Thesis

In the US, restaurant sales reached almost $800 billion in 2021 and 51% of the average US family’s food spend goes to restaurants. While hundreds of billions of dollars in value have been created in the food delivery space with companies like Doordash, Uber Eats, and Grubhub, online delivery still only accounts for 8% of the restaurant industry. Broken down by generation, 59% of orders from millennials for the average restaurant are takeout orders. However, across all generations, 90% of all takeout purchasing still happening offline.

Snackpass is a company that is seeking to bring more restaurant takeout transactions online with the addition of a social commerce layer to the restaurant takeout order experience. For consumers, its appeal is in its online, social approach to ordering and picking up food that provides a convenient and cheaper way to get takeout. For restaurants, Snackpass provides the prospect of increased sales and the acquisition of new loyal repeat customers. As Snackpass investor General Catalyst puts it, the company has the potential to “bring Takeout into the digital age by leveraging the first P2P mobile-based social feed for food.”

Founding Story

In 2017, Kevin Tan was a senior at Yale when he teamed up with fellow Yale undergrads Jamie Marshall and Jonathan Cameron to found Snackpass. Tan was friends with the owner of a local restaurant called Brick Oven Pizza and was helping him with web design when he began to dig deeper into what pain points restaurant owners and restaurant clientele faced.

Source: DormRoomFund; Jamie Marshall (left) and Kevin Tran (right)

He was able to identify two main pain points: first, people didn’t want to wait in line and second, they wanted cheaper food. Another key insight was that eating was inherently a social activity, and if they could make ordering food a fun and social experience, they could potentially grow faster and engender more user love. Building on these insights, the team launched an MVP of Snackpass called Happy Hour that allowed restaurants to offer discounts and loyalty points to Yale students.

The first customer of Happy Hour was Tan’s roommate, and the next 100 customers came from flyers that the co-founders put up all around campus. It quickly gained traction at Yale, reaching over 80% of the campus within a semester of launch with most Yale students using it at least once a week. There was so much demand that Tan, Marshall, and Cameron found themselves helping restaurants wash blenders and distributing orders to keep up.

The initial value proposition for restaurants was that it would help them reach more customers and sell more food, while the value proposition for Yale students was that they could get access to deals on food and not have to wait in line. Another key feature that drove Snackpass’s early growth was gifting, which allowed people to send food and reward points to their friends.

Tan’s initial idea for this feature came from an attempt at flirting with a girl by gifting her food. Gifting created a social aspect to Snackpass, which allowed the app to slowly build a network effect and other social features. It also meant that existing users had a stronger motivation for introducing their friends to Snackpass, thus driving user growth. Snackpass gained more initial traction through a college ambassador program, which helped them expand from Yale to 10 new campuses. From there, Snackpass has created new products, from self-service kiosks for restaurants to a fuller suite of consumer-facing social ordering features.

Product

Social Features

Gifting. Gifting has been a key feature of Snackpass from the very beginning, powering its viral growth on college campuses. Gifting provides consumers with a fun way to connect with their friends, thereby introducing new users to the Snackpass platform.

Source: Snackpass

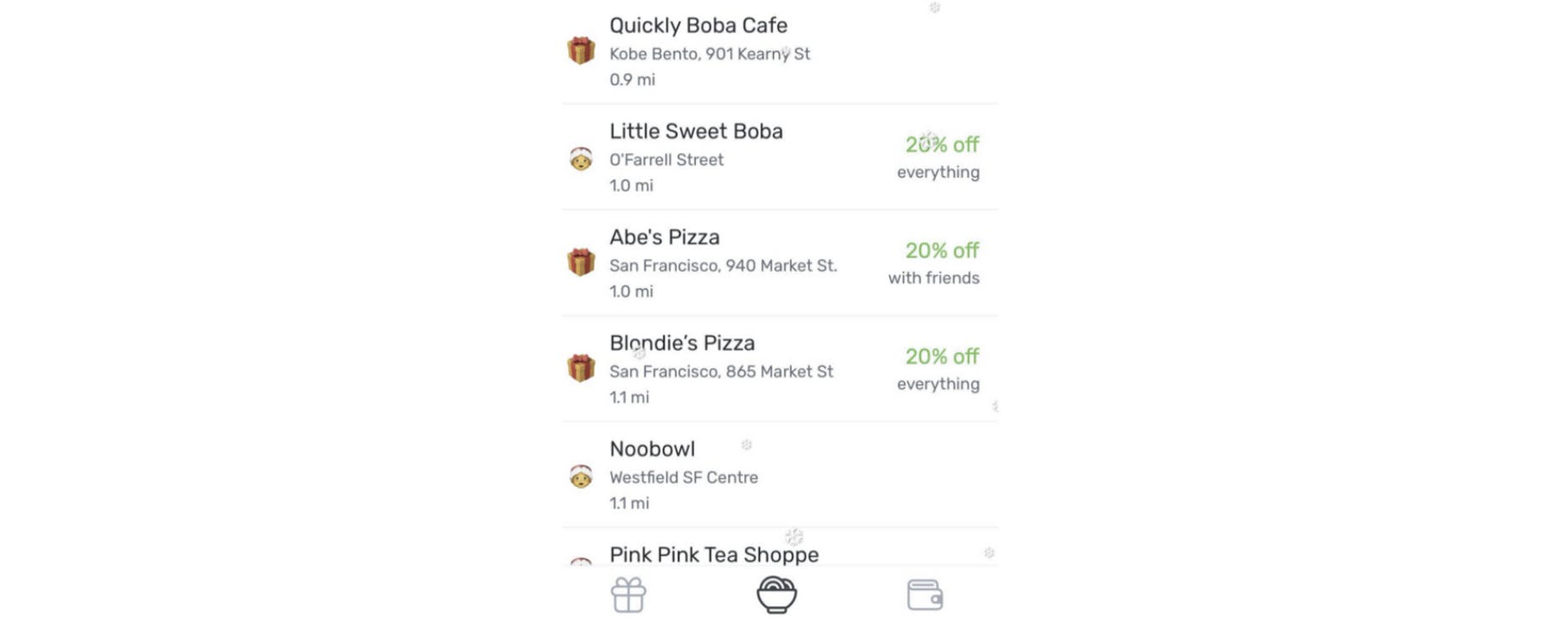

Group ordering discounts. Group ordering is another feature that attempts to bring a social aspect to food ordering. With group ordering, friends can band together to buy in bulk and access discounts, as with the “20% off” discount shown below.

Source: Snackpass

Collaborative challenges and gamification. Snackpass uses gamification to encourage additional usage on the app by offering gamified incentives and collaborative challenges. It makes ordering food and sending gifts more than just a way to provide sustenance by triggering feelings of progress and fulfillment as users work together towards a goal.

Source: Snackpass

Social Feed. Snackpass has a Venmo-like social feed where users can see what their friends are ordering and doing. Snackpass CEO Kevin Tan mentioned in an interview that this can make the platform more interesting as, observing that “there’s some drama or intrigue there seeing who’s sending gifts to who. People even look at the feed in the way they look at someone’s Instagram to see what’s going on with them.” One investor in Snackpass noted that this “Venmo-for-food" feed “nudges users to order together (more volume to restaurants), gift free products to friends (free customer acquisition), and of course discover what to eat.

Loyalty Rewards. Orders made on Snackpass enable users to earn loyalty points and gift points. This means that users are able to access lower costs, and are also incentivized to bring their friends to the platform through the use of gift points which allow one to buy gifts for friends on Snackpass.

Campus-specific integrations

Meal-plan syncing. Snackpass’s meal-plan syncing feature decreases the activation energy needed for users on college campuses, currently Snackpass’s main user base, to start using Snackpass. By syncing with students’ meal plans, Snackpass makes it easier for users to begin making orders on Snackpass since they already have a prepaid balance that they can spend through the app.

Club-based wallets. Since students on campuses are often organized together through student groups and clubs, Snackpass offers club-based wallets to capture large groups of users at once and enable club members to access group discounts and easy group ordering for both club events as well as for general everyday consumption by club members.

POS System & Self-Serve Kiosk

In addition, Snackpass offers a POS system product for restaurants that can be turned into a self-serve kiosk, and has a built-in loyalty program and operations automation for payroll and inventory management. These integrations reduce employee labor costs (by up to 90%), decrease service and wait times, and allow partners to get through more customers faster. Snackpass advertises its POS systems as “built for the next generation of guests.”

Source: Snackpass

Market

Customer

Consumers: Takeout is a large market for consumers that Snackpass is targeting. 60% of US customers order delivery or takeout once a week. However, consumers can only spend so much on delivery orders — the average order value for delivery platforms is $20-$30 per meal — and could benefit from a streamlined, lower cost takeout channel to complement the delivery channel. The majority of takeout orders still happen offline, which prevents rewards for loyal customers, creates long lines and high costs in employee hours, and no ability to know customers. It also makes for a less streamlined and less convenient ordering and pickup experience for customers, especially when compared to mobile ordering. 52% of takeout orders are done over the phone, and 45% of consumers said that loyalty programs or mobile ordering would encourage them to order from restaurants more often. Snackpass’s college-focused customer base is particularly active in ordering takeout — 59% of orders from millennials for the average restaurant are takeout orders.

Restaurants: Restaurants are always looking to increase sales and make their operations more efficient. Efficiency has come into focus with wage inflation during 2022, as wage increases have caused 47% of restaurant operators to reduce employee shift hours and 16% of them to halt hiring efforts to save on labor costs. 52% of restaurant professionals named high operating as a top challenge. The COVID-19 pandemic also meant that many restaurants adopted e-commerce and digital solutions more readily, becoming used to engaging with their customers through mobile ordering platforms. In 2022, mobile orders accounted for 14% of an average restaurant’s total revenue. Snackpass presents these restaurants with a differentiated digital platform offering that can help them increase sales, reduce labor costs, acquire new customers, and re-engage existing customers.

Market Size

Snackpass estimates that takeout is a $600 billion opportunity. 90% of all takeout purchasing still happens offline, and Snackpass can slowly chip away at that number to bring more and more takeout ordering online.

Competition

Food Social Commerce Competitors

There is no dominant player in the food social commerce market, as it is still a nascent one in the US that many are trying to conquer. Apps like Repeat, Tapingo, Allset and Ritual are relatively small players that seek to tackle either takeout or adding a social layer on top of ordering. Snackpass has emerged as the largest player among this class of newer competitors, but it remains to be seen how sticky Snackpass’s platform can be in the face of these growing competitors, especially outside of the college setting.

Delivery Giants

Online delivery apps like Doordash, Uber Eats, and Grubhub compete with Snackpass through their own takeout offerings. Though the core competence of these companies is delivery, they all offer takeout and pickup options, and as Snackpass proves out the potential of the takeout market, we could see increased investment by delivery giants in their takeout offerings. These players also threaten Snackpass from the social commerce front, as group ordering is a feature that many of these platforms support and that is often used in corporate or group settings. Doordash has also recently rolled out group ordering discounts for consumers as well. In its current state, Snackpass still has to compete with these takeout offerings as they are, and it has done so with some success, especially in colleges, with its social features. Snackpass will have to fight these players for share in the US takeout market.

Point of Sale (POS) Players

As Snackpass expands into self-service kiosks, it may run into competition from entrenched restaurant POS providers like Square, Toast, Lightspeed, and Clover. Switching costs for restaurant POS are high. Restaurants who want to switch from one POS to another need to rip out all the systems and data that they’ve built around one POS provider first and then fully transfer all of that over to the new POS provider. However, it has already launched several POS integrations with notable partners, including the dim sum store Mei Lai Wah, one of the oldest in New York City.

Business Model

Snackpass charges commission on orders. The commission rates can vary, but they start at 7%. This take rate is much lower than delivery-focused peers, which makes it a more attractive partner for restaurants. Snackpass also cites the fact that “customers on Snackpass order twice as much as customers who stand in line to pay at the register”, and that Snackpass can help restaurants achieve 10x lower labor costs.

On the cost side, because Snackpass is so focused on pickup and takeout, it doesn’t have to spend as much on building out a robust delivery infrastructure unlike its delivery-focused peers. This means Snackpass’s business likely has much lower operating costs than companies like Doordash or Grubhub.

Traction

In June 2021, in conjunction with Snackpass’s Series B announcement, it was reported that the platform had crossed the 500K user mark and reached 13 college towns. In September 2021, Tan noted in an interview that Snackpass has already partnered with ~1K restaurants and aims to have reached 10K restaurants by the end of 2022.

The company also saw 7x growth from April 2020 to April 2021, and reported strong user engagement metrics with the average customer ordering 4.5 times a month. During this period, overall engagement on the platform was 5-10x higher than delivery platforms like UberEats. The company has stated that it’s already profitable in certain markets. All of this amounts to Snackpass doing about $60 million in GMV. If we apply the 7% take rate mentioned above to this GMV number, this suggests a revenue figure of ~$4 million.

In June 2024, a partnership was announced between Snackpass and Presotea, an up-and-coming Taiwanese bubble tea franchise with over 400 stores in 12 countries. The partnership involves a fully integrated front and back-of-house system with self-serve kiosks, duo registers, customer pickup screens, digital menus, a kitchen display system, receipt printers, label printers, and an online ordering page. Prototea is also developing a custom app with the Snackpass team.

Valuation

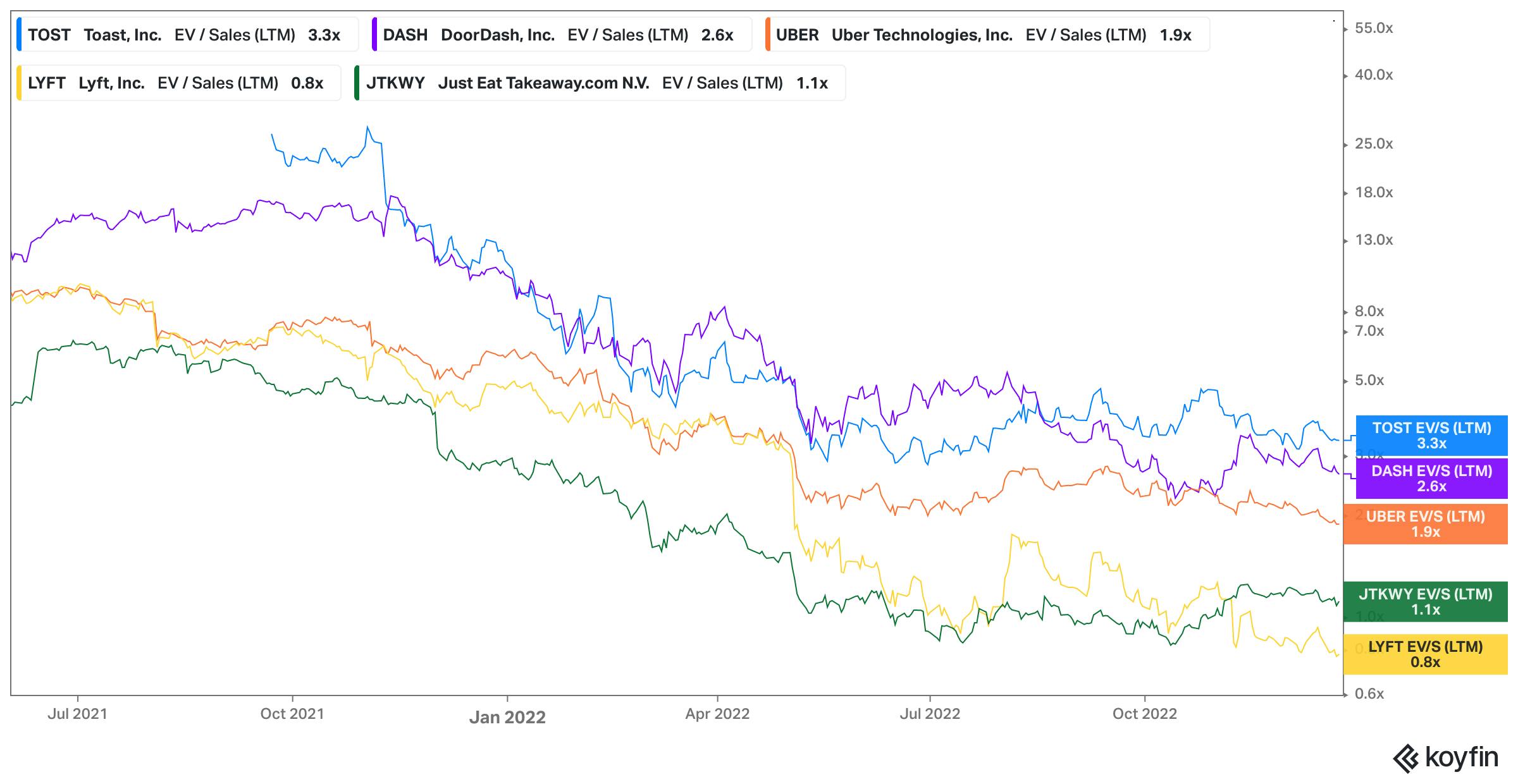

In June 2021, Snackpass announced that it had raised a $70 million Series B at a valuation of over $400 million led by Craft Ventures, with participation from Andreessen Horowitz. Andreessen had previously led Snackpass’s $21 million Series A in Dec 2019 along with General Catalyst and Y Combinator. This brings its total funding raised to over $95 million. With ~$4 million in estimated revenue, this would put Snackpass’s revenue multiple at ~100x. Comparable restaurant software and marketplace software companies like Toast, Doordash, Just Eat Takeaway, Uber, and Lyft are currently trading between 0.8-3.3x revenue, down from a high for some of these companies of ~30x revenue in 2021.

Source: Koyfin

Key Opportunities

Expanding Beyond Food Takeout

Snackpass can expand beyond the food takeout market, and can move into adjacent spaces such as grocery. It has already formed partnerships with off-campus grocery stores, and can continue to grow towards the mission of being the social commerce layer for all of one’s food needs, beyond being limited to just takeout.

Following the College User Base Beyond Graduation

Snackpass has built a strong customer base across college campuses in the US, and it has an opportunity to continue to grow with that customer base as they graduate from college and increase their discretionary spending as full time members of the workforce. Snackpass can continue support the needs of the loyal campus customer base they’ve already acquired, and such a strategy would likely yield higher average revenue per user as discretionary spend tends to increase as consumers get older and richer.

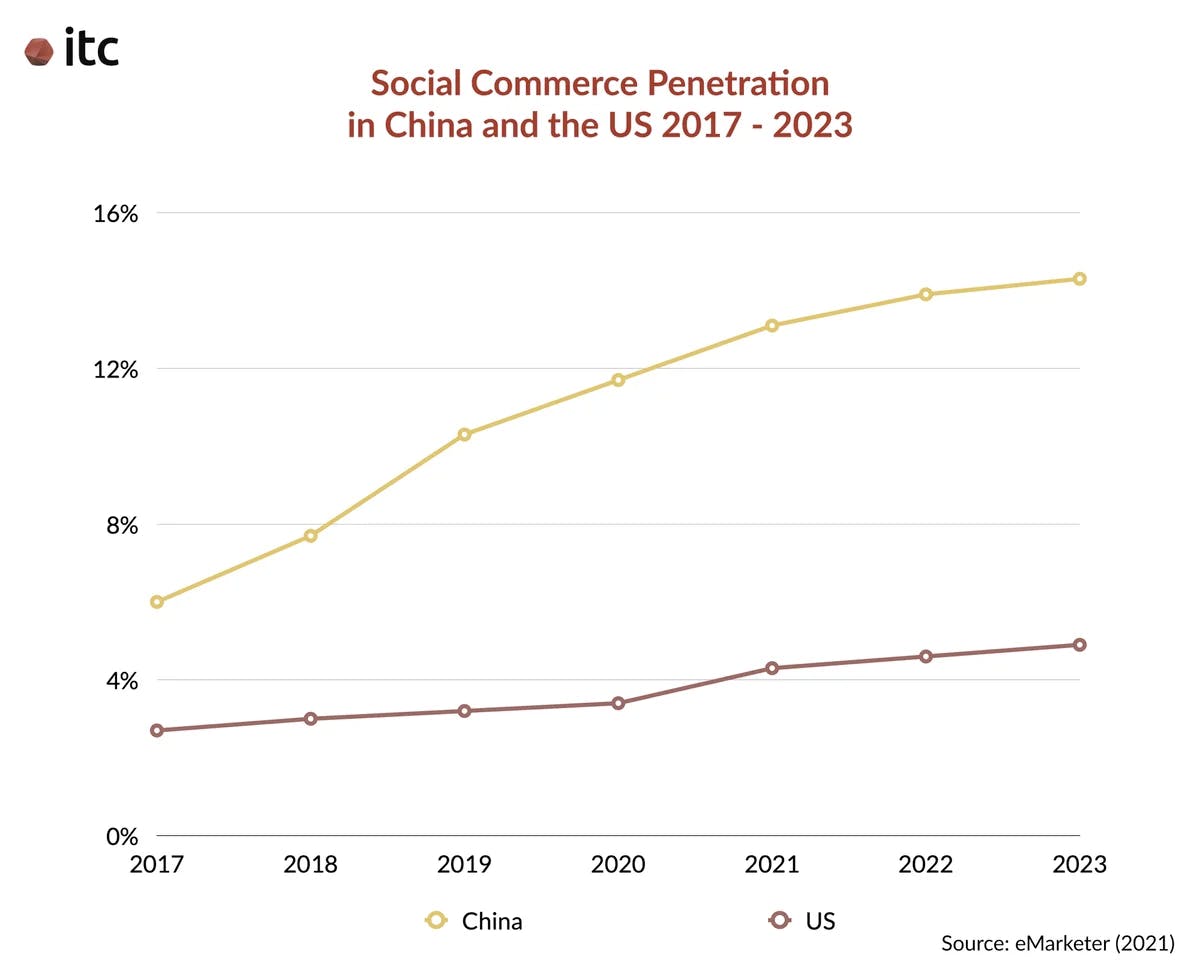

Driving Adoption of Social Commerce at Scale

The Chinese market offers a compelling example of what the upside could be for behavior changes to drive more adoption of social commerce at scale. A representative at Pinduoduo, a social commerce giant in China, noted that “The most significant shift in consumer behavior we see in China is the move away from the search, pay and leave’ model of legacy e-commerce platforms to a social commerce model such as Pinduoduo’s, which more closely mimics the offline shopping experience by integrating the serendipitous joy in finding great buys and the social interaction that shopping together brings.” As a result, China has the most developed social commerce market in the world, with nearly 800 million participants, far outpacing the US.

Source: eMarketer (2021)

Snackpass has been able to bring social commerce to college campuses, and if Snackpass is able to drive a similar behavior change towards social commerce in the US, it could unlock viral growth across the entire US population and replicate the same success it had on campuses but on a much larger scale.

Supercharge Gamification and User Engagement

Snackpass can take another page out of Pinduoduo’s book. Pinduoduo started with a social commerce experience, and then heavily layered on gamification to drive more user engagement and spend. One game on Pinduoduo which rewarded playing with real life grocery rewards experienced particularly rapid growth, scaling from 11 million DAUs to 60 million DAUs in just 6 months. Each gamified experience brought consumers closer to a purchasing event.

Snackpass can emulate this model to supercharge user activity on the platform by implementing many of the gamified engagement hacks that Pinduoduo launched, such as:

A wheel to spin to earn daily coupons

Discounts for sharing invite links with friends

Discounts for leaving reviews

Rewards for daily check-ins similar to Snapstreaks

Flash sales

Leaderboards showing who saved the most money

Games where you level up through making more purchases, engaging with friends, and spending time in-app

Discounts hidden in app to be discovered by users

Key Risks

Scaling Adoption Beyond College Campuses

Snackpass has been a viral phenomenon in many universities, reminiscent of the early days of Facebook, but it must be able to expand out of the college niche and cross the chasm if it is to become the social commerce layer for food. College campuses have very unique characteristics and network effects resulting from tight network clusters that are not as present in many other segments of society, so it remains to be seen if Snackpass can replicate its college success as it tries to expand outside of them.

Increased Focus on Takeout by Large Delivery Incumbents

Snackpass has shown how important and lucrative the takeout market can be, and lucrative markets often attract new entrants. Large delivery incumbents with hefty financial and human capital resources like Doordash, Uber Eats, and Grubhub already offer pickup/takeout, and can potentially invest more in that part of their platforms. For Snackpass, this could mean increased competition over signing restaurants onto their platform, and downward pressure on the take rate it can command. These players could also build their own social layers on top of their platforms and try to steal Snackpass’s secret social sauce. It also remains to be seen whether Snackpass can outcompete these players in non college-campus settings.

Need to Grow into Valuation

As mentioned in the valuation section, Snackpass likely was valued at a very high revenue multiple in its last round, and must scale revenue rapidly to grow into the $400 million valuation. If it is unable to do so, this could make it more difficult to raise future rounds of financing, which can affect the business’s runway. Though it experienced 7x growth from April 2020 to April 2021, it needs to prove that strong growth can continue as it expands out of the college niche.

Summary

Snackpass is creating the social commerce layout for food, starting with takeout on college campuses. It has grown virally across campuses in America, providing students with a sticky ordering experience and helping local restaurants sell more and acquire new customers. Snackpass has many opportunities to capitalize on its early traction as it begins to expand from college campuses into society at large, but it must overcome hurdles such as escalating competition and expanding beyond its core college student customer base in order to do so.