Thesis

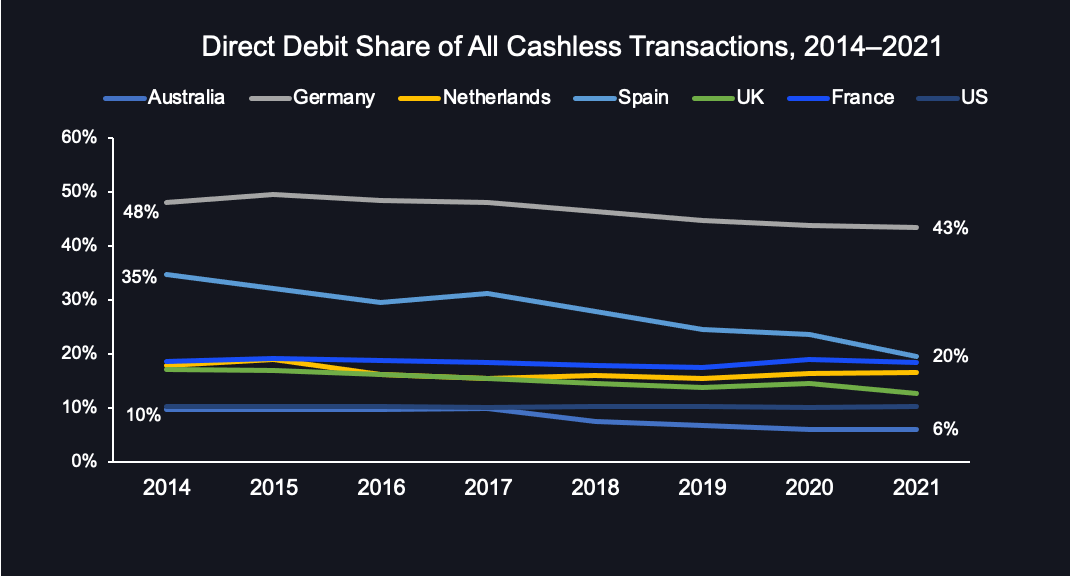

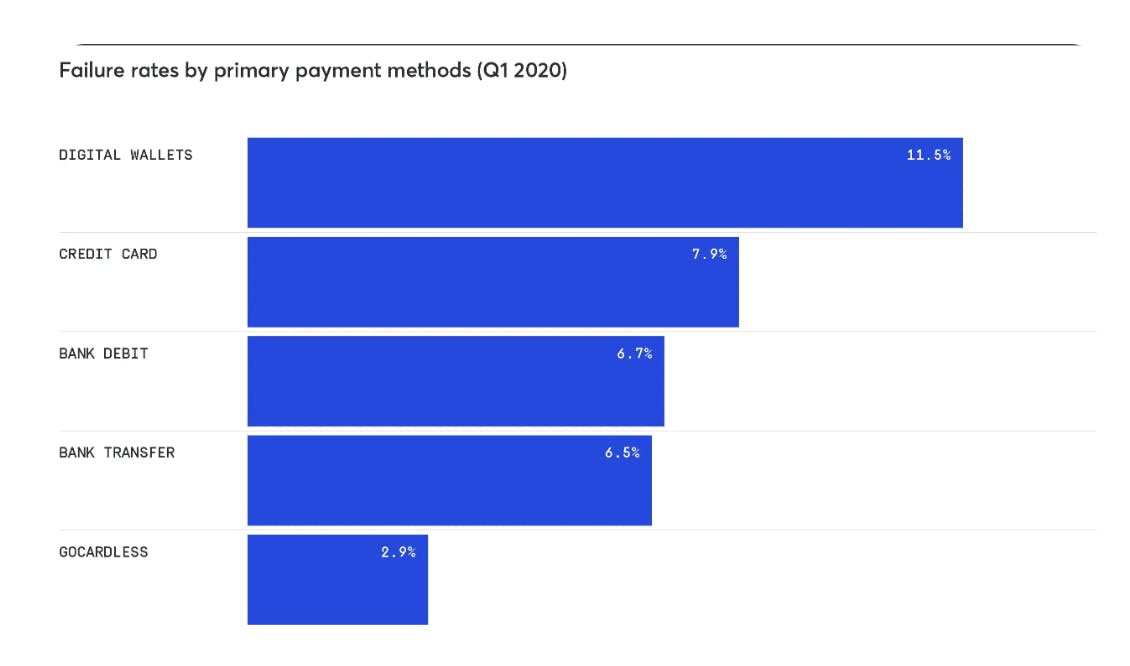

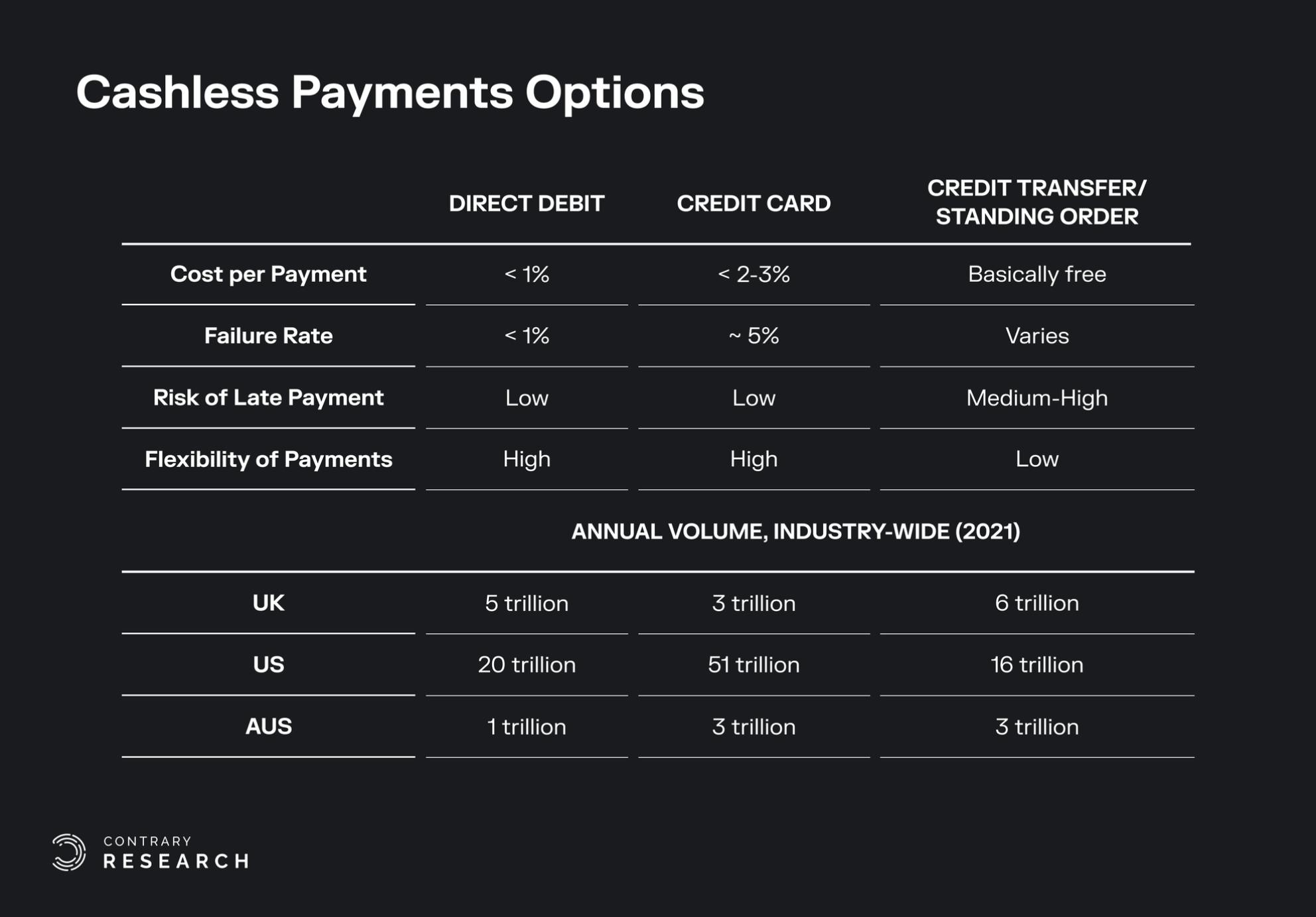

Many ecommerce merchants offer multiple payment options at the point of sale. Some of these options offer short-term credit to finance purchases, such as the buy now, pay later models of Klarna, Affirm, and AfterPay. Additionally, with the growth of ecommerce, cashless payments have become a necessary and convenient way to pay. Today, 83% of American adults have at least one credit card and 41% of American consumers do not use cash to pay in a regular week. For simple, ad hoc debit-based transactions or subscription-based recurring payments, a credit or debit card proves to be an expensive and less reliable option over direct, bank-to-bank transactions. Credit card networks like Visa and MasterCard charge a merchant an average of 2-3% per transaction and fail 7.9% of the time. Meanwhile, digital wallet transactions fail 11.5% of the time on average.

These failures are estimated to cost the global economy $118.5 billion in lost fees and time, and frustrated customers lead to churn, with 60% of businesses in 2021 in claiming that failed payments had resulted in lost customers. Meanwhile, cards and other payment methods are more prone to fraud at increasing rates: the Federal Trade Commission observed a 44.7% increase in fraud between 2020 and 2021. For every $1 in fraud, merchants are estimated to incur $3.75 in related reconciliation costs, and the global tech industry is expected to incur over $400 billion in fraud-related costs in the decade following 2022. Cutting down on failed and fraudulent payments could save individual merchants millions of dollars.

GoCardless offers a direct debit solution that directly connects merchants to banks, enabling them to bypass the high fees and failure rates associated with cards and digital wallets. GoCardless offers direct bank-to-bank payments as an alternative to cards and their substantial fees, slow networks, and high failure rates. The company claims to help merchants by reducing the cost of taking payments by 56%. It claims a low 2.9% failure rate and integrates automated payment recovery and fraud prevention.

Founding Story

In 2011, Oxford students Hiroki Takeuchi (CEO), Matt Robinson, and Tom Blomfield thought about starting a company but didn’t know what sector they should dig into. Although none of the trio knew anything about payments, they decided it was the best sector to explore, and they settled on the idea of helping small and medium-sized businesses collect recurring payments. In early 2011, they pitched their idea, named GoCardless, to Y Combinator, and hours later landed $150K in funding. Takeuchi handled frontend, Robinson (who later founded Nested) tackled business, marketing, and sales, and Blomfield (who later started Monzo Bank) handled backend coding.

GoCardless planned to operate in a space that is heavily regulated in the UK and it needed a payments license to launch. Fortunately, Robinson’s friend worked in the regulator’s office. He asked that friend to dinner and booked the latest reservation he could find so they had no choice but to stay at the office and, Robinson thought, give GoCardless a better chance at getting its application approved. His plan worked: “It was a record time anyone had ever been regulated as a payments institution,” Robinson said.

With the license in hand, GoCardless raised funds from Accel Partners and others in 2012. Their first direct debit product officially launched in the UK in 2013, and a year later expanded to France, Germany, and Spain. In 2017, after Robinson and Blomfield had moved on to their next ventures, Takeuchi, the current CEO, suffered a cycling accident that put him in the hospital. Just 24 hours after surgery, Takeuchi called into a crisis-time conference convened with the company’s investors. He asserted, “I’m coming back.”

Takeuchi is the only remaining member of the original founding team, and has led GoCardless through an international expansion which has seen it establish offices in France, Latvia, Australia, and the US.

Product

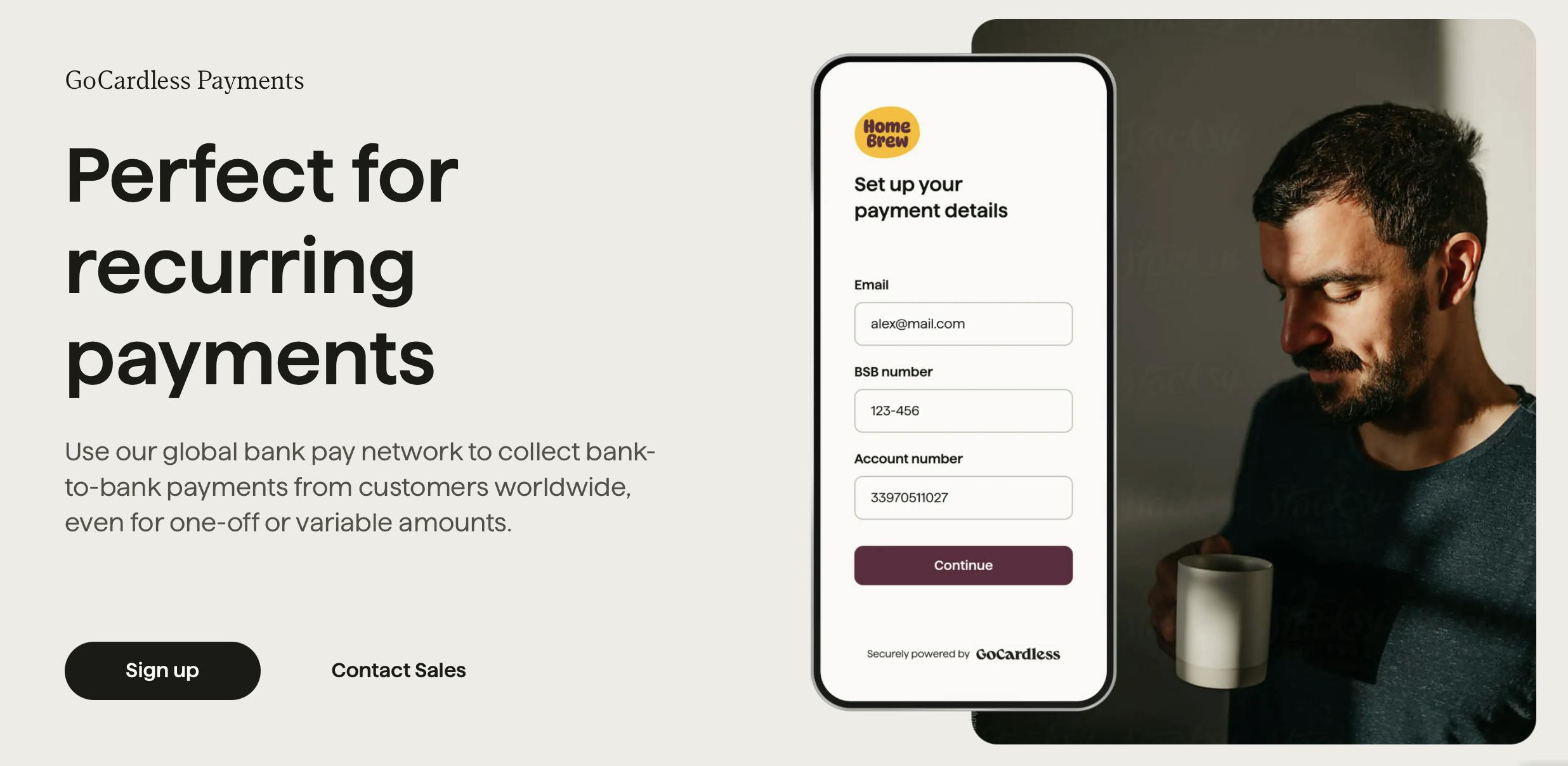

GoCardless’s product is a global account-to-account payment network that facilitates direct debit solutions for businesses, enabling them to collect recurring payments from customers across multiple countries.

Recurring Payments

Source: GoCardless

Since its founding, GoCardless has processed payments using direct debit (or bank-to-bank debit, colloquially known as “auto pay”). Direct debit is a bank payment method where the payer authorizes the payee to pull funds from their account on the due dates. It is simpler to automate than card-based payments, and its recurring payment capabilities are more reliable.

GoCardless claims to collect 97% of payments at the first point of billing, compared to 93% for all other payment methods. “Our view is that being able to move money much more directly from one account to the other is always going to be the best way,” Takeuchi said.

Source: GoCardless

Instant Payments

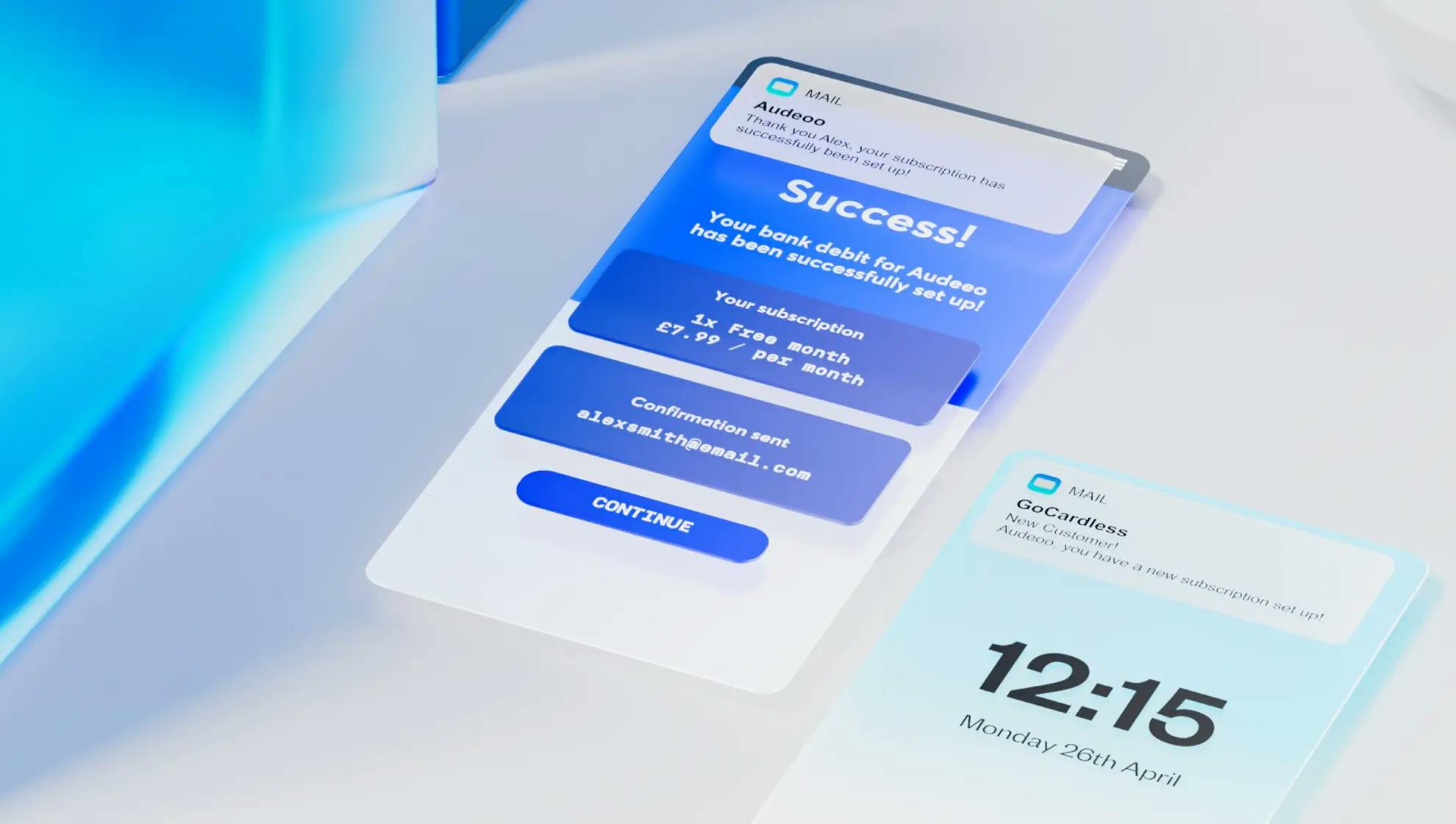

Source: GoCardless

Open banking powers GoCardless’s Instant Bank Pay, or Instant Payments. A merchant can request a payment by sending an email or sharing a link. GoCardless then connects the customer to their bank and the customer authorizes the payment. Once authorized, the merchant receives confirmation of the payment. GoCardless estimates ad hoc payments via direct debit are 54% cheaper than a card payment. Instant Bank Pay also simplifies the process of collecting regular invoices of varying value, as well as processing ad hoc charges on top of recurring payments — an initiation or service fee charged on a regular subscription, for example.

International Payments

Source: GoCardless

Instead of relying on card networks like Mastercard or Visa, direct debit leverages international payment rails such as ACH in the US or SEPA in the Eurozone to withdraw funds directly from customers’ bank accounts.

Providing wholesale access to these international rails means that customers can accept international transactions without needing a bank account in the customer’s country. Since 2019, GoCardless has partnered with foreign exchange provider Wise to process its international payments, which are subject to slightly higher fees than domestic payments. GoCardless currently processes payments in GBP, EUR, USD, SEK, DKK, AUD, NZD, and CAD, and covers over 30 countries.

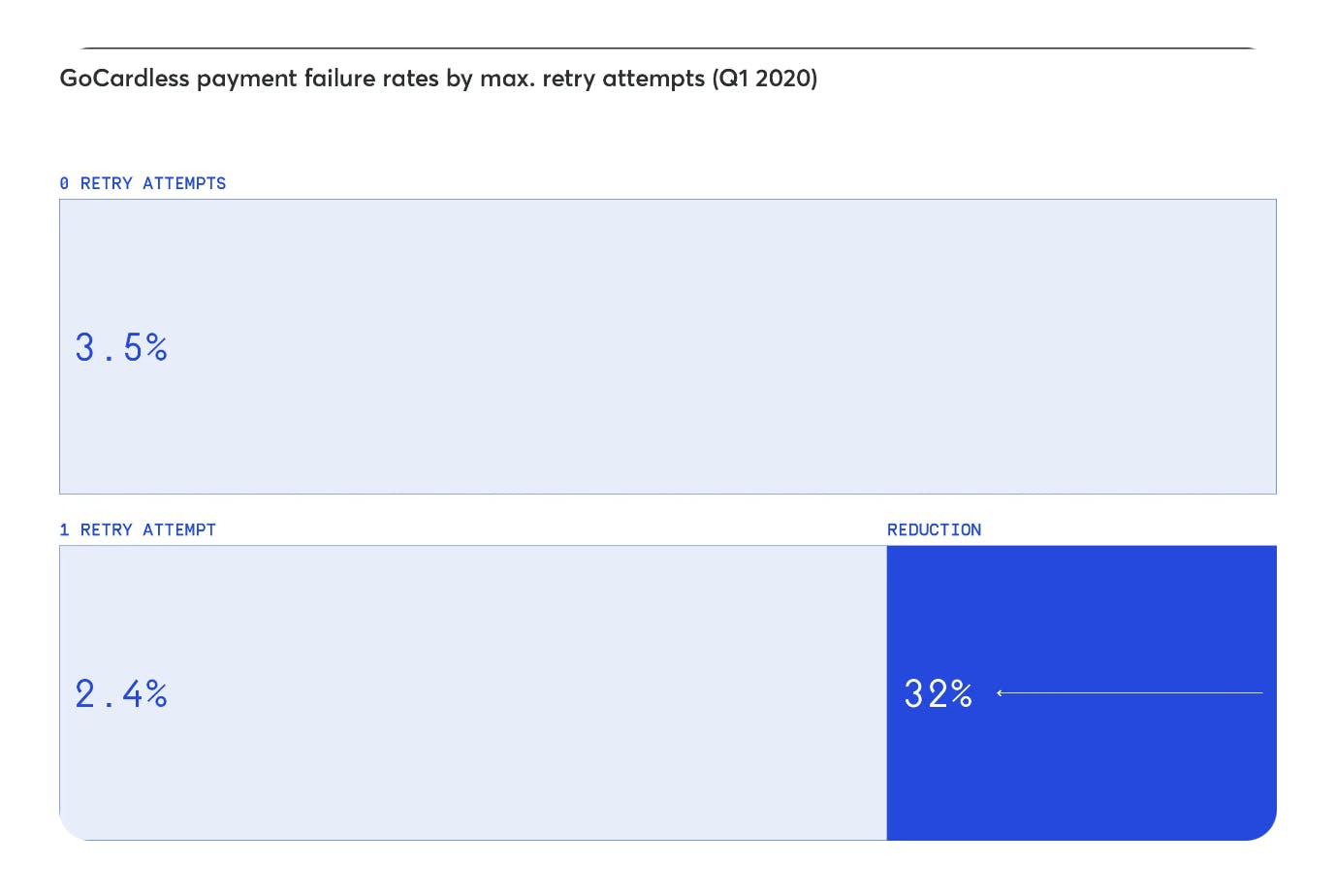

GoCardless Success+

Source: GoCardless

Recurring and ad hoc payments occasionally fail. GoCardless’s Success+ helps merchants chase failed payments and retry them once the customer has the requisite funds. Without these “intelligent retries,” merchants would probably retry the payment themselves and incur processing fees again, possibly without success.

GoCardless estimates that the average recovery rate for failed payments is only 38%. By collecting late payments on a customer’s preferred payment date, GoCardless claims a 70% success rate. Luke Fosset, head of GoCardless’s Australian business, notes that delays from card payments can tie up a merchant’s working capital, while a solution like GoCardless can free up $7 billion in capital to merchants worldwide, reducing their financing costs and encouraging them to invest in their products.

Source: GoCardless

GoCardless Protect+

Source: GoCardless

Protect+ helps merchants avoid fraud by preventing costly chargebacks from happening in the first place. Protect+ offers merchants a decade’s worth of data on GoCardless’s payment processing as well as know-your-customer (KYC) capabilities such as verification of identity, income, and credit risk. Merchants can choose how strictly GoCardless vets customers and their payments, effectively filtering out the riskiest payments. GoCardless has also integrated machine learning to adapt its detection capabilities to new fraudulent behaviors and trends.

Verified Mandates

Source: GoCardless

GoCardless claims that two-thirds of US merchants take up to three days to detect fraudulent payments. Verified Mandates allows the merchant to instantly detect fraud at the point of checkout. This is especially useful for merchants processing a high volume of recurring payments or high-value ad hoc payments. A customer can log into their bank via Plaid's bank-to-bank account connection, which allows the merchant to quickly authorize the customer’s account details. Once the account is verified, GoCardless sends a confirmation to both the merchant and the customer.

GoCardless Bank Account Data

Open banking requires banks to share information with third parties and startups approved by regulators. This allows merchants to access their customers’ bank account data and avoids the payment gateways and networks common to slower, pricier card-based transactions. In the EU, a secure, structured data-sharing agreement called the Payment Services Directive 2 (PSD2) essentially created open banking in 2018, and GoCardless launched its open banking products in 2021.

The company has used open banking to supplement, rather than replace, direct debit. For example, open banking enables variable recurring payments (VRPs), which are similar to direct debit payments but automate more of the associated tasks. VRPs allow the customer to change their payments anytime in the transaction process and permit merchants to make instant adjustments, such as payment holidays or interest rate freezes.

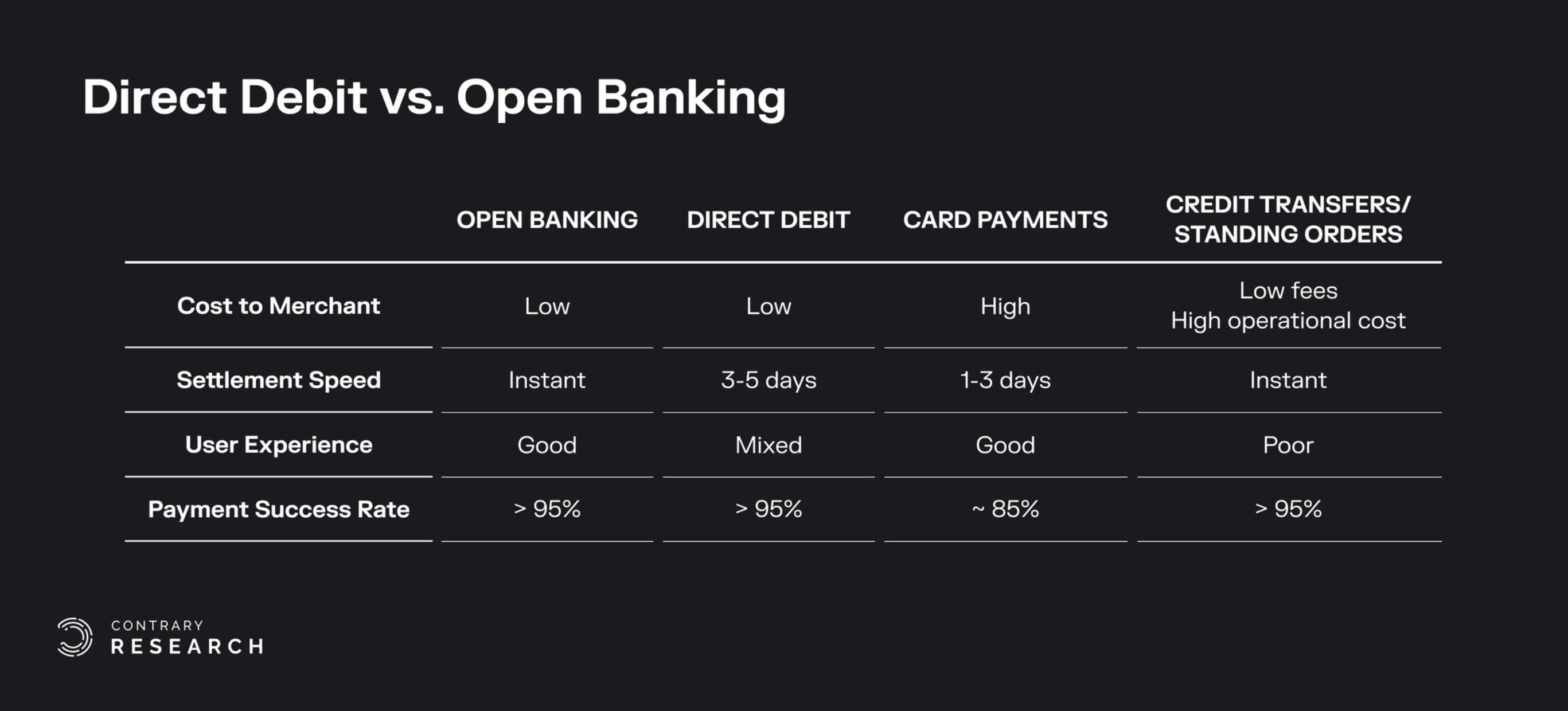

Source: Truelayer, Contrary Research

Open banking may lower borrowing costs for merchants with limited credit history. It may also increase customer retention since credit cards can be a pain point for ecommerce consumers. Unlike the simple bank account numbers used with direct debit, credit cards expire, so cardholders must re-enter details. A bank seldom notifies customers of an upcoming recurring payment, and rather than canceling that payment with the credit card issuer, customers normally have to deal with the service provider — a process that can be deliberately difficult, as illustrated by the recent federal suit against Amazon’s Prime subscription process. These sorts of payment failures may cause customer churn, leaving merchants with the bill. Merchants currently write off 11-15% of uncollected funds as bad debt.

By contrast, when a merchant uses GoCardless, a customer can simply use the same payment type for both recurring and ad hoc purchases — for example, the same account used for a gym membership can pay for a one-time personal training session. While this was possible with GoCardless’s direct debit capabilities, it is simplified with open banking.

Source: GoCardless

Market

Customer

GoCardless is a B2B company primarily servicing merchants who charge customers on a recurring basis, meaning any services based around subscriptions (like gyms or newspapers) or recurring payments (like auto loans or utilities). Using GoCardless’s dashboard and platform, merchants can easily renew, amend, and pause payment plans. As of 2022, the company’s top 20 merchants accounted for 10% of its revenue.

GoCardless’s REST API allows integration with a merchant’s website or application, enabling recurring payments from their customers and simplifying the billing process. GoCardless also partners with hundreds of businesses to design custom integrations for merchants who rely on recurring payments, such as accounting and billing software companies (e.g., Quickbooks) or subscription management platforms (e.g., Zuora). That means small business customers of these services can access the payments capabilities of GoCardless via their service provider. For example, GoCardless for Salesforce collects payments and manages customer data within the Salesforce CRM platform. These partnerships accounted for 41% of GoCardless’s revenue in 2022.

Market Size

As consumers increasingly switch from cash to digital payments, the market for direct debit may also increase. Across GoCardless’s primary markets — the UK, US, France, the Netherlands, Germany, Spain, and Australia — takeup varies widely compared to other cashless payments methods. In the UK, for example, direct debit is only 1% of cashless payments by value, or $890 billion in 2021, compared to credit transfers at $69.1 trillion.

In the US, by contrast, direct debit represented 27% of cashless payment value in 2021. Direct debit’s share of payment volumes is actually declining across most of GoCardless’s markets, but overall payment volumes continue to increase. For example, UK consumers and businesses processed 4.6 billion payments by volume using direct debit in 2021, and this is expected to grow to 5.7 billion by 2031.

GoCardless is targeting recurring payments, allowing its low fee-per-payment to accumulate over the life of a customer’s subscription or membership. The recurring transaction value, estimated at $13.2 trillion in 2023, is projected to increase to $15.4 trillion by 2027. GoCardless’s other target market, ad hoc payments, is difficult to size given the variable and one-time nature of payments adjustments, bonuses, or gifts. However, many merchants who collect recurring revenue also request ad hoc functionality. (As a representative example, that figure is 88% of merchants in Germany.)

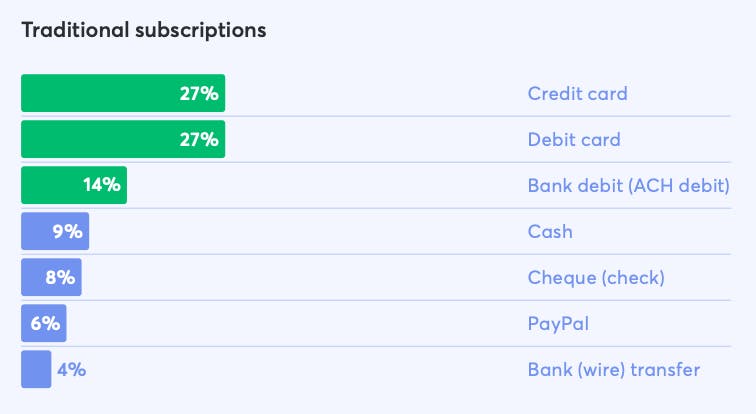

UK-based merchants represented about 80% of GoCardless’s 2022 revenue, as direct debit claims 58% of traditional subscription payment methods. Its next largest markets were France (8%), Germany (3%), the US (2%), and Australia (2%).

Competition

By offering a lower fee-per-payment service GoCardless is indirectly competing with the major card networks, such as MasterCard and Visa, which charge 2–3% per transaction. However, these are the overwhelming incumbents, together claiming about 80% of the credit card payments network. Although GoCardless hopes to gain market share from these dominant players, it is in direct competition with a range of large payment providers who also hope to establish a larger position — namely, Klarna, Stripe, PayPal, Venmo, and WorldPay. In 2022, GoCardless admitted that, faced with competition like this, it currently has “very low market share.”

Source: GoCardless, Bank for International Settlements, Contrary Research

PayPal: PayPal, founded in 1998, is a financial services company that provides online payment solutions. GoCardless has partnered with PayPal as one of its point-of-sale options but observes that, as a competitor in payment processing, it has a very low consumer preference share, averaging around 10% across major markets (excluding Germany) in 2021. That said, PayPal enjoys the largest share of the payments market and has also integrated open banking functionality. PayPal established itself as a go-to service for international transfers and offers a suite of fraud prevention tools to rival GoCardless’s Protect+, Verified Mandates, and Success+ capabilities. Even so, PayPal is primarily known as an ad hoc card processor, whereas GoCardless sells merchants on the advantages of bank-to-bank payments, specifically targeting subscription-based businesses. PayPal is publicly listed on the NASDAQ, with a market cap of $58.5 billion in November 2023.

PayU: PayU, founded in 2002, is a Netherlands-based payments processor that has expanded into emerging markets through nine acquisitions — including a 2019 acquisition of a recurring payments specialist, Turkey-based Iyzico. The company offers recurring payments, instant refunds, online platforms, and lending solutions, among other services. PayU does not compete directly in GoCardless’s major markets but is becoming a dominant player in markets where GoCardless may seek to expand. Although its valuation is not disclosed, the company has made high-profile acquisitions across Asia, Europe, and Latin America. It is owned by South African holding company Naspers, which has folded many of its international payments processors under the PayU brand.

Elavon: Founded in 1991, Elavon operates a payments gateway to compete with Stripe and PayPal, and in 2019 purchased Sage Pay for $300 million. With Sage Pay, Elavon expanded its merchant offering with cash transfer and secure online payments, a service comparable to GoCardless. Across all of its payments services, Elavon currently claims 2 million users in 36 countries and processes 6 billion transactions annually, totalling $600 billion. Elavon operates as a subsidiary of bank holding company U.S. Bancorp.

Payoneer: Payoneer, founded in 2005, launched as a cross-border payments platform and now allows users to get paid in multiple currencies. As of 2023, Payoneer claimed its B2B transaction volumes increased 39% over 2022. It offers services to freelancers and small online businesses while also establishing partnerships with Walmart, eBay, Airbnb, and other major companies. A public company, Payoneer had a market cap of $1.9 billion in November 2023.

Business Model

Source: GoCardless

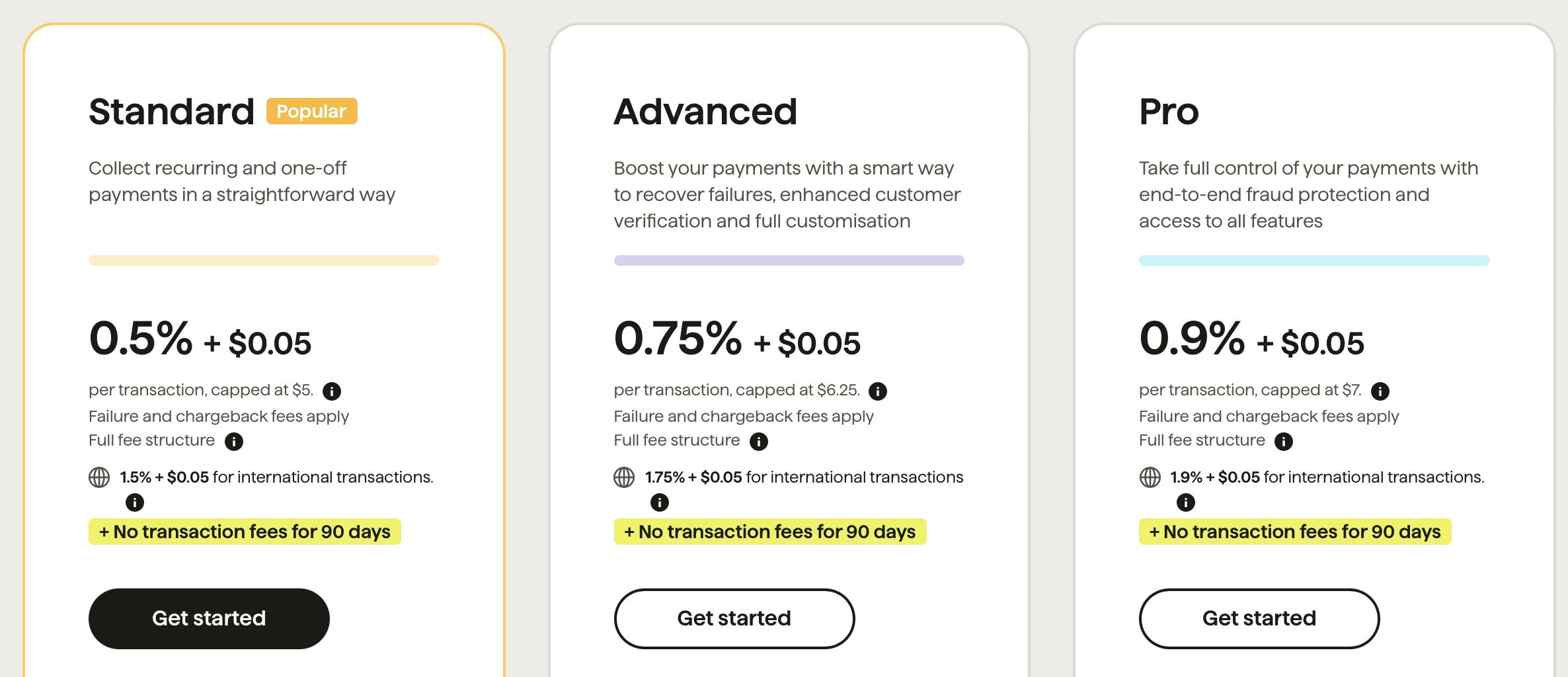

GoCardless offers merchants three tiers of payment processing capabilities: Standard, Advanced, and Pro. All three tiers offer no transaction fees for 90 days. The tiers are based on transaction-based pricing, with a cap on a per-transaction basis. This amounts to:

Standard: 0.5% per transaction + $0.05, capped at $5. 1.5% + $0.05 for international transactions.

Advanced: 0.75% per transaction + $0.05, capped at $5. 1.75% + $0.05 for international transactions.

Pro: 0.9% per transaction + $0.05, capped at $5. 1.9% + $0.05 for international transactions.

The difference between the pricing tiers is in the features offered. The Standard package offers recurring and one-off payments only, while the Advanced tier introduces the Success+ product for enhanced customer verification and failed payment recovery, and the Pro tier introduces Protect+ fraud protection. GoCardless also offers custom pricing for its large enterprise partners which process significant transaction volume.

Traction

The technology for direct bank payments has existed for almost half a century, but once ecommerce was established, it took years for companies like GoCardless to enable small businesses to access these rails. GoCardless aspires to be the world's leading network for direct debit payments, and as of 2022 had generated $93.6 million in revenue (+45% year-over-year) on over $30 billion in transactions for 76K merchants (+10K year-over-year).

The company offers international recurring billing for 31 countries and eight currencies. In the past few years, GoCardless has secured major clients such as DocuSign, Epson, and TripAdvisor. In 2022, PayPal agreed to offer GoCardless to its customers, and Klarna selected GoCardless as its US bank debit payment provider for its 21 million US customers. Revenue outside of the UK increased 68% between 2021 and 2022.

In 2021, GoCardless seized upon the opportunities presented by open banking to offer its 76K merchants even faster and cheaper payments.

In July 2022, GoCardless purchased SIA Nordigen Solutions, a Latvian company that has established APIs with several banks, which helped the company expand its open banking products.

In June 2023, the company cut 135 jobs, amounting to 15% of its headcount, in a bid to reduce costs and achieve profitability. Takeuchi said revenue continued to “grow strongly” but that the cuts were necessary to achieve the company’s desired profitability timeline.

Valuation

As of 2023, GoCardless has raised $529.3 million, putting the company at a $2.1 billion valuation (with a revenue multiple of 21.8x). In 2022, it secured a $312 million Series G led by Permira with BlackRock Private Equity Partners and Hambro Perks participating as the company eyed expanded open banking capabilities and broader geographic markets. The US offers a significant growth opportunity, but it will face competition from incumbents and a consumer base that has historically relied on cards for ecommerce payments.

Key Opportunities

Open Banking

GoCardless’s open banking products offer merchants 720 days’ worth of a consumer’s banking data and partners with 2.3K banks in the UK and EU, capabilities made possible by GoCardless’s 2022 purchase of Nordigen (valued at $4.3 million in 2019). The thesis for open banking is that consumers will realize the benefits of sharing their banking data for the sake of faster and cheaper payments, which will become more important as ecommerce continues to grow, and as more payment options are presented at the point of sale. Initially, the adoption of open banking was slow, possibly due to security concerns over sharing banking data. In 2022, CEO Takeuchi claimed open banking transaction volume had increased 50% over 2021.

International Expansion

In 2021, GoCardless’s home country of the UK still comprised 80% of its revenue, but it has been expanding internationally, with France its second-largest market. Direct debit is already a preferred payment method in Europe, whereas the US market may be harder to break into given its consumers’ reliance on credit cards. Currently, bank debit (ACH) is only 27% of traditional subscriptions. That said, the US cashless payment volumes far exceed that of any EU country, so there is a lot of potential to gain market share, aided by recent US partnerships with PayPal and Klarna.

Source: GoCardless

Demographic Changes

Consumer affinity for credit cards is changing as large ecommerce merchants begin offering a wider variety of payment options, such as the buy-now, pay-later (BNPL) model popularized by Klarna and others. The majority of BNPL users are under the age of 35, and 77% of younger consumers claim they trust merchants who offer them their preferred payment method.

Gen Z, for example, prefers digital wallets and mobile payments, which are already standard in the EU and UK but have yet to gain widespread adoption in the credit-card-dominated US; only 27% of Gen Z consumers report using store credit cards. However, it’s not clear that younger consumers demonstrate any loyalty to a particular payment method — Gen Z consumers are also major users of peer-to-peer payments and drove cryptocurrency adoption.

Customer Stickiness

In a recent interview, communications director Nicola Hamilton noted that its B2B customers are unlikely to leave GoCardless once it is integrated into their systems, meaning customers are very sticky and GoCardless can rely on merchant contracts. The company added 10K merchants between 2021 and 2022, and its partnerships may substantially improve this number.

Key Risks

Credit Risk

Because GoCardless depends on the success of its merchants, the accumulation of bad debt and write-offs due to failed payments, chargebacks, or fraudulent payments is always present. In 2020, the company found that 45% of failed payments turn into bad debt. The company sees this as a significant enough risk that it tripled its bad debt provision to $2 million in 2022. The company has provisioned $2.4 million for failed payments and $4.9 million for loss due to fraud. In 2022, GoCardless reported that $4 million in payments from merchants were 30 days or more overdue.

Growth

In a June 2023 interview, communications director Nicola Hamilton said the customer stickiness that GoCardless enjoys is also its biggest growth constraint. As loyal as its merchants are to GoCardless, many potential customers are reluctant to change to GoCardless from their payments processor. The company’s open banking product development depends on a global trend toward direct debit payments and increased use cases for automated account-to-account payments, which is uncertain and depends in part on PSD2. Gen Z consumers, who make some of the loudest demands for cashless payments and more options at the point of sale such as GoCardless, are also seeing high rates of late payments.

Dependence on Recurring Payments

Direct debit payments trend downward during economic downturns, as consumers pay necessary bills like utilities and mortgages and forego subscriptions and memberships. Given the popularity of subscription-based businesses, there may be a consumer backlash that limits new subscriptions and therefore constrains the growth of GoCardless’s recurring payments services. Indeed, the company has cited the high inflation rates and low rates of economic growth as affecting the merchants on whom GoCardless relies for revenue.

Security

Data on consumer payments, spending behavior, and credit history can be highly valuable, presenting risks to a merchant and that merchant’s payment processor. In 2017, thieves stole 19 laptops with GoCardless data on them. Although this type of physical security breach is easily avoided, there are other risks with payments data, mainly breaches that may compromise privacy and data protection. Moreover, its infrastructure remains UK-centric, and it will need to accommodate its security infrastructure for expansion into other countries, which may have different rules and different risk factors.

Regulatory Risks

All payments companies in the UK and EU must meet anti-money laundering and counter-terrorist financing requirements, which can involve burdensome due diligence made stricter by the EU’s Strong Customer Authentication. GoCardless’s home country, the UK, and its designated regulator, the Financial Conduct Authority, are relatively friendly toward fintechs by international standards (and its direct debit technology was actually invented in the UK, meaning the team’s original pitch to regulators was a simple one). Attitudes toward technology companies may change, though, and the company’s planned geographic expansion means launching its products under different regulatory regimes that may be less friendly to fintechs.

Summary

GoCardless is a payment processor offering faster, cheaper payments to merchants using its direct debit and open banking products. The company also helps merchants cut down on failed and fraudulent payments with a platform that offers automated payment retries and advanced know-your-customer capabilities. As ecommerce continues to grow and consumers demand more payment options at checkout, GoCardless offers a convenient and cheaper option than credit and debit cards or digital wallets. Besides the operational benefits of GoCardless’s platform, merchants have an incentive to offer preferred payment methods such as GoCardless to attract and retain customers. GoCardless has expanded to several countries, with perhaps its greatest potential in the US, where it has landed major partnerships with Klarna and PayPal.