Thesis

The internet has made freelance work and self-service projects more accessible than ever before. The term “gig economy” has been characterized as flexible jobs with short-term responsibilities, usually without lengthy contracts. In many ways, this type of work became popular during the financial crisis when people took on temporary jobs to cope with financial instability. These additional streams of income served as a necessary bridge to cover any shortfall in a living wage. The proliferation of platforms like Uber, Grubhub, and Airbnb has made flexible occupations not just mainstream but even an attractive option for additional income. In 2023, the gig economy encompassed over 12% of the global labor market, with 70% of independent contractors working by choice rather than necessity.

The COVID-19 pandemic dramatically accelerated the growth of this type of work as traditional work structures shifted and ride-sharing, food delivery, and home-rental gigs became prominent. Between 2019 to 2024, the US saw a 90% increase in full-time freelancers and a 130% increase in those working part-time. Freelancing, a meaningful subset of the gig economy, has seen rising popularity as platforms like Fiverr and Upwork provide an efficient marketplace to hire specialized individuals. In 2023, freelancers contributed more than $1.3 trillion to the US economy in earnings. Self-employment altogether hit a new high in the US in 2023, as 64 million Americans — more than 38% of the US workforce — performed independent contracting work. That’s 4 million additional self-employed workers in 2022, a 16x increase.

However, both gig workers and freelancers share common challenges, including the lack of benefits like health insurance and the responsibility for self-managed taxes (1099-K for gig workers, 1099-NEC for freelancers). The rapid development of the self-employed economy has also meant that traditional banks have not developed optimal financial solutions yet. One 2023 report in the UK found that 70% of gig workers have struggled to gain approval for financial services, with 66% denied for a loan. This is not necessarily a result of oversight or bad banking practices. The challenge is that gig workers experience uniquely volatile employment variables, such as inconsistent income patterns and self-managed tax requirements, that make it difficult for traditional approaches to determine creditworthiness.

Found has created a banking platform tailored for freelancers and small businesses in an effort to bridge this gap. As the gig economy continues to be a profitable pursuit and more individuals face the characteristically complex tax requirements, Found is positioned to step in as a niche financial intermediary. The platform offers features including automatic expense categorization, auto-generated P&L reports, and free business insight reports that seek to simplify self-employment.

Founding Story

Source: TechCrunch

Found was established in 2019 by two former Square executives, Lauren Myrick (CEO) and Connor Dunn (CIO). The founders had backgrounds in accounting, engineering, and financial services to tackle common banking headaches for individuals and small businesses.

After graduating from UC Santa Barbara with a major in economics, Myrick worked as an associate at Deloitte and as a public accountant. Shortly after, she began at Square in 2010 as the company’s second-ever product manager, helping launch its point-of-sale (POS) and SaaS products. She was promoted to general manager of Square Payroll in 2014, where she was responsible for all divisions under the product. Towards the end of her time at Square in 2018, Myrick was working on payroll and began noticing that there was a “growing movement shifting from W-2 workers, and people who work at large companies, towards self-employment.” This thesis was reinforced by estimates that the majority of the US workforce would be self-employed by 2027. She similarly discovered that filing taxes was a significant pain point for freelance and small business owners.

“Many people don't realize that managing your finances when you're self-employed differs quite a bit from when you are a W-2 employee. There are different tax requirements and forms, and you are on your own to figure out how much you need to pay in taxes. We also saw a common theme that people start their own businesses because they want freedom, flexibility and creative control — not so they can become their own accountants.”

Myrick understood these struggles on a personal level, as her sister was a yoga studio owner and self-employed fitness instructor. Without a finance background, it was difficult for her sister to simultaneously run a self-owned business and understand complex tax regulations. Seeing the problem as one she was uniquely suited to solve with her background, Myrick began ideating an ideal financial product for this niche. She cites Square founder Jack Dorsey’s approach to product as an inspiration for her conception of Found.

Her co-founder, Dunn, had studied computer science at the University of Warwick and graduated in 2011. He worked as a full-stack generalist engineer at Trigger Corp to help simplify native mobile app development for HTML developers. Eventually, he also joined Square in 2013, and became Engineering Lead on Payroll with Myrick in 2016. Sold on the vision for a better future for individual banking, they started sifting through packets of IRS documentation and sitting with lawyers specialized in sole proprietor taxes to understand the focal problems at hand. This tedious and time-consuming process, in tandem with interviewing scores of self-employed individuals, validated their mission. Ultimately, they decided that the market desperately needed a service to package bookkeeping and combine it into a simple software. In 2019, Myrick and Dunn started what was previously known as Indie, but became Found.

Product

Found provides business banking, accounting, and tax solutions for freelancers, individuals, and small businesses.

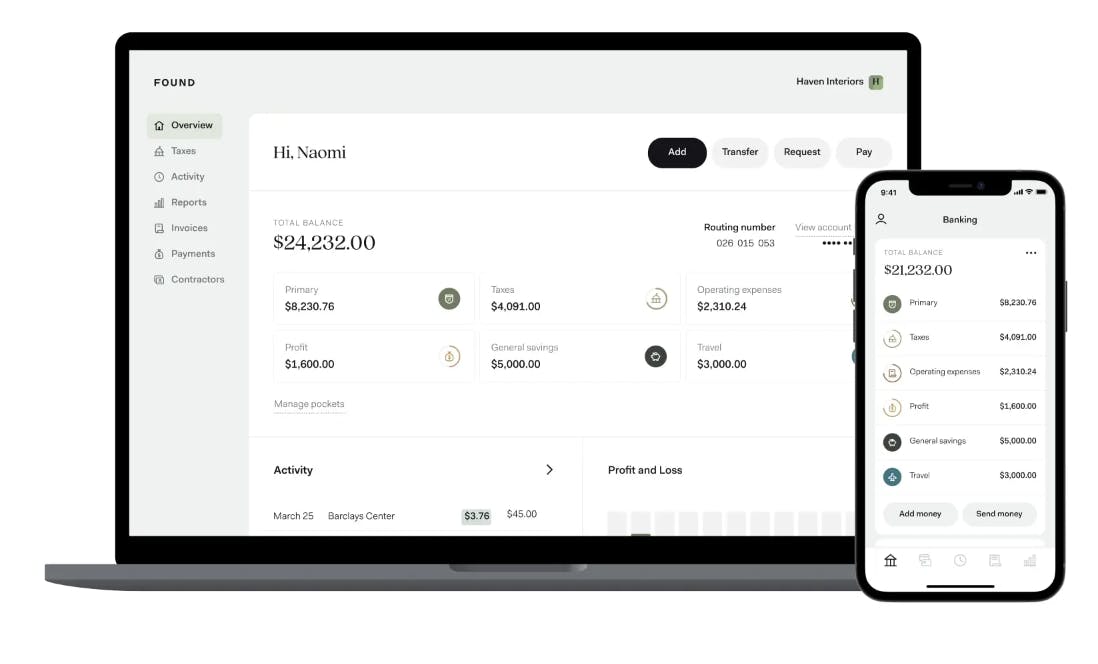

Banking

Found partnered with Piermont Bank to bring business banking services and FDIC insurance to its products. Each account comes with its own routing and checking numbers. It offers a business debit card in collaboration with Mastercard, which can be utilized in sync with a virtual card for free unlimited ACH transfers and seamless payments. These virtual cards can be simultaneously distributed to other trusted employees. Utilizing the card automatically allows Found to track expenditures that can be segmented, analyzed, and tracked for accounting and tax purposes.

Customers can categorize expenses and save receipts, run business reports, see tax estimates in real time, and auto-save the right amounts to avoid unnecessary tax-time incursions. Funds can also be linked to external platforms like Venmo, Cash App, PayPal, and QuickBooks for domestic and international payments. All transfers between Found accounts are free and encrypted according to Advanced Encryption Standards (AES256) and SOC-2 compliance.

Source: Found

Accounting

Found’s accounting module has several features, including invoicing, contractor payments, reporting, accountant tools, and Found Plus.

Invoicing: Found's invoicing platform offers free, unlimited, and customizable invoice creation tailored for self-employed individuals and small businesses. Users can design professional invoices by adding their logo, selecting brand colors, and including personalized notes. The platform supports various payment methods, including credit/debit cards, bank transfers, and Cash App Pay, with integration through Stripe for card payments. Additional features encompass scheduling recurring invoices, sending automatic payment reminders, and tracking invoice status, such as when an invoice is viewed or paid. Invoices can be managed directly through the Found app, with payments deposited into the user's Found account, which also facilitates bookkeeping and tax management. Myrick, in a May 2023 interview, said 25% of Found customers utilize the invoices feature to get paid.

Contractor Payments: Found's contractor management platform offers a solution for hiring, paying, and managing 1099 contractors without monthly or per-contractor fees. Users can collect and securely store W-9 forms digitally, send payments via email or text with options like ACH and instant debit card transfers, and automate the generation and filing of 1099-NEC forms for contractors paid over $600 annually. The platform also enables scheduling payments in advance, duplicating past payments, and automatically recording transactions as deductible expenses, integrating banking, payments, and bookkeeping into a single interface.

Reporting & Insights: Found's real-time insights and reporting feature offers self-employed individuals and small business owners immediate access to auto-generated income, expense, and profit and loss reports. The platform provides up-to-date tax estimates that adjust in real time based on user income and expenses, helping users prepare for quarterly tax payments. Users can import financial activity from various sources, including bank accounts, cards, Venmo, and PayPal, to monitor their business finances comprehensively. Real-time notifications alert users to transactions such as card usage, payments received, expense tracking, and invoice sending, facilitating timely financial management. These features are accessible through Found's mobile and desktop applications, enabling users to manage their business finances efficiently from a single interface.

Accountant Tools & Resources: Found provides an integrated banking and accounting platform designed to assist accountants and bookkeepers in managing multiple self-employed clients efficiently. The platform offers real-time access to clients' financial activities, allowing professionals to view transactions, categorize expenses, export reports, and access Schedule C forms without the need for document exchanges. Features include automated expense tracking, budgeting tools, and the ability to communicate directly with clients about specific transactions within the app, reducing reliance on emails and meetings. Found's system supports collaboration through both desktop and mobile applications, aiming to streamline financial workflows for accounting professionals and their clients.

Found Plus: Found Plus is a premium subscription service offered by Found, designed to enhance financial management for self-employed individuals and small business owners. Priced at $19.99 per month or $149.99 annually, Found Plus includes all standard Found features along with additional tools such as unlimited custom expense rules, categories, and tags; automated receipt scanning; and the ability to import transactions from Venmo and PayPal. Subscribers can earn 1.5% APY on balances up to $20K and have access to in-app quarterly federal tax payments for Schedule C filers. The service also offers priority customer support and a 30-day free trial for new users.

In March 2024, Found released Pockets, a management system that allows customers to earmark and separate funds into different categories that work best for businesses. It assists in managing multiple revenue streams, saving money for various expenses, as well as paying 1099 contractors. Custom categories can be assembled, but are automatically prepared with two main components: Primary and Taxes pockets. The Primary pocket contains spendable money from received deposits and payments, while the Taxes pocket contains funds set aside for quarterly tax payments.

Taxes

Found's tax management tools are designed to assist freelancers, contractors, and self-employed individuals by automating key aspects of tax preparation. The platform enables users to automatically allocate a portion of their income into a dedicated tax savings account, provides real-time tax estimates that adjust with income and expenses, and identifies potential tax deductions through expense categorization. Users can generate necessary tax forms, such as Schedule C, and Found Plus subscribers have the added capability to make quarterly federal tax payments directly through the app. Additionally, the platform supports the import of transactions from external sources like PayPal and Venmo to ensure comprehensive financial tracking. These features are accessible via Found's mobile and desktop applications, aiming to streamline the tax process for self-employed professionals.

Found automatically allocates a portion of each income deposit into a tax savings account every time customers get paid, along with real-time updated tax estimates for upcoming payments. Write-offs are optimized so that every single purchase or transaction is sorted to collect the most optimal tax deduction. As of December 2024, only federal taxes can be paid on the platform.

Market

Customer

Found is intended for freelancers and small businesses, defining its mission to provide “all-in-one banking for the self-employed”. On its website, it specifies the scope to encompass “freelancers to single-member S-corps and consultants to contractors”. As of February 2025, Found supports more than 500K business owners.

Market Size

The global gig economy market was estimated to be around $556.7 billion in 2024 and grow at a 16.2% CAGR to reach $1.8 trillion by 2032. Found simultaneously taps into the small business market as well. In 2024, 33.3 million businesses qualified as small, according to the U.S. Small Business Administration Office of Advocacy. Specifically, Found could address the expected $455 billion of gross volume transacted in the global gig economy in 2024. One study found that 84% of millennial-operated SMBs are already using or have considered using alternatives to traditional banks to run their finances, demonstrating an expanding avenue with a younger audience.

Competition

Digital Banking Platforms

Mercury: Founded in 2017, Mercury is a fintech company that provides banking services primarily to early-stage startups. In March 2025, Mercury raised a $300 million Series C round led by Sequoia Capital, doubling its valuation to $3.5 billion. The platform offers FDIC-insured bank accounts through partnerships. Originally, Mercury worked with Evolve Bank & Trust, but in March 2025, the company ended its relationship with Evolve and focused on partnerships with banks like Choice Financial Group, Column, and Patriot Bank. In addition, Mercury offers tools like the Mercury IO corporate card and Mercury Raise, a service connecting startups with investors. Notably, Mercury gained significant traction following the collapse of Silicon Valley Bank in 2023, attracting 26K new customers to Mercury in four months who were seeking reliable banking alternatives.

Novo: Novo was founded in 2018 with notable investors including Crosslink Capital and Rainfall Ventures, raising $296 million over nine rounds as of December 2024. Built for small business owners and also offering its own debit card in partnership with Mastercard, it additionally offers financing, invoices, integrations, and partner perks. It supports 250K small businesses as of December 2024.

Lili: Lili was founded in 2019 with notable investors including Group 11 and Target Global, raising $80 million over three rounds as of December 2024. Its platform offers business banking, accounting, payments, and tax preparation products, along with four tiers of subscription - Basic, Pro, Smart, and Premium. Pricing ranges from free to $33 per month for Premium, enabling exclusive benefits such as a Lili Visa debit card. It is also developing Lili AI, an AI accountant designed to streamline core bookkeeping and deliver creative financial insights.

Bluevine: Founded in 2013, Bluevine is a fintech company offering banking solutions tailored for small and medium-sized businesses. The company has raised over $769 million in equity and debt funding from investors like Menlo Ventures and Lightspeed, as well as lenders like Atalaya Capital and Fortress Credit Corp. Bluevine's platform provides business checking accounts with features such as high-yield interest, low or no monthly fees, and sub-accounts for budgeting. Additionally, it offers lines of credit up to $250K and term loans up to $500K, catering to the diverse financial needs of businesses.

HoneyBook: HoneyBook was founded in 2013 with notable investors including Norwest Venture Partners and Citi Ventures, and had raised $498 million as of May 2025. HoneyBook focuses on client-flow management, as well as invoice and payment features, and has transacted $8 billion in earnings for members, with 90% of invoices paid on time on its platform.

Adjacent Players

Brex: Brex was founded in 2017 after graduating from Y Combinator, and has raised a total of $1.5 billion over 12 funding rounds as of May 2025. Brex offers a business account to execute cash transfers, send checks, and manage spend. With 30K companies as of May 2025, Brex’s business banking product has helped customers control a combined $51 billion, earn $680 million in rewards, and save 11 million hours with automated features. Its free Essentials account is geared towards startups and small businesses, making Brex a major incumbent in the niche. Existing Brex customers include Scale AI, DoorDash, and Airtable.

Intuit: Intuit was founded in 1983 and is a publicly traded company with a market cap of $182.5 billion as of May 2025. Its accounting software product, QuickBooks, provides a tailored solution for small businesses that includes advanced accounting, payments, payroll, and time tracking. In addition, it offers a live bookkeeping service to keep accounts up-to-date. It offers pricing plans without a free option — the standard Simple Start begins at $17.50 per month, up to its Advanced $117.50 per month option. As the industry’s standard, Intuit’s QuickBooks estimated 29 million customers comprise a significant portion of the overall market share.

Plaid: Founded in 2013, Plaid had raised $1.3 billion across eight rounds from investors like Franklin Templeton, Andreessen Horowitz, Norwest Venture Partners, BlackRock, and BoxGroup as of May 2025. The company offers a business finance platform with faster payroll payments, simplified expense management, smoother invoicing, and improved bookkeeping. Covering [12K] financial institutions across the globe, its integrated business accounting platform and product development API create a strong synergy. However, it is not as specifically tailored towards small businesses as other incumbents.

Status Quo

In addition to other platforms, there are also a variety of offerings from large incumbent financial institutions like Chase, Citibank, and Wells Fargo. These offer broad financial services such as loans and investments, but have been making strides in catering to niche customers. Between 2020 and 2023, one study found that the top 50 US banks accounted for the acquisition of 50 fintech platforms alone. This effort to diversify product offerings is a strong movement to include increased target users.

Business Model

Found operates under a freemium model and offers two types of accounts: Found Free and Found Plus. Free plan members are not charged any fees for opening and using an account and can utilize Found’s business banking, automated accounting, and tax tools at no additional premium. Expedited transactions, such as instant deposits and withdrawals, are subject to a 1.75% fee, while wire transfers are charged a $15 transaction fee.

Found Plus is offered at a $20 per month or $150 per year rate. It supports the same features as Found Free but includes other premium tools like advanced automation, 1.5% APY on balances up to $20K to earn interest on accounts, and priority support. It also allows customers to import activity from other banks, credit cards, and Venmo accounts to help centralize financial processes.

Traction

Prior to Found’s $60 million Series B in 2022, the company had seen 20x growth in customers the year prior. As of May 2025, the company now supports more than 500K business owners across its platform. Found debuted on Forbes’ ninth annual FinTech 50 list, highlighting Myrick as one of the eight new CEOs on the list. Throughout 2024, Found partnered with companies including Revenued, Care.com, and Marqueta. One unverified estimate indicated that Found’s 2024 revenue was $42.7 million.

Valuation

In July 2024, Found raised a $50 million Series C round led by Sequoia Capital, taking Found’s total raised capital to $121.2 million over six total funding rounds. This represents a smaller total round size from its last round two years ago, when Founders Fund led a $60 million Series B round in February 2022. Other notable existing previous investors include Lightspeed Venture Partners, Khosla Ventures, and Mischief. As of July 2024, this latest round has pushed Found’s valuation to over $400 million.

Key Opportunities

Macroeconomic Tailwinds

The growth in both revenue created by freelancers — $1.3 trillion to the U.S. economy in annual earnings in 2023 — and the growing popularity of self-employment helps create a prime market ripe for disruption with tailored financial services. Found’s product offerings are poised to ride industry tailwinds in search of a solution-based product in a time of need. It specifically alleviates cash flow issues, a problem that US Bank discovered in 2023 is why 82% of small- and medium-sized businesses (SMBs) fail.

Strategic Partnerships

Found has focused on developing partnerships with relevant companies in which product integration would be specifically helpful. For example, it partnered with Revenued in February 2024, a platform offering small business owners access to capital. Utilizing data collected by 20K active small businesses using Revenued, it was discovered that partnerships with traditional banks and local credit unions cost small businesses more than $700 in annual fees.

In an initial pilot linking Found’s product on the Revenued website, more than 34% of website traffic clicked on the offering to learn more, and according to Found’s COO Nick Adler, 10% of that qualified traffic signed up for a Found account. Additional integrations linking Found applicabilities to other horizontal industries are a strong strategic play. Existing additional partnerships include the pet-sitting platform Rover, the therapy platform Alma, and the caregiver marketplace Care.com.

Key Risks

Crowded Market

The growing gig economy did not pass unnoticed by other fintech and banking platforms, and strong competition has quickly marked the rapidly developing market. Startups such as Lili and incumbents like Intuit QuickBooks offer strikingly similar products to some of Found’s product modules, sharing banking and expense features as practical standard offerings. Found is under pressure to continue innovating new features, such as the release of Pockets in March 2024, to stay ahead of the curve and maintain a meaningful product differentiation.

Inconsistent Usage

As Found depends on a market reliant on a user base marked by inconsistent transaction volume, the conversion rate to its Premium plan may be more volatile than other fintech products targeting individuals with more predictable financial behaviors. The fickle income streams of the gig economy could spill over into unpredictable product utilization. This creates low switching costs, and competitors could dissuade and shift users to their own product if they offer better benefits or lower fees. This exacerbates churn risk, in which Found must develop additional unique products to present a more considerable moat.

Summary

Found is a fintech platform tailored for self-employed freelancers and SMBs to streamline financial solutions spanning banking, taxes, and accounting solutions. The growing population of workers in the gig economy, estimated to comprise more than half of the US workforce by 2027, has made the market ripe for disruption. Its applicabilities are agnostic to industry and span multiple horizontals, including healthcare, artistic freelancing, and food delivery.

Found raised a $50 million Series C in July 2024 at a valuation greater than $400 million, and its growth from 40 employees in 2022 to over 100 in 2024 suggests that the company has been able to ride industry tailwinds. The question now is how competitive Found can stay against incumbent solutions and how well those industry tailwinds persist. While Found has found a sizable niche, with over 500K business owners utilizing Found as of May 2025, this is a rapidly evolving and volatile market.