Thesis

Small to medium-sized businesses (SMBs) represent 99.9% of all firms in the US and generated over $150 billion in banking revenue across deposits, payments, and lending in 2023. Bank accounts play a pivotal role in company operations, from payroll, receivables, credit cards, and taxes to financial reporting and cash flow forecasting. 75% of SMBs undergoing some kind of financial stress are the most likely to use a digital bank as their primary financial institution. Traditional banks have long underserved them, deterred by low average contract values, high churn, and fragmented needs.

Digital banking is expected to reach a market size of $2.3 trillion by 2032. The COVID-19 pandemic has resulted in a spike in digital banking usage for both large and small banks. For example, Wells Fargo saw a 35% growth in remote check deposits and a 50% growth in online wire transfers in 2021. Taken together, these trends have created an opportunity to rethink the banking experience with startups in mind. But the experience has remained fragmented, with legacy interfaces, siloed workflows, and little product innovation. Meanwhile, digital banks have focused mostly on consumers or gig workers, leaving a clear opportunity to build a banking stack purpose-built for high-growth companies.

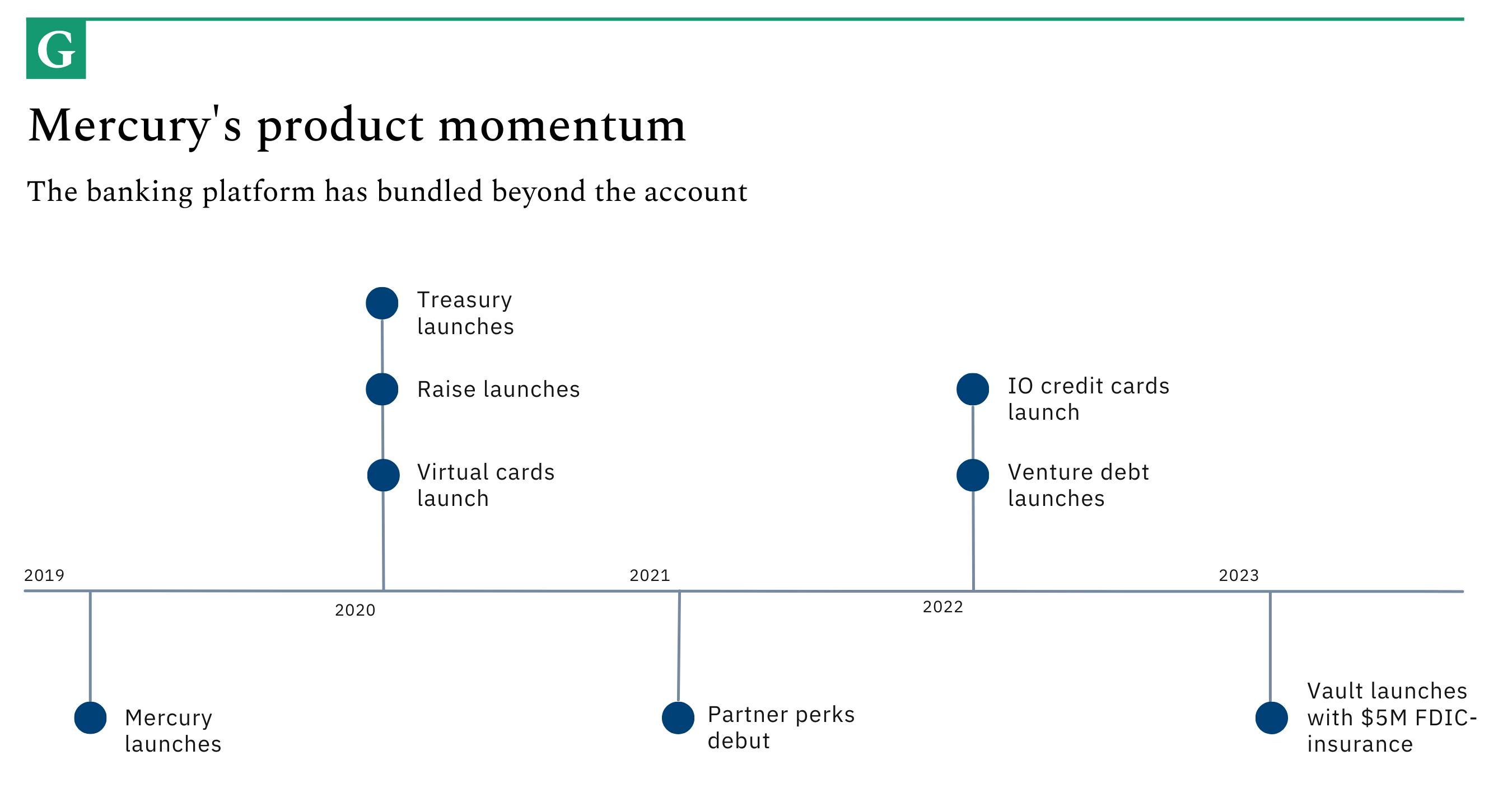

Mercury is executing against this gap. Since launching in 2019, it has built a banking platform that includes FDIC-insured checking and savings accounts, global wires, debit and credit cards, cash management, and team controls, all through a self-serve platform. Following the collapse of Silicon Valley Bank in 2023, Mercury became the banking partner for many founders, with over 200K businesses onboarded. As digital banking becomes the norm and startups demand software-like experiences from their banks, Mercury is well-positioned to become the leading operating system for startup banking — and increasingly, for financial operations more broadly.

Founding Story

Mercury was founded by Immad Akhund (CEO), Max Tagher (CTO), and Jason Zhang (COO) in San Francisco in 2017. The trio had previously worked together at mobile ad network Heyzap, founded by Akhund in 2008, where Tagher was a software engineer, while Zhang was the VP of business development. Heyzap was acquired by Fyber in 2015 for $45 million.

Source: Sequoia Capital

Akhund first had the idea for Mercury in 2013 after noticing a sharp contrast in how quickly startup tooling was evolving — Stripe, Gusto, and Rippling had dramatically improved, but banking remained stubbornly outdated. Despite seeing the opportunity early, he waited until 2017 to launch the company, believing someone else would inevitably modernize startup banking.

While running Heyzap, the founders had frequently felt constrained by cash flow and frustrated by the complexity of basic banking and accounting operations. After the company’s exit, Akhund became an angel investor and repeatedly saw those same pain points holding back other startup founders — lengthy application processes, hidden fees, in-person branch visits, and poorly designed user interfaces.

Inspired by the rise of European challenger banks, Akhund began exploring how a technology-first banking experience could better serve startups. He spent three months meeting with around 60 banks and over 100 founders to understand the landscape. Eventually, Mercury partnered with Evolve Bank & Trust, Choice Financial Group, and Patriot Bank to provide the underlying infrastructure for its offering.

After raising a $5 million seed round in 2017, Akhund, Tagher, and Zhang kept the team at just nine people, while working for 18 months to build a complete product. Competing with legacy banking providers meant Mercury couldn’t launch with a semi-functional MVP. The team aimed for what Akhund called a “minimum delightful product,” delivering domestic and international wires, multi-user permissions, a clean UI, and support for immigrant founders from day one. Mercury launched its private alpha in April 2019, and within the first week, one customer transferred $1 million into their account. Public launch followed shortly after, growing 30-40% month-over-month.

Product

Mercury’s core product is a business checking and savings account, which acts as the gateway to its broader financial stack. Once onboarded, customers can access adjacent offerings such as treasury management, financing solutions, and financial operations tools — all integrated into a single platform. In April 2024, Mercury also expanded into personal banking, aiming to serve founders and operators across both their business and individual financial needs.

Source: The Generalist

Business Banking

Mercury’s flagship product is a fully digital, FDIC-insured business checking and savings account designed for startups and SMBs. It offers a clean user interface, rapid onboarding, and automation-friendly infrastructure, as a modern alternative to legacy banks. In April 2023, Mercury announced a partnership with Stripe Atlas that enables startups to set up business banking faster. With the partnership, startups can get a bank account before the IRS issues an Employer Identification Number (EIN).

Source: Mercury

As of August 2025, Mercury is available to companies based in the US, British Overseas Territories, UAE, Bahamas, Bermuda, Singapore, and Jersey. While Mercury is a fintech company, and not an FDIC-insured bank itself, it operates in partnership with regulated institutions, which hold the underlying licenses. Checking and savings accounts are provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC. Deposit insurance covers the failure of an insured bank. Checking and savings account deposits may be held by sweep network banks. Certain conditions must be satisfied for pass-through insurance to apply.

Mercury’s partners were selected for their strong financial standing, regulatory compliance, and willingness to support its fast-paced product development. Every Mercury account comes with read-and-write API access, which allows customers to build customizable automation. This can be used to carry out key banking and accounting activities such as creating dashboards, building custom sweep rules, reconciling transactions, querying account data, and programmatically initiating ACH payments.

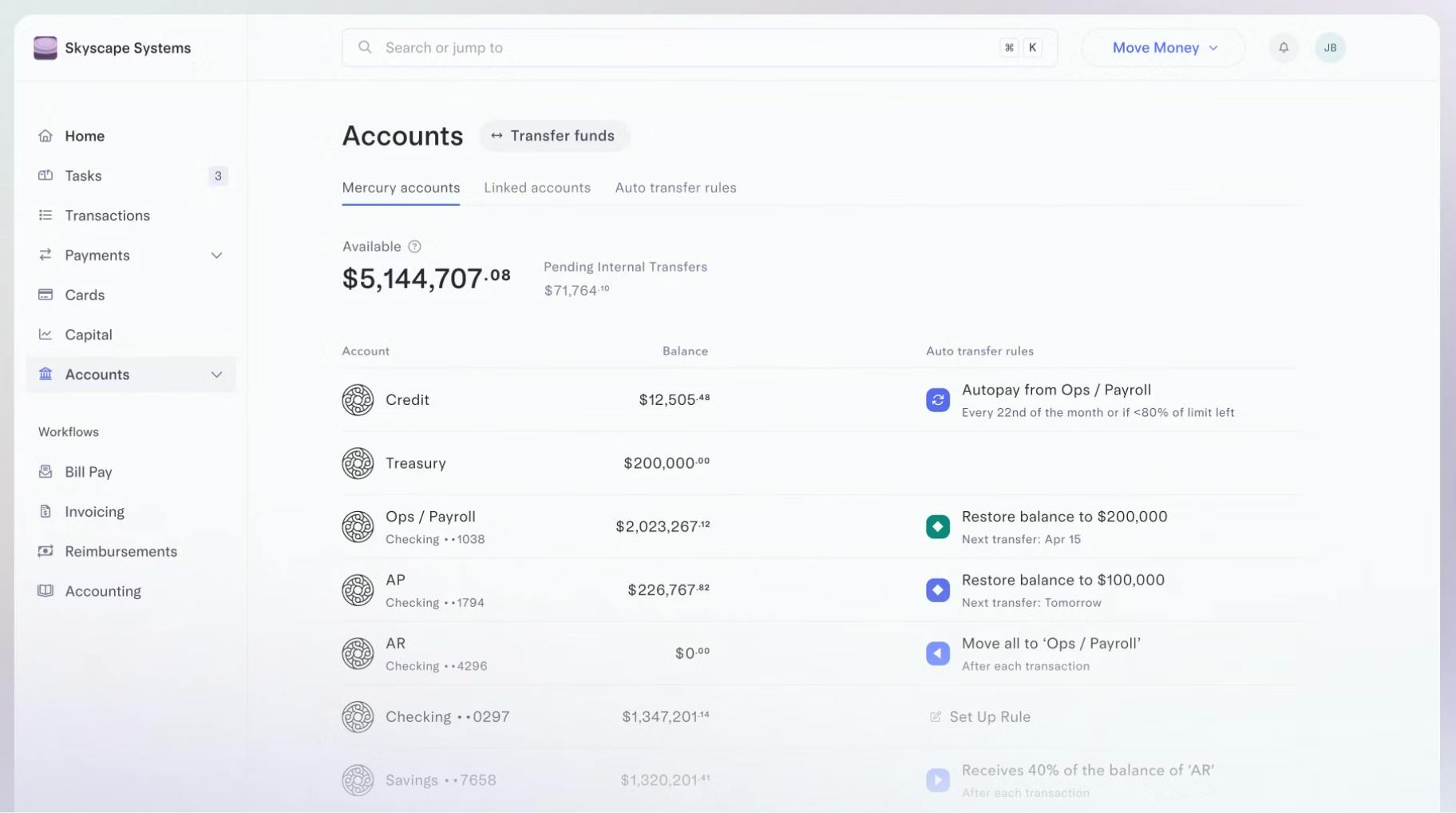

Treasury

Source: Mercury

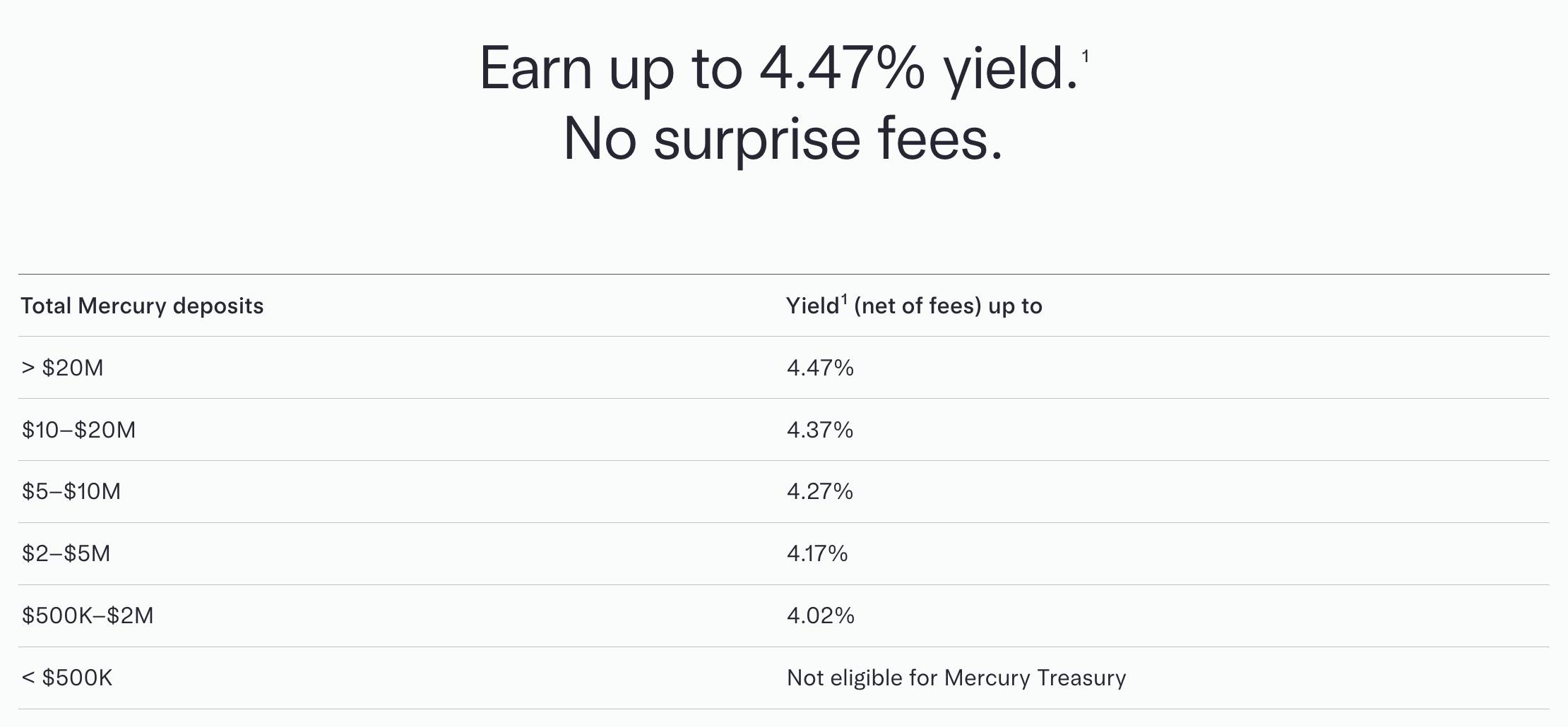

Mercury Treasury helps startups earn yield on idle cash while preserving liquidity and minimizing risk. As of April 2025, the net yield ranges from 4.02% to 4.47%, and the product is available to companies with at least $500K in deposits, offering access to low-risk, high-liquidity portfolios managed by J.P. Morgan and Morgan Stanley. Funds are held in the customer’s name, and Mercury enables same-day withdrawals and custom auto-transfer rules between operating and investment accounts.

For startups with over $25 million on deposit, Mercury offers a white-glove service through Mercury Treasury Solutions by Morgan Stanley, which provides personalized portfolio management and access to a wider range of short-term securities. Mercury charges no account opening, transaction, or minimum balance fees for Treasury. Instead, it collects a percentage of monthly Treasury balances, typically ranging from 0.15% to 0.60%.

Mercury Treasury is offered by Mercury Advisory, LLC, an SEC-registered investment adviser. This communication does not constitute an offer to sell or the solicitation of any offer to purchase any security. Funds in Mercury Treasury are subject to investment risks, including possible loss of the principal invested, and past performance is not indicative of future results. The company provides full disclosures on the product as well. Mercury Advisory is a wholly-owned subsidiary of Mercury Technologies. Mercury Treasury is not insured by the FDIC. Funds in Mercury Treasury are not deposits or other obligations of Choice Financial Group, Column N.A., or Evolve Bank & Trust, and are not guaranteed by Choice Financial Group, Column N.A., or Evolve Bank & Trust.

Financing Solutions

Source: Mercury

Mercury provides three financing tools tailored to the needs of startups and SMBs: IO credit cards, venture debt, and working capital loans. These offerings are designed to support cash flow, reduce dilution, and unlock runway without compromising financial control.

Credit Cards

The Mercury IO Mastercard offers a flexible credit line with no interest, no annual fees, and 1.5% cashback on all spending, automatically deposited into the customer’s account. Unlike traditional business cards that rely heavily on credit history, Mercury’s underwriting is based on real-time cash balances, allowing newer startups with minimal credit history to qualify with as little as $25K in deposits. Customers can issue unlimited virtual and physical cards, set merchant locks and spending limits, and sync transactions with accounting software like QuickBooks, Xero, and NetSuite. As of August 2025, the IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard. To receive cash back, customers’ Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.

Venture Debt

Mercury’s venture debt solution is designed for VC-backed companies seeking non-dilutive capital to extend their runway. Loans typically range from 30-50% of the most recent VC round and come with competitive rates, no prepayment penalties, and optional refinancing following future fundraising rounds. The application process is streamlined through Mercury’s dashboard and approved founders receive access to a dedicated capital advisor and relationship manager.

Mercury’s Venture Debt loans are originated from Mercury Lending, LLC (NMLS: 2606284) and serviced by Mercury Servicing, LLC (NMLS:2606285).

Working Capital

Focused on ecommerce brands, Mercury’s working capital loans are structured to help merchants scale inventory, marketing, and operations. Loans come with flat-fee pricing, fixed weekly repayment schedules, and no personal guarantees or collateral requirements. Unlike revenue-based financing models, Mercury’s fixed structure allows for clearer cash flow planning. Eligibility requires $250K in annual sales and at least 6 months of operating history, and each borrower is paired with an e-commerce lending specialist to help with growth planning and future capital needs.

Mercury’s Working Capital loans are originated from Mercury Lending, LLC (NMLS: 2606284) and serviced by Mercury Servicing, LLC (NMLS:2606285).

Financial Operations

Source: Mercury

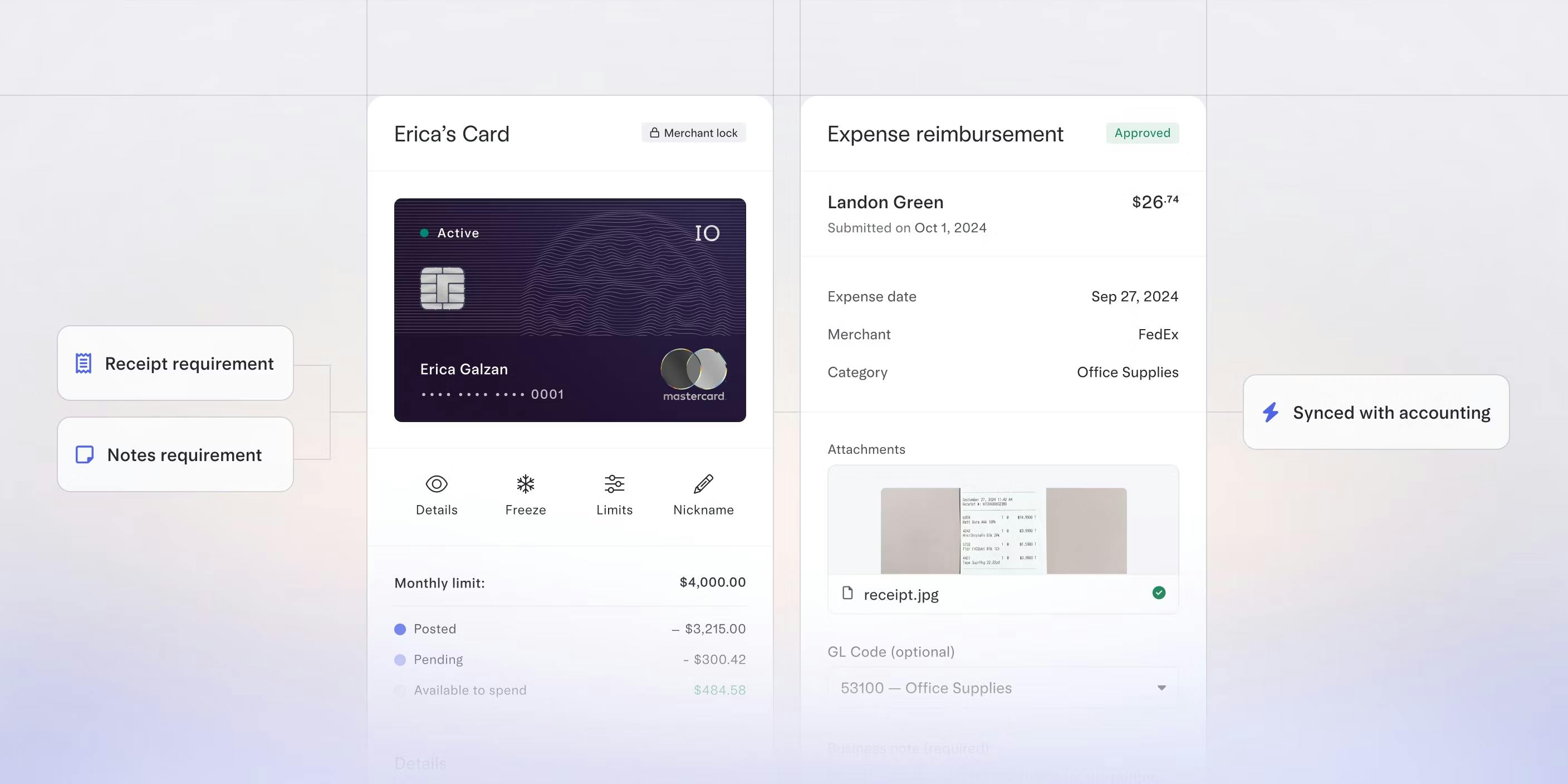

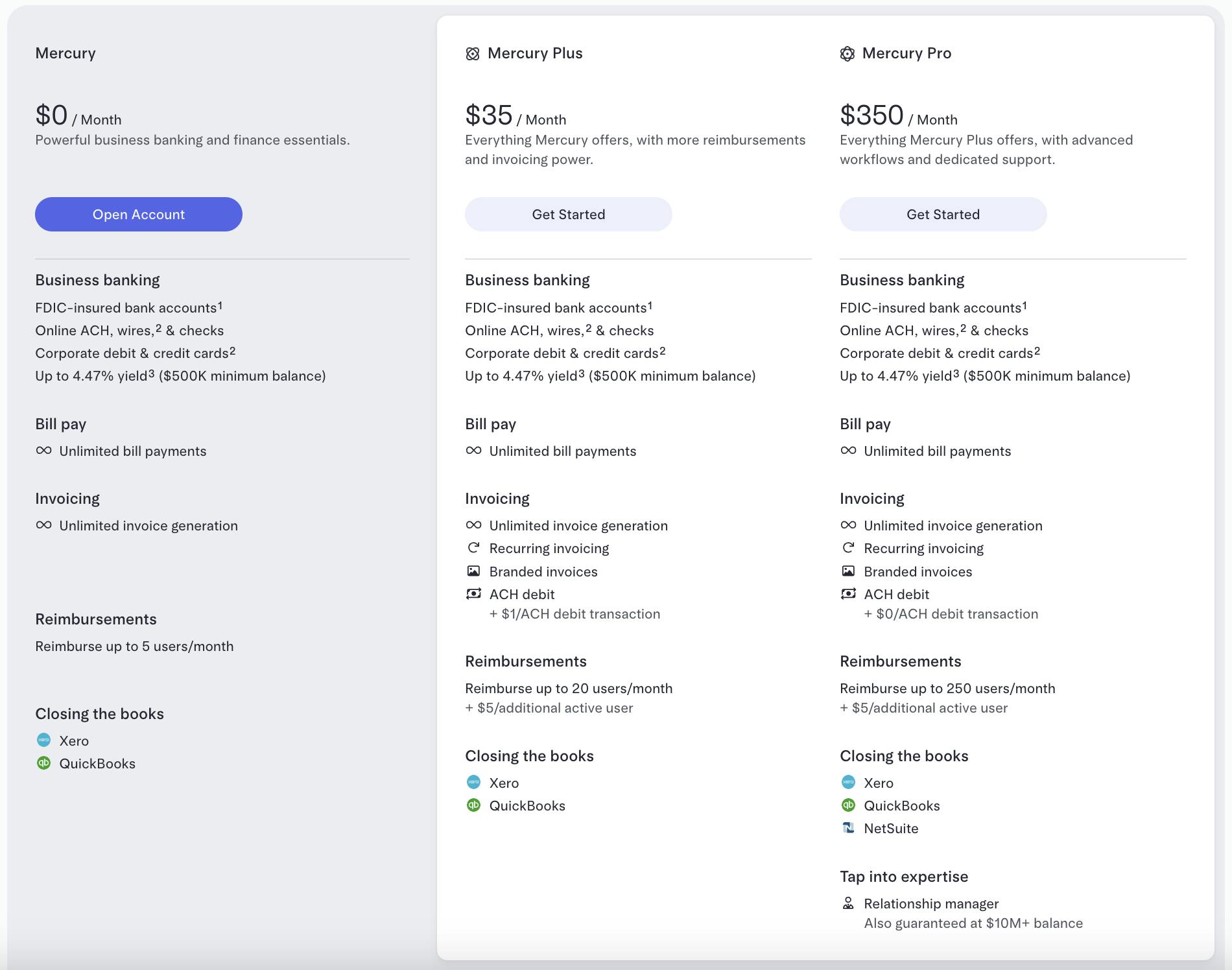

In 2024, Mercury expanded beyond core banking to launch a full suite of financial operations tools, including bill pay, invoicing, expense management, and accounting automations. These new capabilities bring Mercury into direct competition with fintech players like Ramp*, Brex, and Navan, offering startups an integrated back office stack directly within their bank.

Bill Pay

Mercury Bill Pay is an accounts payable tool that automates every step of paying vendors. Incoming invoices are automatically parsed using AI, deduplicated, and populated into a bill inbox sorted by status and due date. Admins can approve payments inside Slack or the Mercury app, set multilayered approval rules, and choose from ACH, wire, or check. Bill Pay also includes vendor management features and fraud controls such as whitelist-only payments and tax document collection. All bill data syncs directly to accounting software.

Invoicing

Mercury’s invoicing tool allows startups to generate branded invoices, track payments, and receive funds via ACH, credit card, Apple Pay, Google Pay, and more. Users can filter by invoice status, automate reminders, edit invoices post-send, and set up recurring billing. Payments are automatically matched to the correct invoices and synced to QuickBooks, NetSuite, or Xero. The core invoicing features are free, with advanced capabilities like custom branding and recurring invoices available on paid plans, starting at $29.90 per month.

Expense Management

Mercury combines corporate cards and reimbursements into a single employee expense platform. Admins can issue unlimited virtual and physical cards, set granular spend controls, require receipts, and earn 1.5% cashback. Employees can also submit out-of-pocket expenses via receipt scanning and receive reimbursements in a few clicks. Admins can flag out-of-policy expenses, assign user permissions, and integrate the system with HR/payroll tools. Reimbursements for up to five active users are free, with paid plans available for larger teams.

Accounting Automations

Mercury’s accounting suite reduces manual work by syncing bills, card transactions, expenses, and payments into popular accounting platforms. Teams can set custom rules for categorization, require receipts above certain thresholds, and automate reminders for employees. Finance leads and bookkeepers can review transaction coding before data is pushed into QuickBooks, NetSuite, or Xero. Additional features include bank statement sharing, tax document storage, and user-level access controls.

Personal Banking

Source: Banking Dive

In April 2024, Mercury expanded beyond business banking with the launch of Mercury Personal, a premium consumer offering designed for founders and investors who requested the same product functionality as they experienced in their business accounts.

Customers can set up high-yield savings accounts earning up to 5.00% APY, automate transfers between accounts, issue multiple debit cards with spending limits, and share access with others using customizable permissions. Personal accounts also benefit from up to $5M in FDIC insurance via Mercury’s partner banks and sweep network.

Rather than targeting the underbanked or high-net-worth segments served by most neobanks and private banks, Mercury is positioning Personal as a modern operating system for tech-forward individuals. The product is tailored for those who want full control over their finances without relying on in-branch visits or relationship managers.

Mercury Personal is priced at $240 per year and includes unlimited domestic wires, ACH transfers, ATM fee reimbursements, and no minimum balance requirements. It also allows users to seamlessly switch between their business and personal accounts under a single login.

Market

Customer

Mercury targets digital entrepreneurs — primarily startups, ecommerce companies, and professional services providers. Traditionally, banks have hesitated to bank or lend to startups because they were viewed as too risky. Before its collapse, nearly half of all startups in the US were banked by SVB, as they were unable to access credit cards or loans from other banks.

Even though Mercury started out servicing startups, they make up less than 40% of its customer base as of May 2024. Its second largest customer base consists of ecommerce companies, followed by accounting firms and VC funds. In April 2024, Mercury released its personal banking service in limited access, planning to roll it out for wider use by the end of 2025. Some of Mercury’s customers include Linear, Phantom, ElevenLabs, and Supabase. At the start of 2024, there were over 200K businesses using the bank.

Market Size

Mercury operates at the intersection of two markets: commercial banking and financial operations software. In 2019, Akhund stated that over 3 million businesses are created annually in the US, and banking those businesses is a $400 billion industry. In 2023, there were 5.5 million new business applications in the US, and every business needs a banking partner.

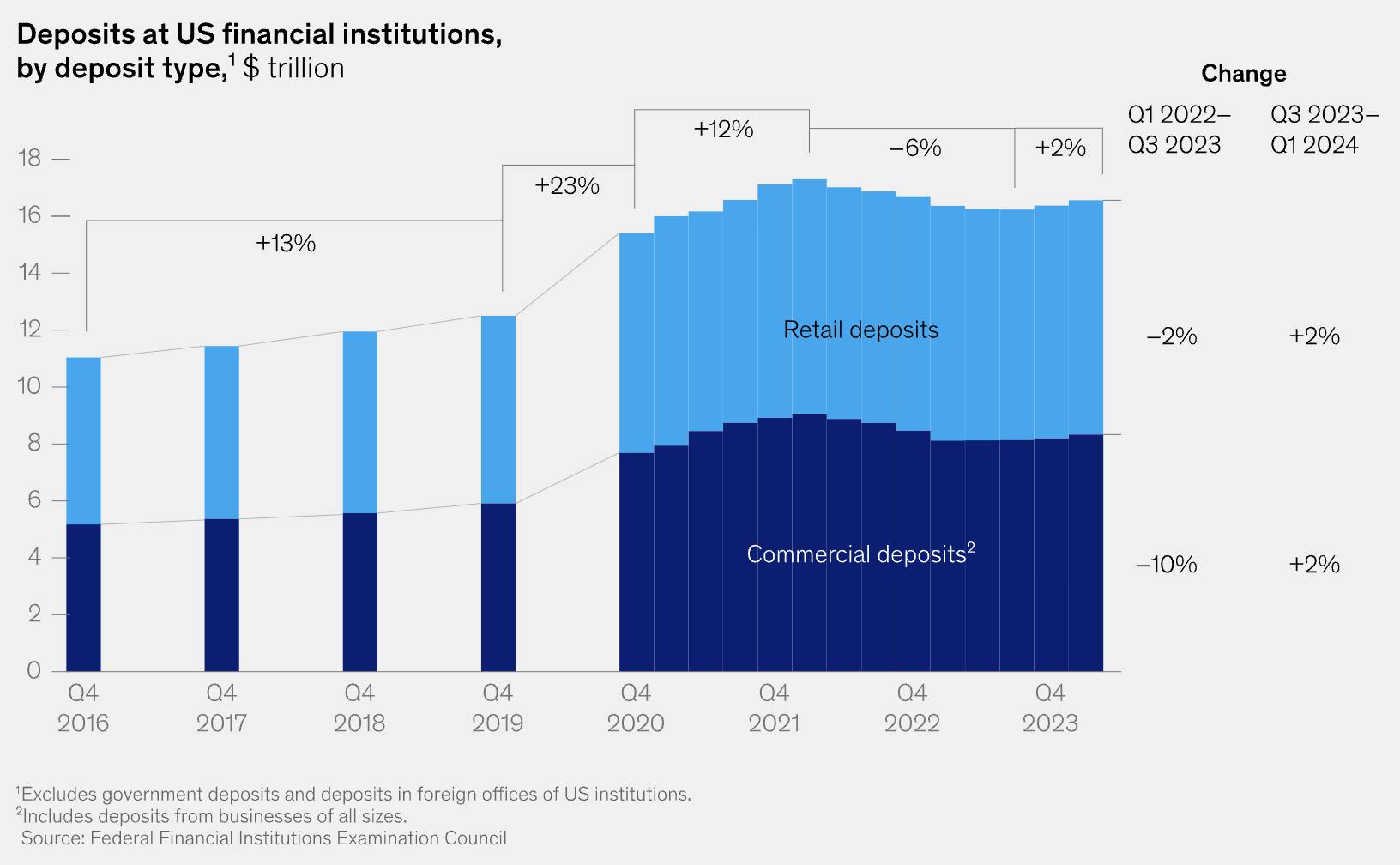

As of August 2025, customers held over $18 trillion in deposits at commercial banks in the US, divided equally between retail deposits and commercial deposits. Combined revenues of financial technology companies worldwide are projected to increase from $245 billion in 2023 to $1.5 trillion in 2030.

Source: McKinsey

Competition

Mercury competes across three fronts: neobanks, broader fintech platforms, and traditional incumbents. Players in each of these segments are positioning themselves as the financial operating systems for startups and SMBs.

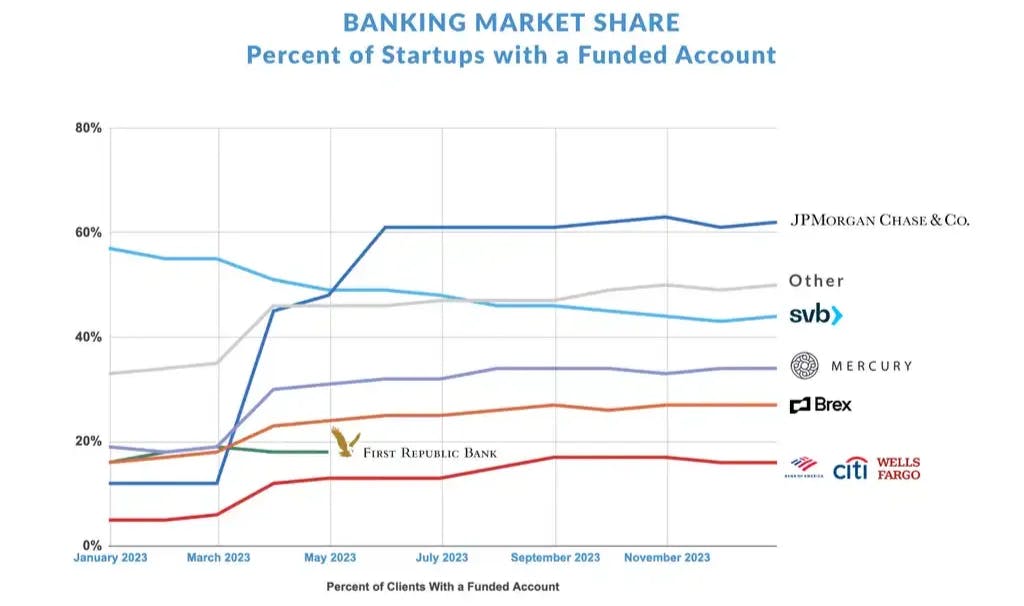

Source: Kruze Consulting

Startup Banks

Brex: Brex is a spend management platform founded in San Francisco, California in 2017, which launched a banking product as an adjacent offering to its core corporate card product. Brex was valued at $12.3 billion in January 2022 and has raised $1.5 billion in funding as of August 2025. In the aftermath of SVB’s collapse, Brex, like Mercury, experienced billions of dollars of deposit inflows. In one sampling of former SVB customers, an estimated ~9% opened a bank account with Brex in this period of time (this figure for Mercury in the same sample was ~20%). Brex uses JPMorgan and Column Bank as its partner banks, just as Mercury uses Choice Financial Group and Evolve Bank & Trust. As of August 2025, Brex has over 30K customers on its platform.

Novo: Novo is a digital banking platform for small business owners, entrepreneurs, and freelancers. It was founded in 2016 in Miami, Florida. Novo was valued at $700 million as of January 2022 and has raised $296 million in total funding. As part of its offering, Novo provides an app marketplace that lets small businesses customize their banking experience with dozens of native integrations. As of August 2025, Novo had over $30 billion in lifetime transactions and more than 250K customers.

Rho: Rho is a digital banking service for startups. It was founded in 2018 in New York, and has raised $194 million in total funding. It offers up to $75 million in deposit insurance through sweep networks, which is much more than most startup banking peers, including Mercury. However, unlike Mercury, it does not have a venture debt offering. Its annualized transaction volume grew from a little less than $2 billion in December 2020 to a cumulative volume of $3 billion in November 2021.

Fintech Platforms

Ramp*: Founded in 2019 in New York, Ramp* is a financial technology company that provides businesses with corporate cards and a financial platform to streamline expense management, bill payments, procurement, travel booking, and treasury services. In June 2025, Ramp raised a $200 million Series E round, followed by another $500 million round just 45 days later, raising its valuation to $22.5 billion. As of August 2025, Ramp had raised over $2.7 billion in funding. Unlike Mercury, which focuses primarily on banking services for startups, Ramp offers a broader suite of financial tools, positioning itself as a financial operations platform integrating on top of a bank.

Navan: Founded in 2015 in Palo Alto, California, Navan (formerly TripActions) is a travel, corporate card, and expense management platform that streamlines corporate travel bookings and automates expense reporting for businesses. As of August 2025, the company had raised $2.2 billion in funding and was valued at $9.2 billion in October 2022.

Rippling: Founded in 2016 in San Francisco, California, Rippling is a workforce management platform that integrates HR, IT, and finance operations into a single system, streamlining processes such as payroll, benefits administration, and expense tracking. Rippling has raised $2.4 billion from investors and was valued at $16.8 billion as of August 2025.

Incumbent Banks

Mercury competes with legacy banking giants like JPMorgan, Wells Fargo, Citibank, and Bank of America. This category includes regional banks that have focused on serving startups, such as Silicon Valley Bank and First Republic Bank.

Business Model

Mercury does not charge for account opening, maintenance, or overdrafts. Most core banking services, such as domestic wires, ACH transfers, and issuing multiple cards, are free for users. Mercury generates revenue across several channels, combining traditional banking economics with modern fintech monetization strategies. Its primary revenue sources include:

Interest on Deposits: Mercury shares in the interest earned on customer deposits through revenue-sharing agreements with its partner banks.

Interchange Fees: When customers use Mercury’s debit or IO credit cards, Mercury earns a percentage of the interchange fees charged to merchants by Visa and Mastercard.

Foreign Exchange & Wire Fees: Mercury charges a 1% fee on international wires and foreign currency exchanges.

Product Fees: Mercury earns fees from premium services like Mercury Treasury and Mercury Venture Debt — including origination fees, interest payments, and small equity warrants.

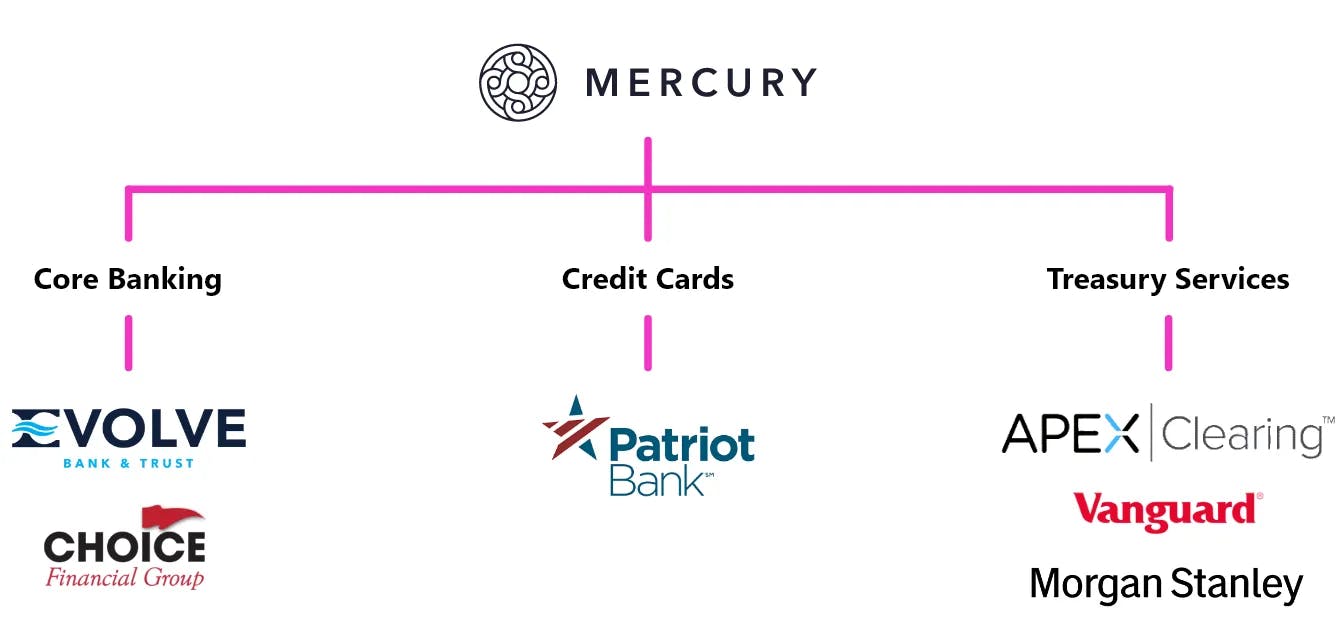

Source: Mercury

Mercury’s partner-based model allows it to operate as a financial technology platform rather than a licensed bank. Its services are built atop regulated financial institutions, enabling it to offer full-featured banking without holding a charter. Core business accounts are supported by Choice Financial Group and Column N.A., a bank founded by Plaid cofounder William Hockey, which now serve as Mercury’s primary banking partners. Mercury previously worked with Evolve Bank & Trust but began transitioning away in March 2025 following operational issues. Beyond core banking, Mercury partners with Patriot Bank to issue its IO credit card, and leverages Apex Clearing and Morgan Stanley to power cash management for its Treasury product.

Source: Fintech Blueprint

Most of Mercury’s growth has come through word of mouth — Mercury estimates that 60% of customer acquisition is organic. Moreover, it maintains strategic partnerships with over 500 venture firms, law firms, accountants, and startup service providers, including OnDeck, Kruze Consulting, and Orrick. These partners drive new business to Mercury via referrals, onboarding support, and co-marketing efforts, helping Mercury position itself as the default financial platform for startups.

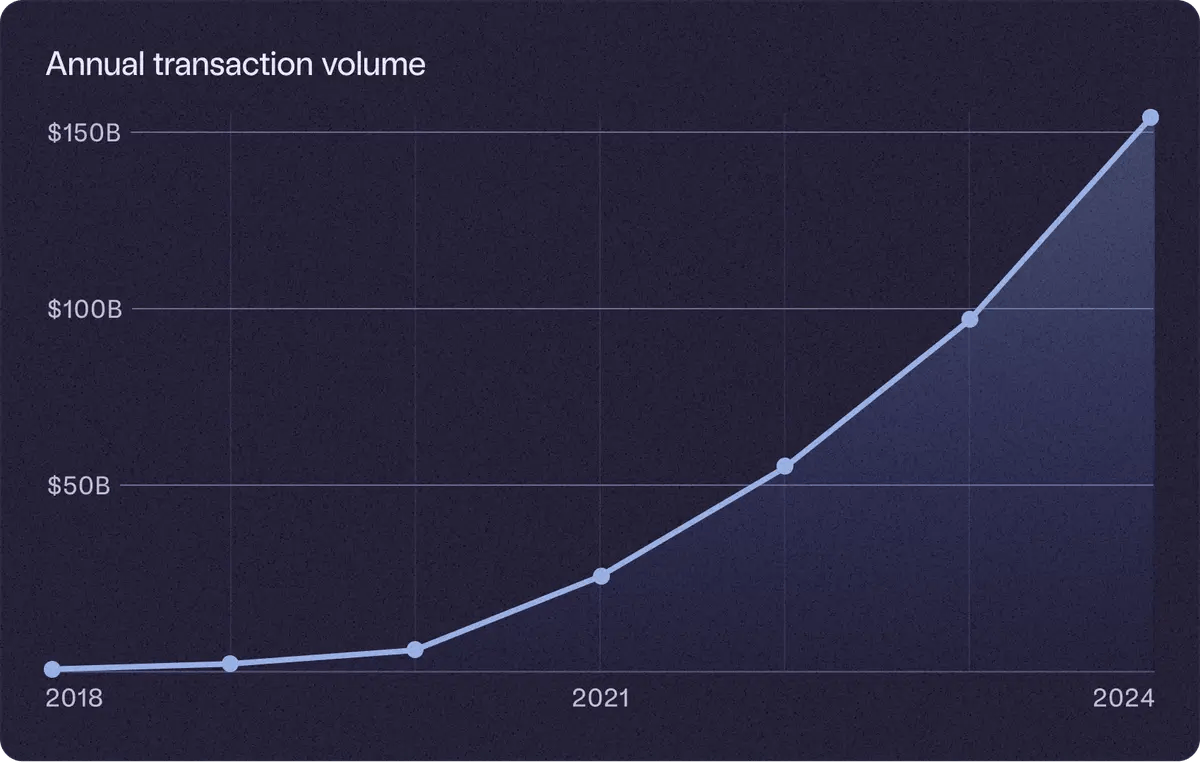

Traction

Mercury has emerged as a leading banking platform for startups, growing from 100K customers in early 2023 to over 200K by early 2025. In the aftermath of the March 2023 SVB crisis, it was estimated that ~20% of SVB customers opened a new account at Mercury. Akhund stated that in just 6 days after the SVB collapse, Mercury had added more than $2 billion in deposits and thousands of customers. During that stretch, Mercury experienced more signups in 2 days than it normally would have in a whole week. Additionally, Mercury saw a spike in interest and signups from VC funds that were looking to bank with Mercury after the SVB collapse.

In 2023, the company processed $95 billion in transactions, up from $50 billion in 2022, and grew that figure to $156 billion in 2024. Revenue reached $500 million in 2024, with profitability maintained since 2022. The company has also grown its headcount to 850 employees, with plans to surpass 1K employees in 2025.

Source: Mercury

Mercury’s Net Promoter Score (NPS) is reportedly above 80, compared to an average of 34 for traditional banks. It remains especially popular among early-stage founders. According to Kruze Consulting, nearly 40% of new startups choose Mercury as of March 2024, having trusted it with more than half of their total cash reserves. Among YC companies, more than 50% used Mercury in March 2023. In 2024, Mercury has been featured in the Forbes Fintech 50 list.

Valuation

In March 2025, Mercury raised a $300 million Series C round at a $3.5 billion post-money valuation — more than double its $1.6 billion valuation from its prior $120 million Series B in 2021. Its latest round was led by Sequoia Capital, with participation from existing investors Coatue, CRV, and Andreessen Horowitz, as well as new backers Spark Capital and Marathon. The raise brought Mercury’s total funding to $452 million.

Following its Series B round in July 2021, Mercury allowed customers to invest via the equity crowdfunding Wefunder. Mercury raised $5 million from 2.5K investors within 90 minutes on Wefunder, and the round reached $23 million in reservations over the next 9 days after the Wefunder launch. Akhund felt it made sense for Mercury customers to become owners of Mercury.

Key Opportunities

Financial Automation Tools

Senior leaders at Mercury have noted the opportunity to add adjacent offerings to the core banking platform. In 2023, Mercury’s VP of Finance Dan Kang has said that “there's so much value we can drive regarding workflow automation for accounting and finance teams. We want to give them back time.” In the following year, Mercury released its financial workflow suite, introducing Bill Pay, Invoicing, Expense Management and Accounting Automation products. Building offerings focused on workflow automation for accounting and finance processes could create more value for customers, entrench them deeper into the Mercury ecosystem, and drive more revenue. In the same way that other fintech companies see banking as a potential offering to build and attach to their core non-banking platforms, Mercury can expand from its core banking platform into other fintech services, and perhaps eventually become the single source of truth for all things finance and banking for its customers.

Personal Banking

In 2024, Mercury expanded beyond business accounts with the launch of Mercury Personal, a consumer banking product aimed at founders, investors, and operators. Priced at $240/year, Mercury Personal brings the same design philosophy and product quality from its business accounts to individual users. This move deepens Mercury’s relationship with its core audience, allowing it to serve the same user across both business and personal contexts. It also positions Mercury to capture high-income, tech-forward consumers who are underserved by legacy banks and unimpressed by consumer neobanks. Over time, this could open the door to new lines of business such as founder-focused lending, personal investing tools, or bundled business and personal financial services.

Becoming a Bank

In March 2025, Mercury announced it was cutting ties with longtime partner Evolve Bank & Trust, citing a string of operational issues. Going forward, Mercury will rely on Choice Financial Group and Column N.A. for new and migrated accounts. While the company has so far avoided becoming a licensed bank, this shift highlights the fragility of relying on partner institutions and raises the question of whether Mercury should pursue its own banking charter.

Becoming a bank would give Mercury full control over customer experience, compliance, and product velocity. It would also reduce exposure to third-party risk and improve unit economics by eliminating revenue sharing with partner banks. The trade-off is a higher regulatory burden and slower iteration cycles. But as Mercury scales toward becoming a financial system of record for startups and founders, owning its own banking infrastructure could become a strategic necessity.

Key Risks

Deteriorating Trust in Smaller Banks

As a result of the SVB collapse, smaller banks are losing deposits as depositors flee to safety in larger, systemically important banks that could be more resilient to any bank run risks. The 25 biggest US banks gained $120 billion in deposits in the days after SVB collapsed. All the US banks below that level lost $108 billion over the same period. It was the largest weekly decline for the smaller banks’ deposits. Though Mercury has benefited from this, it still is a much smaller, much younger banking provider (and so are the two banks that Mercury partners with) than the legacy incumbents, and it remains to be seen whether Mercury can result in the long-term buck the trend of smaller banks losing trust. The balance sheets of Mercury’s partner banks Column N.A. and Choice Financial Group are weaker than the balance sheets of giants like JP Morgan, which famously has a “fortress balance sheet.” In late 2022, multiple VC funds including Sequoia Capital and Craft Ventures have advised startups to move funds away from Evolve-backed platforms, which resulted in about $200 million of deposits moving off of Mercury.

Graduation Risk

Mercury may face the risk of their customers graduating to more established banks like JP Morgan or Bank of America as they mature and grow in size. As startups grow and become more established, they may need more specialized services, such as international banking or investment management, that Mercury may not be as well-equipped to provide as larger, older banks are. Established banks like JP Morgan have larger networks, resources, and additional services that may be more appealing to startups as they grow into larger companies with more needs. This need for additional resources and services beyond what Mercury offers, but within the realm of what a big bank like JP Morgan can offer, has been cited by customers as a feature request — one Mercury customer noted that while they see Mercury as a 10 out of 10 product experience, it lacks some of the “ancillary personal services” like founder lending. It also lacks a proactive, high-touch networking service that can help with fundraising.

Moreover, Mercury's customers may be more likely to switch to a larger, more established bank due to concerns about the stability of a startup bank, especially in light of the SVB crisis. Startups may prefer to move to larger banks that have a more proven track record of stability and reliability as soon as these startups grow to the size such that those large banks are ready and willing to bank them. This risk stems from one of Mercury’s value propositions — that it makes it easy for startups to get bank accounts when they are small and thus cannot easily obtain bank accounts at established banking institutions. Mercury's growth prospects may be limited if many of its customers do end up graduating to larger banks.

Summary

Mercury was founded to solve a long-standing gap in business banking: traditional banks have failed to meet the needs of startups. By combining a tech-forward interface with streamlined onboarding and thoughtful features like treasury management, startup financing solutions, and financial automation, Mercury has scaled to serve over 200K businesses in 2024. The collapse of SVB accelerated its rise, positioning Mercury as a new default for early-stage companies. Today, Mercury is extending its ambitions beyond startups, expanding into personal banking. The challenge ahead lies in defending against incumbents and all-in-one fintech platforms, retaining customers as they scale, and building trust at a time when smaller financial institutions face growing scrutiny.