Thesis

Traditional inbound recruitment, where companies wait for candidates to apply for open jobs listed on various job boards and their websites, can be contrasted with a more proactive strategy of directly identifying and reaching out to desirable talent. Proactive recruitment may become a bigger part of the future of recruitment; as much as 70% of the global workforce are passive candidates who aren’t actively looking for new work but would be willing to change jobs for the right opportunity.

After a macroeconomic downturn in 2022, layoffs began to impact the labor market. The tech industry alone saw more than 240K layoffs in 2023. A cooling job market across the economy led to the jobless rate reaching a two-year high in October 2023, and some economists anticipated that "softening labor demand will remain a theme moving forward." With an increasing number of job-seekers on the market, outbound recruiting remains an important tool for hiring top talent. It continues to require precision and targeting candidates in an informed way.

However, the proactive recruiting approach creates significant operational challenges. Individual recruiters shoulder multiple responsibilities, like aggregating vast amounts of candidate data from various sources like job networks, maintaining ongoing connections with each candidate throughout the hiring pipeline, and fulfilling the needs of hiring managers and teams. As such, a new market has emerged for recruiting software that automates the process of outreach, centralizes candidate data, and manages applicant tracking.

Gem, which describes itself as a “Salesforce for hiring”, is a talent acquisition platform that seeks to streamline the hiring process by aggregating data, automating outreach, and tracking candidate interaction. It offers both a candidate relationship management (CRM) tool and a centralized applicant tracking system (ATS), with a range of integrations with other recruiting software and job networks like LinkedIn.

Founding Story

Source: Gem

Gem was founded in 2017 by Steve Bartel (CEO) and Nick Bushak (CTO). Before founding Gem, Bartel worked as an engineering manager at Dropbox, and Bushak was an engineering manager at Facebook (now Meta).

Bartel and Bushak first met as undergrads at MIT. As engineering managers at their respective companies, both men were responsible for hiring decisions. Bartel found that he spent a significant amount of his time at Dropbox focused on recruitment, and Bushak was dealing with similar challenges at Facebook. During Bartel’s stint at Dropbox, the company was expanding rapidly, and there were few effective ways to track promising candidates besides manually maintained spreadsheets. Strong candidates with whom Dropbox and its engineers wanted to keep in touch were dubbed “gems”.

In the 2010s, the recruiting industry embraced a more proactive strategy for candidate sourcing, focusing more on directly finding and engaging potential hires instead of waiting for applications. This operational model was in part supported by the increasing popularity of professional networks like LinkedIn, which made it possible to keep track of candidates as they moved in and out of jobs and developed their skills.

Bartel described this new recruitment model this way:

“What folks have realized is that you just can't hire enough of the right people by sitting around and waiting for them to apply. I think organizations are competing harder than ever for the right talent [and] recruiting is starting to look a lot more like sales and marketing, where companies are taking a more proactive approach and engaging with passive talent rather than waiting for them to apply.”

Bartel and Bushak identified that, while LinkedIn was a useful database of potential talent and that platforms like Workday could manage employees once they were hired, there was an opening in the middle for software that could build relationships with job candidates over time. Bushak had worked with Facebook’s internal recruitment software, but he understood most companies would not have access to similar resources.

Bartel left Dropbox in 2015 and was soon followed by Bushak, who left Facebook in 2017. In 2017, the pair founded Gem under its original name, ZenSourcer. The nascent company was accepted into Y Combinator as part of the Summer 2017 batch. Although it was originally focused specifically on candidate sourcing, after rebranding as Gem in 2019 it began to describe its product as a “candidate relationship manager” which helps companies find, track, and nurture passive talent.

Product

Recruiting CRM

Source: Gem

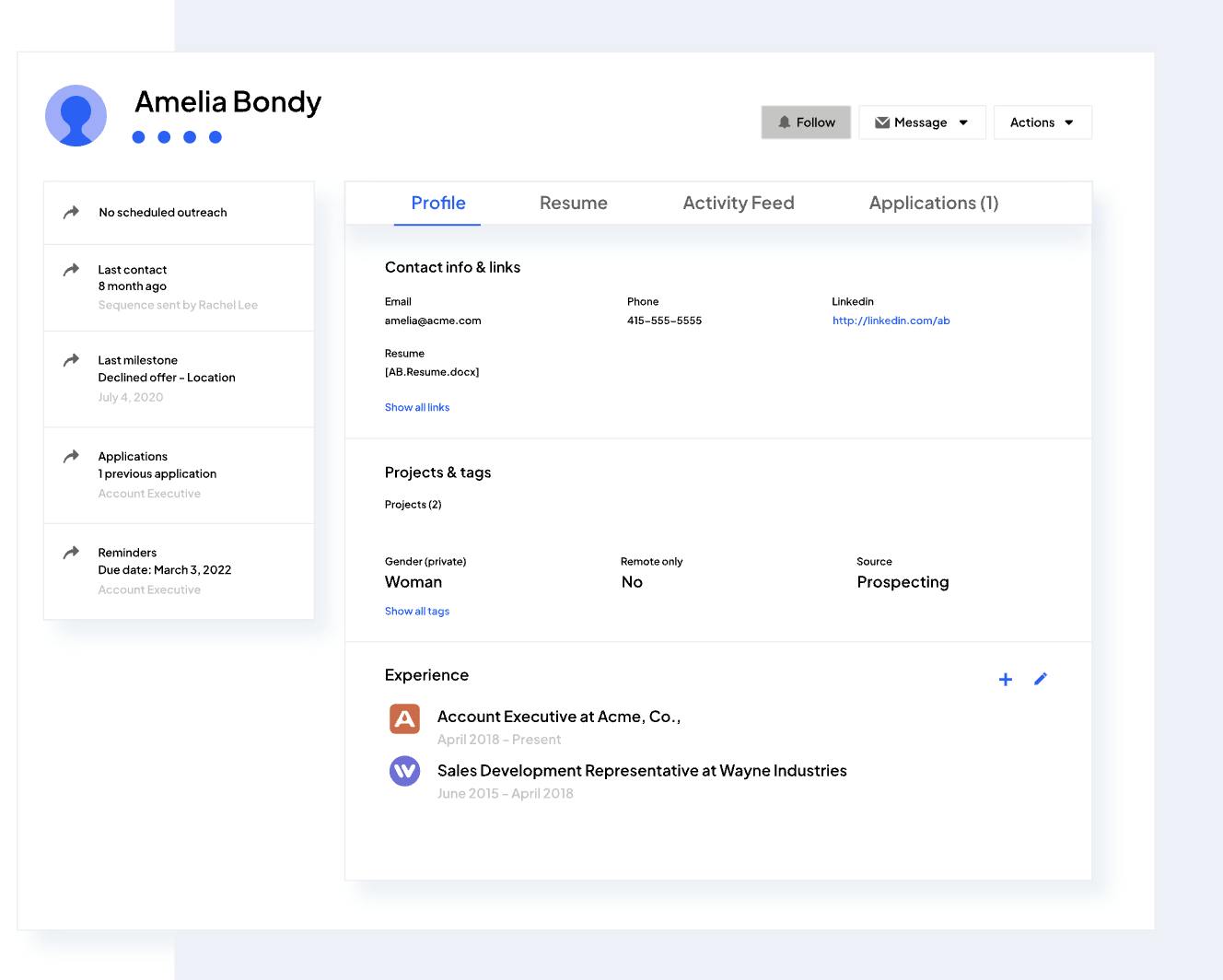

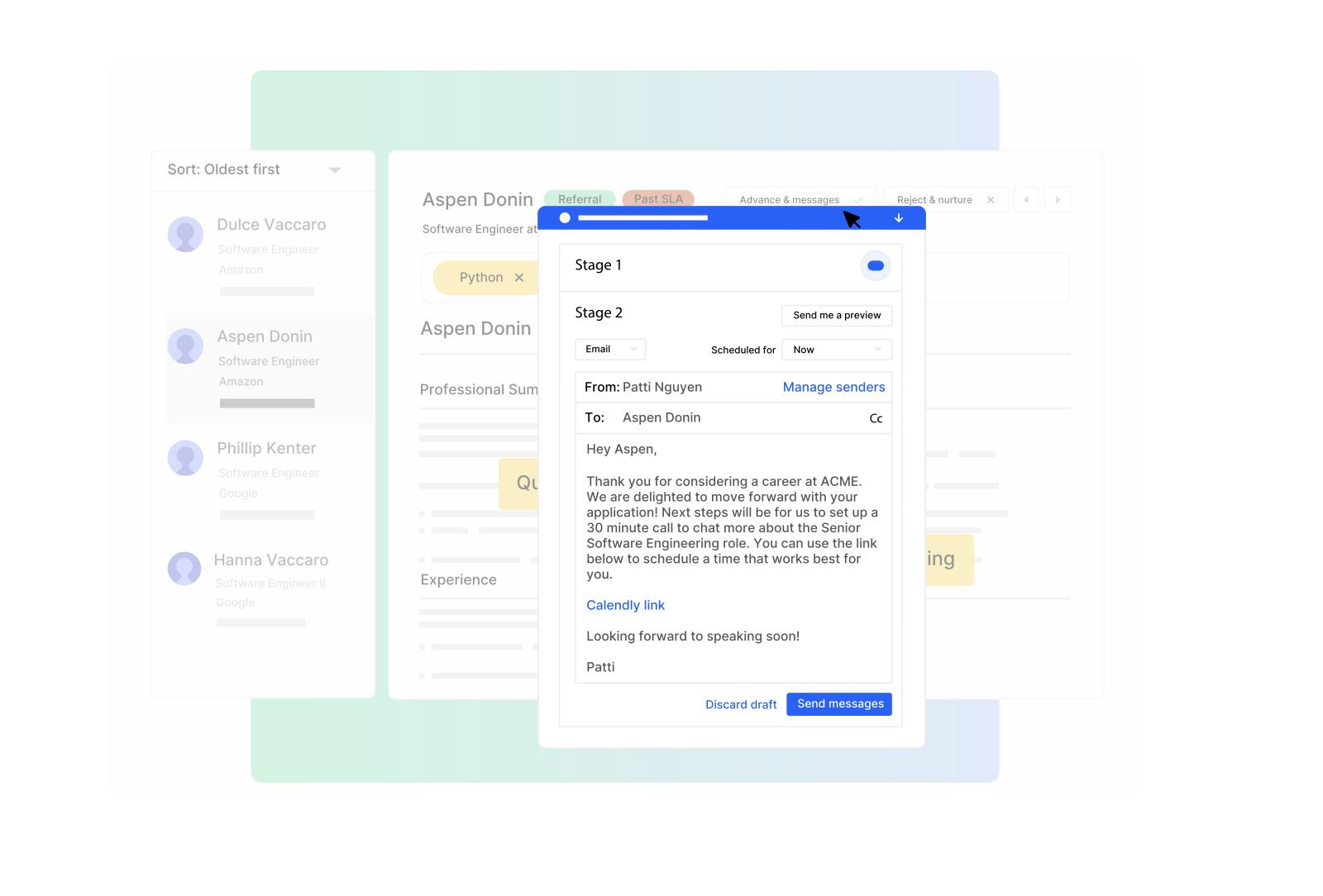

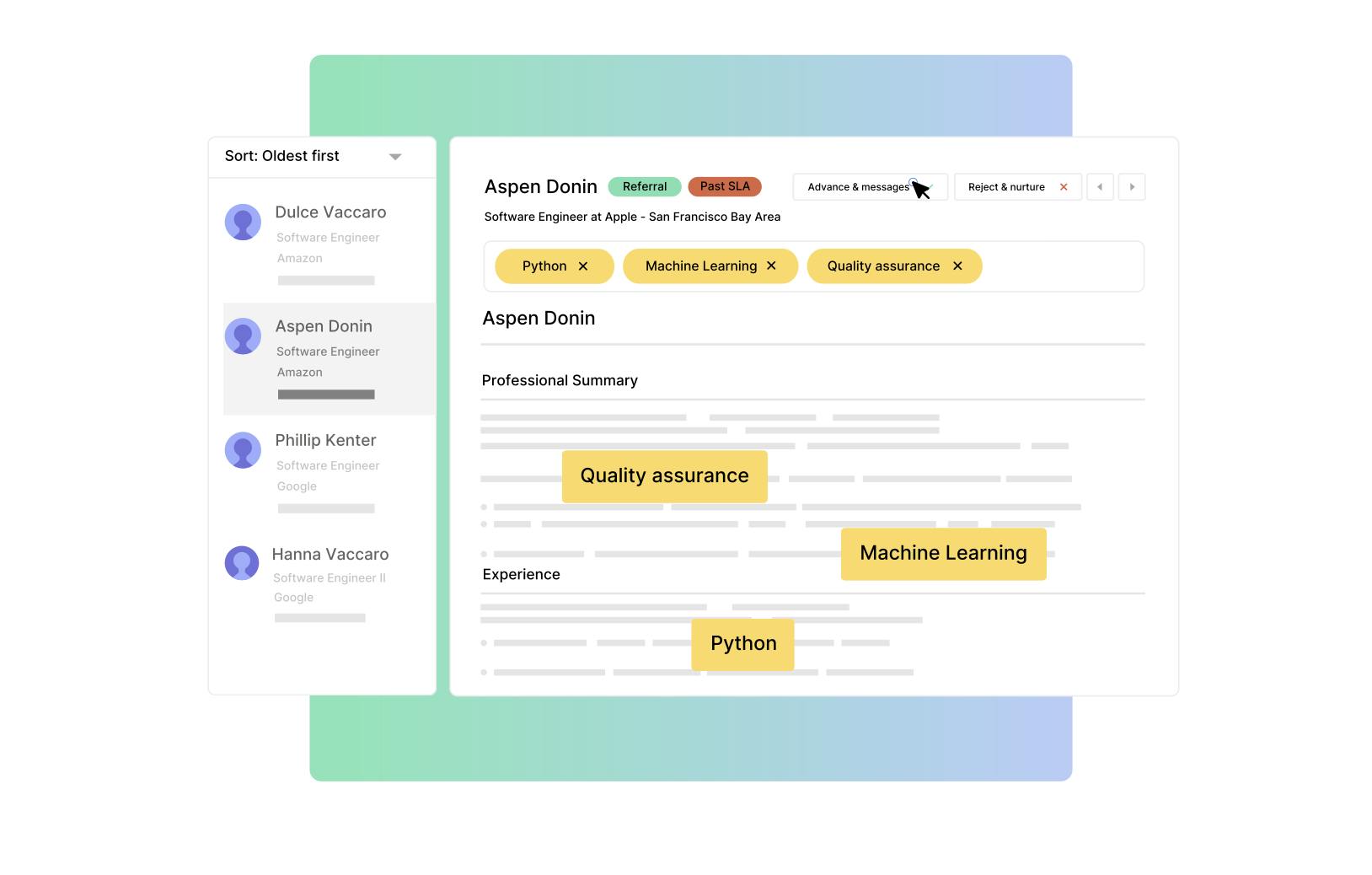

Gem’s candidate relationship manager (CRM) unifies touchpoints across recruiting and communication platforms employed by the user, allowing teams to visualize the candidate journey, personalize experiences, and build talent pools. As of December 2023, Gem integrates with 18 applicant tracking systems (ATS), each of which can be used to gather data on a candidate.

Within Gem’s CRM, each candidate profile has a list of past interactions, relevant skills, career updates, previous job applications, and personal information, giving recruiters context regarding their relationship with the applicant. Data from any of the applicant tracking systems or Gem’s other tools is automatically synced with Gem’s CRM, allowing recruiters to both capture and retrieve data on demand. Recruiters can search within Gem’s CRM to engage and re-engage with candidates and track their career trajectory across job changes and other milestones.

Sourcing & Recruiting

Source: Gem

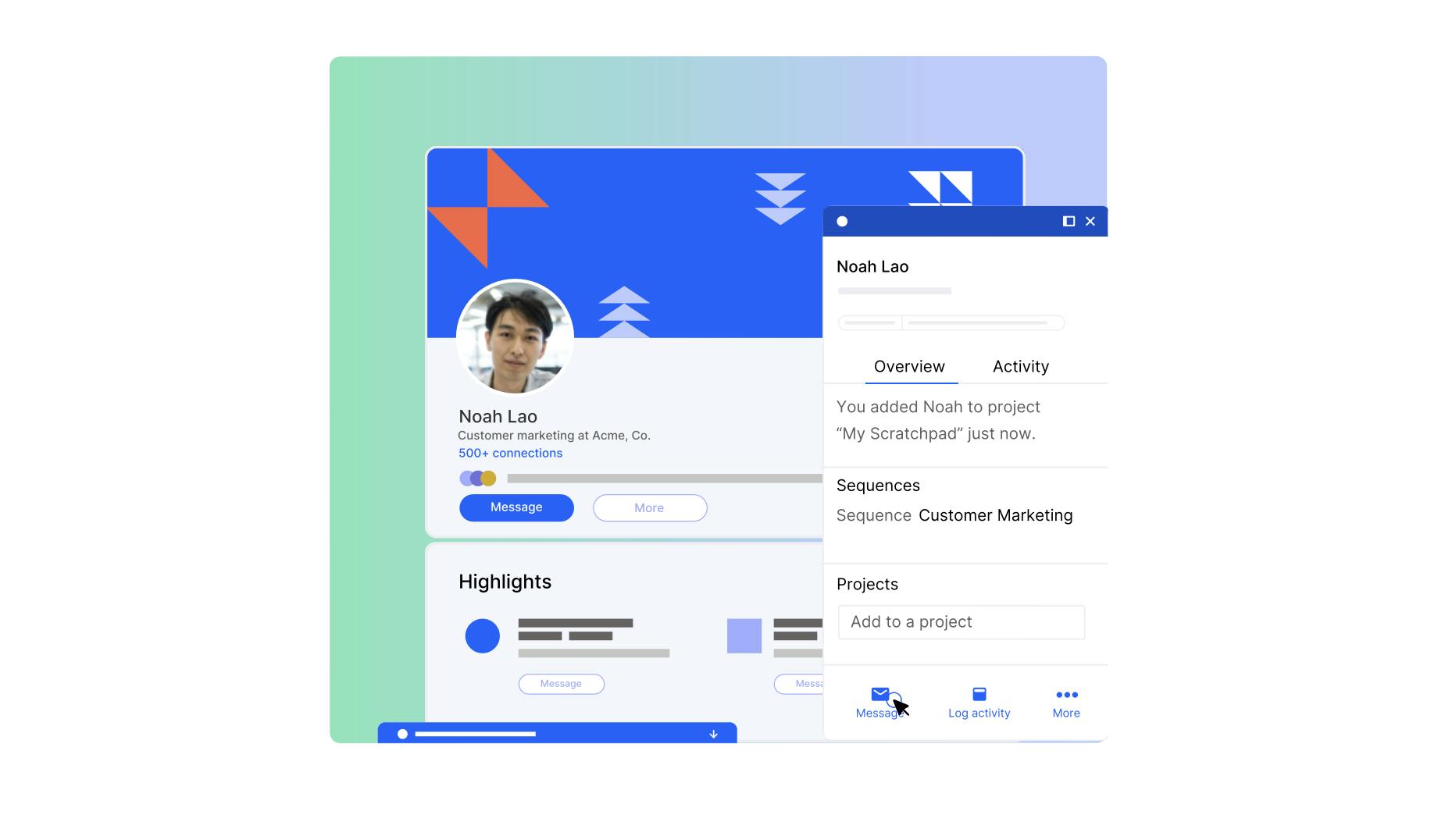

Gem's sourcing and recruiting offering is an AI-powered platform designed to enhance recruiter efficiency. The platform enables personalized and automated outreach across multiple channels. The company claims its platform saves recruiters 1-3 hours per day in talent sourcing. It tracks candidate interactions from multiple sources for personalized communication and uses advanced filters for efficient application review. Gem provides interactive dashboards for hiring manager collaboration and accountability, streamlining the recruitment process. As of December 2023, Gem integrates with 20+ sourcing platforms.

Talent Compass

Source: Gem

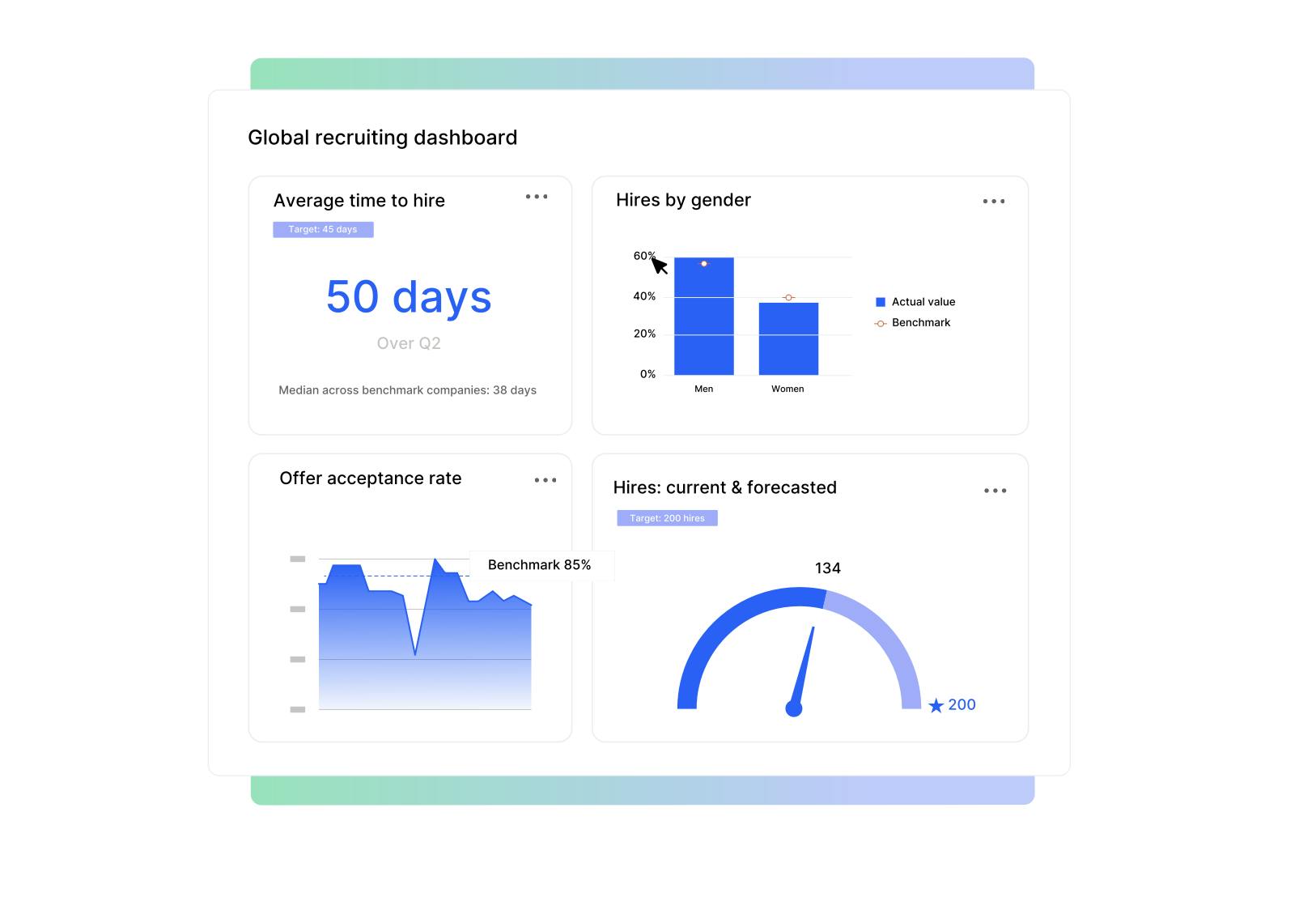

Gem’s Talent Compass is a simplified view for recruiters to analyze performance, allowing teams to strategically allocate resources. It includes two-way ATS integration, reporting, and benchmarking against industry peers. The platform allows for standardized reporting with customizable templates and enables strategic recruiting conversations through its analytics interface. It visualizes the recruiting funnel to improve candidate pass-through and uses forecasting models for hiring goals. The system supports diversity recruiting strategies with predictive analytics and offers insights into resource allocation.

Users can view their entire talent pipeline at a glance using the Talent Compass’s Pipeline Analytics tool, which gives recruiters a full-funnel view of their hiring campaign. Key data points displayed in this view include stage outcomes, total applicant volume, and average time-to-hire.

Talent Marketing

Source: Gem

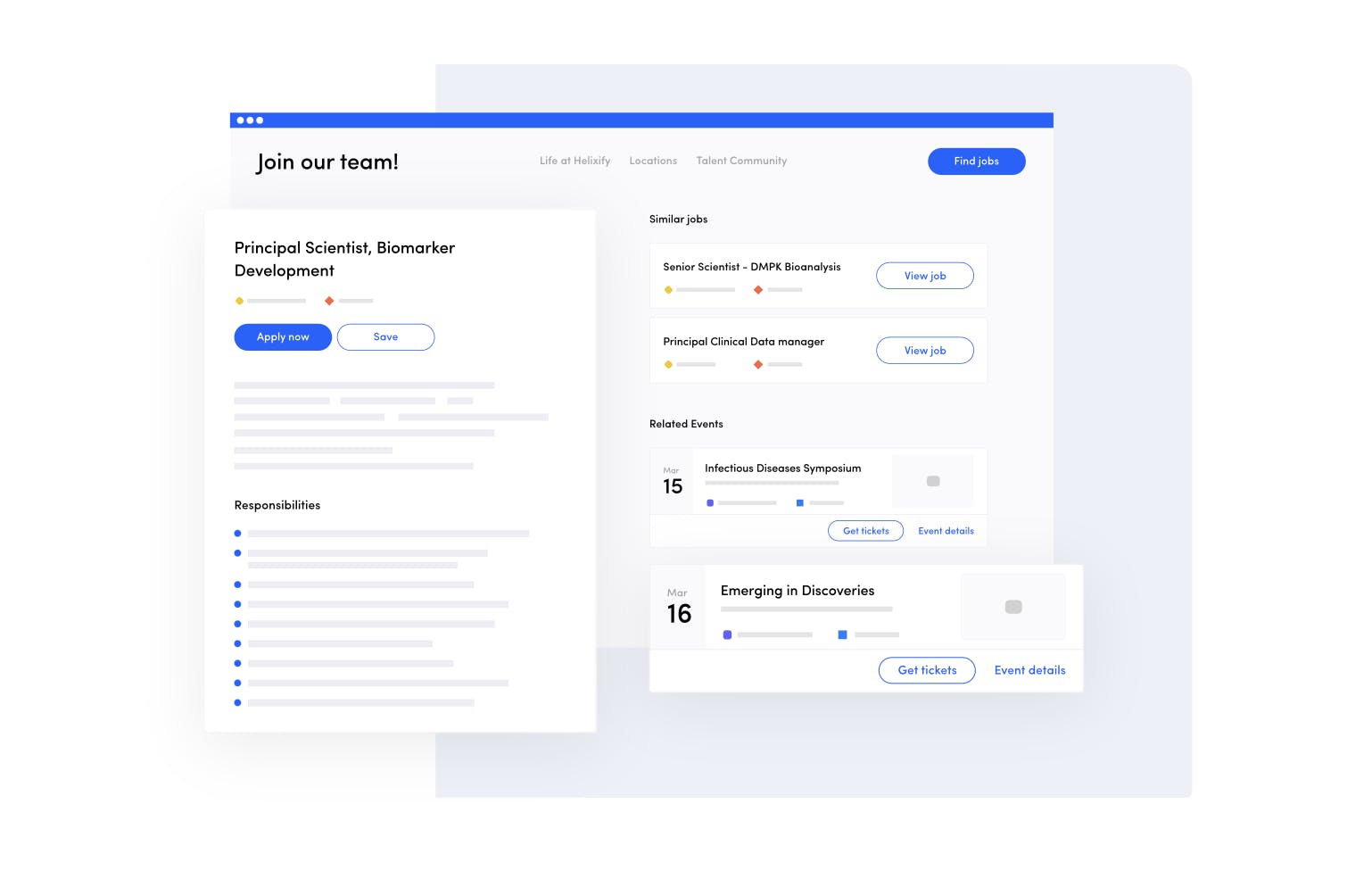

Gem's Talent Marketing offering provides a platform for recruitment marketing, including career sites, landing pages, event management, and branded campaigns. It streamlines content creation for talent acquisition teams, reducing dependence on marketing and IT departments. It also provides analytics to connect marketing efforts with recruitment outcomes and features an interface for designing content. Users can execute marketing strategies across multiple channels from Gem’s central platform, allowing them to manage branding and employer messaging in one location. Meanwhile, recruiters can optimize their marketing strategies using consolidated data, which includes click rates, stage-specific analytics, and comparisons across different campaigns.

Gem ATS

Source: Gem

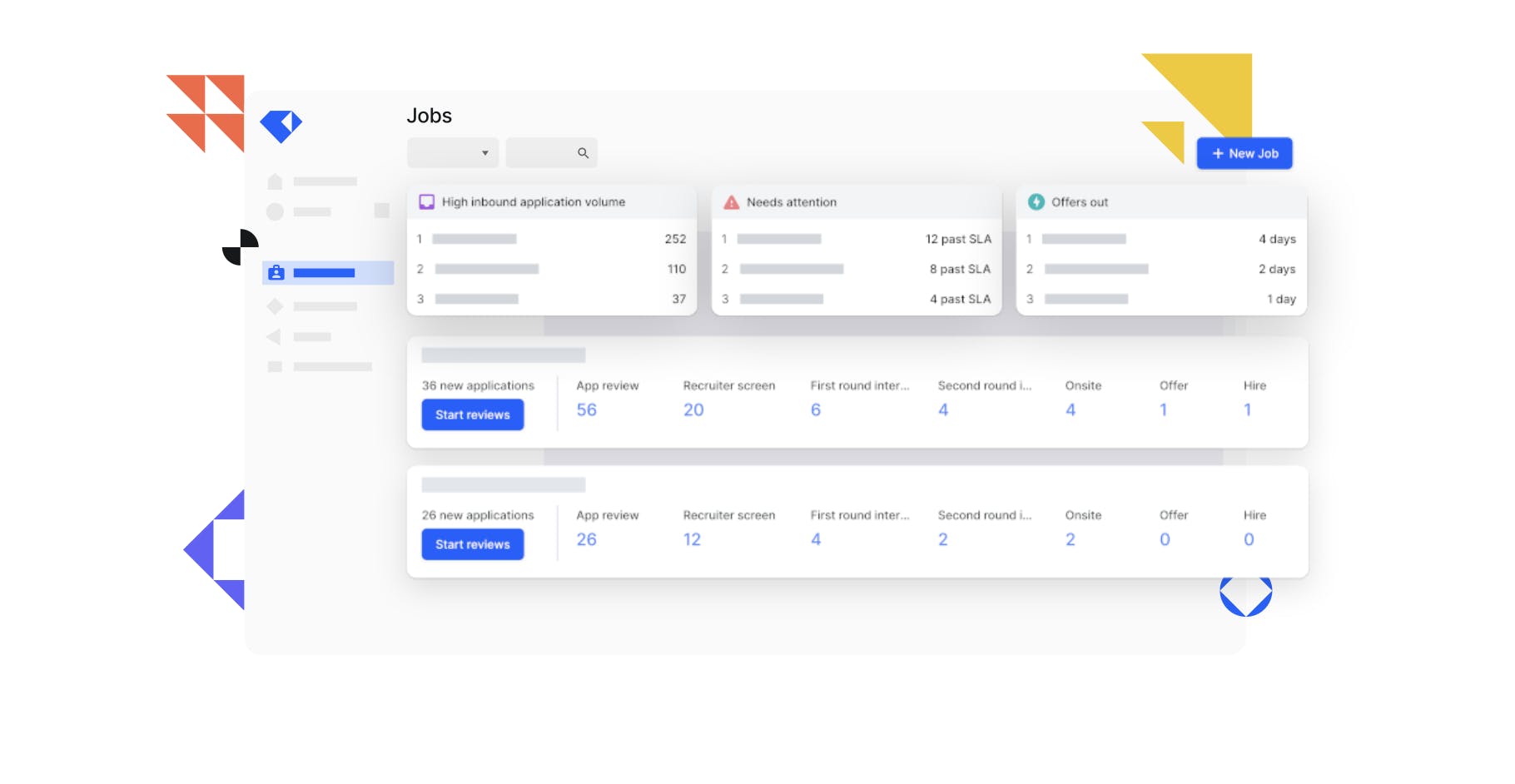

Gem's Applicant Tracking System (ATS) is an integrated hiring platform that includes sourcing, CRM, and analytics tools. The system supports scalable recruitment processes for both startups and large enterprises. It automates and personalizes candidate outreach, speeds up the review of inbound applications with advanced filters, and provides analytics for optimizing recruiting strategies.

Inbound Application Review

Source: Gem

Gem's Application Review solution streamlines the process of reviewing inbound job applications. It provides filtering options and bulk actions to quickly sift through unqualified candidates. Recruiters can gather context on potential talent from social networks and past interactions. The system highlights resume keywords, organizes applicant queues, and supports building talent pipelines for future job openings.

Talent Pipeline

Source: Gem

Gem’s Talent Pipeline allows recruiters to manage all active candidates and their inbound applications. As of December 2023, it is only compatible with the Greenhouse ATS, though it still provides context from other external sources feeding into Gem’s CRM. Within the Talent Pipeline tool, users can view candidates in one of two ways:

Active: This view allows recruiters to see candidates across different Greenhouse jobs, separated into different hiring stages.

Consolidated: The consolidated view hones in on the jobs specific to the user’s hiring team as opposed to a role-by-role view.

Gem’s Talent Pipeline allows recruiters and hiring managers to meet their service level agreements (SLAs). It offers built-in status and SLA indicators that update according to time-sensitive metrics, allowing users to prioritize their hiring efforts accordingly. To meet deadlines, Gem offers automated applicant filters and templated emails, all synced with the ATS.

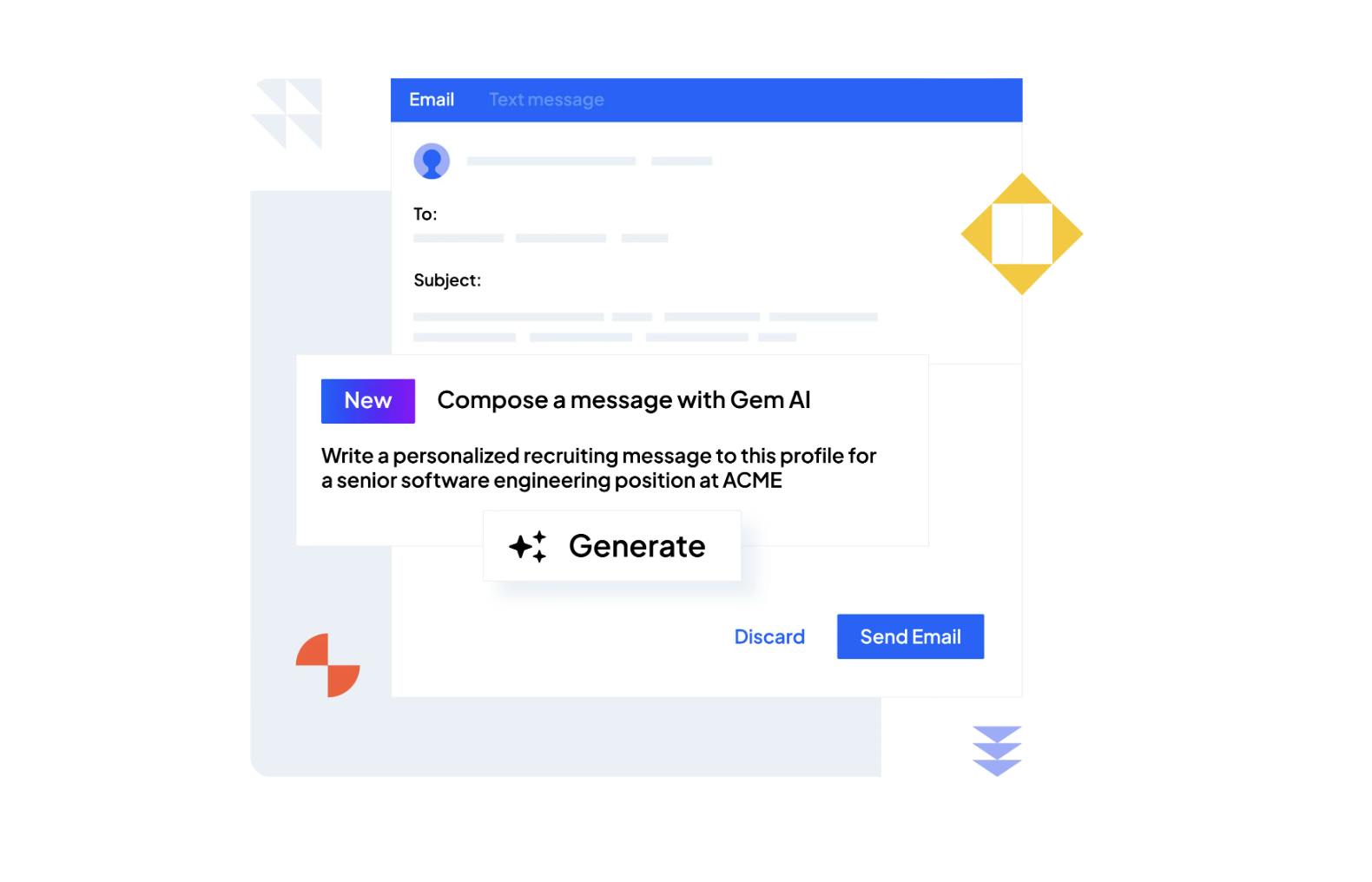

Gem AI

Source: Gem

Gem uses generative AI to identify valuable candidates, personalize communications, and hire talent. Its matching engine identifies talent that is similar to a customer’s top candidates and conducts analysis to find those most likely to be open to a job offer. The system auto-generates outreach messages to potential talent based on their attributes and profile signals. The company claims that customers using Gem AI experience a boost in conversion rates of up to 50%. Gem says that no final decisions are made automatically by AI, which it describes as a protective measure to prevent “potential bias and regulatory scrutiny”.

Market

Customer

Gem’s target customer segment includes businesses seeking to quickly and efficiently fill open positions. Gem serves both startups and larger enterprises, and is used by over 1.2K companies as of December 2023. Notable customers include Databricks, Robinhood, Reddit, Unity, Twilio, Stripe, Toast, Dropbox, and Airbnb.

Source: Gem

Market Size

In April 2023, it was estimated there were 33.2 million small businesses in the US, representing 99.9% of total businesses. Of those businesses, 20% have more than one employee. There were 5.9 million hires across the US in October 2023 alone, and 8.7 million job openings. The Bureau of Labor Statistics projects that the US economy will add 4.7 million jobs between 2023 and 2032.

Since its Series C, Gem has also pursued international expansion. Should Gem continue to expand into Western Europe and East Asia, geographies representing 26.3 million and 71 million micro, small, and medium-sized enterprises (MSMEs) respectively, could gain access to a significantly larger global market.

As a result of increased competition for talent, the market for end-to-end recruiting has begun to develop rapidly. In 2022, the online recruitment technology market was valued at $10 billion globally and is projected to grow to $30.9 billion by 2030.

Competition

Gem’s competition can be separated into two categories: direct competitors in the form of talent acquisition companies, and indirect competition from professional networking platforms and job marketplaces.

Talent Acquisition

SeekOut: SeekOut, founded in 2016, provides a software platform offering talent acquisition, management, and analytics. Like Gem, SeekOut aims to bring the various functions required for the talent pipeline into a single platform. It also offers a range of integrations with external data sources and an AI engine for surfacing talent insights. SeekOut has raised a total of $188.6 million and was last valued at $1.2 billion in January 2022. It reports having over 1K customers as of December 2023.

Lever: Founded in San Francisco in 2012, Lever is a talent acquisition company that provides centralized candidate CRM/ATS solutions. It was accepted into Y Combinator’s Summer 2012 batch and over the next decade, it raised $122.8 million before being acquired by Employ Inc. in August 2022. Like Gem, Lever implements many cross-platform integrations to collect and aggregate candidate data into its talent CRM. Its software is significantly broader than Gem’s, with 300+ product integrations including Slack, Oracle HCM, and DocuSign. As of December 2023, it has over 5K customers, with clients including Netflix, Fullstack Labs, and Spotify.

Workable: Founded in 2012 in Athens, Greece, Workable is a recruiting software platform geared towards passive candidate sourcing. Unlike Gem, which focuses on targeted talent acquisition, Workable’s automated job postings and distribution campaigns are intended to maximize inbound prospects. Although Workable and Gem provide similar services for recruiting teams, the two can be used together – Gem even has an integration enabling profiles to be uploaded to Workable. As of December 2023, Workable has raised $84.2 million and has over 27K customers worldwide. Workable raised $50 million at an undisclosed valuation in November 2018.

Professional Networking

ZipRecruiter: Founded in 2010, ZipRecruiter is an AI-powered job marketplace. Recruiters using its platform can post job openings, which can be accessed publicly by job seekers. In August 2023, it had over 15 million active job postings from over 2.8 million businesses. Although ZipRecruiter doesn’t offer the same outbound talent acquisition tools as Gem, its platform provides an extensive ATS for recruiting teams to analyze sourcing efforts, making it a potential competitor. ZipRecruiter is publicly listed on the NYSE, with a market cap of $1.3 billion in December 2023.

Indeed: Indeed is a job search platform claiming over 350 million unique monthly visitors and 245 million user profiles as of December 2023. Like ZipRecruiter, it provides a two-sided marketplace for recruiters and job seekers. Founded in 2004, Indeed was acquired by Japanese conglomerate Recruit in 2012. Despite being one of Gem’s key sources of user data, Indeed indirectly competes with Gem as a talent acquisition platform. Nonetheless, its primary service for recruiting teams is mass-market job postings, which can either be used in place of or with Gem’s talent-sourcing solutions.

LinkedIn Recruiter: LinkedIn is a professional networking site. Since its founding in 2003, it has grown to be one of the largest professional networks, with over 930 million users as of August 2023. In 2016, LinkedIn was acquired by Microsoft for $26.2 billion. LinkedIn’s platform gives recruiting teams a wide variety of solutions to optimize the hiring process, namely with its centralized candidate profiles, in-built InMail messaging campaigns, and targeted job postings.

In 2008, LinkedIn launched LinkedIn Recruiter, which directly competes with Gem. It allows for candidate sourcing and pipeline management. Like Gem, it integrates with a customer's existing ATS. Gem has sought to compete with many of LinkedIn’s candidate sourcing features through its LinkedIn integration, including gathering candidate profiles and automating InMail messages.

Business Model

Source: Gem

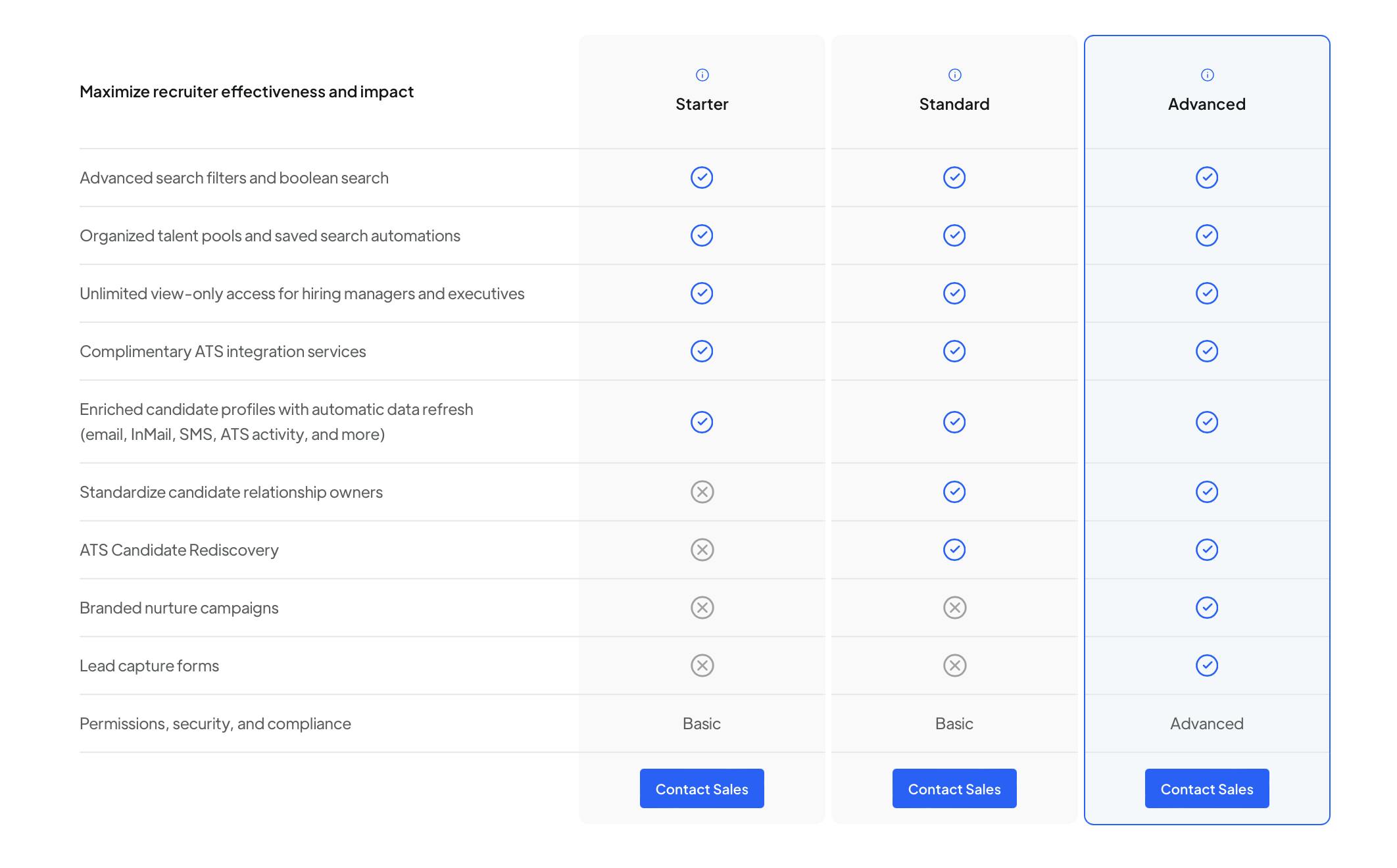

Gem operates on a SaaS model, with pricing depending on various factors such as team size and customization preferences. Though specific pricing is not publicly available, the company offers three tiers of service:

Starter: Described by Gem as being for “small businesses”, the Starter package offers the key integrations and data synchronization necessary for recruiters to access and utilize relevant candidate information.

Standard: Gem’s Standard package gives companies greater control over applicant tracking, and are also given access to the Pipeline Management suite.

Advanced: The Advanced package offers greater strategic value for enterprises, with more features from its Talent Compass toolkit.

Although Gem’s pricing isn’t publicly available, customers reported annual costs of around $4K per seat as of September 2021. By comparison, a February 2023 study estimated the average cost per hire in the United States to be $4.7K. Workable charges around $1.5K per seat annually, while Jobvite charges $6K annually.

Traction

By the time of Gem’s Series C in September 2021, it had acquired notable customers including Roblox, Robinhood, Carta, Slack, DoorDash*, Snap, Dropbox, and Pinterest. In March 2022, Gem was recognized in software marketplace G2’s Top 100 Highest Satisfaction Products list. By June 2022, Gem’s customers include over 130 companies with valuations of over $1 billion. As of December 2023, Gem had over 1.2K total customers. Based on announced YoY growth figures, its revenue was estimated to be around $43 million in 2021. In April 2022, Gem reported that it had facilitated 230K hires in the preceding year.

In November 2022, Gem laid off 100 employees, which was approximately one third of its workforce at the time, with the company citing a "volatile macroeconomic situation in which many of our growth-stage tech customers are reducing or stopping their hiring altogether." This was followed by a second round of layoffs in August 2023 when 70 employees were let go. CEO Steve Bartel stated in a LinkedIn post that "the need for recruiting software has decreased" with companies slowing down their hiring, but asserting that the restructuring would allow Gem to "weather any storm, including a prolonged economic downturn."

Valuation

As of December 2023, Gem has raised $148 million in total funding. Its most recent fundraising round as of December 2023 was a $100 million Series C in September 2021, which valued the company at $1.2 billion. Its earlier investors included Accel and Greylock, with new investors including Sapphire and Meritech joining its board in its Series C.

Key Opportunities

Global Expansion

The global labor force was 3.4 billion people in 2021, with the staffing and recruitment industry estimated at $683.2 billion in 2022. There is a significant opportunity for Gem to continue to expand outside of the US in tight labor markets, targeting industries where proactive hiring strategies are necessary for firms to find and retain talent. To maintain momentum in global recruitment markets, Gem must adapt to diverse cultural, economic, and regulatory landscapes, including hiring systems and processes that may be significantly different from those in the US.

Evolving Recruitment Strategies

The shift toward proactive recruiting has created incentives for hiring teams to improve their tooling to meet the new challenge. In a June 2022 interview, Gem CEO Steve Bartel stated:

“[Recruiting is] starting to look a lot more like sales and marketing: You wouldn't wait for a customer to come and find you, but you would go and engage with and sell and market. I think that trend is going to continue.”

Tools such as Gem empower recruiting teams with data-driven insights on recruiting strategies, to allow them to increase conversion rates similar to traditional marketing teams. As the recruiting market continues to adopt new strategies, Gem will have the opportunity to benefit.

Vertical Expansion

By expanding its product range beyond recruitment to cover more aspects of HR management, Gem could become a more comprehensive platform, addressing a wider range of customer needs. This could include performance management, employee engagement, or learning and development tools, helping manage the employee experience beyond the recruitment phase. By offering a more holistic HR management solution, Gem could appeal to organizations looking for more vertically integrated solutions.

Key Risks

AI Recruiting

With the rise of generative AI systems like OpenAI’s GPT, automated recruiting workflows have become ever more popular. In particular, recruitment experiences are becoming increasingly automated and personalized with the help of AI.

In 2022, it was reported that Amazon had been working on AI to replace its recruiters for at least two years. Known as the Automated Applicant Evaluation, or AAE, it was capable of managing the applicant pipeline management and screening without demographic biases. In October 2021, it had reportedly “[achieved] precision comparable to that of the manual process and is not evidencing adverse impact”. Gem has sought to expand its own AI toolkit, but the spread of both proprietary and general AI systems for recruitment may make it challenging for Gem to penetrate new markets and expand its customer base.

Market Fragmentation

As more talent teams have been for talent, there has been a proliferation of talent software companies. This has fragmented the market, making it challenging for all-in-one tools such as Gem that provide sourcing, ATS, and talent CRM solutions to gain significant market share. Moving forward, Gem’s ability to maintain its footing among its customer base could be challenged by rival solutions and increased competition.

Economic Headwinds

In the past, Gem had benefited from a tight labor market which compelled employers to adopt proactive hiring strategies to find and secure in-demand talent. However, after a macroeconomic downturn in 2022, layoffs began to impact the labor market, with the tech industry alone seeing more than 240K layoffs in 2023. This downturn caused a cooldown in the hiring market and severely impacted Gem's business, leading to two rounds of layoffs in November 2022 and August 2023.

Although CEO Steve Bartel has stated that the company is now structured to withstand a prolonged downturn in the hiring market, it is clear that the recruiting software market can be heavily impacted by economic volatility. Moving forward, Gem must adapt to this reality and find a way forward in changing market conditions.

Summary

Gem is a recruitment software platform that streamlines the hiring process by automating outreach, tracking candidate interactions, and providing analytics to optimize talent acquisition strategies. The company has built a platform that helps identify, track, and nurture passive talent for both active and future roles. To maintain momentum, Gem must continue to develop its offering through global expansion and further software and AI innovation and adapt to further shifts and uncertainties in the global labor market.

*Contrary is an investor in DoorDash through one or more affiliates.