Thesis

Recent decades have seen a dramatic change to the workforce as the rise of remote work has broken down geographical barriers to hiring. Businesses can now hire staff from anywhere worldwide, allowing them to access the best available talent for any given role. This gives workers more freedom to work from home and increase their income without moving to expensive areas or commuting long distances. A 2022 survey found that 87% of employees who have the chance to work remotely take that opportunity. The outbreak of COVID-19, in conjunction with new enterprise connectivity software, accelerated the move to remote work, including in industries previously hesitant to embrace the trend.

However, paying a global workforce can be complex. It is particularly challenging for companies who employ staff across multiple countries, as they must constantly consolidate different data streams, manually track regional and national labor and payroll regulations, and spend valuable time and resources to set up local entities in new areas. These companies are faced with suboptimal, expensive options, like opening a foreign subsidiary or hiring a professional employment organization, which is a local firm that hires employees on their behalf and can charge up to 15% of payroll. By 2022, 75% of employers reported difficulty recruiting qualified personnel, an increase of 21% from 2019. The global payroll & HR solutions market was valued at $26.4 billion in 2022 and is projected to reach $50.4 billion by 2030.

Papaya Global offers a global payroll solution supporting all forms of employment. It provides an end-to-end platform, from employee onboarding and ongoing management to global payments and payroll. It helps companies with labor law compliance in the jurisdictions in which they operate, offers management of employment benefits, and ensures data privacy in compliance with GDPR.

Founding Story

Papaya Global was founded in 2016 in Israel by Eynat Guez (CEO), Ruben Drong (CIO), and Ofer Herman (ex-CTO). Drong previously started multiple companies in Israel, and Herman has previously cofounded a company and served as its CTO.

Guez started her career at LR Group, a holding company for large African infrastructure projects. She then started a business offering inbound and outbound corporate relocation services. She later founded another firm centered around global mobility and employment in China, quickly expanding across Asia. She faced common client frustrations around the manual processes and slow communication associated with managing global workforces across multiple countries and jurisdictions.

Considering her options, Guez looked deeper into the global workforce management industry. Her firsthand experience helped her identify common pain points and she consequently came up with the idea for Papaya Global. After her initial request for two close friends to become cofounders was declined, Guez connected with Herman and Drong, who ultimately became cofounders.

Product

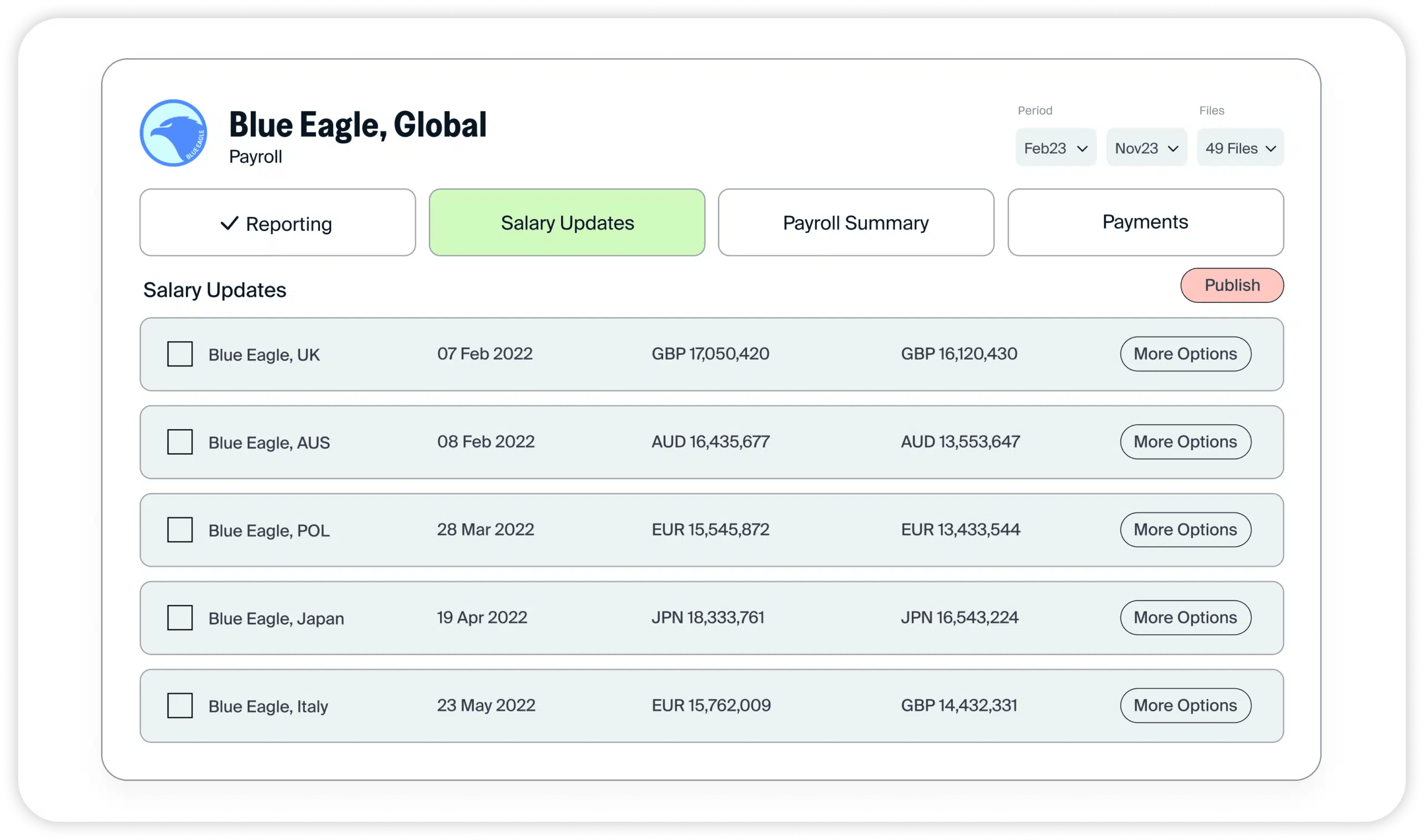

Payroll

Papaya Global's platform supports the entire global workforce process, from hiring and onboarding to paying employees. It allows HR and finance teams to work the same set of tools through its Payroll OS. It supports all types of employment, allowing companies to transition from contractors or employer of record (EoR) hires to full-time payroll employees. Companies can connect human resource information (HRIS) software with Payroll OS, feeding data from existing HR systems onto Papaya’s platform. Users can then create a flow from HRIS data and integrate it with payments, benefits, and other deductibles. An alert system warns customers of any possible compliance issues with local payroll and employment laws.

The company offers a self-service portal for employees. Also available via a mobile app, this portal lets employees manage payslips, time off, and a range of documents such as contracts and identification.

Source: Papaya Global

Papaya Global’s platform allows contractors to generate digital invoices (or submit their own) through the online portal, while customers are able to pay their contractors’ invoices in local currencies with a single bulk payment.

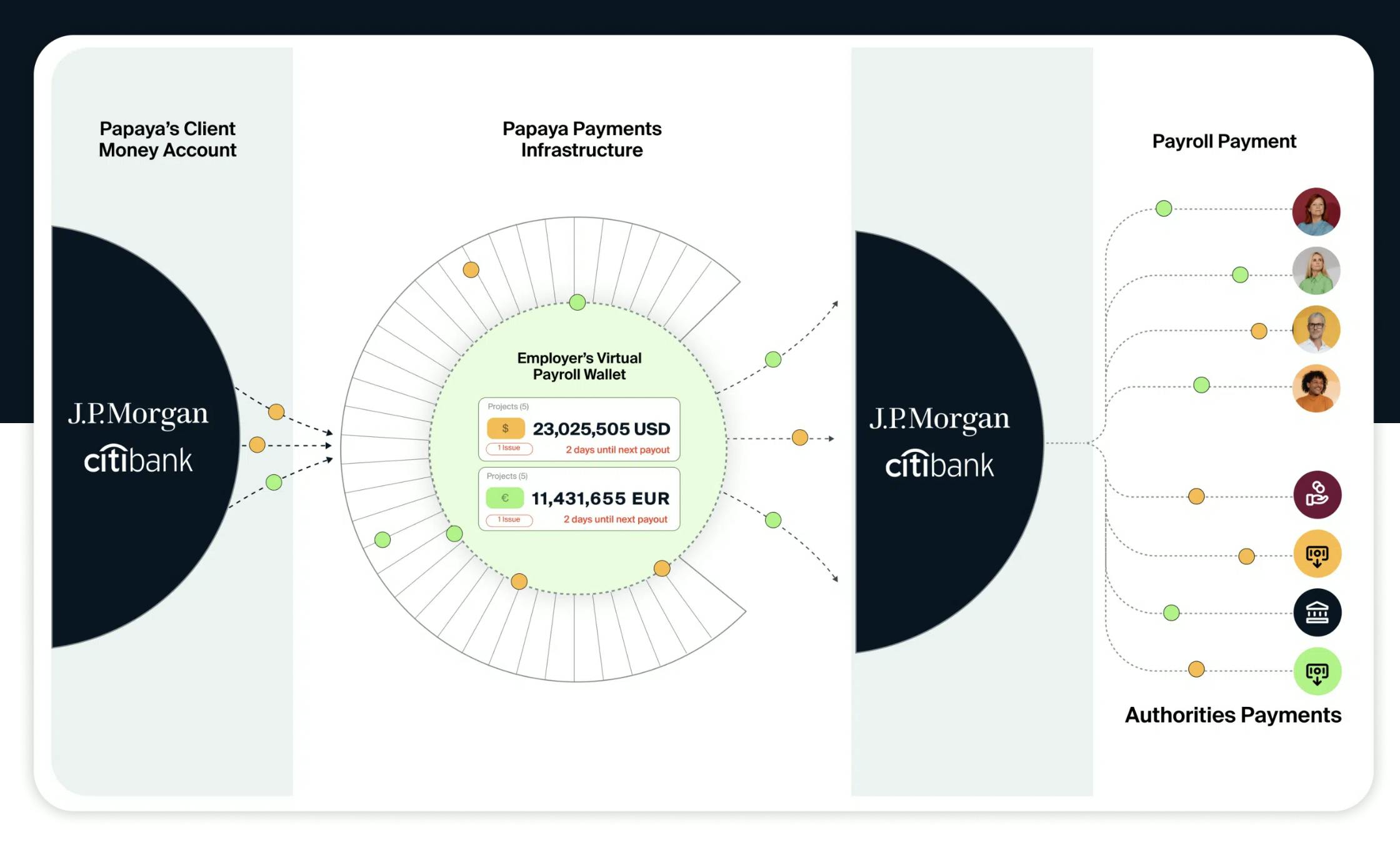

Payments

The platform offers global payroll payments and remittance services across 160+ countries and major currencies, using banking rails powered by J.P. Morgan and Citibank and a network of money transfer licenses. Instead of managing multiple local bank accounts, companies can fund virtual payroll bank accounts, which the company refers to as "wallets", using 12 major global currencies, including USD, and pay in any of the supported local currencies. Papaya Global’s 2022 acquisition of digital remittance provider Azimo allowed the company to further broaden its payment networks. Papaya Global’s payments solution includes KYC setup, regulation compliance, and client protection through transactional monitoring, screening, and AML checks.

Source: Papaya Global

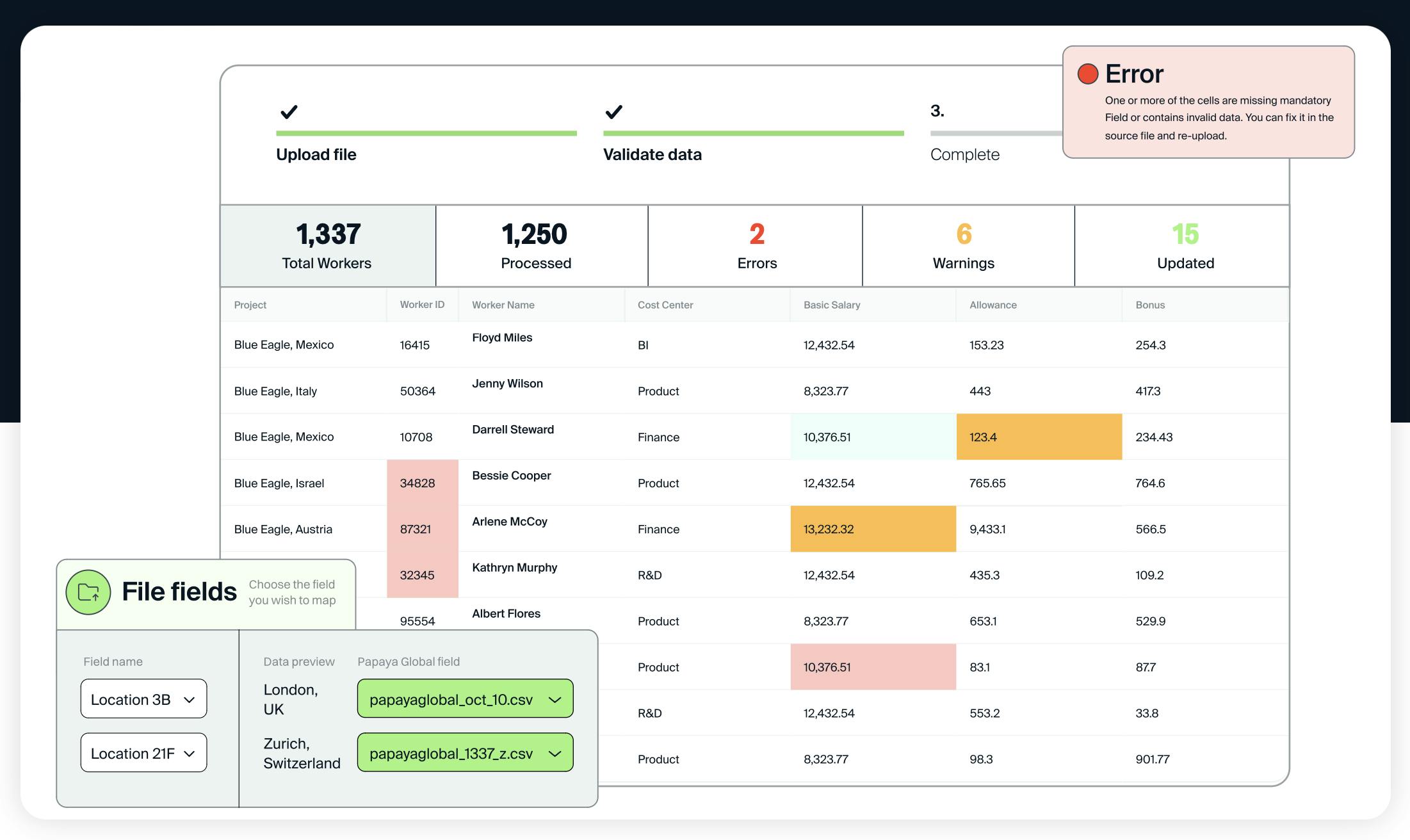

Enterprise Connectivity

Papaya Global gives visibility and control across the process from first contact to final contract. It offers integrations with human capital management (HCM) and enterprise resource planning (ERP) software, such as Workday, BambooHR, and Expensify, so that companies can manage the entire employment journey in one place. HR teams can collect and standardize the documents and data needed to onboard people in 160+ countries. The system is updated to comply with changing local regulations. Companies can create and maintain compliant contracts for all seniority levels.

Source: Papaya Global

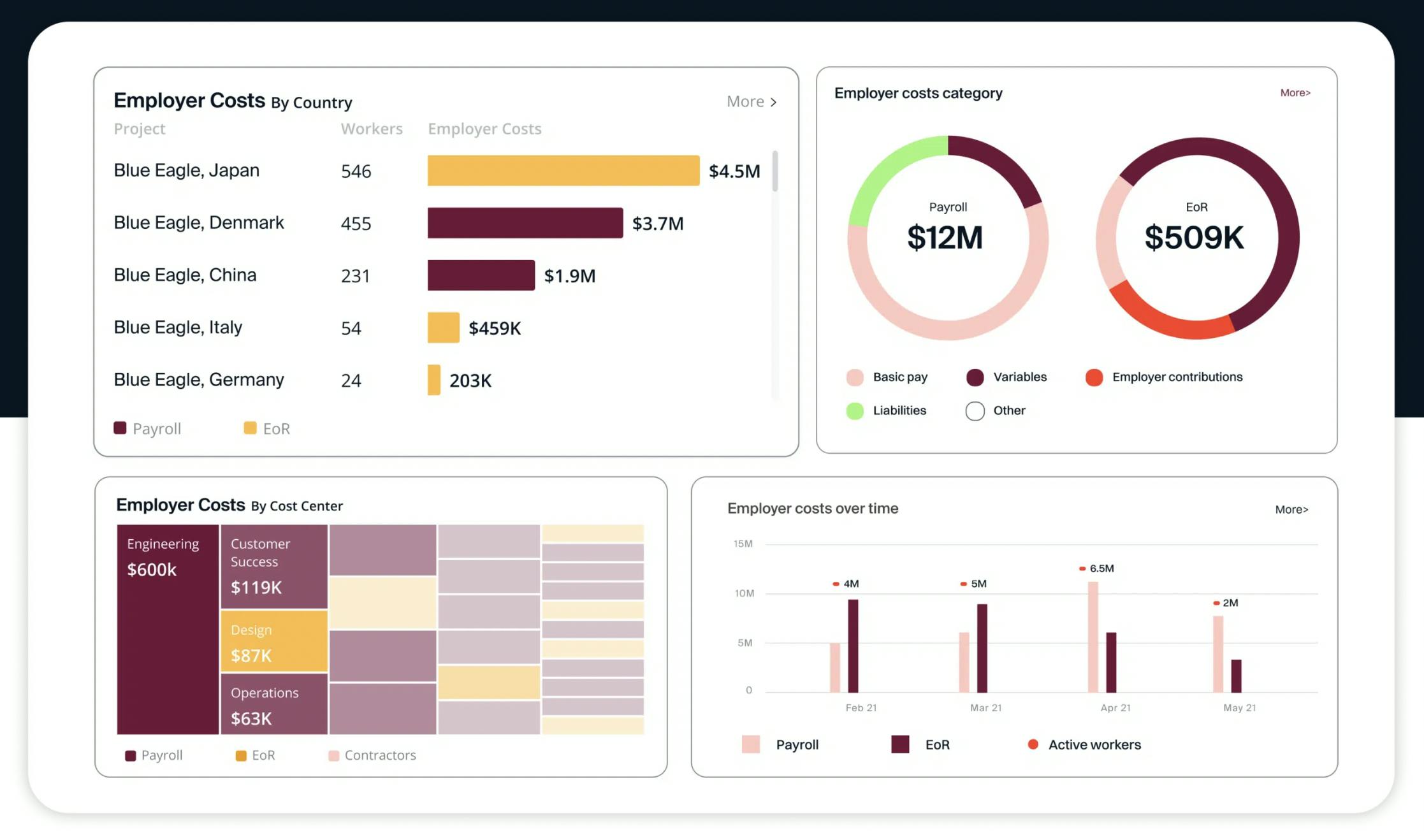

Data and Insights

Companies can consolidate their workforce data and see global employment spending in a single view across payroll partners, EoR, and contractors. The analytics dashboard consolidates data from all integrations, removing the need for companies to get individual reports from the different platforms. Companies can keep track of broader insights like fair pay, gender distribution and employee attrition, forecast their billing and deposits, and utilize built-in contract lifecycle management tools for employees of all seniority levels. The platform is compatible with software like Power BI, allowing data teams to develop further insights.

Source: Papaya Global

Market

Customer

Papaya Global’s target customer base includes companies of all sizes which intend to hire contractors and full-time workers in markets outside their country.

Before Papaya Global, one senior Payroll Manager said that manually completing tasks like emailing employee representatives in different countries made the payroll process take “3x as long”. With Papaya Global’s software and built-in integrations, the customer can complete most tasks and calculations within a few clicks. Similarly, another COO described how, prior to the spread of modern-day EoR and contractor solutions, companies looking to hire internationally were confined to registering a legal entity in each new country, a solution both costly and time-consuming.

As of June 2023, Papaya Global serves over 1000 customers, including Microsoft, Toyota, Canva, Shopfiy, Vimeo, and Wix.

Market Size

The global payroll software market is expected to reach $46.6 billion in 2028. The global employer of record market is expected to reach $6.8 billion by 2028, from $4.2 billion in 2021. The global human resource technology market is projected to grow to $39.9 billion by 2029.

According to Deloitte, 35% of organizations globally allow employees to work remotely from other countries.

Competition

The global payroll market contains numerous players, including both legacy incumbents and newer, software-focused startups. A primary differentiator between the players is the list of countries and territories they support. Another is which parts of the employment value chain the company focuses on, such as core payroll solutions, employee payments, HCM, EoRs, or some combination of the above.

Deel: Founded in 2018, Deel is a global payroll platform similar to Papaya Global that streamlines HR workflows, consolidates different streams data, and provides solutions for different employment methods like EoR and contractors. Unlike Papaya Global, Deel owns entities in every EoR market and does not simply partner with them. However, Deel does not offer an in-house banking and payments system, unlike like Papaya Global. Deel has raised $679 million in funding.

Remote: Remote offers international payroll, benefits, and compliance services for employees and contractors. It was founded in 2017 and raised $496 million in funding. Its platform includes payroll, benefits, taxes, and local compliance for contractors and full-time employees. In its effort to establish global infrastructure, Remote has built its own entities to provide its customers with more control compared to an outsourced partnership model that competitors like Papaya Global use.

Rippling: Rippling offers an all-in-one platform to help manage HR and IT operations. It was founded in 2016 and has raised $697 million in funding. It has built a centralized platform where employee data across HR, IT, and finance products can be managed. Rippling Global, Rippling’s global hiring solution was launched in October 2022 and offers Rippling customers the ability to hire, pay and manage a workforce worldwide.

Gusto: Gusto provides payroll, benefits, human resources, and integration services for US small- and medium-sized businesses. It was founded in 2011 and has raised $746 million in funding. It competes with Deel’s recently announced US Payroll offering, an expansion of Deel’s global payroll offering with its first in-house payroll engine, starting in the US.

Oyster: Oyster, founded in 2020, is another global end-to-end platform — offering HR, payroll, and employment solutions in 120+ currencies. Unlike Papaya Global, it also provides recruitment and benefits services. Their platform is tailored to larger multinational companies seeking an end-to-end HR solution. It has raised $224 million in funding.

Before the emergence of new players such as Papaya Global, Deel, and Remote, legacy companies like Globalization Partners were helping companies hire employees globally through an Employer of Record (EOR) model, acting on behalf of clients as the legal employer. These traditional EOR companies usually target larger enterprises, offering opaque pricing with 15% or more markups on top of employee salaries and hidden fees such as setup, onboarding, and offboarding costs.

Business Model

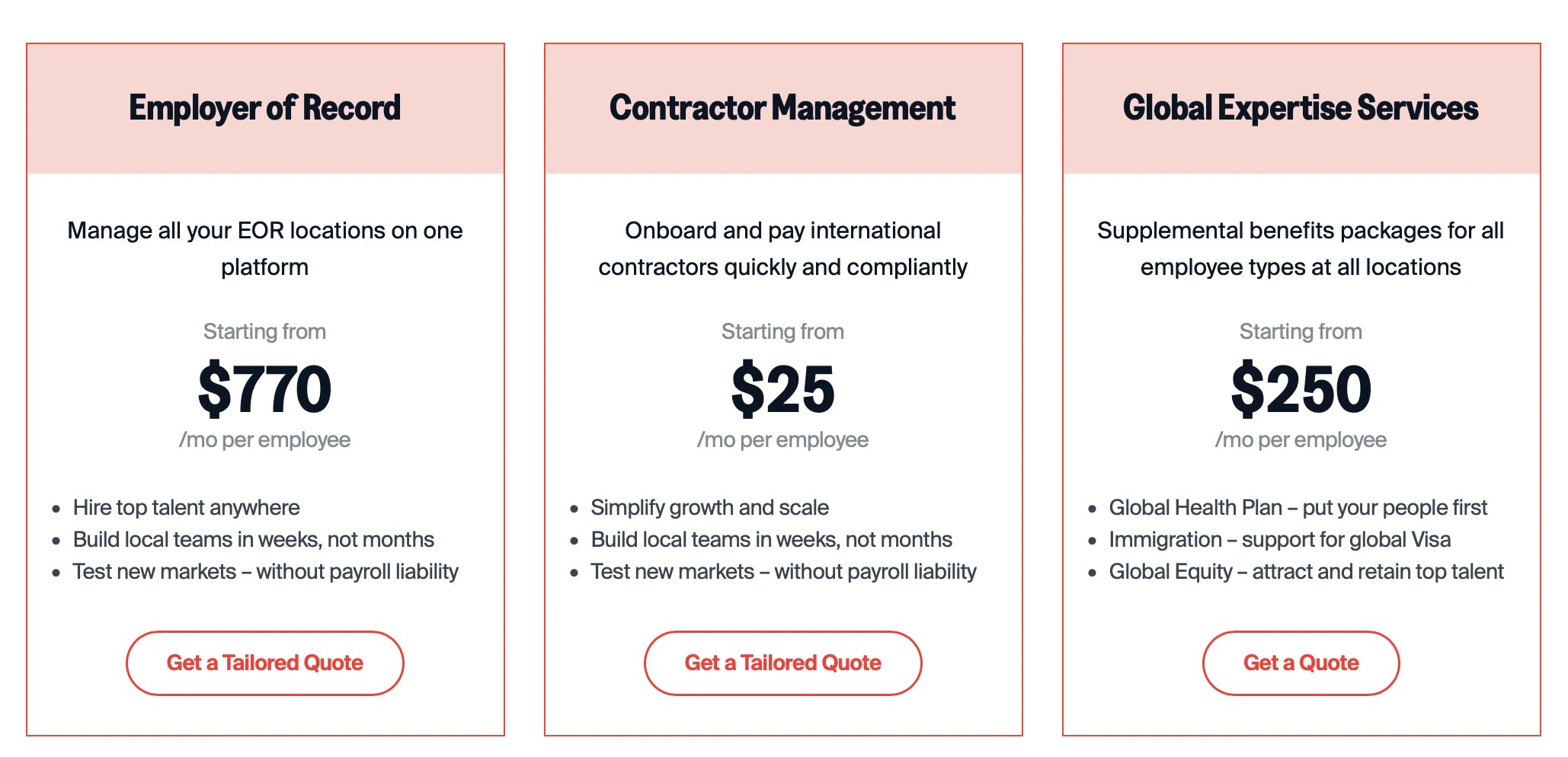

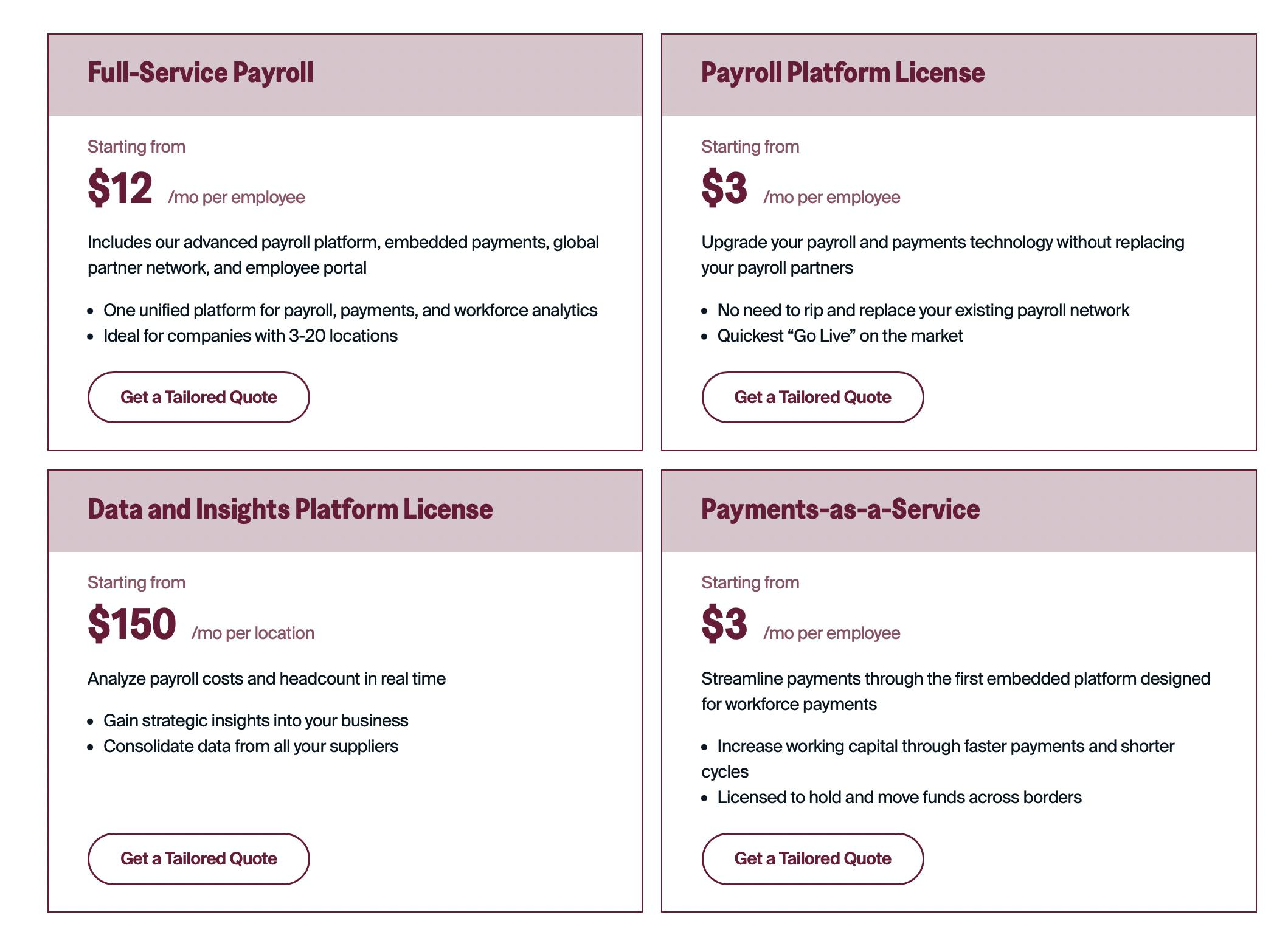

Papaya Global makes money by charging a subscription for its solutions. Clients pay a flat rate of $770/month per employee for EoR services, $25/month for contractors, and $250/month for global expertise services, which includes health plans and immigration support.

Source: Papaya Global

Using the price calculator on Papaya Global’s site, clients can estimate their total yearly costs depending on the countries they are registered in, the number of employees, and the services they use.

Source: Papaya Global

Traction

In September 2021, the company said it saw a 300%+ revenue growth year-over-year for each of the prior 3 years. In November 2021, it said it recorded an annual revenue rate of $90 million. As of June 2023, Papaya Global works with over 1,000 companies and manages ~$3 billion in global payroll.

Valuation

In September 2021, Papaya Global announced a $250 million Series D, led by Insight Partners, at a $3.7 billion valuation, growing 10x in one year. The company has raised $444.5 million, with involvement from other notable investors such as Bessemer Ventures, Scale Ventures, Workday Ventures, and Tiger Global Management.

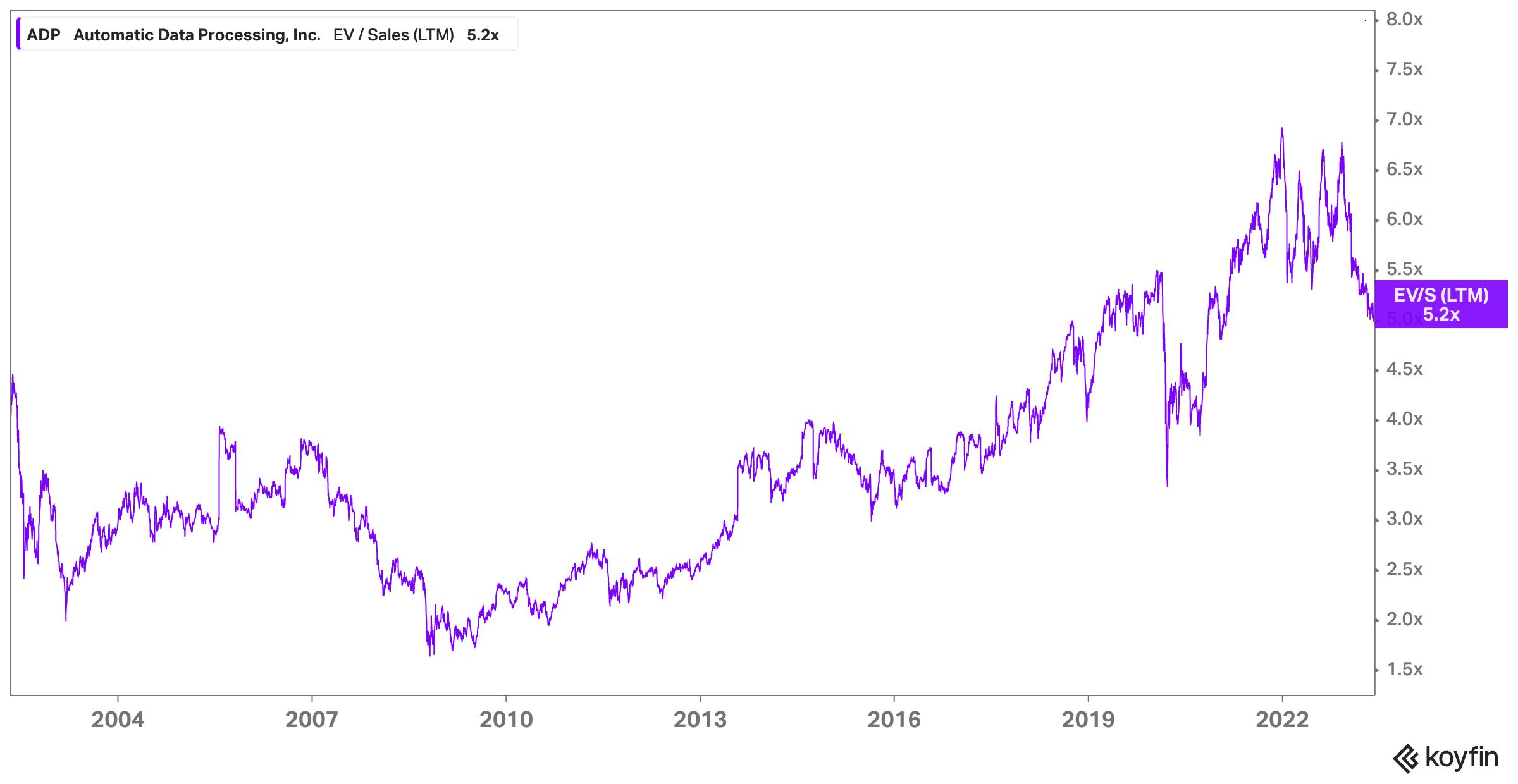

Papaya Global's close public market comparison is the payroll giant ADP. At the end of 2021, ADP traded at a multiple of ~7x LTM revenue. Papaya Global ended 2021 with a $3.7 billion valuation and $90 million in annual revenue, representing a 41x revenue multiple. As of July 2023, ADP's multiple has reduced to 5.2x LTM revenue. ADP's annual revenue in 2022 was ~$17 billion.

Source: Koyfin

Key Opportunities

Changing Workforce Dynamics

As the COVID-19 pandemic revealed, there is no one-size-fits-all in terms of how companies structure their workforces. The pandemic, which accelerated existing remote work trends, forced companies to implement new solutions to manage their employees.

Data suggests that changes to traditional workforce settings may continue long after COVID. McKinsey found in 2022 that moving to a “flexible working arrangement” was the third-highest motivator for finding a new job, behind only better compensation and future career opportunities. Moreover, companies who restructured their workforces during the pandemic and realized greater efficiencies may be more willing to change and adapt their organizational structure in the future. Another study in June 2023 found that 68% of companies in the U.S. were considering outsourcing their services to emerging countries like Argentina, the Philippines, and India.

Further changes in employee demands and workforce structures will only increase the need for more automated and comprehensive global payroll solutions. If Papaya Global can expand its product and country offerings, then it can benefit significantly from future global employment trends.

Deeper Integrations

One of Papaya Global’s core value propositions is the ability to connect the platform with popular human capital management (HCM) and enterprise resource planning (ERP) software like Workday, SAP, Expensify, and BambooHR. Data like time and attendance information, journal entries and worker expenses flow into Papaya Global via native integrations or APIs, allowing companies to maintain a single source of truth on one platform. According to Papaya Global’s website, further integrations with leading HCMs like HiBob, Namely, and UKG are slated for release in the future. By continuing to broaden its suite of integrations, more global companies can use Papaya.

Key Risks

Sustainability of Remote Work

COVID-induced remote work and employee relocation helped accelerate Papaya Global’s growth. While workforce structures have changed in recent years and are likely to change further, the sustainability of remote and hybrid workforces is still being evaluated. In the years since the beginning of the pandemic, major companies like Meta, Amazon, and Disney have reduced the amount of time employees are permitted to work remotely. Debates about the effect of remote work on productivity and collaboration are unresolved, and it is unclear the degree to which it will remain a fixture of the economy going forward. If a return to in-person work develops into a broader trend in the coming years, this would present a customer acquisition risk to all companies which support remote work, including Papaya Global.

Competitor Innovation

One of Papaya Global’s unique value propositions is its native payments system, which is available to its customers via its payroll platform. While this helps differentiate Papaya Global from its direct competitors like Deel and Remote, it is not an impenetrable moat and could be replicated. Major competitors like Rippling have already built all-in-one systems that help companies manage their workforce needs including HR, benefits, app provisioning, payroll, and payments. While companies like Rippling focused on their domestic market, Papaya Global should consider platforms and how they can potentially displace Papaya if they focus on developing global payroll solutions.

Compliance

Payroll compliance requires intimate knowledge of local regulations. For example, Argentine labor laws regarding working times and overtime rates differ from North America's, while India has its own tax and currency exchange rates constantly fluctuating. To ensure the security and satisfaction of its clients, Papaya Global must constantly track and adapt to new regulations in the 160+ countries it serves. While the company has partnerships with experts and entities across every region, Papaya Global is still liable for any compliance-related issues experienced by customers. As Papaya continues to scale into new regions, it will face greater compliance risk. Failure to do so could result in customer attrition and loss of brand equity.

Summary

Payroll is fundamental to every organization, helping companies achieve their goals by ensuring that employees are rightfully compensated for their work. Thanks to the COVID-19 pandemic and the global remote work shift, adaptable and customizable workforce management solutions became increasingly necessary. Papaya Global is taking on legacy solutions like ADP and competitors like Remote and Oyster to provide the first global workforce solution that combines payments, automated payroll, and compliance on a single platform. The company has established services in 160+ countries, partnering with local experts and entities to ensure legal and regulatory compliance. With all that said, the key question remains as to whether Papaya can continue to capitalize on changing workforce dynamics and maintain pace in an increasingly competitive landscape.