Thesis

HR practices at many companies are still stuck in the past, with some organizations moving to HR SaaS more slowly than might be anticipated. Nevertheless, the adoption of HR platforms continues among businesses of all sizes. According to a 2023 survey of organizations from 5K to 50K employees across various industries, almost half of organizations surveyed expected to be on a SaaS or hybrid HR solution by 2025.

The HR software market was valued at $22.4 billion in 2022 and is expected to reach $43 billion by 2028, expanding at a CAGR of 11.5%. Growth is being driven by the longer-term secular trend towards digitization that is still working its way to late adopters, as well as newer catalysts like the rise of remote work and the growing adoption of AI and automation.

Lattice is a company that describes its product as a “people management platform” that is intended to help companies drive performance. It helps businesses with performance management, goal setting, and employee engagement with tools around performance tracking, compensation tracking, analytics, OKR and goal setting, and more.

Founding Story

Lattice was founded in 2015 by Jack Altman (former CEO) and Eric Koslow (former CTO). Prior to founding Lattice, Altman had been a lead developer at Teespring, where Koslow was a lead engineer. At Teespring, they became friends with a close relationship and set out to start a company together. As Altman put it:

“We didn’t even think about Lattice as HR software when we left [Teepsring]. We just knew we wanted to start a company.”

The initial inspiration for what would become Lattice came from issues the pair encountered while at Teespring, which grew virally and which Altman described as therefore being somewhat chaotic when it came to people management. As he put it in an interview:

“We didn’t know anything about HR software. We knew there were things about Teespring’s culture that had gone a way we didn’t love as a result of not having infrastructure for feedback, listening to employees, having clear career development, and having compensation conversations, and all the stuff that Lattice does… we just didn’t have it.”

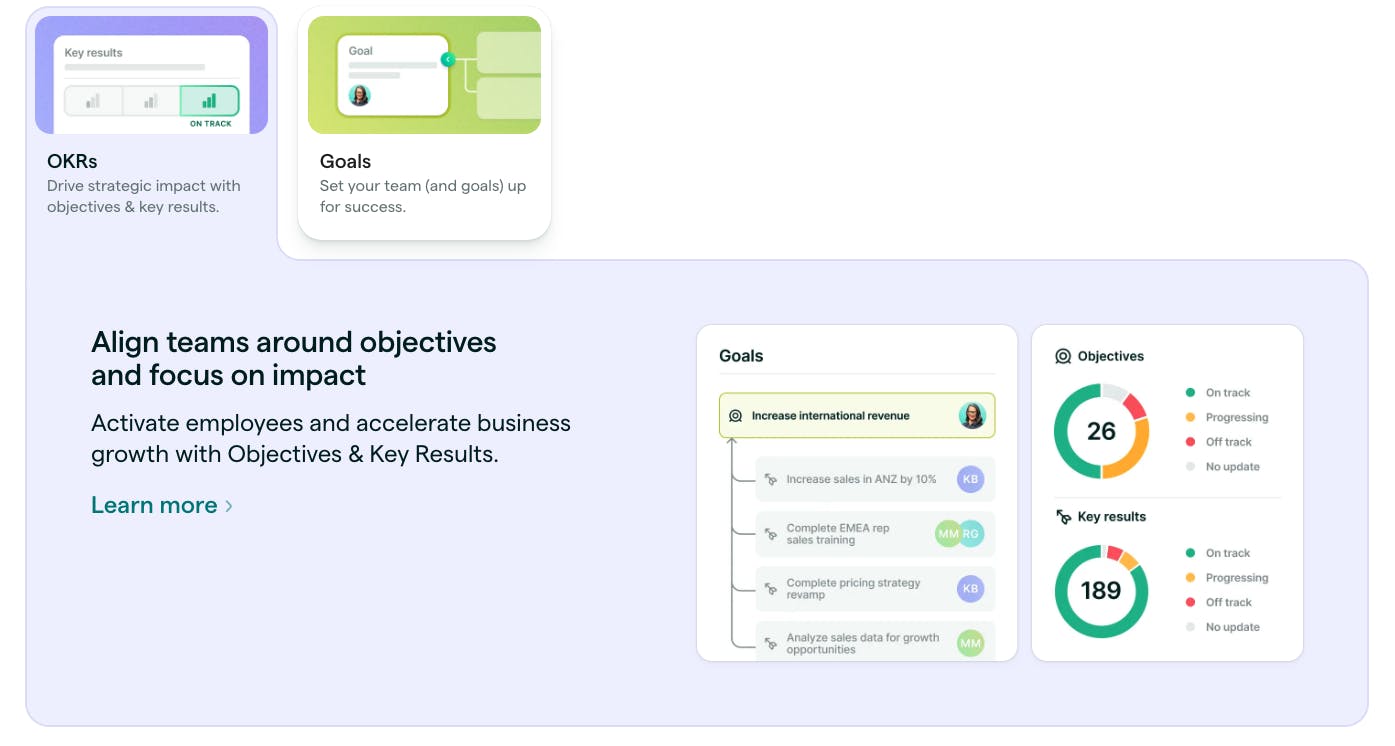

The initial direction of the company was a company goal-setting product for OKRs (objectives and key results). According to Altman, although there was a lot of initial interest because many companies struggled with goal setting, the software solution they built was not able to retain users. In his words:

“What we built first was an OKR tool…. and we were able to get a lot of interest because… managing goals at a company is in fact a big problem. We would post on ProductHunt or directly email people …. tons of CEOs of like 100-200 person companies would be like ‘I need this… I’ve been struggling with goals.' It’s a real problem, but software is not a good solution to every problem.”

Altman realized “within the first several months” that software would not be the key to a solution for goal-setting at a company, and that therefore it would never be a big business and that the young company would need to pivot. The co-founders therefore went to their users and spoke to HR teams to ask about other paint points.

Altman said that it became “blatantly obvious” in the course of these conversations that there was a big gap in the market around performance reviews and the company started mocking up a product. The results were near-instantaneous; as Altman recalled, “After nine months of beating our heads against the wall on the OKR product, we were able to sell annual contracts on design mockups on reviews”.

The product-market fit for the performance review product was instant, and although Altman said that the company had raised its 2016 seed round off the back of its OKR product, it raised its Series A the following year off of performance reviews.

Koslow stepped down from his role as CTO to pursue another startup in May 2022, and Jack Altman stepped down as CEO in December 2023, saying that he wanted to “return to his first love: the earliest stages of company-building”. His replacement was former Salesforce executive Sarah Joyce Franklin, who became CEO as of January 2024.

Product

Lattice is a software company offering performance management and employee engagement solutions. Lattice’s tools are intended to help businesses improve employee retention and create winning cultures. Lattice’s complete employee success platform consists of six main products: Performance Management, Compensation, Analytics, OKRs & Goals, Grow, and Engagement. It also has a forthcoming HRIS (human resources information system) product.

Performance Management

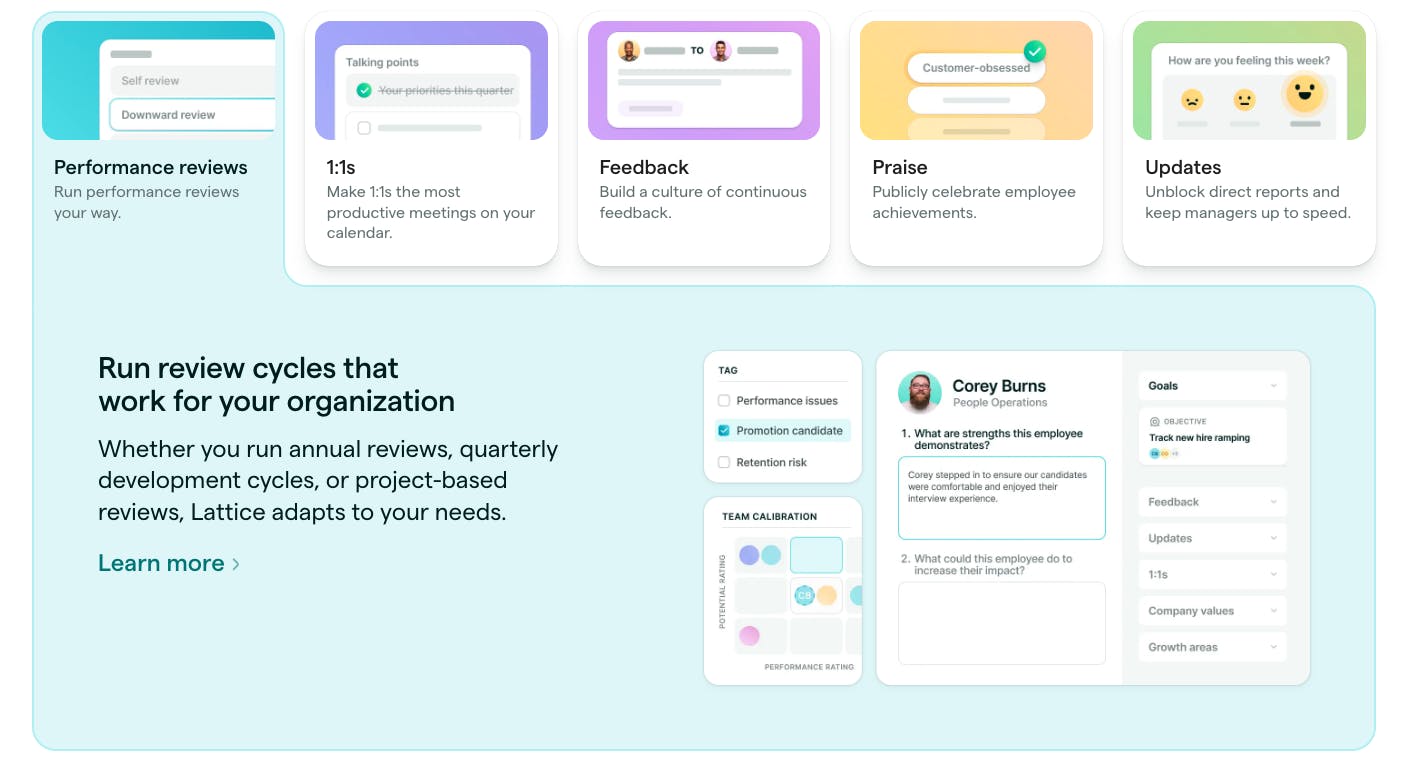

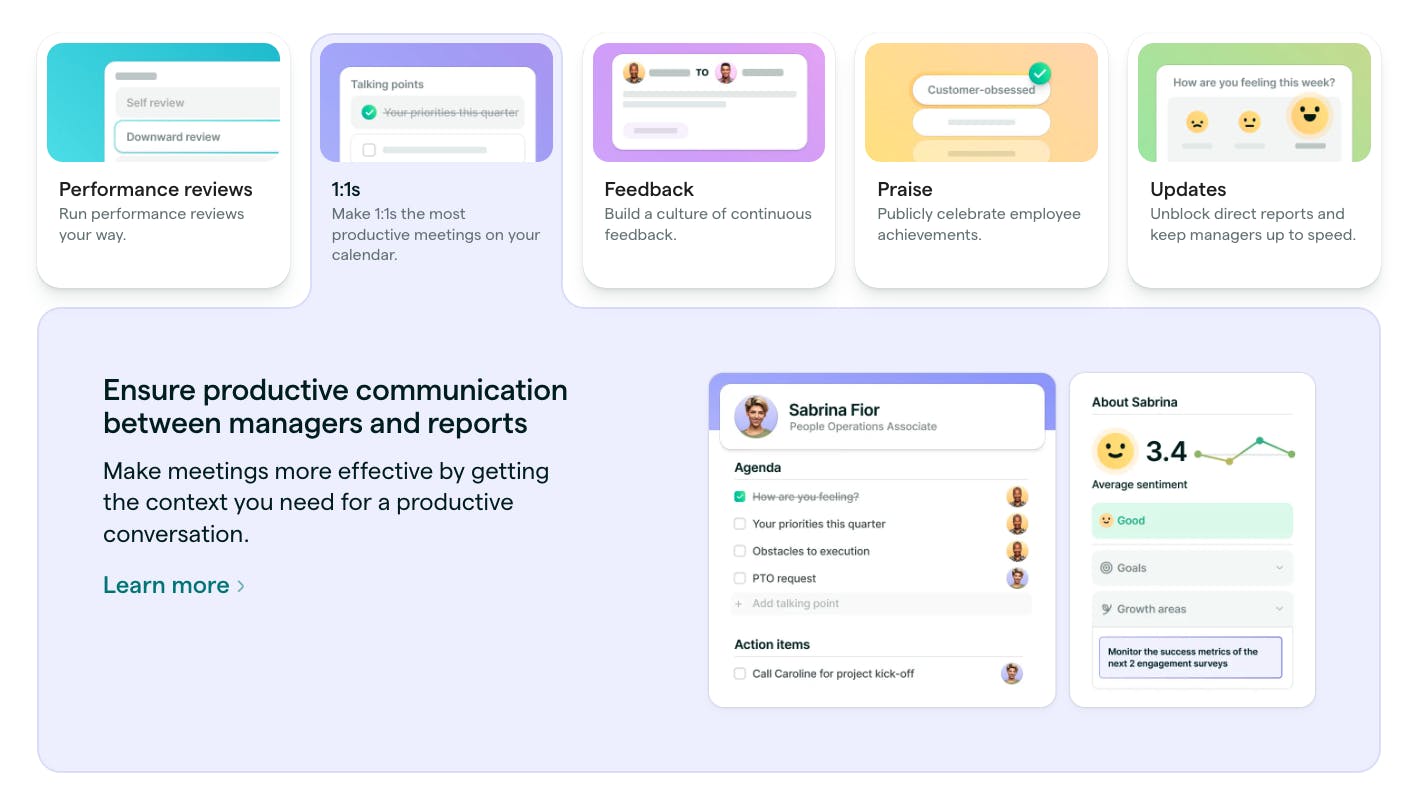

Lattice’s Performance Management tool is intended to help ensure that employees feel valued, supported, and empowered. The Performance Management tool consists of five solutions: Performance Reviews, 1:1s, Feedback, Praise, and Updates.

Performance Reviews

Source: Lattice

The Performance Review solution is intended to streamline the review process. It is customizable based on how often a company conducts performance reviews, whether annual, quarterly, or on a per-project basis.

1:1s

Source: Lattice

Although annual performance reviews are important, continuous feedback throughout the year can help employees improve their work. Lattice’s Feedback tool fills the gap between annual reviews by providing employees with real-time feedback. The feedback tool also provides an option for employees and managers to request feedback from peers to gain more insight into how they can improve.

Praise

Source: Lattice

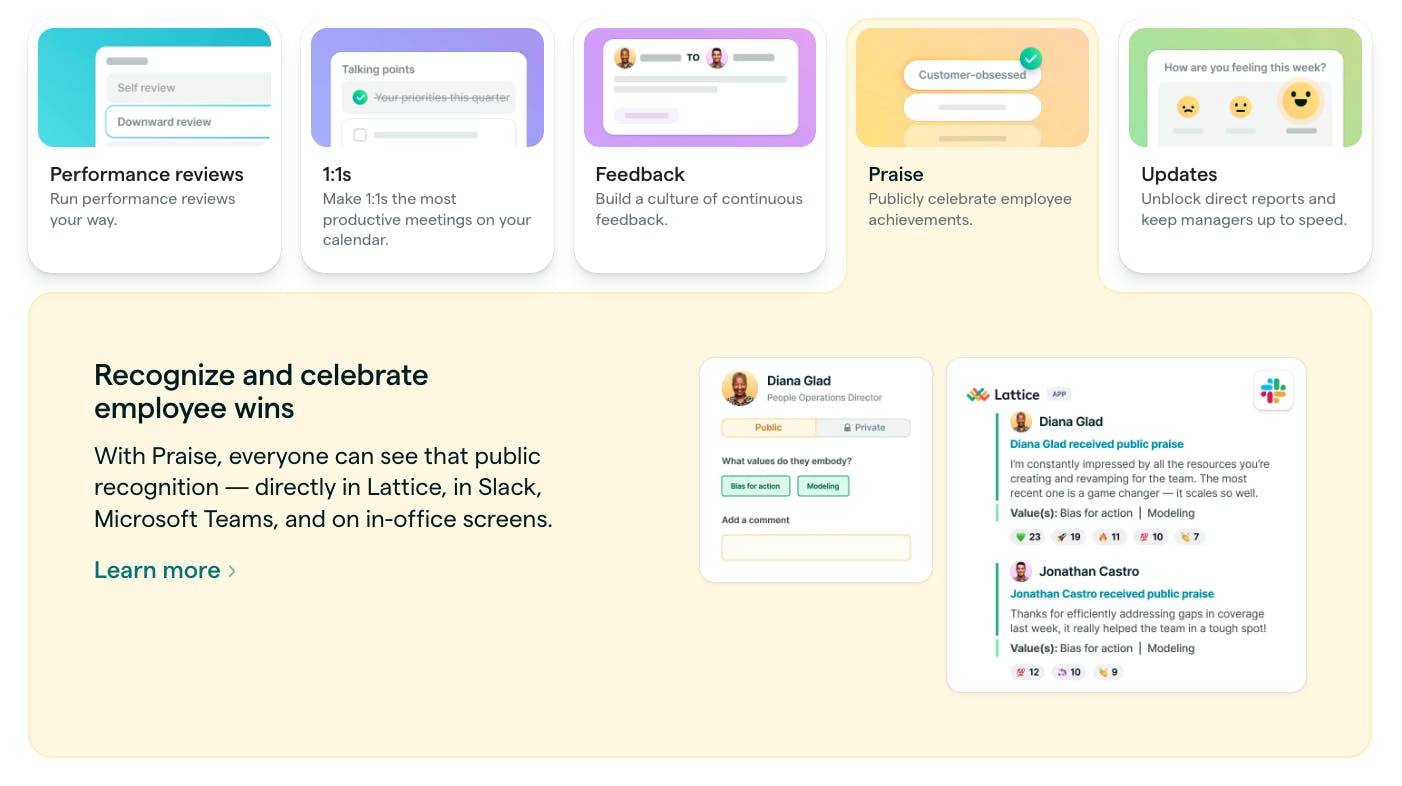

Lattice’s Praise tool is intended to help companies to build a performance culture. It allows peers to give public praise and recognition to one another. The solution integrates with Slack and Microsoft Teams so employees throughout an organization can see when someone receives a praise posting.

Updates

Source: Lattice

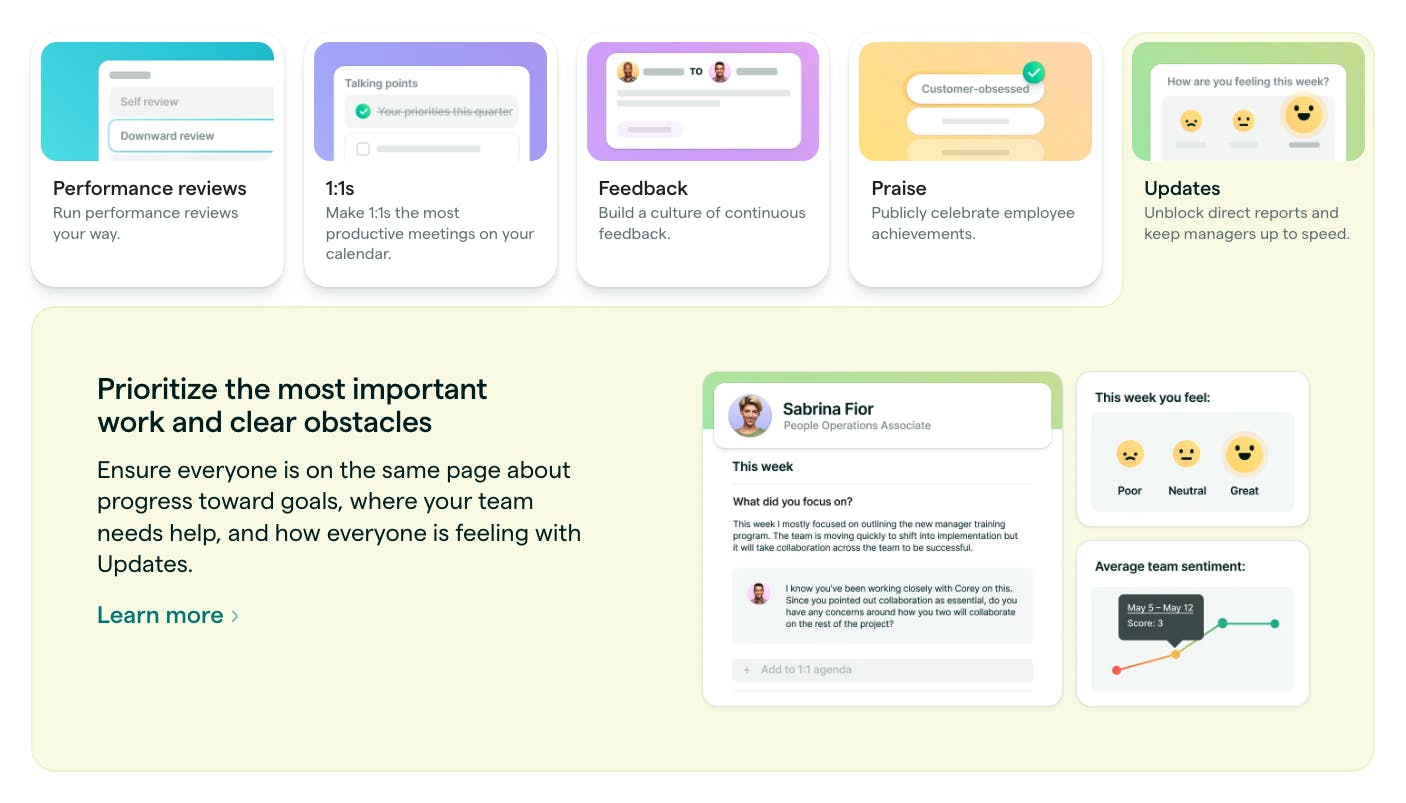

Finally, the Updates solution ensures all team members are on the same page regarding progress toward goals and employee sentiment. HR teams can customize update questions to see how people are feeling and where they may need help.

Compensation

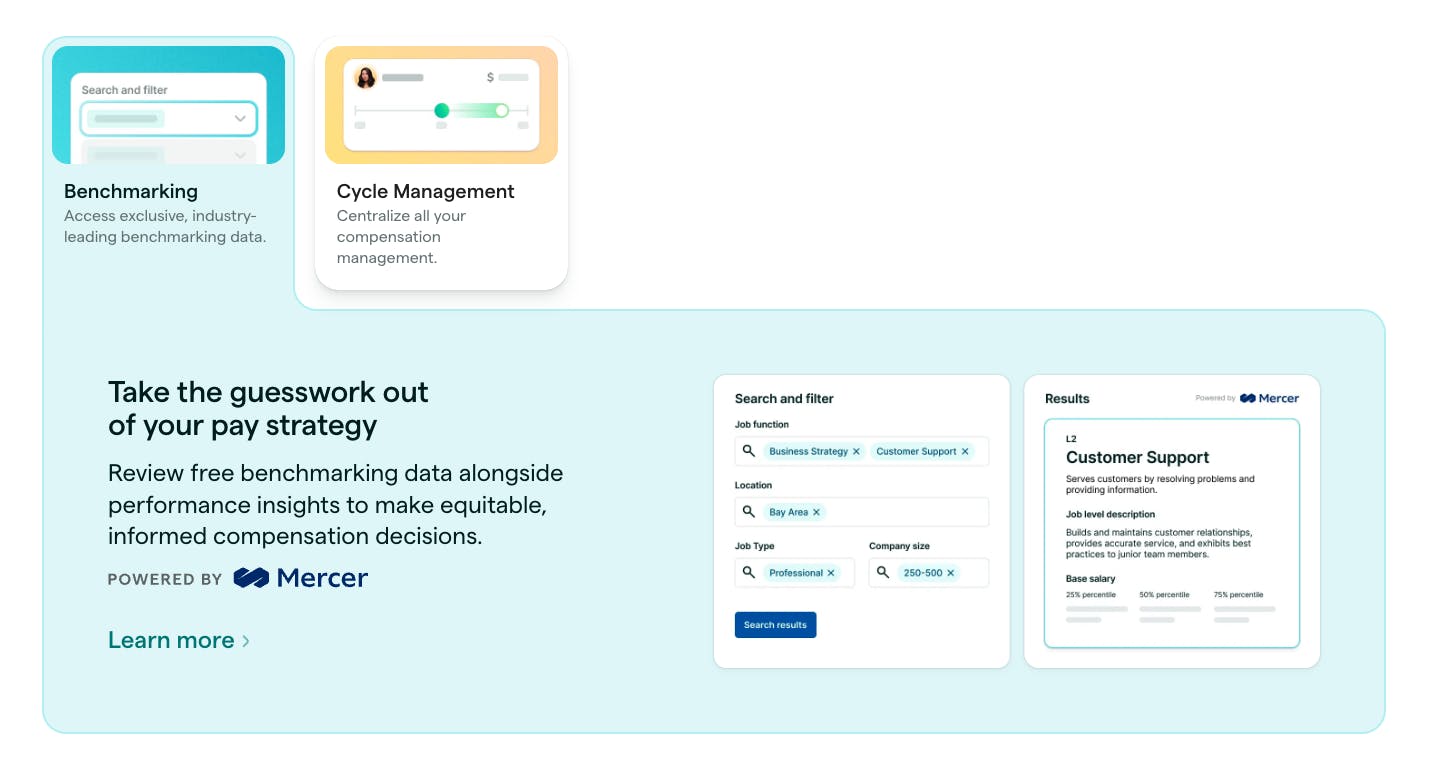

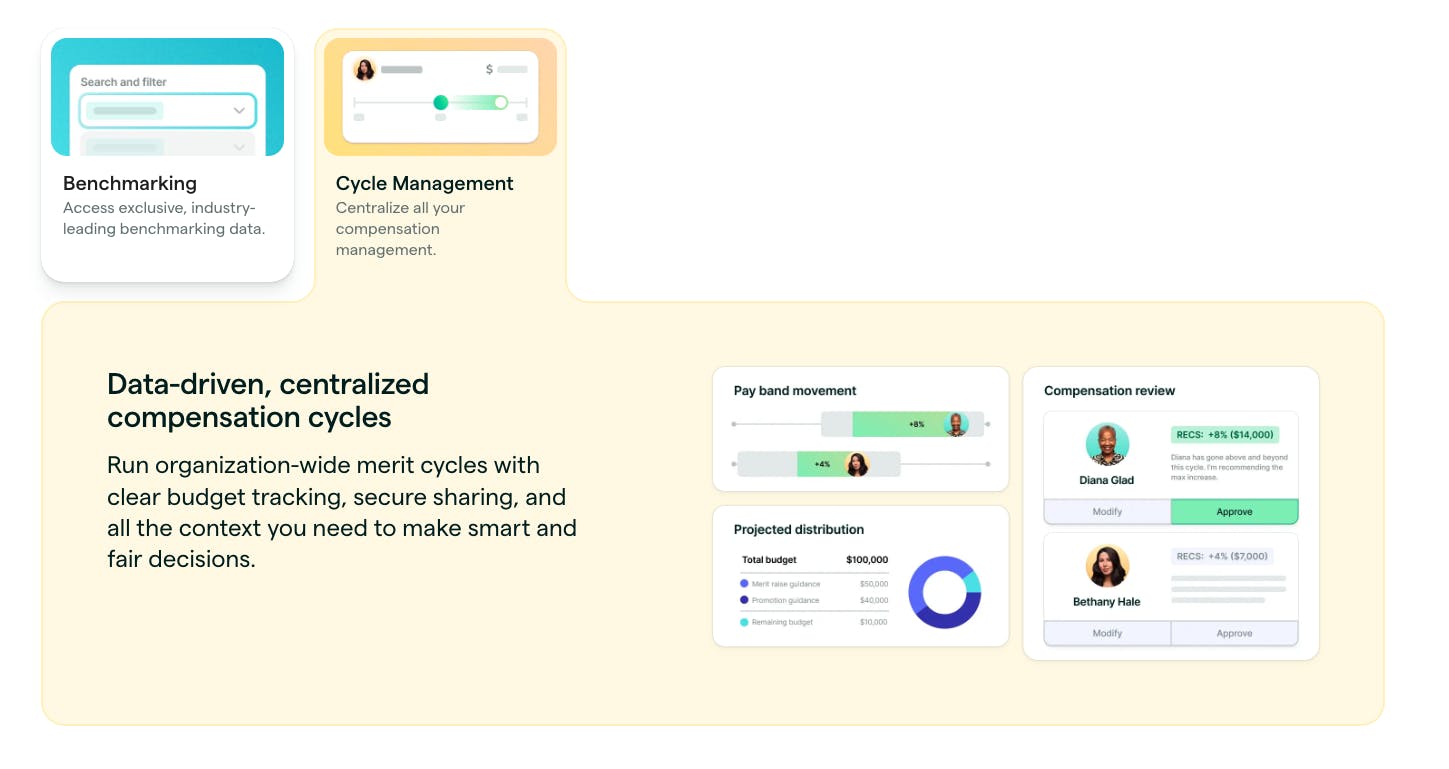

Introduced in July 2022, the Compensation tool is a more recent addition to Lattice’s platform. The compensation offering integrates performance data to make pay decisions more transparent, encompassing both benchmarking and cycle management solutions.

Benchmarking

Source: Lattice

Lattice’s benchmarking solution is intended to help reduce employee turnover and also the cost of hiring and retaining top performers. It provides market data to help employers ensure employees are paid competitively according to their role, location, and industry. Data is updated in real-time, and this solution also provides tools to help reduce internal pay disparities.

Cycle Management

Source: Lattice

Lattice’s cycle management tool is intended to help customers centralize their management of employee compensation with budget tracking, secure sharing capabilities, and the ability to pull in data from across an organization to help inform compensation cycles.

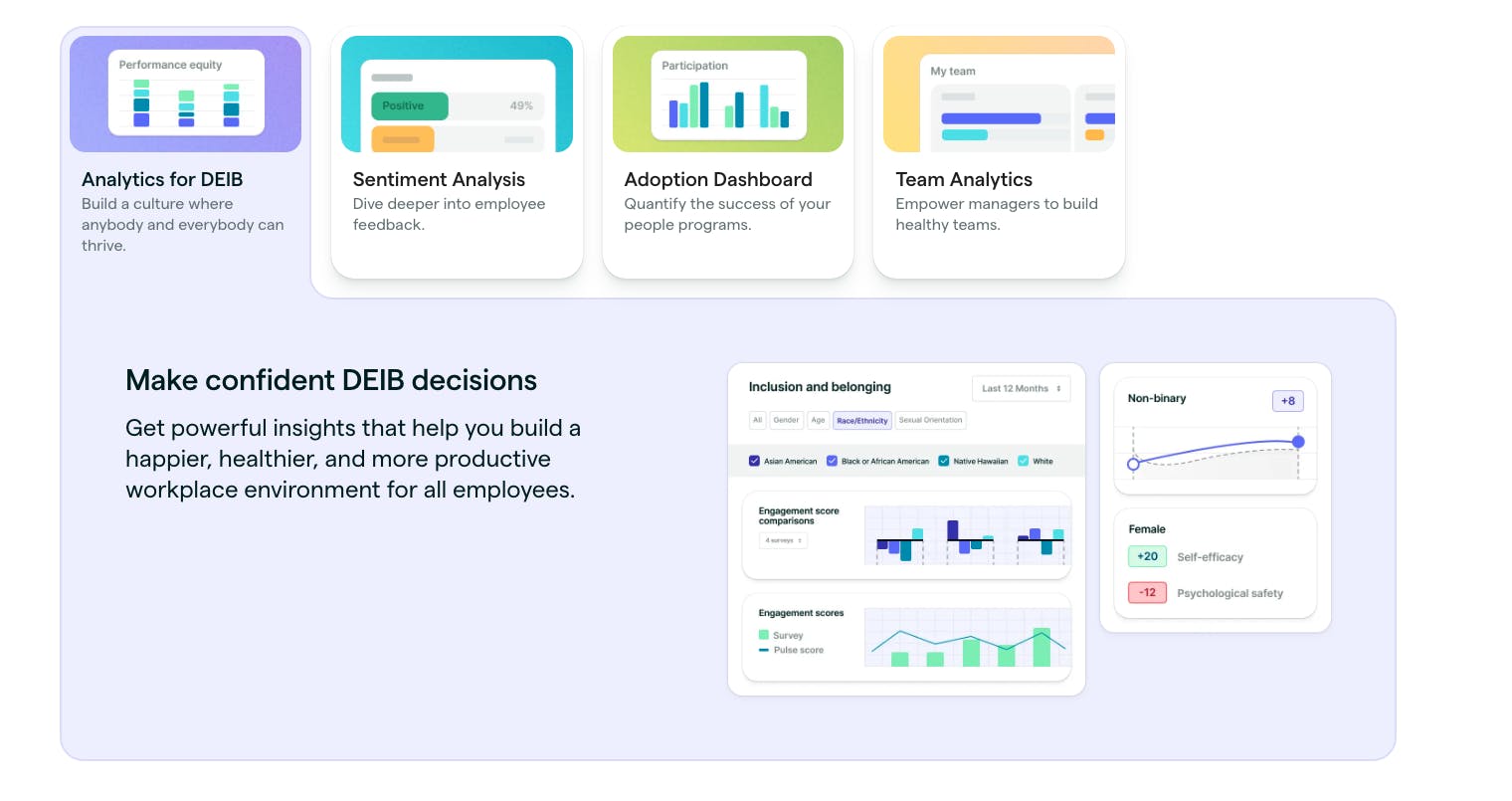

Analytics

Source: Lattice

Lattice’s Analytics tool could be seen as the driving force behind other solutions within the Lattice suite. It connects separate data sources about a company’s employees. Performance data, engagement surveys, and employee growth data are centralized in dashboards. Analytics provide insights across these sources of data which enables HR teams to answer questions regarding culture and employee experience via sentiment analysis.

OKR and Goals

Source: Lattice

Lattice launched an OKR module in March 2022, returning to its original roots (its first product having been an OKR tool). The OKR and Goals solution integrates the company’s objectives and key results into the daily routines of all employees. This accelerates growth by connecting a company’s people strategy with its business strategy. Strategic objectives and goals are made clear to all team members, helping them stay on track with organization-wide goals.

Engagement

Source: Lattice

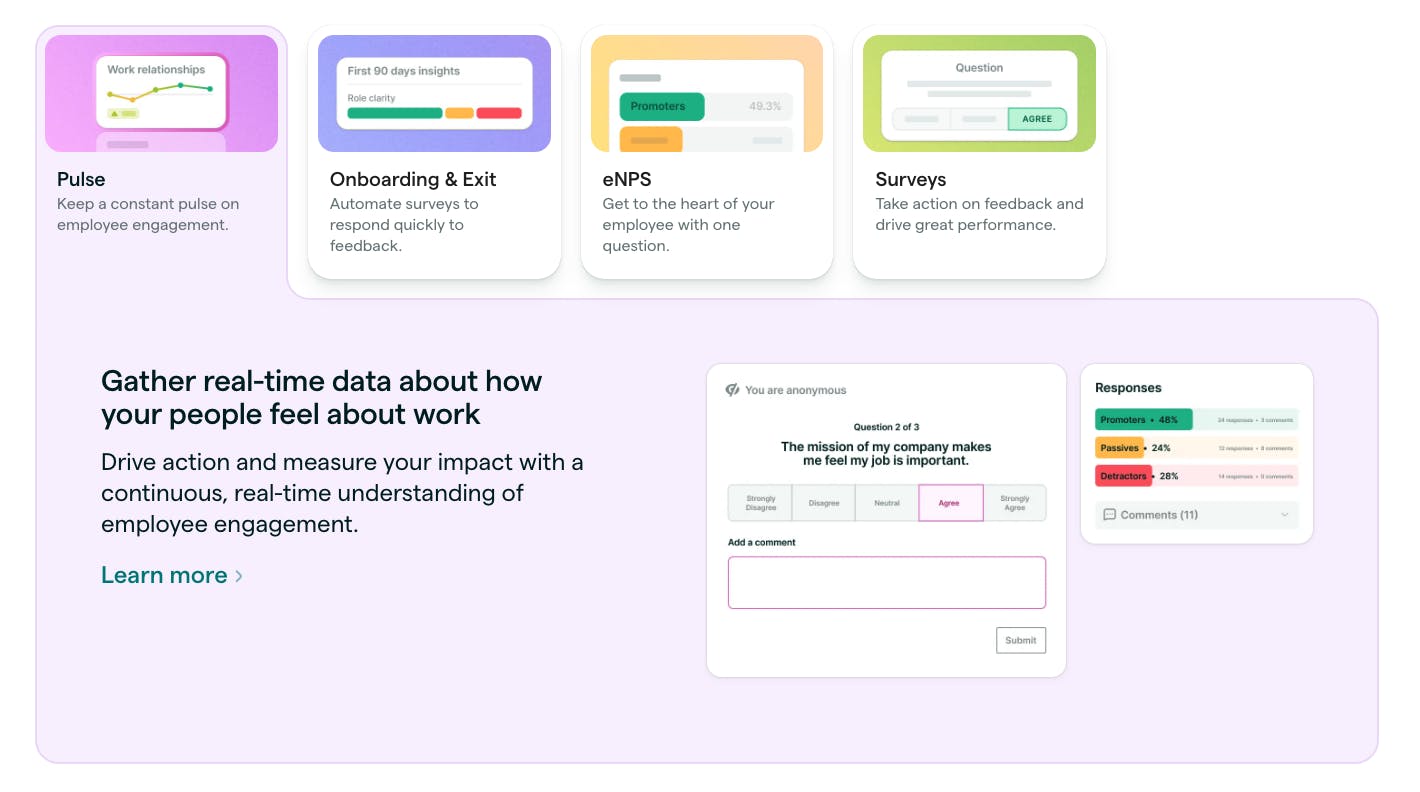

The Engagement solution helps companies understand what keeps their employees engaged. It guides HR teams to the most beneficial steps to ensure engagement moving forward. The Engagement tool includes three specific solutions: Pulse, Onboarding and Exit, and eNPS.

The Pulse solution involves employee engagement surveys that uncover real-time insights on engagement. Surveys help HR teams to identify what aspects motivate employees and identify areas that need improvement. Managers can share metrics and results with their employees so all members of the team are informed.

When employees onboard and exit, HR teams must gather information to avoid attrition and encourage retention. Lattice’s Onboarding and Exit tool automates the process of requesting, managing, and analyzing survey results whenever an employee leaves or joins. By learning from previous cohorts and new entrants, companies can take steps to improve the areas that may have led to regrettable attrition.

Lattice’s eNPS, or employee net promoter score, allows companies to assess employee satisfaction by measuring their willingness to recommend the company to peers. Employee satisfaction is based on different themes including work relationships and psychological safety.

Grow

Source: Lattice

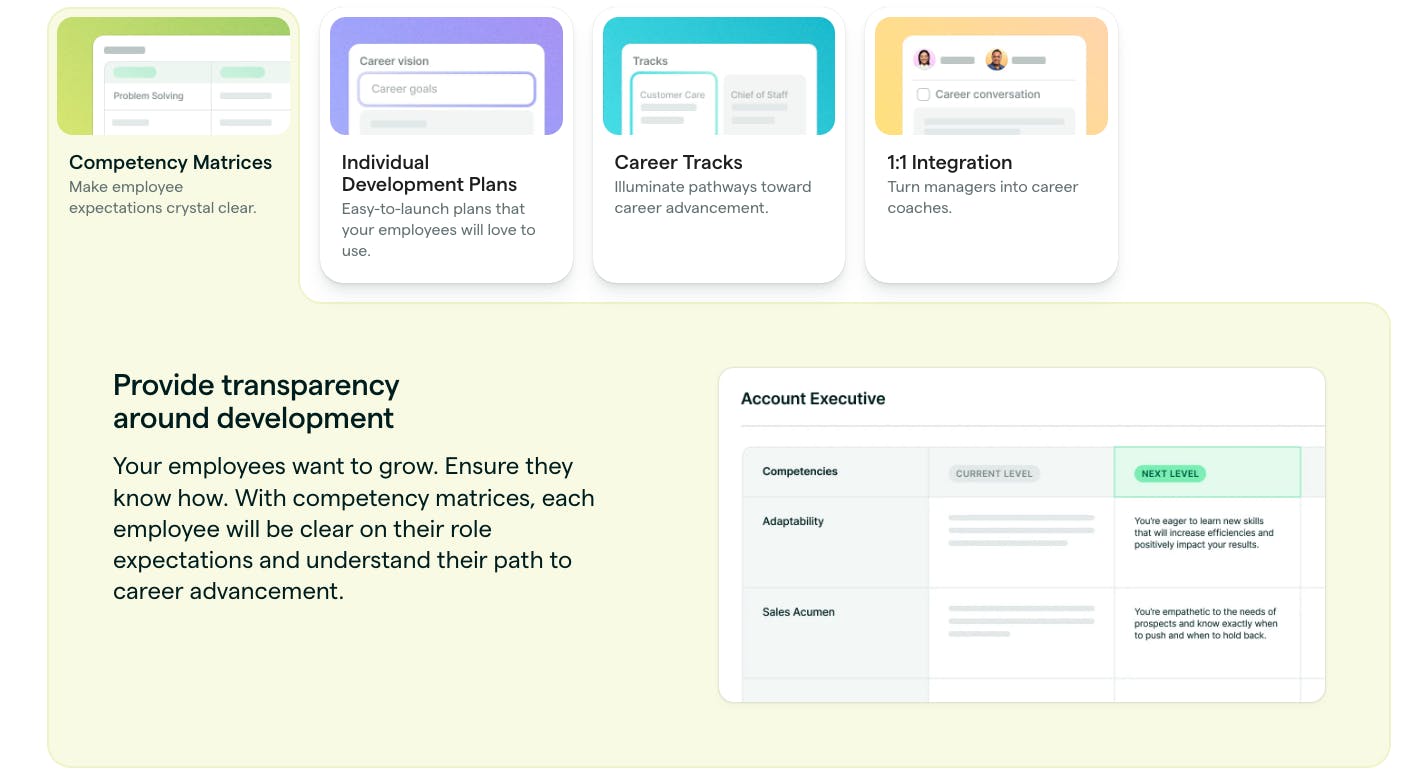

As employee attrition continues to be a major pain point for employers, one solution to encourage retention is career transparency. Lattice’s Grow solution is a way for companies to communicate potential career progression for their employees. The Grow solution includes three tools: Competency Matrices, Individual Development Plans, and Career Tracks.

A key part of career progression is understanding how expectations and skills will develop. Lattice’s Competency Matrix tool maps out role expectations for each stage of progression within a specific job title. Having a forward-looking chart helps employees prepare and understand their path to career advancement. The Individual Development Plan is a tool that gives employees agency over their growth. Employees can build out career plans that HR teams can view and provide ongoing guidance to help people achieve their goals.

Lattice’s Career Tracks solution is a library of templates and matrices inspired by companies with leading people strategies. The templates include the progressions of role expectations for various job titles including software engineer and customer success manager. Companies can download the career track templates, customize them to their liking, and see their employees succeed.

HRIS

Lattice describes its forthcoming HRIS product as “the HR information system built to work seamlessly with Lattice’s trusted Talent Suite.” As of January 2024, it is not publicly available and the landing page for the product includes the option to join a waitlist. According to Lattice, the system will allow customers to simplify their HR tech stacks, make new hires feel more welcome with a “rich onboarding experience”, compare employee records, proactively manage employees, and integrate with other HR tools.

Market

Customer

Source: Lattice

Lattice serves both small businesses with less than 100 employees and enterprise-level organizations with thousands of employees. Lattice believes having a strong people strategy implemented through comprehensive employee success technology is important for all businesses, regardless of size. As of January 2024, the company has over 5K businesses as customers, including notable companies like Slack, Robinhood, Gusto, Allbirds, Monzo, HelloFresh, and Webflow.

Market Size

The HR software market was valued at $22.4 billion in 2022 and is expected to reach $43 billion by 2028, expanding at a CAGR of 11.5%. Growth is being driven by the longer-term secular trend towards digitization that is still working its way to late adopters, as well as newer catalysts like the rise of remote work and the growing adoption of AI and automation.

Remote work accounted for for 28% of workdays in early 2023, versus only 6% before 2019. A July 2023 survey found that US executives expect hybrid and remote work to continue to increase for the next five years. 57% of workers in 2023 say they’d leave their jobs if not allowed to work remotely. As a result of the decline of in-person offices, performance management and feedback is increasingly necessary.

Meanwhile, employee turnover, one of the pain points that Lattice builds solutions for, is a growing problem for many organizations. A record 47 million Americans quit their jobs in 2021, and this record was broken by the ~50.5 million people who quit their jobs in 2022, compared to 42 million who quit in 2019. This rate of employee turnover is likely to persist; 56% of workers surveyed in April 2023 said that they planned to look for a new job within the next year.

Competition

Culture Amp: Culture Amp, which was founded in 2009 and is based in Melbourne, Australia, is a platform that helps businesses build a strong company culture. It offers surveys, pulse checks, and other tools to help measure employee engagement and satisfaction. Culture Amp also has some performance management features, such as goal setting and feedback. In July 2021, the company raised a $100 million Series F at a $1.5 billion valuation, led by Sequoia Capital China and TDM Growth Partners. It has raised a total of $257.5 million in funding as of January 2024.

Leapsome: Leapsome, founded in 2016 and based in Berlin is a comprehensive HR platform that offers performance management, continuous feedback, employee recognition, and goal setting. It's known for its user-friendly interface and strong analytics capabilities. It raised a $60 million Series A in March 2022 at an undisclosed valuation to “further accelerate its US market presence.” Notable investors included US-based Insight Partners, Sweden-based Creandum, and Germany-based Visionaries Club.

BambooHR: BambooHR, founded in 2008, is an HR platform that focuses on payroll, benefits, and onboarding for SMEs. However, it also offers some performance management features, such as goal setting and performance reviews. The company's funding amount is undisclosed and according to one third-party estimate achieved $189.7 million in revenue in 2023.

Reflektive: Reflektive, founded in 2014, is a performance management platform that uses continuous feedback to help employees improve. It's known for its 360-degree feedback feature, which allows employees to get feedback from their peers, managers, and even direct reports. It has raised a total of $101.6 million in funding as of January 2024, with its most recent round having been a $60 million Series C in 2018 at an undisclosed valuation led by TPG growth.

Business Model

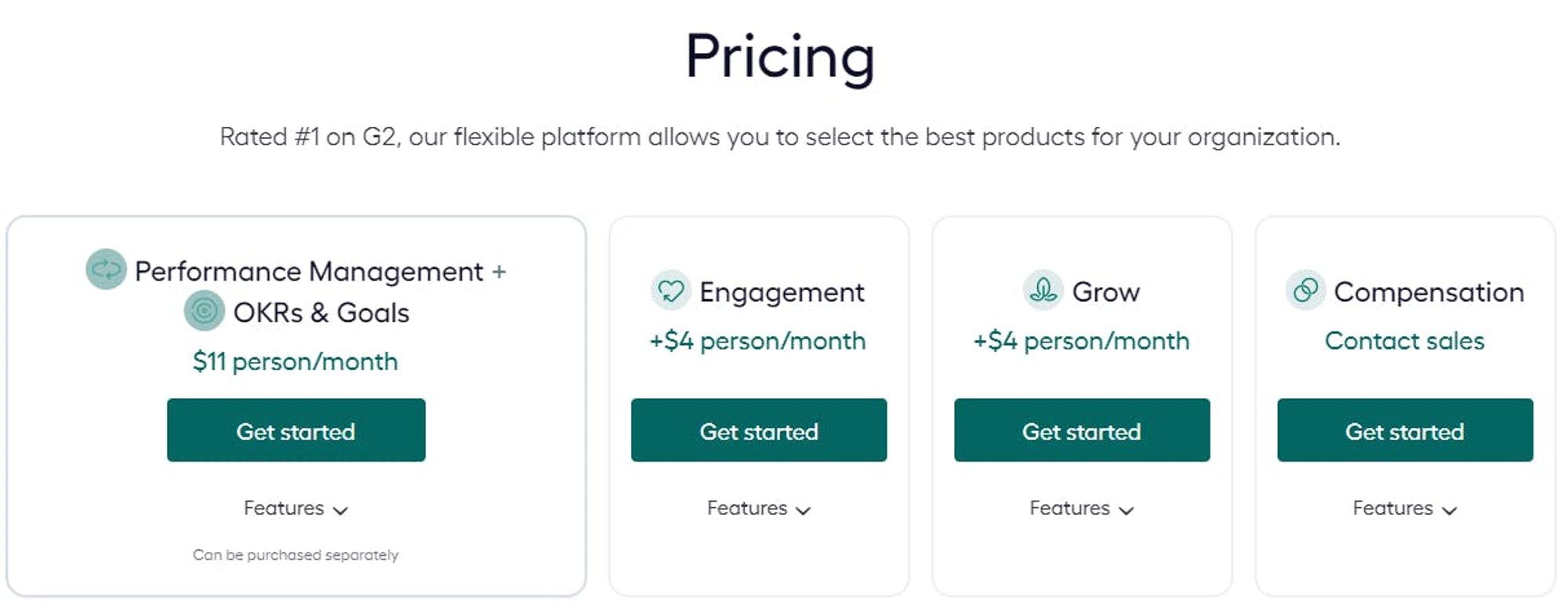

Source: Lattice

Lattice is a SaaS business that generates revenue through subscription plans based on the customer’s needs. As of January 2024, the Performance Management and the OKR & Goals tools can be bundled together for $11 per person per month. The Engagement and Grow solutions can be added on for an additional $4 per person per month for each tool.

Lattice Advisory Services program is another way Lattice generates revenue. The LAS program operates under a business model one would expect to find at a consulting firm. Customers will pay for the people strategy services they receive from the Lattice Advisory team.

Traction

As of January 2024, Lattice is used by more than 5K businesses including notable companies like Slack, Gusto, Intercom, Ramp, NPR, Calm, and Tide. In August 2023, Lattice was included in the Inc. 5000 list of the fastest-growing private companies, and in November 2023 it was ranked #143 fastest-growing company in North America by Deloitte Technology’s 2022 Fast 500. This was despite a 15% layoff that the company conducted in January 2023, citing macroeconomic conditions. According to the company’s blog:

“While our revenue has grown by five times since the start of the pandemic, our costs have grown by even more as we geared up for a continued rate of growth that now looks unlikely.”

With the stepping down of Jack Altman as CEO in December 2023, the company began preparing for “a new phase of sustainable growth.”

Valuation

In January 2022, Lattice saw its valuation triple from its previous round to $3 billion during its $175 million Series F, which brought the company’s total funding to $329.3 million. The Series F was led by Dragoneer and other notable investors included Tiger Global, Founders Fund, Thrive Capital, Shasta, and Khosla Ventures.

Key Opportunities

Product Expansion

Lattice has plenty of potential product expansion opportunities it can explore. Throughout its history, Lattice has gone through major product expansions and is gearing up for another with the forthcoming HRIS product. The expansions are one of the many factors contributing to Lattice’s continuing traction. Future expansions could consist of more traditional HR tools, a direction that Lattice has begun to explore with its compensation product which was released in 2022.

Consolidation

The explosion of new solutions in HR tech following the rise of remote work has led to a crowded market. Many HR tech companies are racing to build a more comprehensive offering. This presents an opportunity for companies like Lattice to establish a favorable position through consolidation as the market matures. In a March 2022 article written by BCG, the authors confirm this opportunity, stating:

“The next 18 to 24 months will be a critical window of opportunity for talent management providers to stake out their positions, establish their role in emerging talent ecosystems, and claim share.”

International Expansion

In September 2021, Lattice expanded internationally by opening an office in London. Before its formal presence in Europe, Lattice’s customer base consisted of a growing portfolio of 400 international customers. Expanding to London will allow Lattice to provide better regional support to its international customers. Over the next 10 years, Lattice is planning an investment of $110 million in the UK region to hire more international team members and perfect its go-to-market strategy throughout Europe. International expansion presents a key opportunity for Lattice to strengthen its position as a leader in the global HR technology industry.

Key Risks

Lack of Adoption Across Other Industries

Although people strategy is a crucial aspect for most industries, there are some that may be less focused on having a comprehensive employee success platform. Lattice focuses on providing solutions for five industries: Agencies, Professional Services, Technology, Banks / Credit Unions, and Fintech. Lattice chose to target these industries because its tools are best suited to desk-based knowledge workers.

Conversely, front-line employees working in deskless settings are outside of Lattice’s scope as they require a significantly different set of tools. Former CEO Jack Altman said in 2022 that he believed that Lattice could tackle this issue and would like to target front-line, deskless industries in the future. Doing so presents a potential risk of little to no traction in industries with less need for employee success platforms.

Unfruitful Product Expansions

Although previous expansions have been successful, Altman has recognized that future expansions carry a potential risk as they can lead Lattice down unfruitful paths. Given the company’s core mission of making work meaningful by bringing the employee experience to the forefront, the endless possibilities to expand the product offering could lead to less successful products that take up time and resources.

Summary

Lattice, founded in 2015 by Jack Altman and Eric Koslow, is a people management platform that helps companies drive performance through performance management, goal setting, and employee engagement. The company pivoted from its initial focus on OKR tools to a successful performance review product. Lattice offers a suite of products including Performance Management, Compensation, Analytics, OKRs & Goals, Grow, and Engagement.

The HR software market, valued at $22.4 billion in 2022, is expected to reach $43 billion by 2028, with growth driven by digitization trends and the rise of remote work. Lattice's SaaS business model generates revenue through subscription plans, with a valuation of $3 billion as of January 2022. Lattice serves both small businesses and enterprise-level organizations, boasting over 5K customers, including notable companies like Slack, Gusto, and Webflow. Key opportunities include product expansion, consolidation in the crowded HR tech market, international expansion, and potential risks include limited adoption across industries and competition in the evolving market.