑off tanks, it must either launch with excess propellant, slashing payload mass and profit, or accept diminished performance that undermines its “hours‑to‑GEO” value proposition.

Regulatory Headwinds

The US Federal Aviation Administration is drafting upper‑stage and on-orbit servicing rules aimed at debris mitigation; the agency expects to finalize the framework in 2025, according to SpaceNews. Early outlines point to continuous tracking requirements, post‑mission disposal bonds, and expanded licensing that covers every autonomous burn the tug performs. Each new mandate adds legal overhead, lengthens certification timelines, and inflates insurance premiums. For a pre‑revenue startup, even a year‑long slip in license approval could exhaust runway before the first commercial payload ever docks to a Helios stage, as recent licensing delays illustrate.

Summary

Impulse Space builds high-thrust orbital transfer vehicles that shorten LEO-to-GEO delivery times from months to hours, filling a clear gap in the growing space logistics sector. It has engineered a proprietary propulsion stack around chemical engines Saiph, Rigel, and Deneb, which are designed for fast, green, and modular operations. These engines power the Mira and Helios vehicles, which carry payloads from low-cost launch drop-offs to final orbits at record speed. With over thirty commercial, defense, and civil contracts secured and more than $500 million in funding, Impulse has gained early validation for its differentiated approach to rapid, last-mile delivery in space. Customers include SES, Vast, the US Space Force, NASA, and Anduril, who are all seeking to accelerate orbital mobility for economic or strategic reasons.

Key opportunities for Impulse include strong market growth of space logistics, which is projected to reach nearly $20 billion by 2040; shifting regulations that favor safer propellants; and the emergence of cheap heavy-lift rockets, which make last-mile services more relevant. Impulse’s propulsion components also show potential for revenue diversification. That said, its dependency on Falcon 9 rideshares, the technical complexity of cryogenic propellant management, and the looming threat of direct-to-GEO launches present meaningful risks. Sustained technical execution and timing will be critical to establishing Impulse as a long-term infrastructure provider in the space economy.